Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Cinedigm Corp. | exhibit322063017.htm |

| EX-32.1 - EXHIBIT 32.1 - Cinedigm Corp. | exhibit321063017.htm |

| EX-31.2 - EXHIBIT 31.2 - Cinedigm Corp. | exhibit312063017.htm |

| EX-31.1 - EXHIBIT 31.1 - Cinedigm Corp. | exhibit311063017.htm |

| 10-Q - 10-Q - Cinedigm Corp. | cidm-6x30x17x10q.htm |

August 10, 2017

WAIVER

BY ELECTRONIC TRANSMISSION

Cinedigm Corp.

45 West 36th Street, 7th Floor

New York, NY 10018

Attn: Jeffrey S. Edell, Chief Financial Officer

Email: jedell@cinedigm.com

New York, NY 10018

Attn: Jeffrey S. Edell, Chief Financial Officer

Email: jedell@cinedigm.com

RE: Limited Waiver of Debt Service Coverage Ratio Covenant and Amendment to Credit Agreement

Ladies and Gentlemen:

We refer to the Second Amended and Restated Credit Agreement, dated as of April 29, 2015 (as amended, amended and restated, supplemented or otherwise modified before the date hereof, the “Credit Agreement”), among Cinedigm Corp. (the “Borrower”), certain Lenders, Société Générale, as Administrative Agent, and CIT Bank, N.A. (formerly known as OneWest Bank, N.A. and OneWest Bank, FSB), as Collateral Agent. Capitalized terms used and not defined herein shall have the meanings assigned thereto in the Credit Agreement.

Section 5.2 of the Credit Agreement requires the Borrower to maintain, as of the end of the Fiscal Quarter ending June 30, 2017, a Consolidated Debt Service Coverage Ratio of not less than 1.25:1.00.

Subject to the satisfaction of the conditions precedent set forth below, the Lenders hereby waive the Borrower’s compliance with Section 5.2 of the Credit Agreement solely for the Fiscal Quarter ending June 30, 2017.

Section 2.6 of the Credit Agreement permits the Borrower to, at any time, reduce the Revolving Aggregate Maximum Credit Amount. The Borrower hereby elects to reduce the Revolving Aggregate Maximum Credit Amount to $17,100,000, effective immediately. The Administrative Agent and the Required Lenders hereby waive the three Business Days’ notice period set forth in Section 2.6 of the Credit Agreement in connection with such reduction. In accordance with Section 2.6 of the Credit Agreement, such reduction of the Revolving Aggregate Maximum Credit Amount shall be (i) permanent and may not be reinstated, and (ii) made ratably among the Lenders in accordance with each Lender’s Applicable Percentage.

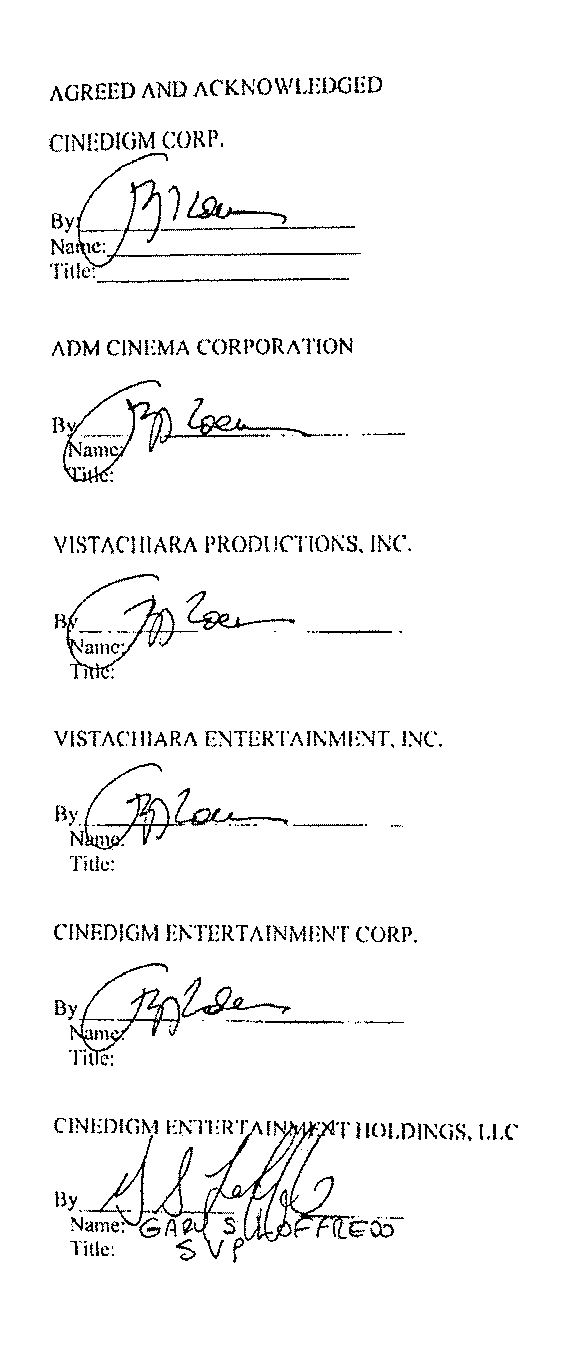

The Administrative Agent, the Required Lenders, and, by signing below, the Borrower and each other Loan Party hereby agree that, effective as of the date hereof:

2

(i) Section 5.1 of the Credit Agreement is hereby amended and restated as follows:

“Minimum Liquidity. The Borrower shall maintain (a) at all times from July 15, 2016 through October 13, 2017, an aggregate amount of Minimum Liquidity of at least $800,000, and (b) at all times after October 13, 2017, at least $5,000,000 in Minimum Liquidity.”

(ii) Notwithstanding anything to the contrary in the Credit Agreement or any other Loan Document, on the date the outstanding Obligations are repaid in full, the Borrower shall pay to the Administrative Agent, for the ratable benefit of the Lenders, a fee equal to 2.00% of the aggregate Commitments as of the date of such repayment, which fee shall be fully earned and nonrefundable when paid and shall be deemed an Obligation under the Credit Agreement.

This letter agreement shall become effective upon (i) the receipt by the Administrative Agent, for the ratable benefit of each Lender that has signed this letter agreement (such Lenders, the “Consenting Lenders”), from the Borrower of a waiver fee equal to 1.00% of the aggregate Commitments of the Consenting Lenders as of the date hereof, which fee shall be fully earned and nonrefundable when paid, and (ii) the receipt by the Administrative Agent from the Borrower of an amount equal to all out-of-pocket expenses incurred by the Agents in connection with this letter agreement, including the fees, charges and disbursements of counsel.

The waiver granted pursuant to the terms hereof is limited strictly to its respective terms, shall not be deemed to be a waiver or modification or any provision of the Credit Agreement except as expressly provided above, shall not extend to or effect any of the other obligations of Borrower under the Credit Agreement and shall not impair any rights consequent thereon. The Lenders shall have no obligation to issue any other or further waiver or any amendments or acknowledgements with respect to the matters addressed herein or any other matter. The Borrower (i) affirms and ratifies all of its obligations under the Credit Agreement and the other Loan Documents, (ii) agrees that, except as otherwise expressly provided above, the waiver set forth in this letter agreement does not constitute a waiver, forbearance or other indulgence with respect to any Event of Default existing or hereafter arising, (iii) agrees that, except as expressly provided above, nothing contained in this letter agreement shall be deemed to constitute a waiver of any rights or remedies that the Lenders, the Administrative Agent or the Collateral Agent may have under the Credit Agreement or any other Loan Document or under applicable law, and (iv) represents and warrants that (x) this letter agreement has been duly authorized, executed and delivered by it and this letter agreement, the Credit Agreement and the other Loan Documents constitute its legal, valid and binding obligations, enforceable in accordance with their terms, (y) the representations and warranties contained in the Loan Documents, other than those expressly made as of a specific date, are true and correct in all material respects as if made on the date hereof, and (z) the cash flow forecasts delivered by the Borrower under Section 6.1(l) of the Credit Agreement are true and accurate in all material respects and there have been no material misrepresentations of the Borrower’s or its Subsidiaries’ cash flows, including intra-period cash flows, as of the date hereof.

This letter agreement is a Loan Document. On and after the date hereof, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein” or words

3

of like import referring to the Credit Agreement, and each reference in the other Loan Documents to the “Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the Credit Agreement shall mean and be a reference to the Credit Agreement as amended by this letter agreement.

7