Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STAAR SURGICAL CO | v472677_8k.htm |

Exhibit 99.1

INVESTOR PRESENTATION NASDAQ: STAA August 2017 Evolution in Visual Freedom ™

™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH F ORWARD - L OOKING S TATEMENTS All statements in this presentation that are not statements of historical fact are forward - looking statements, including statements about any of the following : any projections of earnings, revenue, sales, profit margins, cash, working capital, effective tax rate or any other financial items ; the plans, strategies, and objectives of management for future operations or prospects for achieving such plans ; statements regarding new, existing, or improved products, including but not limited to, expectations for sales, marketing and clinical initiatives, investment imperatives, expectations for success and timing of new, existing, or improved products in the U . S . or international markets or government approval of new or improved products (including the Toric ICL in the U . S . ) ; the nature, timing and likelihood of resolving issues cited in the FDA’s 2014 Warning Letter or 2015 FDA Form 483 ; future economic conditions or size of market opportunities ; expected costs of quality system or FDA remediation ; statements of belief, including as to achieving 2017 plans ; expected regulatory activities and approvals, product launches, and any statements of assumptions underlying any of the foregoing . Important additional factors that could cause actual results to differ materially from those indicated by such forward - looking statements are set forth in the company’s Annual Report on Form 10 - K for the year ended December 30 , 2016 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings . ” We disclaim any intention or obligation to update or revise any financial projections or forward - looking statements due to new information or events . These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements . The risks and uncertainties include the following : our limited capital resources and limited access to financing ; the negative effect of unstable global economic conditions on sales of products, especially products such as the ICL used in non - reimbursed elective procedures ; changes in currency exchange rates ; the discretion of regulatory agencies to approve or reject new, existing or improved products, or to require additional actions before approval (including but not limited to FDA requirements regarding the TICL and/or actions related to the 2014 FDA Warning Letter or 2015 FDA Form 483 ) or to take enforcement action ; research and development efforts will not be successful or may be delayed in delivering products for launch ; the purchasing patterns of distributors carrying inventory in the market ; the willingness of surgeons and patients to adopt a new or improved product and procedure ; and patterns of Visian ICL use that have typically limited our penetration of the refractive procedure market . The Visian Toric ICL and the Visian ICL with CentraFLOW are not yet approved for sale in the United States . In addition, to supplement the GAAP numbers, this presentation includes supplemental non - GAAP financial information, which STAAR believes investors will find helpful in understanding its operating performance . “Adjusted Net Income or (Loss)” excludes the following items that are included in “Net Income (Loss)” as calculated in accordance with U . S . generally accepted accounting principles (“GAAP”) : gain or loss on foreign currency transactions, stock - based compensation expenses and remediation expenses . A table reconciling the GAAP information to the non - GAAP information is included in our financial release which can be found in our Form 8 - K filed on August 2 , 2017 and also available on our website .

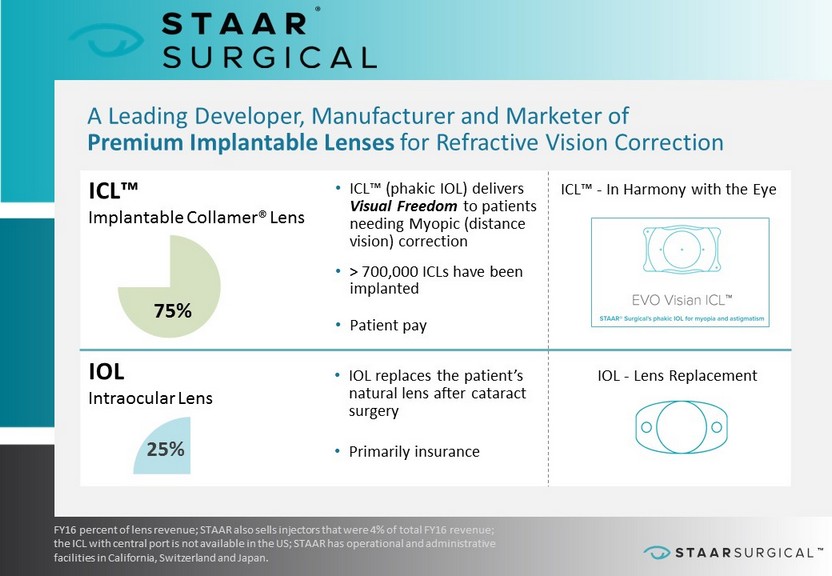

™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH A Leading Developer, Manufacturer and Marketer of Premium Implantable Lenses for Refractive Vision Correction FY16 percent of lens revenue; STAAR also sells injectors that were 4% of total FY16 revenue; the ICL with central port is not available in the US; STAAR has operational and administrative facilities in California, Switzerland and Japan. ICL™ Implantable Collamer® Lens • ICL™ (phakic IOL) delivers Visual Freedom to patients needing Myopic (distance vision) correction • > 700,000 ICLs have been implanted • Patient pay IOL Intraocular Lens • IOL replaces the patient’s natural lens after cataract surgery • Primarily insurance 75% 25% ICL™ - In Harmony with the Eye IOL - Lens Replacement

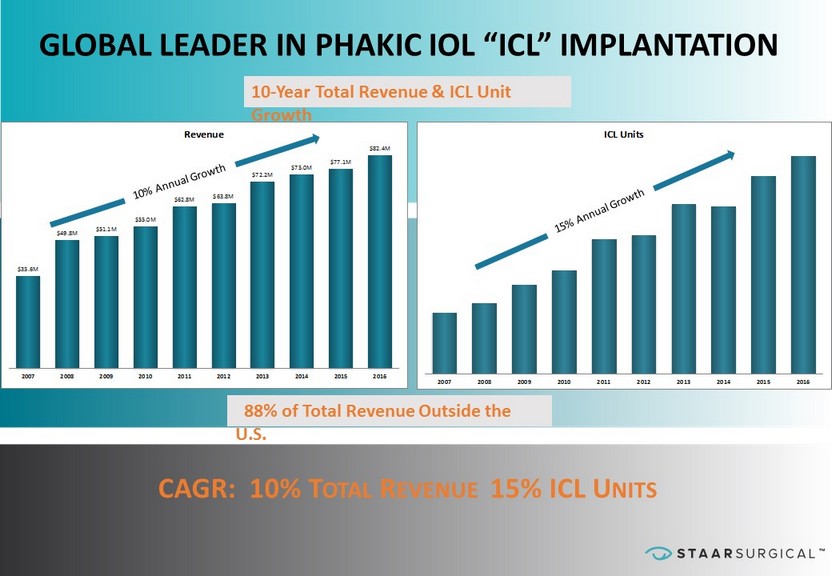

™ ™ $35.6M $49.8M $51.1M $55.0M $62.8M $63.8M $72.2M $75.0M $77.1M $82.4M 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Revenue 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 ICL Units GLOBAL LEADER IN PHAKIC IOL “ICL” IMPLANTATION CAGR: 10% T OTAL R EVENUE 15% ICL U NITS 10 - Year Total Revenue & ICL Unit Growth 88% of Total Revenue Outside the U.S.

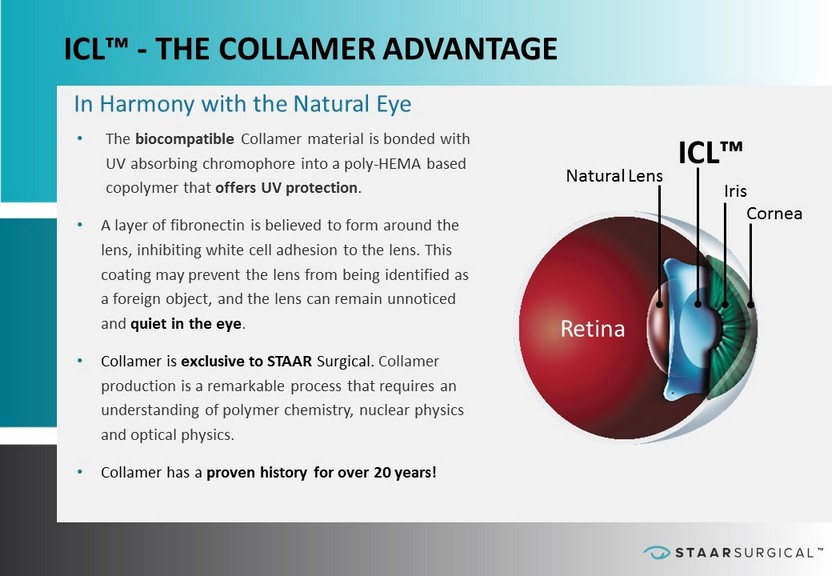

™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH ICL™ - THE COLLAMER ADVANTAGE • The biocompatible Collamer material is bonded with UV absorbing chromophore into a poly - HEMA based copolymer that offers UV protection . • A layer of fibronectin is believed to form around the lens, inhibiting white cell adhesion to the lens. This coating may prevent the lens from being identified as a foreign object, and the lens can remain unnoticed and quiet in the eye . • Collamer is exclusive to STAAR Surgical. Collamer production is a remarkable process that requires an understanding of polymer chemistry, nuclear physics and optical physics. • Collamer has a proven history for over 20 years! In Harmony with the Natural Eye Iris Cornea ICL™ Retina Natural Lens

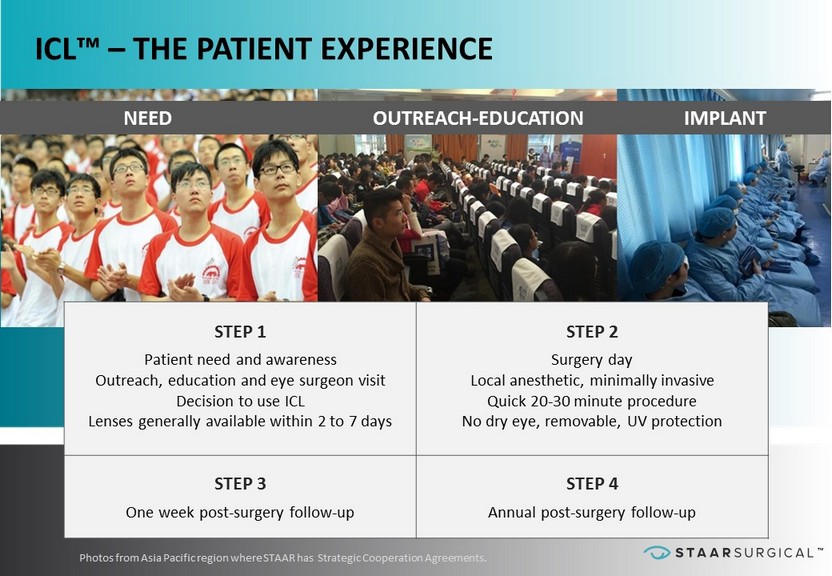

™ ICL™ – THE PATIENT EXPERIENCE NEED OUTREACH - EDUCATION IMPLANT Photos from Asia Pacific region where STAAR has S trategic C ooperation A greements. STEP 1 Patient need and awareness Outreach, education and eye surgeon visit Decision to use ICL Lenses generally available within 2 to 7 days STEP 2 Surgery day Local anesthetic, minimally invasive Quick 20 - 30 minute procedure No dry eye, removable, UV protection STEP 3 One week post - surgery follow - up STEP 4 Annual post - surgery follow - up

™ PATIENT TESTIMONIALS We invite you to visit staar.com, discoverevo.com and discovericl.com

™ MYOPIA A Growing Global Concern… High Myopia Could Impact Almost One Billion People by 2050… • Researchers expect dramatic increase in myopia - More screen use and near vision work - Less time spent outdoors - Positive correlation between education level and myopia incidence • Patients face risks in allowing high myopia to go untreated - Glaucoma - Cataracts - Macular degeneration - Retinal detachment Journal of Ophthalmology; The Atlantic, February 19, 2016; and Singapore Health Promotion Board.

™ PRESBYOPIA A New Refractive Market Opportunity Impacts 1.7 Billion People Globally… • An inability to focus on near distances - An age - related loss of lens accommodation - First symptoms generally appear age 42 to 44 • Surgical Refractive options - Monofocal Corneal Inlays (KAMRA, Raindrop) - Lasik (SMILE) - Refractive Lens Exchange (RLE) • An ICL refractive solution could be more desirable to patients seeking Visual Freedom

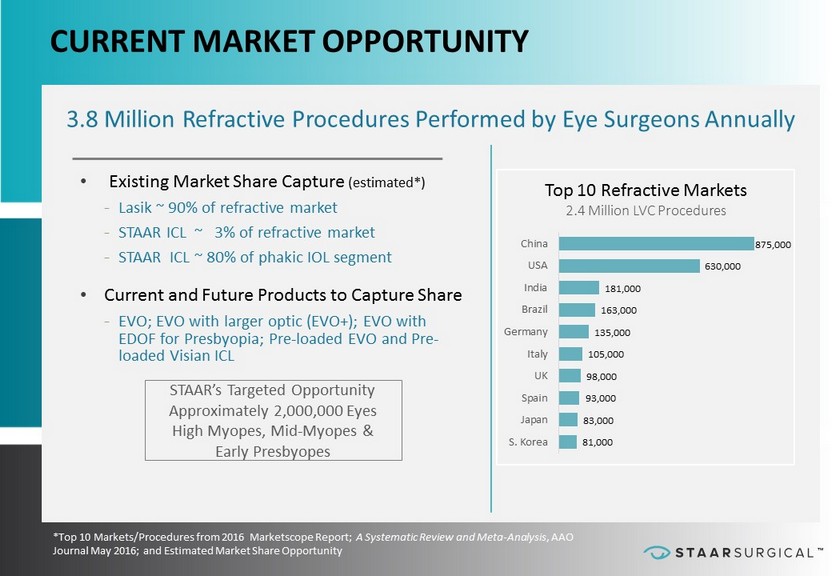

™ BUILDING A FOUNDATION FOR CONSISTENT GROWTH CURRENT MARKET OPPORTUNITY 3.8 Million Refractive Procedures Performed by Eye Surgeons Annually • Existing Market S hare C apture (estimated*) - Lasik ~ 90% of refractive market - STAAR ICL ~ 3 % of refractive market - STAAR ICL ~ 80% of phakic IOL segment • Current and Future Products to Capture Share - EVO; EVO with larger optic (EVO+); EVO with EDOF for Presbyopia; Pre - loaded EVO and Pre - loaded Visian ICL STAAR’s Targeted Opportunity Approximately 2,000,000 Eyes High Myopes, Mid - Myopes & Early Presbyopes *Top 10 Markets/Procedures from 2016 Marketscope Report ; A S ystematic R eview and Meta - Analysis , AAO Journal May 2016; and Estimated M arket S hare O pportunity 81,000 83,000 93,000 98,000 105,000 135,000 163,000 181,000 630,000 875,000 S. Korea Japan Spain UK Italy Germany Brazil India USA China Top 10 Refractive Markets 2.4 Million LVC Procedures

™ STRATEGIC FOCUS Building a Foundation for Consistent Growth (2015 – 2017) Investments targeted to rebuild and strengthen base business model I. Engender Culture of Quality • FDA Remediation and Systemic Change II. Build R & D Continuum • Myopia/ Presbyopia/ Cataract Care III. Develop Clinical Expertise • Global Clinical Validation and Clinical Utility Competency IV. Create an Extraordinary Surgeon and Patient Experience V. Invest in Proprietary Technology and Process Improvements VI. Properly Size Commercial Strategic Investment – People and Services VII. Deliver Shareholder Value

™ STRATEGIC PROGRESS Building a Foundation for Consistent Growth (2015 - 2017) 1. Acquired and validated New Quality Management System … established Culture of Quality 2. Hired Top Talent in R&D, Clinical and Medical Affairs, Quality and Operations 3. Developed and closed Transformational Strategic Cooperation Agreements with several large hospitals and clinics representing committed future volume > 20% of ICL business 4. Created New Strategic Direction to position STAAR as a premium and primary provider of lenses delivering Visual Freedom to patients

™ STRATEGIC PROGRESS Building a Foundation for Consistent Growth (2015 – 2017) 5. Rebranded STAAR… Launched Evolution in Visual Freedom™ global websites in all major markets… discovervisianicl.com and discoverEVO.com 6. Successfully Launched EVO+™ Expanded Optic ICL Lenses in Europe with clinical papers and patient experience data supporting lens performance 7. Received regulatory approval and Launched EVO™ Aspheric and Toric ICL Lenses in Canada with surgeons trained and patient demand aligned for immediate target market adoption. 8. Completed Cataract Care Analysis and Implemented Strategy … expanding with premium Collamer IOL with EDOF optic planned for future development The EVO Visian ICL with central port is not available in the US. discoverEVO.com and discovervisianicl.com

™ STRATEGIC PROGRESS Building a Foundation for Consistent Growth (2015 - 2017) 9. Built Clinical and Medical Affairs competency … completed global meta analysis of all peer reviewed clinical data on ICL with published paper in Clinical Ophthalmology June 2016 10. Received CE Mark approval for EVO with Aspheric ( EDOF ) Optic next generation ICL lenses. New lenses to be introduced to select group of surgeons for early effectiveness observational use

™ STRATEGIC PROGRESS Building a Foundation for Consistent Growth (2015 - 2017) 11. Achieved record total revenue and ICL unit sales 12. Met all internal requirements on budget and on time for FDA Remediation and Systemic Change . Notified FDA we are ready for inspection 13. All currently CE Marked and commercially available products re - certified for 5 Years by DEKRA our EU Notified Body.

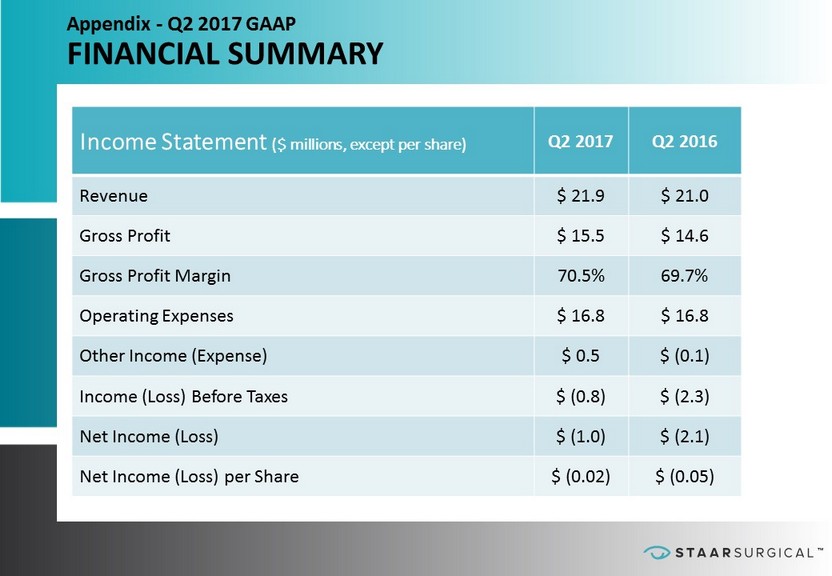

™ Appendix - Q2 2017 GAAP FINANCIAL SUMMARY Income Statement ($ millions, except per share) Q2 2017 Q2 2016 Revenue $ 21.9 $ 21.0 Gross Profit $ 15.5 $ 14.6 Gross Profit Margin 70.5% 69.7% Operating Expenses $ 16.8 $ 16.8 Other Income (Expense) $ 0.5 $ (0.1) Income (Loss) Before Taxes $ (0.8) $ (2.3) Net Income (Loss) $ ( 1.0) $ (2.1) Net Income (Loss) per Share $ (0.02) $ (0.05)

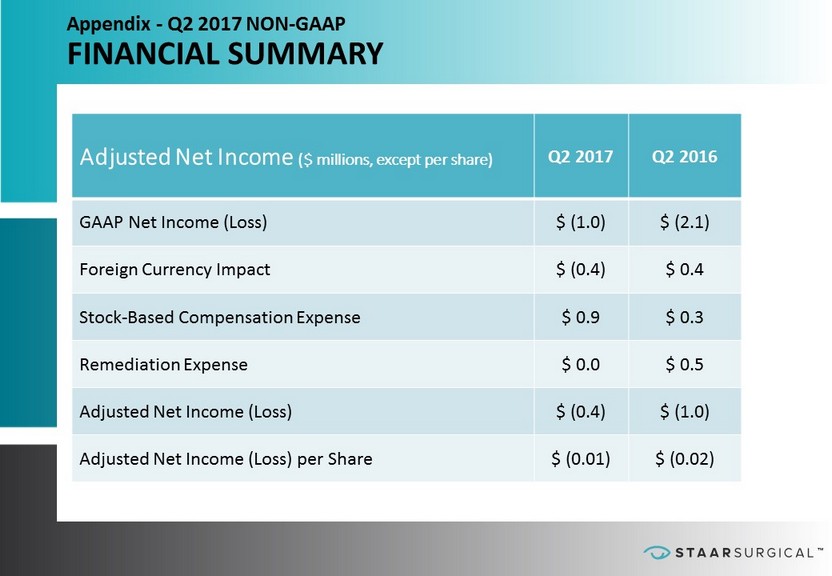

™ Appendix - Q2 2017 NON - GAAP FINANCIAL SUMMARY Adjusted Net Income ($ millions, except per share) Q2 2017 Q2 2016 GAAP Net Income (Loss) $ (1.0) $ (2.1) Foreign Currency Impact $ (0.4) $ 0.4 Stock - Based Compensation Expense $ 0.9 $ 0.3 Remediation Expense $ 0.0 $ 0.5 Adjusted Net Income (Loss) $ (0.4) $ (1.0) Adjusted Net Income (Loss) per Share $ (0.01) $ (0.02)

™ 1H 2017 RESULTS Key Takeaways • Net Sales of $42.3 Million Up 5% from the Prior Year Period • ICL Sales Up 11% and Units Up 15% from the Prior Year Period • IOL Sales Down 11% from the Prior Year Period • Gross Margin Improved to 71.1% of Sales from 68.6% of Sales in the Prior Year Period Forward Looking Metrics • Double Digit ICL Unit Growth Projected for 2017 • Gross Margin Expansion Projected for 2017 • Continued Investment in Operations to Support Base Business and Investment in Strategic Priorities; Overall 2017 Planned Expenses Less than 2016 • Strategic Direction for 2018 – 2020 in Process

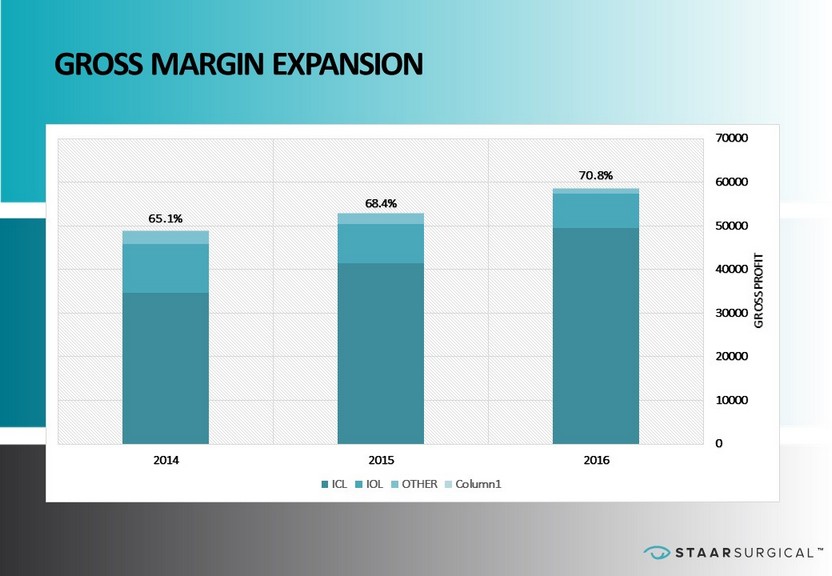

™ GROSS MARGIN EXPANSION 65.1% 68.4% 70.8% 2014 2015 2016 0 10000 20000 30000 40000 50000 60000 70000 GROSS PROFIT ICL IOL OTHER Column1

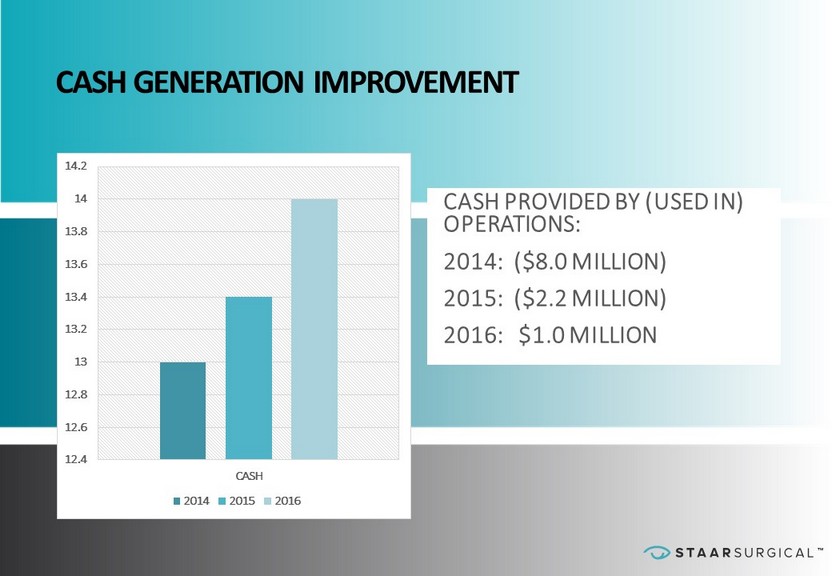

™ CASH GENERATION IMPROVEMENT 12.4 12.6 12.8 13 13.2 13.4 13.6 13.8 14 14.2 CASH 2014 2015 2016 CASH PROVIDED BY (USED IN) OPERATIONS: 2014: ($8.0 MILLION) 2015: ($2.2 MILLION) 2016: $1.0 MILLION

™ INVESTMENT CONSIDERATIONS x Growing “Millions of Eyes” Global Opportunity x Double - Digit ICL Unit Growth x Expanding Gross Margin x Operating Expense Investments Well Managed to Support Base Business and Strategic Priorities x Transformative Strategic Agreements/Alliances x Completed FDA Remediation Plan on Time and On - Budget x CE Marked and Commercially Available Products Re - Certified for 5 Years

INVESTOR PRESENTATION NASDAQ: STAA August 2017 Evolution in Visual Freedom ™