Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANCORPSOUTH INC | d450874d8k.htm |

BANCORPSOUTH, INC. Pending Acquisitions Update September 2017 Exhibit 99.1

Forward Looking Information Certain statements contained in this this presentation and the accompanying slides may not be based upon historical facts and are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may be identified by their reference to a future period or periods or by the use of forward-looking terminology such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “foresee,” “hope,” “intend,” “may,” “might,” “plan,” “will,” or “would” or future or conditional verb tenses and variations or negatives of such terms. These forward-looking statements include, without limitation, those relating to the terms, timing and closings of the proposed mergers with Ouachita Bancshares Corp. and Central Community Corporation, the acceptance by customers of Ouachita Bancshares Corp. and Central Community Corporation of the Company’s products and services if the proposed mergers close, the terms, timing and closing of the Reorganization, the proposed impact of the Reorganization on the Surviving Entity, the ability of the Company and the Bank to close the Reorganization in a timely manner or at all, the Company’s ability to operate its regulatory compliance programs consistent with federal, state, and local laws, including its Bank Secrecy Act (“BSA”) and anti-money laundering (“AML”) compliance program and its fair lending compliance program, the Company’s compliance with the consent order it entered into with the Consumer Financial Protection Bureau and the United States Department of Justice related to the Company’s fair lending practices (the “Consent Order”), amortization expense for intangible assets, goodwill impairments, loan impairment, utilization of appraisals and inspections for real estate loans, maturity, renewal or extension of construction, acquisition and development loans, net interest revenue, fair value determinations, the amount of the Company’s non-performing loans and leases, credit quality, credit losses, liquidity, off-balance sheet commitments and arrangements, valuation of mortgage servicing rights, allowance and provision for credit losses, early identification and resolution of credit issues, utilization of non-GAAP financial measures, the ability of the Company to collect all amounts due according to the contractual terms of loan agreements, the Company’s reserve for losses from representation and warranty obligations, the Company’s foreclosure process related to mortgage loans, the resolution of non-performing loans that are collaterally dependent, real estate values, fully-indexed interest rates, interest rate risk, interest rate sensitivity, calculation of economic value of equity, impaired loan charge-offs, diversification of the Company’s revenue stream, the growth of the Company’s insurance business and commission revenue, the growth of the Company’s customer base and loan, deposit and fee revenue sources, the Company’s ability to efficiently manage capital, liquidity needs and strategies, sources of funding, net interest margin, declaration and payment of dividends, the utilization of the Company’s share repurchase program, the implementation and execution of cost saving initiatives, improvement in the Company’s efficiencies, operating expense trends, future acquisitions and consideration to be used therefor and the impact of certain claims and ongoing, pending or threatened litigation, administrative and investigatory matters. The Company cautions readers not to place undue reliance on the forward-looking statements contained in this this presentation and the accompanying slides, in that actual results could differ materially from those indicated in such forward-looking statements as a result of a variety of factors. These factors may include, but are not limited to, the Company’s ability to operate its regulatory compliance programs consistent with federal, state, and local laws, including its BSA/AML compliance program and its fair lending compliance program, the Company’s ability to successfully implement and comply with the Consent Order, the ability of the Company, Ouachita Bancshares Corp. and Central Community Corporation to obtain regulatory approval of and close the proposed mergers, the willingness of Ouachita Bancshares Corp. and Central Community Corporation to proceed with the proposed mergers, the potential impact upon the Company of the delay in the closings of these proposed mergers, the ability of the Company and the Bank to complete the Reorganization, the ability of the Company and the Bank to satisfy the conditions to the completion of the Reorganization, including the receipt of Company shareholder approval and the receipt of regulatory approvals required for the Reorganization, the ability of the Company and the Bank to meet expectations regarding the timing, completion and accounting and tax treatments of the Reorganization, the possibility that any of the anticipated benefits of the Reorganization will not be realized or will not be realized as expected, the failure of the Reorganization to close for any other reason, the possibility that the Reorganization may be more expensive to complete than anticipated, including as a result of unexpected factors or events, the lack of availability of the Bank’s filings mandated by the Securities Exchange Act of 1934, as amended, from the SEC’s publicly available website after the closing of the Reorganization, the impact of any ongoing, pending or threatened litigation, administrative and investigatory matters involving the Company, conditions in the financial markets and economic conditions generally, the adequacy of the Company’s provision and allowance for credit losses to cover actual credit losses, the credit risk associated with real estate construction, acquisition and development loans, limitations on the Company’s ability to declare and pay dividends, the availability of capital on favorable terms if and when needed, liquidity risk, governmental regulation, including the Dodd-Frank Act, and supervision of the Company’s operations, the short-term and long-term impact of changes to banking capital standards on the Company’s regulatory capital and liquidity, the impact of regulations on service charges on the Company’s core deposit accounts, the susceptibility of the Company’s business to local economic and environmental conditions, the soundness of other financial institutions, changes in interest rates, the impact of monetary policies and economic factors on the Company’s ability to attract deposits or make loans, volatility in capital and credit markets, reputational risk, the impact of the loss of any key Company personnel, the impact of hurricanes or other adverse weather events, any requirement that the Company write down goodwill or other intangible assets, diversification in the types of financial services the Company offers, the growth of the Company’s insurance business and commission revenue, the growth of the Company’s loan, deposit and fee revenue sources, the Company’s ability to adapt its products and services to evolving industry standards and consumer preferences, competition with other financial services companies, risks in connection with completed or potential acquisitions, the Company’s growth strategy, interruptions or breaches in the Company’s information system security, the failure of certain third-party vendors to perform, unfavorable ratings by rating agencies, dilution caused by the Company’s issuance of any additional shares of its common stock to raise capital or acquire other banks, bank holding companies, and insurance agencies, the utilization of the Company’s share repurchase program, the implementation and execution of cost savings initiatives, other factors generally understood to affect the assets, business, cash flows, financial condition, liquidity, prospects and/or results of operations of financial services companies and other factors detailed from time to time in the Company’s press and news releases, and this presentation and the accompanying slides, reports and other filings with the SEC. Forward-looking statements speak only as of the date that they were made, and, except as required by law, the Company does not undertake any obligation to update or revise forward-looking statements to reflect events or circumstances that occur after the date of this this presentation and the accompanying slides.

The Reorganization and the Amended Plan of Reorganization Although this presentation primarily relates to the proposed mergers with Ouachita Bancshares Corp. and Central Community Corporation, it also includes references to the Reorganization (defined below) and the Amended Plan of Reorganization (defined below). BancorpSouth, Inc. (the “Company”) currently expects that the Reorganization will be completed prior to the completion of the Company’s proposed mergers with Ouachita Bancshares Corp. and Central Community Corporation. As previously announced, on August 15, 2017, the Company entered into that certain Amended and Restated Agreement and Plan of Reorganization, dated as of August 15, 2017 (the “Amended Plan of Reorganization”), by and between the Company and BancorpSouth Bank (the “Bank”). The Amended Plan of Reorganization provides that the Company will be merged with and into the Bank (the “Reorganization”) with the Bank continuing as the surviving entity. The Amended Plan of Reorganization was filed as Exhibit 2.1 to the Company’s Current Report on Form 8-K that was filed with the Securities and Exchange Commission (the “SEC”) on August 15, 2017. The Company currently expects to complete the Reorganization before year-end 2017, assuming all of the conditions to completion of the Reorganization have been satisfied, although neither the Company nor the Bank can provide any assurances that the Reorganization will close timely or at all. On August 29, 2017, the Company filed with the SEC and mailed to its shareholders a definitive proxy statement/offering circular which describes the Reorganization and the Amended Plan of Reorganization. A special meeting of the Company’s shareholders will be held on September 27, 2017 for the purpose of voting upon the approval of the Amended Plan of Reorganization. BEFORE MAKING ANY VOTING DECISION WITH RESPECT TO THE REORGANIZATION, SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT/OFFERING CIRCULAR AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE REORGANIZATION. The definitive proxy statement/offering circular, as well as other filings containing information about the Company and the Bank, are available without charge at the SEC’s internet website (www.sec.gov). Copies of the definitive proxy statement/offering circular can also be obtained, without charge, from the Company’s investor relations website at www.bancorpsouth.investorroom.com. The Company and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from the Company’s shareholders in respect of the Reorganization. Certain information about the Company’s directors and executive officers is set forth in its Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on February 27, 2017, and in its Definitive Proxy Statement on Schedule 14A for its 2017 annual meeting of shareholders, which was filed with the SEC on March 22, 2017. Any other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, are included in the definitive proxy statement/offering circular and other relevant documents filed with the SEC.

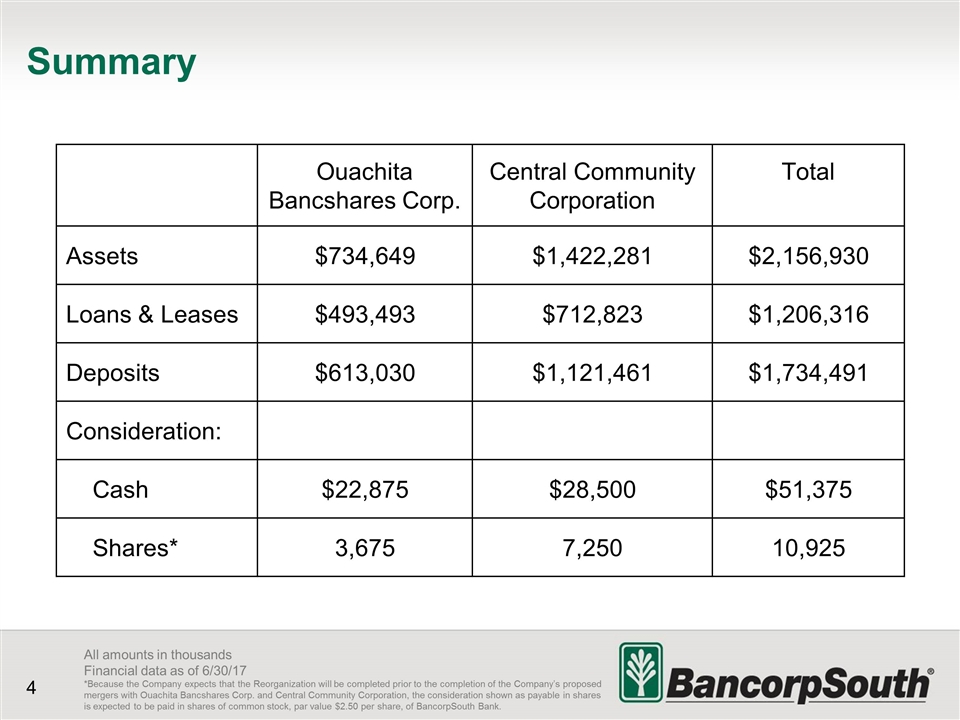

Summary All amounts in thousands Financial data as of 6/30/17 *Because the Company expects that the Reorganization will be completed prior to the completion of the Company’s proposed mergers with Ouachita Bancshares Corp. and Central Community Corporation, the consideration shown as payable in shares is expected to be paid in shares of common stock, par value $2.50 per share, of BancorpSouth Bank. Ouachita Bancshares Corp. Central Community Corporation Total Assets $734,649 $1,422,281 $2,156,930 Loans & Leases $493,493 $712,823 $1,206,316 Deposits $613,030 $1,121,461 $1,734,491 Consideration: Cash $22,875 $28,500 $51,375 Shares* 3,675 7,250 10,925

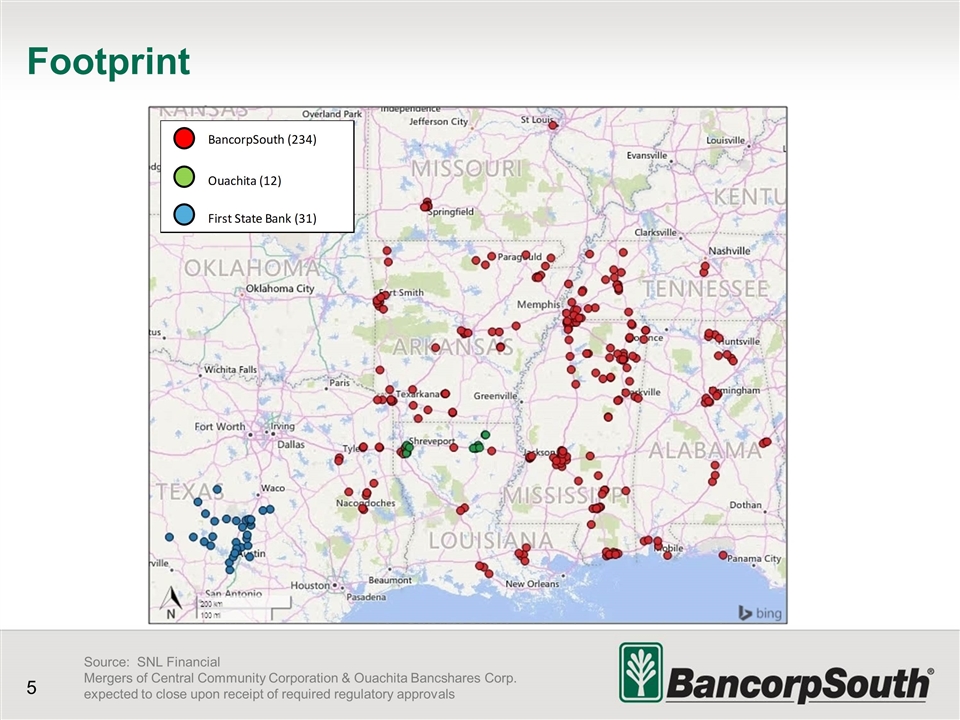

Footprint Source: SNL Financial Mergers of Central Community Corporation & Ouachita Bancshares Corp. expected to close upon receipt of required regulatory approvals

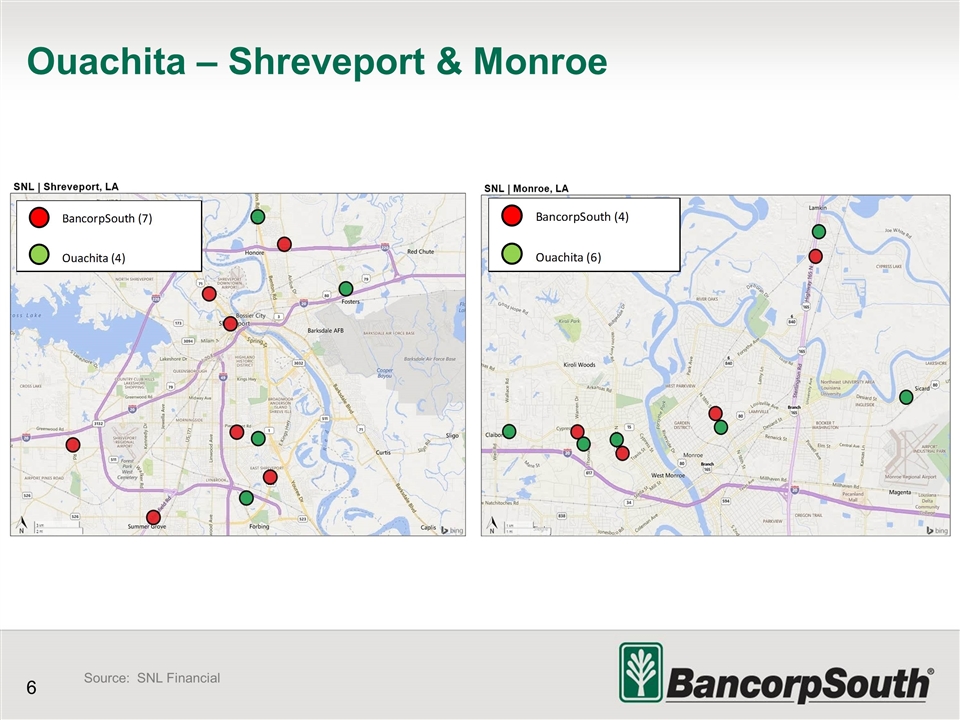

Ouachita – Shreveport & Monroe Source: SNL Financial

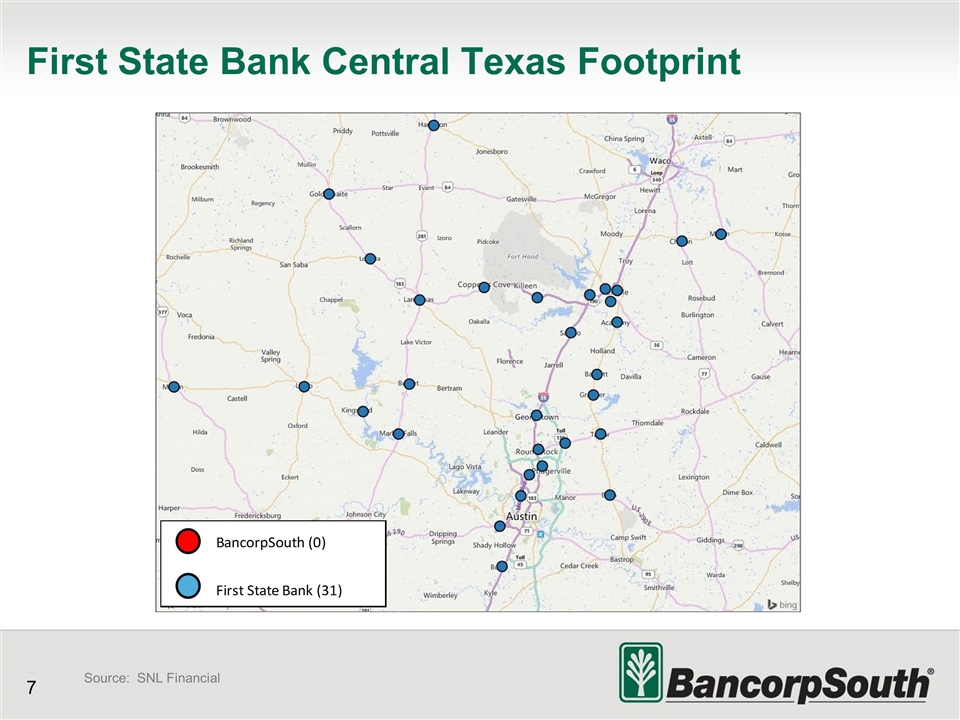

First State Bank Central Texas Footprint Source: SNL Financial

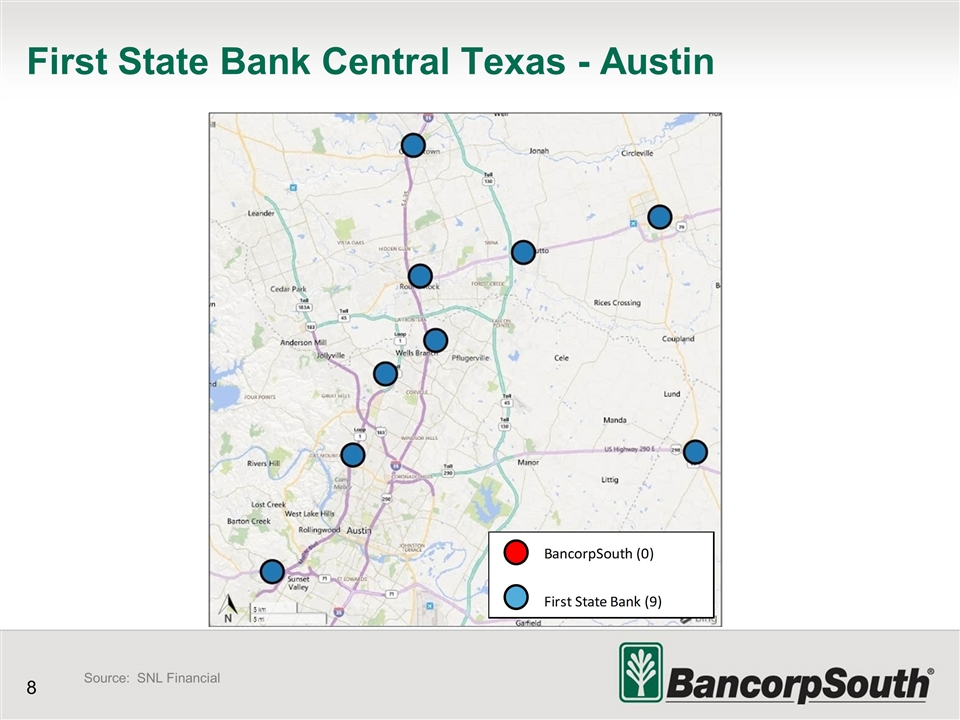

First State Bank Central Texas - Austin Source: SNL Financial

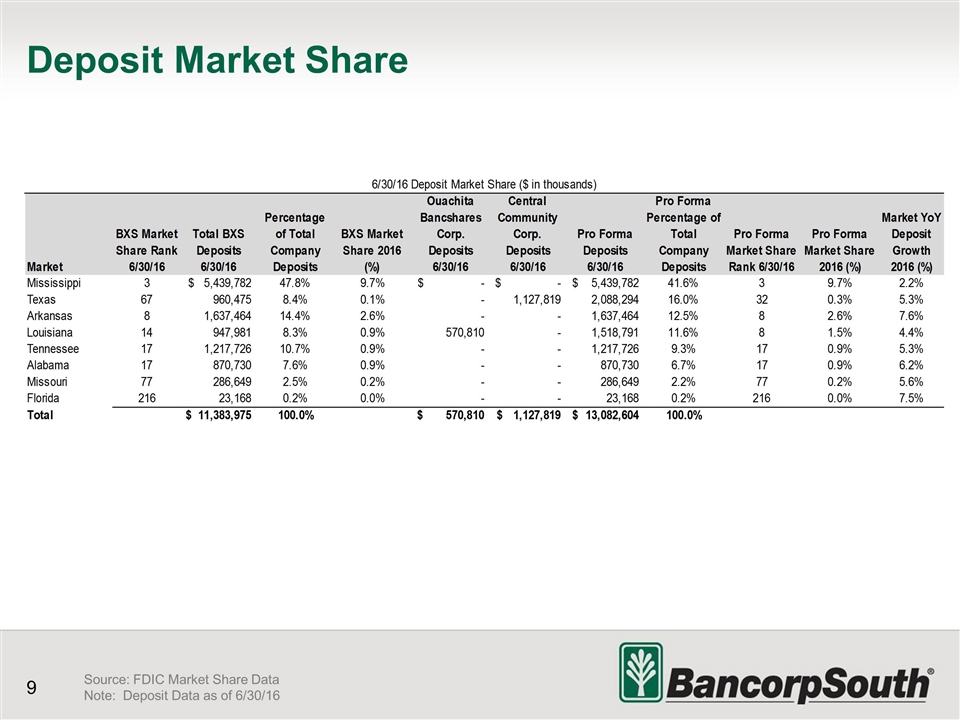

Deposit Market Share Source: FDIC Market Share Data Note: Deposit Data as of 6/30/16

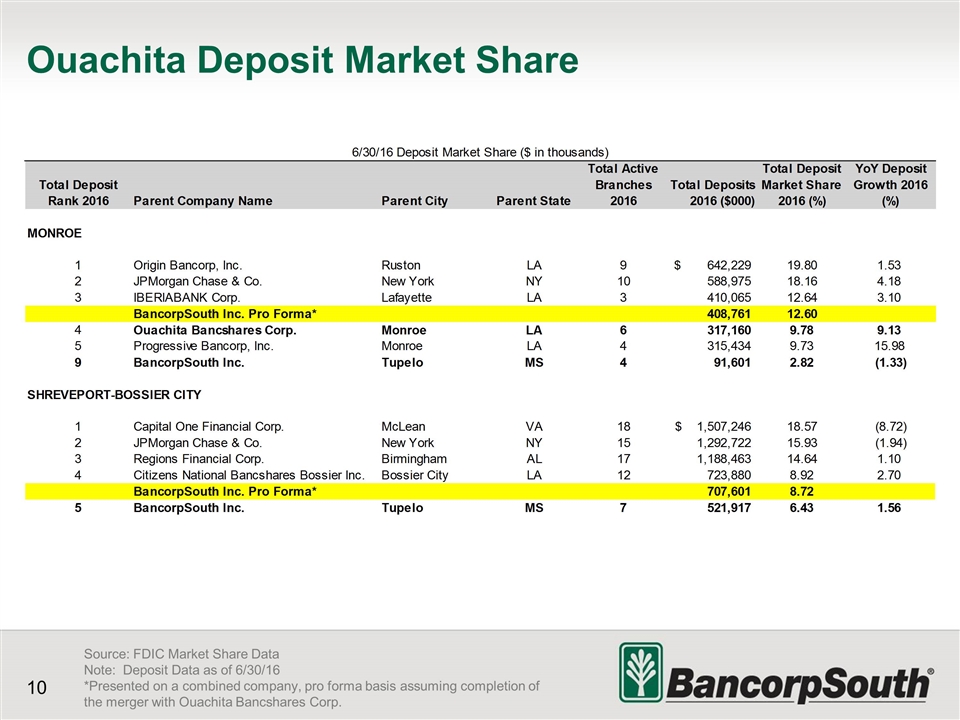

Ouachita Deposit Market Share Source: FDIC Market Share Data Note: Deposit Data as of 6/30/16 *Presented on a combined company, pro forma basis assuming completion of the merger with Ouachita Bancshares Corp.

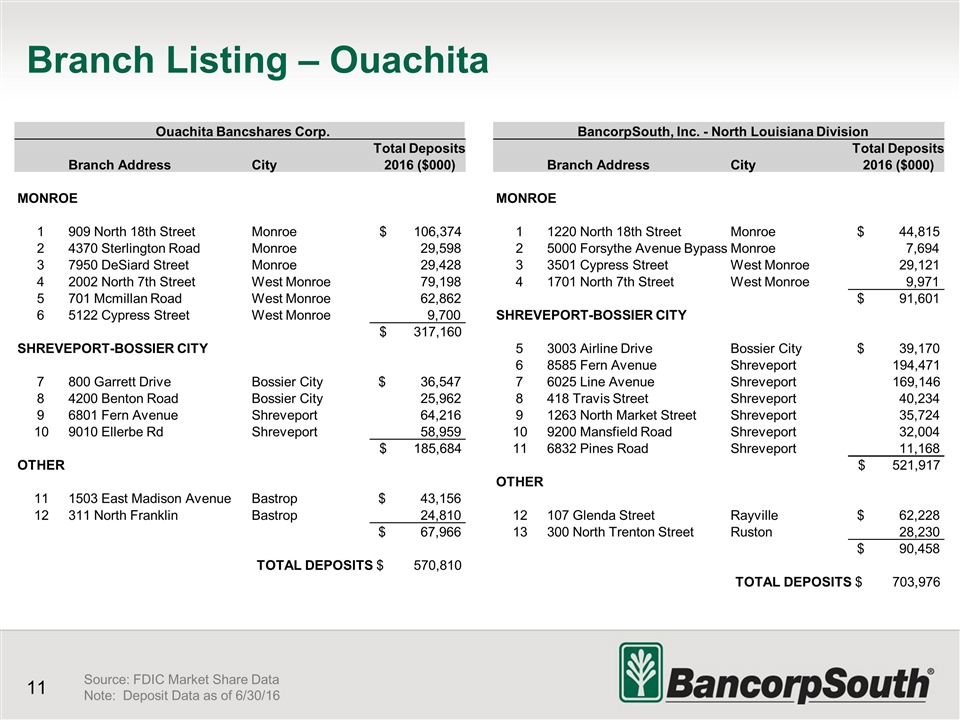

Branch Listing – Ouachita Source: FDIC Market Share Data Note: Deposit Data as of 6/30/16 Branch Address City Total Deposits 2016 ($000) Branch Address City Total Deposits 2016 ($000) 1 909 North 18th Street Monroe 106,374 $ 1 1220 North 18th Street Monroe 44,815 $ 2 4370 Sterlington Road Monroe 29,598 2 5000 Forsythe Avenue Bypass Monroe 7,694 3 7950 DeSiard Street Monroe 29,428 3 3501 Cypress Street West Monroe 29,121 4 2002 North 7th Street West Monroe 79,198 4 1701 North 7th Street West Monroe 9,971 5 701 Mcmillan Road West Monroe 62,862 91,601 $ 6 5122 Cypress Street West Monroe 9,700 317,160 $ 5 3003 Airline Drive Bossier City 39,170 $ 6 8585 Fern Avenue Shreveport 194,471 7 800 Garrett Drive Bossier City 36,547 $ 7 6025 Line Avenue Shreveport 169,146 8 4200 Benton Road Bossier City 25,962 8 418 Travis Street Shreveport 40,234 9 6801 Fern Avenue Shreveport 64,216 9 1263 North Market Street Shreveport 35,724 10 9010 Ellerbe Rd Shreveport 58,959 10 9200 Mansfield Road Shreveport 32,004 185,684 $ 11 6832 Pines Road Shreveport 11,168 521,917 $ 11 1503 East Madison Avenue Bastrop 43,156 $ 12 311 North Franklin Bastrop 24,810 12 107 Glenda Street Rayville 62,228 $ 67,966 $ 13 300 North Trenton Street Ruston 28,230 90,458 $ TOTAL DEPOSITS 570,810 $ TOTAL DEPOSITS 703,976 $ OTHER Ouachita Bancshares Corp. BancorpSouth, Inc. - North Louisiana Division MONROE SHREVEPORT-BOSSIER CITY OTHER MONROE SHREVEPORT-BOSSIER CITY

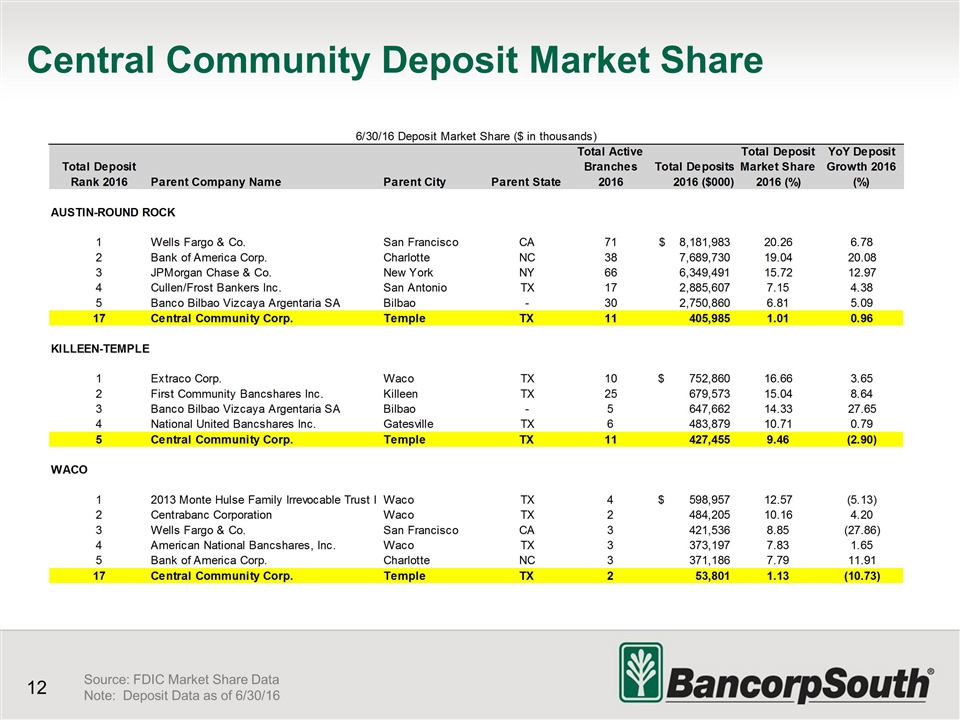

Central Community Deposit Market Share Source: FDIC Market Share Data Note: Deposit Data as of 6/30/16

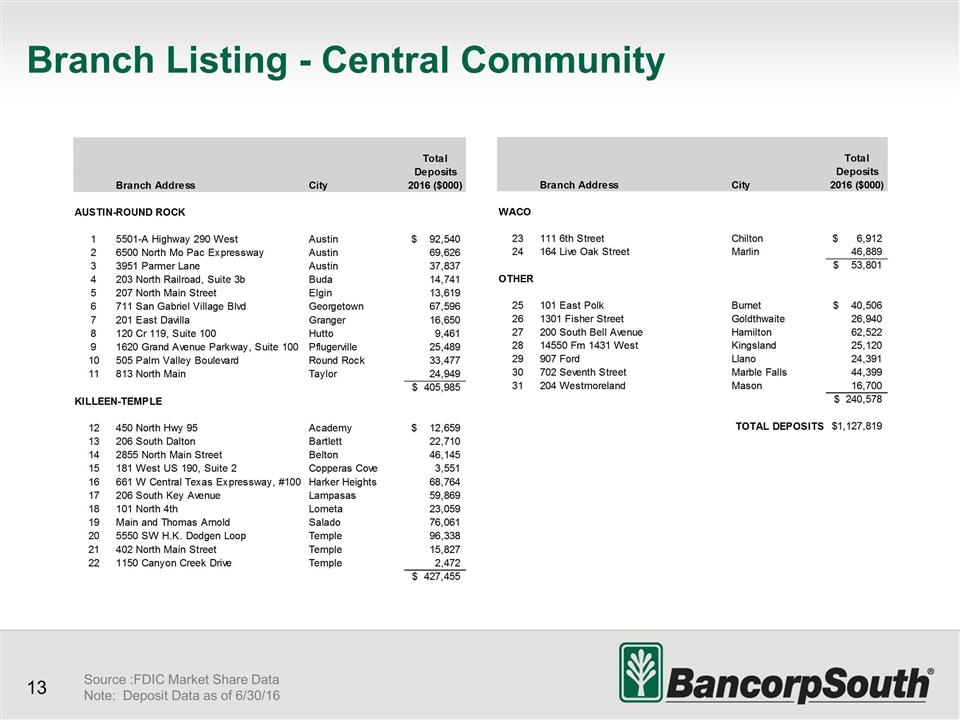

Branch Listing - Central Community Source :FDIC Market Share Data Note: Deposit Data as of 6/30/16

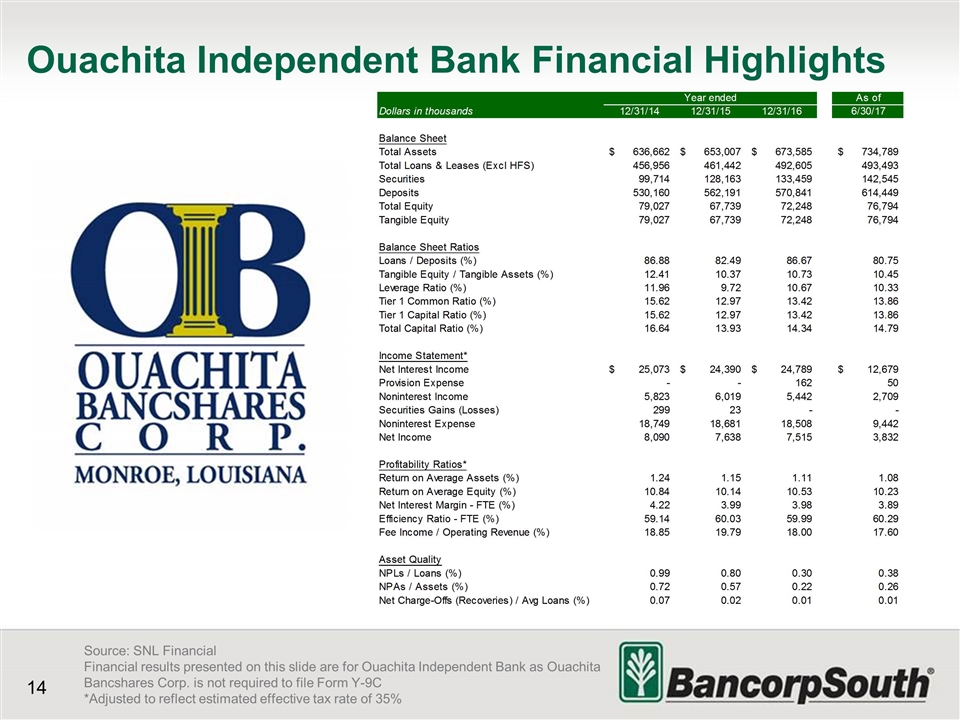

Ouachita Independent Bank Financial Highlights 4 Source: SNL Financial Financial results presented on this slide are for Ouachita Independent Bank as Ouachita Bancshares Corp. is not required to file Form Y-9C *Adjusted to reflect estimated effective tax rate of 35%

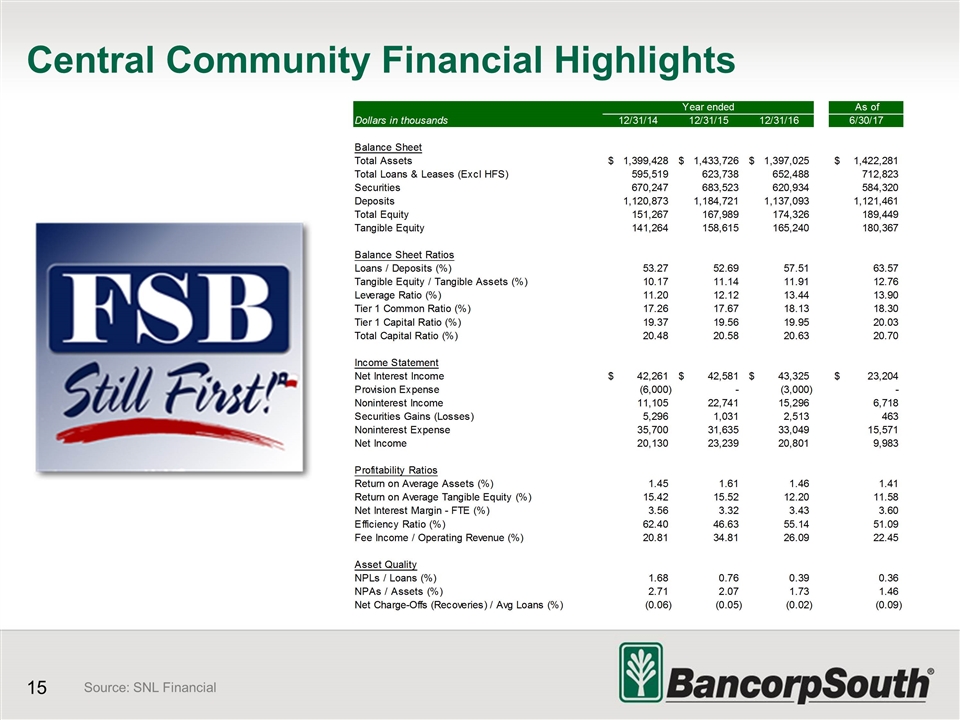

Central Community Financial Highlights Source: SNL Financial

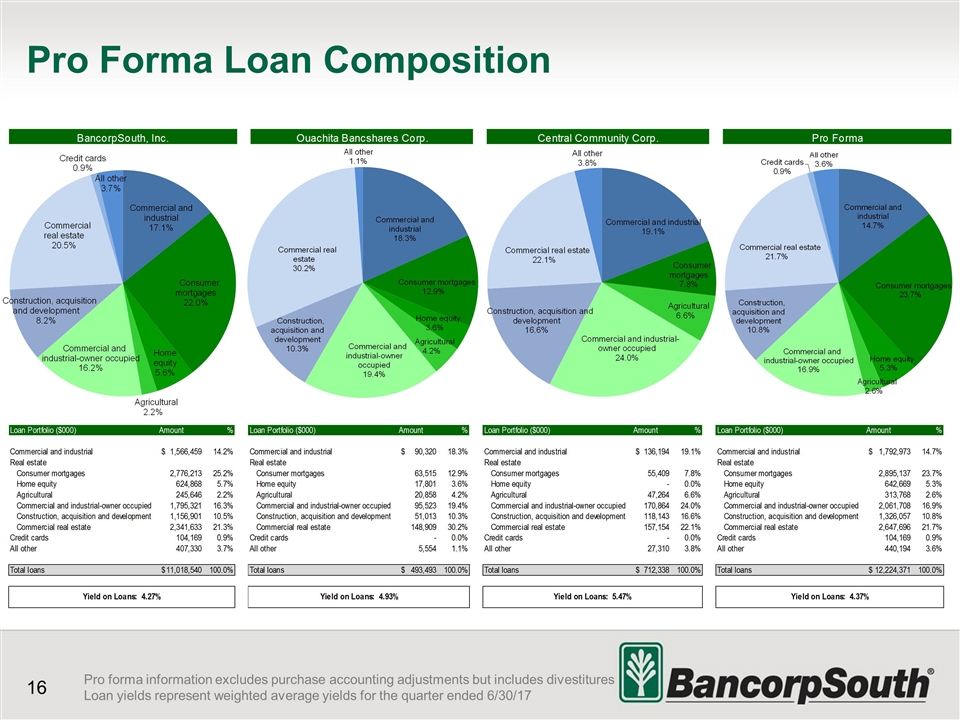

Pro Forma Loan Composition Pro forma information excludes purchase accounting adjustments but includes divestitures Loan yields represent weighted average yields for the quarter ended 6/30/17

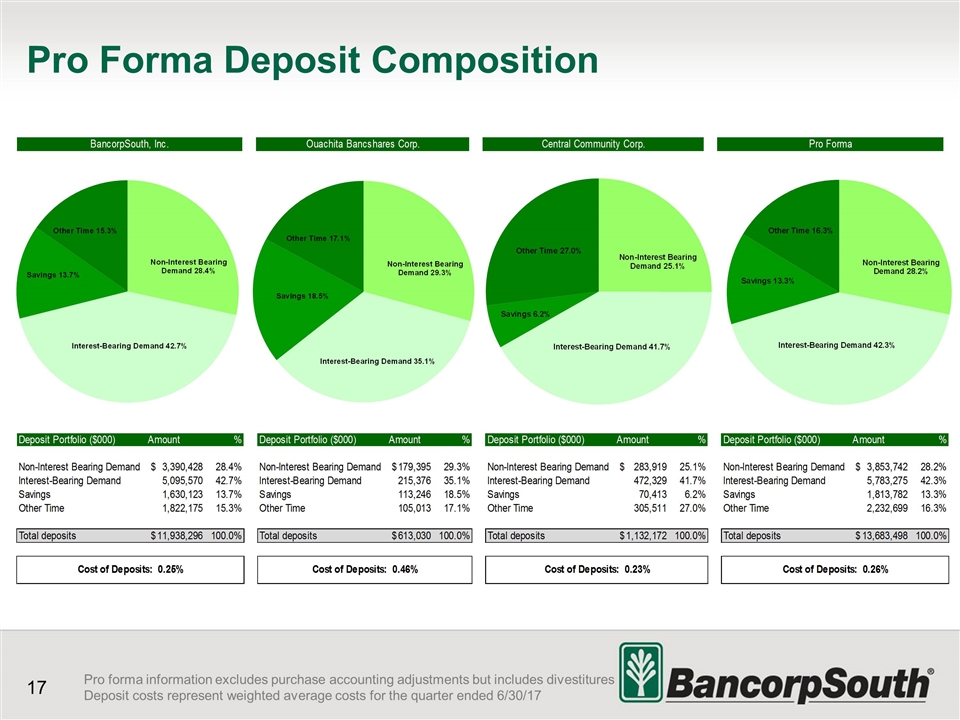

Pro Forma Deposit Composition Pro forma information excludes purchase accounting adjustments but includes divestitures Deposit costs represent weighted average costs for the quarter ended 6/30/17

*Reference to BancorpSouth’s website does not constitute incorporation by reference of the information contained on the website and is not, and should not, be deemed part of this presentation BancorpSouth’s common stock is listed on the New York Stock Exchange under the symbol BXS. Additional information can be found at www.bancorpsouth.investorroom.com.* Investor Inquiries: Will Fisackerly Director of Corporate Finance BancorpSouth, Inc. 662-680-2475 will.fisackerly@bxs.com