Attached files

| file | filename |

|---|---|

| EX-10.03 - EXHIBIT 10.03 COMMERCIAL VALUATION OF PROPERTIES - Homie Recipes, Inc. | f8k081617_ex10z03.htm |

| EX-10.02 - EXHIBIT 10.02 FARM LAND PURCHASE AGREEMENT - Homie Recipes, Inc. | f8k081617_ex10z02.htm |

| EX-10.01 - EXHIBIT 10.01 SHARE EXCHANGE AGREEMENT - Homie Recipes, Inc. | f8k081617_ex10z01.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 14, 2017

HOMIE RECIPES, INC.

(Exact name of registrant as specified in its charter)

Nevada |

|

| 333-331830 |

| 45-5589664 |

(State or other jurisdiction |

|

| (Commission File Number) |

| (IRS Employer |

of Incorporation) |

|

|

|

| Identification Number) |

|

|

|

Nikolaou Basiliadi 13 Greece, Pella Giannista 581000 Tel: +30 238-202-6939 |

|

|

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

112 North Curry Street

Carson City, NV 89703

Tel: (775) 321-8225

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Page 1 of 24

FORWARD LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this Current Report (“Report”), should be considered carefully in evaluating the Company. This Current Report (including without limitation the following factors that may affect operating results) contains forward-looking statements regarding us and our business, financial condition, results of operations and prospects. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Current Report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements. Forward-looking statements in this Report reflect the good-faith judgment of our management and those statements are based on facts and factors as currently know by our management.

Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed in this Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Report.

ITEM 1.01ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On August 14, 2017, Homie Recipes, Inc., a Nevada corporation (the “Company” or “HOMR”) entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with Stevva Ltd., a company duly formed under the laws of Greece (Corp#: 800867003) (“STVV”), and the sole-shareholder of STVV (the “STVV Shareholder”). Pursuant to the Share Exchange Agreement, the Company will acquire 100% of the issued and outstanding equity of STVV, from the STVV shareholder (the “STVV Shares”) and in exchange, the Company shall issue to STVV, upon Closing of the Share Exchange Agreement, an aggregate of Forty-Five Million (45,000,000) shares of Company stock (“HOMR SHARES”), and as result of the Share Exchange Agreement, STVV shall become a wholly-owned subsidiary of the Company. The Share Exchange Agreement contains customary representations and warranties. As of the date hereof, the closing conditions have been satisfied and the parties consider the Share Exchange Agreement closed (the “Closing Date”).

Further, the Share Exchange Agreement contains a post-closing condition such that the Company’s majority shareholder shall, within 5 days of the Closing Date of the Share Exchange Agreement, cause the cancellation of 39,000,980 shares of its restricted common stock currently beneficially owned by him and such stock shall be returned to the Company’s treasury.

The foregoing description of the Share Exchange Agreement is not complete and is qualified in its entirety by reference to the full text thereof, which is filed as Exhibit 10.01 to this Current Report on Form 8-K and incorporated by reference into this Item 1.01.

ITEM 2.01COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS

The information provided in Item 1.01 of this Current Report on Form 8-K related to the aforementioned Share Exchange Agreement is incorporated by reference into this Item 2.01. We have included the information that would be required if the registrant were filing a general form for registration of securities on Form 10, including a complete description of the business and operations of STVV such information can be found under Item 5.06 of this Current Report.

ITEM 3.02UNREGISTERED SALES OF EQUITY SECURITIES.

The information provided in Item 1.01 and 2.01 of this Report on Form 8-K related to the aforementioned Share Exchange Agreement is incorporated by reference into this Item 3.02. The Share Exchange Agreement is an exempt transaction pursuant to Section 4(2) of the Securities Act as the share issuance to the STVV Shareholders was a private transaction by the Company and did not involve any public offering.

Exemption from Registration. The shares of common stock to be issued, pursuant to the Share Exchange Agreement, shall be issued in reliance upon an exemption from registration afforded under Section 4(2) of the Securities Act for transactions by an issuer not involving a public offering, or Regulation D promulgated thereunder, or Regulation S for offers and sales of securities outside the United States. The Share Exchange is an exempt transaction pursuant to Section 4(2) of the Securities Act as the share exchange was a private transaction by the Company and did not involve any public offering. Additionally, we relied upon the exemption afforded by Rule 506 of Regulation D of the Securities Act which is a safe harbor for the private offering exemption of Section 4(2) of the Securities Act whereby an issuer may sell its securities to an unlimited number of accredited investors, as that term is defined in Rule 501 of Regulation D. Further, we relied upon the safe harbor provision of Rule 903 of Regulation S of the Securities Act which permits offers or sales of securities by the Company outside of the United States that are not made to “U.S. persons” or for the account or benefit of a “U.S. person”, as that term is defined in Rule 902 of Regulation S.

Page 2 of 24

ITEM 5.01CHANGES IN CONTROL OF REGISTRANT

The information provided in Item 1.01 of this Current Report on Form 8-K related to the aforementioned Share Exchange Agreement is incorporated by reference into this Item 5.01.

Immediately prior to the Closing Date of the Share Exchange, the total number of issued and outstanding shares of the Company’s Common Stock was 69,819,980. Concurrently with the Closing of the Share Exchange Agreement, and as a condition thereof, the Company’s current majority shareholder cancelled 39,000,980 shares of the Company’s Common Stock beneficially owned by him and such shares were returned to the Company’s treasury.

Accordingly, immediately after the Closing, and upon the issuance of the HOMR Shares, the Company has a total of 75,819,000 shares of common stock issued and outstanding, after giving effect to the issuances and cancellation of the Company’s Common Stock pursuant to the terms and conditions of the Share Exchange Agreement. As of the Closing, the STVV Shareholder is the beneficial owner of approximately 60.00% of the issued and outstanding shares of the Company’s Common Stock, and therefor gained control of the Company. The Share Exchange is being accounted for as a “reverse acquisition,” as the STVV Shareholder owns a majority of the outstanding shares of the Company’s capital stock immediately following the closing of the Share Exchange Agreement. The Board of Directors and management, after the Share Exchange Agreement, are comprised of STVV’s management team. Furthermore, the operations of STVV are the continuing operations of the Company, therefore, STVV is deemed to be the acquirer in the reverse acquisition.

As a result of the Share Exchange Agreement, the following changes to the Company’s directors and officers have occurred:

As of August 14, 2017, Jose Mari C. Chin resigned from all positions with the Company, including but not limited to those of President, Chief Executive Officer, Secretary and Director.

As of August 14, 20017, Theodoros Kerasidis was appointed a member of the Company’s Board of Directors and as the Company’s President, Chief Executive Officer, Chief Financial Officer and Secretary.

The biography for Mr. Kerasidis is set forth below:

Mr. Theodoros Kerasidis – Kerasidis has a Bachelor of Business Administration and prior to starting Stevva Ltd., was President of Agricultural Cooperative Stevia. As President he was responsible for the organization which was founded to promote stevia adoption by Greek and EU farmers. Kerasidis is a pioneer in EU stevia growing having founded one of the first ever commercial stevia plantations in Europe. Mr. Kerasidis is a seasoned agricultural executive, with over a decade of stevia and other perennial crop experience in the agricultural region of Greece as well as Eastern Africa; including;

1.March 2012 - present - President of Agricultural Association Stevia Pellas (description above);

2.October 2010 – September 2011 - Director of Advertising – MpeskaiEsy an online shopping outlet;

3.January 2007 – October 2010 - Agriculture Technician - Kerasidis Farms; is a small organization in the vegetables and melons farms industry.

ITEM 5.06CHANGE IN SHELL COMPANY STATUS

As a result of closing the Share Exchange Agreement, the Company is no longer a shell corporation as that term is defined in Rule 405 of the Securities Act and Rule 12b-2 of the Exchange Act.

FORM 10 DISCLOSURE

As disclosed elsewhere in this Report, we completed a Share Exchange Agreement with Stevva Ltd. Item 2.01(f) and 5.01(a)(8) of Form 8-K states that if the registrant was a shell company, as we were, immediately before the transaction disclosed under Item 2.01, then the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10 under the Exchange Act.

The financial information included in the Company’s Form 10-K for the year ended June 30, 2016, as filed with the SEC on July 31, 2017, and the Company’s Form 10-Q for the period ended March 31, 2017, as filed with the SEC on July 31, 2017 is hereby incorporated by this reference.

Page 3 of 24

FORM 10 DISCLOSURE

ITEM 1.BUSINESS

Our Corporate History and Background

Homie Recipes, Inc. was incorporated in the State of Nevada as a for-profit company on June 22, 2012 and established June 30 as its fiscal year end. Homie was founded with the intent to stream videos and written recipes through a website. Our goal was to stream free recipes for ‘special’ homemade cuisines and food items. We intend to have recipes that are personal and have special meaning, on our website. We planned on having an introductory segment for our videos, where a person will tell their story behind the recipe, explaining why they love it so much. As of the date hereof, we had been unable to raise additional funds to implement our operations. As a result of the current difficult economic environment and our lack of funding to implement our business plan, we have continuously analyzed strategic alternatives available to our Company to continue as a going concern.

Jose Mari C. Chin has been the Company’s sole officer and director from inception through the Closing of the Share Exchange Agreement with STVV. He has acted as the Company’s President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer and Director.

On August 14, 2017, Homie Recipes, Inc., Inc., a Nevada corporation (the “Company” or “HOMR”) entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with Stevva Ltd., a company duly formed under the laws of Greece (Corp#: 800867003) (“STVV”), and the sole-shareholder of STVV (the “STVV Shareholder”). Pursuant to the Share Exchange Agreement, the Company will acquire 100% of the issued and outstanding equity of STVV, from the STVV shareholder (the “STVV Shares”) and in exchange, the Company shall issue to STVV, upon Closing of the Share Exchange Agreement, an aggregate of Forty-Five Million (45,000,000) shares of Company stock (“HOMR SHARES”), and as result of the Share Exchange Agreement, STVV became a wholly-owned subsidiary of the Company.

Stevva Ltd. Acquisition

We believe that the acquisition of Stevva Ltd. will allow the Company to take a large step forward in an exciting new industry. Even though Stevva Ltd., is a newly formed business venture with no historical operations, the Company believes that this venture, being born out of years of experience and through diligent planning, gives the existing HOMR shareholders an opportunity to realize the initial goals and ambitions of the of the Company.

Stevva Ltd. is the owner of approximately 6 acres (or 23,928 square meters) of prime farmlands in Pella Giannitsa, Greece and the Company’s new business direction is grow and cultivate “Stevia” on these parcels.

Stevia is a low-carbohydrate, low-sugar food and beverage ingredient. The Stevia is of high quality and grown in ideal crop conditions in Giannitsa, Greece. Stevia seedlings and dried leaves of Stevia to refineries. Stevia has zero-calories and is 300 times sweeter than sugar. Diabetics and dieters ingest Stevia to reduce their sugar intake because of its zero-calorie content and because it is not metabolized by the body. The global market for non-sugar sweeteners is expected to reach $10 billion by the end of 2017.

As an initial step, the Company will focus on providing plants and education to nearby farmers who would like to grow stevia. The Company will initially assist them through the whole process and we will eventually assist them in selling the final plant/product to the companies mainly abroad. We intend to offer them our help, knowledge and experience to do so. Then, we will harvest it and sell it for those farmers and intend to sell the harvested product mainly abroad.

The full legal description of the owned parcels is as follows: (i) Field Number 115 located in the SAAK PENTAPLATANOU with a total area of 14,000 square meters; (ii) Field Number 117 located in the SAAK PENTAPLATANOU with a total area of 9,928 square meters. The total independent appraisal for the combined parcels is approximately $62,200.00. The Farm Land Purchase Agreement and the Independent Valuation of the parcels are attached to this Current Report as 10.02 and 10.03 respectively.

Page 4 of 24

Products – Stevia

Stevia leaf extracts are 300 times sweeter than sugar and one of the fastest growing food ingredients worldwide. Stevia is the only commercially viable, naturally derived, no calorie sweetener for global food and beverage applications. Stevia is currently considered as "green gold", a natural sweetener used to reduce sugar and synthetic sweeteners as aspartame or sucralose. Stevia is a calorie and carbohydrate free, natural sugar substitute with a zero-glycemic index. Made from the extract of the leaves from the plant species Stevia Rebaudiana, Stevia is a herb that is native to Central and South America where, it can be found growing in the wild as a small shrub. Stevia has been used as a natural sugar substitute and flavoring for hundreds of years.

The glycoside compounds that give Stevia its sweet taste, stevioside and rebaudioside, are up to 300 times as sweet assucrose.

Uses of Stevia

Stevia is widely a sweetener ingredient and additive in food and beverages worldwide. Some of its uses are:

Zero Calorie Sugar Substitute.

Sweetener in Beverage Production.

Sweetener as a Food and Confection Additive.

Preservative.

Health and Dietary Supplement.

Medicine.

Pharmaceutical Products.

Greece Advantages

Some strategic advantages of locating the Company in Greece are:

Excellent soil conditions for growing Stevia.

Stevia can be grown better in valleys, such as those in Pella.

Abundant and skilled labor in agricultural techniques.

Cost efficiencies due to labor and infrastructure.

Possibility to expand in other part of Greece.

Low cost access in Europe.

Unique Investment Opportunity.

The Strategic Location (Within Europe, borders with Eastern Countries etc.)

No minimum stay requirement.

Expand Use of Stevia in Greek gastronomy the past years.

2017 is a safer and steadier economic environment in Greece.

Page 5 of 24

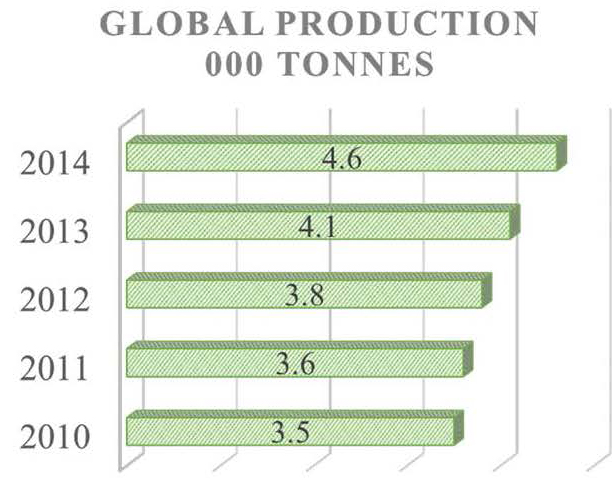

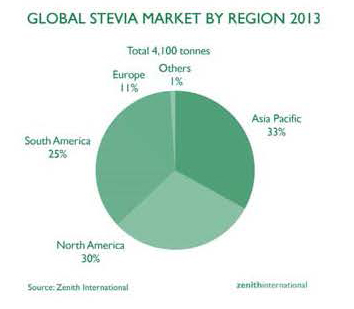

Stevia Market Size

Stevia has high sweetness and zero calories making it a desirable sweetener with a global demand. According to WHO estimates, Stevia has the potential to replace 20-30% of all dietary sweeteners in the coming years. According to the Global Markets for Non-Sugar Sweeteners, BBC Research, September 2015:

The global market for non-sugar sweeteners is expected to rise at a compound annual growth rate of 1.1% and reach nearly $10 billion by 2016.

The North American market is 60% of the global market and estimated to reach nearly $6 billion in 2016.

The European market represents the second largest market category with the expected sale of nearly $2 billion in 2016.

Both the food processing industry and consumers are looking for a viable sweetening option such as Stevia. Although sugar (sucrose) has dominated the sweetening market, its importance is getting reduced due to the soaring rates of and consumer demand for healthier alternatives to sugar. The United States and Japan are the leading economies of world with a 60% share in global Stevia consumption. China is the world leader in production and extraction of Stevia leaves with an 80% share. Stevia made a large impact within the $8 billion high intensity sweetener category, overtaking Aspartame within its first year of launch. The potential market for Stevia has expanded to the entire sweetener market and across all food & beverage categories. Stevia is gradually replacing artificial sweeteners.

Business Model

We intend to work closely with an R&D team to ensure that the cultivation process and our product set new benchmarks in the Stevia market. The Company will grow the Stevia seedlings into mature plants when they are harvested, dried and packaged to be sent to a major refinery. Although, we do not have any material contract with a refinery, discussions are under way and we expect such a deal to be finalized shortly. We have done extensive research in various forms so as to achieve the best performance based on weather conditions in Greece. After 5 years of continuous efforts we have achieved the optimal results of production and plant quality that exists today.

Stevia Plantation

Stevva’s mission is the introduction of a new agricultural production in Greece with the highest quality of plants at farming areas eager to adapt new plants for a higher performance yield and with a secured future sale of their production.

Page 6 of 24

Executive Management

Mr. Theodore Kerasidis - Kerasidis has a Bachelor of Business Administration and prior to starting Stevva Ltd., was President of Agricultural Cooperative Stevia. As President he was responsible for the organization which was founded to promote stevia adoption by Greek and EU farmers. Kerasidis is a pioneer in EU stevia growing having founded one of the first ever commercial stevia plantations in Europe. Mr. Kerasidis is a seasoned agricultural executive, with over a decade of stevia and other perennial crop experience in the agricultural region of Greece as well as Eastern Africa; including;

1. March 2012 - present - President of Agricultural Association Stevia Pellas (description above);

2. October 2010 – September 2011 - Director of Advertising – MpeskaiEsy an online shopping outlet;

3. January 2007 – October 2010 - Agriculture Technician - Kerasidis Farms; is a small organization in the vegetables and melons farms industry.

Non-Executive Management

Mr. Bruce Irambona - Mr Bruce Irambona has a 10-year experience of agricultural management in East Africa and has managed Stevia operations since 2011, Graduate of the National University of Rwanda Engineering degree in agriculture economics and agribusiness.

Mr. Chris Kalenderis - Mr. Chris Kalenderis .Highly skilled in practical farm operations including plowing, planting, Irrigating and fertilizing .Experience in using service equipment such as tractors and milking machines. Over five years of dedicated experience working in a farmhouse.

Ms. Rachel Kerasidou - Ms. Rachel Kerasidou is a well-rounded professional who has solid background and experience in the field of research and development pertaining to crop growth and the factors that affect that dictate their mortality and development rate such as climate conditions, soil, temperature, humidity, etc. ; an expert in the study of forest conservation and emission avoidance, reduction, and mitigation. She has received a bachelor degree in Agricultural sciences from the University of Kalamata.

Mr. Panos Basileiadis – Mr. Basileisdis is senior executive with a high degree of commercial insight and business acumen. Extensive multi-industry global experience gained with a number of world-class multinationals. Ability to deliver in a challenging operational environment.

Mr. Gregory Mazetsis – Mr. Mazetsis A highly efficient, hardworking and talented design engineer with a comprehensive understanding of 12 design processes and also manufacturing and construction methods. Experienced in all the design stages of a product, including research, development and manufacture right through installation and final commissioning.

Environmental Profile

The Company will follow the environmental lead provided by major worldwide distributors with the mission to lower the carbon footprint of Stevia cultivation. All farming done by Stevva is at the highest standards of sustainability.

What is Stevia?

In its natural form, Stevia Rebaudiana is a leafy green plant found in Paraguay and Brazil. The glycosides in its leaves, including up to 10% Stevioside, account for its incredible sweetness, making it unique among the nearly 300 species of Stevia plants. It has been used in those regions for hundreds of years as a sweetener and also as a treatment for burns, colic and stomach problems. Stevia is intensely sweet, has zero calories and has a glycemic index value of 0 which makes it ideal for diabetics compared to other mainstream sweeteners such as sugar that has a Glycemic index value of 80. The Stevia plant contains several sweet-tasting compounds known as steviol glycosides, which have been estimated to be 300 times as sweet as sugar.

The Stevia plant (Stevia Rebaudiana), belongs to the Compositae (sunflower family of plants) and is one of only two of the approximately 300 members of the genus Stevia producing sweet steviol glycosides. Originating in the South American wild, it could be found growing in semi-arid habitat ranging from grassland to scrub forest to mountain terrain. The plant made its way to Pacific Rim countries where in recent decades it became cultivated domestically, used in its raw leaf form and now is commercially processed into sweetener.

Page 7 of 24

Stevia has a long history of use as a sweetener, due to the presence of sweet crystalline glycosides called Stevioside and Rebaudioside A which are 300 times sweeter than sucrose. Stevioside and Rebaudioside A are non-caloric, non-fermentable, non-discoloring, heat stable at 95°C and have a lengthy shelf life. The product can be added to cooked/baked goods or processed foods and beverages. In the Pacific Rim countries, Korea, Japan and China, Stevia is regularly used in preparation of food and pharmaceutical products.

Cultivation Methods

The Company grows Stevia in Giannitsa, Greece. The climate and soil conditions in this area are perfect for cultivating this sweet plant. Stevia is grown best in environments with long days of sunshine. It is native to semi-humid, sub-tropical climates where temperatures typically range from -6°C to 43°C. While tolerant of mild frost, hard frosts will kill the roots of the plant. It is a perennial plant that can be harvested several times a year if grown in an optimal environment such as Rwanda.

Stevia producers use conventional breeding techniques to increase the sweet compounds found in the leaves of the plant. Stevia plants are not genetically modified organisms (non-GMO). Stevia farming provides a profitable crop for thousands of independent farmers of varying scales in Asia, South America, and Africa. Stevia is not replacing food crops, but is being cultivated as a cash crop on smaller plots of farmlands in addition to food crops for added income.

Time of harvesting depends on variety and the growing season. Generally, harvesting occurs twice, in mid to late October when plants are 40-60 cm in height and in July. Optimum yield (biomass), and stevioside quality and quantity are best just prior to flowering.

Irrigation is to be considered as complementary to rain. Since rainfall can't be guaranteed, irrigation is needed in the critical periods such as the implantation period, after harvest and during high temperature peaks. The three most common types of irrigation are: (i) by pivots, if you have plenty of water; (ii) with sprinklers, in a relatively small area; or (ii) by dripping, if water quantity is a problem. An adequate water supply will avoid stress in the plants, which will result in less diseases and better biomass production.

The geographical location will determine the months of the year in which the seedlings can be brought to the field. There are two alternatives for planting the seedling: with bare root or coming from a tray with the corresponding root ball. If done with a machine, 3 – 4 people are needed to achieve 1 hectare per day. Drying of the woody stems and soft green leaf material is completed immediately after harvesting utilizing a drying wagon or a kiln. Depending on weather conditions and density of loading, it generally takes 24 to 48 hours to dry Stevia at 40°C to 50°C. An estimated 21,500 kg/ha of green weight is dried down to 6,000 kg/ha of dry weight.

Packaging

Dry leaves are stored in plastic lined cardboard boxes, sealed, strapped and labeled for further processing. Once Stevia leaves are picked, separated from their stems and dried on the farm, they are shipped to a refinery. After being refined, the final product is distributed to major food and beverage companies.

Greece Overview

The municipal unit Giannitsa has an area of 208.105 km2. Its population is 31,983 people (2011 census). It includes a few outlying villages (Mesiano, Melissi, Pentaplatanos, Archontiko, Ampelies and Damiano). The municipality Pella as a whole includes many villages and has 63,122 inhabitants. The city is located in the center of Macedonia between Mount Paiko and the plain of Giannitsa, and is the economic, commercial and industrial center of the Pella regional unit. European route E86 (Greek National Road 2) runs along the south of the city. The former shallow, swampy, and variable-sized Giannitsa Lake or Loudias Lake, fed by the Loudias River and south of the city, was drained in 1928-1932 by the New York Foundation Company. Greece, as member of European Union, can take advantage of the free trade policy by which the European Economic Area (EEA) and Turkey, have the right to export and import goods freely. This means that governments may not limit quantities of imports/exports nor restrict trade in any other way.

Future Plans and Projects

In addition to increasing its production of Stevia, the Company plans to broaden its scope and market reach by introducing other crops that are in high demand for additional profit growth and risk mitigation purposes such as quinoa and chia seeds. Furthermore, we would ideally like to make a training center for the cultivation and production of stevia for the farmers who want to know how it is done. Such seminars do not exist in Greece. And further in future we would like to be those who will convert the dry leaves into the final product that can be directly sold to major worldwide companies for use.

Page 8 of 24

Stevia Market

According to WHO estimates, Stevia has the potential to replace 20-30% of all dietary sweeteners in the coming years.

Source: Zenith International

The United States and Japan are the leading economies of world with 60% share in global Stevia consumption while China with 80% share is the world leader in production and extraction of Stevia leaves. The rise in global Stevia products crossed the 150% mark in the beginning of this decade and is going to expand with recent EU clearings on low-sugar products. Stevia is gradually replacing sweetening agents in the Food & Beverage Industry. The widespread rollout of products containing Stevia resulted in a massive 400% increase in launches globally between 2008-2012 and 158% between 2011-12. As rising levels of obesity and diabetes continue to generate headlines, there has never been so much emphasis on reducing caloric intake as well as consuming healthier foods and beverages.

While people in Japan and South America have used Stevia as a sweetener for decades, Zenith International pointed to 2008 as a turning point for Stevia’s increase in global use. That year the U.S. Food and Drug Administration said it had no objection to the Generally Recognized as Safe (GRAS) status of Rebaudioside A, a steviol glycoside within the Stevia leaf, as an ingredient in foods and beverages. Regulatory approval in other parts of the world followed, including the European Union in 2011.

Page 9 of 24

Marketing Plan

The Company intends to sell its production yield large manufactures of Stevia, who in turn sell to major name brand clients. Once we secure a contract with a major buyer whereby they will purchases our entire crop, there is little need for the expense of a strenuous marketing plan. However, the Company will set up basic marketing materials in order to inform its stakeholders and industry participants of the ongoing progress and activities of the Company.

Marketing Objective

The Company plans to undertake a scaled down marketing strategy and develop a website for the dissemination of Company news and reports of the results of its activities and other information to stakeholders and industry participants.

Strategy

We intend to become a dedicated business to business product provider. The Company’s core strategy is to provide Stevia to distributors, wholesalers, and refiners in the food and beverage ingredient industry. The Company will highlight the following:

Quality.

Price.

Availability.

Working with the community in Greece/ providing employment in Greece.

Working for the economic development of Greece.

Trade Shows

In order to broaden market reach and industry contacts, management will attend key industry trade shows in North America and Europe. It is estimated that the company will attend at least 4 events annually.

Industry Associations – The Company plans to join business associations focused on the Stevia industry including:

Global Stevia Institute (GSI) - GSI was launched in June 2010, as an educational resource for scientists, health professionals, food and beverage manufacturers, public affairs leaders, and consumers. Since then, the GSI has worked internationally to educate about Stevia. The GSI provides information in multiple languages, including Spanish, French, German, Portuguese and Chinese. The GSI also organizes educational events for scientists, health professionals, and other influencers at international, regional and national forums.

International Stevia Council - The International Stevia Council is a global trade association representing the interests of companies that process, manufacture and/or market Stevia sweetener products. The International Stevia Council is a 501(c)(6) not-for-profit organization incorporated under the law of the State of Delaware in the United States (US). The Council has been created in July 2010 by eleven founding members.

Employees

We currently have 7 full-time employees.

ITEM 1A.RISK FACTORS

You should carefully consider each of the risks and uncertainties described below and elsewhere in this Current Report on Form 8-K, as well as any amendments or updates reflected in subsequent filings with the SEC. We believe these risks and uncertainties, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results and could materially and adversely affect our business operations, results of operations, financial condition and liquidity. Further, additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our results and business operations.

Page 10 of 24

Risks Associated with Our Business

We face intense competition which could prohibit us from developing a customer base and generating revenue.

The industries within which we compete, including the sweetener industry is highly competitive with companies that have greater capital resources, facilities and diversity of product lines. Additionally, if demand for stevia continues to grow, we expect many new competitors to enter the market as there are no significant barriers to stevia production. More established agricultural companies with much greater financial resources which do not currently compete with us may be able to easily adapt their existing operations to production of stevia. Due to this competition, there is no assurance that we will not encounter difficulties in obtaining revenues and market share or in the positioning of our services or that competition in the industry will not lead to reduced prices for the stevia leaf. Our competitors may also introduce new non-stevia based low-calorie sweeteners or be successful in developing a fermentation-derived stevia ingredient or other alternative production method which could also increase competition and decrease demand for stevia-based products.

We will produce products for consumption by consumers that may expose us to litigation based on consumer claims and product liability.

The stevia produced at our farms will be integrated into stevia-based products which will be consumed by the general public. Additionally, we may manufacture and sell private label stevia-based food products. Even though we intend to grow and sell products that are safe, we have potential product risk from the consuming public. We could be party to litigation based on consumer claims, product liability or otherwise that could result in significant liability for us and adversely affect our financial condition and operations.

If our services do not gain acceptance among stevia growers our future growth and development may suffer.

Our business model relies on the assumption that we will be able to develop methods and protocols, secure valuable plant strains for stevia farming that will be attractive to both stevia growers and manufacturers. If our methods and protocols do not gain acceptance among growers or manufacturers our business will suffer. A number of factors may affect the market acceptance of our products and services, including, among others, the perception by growers of the effectiveness of our methods and protocols, the perception among manufacturers of the quality of stevia produced and our ability to fund marketing efforts, and the effectiveness of such marketing efforts. If such products and services do not gain acceptance by growers and/or manufacturers, we may not be able to fund future operations, including the expansion of our own farming projects and development and/or acquisition of additional intellectual property, which inability would have a material adverse effect on our business, financial condition and operating results.

Any failure to adequately establish a network of growers and manufacturers will impede our growth.

We expect to be substantially dependent on manufacturers to purchase the stevia produced both at our own farms and at those of our customers. The relationship with this manufacturer and its perception of the stevia produced using our farm management services will determine its willingness to enter into purchase contracts with us and our customers on attractive terms. Our ability to secure such contracts will influence our attractiveness to growers who are potentially interested in partnering with us. Achieving significant growth in revenue will depend, in large part, on our success in establishing this production network. If we are unable to develop an efficient production network, it will make our growth more difficult and our business could suffer.

If we are unable to deliver a consistent, high quality stevia leaf at sufficient volumes, our relationship with our manufacturers may suffer and our operating results will be adversely affected.

Manufacturers will expect us to be able to consistently deliver stevia at sufficient volumes, while meeting their established quality standards. If we are unable to consistently deliver such volumes either from our own farms, or those of our grower partners, our relationship with these manufacturers could be adversely affected which could have a negative impact on our operating results.

Changes in consumer preferences or negative publicity or rumors may reduce demand for our products.

Recent data suggests consumers are adopting stevia as a sweetener in many products. However, stevia is a relatively new ingredient in consumer products and many consumers are not familiar with it. Therefore, any negative reports or rumors regarding either the taste or perceived health effects of stevia, whether true or not, could have a severe impact on the demand for stevia-based products. Manufacturers may decide to rely on alternative sweeteners which have a more established history with consumers. Primarily operating at the grower level, we will have little opportunity to influence these perceptions and there can be no assurance that the increased adoption of stevia in consumer food and beverage products will continue. Additionally, new sweeteners with similar characteristics to stevia may emerge which could be cheaper to produce or be perceived to have other qualities superior to stevia. Any of these factors could adversely affect our ability to produce revenues and our business, financial condition and results of operations would suffer.

Page 11 of 24

If we fail to attract and retain key personnel, our business may suffer.

Given the nature of which our business is based, our future success is dependent, in large part, upon our ability to attract and retain highly qualified managerial, technical and sales personnel. If we lose the services of either of our executive officers, our financial condition and results of operations could be materially and adversely affected. Our success also depends upon our ability to identify, hire and retain other highly skilled technical, managerial, editorial, sales, marketing and other professionals. Competition for such personnel is intense. We cannot be certain of our ability to identify, hire and retain adequately qualified personnel. Failure to identify, hire and retain necessary key personnel could have a material adverse effect on our business and results of operations.

Our directors and named executive officers are also our principal stockholders, as such they will be able to exert significant influence over matters submitted to stockholders for approval, which could delay or prevent a change in corporate control or result in the entrenchment of management or the Board of Directors, possibly conflicting with the interests of other stockholders.

Our directors and named executive officers are also our principal stockholders as such they exert significant influence in determining the outcome of corporate actions requiring stockholder approval and otherwise control of our business. This control could have the effect of delaying or preventing a change in control or entrenching management or the Board of Directors, which could conflict with the interests of our other stockholders and, consequently, could adversely affect the market price of our common stock.

Business disruptions could affect our operating results

A significant portion of our development activities and certain other critical business operations are concentrated in a few geographic areas. A major earthquake, fire or other catastrophic event that results in the destruction or disruption of any of our critical facilities could severely affect our ability to conduct normal business operations and, as a result, our future financial results could be materially and adversely affected.

We have a “going concern” opinion from our auditors, indicating the possibility that we may not be able to continue to operate.

Our independent registered public accountants have expressed substantial doubt about our ability to continue as a going concern. The “going concern” opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital, our ability to continue our operations will be significantly impaired. As a result we may have to liquidate our business and investors may lose their investments. Investors should consider our independent registered public accountant’s comments when deciding whether to invest in the Company.

Risks Relating to Ownership of Our Securities

Our stock price may be volatile, which may result in losses to our shareholders.

The stock markets have experienced significant price and trading volume fluctuations, and the market prices of companies listed on the OTCMarkets quotation system in which shares of our common stock are listed, have been volatile in the past and have experienced sharp share price and trading volume changes. The trading price of our common stock is likely to be volatile and could fluctuate widely in response to many factors, including the following, some of which are beyond our control:

variations in our operating results;

changes in expectations of our future financial performance, including financial estimates by securities analysts and investors;

changes in operating and stock price performance of other companies in our industry;

additions or departures of key personnel; and

future sales of our common stock.

Domestic and international stock markets often experience significant price and volume fluctuations. These fluctuations, as well as general economic and political conditions unrelated to our performance, may adversely affect the price of our common stock.

Our common shares may become thinly traded and you may be unable to sell at or near ask prices, or at all.

We cannot predict the extent to which an active public market for trading our common stock will be sustained. Although the trading price of our common shares increased significantly recently, it has historically been sporadically or “thinly-traded” meaning that the number of persons interested in purchasing our common shares at or near bid prices at certain given time may be relatively small or non-existent.

Page 12 of 24

This situation is attributable to a number of factors, including the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community who generate or influence sales volume. Even if we came to the attention of such persons, those persons tend to be risk-averse and may be reluctant to follow, purchase, or recommend the purchase of shares of an unproven company such as ours until such time as we become more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels will be sustained.

The market price for our common stock is particularly volatile given our status as a relatively small company, which could lead to wide fluctuations in our share price. You may be unable to sell your common stock at or above your purchase price if at all, which may result in substantial losses to you.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market, management will strive within the confines of practical limitations to prevent the described patterns from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility of our share price.

We do not anticipate paying any cash dividends to our common shareholders.

We presently do not anticipate that we will pay dividends on any of our common stock in the foreseeable future. If payment of dividends does occur at some point in the future, it would be contingent upon our revenues and earnings, if any, capital requirements, and general financial condition. The payment of any common stock dividends will be within the discretion of our Board of Directors. We presently intend to retain all earnings after paying the interest for the preferred stock, if any, to implement our business plan; accordingly, we do not anticipate the declaration of any dividends for common stock in the foreseeable future.

Volatility in our common share price may subject us to securities litigation.

The market for our common stock is characterized by significant price volatility as compared to seasoned issuers, and we expect that our share price will continue to be more volatile than a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation. Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

The elimination of monetary liability against our directors, officers and employees under Nevada law and the existence of indemnification rights of our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against our directors, officers and employees.

Our Articles of Incorporation contains a specific provision that eliminates the liability of our directors and officers for monetary damages to our company and shareholders. Further, we are prepared to give such indemnification to our directors and officers to the extent provided for by Nevada law. We may also have contractual indemnification obligations under our employment agreements with our officers. The foregoing indemnification obligations could result in our company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our company and shareholders.

Page 13 of 24

Our business is subject to changing regulations related to corporate governance and public disclosure that have increased both our costs and the risk of noncompliance.

Because our common stock is publicly traded, we are subject to certain rules and regulations of federal, state and financial market exchange entities charged with the protection of investors and the oversight of companies whose securities are publicly traded. These entities, including the Public Company Accounting Oversight Board, the SEC and FINRA, have issued requirements and regulations and continue to develop additional regulations and requirements in response to corporate scandals and laws enacted by Congress, most notably the Sarbanes-Oxley Act of 2002. Our efforts to comply with these regulations have resulted in, and are likely to continue resulting in, increased general and administrative expenses and diversion of management time and attention from revenue-generating activities to compliance activities. Because new and modified laws, regulations and standards are subject to varying interpretations in many cases due to their lack of specificity, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing revisions to our disclosure and governance practices.

ITEM 2.FINANCIAL INFORMATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

This discussion summarizes the significant factors affecting the operating results, financial condition, liquidity and cash flows of the Company for the fiscal year ended June 30, 2016. The discussion and analysis that follows should be read together with our consolidated financial statements and the notes to the consolidated financial statements included elsewhere in this Annual Report on Form 10-K. Except for historical information, the matters discussed in this section are forward looking statements that involve risks and uncertainties and are based upon judgments concerning various factors that are beyond the Company’s control. Consequently, and because forward-looking statements are inherently subject to risks and uncertainties, the actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. You are urged to carefully review and consider the various disclosures made by us in this report.

Critical Accounting Policies and Estimates

Use of Estimates and Assumptions

Preparation of the financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Income Taxes

An asset and liability approach is used for financial accounting and reporting for income taxes. Deferred income taxes arise from temporary differences between income tax and financial reporting and principally relate to recognition of revenue and expenses in different periods for financial and tax accounting purposes and are measured using currently enacted tax rates and laws. In addition, a deferred tax asset can be generated by net operating loss carryforwards (“NOLs”). If it is more likely than not that some portion or all of a deferred tax asset will not be realized, a valuation allowance is recognized.

Recently Issued Accounting Pronouncements

In August 2014, the Financial Accounting Standards Board issued Accounting Standards Update 2014-15, Presentation of Financial Statements- Going Concern. The Update provides U.S. GAAP guidance on management’s responsibility in evaluating whether there is substantial doubt about a company’s ability to continue as a going concern and about related footnote disclosures. For each reporting period, management will be required to evaluate whether there are conditions or events that raise substantial doubt about a company’s ability to continue as a going concern within one year from the date the financial statements are issued. The amendments in this Update are effective for the annual period ending after December 15, 2016, and for annual periods and interim periods thereafter. The Company is currently evaluating the effects of ASU 2014-15 on the consolidated financial statements

Results of Operations

Fiscal Years Ended June 30, 2016 and 2015

During the fiscal year ended June 30, 2016, we had no revenues and expenses totaled $20,079 made up of $20,079 in professional fees. During the fiscal year ended June 30, 2015, we had no revenues and expenses totaled $40,343, made up of $40,343 in professional fees. In 2015, we incurred more professional expense because of a potential business combination proposal.

Page 14 of 24

Liquidity and Capital Resources

As of June 30, 2016, current assets were $0 and current liabilities were $181,988. Our working capital deficit as of June 30, 2016 was $181,988. As of June 30, 2015, current assets were $0 and current liabilities were $159,909. Our working capital deficit as of June 30, 2015 was $159,909.

Net cash used in operating activities for the fiscal year ended June 30, 2016 was $14,823 as compared to $57,060 for the fiscal year ended June 30, 2015. Net cash provided by financing activities for the fiscal year ended June 30, 2016 was $14,823 as compared to $57,060 for the fiscal year ended June 30, 2015.

On October 15, 2012, a Registration Statement on Form S-1 was declared effective by the SEC, registering 4,000,000 shares of our common stock. We raised $5,250 by sale of our common stock and such offering has been completed.

The Company is evaluating other business opportunities and has access to sufficient funds to complete these evaluations and will announce funding requirements once a decision is reached. These funding requirements will include funds required to execute on our business strategy, including additional working capital commensurate with the operational needs of planned marketing, development and production efforts. We anticipate that we will be able to raise sufficient amounts of working capital through debt or equity offerings as may be required to meet our short-term and long-term obligations. However, changes in operating plans, increased expenses, acquisitions, or other events, may cause us to seek additional equity or debt financing in the future.

We have generated no revenue and therefore we may not be able to produce adequate cash flows to support our existing operations. Moreover, the historical and existing capital structure is not adequate to fund our planned growth. We intend to finance our operations in part by issuing additional common stock, warrants and through bridge financing. There can be no assurance that we will be successful in procuring the financing we are seeking. Additionally, there can be no assurance that operations and other capital resources will provide cash in sufficient amounts to maintain planned or future levels of capital expenditures. To meet future objectives, we will need to meet revenue targets and sell additional equity and debt securities, which most likely will result in dilution to current stockholders. We may also seek additional loans where the incurrence of indebtedness would result in increased debt service obligations and could require the Company to agree to operating and financial covenants that would restrict our operations.

Financing may not be available in amounts or on terms acceptable to us, if at all. Any failure by us to raise additional funds on terms favorable to us, or at all, could limit our ability to expand business operations and could harm our overall business prospects. In addition, we cannot be assured of profitability in the future.

Off-Balance Sheet Arrangements

We have not entered into any other financial guarantees or other commitments to guarantee the payment obligations of any third parties. We have not entered into any derivative contracts that are indexed to our shares and classified as shareholder’s equity or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. We do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

Trends

We are unaware of any known trends, events or uncertainties that have had, or are reasonably likely to have, a material impact on our business or income, either in the long term of short term, other than as described in this section or in “Risk Factors”.

Changes in and Disagreements with Accountants on Accounting Procedures and Financial Disclosure

None exist.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Page 15 of 24

Emerging Growth Company

We are an emerging growth company as defined in Section 2(a)(19) of the Securities Act. We will continue to be an emerging growth company until: (i) the last day of our fiscal year during which we had total annual gross revenues of $1,000,000,000 or more; (ii) the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common stock pursuant to an effective registration statement under the Securities Act; (iii) the date on which we have, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or (iv) the date on which we are deemed to be a large accelerated filer, as defined in Section 12b-2 of the Exchange Act.

As an emerging growth company, we are exempt from:

| Sections 14A(a) and (b) of the Exchange Act, which require companies to hold stockholder advisory votes on executive compensation and golden parachute compensation; |

|

|

| The requirement to provide, in any registration statement, periodic report or other report to be filed with the Securities and Exchange Commission (the “Commission” or “SEC”), certain modified executive compensation disclosure under Item 402 of Regulation S-K or selected financial data under Item 301 of Regulation S-K for any period before the earliest audited period presented in our initial registration statement; |

|

|

| Compliance with new or revised accounting standards until those standards are applicable to private companies; |

|

|

| The requirement under Section 404(b) of the Sarbanes-Oxley Act of 2002 to provide auditor attestation of our internal controls and procedures; and |

|

|

| Any Public Company Accounting Oversight Board (“PCAOB”) rules regarding mandatory audit firm rotation or an expanded auditor report, and any other PCAOB rules subsequently adopted unless the Commission determines the new rules are necessary for protecting the public. |

We have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the Jumpstart Our Business Startups Act.

We are also a smaller reporting company as defined in Rule 12b-2 of the Exchange Act. As a smaller reporting company, we are not required to provide selected financial data pursuant to Item 301 of Regulation S-K, nor are we required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. We are also permitted to provide certain modified executive compensation disclosure under Item 402 of Regulation S-K.

Critical Accounting Policies

Use of Estimates

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. We regularly evaluate estimates and assumptions related to deferred income tax asset valuation allowances. We base our estimates and assumptions on current facts, historical experience and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by us may differ materially and adversely from our estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Selected Financial Data

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Quantitative and Qualitative Disclosures About Market Risk

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Page 16 of 24

ITEM 3.PROPERTIES

Stevva Ltd. is the owner of approximately 6 acres of prime farmland in Pella Giannitsa, Greece. The full legal description of the owned parcels is as follows: (i) Field Number 115 located in the SAAK PENTAPLATANOU with a total area of 14,000 square meters; (ii) Field Number 117 located in the SAAK PENTAPLATANOU with a total area of 9,928 square meters.

ITEM 4.SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of the date of this Current Report by: (i) each of our directors; (ii) each of our executive officers; and (iii) each person or group known by us to beneficially own more than 5% of our issued and outstanding shares of common stock. Unless otherwise indicated, the shareholders listed below possess sole voting and investment power with respect to the shares they own.

As of August 15, 2017, there are 75,819,000 common shares issued and outstanding, 0 shares issuable upon the exercise of stock purchase options within 60 days, and 0 shares issuable upon the exercise of stock purchase warrants within 60 days.

Name and Address of Beneficial Owner | Title of Class | Shares Held | Percent of Class1 |

Theodoros Kerasidis(2) 112 North Curry Street Carson City, NV, 89703 | Common | 45,000,000 | 59.35% |

1 The number and percentage of shares beneficially owned is determined under rules promulgated by the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares, which the individual has the right to acquire within 60 days through the exercise of any stock option or other right. The entities or persons named in the table have sole voting and investment power with respect to all shares of common stock shown that are beneficially owned by them, subject to community property laws where applicable and the information contained in the footnotes to this table.

2The table presumes the cancellation of 39,000,980 shares pursuant to the terms and conditions of the Share Exchange Agreement.

ITEM 5.DIRECTORS AND EXECUTIVE OFFICERS

Identification of Executive Officers and Directors of the Company

Name and Address of Beneficial Owner Directors and Officers: |

AGE | Class | Shares Held or Controlled | Percentage of Class |

Theodoros Kerasidis(3) 112 North Curry Street Carson City, NV, 89703 |

43 | Common |

45,000,000

| 59.35% |

All executive officers and directors as a group |

| Common | 45,000,000 | 59.35% |

1The number and percentage of shares beneficially owned is determined under rules promulgated by the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares, which the individual has the right to acquire within 60 days through the exercise of any stock option or other right. The entities or persons named in the table have sole voting and investment power with respect to all shares of common stock shown that are beneficially owned by them, subject to community property laws where applicable and the information contained in the footnotes to this table.

2 On August 14, 2017, Theodoros Kerasidis was appointed as the Company’s Chief Executive Officer, President, Chief Financial Officer and Secretary and as a Member of the Company’s Board of Directors.

3 The table presumes the cancellation of 39,000,980 shares pursuant to the terms and conditions of the Share Exchange Agreement.

Page 17 of 24

Term of Office

Each director of the Company serves for a term of one year and until his successor is elected and qualified at the next Annual Shareholders’ Meeting, or until his death, resignation or removal. Each officer of the Company serves for a term of one year and until his successor is elected and qualified at a meeting of the Board of Directors.

Significant Employees

None.

Family Relationships

There are no family relationships among the Company’s officers, directors or persons nominated for such positions.

Involvement in Certain Legal Proceedings

During the past ten years no director, executive officer, promoter or control person of the Company has been involved in the following:

(1) A petition under the Federal bankruptcy laws or any state insolvency law which was filed by or against, or a receiver, fiscal agent or similar officer was appointed by a court for the business or property of such person, or any partnership in which he was a general partner at or within two years before the time of such filing, or any corporation or business association of which he was an executive officer at or within two years before the time of such filing;

(2) Such person was convicted in a criminal proceeding or is a named subject of a pending criminal proceeding (excluding traffic violations and other minor offenses);

(3) Such person was the subject of any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining him from, or otherwise limiting, the following activities:

i.Acting as a futures commission merchant, introducing broker, commodity trading advisor, commodity pool operator, floor broker, leverage transaction merchant, any other person regulated by the Commodity Futures Trading Commission, or an associated person of any of the foregoing, or as an investment adviser, underwriter, broker or dealer in securities, or as an affiliated person, director or employee of any investment company, bank, savings and loan association or insurance company, or engaging in or continuing any conduct or practice in connection with such activity;

ii.Engaging in any type of business practice; or

iii.Engaging in any activity in connection with the purchase or sale of any security or commodity or in connection with any violation of Federal or State securities laws or Federal commodities laws;

(4) Such person was the subject of any order, judgment or decree, not subsequently reversed, suspended or vacated, of any Federal or State authority barring, suspending or otherwise limiting for more than 60 days the right of such person to engage in any activity described in paragraph (f)(3)(i) of this section, or to be associated with persons engaged in any such activity;

(5) Such person was found by a court of competent jurisdiction in a civil action or by the Commission to have violated any Federal or State securities law, and the judgment in such civil action or finding by the Commission has not been subsequently reversed, suspended, or vacated;

(6) Such person was found by a court of competent jurisdiction in a civil action or by the Commodity Futures Trading Commission to have violated any Federal commodities law, and the judgment in such civil action or finding by the Commodity Futures Trading Commission has not been subsequently reversed, suspended or vacated;

Page 18 of 24

(7) Such person was the subject of, or a party to, any Federal or State judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated, relating to an alleged violation of:

i.Any Federal or State securities or commodities law or regulation; or

ii.Any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order; or

iii.Any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

(8) Such person was the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member.

Code of Ethics

The Company has not adopted any formal Code of Ethics.

Committees of the Board of Directors

The Company does not presently have a separately designated standing audit committee, compensation committee, nominating committee, executive committee or any other committees of our Board of Directors. The functions of those committees are undertaken by our Board of Directors

Audit Committee

The Company has not established a separately designated standing audit committee. However, the Company intends to establish a new audit committee of the Board of Directors that shall consist of independent directors. The audit committee’s duties will be to recommend to the Company’s board of directors the engagement of an independent registered public accounting firm to audit the Company’s financial statements and to review the Company’s accounting and auditing principles. The audit committee will review the scope, timing and fees for the annual audit and the results of audit examinations performed by the internal auditors and independent registered public accounting firm, including their recommendations to improve the system of accounting and internal controls. The audit committee shall at all times be composed exclusively of directors who are, in the opinion of the Company’s board of directors, free from any relationship which would interfere with the exercise of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting principles.

ITEM 6.EXECUTIVE COMPENSATION

The following table sets forth information concerning all cash and non-cash compensation awarded to, earned by or paid to the named persons for services rendered in all capacities during the noted periods. No other executive officer received total annual salary and bonus compensation in excess of $100,000.

SUMMARY COMPENSATION TABLE1 | ||||

Name and Principal Position | FiscalYear | Salary ($) | All Other Compensation ($)2 | Total ($) |

Theodoros Kerasidis President, CEO, CFO, Secretary & Director | 2017 | NIL | NIL | NIL |

2016 | NIL | NIL | NIL | |

2015 | NIL | NIL | NIL | |

Jose Mari C. Chin President, CEO, CFO, Secretary & Director | 2017 | NIL | NIL | NIL |

2016 | NIL | NIL | NIL | |

2015 | NIL | NIL | NIL | |

We have omitted certain columns in the summary compensation table pursuant to Item 402(a)(5) of Regulation S-K as no compensation was awarded to, earned by, or paid to any of the executive officers or directors required to be reported in that table or column in any fiscal year covered by that table.

The “All Other Compensation” column is used to disclose the aggregate amount of all compensation that the company could not properly report in any other column of the Summary Compensation Table (with a limited exceptions).

Page 19 of 24

Option Grants

We have not granted any options or stock appreciation rights to our named executive officers or directors since inception. We do not have any stock option plans.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may be granted at the discretion of the board of directors or a committee thereof.

Compensation Committee

We do not currently have a compensation committee of the board of directors or a committee performing similar functions. The board of directors as a whole participates in the consideration of executive officer and director compensation.

Indebtedness of Directors, Senior Officers, Executive Officers and Other Management

None of our directors or executive officers or any associate or affiliate of our company during the last two fiscal years is or has been indebted to our company by way of guarantee, support agreement, letter of credit or other similar agreement or understanding currently outstanding.

ITEM 7.CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, AND DIRECTOR INDEPENDENCE

Related Party Transactions

Other than disclosed in herein. None of the directors or executive officers of the Company, nor any person who owned of record or was known to own beneficially more than 5% of the Company’s outstanding shares of its common stock, nor any associate or affiliate of such persons or companies, has any material interest, direct or indirect, in any transaction that has occurred during the past two fiscal years, or in any proposed transaction, which has materially affected or will affect the Company.

With regard to any future related party transaction, we plan to fully disclose any and all related party transactions in the following manner:

Disclosing such transactions in reports where required;

Disclosing in any and all filings with the SEC, where required;

Obtaining disinterested directors consent; and

Obtaining shareholder consent where required.

Director Independence

For purposes of determining director independence, we have applied the definitions set out in NASDAQ Rule 5605(a)(2). The OTCBB on which shares of the Company’s Common Stock are quoted does not have any director independence requirements. The NASDAQ definition of “Independent Director” means a person other than an Executive Officer or employee or any other individual having a relationship, which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

According to the NASDAQ definition, we have no independent directors.

Review, Approval or Ratification of Transactions with Related Persons

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.