Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Service Properties Trust | hpt8-kq22017.htm |

| EX-99.1 - EXHIBIT 99.1 - Service Properties Trust | ex991hptq2_17earningsrelea.htm |

All amounts in this report are unaudited.

Hospitality Properties Trust

Second Quarter 2017

Supplemental Operating and Financial Data

Sonesta Resort Hilton Head Island, Hilton Head, SC

Operator: Sonesta International Hotels Corporation

Guest Rooms: 340

Exhibit 99.2

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

TABLE OF CONTENT

S

TABLE OF CONTENTS PAGE

CORPORATE INFORMATION 6

Company Profile 7,8

Investor Information 9

Research Coverage 10

FINANCIALS

Key Financial Data 12

Condensed Consolidated Balance Sheets 13

Condensed Consolidated Statements of Income 14

Notes to Condensed Consolidated Statements of Income 15

Condensed Consolidated Statements of Cash Flows 16

Debt Summary 17

Debt Maturity Schedule 18

Leverage Ratios, Coverage Ratios and Public Debt Covenants 19

FF&E Reserve Escrows 20

Property Acquisition and Disposition Information Since January 1, 2017 21

Calculation of EBITDA and Adjusted EBITDA 22

Calculation of Funds from Operations (FFO) and Normalized FFO Available for Common Shareholders 23

Non-GAAP Financial Measures Definitions 24

OPERATING AGREEMENTS AND PORTFOLIO INFORMATION

Portfolio by Operating Agreement and Manager 26

Portfolio by Brand 27

Operating Agreement Information 28-30

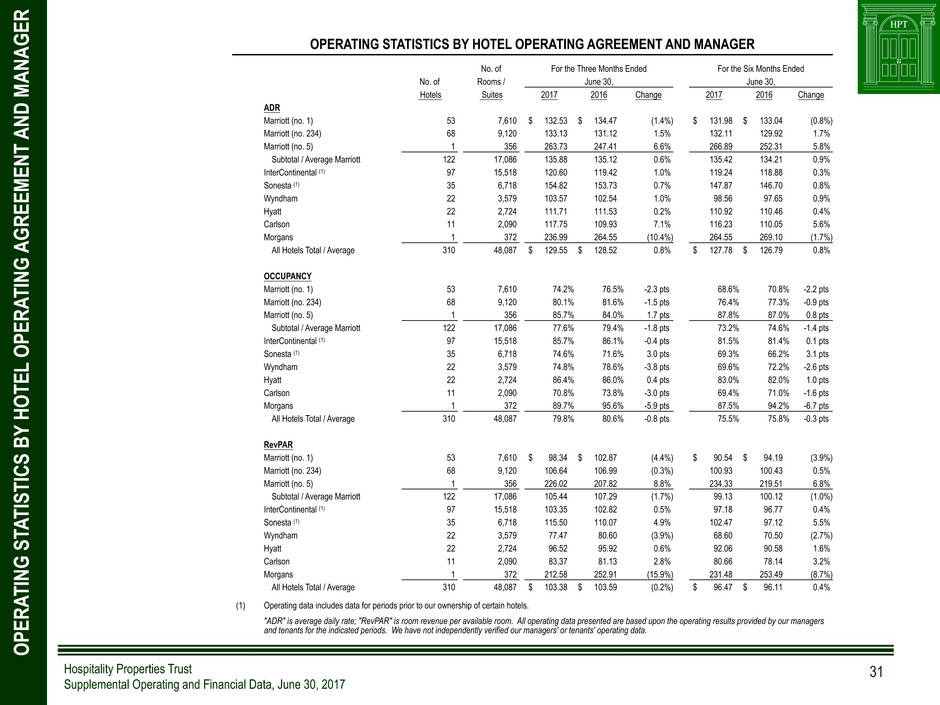

Operating Statistics by Hotel Operating Agreement and Manager 31

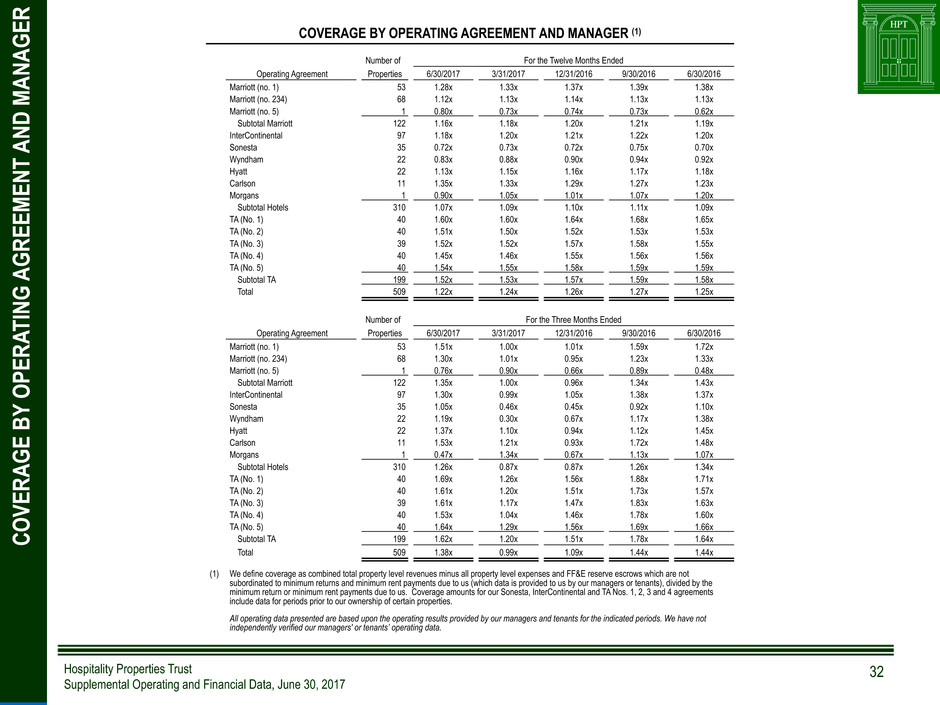

Coverage by Operating Agreement and Manager 32

2

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

W

ARNING CONCERNING FO

RW

ARD LOOKING S

TA

TEMENT

S

3

THIS PRESENTATION OF SUPPLEMENTAL OPERATING AND FINANCIAL DATA CONTAINS STATEMENTS THAT CONSTITUTE FORWARD LOOKING STATEMENTS WITHIN THE MEANING OF

THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND OTHER SECURITIES LAWS. ALSO, WHENEVER WE USE WORDS SUCH AS “BELIEVE”, “EXPECT”, “ANTICIPATE”, “INTEND”,

“PLAN”, “ESTIMATE”, "WILL", “MAY” AND NEGATIVES OR DERIVATIVES OF THESE OR SIMILAR EXPRESSIONS, WE ARE MAKING FORWARD LOOKING STATEMENTS. THESE FORWARD LOOKING

STATEMENTS ARE BASED UPON OUR PRESENT INTENT, BELIEFS OR EXPECTATIONS, BUT FORWARD LOOKING STATEMENTS ARE NOT GUARANTEED TO OCCUR AND MAY NOT OCCUR.

FORWARD LOOKING STATEMENTS IN THIS REPORT RELATE TO VARIOUS ASPECTS OF OUR BUSINESS, INCLUDING:

• OUR HOTEL MANAGERS’ OR TENANTS’ ABILITIES TO PAY THE CONTRACTUAL AMOUNTS OF RETURNS OR RENTS DUE TO US,

• OUR ABILITY TO COMPETE FOR ACQUISITIONS EFFECTIVELY,

• OUR POLICIES AND PLANS REGARDING INVESTMENTS, FINANCINGS AND DISPOSITIONS,

• OUR ABILITY TO PAY DISTRIBUTIONS TO OUR SHAREHOLDERS AND THE AMOUNT OF SUCH DISTRIBUTIONS,

• OUR ABILITY TO RAISE DEBT OR EQUITY CAPITAL,

• OUR ABILITY TO APPROPRIATELY BALANCE OUR USE OF DEBT AND EQUITY CAPITAL,

• OUR INTENT TO MAKE IMPROVEMENTS TO CERTAIN OF OUR PROPERTIES AND THE SUCCESS OF OUR HOTEL RENOVATIONS TO IMPROVE OUR HOTELS' RATES AND OCCUPANCIES,

• OUR ABILITY TO ENGAGE AND RETAIN QUALIFIED MANAGERS AND TENANTS FOR OUR HOTELS AND TRAVEL CENTERS ON SATISFACTORY TERMS,

• THE FUTURE AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY,

• OUR ABILITY TO PAY INTEREST ON AND PRINCIPAL OF OUR DEBT,

• OUR CREDIT RATINGS,

• THE ABILITY OF TRAVELCENTERS OF AMERICA LLC, OR TA, TO PAY CURRENT AND DEFERRED RENT AMOUNTS AND OTHER OBLIGATIONS DUE TO US,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF THE RMR GROUP INC., OR RMR INC.,

• OUR EXPECTATION THAT WE BENEFIT FROM OUR OWNERSHIP OF AFFILIATES INSURANCE COMPANY, OR AIC, AND FROM OUR PARTICIPATION IN INSURANCE PROGRAMS ARRANGED

BY AIC,

• OUR QUALIFICATION FOR TAXATION AS A REAL ESTATE INVESTMENT TRUST, OR REIT, AND

• OTHER MATTERS.

OUR ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THOSE CONTAINED IN OR IMPLIED BY OUR FORWARD LOOKING STATEMENTS AS A RESULT OF VARIOUS FACTORS. FACTORS

THAT COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR FORWARD LOOKING STATEMENTS AND UPON OUR BUSINESS, RESULTS OF OPERATIONS, FINANCIAL CONDITION, FUNDS FROM

OPERATIONS, OR FFO, AVAILABLE FOR COMMON SHAREHOLDERS, NORMALIZED FFO AVAILABLE FOR COMMON SHAREHOLDERS, EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION AND

AMORTIZATION, OR EBITDA, EBITDA AS ADJUSTED, OR ADJUSTED EBITDA, CASH FLOWS, LIQUIDITY AND PROSPECTS INCLUDE, BUT ARE NOT LIMITED TO:

• THE IMPACT OF CONDITIONS AND CHANGES IN THE ECONOMY AND THE CAPITAL MARKETS ON US AND OUR MANAGERS AND TENANTS,

• COMPETITION WITHIN THE REAL ESTATE, HOTEL, TRANSPORTATION AND TRAVEL CENTER INDUSTRIES, PARTICULARLY IN THOSE MARKETS IN WHICH OUR PROPERTIES ARE

LOCATED,

• COMPLIANCE WITH, AND CHANGES TO, FEDERAL, STATE AND LOCAL LAWS AND REGULATIONS AFFECTING THE REAL ESTATE, HOTEL, TRANSPORTATION AND TRAVEL CENTER

INDUSTRIES, ACCOUNTING RULES, TAX LAWS AND SIMILAR MATTERS,

• LIMITATIONS IMPOSED ON OUR BUSINESS AND OUR ABILITY TO SATISFY COMPLEX RULES IN ORDER FOR US TO QUALIFY FOR TAXATION AS A REIT FOR U.S. FEDERAL INCOME TAX

PURPOSES,

• ACTS OF TERRORISM, OUTBREAKS OF SO CALLED PANDEMICS OR OTHER MANMADE OR NATURAL DISASTERS BEYOND OUR CONTROL, AND

• ACTUAL AND POTENTIAL CONFLICTS OF INTEREST WITH OUR RELATED PARTIES, INCLUDING OUR MANAGING TRUSTEES, TA, SONESTA INTERNATIONAL HOTELS CORPORATION, OR

SONESTA, RMR INC., THE RMR GROUP LLC, OR RMR LLC, AIC AND OTHERS AFFILIATED WITH THEM.

WARNING CONCERNING FORWARD LOOKING STATEMENTS

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

FO

RW

ARD LOOKING S

TA

TEMENTS (continued

)

4

FOR EXAMPLE:

• OUR ABILITY TO MAKE FUTURE DISTRIBUTIONS TO OUR SHAREHOLDERS AND TO MAKE PAYMENTS OF PRINCIPAL AND INTEREST ON OUR INDEBTEDNESS DEPENDS UPON A NUMBER OF FACTORS,

INCLUDING OUR FUTURE EARNINGS, THE CAPITAL COSTS WE INCUR TO MAINTAIN OUR PROPERTIES AND OUR WORKING CAPITAL REQUIREMENTS. WE MAY BE UNABLE TO PAY OUR DEBT

OBLIGATIONS OR TO MAINTAIN OUR CURRENT RATE OF DISTRIBUTIONS ON OUR COMMON SHARES AND FUTURE DISTRIBUTIONS MAY BE REDUCED OR ELIMINATED,

• THE SECURITY DEPOSITS WHICH WE HOLD ARE NOT IN SEGREGATED CASH ACCOUNTS OR OTHERWISE SEPARATE FROM OUR OTHER ASSETS AND LIABILITIES. ACCORDINGLY, WHEN WE RECORD

INCOME BY REDUCING OUR SECURITY DEPOSIT LIABILITIES, WE DO NOT RECEIVE ANY ADDITIONAL CASH PAYMENT. BECAUSE WE DO NOT RECEIVE ANY ADDITIONAL CASH PAYMENT AS WE APPLY

SECURITY DEPOSITS TO COVER PAYMENT SHORTFALLS, THE FAILURE OF OUR MANAGERS OR TENANTS TO PAY MINIMUM RETURNS OR RENTS DUE TO US MAY REDUCE OUR CASH FLOWS AND OUR

ABILITY TO PAY DISTRIBUTIONS TO SHAREHOLDERS,

• AS OF JUNE 30, 2017, APPROXIMATELY 79% OF OUR AGGREGATE ANNUAL MINIMUM RETURNS AND RENTS WERE SECURED BY GUARANTEES OR SECURITY DEPOSITS FROM OUR MANAGERS AND

TENANTS. THIS MAY IMPLY THAT THESE MINIMUM RETURNS AND RENTS WILL BE PAID. IN FACT, CERTAIN OF THESE GUARANTEES AND SECURITY DEPOSITS ARE LIMITED IN AMOUNT AND DURATION

AND ALL THE GUARANTEES ARE SUBJECT TO THE GUARANTORS’ ABILITIES AND WILLINGNESS TO PAY. FURTHER, THE GUARANTEE BY WYNDHAM HOTEL GROUP, OR WYNDHAM, OF THE MINIMUM

RETURNS DUE FROM OUR HOTELS THAT ARE MANAGED BY WYNDHAM WAS DEPLETED AS OF JUNE 30, 2017. WE DO NOT KNOW WHETHER WYNDHAM WILL CONTINUE TO PAY THE MINIMUM RETURNS

DUE TO US DESPITE THE DEPLETED GUARANTEE OR IF WYNDHAM WILL DEFAULT ON ITS PAYMENTS. THE BALANCE OF OUR ANNUAL MINIMUM RETURNS AND RENTS AS OF JUNE 30, 2017 WAS NOT

GUARANTEED NOR DO WE HOLD A SECURITY DEPOSIT WITH RESPECT TO THOSE AMOUNTS. WE CANNOT BE SURE OF THE FUTURE FINANCIAL PERFORMANCE OF OUR PROPERTIES AND WHETHER

SUCH PERFORMANCE WILL COVER OUR MINIMUM RETURNS AND RENTS, WHETHER THE GUARANTEES OR SECURITY DEPOSITS WILL BE ADEQUATE TO COVER FUTURE SHORTFALLS IN THE MINIMUM

RETURNS OR RENTS DUE TO US, OR REGARDING OUR MANAGERS’, TENANTS’ OR GUARANTORS’ FUTURE ACTIONS IF AND WHEN THE GUARANTEES AND SECURITY DEPOSITS EXPIRE OR ARE

DEPLETED OR THEIR ABILITIES OR WILLINGNESS TO PAY MINIMUM RETURNS AND RENTS OWED TO US,

• WE HAVE RECENTLY RENOVATED CERTAIN HOTELS AND ARE CURRENTLY RENOVATING ADDITIONAL HOTELS. WE CURRENTLY EXPECT TO FUND $39.3 MILLION DURING THE REMAINDER OF 2017 AND

$30.7 MILLION IN 2018 FOR RENOVATIONS AND OTHER CAPITAL IMPROVEMENT COSTS AT OUR HOTELS AND THESE AMOUNTS WILL INCREASE IF AND AS WE CONCLUDE OUR PENDING AND OTHER

ACQUISITIONS. THE COST OF CAPITAL PROJECTS ASSOCIATED WITH SUCH RENOVATIONS MAY BE GREATER THAN WE NOW ANTICIPATE. OPERATING RESULTS AT OUR HOTELS MAY DECLINE AS A

RESULT OF HAVING ROOMS OUT OF SERVICE OR OTHER DISRUPTIONS DURING RENOVATIONS. ALSO, WHILE OUR FUNDING OF THESE CAPITAL PROJECTS WILL CAUSE OUR CONTRACTUAL MINIMUM

RETURNS TO INCREASE, THE HOTELS’ OPERATING RESULTS MAY NOT INCREASE OR MAY NOT INCREASE TO THE EXTENT THAT THE MINIMUM RETURNS INCREASE. ACCORDINGLY, COVERAGE OF OUR

MINIMUM RETURNS AT THESE HOTELS MAY REMAIN DEPRESSED FOR AN EXTENDED PERIOD,

• WE AND CARLSON HAVE AGREED TO PURSUE THE SALE OF CERTAIN HOTELS THAT CARLSON MANAGES. HOWEVER, WE MAY NOT SUCCEED IN SELLING THESE HOTELS AND ANY SALE WE MAY

COMPLETE MAY BE FOR A PRICE BELOW OUR CARRYING VALUE,

• WE AND CARLSON HAVE AGREED THAT THE NET PROCEEDS FROM THE SALE OF THREE HOTELS THEY HAVE AGREED TO PURSUE SELLING WILL BE USED TO FUND CERTAIN RENOVATIONS AT

CERTAIN OF THE REMAINING HOTELS CARLSON MANAGES FOR US. WE HAVE ALSO AGREED TO FUND AN ADDITIONAL $35 MILLION FOR RENOVATION COSTS FOR THOSE OTHER CARLSON MANAGED

HOTELS IN EXCESS OF THE NET SALES PROCEEDS FROM THE SALES OF THE THREE HOTELS AND AVAILABLE FF&E RESERVES. THE COMMITMENT TO FUND RENOVATIONS MAY IMPLY AN

EXPECTATION THAT THE OPERATING RESULTS OF THE APPLICABLE HOTELS WILL IMPROVE AS A RESULT OF THOSE RENOVATIONS. HOWEVER, WE CANNOT BE SURE THAT THE PERFORMANCE OF

THOSE HOTELS WOULD IMPROVE AND THEY COULD DECLINE WHILE THE RENOVATIONS ARE BEING PERFORMED AND THEREAFTER. FURTHER THE COSTS TO COMPLETE THE RENOVATIONS COULD

BE GREATER, AND THE TIME TO COMPLETE THE RENOVATIONS COULD TAKE LONGER, THAN EXPECTED. IN ADDITION, ANY IMPROVED RESULTS OF THE RENOVATED HOTELS MAY NOT OFFSET THE

RENOVATION COSTS OR OTHERWISE GENERATE THE EXPECTED RETURNS,

• WE EXPECT TO PURCHASE FROM TA DURING THE REMAINDER OF 2017 APPROXIMATELY $32.9 MILLION OF CAPITAL IMPROVEMENTS TA EXPECTS TO MAKE TO THE TRAVEL CENTERS WE LEASE TO TA.

PURSUANT TO THE TERMS OF THE APPLICABLE LEASES, THE ANNUAL RENT PAYABLE TO US BY TA WILL INCREASE AS A RESULT OF ANY SUCH PURCHASES. WE MAY ULTIMATELY PURCHASE MORE OR

LESS THAN THIS BUDGETED AMOUNT. TA MAY NOT REALIZE RESULTS FROM ANY OF THESE CAPITAL IMPROVEMENTS WHICH EQUAL OR EXCEED THE INCREASED ANNUAL RENTS IT WILL BE

OBLIGATED TO PAY TO US, WHICH COULD INCREASE THE RISK OF TA BEING UNABLE TO PAY AMOUNTS DUE TO US,

• HOTEL ROOM DEMAND AND TRUCKING ACTIVITY ARE OFTEN REFLECTIONS OF THE GENERAL ECONOMIC ACTIVITY IN THE COUNTRY AND IN THE GEOGRAPHIC AREAS WHERE OUR PROPERTIES ARE

LOCATED. IF ECONOMIC ACTIVITY IN THE COUNTRY DECLINES, HOTEL ROOM DEMAND AND TRUCKING ACTIVITY MAY DECLINE AND THE OPERATING RESULTS OF OUR HOTELS AND TRAVEL CENTERS

MAY DECLINE, THE FINANCIAL RESULTS OF OUR HOTEL MANAGERS AND OUR TENANTS, INCLUDING TA, MAY SUFFER AND THESE MANAGERS AND TENANTS MAY BE UNABLE TO PAY OUR RETURNS OR

RENTS. ALSO, DEPRESSED OPERATING RESULTS FROM OUR PROPERTIES FOR EXTENDED PERIODS MAY RESULT IN THE OPERATORS OF SOME OR ALL OF OUR HOTELS AND OUR TRAVEL CENTERS

BECOMING UNABLE OR UNWILLING TO MEET THEIR OBLIGATIONS OR THEIR GUARANTEES AND SECURITY DEPOSITS WE HOLD MAY BE EXHAUSTED,

• HOTEL SUPPLY GROWTH HAS BEEN INCREASING AND MAY AFFECT OUR HOTEL OPERATORS' ABILITY TO GROW AVERAGE DAILY RATE, OR ADR, AND OCCUPANCY, AND ADR AND OCCUPANCY COULD

DECLINE DUE TO INCREASED COMPETITION WHICH MAY CAUSE OUR HOTEL OPERATORS TO BECOME UNABLE TO PAY OUR RETURNS OR RENTS,

• IF THE CURRENT LEVEL OF COMMERCIAL ACTIVITY IN THE COUNTRY DECLINES, IF THE PRICE OF DIESEL FUEL INCREASES SIGNIFICANTLY, IF FUEL CONSERVATION MEASURES ARE INCREASED, IF

FREIGHT BUSINESS IS DIRECTED AWAY FROM TRUCKING, IF TA IS UNABLE TO EFFECTIVELY COMPETE OR OPERATE ITS BUSINESS, IF FUEL EFFICIENCIES, THE USE OF ALTERNATIVE FUELS OR

TRANSPORTATION TECHNOLOGIES REDUCE THE DEMAND FOR PRODUCTS AND SERVICES TA SELLS OR FOR VARIOUS OTHER REASONS, TA MAY BECOME UNABLE TO PAY CURRENT AND DEFERRED

RENTS DUE TO US,

• OUR ABILITY TO GROW OUR BUSINESS AND INCREASE OUR DISTRIBUTIONS DEPENDS IN LARGE PART UPON OUR ABILITY TO BUY PROPERTIES THAT GENERATE RETURNS OR CAN BE LEASED FOR

RENTS WHICH EXCEED OUR OPERATING AND CAPITAL COSTS. WE MAY BE UNABLE TO IDENTIFY PROPERTIES THAT WE WANT TO ACQUIRE OR TO NEGOTIATE ACCEPTABLE PURCHASE PRICES,

ACQUISITION FINANCING, MANAGEMENT CONTRACTS OR LEASE TERMS FOR NEW PROPERTIES,

• CONTINGENCIES IN OUR ACQUISITION AND SALE AGREEMENTS MAY NOT BE SATISFIED AND OUR PENDING ACQUISITIONS AND SALES AND ANY RELATED MANAGEMENT ARRANGEMENTS WE EXPECT

TO ENTER MAY NOT OCCUR, MAY BE DELAYED OR THE TERMS OF SUCH TRANSACTIONS OR ARRANGEMENTS MAY CHANGE,

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

FO

RW

ARD LOOKING S

TA

TEMENTS (continued

)

5

• AT JUNE 30, 2017, WE HAD $49.7 MILLION OF CASH AND CASH EQUIVALENTS, $722.0 MILLION AVAILABLE UNDER OUR $1.0 BILLION REVOLVING CREDIT FACILITY AND SECURITY DEPOSITS AND

GUARANTEES COVERING SOME OF OUR MINIMUM RETURNS AND RENTS. THESE STATEMENTS MAY IMPLY THAT WE HAVE ABUNDANT WORKING CAPITAL AND LIQUIDITY. HOWEVER, OUR

MANAGERS AND TENANTS MAY NOT BE ABLE TO FUND MINIMUM RETURNS AND RENTS DUE TO US FROM OPERATING OUR PROPERTIES OR FROM OTHER RESOURCES; IN THE PAST AND

CURRENTLY, CERTAIN OF OUR TENANTS AND HOTEL MANAGERS HAVE IN FACT NOT PAID THE MINIMUM AMOUNTS DUE TO US FROM THEIR OPERATIONS OF OUR LEASED OR MANAGED

PROPERTIES. ALSO, CERTAIN OF THE SECURITY DEPOSITS AND GUARANTEES WE HAVE TO COVER ANY SUCH SHORTFALLS ARE LIMITED IN AMOUNT AND DURATION, AND ANY SECURITY

DEPOSITS WE APPLY FOR SUCH SHORTFALLS DO NOT RESULT IN ADDITIONAL CASH FLOWS TO US. OUR PROPERTIES REQUIRE, AND WE HAVE AGREED TO PROVIDE, SIGNIFICANT FUNDING FOR

CAPITAL IMPROVEMENTS, RENOVATIONS AND OTHER MATTERS. ACCORDINGLY, WE MAY NOT HAVE SUFFICIENT WORKING CAPITAL OR LIQUIDITY,

• WE MAY BE UNABLE TO REPAY OUR DEBT OBLIGATIONS WHEN THEY BECOME DUE,

• CONTINUED AVAILABILITY OF BORROWINGS UNDER OUR REVOLVING CREDIT FACILITY IS SUBJECT TO OUR SATISFYING CERTAIN FINANCIAL COVENANTS AND OTHER CREDIT FACILITY

CONDITIONS THAT WE MAY BE UNABLE TO SATISFY,

• ACTUAL COSTS UNDER OUR REVOLVING CREDIT FACILITY OR OTHER FLOATING RATE DEBT WILL BE HIGHER THAN LIBOR PLUS A PREMIUM BECAUSE OF FEES AND EXPENSES ASSOCIATED WITH

SUCH FACILITIES,

• THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN MAY BE INCREASED TO UP TO $2.3 BILLION ON A COMBINED BASIS IN CERTAIN

CIRCUMSTANCES; HOWEVER, INCREASING THE MAXIMUM BORROWING AVAILABILITY UNDER OUR REVOLVING CREDIT FACILITY AND TERM LOAN IS SUBJECT TO OUR OBTAINING ADDITIONAL

COMMITMENTS FROM LENDERS, WHICH MAY NOT OCCUR,

• THE PREMIUMS USED TO DETERMINE THE INTEREST RATE PAYABLE ON OUR REVOLVING CREDIT FACILITY AND TERM LOAN AND THE FACILITY FEE PAYABLE ON OUR REVOLVING CREDIT FACILITY

ARE BASED ON OUR CREDIT RATINGS. FUTURE CHANGES IN OUR CREDIT RATINGS MAY CAUSE THE INTEREST AND FEES WE PAY TO INCREASE,

• WE HAVE THE OPTION TO EXTEND THE MATURITY DATE OF OUR REVOLVING CREDIT FACILITY UPON PAYMENT OF A FEE AND MEETING OTHER CONDITIONS; HOWEVER, THE APPLICABLE

CONDITIONS MAY NOT BE MET,

• THE BUSINESS AND PROPERTY MANAGEMENT AGREEMENTS BETWEEN US AND RMR LLC HAVE CONTINUING 20 YEAR TERMS. HOWEVER, THOSE AGREEMENTS PERMIT EARLY TERMINATION IN

CERTAIN CIRCUMSTANCES. ACCORDINGLY, WE CANNOT BE SURE THAT THESE AGREEMENTS WILL REMAIN IN EFFECT FOR CONTINUING 20 YEAR TERMS,

• WE BELIEVE THAT OUR RELATIONSHIPS WITH OUR RELATED PARTIES, INCLUDING RMR LLC, RMR INC., TA, SONESTA, AIC AND OTHERS AFFILIATED WITH THEM MAY BENEFIT US AND PROVIDE US

WITH COMPETITIVE ADVANTAGES IN OPERATING AND GROWING OUR BUSINESS. HOWEVER, THE ADVANTAGES WE BELIEVE WE MAY REALIZE FROM THESE RELATIONSHIPS MAY NOT

MATERIALIZE,

• RMR INC. MAY REDUCE THE AMOUNT OF ITS DISTRIBUTIONS TO ITS SHAREHOLDERS, INCLUDING US,

• MARRIOTT INTERNATIONAL, INC., OR MARRIOTT, HAS NOTIFIED US THAT IT DOES NOT INTEND TO EXTEND ITS LEASE FOR OUR RESORT HOTEL ON KAUAI, HAWAII WHEN THAT LEASE EXPIRES ON

DECEMBER 31, 2019 AND WE INTEND TO HAVE DISCUSSIONS WITH MARRIOTT ABOUT THE FUTURE OF THIS HOTEL. THESE STATEMENTS MAY IMPLY THAT MARRIOTT WILL NOT OPERATE THIS

HOTEL IN THE FUTURE OR THAT WE MAY RECEIVE LESS CASH FLOW FROM THIS HOTEL IN THE FUTURE. OUR DISCUSSIONS WITH MARRIOTT HAVE ONLY RECENTLY BEGUN. AT THIS TIME WE

CANNOT PREDICT HOW OUR DISCUSSIONS WITH MARRIOTT WILL IMPACT THE FUTURE OF THIS HOTEL. FOR EXAMPLE, THIS HOTEL MAY CONTINUE TO BE OPERATED BY MARRIOTT ON

DIFFERENT CONTRACT TERMS THAN THE CURRENT LEASE, WE MAY IDENTIFY A DIFFERENT OPERATOR FOR THIS HOTEL OR THE CASH FLOWS WHICH WE RECEIVE FROM OUR OWNERSHIP OF

THIS HOTEL MAY BE DIFFERENT THAN THE RENT WE NOW RECEIVE. ALSO, ALTHOUGH THE CURRENT LEASE EXPIRES ON DECEMBER 31, 2019, WE AND MARRIOTT MAY AGREE UPON A DIFFERENT

TERMINATION DATE, AND

• WE HAVE ADVISED MORGANS HOTEL GROUP, OR MORGANS, THAT THE CLOSING OF ITS MERGER WITH SBE ENTERTAINMENT GROUP, LLC, OR SBE, WAS IN VIOLATION OF OUR AGREEMENT WITH

MORGANS, WE HAVE FILED AN ACTION FOR UNLAWFUL DETAINER AGAINST MORGANS AND SBE TO COMPEL MORGANS AND SBE TO SURRENDER POSSESSION OF THE SAN FRANCISCO HOTEL

WHICH MORGANS HISTORICALLY LEASED FROM US, AND WE ARE IN DISCUSSIONS WITH MORGANS AND SBE REGARDING THIS MATTER. THE OUTCOME OF THIS PENDING LITIGATION AND OF OUR

DISCUSSIONS WITH MORGANS AND SBE IS NOT ASSURED, BUT WE BELIEVE THAT MORGANS MAY SURRENDER POSSESSION OF THIS HOTEL OR THAT THE COURT WILL DETERMINE THAT

MORGANS AND SBE HAVE BREACHED THE HISTORICAL LEASE. WE ALSO BELIEVE THAT THIS HOTEL MAY REQUIRE SUBSTANTIAL CAPITAL INVESTMENT TO REMAIN COMPETITIVE IN ITS MARKET.

THE CONTINUATION OF OUR DISPUTE WITH MORGANS AND SBE REQUIRES US TO EXPEND LEGAL FEES AND THE RESULT OF THIS DISPUTE MAY CAUSE US SOME LOSS OF RENT, AT LEAST UNTIL

THIS HOTEL MAY BE RENOVATED AND OPERATIONS IMPROVE. LITIGATION AND DISPUTES WITH TENANTS OFTEN PRODUCE UNEXPECTED RESULTS AND WE CAN PROVIDE NO ASSURANCE

REGARDING THE RESULTS OF THIS DISPUTE.

CURRENTLY UNEXPECTED RESULTS COULD OCCUR DUE TO MANY DIFFERENT CIRCUMSTANCES, SOME OF WHICH ARE BEYOND OUR CONTROL, SUCH AS ACTS OF TERRORISM, NATURAL

DISASTERS, CHANGES IN OUR MANAGERS’ OR TENANTS’ REVENUES OR EXPENSES, CHANGES IN OUR MANAGERS’ OR TENANTS’ FINANCIAL CONDITIONS, THE MARKET DEMAND FOR HOTEL ROOMS OR

FUEL OR CHANGES IN CAPITAL MARKETS OR THE ECONOMY GENERALLY.

THE INFORMATION CONTAINED IN OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION, OR SEC, INCLUDING UNDER THE CAPTION “RISK FACTORS” IN OUR PERIODIC REPORTS, OR

INCORPORATED THEREIN, IDENTIFIES OTHER IMPORTANT FACTORS THAT COULD CAUSE DIFFERENCES FROM OUR FORWARD LOOKING STATEMENTS. OUR FILINGS WITH THE SEC ARE AVAILABLE ON THE

SEC’S WEBSITE AT WWW.SEC.GOV.

YOU SHOULD NOT PLACE UNDUE RELIANCE UPON OUR FORWARD LOOKING STATEMENTS.

EXCEPT AS REQUIRED BY LAW, WE DO NOT INTEND TO UPDATE OR CHANGE ANY FORWARD LOOKING STATEMENTS AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHERWISE.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

CORPORATE INFORMATION

Staybridge Suites Ft. Lauderdale, Ft. Lauderdale, FL

Operator: InterContinental Hotels Group

Guest Rooms: 141

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

COM

PAN

Y PROFIL

E

7

COMPANY PROFILE

Hospitality Properties Trust, or HPT, we, our, or us, is a real estate investment trust, or REIT. As of June 30, 2017,

we owned 310 hotels and 199 travel centers located in 45 states, Puerto Rico and Canada. Our properties are

operated by other companies under long term management or lease agreements. We have been investment grade

rated since 1998 and we are currently included in a number of financial indices, including the S&P MidCap 400 Index,

the Russell 1000 Index, the MSCI U.S. REIT Index, the FTSE EPRA/NAREIT United States Index and the S&P REIT

Composite Index.

The Company:

Management:

HPT is managed by The RMR Group LLC, the operating subsidiary of The RMR Group Inc. (Nasdaq: RMR).

RMR is an alternative asset management company that was founded in 1986 to manage real estate companies

and related businesses. RMR primarily provides management services to four publicly owned real estate

investment trusts, or REITs, and three real estate related operating businesses. In addition to managing HPT,

RMR manages Senior Housing Properties Trust, a REIT that primarily owns healthcare, senior living and medical

office buildings, Select Income REIT, a REIT which owns properties that are primarily leased to single tenants,

and Government Properties Income Trust, a REIT that primarily owns properties leased to the U.S. and state

governments. RMR also provides management services to TravelCenters of America LLC, a publicly traded

operator of travel centers along the U.S. Interstate Highway System (including all the travel centers that HPT

owns), convenience stores and restaurants, Five Star Senior Living Inc., a publicly traded operator of senior living

communities, and Sonesta International Hotels Corporation, a privately owned franchisor and operator of hotels

(including some of the hotels that HPT owns) and cruise ships. RMR also manages publicly traded securities of

real estate companies and private commercial real estate debt funds through wholly owned SEC registered

investment advisory subsidiaries. As of June 30, 2017, RMR had $27.9 billion of real estate assets under

management and the combined RMR managed companies had approximately $11 billion of annual revenues,

over 1,400 properties and approximately 53,000 employees. We believe that being managed by RMR is a

competitive advantage for HPT because of RMR’s depth of management and experience in the real estate

industry. We also believe RMR provides management services to us at costs that are lower than we would have

to pay for similar quality services.

Corporate Headquarters:

Two Newton Place

255 Washington Street, Suite 300

Newton, MA 02458-1634

(t) (617) 964-8389

(f) (617) 969-5730

Stock Exchange Listing:

Nasdaq

Trading Symbol:

Common Shares: HPT

Senior Unsecured Debt Ratings:

Standard & Poor's: BBB-

Moody's: Baa2

Key Data (as of June 30, 2017)

(dollars in 000s)

Total Properties: 509

Hotels 310

Travel centers 199

Number of Hotel Rooms/Suites 48,087

Q2 2017 total revenues $ 570,603

Q2 2017 net income available for

common shareholders $ 60,699

Q2 2017 Normalized FFO

available for common

shareholders(1) $ 173,604

(1) See pages 23-24 for the calculation of FFO

available for common shareholders and

Normalized FFO available for common

shareholders and a reconciliation of net income

available for common shareholders, determined

in accordance with U.S. generally accepted

accounting principles, or GAAP, to these

amounts.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

COM

PAN

Y PROFILE (continued

)

8

COMPANY PROFILE

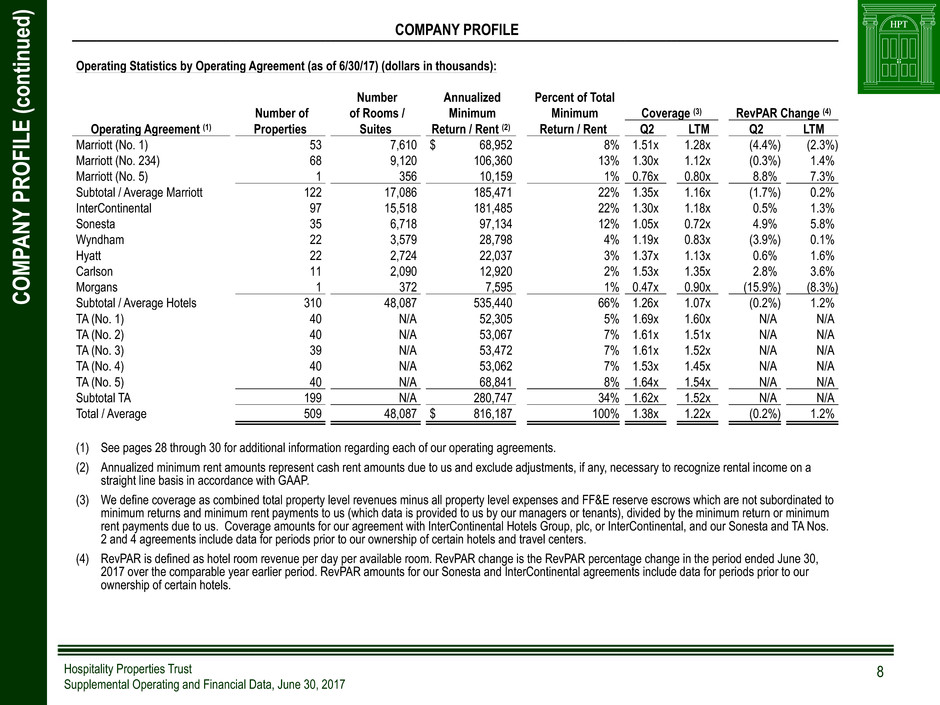

Operating Statistics by Operating Agreement (as of 6/30/17) (dollars in thousands):

Number Annualized Percent of Total

Number of of Rooms / Minimum Minimum Coverage (3) RevPAR Change (4)

Operating Agreement (1) Properties Suites Return / Rent (2) Return / Rent Q2 LTM Q2 LTM

Marriott (No. 1) 53 7,610 $ 68,952 8% 1.51x 1.28x (4.4%) (2.3%)

Marriott (No. 234) 68 9,120 106,360 13% 1.30x 1.12x (0.3%) 1.4%

Marriott (No. 5) 1 356 10,159 1% 0.76x 0.80x 8.8% 7.3%

Subtotal / Average Marriott 122 17,086 185,471 22% 1.35x 1.16x (1.7%) 0.2%

InterContinental 97 15,518 181,485 22% 1.30x 1.18x 0.5% 1.3%

Sonesta 35 6,718 97,134 12% 1.05x 0.72x 4.9% 5.8%

Wyndham 22 3,579 28,798 4% 1.19x 0.83x (3.9%) 0.1%

Hyatt 22 2,724 22,037 3% 1.37x 1.13x 0.6% 1.6%

Carlson 11 2,090 12,920 2% 1.53x 1.35x 2.8% 3.6%

Morgans 1 372 7,595 1% 0.47x 0.90x (15.9%) (8.3%)

Subtotal / Average Hotels 310 48,087 535,440 66% 1.26x 1.07x (0.2%) 1.2%

TA (No. 1) 40 N/A 52,305 5% 1.69x 1.60x N/A N/A

TA (No. 2) 40 N/A 53,067 7% 1.61x 1.51x N/A N/A

TA (No. 3) 39 N/A 53,472 7% 1.61x 1.52x N/A N/A

TA (No. 4) 40 N/A 53,062 7% 1.53x 1.45x N/A N/A

TA (No. 5) 40 N/A 68,841 8% 1.64x 1.54x N/A N/A

Subtotal TA 199 N/A 280,747 34% 1.62x 1.52x N/A N/A

Total / Average 509 48,087 $ 816,187 100% 1.38x 1.22x (0.2%) 1.2%

(1) See pages 28 through 30 for additional information regarding each of our operating agreements.

(2) Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to recognize rental income on a

straight line basis in accordance with GAAP.

(3) We define coverage as combined total property level revenues minus all property level expenses and FF&E reserve escrows which are not subordinated to

minimum returns and minimum rent payments to us (which data is provided to us by our managers or tenants), divided by the minimum return or minimum

rent payments due to us. Coverage amounts for our agreement with InterContinental Hotels Group, plc, or InterContinental, and our Sonesta and TA Nos.

2 and 4 agreements include data for periods prior to our ownership of certain hotels and travel centers.

(4) RevPAR is defined as hotel room revenue per day per available room. RevPAR change is the RevPAR percentage change in the period ended June 30,

2017 over the comparable year earlier period. RevPAR amounts for our Sonesta and InterContinental agreements include data for periods prior to our

ownership of certain hotels.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

INVES

TOR INFORM

ATIO

N

9

INVESTOR INFORMATION

Board of Trustees

Donna D. Fraiche John L. Harrington William A. Lamkin

Independent Trustee Lead Independent Trustee Independent Trustee

Adam D. Portnoy Barry M. Portnoy

Managing Trustee Managing Trustee

Senior Management

John G. Murray Mark L. Kleifges Ethan S. Bornstein

President and Chief Operating Officer Chief Financial Officer and Treasurer Senior Vice President

Contact Information

Investor Relations Inquiries

Hospitality Properties Trust Financial inquiries should be directed to Mark L. Kleifges,

Two Newton Place Chief Financial Officer and Treasurer, at (617) 964-8389

255 Washington Street, Suite 300 or mkleifges@rmrgroup.com.

Newton, MA 02458-1634

(t) (617) 964-8389 Investor and media inquiries should be directed to

(f) (617) 969-5730 Katie Strohacker, Senior Director, Investor Relations at

(email) info@hptreit.com (617) 796-8232, or kstrohacker@rmrgroup.com

(website) www.hptreit.com

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

RESEARCH COVERAG

E

10

RESEARCH COVERAGE

Equity Research Coverage

Baird Canaccord Genuity D.A. Davidson & Co.

Michael Bellisario Ryan Meliker James O. Lykins

(414) 298-6130 (212) 389-8094 (503) 603-3041

mbellisario@rwbaird.com rmeliker@canaccordgenuity.com jlykins@dadco.com

FBR & Co. Janney Montgomery Scott JMP Securities

Bryan Maher Tyler Batory Whitney Stevenson

(646) 885-5423 (215) 665-4448 (212) 906-3538

bmaher@fbr.com tbatory@janney.com wstevenson@jmpsecurities.com

Stifel Nicolaus Wells Fargo Securities

Simon Yarmak Jeffrey Donnelly

(443) 224-1345 (617) 603-4262

yarmaks@stifel.com jeff.donnelly@wellsfargo.com

Debt Research Coverage

Credit Suisse Wells Fargo Securities

John Giordano Thierry Perrein

(212) 538-4935 (704) 715-8455

john.giordano@credit-suisse.com thierry.perrein@wellsfargo.com

Rating Agencies

Moody’s Investors Service Standard & Poor’s

Griselda Bisono Michael Souers

(212) 553-4985 (212) 438-2508

griselda.bisono@moodys.com michael.souers@standardandpoors.com

HPT is followed by the analysts and its publicly held debt is rated by the rating agencies listed above. Please note that any opinions, estimates or forecasts regarding HPT's

performance made by these analysts or agencies do not represent opinions, forecasts or predictions of HPT or its management. HPT does not by its reference above imply

its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

All amounts in this report are unaudited.

Hospitality Properties Trust

Second Quarter 2017

Supplemental Operating and Financial Data

Sonesta Resort Hilton Head Island, Hilton Head, SC

Operator: Sonesta International Hotels Corporation

Guest Rooms: 340

FINANCIALS

Courtyard Columbia, Columbia, MD

Operator: Marriott International, Inc.

Guest Rooms: 152

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

KE

Y FINANCIA

L D

AT

A

12

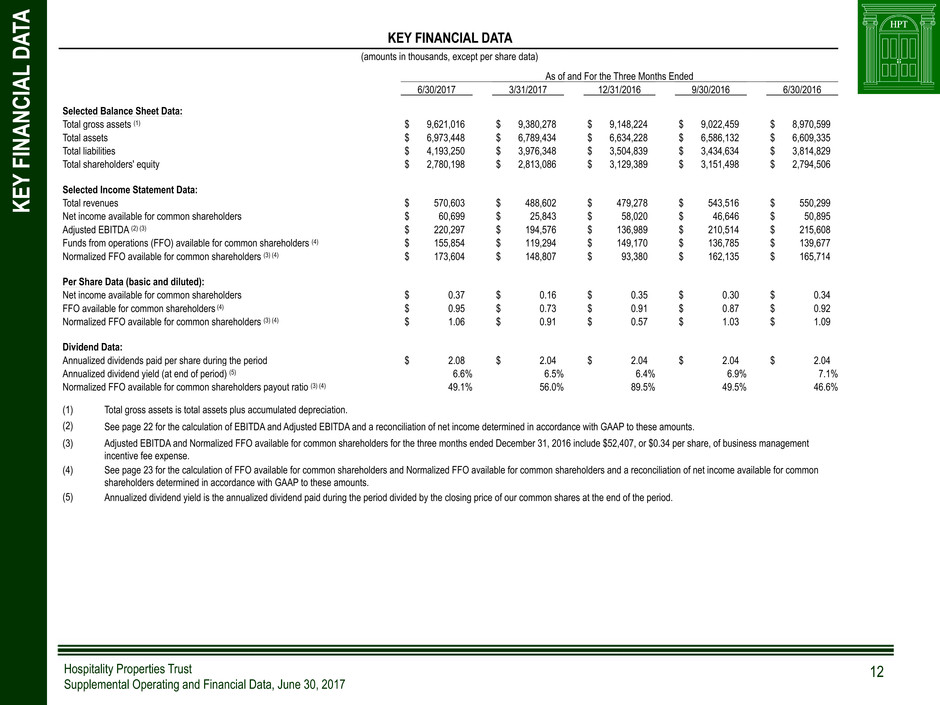

KEY FINANCIAL DATA

(amounts in thousands, except per share data)

As of and For the Three Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Selected Balance Sheet Data:

Total gross assets (1) $ 9,621,016 $ 9,380,278 $ 9,148,224 $ 9,022,459 $ 8,970,599

Total assets $ 6,973,448 $ 6,789,434 $ 6,634,228 $ 6,586,132 $ 6,609,335

Total liabilities $ 4,193,250 $ 3,976,348 $ 3,504,839 $ 3,434,634 $ 3,814,829

Total shareholders' equity $ 2,780,198 $ 2,813,086 $ 3,129,389 $ 3,151,498 $ 2,794,506

Selected Income Statement Data:

Total revenues $ 570,603 $ 488,602 $ 479,278 $ 543,516 $ 550,299

Net income available for common shareholders $ 60,699 $ 25,843 $ 58,020 $ 46,646 $ 50,895

Adjusted EBITDA (2) (3) $ 220,297 $ 194,576 $ 136,989 $ 210,514 $ 215,608

Funds from operations (FFO) available for common shareholders (4) $ 155,854 $ 119,294 $ 149,170 $ 136,785 $ 139,677

Normalized FFO available for common shareholders (3) (4) $ 173,604 $ 148,807 $ 93,380 $ 162,135 $ 165,714

Per Share Data (basic and diluted):

Net income available for common shareholders $ 0.37 $ 0.16 $ 0.35 $ 0.30 $ 0.34

FFO available for common shareholders (4) $ 0.95 $ 0.73 $ 0.91 $ 0.87 $ 0.92

Normalized FFO available for common shareholders (3) (4) $ 1.06 $ 0.91 $ 0.57 $ 1.03 $ 1.09

Dividend Data:

Annualized dividends paid per share during the period $ 2.08 $ 2.04 $ 2.04 $ 2.04 $ 2.04

Annualized dividend yield (at end of period) (5) 6.6% 6.5% 6.4% 6.9% 7.1%

Normalized FFO available for common shareholders payout ratio (3) (4) 49.1% 56.0% 89.5% 49.5% 46.6%

(1) Total gross assets is total assets plus accumulated depreciation.

(2) See page 22 for the calculation of EBITDA and Adjusted EBITDA and a reconciliation of net income determined in accordance with GAAP to these amounts.

(3) Adjusted EBITDA and Normalized FFO available for common shareholders for the three months ended December 31, 2016 include $52,407, or $0.34 per share, of business management

incentive fee expense.

(4) See page 23 for the calculation of FFO available for common shareholders and Normalized FFO available for common shareholders and a reconciliation of net income available for common

shareholders determined in accordance with GAAP to these amounts.

(5) Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of our common shares at the end of the period.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

CONDENSED CONSOLID

ATED BALANCE SHEET

S

13

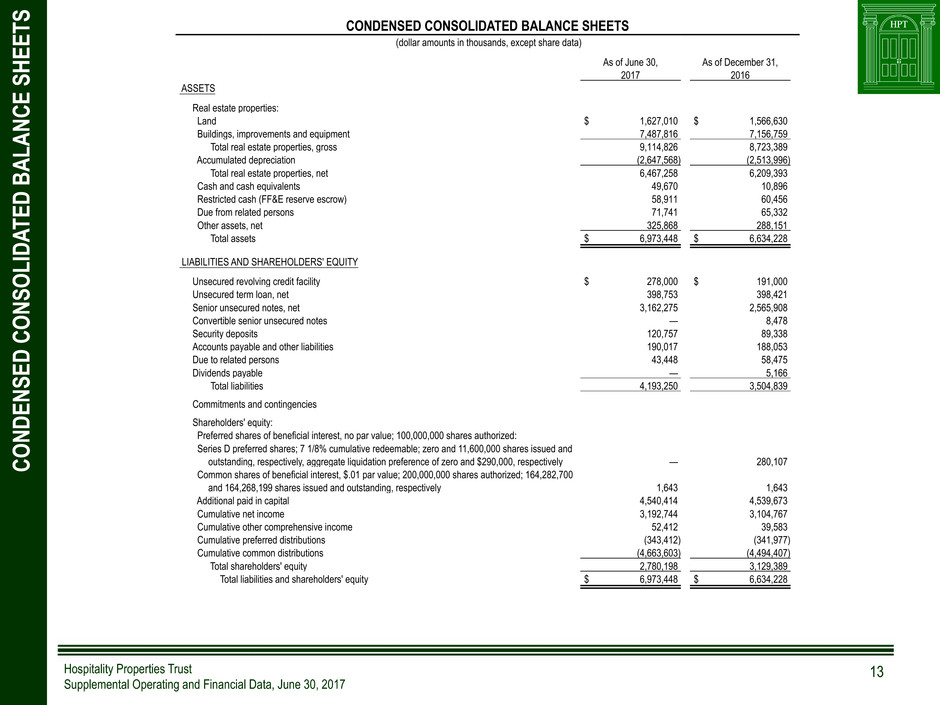

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollar amounts in thousands, except share data)

As of June 30, As of December 31,

2017 2016

ASSETS

Real estate properties:

Land $ 1,627,010 $ 1,566,630

Buildings, improvements and equipment 7,487,816 7,156,759

Total real estate properties, gross 9,114,826 8,723,389

Accumulated depreciation (2,647,568) (2,513,996)

Total real estate properties, net 6,467,258 6,209,393

Cash and cash equivalents 49,670 10,896

Restricted cash (FF&E reserve escrow) 58,911 60,456

Due from related persons 71,741 65,332

Other assets, net 325,868 288,151

Total assets $ 6,973,448 $ 6,634,228

LIABILITIES AND SHAREHOLDERS' EQUITY

Unsecured revolving credit facility $ 278,000 $ 191,000

Unsecured term loan, net 398,753 398,421

Senior unsecured notes, net 3,162,275 2,565,908

Convertible senior unsecured notes — 8,478

Security deposits 120,757 89,338

Accounts payable and other liabilities 190,017 188,053

Due to related persons 43,448 58,475

Dividends payable — 5,166

Total liabilities 4,193,250 3,504,839

Commitments and contingencies

Shareholders' equity:

Preferred shares of beneficial interest, no par value; 100,000,000 shares authorized:

Series D preferred shares; 7 1/8% cumulative redeemable; zero and 11,600,000 shares issued and

outstanding, respectively, aggregate liquidation preference of zero and $290,000, respectively — 280,107

Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 164,282,700

and 164,268,199 shares issued and outstanding, respectively 1,643 1,643

Additional paid in capital 4,540,414 4,539,673

Cumulative net income 3,192,744 3,104,767

Cumulative other comprehensive income 52,412 39,583

Cumulative preferred distributions (343,412) (341,977)

Cumulative common distributions (4,663,603) (4,494,407)

Total shareholders' equity 2,780,198 3,129,389

Total liabilities and shareholders' equity $ 6,973,448 $ 6,634,228

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

CONDENSED CONSOLID

ATED S

TA

TEMENTS OF INCOM

E

14

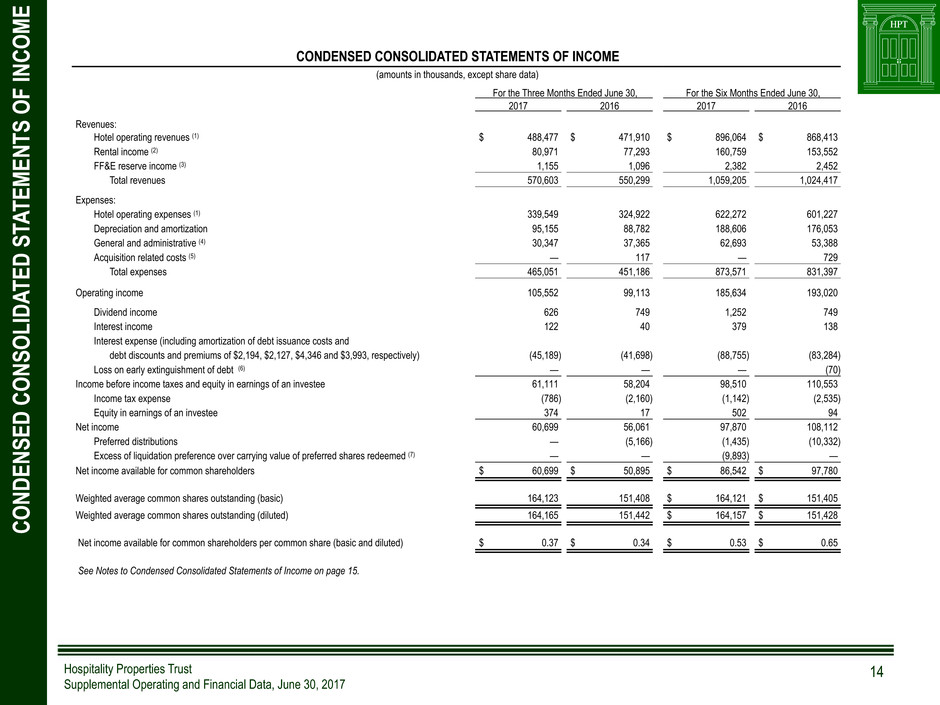

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(amounts in thousands, except share data)

For the Three Months Ended June 30, For the Six Months Ended June 30,

2017 2016 2017 2016

Revenues:

Hotel operating revenues (1) $ 488,477 $ 471,910 $ 896,064 $ 868,413

Rental income (2) 80,971 77,293 160,759 153,552

FF&E reserve income (3) 1,155 1,096 2,382 2,452

Total revenues 570,603 550,299 1,059,205 1,024,417

Expenses:

Hotel operating expenses (1) 339,549 324,922 622,272 601,227

Depreciation and amortization 95,155 88,782 188,606 176,053

General and administrative (4) 30,347 37,365 62,693 53,388

Acquisition related costs (5) — 117 — 729

Total expenses 465,051 451,186 873,571 831,397

Operating income 105,552 99,113 185,634 193,020

Dividend income 626 749 1,252 749

Interest income 122 40 379 138

Interest expense (including amortization of debt issuance costs and

debt discounts and premiums of $2,194, $2,127, $4,346 and $3,993, respectively) (45,189) (41,698) (88,755) (83,284)

Loss on early extinguishment of debt (6) — — — (70)

Income before income taxes and equity in earnings of an investee 61,111 58,204 98,510 110,553

Income tax expense (786) (2,160) (1,142) (2,535)

Equity in earnings of an investee 374 17 502 94

Net income 60,699 56,061 97,870 108,112

Preferred distributions — (5,166) (1,435) (10,332)

Excess of liquidation preference over carrying value of preferred shares redeemed (7) — — (9,893) —

Net income available for common shareholders $ 60,699 $ 50,895 $ 86,542 $ 97,780

Weighted average common shares outstanding (basic) 164,123 151,408 $ 164,121 $ 151,405

Weighted average common shares outstanding (diluted) 164,165 151,442 $ 164,157 $ 151,428

Net income available for common shareholders per common share (basic and diluted) $ 0.37 $ 0.34 $ 0.53 $ 0.65

See Notes to Condensed Consolidated Statements of Income on page 15.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

NOTES

TO CONDENSED CONSOLID

ATED S

TA

TEMENTS OF INCOME

15

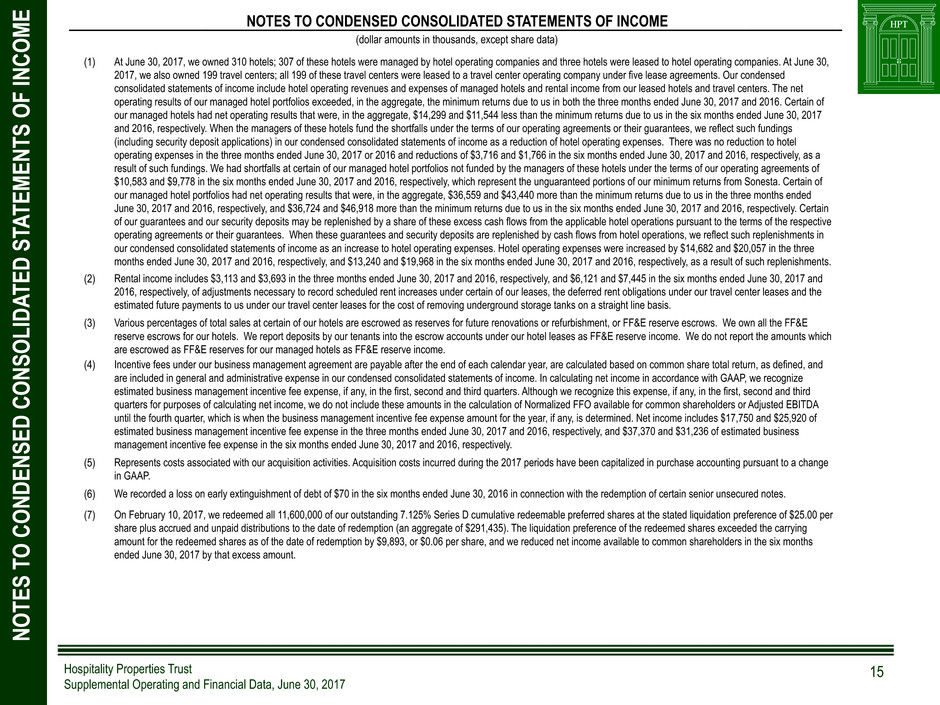

NOTES TO CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(dollar amounts in thousands, except share data)

(1) At June 30, 2017, we owned 310 hotels; 307 of these hotels were managed by hotel operating companies and three hotels were leased to hotel operating companies. At June 30,

2017, we also owned 199 travel centers; all 199 of these travel centers were leased to a travel center operating company under five lease agreements. Our condensed

consolidated statements of income include hotel operating revenues and expenses of managed hotels and rental income from our leased hotels and travel centers. The net

operating results of our managed hotel portfolios exceeded, in the aggregate, the minimum returns due to us in both the three months ended June 30, 2017 and 2016. Certain of

our managed hotels had net operating results that were, in the aggregate, $14,299 and $11,544 less than the minimum returns due to us in the six months ended June 30, 2017

and 2016, respectively. When the managers of these hotels fund the shortfalls under the terms of our operating agreements or their guarantees, we reflect such fundings

(including security deposit applications) in our condensed consolidated statements of income as a reduction of hotel operating expenses. There was no reduction to hotel

operating expenses in the three months ended June 30, 2017 or 2016 and reductions of $3,716 and $1,766 in the six months ended June 30, 2017 and 2016, respectively, as a

result of such fundings. We had shortfalls at certain of our managed hotel portfolios not funded by the managers of these hotels under the terms of our operating agreements of

$10,583 and $9,778 in the six months ended June 30, 2017 and 2016, respectively, which represent the unguaranteed portions of our minimum returns from Sonesta. Certain of

our managed hotel portfolios had net operating results that were, in the aggregate, $36,559 and $43,440 more than the minimum returns due to us in the three months ended

June 30, 2017 and 2016, respectively, and $36,724 and $46,918 more than the minimum returns due to us in the six months ended June 30, 2017 and 2016, respectively. Certain

of our guarantees and our security deposits may be replenished by a share of these excess cash flows from the applicable hotel operations pursuant to the terms of the respective

operating agreements or their guarantees. When these guarantees and security deposits are replenished by cash flows from hotel operations, we reflect such replenishments in

our condensed consolidated statements of income as an increase to hotel operating expenses. Hotel operating expenses were increased by $14,682 and $20,057 in the three

months ended June 30, 2017 and 2016, respectively, and $13,240 and $19,968 in the six months ended June 30, 2017 and 2016, respectively, as a result of such replenishments.

(2) Rental income includes $3,113 and $3,693 in the three months ended June 30, 2017 and 2016, respectively, and $6,121 and $7,445 in the six months ended June 30, 2017 and

2016, respectively, of adjustments necessary to record scheduled rent increases under certain of our leases, the deferred rent obligations under our travel center leases and the

estimated future payments to us under our travel center leases for the cost of removing underground storage tanks on a straight line basis.

(3) Various percentages of total sales at certain of our hotels are escrowed as reserves for future renovations or refurbishment, or FF&E reserve escrows. We own all the FF&E

reserve escrows for our hotels. We report deposits by our tenants into the escrow accounts under our hotel leases as FF&E reserve income. We do not report the amounts which

are escrowed as FF&E reserves for our managed hotels as FF&E reserve income.

(4) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return, as defined, and

are included in general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance with GAAP, we recognize

estimated business management incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third

quarters for purposes of calculating net income, we do not include these amounts in the calculation of Normalized FFO available for common shareholders or Adjusted EBITDA

until the fourth quarter, which is when the business management incentive fee expense amount for the year, if any, is determined. Net income includes $17,750 and $25,920 of

estimated business management incentive fee expense in the three months ended June 30, 2017 and 2016, respectively, and $37,370 and $31,236 of estimated business

management incentive fee expense in the six months ended June 30, 2017 and 2016, respectively.

(5) Represents costs associated with our acquisition activities. Acquisition costs incurred during the 2017 periods have been capitalized in purchase accounting pursuant to a change

in GAAP.

(6) We recorded a loss on early extinguishment of debt of $70 in the six months ended June 30, 2016 in connection with the redemption of certain senior unsecured notes.

(7) On February 10, 2017, we redeemed all 11,600,000 of our outstanding 7.125% Series D cumulative redeemable preferred shares at the stated liquidation preference of $25.00 per

share plus accrued and unpaid distributions to the date of redemption (an aggregate of $291,435). The liquidation preference of the redeemed shares exceeded the carrying

amount for the redeemed shares as of the date of redemption by $9,893, or $0.06 per share, and we reduced net income available to common shareholders in the six months

ended June 30, 2017 by that excess amount.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

CONDENSED CONSOLID

ATED S

TA

TEMENTS OF CASH FLOW

S

16

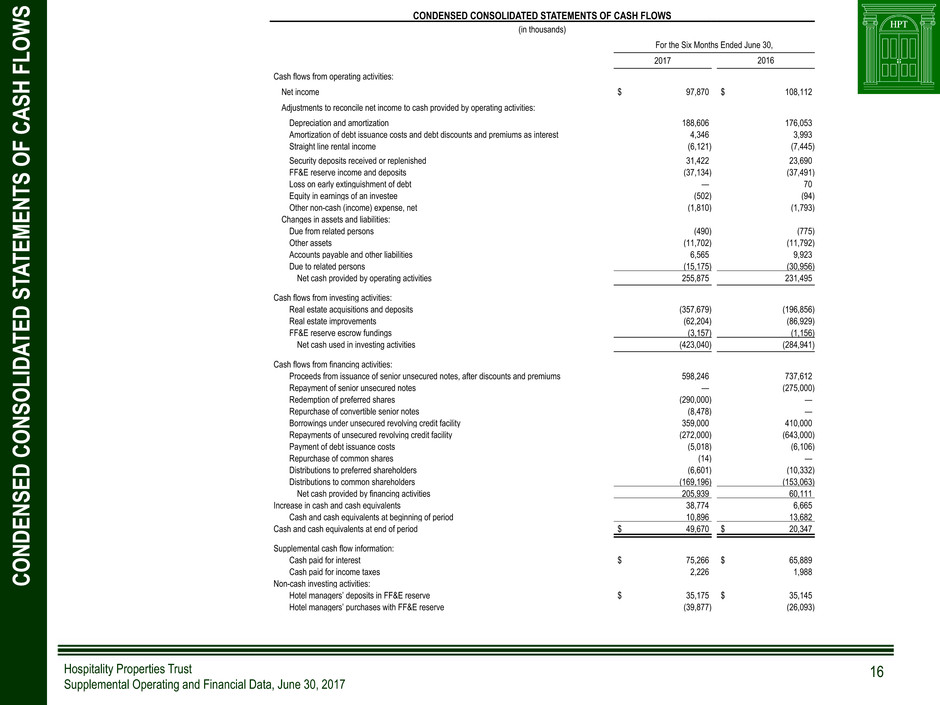

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the Six Months Ended June 30,

2017 2016

Cash flows from operating activities:

Net income $ 97,870 $ 108,112

Adjustments to reconcile net income to cash provided by operating activities:

Depreciation and amortization 188,606 176,053

Amortization of debt issuance costs and debt discounts and premiums as interest 4,346 3,993

Straight line rental income (6,121) (7,445)

Security deposits received or replenished 31,422 23,690

FF&E reserve income and deposits (37,134) (37,491)

Loss on early extinguishment of debt — 70

Equity in earnings of an investee (502) (94)

Other non-cash (income) expense, net (1,810) (1,793)

Changes in assets and liabilities:

Due from related persons (490) (775)

Other assets (11,702) (11,792)

Accounts payable and other liabilities 6,565 9,923

Due to related persons (15,175) (30,956)

Net cash provided by operating activities 255,875 231,495

Cash flows from investing activities:

Real estate acquisitions and deposits (357,679) (196,856)

Real estate improvements (62,204) (86,929)

FF&E reserve escrow fundings (3,157) (1,156)

Net cash used in investing activities (423,040) (284,941)

Cash flows from financing activities:

Proceeds from issuance of senior unsecured notes, after discounts and premiums 598,246 737,612

Repayment of senior unsecured notes — (275,000)

Redemption of preferred shares (290,000) —

Repurchase of convertible senior notes (8,478) —

Borrowings under unsecured revolving credit facility 359,000 410,000

Repayments of unsecured revolving credit facility (272,000) (643,000)

Payment of debt issuance costs (5,018) (6,106)

Repurchase of common shares (14) —

Distributions to preferred shareholders (6,601) (10,332)

Distributions to common shareholders (169,196) (153,063)

Net cash provided by financing activities 205,939 60,111

Increase in cash and cash equivalents 38,774 6,665

Cash and cash equivalents at beginning of period 10,896 13,682

Cash and cash equivalents at end of period $ 49,670 $ 20,347

Supplemental cash flow information:

Cash paid for interest $ 75,266 $ 65,889

Cash paid for income taxes 2,226 1,988

Non-cash investing activities:

Hotel managers’ deposits in FF&E reserve $ 35,175 $ 35,145

Hotel managers’ purchases with FF&E reserve (39,877) (26,093)

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

DEBT SUMMA

RY

17

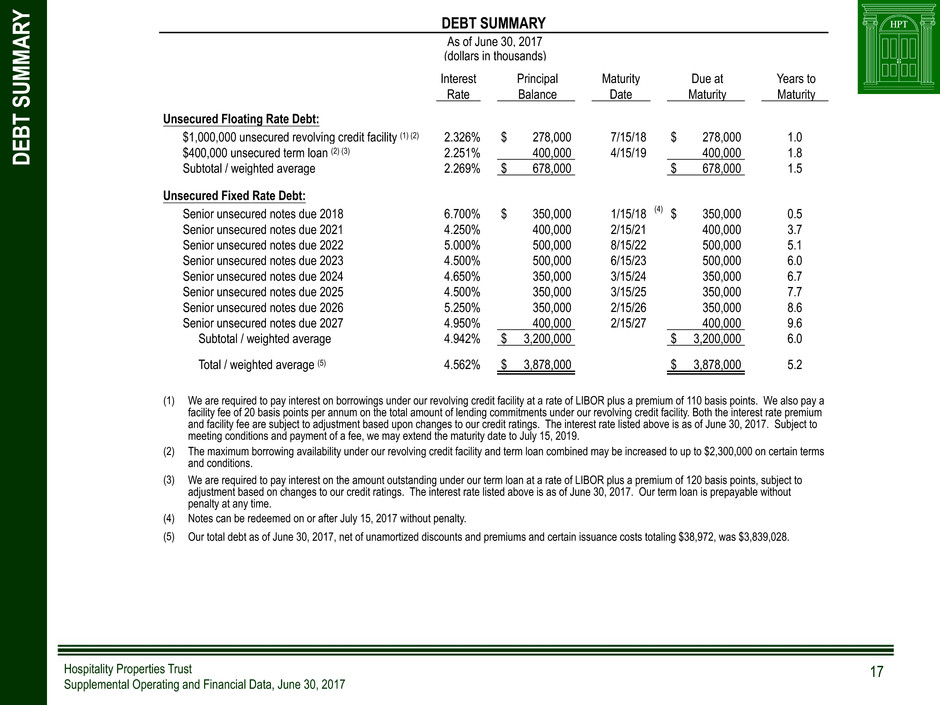

DEBT SUMMARY

As of June 30, 2017

(dollars in thousands)

Interest Principal Maturity Due at Years to

Rate Balance Date Maturity Maturity

Unsecured Floating Rate Debt:

$1,000,000 unsecured revolving credit facility (1) (2) 2.326% $ 278,000 7/15/18 $ 278,000 1.0

$400,000 unsecured term loan (2) (3) 2.251% 400,000 4/15/19 400,000 1.8

Subtotal / weighted average 2.269% $ 678,000 $ 678,000 1.5

Unsecured Fixed Rate Debt:

Senior unsecured notes due 2018 6.700% $ 350,000 1/15/18 (4) $ 350,000 0.5

Senior unsecured notes due 2021 4.250% 400,000 2/15/21 400,000 3.7

Senior unsecured notes due 2022 5.000% 500,000 8/15/22 500,000 5.1

Senior unsecured notes due 2023 4.500% 500,000 6/15/23 500,000 6.0

Senior unsecured notes due 2024 4.650% 350,000 3/15/24 350,000 6.7

Senior unsecured notes due 2025 4.500% 350,000 3/15/25 350,000 7.7

Senior unsecured notes due 2026 5.250% 350,000 2/15/26 350,000 8.6

Senior unsecured notes due 2027 4.950% 400,000 2/15/27 400,000 9.6

Subtotal / weighted average 4.942% $ 3,200,000 $ 3,200,000 6.0

Total / weighted average (5) 4.562% $ 3,878,000 $ 3,878,000 5.2

(1) We are required to pay interest on borrowings under our revolving credit facility at a rate of LIBOR plus a premium of 110 basis points. We also pay a

facility fee of 20 basis points per annum on the total amount of lending commitments under our revolving credit facility. Both the interest rate premium

and facility fee are subject to adjustment based upon changes to our credit ratings. The interest rate listed above is as of June 30, 2017. Subject to

meeting conditions and payment of a fee, we may extend the maturity date to July 15, 2019.

(2) The maximum borrowing availability under our revolving credit facility and term loan combined may be increased to up to $2,300,000 on certain terms

and conditions.

(3) We are required to pay interest on the amount outstanding under our term loan at a rate of LIBOR plus a premium of 120 basis points, subject to

adjustment based on changes to our credit ratings. The interest rate listed above is as of June 30, 2017. Our term loan is prepayable without

penalty at any time.

(4) Notes can be redeemed on or after July 15, 2017 without penalty.

(5) Our total debt as of June 30, 2017, net of unamortized discounts and premiums and certain issuance costs totaling $38,972, was $3,839,028.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

DEBT M

ATURIT

Y SCHEDUL

E

18

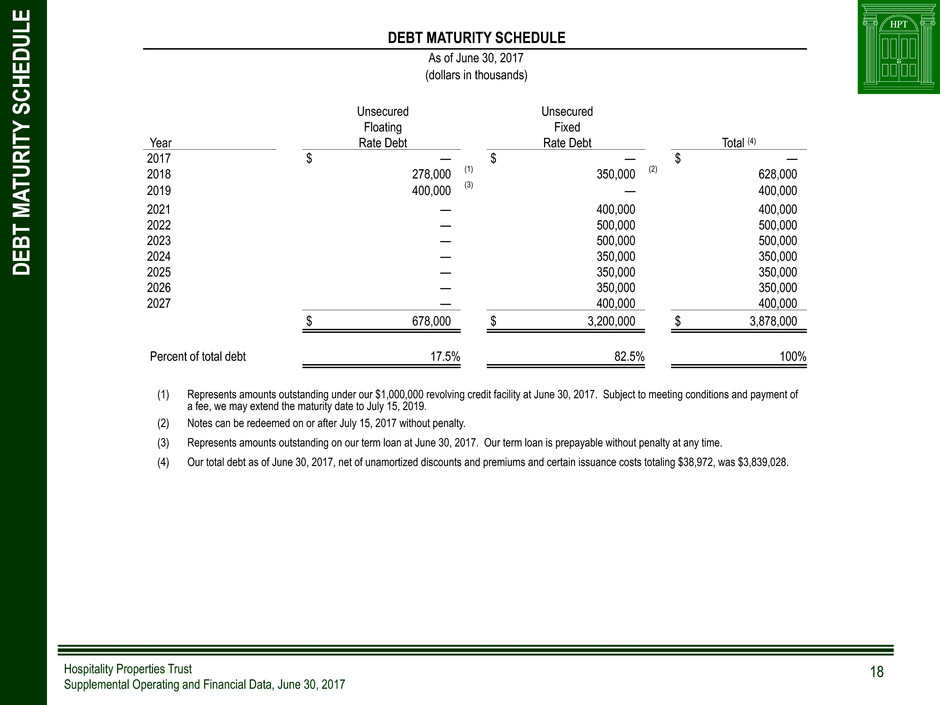

DEBT MATURITY SCHEDULE

As of June 30, 2017

(dollars in thousands)

Unsecured Unsecured

Floating Fixed

Year Rate Debt Rate Debt Total (4)

2017 $ — $ — $ —

2018 278,000 (1) 350,000 (2) 628,000

2019 400,000 (3) — 400,000

2021 — 400,000 400,000

2022 — 500,000 500,000

2023 — 500,000 500,000

2024 — 350,000 350,000

2025 — 350,000 350,000

2026 — 350,000 350,000

2027 — 400,000 400,000

$ 678,000 $ 3,200,000 $ 3,878,000

Percent of total debt 17.5% 82.5% 100%

(1) Represents amounts outstanding under our $1,000,000 revolving credit facility at June 30, 2017. Subject to meeting conditions and payment of

a fee, we may extend the maturity date to July 15, 2019.

(2) Notes can be redeemed on or after July 15, 2017 without penalty.

(3) Represents amounts outstanding on our term loan at June 30, 2017. Our term loan is prepayable without penalty at any time.

(4) Our total debt as of June 30, 2017, net of unamortized discounts and premiums and certain issuance costs totaling $38,972, was $3,839,028.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

LEVERAGE R

ATIOS, COVERAGE R

ATIOS

AND PUBLIC DEBT COVENANT

S

19

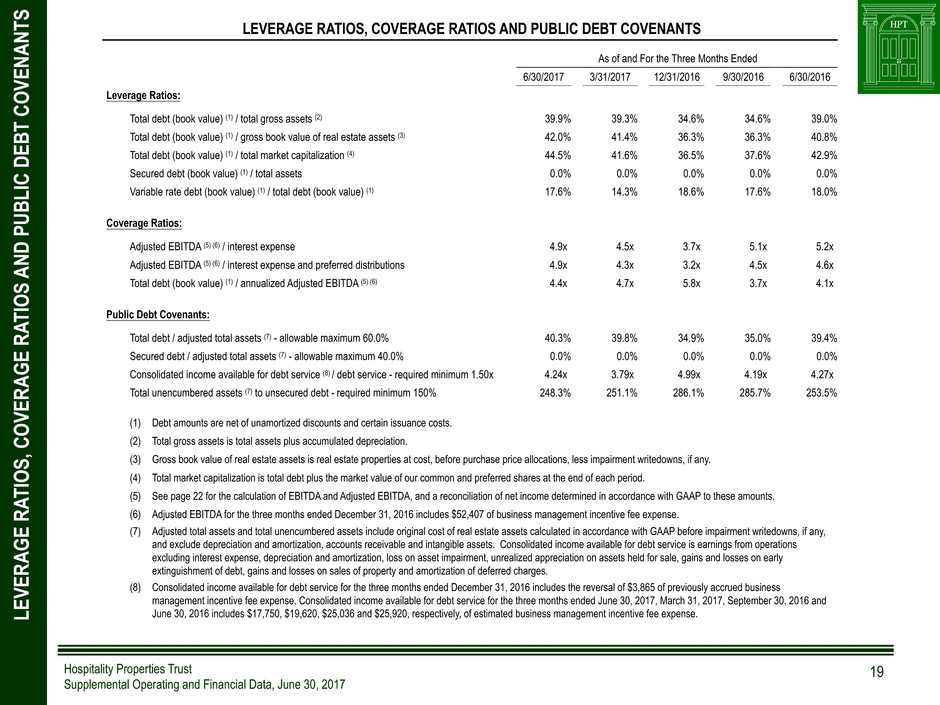

LEVERAGE RATIOS, COVERAGE RATIOS AND PUBLIC DEBT COVENANTS

As of and For the Three Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Leverage Ratios:

Total debt (book value) (1) / total gross assets (2) 39.9% 39.3% 34.6% 34.6% 39.0%

Total debt (book value) (1) / gross book value of real estate assets (3) 42.0% 41.4% 36.3% 36.3% 40.8%

Total debt (book value) (1) / total market capitalization (4) 44.5% 41.6% 36.5% 37.6% 42.9%

Secured debt (book value) (1) / total assets 0.0% 0.0% 0.0% 0.0% 0.0%

Variable rate debt (book value) (1) / total debt (book value) (1) 17.6% 14.3% 18.6% 17.6% 18.0%

Coverage Ratios:

Adjusted EBITDA (5) (6) / interest expense 4.9x 4.5x 3.7x 5.1x 5.2x

Adjusted EBITDA (5) (6) / interest expense and preferred distributions 4.9x 4.3x 3.2x 4.5x 4.6x

Total debt (book value) (1) / annualized Adjusted EBITDA (5) (6) 4.4x 4.7x 5.8x 3.7x 4.1x

Public Debt Covenants:

Total debt / adjusted total assets (7) - allowable maximum 60.0% 40.3% 39.8% 34.9% 35.0% 39.4%

Secured debt / adjusted total assets (7) - allowable maximum 40.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Consolidated income available for debt service (8) / debt service - required minimum 1.50x 4.24x 3.79x 4.99x 4.19x 4.27x

Total unencumbered assets (7) to unsecured debt - required minimum 150% 248.3% 251.1% 286.1% 285.7% 253.5%

(1) Debt amounts are net of unamortized discounts and certain issuance costs.

(2) Total gross assets is total assets plus accumulated depreciation.

(3) Gross book value of real estate assets is real estate properties at cost, before purchase price allocations, less impairment writedowns, if any.

(4) Total market capitalization is total debt plus the market value of our common and preferred shares at the end of each period.

(5) See page 22 for the calculation of EBITDA and Adjusted EBITDA, and a reconciliation of net income determined in accordance with GAAP to these amounts.

(6) Adjusted EBITDA for the three months ended December 31, 2016 includes $52,407 of business management incentive fee expense.

(7) Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment writedowns, if any,

and exclude depreciation and amortization, accounts receivable and intangible assets. Consolidated income available for debt service is earnings from operations

excluding interest expense, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early

extinguishment of debt, gains and losses on sales of property and amortization of deferred charges.

(8) Consolidated income available for debt service for the three months ended December 31, 2016 includes the reversal of $3,865 of previously accrued business

management incentive fee expense. Consolidated income available for debt service for the three months ended June 30, 2017, March 31, 2017, September 30, 2016 and

June 30, 2016 includes $17,750, $19,620, $25,036 and $25,920, respectively, of estimated business management incentive fee expense.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

FF&E RESE

RVE ESCROW

S

20

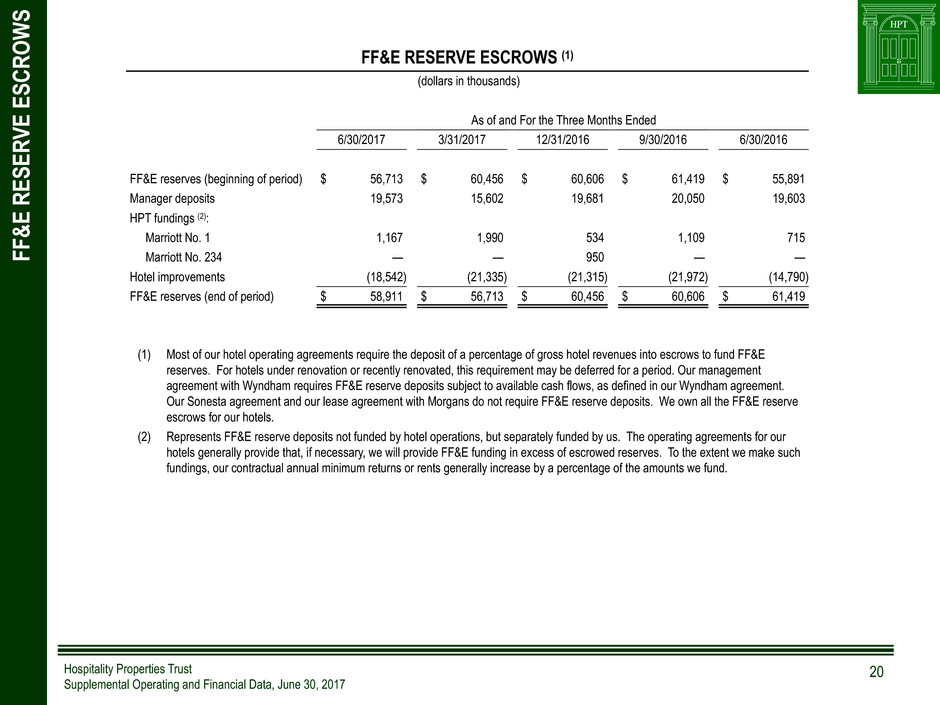

FF&E RESERVE ESCROWS (1)

(dollars in thousands)

As of and For the Three Months Ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

FF&E reserves (beginning of period) $ 56,713 $ 60,456 $ 60,606 $ 61,419 $ 55,891

Manager deposits 19,573 15,602 19,681 20,050 19,603

HPT fundings (2):

Marriott No. 1 1,167 1,990 534 1,109 715

Marriott No. 234 — — 950 — —

Hotel improvements (18,542) (21,335) (21,315) (21,972) (14,790)

FF&E reserves (end of period) $ 58,911 $ 56,713 $ 60,456 $ 60,606 $ 61,419

(1) Most of our hotel operating agreements require the deposit of a percentage of gross hotel revenues into escrows to fund FF&E

reserves. For hotels under renovation or recently renovated, this requirement may be deferred for a period. Our management

agreement with Wyndham requires FF&E reserve deposits subject to available cash flows, as defined in our Wyndham agreement.

Our Sonesta agreement and our lease agreement with Morgans do not require FF&E reserve deposits. We own all the FF&E reserve

escrows for our hotels.

(2) Represents FF&E reserve deposits not funded by hotel operations, but separately funded by us. The operating agreements for our

hotels generally provide that, if necessary, we will provide FF&E funding in excess of escrowed reserves. To the extent we make such

fundings, our contractual annual minimum returns or rents generally increase by a percentage of the amounts we fund.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

PROPERT

Y

ACQUISITION

AND DISPOSITION INFORM

ATION SINCE JANUA

RY

1, 201

7

21

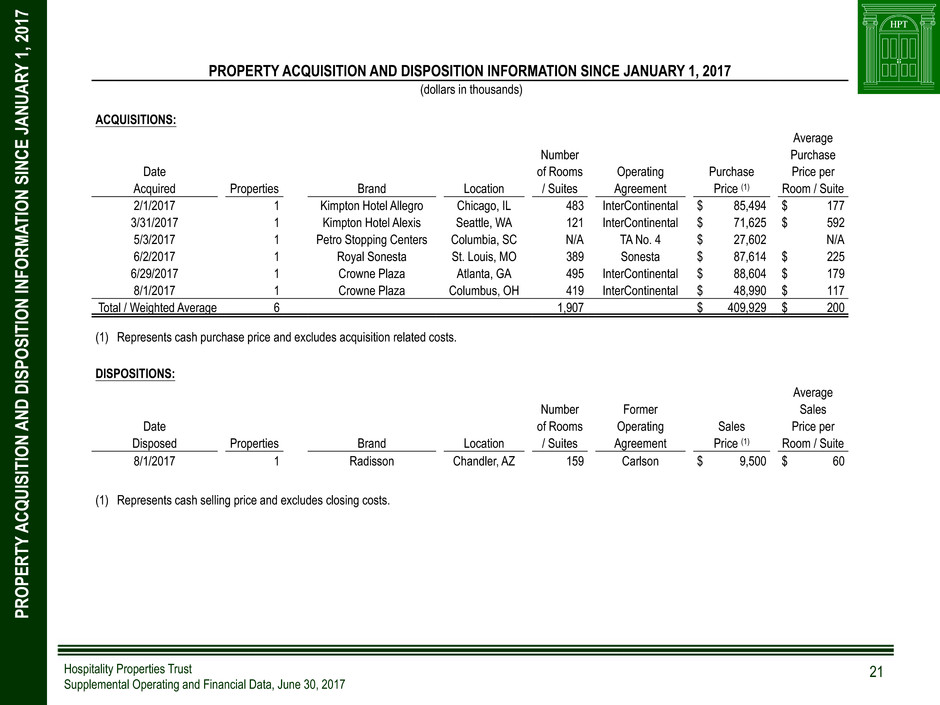

PROPERTY ACQUISITION AND DISPOSITION INFORMATION SINCE JANUARY 1, 2017

(dollars in thousands)

ACQUISITIONS:

Average

Number Purchase

Date of Rooms Operating Purchase Price per

Acquired Properties Brand Location / Suites Agreement Price (1) Room / Suite

2/1/2017 1 Kimpton Hotel Allegro Chicago, IL 483 InterContinental $ 85,494 $ 177

3/31/2017 1 Kimpton Hotel Alexis Seattle, WA 121 InterContinental $ 71,625 $ 592

5/3/2017 1 Petro Stopping Centers Columbia, SC N/A TA No. 4 $ 27,602 N/A

6/2/2017 1 Royal Sonesta St. Louis, MO 389 Sonesta $ 87,614 $ 225

6/29/2017 1 Crowne Plaza Atlanta, GA 495 InterContinental $ 88,604 $ 179

8/1/2017 1 Crowne Plaza Columbus, OH 419 InterContinental $ 48,990 $ 117

Total / Weighted Average 6 1,907 $ 409,929 $ 200

(1) Represents cash purchase price and excludes acquisition related costs.

DISPOSITIONS:

Average

Number Former Sales

Date of Rooms Operating Sales Price per

Disposed Properties Brand Location / Suites Agreement Price (1) Room / Suite

8/1/2017 1 Radisson Chandler, AZ 159 Carlson $ 9,500 $ 60

(1) Represents cash selling price and excludes closing costs.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

CALCUL

ATION OF EBITD

A

AND

ADJUSTED EBITD

A

22

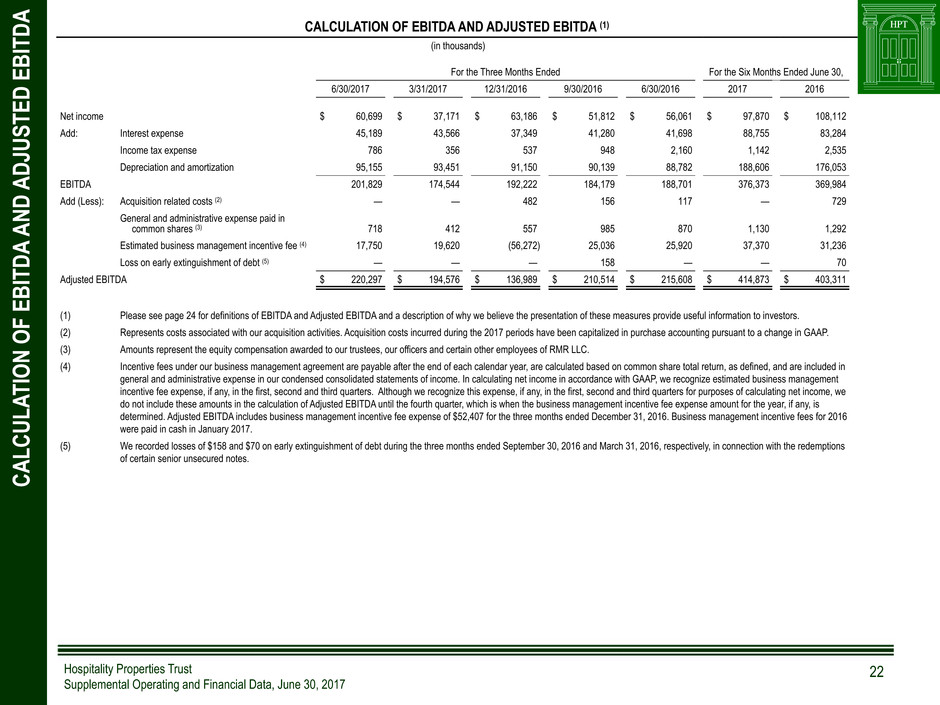

CALCULATION OF EBITDA AND ADJUSTED EBITDA (1)

(in thousands)

For the Three Months Ended For the Six Months Ended June 30,

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016 2017 2016

Net income $ 60,699 $ 37,171 $ 63,186 $ 51,812 $ 56,061 $ 97,870 $ 108,112

Add: Interest expense 45,189 43,566 37,349 41,280 41,698 88,755 83,284

Income tax expense 786 356 537 948 2,160 1,142 2,535

Depreciation and amortization 95,155 93,451 91,150 90,139 88,782 188,606 176,053

EBITDA 201,829 174,544 192,222 184,179 188,701 376,373 369,984

Add (Less): Acquisition related costs (2) — — 482 156 117 — 729

General and administrative expense paid in

common shares (3) 718 412 557 985 870 1,130 1,292

Estimated business management incentive fee (4) 17,750 19,620 (56,272) 25,036 25,920 37,370 31,236

Loss on early extinguishment of debt (5) — — — 158 — — 70

Adjusted EBITDA $ 220,297 $ 194,576 $ 136,989 $ 210,514 $ 215,608 $ 414,873 $ 403,311

(1) Please see page 24 for definitions of EBITDA and Adjusted EBITDA and a description of why we believe the presentation of these measures provide useful information to investors.

(2) Represents costs associated with our acquisition activities. Acquisition costs incurred during the 2017 periods have been capitalized in purchase accounting pursuant to a change in GAAP.

(3) Amounts represent the equity compensation awarded to our trustees, our officers and certain other employees of RMR LLC.

(4) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in

general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management

incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we

do not include these amounts in the calculation of Adjusted EBITDA until the fourth quarter, which is when the business management incentive fee expense amount for the year, if any, is

determined. Adjusted EBITDA includes business management incentive fee expense of $52,407 for the three months ended December 31, 2016. Business management incentive fees for 2016

were paid in cash in January 2017.

(5) We recorded losses of $158 and $70 on early extinguishment of debt during the three months ended September 30, 2016 and March 31, 2016, respectively, in connection with the redemptions

of certain senior unsecured notes.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

CALCUL

ATION OF FUNDS FROM OPER

ATIONS (FFO)

AND NORMALIZED FF

O

AV

AILABLE FOR COMMON SHAREHOLDERS

23

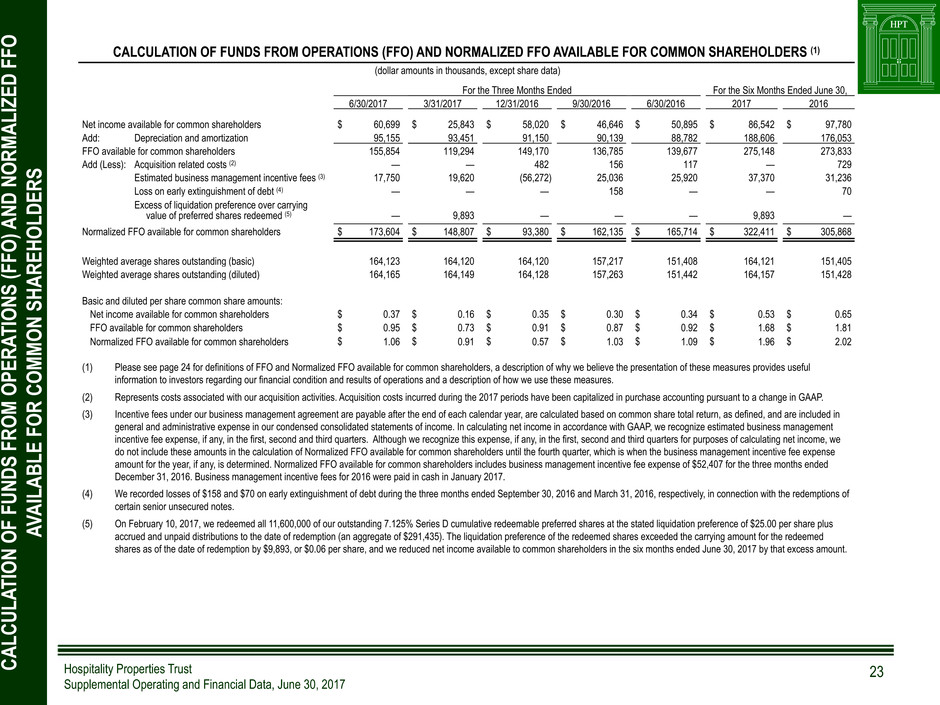

CALCULATION OF FUNDS FROM OPERATIONS (FFO) AND NORMALIZED FFO AVAILABLE FOR COMMON SHAREHOLDERS (1)

(dollar amounts in thousands, except share data)

For the Three Months Ended For the Six Months Ended June 30,

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016 2017 2016

Net income available for common shareholders $ 60,699 $ 25,843 $ 58,020 $ 46,646 $ 50,895 $ 86,542 $ 97,780

Add: Depreciation and amortization 95,155 93,451 91,150 90,139 88,782 188,606 176,053

FFO available for common shareholders 155,854 119,294 149,170 136,785 139,677 275,148 273,833

Add (Less): Acquisition related costs (2) — — 482 156 117 — 729

Estimated business management incentive fees (3) 17,750 19,620 (56,272) 25,036 25,920 37,370 31,236

Loss on early extinguishment of debt (4) — — — 158 — — 70

Excess of liquidation preference over carrying

value of preferred shares redeemed (5) — 9,893 — — — 9,893 —

Normalized FFO available for common shareholders $ 173,604 $ 148,807 $ 93,380 $ 162,135 $ 165,714 $ 322,411 $ 305,868

Weighted average shares outstanding (basic) 164,123 164,120 164,120 157,217 151,408 164,121 151,405

Weighted average shares outstanding (diluted) 164,165 164,149 164,128 157,263 151,442 164,157 151,428

Basic and diluted per share common share amounts:

Net income available for common shareholders $ 0.37 $ 0.16 $ 0.35 $ 0.30 $ 0.34 $ 0.53 $ 0.65

FFO available for common shareholders $ 0.95 $ 0.73 $ 0.91 $ 0.87 $ 0.92 $ 1.68 $ 1.81

Normalized FFO available for common shareholders $ 1.06 $ 0.91 $ 0.57 $ 1.03 $ 1.09 $ 1.96 $ 2.02

(1) Please see page 24 for definitions of FFO and Normalized FFO available for common shareholders, a description of why we believe the presentation of these measures provides useful

information to investors regarding our financial condition and results of operations and a description of how we use these measures.

(2) Represents costs associated with our acquisition activities. Acquisition costs incurred during the 2017 periods have been capitalized in purchase accounting pursuant to a change in GAAP.

(3) Incentive fees under our business management agreement are payable after the end of each calendar year, are calculated based on common share total return, as defined, and are included in

general and administrative expense in our condensed consolidated statements of income. In calculating net income in accordance with GAAP, we recognize estimated business management

incentive fee expense, if any, in the first, second and third quarters. Although we recognize this expense, if any, in the first, second and third quarters for purposes of calculating net income, we

do not include these amounts in the calculation of Normalized FFO available for common shareholders until the fourth quarter, which is when the business management incentive fee expense

amount for the year, if any, is determined. Normalized FFO available for common shareholders includes business management incentive fee expense of $52,407 for the three months ended

December 31, 2016. Business management incentive fees for 2016 were paid in cash in January 2017.

(4) We recorded losses of $158 and $70 on early extinguishment of debt during the three months ended September 30, 2016 and March 31, 2016, respectively, in connection with the redemptions of

certain senior unsecured notes.

(5) On February 10, 2017, we redeemed all 11,600,000 of our outstanding 7.125% Series D cumulative redeemable preferred shares at the stated liquidation preference of $25.00 per share plus

accrued and unpaid distributions to the date of redemption (an aggregate of $291,435). The liquidation preference of the redeemed shares exceeded the carrying amount for the redeemed

shares as of the date of redemption by $9,893, or $0.06 per share, and we reduced net income available to common shareholders in the six months ended June 30, 2017 by that excess amount.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

NON-GAA

P FINANCIA

L MEASURES DEFINITION

S

24

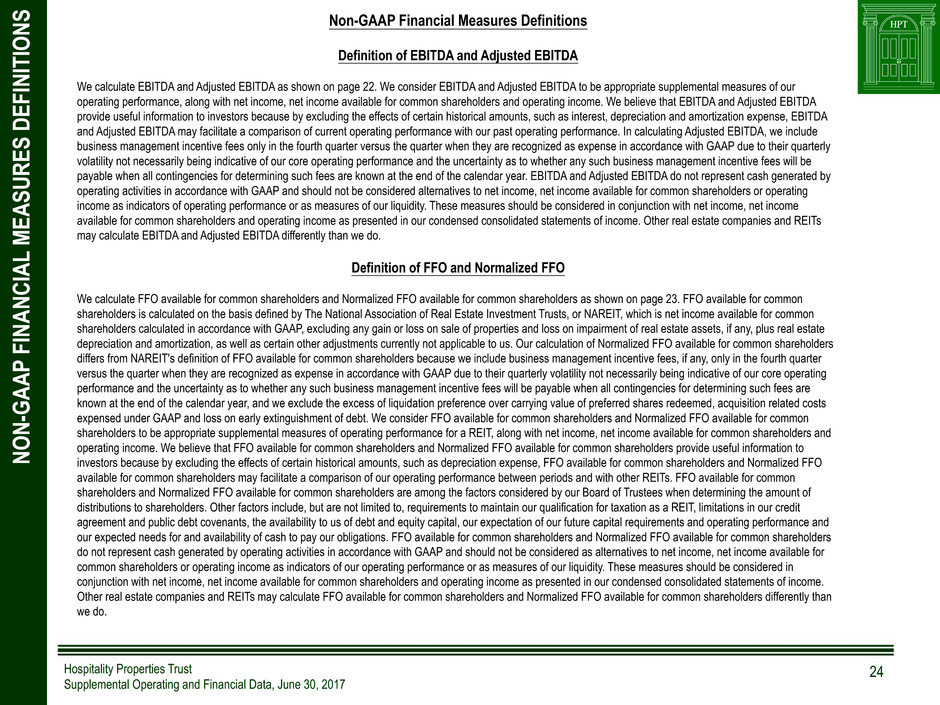

Non-GAAP Financial Measures Definitions

Definition of EBITDA and Adjusted EBITDA

We calculate EBITDA and Adjusted EBITDA as shown on page 22. We consider EBITDA and Adjusted EBITDA to be appropriate supplemental measures of our

operating performance, along with net income, net income available for common shareholders and operating income. We believe that EBITDA and Adjusted EBITDA

provide useful information to investors because by excluding the effects of certain historical amounts, such as interest, depreciation and amortization expense, EBITDA

and Adjusted EBITDA may facilitate a comparison of current operating performance with our past operating performance. In calculating Adjusted EBITDA, we include

business management incentive fees only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly

volatility not necessarily being indicative of our core operating performance and the uncertainty as to whether any such business management incentive fees will be

payable when all contingencies for determining such fees are known at the end of the calendar year. EBITDA and Adjusted EBITDA do not represent cash generated by

operating activities in accordance with GAAP and should not be considered alternatives to net income, net income available for common shareholders or operating

income as indicators of operating performance or as measures of our liquidity. These measures should be considered in conjunction with net income, net income

available for common shareholders and operating income as presented in our condensed consolidated statements of income. Other real estate companies and REITs

may calculate EBITDA and Adjusted EBITDA differently than we do.

Definition of FFO and Normalized FFO

We calculate FFO available for common shareholders and Normalized FFO available for common shareholders as shown on page 23. FFO available for common

shareholders is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or NAREIT, which is net income available for common

shareholders calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate

depreciation and amortization, as well as certain other adjustments currently not applicable to us. Our calculation of Normalized FFO available for common shareholders

differs from NAREIT's definition of FFO available for common shareholders because we include business management incentive fees, if any, only in the fourth quarter

versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of our core operating

performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are

known at the end of the calendar year, and we exclude the excess of liquidation preference over carrying value of preferred shares redeemed, acquisition related costs

expensed under GAAP and loss on early extinguishment of debt. We consider FFO available for common shareholders and Normalized FFO available for common

shareholders to be appropriate supplemental measures of operating performance for a REIT, along with net income, net income available for common shareholders and

operating income. We believe that FFO available for common shareholders and Normalized FFO available for common shareholders provide useful information to

investors because by excluding the effects of certain historical amounts, such as depreciation expense, FFO available for common shareholders and Normalized FFO

available for common shareholders may facilitate a comparison of our operating performance between periods and with other REITs. FFO available for common

shareholders and Normalized FFO available for common shareholders are among the factors considered by our Board of Trustees when determining the amount of

distributions to shareholders. Other factors include, but are not limited to, requirements to maintain our qualification for taxation as a REIT, limitations in our credit

agreement and public debt covenants, the availability to us of debt and equity capital, our expectation of our future capital requirements and operating performance and

our expected needs for and availability of cash to pay our obligations. FFO available for common shareholders and Normalized FFO available for common shareholders

do not represent cash generated by operating activities in accordance with GAAP and should not be considered as alternatives to net income, net income available for

common shareholders or operating income as indicators of our operating performance or as measures of our liquidity. These measures should be considered in

conjunction with net income, net income available for common shareholders and operating income as presented in our condensed consolidated statements of income.

Other real estate companies and REITs may calculate FFO available for common shareholders and Normalized FFO available for common shareholders differently than

we do.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

OPERATING AGREEMENTS AND PORTFOLIO INFORMATION

TownePlace Suites Scottsdale, Scottsdale, AZ

Operator: Marriott International Inc.

Guest Rooms: 130

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

PORTFOLIO B

Y OPER

ATING

AGREEMENT

AND MANAGER

26

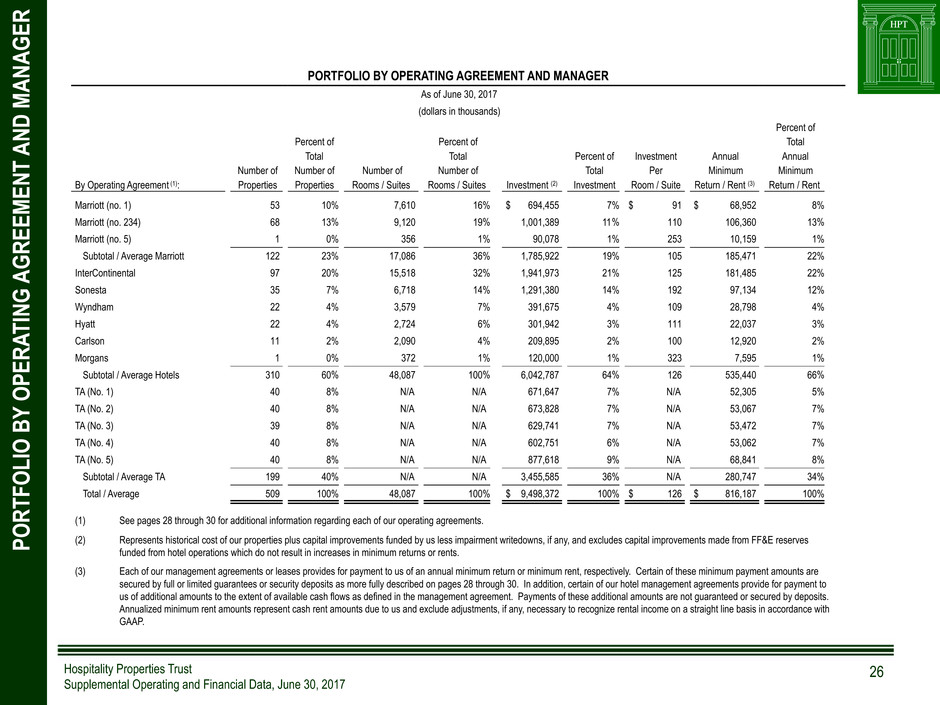

PORTFOLIO BY OPERATING AGREEMENT AND MANAGER

As of June 30, 2017

(dollars in thousands)

Percent of

Percent of Percent of Total

Total Total Percent of Investment Annual Annual

Number of Number of Number of Number of Total Per Minimum Minimum

By Operating Agreement (1): Properties Properties Rooms / Suites Rooms / Suites Investment (2) Investment Room / Suite Return / Rent (3) Return / Rent

Marriott (no. 1) 53 10% 7,610 16% $ 694,455 7% $ 91 $ 68,952 8%

Marriott (no. 234) 68 13% 9,120 19% 1,001,389 11% 110 106,360 13%

Marriott (no. 5) 1 0% 356 1% 90,078 1% 253 10,159 1%

Subtotal / Average Marriott 122 23% 17,086 36% 1,785,922 19% 105 185,471 22%

InterContinental 97 20% 15,518 32% 1,941,973 21% 125 181,485 22%

Sonesta 35 7% 6,718 14% 1,291,380 14% 192 97,134 12%

Wyndham 22 4% 3,579 7% 391,675 4% 109 28,798 4%

Hyatt 22 4% 2,724 6% 301,942 3% 111 22,037 3%

Carlson 11 2% 2,090 4% 209,895 2% 100 12,920 2%

Morgans 1 0% 372 1% 120,000 1% 323 7,595 1%

Subtotal / Average Hotels 310 60% 48,087 100% 6,042,787 64% 126 535,440 66%

TA (No. 1) 40 8% N/A N/A 671,647 7% N/A 52,305 5%

TA (No. 2) 40 8% N/A N/A 673,828 7% N/A 53,067 7%

TA (No. 3) 39 8% N/A N/A 629,741 7% N/A 53,472 7%

TA (No. 4) 40 8% N/A N/A 602,751 6% N/A 53,062 7%

TA (No. 5) 40 8% N/A N/A 877,618 9% N/A 68,841 8%

Subtotal / Average TA 199 40% N/A N/A 3,455,585 36% N/A 280,747 34%

Total / Average 509 100% 48,087 100% $ 9,498,372 100% $ 126 $ 816,187 100%

(1) See pages 28 through 30 for additional information regarding each of our operating agreements.

(2) Represents historical cost of our properties plus capital improvements funded by us less impairment writedowns, if any, and excludes capital improvements made from FF&E reserves

funded from hotel operations which do not result in increases in minimum returns or rents.

(3) Each of our management agreements or leases provides for payment to us of an annual minimum return or minimum rent, respectively. Certain of these minimum payment amounts are

secured by full or limited guarantees or security deposits as more fully described on pages 28 through 30. In addition, certain of our hotel management agreements provide for payment to

us of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed or secured by deposits.

Annualized minimum rent amounts represent cash rent amounts due to us and exclude adjustments, if any, necessary to recognize rental income on a straight line basis in accordance with

GAAP.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

PORTFOLIO B

Y BRAN

D

27

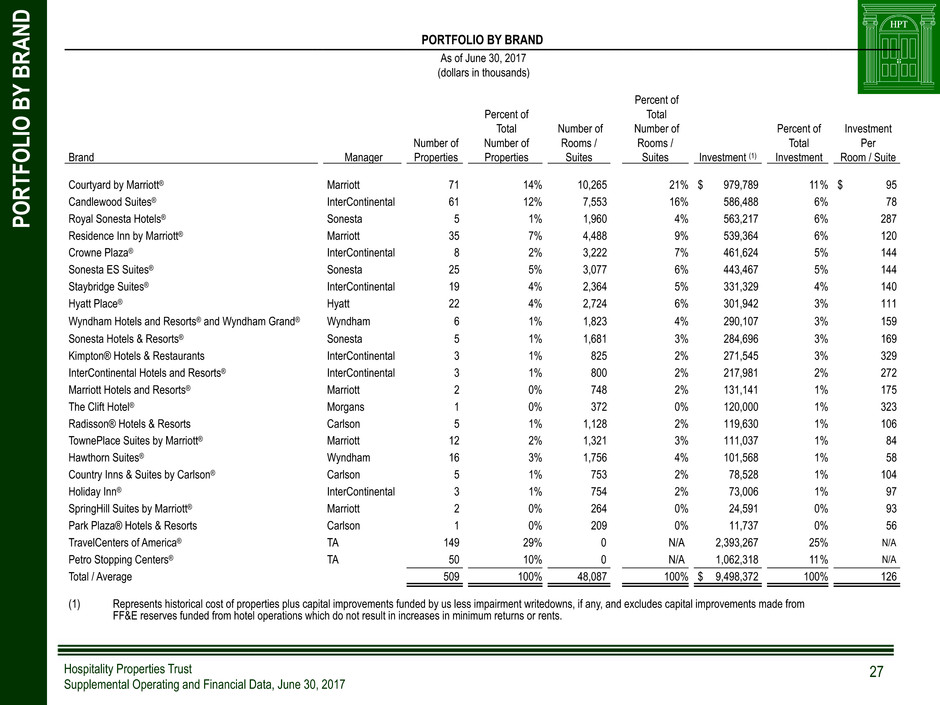

PORTFOLIO BY BRAND

As of June 30, 2017

(dollars in thousands)

Percent of

Percent of Total

Total Number of Number of Percent of Investment

Number of Number of Rooms / Rooms / Total Per

Brand Manager Properties Properties Suites Suites Investment (1) Investment Room / Suite

Courtyard by Marriott® Marriott 71 14% 10,265 21% $ 979,789 11% $ 95

Candlewood Suites® InterContinental 61 12% 7,553 16% 586,488 6% 78

Royal Sonesta Hotels® Sonesta 5 1% 1,960 4% 563,217 6% 287

Residence Inn by Marriott® Marriott 35 7% 4,488 9% 539,364 6% 120

Crowne Plaza® InterContinental 8 2% 3,222 7% 461,624 5% 144

Sonesta ES Suites® Sonesta 25 5% 3,077 6% 443,467 5% 144

Staybridge Suites® InterContinental 19 4% 2,364 5% 331,329 4% 140

Hyatt Place® Hyatt 22 4% 2,724 6% 301,942 3% 111

Wyndham Hotels and Resorts® and Wyndham Grand® Wyndham 6 1% 1,823 4% 290,107 3% 159

Sonesta Hotels & Resorts® Sonesta 5 1% 1,681 3% 284,696 3% 169

Kimpton® Hotels & Restaurants InterContinental 3 1% 825 2% 271,545 3% 329

InterContinental Hotels and Resorts® InterContinental 3 1% 800 2% 217,981 2% 272

Marriott Hotels and Resorts® Marriott 2 0% 748 2% 131,141 1% 175

The Clift Hotel® Morgans 1 0% 372 0% 120,000 1% 323

Radisson® Hotels & Resorts Carlson 5 1% 1,128 2% 119,630 1% 106

TownePlace Suites by Marriott® Marriott 12 2% 1,321 3% 111,037 1% 84

Hawthorn Suites® Wyndham 16 3% 1,756 4% 101,568 1% 58

Country Inns & Suites by Carlson® Carlson 5 1% 753 2% 78,528 1% 104

Holiday Inn® InterContinental 3 1% 754 2% 73,006 1% 97

SpringHill Suites by Marriott® Marriott 2 0% 264 0% 24,591 0% 93

Park Plaza® Hotels & Resorts Carlson 1 0% 209 0% 11,737 0% 56

TravelCenters of America® TA 149 29% 0 N/A 2,393,267 25% N/A

Petro Stopping Centers® TA 50 10% 0 N/A 1,062,318 11% N/A

Total / Average 509 100% 48,087 100% $ 9,498,372 100% 126

(1) Represents historical cost of properties plus capital improvements funded by us less impairment writedowns, if any, and excludes capital improvements made from

FF&E reserves funded from hotel operations which do not result in increases in minimum returns or rents.

Hospitality Properties Trust

Supplemental Operating and Financial Data, June 30, 2017

OPER

ATING

AGREEMENT INFORM

ATIO

N

28

Marriott No. 1- We lease 53 Courtyard by Marriott® branded hotels in 24 states to one of our taxable REIT subsidiaries, or TRSs. The hotels are managed by a subsidiary of Marriott under a

combination management agreement which expires in 2024; Marriott has two renewal options for 12 years each for all, but not less than all, of the hotels.

We have no security deposit or guaranty from Marriott for these 53 hotels. Accordingly, payment by Marriott of the minimum return due to us under this management agreement is limited to the

hotels' available cash flows after payment of operating expenses and funding of the FF&E reserve. In addition to our minimum return, this agreement provides for payment to us of 50% of

available cash flows after payment of hotel operating expenses, funding of the required FF&E reserve, payment of our minimum return and payment of certain management fees.

Marriott No. 234- We lease 68 of our Marriott branded hotels (one full service Marriott®, 35 Residence Inn by Marriott®, 18 Courtyard by Marriott®, 12 TownePlace Suites by Marriott® and two

SpringHill Suites by Marriott® hotels) in 22 states to one of our TRSs. The hotels are managed by subsidiaries of Marriott under a combination management agreement which expires in 2025;

Marriott has two renewal options for 10 years each for all, but not less than all, of the hotels.

We originally held a security deposit of $64,700 under this agreement to cover payment shortfalls of our minimum return. As of June 30, 2017, the available balance of this security deposit was

$22,346. This security deposit may be replenished from a share of future cash flows from these hotels in excess of our minimum return and certain management fees. Marriott has also

provided us with a $40,000 limited guaranty to cover payment shortfalls up to 90% of our minimum return after the available security deposit balance has been depleted, which expires in 2019.

As of June 30, 2017, the available Marriott guaranty was $30,672.

In addition to our minimum return, this agreement provides for payment to us of 62.5% of excess cash flows after payment of hotel operating expenses, funding of the required FF&E reserve,

payment of our minimum return, payment of certain management fees and replenishment of the security deposit. This additional return amount is not guaranteed or secured by the security

deposit.

Marriott No. 5- We lease one Marriott® branded hotel in Kauai, HI to a subsidiary of Marriott under a lease that expires in 2019. Marriott has four renewal options for 15 years each. On August

31, 2016, Marriott notified us that it will not exercise its renewal option at the expiration of the current lease term ending on December 31, 2019. This lease is guaranteed by Marriott and

provides for increases in the annual minimum rent payable to us based on changes in the consumer price index.

InterContinental- We lease our 96 InterContinental branded hotels (19 Staybridge Suites®, 61 Candlewood Suites®, two InterContinental®, eight Crowne Plaza®, three Holiday Inn® and three

Kimpton® Hotels & Restaurants) in 28 states in the U.S. and Ontario, Canada to one of our TRSs. These 96 hotels are managed by subsidiaries of InterContinental under a combination

management agreement. We lease one additional InterContinental® branded hotel in Puerto Rico to a subsidiary of InterContinental. The annual minimum return amount presented in the table

on page 26 includes $7,904 of minimum rent related to the leased Puerto Rico hotel. The management agreement and the lease expire in 2036; InterContinental has two renewal options for 15

years each for all, but not less than all, of the hotels.