Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INNOVATE Corp. | a8-krecompanyoverviewaug20.htm |

HC2 HOLDINGS, INC.

© HC2 Holdings, Inc. 2017

Corporate Overview

August 2017

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Special Note Regarding Forward-Looking Statements. Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: This presentation contains, and certain oral statements

made by our representatives from time to time may contain, forward-looking statements. Generally, forward-looking statements include information describing actions, events, results, strategies

and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,” “might,” or

“continues” or similar expressions. The forward-looking statements in this presentation include without limitation statements regarding our expectation regarding building shareholder value. Such

statements are based on the beliefs and assumptions of HC2's management and the management of HC2's subsidiaries and portfolio companies. The Company believes these judgments are

reasonable, but you should understand that these statements are not guarantees of performance or results, and the Company’s actual results could differ materially from those expressed or

implied in the forward-looking statements due to a variety of important factors, both positive and negative, that may be revised or supplemented in subsequent reports on Forms 10-K, 10-Q and

8-K. Such important factors include, without limitation, issues related to the restatement of our financial statements; the fact that we have historically identified material weaknesses in our internal

control over financial reporting, and any inability to remediate future material weaknesses; capital market conditions; the ability of HC2's subsidiaries and portfolio companies to generate

sufficient net income and cash flows to make upstream cash distributions; volatility in the trading price of HC2 common stock; the ability of HC2 and its subsidiaries and portfolio companies to

identify any suitable future acquisition opportunities; our ability to realize efficiencies, cost savings, income and margin improvements, growth, economies of scale and other anticipated benefits

of strategic transactions; difficulties related to the integration of financial reporting of acquired or target businesses; difficulties completing pending and future acquisitions and dispositions;

effects of litigation, indemnification claims, and other contingent liabilities; changes in regulations and tax laws; and risks that may affect the performance of the operating subsidiaries and

portfolio companies of HC2. These risks and other important factors discussed under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission (“SEC”), and our other reports filed with the SEC could cause actual results to differ materially from those indicated by the forward-looking statements made in this

presentation .

You should not place undue reliance on forward-looking statements. All forward-looking statements attributable to HC2 or persons acting on its behalf are expressly qualified in their entirety by

the foregoing cautionary statements. All such statements speak only as of the date made, and HC2 undertakes no obligation to update or revise publicly any forward-looking statements,

whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

In this presentation, HC2 refers to certain financial measures that are not presented in accordance with U.S. generally accepted accounting principles (“GAAP”), including Core Operating

Subsidiary Adjusted EBITDA, Total Adjusted EBITDA (excluding Insurance) and Insurance AOI.

Management believes that Adjusted EBITDA measures provide investors with meaningful information for gaining an understanding of certain results as it is frequently used by the financial

community to provide insight into an organization’s operating trends and facilitates comparisons between peer companies, because interest, taxes, depreciation, amortization and the other

items for which adjustments are made as noted in the definition of Adjusted EBITDA below can differ greatly between organizations as a result of differing capital structures and tax strategies.

Adjusted EBITDA can also be a useful measure of a company’s ability to service debt. In addition, management uses Adjusted EBITDA measures in evaluating certain of the Company’s

segments performance because they eliminate the effects of considerable amounts of noncash depreciation and amortization and items not within the control of the Company’s operations

managers. While management believes that these non-US GAAP measurements are useful as supplemental information, such adjusted results are not intended to replace our US GAAP financial

results and should be read together with HC2’s results reported under GAAP.

Management defines Adjusted EBITDA as Net income (loss) adjusted to exclude the impact of depreciation and amortization; amortization of equity method fair value adjustments at

acquisition; (gain) loss on sale or disposal of assets; lease termination costs; asset impairment expense; (gain) loss on early extinguishment or restructuring of debt; interest expense; net gain (loss)

on contingent consideration; other (income) expense, net; foreign currency transaction (gain) loss included in cost of revenue; income tax (benefit) expense; (gain) loss from discontinued

operations; noncontrolling interest; bonus to be settled in equity; share-based compensation expense; acquisition and nonrecurring items. Adjusted EBITDA excludes results of our Insurance

segment. A reconciliation of Adjusted EBITDA to Net income (loss) is included in the financial tables at the end of this release.

Management recognizes that using Adjusted EBITDA as a performance measure has inherent limitations as an analytical tool as compared to net income (loss) or other U.S. GAAP financial

measures, as these non-GAAP measures exclude certain items, including items that are recurring in nature, which may be meaningful to investors. As a result of the exclusions, Adjusted EBITDA

should not be considered in isolation and do not purport to be alternatives to net income (loss) or other U.S. GAAP financial measures as a measure of our operating performance.

Management believes that Insurance AOI measures, used frequently in the insurance industry, provide investors with meaningful information for gaining an understanding of certain results and

provides insight into an organization’s operating trends and facilitates comparisons between peer companies.

Management defines Insurance AOI as Net income (loss) for the Insurance segment adjusted to exclude the impact of net investment gains (losses), including other-than-temporary impairment

losses recognized in operations; asset impairment; intercompany elimination and acquisition and non-recurring items. Management believes that Insurance AOI provides a meaningful financial

metric that helps investors understand certain results and profitability. While these adjustments are an integral part of the overall performance of the Insurance segment, market conditions

impacting these items can overshadow the underlying performance of the business. Accordingly, we believe using a measure which excludes their impact is effective in analyzing the trends of

our operations.

By accepting this document, each recipient agrees to and acknowledges the foregoing terms and conditions.

Safe Harbor Disclaimers

1

Company Overview

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Holdings, Inc.

3

W ho W e Are

W ha t W e Do

Di v ers i f i ed h o l d i n g c omp a n y

Pe r man ent c a p i ta l

S t r a teg ic a n d f i n a n c i a l p a r tne r

Te a m o f v i s ion ar ie s

B u y a n d b u i l d c omp a n ies

E x e cute b u s in es s p l a n s

De l i v e r s u s ta i nab l e v a l ue f o r

s h a reh o lders

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Investment Highlights

4

Why Invest in HC2?

Leadership team has diverse network resulting in unique deal flow

Unique combination of operating entities accessible through one

investment

– Controlling stakes in leading, stable, cash flow generating businesses

– Option value opportunities with significant equity upside potential

Long-term strategy allows management teams the ability to

execute business plans

Diversification across a number of industries

Financial flexibility

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

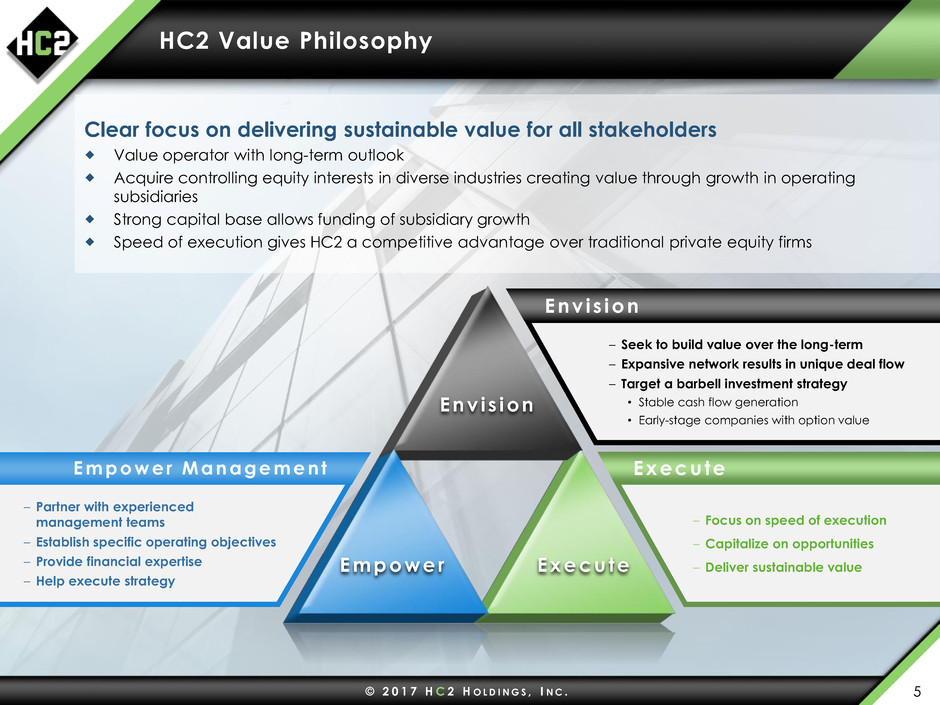

Clear focus on delivering sustainable value for all stakeholders

Value operator with long-term outlook

Acquire controlling equity interests in diverse industries creating value through growth in operating

subsidiaries

Strong capital base allows funding of subsidiary growth

Speed of execution gives HC2 a competitive advantage over traditional private equity firms

Env i s ion

Execute Empower

– Seek to build value over the long-term

– Expansive network results in unique deal flow

– Target a barbell investment strategy

• Stable cash flow generation

• Early-stage companies with option value

Env i s ion

– Partner with experienced

management teams

– Establish specific operating objectives

– Provide financial expertise

– Help execute strategy

E m p o w e r M a n a g e m e nt

– Focus on speed of execution

– Capitalize on opportunities

– Deliver sustainable value

Execute

HC2 Value Philosophy

5

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Company Snapshot

6

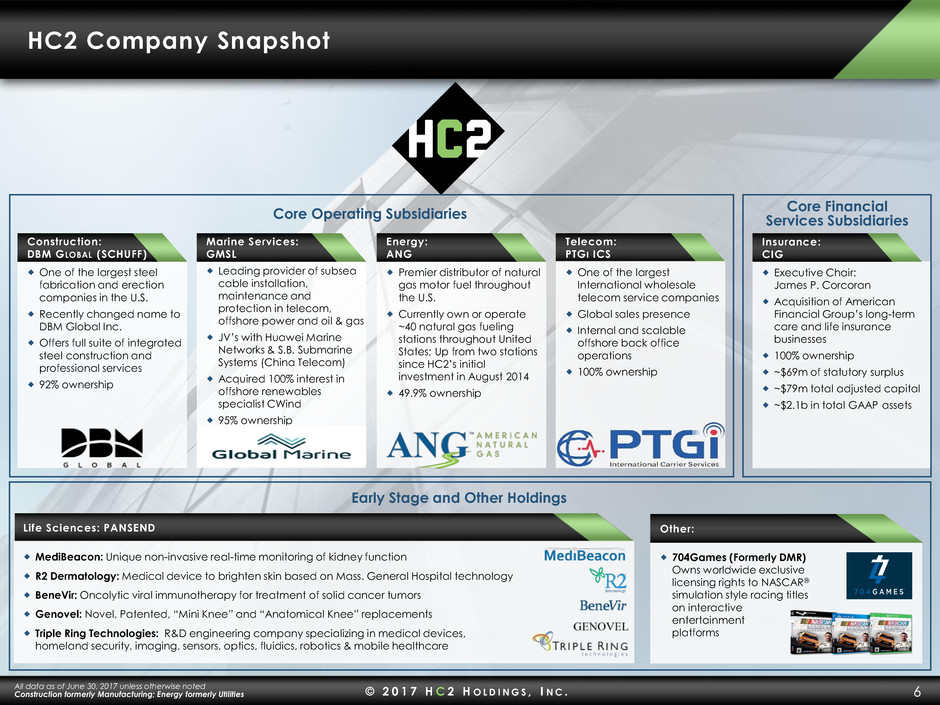

Early Stage and Other Holdings

Core Operating Subsidiaries

One of the largest steel

fabrication and erection

companies in the U.S.

Recently changed name to

DBM Global Inc.

Offers full suite of integrated

steel construction and

professional services

92% ownership

Construction:

DBM GLOBAL (SCHUFF)

Leading provider of subsea

cable installation,

maintenance and

protection in telecom,

offshore power and oil & gas

JV’s with Huawei Marine

Networks & S.B. Submarine

Systems (China Telecom)

Acquired 100% interest in

offshore renewables

specialist CWind

95% ownership

Marine Services:

GMSL

Premier distributor of natural

gas motor fuel throughout

the U.S.

Currently own or operate

~40 natural gas fueling

stations throughout United

States; Up from two stations

since HC2’s initial

investment in August 2014

49.9% ownership

Energy:

ANG

Telecom:

PTGI ICS

One of the largest

International wholesale

telecom service companies

Global sales presence

Internal and scalable

offshore back office

operations

100% ownership

Life Sciences: PANSEND

MediBeacon: Unique non-invasive real-time monitoring of kidney function

R2 Dermatology: Medical device to brighten skin based on Mass. General Hospital technology

BeneVir: Oncolytic viral immunotherapy for treatment of solid cancer tumors

Genovel: Novel, Patented, “Mini Knee” and “Anatomical Knee” replacements

Triple Ring Technologies: R&D engineering company specializing in medical devices,

homeland security, imaging, sensors, optics, fluidics, robotics & mobile healthcare

Core Financial

Services Subsidiaries

Executive Chair:

James P. Corcoran

Acquisition of American

Financial Group’s long-term

care and life insurance

businesses

100% ownership

~$69m of statutory surplus

~$79m total adjusted capital

~$2.1b in total GAAP assets

Insurance:

CIG

All data as of June 30, 2017 unless otherwise noted

Construction formerly Manufacturing; Energy formerly Utilities

704Games (Formerly DMR)

Owns worldwide exclusive

licensing rights to NASCAR®

simulation style racing titles

on interactive

entertainment

platforms

Other:

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Executive Leadership Team

7

Philip A. Falcone

Chairman of the Board,

Chief Executive Officer and President

Michael J. Sena

Chief Financial Officer

Paul K. Voigt

Senior Managing Director

Paul L. Robinson

Chief Legal Officer & Corporate Secretary

Suzi Raftery Herbst

Chief Administrative Officer

Andrew G. Backman

Managing Director

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

$0

$2

$4

$6

$8

$10

$12

$14

HC2 Stock Performance & Timeline

8

Note: As a result of the Schuff Tender, HC2’s ownership increased to 89% and

subsequently through open market share purchases increased to 92%

*Pending Federal Communications Communication approval

5/29/2014

HC2 Acquires

Schuff (65%)

HC2 Acquires

Global Marine (97%)

9/22/2014

HC2 Announces

Results of Schuff

Tender Offer

10/7/2014

$250M Senior

Secured Notes

Offering

Closing

11/20/2014

NYSE MKT Listing

Announced

12/23/2014

HC2 Forms Continental

Insurance Group

4/14/2015

$50M Tack-On to

Senior Secured Notes

3/23/2015

HC2 Acquires

Interest in

Gaming Nation

6/10/2015

HC2 closes LTC and Life

Insurance Acquisition

12/24/2015

Global Marine Acquires

Majority Interest in CWind

2/3/2016

R2 Dermatology

Receives FDA Approval

10/5/2016

2014 2015 2016 2017

$55M Tack-

On Senior

Secured

Notes

1/31/2017

Company

Renamed "HC2"

4/14/2014

HRG Group

Acquires

Majority Interest

in "PTGi“

1/8/2014

8/01/2014

HC2 Initial

Investment in ANG

MediBeacon

Awarded Gates

Foundation grant

10/18/2016

MediBeacon Completes

Pilot Two Testing

3/2/2017

ANG Adds 18

CNG Stations

Through Two

Transactions

12/15/2016

BeneVir Granted New Oncolytic

Immunotherapy Patent

4/15/2017

$59M Equity Offering

11/9/2015

Transfer Listing to NYSE

5/16/2017

$38M Tack-On

Senior Secured Notes

6/27/2017

HC2 Announces Acquisition of

Majority Interest in DTV America*

6/27/2017

R2 Dermatology Receives

2nd FDA Approval

7/12/17

Segment Detail

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Sacramento Kings Arena

DBM Global Inc. (Schuff Intl.) – Company Snapshot

10

DBM Global Inc. is focused on delivering world class, sustainable value to its clients through a

highly collaborative portfolio of companies which provide better designs, more efficient

construction and superior asset management solutions

The Company offers integrated steel construction services from a single source and

professional services which include design-assist, design-build, engineering, BIM

participation, 3D steel modeling/detailing, fabrication, advanced field erection, project

management and state-of-the-art steel management systems

Major market segments include commercial, healthcare, convention centers, stadiums,

gaming and hospitality, mixed use and retail, industrial, public works, bridges, transportation

and international projects

Business Description:

Rustin Roach – President and CEO

Michael Hill – CFO and Treasurer

Scott Sherman – VP, General Counsel

Select Management:

Apple World Headquarters

Select Customers:

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

DBM Global Inc. (Schuff Intl.) – Company Snapshot

11

Core

Activities

The largest structural

steel fabricator and

erector in the U.S.

In-house structural &

design engineering

expertise

Provides structural steel

fabrication & erection

services for smaller

projects leveraging

subcontractors and in-

house project

managers

Manufactures

equipment for use in

the petrochemical oil

& gas industries, such

as: pollution control

scrubbers, tunnel liners,

pressure vessels,

strainers, filters &

separators

A highly experienced

global Detailing and

3D BIM Modelling

company

A global Building

Information Modelling

(BIM), Steel Detailing

and Rebar Detailing

firm

Products

and Service

Offerings

Structural Steel

fabrication

Steel erection services

Structural engineering

& design services

Preconstruction

engineering services

BIM (Building

Information Modeling)

Project Management

(proprietary SIMS plat.)

Structural Steel

fabrication

(subcontracted)

Steel erection services

(subcontracted)

Project Management

(proprietary SIMS

platform)

Design engineering

Fabrication services

Steel Detailing

3D BIM Modelling

BIM Management

Integrated Project

Delivery (IPD)

3D Animation and

Visualization

Steel Detailing

Rebar Detailing

3D BIM Modelling

Connection Design

Forensic Modelling &

Animation

Industries

Served

Commercial

Conv. & Event Centers

Energy

Government

Healthcare

Industrial & Mining

Infrastructure

Leisure

Retail

Transportation

Commercial

Government

Healthcare

Leisure

Retail

Transportation

Petrochemical

Oil & gas infrastructure

Pipelines

Commercial

Conv. & Event Centers

Energy

Government

Healthcare

Industrial & Mining

Infrastructure

Leisure

Retail

Transportation

Commercial

Conv. & Event Centers

Energy

Government

Healthcare

Industrial & Mining

Infrastructure

Leisure

Retail

Transportation

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Global Marine Group – Company Snapshot

12

“Engineering a Clean and Connected Future”

Leading provider of offshore marine engineering delivered via two business units:

Global Marine: Focusing on the telecommunications sector

CWind: Focused on offshore renewables and power

Founded in 1850 - Headquartered in UK with major regional hub in Singapore and an

established European base in Germany

Global Marine Group - Business Description:

Select Customers:

Installed roughly 21% of the world's

subsea fiber optic cable, amounting to

300,000km

In maintenance, Global Marine benefits

from long-term contracts with high

renewal rates; Responsible for 385,000km

of the total 1,200,000km of global in-

service cable

Significant opportunities in Telecom

through 49% owned strategic joint

ventures with Huawei Technologies

(HMN) and China Telecom (SBSS)

Global Marine Highlights:

Responsible for the Global Marine Group’s

power cable capabilities

CWind delivers a broad spectrum of

topside and subsea services to developers

and has experience at over 40 wind farms

to date

CWind is strongly differentiated as the only

integrated service provider

CWind is recognized for having the most

fuel efficient Crew Transport Vessel (CTV)

fleet in the market

CWind Highlights:

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Global Marine Group – Company Snapshot

13

Core

Activities

Maintenance

Provision of vessels on

standby to repair fiber optic

telecom cables in defined

geographic zones

Location of fault, cable

recovery, jointing and re-

deployment of cables

Operation of depots storing

cable and spare parts across

the globe

Management of customer

data through the life of the

cable system

Installation

Provision of turnkey repeated

telecom systems via Huawei

Marine Networks (“HMN”)

joint-venture

Installation contracts for

telecom customers

Services include route

planning, route survey, cable

mapping, route engineering,

laying, trenching and burial

at all depths

Fiber optic communications

and power infrastructure to

offshore platforms

Permanent Reservoir

Monitoring (“PRM”) systems

Wind Farm

Offshore wind planning,

construction and operations

& maintenance support

services

Fleet of Crew Transfer Vessels

(CTVs) which have a

historically high utilisation and

are positioned 4th in the overall

CTV market

Over 250 certified &

experienced personnel

including technicians, riggers,

slingers, lifting supervisors &

foremen

Offshore training facility

Power Cable

Installation for inter-array

power cables for offshore

wind market

Maintenance provision,

including cable storage,

power joint development and

vessel availability

Offshore wind planning,

Interconnector installation

Services include route

planning, route survey, cable

mapping, route engineering,

laying, trenching and burial at

all depths

Vessels

Cable Retriever

Pacific Guardian

Wave Sentinel

Cable Innovator

CS Sovereign

CS Recorder

Networker

18 Crew Transfer Vessels in

CWind Fleet

CS Sovereign

Joint

Venture

Sino British Submarine Systems

in Asia (SBSS); Joint venture

(49%) with China Telecom

International Cableship Pte

Ltd (“ICPL”)

Joint venture (30%) with

SingTel and ASEAN Cableship

SCDPL; Joint venture (40%)

with SingTel

Huawei Marine Networks;

Joint venture (49%) with

Huawei Technologies

Sino British Submarine Systems

in Asia (SBSS); Joint venture

(49%) with China Telecom

National Wind Farm Training

Centers (100%)

Sino British Submarine Systems

in Asia; Joint venture (49%)

with China Telecom

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

American Natural Gas – Company Snapshot

14

Designs, builds, owns, operates and maintains compressed

natural gas commercial fueling stations for transportation

Current ownership 49.9% with ability to increase to 63%

In-depth experience in the natural gas fueling industry

Building a premier nationwide network of publically accessible heavy duty CNG

fueling stations throughout the United States designed and located to serve fleet

customers

– Acquired 18 CNG stations from Questar Fueling Co. and Constellation CNG (4Q16)

– Currently ~40 stations owned and/or operated in 15 states across the United States*

– Expect to expand station footprint via organic and select M&A opportunities

American transportation sector is rapidly converting from foreign-dependent

diesel fuel to clean burning natural gas:

– Dramatically reduces emissions

– Extends truck life

– Significantly reduces fuel cost

Given the cost effectiveness of CNG, its environmental friendliness and the

abundance of natural gas reserves in the United States, CNG is the best candidate

for alternatives to gasoline and diesel for the motor vehicle market

All data as of June 30, 2017 unless otherwise noted

*Including stations under development

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

PTGi International Carrier Services (“PTGi ICS”)

15

Leading international wholesale telecom

service company providing voice and data

call termination to the telecom industry worldwide

Provides transit and termination of telephone calls through its own global

network of next-generation IP soft switches and media gateways,

connecting the networks of incumbent telephone companies, mobile

operators and OTT companies worldwide

Restructured in 2014 PTGi ICS now delivers industry leading technology via

best of breed sales and operational support teams

– 2Q17: Ninth consecutive quarter of positive Adjusted EBITDA

In business since 1997, recognized as a trusted business partner globally

Headquartered in Herndon, Virginia with representation across North

America, South America, the Middle East and Europe

All data as of June 30, 2017 unless otherwise noted

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Continental Insurance Group – Company Snapshot

16

April 2015: HC2 established Continental Insurance Group (“CIG”) as its insurance platform

led by industry veteran Jim Corcoran, as Executive Chairman

December 2015: HC2 completed the acquisition of American Financial Group’s long-term

care and life insurance businesses, United Teacher Associates Insurance Company and

Continental General Insurance Company

The formation of Continental Insurance Group (“CIG”) to invest in the long-term care

and life insurance sector is consistent with HC2’s overall strategy of taking advantage

of dislocated and undervalued operating businesses

Through CIG, HC2 intends to build an attractive platform of insurance businesses

James P. Corcoran, Executive Chair, has extensive experience in the insurance

industry on both the corporate and regulatory side as the former Superintendent of

Insurance of the State of New York

Combined measures as of June 30, 2017:

– Statutory Surplus ~$69 million

– Total Adjusted Capital ~$79 million

– GAAP Assets of ~$2.1 billion

Completed merging CGI and UTA into one legal entity (12/16)

– Beneficial to statutory capital

All data as of June 30, 2017 unless otherwise noted

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Pansend

17

All data as of June 30, 2017 unless otherwise noted

HC2’s Pansend Life Sciences Segment Is Focused on the

Development of Innovative Healthcare Technologies and Products

80% equity ownership of company focused on immunotherapy; Oncolytic virotherapy for treatment of solid

cancer tumors

Founded by Dr. Matthew Mulvey & Dr. Ian Mohr (who co-developed T-Vec); Biovex (owner of T-Vec) acquired

by Amgen for ~$1billion

Benevir’s T-Stealth is a second generation oncolytic virus with new features and new intellectual property

BeneVir holds exclusive worldwide license to develop BV-2711 (T-Stealth)

Granted new patent entitled “Oncolytic Herpes Simplex Virus and Therapeutic Uses Thereof”, covering the composition of

matter for Stealth-1H, BeneVir’s lead oncolytic immunotherapy, as well as other platform assets (2Q17)

75% equity ownership of dermatology company focused on lightening and brightening skin

Founded by Pansend in partnership with Mass. General Hospital and inventors Dr. Rox Anderson,

Dieter Manstein and Dr. Henry Chan

Over $20 billion global market

Received Food and Drug Administration approval for the R2 Dermal Cooling System (4Q16)

Received Food and Drug Administration approval for second generation R2 Dermal Cooling System (2Q17)

80% equity ownership in company with unique knee replacements based on technology from Dr. Peter Walker, NYU Dept.

of Orthopedic Surgery and one of the pioneers of the original Total Knee.

“Mini-Knee” for early osteoarthritis of the knee; “Anatomical Knee” – A Novel Total Knee Replacement

Strong patent portfolio

50% equity ownership in company with unique technology and device for monitoring of real-time kidney function

Current standard diagnostic tests measure kidney function are often inaccurate and not real-time

MediBeacon’s Optical Renal Function Monitor will be first and only, non-invasive system to enable real-time, direct monitoring

of renal function at point-of-care

$3.5 billion potential market

Successfully completed a key clinical study of its unique, real-time kidney monitoring system on subjects with impaired kidney

function at Washington University in St. Louis. (1Q17)

Profitable technology and product development company

Areas of expertise include medical devices, homeland security, imaging systems, sensors, optics, fluidics, robotics and mobile

healthcare

Located in Silicon Valley and Boston area with over 90,000 square feet of working laboratory and incubator space

Contract R&D market growing rapidly

Customers include Fortune 500 companies and start-ups

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

704Games

(Formerly Dusenberry Martin Racing (DMi, Inc.))

18

On December 31, 2014, HC2 / DMR (re-branded 704Games)

completed a $6 million asset purchase agreement to acquire

worldwide exclusive licensing rights to NASCAR® simulation

style racing titles on interactive entertainment platforms

Owns all the code, artwork and animation previously developed for legacy games

Headquartered in Charlotte, NC in NASCAR® Headquarters building (NASCAR ® Plaza)

License also extends to NASCAR® racetracks and all the leading NASCAR® race teams and drivers

Since inception, 704Games developed an all-new NASCAR® racing simulation game, NASCAR Heat

Evolution, for PlayStations 4, Xbox One and PC, as well as NASCAR-themed mobile trivia and slots

games

In April, 2016, DMR secured $8.0m in additional equity growth capital from consortium of

new investors including superstar drivers Joey Logano and Brad Keselowski

NASCAR® Heat Evolution successfully released on September 13, 2016

NASCAR® Heat Evolution announced 2017 Team Update available February 21, 2017

– Team & Roster Updates, New Drivers, New Paint Schemes, 2017 NASCAR® Schedule, etc.

DMR Re-brands to 704Games – Appoints racing industry veteran Paul Brooks as CEO

and Brad Keselowski to Board of Directors (March 2017)

NASCAR® Heat Mobile game released (May 2017)

NASCAR® Heat 2 scheduled for release on September 12, 2017

All data as of June 30, 2017 unless otherwise noted

Appendix:

2Q17 Highlights /

Select Financial Data

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

2Q17 Highlights and Recent Developments

20

Second quarter performance once again highlight the unique value HC2 brings to the

market with our diverse, uncorrelated industry holdings

– Construction: $590 million backlog; >$800 million inclusive of contracts awarded, but not yet

signed; >$400 million of additional potential opportunities that could be awarded including

sporting arenas/stadiums, healthcare facilities, commercial office buildings and convention

centers

– Marine Services: Continued strong joint venture performance, in particular Huawei Marine;

Long-term offshore power, telecom install and telecom maintenance fundamentals remain

strong

– Telecommunications: Continued focus on higher margin wholesale traffic mix and improved

operating efficiencies

– Energy: Continued growth due to increase in number of fueling stations owned and/or

operated

Adjusted EBITDA for Core Operating Subsidiaries*

– $17.9 million in second quarter, as compared to $27.1 million in the year-ago quarter

– $45.7 million year-to-date, as compared to $39.8 million for the year-ago period

Cash and Investments as of June 30, 2017:

– $1.7 billion of consolidated cash, cash equivalents and investments, which includes

the Insurance segment

– $104.6 million in Consolidated Cash (excluding Insurance segment)

Cumulative outstanding Preferred Equity of $26.7 million at June 30, 2017;

Down significantly from $55.0 million of total Preferred issued

* Core Operating Subsidiaries include Construction, Marine Services,

Telecommunications and Energy. Construction formerly Manufacturing: Energy

formerly Utilities

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Segment Overview

21

Early Stage and Other Holdings

Core Operating Subsidiaries

2Q17 Revenue: $138.9m

2Q17 Adjusted EBITDA: $11.1m

YTD Adjusted EBITDA: $19.7m

Backlog $590m; >$800m with

contracts awarded, but not

yet signed

Solid long-term pipeline with

additional >$400m in

potential project value that

could be awarded over next

several quarters

Construction:

DBM GLOBAL (SCHUFF)

2Q17 Revenue: $36.4m

2Q17 Adjusted EBITDA: $3.6m

YTD Adjusted EBITDA: $20.0m

Continued strong joint

venture performance; Solid

long term telecom and

offshore power maintenance

& install opportunities

Marine Services:

GMSL

2Q17 Revenue: $4.1m

2Q17 Adjusted EBITDA: $1.0m

YTD Adjusted EBITDA: $2.2m

Delivered 2,814,000 Gasoline

Gallon Equivalents (GGEs) in

2Q17 vs. 828,000 GGEs in

2Q16

~40 stations currently owned

and / or operated vs. two

stations at time of HC2’s initial

investment in 3Q14

Energy:

ANG

Telecom:

PTGI ICS

2Q17 Revenue: $160.6m

2Q17Adjusted EBITDA: $2.2m

YTD Adjusted EBITDA: $3.8m

Continued focus on higher

margin wholesale traffic mix

and improved operating

efficiencies

Life Sciences: PANSEND

MediBeacon: Completed “Pilot Two” Clinical Study at Washington University in St. Louis (1Q17)

R2 Dermatology: Received FDA Approval for second generation R2 Dermal Cooling System (2Q17)

BeneVir: Granted additional patent protecting oncolytic immunotherapy Stealth-1H & other assets (2Q17)

Genovel: Novel, Patented, “Mini Knee” and “Anatomical Knee” replacements

Triple Ring Technologies: R&D engineering company specializing in medical devices,

homeland security , imaging, sensors, optics, fluidics, robotics & mobile healthcare

Core Financial

Services Subsidiaries

~$69m of statutory surplus

~$79m total adjusted capital

~$2.1b in total GAAP assets

Completed merging CGI

and UTA into one legal entity;

meaningful cost savings,

lower required statutory

capital (4Q16)

Platform for growth through

additional M&A

Insurance:

CIG

All data as of June 30, 2017 unless otherwise noted

Construction formerly Manufacturing; Energy formerly Utilities

704Games (Formerly DMR)

Owns worldwide exclusive

licensing rights to NASCAR®

simulation style racing titles

on interactive

entertainment

platforms

Other:

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Segment Financial Summary

22

All data as of June 30, 2017 unless otherwise noted

Construction formerly Manufacturing; Energy formerly Utilities

($m) Q2 2017 Q2 2016 YTD 2017 YTD 2016

Adjusted

EBITDA

Core Operating Subsidiaries

Construction $11.1 $13.2 $19.7 $24.7

Marine Services 3.6 11.8 $20.0 $12.3

Energy 1.0 0.5 $2.2 $0.9

Telecom 2.2 1.5 $3.8 $1.8

Total Core Operating $17.9 $27.1 $45.7 $39.8

Early Stage and Other Holdings

Life Sciences ($4.9) ($2.7) ($9.0) ($5.3)

Other (2.2) (3.3) ($3.3) ($7.3)

Total Early Stage and Other ($7.1) ($6.0) ($12.3) ($12.6)

Non-Operating Corporate ($6.3) ($5.9) ($12.2) ($11.6)

Total HC2 (excluding Insurance) $4.6 $15.2 $21.3 $15.5

Adjusted

Operating Income

Core Financial Services

Insurance $2.6 ($4.7) $1.6 ($7.3)

Note: Reconciliations of Adjusted EBITDA and Adjusted Operating Income to U.S. GAAP Net Income in appendix. Table may not foot due to rounding. Adjusted Operating Income for Q1 2016 has been

adjusted to exclude certain intercompany eliminations to better reflect the results of the Insurance segment, and remain consistent with internally reported metrics. Additional details in appendix. Q1 2016

benefitted from the release of valuation allowance impacting the net tax provision

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Construction: DBM Global Inc. (Schuff)

23

2Q17 Net Income1: $4.2m vs. $9.4m for 2Q16; YTD17 Net Income $7.4m vs. $13.7m for YTD16

2Q17 Adjusted EBITDA: $11.1m vs. $13.2m for 2Q16 driven in part by better than bid performance on commercial projects in

2Q16 (Apple Headquarters and Wilshire Grand)

YTD Adjusted EBITDA: $19.7m vs. $24.7m for the comparable 2016 year-to-date period, due primarily to timing associated

with design changes on certain existing projects in 1Q17 backlog and better-than bid performance on Apple

Headquarters and Wilshire Grand in 2Q16

Expect to remain on track for solid full year 2017 performance based on current backlog and 2H17 projected workflow

Recorded backlog of $590m at end of 2Q17

Taking into consideration awarded, but not yet signed contracts, backlog would have been >$800m

Continue to see large opportunities totaling >$400 million that could be awarded over next several quarters including new

sporting arenas or stadiums, healthcare facilities, commercial office buildings and convention centers

Second Quarter Update

Continue to select profitable, strategic and “core competency” jobs, not all jobs

Solid long-term pipeline of prospective projects; No shortage of transactions to evaluate

Commercial / Stadium / Healthcare sectors remain strong

Opportunities to add higher margin, value added services to overall product offering

Strategic Initiatives

Mile High Stadium Loma Linda Hospital

$45.8

$52.0

$59.9

$526.1

$513.8

$502.7

2014PF 2015A 2016A

Historical Performance

Adjusted EBITDA Revenue

All data as of June 30, 2017 unless otherwise noted

Construction formerly Manufacturing

10.1%

11.9%

8.7%

(1) Second quarter 2016 inclusive of a $1.3 million prior period beneficial adjustment to depreciation & amortization expense

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Marine Services: Global Marine Group

24

Joint Venture established in 1995 with China Telecom

China’s leading provider of submarine cable installation

Located in Shanghai and possesses a fleet of advanced purpose-built cable ships

Currency Exchange: CNY:USD 1:0.129

All data as of June 30, 2017 unless otherwise noted

2Q17 Net (Loss): $(3.1)m vs. Net Income of $6.0m for 2Q16; YTD17 Net Income $8.1m vs. $0.1m for YTD16

2Q17 Adjusted EBITDA: $3.6m vs. $11.8m for 2Q16 due primarily to higher costs associated with two off shore

power installation & repair projects in 2Q17 and very strong joint venture performance from Huawei Marine in 2Q16

YTD17 Adjusted EBITDA: $20.0m vs. $12.3m for the comparable 2016 year-to-date period due primarily to higher total joint

venture income in 1H17, in particular Huawei Marine, and a one-time telecom charge in 1Q16

Huawei Marine backlog at record levels at end of 2Q17

Expect to remain on track for solid full year 2017 performance based on current backlog and 2H17 projected workflow

Positioned well for solid long-term telecom maintenance & install opportunities

Positioned well for significant long-term offshore power maintenance & install opportunities

Second Quarter Update

Strategic Initiatives

Total HMN* 2016 2015 2014

Revenue ~$207m ~$203m ~$88m

Profit ~$25m ~$14m ~$2m

Cash / Equivalents ~$48m ~$27m ~$16m

$50.0

$42.1 $41.2

$163.6

$134.9

$161.9

2014PF 2015A 2016A

Historical Performance

Adjusted EBITDA Revenue

Note: 2014 PF Adj. EBITDA inclusive of approx. $10m offshore power installation vs. minimal contribution in 2015 & 1H16 as a result of Prysmian agreement which expired in 4Q15

29.8%

31.2% 25.4%

49% ownership 49% ownership

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

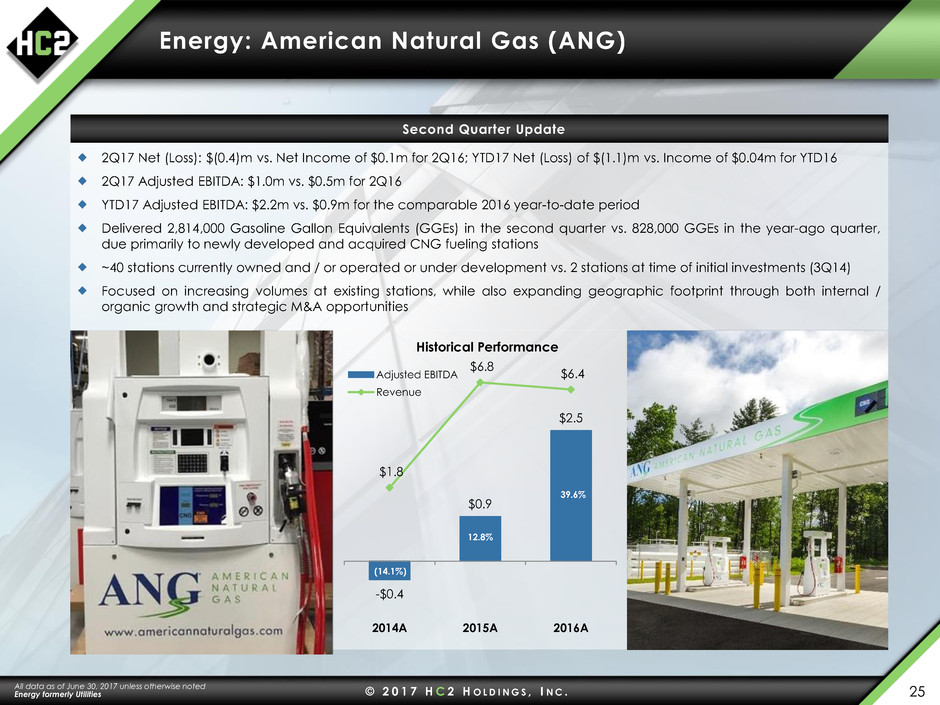

2Q17 Net (Loss): $(0.4)m vs. Net Income of $0.1m for 2Q16; YTD17 Net (Loss) of $(1.1)m vs. Income of $0.04m for YTD16

2Q17 Adjusted EBITDA: $1.0m vs. $0.5m for 2Q16

YTD17 Adjusted EBITDA: $2.2m vs. $0.9m for the comparable 2016 year-to-date period

Delivered 2,814,000 Gasoline Gallon Equivalents (GGEs) in the second quarter vs. 828,000 GGEs in the year-ago quarter,

due primarily to newly developed and acquired CNG fueling stations

~40 stations currently owned and / or operated or under development vs. 2 stations at time of initial investments (3Q14)

Focused on increasing volumes at existing stations, while also expanding geographic footprint through both internal /

organic growth and strategic M&A opportunities

Second Quarter Update

-$0.4

$0.9

$2.5

$1.8

$6.8

$6.4

2014A 2015A 2016A

Historical Performance

Adjusted EBITDA

Revenue

Energy: American Natural Gas (ANG)

25

All data as of June 30, 2017 unless otherwise noted

Energy formerly Utilities

39.6%

12.8%

(14.1%)

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Strong quarterly results again due to continued focus on higher margin wholesale traffic mix and improved

operational efficiencies

– 2Q17 Net Income: $2.1m vs. $1.0m for 2Q16; YTD17 Net Income of $3.6m vs. $2.2m for YTD16

– 2Q17 Adjusted EBITDA: $2.2m vs. $1.5m for 2Q16

– YTD17 Adjusted EBITDA: $3.8m vs. $1.8m for the comparable 2016 year-to-date period

– Fourth consecutive quarter of cash dividend to HC2

One of the key objectives: leverage the infrastructure and management expertise within PTGi-ICS

– Over 800+ wholesale interconnections globally provides HC2 the opportunity to leverage the existing cost effective

infrastructure by bolting on higher margin products and M&A opportunities

– A focused strategic initiative has been launched within PTGi-ICS to identify potential M&A opportunities

Second Quarter Update

Telecommunications: PTGi-ICS

26

$(1.2)

$2.0

$5.6

$162.0

$460.4

$735.0

2014A 2015A 2016A

Historical Performance

Adjusted EBITDA

Revenue

All data as of June 30, 2017 unless otherwise noted

0.8%

0.4%

(0.1%)

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Insurance: Continental Insurance Group

27

Note: Reconciliation of Adjusted Operating Income to U.S. GAAP Net Income in

appendix. All data as of June 30, 2017 unless otherwise noted

Continental Insurance Group serves as a platform for run-off Long Term Care (“LTC”) books of business and for acquiring

additional run-off LTC businesses

– 2Q17 Net Income: $0.2m vs. Net (Loss) of $(2.3)m for 2Q16; YTD17 Net (Loss) of $(0.6)m vs. $(9.8)m for YTD16

– 2Q17 Adjusted Operating Income: $2.6m vs. $(4.7)m for 2Q16

– YTD17 Adjusted Operating Income: $1.6m vs. $(7.3)m for comparable 2016 period

– ~$69m statutory surplus at end of second quarter

– ~$79m total adjusted capital at end of second quarter

– ~$2.1b in total GAAP assets at June 30, 2017

– Completed merging CGI and UTA into one legal entity; Beneficial to statutory capital (12/16)

Strategy:

– A concentrated focus on LTC and acquisitions of additional books of run-off LTC business

– A platform to provide a vehicle for multi-line insurers who do not consider LTC a core business segment

to exit the market

– Enhancing efficiency and effectiveness through scale and a concentrated focus on LTC

Second Quarter Update

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Pansend

28

All data as of June 30, 2017 unless otherwise noted

HC2’s Pansend Life Sciences Segment Is Focused on the

Development of Innovative Healthcare Technologies and Products

80% equity ownership of company focused on immunotherapy; Oncolytic virotherapy for treatment of solid

cancer tumors

Founded by Dr. Matthew Mulvey & Dr. Ian Mohr (who co-developed T-Vec); Biovex (owner of T-Vec) acquired

by Amgen for ~$1billion

Benevir’s T-Stealth is a second generation oncolytic virus with new features and new intellectual property

BeneVir holds exclusive worldwide license to develop BV-2711 (T-Stealth)

Granted new patent entitled “Oncolytic Herpes Simplex Virus and Therapeutic Uses Thereof”, covering the composition of

matter for Stealth-1H, BeneVir’s lead oncolytic immunotherapy, as well as other platform assets (2Q17)

75% equity ownership of dermatology company focused on lightening and brightening skin

Founded by Pansend in partnership with Mass. General Hospital and inventors Dr. Rox Anderson,

Dieter Manstein and Dr. Henry Chan

Over $20 billion global market

Received Food and Drug Administration approval for the R2 Dermal Cooling System (4Q16)

Received Food and Drug Administration approval for second generation R2 Dermal Cooling System (2Q17)

80% equity ownership in company with unique knee replacements based on technology from Dr. Peter Walker, NYU Dept.

of Orthopedic Surgery and one of the pioneers of the original Total Knee.

“Mini-Knee” for early osteoarthritis of the knee; “Anatomical Knee” – A Novel Total Knee Replacement

Strong patent portfolio

50% equity ownership in company with unique technology and device for monitoring of real-time kidney function

Current standard diagnostic tests measure kidney function are often inaccurate and not real-time

MediBeacon’s Optical Renal Function Monitor will be first and only, non-invasive system to enable real-time, direct monitoring

of renal function at point-of-care

$3.5 billion potential market

Successfully completed a key clinical study of its unique, real-time kidney monitoring system on subjects with impaired kidney

function at Washington University in St. Louis. (1Q17)

Profitable technology and product development company

Areas of expertise include medical devices, homeland security, imaging systems, sensors, optics, fluidics, robotics and mobile

healthcare

Located in Silicon Valley and Boston area with over 90,000 square feet of working laboratory and incubator space

Contract R&D market growing rapidly

Customers include Fortune 500 companies and start-ups

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Notable Financial and Other Updates

29

Collateral Coverage Ratio at Quarter End Exceeded 2.0x

$104.6 million in Consolidated Cash (excluding Insurance segment)

– $56.0 million Corporate Cash

$11.5 million Received in Dividends and Tax Share from DBM Global and PTGi ICS in Second Quarter

Cumulative Outstanding Amount of Preferred Equity $26.7 million at June 30, 2017

– Reduced a total of $28.5 million from $55.0 million of total preferred issued

$38 million Private Placement of 11% Senior Secured Notes Completed in Second Quarter

– Net proceeds for working capital, general corporate purposes, as well as the financing of

acquisitions and investments;

– Notes issued at an issue price of 101.000% plus accrued interest from June 1, 2017

Entered into a series of transactions that, if certain conditions are met and approved by the Federal

Communications Commission, will result in HC2 and its subsidiaries owning over 50% of shares of

common stock of DTV America Corporation (“DTVA”)

– DTVA is an aggregator and operator of low power television licenses and stations across the United

States. DTVA currently owns and operates >50 LPTV stations in more than 40 U.S. cities

All data as of June 30, 2017 unless otherwise noted

(1) Market capitalization on a fully diluted basis, excluding preferred equity, using a common stock price per share of $5.98 on August 8, 2017

(2) Cash and cash equivalents

(3) Enterprise Value is calculated by adding market capitalization, total preferred equity and total debt amounts, less Corporate cash

($m) Balance Sheet (at June 30, 2017)

Market Cap(1) $257.1

Preferred Equity $26.7

Total Debt $400.0

Corporate Cash(2) $56.0

Enterprise Value(3) $627.8

Appendix:

Reconciliations

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA

Three Months Ended June 30, 2017

31

(in thousands)

Three Months Ended June 30, 2017

Construction

Marine

Services

Energy Telecom

Life

Sciences

Other &

Elimination

Net Income (loss) attributable to HC2 Holdings, Inc. $ (17,911)

Less: Net Incom e (loss) attributable to HC2 Holdings Insurance Segm ent 164

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment 4,179$ (3,053)$ (365)$ 2,060$ (4,106)$ (3,757)$ (13,033)$ (18,075)$

Adjustm ents to reconcile net incom e (loss) to Adjusted EBITDA:

Depreciation and amortization 1,240 5,255 1,381 94 41 331 16 8,358

Depreciation and amortization (included in cost of revenue) 1,302 - - - - - - 1,302

Amortization of equity method fair value adjustment at acquisition - (325) - - - - - (325)

Asset impairment expense - - - - - 1,810 - 1,810

(Gain) loss on sale or disposal of assets (145) - 18 - - - - (127)

Lease termination costs - 55 - - - - - 55

Interest expense 174 1,040 154 14 - 16 10,675 12,073

Net loss on contingent consideration - - - - - - 88 88

Other (income) expense, net 28 490 255 (9) (11) 803 214 1,770

Foreign currency (gain) loss (included in cost of revenue) - 83 - - - - - 83

Income tax (benefit) expense 3,232 (134) (1) - (0) 0 (6,543) (3,446)

Noncontrolling interest 369 (156) (492) - (911) (1,372) - (2,562)

Bonus to be settled in equity - - - - - - 585 585

Shar -based payment expense - 394 91 - 76 18 527 1,106

Acquisition and nonrecurring items 701 - - - - - 1,168 1,869

Adjusted EBITDA 11,080$ 3,649$ 1,041$ 2,159$ (4,911)$ (2,151)$ (6,303)$ 4,564$

Total Core Operating Subsidiaries 17,929$

Non-

operating

Corporate

HC2

Early Stage & OtherCore Operating Subsidiaries

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA

Three Months Ended June 30, 2016

32

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other &

Elimination

Net Income (loss) attributable to HC2 Holdings, Inc. 1,935$

Less: Net Incom e (loss) attributable to HC2 Holdings Insurance Segm ent (2,293)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment 9,364$ 6,002$ 68$ 1,009$ (2,004)$ (2,608)$ (7,603)$ 4,228$

Adjustm ents to reconcile net incom e (loss) to Adjusted EBITDA:

Depreciation and amortization 303 6,084 468 140 36 336 - 7,367

Depreciation and amortization (included in cost of revenue) (206) - - - - - - (206)

Amortization of equity method fair value adjustment at acquisition - (359) - - - - - (359)

(Gain) loss on sale or disposal of assets (1,845) 7 - - - 1 - (1,837)

Lease termination costs - - - 338 - - - 338

Interest expense 303 1,285 14 - - 1 8,966 10,569

Net gain on contingent consideration - (192) - - - - - (192)

Other (income) expense, net (32) 403 (344) 29 - (10) 465 511

Foreign currency (gain) loss (included in cost of revenue) - (1,540) - - - - - (1,540)

Income tax (benefit) expense 4,524 (212) - - - 1 (9,404) (5,091)

N nc ntrolling interest 768 200 244 - (812) (1,044) - (644)

Share-base payment expense - 152 90 - 34 40 1,359 1,675

Acquisition and nonrecurring items - - - 18 - - 313 331

Adjusted EBITDA 13,179$ 11,830$ 540$ 1,534$ (2,746)$ (3,283)$ (5,904)$ 15,150$

Total Core Operating Subsidiaries 27,083$

Core Operating Subsidiaries Early Stage & Other

Non-

operating

Corporate

HC2

Three Months Ended June 30, 2016

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA

Six Months Ended June 30, 2017

33

(in thousands)

Six Months Ended June 30, 2017

Construction

Marine

Services

Energy Telecom

Life

Sciences

Other &

Elimination

Net Income (loss) attributable to HC2 Holdings, Inc. $ (32,407)

Less: Net Incom e (loss) attributable to HC2 Holdings Insurance Segm ent (597)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment 7,382$ 8,099$ (1,062)$ 3,562$ (7,516)$ (9,187)$ (33,088)$ (31,810)$

Adjustm ents to reconcile net incom e (loss) to Adjusted EBITDA:

Depreciation and amortization 2,880 10,340 2,629 191 79 661 33 16,813

Depreciation and amortization (included in cost of revenue) 2,542 - - - - - - 2,542

Amortization of equity method fair value adjustment at acquisition - (650) - - - - - (650)

Asset impairment expense - - - - - 1,810 - 1,810

(Gain) loss on sale or disposal of assets (393) (3,500) 14 - - - - (3,879)

Lease termination costs - 249 - - - - - 249

Interest expense 381 2,342 290 23 - 2,407 20,745 26,188

Net loss on contingent consideration - - - - - - 319 319

Other (income) expense, net 7 1,555 1,375 65 (15) 2,918 258 6,163

Foreign currency (gain) loss (included in cost of revenue) - 107 - - - - - 107

Income tax (benefit) expense 5,311 376 12 - (0) 0 (4,366) 1,333

Noncontrolling interest 632 338 (1,239) - (1,702) (1,977) - (3,948)

Bonus to be settled in equity - - - - - - 585 585

Shar -based payment expense - 739 182 - 168 47 1,489 2,625

Acquisition and nonrecurring items 946 - - - - - 1,861 2,807

Adjusted EBITDA 19,688$ 19,995$ 2,201$ 3,841$ (8,986)$ (3,321)$ (12,164)$ 21,254$

Total Core Operating Subsidiaries 45,725$

HC2

Early Stage & OtherCore Operating Subsidiaries

Non-

operating

Corporate

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted EBITDA

Six Months Ended June 30, 2016

34

(in thousands)

Construction

Marine

Services

Telecom Energy

Life

Sciences

Other &

Elimination

Net Income (loss) attributable to HC2 Holdings, Inc. (28,527)$

Less: Net Incom e (loss) attributable to HC2 Holdings Insurance Segm ent (9,789)

Net Income (loss) attributable to HC2 Holdings, Inc., excluding

Insurance Segment 13,748$ 84$ 41$ 2,211$ (706)$ (13,104)$ (21,012)$ (18,738)$

Adjustm ents to reconcile net incom e (loss) to Adjusted EBITDA:

Depreciation and amortization 832 11,239 897 246 55 672 - 13,941

Depreciation and amortization (included in cost of revenue) 1,727 - - - - - - 1,727

Amortization of equity method fair value adjustment at acquisition - (717) - - - - - (717)

(Gain) loss on sale or disposal of assets (941) (10) - - - 1 - (950)

Lease termination costs - - - 338 - - - 338

Interest expense 613 2,355 23 - - 1 17,903 20,895

Net gain on contingent consideration - (192) - - - - - (192)

Other (income) expense, net (76) 1,015 (375) (996) (3,221) 5,996 (1,146) 1,197

Foreign currency (gain) loss (included in cost of revenue) - (1,687) - - - - - (1,687)

Income tax (benefit) expense 7,969 (852) - - - - (13,630) (6,513)

N nc ntrolling interest 829 45 222 - (1,532) (1,088) - (1,524)

Share-based payment expense - 761 104 - 56 200 3,745 4,866

Acquisition and nonrecurring items - 266 27 18 - - 2,514 2,825

Adjusted EBITDA 24,701$ 12,307$ 939$ 1,817$ (5,348)$ (7,322)$ (11,626)$ 15,468$

Total Core Operating Subsidiaries 39,764$

Early Stage & Other

Non-

operating

Corporate

HC2

Six Months Ended June 30, 2016

Core Operating Subsidiaries

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

Reconciliation of U.S. GAAP Net Income (Loss) to Insurance AOI

Three and Six Months Ended June 30, 2017 and 2016

35

The calculation of Insurance Net Loss has been revised to exclude adjustments for intercompany eliminations as they are not considered relevant in evaluating the performance of our

Insurance segment. For first quarter 2016, this resulted in a change to the previously reported Insurance loss of ($12.3) million for the quarter to a loss of ($7.5) million.

The calculation of Insurance AOI has been revised to exclude adjustments for intercompany eliminations as they are not considered relevant in evaluating the performance of our

Insurance segment. For first quarter 2016, this resulted in a change to the previously reported Insurance AOI loss of ($3.6) million for the quarter to a loss of ($2.6) million.

(in thousands)

2017 2016

Increase/

(Decrease)

2017 2016

Increase/

(Decrease)

Net Income (loss) - Insurance segment 164$ (2,293)$ 2,457$ (597)$ (9,789)$ 9,192$

Effect of inv estment (gains) losses (1,095) (2,418) 1,323 (1,876) 2,457 (4,333)

Asset impairment expense 2,842 - 2,842 3,364 - 3,364

Acquisition and non-recurring items 736 - 736 736 - 736

Insurance AOI 2,647$ (4,711)$ 7,358$ 1,627$ (7,332)$ 8,959$

Adjusted Operating Income - Insurance ("Insurance AOI")

Three Months Ended June 30, Six Months Ended June 30,

Appendix:

Biographies

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Executive Leadership Team

37

Philip A. Falcone Served as a director of HC2 since January 2014 and Chairman of the Board, Chief

Executive Officer and President of HC2 since May 2014

Served as a director, Chairman of the Board and Chief Executive Officer of HRG Group

Inc. (“HRG”) from July 2009 to December 2014

From July 2009 to June 2011, served as the President of HRG

Chief Investment Officer and Chief Executive Officer of Harbinger Capital Partners, LLC

(“Harbinger Capital”)

Before founding Harbinger Capital in 2001, managed the High Yield and Distressed

trading operations for Barclays Capital from 1998 to 2000

Received an A.B. in Economics from Harvard University

Chairman of the Board

Chief Executive Officer

President

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Executive Leadership Team

38

Michael J. Sena Chief Financial Officer of HC2 since June 2015

Served as the Chief Accounting Officer of HRG from November 2012 to May 2015

From January 2009 to November 2012, held various accounting and financial reporting

positions with the Reader’s Digest Association, Inc., last serving as Vice President and

North American Controller

Served as Director of Reporting and Business Processes for Barr Pharmaceuticals from

July 2007 until January 2009

Held various positions with PricewaterhouseCoopers

Mr. Sena is a Certified Public Accountant and holds a Bachelor of Science in

Accounting from Syracuse University

Chief Financial Officer

Paul K. Voigt Senior Managing Director of HC2 since May 2014

Prior to joining HC2, served as Executive Vice President on the sales and trading desk at

Jefferies from 1996 to 2013

Served as Managing Director on the High Yield sales desk at Prudential Securities from

1988 to 1996

Mr. Voigt received an MBA from the University of Southern California in 1988 after

playing professional baseball. Graduated from the University of Virginia where he

received a Bachelor of Science in Electrical Engineering

Senior Managing Director

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Executive Leadership Team

39

Paul L. Robinson Chief Legal Officer & Corporate Secretary of HC2 since March 2016

Served as Executive Vice President, Chief Legal Officer and Corporate Secretary for

SEACOR Holdings Inc. for nearly nine years prior to HC2

Held various positions at Comverse Technology, Inc., including Chief Operating Officer,

Executive Vice President, General Counsel and Corporate Secretary

Served as associate attorney at Kramer, Levin, Naftalis & Frankel, LLP.; Counsel to the

United States Senate Committee on Governmental Affairs and associate attorney at

Skadden, Arps, Slate, Meagher & Flom LLP

Mr. Robinson earned a Bachelor of Arts degree in Political Science and was Phi Beta

Kappa from State University of New York at Binghamton and a J.D., cum laude, from

Boston University School of Law

Chief Legal Officer &

Corporate Secretary

Andrew G. Backman Managing Director of Investor Relations & Public Relations of HC2 since April 2016

Prior to joining HC2, served as Managing Director of Investor Relations and Public

Relations for RCS Capital and AR Capital (now AR Global) from 2014 to 2016

Founder and Chief Executive Officer of InVisionIR, a New York-based advisory and

consulting firm from 2011 to 2014

Served as Senior Vice President, Investor Relations & Marketing of iStar Financial from

2004 to 2010

Served as Vice President, Investor Relations and Marketing Communications for Corvis

Corporation / Broadwing Communications from 2000 to 2004

Spent first 10 years of career at Lucent Technologies and AT&T Corp.

Mr. Backman earned a Bachelor of Arts degree in Economics from Boston College and

graduated from AT&T / Lucent Technologies’ prestigious Financial Leadership Program

Managing Director

© 2 0 1 7 H C 2 H O L D I N G S , I N C .

HC2 Executive Leadership Team

40

Suzi Raftery Herbst

Chief Administrative Officer of HC2 since March 2015 with over 17 years of diverse

human resources, recruiting, equity and foreign exchange sales experience

Prior to joining HC2, served as Senior Vice President and Director

of Human Resources of Harbinger Capital and HRG

Previously served as Head of Recruiting at Knight Capital Group

Previously held various positions in Human Resources, as well as Foreign Exchange Sales

at Cantor Fitzgerald after beginning her career in Equity Sales at Merrill Lynch

Ms. Herbst earned a Bachelor of Arts degree in Communications and Studio Art from

Marist College

Chief Administrative

Officer

HC2 HOLDINGS, INC.

© HC2 Holdings, Inc. 2017

A n d r e w G . B a c k m a n • i r @ h c 2 . c om • 2 1 2 . 2 3 5 . 2 6 9 1 • 4 5 0 P a r k A v e n u e , 3 0 t h F l o o r , N e w Y o r k , N Y 1 0 0 2 2

August 2017