Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Employers Holdings, Inc. | egi_purchaseagreement-8k.htm |

Exhibit 10.1

STOCK PURCHASE AGREEMENT

between

PARTNER REINSURANCE COMPANY OF THE U.S.

and

EMPLOYERS GROUP, INC.

Dated as of August 11, 2017

Table of Contents | ||

Page | ||

ARTICLE I | THE PURCHASE AND TRANSACTION | 1 |

Section 1.1 | Purchase and Sale of the Shares | 1 |

Section 1.2 | Purchase Price | 1 |

Section 1.3 | Adjustments to Purchase Price | 2 |

Section 1.4 | Closing | 4 |

Section 1.5 | Withholding | 4 |

ARTICLE II | REPRESENTATIONS AND WARRANTIES BY THE SELLER | 5 |

Section 2.1 | Organization and Qualification of the Seller | 5 |

Section 2.2 | Corporate Action | 5 |

Section 2.3 | Authority | 5 |

Section 2.4 | Organization and Qualification of the Company | 5 |

Section 2.5 | No Subsidiaries of the Company | 6 |

Section 2.6 | Capitalization of the Company | 6 |

Section 2.7 | Certificate of Incorporation and By-laws | 6 |

Section 2.8 | Validity | 6 |

Section 2.9 | Governmental Approvals | 7 |

Section 2.10 | Third Party Approvals | 7 |

Section 2.11 | Conflict With Laws and Other Instruments | 7 |

Section 2.12 | Financial Statements | 7 |

Section 2.13 | No Material Adverse Effect | 7 |

Section 2.14 | Taxes | 8 |

Section 2.15 | Litigation | 9 |

Section 2.16 | Employees | 9 |

Section 2.17 | Powers of Attorney and Agents | 10 |

Section 2.18 | Environmental Matters | 10 |

Section 2.19 | Assets and Property | 10 |

Section 2.20 | No Liabilities | 10 |

Section 2.21 | Special Deposits; Accounts | 11 |

Section 2.22 | Corporate Records | 11 |

Section 2.23 | Compliance | 11 |

Section 2.24 | Brokers or Finders | 12 |

Section 2.25 | Contracts | 12 |

Section 2.26 | Absence of Certain Changes or Events | 13 |

Section 2.27 | Embargoed Persons | 14 |

ARTICLE III | REPRESENTATIONS AND WARRANTIES BY THE PURCHASER | 14 |

Section 3.1 | Corporate Existence, Power and Authority | 14 |

Section 3.2 | Corporate Action | 14 |

Section 3.3 | Validity | 14 |

Section 3.4 | Conflict with Other Instruments | 15 |

Section 3.5 | Brokers or Finders | 15 |

i

Table of Contents | ||

(continued) | ||

Page | ||

Section 3.6 | Governmental Approvals | 15 |

Section 3.7 | Litigation | 15 |

Section 3.8 | No Securities Acts Violation | 15 |

Section 3.9 | Availability of Funds | 15 |

ARTICLE IV | COVENANTS OF THE SELLER | 16 |

Section 4.1 | Operate in the Ordinary Course | 16 |

Section 4.2 | Access to Records | 16 |

Section 4.3 | [Intentionally omitted] | 16 |

Section 4.4 | Cooperation in Regulatory Filings | 16 |

Section 4.5 | Prohibited Conduct | 16 |

Section 4.6 | Special Deposits | 17 |

Section 4.7 | Preservation of Licenses | 17 |

Section 4.8 | No Amendments | 18 |

Section 4.9 | Agreements and Indebtedness | 18 |

Section 4.10 | Exclusivity | 18 |

Section 4.11 | Delivery of Financial Statements and Regulatory Filings | 19 |

Section 4.12 | Termination of Signing Powers | 19 |

Section 4.13 | Dividends and Other Distributions | 19 |

Section 4.14 | Liquidation of Investment Assets | 19 |

ARTICLE V | COVENANTS OF THE PURCHASER | 20 |

Section 5.1 | Acquisition Statement and Compliance with Insurance Laws; Other Approvals | 20 |

Section 5.2 | Post-Closing Access/Responsibilities | 20 |

Section 5.3 | Company Name | 21 |

ARTICLE VI | CONDITIONS PRECEDENT TO OBLIGATION OF THE PURCHASER TO CLOSE | 21 |

Section 6.1 | Representations and Warranties of the Seller | 21 |

Section 6.2 | Compliance with Covenants | 22 |

Section 6.3 | No Injunctions or Orders | 22 |

Section 6.4 | Directors and Officers | 22 |

Section 6.5 | Regulatory Approvals | 22 |

Section 6.6 | Delivery of Certificates for the Shares | 22 |

Section 6.7 | Delivery of Closing Documents by the Seller | 22 |

Section 6.8 | Capital and Surplus | 22 |

Section 6.9 | Other Transaction Agreements | 22 |

Section 6.10 | Termination of Agents, Brokers, Etc | 23 |

Section 6.11 | Termination of Agreements | 23 |

Section 6.12 | No Material Adverse Effect | 23 |

ii

Table of Contents | ||

(continued) | ||

Page | ||

ARTICLE VII | CONDITIONS PRECEDENT TO OBLIGATION OF THE SELLER TO CLOSE | 23 |

Section 7.1 | Representations and Warranties | 23 |

Section 7.2 | Compliance with Covenants | 23 |

Section 7.3 | No Injunctions or Orders | 23 |

Section 7.4 | Regulatory Approvals | 23 |

Section 7.5 | Payment of Purchase Price | 23 |

Section 7.6 | Delivery of Closing Documents by the Purchaser | 24 |

ARTICLE VIII | INDEMNIFICATION | 24 |

Section 8.1 | Indemnity by the Seller | 24 |

Section 8.2 | Indemnity by the Purchaser | 24 |

Section 8.3 | Notice and Defense of Third Party Claims | 24 |

Section 8.4 | Direct Claims | 26 |

Section 8.5 | Limitations | 26 |

Section 8.6 | Tax Matters | 26 |

Section 8.7 | [Intentionally omitted] | 26 |

Section 8.8 | [Intentionally omitted] | 26 |

Section 8.9 | Waiver and Release | 26 |

ARTICLE IX | TAX MATTERS | 27 |

Section 9.1 | Tax Indemnities | 27 |

Section 9.2 | Preparation of Tax Returns, Etc | 28 |

Section 9.3 | Tax Cooperation and Exchange of Information | 29 |

Section 9.4 | Conveyance Taxes | 29 |

Section 9.5 | Contests | 29 |

Section 9.6 | Tax Covenants | 30 |

Section 9.7 | Miscellaneous | 30 |

Section 9.8 | Certain Definitions Relating to Taxes | 31 |

ARTICLE X | TERMINATION | 32 |

Section 10.1 | Termination | 32 |

Section 10.2 | Effect of Termination | 32 |

ARTICLE XI | MISCELLANEOUS PROVISIONS | 33 |

Section 11.1 | Expenses | 33 |

Section 11.2 | Exhibits and Schedules: This Agreement | 33 |

Section 11.3 | Amendments and Waivers | 33 |

Section 11.4 | Other Instruments to be Executed; Further Assurances | 33 |

Section 11.5 | Public Statements; Confidentiality | 33 |

Section 11.6 | Parties Bound | 34 |

iii

Table of Contents | ||

(continued) | ||

Page | ||

Section 11.7 | Governing Law | 34 |

Section 11.8 | Notices | 35 |

Section 11.9 | Number and Gender of Words | 36 |

Section 11.10 | Severability | 36 |

Section 11.11 | Currency | 37 |

Section 11.12 | Entire Agreement | 37 |

Section 11.13 | Waiver | 37 |

Section 11.14 | Counterparts; Effectiveness | 37 |

Section 11.15 | Assignment | 37 |

Section 11.16 | Headings; Construction; Interpretation | 37 |

Section 11.17 | Third Party Beneficiaries | 38 |

Section 11.18 | Other Representations and Warranties; Remedies Exclusive | 38 |

iv

Table of Contents

(continued)

EXHIBITS |

Exhibit A — Definitions |

Exhibit B — Transfer and Assumption Agreement |

Exhibit C — Guaranty |

SCHEDULES |

2.4 – Licensed States |

2.5 – Securities Owned |

2.9 – Governmental Approvals |

2.10 – Third Party Approvals |

2.11 – Conflicts with Other Instruments |

2.14(e) – Tax Extensions or Waivers |

2.14(l) – Tax Indemnities |

2.15 – Litigation |

2.17 – Powers of Attorney and Agents |

2.21(a) – Special Deposits |

2.21(b) – Bank Accounts and Safe Deposit Boxes |

2.23(a) – Compliance Violations |

2.23(b) – Governmental Proceedings/Investigations/Examinations |

2.25 – Contracts |

2.26 – Absence of Certain Changes |

3.6 – Governmental Approvals |

4.1 – Operation in the Ordinary Course |

4.5 – Prohibited Contact |

4.9(a) – Agreements Other Than Transfer and Assumption Agreement and Guaranty |

4.9(b) – Terminated Agreements |

v

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT (this “Agreement”) dated as of August 11, 2017, by and between Partner Reinsurance Company of the U.S., a New York corporation (the “Seller”), and Employers Group, Inc., a Nevada corporation (the “Purchaser” and, with the Seller, collectively, the “Parties” and individually a “Party”). Defined terms used and not defined herein have the meaning ascribed thereto in Exhibit A.

W I T N E S S E T H:

WHEREAS, the Seller beneficially owns 300,000 shares of common stock, $20.00 par value per share (the “Shares”), representing 100% of the issued and outstanding capital stock, of PartnerRe Insurance Company of New York, a New York corporation (the “Company”);

WHEREAS, the Company has been engaged in the Business, for which it has become licensed as an admitted insurer or accredited as a reinsurer in various jurisdictions; and

WHEREAS, the Seller desires to sell to the Purchaser, and the Purchaser desires to purchase from the Seller, all of the Shares, on the terms and conditions hereinafter set forth.

NOW THEREFORE, in consideration of the premises set forth above, and subject to the terms and conditions stated herein, the Parties hereto, intending to be legally bound, agree as follows:

ARTICLE I

The Purchase and Sale Transaction

Section 1.1Purchase and Sale of the Shares. The Purchaser agrees to purchase from the Seller, and the Seller agrees to sell, assign, transfer and deliver to the Purchaser, on the Closing Date, the Shares for the consideration specified in Section 1.2 on the terms and conditions provided for herein.

Section 1.2Purchase Price. (a) Subject to adjustment pursuant to Section 1.3, the Purchaser agrees to pay to the Seller, and the Seller agrees to accept from the Purchaser, as payment for the Shares an amount in cash (the “Purchase Price”), equal to the sum of:

(i)The amount of statutory capital and surplus of the Company in accordance with Statutory Accounting Principles as of the Closing as set forth in the Estimated Closing Statement (the “Initial Statutory Capital and Surplus”); plus

(ii)Five Million Eight Hundred Thousand Dollars ($5,800,000.00).

(b)Subject to any Requirement of Law including, without limitation, any approval of the New York Department and any limits imposed by the New York Department restricting the amount of the dividends or other distributions which the Company may pay to the Seller, the Seller will use its reasonable efforts to reduce the Initial Statutory Capital and Surplus of the Company on the Closing Date to an amount not less than the amount required by applicable Requirements of Law after giving effect to the transactions contemplated by the Transfer and Assumption Agreement and not substantially more than Forty Million Dollars ($40,000,000), which

1

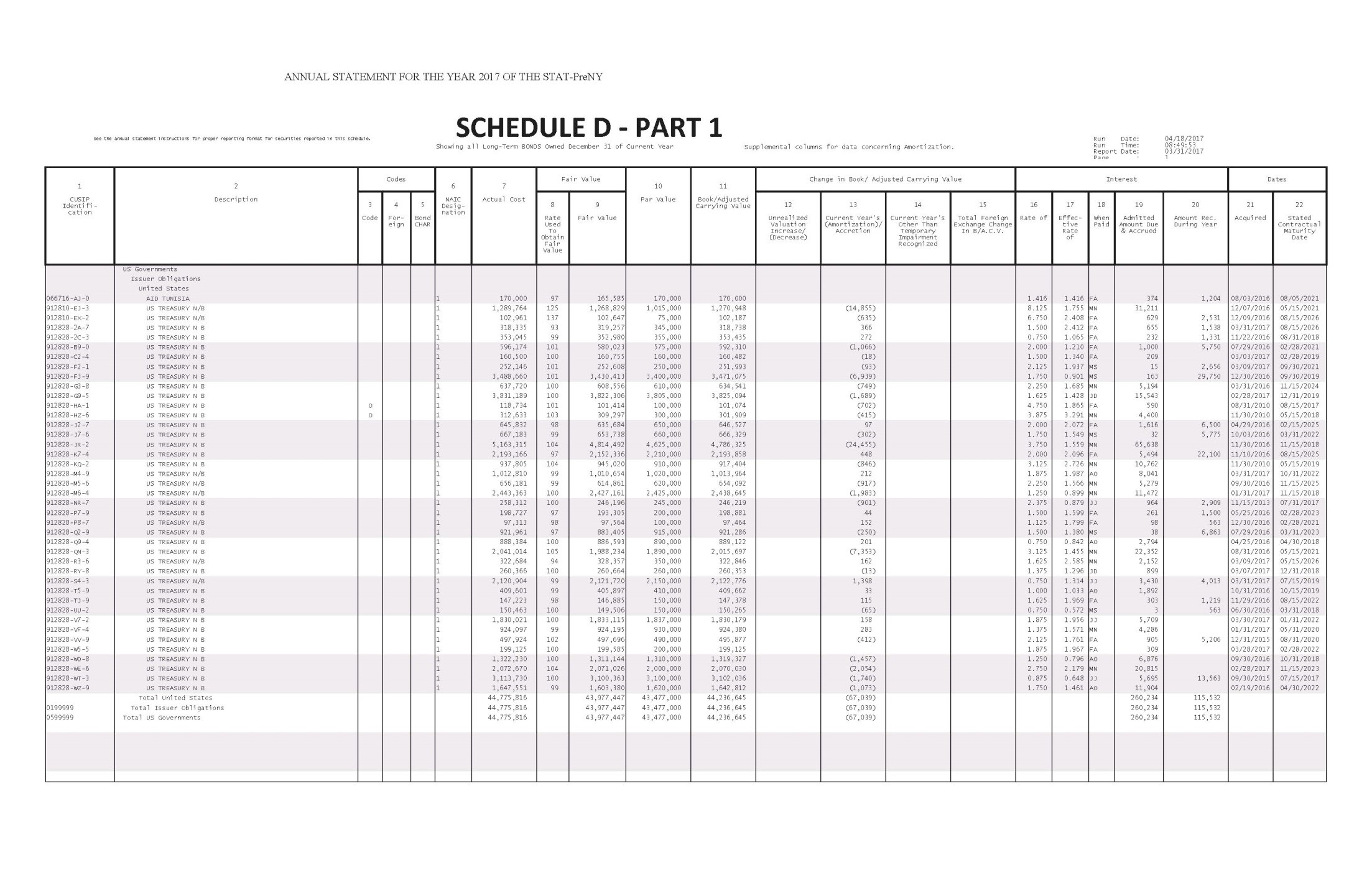

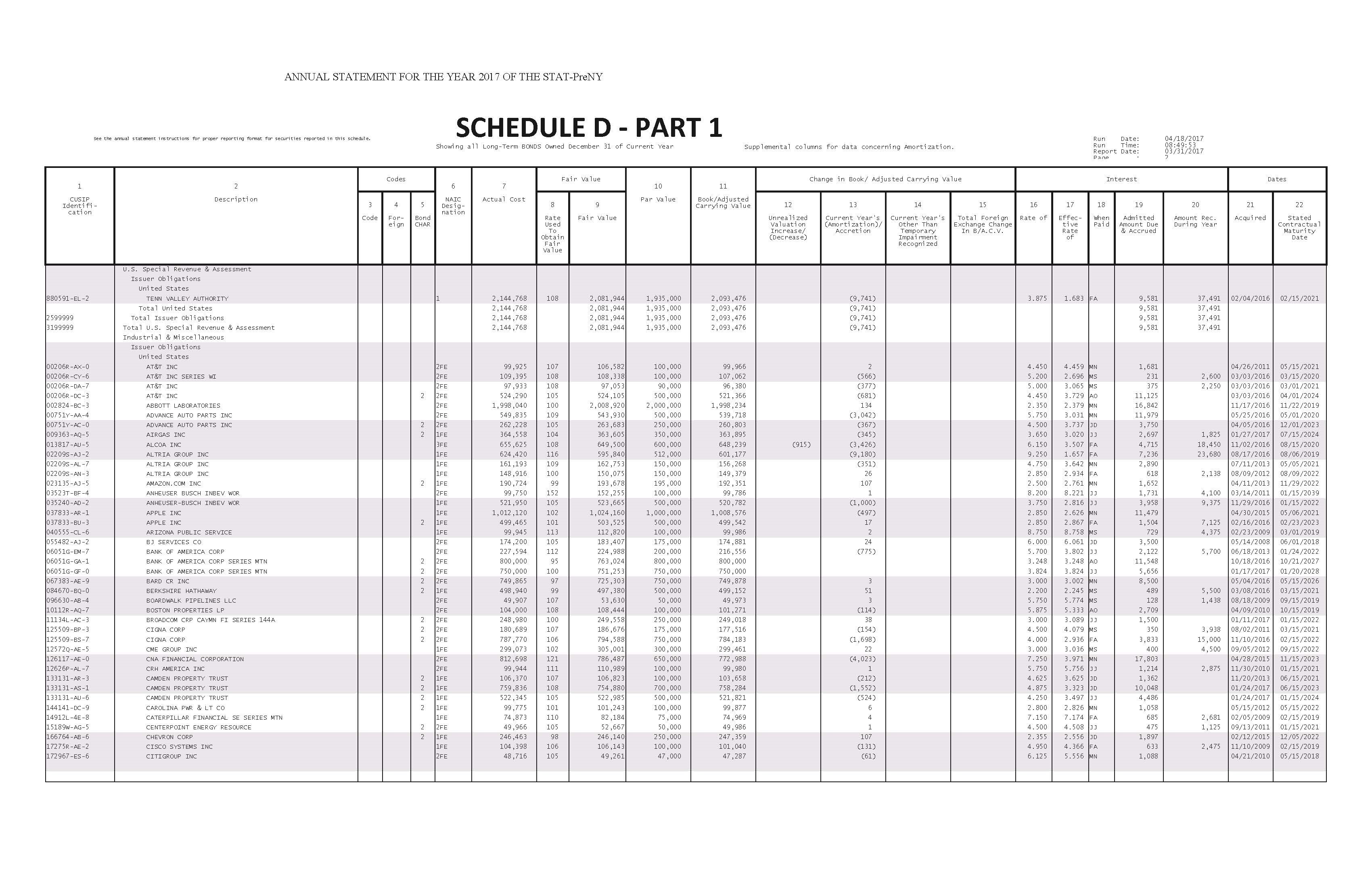

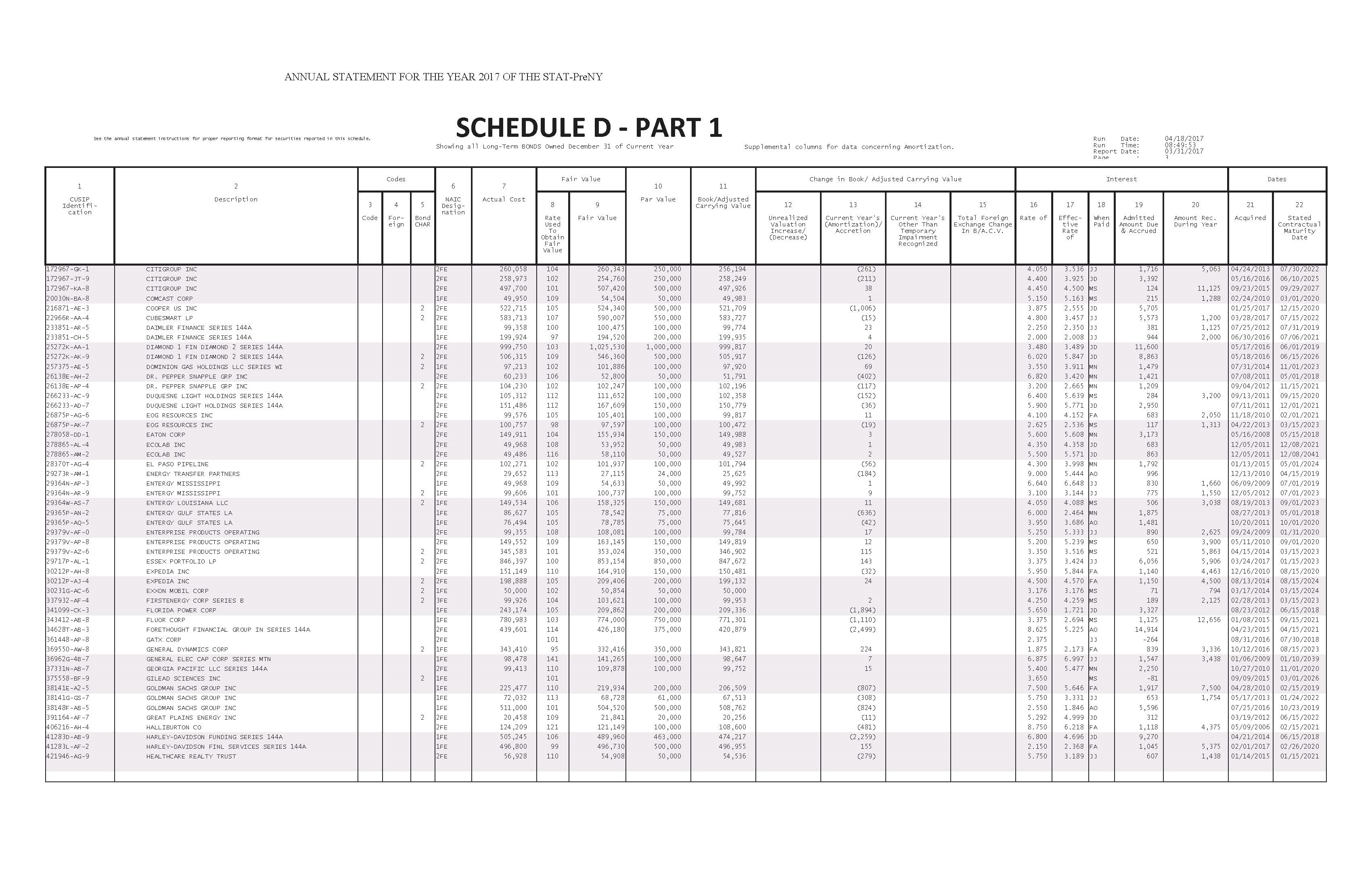

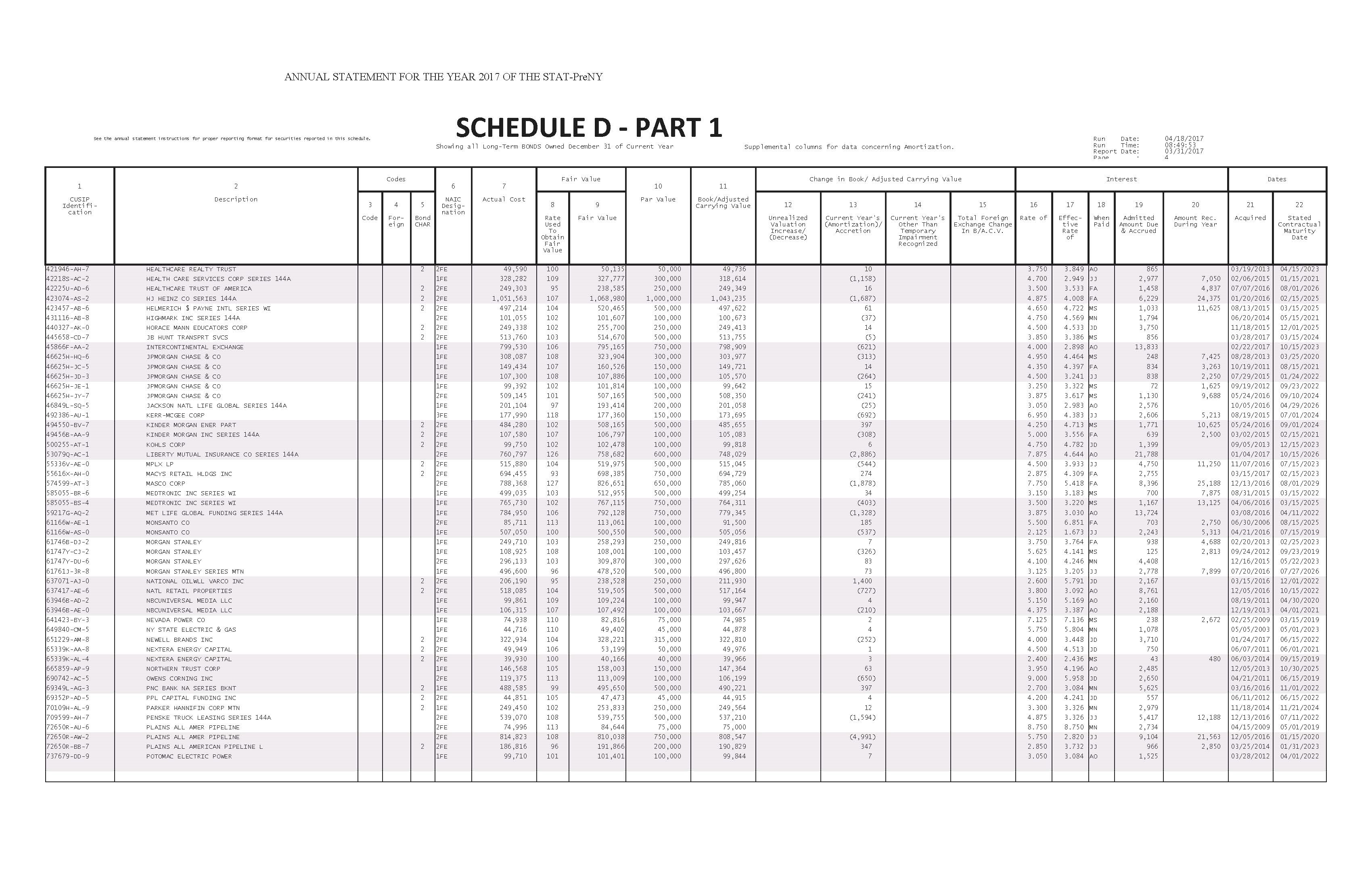

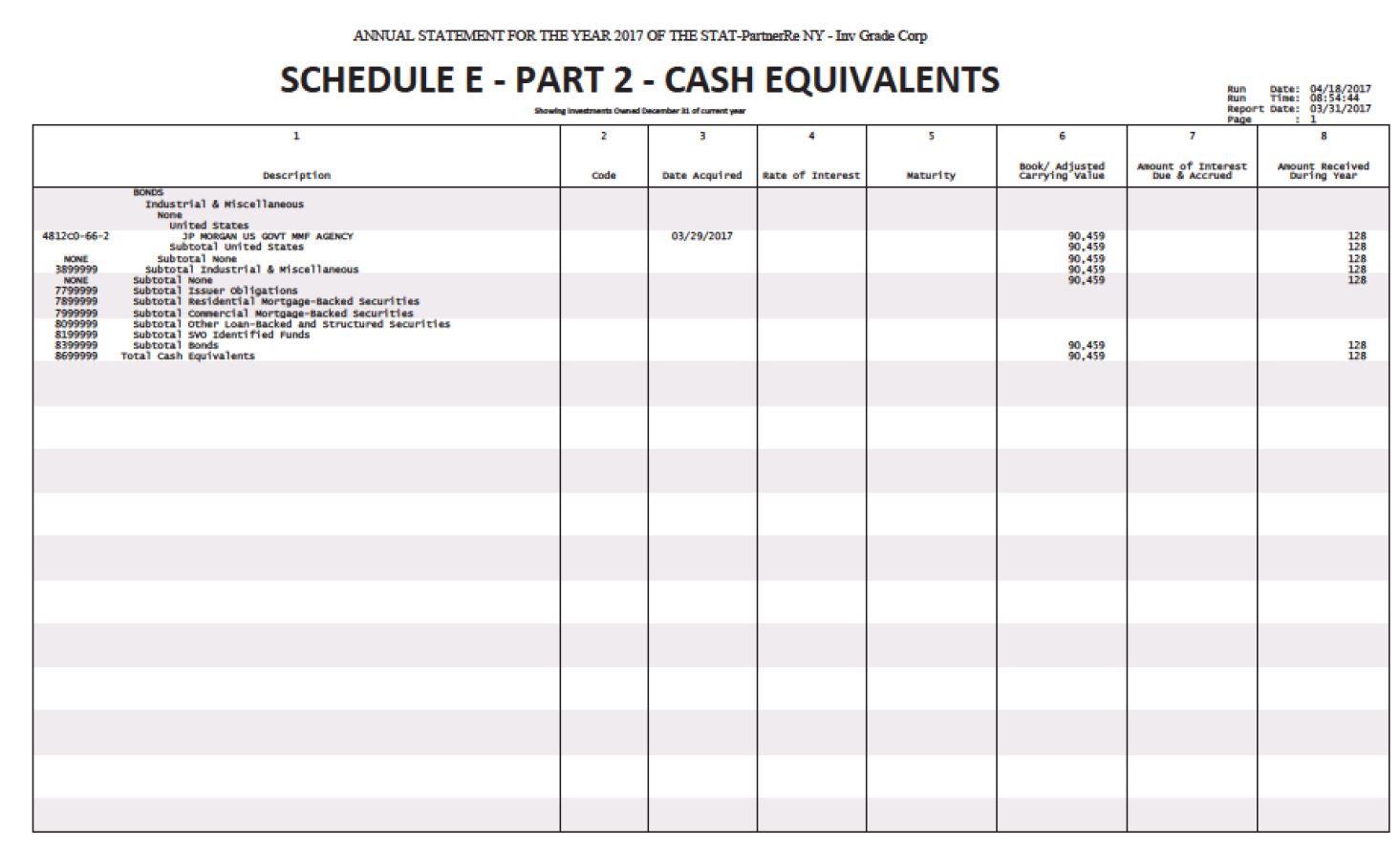

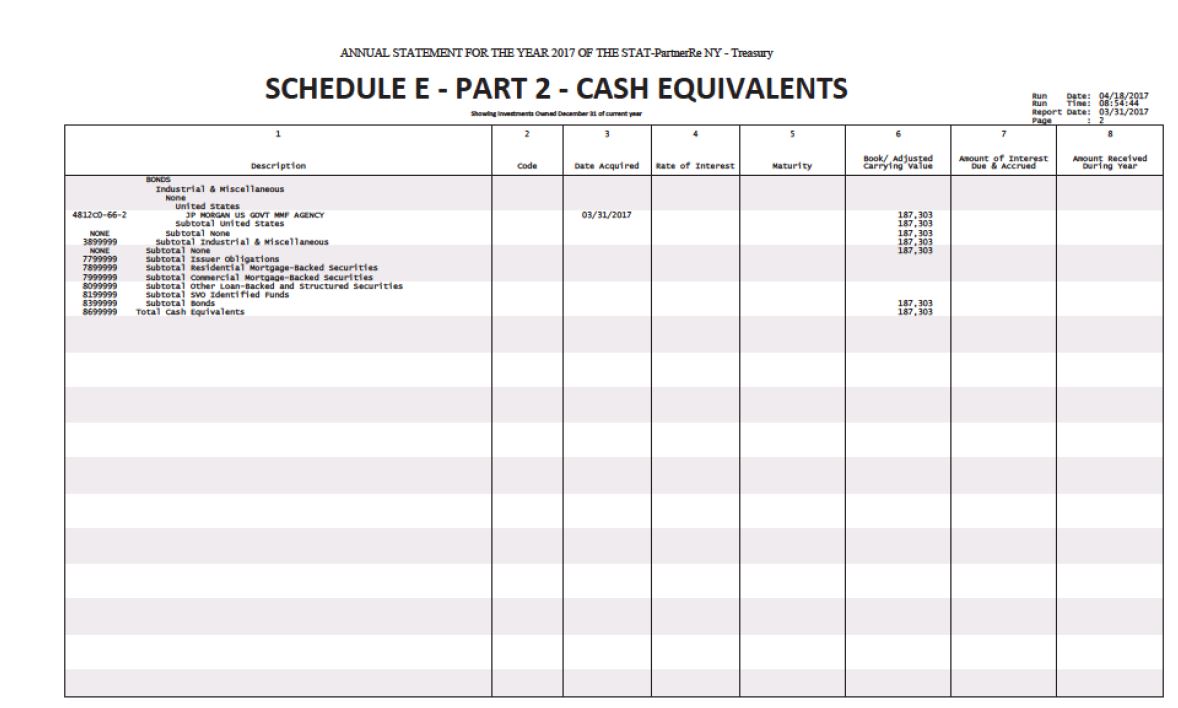

includes Special Deposits. The Purchaser acknowledges that, on the Closing Date, the Initial Statutory Capital and Surplus shall only include cash, cash equivalents and United States Treasury securities.

(c)Subject to Section 1.3, the Purchase Price shall be payable by the Purchaser at the Closing by wire transfer of immediately available funds to an account designated in writing by the Seller at least three (3) Business Days prior to the anticipated Closing Date.

(d)No later than two (2) Business Days prior to the anticipated Closing Date, the Seller shall provide to the Purchaser a statement (the “Estimated Closing Statement”) setting forth an estimated balance sheet of the Company reflecting the Seller’s good faith estimate of the statutory financial position of the Company as of the Closing Date, which shall be in accordance with Statutory Accounting Principles in effect as of the date of the Estimated Closing Statement. The Initial Statutory Capital and Surplus reflected on the Estimated Closing Statement will be calculated as set forth in the immediately preceding sentence (except for the Company’s investment assets, which will be valued at fair market value as of the date of the Estimated Closing Statement) and will be the amount of Initial Statutory Capital and Surplus to be paid by the Purchaser as provided in Section 1.2(b) above.

Section 1.3Adjustments to Purchase Price.

The Purchase Price shall be subject to adjustment at and/or subsequent to the Closing at the times and as provided in this Section 1.3.

(a)Seller (on or prior to the Closing Date) shall notify Purchaser in writing if any of the Company’s licenses or accreditations to transact insurance or reinsurance business in the jurisdictions listed on Schedule 2.4 or any of the authorizations under each of those licenses or accreditations to write specific lines of insurance or reinsurance business (collectively the “Licenses”, and each such jurisdiction a “Licensed State”) have been and continue to be rescinded, terminated, revoked, nonrenewed, suspended or are in a proceeding with respect to any of the foregoing or are otherwise materially restricted or impaired (a “Rescinded License”) at the time of the Closing as a result of conduct (or a failure to act) occurring prior to the Closing Date by the Seller, the Company or their respective Affiliates. After the Closing Date, if any of the Licenses becomes and continues to be a Rescinded License as a result of conduct (or a failure to act) occurring prior to the Closing Date by the Seller, the Company or their respective Affiliates, Purchaser shall notify Seller in writing prior to the date that is sixty (60) days following the Closing Date.

(b)Prior to and on the Closing Date, the Seller, at its own expense, will use its reasonable efforts, with the cooperation of the Purchaser, as needed, to eliminate, cure or resolve any restriction, impairment or proceeding resulting in a License being a Rescinded License, so as to enable the Company to continue writing all lines of insurance and reinsurance business in such states that the Company was licensed or accredited to write prior to such License becoming a Rescinded License (such elimination or cure, a “License Cure”). After the Closing Date, the Purchaser, at Seller’s expense, will use its reasonable efforts, with the cooperation of Seller, to obtain License Cures; provided, that (i) the Purchaser shall, in good faith, give due consideration to any and all recommendations of the Seller in connection with obtaining a License Cure, (ii) the expenses

2

incurred in connection with a License Cure must be reasonable for a matter of such nature and (iii) in no event shall the Seller’s expenses exceed the amount of the License Value for such License.

(c)If there is any Licensed State in which a Rescinded License exists on and as of the Closing Date and, notwithstanding the exercise of Seller’s reasonable efforts, the Seller fails to obtain a License Cure prior to the Closing Date with respect thereto, the Purchaser shall withhold the License Value with respect to such Licensed State from the Purchase Price otherwise payable by the Purchaser to the Seller on the Closing Date; provided, however, that (i) if such License Cure has been obtained prior to the date that is three (3) months after the Closing Date, then the Purchaser shall promptly (but in any event no more than fifteen (15) days following such License Cure) pay to the Seller the full License Value for such Licensed State, and (ii) if such License Cure has been obtained after the three (3) month anniversary of the Closing Date but prior to the date that is six (6) months after the Closing Date, then the Purchaser shall promptly (but in any event no more than fifteen (15) days following such License Cure) pay to the Seller seventy-five percent (75%) of the License Value for such Licensed State. For the avoidance of doubt, with respect to this Section 1.3(c), any License Cure obtained after the six (6) month anniversary of the Closing Date shall not entitle the Seller to payment of any part of the License Value with respect to such Licensed State.

(d)If there is any Licensed State where a License becomes a Rescinded License after the Closing Date and prior to the date that is sixty (60) days following the Closing attributable to the action (or failure to act) of the Seller, the Company or their respective Affiliates prior to the Closing Date, (i) the Purchaser will notify the Seller of such status as a Rescinded License promptly after the Purchaser receives written notice of such Rescinded License and provide to Seller any information available to the Purchaser as to the reason for such Rescinded License, and (ii) notwithstanding the exercise of Purchaser’s reasonable efforts to obtain a License Cure, the Seller will promptly (but in any event no more than fifteen (15) days following such deadlines below) pay to the Purchaser with respect to such Licensed State (A) twenty-five percent (25%) of the License Value, if such License Cure has not been obtained prior to the date that is three (3) months after the date when the License became a Rescinded License, and (B) the remaining seventy-five percent (75%) of the License Value if such License Cure has not been obtained prior to the date that is six (6) months after the date when the License became a Rescinded License. For the avoidance of doubt, with respect to this Section 1.3(d), if the License Cure is obtained after the six (6) month anniversary of the date when the License became a Rescinded License, the Purchaser shall be entitled to repayment in full of the License Value with respect to such Licensed State.

(e)(i) No later than sixty (60) days after the Closing Date, Purchaser shall deliver to Seller a statement (the “Final Closing Statement”) setting forth the balance sheet of the Company as of the Closing Date, prepared in good faith from the books and records of the Company and in accordance with Statutory Accounting Principles in effect as of the Closing Date. Seller shall have thirty (30) days from the date on which the Final Closing Statement is delivered to review such statement (the “Review Period”).

(ii) If Seller disagrees with the Final Closing Statement, Seller may, on or prior to the last day of the Review Period, deliver a notice to Buyer setting forth, in reasonable detail, each disputed item or amount and the basis for Seller’s disagreement therewith (the “Dispute Notice”). The Dispute Notice shall set forth, with respect to each disputed item, Seller’s position

3

as to the correct amount or computation that should have been included in the Final Closing Statement.

(iii) If no Dispute Notice is received by Purchaser with respect to any item in the Final Closing Statement on or prior to the last day of the Review Period, the amount or computation with respect to such item as set forth in the Final Closing Statement shall be deemed accepted by Seller, whereupon the amount or computation of such item or items shall be final and binding on the parties.

(iv) If a Dispute Notice is received by Purchaser, then the Parties will endeavor in good faith to resolve by mutual agreement all matters identified in the Dispute Notice. In the event that the Parties are unable to resolve by mutual agreement any matter in the Dispute Notice within ten (10) Business Days, then the Parties shall jointly engage PriceWaterhouseCoopers to make a final determination with respect to all matters in dispute, the cost of which shall be borne equally by the Parties. The report of the independent accounting or actuarial firm (the “Final Report”) shall be final and binding on the Parties, and shall be deemed a final arbitration award that is binding on the Parties, and, absent fraud, no Party shall seek further recourse to courts, other tribunals or otherwise, other than to enforce the Final Report.

(v) If the statutory capital and surplus of the Company reflected in the Final Closing Statement or, if applicable, the Final Report (the “Final Statutory Capital and Surplus”) is more than the Initial Statutory Capital and Surplus, then Purchaser shall remit to Seller an amount equal to the absolute value of such difference within ten (10) Business Days of the end of the Review Period or the date of the Final Report, as applicable. If the Final Statutory Capital and Surplus is less than the Initial Statutory Capital and Surplus, then Seller shall remit to Purchaser an amount equal to the absolute value of such difference within ten (10) Business Days of the end of the Review Period or the date of the Final Report, as applicable.

Section 1.4Closing. The Closing shall take place at the offices of Morgan, Lewis & Bockius LLP located at One State Street, Hartford, Connecticut at 10:00 a.m., local time, within seven (7) Business Days following the date on which the approval of the acquisition of the Shares by the Purchaser has been obtained from the New York Department or such other time and date as the Parties hereto may agree in writing, subject to satisfaction or waiver of each of the closing conditions set forth in ARTICLES VI and VII. Notwithstanding the foregoing, if the approval of the acquisition of the Shares by the Purchaser is obtained from the New York Department within seven (7) Business Days prior to the end of any calendar quarter and all other conditions to closing have been satisfied or waived, each of the Seller and the Purchaser shall use reasonable efforts to consummate the Closing prior to the end of such calendar quarter.

Section 1.5Withholding. Notwithstanding anything in this Agreement to the contrary, the Purchaser shall be entitled to deduct and withhold from the consideration otherwise payable to any Person pursuant to this Agreement any amount as may be required to be deducted and withheld with respect to the making of such payment under the Code, or any other provision of Tax law; provided, that Purchaser shall take reasonable efforts to provide sufficient time and opportunity for the Seller to review Purchaser’s decision to withhold on any payments made pursuant to this Agreement, and that all Parties shall, to the extent reasonably practicable and as permitted by law, work together to avoid or reduce any such withholding obligation. To the extent that amounts are

4

so withheld or deducted by the Purchaser such withheld amounts shall be treated for all purposes of this Agreement as having been paid to such Person in respect of which such deduction and withholding was made by the Purchaser.

ARTICLE II

Representations and Warranties by the Seller

The Seller hereby represents and warrants to the Purchaser as of the date hereof and as of the Closing Date, in each case as set forth in this ARTICLE II. All disclosures to be made by the Seller in connection with, or exceptions to, these representations and warranties are made by the Seller solely in the Schedules attached to this Agreement.

Section 2.1Organization and Qualification of the Seller. The Seller is a corporation, duly organized, validly existing and in good standing under the laws of the State of New York. The Seller has all requisite corporate authority to carry on its business as the same is being conducted on the date hereof, to own or otherwise possess all of the assets and properties it owns or otherwise possesses on the date hereof, to execute and deliver this Agreement and to perform its obligations hereunder.

Section 2.2Corporate Action. The authorization, execution and delivery of this Agreement and the Transfer and Assumption Agreement by the Seller, and the consummation by the Seller of the transactions contemplated herein and therein, have been authorized by all requisite corporate action, if any, on the part of the Seller, including the approval, if any, by the Board of Directors of the Seller.

Section 2.3Authority. The Seller has full corporate power and authority to execute and deliver the Transaction Agreements to which it is a party and to take the actions and carry out the transactions contemplated by the Transaction Agreements. The execution, delivery and performance by the Seller of the Transaction Agreements to which it is a party, and the consummation of the transactions contemplated thereby, have been duly authorized and approved by all required corporate action on the part of the Seller.

Section 2.4Organization and Qualification of the Company. The Company is a corporation, duly organized, validly existing and in good standing under the laws of the State of New York. Except as set forth in Schedule 2.4 hereto, the Company (i) is duly licensed as a domestic insurance company in the State of New York, (ii) is duly licensed or accredited as a foreign insurance or reinsurance company in each other jurisdiction listed on Schedule 2.4, which are the only jurisdictions other than the State of New York in which the Company is licensed or accredited, and (iii) has the required minimum Statutory Capital and Surplus required in each such jurisdiction. The Seller has made available to the Purchaser true and complete copies of each of the Company’s Licenses, reflecting all amendments thereto, for New York and each of the jurisdictions listed in Schedule 2.4 where the Company is licensed or accredited to conduct the Business. Except as set forth in Schedule 2.4, (a) the Company is in good standing in each such jurisdiction, and each License is in full force and effect in all respects, and (b) there are no investigations, proceedings, actions or claims pending, threatened in writing or, to the Seller’s Knowledge, threatened orally, in any jurisdiction to suspend, restrict and/or revoke any License of the Company or any of its lines of authority in each state in which it has a License or, to the Knowledge of the Seller, any basis for

5

any such suspension, restriction or revocation. Except as may be required by an applicable governmental or regulatory authority as a condition to writing new business, the Company is not subject to any Requirement of Law limiting or restricting its ability in any respect to make full use of its Licenses in accordance with the terms thereof. Subject to the receipt of all Required Approvals, none of the Licenses will be terminated or impaired or become terminable, in whole or in part, as a result of the transactions contemplated herein.

Section 2.5No Subsidiaries of the Company. The Company does not own, either directly or indirectly, any voting securities or other equity of any corporation, partnership or other business entity, other than marketable securities and other investments set forth on Schedule 2.5, and is not a participant in any joint venture with any other person, including special purpose vehicles, or other off balance sheet arrangements.

Section 2.6Capitalization of the Company. The entire authorized capital stock of the Company consists of 300,000 shares of common stock with a par value of $20.00 per share. The Shares have been validly issued and are fully paid and nonassessable and they constitute all of the issued and outstanding capital stock of the Company. The Seller is the sole holder of lawful record and beneficial owner of the Shares free and clear of all Liens. Except for the Shares, there are no outstanding voting securities, equity interests, options or warrants, or other agreements or rights to purchase or otherwise acquire securities convertible into any of the Shares or any other shares of common stock or preferred stock of the Company. Except for this Agreement, neither the Seller nor the Company has made any commitment to issue or to sell any of the Shares or any other shares of common stock or preferred stock of the Company or any options, warrants, rights or convertible securities or evidences of indebtedness of the Company. There are no shareholder agreements, voting trust, proxy or other agreement or understanding with respect to the voting of the Shares. The transfer of the Shares to the Purchaser in accordance with this Agreement will deliver good and marketable title in and to the Shares to the Purchaser, free and clear of all Liens (other than Liens, if any, created by the Purchaser).

Section 2.7Certificate of Incorporation and By-laws. The Seller has delivered to the Purchaser a true, correct and complete copy of the Certificate of Incorporation and the By-Laws of the Company in effect on the date of this Agreement reflecting all amendments thereto.

Section 2.8Validity. Each of this Agreement and the Transfer and Assumption Agreement constitutes the legal, valid and binding obligation of the Seller, enforceable against the Seller in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, reorganization, insolvency, moratorium and other similar laws presently or hereafter in force affecting the enforcement of creditors’ rights generally and subject to general equitable principles limiting the right to obtain specific performance or other equitable relief.

6

Section 2.9Governmental Approvals. Except for the approval of the New York Department, as described in Section 5.1, and any necessary consents, authorizations and regulatory approvals set forth on Schedule 2.9 hereto, no authorization, consent or approval or other order or action of a governmental or regulatory body or authority is required for (i) the execution and delivery of any Transaction Agreement by the Seller to which it is a party, (ii) the consummation by the Seller of the transactions provided for therein, or (iii) the transfer of the Shares to the Purchaser on the Closing Date.

Section 2.10Third Party Approvals. Except for the Required Approvals and as set forth on Schedule 2.10, no authorization, consent or approval from any third party is required for (i) the execution and delivery of any Transaction Agreement by the Seller to which it is a party, (ii) the consummation by the Seller of the transactions provided for herein, or (iii) the transfer on the records of the Company of the Shares to the Purchaser on the Closing Date.

Section 2.11Conflict With Laws and Other Instruments. Assuming the receipt of all Required Approvals, except as disclosed on Schedule 2.11 the execution, delivery and performance of any Transaction Agreement by the Seller and the consummation of the transactions contemplated thereby do not and will not (i) materially conflict with or result in the material breach of any of the terms, conditions or provisions of, or constitute a material default (or an event which with the passage of time or notice or both would become a material default) under (A) the Certificate of Incorporation or By-Laws or other organizational documents, as the case may be, of the Seller or the Company or (B) any material mortgage, note, bond, indenture, agreement, contract, license or other instrument or obligation to which either the Seller or the Company is a party or by which either of them or any of their respective properties may be bound or affected or (ii) violate any law or regulation, or order, writ, judgment, injunction or decree of any court, administrative agency or governmental body applicable to the Seller or the Company in effect on the date hereof or on the Closing Date.

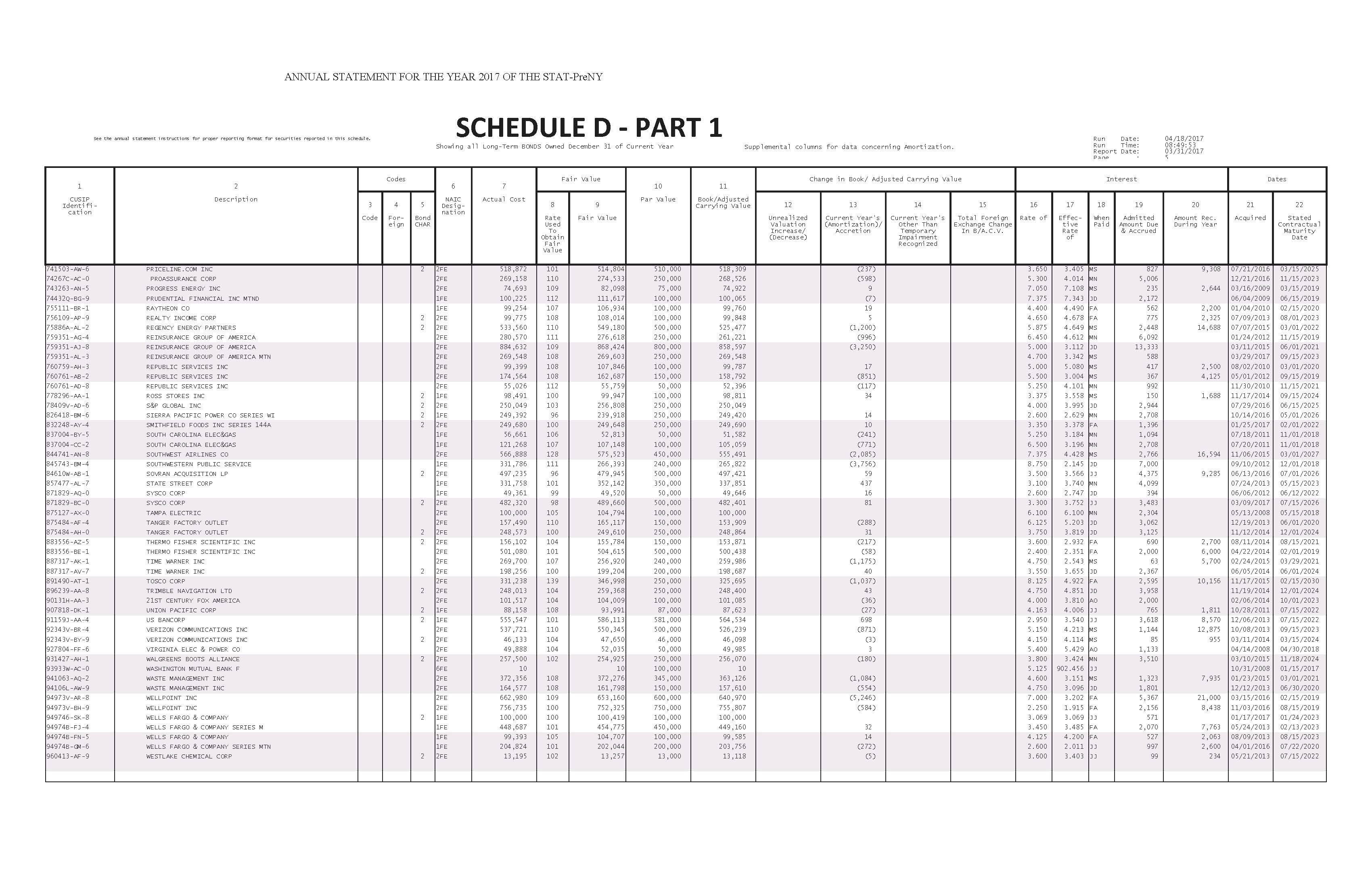

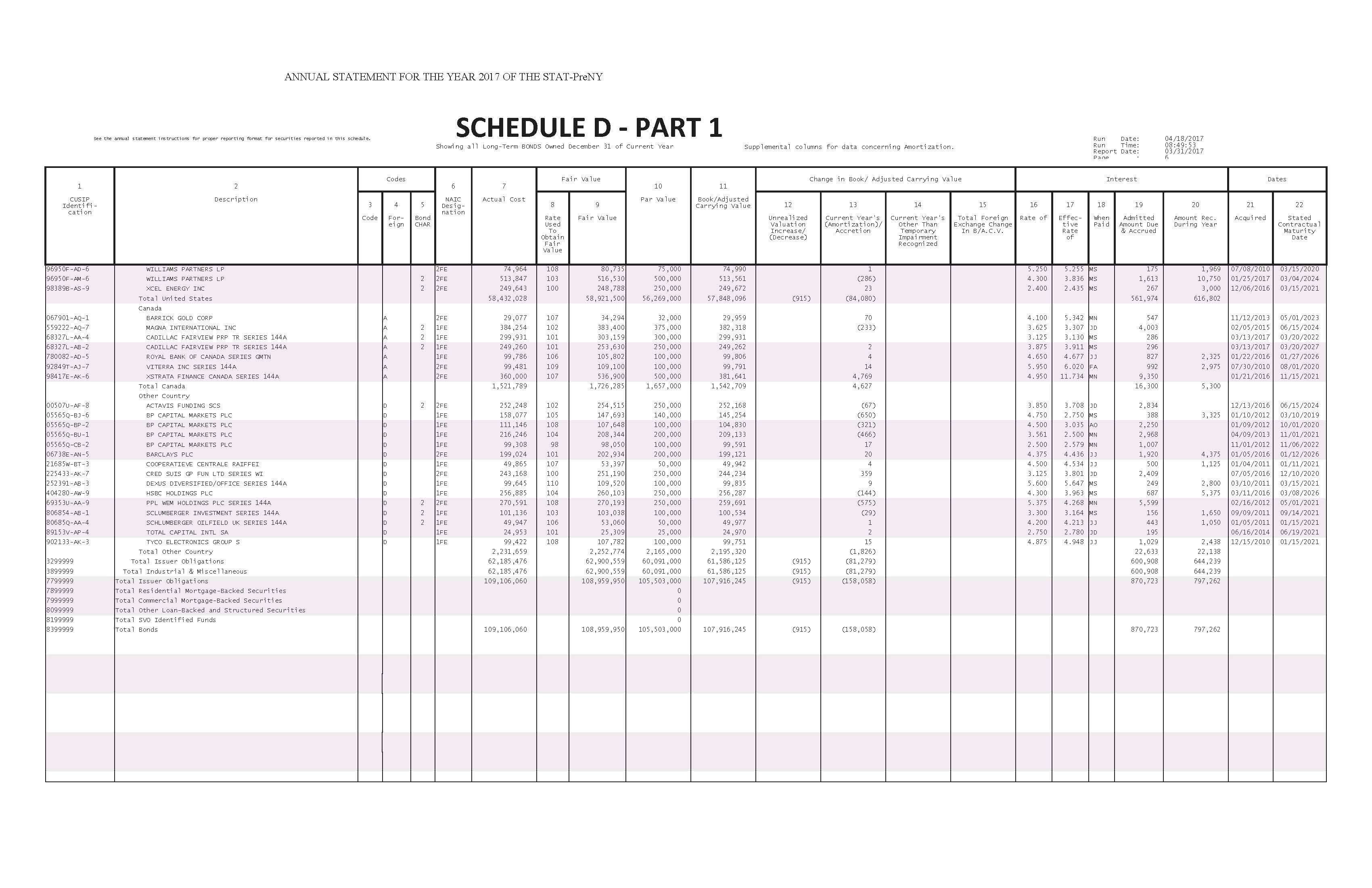

Section 2.12Financial Statements.

(a)The statutory financial statements of the Company, filed with the New York Department (the “Statutory Financial Statements”) and delivered to the Purchaser prior to the execution and delivery of this Agreement, for the fiscal years ended December 31, 2015 and 2016 and for the fiscal quarter ended on March 31, 2017, have been prepared in accordance with the Statutory Accounting Principles which, except as noted in the Statutory Financial Statements, have been applied on a consistent basis.

(b)The Statutory Financial Statements fairly present in all material respects the financial condition, the results of operations, surplus as regards policyholders and changes in financial position of the Company as of and for the respective dates and periods indicated therein, in accordance with Statutory Accounting Principles applied thereto on a consistent basis.

Section 2.13No Material Adverse Effect. Except for the transactions contemplated by this Agreement, there has been no event, circumstance or condition occurring or in effect since January 1, 2017, which, individually or in the aggregate, is or would reasonably be expected to result in a Material Adverse Effect.

7

Section 2.14Taxes.

(a)All Tax Returns required to have been filed by or with respect to the Company have been timely filed (taking into account any extension of time to file granted or obtained), all such Tax Returns were true, correct and complete in all material respects at the time of filing and all Taxes required to have been paid by or with respect to the Company have been timely paid. The Company has made available to Purchaser all material Tax Returns filed by or with respect to the Company in the past five years (other than the consolidated income Tax Returns for the group of which PartnerRe U.S. Corporation is the parent).

(b)All Taxes required to have been withheld, collected or remitted by the Company have been withheld, collected or remitted, as the case may be.

(c)No deficiency for any material amount of Tax has been proposed, asserted or assessed by any governmental authority in writing against the Company that has not been satisfied by payment, settled or withdrawn.

(d)There is no tax audit, examination, suit or other tax proceeding now in progress, pending, threatened in writing or, to the Knowledge of the Seller, threatened orally against the Company.

(e)There are no outstanding waivers extending the statutory period of limitations on assessment or payment of Taxes due from the Company except as disclosed in Schedule 2.14(e).

(f)There are no Tax Liens (other than Liens for Taxes which are not yet due and payable) on any assets of the Company.

(g)None of the assets of the Company directly or indirectly secures any debt the interest on which is tax exempt under Section 103(a) of the Code.

(h)The Company is a U.S. domestic corporation, and the Company has not been a United States real property holding corporation within the meaning of Section 897(c)(2) of the Code during the applicable period specified in Section 897(c)(1)(A)(ii) of the Code.

(i)The Company has not constituted either a “distributing corporation” or a “controlled corporation” in a distribution of stock qualifying, or intended to qualify, for tax-free treatment under Section 355 of the Code during the two (2) -year period ending on the date of this Agreement.

(j)The Company has not (A) entered into a closing agreement pursuant to Section 7121 of the Code (or any similar provision of state, local or foreign law) with any governmental authority or (B) received or sought, or participated in a request for, a ruling (or other determination or form of advice) from any governmental authority pertaining to the treatment of any item for Tax purposes.

8

(k)Within the past five (5) years, the Company has not received a written claim from any governmental authority in a jurisdiction where the Company does not file Tax Returns to the effect that, or inquiring as to whether, the Company is or may be subject to taxation by that jurisdiction.

(l)Except as set forth on Schedule 2.14(l), the Company is not a party to any Tax indemnity, Tax sharing or Tax allocation agreement.

(m)The Company has not executed or filed with any Taxing Authority any power of attorney relating to Taxes, which power of attorney remains outstanding.

(n)The Company has not engaged in any “listed transaction” as defined in Section 1.6011-4 of the Treasury Regulations.

(o)The Seller and the Company are members of an “affiliated group” within the meaning of Section 1504 of the Code, and PartnerRe U.S. Corporation is the “common parent” of such affiliated group.

(p)There are no adjustments under Section 481 of the Code (or any similar adjustments under any provision of the Code or the corresponding foreign, state or local Tax laws) that are required to be taken into account by the Company in any period ending after the Closing Date by reason of a change in method of accounting in any taxable period ending on or before the Closing Date.

(q)The Company is not a party to any joint venture, partnership, or other arrangement or contract that could be treated as a partnership for federal income tax purposes.

Section 2.15Litigation. (a) Except as disclosed on Schedule 2.15 and except for claims for payments of amounts due under insurance or reinsurance policies or contracts in the ordinary course of business, for the past two (2) years there have not been, and currently there are no, actions, suits, investigations or claims (including legal, administrative or arbitration proceedings) pending, threatened in writing or, to the Knowledge of the Seller, threatened orally before or by any governmental authority, nor is there any outstanding order, judgment, writ, injunction or decree of any court, governmental authority or arbitration tribunal, in each case by, against or affecting the Company, its Business or any of its assets (including, without limitation, the Licenses).\

(b)There is no action, suit, proceeding or investigation of the Seller which is pending, threatened in writing or, to the Knowledge of the Seller, threatened orally, which questions the validity or propriety of any Transaction Agreement or any action taken by the Seller in connection therewith.

Section 2.16Employees. (a) The Company does not have and for the past two (2) years has not had any employees.

(b)There are no written or oral employment or consulting agreements, severance pay plans, pension, retirement, profit sharing, employee relations policies, practices and arrangements, agreements with respect to leased or temporary employees, executive compensation

9

plans, incentive compensation plans or arrangements, vacation pay plans or arrangements, sick pay plans, deferred compensation and bonus plans, incentive stock option, stock ownership and stock purchase plans, or any other employee benefit programs, arrangements, agreements or understandings, including medical, vision, dental or other health plans, insurance and disability plans, including, without limitation, “any employee benefit plan” as defined in Section 3(3) of ERISA, in effect to which the Company contributes or is a party, or under which the Company may have liability.

Section 2.17Powers of Attorney and Agents. Except as set forth in Schedule 2.17, no person holds a power of attorney granted by the Company except statutory agents for service of process.

Section 2.18Environmental Matters. (a) Except for claims for payments of amounts due under insurance or reinsurance policies or contracts in the ordinary course of business, there are no litigation, suits, claims, proceedings or investigations or private or governmental enforcement actions or orders pending, threatened in writing or, to the Knowledge of the Seller, threatened orally against the Company with respect to any Hazardous Material or Environmental Law applicable to the Company.

(b)Neither the Seller nor its Affiliates nor the Company has received any written notice in the past two (2) years from any governmental authority or other person of any claims or potential violations by the Company of, or liability under, any Environmental Law.

(c)For purposes of this Section 2.18, “Environmental Law” means any Requirement of Law relating to pollution or protection of the environment, health, safety, or natural resources or to the use, handling, transportation, treatment, storage, disposal, release or discharge of Hazardous Materials; and “Hazardous Material” means any material, substance, waste, pollutant, contaminant, chemical or other matter that is defined as a hazardous material, hazardous substance, hazardous waste, toxic material, toxic substance or other term having a similar meaning under any Requirement of Law or is otherwise subject to elimination, abatement, removal, remediation or cleanup under any Requirement of Law.

Section 2.19Assets and Property. The Company owns and has good and marketable title to all of its assets and properties, free and clear of any Liens (other than Liens for Taxes which are due and not yet payable and Liens, if any, created by the Purchaser), except for Special Deposits. On the Closing Date, the Company’s assets will be (i) those assets reflected on its Estimated Closing Statement and (ii) all other assets retained by the Company pursuant to the Transfer and Assumption Agreement, including, without limitation, its minute books and other corporate records, operational books and records, Licenses referred to in Schedule 2.4, and the Statutory Capital and Surplus (as provided in Section 1.2 of this Agreement).

Section 2.20No Liabilities. All liabilities of the Company that have arisen or could arise under any insurance contract or any reinsurance contract to which the Company is a party have been and will be assumed pursuant to the Transfer and Assumption Agreement. As of the date of this Agreement, the Company has no liabilities (and there is no existing condition, situation or set of circumstances which will or would reasonably be expected to result in any liability) of any nature, whether absolute, accrued, contingent or otherwise or whether due or to become due, except for (a)

10

liabilities disclosed on the Reference Balance Sheet, (b) liabilities incurred in the ordinary course of business since the date of the Reference Balance Sheet, which liabilities (i) are not prohibited or limited by this Agreement or any other Transaction Agreement and (ii) would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect and (c) liabilities to be assumed pursuant to the Transfer and Assumption Agreement. As of the Closing Date, the Company has no liabilities (and there is no existing condition, situation or set of circumstances which will or would reasonably be expected to result in any liability) of any nature, whether absolute, accrued, contingent or otherwise or whether due or to become due, except for (a) liabilities disclosed on the Reference Balance Sheet and (b) liabilities incurred in the ordinary course of business since the date of the Reference Balance Sheet, which liabilities (i) are not prohibited or limited by this Agreement or any other Transaction Agreement, and (ii) would not, individually or in the aggregate, reasonably be expected to result in a Material Adverse Effect, in the case of each of clause (a), (b)(i) and (b)(ii), other than those assumed pursuant to the Transfer and Assumption Agreement.

Section 2.21Special Deposits; Accounts. (a) Schedule 2.21(a) contains a list of all Special Deposits and the location of such Special Deposits. No other Special Deposits are required by any Requirement of Law in order to maintain any of the Licenses or to conduct the Business.

(b)Schedule 2.21(b) contains a complete and correct listing of each bank account and other financial institution account and safe deposit box maintained by the Company, and the names of persons authorized to access such accounts or boxes.

Section 2.22Corporate Records. Each of the corporate minute books and stock record books of the Company contains, respectively, a true and correct record of all of the material corporate actions and stock records of the Company since March 1, 1999.

Section 2.23Compliance. (a) Except as set forth on Schedule 2.23(a), the Company is not, and at all times during the two (2) year period preceding the date hereof has not been, in violation of any Requirement of Law (i) with respect to the Licenses (including the related lines of authority) that is material or (ii) that, to the Seller’s Knowledge, is or would reasonably be expected to result in a Material Adverse Effect. Schedule 2.23(a) sets forth a list of all such violations (including any penalties incurred with respect thereto), and the Seller or the Company, as applicable, has resolved or cured any such violation in the manner set forth on Schedule 2.23(a) such that the violation will not materially impair the Company’s Licenses or the ability to do Business. No event has occurred or circumstance exists that, with notice or the passage of time or both, would reasonably be expected to constitute or result in a violation in any material respect of, or failure to comply in all material respects with, any Requirement of Law to which the Company, or to which any of its assets (including the Licenses), owned or used by it, is or has been subject during the two (2) year period preceding the date hereof. Except as set forth on Schedule 2.23(a), neither the Company nor the Seller within the two (2) year period preceding the date hereof has received written notice from any governmental authority regarding any actual, alleged, possible, or potential violation of, or failure to comply with, any Requirement of Law to which the Company, or to which any of its assets (including the Licenses), owned or used by it, is or has been subject.

(b)Schedule 2.23(b) lists all material governmental proceedings, examinations or investigations conducted within the two (2) year period preceding the date hereof with respect to the Company’s Business or Licenses and, except as set forth on Schedule 2.23(b), none of which

11

were determined adversely to the Company. Except as set forth on Schedule 2.23(b), the Company is currently not the subject of, threatened in writing with, or, to the Seller’s Knowledge, threatened orally with any governmental proceedings, examinations or investigations, including without limitation any state insurance department proceedings or investigations. The Company has filed all material reports, data, registrations, filings, other information and applications required during the past two (2) years to be filed with or otherwise to be provided to any governmental authority with jurisdiction over the Company or its Business, properties or assets (including the Licenses), and all required regulatory approvals in respect thereof are in full force and effect. Except as set forth in Schedule 2.23(b), all such regulatory filings were complete and correct when filed and remain in compliance with applicable Requirements of Law, and no deficiencies have been asserted by any governmental authority with respect to such regulatory filings which have not been fully cured or otherwise resolved.

Section 2.24Brokers or Finders. (i) No broker, advisor or finder has acted directly or indirectly for the Seller or any of its Affiliates in connection with this Agreement or the transactions contemplated hereby other than Merger & Acquisition Services, Inc., the fees and expenses of which will be paid by the Seller, (ii) no Person is entitled to any brokerage, advisory or finder’s fee or other commission based in any way on agreements, arrangements or understandings with the Seller or any of its Affiliates relating to the sale of the Company to the Purchaser (“Seller Fees”) other than Merger & Acquisition Services, Inc. and (iii) if any Seller Fees are due, they will be the sole obligations of the Seller and neither the Company nor the Purchaser shall have any liability therefor.

Section 2.25Contracts. Except as set forth in Schedule 2.25 hereto, and except for any contracts to be transferred and assumed pursuant to the Transfer and Assumption Agreement, the Company is not:

(a)a party to, nor is it bound by, nor are its assets subject to, any Lien, contract, mortgage, indenture, note guaranty, lease, commitment or agreement of any kind;

(b)a party to any agreement, commitment or instrument evidencing indebtedness of the Company whether directly or indirectly by way of purchase money obligations, conditional sale, lease purchase, guaranty or otherwise;

(c)a party to or obligated under any agreement, contract or other instrument to pay any fees, bonus or other amount upon or following any threatened or actual change in control, or change in the nature of the Company’s Business or any other aspect of its operations;

(d)a party to any contract or agreement not of the type covered by any other subsections of this Section 2.25 which by its terms does not terminate or is not terminable by and without penalty or cost to the Company within thirty (30) Business Days and which is not indemnifiable pursuant to this Agreement or assumed under the Existing Reinsurance Contracts;

(e)a party to any contract with any governmental entity or third party containing any provision or covenant (i) restricting, restraining or impairing the ability of the Company to engage in any line of the insurance or reinsurance business, to compete with any Person, to do business with any Person or in any location or to employ any Person, or (ii) restricting, restraining or impairing the ability of any Person to obtain products or services from the Company;

12

(f)a party to any agreement with any agent, broker, producer or other intermediary that is or was a distributor of products of the Company pursuant to which any such agent, broker, producer or other intermediary currently has authority to bind the Company to insurance policies or other obligations;

(g)a party to any forward foreign exchange contract or substantially identical instrument; or

(h)in default under any agreement, lease, license, accreditation or other arrangement otherwise material to its ability to operate an insurance or reinsurance business.

Section 2.26Absence of Certain Changes or Events. Except as set forth on Schedule 2.26, since January 1, 2017, there has not been:

(a)any change in the assets, liabilities, operating results or condition (financial or otherwise) of the Company that would reasonably be expected to result in a Material Adverse Effect;

(b)any redemption, purchase or other acquisition of any of the Company’s capital stock or other securities of the Company except as may occur after the date hereof solely pursuant to the terms of this Agreement;

(c)any grant of any option to purchase or other right to acquire any of the Shares or any capital stock of the Company, any grant of any stock appreciation rights, or any issuance of shares of capital stock (whether treasury shares or otherwise) by the Company;

(d)any indebtedness incurred for borrowed money or commitment to borrow money by the Company;

(e)any sale, assignment or transfer of any Licenses;

(f)any mortgage, pledge, transfer of a security interest in, or Lien, created by the Seller or the Company, with respect to any of the Company’s material properties or assets, including but not limited to its Licenses, excluding Liens for taxes not yet due or payable;

(g)any dividend, distribution or payment on shares of capital stock of the Company declared, made, set aside or paid, except as contemplated pursuant to and consistent with the terms of this Agreement;

(h)with respect to the Company, any making, revocation of or change in any election in respect of Taxes, filing of any amended Tax Return, entering into any closing agreement, settling any claim or assessment in respect of Taxes, surrendering by any affirmative action any right to claim a refund of Taxes, or consenting to any extension or waiver of any statute of limitation applicable to any claim or assessment in respect of Taxes; or

(i)any amount which is presently due and payable from the Company in respect of any guaranties or similar instruments, issued by the Company guaranteeing loans advanced to its agents by any financial institution under any agent loan program or similar type program.

13

The Company has not entered into any oral or written agreement as to any of the acts or things described in this Section 2.26.

Section 2.27Embargoed Persons. The Company is not, and is not acting, directly or indirectly for or on behalf of, any Person, who is (i) identified on the Specially Designated Nationals and Blocked Persons List maintained by the United States Treasury Department Office of Foreign Assets Control or any similar list maintained pursuant to any Requirement of Law, (ii) subject to trade restrictions under United States Requirement of Law, including, without limitation, the International Emergency Economic Powers Act, 50 U.S.C. § 1701 et seq., the Trading with the Enemy Act, 50 U.S.C. App. 1 et seq., and any Executive Orders or regulations promulgated under any such laws, (iii) subject to blocking, sanction or reporting under the USA Patriot Act, as amended; Executive Order 13224, as amended; Title 31, Parts 595, 596 and 597 of the U.S. Code of Federal Regulations, as they exist from time to time; and any other Requirement of Law or Executive Order or regulation through which the U.S. Department of the Treasury has or may come to have sanction authority, or (iv) subject to or covered by any other sanction laws of the United States (the Persons referred to in clauses (i) through (iv), each an “Embargoed Person”). The Company is not engaged in, facilitating or taking part in, and to the Knowledge of the Seller has not engaged in, facilitated or taken part in, any transaction or business, directly or indirectly, with, on behalf of or in connection with, any Embargoed Person.

ARTICLE III

Representations and Warranties by the Purchaser

The Purchaser represents and warrants to the Seller as of the date hereof and as of the Closing Date, in each case as set forth in this ARTICLE III. All disclosures to be made by Purchaser in connection with, or exceptions to, these representations and warranties are made by Purchaser solely in the Schedules attached to this Agreement.

Section 3.1Corporate Existence, Power and Authority. The Purchaser is a corporation duly organized, validly existing and in good standing under the laws of the State of Nevada and has all requisite corporate power and authority to enter into this Agreement and to consummate the transactions contemplated herein.

Section 3.2Corporate Action. The execution and delivery of this Agreement by the Purchaser, and the consummation by the Purchaser of the transactions contemplated herein, have been authorized by all requisite corporate action on the part of the Purchaser.

Section 3.3Validity. This Agreement constitutes the legal, valid and binding obligation of the Purchaser, enforceable against the Purchaser in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, reorganization, insolvency, moratorium and other similar laws presently or hereafter in force affecting the enforcement of creditors’ rights generally and subject to general equitable principles limiting the right to obtain specific performance or other equitable relief.

14

Section 3.4Conflict with Other Instruments. Neither the execution and delivery of this Agreement by the Purchaser nor the consummation of the transactions contemplated hereby (i) conflict with, result in a breach of the terms, conditions or provisions of, or constitute a default (or an event which with notice or passage of time or both would become a default) under, the Articles of Incorporation or By-Laws of the Purchaser or any material indenture, mortgage, lease, agreement, contract, note or other instrument or obligation to which the Purchaser is a party or by which it or its properties may be bound or affected; or (ii) violate any law or regulation to which the Purchaser is subject or by which it or its properties are bound in effect on the date hereof or the Closing Date.

Section 3.5Brokers or Finders. (i) No broker, advisor or finder has acted, directly or indirectly, for the Purchaser in connection with this Agreement, or the transactions contemplated hereby, (ii) no Person is entitled to any brokerage, advisory or finder’s fee or other commission based in any way on agreements, arrangements or understandings with the Purchaser relating to the sale of the Company to the Purchaser (“Purchaser Fees”), and (iii) if any Purchaser Fees are due, they will be the sole obligations of the Purchaser and neither the Company nor the Seller shall have any liability therefor.

Section 3.6Governmental Approvals. (a) Except for the approval of the New York Department, as described in Section 5.1, and as otherwise set forth on Schedule 3.6, no authorization, consent or approval or other order or action of or filing with any court, administrative agency or other governmental or regulatory body or authority is required for the execution and delivery by the Purchaser of this Agreement or the Purchaser’s consummation of the transactions contemplated hereby.

(b)There are no facts or circumstances relating to the Purchaser or any Affiliate thereof (including the operations, management, business or regulatory matters thereof) which, to the Knowledge of the Purchaser, would cause any rejection, limitation or restriction or a delay in connection with the approval of the Acquisition Statement as contemplated by Section 5.1 or any License of the Company as a result of the transactions contemplated hereby.

Section 3.7Litigation. There is no action, suit, proceeding or investigation of the Purchaser which is pending, threatened in writing or, to the Knowledge of the Purchaser, threatened orally against the Purchaser which questions the validity or propriety of any Transaction Agreement or any action taken by the Purchaser in connection therewith.

Section 3.8No Securities Acts Violation. The Purchaser acknowledges that the Shares to be delivered to the Purchaser have not been registered under the Acts. On the Closing Date, the Purchaser will acquire the Shares for its own account for investment, with no intention of reselling or otherwise disposing of all or any portion of the Shares in a manner which would constitute a violation of the Acts.

Section 3.9Availability of Funds. The Purchaser has cash or other assets available or has access to cash or other assets sufficient to enable it to pay the Purchase Price and otherwise consummate the transactions contemplated by this Agreement and the other Transaction Agreements at the Closing.

15

ARTICLE IV

Covenants of the Seller

Section 4.1.Operate in the Ordinary Course. The Seller covenants and agrees that between the date of this Agreement and the Closing Date, the Company will operate its business only in the ordinary course of business consistent with past practice since January 1, 2017, except as otherwise agreed herein.

Section 4.2.Access to Records. The Seller agrees that (i) between the date of this Agreement and the Closing Date, the Seller will cause the Company to make available to the Purchaser and its authorized representatives at reasonable times, upon reasonable notice and under reasonable circumstances all the Company records, minute books, stock books, seals, examination reports, annual statements, financial statements, contracts and any other documents of the Company reasonably requested by the Purchaser, and (ii) after the Closing Date, the Seller will provide the Purchaser with any information which the Purchaser reasonably may request in order to respond to litigation and to comply with regulatory requirements and requests, subject to the Seller’s rights to withhold such information in order to protect its attorney-client privileged communications or to comply with confidentiality obligations. The Purchaser recognizes the proprietary nature of all of the information as it pertains to the Seller and its Affiliates (other than the Company from and after the Closing) provided pursuant to this Section 4.2, whether in oral or written form, and agrees not to reveal or disclose such information to any third party except as required by law or governmental authority; provided, however, that such confidentiality obligations will not apply to any information that becomes generally available to the public other than as a result of the breach of this Section 4.2 or information not otherwise known by the Purchaser that becomes available to the Purchaser from a Person other than the Seller and which Person is or was not, to the knowledge of the Purchaser, otherwise in violation of a confidentiality agreement with the Seller with respect to the disclosure of such information.

Section 4.3.[Intentionally omitted].

Section 4.4.Cooperation in Regulatory Filings. The Seller shall reasonably cooperate with the Purchaser in connection with the Purchaser’s preparation and filing of the Acquisition Statement and any other filing to be made by the Purchaser in respect of any Required Approval. Upon the request of the Purchaser, the Seller shall use its reasonable efforts to facilitate approval of, and to do or cause to be done all things necessary, proper or advisable by the Seller to consummate and make effective, the transactions contemplated by this Agreement; provided however, that the Seller shall not be required to take any action or agree to any condition or restriction not customarily required for the type of acquisition as set forth in this Agreement.

Section 4.5.Prohibited Conduct. Except as set forth on Schedule 4.5 or as otherwise permitted or required by this Agreement, between the date of execution hereof and the Closing Date, unless the Purchaser has given its prior written consent, or such action is required or contemplated by this Agreement or any Requirement of Law, the Seller shall not cause or permit the Company to do any of the following:

16

(a)issue, sell, pledge, dispose of or encumber any stock or security of the Company of whatsoever kind, or grant any option to purchase, or other right to acquire, any stock or security of the Company;

(b)introduce any new method of accounting for financial reporting or Tax purposes in connection with the Company unless as the result of a Requirement of Law or recommendation by the Seller’s auditors;

(c)change the Company’s auditors or actuaries without the prior written consent of the Purchaser, which shall not be unreasonably withheld or delayed;

(d)make, revoke or change any election in respect of Taxes, file any amended Tax Return, enter into any closing agreement, settle any claim or assessment in respect of Taxes, surrender any right to claim a refund of Taxes, or consent to any extension or waiver of any statute of limitation applicable to any claim or assessment in respect of Taxes;

(e)mortgage, pledge or grant a Lien on any of the Company’s properties or assets;

(f)incur any liabilities (including, without limitation, making any loan commitment by the Company) other than those to be discharged by the Seller at or prior to the Closing;

(g)take any action (or omit to take any action) that would constitute a Material Adverse Effect;

(h)transact any insurance or reinsurance business or any other aspect of its operations except in the ordinary course of business consistent with past practices since January 1, 2017;

(i)make any new or additional investments of the assets of the Company other than in cash, cash equivalents, United States Treasury securities or investment grade corporate bonds, unless required by a Requirement of Law in connection with a Special Deposit; or

(j)make any offer or commitment or incur any obligation to enter into any contract, arrangement or transaction of a type described in this Section 4.5.

Section 4.6.Special Deposits. The Special Deposits listed on Schedule 2.21(a) shall be maintained through the Closing Date and will constitute assets to be included in the Company’s Statutory Capital and Surplus.

Section 4.7.Preservation of Licenses. The Seller covenants and agrees that from and after the date of the execution of this Agreement through and including the Closing Date, the Seller will cause the Company to use its reasonable efforts to preserve and keep in full force and effect the Licenses. In addition, subject to applicable Requirements of Law, the Seller shall, and shall cause the Company to, deliver to the Purchaser promptly upon receipt copies of all communications with state regulatory authorities that involves or could reasonably be expected to result in any

17

rescission, termination, revocation, nonrenewal, suspension, or material restriction or impairment of any of the Licenses, or any notice of any proceeding or anticipated proceeding with respect to any of the foregoing.

Section 4.8.No Amendments. Except as contemplated by this Agreement, the Seller shall take no action to cause or allow the Company’s Certificate of Incorporation or By-Laws to be amended prior to the Closing other than as may be necessary, in the reasonable opinion of the Seller and with the prior written consent of the Purchaser (such consent not to be unreasonably withheld), to preserve one or more of the Licenses of the Company or to otherwise comply with any Requirement of Law.

Section 4.9.Agreements and Indebtedness. On the Closing Date, the Transfer and Assumption Agreement and the Guaranty shall be in effect, and, other than the Transfer and Assumption Agreement and the Guaranty, there shall be no (i) outstanding indebtedness or other liability of the Seller or any of its Affiliates to the Company, or of the Company to any of its Affiliates, and (ii) agreements in effect between the Company and any other Persons other than such agreements as set forth on Schedule 4.9(a). On or prior to the Closing Date, the Seller shall cause the Company to terminate, or, subject to the approval or non-disapproval of any applicable regulatory authority, terminate the participation of the Company as a party to, each of the contracts set forth on Schedule 4.9(b) (the “Terminated Agreements”), which shall include, without limitation, intercompany agreements and agreements pertaining to the Prior Insurance Business (other than the Transfer and Assumption Agreement and the Guaranty).

Section 4.10.Exclusivity. Between the date hereof and the Closing Date or the earlier termination of this Agreement, the Seller shall, and shall cause the Company and its and their respective affiliates, officers, directors, employees and representatives, not to directly or indirectly (i) initiate, solicit, encourage or knowingly facilitate the submission of any inquiries, proposals or offers that constitute, or may reasonably be expected to lead to, any Alternative Transaction Proposal, (ii) engage or participate in any discussions or negotiations regarding, or provide or cause to be provided any information or data relating to the Seller or the Company in furtherance of, or have any discussions with any Person relating to, an actual or proposed Alternative Transaction Proposal or (iii) enter into any letter of intent, agreement in principle, merger agreement, acquisition agreement, option agreement or other similar statement of intention or agreement relating to any Alternative Transaction Proposal. The Seller will immediately cease and cause to be terminated any activities, discussions or negotiations conducted prior to the date hereof with any parties other than the Purchaser or its Affiliates with respect to any Alternative Transaction Proposal. The Seller will also promptly notify the Purchaser of any inquiry or proposal received by the Seller, the Company or their respective Affiliates, officers, directors, employees and representatives with respect to an Alternative Transaction Proposal received on or subsequent to the date hereof that relates to an Alternative Transaction Proposal first made prior to the date hereof (including, for the avoidance of doubt, any proposal on or subsequent to the date hereof that relates to an Alternative Transaction Proposal first made prior to the date hereof).

18

Section 4.11.Delivery of Financial Statements and Regulatory Filings.

(a)No later than ten (10) days prior to filing with the applicable regulatory authorities, the Seller shall cause the Company to deliver to the Purchaser true, correct and complete copies for its information only of any financial statements and other material filings to be made by the Company with any such regulatory authority on or prior to the Closing Date. If the Purchaser communicates any comments relating thereto within five (5) days of its receipt thereof, the Seller shall reasonably and in good faith consider reflecting, in whole or in part, such comments regarding such financial statements and other material filings.

(b) The Seller shall prepare and file (at its sole cost and expense) the Statutory Financial Statements of the Company for each fiscal quarter that ends after the date hereof and prior to the Closing Date and that are required to be filed on or prior to the Closing Date. For any subsequent Statutory Financial Statements, the Seller shall provide the Purchaser and/or the Company with any information in the Seller’s possession that the Purchaser and/or the Company may reasonably request in order that the Purchaser and/or the Company may prepare such Statutory Financial Statements. The Statutory Financial Statements prepared by the Seller in accordance with this Section 4.11 will be prepared in accordance with the Statutory Accounting Principles which, except as noted in such financial statements, have been applied on a consistent basis with the Statutory Financial Statements of the Company for the years ended December 31, 2015 and December 31, 2016 filed with the New York Department.

Section 4.12.Termination of Signing Powers. At least three (3) Business Days prior to the Closing Date, the Seller shall, or the Seller shall cause the Company to, deliver written notification to any bank (or other financial institution) which maintains, on behalf of the Company, any account or safe deposit box listed on Schedule 2.21(b) notifying any such bank of the entry into this Agreement, and notifying any and all such banks that the check signing or withdrawal powers or other authority of all persons with respect to the accounts or safe deposit boxes of the Company maintained therein are revoked immediately upon receipt by any such bank from the Seller of notice of the consummation of the Closing. The Seller will cooperate with the Purchaser in communicating with the bank(s) as to the transition of control of these accounts from the Seller to the Purchaser.

Section 4.13.Dividends and Other Distributions. The Seller covenants and agrees that between the date of this Agreement and the Closing Date, the Seller will not cause to be made, or permit the Company to make or agree to, any distribution of cash, properties or other assets of the Company by way of dividends, distributions, redemptions, assignments or otherwise, and whether or not in respect of the Shares; provided, however, that as contemplated by Section 1.2(b), the Company shall, to the extent legally permitted and subject to any Requirement of Law, make distributions and assignments of assets from time to time so that the Statutory Capital and Surplus of the Company shall be in compliance with the requirements set forth in Section 1.2(b).

Section 4.14.Liquidation of Investment Assets. The Seller covenants and agrees that prior to the Closing Date the Seller shall use reasonable efforts to cause the Company, to the extent legally permitted and subject to any Requirements of Laws, to liquidate the Company’s investment assets (other than the Special Deposits) such that the Statutory Capital and Surplus of the Company on the Closing Date shall comply with the requirements set forth in Section 1.2(b).

19

ARTICLE V

Covenants of the Purchaser

Section 5.1Acquisition Statement and Compliance with Insurance Laws; Other Approvals. As soon as reasonably possible and in any event not later than August 31, 2017, the Purchaser shall file the Acquisition Statement with the New York Department and contemporaneously provide the Seller with a copy of such filing. The Purchaser shall take all other actions in connection with such filing and each other Required Approval in order to permit the Purchaser to be authorized (subject to the terms and conditions of this Agreement) to consummate the transactions contemplated by the Transaction Agreements, including, without limitation, the filing of any amendment to the Acquisition Statement required by a Requirement of Law, and shall not take or cause to be taken any action that, to the Knowledge of Purchaser, would have the effect of delaying, impairing or impeding the making of any such filing or the receipt of any Required Approval in connection therewith; provided however, that the Purchaser shall not be required to take any action or agree to any condition or restriction not customarily required for the type of acquisition as set forth in this Agreement. The Purchaser shall provide to the Seller copies of the Acquisition Statement and all other filings in respect of any Required Approval prior to the filing or submission thereof so that the Seller has a reasonable opportunity to review and comment thereon and, subject to applicable Requirements of Law, the Purchaser shall provide the Seller with copies of all material correspondence between the Purchaser or its Affiliates and any governmental or regulatory authority and shall advise the Seller of all material communications with any governmental or regulatory authority concerning any such filing. None of the Purchaser or any of its Affiliates shall participate or agree to participate in any material meeting with any governmental or regulatory authority relating to the Acquisition Statement or any other Required Approval unless it consults with the Seller in advance and, to the extent permitted by such governmental or regulatory authority, affords the Seller the opportunity to attend such meeting (whether in person or by telephone) and provides reasonable notice in advance thereof. The costs and expenses incurred pursuant to this Section 5.1(a) shall be borne by the Purchaser, except for the costs of any action required of the Seller by a governmental or regulatory authority in connection therewith.

Section 5.2Post-Closing Access/Responsibilities. After the Closing, the Purchaser will cause the Company to afford to the Seller and its agents and representatives, at reasonable times during normal business hours, upon reasonable notice and under reasonable circumstances, reasonable access to the properties, books and records of the Company to the extent they relate to the period ending on or before the Closing Date to the extent necessary or desirable to permit the Seller to determine or investigate any matter relating to its rights and obligations with respect to any period ending on or before the Closing Date, subject to the Purchaser’s rights to withhold such information in order to protect its attorney-client privileged communications or to comply with confidentiality obligations. The Seller may make and retain copies at its own expense of any books and records of the Company that it reasonably expects to need for the express purposes set forth in the preceding sentence. The Seller recognizes the proprietary nature of all of the information as it pertains to the Purchaser and its Affiliates (including the Company from and after the Closing) provided pursuant to this Section 5.2, whether in oral or written form, and agrees not to reveal or disclose such information to any third party except as required by law or a governmental authority. The Seller shall be entitled to any refunds, reinsurance proceeds or other amounts (i) paid to the Company pursuant to or resulting from any of the Terminated Agreements or any of the rights or assets transferred to the Seller pursuant to the Transfer and Assumption Agreement or (ii) that are

20

due on any premium tax return or as a result of any assessments by the State of New York or any other state or the agencies thereof, but only to the extent related to any period ending prior to the Closing Date; provided, however, that in the event that a refund is made on amounts paid both before and after the Closing Date, the Seller shall only be entitled to that portion of the refund representing the percentage of amounts paid by the Seller prior to the Closing Date against the total amount upon which such refund is made. The Purchaser shall use its reasonable efforts to cooperate with the Seller and cause the Company, at the Seller’s expense, to recoup such assessments and refunds and other amounts on behalf of the Seller. To the extent that the Purchaser, the Company or any of their respective Affiliates receives any tax refund to which the Seller is entitled, in full or in part, pursuant to this Section 5.2, the Purchaser shall cause the recipient of such tax refund to remit within ten (10) days of the receipt thereof the amount due to the Seller pursuant to this Section 5.2 to an account designated by the Seller.

Section 5.3Company Name. On the Closing Date or as soon as practicable and in any case not later than ten (10) days thereafter the Purchaser shall file or cause to be filed with the New York Department a Certificate of Amendment to the Certificate of Incorporation of the Company changing the name of the Company to remove the name “PartnerRe” therefrom. The Purchaser acknowledges and agrees that the names “PartnerRe”, “Partner Reinsurance” and any and all derivatives thereof (the “Excluded Marks”), and all rights and interest therein, are excluded from the purchase and sale of the Shares pursuant to this Agreement, and that the Excluded Marks are and shall from and after the Closing remain the sole and exclusive property of the Seller and its Affiliates.

ARTICLE VI

Conditions Precedent to Obligation of the Purchaser to Close

The obligation of the Purchaser under this Agreement to purchase the Shares on the Closing Date shall be subject to the satisfaction of the following conditions precedent or waiver by the Purchaser thereof in writing:

Section 6.1Representations and Warranties of the Seller. Each of the representations and warranties made by the Seller in ARTICLE II (other than those in Sections 2.1-2.6, 2.8, 2.11, 2.13 and 2.24) shall be true and correct in all material respects (without giving any effect to any limitation as to “materiality” set forth therein), and each of the representations and warranties made by the Seller in Sections 2.1-2.6, 2.8, 2.11, 2.13 and 2.24 shall be true and correct in all respects, in each case as of the date of this Agreement and at the time of the Closing on the Closing Date (except for any such representations and warranties that speak to a certain date, in which case on and as of such date).

21

Section 6.2Compliance with Covenants. The Seller shall have complied with and performed in all material respects all covenants and agreements required to be performed by the Seller herein on or before the Closing Date.