Attached files

Exhibit 10.7

EXECUTION VERSION

QUINTANA ENERGY SERVICES LP

WARRANT AGREEMENT

This Warrant Agreement dated as of December 16, 2016 (this “Agreement”) is entered into by and among Quintana Energy Services LP, a Delaware limited partnership (“QES”), and the purchasers party hereto (each, a “Purchaser” and collectively, the “Purchasers”). All capitalized terms used but not defined herein shall have the respective meanings ascribed to such terms in the Warrant Purchase Agreement (as hereinafter defined).

WHEREAS, pursuant to a Warrant Purchase Agreement dated as of the date hereof (the “Warrant Purchase Agreement”) by and among QES and the Purchasers, QES proposes to issue to the Purchasers certain Warrants, as hereinafter described (the “Warrants”), to purchase an aggregate of 227,885,578 common units representing limited partner interests (subject to adjustment) of QES or, if at such time of exercise of the Warrants QES has been converted into a corporation, an equivalent number of shares of common stock of the converted QES (such common units or shares of common stock, the “Common Stock,” and together with any other securities issuable upon exercise of the Warrants, the “Warrant Shares”);

NOW, THEREFORE, in consideration of the premises and the mutual agreements herein set forth, the parties hereto agree as follows:

Section 1. Warrant Certificates. QES will issue and deliver a certificate or certificates evidencing the Warrants (the “Warrant Certificates”) pursuant to the terms of the Warrant Purchase Agreement. Such Warrant Certificates shall be substantially in the form set forth as Exhibit A attached hereto. Warrant Certificates shall be dated the date of issuance by QES.

Section 2. Execution of Warrant Certificates. Warrant Certificates shall be signed on behalf of QES by its (or its general partner’s) Chairman of the Board, Chief Executive Officer, President or a Vice President. Each such signature upon the Warrant Certificates may be in the form of a facsimile signature of the present or any future Chairman of the Board, Chief Executive Officer, President or Vice President, and may be imprinted or otherwise reproduced on the Warrant Certificates and for that purpose QES may adopt and use the facsimile signature of any person who shall have been Chairman of the Board, Chief Executive Officer, President or Vice President, notwithstanding the fact that at the time the Warrant Certificates shall be delivered or disposed of he shall have ceased to hold such office. Each Warrant Certificate shall also be signed on behalf of QES by a manual or facsimile signature of its (or its general partner’s) Secretary or an Assistant Secretary.

Section 3. Registration. QES (or its general partner) shall number and register the Warrant Certificates and the Warrant Shares in registers (the “Warrant Register” and the “Warrant Shares Register,” respectively) as they are issued. QES may deem and treat the registered holder(s) from time to time of the Warrant Certificates (the “Holders”) as the absolute owner(s) thereof (notwithstanding any notation of ownership or other writing thereon made by anyone) for all purposes and shall not be affected by any notice to the contrary. The Warrants shall be registered initially in such name or names as the Purchasers shall designate.

Section 4. Restrictions on Transfer; Registration of Transfers. Prior to any proposed transfer of the Warrants or the Warrant Shares, unless such transfer is made pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”), the transferring Holder will, if requested by QES, deliver to QES an opinion of counsel, reasonably satisfactory in form and substance to QES, to the effect that the Warrants or Warrant Shares, as applicable, may be sold or otherwise transferred without registration under the Securities Act; provided, however, that with respect to transfers by a Holder to its Affiliate or Affiliates, no such opinion shall be required. Upon original issuance thereof, and until such time as the same shall have been registered under the Securities Act or sold pursuant to Rule 144 promulgated thereunder (or any similar rule or regulation), each Warrant Certificate shall bear the legend included on the first page of Exhibit A, unless in the opinion of such counsel, such legend is no longer required by the Securities Act.

Subject to the conditions to transfer contained in the Amended and Restated Equity Rights Agreement dated as of the date hereof, by and among QES Holdco LLC, QES, Quintana Energy Services GP LLC (“QES GP”), Archer Holdco LLC, Geveran Investments Limited and Robertson QES Investment LLC (as such agreement may be amended or amended and restated from time to time, the “Equity Rights Agreement”), QES shall from time to time register the transfer of any outstanding Warrant Certificates in the Warrant Register to be maintained by QES (or its general partner) upon surrender thereof accompanied by a written instrument or instruments of transfer in form reasonably satisfactory to QES, duly executed by the registered Holder or Holders thereof or by the duly appointed legal representative thereof or by a duly authorized attorney. Upon any such registration of transfer, a new Warrant Certificate shall be issued to the transferee Holder(s) and the surrendered Warrant Certificate shall be canceled and disposed of by QES. Any attempted transfer in violation of the Equity Rights Agreement shall be null and void ab initio.

Section 5. Warrants; Exercise of Warrants.

(a) Subject to the terms of this Agreement, each Holder shall have the right, which may be exercised commencing on the date of issuance of the Warrants and until 5:00 p.m., Eastern time, on December 16, 2026 (the “Expiration Date”), to receive from QES the number of fully paid and nonassessable Warrant Shares (and such other consideration) that the Holder may at the time be entitled to receive on exercise of such Warrants and payment of the Exercise Price then in effect for such Warrant Shares. Each Warrant not exercised prior to 5:00 p.m., Eastern time, on the Expiration Date shall become void and all rights thereunder and all rights in respect thereof under this Agreement shall cease as of such time. No adjustments as to dividends will be made upon exercise of the Warrants, except as otherwise expressly provided herein.

(b) In the event that Holders would have any obligation to sell their Warrant Shares under the terms of the Equity Rights Agreement if they were holders of Common Stock, the Warrants shall be deemed exercised and the Holders shall sell their Warrant Shares as required by the terms of the Equity Rights Agreement. If a Holder shall fail to comply with the terms of this Agreement or the Equity Rights Agreement in connection with the surrender of Warrants or the sale of Warrant Shares as contemplated by the Equity Rights Agreement such Holder shall receive only the consideration (without interest) that such Holder would have received had such Holder complied with such terms and the Warrants shall cease to have any other rights.

2

(c) The price at which each Warrant shall be exercisable (the “Exercise Price”) shall initially be $0.01 per share, subject to adjustment pursuant to the terms hereof.

(d) A Warrant may be exercised upon surrender to QES at its (or its general partner’s) office designated for such purpose (as provided for in Section 13 hereof) of the Warrant Certificate or Certificates to be exercised with the form of election to purchase attached thereto duly filled in and signed, and upon payment to QES of the Exercise Price for the number of Warrant Shares in respect of which such Warrants are then exercised. Payment of the aggregate Exercise Price shall be made in cash or by certified or official bank check payable to the order of QES.

(e) Subject to the provisions of Section 6 hereof, upon such surrender of Warrant Certificates and payment of the Exercise Price, QES shall issue and cause to be delivered, as promptly as practicable, to or upon the written order of the Holder and in such name or names as such Holder may designate a certificate or certificates for the number of full Warrant Shares issuable upon the exercise of such Warrants (and such other consideration as may be deliverable upon exercise of such Warrants) together with cash for fractional Warrant Shares as provided in Section 11 hereof. The certificate or certificates for such Warrant Shares shall be deemed to have been issued and the person so named therein shall be deemed to have become a holder of record of such Warrant Shares as of the date of the surrender of such Warrants and payment of the Exercise Price, irrespective of the date of delivery of such certificate or certificates for Warrant Shares. QES shall register the Warrant Shares in the Warrant Shares Register, as provided in Section 3 hereof, and shall from time to time register the transfer of any outstanding Warrant Shares in the Warrant Shares Register.

(f) Subject to Section 5(b) hereof, each Warrant shall be exercisable, at the election of the Holder thereof, either in full or from time to time in part and, in the event that a Warrant Certificate is exercised in respect of fewer than all of the Warrant Shares issuable on such exercise at any time prior to the date of expiration of the Warrants, a new certificate evidencing the remaining Warrant or Warrants will be issued and delivered pursuant to the provisions of this Section 5 and of Section 2 hereof.

(g) All Warrant Certificates surrendered upon exercise of Warrants shall be cancelled and disposed of by QES. QES (or its general partner) shall keep copies of this Agreement and any notices given or received hereunder shall be available for inspection by the Holders during normal business hours at QES’ (or its general partner’s) office.

(h) In addition to and without limiting the rights of the Holder under the terms hereof, at a Holder’s option, a Warrant Certificate may be exercised by being exchanged in whole or in part at any time or from time to time prior to the Expiration Date for a number of shares of Common Stock having an aggregate Specified Value (as defined in Section 10(g) hereof) on the date of such exercise equal to the difference between (x) the

3

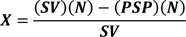

Specified Value of the number of Warrant Shares in respect of which such Warrant Certificate is then exercised and (y) the aggregate Exercise Price for such shares in effect at such time. The following equation illustrates how many Warrant Shares would then be issued upon exercise pursuant to this subsection:

where:

| SV | = | Specified Value per Warrant Share at date of exercise. | ||

| PSP | = | Per share Exercise Price at date of exercise. | ||

| N | = | Number of Warrant Shares in respect of which the Warrant Certificate is being exercised by exchange. | ||

| X | = | Number of Warrant Shares issued upon exercise by exchange. | ||

Upon any such exercise, the number of Warrant Shares purchasable upon exercise of such Warrant Certificate shall be reduced by the number of Warrant Shares so exchanged and, if a balance of purchasable Warrant Shares remain after such exercise, QES shall execute and deliver to the holder hereof a new Warrant for such balance of Warrant Shares.

No payment of any cash or other consideration to QES shall be required from the Holder of a Warrant in connection with any exercise thereof by exchange pursuant to this subsection. Such exchange shall be effective upon the date of receipt by QES of the original Warrant Certificate surrendered for cancellation and a written request from the Holder thereof that the exchange pursuant to this subsection be made, or at such later date as may be specified in such request. No fractional shares arising out of the above formula for determining the number of Warrant Shares issuable in such exchange shall be issued, and QES shall in lieu thereof make payment to the Holder of cash in the amount of such fraction multiplied by the Specified Value of a Warrant Share on the date of the exchange.

Section 6. Taxes.

(a) Withholding and Reporting Requirements. QES shall comply with all applicable tax withholding and reporting requirements imposed by any governmental authority, and all distributions, including deemed distributions, pursuant to the Warrants or Warrant Shares will be subject to applicable withholding and reporting requirements. Notwithstanding any provision to the contrary, QES will be authorized to (i) take any actions that may be necessary or appropriate to comply with such withholding and reporting requirements, (ii) apply a portion of any cash distribution to be made under the Warrants or Warrant Shares to pay applicable withholding taxes, (iii) liquidate a portion of any non-cash distribution to be made under the Warrants or Warrant Shares to generate

4

sufficient funds to pay applicable withholding taxes or (iv) establish any other mechanisms QES believes are reasonable and appropriate, including requiring Holders to submit appropriate tax and withholding certifications (such as IRS Forms W-9 and the appropriate IRS Forms W-8, as applicable) as a condition of receiving the benefit of any adjustment pursuant to Section 10.

(b) Payment of Taxes. QES will pay all documentary stamp taxes and other governmental charges (excluding all foreign, federal or state income, franchise, property, estate, inheritance, gift or similar taxes) in connection with the issuance or delivery of the Warrants hereunder, as well as all such taxes attributable to the initial issuance or delivery of Warrant Shares upon the exercise of Warrants and payment of the Exercise Price. QES shall not, however, be required to pay any tax that may be payable in respect of any subsequent transfer of the Warrants or any transfer involved in the issuance and delivery of Warrant Shares in a name other than that in which the Warrants to which such issuance relates were registered, and, if any such tax would otherwise be payable by QES, no such issuance or delivery shall be made unless and until the person requesting such issuance has paid to QES the amount of any such tax, or it is established to the reasonable satisfaction of QES that any such tax has been paid.

Section 7. Right to Certain Payments or Distributions. If QES at any time or from time to time after the date hereof declares, orders, pays or makes a cash distribution or makes any payment on or with respect to its Common Stock, each Holder shall be entitled to receive its pro rata share of the cash (as if the Warrants held by such Holder had been exercised in full and converted to Warrant Shares (as adjusted) in accordance with the provisions of Section 5 immediately prior to the close of business on the day immediately preceding the record date). Each Holder’s “pro rata share” for purposes of this Section 7 is the ratio that (1) the number of Warrant Shares for which the Warrants held by such Holder are then exercisable (as adjusted pursuant to this Warrant Agreement) bears to (2) the number of units or shares of Common Stock outstanding on the record date for any such distribution or otherwise entitled to participate in the distribution (including the Warrant Shares referred to in clause (1)).

Section 8. Mutilated or Missing Warrant Certificates. If a mutilated Warrant Certificate is surrendered to QES, or if the Holder of a Warrant Certificate claims and submits an affidavit or other evidence satisfactory to QES to the effect that the Warrant Certificate has been lost, destroyed or wrongfully taken, QES shall issue a replacement Warrant Certificate. If required by QES such Holder must provide an indemnity bond, or other form of indemnity, sufficient in the judgment of QES to protect QES from any loss that it may suffer if a Warrant Certificate is replaced. If any Purchaser or any other institutional Holder (or nominee thereof) is the owner of any such lost, stolen or destroyed Warrant Certificate, then the affidavit of an authorized officer of such owner, setting forth the fact of loss, theft or destruction and of its ownership of the Warrant Certificate at the time of such loss, theft or destruction shall be accepted as satisfactory evidence thereof and no further indemnity shall be required as a condition to the execution and delivery of a new Warrant Certificate other than the unsecured written agreement of such owner to indemnify QES or, at the option of such Purchaser or other institutional Holder, provide an indemnity bond in the amount of the Specified Value of the Warrant Shares for which such Warrant Certificate was exercisable.

5

Section 9. Reservation of Warrant Shares. If at such time of exercise of the Warrants QES has been converted into a corporation, then the converted QES shall at all times reserve and keep available, free from preemptive rights, out of the aggregate of its authorized but unissued Common Stock or its authorized and issued Common Stock held in its treasury, for the purpose of enabling it to satisfy any obligation to issue Warrant Shares upon exercise of Warrants, the maximum number of shares of Common Stock that may then be deliverable upon the exercise of all outstanding Warrants, but such shares of Common Stock shall be subject to the terms and conditions of the Equity Rights Agreement if such agreement is then in effect.

The converted QES or, if appointed, the transfer agent for the Common Stock and each transfer agent for any shares of the converted QES’ capital stock issuable upon the exercise of any of the Warrants (collectively, the “Transfer Agent”), will be irrevocably authorized and directed at all times to reserve such number of authorized shares as shall be required for such purpose. QES shall keep a copy of this Agreement on file with any such Transfer Agent. QES will supply any such Transfer Agent with duly executed certificates for such purposes and will provide or otherwise make available all other consideration that may be deliverable upon exercise of the Warrants. QES will furnish any such Transfer Agent a copy of all notices of adjustments and certificates related thereto, transmitted to each Holder pursuant to Section 12 hereof.

Before taking any action that would cause an adjustment pursuant to Section 10 hereof to reduce the Exercise Price below the then par value (if any) of the Warrant Shares, QES shall take any action that may, in the opinion of its counsel, be necessary in order that QES may validly and legally issue fully paid and nonassessable Warrant Shares at the Exercise Price as so adjusted.

QES covenants that all Warrant Shares and other capital stock issued upon exercise of Warrants will, upon payment of the Exercise Price therefor and issue thereof, be validly authorized and issued, fully paid, nonassessable, free of preemptive rights and free, subject to Section 6 hereof, from all taxes (other than income taxes), liens, charges and security interests with respect to the issue thereof, but such Warrant Shares shall be subject to the terms and conditions of the Equity Rights Agreement if such agreement is then in effect.

Section 10. Adjustment of Exercise Price and Warrant Number. The number of shares of Common Stock issuable upon the exercise of each Warrant (the “Warrant Number”) is initially one. The Warrant Number is subject to adjustment from time to time upon the occurrence of the events enumerated in, or as otherwise provided in, this Section 10.

(a) Adjustment for Change in Capital Stock. If QES:

(i) pays a dividend or makes a distribution on its Common Stock in shares of its Common Stock;

(ii) subdivides or reclassifies its outstanding units or shares of Common Stock into a greater number of units or shares;

(iii) combines or reclassifies its outstanding units or shares of Common Stock into a smaller number of units or shares;

6

(iv) makes a distribution on Common Stock in shares of its capital stock other than Common Stock; or

(v) issues by reclassification of its Common Stock any shares of its capital stock (other than reclassifications arising solely as a result of a change in the par value or no par value of the Common Stock);

then the Warrant Number in effect immediately prior to such action shall be proportionately adjusted so that the Holder of any Warrant thereafter exercised may receive the aggregate number and kind of shares of capital stock of QES that it would have owned immediately following such action if such Warrant had been exercised immediately prior to such action.

The adjustment shall become effective immediately after the record date in the case of a dividend or distribution and immediately after the effective date in the case of a subdivision, combination or reclassification.

Such adjustment shall be made successively whenever any event listed above shall occur. If the occurrence of any event listed above results in an adjustment under subsection (b) or (c) of this Section 10, no further adjustment shall be made under this subsection (a).

QES shall not issue units or shares of Common Stock as a dividend or distribution on any class of capital stock other than Common Stock, unless the Holders also receive such dividend or distribution on a ratable basis or the appropriate adjustment to the Warrant Number is made under this Section 10.

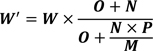

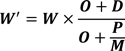

(b) Adjustment for Rights Issue. If QES distributes (and receives no consideration therefor) any rights, options or warrants (regardless of whether immediately exercisable) to all holders of any class of its Common Stock entitling them to purchase units or shares of Common Stock at a price per share less than the Specified Value per unit or share on the record date relating to such distribution, the Warrant Number shall be adjusted in accordance with the following formula:

where:

| W’ | = | the adjusted Warrant Number. | ||

| W | = | the Warrant Number immediately prior to the record date for any such distribution. | ||

| O | = | the number of units or shares of Common Stock outstanding on the record date for any such distribution. | ||

7

| N | = | the number of additional units or shares of Common Stock issuable upon exercise of such rights, options or warrants. | ||

| P | = | the exercise price per share of such rights, options or warrants. | ||

| M | = | the Specified Value per unit or share of Common Stock on the record date for any such distribution. | ||

The adjustment shall be made successively whenever any such rights, options or warrants are issued and shall become effective immediately after the record date for the determination of stockholders entitled to receive the rights, options or warrants. If at the end of the period during which such rights, options or warrants are exercisable, not all rights, options or warrants shall have been exercised, the adjusted Warrant Number shall be immediately readjusted to what it would have been if “N” in the above formula had been the number of shares actually issued.

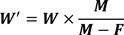

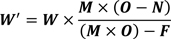

(c) Adjustment for Other Distributions. If QES distributes to all holders of any class of its Common Stock (i) any evidences of indebtedness of QES or any of its subsidiaries, (ii) any cash or other assets of QES or any of its subsidiaries, or (iii) any rights, options or warrants to acquire any of the foregoing or to acquire any other securities of QES, then, except to the extent the Holders participate in such distribution pursuant to Section 7, the Warrant Number shall be adjusted in accordance with the following formula:

where:

| W’ | = | the adjusted Warrant Number. | ||

| W | = | the Warrant Number immediately prior to the record date mentioned below. | ||

| M | = | the Specified Value per unit or share of Common Stock on the record date mentioned below. | ||

| F | = | the fair market value on the record date mentioned below of the indebtedness, assets, rights, options or warrants distributable to the holder of one unit or share of Common Stock. | ||

The adjustment shall be made successively whenever any such distribution is made and shall become effective immediately after the record date for the determination of stockholders entitled to receive the distribution. If an adjustment is made pursuant to this subsection (c) as a result of the issuance of rights, options or warrants and at the end of the period during which any

8

such rights, options or warrants are exercisable, not all such rights, options or warrants shall have been exercised, the adjusted Warrant Number shall be immediately readjusted as if “F” in the above formula was the fair market value on the record date of the indebtedness or assets actually distributed upon exercise of such rights, options or warrants divided by the number of units or shares of Common Stock outstanding on the record date.

This subsection does not apply to any transaction described in subsection (a) of this Section 10 or to rights, options or warrants referred to in subsection (b) of this Section 10.

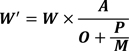

(d) Adjustment for Common Stock Issue. If QES issues units or shares of Common Stock for a consideration per unit or share that is less than the Specified Value per unit or share on the date QES fixes the offering price of such additional units or shares of Common Stock, the Warrant Number shall be adjusted in accordance with the following formula:

where:

| W’ | = | the adjusted Warrant Number. | ||

| W | = | the Warrant Number immediately prior to any such issuance. | ||

| O | = | the number of units or shares of Common Stock outstanding immediately prior to the issuance of such additional units or shares of Common Stock. | ||

| P | = | the aggregate consideration received for the issuance of such additional units or shares of Common Stock. | ||

| M | = | the Specified Value per unit or share of Common Stock on the date of issuance of such additional units or shares of Common Stock. | ||

| A | = | the number of units or shares of Common Stock outstanding immediately after the issuance of such additional units or shares of Common Stock. | ||

The adjustment shall be made successively whenever any such issuance is made, and shall become effective immediately after such issuance.

9

This subsection (d) does not apply to any of the transactions described in subsection (a) of this Section 10 or the issuances described below:

(i) the issuance of units or shares of Common Stock upon the conversion, exercise or exchange of any Convertible Securities (as defined below) outstanding on the date hereof or the Warrants or for which an adjustment has been made pursuant to this Section 10; or

(ii) (A) the grant of rights to purchase units or shares of Common Stock representing, in the aggregate, up to 10% of the outstanding units or shares of Common Stock on a fully-diluted basis, and the issuance of such units or shares of Common Stock upon exercise of such rights, to directors or members of management of QES (or its general partner) and its subsidiaries pursuant to management incentive plans, stock option and stock purchase plans or agreements adopted by the board of directors of QES (or its general partner) and (B) following the acquisition by QES of any of the rights or units or shares referred to in clause (A), the reissuance of any such acquired rights and the issuance of units or shares of Common Stock upon exercise thereof.

(e) Adjustment for Convertible Securities Issue. If QES issues any options, warrants or other securities convertible into or exchangeable or exercisable for Common Stock (“Convertible Securities”) (other than securities issued in transactions described in subsection (b) or (c) of this Section 10) for a consideration per unit or share of Common Stock initially deliverable upon conversion, exchange or exercise of such securities that is less than the Specified Value per unit or share of Common Stock on the date of issuance of such securities, the Warrant Number shall be adjusted in accordance with the following formula:

where:

| W’ | = | the adjusted Warrant Number. | ||

| W | = | the Warrant Number immediately prior to any such issuance. | ||

| O | = | the number of units or shares of Common Stock outstanding immediately prior to the issuance of such Convertible Securities. | ||

| P | = | the sum of the aggregate consideration received for the issuance of such Convertible Securities and the aggregate minimum consideration receivable by QES for issuance of Common Stock upon conversion or in exchange for, or upon exercise of, such Convertible Securities. | ||

| M | = | the Specified Value per unit or share of Common Stock on the date of issuance of such Convertible Securities. | ||

| D | = | the maximum number of units or shares of Common Stock deliverable upon conversion or in exchange for or upon exercise of such Convertible Securities at the initial conversion, exchange or exercise rate. | ||

10

The adjustment shall be made successively whenever any such issuance is made, and shall become effective immediately after such issuance.

If all of the Common Stock deliverable upon conversion, exchange or exercise of such Convertible Securities has not been issued when the conversion, exchange or exercise rights of such Convertible Securities have expired or been terminated, then the adjusted Warrant Number shall promptly be readjusted to the adjusted Warrant Number that would then be in effect had the adjustment upon the issuance of such securities been made on the basis of the actual number of units or shares of Common Stock issued upon conversion, exchange or exercise of such Convertible Securities. If the aggregate minimum consideration receivable by QES for issuance of Common Stock upon conversion or in exchange for, or upon exercise of, such Convertible Securities shall be increased by virtue of provisions therein contained or upon the arrival of a specified date or the happening of a specified event, then the Warrant Number shall promptly be readjusted to the Warrant Number that would then be in effect had the adjustment upon the issuance of such Convertible Securities been made on the basis of such increased minimum consideration.

This subsection (e) does not apply to the issuance of the Warrants or to any of the transactions described in paragraph (b) of this Section 10 or excluded from the provisions of paragraph (d) of this Section 10.

(f) Adjustment for Tender Offer. If QES (or its general partner) or any subsidiary of QES consummates a tender offer for any Common Stock and purchases units or shares of Common Stock pursuant to such tender offer for an aggregate consideration having a fair market value (as determined reasonably and in good faith by the board of directors of QES (or its general partner) and described in a board resolution) as of the last time (the “Expiration Time”) that tenders may be made pursuant to such tender offer (as it shall have been amended) that, together with (i) the aggregate of the cash plus the fair market value (as determined reasonably and in good faith by the board of directors of QES (or its general partner) and described in a board resolution) of the consideration paid in respect of any other tender offer by QES (or its general partner) or any subsidiaries of QES for any Common Stock consummated within the 12 months preceding the Expiration Time and in respect of which no adjustment pursuant to this subsection (f) has been made previously and (ii) the aggregate amount of any distributions to all holders of Common Stock made exclusively in cash within 12 months preceding the Expiration Time exceeds 5.0% of the product of the Specified Value per unit or share of Common Stock immediately prior to the Expiration Time times the number of units or shares of Common Stock outstanding (including any tendered units or shares) at the Expiration Time, the Warrant Number shall be adjusted in accordance with the following formula:

11

where:

| W’ | = | the adjusted Warrant Number. | ||

| W | = | the Warrant Number immediately prior to the Expiration Time. | ||

| M | = | the Specified Value per unit or share of Common Stock immediately prior to the Expiration Time. | ||

| O | = | the number of units or shares of Common Stock outstanding (including any tendered units or shares) at the Expiration Time. | ||

| F | = | the fair market value of the aggregate consideration paid for all units or shares of Common Stock purchased pursuant to the tender offer. | ||

| N | = | the number of units or shares of Common Stock accepted for payment in such tender offer. | ||

If the number of units or shares of Common Stock accepted for payment in such tender offer or the aggregate consideration payable therefor have not been finally determined by the opening of business on the day following the Expiration Time, the adjustment required by this subsection (f) shall, pending such final determination, be made based upon the preliminary announced results of such tender offer, and, after such final determination shall have been made, the adjustment required by this subsection (f) shall be based upon the number of units or shares accepted for payment in such tender offer and the aggregate consideration payable therefor as so finally determined.

(g) “Specified Value” per unit or share of Common Stock or of any other security (herein collectively referred to as a “Security”) at any date shall be:

(i) if the Security is not registered under the Exchange Act, (1) the value of the Security determined in good faith by the board of directors of QES (or its general partner) and certified in a board resolution, based on the most recently completed arm’s-length transaction between QES and a person other than an Affiliate of QES in which such determination is necessary and the closing of which occurs on such date or shall have occurred within the six months preceding such date, (2) if no such transaction shall have occurred on such date or within such six-month period, the value of the Security most recently determined as of a date within the six months preceding such date by an Independent Financial Expert or (3) if neither clause (1) nor (2) is applicable, the value of the Security as mutually agreed by QES and Holders of a majority of the Warrants outstanding; provided, however, that if QES and such Holders are unable to mutually agree upon such value, QES shall select an Independent Financial Expert who shall determine the value of such Security;

12

(ii) if the Security is registered under the Exchange Act, the average of the daily market prices for each business day during the period commencing 10 business days before such date and ending on the date one day prior to such date or, if the Security has been registered under the Exchange Act for less than 30 consecutive business days before such date, then the average of the daily market prices (as hereinafter defined) for all of the business days before such date for which daily market prices are available. If the market price is not determinable for at least 15 business days in such period, the Specified Value of the Security shall be determined as if the Security was not registered under the Exchange Act; or

(iii) if the Security is registered under the Exchange Act and is being sold in a firm commitment underwritten public offering registered under the Securities Act, the public offering price of such Security set forth on the cover page of the prospectus relating to such offering.

The “market price” for any Security on each business day means: (A) if such Security is listed or admitted to trading on any securities exchange, the closing price, regular way, on such day on the principal exchange on which such Security is traded, or if no sale takes place on such day, the average of the closing bid and asked prices on such day or (B) if such Security is not then listed or admitted to trading on any securities exchange, the last reported sale price on such day, or if there is no such last reported sale price on such day, the average of the closing bid and the asked prices on such day, as reported by a reputable quotation source designated by QES. If there are no such prices on a business day, then the market price shall not be determinable for such business day.

In the case of Common Stock, if more than one class of Common Stock is outstanding, the “Specified Value” shall be the highest of the Specified Values per unit or share of such classes of Common Stock.

“Independent Financial Expert” shall mean a nationally recognized investment banking firm selected by QES that (i) does not (and whose directors, officers, employees and Affiliates do not) have a direct or indirect financial interest in QES or any of its Affiliates, (ii) has not been, and, at the time it is called upon to serve as an Independent Financial Expert under this Agreement is not (and none of whose directors, officers, employees or Affiliates is) a promoter, director or officer of QES (or its general partner), (iii) has not been retained by QES or any of its Affiliates for any purpose, other than to perform an equity valuation, within the preceding 12 months, and (iv) in the reasonable judgment of the board of directors of QES (or its general partner), is otherwise qualified to serve as an independent financial advisor. Any such person may receive customary compensation and indemnification by QES for opinions or services it provides as an Independent Financial Expert.

13

(h) Consideration Received. For purposes of any computation respecting consideration received pursuant to subsections (d) and (e) of this Section 10, the following shall apply:

(1) in the case of the issuance of units or shares of Common Stock for cash, the consideration shall be the amount of such cash (without any deduction being made for any commissions, discounts or other expenses incurred by QES for any underwriting of the issue or otherwise in connection therewith);

(2) in the case of the issuance of units or shares of Common Stock for a consideration in whole or in part other than cash, the consideration other than cash shall be deemed to be the fair market value thereof (irrespective of the accounting treatment thereof) as determined in good faith by the board of directors of QES (or its general partner); and

(3) in the case of the issuance of options, warrants or other securities convertible into or exchangeable or exercisable for units or shares of Common Stock, the aggregate consideration received therefor shall be deemed to be the consideration received by QES for the issuance of such securities plus the additional minimum consideration, if any, to be received by QES upon the conversion, exchange or exercise thereof (the consideration in each case to be determined in the same manner as provided in clauses (1) and (2) of this subsection).

(i) When De Minimis Adjustment May Be Deferred. No adjustment in the Warrant Number need be made unless the adjustment would require an increase or decrease of at least 1.0% in the Warrant Number. Any adjustment that is not made shall be carried forward and taken into account in any subsequent adjustment, provided that no such adjustment shall be deferred beyond the date on which a Warrant is exercised.

All calculations under this Section 10 shall be made to the nearest 1/100th of a unit or share.

(j) Adjustment to Exercise Price. Upon each adjustment to the Warrant Number pursuant to this Section 10, the Exercise Price shall be adjusted so that it is equal to the Exercise Price in effect immediately prior to such adjustment multiplied by a fraction, the numerator of which is the Warrant Number in effect immediately prior to such adjustment, and the denominator of which is the Warrant Number in effect immediately after such adjustment.

(k) When No Adjustment Required. If an adjustment is made upon the establishment of a record date for a distribution subject to subsection (a), (b) or (c) of this Section 10 and such distribution is subsequently cancelled, the Warrant Number and Exercise Price then in effect shall be readjusted, effective as of the date when the board of directors of QES (or its general partner) determines to cancel such distribution, to that Warrant Number and Exercise Price that would have been in effect if such record date had not been fixed.

14

To the extent the Warrants become convertible into cash, no adjustment need be made thereafter as to the amount of cash into which such Warrants are exercisable. Interest will not accrue on the cash.

(l) Notice of Adjustment. Whenever the Warrant Number or Exercise Price is adjusted, QES shall provide the notices required by Section 12 hereof.

(m) Voluntary Reduction. QES from time to time may reduce the Exercise Price by any amount for any period of time (including, without limitation, permanently) if the period is at least 20 days and if the reduction is irrevocable during the period.

Whenever the Exercise Price is reduced, QES shall mail to the Holders a notice of the reduction. QES shall mail the notice at least 15 days before the date the reduced Exercise Price takes effect. The notice shall state the reduced Exercise Price and the period it will be in effect.

A reduction of the Exercise Price under this subsection (m) (other than a permanent reduction) does not change or adjust the Exercise Price otherwise in effect for purposes of subsections (a), (b), (c), (d), (e) or (f) of this Section 10.

(n) Reorganizations. In case of any capital reorganization, other than in the cases referred to in subsections (a), (b), (c), (d), (e) or (f) of this Section 10, or the consolidation or merger of QES with or into another entity (other than a merger or consolidation in which QES is the continuing entity and which does not result in any reclassification of the outstanding units or shares of Common Stock into units or shares of other stock or other securities or property), or the sale of the property of QES as an entirety or substantially as an entirety (collectively, such actions being hereinafter referred to as “Reorganizations”), there shall thereafter be deliverable upon exercise of any Warrant (in lieu of the number of units or shares of Common Stock theretofore deliverable) the number of units or shares of stock or other securities or property to which a holder of the number of units or shares of Common Stock that would otherwise have been deliverable upon the exercise of such Warrant would have been entitled upon such Reorganization if such Warrant had been exercised in full immediately prior to such Reorganization. In case of any Reorganization, appropriate adjustment, as determined in good faith by the board of directors of QES (or its general partner), whose determination shall be described in a duly adopted resolution certified by QES’ (or its general partner’s) Secretary or Assistant Secretary, shall be made in the application of the provisions herein set forth with respect to the rights and interests of Holders so that the provisions set forth herein shall thereafter be applicable, as nearly as possible, in relation to any units or shares or other property thereafter deliverable upon exercise of Warrants.

QES shall not effect any such Reorganization unless prior to or simultaneously with the consummation thereof the successor entity (if other than QES) resulting from such Reorganization or the entity purchasing or leasing such assets or other appropriate entity shall expressly assume, by a supplemental Warrant Agreement or other acknowledgment executed and delivered to the Holder(s), the obligation to deliver to each such Holder such units or shares of stock, securities or assets as, in accordance with the foregoing provisions, such Holder may be entitled to purchase, and all other obligations and liabilities under this Agreement.

15

(o) Form of Warrants. Irrespective of any adjustments in the Exercise Price or the number or kind of units or shares purchasable upon the exercise of the Warrants, Warrants theretofore or thereafter issued may continue to express the same price and number and kind of units or shares as are stated in the Warrants initially issuable pursuant to this Agreement.

(p) Other Dilutive Events. In case any event shall occur as to which the provisions of this Section 10 are not strictly applicable but the failure to make any adjustment would not fairly protect the purchase rights represented by the Warrants in accordance with the essential intent and principles of such sections, then, in each such case, QES shall make a good faith adjustment to the Exercise Price and Warrant Number into which each Warrant is exercisable in accordance with the intent of this Section 10 and, upon the written request of the Holders of a majority of the Warrants, shall appoint a firm of independent certified public accountants of recognized national standing (which may be the regular auditors of QES), which shall give their opinion upon the adjustment, if any, on a basis consistent with the essential intent and principles established in this Section 10, necessary to preserve, without dilution, the purchase rights represented by these Warrants. Upon receipt of such opinion, QES shall promptly mail a copy thereof to the Holder of each Warrant and shall make the adjustments described therein.

(q) Miscellaneous. For purpose of this Section 10, the term “units or shares of Common Stock” shall mean (i) units or shares of any class of stock designated as Common Stock of QES as of the date of this Agreement, (ii) units or shares of any other class of stock resulting from successive changes or reclassification of such shares consisting solely of changes in par value, or from par value to no par value, or from no par value to par value and (iii) units or shares of Common Stock of QES or options, warrants or rights to purchase units or shares of Common Stock of QES or securities convertible into or exchangeable for units or shares of Common Stock of QES outstanding on the date hereof and units or shares of Common Stock of QES issued upon exercise, conversion or exchange of such securities. In the event that at any time, as a result of an adjustment made pursuant to this Section 10, the Holders of Warrants shall become entitled to purchase any securities of QES other than, or in addition to, units or shares of Common Stock, thereafter the number or amount of such other securities so purchasable upon exercise of each Warrant shall be subject to adjustment from time to time in a manner and on terms as nearly equivalent as practicable to the provisions with respect to the Warrant Shares contained in subsections (a) through (p) of this Section 10, inclusive, and the provisions of Sections 5, 6, 9 and 11 hereof with respect to the Warrant Shares or the Common Stock shall apply on like terms to any such other securities.

Section 11. Fractional Interests. QES shall not be required to issue fractional Warrant Shares on the exercise of Warrants. If more than one Warrant shall be presented for exercise in full at the same time by the same holder, the number of full Warrant Shares which shall be issuable upon the exercise thereof shall be computed on the basis of the aggregate number of Warrant Shares purchasable on exercise of the Warrants so presented. If any fraction of a

16

Warrant Share would, except for the provisions of this Section 11, be issuable on the exercise of any Warrants (or specified portion thereof), QES shall, pay an amount in cash equal to the fair market value of the Warrant Share so issuable (as determined in good faith by the board of directors of QES (or its general partner)), multiplied by such fraction.

Section 12. Notices to Holders. Upon any adjustment pursuant to Section 10 hereof, QES shall promptly thereafter (i) cause to be filed with QES a certificate of an officer of QES (or its general partner) setting forth the Warrant Number and Exercise Price after such adjustment and setting forth in reasonable detail the method of calculation and the facts upon which such calculations are based, and (ii) cause to be given to each of the Holders at its address appearing on the Warrant Register written notice of such adjustments. Where appropriate, such notice may be given in advance and included as a part of the notice required to be mailed under the other provisions of this Section 12.

In case:

(a) QES shall authorize the issuance to all holders of units or shares of Common Stock of rights, options or warrants to subscribe for or purchase units or shares of Common Stock or of any other subscription rights or warrants;

(b) QES shall authorize the distribution to all holders of units or shares of Common Stock of assets, including cash, evidences of its indebtedness, or other securities;

(c) of any consolidation or merger to which QES is a party and for which approval of any equityholders of QES is required, or of the conveyance or transfer of the properties and assets of QES substantially as an entirety, or of any reclassification or change of Common Stock issuable upon exercise of the Warrants (other than a change in par value, or from par value to no par value, or from no par value to par value, or as a result of a subdivision or combination), or a tender offer or exchange offer for units or shares of Common Stock;

(d) of the voluntary or involuntary dissolution, liquidation or winding up of QES; or

(e) QES proposes to take any action that would require an adjustment to the Warrant Number or the Exercise Price pursuant to Section 10 hereof.

then QES shall cause to be given to each of the Holders at its address appearing on the Warrant Register, at least 20 days prior to the applicable record date hereinafter specified, or the date of the event in the case of events for which there is no record date, in accordance with the provisions of Section 13 hereof, a written notice stating (i) the date as of which the holders of record of units or shares of Common Stock to be entitled to receive any such rights, options, warrants or distribution are to be determined, (ii) the initial expiration date set forth in any tender offer or exchange offer for units or shares of Common Stock, or (iii) the date on which any such consolidation, merger, conveyance, transfer, dissolution, liquidation or winding up is expected to become effective or consummated, and the date as of which it is expected that holders of record of units or shares of Common Stock shall be entitled to exchange such shares for securities or

17

other property, if any, deliverable upon such reclassification, consolidation, merger, conveyance, transfer, dissolution, liquidation or winding up. The failure to give the notice required by this Section 12 or any defect therein shall not affect the legality or validity of any distribution, right, option, warrant, consolidation, merger, conveyance, transfer, dissolution, liquidation or winding up, or the vote upon any action.

Nothing contained in this Agreement or in any Warrant Certificate shall be construed as conferring upon the Holders (prior to the exercise of such Warrants) the right to vote or to consent or to receive notice as an equityholder in respect of the meetings of equityholders or the election of members of the board of directors of QES (or its general partner) or any other matter, or any rights whatsoever as equityholders of QES; provided, however, that nothing in the foregoing provision is intended to detract from any rights explicitly granted to any Holder hereunder.

Section 13. Notices to QES and Holders. All notices and other communications provided for or permitted hereunder shall be made by hand-delivery, first-class mail, facsimile transmission, e-mail transmission or overnight air courier guaranteeing next day delivery using the information under “Address for Notices” set forth on each party’s signature page hereto.

All such notices and communications shall be deemed to have been duly given: at the time delivered by hand, if personally delivered; five business days after being deposited in the mail, postage prepaid, if mailed (so long as a fax copy is sent and receipt confirmed within two business days after mailing); when receipt is confirmed, if faxed or e-mailed; and the next business day after timely delivery to the courier, if sent by overnight air courier guaranteeing next day delivery. The parties may change the addresses to which notices are to be given by giving five days’ prior written notice of such change in accordance herewith.

Section 14. Successors. All the covenants and provisions of this Agreement by or for the benefit of QES or the Holders shall bind and inure to the benefit of their respective successors and assigns hereunder.

Section 15. Termination. This Agreement shall terminate if all Warrants have been exercised pursuant to this Agreement.

Section 16. Governing Law; Submission To Jurisdiction. This Agreement and all issues hereunder shall be governed by and construed in accordance with the laws of the State of Texas. Any legal action or proceeding with respect to this Agreement may be brought in the courts of the State of Texas sitting in Harris County or of the United States for the Southern District of such state, and by execution and delivery of this Agreement, each party hereto consents to the non-exclusive jurisdiction of those courts. Each party hereto irrevocably waives any objection, including any objection to the laying of venue or based on the grounds of forum non conveniens, which it may now or hereafter have to the bringing of any action or proceeding in such jurisdiction in respect of this Agreement or any issue hereunder. Each party hereto waives personal service of any summons, complain or other process, which may be made by any other means permitted by the law of such state. Each party hereto irrevocably consents to service of process in the manner provided for notices in Section 13 hereof. Nothing in this Agreement will affect the right of any party hereto to serve process in any other manner permitted by applicable law.

18

Section 17. Jury Trial Waiver. As permitted by applicable law, each party hereto waives its respective rights to a trial before a jury in connection with any claim, dispute or controversy arising between the parties hereto with respect to this Agreement or any issue hereunder, and such claim, dispute or controversy shall be resolved by a judge sitting without a jury.

Section 18. Benefits of this Agreement. Nothing in this Agreement shall be construed to give to any person or corporation other than QES and the Holders any legal or equitable right, remedy or claim under this Agreement; but this Agreement shall be for the sole and exclusive benefit of QES and the Holders.

Section 19. Counterparts. This Agreement may be executed in any number of counterparts and each of such counterparts shall for all purposes be deemed to be an original, and all such counterparts shall together constitute but one and the same instrument.

Section 20. Amendments and Waivers.

(a) This Agreement and the Warrants may be amended, or their provisions waived, by QES and the unanimous approval of all Holders; provided that, to the extent applicable, QES and any individual Holder may amend this Agreement or the Warrants held by such Holder solely with respect to such Holder’s own rights and obligations (and without amending any other Holder’s rights or obligations or the rights or obligations of QES with respect to such other Holder) without the approval of any other Holder.

(b) QES agrees it will not solicit, request or negotiate for or with respect to any proposed waiver or amendment of any of the provisions of this Agreement or any Warrant unless each Holder (irrespective of the amount of Warrants then owned by it) shall substantially concurrently be informed thereof by QES and shall be afforded the opportunity of considering the same and shall be supplied by QES with sufficient information (including any offer of remuneration) to enable it to make an informed decision with respect thereto which information shall be the same as that supplied to each other Holder. QES will not directly or indirectly, pay or cause to be paid any remuneration whether by way of supplement or additional interest fee or otherwise, to any Holder as consideration for or as an inducement to the entering into by any Holder of any waiver or amendment of any of the terms and provisions of this Agreement or any Warrant unless such remunerations is concurrently paid on the same terms, ratably to each Holder whether or not such Holder signs such waiver or consent, provided that the foregoing is not intended to preclude the adoption of any amendment or the giving of any waiver by the Holders of a majority of the Warrants to the extent permitted by the other provisions of this Section 20.

Section 21. Entire Agreement. This Agreement, together with the Warrants, the Equity Rights Agreement and the Amended and Restated Registration Rights Agreement, dated as of the date hereof (the “Registration Rights Agreement”), by and among QES, QES GP, QES Holdco LLC, Archer Holdco LLC, Geveran Investments Limited and Robertson QES Investment LLC,

19

constitute the entire agreement and understanding of the parties hereto and with respect to the subject matter contained herein, and there are no restrictions, promises, representations, warranties, covenants or undertakings with respect to the subject matter hereof, other than as expressly set forth or referred to herein or therein. This Agreement, the Warrants, the Equity Rights Agreement and the Registration Rights Agreement supersede all prior agreements and understandings among the parties hereto with respect to the subject matter hereof.

20

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed as of the day and year first above written.

| QUINTANA ENERGY SERVICES LP | ||||

| By: | Quintana Energy Services GP LLC, | |||

| its general partner | ||||

| By: | /s/ Rogers Herndon | |||

| Name: | Rogers Herndon | |||

| Title: | President and Chief Executive Officer | |||

Address for Notices:

Quintana Energy Services LP

1415 Louisiana Street, Suite 2400

Houston, TX 77008

Attn: D. Rogers Herndon

Facsimile No.: (713) 751-7520

E-mail: rherndon@qeplp.com

with a copy (which shall not constitute notice) to:

Kirkland & Ellis LLP

600 Travis, Suite 3300

Houston, TX 77002

Attn: Adam Larson

Facsimile No.: (713) 835-3601

E-mail: adam.larson@kirkland.com

Signature Page to QES Warrant Agreement

Purchasers:

| ARCHER HOLDCO LLC | ||

| By: | /s/ Max Bouthillette | |

| Name: | Max Bouthillette | |

| Title: | President | |

Address for Notices:

Archer Holdco LLC

c/o Archer Well Company Inc.

12101 Cutten Road

Houston, TX 77066

Attn: Legal

Facsimile No.: (281) 301-2795

E-mail: Legal@archerwell.com

with a copy (which shall not constitute notice) to:

Andrews Kurth Kenyon LLP

600 Travis, Suite 4200

Houston, TX 77002

Attn: Henry Havre

Facsimile No.: (713) 220-4285

E-mail: HenryHavre@andrewskurth.com

Signature Page to QES Warrant Agreement

| GEVERAN INVESTMENTS LIMITED | ||

| By: | /s/ Irene Theocharous and /s/ Spyros Episkopou | |

| Name: | Irene Theocharous and Spyros Episkopou | |

| Title: | Director | |

| By: | /s/ Spyros Episkopou | |

| Name: | Spyros Episkopou | |

| Title: | Director | |

Address for Notices:

Geveran Investments Limited

c/o Seatankers Management Co. Ltd

Correspondence address:

PO Box 53562, CY 3399 Limassol, Cyprus

and

Mailing address:

Deana Beach Apts

Block 1-Flat411, Fourth Floor

33 Promachon Eleftherias Street

Ayios Athanasios

CY4103-Limassol

Cyprus

Signature Page to QES Warrant Agreement

| ROBERTSON QES INVESTMENT LLC | ||

| By: | /s/ Corbin J. Robertson, Jr. | |

| Name: | Corbin J. Robertson, Jr. | |

| Title: | Manager | |

Address for Notices:

Robertson QES Investment LLC

c/o Corbin J. Robertson, Jr.

1201 Louisiana Street, Suite 3400

Houston, Texas 77002

Attention: D. Rogers Herndon

Facsimile No.: (713) 751-7520

E-mail: rherndon@qeplp.com

Signature Page to QES Warrant Agreement

EXHIBIT A

[Form of Warrant Certificate]

THE SECURITIES REPRESENTED BY THIS CERTIFICATE WERE ORIGINALLY ISSUED ON DECEMBER 16, 2016, AND THE OFFER AND SALE OF SUCH SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”). THE SECURITIES MAY NOT BE SOLD OR OFFERED FOR SALE OR OTHERWISE DISTRIBUTED EXCEPT IN CONJUNCTION WITH AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT, OR IN COMPLIANCE WITH RULE 144 OR PURSUANT TO ANOTHER EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT. THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO A WARRANT AGREEMENT, THE EQUITY RIGHTS AGREEMENT (AS DEFINED BELOW) AND A WARRANT PURCHASE AGREEMENT, EACH DATED AS OF DECEMBER 16, 2016, AMONG THE ISSUER OF SUCH SECURITIES (“QES”), THE PURCHASERS REFERRED TO THEREIN AND THE OTHER PARTIES THERETO. THE TRANSFER OF THIS CERTIFICATE IS SUBJECT TO THE CONDITIONS SPECIFIED IN SUCH AGREEMENTS AND QES RESERVES THE RIGHT TO REFUSE THE TRANSFER OF THIS CERTIFICATE UNTIL SUCH CONDITIONS HAVE BEEN FULFILLED WITH RESPECT TO SUCH TRANSFER. A COPY OF SUCH AGREEMENTS WILL BE FURNISHED WITHOUT CHARGE BY QES TO THE HOLDER HEREOF UPON WRITTEN REQUEST.

THE SHARES ISSUABLE UPON EXERCISE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE ARE SUBJECT TO THE PREFERENCES, POWERS, QUALIFICATIONS AND RIGHTS OF EACH CLASS AND SERIES AS SET FORTH IN QES’ CERTIFICATE OF FORMATION AND LIMITED PARTNERSHIP AGREEMENT, AS AMENDED. QES WILL FURNISH A COPY OF THE CERTIFICATE OF FORMATION, LIMITED PARTNERSHIP AGREEMENT AND ANY RELEVANT AMENDMENTS THERETO TO THE HOLDER OF THIS CERTIFICATE UPON WRITTEN REQUEST.

| No. | Warrants |

Warrant Certificate

QUINTANA ENERGY SERVICES LP

This Warrant Certificate certifies that , or registered assigns, is the registered holder of the number of Warrants (the “Warrants”) set forth above to purchase Common Stock, $0.001 par value (the “Common Stock”), of Quintana Energy Services LP, a Delaware limited partnership (“QES”). Each Warrant entitles the holder upon exercise to receive from QES one fully paid and nonassessable common unit representing a limited partner interest of QES or, if at such time of exercise of the Warrants represented by this Warrant Certificate QES has been converted into a corporation, an equivalent number of shares of common stock of the converted QES (such common unit or shares of common stock, a “Warrant Share”), at the initial exercise price (the “Exercise Price”) of $0.01, payable in lawful money of the United States of America, upon surrender of this Warrant Certificate and payment of the Exercise Price at the office of QES (or its general partner) designated for such purpose, but only subject to the conditions set forth herein and in the Warrant Agreement referred to hereinafter. The Exercise Price and number of Warrant Shares issuable upon exercise of the Warrants are subject to adjustment upon the occurrence of certain events, as set forth in the Warrant Agreement. Each Warrant is exercisable at any time prior to 5:00 p.m., Eastern time, on December 16, 2026.

The Warrants evidenced by this Warrant Certificate are part of a duly authorized issue of Warrants, and are issued or to be issued pursuant to a Warrant Agreement dated as of December 16, 2016 (the “Warrant Agreement”), duly executed and delivered by QES, which Warrant Agreement is hereby incorporated by reference in and made a part of this instrument and is hereby referred to for a description of the rights, limitation of rights, obligations, duties and immunities thereunder of QES and the holders (the words “holders” or “holder” meaning the registered holders or registered holder) of the Warrants. A copy of the Warrant Agreement may be obtained by the holder hereof upon written request to QES. Capitalized terms used and not defined herein shall have the meaning ascribed thereto in the Warrant Agreement.

A-1

The holder hereof may exercise the Warrants evidenced hereby under and pursuant to the terms and conditions of the Warrant Agreement by surrendering this Warrant Certificate, with the form of election to purchase set forth hereon (and by this reference made a part hereof) properly completed and executed, and, to the extent the Warrants are not being exchanged pursuant to the Warrant exchange provisions of Section 5 of the Warrant Agreement, together with payment of the Exercise Price in cash or by certified or bank check at the office of QES designated for such purpose. In the event that upon any exercise of Warrants evidenced hereby the number of Warrants exercised shall be less than the total number of Warrants evidenced hereby, there shall be issued by QES to the holder hereof or its registered assignee a new Warrant Certificate evidencing the number of Warrants not exercised.

The Warrant Agreement provides that upon the occurrence of certain events the number of Warrant Shares issuable upon exercise of a Warrant and the Exercise Price set forth on the face hereof may, subject to certain conditions, be adjusted.

The holder hereof will have rights and obligations with respect to the Warrant Shares as provided in the Amended and Restated Equity Rights Agreement dated as of December 16, 2016 (the “Equity Rights Agreement”) by and among QES, Quintana Energy Services GP LLC and the persons party thereto. Copies of the Equity Rights Agreement may be obtained by the holder hereof upon written request to QES.

Warrant Certificates, when surrendered at the office of QES (or its general partner) by the registered holder thereof in person or by legal representative or attorney duly authorized in writing, may be exchanged, in the manner and subject to the limitations provided in the Warrant Agreement, but without payment of any service charge, for another Warrant Certificate or Warrant Certificates of like tenor evidencing in the aggregate a like number of Warrants.

Subject to the terms and conditions of the Warrant Agreement, upon due presentation for registration of transfer of this Warrant Certificate at the office of QES (or its general partner) a new Warrant Certificate or Warrant Certificates of like tenor and evidencing in the aggregate a like number of Warrants shall be issued to the transferee(s) in exchange for this Warrant Certificate, subject to the limitations provided in the Warrant Agreement, without charge except for any tax or other governmental charge imposed in connection therewith.

QES may deem and treat the registered holder(s) thereof as the absolute owner(s) of this Warrant Certificate (notwithstanding any notation of ownership or other writing hereon made by anyone), for the purpose of any exercise hereof, of any distribution to the holder(s) hereof, and for all other purposes, and QES shall not be affected by any notice to the contrary. Neither the Warrants nor this Warrant Certificate entitles any holder hereof to any rights of a equityholder of QES.

IN WITNESS WHEREOF, QES has caused this Warrant Certificate to be signed by its (or its general partner’s) Chairman of the Board, Chief Executive Officer, President or Vice President and by its (or its general partner’s) Secretary or Assistant Secretary.

Dated: December 16, 2016

(Signature Page Follows)

A-2

| QUINTANA ENERGY SERVICES LP | ||||

| By: | Quintana Energy Services GP LLC, | |||

| its general partner | ||||

| By: |

| |||

| Name: |

| |||

| Title: |

| |||

| By: |

| |||

| Name: |

| |||

| Title: |

| |||

A-3

FORM OF ELECTION TO PURCHASE

(To Be Executed Upon Exercise of Warrant)

The undersigned hereby irrevocably elects to exercise the right, represented by this Warrant Certificate, to:

(Check Applicable Box)

| ☐ | receive units or shares of Common Stock and herewith tenders payment for such units or shares to the order of Quintana Energy Services LP in the amount of $ in accordance with the terms hereof. |

| ☐ | exchange Warrants for units or shares of Common Stock and herewith tenders Warrants to purchase units or shares of Common Stock as payment for such number of units or shares of Common Stock as determined in accordance with the Warrant exchange procedures of Section 5 of the Warrant Agreement. |

The undersigned requests that a certificate for such units or shares be registered in the name of , whose address is and that such units or shares be delivered to , whose address is .

If said number of units or shares is less than all of the units or shares of Common Stock purchasable hereunder, the undersigned requests that a new Warrant Certificate representing the remaining balance of such units or shares be registered in the name of , whose address is , and that such Warrant Certificate be delivered to , whose address is .

| Signature(s): |

|

| NOTE: | The above signature(s) must correspond with the name written upon the face of this Warrant Certificate in every particular, without alteration or enlargement or any change whatever. If this Warrant is held of record by two or more joint owners, all such owners must sign. | |||||||

| Date: | ||||||||

A-4

FORM OF ASSIGNMENT

(To be signed only upon assignment of Warrant Certificate)

FOR VALUE RECEIVED, hereby sells, assigns and transfers unto whose address is and whose social security number or other identifying number is , the within Warrant Certificate, together with all right, title and interest therein and to the Warrants represented thereby, and does hereby irrevocably constitute and appoint , attorney, to transfer said Warrant Certificate on the books of the within-named corporation, with full power of substitution in the premises.

| Signature(s): |

|

| NOTE: | The above signature(s) must correspond with the name written upon the face of this Warrant Certificate in every particular, without alteration or enlargement or any change whatever. If this Warrant is held of record by two or more joint owners, all such owners must sign. | |||||||

| Date: | ||||||||

A-5