Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Manning & Napier, Inc. | exhibit322_q22017form10-q.htm |

| EX-32.1 - EXHIBIT 32.1 - Manning & Napier, Inc. | exhibit321_q22017form10-q.htm |

| EX-31.2 - EXHIBIT 31.2 - Manning & Napier, Inc. | exhibit312_q22017form10-q.htm |

| EX-31.1 - EXHIBIT 31.1 - Manning & Napier, Inc. | exhibit311_q22017form10-q.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________

FORM 10-Q

_____________________________________________________________

(Mark One)

x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2017

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35355

_____________________________________________________________

MANNING & NAPIER, INC.

(Exact name of registrant as specified in its charter)

_____________________________________________________________

Delaware | 45-2609100 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

290 Woodcliff Drive Fairport, New York | 14450 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(585) 325-6880

_____________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act:

Large accelerated filer | ¨ | Accelerated filer | x | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Emerging growth company | ¨ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

Class | Outstanding at August 4, 2017 | |

Class A common stock, $0.01 par value per share | 15,079,347 | |

Class B common stock, $0.01 par value per share | 1,000 | |

TABLE OF CONTENTS

Page | ||

Part I | ||

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Part II | ||

Item 1A. | ||

Item 6. | ||

In this Quarterly Report on Form 10-Q, “we”, “our”, “us”, the “Company”, “Manning & Napier” and the “Registrant” refers to Manning & Napier, Inc. and, unless the context otherwise requires, its consolidated direct and indirect subsidiaries and predecessors. | ||

i

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

Manning & Napier, Inc.

Consolidated Statements of Financial Condition

(In thousands, except share data)

June 30, 2017 | December 31, 2016 | |||||||

(unaudited) | ||||||||

Assets | ||||||||

Cash and cash equivalents | $ | 92,958 | $ | 100,819 | ||||

Accounts receivable | 11,727 | 15,434 | ||||||

Accounts receivable—affiliated mutual funds | 5,988 | 6,761 | ||||||

Investment securities | 45,251 | 36,475 | ||||||

Investment securities - consolidated funds | — | 995 | ||||||

Prepaid expenses and other assets | 3,850 | 4,883 | ||||||

Total current assets | 159,774 | 165,367 | ||||||

Property and equipment, net | 5,599 | 5,680 | ||||||

Net deferred tax assets, non-current | 39,922 | 41,905 | ||||||

Goodwill | 4,829 | 4,829 | ||||||

Other long-term assets | 2,796 | 2,818 | ||||||

Total assets | $ | 212,920 | $ | 220,599 | ||||

Liabilities | ||||||||

Accounts payable | $ | 1,315 | $ | 2,053 | ||||

Accrued expenses and other liabilities | 25,735 | 35,115 | ||||||

Deferred revenue | 10,483 | 10,210 | ||||||

Total current liabilities | 37,533 | 47,378 | ||||||

Other long-term liabilities | 3,684 | 4,034 | ||||||

Amounts payable under tax receivable agreement, non-current | 34,709 | 34,709 | ||||||

Total liabilities | 75,926 | 86,121 | ||||||

Commitments and contingencies (Note 8) | ||||||||

Shareholders’ equity | ||||||||

Class A common stock, $0.01 par value; 300,000,000 shares authorized; 15,079,347 and 14,982,880 shares issued and outstanding at June 30, 2017 and December 31, 2016, respectively | 151 | 150 | ||||||

Class B common stock, $0.01 par value; 2,000 shares authorized, 1,000 shares issued and outstanding at June 30, 2017 and December 31, 2016 | — | — | ||||||

Additional paid-in capital | 198,486 | 200,158 | ||||||

Retained deficit | (36,074 | ) | (37,383 | ) | ||||

Accumulated other comprehensive income (loss) | (28 | ) | (13 | ) | ||||

Total shareholders’ equity | 162,535 | 162,912 | ||||||

Noncontrolling interests | (25,541 | ) | (28,434 | ) | ||||

Total shareholders’ equity and noncontrolling interests | 136,994 | 134,478 | ||||||

Total liabilities, shareholders’ equity and noncontrolling interests | $ | 212,920 | $ | 220,599 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

1

Manning & Napier, Inc.

Consolidated Statements of Operations

(In thousands, except share data)

(Unaudited)

Three months ended June 30, | Six months ended June 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Revenues | ||||||||||||||||

Investment management services revenue | $ | 51,536 | $ | 64,505 | $ | 107,021 | $ | 126,547 | ||||||||

Expenses | ||||||||||||||||

Compensation and related costs | 22,233 | 24,379 | 45,614 | 46,346 | ||||||||||||

Distribution, servicing and custody expenses | 7,084 | 8,950 | 14,495 | 17,792 | ||||||||||||

Other operating costs | 7,234 | 8,213 | 15,212 | 16,666 | ||||||||||||

Total operating expenses | 36,551 | 41,542 | 75,321 | 80,804 | ||||||||||||

Operating income | 14,985 | 22,963 | 31,700 | 45,743 | ||||||||||||

Non-operating income (loss) | ||||||||||||||||

Interest expense | (2 | ) | (106 | ) | (12 | ) | (212 | ) | ||||||||

Interest and dividend income | 238 | 180 | 418 | 316 | ||||||||||||

Change in liability under tax receivable agreement | — | — | — | (18 | ) | |||||||||||

Net gains (losses) on investments | 610 | 206 | 1,582 | 1,272 | ||||||||||||

Total non-operating income (loss) | 846 | 280 | 1,988 | 1,358 | ||||||||||||

Income before provision for income taxes | 15,831 | 23,243 | 33,688 | 47,101 | ||||||||||||

Provision for income taxes | 1,242 | 1,545 | 2,585 | 3,219 | ||||||||||||

Net income attributable to controlling and noncontrolling interests | 14,589 | 21,698 | 31,103 | 43,882 | ||||||||||||

Less: net income attributable to noncontrolling interests | 12,904 | 19,093 | 27,521 | 38,859 | ||||||||||||

Net income attributable to Manning & Napier, Inc. | $ | 1,685 | $ | 2,605 | $ | 3,582 | $ | 5,023 | ||||||||

Net income per share available to Class A common stock | ||||||||||||||||

Basic | $ | 0.12 | $ | 0.17 | $ | 0.25 | $ | 0.34 | ||||||||

Diluted | $ | 0.12 | $ | 0.17 | $ | 0.25 | $ | 0.33 | ||||||||

Weighted average shares of Class A common stock outstanding | ||||||||||||||||

Basic | 14,111,368 | 13,960,768 | 14,077,313 | 13,852,949 | ||||||||||||

Diluted | 14,298,834 | 14,243,579 | 14,256,911 | 14,209,811 | ||||||||||||

Cash dividends declared per share of Class A common stock | $ | 0.08 | $ | 0.16 | $ | 0.16 | $ | 0.32 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

2

Manning & Napier, Inc.

Consolidated Statements of Comprehensive Income

(In thousands)

(Unaudited)

Three months ended June 30, | Six months ended June 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

Net income attributable to controlling and noncontrolling interests | $ | 14,589 | $ | 21,698 | $ | 31,103 | $ | 43,882 | ||||||||

Net unrealized holding gain (loss) on investment securities, net of tax | (9 | ) | 3 | (15 | ) | 6 | ||||||||||

Comprehensive income | $ | 14,580 | $ | 21,701 | $ | 31,088 | $ | 43,888 | ||||||||

Less: Comprehensive income attributable to noncontrolling interests | 12,895 | 19,096 | 27,506 | 38,865 | ||||||||||||

Comprehensive income attributable to Manning & Napier, Inc. | $ | 1,685 | $ | 2,605 | $ | 3,582 | $ | 5,023 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

3

Manning & Napier, Inc.

Consolidated Statements of Shareholders’ Equity

(In thousands, except share data)

(Unaudited)

Common Stock – class A | Common Stock – class B | Additional Paid in Capital | Retained Deficit | Accumulated Other Comprehensive Income (Loss) | Non Controlling Interests | |||||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | Total | ||||||||||||||||||||||||||||||

Balance—December 31, 2015 | 14,755,130 | $ | 148 | 1,000 | $ | — | $ | 205,760 | $ | (37,149 | ) | $ | (3 | ) | $ | (33,976 | ) | $ | 134,780 | |||||||||||||||

Net income | — | — | — | — | — | 5,023 | — | 38,859 | 43,882 | |||||||||||||||||||||||||

Distributions to noncontrolling interests | — | — | — | — | — | — | — | (20,153 | ) | (20,153 | ) | |||||||||||||||||||||||

Net changes in unrealized investment securities gains or losses | — | — | — | — | — | — | 6 | — | 6 | |||||||||||||||||||||||||

Common stock issued under equity compensation plan | 277,750 | 2 | — | — | (2 | ) | — | — | — | — | ||||||||||||||||||||||||

Shares withheld to satisfy tax withholding requirements related to restricted stock units granted | — | — | — | — | (162 | ) | — | — | (791 | ) | (953 | ) | ||||||||||||||||||||||

Equity-based compensation | — | — | — | — | 357 | — | — | 1,747 | 2,104 | |||||||||||||||||||||||||

Dividends declared on Class A common stock - $0.32 per share | — | — | — | — | — | (4,754 | ) | — | — | (4,754 | ) | |||||||||||||||||||||||

Impact of changes in ownership of Manning & Napier Group, LLC | — | — | — | — | (2,144 | ) | — | — | (13,991 | ) | (16,135 | ) | ||||||||||||||||||||||

Balance—June 30, 2016 | 15,032,880 | $ | 150 | 1,000 | $ | — | $ | 203,809 | $ | (36,880 | ) | $ | 3 | $ | (28,305 | ) | $ | 138,777 | ||||||||||||||||

Balance—December 31, 2016 | 14,982,880 | $ | 150 | 1,000 | $ | — | $ | 200,158 | $ | (37,383 | ) | $ | (13 | ) | $ | (28,434 | ) | $ | 134,478 | |||||||||||||||

Net income | — | — | — | — | — | 3,582 | — | 27,521 | 31,103 | |||||||||||||||||||||||||

Distributions to noncontrolling interests | — | — | — | — | — | — | — | (17,660 | ) | (17,660 | ) | |||||||||||||||||||||||

Net changes in unrealized investment securities gains or losses | — | — | — | — | — | — | (15 | ) | — | (15 | ) | |||||||||||||||||||||||

Common stock issued under equity compensation plan, net of forfeitures | 96,467 | 1 | — | — | (1 | ) | — | — | — | — | ||||||||||||||||||||||||

Shares withheld to satisfy tax withholding requirements related to restricted stock units vested | — | — | — | — | (48 | ) | — | — | (224 | ) | (272 | ) | ||||||||||||||||||||||

Equity-based compensation | — | — | — | — | 253 | — | — | 1,183 | 1,436 | |||||||||||||||||||||||||

Dividends declared on Class A common stock - $0.16 per share | — | — | — | — | — | (2,273 | ) | — | — | (2,273 | ) | |||||||||||||||||||||||

Impact of changes in ownership of Manning & Napier Group, LLC (Note 4) | — | — | — | — | (1,876 | ) | — | — | (7,927 | ) | (9,803 | ) | ||||||||||||||||||||||

Balance—June 30, 2017 | 15,079,347 | $ | 151 | 1,000 | $ | — | $ | 198,486 | $ | (36,074 | ) | $ | (28 | ) | $ | (25,541 | ) | $ | 136,994 | |||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

4

Manning & Napier, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

Six months ended June 30, | ||||||||

2017 | 2016 | |||||||

Cash flows from operating activities: | ||||||||

Net income attributable to controlling and noncontrolling interests | $ | 31,103 | $ | 43,882 | ||||

Adjustment to reconcile net income to net cash provided by operating activities: | ||||||||

Equity-based compensation | 1,436 | 2,104 | ||||||

Depreciation and amortization | 875 | 1,133 | ||||||

Change in amounts payable under tax receivable agreement | — | 18 | ||||||

Net (gains) losses on investment securities | (1,582 | ) | (1,272 | ) | ||||

Deferred income taxes | 1,983 | 1,794 | ||||||

Amortization of debt issuance costs | — | 78 | ||||||

(Increase) decrease in operating assets and increase (decrease) in operating liabilities: | ||||||||

Accounts receivable | 3,387 | 1,701 | ||||||

Accounts receivable—affiliated mutual funds | 773 | 1,398 | ||||||

Due from broker - consolidated funds | — | 3,795 | ||||||

Prepaid expenses and other assets | 1,033 | 367 | ||||||

Accounts payable | (738 | ) | (523 | ) | ||||

Accrued expenses and other liabilities | (8,017 | ) | (10,596 | ) | ||||

Deferred revenue | 273 | (469 | ) | |||||

Other long-term liabilities | (315 | ) | (243 | ) | ||||

Net cash provided by operating activities | 30,211 | 43,167 | ||||||

Cash flows from investing activities: | ||||||||

Purchase of property and equipment | (750 | ) | (147 | ) | ||||

Sale of investments | 4,243 | 7,283 | ||||||

Purchase of investments | (25,822 | ) | (2,849 | ) | ||||

Due from broker | — | 4,015 | ||||||

Proceeds from maturity of investments | 15,364 | — | ||||||

Acquisitions, net of cash received | 320 | (9,328 | ) | |||||

Net cash used in investing activities | (6,645 | ) | (1,026 | ) | ||||

Cash flows from financing activities: | ||||||||

Distributions to noncontrolling interests | (17,660 | ) | (20,153 | ) | ||||

Dividends paid on Class A common stock | (3,596 | ) | (4,718 | ) | ||||

Payment of shares withheld to satisfy withholding requirements | (271 | ) | (953 | ) | ||||

Payment of capital lease obligations | (97 | ) | (109 | ) | ||||

Purchase of Class A units of Manning & Napier Group, LLC | (9,803 | ) | (16,135 | ) | ||||

Net cash used in financing activities | (31,427 | ) | (42,068 | ) | ||||

Net (decrease) increase in cash and cash equivalents | (7,861 | ) | 73 | |||||

Cash and cash equivalents: | ||||||||

Beginning of period | 100,819 | 117,591 | ||||||

End of period | $ | 92,958 | $ | 117,664 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

5

Manning & Napier, Inc.

Notes to Consolidated Financial Statements

Note 1—Organization and Nature of the Business

Manning & Napier, Inc. ("Manning & Napier", or the "Company") provides a broad range of investment solutions through separately managed accounts, mutual funds, and collective investment trusts, as well as a variety of consultative services that complement its investment process. Founded in 1970, the Company offers U.S. and non-U.S. equity, fixed income and a range of blended asset portfolios, such as life cycle funds and actively-managed exchange-traded fund ("ETF")-based portfolios. Headquartered in Fairport, New York, the Company serves a diversified client base of high net worth individuals and institutions, including 401(k) plans, pension plans, Taft-Hartley plans, endowments and foundations.

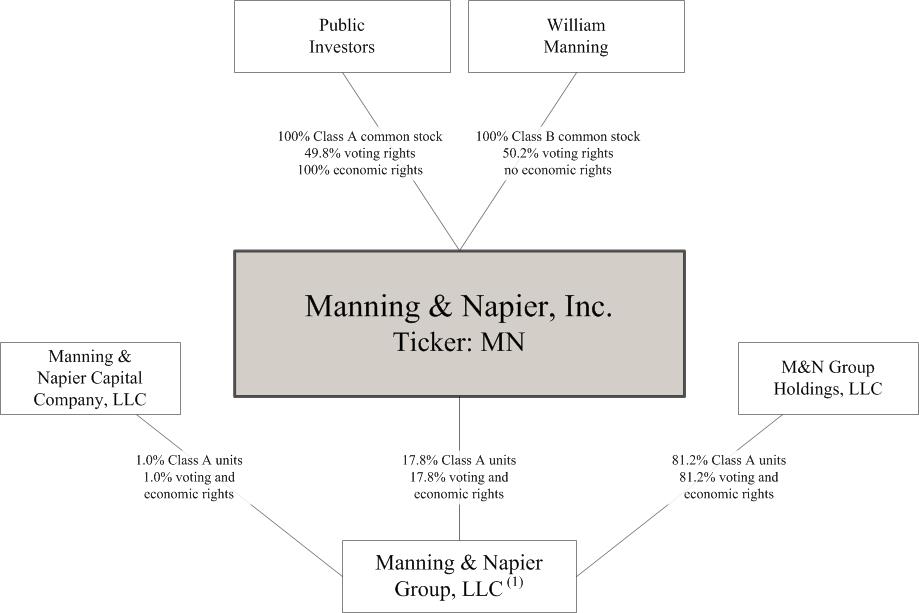

The Company is the sole managing member of Manning & Napier Group, LLC and its subsidiaries ("Manning & Napier Group"), a holding company for the investment management businesses conducted by its operating subsidiaries. The diagram below depicts the Company's organization structure as of June 30, 2017.

(1) | The consolidated operating subsidiaries of Manning & Napier Group include Manning & Napier Advisors, LLC ("MNA"), Manning & Napier Alternative Opportunities, LLC, Perspective Partners LLC, Manning & Napier Information Services, LLC, Manning & Napier Benefits, LLC, Manning & Napier Investor Services, Inc., Exeter Trust Company and Rainier Investment Management, LLC. |

Note 2—Summary of Significant Accounting Policies

Critical Accounting Policies

There have been no significant changes in our critical accounting policies and estimates from those that were disclosed in our Annual Report on Form 10-K for the year ended December 31, 2016.

The Company believes that the disclosures herein are adequate so that the information presented is not misleading; however, these financial statements should be read in conjunction with the financial statements and the notes thereto in our Annual Report on Form 10-K for the year ended December 31, 2016. The financial data for the interim periods may not necessarily be indicative of results for future interim periods or for the full year.

6

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Basis of Presentation

The accompanying unaudited consolidated financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and related rules and regulations of the U.S. Securities and Exchange Commission (“SEC”) for interim financial reporting and include all adjustments, consisting only of normal recurring adjustments which are, in the opinion of management, necessary for a fair statement of the results for the interim period.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates or assumptions that affect the reported amounts and disclosures in the consolidated financial statements. Actual results could differ from these estimates or assumptions.

Revision of Previously Reported Consolidated Statements of Operations

In the quarter ended September 30, 2016, the Company revised its treatment of payments made to certain advisory clients, in accordance with Accounting Standard Codification ("ASC") 605-50, Revenue Recognition - Customer Payments and Incentives to properly present these payments as a reduction to revenue. The Company assessed the materiality of this item on its fiscal year ended December 31, 2015, and all prior and subsequent periods, and concluded that the reclassification was not material to any such periods. The statements of operations for the three and six months ended June 30, 2016 included herein have been revised to reflect the proper presentation of investment management services revenue and distribution, servicing and custody expenses. The reclassification has no impact on operating income or net income. The impact is illustrated below:

Three months ended June 30, 2016 | Six months ended June 30, 2016 | ||||||

(in thousands) | |||||||

Investment management services revenue, as previously reported | $ | 67,541 | $ | 132,079 | |||

Revision | (3,036 | ) | (5,532 | ) | |||

Investment management services revenue, as revised | $ | 64,505 | $ | 126,547 | |||

Distribution, servicing and custody expenses, as previously reported | $ | 11,986 | $ | 23,324 | |||

Revision | (3,036 | ) | (5,532 | ) | |||

Distribution, servicing and custody expenses, as revised | $ | 8,950 | $ | 17,792 | |||

Principles of Consolidation

The Company consolidates all majority-owned subsidiaries. In addition, as of June 30, 2017, Manning & Napier holds an economic interest of approximately 17.8% in Manning & Napier Group but, as managing member, controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statements of financial condition with respect to the remaining economic interest in Manning & Napier Group held by Manning & Napier Group Holdings, LLC (“M&N Group Holdings”) and Manning & Napier Capital Company, LLC (“MNCC”).

All material intercompany transactions have been eliminated in consolidation.

In accordance with Accounting Standards Update ("ASU") 2015-02, Consolidation (Topic 810) – Amendments to the Consolidation Analysis, the determination of whether a company is required to consolidate an entity is based on, among other things, an entity’s purpose and design, a company’s ability to direct the activities of the entity that most significantly impact the entity’s economic performance, and whether a company is obligated to absorb losses or receive benefits that could potentially be significant to the entity. The standard also requires ongoing assessments of whether a company is the primary beneficiary of a variable interest entity (“VIE”). When utilizing the voting interest entity ("VOE") model, controlling financial interest is generally defined as majority ownership of voting interests.

The Company provides seed capital to its investment teams to develop new products and services for its clients. The original seed investment may be held in a separately managed account, comprised solely of the Company's investments or within a mutual fund, where the Company's investments may represent all or only a portion of the total equity investment in the mutual fund. Pursuant to U.S. GAAP, the Company evaluates its investments in mutual funds on a regular basis and consolidates such mutual funds for which it holds a controlling financial interest. When no longer deemed to hold a controlling financial interest, the Company would deconsolidate the fund and classify the remaining investment as either an equity method investment or as trading securities, as applicable.

The Company serves as the investment adviser for Manning & Napier Fund, Inc. series of mutual funds (the “Fund”), Exeter Trust Company Collective Investment Trusts (“CIT”), Rainier Investment Management Mutual Funds and Rainier Multiple Investment Trust. The Fund, CIT, Rainier Investment Management Mutual Funds and Rainier Multiple Investment

7

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Trust are legal entities, the business and affairs of which are managed by their respective boards of directors. As a result, each of these entities is a VOE. The Company holds, in limited cases, direct investments in a mutual fund (which are made on the same terms as are available to other investors) and consolidates each of these entities where it has a controlling financial interest or a majority voting interest. The Company's investments in the Fund amounted to approximately $1.4 million as of June 30, 2017 and $1.3 million as of December 31, 2016. As of December 31, 2016, the Company maintained a controlling financial interest in one mutual fund, Manning & Napier Fund, Inc. Quality Equity Series, and consolidated the mutual fund. As of June 30, 2017, the Company no longer maintained a controlling financial interest, but did retain significant influence in the mutual fund, which was accounted for as an equity method investment.

Cash and Cash Equivalents

The Company generally considers all highly liquid investments with original maturities of three months or less to be cash equivalents. Cash and cash equivalents are primarily held in operating accounts at major financial institutions and also in money market securities. Cash equivalents are stated at cost, which approximates market value due to the short-term maturity of these investments. The fair value of cash equivalents have been classified as Level 1 in accordance with the fair value hierarchy.

Investment Securities

Investment securities are classified as either trading, equity method investments or available-for-sale and are carried at fair value. Fair value is determined based on quoted market prices in active markets for identical or similar instruments.

Investment securities classified as trading consist of equity securities, fixed income securities, and investments in mutual funds for which the Company provides advisory services. Realized and unrealized gains and losses on trading securities are recorded in net gains (losses) on investments in the consolidated statements of operations. At June 30, 2017, trading securities consist solely of investments held by the Company to provide initial cash seeding for product development purposes.

Investments classified as equity method investments represent seed investments in which the Company owns between 20-50% of the outstanding voting interests in the affiliated fund or when it is determined that the Company is able to exercise significant influence but not control over the investments. If the seed investment results in significant influence, but not control, the investment will be accounted for as an equity method investment. When using the equity method, the Company recognizes its share of the investee's net income or loss for the period which is recorded in net gains (losses) on investments in the consolidated statements of operations.

Investment securities classified as available-for-sale consist of U.S. Treasury notes and other short-term investments. Unrealized gains and losses on available-for-sale securities are excluded from earnings and are reported, net of deferred income tax, as a separate component of accumulated other comprehensive income in stockholders’ equity until realized. The Company periodically reviews each individual security position that has an unrealized loss, or impairment, to determine if that impairment is other-than-temporary. If impairment is determined to be other-than-temporary, the carrying value of the security will be written down to fair value and the loss will be recognized in earnings. Realized gains and losses on sales of available-for-sale securities are computed on a specific identification basis and are recorded in net gains (losses) on investments in the consolidated statements of operations.

Property and Equipment

Property and equipment is presented net of accumulated depreciation of approximately $11.9 million and $11.6 million as of June 30, 2017 and December 31, 2016, respectively.

Goodwill and Intangible Assets

Goodwill represents the excess cost over the fair value of the identifiable net assets of acquired companies. Identifiable intangible assets generally represent the cost of client relationships and investment management agreements acquired as well as trademarks. Goodwill and indefinite-lived assets are tested for impairment annually or more frequently if events or circumstances indicate that the carrying value may not be recoverable. Intangible assets subject to amortization are tested for impairment whenever events or circumstances indicate that the carrying value may not be recoverable. Goodwill and intangible assets require significant management estimate and judgment, including the valuation and expected life determination in connection with the initial purchase price allocation and the ongoing evaluation for impairment.

On May 10, 2017, the Company entered into an agreement to sell certain U.S. mutual funds to a third party. The transaction is expected to close during the third quarter of 2017, with the selling price based on the total assets under management on the transaction closing date. As of June 30, 2017, the assets under management for these products was approximately $0.5 billion. The carrying value of the intangible assets for client relationships associated with these products was $0 as of June 30, 2017.

Operating Segments

8

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The Company operates in one segment, the investment management industry.

Revenue

The majority of the Company’s revenues are based on fees charged to manage customers’ portfolios. Investment management fees are generally computed as a percentage of assets under management ("AUM") and recognized as earned. Fees for providing investment advisory services are computed and billed in accordance with the provisions of the applicable investment management agreements. For the Company’s separately managed accounts, clients either pay investment management fees in advance, typically for a semi-annual or quarterly period, or in arrears, typically for a monthly or quarterly period. When investment management fees are paid in advance, the Company defers the revenue and recognizes it over the applicable period. When investment management fees are paid in arrears, the Company estimates revenues based on AUM market values as of the most recent month end date, and adjusts to actual when billed. For mutual funds and collective investment trust vehicles, the Company’s fees are calculated and earned daily based on AUM. Investment management fees are presented net of cash rebates and fees waived pursuant to contractual expense limitations of the funds.

The Company is contractually obligated to make payments to certain advisory clients with the intent of providing those clients a discounted fee. In accordance with ASC 605-50, Revenue Recognition - Customer Payments and Incentives, these payments are presented as a reduction to revenue. Incentives reported as a reduction to revenue for the three and six months ended June 30, 2017 were less than $0.1 million and $3.4 million, respectively, and $3.0 million and $5.5 million for the three and six months ended June 30, 2016, respectively.

The Company has agreements with third parties who provide distribution and administrative services for its mutual funds, collective investment trusts and certain separately managed accounts. Third party agreements are evaluated against ASC 605-45 Revenue Recognition - Principal Agent Considerations to determine whether revenue should be reported gross or net of payments to third-party service providers. In management's judgment there are various indicators that support gross revenue reporting, the most notable being the Company acts as primary obligor and therefore principal service provider. Based on this evaluation, investment management service revenue is recorded gross of distribution and administrative fees paid to third parties.

Advisory Agreements

The Company derives significant revenue from its role as advisor to affiliated mutual funds and collective investment trusts. Fees earned for advisory related services were approximately $21.1 million and $45.2 million for the three and six months ended June 30, 2017, respectively, and $29.9 million and $57.8 million for the three and six months ended June 30, 2016, respectively, which represents greater than 10% of the Company's revenue in each period.

Recent Accounting Pronouncements

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers (Topic 606), which supersedes existing accounting standards for revenue recognition and creates a single framework. The revenue standard contains principals that will be applied to determine the measurement of revenue and timing of recognition. We will adopt the new standard on its effective date of January 1, 2018. We have not yet selected whether we will adopt the standard using the retrospective approach with adjustment to each prior period or modified retrospective approach with the cumulative effect of initial application recognized at the date of initial application. We are continuing to assess the impact of adoption though early conclusions indicate the standard will not have a material impact on our financial condition and results of operations. While we have not identified material changes in the timing of revenue recognition, we continue to evaluate the presentation of certain revenue related costs on a gross versus net basis as well as the additional disclosures required by the standard.

In January 2016, the FASB issued ASU 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities, which requires all equity investments to be measured at fair value with changes in the fair value recognized through net income. ASU 2016-01 will be effective on January 1, 2018 and will result in a cumulative-effect adjustment to the balance sheet upon adoption. The Company is currently evaluating the impact that ASU 2016-01 will have on its consolidated financial statements.

In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which is intended to increase transparency and comparability among organizations by recognizing all lease transactions (with terms in excess of 12 months) on the balance sheet as a lease liability and a right-of-use asset (as defined). The new guidance will be effective for fiscal years beginning after December 15, 2018, with earlier application permitted. Upon adoption, the lessee will apply the new standard retrospectively to all periods presented or retrospectively using a cumulative effect adjustment in the year of adoption. The Company is currently evaluating the impact that ASU 2016-02 will have on its consolidated financial statements.

In March 2016, the FASB issued ASU 2016-09, Stock Compensation - Stock Compensation (Topic 718), Improvements to Employee Share-Based Payment Accounting, which is intended to simplify several aspects of the accounting for share-based

9

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

payment award transactions. The guidance is effective for fiscal years beginning after December 15, 2016. The Company's adoption of these amendments on January 1, 2017 did not have a material impact on its consolidated financial statements.

In August 2016, the FASB issued ASU 2016-15, Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments, to clarify guidance on the classification of certain cash receipts and cash payments in the statement of cash flows. The FASB issued the ASU with the intent of reducing diversity in practice regarding eight types of cash flows. The ASU is effective for annual reporting periods beginning after December 15, 2017, including interim periods within those annual reporting periods. The Company is evaluating the effect of adopting this new accounting standard.

In January 2017, the FASB issued ASU 2017-04, Intangibles - Goodwill and Other (Topic 350), Simplifying the Test for Goodwill Impairment, which simplifies the accounting for goodwill impairments by eliminating step two from the goodwill impairment test. The ASU requires goodwill impairments to be measured on the basis of the fair value of the reporting unit relative to the reporting unit's carrying amount rather than on the basis of the implied amount of goodwill relative to the goodwill balance of the reporting unit. The ASU is effective for annual and interim impairment tests for periods beginning after December 15, 2019. Early adoption is allowed for annual and interim impairment tests occurring after January 1, 2017. The Company is evaluating the effect of adopting this new accounting standard.

Note 3—Acquisitions

On April 30, 2016, the Company acquired a majority ownership interest in Rainier Investment Management, LLC ("Rainier”), an active investment management firm. Under the terms of the transaction, the Company initially acquired a 75% ownership interest in Rainier, with the remaining 25% ownership maintained by key professionals at Rainier. As of June 30, 2017, the Company's ownership interest in Rainier increased to 86%, due to the forfeiture of unvested ownership interests by certain individuals retiring from Rainier subsequent to the acquisition.

Consideration transferred included an upfront cash payment on the transaction closing date of $13.0 million, a portion of which was held in escrow. During the second quarter of 2017, the Company received approximately $0.3 million from amounts held in escrow for post closing adjustments. Additional cash payments of up to $32.5 million over a four year period are contingent upon Rainier’s achievement of certain annual financial targets. The fair value of the liability for this contingent consideration recognized on the acquisition date was $3.5 million. As of June 30, 2017 and December 31, 2016, the fair value of this contingent liability was $0.

The transaction was accounted for by the Company using the acquisition method under ASC 805, Business Combinations. During the second quarter of 2016, the Company completed a preliminary allocation of the April 30, 2016 purchase price to the assets acquired and liabilities assumed. During the first quarter of 2017, certain adjustments were recorded to liabilities assumed and the purchase price allocation was finalized as of March 31, 2017. The final purchase price was allocated as follows (in thousands):

Assets acquired | |||

Current assets | $ | 6,998 | |

Property and equipment, net | 783 | ||

Intangible assets | |||

Client relationships | 9,320 | ||

Trademarks | 270 | ||

Goodwill | 3,958 | ||

Total assets acquired | 21,329 | ||

Liabilities assumed | |||

Accounts payable and accrued expenses | 4,023 | ||

Other liabilities | 1,204 | ||

Total liabilities assumed | 5,227 | ||

Purchase price | $ | 16,102 | |

Note 4—Noncontrolling Interests

Manning & Napier holds an economic interest of approximately 17.8% in Manning & Napier Group, but as managing member controls all of the business and affairs of Manning & Napier Group. As a result, the Company consolidates the financial results of Manning & Napier Group and records a noncontrolling interest on its consolidated statement of financial condition with respect to the remaining approximately 82.2% aggregate economic interest in Manning & Napier Group held by M&N Group Holdings and MNCC. Net income attributable to noncontrolling interests on the statements of operations represents the portion of earnings attributable to the economic interest in Manning & Napier Group held by the noncontrolling interests.

10

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following provides a reconciliation from “Income before provision for income taxes” to “Net income attributable to Manning & Napier, Inc.”:

Three months ended June 30, | Six months ended June 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

(in thousands) | ||||||||||||||||

Income before provision for income taxes | $ | 15,831 | $ | 23,243 | $ | 33,688 | $ | 47,101 | ||||||||

Less: gain (loss) before provision for income taxes of Manning & Napier, Inc. (1) | 4 | (2 | ) | 7 | (19 | ) | ||||||||||

Income before provision for income taxes, as adjusted | 15,827 | 23,245 | 33,681 | 47,120 | ||||||||||||

Controlling interest percentage (2) | 17.8 | % | 17.2 | % | 17.6 | % | 17.0 | % | ||||||||

Net income attributable to controlling interest | 2,826 | 4,010 | 5,928 | 7,988 | ||||||||||||

Plus: gain (loss) before provision for income taxes of Manning & Napier, Inc. (1) | 4 | (2 | ) | 7 | (19 | ) | ||||||||||

Income before income taxes attributable to Manning & Napier, Inc. | 2,830 | 4,008 | 5,935 | 7,969 | ||||||||||||

Less: provision for income taxes of Manning & Napier, Inc. (3) | 1,145 | 1,403 | 2,353 | 2,946 | ||||||||||||

Net income attributable to Manning & Napier, Inc. | $ | 1,685 | $ | 2,605 | $ | 3,582 | $ | 5,023 | ||||||||

(1) | Manning & Napier, Inc. incurs certain gains or expenses that are only attributable to it and are therefore excluded from the net income attributable to noncontrolling interests. |

(2) | Income before provision for income taxes is allocated to the controlling interest based on the percentage of units of Manning & Napier Group held by Manning & Napier, Inc. The amount represents the Company's weighted ownership of Manning & Napier Group for the respective periods. |

(3) | The consolidated provision for income taxes is equal to the sum of (i) the provision for income taxes for entities other than Manning & Napier, Inc. and (ii) the provision for income taxes of Manning & Napier, Inc. which includes all U.S. federal and state income taxes. The consolidated provision for income taxes was $1.2 million and $2.6 million for the three and six months ended June 30, 2017, respectively, and $1.5 million and $3.2 million for the three and six months ended June 30, 2016, respectively. |

As of June 30, 2017, a total of 63,941,860 units of Manning & Napier Group were held by the noncontrolling interests. Pursuant to the terms of the exchange agreement entered into at the time of the Company's initial public offering, such units may be exchangeable for shares of the Company's Class A common stock. For any units exchanged, the Company will (i) pay an amount of cash equal to the number of units exchanged multiplied by the value of one share of the Company's Class A common stock less a market discount and expected expenses, or, at the Company's election, (ii) issue shares of the Company's Class A common stock on a one-for-one basis, subject to customary adjustments. As the Company receives units of Manning & Napier Group that are exchanged, the Company's ownership of Manning & Napier Group will increase.

On March 31, 2017, M&N Group Holdings and MNCC exchanged a total of 1,842,711 Class A units of Manning & Napier Group for approximately $9.8 million in cash. Subsequent to the exchange the Class A units were retired, resulting in an increase in Manning & Napier's ownership in Manning & Napier Group. In addition, during the six months ended June 30, 2017, Class A common stock was issued under the Company's 2011 Equity Compensation Plan (the "Equity Plan") for which Manning & Napier, Inc. acquired an equivalent number of Class A units of Manning & Napier Group, net of forfeitures of unvested restricted stock awards. The following is the impact to the Company's equity ownership interest in Manning & Napier Group for the six months ended June 30, 2017:

11

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Manning & Napier Group Class A Units Held | ||||||||||

Manning & Napier | Noncontrolling Interests | Total | Manning & Napier Ownership % | |||||||

As of December 31, 2016 | 13,826,575 | 65,784,571 | 79,611,146 | 17.4% | ||||||

Class A Units issued (1) | 46,467 | — | 46,467 | —% | ||||||

Class A Units exchanged | — | (1,842,711 | ) | (1,842,711 | ) | 0.4% | ||||

As of June 30, 2017 | 13,873,042 | 63,941,860 | 77,814,902 | 17.8% | ||||||

(1) | The impact of the transaction of Manning & Napier's ownership was less than 0.1%. |

Since the Company continues to have a controlling interest in Manning & Napier Group, the aforementioned changes in ownership of Manning & Napier Group were accounted for as equity transactions under ASC 810, Consolidation. Additional paid-in capital and noncontrolling interests in the Consolidated Statements of Financial Position are adjusted to reallocate the Company's historical equity to reflect the change in ownership of Manning & Napier Group.

At June 30, 2017 and December 31, 2016, the Company had recorded a liability of $37.1 million representing the estimated payments due to the selling unit holders under the tax receivable agreement ("TRA") entered into between Manning & Napier and the other holders of Class A Units of Manning & Napier Group. Of these amounts, $2.4 million were included in accrued expenses and other liabilities at June 30, 2017 and December 31, 2016. The Company made no payments pursuant to the TRA during the six months ended June 30, 2017 and 2016.

Obligations pursuant to the TRA are obligations of Manning & Napier. They do not impact the noncontrolling interests. These obligations are not income tax obligations. Furthermore, the TRA has no impact on the allocation of the provision for income taxes to the Company’s net income.

Note 5—Investment Securities

The following represents the Company’s investment securities holdings as of June 30, 2017 and December 31, 2016:

June 30, 2017 | ||||||||||||||||

Cost | Unrealized Gains | Unrealized Losses | Fair Value | |||||||||||||

(in thousands) | ||||||||||||||||

Available-for-sale securities | ||||||||||||||||

U.S. Treasury notes | $ | 7,119 | $ | 5 | $ | (13 | ) | $ | 7,111 | |||||||

Short-term investments | 22,192 | — | — | 22,192 | ||||||||||||

29,303 | ||||||||||||||||

Trading securities | ||||||||||||||||

Equity securities | 6,514 | |||||||||||||||

Fixed income securities | 8,023 | |||||||||||||||

Mutual funds | 314 | |||||||||||||||

14,851 | ||||||||||||||||

Equity method investments | ||||||||||||||||

Mutual funds | 1,097 | |||||||||||||||

Total investment securities | $ | 45,251 | ||||||||||||||

12

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

December 31, 2016 | ||||||||||||||||

Cost | Unrealized Gains | Unrealized Losses | Fair Value | |||||||||||||

(in thousands) | ||||||||||||||||

Available-for-sale securities | ||||||||||||||||

U.S. Treasury notes | $ | 7,093 | $ | 13 | $ | (6 | ) | $ | 7,100 | |||||||

Short-term investments | 14,744 | — | — | 14,744 | ||||||||||||

21,844 | ||||||||||||||||

Trading securities | ||||||||||||||||

Equity securities | 7,176 | |||||||||||||||

Fixed income securities | 7,167 | |||||||||||||||

Mutual funds | 288 | |||||||||||||||

Mutual funds - consolidated funds | 995 | |||||||||||||||

15,626 | ||||||||||||||||

Total investment securities | $ | 37,470 | ||||||||||||||

Investment securities are classified as either trading or available-for-sale and are carried at fair value. Fair value is determined based on quoted market prices in active markets for identical or similar instruments.

Investment securities classified as trading consist of equity securities, fixed income securities and investments in mutual funds for which the Company provides advisory services. At June 30, 2017 and December 31, 2016, trading securities consist solely of investments held by the Company to provide initial cash seeding for product development purposes. The Company recognized approximately $1.2 million and $1.7 million of net unrealized gains related to investments classified as trading during the six months ended June 30, 2017 and 2016, respectively.

Investment securities classified as available-for-sale consist of U.S. Treasury notes and other short-term investments for compliance with certain regulatory requirements and to optimize cash management opportunities. As of June 30, 2017 and December 31, 2016, $0.6 million of these securities was considered restricted. The Company periodically reviews each individual security position that has an unrealized loss, or impairment, to determine if that impairment is other-than-temporary. No other-than-temporary impairment charges have been recognized by the Company during the six months ended June 30, 2017 and 2016.

Note 6—Fair Value Measurements

Fair value is defined as the price that the Company would receive upon selling an investment in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. A fair value hierarchy is provided that gives the highest priority to unadjusted quoted prices in active markets for identical assets and liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3).

The following three-tier fair value hierarchy prioritizes the inputs used in measuring fair value:

•Level 1—observable inputs such as quoted prices in active markets for identical securities;

• | Level 2—other significant observable inputs (including but not limited to quoted prices for similar securities, interest rates, prepayment rates, credit risk, etc.); and |

• | Level 3—significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments). |

13

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following provides the hierarchy of inputs used to derive the fair value of the Company’s financial instruments measured at fair value on a recurring basis as of June 30, 2017 and December 31, 2016:

June 30, 2017 | ||||||||||||||||

Level 1 | Level 2 | Level 3 | Totals | |||||||||||||

(in thousands) | ||||||||||||||||

Equity securities | $ | 6,514 | $ | — | $ | — | $ | 6,514 | ||||||||

Fixed income securities | 1,165 | 6,858 | — | 8,023 | ||||||||||||

Mutual funds | 1,411 | — | — | 1,411 | ||||||||||||

U.S. Treasury notes | — | 7,111 | — | 7,111 | ||||||||||||

Short-term investments | 22,192 | — | — | 22,192 | ||||||||||||

Total assets at fair value | $ | 31,282 | $ | 13,969 | $ | — | $ | 45,251 | ||||||||

Contingent consideration liability | $ | — | $ | — | $ | — | $ | — | ||||||||

Total liabilities at fair value | $ | — | $ | — | $ | — | $ | — | ||||||||

December 31, 2016 | ||||||||||||||||

Level 1 | Level 2 | Level 3 | Totals | |||||||||||||

(in thousands) | ||||||||||||||||

Equity securities | $ | 7,176 | $ | — | $ | — | $ | 7,176 | ||||||||

Fixed income securities | 1,071 | 6,096 | — | 7,167 | ||||||||||||

Mutual funds | 288 | — | — | 288 | ||||||||||||

Mutual funds - consolidated funds | 995 | — | — | 995 | ||||||||||||

U.S. Treasury notes | — | 7,100 | — | 7,100 | ||||||||||||

Short-term investments | 14,744 | — | — | 14,744 | ||||||||||||

Total assets at fair value | $ | 24,274 | $ | 13,196 | $ | — | $ | 37,470 | ||||||||

Contingent consideration liability | $ | — | $ | — | $ | — | $ | — | ||||||||

Total liabilities at fair value | $ | — | $ | — | $ | — | $ | — | ||||||||

Short-term investments consists of certificate of deposits ("CDs") that are stated at cost, which approximate fair value due to the short maturity of the investments.

Valuations of investments in fixed income securities and U.S. Treasury notes can generally be obtained through independent pricing services. For most bond types, the pricing service utilizes matrix pricing, which considers one or more of the following factors: yield or price of bonds of comparable quality, coupon, maturity, current cash flows, type and current day trade information, as well as dealer supplied prices. These valuations are categorized as Level 2 in the hierarchy.

Contingent consideration was a component of the purchase price of Rainier (Note 3). The contingent consideration is payable over a four year period upon Rainier’s achievement of certain financial targets. The fair value of the contingent consideration is calculated on a quarterly basis by forecasting Rainier’s adjusted earnings before interest, taxes and amortization ("EBITA") as defined by the purchase agreement over the contingency period with changes in the fair value included in other operating costs in the consolidated statements of operations.

There were no changes in contingent consideration liability measured at fair value using significant unobservable inputs (Level 3) for the six months ended June 30, 2017. The fair value was $0 at June 30, 2017 and December 31, 2016.

The Company’s policy is to recognize transfers in and transfers out of the valuation levels as of the beginning of the reporting period. There were no transfers between Levels during the six months ended June 30, 2017.

14

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 7—Accrued Expenses and Other Liabilities

Accrued expenses and other liabilities as of June 30, 2017 and December 31, 2016 consisted of the following:

June 30, 2017 | December 31, 2016 | |||||||

(in thousands) | ||||||||

Accrued bonus and sales commissions | $ | 13,292 | $ | 18,342 | ||||

Accrued payroll and benefits | 2,601 | 3,430 | ||||||

Accrued sub-transfer agent fees | 2,787 | 4,785 | ||||||

Dividends payable | 1,206 | 2,397 | ||||||

Amounts payable under tax receivable agreement | 2,364 | 2,364 | ||||||

Other accruals and liabilities | 3,485 | 3,797 | ||||||

Total accrued expenses and other liabilities | $ | 25,735 | $ | 35,115 | ||||

Note 8—Commitments and Contingencies

The Company may from time to time enter into agreements that contain certain representations and warranties and which provide general indemnifications. The Company may also serve as a guarantor of such obligations of one or more of the Manning & Napier Group entities. The Company’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Company that have not yet occurred. The Company expects any risk of liability associated with such guarantees to be remote.

Regulation

As an investment adviser to a variety of investment products, the Company and its affiliated broker-dealer are subject to routine reviews and inspections by the SEC, Financial Industry Regulatory Authority, Inc., National Futures Association and U.S. Commodity Futures Trading Commission. From time to time, the Company may also be subject to claims, be involved in various legal proceedings arising in the ordinary course of its business and be subject to other contingencies. The Company does not believe that the outcome of any of these reviews, inspections or other legal proceedings will have a material impact on its consolidated financial statements; however, litigation is subject to many uncertainties, and the outcome of individual litigated matters is difficult to predict. The Company will establish accruals for matters that are probable, can be reasonably estimated, and may take into account any related insurance recoveries to the extent of such recoveries. As of June 30, 2017 and December 31, 2016, the Company has not accrued for any such claims, legal proceedings, or other contingencies.

Note 9—Earnings per Common Share

Basic earnings per share (“basic EPS”) is computed using the two-class method to determine net income available to Class A common stock. The two-class method includes an earnings allocation formula that determines earnings per share for each participating security according to dividends declared and undistributed earnings for the period. The Company's restricted Class A common shares granted under the 2011 Equity Compensation Plan (the "Equity Plan") have non-forfeitable dividend rights during their vesting period and are therefore considered participating securities under the two-class method. Under the two-class method, the Company's net income available to Class A common stock is reduced by the amount allocated to the unvested restricted Class A common stock. Basic EPS is calculated by dividing net income available to Class A common stock by the weighted average number of common shares outstanding during the period.

Diluted earnings per share (“diluted EPS”) is computed under the more dilutive of either the treasury method or the two-class method. For the diluted calculation, the weighted average number of common shares outstanding during the period is increased by the assumed conversion into Class A common stock of the unvested equity awards and the exchangeable units of Manning & Napier Group, to the extent that such conversion would dilute earnings per share.

15

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

The following is a reconciliation of the income and share data used in the basic and diluted earnings per share computations for the three and six months ended June 30, 2017 and 2016 under the two-class method:

Three months ended June 30, | Six months ended June 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

(in thousands, except share data) | ||||||||||||||||

Net income attributable to controlling and noncontrolling interests | $ | 14,589 | $ | 21,698 | $ | 31,103 | $ | 43,882 | ||||||||

Less: net income attributable to noncontrolling interests | 12,904 | 19,093 | 27,521 | 38,859 | ||||||||||||

Net income attributable to Manning & Napier, Inc. | $ | 1,685 | $ | 2,605 | $ | 3,582 | $ | 5,023 | ||||||||

Less: allocation to participating securities | 102 | 172 | 212 | 334 | ||||||||||||

Net income available to Class A common stock | $ | 1,583 | $ | 2,433 | $ | 3,370 | $ | 4,689 | ||||||||

Weighted average shares of Class A common stock outstanding - basic | 14,111,368 | 13,960,768 | 14,077,313 | 13,852,949 | ||||||||||||

Dilutive effect from unvested equity awards | 187,466 | 282,811 | 179,598 | 356,862 | ||||||||||||

Weighted average shares of Class A common stock outstanding - diluted | 14,298,834 | 14,243,579 | 14,256,911 | 14,209,811 | ||||||||||||

Net income available to Class A common stock per share - basic | $ | 0.12 | $ | 0.17 | $ | 0.25 | $ | 0.34 | ||||||||

Net income available to Class A common stock per share - diluted | $ | 0.12 | $ | 0.17 | $ | 0.25 | $ | 0.33 | ||||||||

The Company’s Class B common stock represent voting interests and do not participate in the earnings of the Company. Accordingly, there is no basic or diluted EPS related to the Company’s Class B common stock.

For both the three and six months ended June 30, 2017, 830,000 unvested equity awards were excluded from the calculation of diluted earnings per common share because the effect would have been anti-dilutive. For the three and six months ended June 30, 2016, 990,000 and 1,010,000, respectively, unvested equity awards were excluded from the calculation of diluted earnings per common share because the effect would have been anti-dilutive.

At June 30, 2017 and 2016 there were 63,941,860 and 65,784,571 Class A Units of Manning & Napier Group outstanding, respectively, which, subject to certain restrictions, may be exchangeable for up to an equivalent number of the Company's Class A common stock. These units were not included in the calculation of diluted earnings per common share for the three and six months ended June 30, 2017 or for the three and six months ended June 30, 2016, because the effect would have been anti-dilutive.

Note 10—Equity Based Compensation

The Equity Plan was adopted by the Company's board of directors and approved by stockholders prior to the consummation of the Company's 2011 initial public offering. Under the Equity Plan, a total of 13,142,813 equity interests are authorized for issuance, and may be issued in the form of Class A common stock, restricted stock units, units of Manning & Napier Group, or certain classes of membership interests in the Company which may convert into units of Manning & Napier Group.

The following table summarizes the award activity for the six months ended June 30, 2017 under the Equity Plan:

Restricted Stock Awards | Weighted Average Grant Date Fair Value | ||||||

Stock awards outstanding at January 1, 2017 | 1,207,788 | $ | 12.56 | ||||

Granted | 70,399 | $ | 5.55 | ||||

Vested | (276,064 | ) | $ | 12.41 | |||

Forfeited | (110,000 | ) | $ | 12.20 | |||

Stock awards outstanding at June 30, 2017 | 892,123 | $ | 12.10 | ||||

For the three and six months ended June 30, 2017, the Company recorded approximately $0.7 million and $1.4 million, respectively, of compensation expense related to awards under the Equity Plan. For the three and six months ended June 30, 2016, the Company recorded approximately $0.8 million and $2.1 million, respectively, of compensation expense related to

16

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

awards under the Equity Plan. As of June 30, 2017, there was unrecognized compensation expense related to Equity Plan awards of approximately $6.6 million, which the Company expects to recognize over a weighted average period of approximately 3.7 years.

During the six months ended June 30, 2017 and 2016, the Company withheld a total of 69,597 and 111,729 restricted shares, respectively, as a result of net share settlements to satisfy employee tax withholding obligations. The Company paid approximately $0.3 million and $1.0 million in employee tax withholding obligations related to these settlements during the six months ended June 30, 2017 and 2016, respectively. These net share settlements had the effect of shares repurchased and retired by the Company, as they reduced the number of shares outstanding.

Note 11—Income Taxes

The Company is comprised of entities that have elected to be treated as either a limited liability company ("LLC") or a “C-Corporation". As such, the entities functioning as LLC’s are not liable for or able to benefit from U.S. federal and most state income taxes on their earnings, and earnings (losses) will be included in the personal income tax returns of each entity’s unit holders. The entities functioning as C-Corporations are liable for or able to benefit from U.S. federal and state and local income taxes on their earnings and losses, respectively.

The Company’s income tax provision and effective tax rate were as follows:

Three months ended June 30, | Six months ended June 30, | |||||||||||||||

2017 | 2016 | 2017 | 2016 | |||||||||||||

(in thousands) | ||||||||||||||||

Earnings from continuing operations before income taxes | $ | 15,831 | $ | 23,243 | $ | 33,688 | $ | 47,101 | ||||||||

Effective tax rate | 7.8 | % | 6.6 | % | 7.7 | % | 6.8 | % | ||||||||

Provision for income taxes | 1,242 | 1,545 | 2,585 | 3,219 | ||||||||||||

Provision for income taxes @ statutory rate | 5,383 | 8,135 | 11,454 | 16,485 | ||||||||||||

Difference between tax at effective vs. statutory rate | $ | (4,141 | ) | $ | (6,590 | ) | $ | (8,869 | ) | $ | (13,266 | ) | ||||

For the three and six months ended June 30, 2017 and 2016, the difference between the Company’s recorded provision and the provision that would result from applying the U.S. statutory rate of 34% and 35%, respectively, is primarily attributable to the benefit resulting from the fact that a significant portion of the Company’s operations include a series of flow-through entities which are generally not subject to federal and most state income taxes. Accordingly, a portion of the Company’s earnings are not subject to corporate level taxes.

Note 12—Related Party Transactions

Transactions with noncontrolling members

From time to time, the Company may be asked to provide certain services, including accounting, legal and other administrative functions for the noncontrolling members of Manning & Napier Group. While immaterial, the Company has not received any reimbursement for such services.

The Company manages the personal funds of certain of the Company's executive officers, including William Manning. Pursuant to the respective investment management agreements, in some instances the Company waives or reduces its regular advisory fees for these accounts and personal funds utilized to incubate products. The aggregate value of the fees earned and fees waived was less than $0.1 million for the six months ended June 30, 2017 and 2016.

Affiliated fund transactions

The Company earns investment advisory fees and administrative service fees under agreements with affiliated mutual funds and collective investment trusts. The aggregate value of revenue earned was approximately $21.1 million and $45.2 million for the three and six months ended June 30, 2017, respectively, and $29.9 million and $57.8 million for the three and six months ended June 30, 2016, respectively. As of June 30, 2017 and December 31, 2016, amounts due from the affiliated mutual funds was approximately $6.0 million and $6.8 million, respectively. As of June 30, 2017 and December 31, 2016, amounts due from affiliated collective investment trusts was approximately $2.4 million and $4.5 million, respectively.

The Company incurs certain expenses on behalf of the collective investment trusts and has contractually agreed to limit its fees and reimburse expenses to limit operating expenses incurred by certain affiliated fund series. The aggregate value of fees waived and expenses reimbursed to, or incurred for, affiliated mutual funds and collective investment trusts was $2.7 million and $2.4 million for the six months ended June 30, 2017 and 2016, respectively.

17

Manning & Napier, Inc.

Notes to Consolidated Financial Statements (Continued)

Note 13—Subsequent Events

Distributions and dividends

On July 25, 2017, the Board of Directors approved a distribution from Manning & Napier Group to Manning & Napier and the noncontrolling interests of Manning & Napier Group. The amount of the distribution will be based on earnings for the quarter ended September 30, 2017, with a maximum amount of $9.0 million. Concurrently, the Board of Directors declared an $0.08 per share dividend to the holders of Class A common stock. The dividend is payable on or about November 1, 2017 to shareholders of record as of October 13, 2017.

18

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

This report contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which reflect our views with respect to, among other things, our operations and financial performance. Words like "believes," "expects," "may," "estimates," "will," "should," "could," "intends," "likely," "plans," or "anticipates" or the negative thereof or other variations thereon or comparable terminology, are used to identify forward-looking statements, although not all forward-looking statements contain these words. Although we believe that we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know about our business and operations, there can be no assurance that our actual results will not differ materially from what we expect or believe. Some of the factors that could cause our actual results to differ materially from our expectations or beliefs are disclosed in the “Risk Factors” section, as well as other sections, of our Annual Report on Form 10-K which include, without limitation: changes in securities or financial markets or general economic conditions; a decline in the performance of our products; client sales and redemption activity; any loss of an executive officer or key personnel; changes in our business related to strategic acquisitions and other transactions; and changes of government policy or regulations. All forward-looking statements speak only as of the date on which they are made and we undertake no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Overview

Our Business

We are an independent investment management firm that provides a broad range of investment solutions, as well as a variety of consultative services that complement our investment process. Founded in 1970, we offer U.S. and non-U.S equity, fixed income, and a range of blended asset portfolios, such as life cycle funds and exchange-traded fund ("ETF")-based portfolios. We serve a diversified client base of high net worth individuals and institutions, including 401(k) plans, pension plans, Taft-Hartley plans, endowments and foundations. Our operations are based principally in the United States, with our headquarters located in Fairport, New York.

Market Developments

Financial markets have had and are likely to continue to have a significant impact on asset flows and the market value of our assets under management ("AUM"). Our one, three, and five year annualized returns for our key investment strategies have generally fallen short of their related benchmarks. In addition, we have experienced increased competition as a result of lower fee passive investment products which have gained popularity over the last decade, such as index funds and ETFs. As a result, we have seen AUM decline since 2014. We anticipate a continued decline in AUM through 2017 as our ability to improve cash flows going forward is dependent in part on our ability to achieve and sustain improved performance. Cash outflows will continue to be a challenge as we have received partial redemption or cancellation notices from several institutional relationships. Our current estimate of the remaining cash outflows resulting from these notices is approximately $0.7 to $1.0 billion. Though the timing is not certain, the outflows are expected to occur over the third and fourth quarters of 2017.

Our Products

We derive substantially all of our revenues from investment management fees earned from providing advisory services to separately managed accounts and mutual funds and collective investment trusts—including those offered by the Manning & Napier Fund, Inc., Exeter Trust Company, Rainier Investment Management Mutual Funds and Rainier Multiple Investment Trust.

Our separate accounts are primarily distributed through our Direct Channel, where our representatives form relationships with high net worth individuals, middle market institutions or large institutions that are working with a consultant. To a lesser extent, we also obtain a portion of our separate account distribution via third parties, either through our Intermediary Channel where national brokerage firm representatives or independent financial advisors select our separate account strategies for their clients, or through our Platform/Sub-Advisory Channel, where unaffiliated registered investment advisors approve our strategies for their product platforms. Our separate account products are a primary driver of our blended asset portfolios for high net worth and middle market institutional clients and financial intermediaries. In contrast, larger institutions and unaffiliated registered investment advisor platforms are a driver of our separate account equity portfolios.

Our mutual funds and collective investment trusts are distributed through financial intermediaries, including brokers, financial advisors, retirement plan advisors and platform relationships. We also distribute our mutual fund and collective investment trusts through our direct sales representatives, in particular within the defined contribution and institutional marketplace. Our mutual fund and collective investment trust products are an important driver of both our blended asset class and equity portfolios.

19

Our AUM was $27.1 billion as of June 30, 2017. The composition of our AUM by vehicle and portfolio is illustrated in the table below:

June 30, 2017 | ||||||||||||||||

AUM - by investment vehicle and portfolio | Blended Asset | Equity | Fixed Income | Total | ||||||||||||

(in millions) | ||||||||||||||||

Separately managed accounts | $ | 10,859.2 | $ | 5,589.9 | $ | 1,265.8 | $ | 17,714.9 | ||||||||

Mutual funds and collective investment trusts | 5,754.6 | 3,504.4 | 101.6 | 9,360.6 | ||||||||||||

Total | $ | 16,613.8 | $ | 9,094.3 | $ | 1,367.4 | $ | 27,075.5 | ||||||||

The composition of our separately managed accounts as of June 30, 2017, by channel and portfolio, is set forth in the table below:

June 30, 2017 | ||||||||||||||||

Blended Asset | Equity | Fixed Income | Total | |||||||||||||

(dollars in millions) | ||||||||||||||||

Separate account AUM | ||||||||||||||||

Direct Channel | $ | 8,181.2 | $ | 4,030.3 | $ | 1,104.1 | $ | 13,315.6 | ||||||||

Intermediary Channel | 2,674.3 | 705.9 | 161.7 | 3,541.9 | ||||||||||||

Platform/Sub-advisor Channel | 3.7 | 853.7 | — | 857.4 | ||||||||||||

Total | $ | 10,859.2 | $ | 5,589.9 | $ | 1,265.8 | $ | 17,714.9 | ||||||||

Percentage of separate account AUM | ||||||||||||||||

Direct Channel | 46 | % | 23 | % | 6 | % | 75 | % | ||||||||

Intermediary Channel | 15 | % | 4 | % | 1 | % | 20 | % | ||||||||

Platform/Sub-advisor Channel | 0 | % | 5 | % | — | % | 5 | % | ||||||||

Total | 61 | % | 32 | % | 7 | % | 100 | % | ||||||||

Percentage of portfolio by channel | ||||||||||||||||

Direct Channel | 75 | % | 72 | % | 87 | % | 75 | % | ||||||||

Intermediary Channel | 25 | % | 13 | % | 13 | % | 20 | % | ||||||||

Platform/Sub-advisor Channel | 0 | % | 15 | % | — | % | 5 | % | ||||||||

Total | 100 | % | 100 | % | 100 | % | 100 | % | ||||||||

Percentage of channel by portfolio | ||||||||||||||||

Direct Channel | 62 | % | 30 | % | 8 | % | 100 | % | ||||||||

Intermediary Channel | 75 | % | 20 | % | 5 | % | 100 | % | ||||||||

Platform/Sub-advisor Channel | 0 | % | 100 | % | — | % | 100 | % | ||||||||

Our separate accounts contributed 46% of our total gross client inflows for the six months ended June 30, 2017 and represented 65% of our total AUM as of June 30, 2017.

Our separate account business has historically been driven primarily by our Direct Channel, where sales representatives form a relationship with high net worth investors, middle market institutions, and large institutional clients working in conjunction with a consultant. The Direct Channel contributed 63% of the total gross client inflows for our separate account business for the six months ended June 30, 2017 and represented 75% of our total separate account AUM as of June 30, 2017. We anticipate the Direct Channel to continue to be the largest driver of new separate account business going forward, given the Direct Channel’s high net worth and middle market institutional client-type focus.

During the six months ended June 30, 2017, blended asset portfolios represented 75% of the separate account gross client inflows from the Direct Channel, while equity and fixed income portfolios represented 7% and 18% respectively. As of June 30, 2017, blended asset and equity portfolios represented 62% and 30%, respectively, of total Direct Channel separate account AUM, while our fixed income portfolios were 8%. We expect our focus on individuals and middle market institutions to continue to drive interest in our blended asset class portfolios, where we provide a comprehensive portfolio of stocks and bonds managed to a client’s specific investment objectives. Our relationships with larger institutions may also be a driver of growth in separately managed account equity strategies, though many of these larger institutions may seek exposure to non-U.S. equity strategies through commingled vehicles rather than separately managed accounts to limit related custody expenses.

20

To a lesser extent, we also obtain separate account business from third parties, including financial advisors or unaffiliated registered investment advisor programs or platforms. During the six months ended June 30, 2017, 23% of the total gross client inflows for separate accounts came from financial advisor representatives (Intermediary Channel), and an additional 15% came from registered investment advisor platforms (Platform/Sub-advisor Channel). The Intermediary and Platform/Sub-advisor Channels represented 25% of our total separate account AUM as of June 30, 2017.

New separate account business through the Intermediary Channel flowed into both our blended asset and equity portfolios, driven by advisors’ needs to identify either a one-stop solution (blended asset portfolio) or to fill a mandate within a multi-strategy portfolio. During the six months ended June 30, 2017, blended asset and equity portfolios represented 48% and 16%, respectively, of the separate account gross client inflows from the Intermediary Channel. As of June 30, 2017, 75% of our separate account AUM derived from financial advisors was allocated to blended asset portfolios, with 20% allocated to equity and 5% allocated to fixed income. We expect that equity and fixed income portfolios may see additional interest from financial advisors over time as more advisors structure a multi-strategy portfolio for their clients.

During the six months ended June 30, 2017, 100% of our separate account gross client inflows from the Platform/Sub-advisory Channel were into equity portfolios. Gross client inflows through the Platform/Sub-advisor Channel are primarily directed to our equity strategies, where we are filling a specific mandate within the investment program or platform product.

Our annualized separate account retention rate across all channels was 76% during the six months ended June 30, 2017, a decrease from our historical retention rate, which was 85% for the twelve months ended December 31, 2016.

The composition of our mutual fund and collective investment trust AUM as of June 30, 2017, by portfolio, is set forth in the table below:

June 30, 2017 | ||||||||||||||||

Blended Asset | Equity | Fixed Income | Total | |||||||||||||

(in millions) | ||||||||||||||||

Mutual fund and collective investment trust AUM | $ | 5,754.6 | $ | 3,504.4 | $ | 101.6 | $ | 9,360.6 | ||||||||