Attached files

| file | filename |

|---|---|

| 8-K - WEC ENERGY GROUP 8-K 08.15.2017 - WEC ENERGY GROUP, INC. | wecenergygroupform8-k08152.htm |

August 2017

1

Cautionary Statement Regarding

Forward-Looking Information

Much of the information contained in this presentation is forward-looking information based upon management’s

current expectations and projections that involve risks and uncertainties. Forward-looking information includes, among

other things, information concerning earnings per share, rate case activity, earnings per share growth, cash flow,

dividend growth and dividend payout ratios, construction costs and capital expenditures, investment opportunities,

corporate initiatives, rate base, and environmental matters. Readers are cautioned not to place undue reliance on this

forward-looking information. Forward-looking information is not a guarantee of future performance and actual results

may differ materially from those set forth in the forward-looking information.

In addition to the assumptions and other factors referred to in connection with the forward-looking information, factors

that could cause WEC Energy Group’s actual results to differ materially from those contemplated in any forward-

looking information or otherwise affect our future results of operations and financial condition include, among others,

the following: general economic conditions, including business and competitive conditions in the company’s service

territories; timing, resolution and impact of future rate cases and other regulatory decisions; the company’s ability to

continue to successfully integrate the operations of its subsidiaries; availability of the company’s generating facilities

and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes;

varying weather conditions; continued industry consolidation; cyber-security threats; the value of goodwill and its

possible impairment; construction risks; equity and bond market fluctuations; the impact of any legislative and

regulatory changes, including changes to existing and/or anticipated environmental standards and tax laws; current

and future litigation and regulatory investigations; changes in accounting standards; and other factors described under

the heading “Factors Affecting Results, Liquidity, and Capital Resources” in Management’s Discussion and Analysis of

Financial Condition and Results of Operations and under the headings “Cautionary Statement Regarding Forward-

Looking Information” and “Risk Factors” contained in WEC Energy Group’s Form 10-K for the year ended December

31, 2016 and in subsequent reports filed with the Securities and Exchange Commission. WEC Energy Group

expressly disclaims any obligation to publicly update or revise any forward-looking information.

2

Well Positioned for the Future

WEC Energy Group

Focused on the fundamentals:

Safety

World-class reliability

Operating efficiency

Financial discipline

Exceptional customer care

3

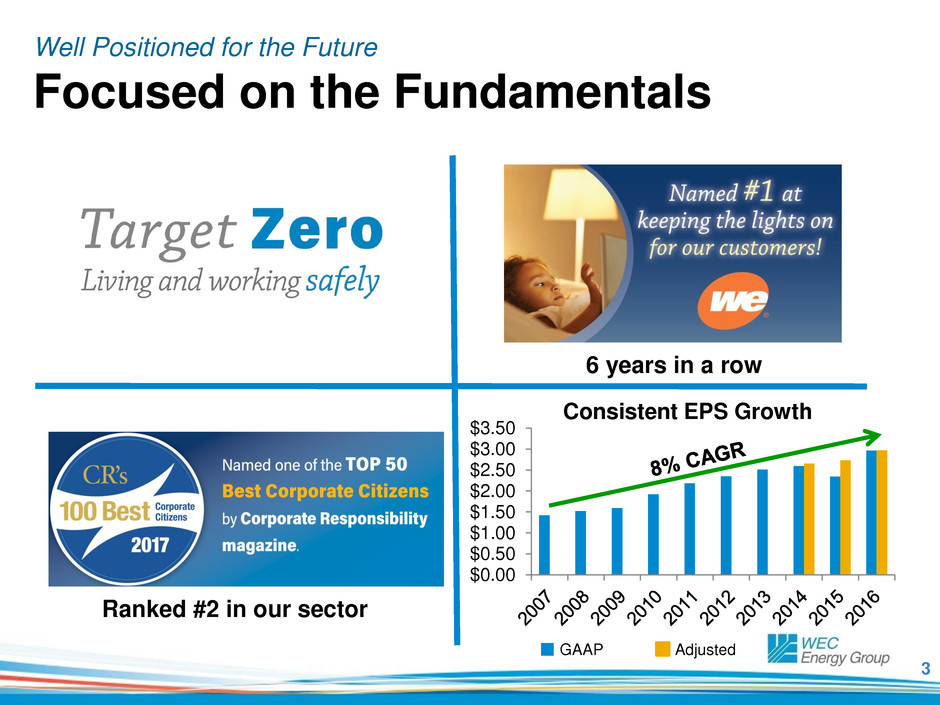

Well Positioned for the Future

Focused on the Fundamentals

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

Consistent EPS Growth

6 years in a row

Ranked #2 in our sector

GAAP Adjusted

4

Well Positioned for the Future

A Compelling Value Proposition

For 2017, targeting earnings per share growth of 5-7 percent

2017 earnings guidance is $3.06 - $3.12 per share, expectation of being

in the upper end of the range

Longer-term earnings per share growth is expected to be

5-7 percent compound annual growth rate off 2015 base of

$2.72 per share

More than 99 percent of earnings from regulated operations

Projecting dividend growth in line with earnings growth

5

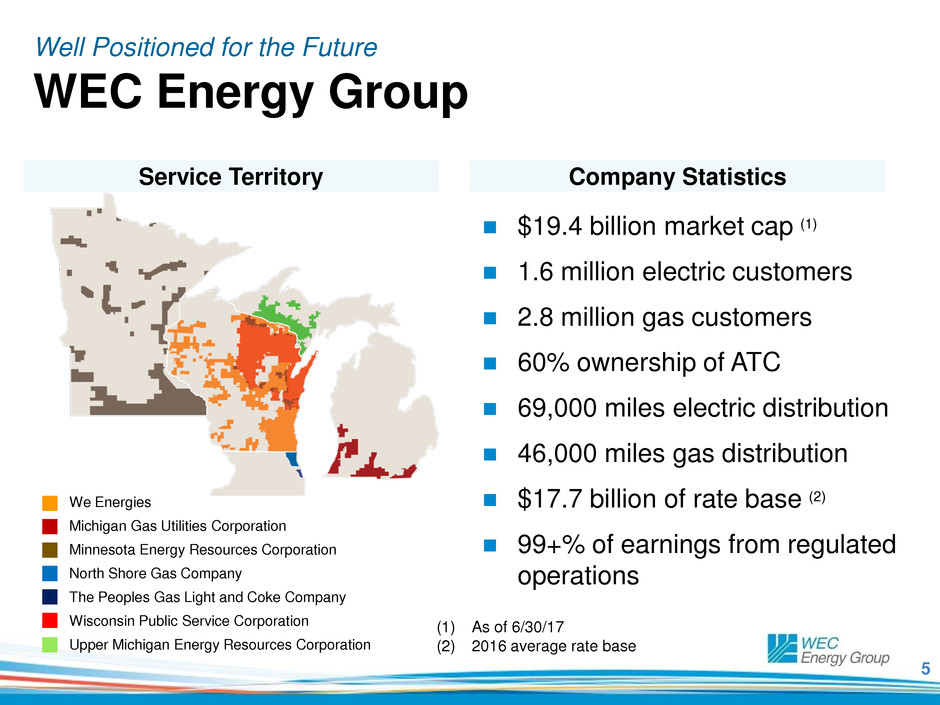

Well Positioned for the Future

WEC Energy Group

$19.4 billion market cap (1)

1.6 million electric customers

2.8 million gas customers

60% ownership of ATC

69,000 miles electric distribution

46,000 miles gas distribution

$17.7 billion of rate base (2)

99+% of earnings from regulated

operations

Company Statistics Service Territory

(1) As of 6/30/17

(2) 2016 average rate base

We Energies

Michigan Gas Utilities Corporation

Minnesota Energy Resources Corporation

North Shore Gas Company

The Peoples Gas Light and Coke Company

Wisconsin Public Service Corporation

Upper Michigan Energy Resources Corporation

6

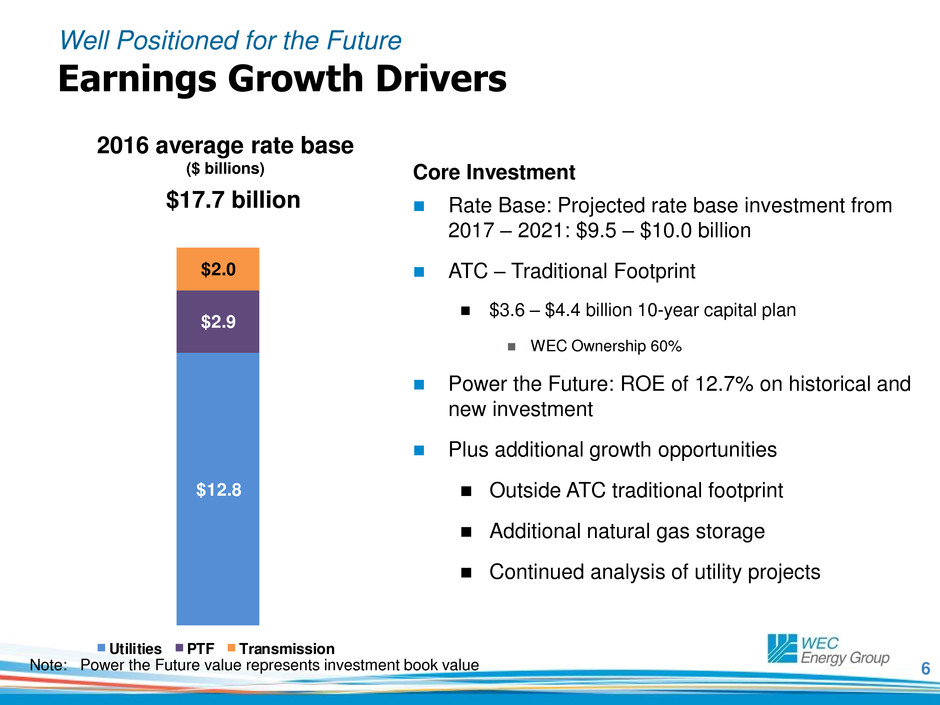

Well Positioned for the Future

Earnings Growth Drivers

$2.7

$5.7

2016 average rate base

($ billions)

$12.8

$2.9

$2.0

Utilities PTF Transmission

Note: Power the Future value represents investment book value

Core Investment

Rate Base: Projected rate base investment from

2017 – 2021: $9.5 – $10.0 billion

ATC – Traditional Footprint

$3.6 – $4.4 billion 10-year capital plan

WEC Ownership 60%

Power the Future: ROE of 12.7% on historical and

new investment

Plus additional growth opportunities

Outside ATC traditional footprint

Additional natural gas storage

Continued analysis of utility projects

$17.7 billion

7

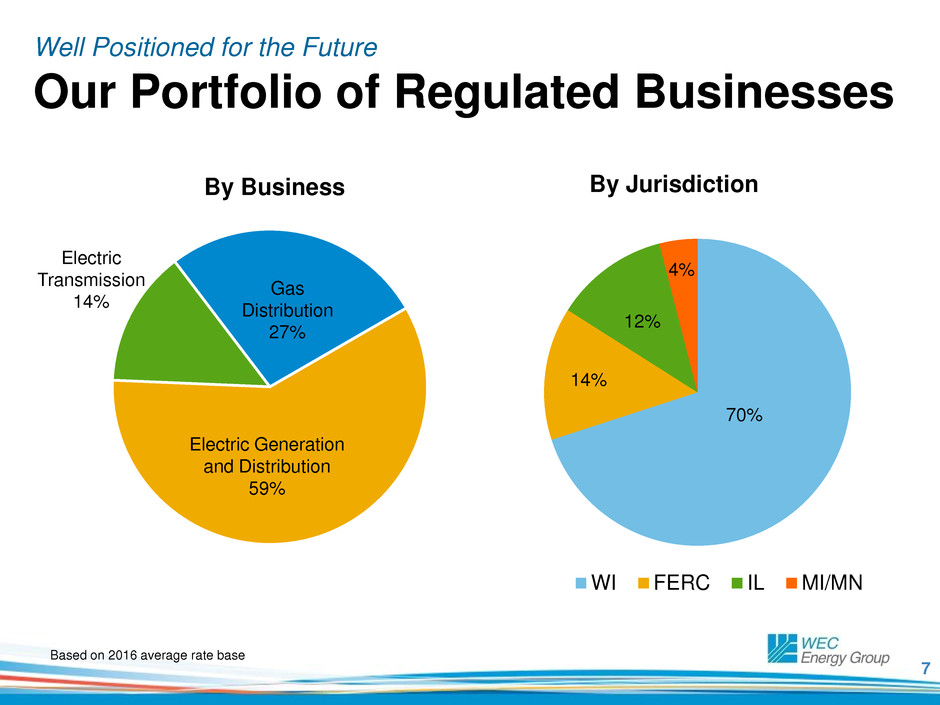

Well Positioned for the Future

Our Portfolio of Regulated Businesses

Electric Generation

and Distribution

59%

Gas

Distribution

27%

Electric

Transmission

14%

Based on 2016 average rate base

70%

14%

12%

4%

WI FERC IL MI/MN

By Jurisdiction By Business

8

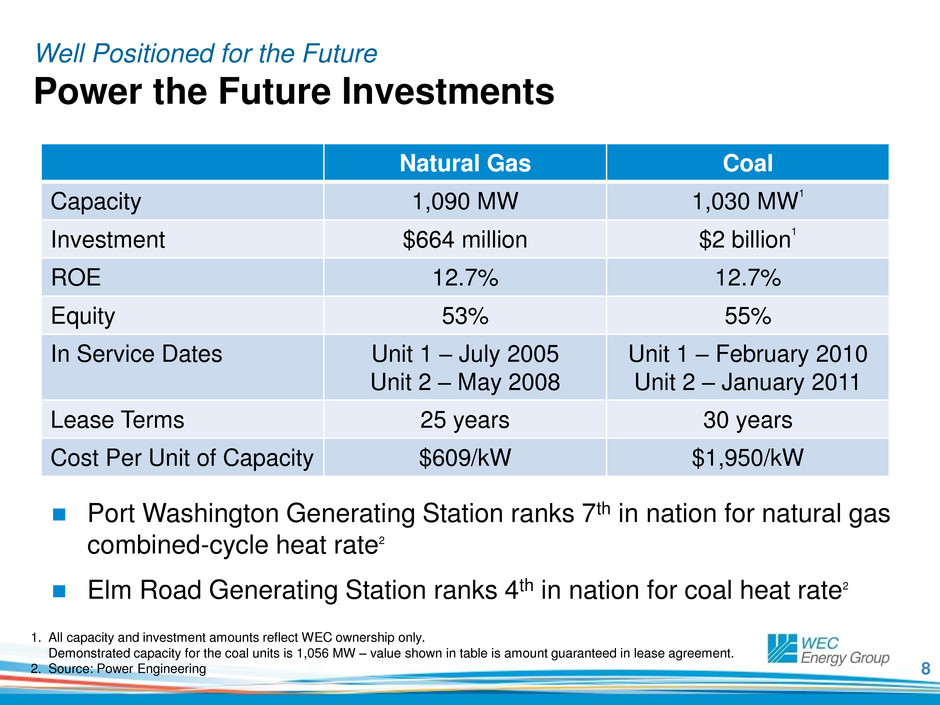

Well Positioned for the Future

Power the Future Investments

Port Washington Generating Station ranks 7th in nation for natural gas

combined-cycle heat rate2

Elm Road Generating Station ranks 4th in nation for coal heat rate2

Natural Gas Coal

Capacity 1,090 MW 1,030 MW

1

Investment $664 million $2 billion

1

ROE 12.7% 12.7%

Equity 53% 55%

In Service Dates Unit 1 – July 2005

Unit 2 – May 2008

Unit 1 – February 2010

Unit 2 – January 2011

Lease Terms 25 years 30 years

Cost Per Unit of Capacity $609/kW $1,950/kW

1. All capacity and investment amounts reflect WEC ownership only.

Demonstrated capacity for the coal units is 1,056 MW – value shown in table is amount guaranteed in lease agreement.

2. Source: Power Engineering

9

Balanced Regulatory Environment

Rate-Making Parameters by Company

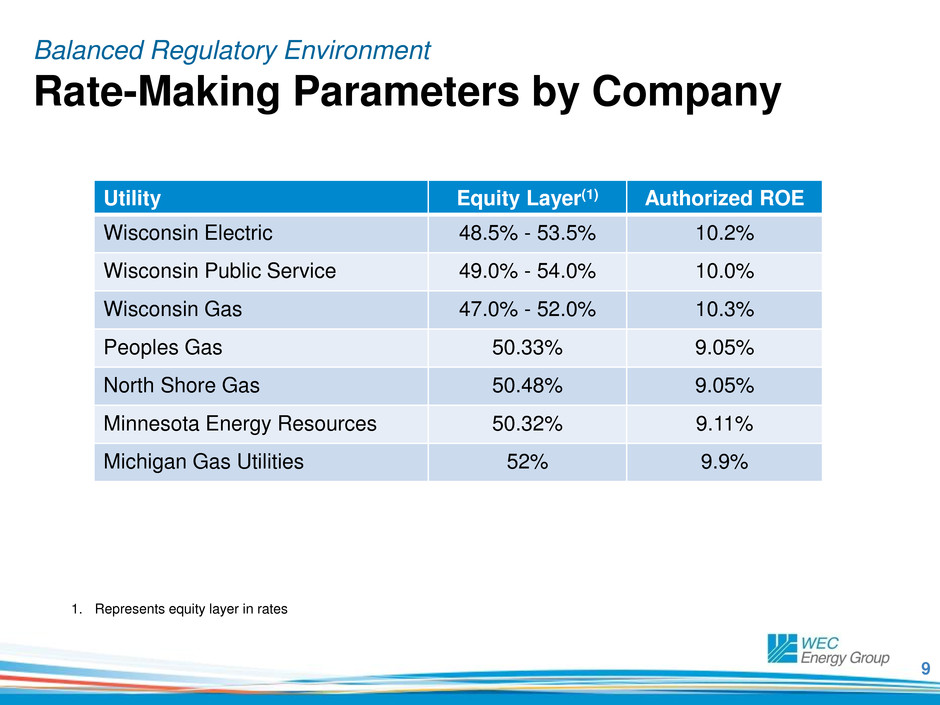

Utility Equity Layer(1) Authorized ROE

Wisconsin Electric 48.5% - 53.5% 10.2%

Wisconsin Public Service 49.0% - 54.0% 10.0%

Wisconsin Gas 47.0% - 52.0% 10.3%

Peoples Gas 50.33% 9.05%

North Shore Gas 50.48% 9.05%

Minnesota Energy Resources 50.32% 9.11%

Michigan Gas Utilities 52% 9.9%

1. Represents equity layer in rates

10

Balanced Regulatory Environment

Rate Case Update

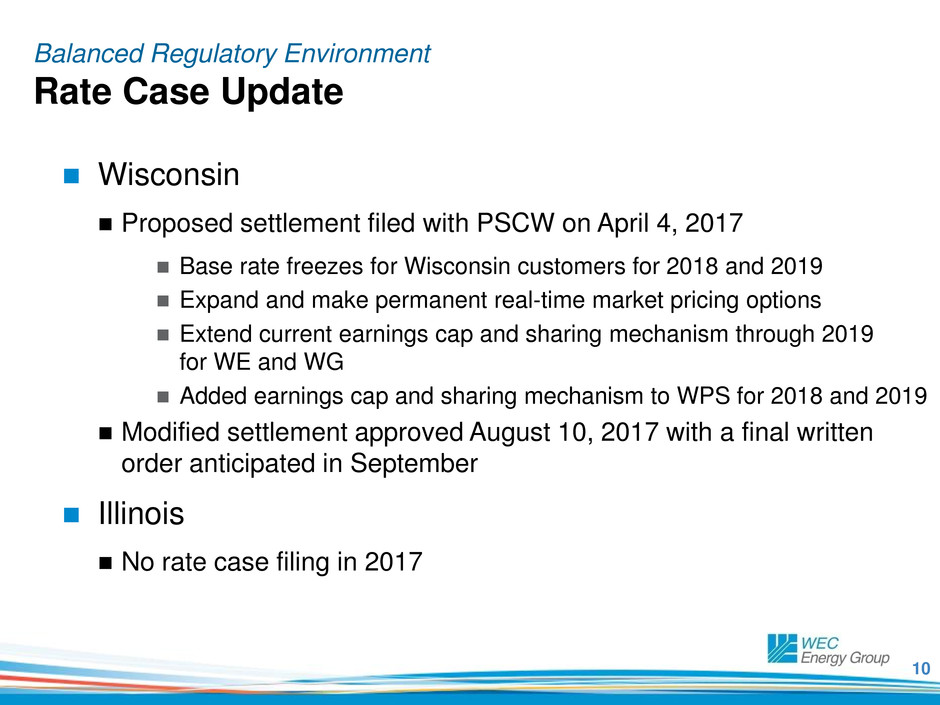

Wisconsin

Proposed settlement filed with PSCW on April 4, 2017

Base rate freezes for Wisconsin customers for 2018 and 2019

Expand and make permanent real-time market pricing options

Extend current earnings cap and sharing mechanism through 2019

for WE and WG

Added earnings cap and sharing mechanism to WPS for 2018 and 2019

Modified settlement approved August 10, 2017 with a final written

order anticipated in September

Illinois

No rate case filing in 2017

11

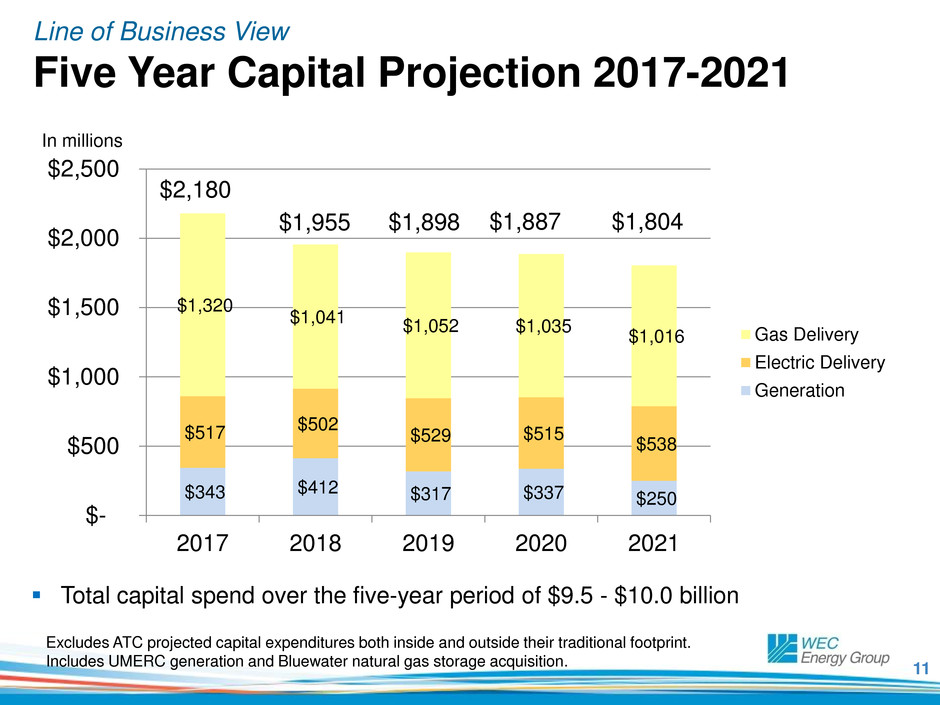

Line of Business View

Five Year Capital Projection 2017-2021

$343 $412 $317 $337 $250

$517 $502 $529 $515 $538

$1,320

$1,041 $1,052 $1,035

$1,016

$-

$500

$1,000

$1,500

$2,000

$2,500

2017 2018 2019 2020 2021

Gas Delivery

Electric Delivery

Generation

$1,804

In millions

Total capital spend over the five-year period of $9.5 - $10.0 billion

$2,180

$1,955 $1,898 $1,887

Excludes ATC projected capital expenditures both inside and outside their traditional footprint.

Includes UMERC generation and Bluewater natural gas storage acquisition.

12

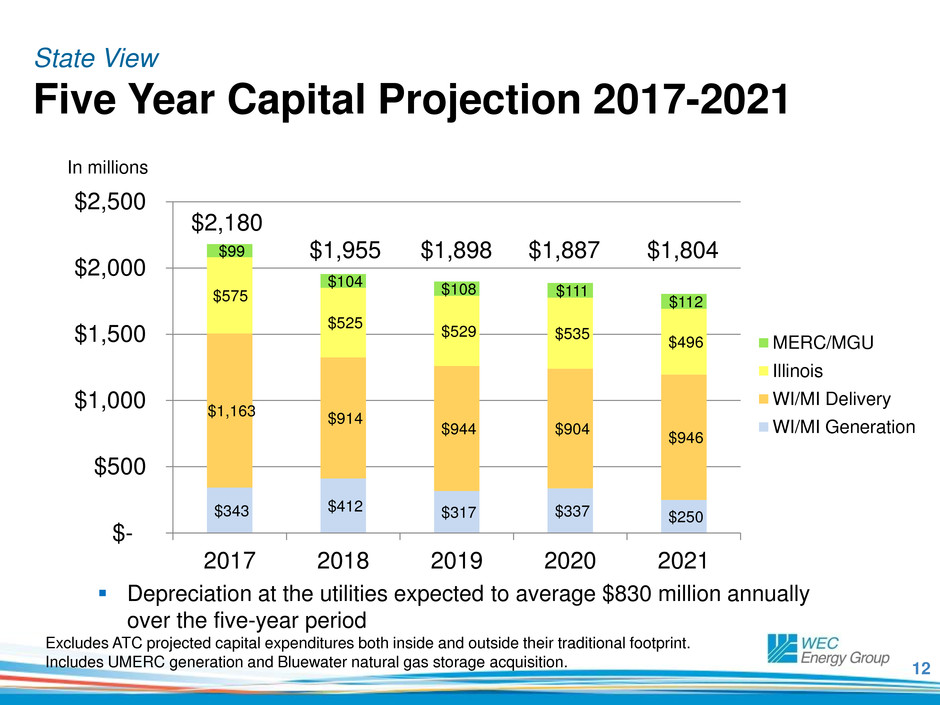

State View

Five Year Capital Projection 2017-2021

$343 $412 $317 $337 $250

$1,163 $914

$944 $904

$946

$575

$525

$529 $535

$496

$99

$104

$108 $111

$112

$-

$500

$1,000

$1,500

$2,000

$2,500

2017 2018 2019 2020 2021

MERC/MGU

Illinois

WI/MI Delivery

WI/MI Generation

In millions

Depreciation at the utilities expected to average $830 million annually

over the five-year period

$1,898

$2,180

$1,804 $1,955 $1,887

Excludes ATC projected capital expenditures both inside and outside their traditional footprint.

Includes UMERC generation and Bluewater natural gas storage acquisition.

13

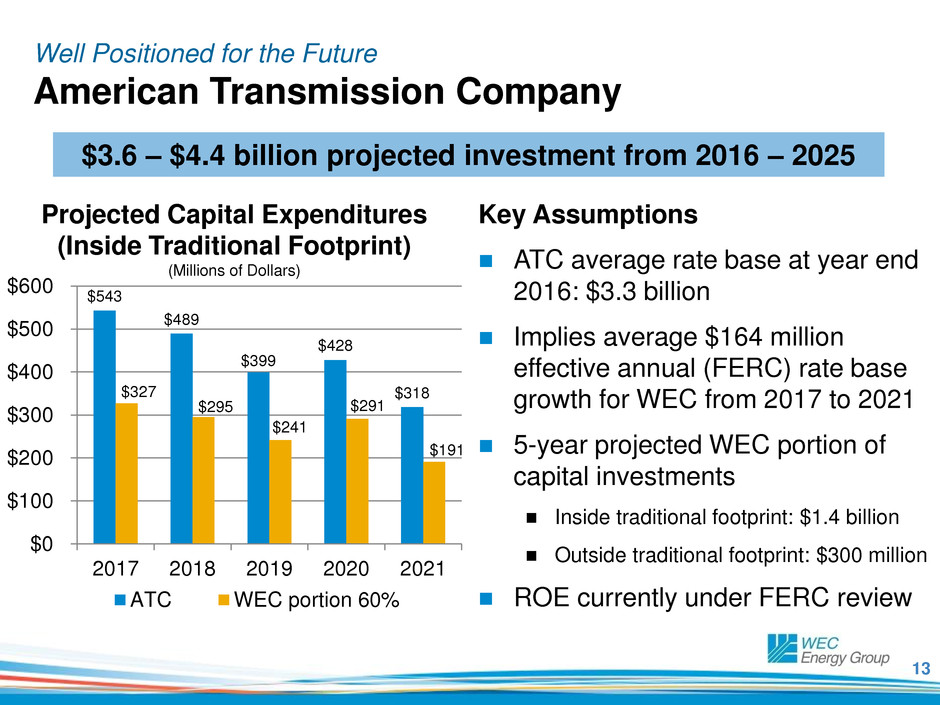

$543

$489

$399

$428

$318 $327

$295

$241

$291

$191

$0

$100

$200

$300

$400

$500

$600

2017 2018 2019 2020 2021

ATC WEC portion 60%

Well Positioned for the Future

American Transmission Company

Key Assumptions

ATC average rate base at year end

2016: $3.3 billion

Implies average $164 million

effective annual (FERC) rate base

growth for WEC from 2017 to 2021

5-year projected WEC portion of

capital investments

Inside traditional footprint: $1.4 billion

Outside traditional footprint: $300 million

ROE currently under FERC review

Projected Capital Expenditures

(Inside Traditional Footprint)

(Millions of Dollars)

$3.6 – $4.4 billion projected investment from 2016 – 2025

14

Well Positioned for the Future

American Transmission Company –

Outside the Traditional Footprint

Joint venture between Duke Energy and ATC (DATC)

Ownership split 50/50 between Duke and ATC

WEC current ownership interest is 30%, potentially growing to 34%

Owns California’s Path 15 transmission line – potential for expansion

Zephyr Power Transmission project

ATC-only outside the footprint

WEC interest: 75%

Joint venture between Arizona Electric Power Cooperative and ATC

(ATC Southwest)

Other transmission projects throughout the U.S.

Alaska

15

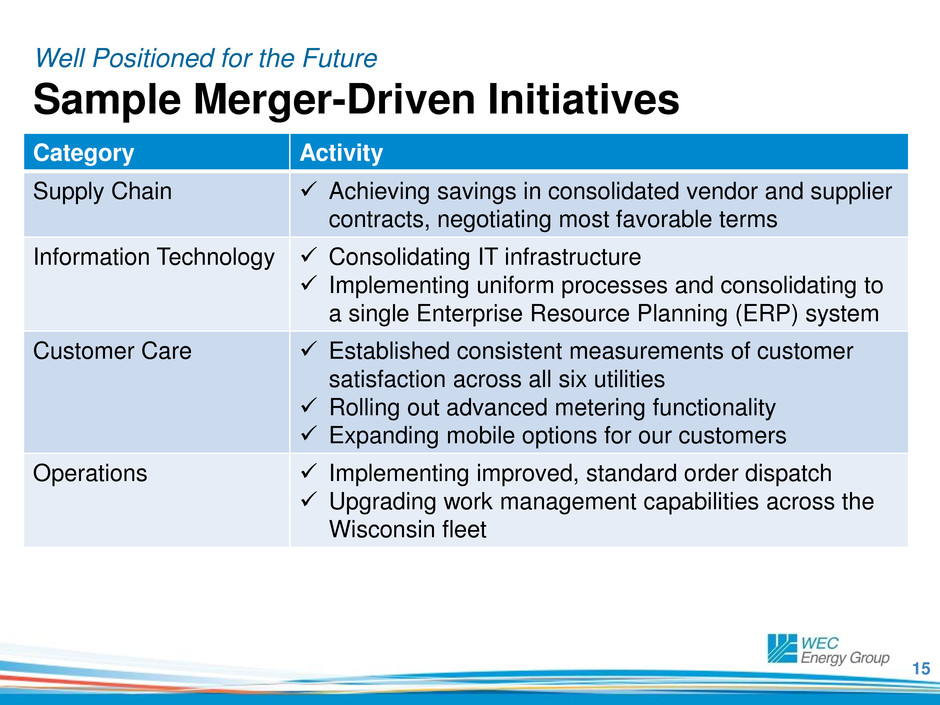

Well Positioned for the Future

Sample Merger-Driven Initiatives

Category Activity

Supply Chain Achieving savings in consolidated vendor and supplier

contracts, negotiating most favorable terms

Information Technology Consolidating IT infrastructure

Implementing uniform processes and consolidating to

a single Enterprise Resource Planning (ERP) system

Customer Care Established consistent measurements of customer

satisfaction across all six utilities

Rolling out advanced metering functionality

Expanding mobile options for our customers

Operations Implementing improved, standard order dispatch

Upgrading work management capabilities across the

Wisconsin fleet

16

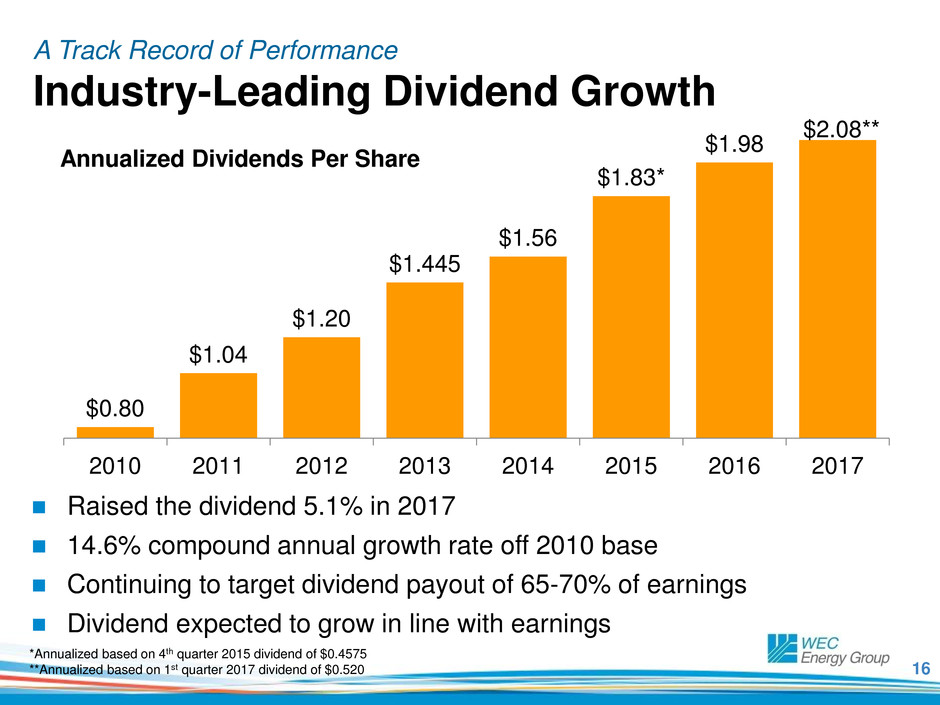

A Track Record of Performance

Industry-Leading Dividend Growth

Raised the dividend 5.1% in 2017

14.6% compound annual growth rate off 2010 base

Continuing to target dividend payout of 65-70% of earnings

Dividend expected to grow in line with earnings

*Annualized based on 4th quarter 2015 dividend of $0.4575

**Annualized based on 1st quarter 2017 dividend of $0.520

Annualized Dividends Per Share

$0.80

$1.04

$1.20

$1.445

$1.56

$1.83*

$1.98

$2.08**

2010 2011 2012 2013 2014 2015 2016 2017

17

Poised for Growth

Key Takeaways for WEC Energy Group

Leading electric and natural gas utility in the Midwest

The eighth largest natural gas distribution company

in the nation

Projected long-term earnings per share growth of

5-7 percent compound annual growth rate off 2015 base

Targeting dividend growth in line with growth in

earnings per share

Majority ownership of American Transmission Company

brings additional transmission investment opportunity

Positioned to deliver among the best risk-adjusted returns

in the industry

Appendix

19

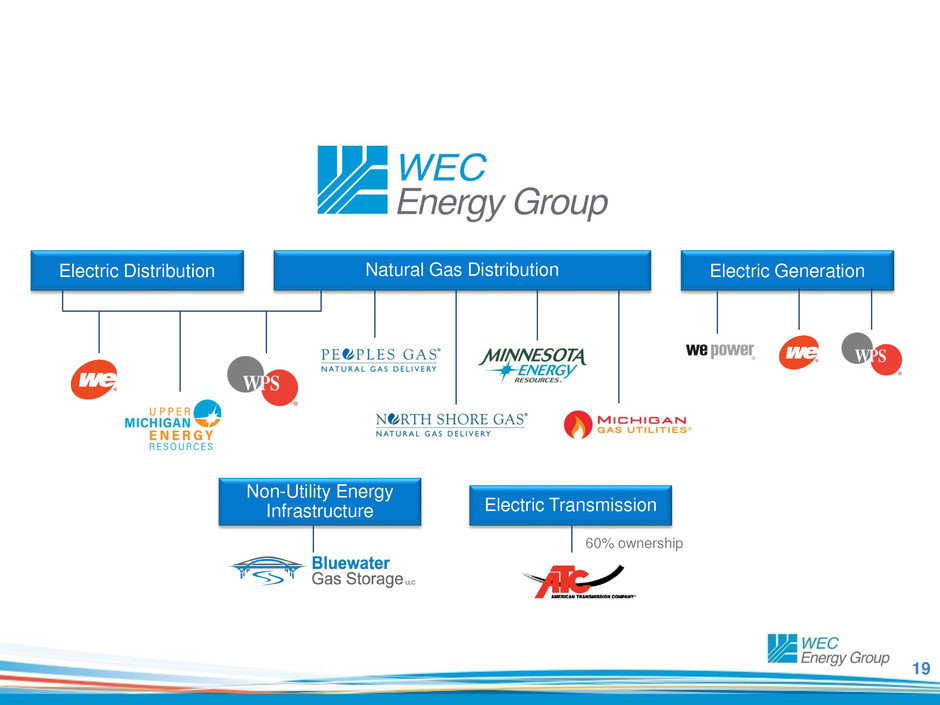

Electric Distribution

Electric Transmission

60% ownership

Electric Generation

Non-Utility Energy

Infrastructure

Natural Gas Distribution

20

Strategic Rationale

Acquisition Overview

WEC Energy Group formed in 2015 when Wisconsin Energy

acquired Integrys in a transaction valued at $9 billion

Acquisition created the leading electric and natural gas

utility in the Midwest

Met or exceeded WEC’s acquisition criteria

Accretive to earnings per share starting in first full calendar year of

combined operations

Largely credit neutral

Long-term growth prospects of combined entity equal to or greater than

stand-alone company

21

Major Construction Projects

Delivering the Future

Committed to infrastructure

investment that will:

Renew and modernize our

delivery networks

Meet new environmental

standards

Reduce operating costs

for customers

22

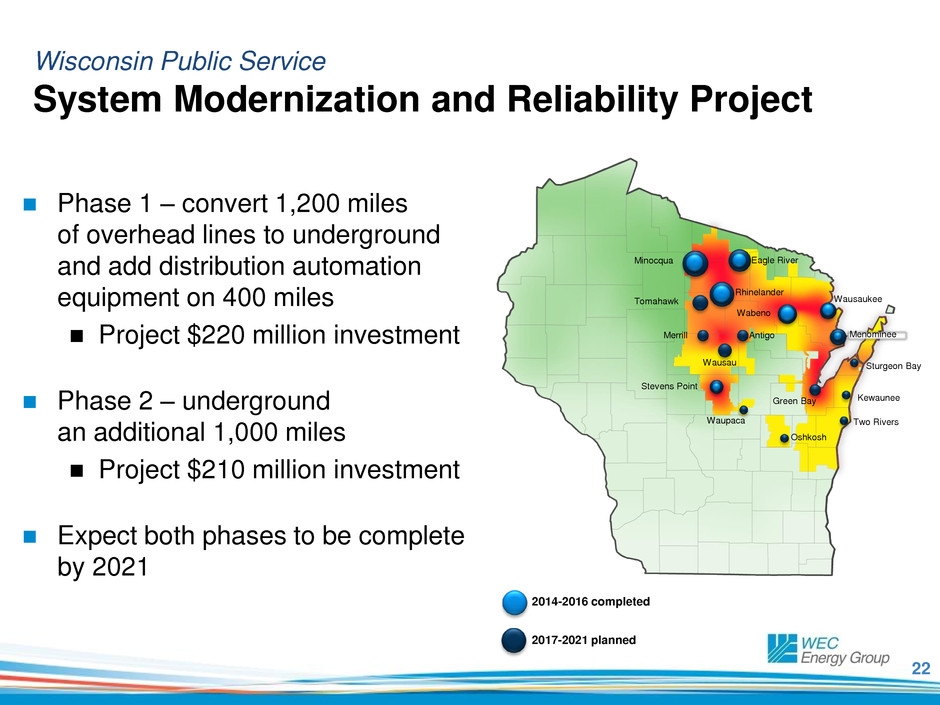

Phase 1 – convert 1,200 miles

of overhead lines to underground

and add distribution automation

equipment on 400 miles

Project $220 million investment

Phase 2 – underground

an additional 1,000 miles

Project $210 million investment

Expect both phases to be complete

by 2021

Wisconsin Public Service

System Modernization and Reliability Project

2017-2021 planned

Green Bay

Two Rivers

Kewaunee

Sturgeon Bay

Waupaca

Oshkosh

Tomahawk

Merrill

Wausau

Antigo

Stevens Point

2014-2016 completed

Minocqua

Rhinelander

Eagle River

Wausaukee

Menominee

Wabeno

23

Major Construction Projects – Peoples Gas

Natural Gas System Modernization Program

Extensive effort to modernize

natural gas infrastructure in

City of Chicago

Ultimately replace 2,000 miles

22 percent complete

Investment recovery under

a monthly bill rider

Project $280 - $300 million average annual investment

Enabling legislation in effect from 2014 – 2023

24

Major Construction Projects – Wisconsin Utilities

Advanced Metering Infrastructure (AMI) Program

AMI is an integrated system of smart meters,

communication networks and data management

systems that enable two-way communication between

utilities and customers

Replaces aging meter reading equipment both on our

network and customer property

Reduces manual effort for disconnects and reconnects

Enhanced outage management capabilities

Improves revenue protection and theft detection

Project to spend approximately $200 million over the

next four years

25

Well Positioned for the Future

Acquisition of Bluewater Natural Gas Holding

Underground natural gas storage facility in Michigan that

will provide one-third of the storage needs for our natural

gas distribution companies in Wisconsin

Bluewater will have long-term service agreements with

the three Wisconsin gas utilities

Total acquisition price: $230 million

Working gas capacity of 23.2 Bcf

Expected to provide a utility return on capital

The Public Service Commission of Wisconsin granted

declaratory ruling and approval on June 15, 2017

Closed acquisition on June 30, 2017

26

Major Construction Projects – Upper Michigan Energy Resources Corp. (UMERC)

Proposed New Generation in the Upper Peninsula

Provides a long-term generation solution for electric reliability in

Upper Peninsula

~180 MW of clean, natural gas-fired Reciprocating Internal

Combustion Engine (RICE) generation

Estimated $265 million ($275 million including AFUDC) investment is

made by the new Michigan utility – UMERC

Half of the investment recovered in retail rates

Half of the investment recovered by a 20-year agreement with

Cliffs Natural Resources

Commercial operation targeted for 2019

Filed for approval with the Michigan Commission on Jan. 30, 2017

Allows for the retirement of Presque Isle Power Plant

27

Well Positioned for the Future

State-of-the-Art Generation Fleet

Natural gas – 3,753 megawatts

Port Washington Generating Station among the

lowest cost combined-cycle plants in country

Coal – 5,044 megawatts

Oak Creek heat rate is top 5% in country

Renewables – 483 megawatts

Wisconsin’s two largest wind farms and biomass plant

Hydro – 169 megawatts

*Owned nameplate capacity

28

Well Positioned for the Future

Supporting a Clean Energy Future

WEC Energy Group has implemented a

multi-emission strategy to achieve greater

environmental benefit for lower cost

Retired older, less efficient coal-fired generation

Added two combined cycle natural gas units

Added state-of-the-art, coal-fired generation with

performance that ranks among the most thermally

efficient coal-fired units in the nation

Invested more than $1 billion in renewable energy –

including biomass and the state’s two largest

wind energy sites

Invested more than $1.5 billion in air quality systems

29

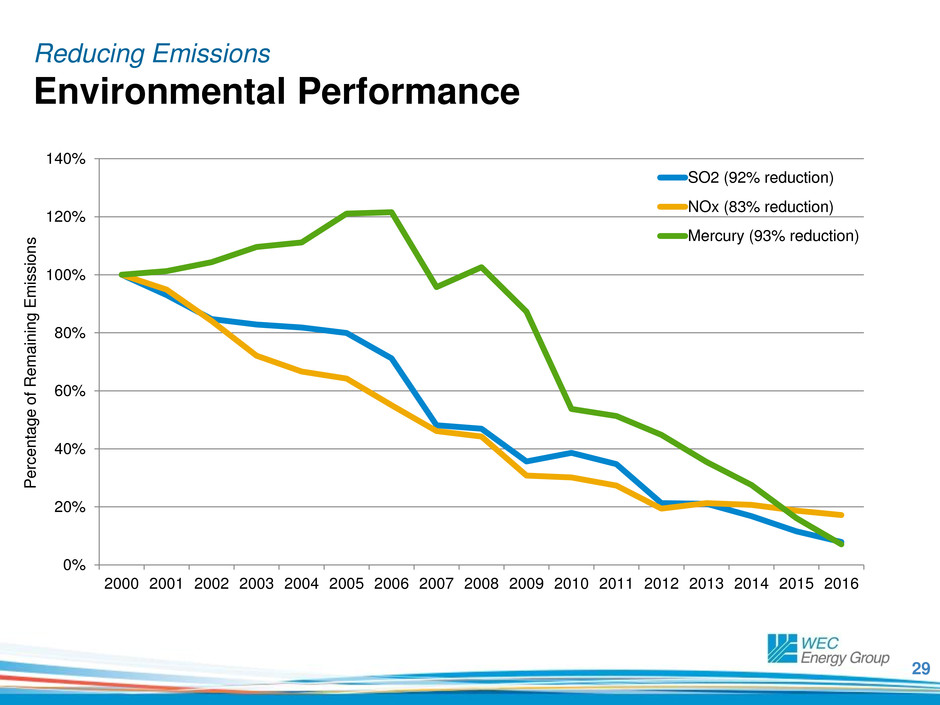

Reducing Emissions

Environmental Performance

P

e

rce

n

ta

g

e

o

f

Re

m

a

ini

n

g

E

m

iss

io

n

s

P

e

rce

n

ta

g

e

o

f

Re

m

a

ini

n

g

E

m

iss

io

n

s

0%

20%

40%

60%

80%

100%

120%

140%

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

SO2 (92% reduction)

NOx (83% reduction)

Mercury (93% reduction)

30

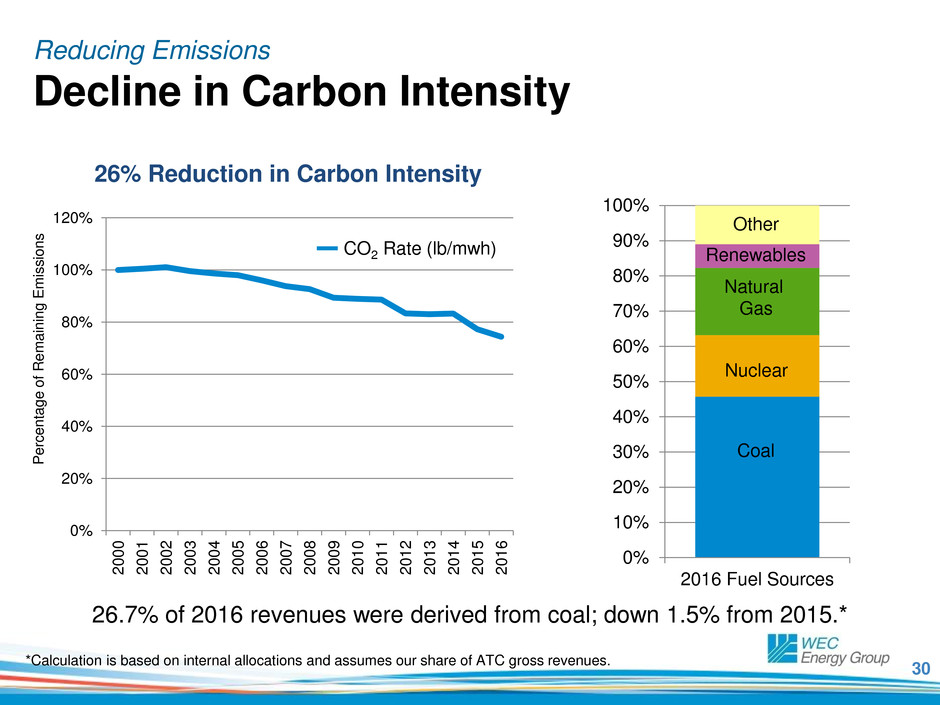

Reducing Emissions

Decline in Carbon Intensity

26% Reduction in Carbon Intensity

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2016 Fuel Sources

Coal

Nuclear

Natural

Gas

Renewables

Other

0%

20%

40%

60%

80%

100%

120%

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

2

0

1

4

2

0

1

5

2

0

1

6

P

erc

e

nta

g

e

o

f

R

em

a

in

in

g

E

mi

s

s

io

n

s

26.7% of 2016 revenues were derived from coal; down 1.5% from 2015.*

*Calculation is based on internal allocations and assumes our share of ATC gross revenues.

CO2 Rate (lb/mwh)

31

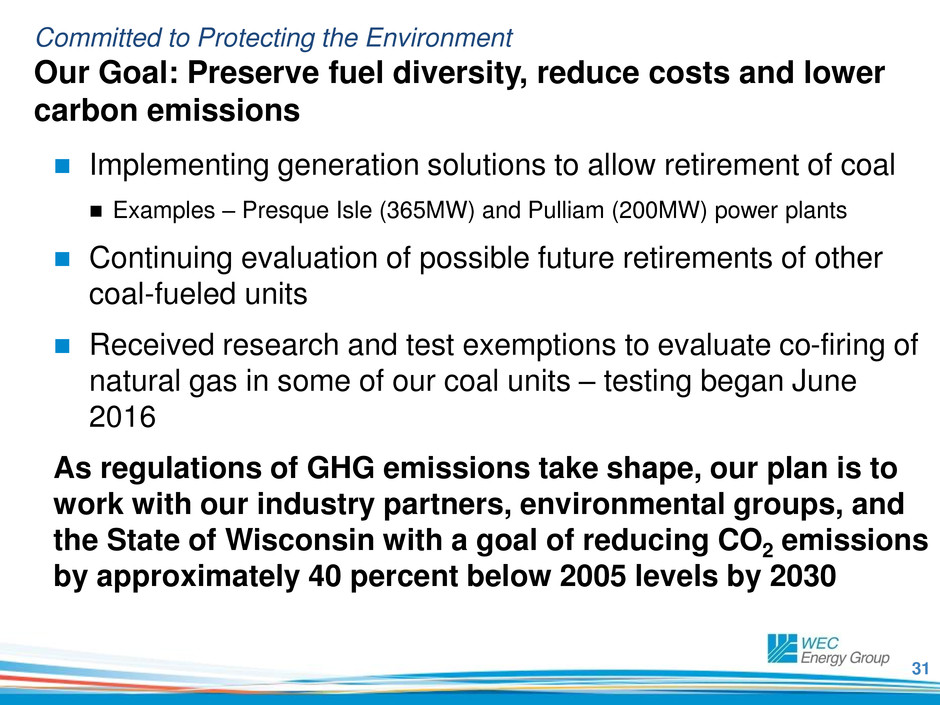

Committed to Protecting the Environment

Our Goal: Preserve fuel diversity, reduce costs and lower

carbon emissions

Implementing generation solutions to allow retirement of coal

Examples – Presque Isle (365MW) and Pulliam (200MW) power plants

Continuing evaluation of possible future retirements of other

coal-fueled units

Received research and test exemptions to evaluate co-firing of

natural gas in some of our coal units – testing began June

2016

As regulations of GHG emissions take shape, our plan is to

work with our industry partners, environmental groups, and

the State of Wisconsin with a goal of reducing CO2 emissions

by approximately 40 percent below 2005 levels by 2030

32

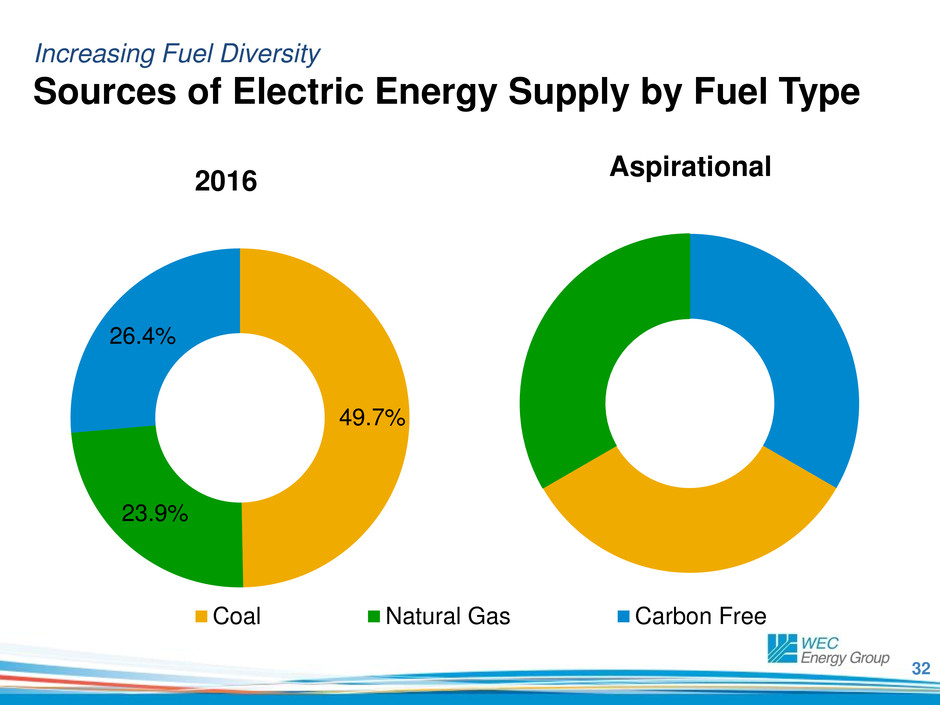

Increasing Fuel Diversity

Sources of Electric Energy Supply by Fuel Type

49.7%

23.9%

26.4%

2016

Coal Natural Gas Carbon Free

Aspirational

33

0

20

40

60

80

100

120

140

AA - A A- BBB+ BBB BBB- Below

Investment

Grade

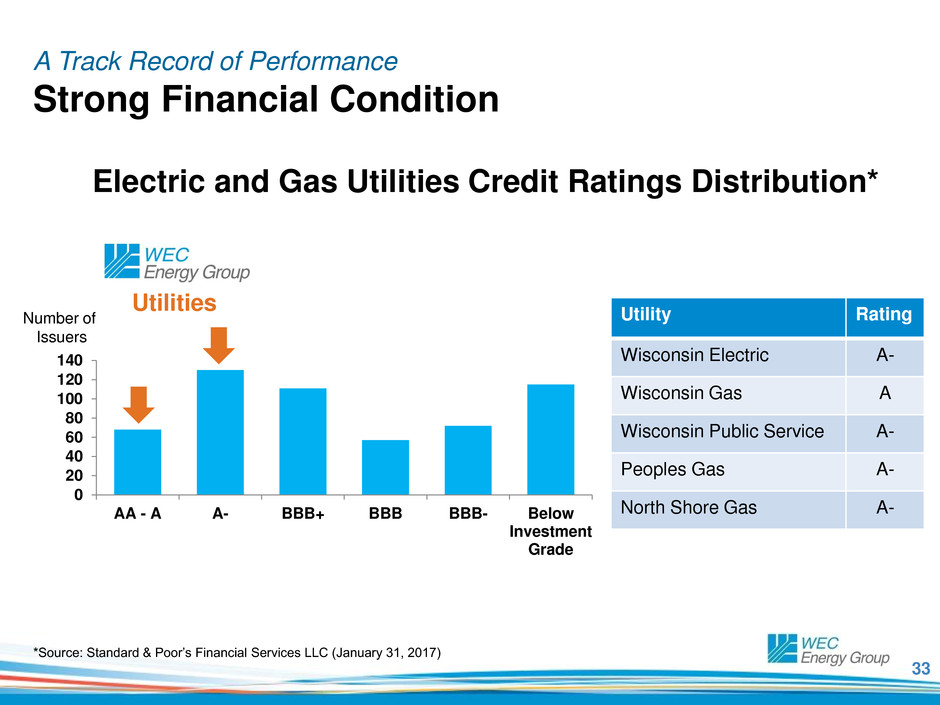

A Track Record of Performance

Strong Financial Condition

Number of

Issuers

*Source: Standard & Poor’s Financial Services LLC (January 31, 2017)

Utilities

Electric and Gas Utilities Credit Ratings Distribution*

Utility Rating

Wisconsin Electric A-

Wisconsin Gas A

Wisconsin Public Service A-

Peoples Gas A-

North Shore Gas A-

34

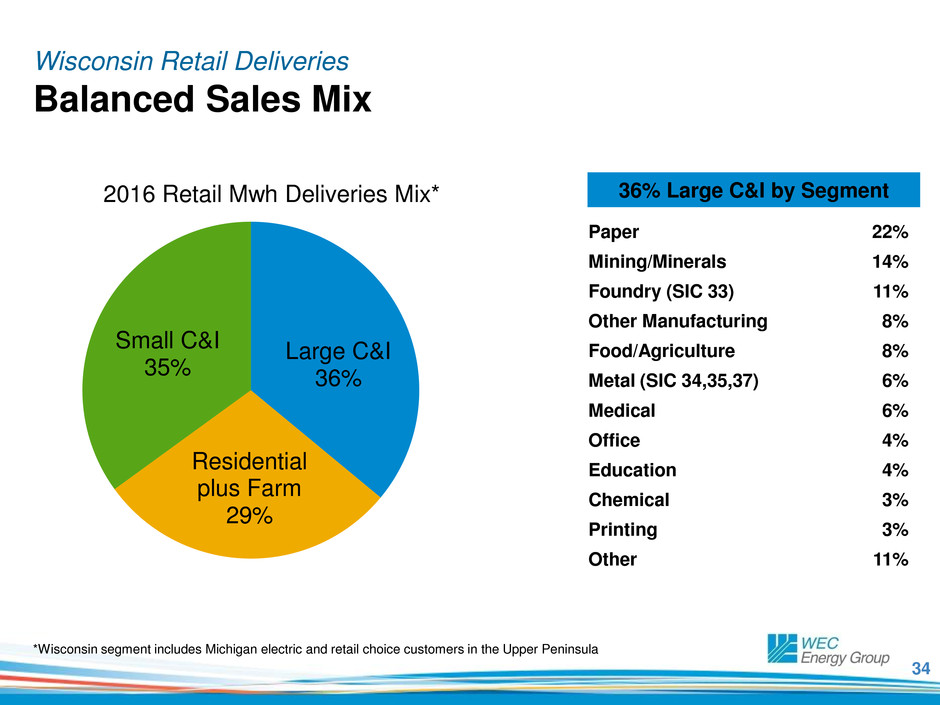

Paper 22%

Mining/Minerals 14%

Foundry (SIC 33) 11%

Other Manufacturing 8%

Food/Agriculture 8%

Metal (SIC 34,35,37) 6%

Medical 6%

Office 4%

Education 4%

Chemical 3%

Printing 3%

Other 11%

36% Large C&I by Segment

Wisconsin Retail Deliveries

Balanced Sales Mix

Large C&I

36%

Residential

plus Farm

29%

Small C&I

35%

2016 Retail Mwh Deliveries Mix*

*Wisconsin segment includes Michigan electric and retail choice customers in the Upper Peninsula

35

Important Local Events

Foxconn in Wisconsin

Foxconn announced July 26, 2017 Wisconsin’s largest economic

development project and largest corporate attraction project in U.S. history,

as measured by jobs.

Capital investment of $10 billion dollars

Goal of creating 13,000 jobs, with an average salary of $53,875, plus benefits

Expect to create at least 22,000 indirect and induced jobs throughout

Wisconsin.

Largest greenfield investments by a foreign-based company in U.S. history as

measured by jobs

One of the largest manufacturing campuses in the world

Project will support 10,000 construction jobs over the next four years and 6,000

indirect jobs from construction

Expected to have a $7 billion annual economic impact on the state

Plans to be operational in 2020

36

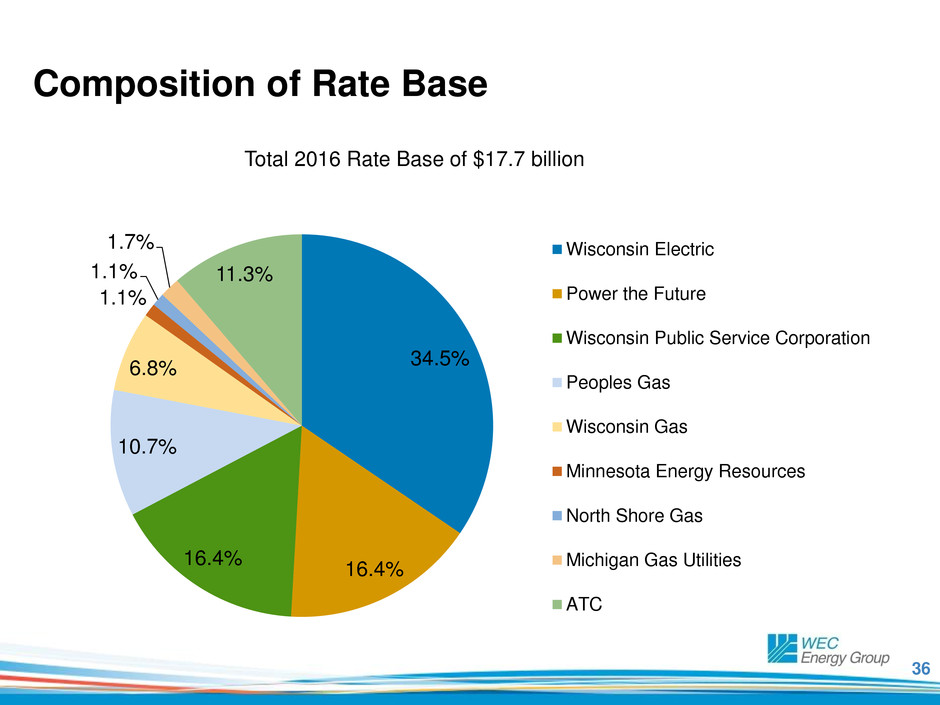

34.5%

16.4%

16.4%

10.7%

6.8%

1.1%

1.1%

1.7%

11.3%

Wisconsin Electric

Power the Future

Wisconsin Public Service Corporation

Peoples Gas

Wisconsin Gas

Minnesota Energy Resources

North Shore Gas

Michigan Gas Utilities

ATC

Composition of Rate Base

Total 2016 Rate Base of $17.7 billion

37

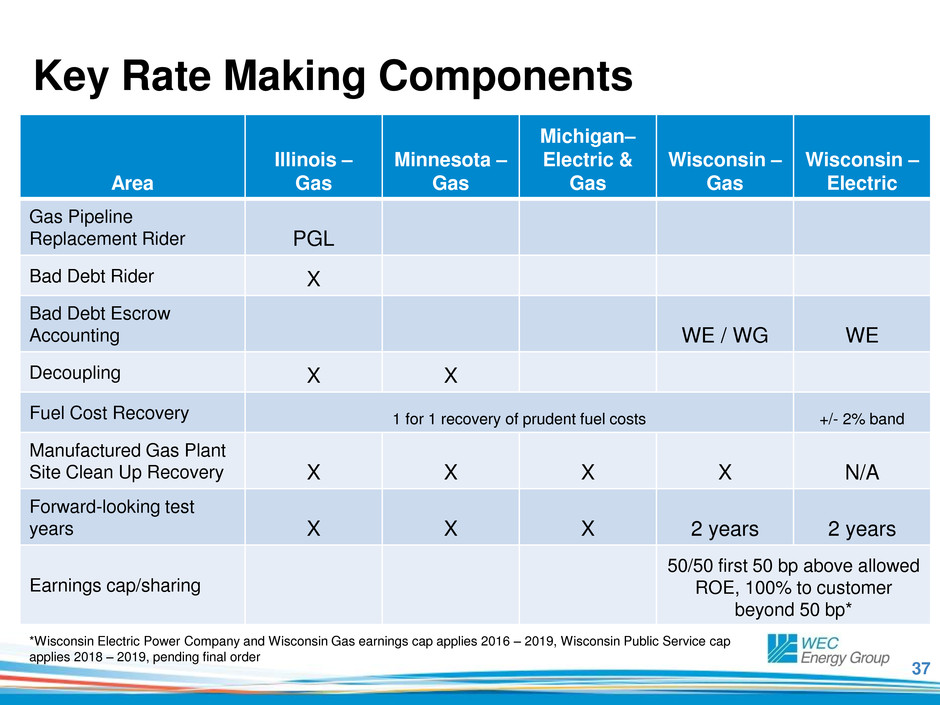

Key Rate Making Components

*Wisconsin Electric Power Company and Wisconsin Gas earnings cap applies 2016 – 2019, Wisconsin Public Service cap

applies 2018 – 2019, pending final order

Area

Illinois –

Gas

Minnesota –

Gas

Michigan–

Electric &

Gas

Wisconsin –

Gas

Wisconsin –

Electric

Gas Pipeline

Replacement Rider PGL

Bad Debt Rider X

Bad Debt Escrow

Accounting WE / WG WE

Decoupling X X

Fuel Cost Recovery 1 for 1 recovery of prudent fuel costs +/- 2% band

Manufactured Gas Plant

Site Clean Up Recovery X X X X N/A

Forward-looking test

years X X X 2 years 2 years

Earnings cap/sharing

50/50 first 50 bp above allowed

ROE, 100% to customer

beyond 50 bp*

38

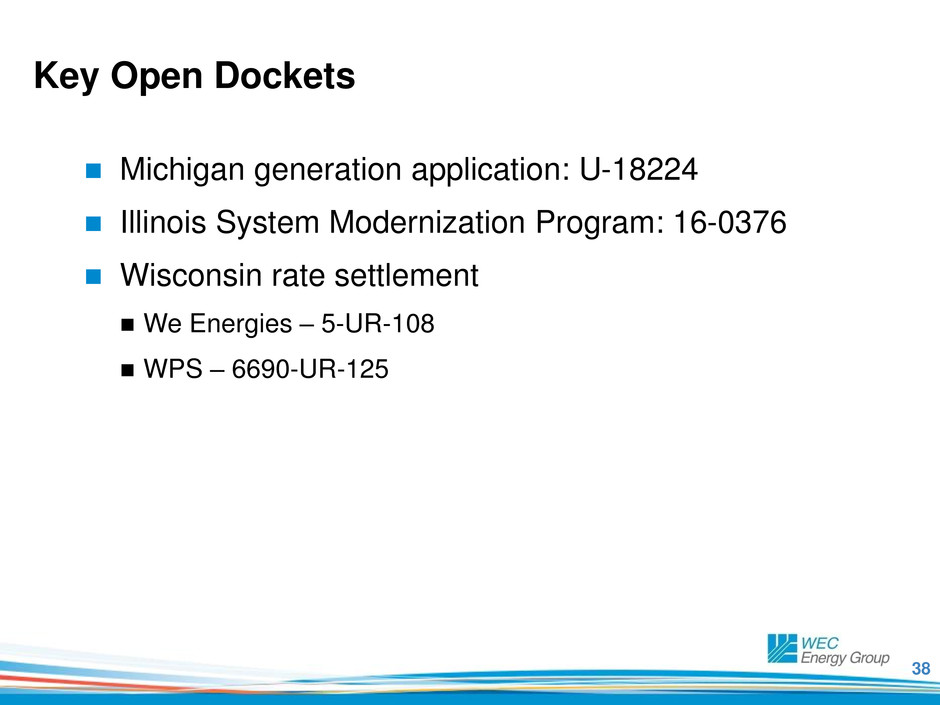

Key Open Dockets

Michigan generation application: U-18224

Illinois System Modernization Program: 16-0376

Wisconsin rate settlement

We Energies – 5-UR-108

WPS – 6690-UR-125

39

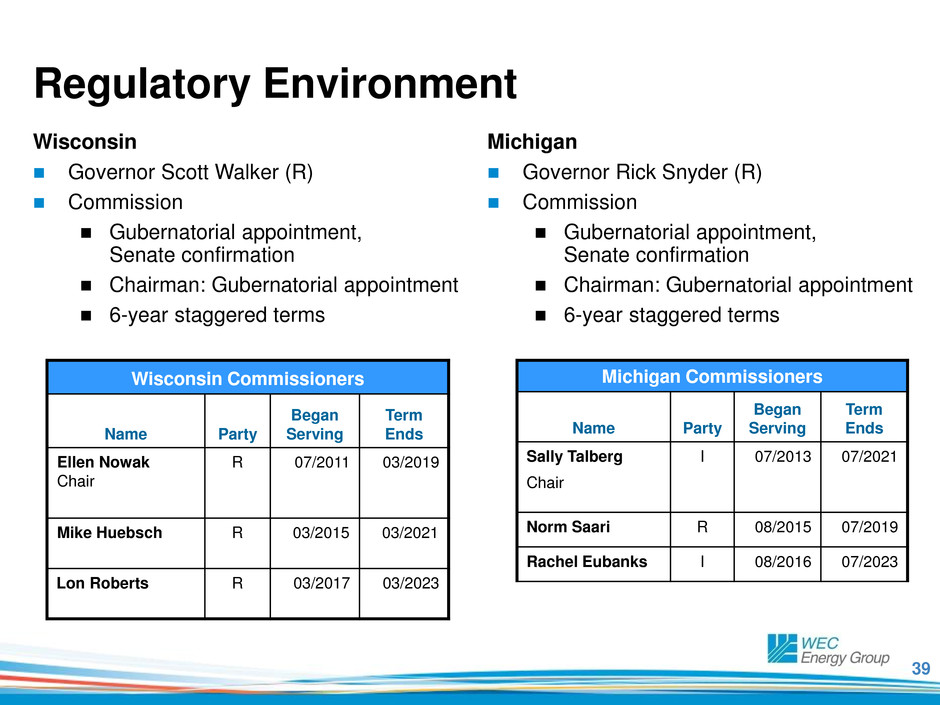

Regulatory Environment

Wisconsin

Governor Scott Walker (R)

Commission

Gubernatorial appointment,

Senate confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Michigan

Governor Rick Snyder (R)

Commission

Gubernatorial appointment,

Senate confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Wisconsin Commissioners

Name Party

Began

Serving

Term

Ends

Ellen Nowak

Chair

R 07/2011 03/2019

Mike Huebsch

R 03/2015 03/2021

Lon Roberts

R 03/2017 03/2023

Michigan Commissioners

Name Party

Began

Serving

Term

Ends

Sally Talberg

Chair

I 07/2013 07/2021

Norm Saari R 08/2015 07/2019

Rachel Eubanks I 08/2016 07/2023

40

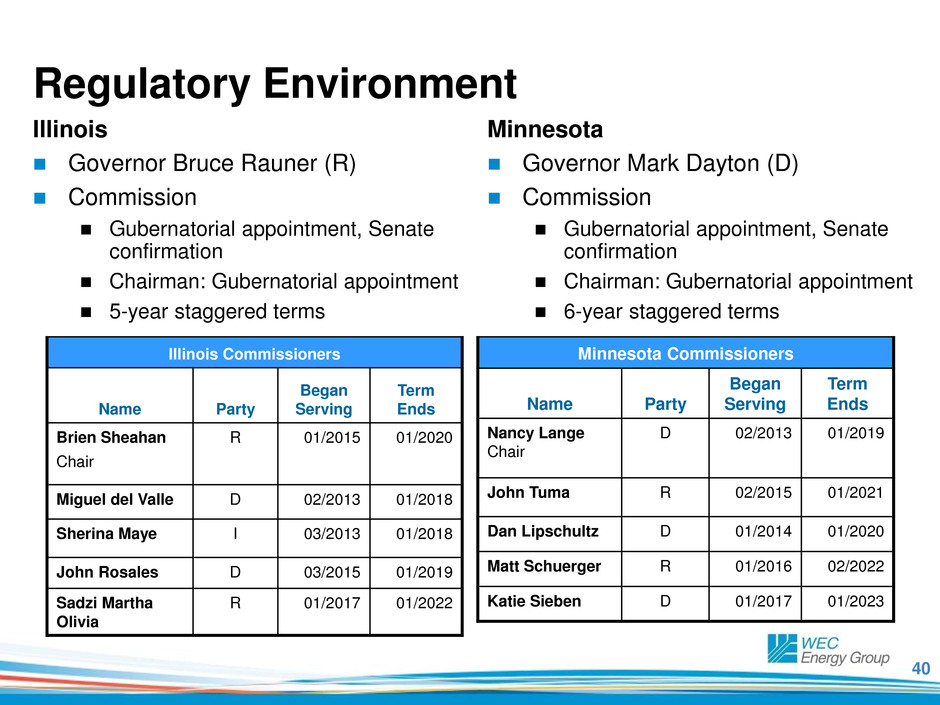

Regulatory Environment

Illinois

Governor Bruce Rauner (R)

Commission

Gubernatorial appointment, Senate

confirmation

Chairman: Gubernatorial appointment

5-year staggered terms

Minnesota

Governor Mark Dayton (D)

Commission

Gubernatorial appointment, Senate

confirmation

Chairman: Gubernatorial appointment

6-year staggered terms

Illinois Commissioners

Name Party

Began

Serving

Term

Ends

Brien Sheahan

Chair

R 01/2015 01/2020

Miguel del Valle D 02/2013 01/2018

Sherina Maye I 03/2013 01/2018

John Rosales D 03/2015 01/2019

Sadzi Martha

Olivia

R 01/2017 01/2022

Minnesota Commissioners

Name Party

Began

Serving

Term

Ends

Nancy Lange

Chair

D 02/2013 01/2019

John Tuma R 02/2015 01/2021

Dan Lipschultz D 01/2014 01/2020

Matt Schuerger R 01/2016 02/2022

Katie Sieben D 01/2017 01/2023

41

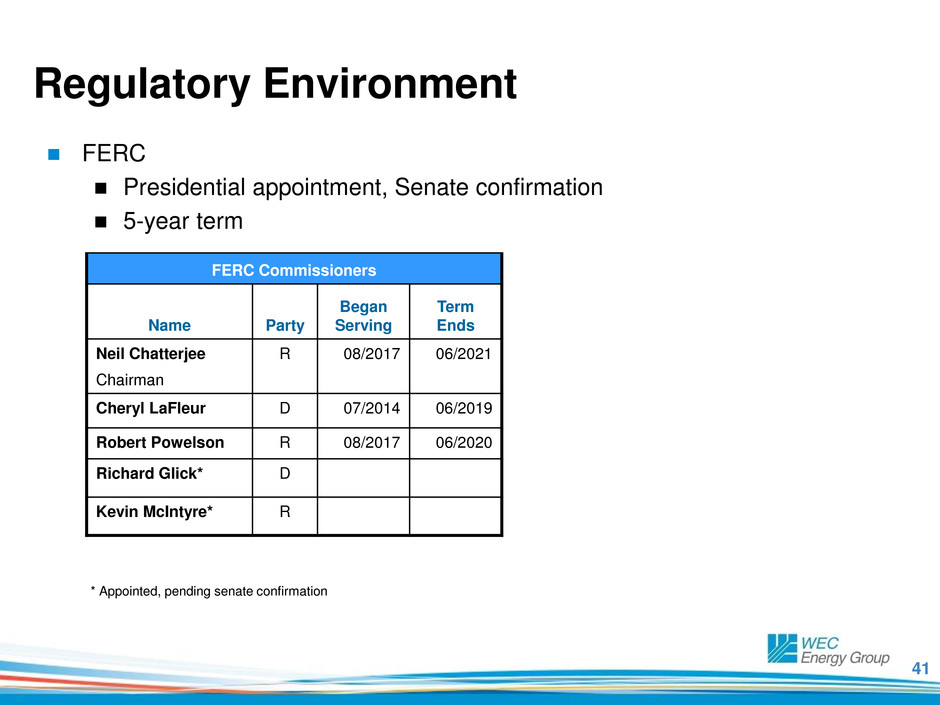

Regulatory Environment

FERC

Presidential appointment, Senate confirmation

5-year term

FERC Commissioners

Name Party

Began

Serving

Term

Ends

Neil Chatterjee

Chairman

R 08/2017 06/2021

Cheryl LaFleur D 07/2014 06/2019

Robert Powelson R 08/2017 06/2020

Richard Glick* D

Kevin McIntyre* R

* Appointed, pending senate confirmation

42

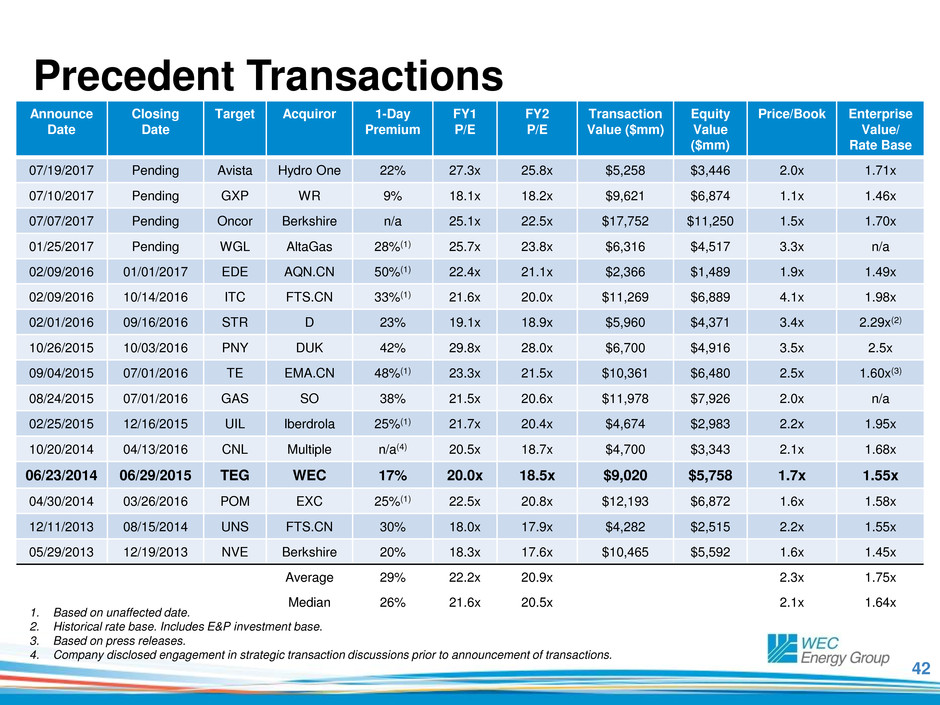

Precedent Transactions

Announce

Date

Closing

Date

Target Acquiror 1-Day

Premium

FY1

P/E

FY2

P/E

Transaction

Value ($mm)

Equity

Value

($mm)

Price/Book Enterprise

Value/

Rate Base

07/19/2017 Pending Avista Hydro One 22% 27.3x 25.8x $5,258 $3,446 2.0x 1.71x

07/10/2017 Pending GXP WR 9% 18.1x 18.2x $9,621 $6,874 1.1x 1.46x

07/07/2017 Pending Oncor Berkshire n/a 25.1x 22.5x $17,752 $11,250 1.5x 1.70x

01/25/2017 Pending WGL AltaGas 28%(1) 25.7x 23.8x $6,316 $4,517 3.3x n/a

02/09/2016 01/01/2017 EDE AQN.CN 50%(1) 22.4x 21.1x $2,366 $1,489 1.9x 1.49x

02/09/2016 10/14/2016 ITC FTS.CN 33%(1) 21.6x 20.0x $11,269 $6,889 4.1x 1.98x

02/01/2016 09/16/2016 STR D 23% 19.1x 18.9x $5,960 $4,371 3.4x 2.29x(2)

10/26/2015 10/03/2016 PNY DUK 42% 29.8x 28.0x $6,700 $4,916 3.5x 2.5x

09/04/2015 07/01/2016 TE EMA.CN 48%(1) 23.3x 21.5x $10,361 $6,480 2.5x 1.60x(3)

08/24/2015 07/01/2016 GAS SO 38% 21.5x 20.6x $11,978 $7,926 2.0x n/a

02/25/2015 12/16/2015 UIL Iberdrola 25%(1) 21.7x 20.4x $4,674 $2,983 2.2x 1.95x

10/20/2014 04/13/2016 CNL Multiple n/a(4) 20.5x 18.7x $4,700 $3,343 2.1x 1.68x

06/23/2014 06/29/2015 TEG WEC 17% 20.0x 18.5x $9,020 $5,758 1.7x 1.55x

04/30/2014 03/26/2016 POM EXC 25%(1) 22.5x 20.8x $12,193 $6,872 1.6x 1.58x

12/11/2013 08/15/2014 UNS FTS.CN 30% 18.0x 17.9x $4,282 $2,515 2.2x 1.55x

05/29/2013 12/19/2013 NVE Berkshire 20% 18.3x 17.6x $10,465 $5,592 1.6x 1.45x

Average 29% 22.2x 20.9x 2.3x 1.75x

Median 26% 21.6x 20.5x 2.1x 1.64x

1. Based on unaffected date.

2. Historical rate base. Includes E&P investment base.

3. Based on press releases.

4. Company disclosed engagement in strategic transaction discussions prior to announcement of transactions.

43

Contact Information

M. Beth Straka

Senior Vice President – Investor Relations and Corporate Communications

Beth.Straka@wecenergygroup.com

414-221-4639

Ashley Knutson

Investor Relations Analyst

Ashley.Knutson@wecenergygroup.com

414-221-2592