Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - MANNKIND CORP | d412831dex322.htm |

| EX-32.1 - EX-32.1 - MANNKIND CORP | d412831dex321.htm |

| EX-31.2 - EX-31.2 - MANNKIND CORP | d412831dex312.htm |

| EX-31.1 - EX-31.1 - MANNKIND CORP | d412831dex311.htm |

| 10-Q - 10-Q - MANNKIND CORP | d412831d10q.htm |

Exhibit 10.3

OFFICE LEASE

BETWEEN

RUSSELL RANCH ROAD II LLC,

a Delaware limited liability company,

AS LANDLORD

AND

MANNKIND CORPORATION,

a Delaware corporation

AS TENANT

OFFICE LEASE

THIS OFFICE LEASE (this “Lease”) is made and entered into as of May 5, 2017 (the “Effective Date”), by and between

“Landlord” RUSSELL RANCH ROAD II LLC, a Delaware limited liability company

and

“Tenant” MANNKIND CORPORATION, a Delaware corporation

ARTICLE I DEFINITIONS

Access Laws: The Americans With Disabilities Act of 1990 (including the Americans with Disabilities Act Accessibility Guidelines for Building and Facilities) and all other Governmental Requirements relating to the foregoing.

Additional Rent: Defined in paragraph captioned “Additional Rent”.

Base Amount Allocable to the Premises: Defined in paragraph captioned “Additional Rent”.

Base Rent: Base Rent shall be as follows:

| Month of Lease Term: | Monthly Base Rent: | |||

| 1 – 12 |

$ | 40,951.00 per month | ||

| 13 – 24 |

$ | 42,179.53 per month | ||

| 25 – 36 |

$ | 43,444.92 per month | ||

| 37 – 48 |

$ | 44,748.26 per month | ||

| 49 – 60 |

$ | 46,090.71 per month | ||

| 61 – 65 |

$ | 47,473.43 per month | ||

Base Rent Credit: See Section 3.2.2 herein.

Base Year: Calendar year 2017.

Brokers: Tenant was represented in this transaction by Jones Lang LaSalle, a licensed real estate broker. Landlord was represented in this transaction by Jones Lang LaSalle and IDS Real Estate Group, each licensed real estate brokers. The parties acknowledge that Jones Lang LaSalle is acting in a Dual Agency role in representing both Landlord and Tenant in this transaction.

Building: The building located on the Land at 30930 Russell Ranch Road, Westlake Village, California, and containing approximately sixty-four thousand three hundred four (64,304) rentable square feet. Landlord shall have the right (but not the obligation) to re-measure the rentable and usable square footage of the Building, and the results of Landlord’s re-measurement shall be provided to Tenant and shall be binding and conclusive on Tenant for all purposes under this Lease. If the amount of the rentable square feet and/or the usable square feet of the Building is adjusted, then Tenant’s Pro Rata Share of the Building shall be equitably adjusted by Landlord accordingly.

Business Day: Calendar days, except for Saturdays and Sundays and holidays when banks are closed in Los Angeles, California.

1

Claims: An individual and collective reference to any and all claims, demands, damages, injuries, losses, liens, liabilities, penalties, fines, lawsuits, actions, other proceedings and expenses (including attorneys’ fees and expenses incurred in connection with the proceeding whether at trial or on appeal).

Commencement Date: The earlier to occur of (i) the date Tenant commences conducting business from the Premises, or (ii) the later of: (a) the date of Substantial Completion of the Landlord Work, (b) the date Tenant has been granted access to the Premises for purposes of installing IT equipment and other related facilities, or (c) August 1, 2017.

Commencement Date Memorandum: Defined in the Section entitled “Commencement Date Memorandum”.

ERISA: The Employee Retirement Income Security Act of 1974, as now or hereafter amended, and the regulations promulgated under it.

Estimated Operating Costs Allocable to the Premises: Defined in the Section captioned “Additional Rent”.

Events of Default: One or more of those events or states of facts defined in the Section captioned “Events of Default”.

Governmental Agency: The United States of America, the State of California, any county, city, district, municipality or other governmental subdivision, court or agency or quasi-governmental agency having jurisdiction over the Land and any board, agency or authority associated with any such governmental entity, including the fire department having jurisdiction over the Land.

Governmental Requirements: Any and all statutes, ordinances, codes, laws, rules, regulations, orders and directives of any Governmental Agency as now or later amended.

Green Agency Ratings: Any one or more of the following ratings, as same may be in effect or amended or supplemented from time to time: The U.S. EPA’s Energy Star® rating and/or Design to Earn Energy Star, the Green Building Initiative’s Green Globes TM for Continual Improvement of Existing Buildings (Green GlobesTM-CIEB), the U.S. Green Building Council’s Leadership in Energy and Environmental Design (LEED) rating system, LEED EBOM (existing buildings operations and maintenance) and any applicable substitute third party or government mandated rating systems.

Guarantor: N/A.

Hazardous Substance(s): Any product, substance, chemical, material or waste whose presence, nature, quantity and/or intensity of existence, use, manufacture, disposal, transportation, spill, release or effect, either by itself or in combination with other material expected to be on the Premises, is a basis for potential liability of Landlord or Landlord’s Agents to any Governmental Agency or third party under any applicable statute or common law theory. Hazardous Substances shall include asbestos, PCB, petroleum or petroleum-based chemicals or substances, urea formaldehyde or any chemical, material, element, compound, solution, mixture, substance or other matter of any kind whatsoever which is now or later defined, classified, listed, designated or regulated as hazardous, toxic or radioactive by any Governmental Agency or is similarly defined pursuant to any applicable Governmental Requirements.

2

Land: The land upon which the Building is located in Westlake Village, California.

Landlord: The limited liability company named on the first page of this Lease, or its successors and assigns as provided in the Section captioned “Assignment by Landlord”.

Landlord Work: See Section 2.8.2 below.

Landlord’s Agents: Landlord’s trustees, affiliates, officers, directors, partners, members, consultants, employees, agents, managers and advisors.

Lease Security Deposit: Forty-Seven Thousand Four Hundred Seventy-Three and 43/100 Dollars ($47,473.43).

Lease Term: Commencing on the Commencement Date and ending on the last day of that calendar month which is sixty-five (65) months after the Commencement Date.

Lender: Defined in Section captioned “Landlord’s Default”.

Manager: IDS Real Estate Group, or its replacement as specified by written notice from Landlord to Tenant.

Manager’s Address: Set forth in Landlord’s signature block below, which address may be changed by written notice from Landlord to Tenant.

Operating Costs: Defined in the Section captioned “Additional Rent”.

Operating Costs Allocable to the Premises: Defined in the Section captioned “Additional Rent”.

Parking: Subject to the terms and conditions of this paragraph and Section 4.11 below and subject to the Parking Encumbrance (as defined below), as of the Commencement Date, Tenant shall have the right, during the Lease Term, to use a total of fifty (50) unreserved parking passes for unreserved parking of Tenant’s automobiles on a non-exclusive first-come, first served basis, in the Project parking area(s) designated by Landlord from time to time; provided, however, that Tenant shall be entitled to convert five (5) of such unreserved parking passes to reserved parking passes (subject to availability as determined by Landlord in Landlord’s sole and absolute discretion), which, if available, shall be for parking spaces located within a reasonable walking distance from the south entrance of the Building.

Permitted Use. General office use, so long as such use is strictly in accordance with Governmental Requirements and matters of record. In no event shall Tenant be permitted to engage in retail, food or restaurant sales or activities at the Premises; provided that the foregoing shall not prohibit the incidental preparation of food and beverages by Tenant’s employees using conventional microwave ovens, toaster ovens or coffee makers customarily found in first-class office spaces.

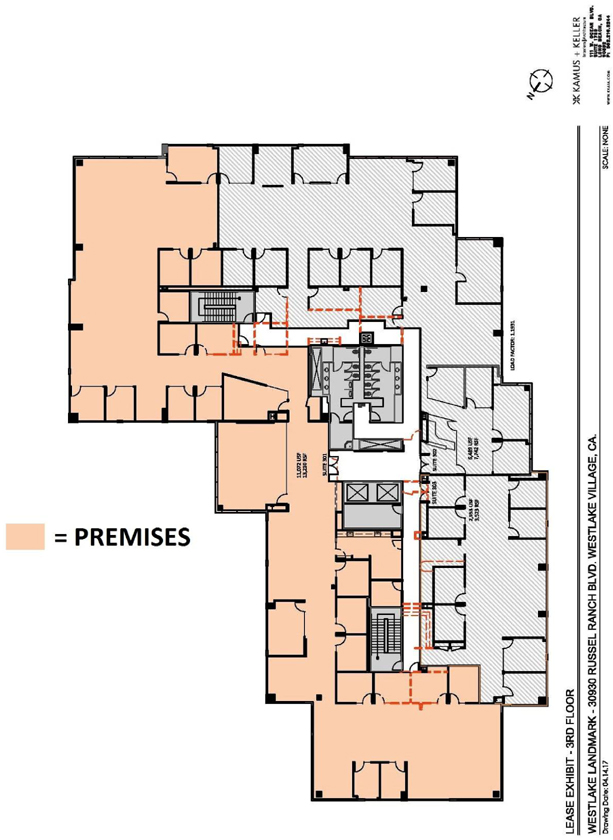

Premises: Approximately thirteen thousand two hundred ten (13,210) rentable square feet on the third (3rd) floor of the Building, as depicted on Exhibit A attached hereto. Such square footage shall be final, conclusive and controlling. Notwithstanding the foregoing, Landlord shall have the right (but not the obligation) to re-measure the rentable and usable square footage of the Premises, and the results of Landlord’s re-measurement shall be provided to Tenant and shall be binding and conclusive on Tenant for all purposes under this Lease. If the amount of the rentable square feet and/or the usable square feet of the Premises and/or Project is adjusted, then Base Rent, Tenant’s Pro Rata Share, and Parking (and all other amounts that Landlord determines are based on the square footage of the Premises) shall be equitably adjusted by Landlord accordingly.

3

Prepaid Rent: Forty Thousand Nine Hundred Fifty-One Dollars ($40,951.00), to be applied toward Base Rent for the first month of the Lease Term.

Prime Rate: Defined in the Section captioned “Default Rate”.

Project: The project known as Westlake Landmark, which includes the Building, the Land, and the other improvements located thereon. The Project currently includes two (2) three story office buildings (including the Building).

Property Taxes: (a) Any form of ad valorem real or personal property tax or assessment imposed by any Governmental Agency on the Land, Building, related improvements or any personal property owned by Landlord associated with such Land, Building or improvements; (b) any other form of tax or assessment, license fee, license tax, tax or excise on rent or any other levy, charge, expense or imposition made or required by any Governmental Agency on any interest of Landlord in such Land, Building, related improvements or personal property; (c) any fee for services charged by any Governmental Agency for any services such as fire protection, street, sidewalk and road maintenance, refuse collection, school systems or other services provided or formerly provided to property owners and residents within the general area of the Land; (d) any governmental impositions allocable to or measured by the area of any or all of such Land, Building, related improvements or personal property or the amount of any base rent, additional rent or other sums payable under any lease for any or all of such Land, Building, related improvements or personal property; (e) any gross receipts or other excise tax allocable to, measured by or a function of any one or more of the matters referred to in clause (d); (f) any impositions by any Governmental Agency on any transaction evidenced by a lease of any or all of such Land, Building, related improvements or personal property or charge with respect to any document to which Landlord is a party creating or transferring an interest or an estate in any or all of such Land, Building, related improvements or personal property; and (g) any increase in any of the foregoing based upon construction of improvements or change of ownership of any or all of such Land, Building, related improvements or personal property. Notwithstanding anything to the contrary set forth in this Lease, in no event shall Property Taxes included in Operating Costs for any Year subsequent to the Base Year be less than the amount of Property Taxes included in Operating Costs for the Base Year. In addition, when calculating Property Taxes for the Base Year, special assessments shall only be deemed included in Property Taxes for the Base Year to the extent that such special assessments are included in Property Taxes for the applicable subsequent Year during the Lease Term. In the event such Property Taxes are eliminated or reduced by any federal, state or municipal body or governmental agency having jurisdiction thereof, and another tax is imposed by way of substitution for (or in addition thereto) all or any part of such Property Taxes, then such substituted (or additional) tax shall be included as Property Taxes under this Lease. Notwithstanding anything to the contrary set forth in this Lease, the amount of Property Taxes for the Base Year and any subsequent calendar year shall be calculated without taking into account any decreases in real estate taxes obtained in connection with Proposition 8, and, therefore, the Property Taxes in the Base Year and/or any subsequent calendar year may be greater than those actually incurred by Landlord, but shall, nonetheless, be the taxes due under this Lease; provided that tax refunds under Proposition 8 shall not be deducted from Property Taxes, but rather shall be the sole property of Landlord. Landlord and Tenant acknowledge and agree that the immediately preceding sentence is not intended to in any way affect (i) the inclusion in Property Taxes of the statutory two percent (2.0%) annual increase in taxes (as such statutory increase may be modified by subsequent legislation), or (ii) the inclusion of real estate taxes in Property Taxes

4

pursuant to the terms of Proposition 13. Notwithstanding the foregoing, Property Taxes shall not include (i) franchise, inheritance or capital stock taxes, or income taxes measured by the net income of Landlord from all sources, unless any such taxes are levied or assessed against Landlord as a substitute for, in whole or in part, any Property Tax; and (iii) penalties, fines, interest or charges due for late payment of Property Taxes by Landlord unless such late payment is due to Tenant’s act or omission.

Substantial Completion: The term “Substantial Completion” shall mean (i) the completion of the Landlord Work, as reasonably determined by Landlord and confirmed pursuant to a walk-through by representatives of Landlord and Tenant, subject only to minor punch list items identified by Tenant in a written notice to Landlord delivered within five (5) days after Landlord tenders possession of the Premises, such that none of the Landlord Work remaining incomplete or needing adjustment shall prevent Tenant’s occupancy of the Premises, and (ii) to the extent legally required, a valid temporary certificate of occupancy (or other governmental approval), or the substantial equivalent of the foregoing (but in all cases only to the extent legally required) has been issued allowing Tenant to commence use of the Premises for the Permitted Use; provided that in the event any such certificate, approval or substantial equivalent cannot be issued as a result of Tenant’s particular use of the Premises or any additional work to be performed by or on behalf of Tenant (if any) outside of the scope of the Landlord Work (including, without limitation, with respect to the installation of any fixtures or equipment), then the delivery of such certificate, approval or substantial equivalent shall not be required for Substantial Completion to occur (and satisfaction of item (i) above shall constitute Substantial Completion). In the event of any dispute as to whether Substantial Completion has occurred, the sign-off by the municipal building inspector shall be conclusive.

Telecommunication Facilities: Equipment, facilities, apparatus and other materials utilized for the purpose of electronic telecommunication, including cable, switches, wires, conduit and sleeves.

Telecommunication Services: Services associated with electronic telecommunications, whether in a wired or wireless mode. Basic voice telephone services are included within this definition.

Tenant: The person or entity(ies) named on the first page of this Lease.

Tenant’s Agents: Any and all officers, partners, members, contractors, subcontractors, consultants, licensees, agents, concessionaires, subtenants, servants, employees, customers, guests, invitees or visitors of Tenant.

Tenant Alterations: Defined in the Section captioned “Tenant Alterations”.

Tenant’s Pro Rata Share: 19.59%.

Year: A calendar year commencing January 1 and ending December 31 or that portion of the calendar year within the Lease Term.

ARTICLE II PREMISES AND TERM

2.1. Lease of Premises. Landlord leases the Premises to Tenant, and Tenant leases the Premises from Landlord, upon the terms and conditions set forth in this Lease. Appurtenant to Tenant’s lease of the Premises and subject to the terms and conditions of this Lease, Tenant shall also have the non-exclusive right, in common with Landlord and other tenants and occupants of the Project, to use the common areas and parking facilities of the Project, and the right of ingress to and egress from the Premises through,

5

over, under, across, and along the common areas and parking facilities. Subject to the terms and conditions of this Lease, Tenant shall have access to the Premises twenty-four (24) hours per day, seven (7) days per week.

2.2 Lease Term.

2.2.1 The Lease Term shall be for the period stated in the definition of that term, unless earlier terminated as provided in this Lease. If this Lease is executed before the Premises become vacant or otherwise available or if any present tenant or occupant of the Premises holds over, and Landlord cannot acquire possession of the Premises in time to deliver them by any estimated or anticipated Commencement Date (or any other date), or if Landlord is otherwise unable to deliver the Premises by any estimated or anticipated Commencement Date (or any other date), this Lease shall not be void or voidable, and Landlord shall not be deemed to be in default hereunder, nor shall Landlord be liable for any loss or damage directly or indirectly arising out of or resulting from such holdover or otherwise. Subject to extension for any delays caused by events of force majeure and/or Tenant or Tenant’s Agents, if Substantial Completion of the Landlord Work fails to occur by November 1, 2017 (the “Outside Date”), then Tenant (as Tenant’s sole remedy for such failure) shall thereafter, prior to the Substantial Completion of the Landlord Work, have the right to terminate this Lease by delivery of written notice of such election to Landlord, which notice must be given, if at all, on or before the date which is ten (10) days following the Outside Date, which termination shall be effective thirty (30) days after Landlord receives Tenant’s termination notice; provided, further, that if Substantial Completion of the Landlord Work occurs during such 30-day period, Tenant’s termination notice shall automatically be deemed null and void. Notwithstanding the foregoing, in the event that Tenant fails to deliver any such Lease termination notice to Landlord within ten (10) days following the Outside Date and/or prior to Substantial Completion of the Landlord Work, Tenant’s right to terminate the Lease as described herein shall automatically terminate and become null and void and be of no further force or effect. If this Lease is terminated pursuant to the terms of this paragraph, this Lease and the rights and obligations of the parties pursuant to this Lease shall cease and terminate following which neither party shall have any further rights or obligations arising out of this Lease or the termination of this Lease, except those rights and obligations expressly surviving expiration or earlier termination of this Lease.

2.2.2 Subject to all Governmental Requirements (defined below), Tenant may enter the Premises after July 31, 2017 (and prior to such date with Landlord’s written consent, which consent shall not be unreasonably withheld if the existing tenant that currently occupies the Premises as of the Effective Date of this Lease has otherwise vacated and surrendered possession of the Premises to Landlord), for the sole purpose of installing Tenant’s furniture, fixtures and equipment (provided, however, Tenant shall only be permitted to enter upon such portions of the Premises, and at such times, as Landlord reasonably determines will not unreasonably interfere with the performance of the Landlord Work). Notwithstanding the foregoing, in no event shall Tenant enter the Premises until such time as Tenant has provided Landlord with evidence that Tenant has fulfilled its obligation to provide insurance pursuant to the provisions of this Lease. Such early entry in and of itself will not advance the Commencement Date. All of the provisions of this Lease shall apply to Tenant and Landlord during any early entry, including, without limitation, the indemnities set forth in this Lease and Tenant’s obligation to not unreasonably interfere with the performance of the Landlord Work, but excluding only the obligation to pay Base Rent until the Commencement Date has occurred, whereupon Base Rent shall immediately commence. During any such early entry, Landlord shall not be responsible for any loss, including theft, damage or destruction to any work or material installed or stored by Tenant at the Premises or for any injury to Tenant or its agents, employees, contractors, subcontractors, subtenants, assigns, licensees or invitees, except to the extent caused by the gross negligence or willful misconduct of Landlord or Landlord’s Agents (subject to the terms and conditions in Section 4.15 below). Landlord shall have the right to post appropriate notices of non-responsibility in connection with any early entry by Tenant.

6

| 2.3 | Intentionally Omitted. |

2.4 Commencement Date Memorandum. Landlord may, at its option, prepare and submit to the Tenant a Commencement Date Memorandum in the form of Exhibit C, completed in good faith by Landlord, and executed by Landlord. The information inserted on the Commencement Date Memorandum shall be controlling and conclusive and shall prevail over any inconsistent provision in this Lease on (a) the mutual execution of the Commencement Date Memorandum by Landlord and Tenant, or (b) the lapse of seven (7) days following delivery of the Commencement Date Memorandum to Tenant without Tenant delivering to Landlord a written objection to all or part of the information in the Commencement Date Memorandum. If Tenant does object in good faith to any information set forth in the Commencement Date Memorandum, it shall execute the Commencement Date Memorandum subject to its specifically-stated, written objections. Tenant must explain the reasons for its objections in reasonable detail. That portion of the Commencement Date Memorandum to which no objection was made shall be conclusive and controlling. Pending resolution of any dispute by agreement or a final determination by a court of competent jurisdiction in accordance with this Lease, Landlord’s information as inserted in the Commencement Date Memorandum shall be utilized subject to any later adjustment agreed or found to be appropriate. Tenant’s refusal or failure to execute a Commencement Date Memorandum shall not constitute a default under this Lease, but shall neither prevent nor delay the occurrence of the Commencement Date. In no event shall this Lease or the Commencement Date Memorandum be recorded without the prior written consent of Landlord, in its sole and absolute discretion.

| 2.5 | Use and Conduct of Business. |

2.5.1 The Premises are to be used only for the Permitted Uses, and for no other business or purpose without the prior consent of Landlord. Landlord makes no representation or warranty as to the suitability of the Premises for Tenant’s intended use. Tenant shall, at its own cost and expense, obtain and maintain any and all licenses, permits, and approvals necessary or appropriate for its use, occupation and operation of the Premises for the Permitted Uses. Tenant’s inability to obtain or maintain any such license, permit or approval necessary or appropriate for its use, occupation or operation of the Premises shall not relieve it of its obligations under this Lease, including the obligation to pay Base Rent and Additional Rent.

2.5.2 No act shall be done in or about the Premises that is unlawful or that will increase the existing rate of insurance on any or all of the Land or Building. Tenant shall not commit or allow to be committed or exist: (a) any waste upon the Premises, (b) any public or private nuisance, or (c) any act or condition which disturbs the quiet enjoyment of any other tenant in the Building, violates any of Landlord’s contracts affecting any or all of the Land or Building, or creates or contributes to any work stoppage, strike, picketing, labor disruption or dispute, interferes in any way with the business of Landlord or any other tenant in the Building or with the rights or privileges of any contractors, subcontractors, licensees, agents, concessionaires, subtenants, servants, employees, customers, guests, invitees or visitors or any other persons lawfully in and upon the Land or Building.

2.5.3 Tenant shall not, without the prior consent of Landlord, use any apparatus, machinery, device or equipment in or about the Premises which will cause any substantial noise or vibration which can be heard or felt outside of the Premises, or any increase in the consumption level of electric power (other than ordinary and typical office equipment typically used in the ordinary course of business by similar office tenants in the Building or other Class A office buildings in the vicinity of the Project). If any of Tenant’s apparatus, machinery, devices or equipment should disturb the quiet enjoyment of any other tenant in the Building, then Tenant shall provide, at its sole cost and expense, adequate insulation or

7

take other such action, including removing such apparatus, machinery, devices or equipment, as may be necessary to eliminate the disturbance. No food or beverage dispensing machines shall be installed by Tenant in the Premises without the prior written consent of Landlord, not to be unreasonably withheld, conditioned or delayed.

2.5.4 Tenant shall not knowingly use or operate the Premises in any manner that will cause the Building or any part thereof not to conform with Landlord’s sustainability practices or the certification of the Building issued pursuant to any Green Agency Rating.

2.6 Compliance with Governmental Requirements and Rules and Regulations. Tenant shall comply with all Governmental Requirements relating to the Premises (including, without limitation, Tenant’s use, occupancy and operation thereof), and/or the use of the Building by Tenant and/or Tenant’s Agents, and all other covenants, conditions and restrictions and other matters of record, and Tenant shall observe such reasonable, non-discriminatory rules and regulations as may be adopted and published by Landlord from time to time for the safety, care and cleanliness of the Premises and the Building, and for the preservation of good order in the Building, including the Rules and Regulations attached to this Lease as Exhibit D. In the event of any conflict between the Rules and Regulations and the terms of this Lease, the terms of this Lease shall control.

2.7 Relocation. Subject to the terms and conditions of this Section 2.7, at any time after the execution of this Lease, Landlord shall have the one time right, but not the obligation, to relocate Tenant from the Premises into any other premises of approximately the same size, quality, and layout, located on the third (3rd) floor of the Building (the “Relocation Premises”). Such Relocation Premises shall be deemed to be the Premises for all purposes hereunder and this Lease shall be deemed modified accordingly and shall remain in full force and effect as so modified; provided, however, if the Relocation Premises is larger or smaller than the Premises, then Base Rent, Tenant’s Pro Rata Share of Operating Costs, and all other sums payable hereunder that are based upon the square footage of the Premises shall be proportionately adjusted (but shall not be increased during the initial Lease Term). In the event Landlord elects to relocate Tenant, Landlord shall provide Tenant with written notice of its election to relocate at least forty-five (45) Business Days prior to the actual relocation date selected by Landlord (the “Relocation Notice”). The date selected by Landlord for the actual relocation of Tenant (which date must be at least forty-five (45) Business Days after the date of the Relocation Notice ) is referred to as the “Selected Date”. Following Landlord’s election and written notice thereof to Tenant, Tenant shall be obligated to relocate to the Relocation Premises by no later than the Selected Date and lease such Relocation Premises from Landlord on the same terms and conditions as this Lease. Landlord shall be obligated to pay to Tenant an allowance (the “Relocation Allowance”) equal to the reasonable out-of-pocket moving expenses actually incurred by Tenant to move from the Premises to the Relocation Premises (including the physical move from the Premises to the Relocation Premises, the expenses associated with the relocation of Telecommunication Facilities and other Tenant electronic installations, and costs for stationery, business cards, invoices, brochures and the like if Tenant’s address, facsimile or telephone numbers are changed in any manner due to the relocation); provided that, Tenant shall submit to Landlord a detailed description of the type and estimated amount of such moving expenses prior to the move and Landlord shall have consented to such expenses, which consent shall not be unreasonably withheld. Tenant shall be solely responsible for any costs and expenses incurred by it with respect to the relocation in excess of the Relocation Allowance. The work to be performed under this Section 2.7 is subject to the union labor requirement as set forth in the Section of this Lease captioned “Tenant’s Work Performance”.

8

2.8 Condition of Premises “AS-IS”.

2.8.1 Subject to Section 2.8.2 below, and except as expressly provided elsewhere in this Lease, Tenant hereby agrees that the Premises shall be taken “as is”, “with all faults”, without any representations or warranties, and Tenant hereby agrees and warrants that it has investigated and inspected the condition of the Premises and the suitability of same for Tenant’s purposes, and Tenant does hereby waive and disclaim any objection to, cause of action based upon, or claim that its obligations hereunder should be reduced or limited because of the condition of the Premises or the Building or the suitability of same for Tenant’s purposes. Tenant acknowledges that neither Landlord nor any agent nor any employee of Landlord has made any representations or warranty with respect to the Premises or the Building or with respect to the suitability of either for the conduct of Tenant’s business, and Tenant expressly warrants and represents that Tenant has relied solely on its own investigation and inspection of the Premises and the Building in its decision to enter into this Lease and let the Premises in an “as is” condition. The taking of possession of the Premises by Tenant shall conclusively establish that the Premises and the Building were at such time in satisfactory condition. Tenant hereby waives subsection 1 of Section 1932 of the Civil Code of California or any successor provision of law.

2.8.2 Landlord shall, on a one-time basis only, using Building-standard materials, guidelines, specifications and procedures (except to the extent otherwise designated by Landlord), perform the following work within the Premises (collectively, the “Landlord Work”): (i) install Tenant’s choice of new Building-standard carpet within the Premises; (ii) install Tenant’s choice of Building-standard VCT flooring in the kitchen and server room within the Premises; (iii) install Tenant’s choice of new Building-standard base molding throughout the Premises; (iv) paint the interior walls of the Premises utilizing Tenant’s choice of Building-standard colors; and (v) move or lift any existing furniture, fixtures and equipment in the Premises as needed to complete the Landlord Work. Except as expressly provided herein, the exact scope and specifications for each element of the Landlord Work shall be determined by Landlord in its commercially reasonable discretion. Landlord shall submit specifications for the Landlord Work at least ten (10) days prior to commencing the Landlord Work. If Tenant fails to give written notice of its approval of such specifications, or fails to send a written notice of its reasonable disapproval setting forth its reasons therefore in reasonably sufficient detail, within such ten (10) day period, Tenant shall be deemed to have approved the specifications submitted by Landlord. Tenant shall not (and Tenant shall ensure that its agents, employees and contractors do not) unreasonably interfere with the performance of the Landlord Work and shall cooperate with Landlord in connection with the performance of the Landlord Work. Landlord shall have no responsibility for, or for any reason be liable to, Tenant for any direct or indirect injury to or interference with Tenant’s business arising from the performance of the Landlord Work, nor shall Tenant be entitled to any compensation or damages from Landlord for loss of the use of the whole or any part of the Premises or of Tenant’s personal property or improvements resulting from the performance of the Landlord Work or Landlord’s or Landlord’s contractor’s or agent’s actions in connection with the performance of the Landlord Work, or for any inconvenience or annoyance occasioned by the performance of the Landlord Work or Landlord’s or Landlord’s contractor’s or agent’s actions in connection with the performance of the Landlord Work. Tenant shall be responsible for any increase in the cost of performing the Landlord Work resulting from any negligent or unreasonable act or omission of Tenant or any agent, employee, contractor, licensee or invitee of Tenant (and Tenant shall pay any such increased costs to Landlord upon demand).

2.8.3 Landlord hereby represents to Tenant that, to the actual knowledge of Landlord, (i) Landlord has not received written notice from a governmental authority with jurisdiction indicating that the Premises contain Hazardous Substances in violation of applicable Governmental Requirements and that remediation is required (which violation has not been cured), and (ii) Landlord has not received written notice from a governmental authority with jurisdiction indicating that the Premises is in violation of applicable Governmental Requirements and that remediation is required (which violation has not been

9

cured). Landlord also hereby represents that, as of the Commencement Date, the existing plumbing, lighting, electrical, mechanical and HVAC systems serving the Premises (collectively, the “Building Systems”) shall be in good working order; provided, however, if Tenant does not deliver written notice to Landlord of any material breach of such representation within thirty (30) days following the Commencement Date, then Tenant shall be deemed to have inspected and accepted the Building Systems in their present condition, and the correction of any subsequently discovered defects shall be the obligation of the applicable party pursuant to the other provisions of this Lease. If a material breach of the foregoing representation exists, and Tenant timely (i.e., within thirty (30) days following the Commencement Date) delivers written notice to Landlord setting forth in reasonable detail a description of such material breach, Landlord shall, as Tenant’s sole and exclusive remedy, rectify the same at Landlord’s expense, and not as part of Operating Costs (provided, however, in no event shall Landlord be responsible for any damages or defects to the extent existing as a result of any act or omission of Tenant or Tenant’s agents, employees, contractors, subcontractors, subtenants, assigns, licensees or invitees, all of which shall be the sole responsibility of Tenant).

2.8.4 Tenant acknowledges that Landlord may elect, in Landlord’s sole and absolute discretion, at anytime during the Lease Term, to install (at Landlord’s sole cost and expense) a multi-tenant corridor (the “Corridor Work”) to demise the Premises from the remainder of the third (3rd) floor during the Tenant’s occupancy of the Premises. If, however, Landlord leases space adjacent to the Premises on the third (3rd) floor of the Building to a third party, then Landlord shall be obligated to perform the Corridor Work (at Landlord’s sole cost and expense) following the date Landlord enters into such lease with such third party, which Corridor Work shall include demolishing any partial walls, installing new drywall, painting same to match the existing wall colors, and modifying the ceiling and flooring as necessary to reasonably match the interior or the Premises. Landlord shall perform and complete the Corridor Work in compliance with all Governmental Requirements. In either of such events, the square footage of the Premises shall not be reduced and Landlord shall use commercially reasonable efforts to not unreasonably interfere with Tenant’s use and occupancy of and access to the Premises during performance of the Corridor Work. Except as expressly provided herein, the exact scope and specifications for each element of the Corridor Work shall be determined by Landlord in its commercially reasonable discretion. Tenant shall not (and Tenant shall ensure that its agents, employees and contractors do not) unreasonably interfere with the performance of the Corridor Work and shall cooperate with Landlord in connection with the performance of the Corridor Work, including, without limitation, by permitting the Landlord to move any equipment and other property which Landlord or its contractor may request be moved (at Landlord’s sole cost and expense). If the Corridor Work is performed during Tenant’s occupancy of the Premises, Landlord shall use commercially reasonable efforts to cause the Corridor Work to be performed outside of normal business hours, but shall not have any obligation to pay overtime or other premiums and, if the Corridor Work is to be performed during normal business hours, Landlord shall use commercially reasonable efforts to minimize unreasonable interference with Tenant’s business in, and occupancy of, the Premises. Tenant hereby agrees that the performance of the Corridor Work in accordance with this Section 2.8.4 shall in no way constitute a constructive eviction of Tenant, or entitle Tenant to any abatement of rent payable pursuant to the Lease. Landlord shall have no responsibility for, or for any reason be liable to, Tenant for any direct or indirect injury to or interference with Tenant’s business arising from the performance of the Corridor Work, nor shall Tenant be entitled to any compensation or damages from Landlord for loss of the use of the whole or any part of the Premises or of Tenant’s personal property or improvements resulting from the performance of the Corridor Work or Landlord’s or Landlord’s contractor’s or agent’s actions in connection with the performance of the Corridor Work, or for any inconvenience or annoyance occasioned by the performance of the Corridor Work or Landlord’s or Landlord’s contractor’s or agent’s actions in connection with the performance of the Corridor Work; provided, however, that Landlord shall be responsible for any actual damage to Tenant’s personal property or personal injury to Tenant’s Agents caused by the gross negligence or willful misconduct of Landlord and/or Landlord’s Agents, but subject in all events to Section 4.15 below. Landlord shall

10

promptly repair any damage to the Premises to the extent caused by Landlord and/or Landlord’s Agents during the performance of the Corridor Work. Tenant shall be responsible for any increase in the cost of performing the Corridor Work resulting from any negligent or unreasonable act or omission of Tenant or any agent, employee, contractor, licensee or invitee of Tenant (and Tenant shall pay any such increased costs to Landlord upon demand).

2.8.5 Landlord will request that the existing tenant of the Premises (the “Existing Tenant”) surrender the Premises to Landlord with certain existing office furniture in place. Tenant shall have the right to designate, by written notice to Landlord delivered within ten (10) Business Days following the mutual execution and delivery of this Lease, that Landlord remove from the Premises any unwanted portion of any such furniture within the Premises that is surrendered by the existing tenant of the Premises (the “Existing Furniture”). Tenant hereby agrees that Landlord makes no representation or warranty with regard to the Existing Furniture, and Tenant shall accept the same in its “as-is” condition, without representation or warranty of any kind (express or implied) by Landlord. Notwithstanding anything to the contrary contained in this Lease, Tenant shall not be obligated to remove the Existing Furniture upon the expiration or earlier termination of the Lease Term.

2.9 Sustainable Building Operations.

2.9.1 This Building is or may become in the future certified under certain Green Agency Ratings or operated pursuant to Landlord’s sustainable building practices, as same may be in effect or modified from time to time. Landlord’s sustainability practices address, without limitation, whole-building operations and maintenance issues including chemical use; indoor air quality; energy efficiency; water efficiency; recycling programs; exterior maintenance programs; and systems upgrades to meet green building energy, water, Indoor Air Quality, and lighting performance standards. All of Tenant’s construction and maintenance methods and procedures, purchase of materials, and disposal of waste must be in compliance with minimum standards and specifications as outlined by the Green Agency Ratings, in addition to all Governmental Requirements.

2.9.2 Tenant shall use commercially reasonable efforts to ensure the use of proven energy and carbon reduction measures (as may be designated by Landlord in writing from time to time), including energy efficient bulbs in task lighting; use of lighting controls; daylighting measures to avoid overlighting interior spaces; closing shades on the south side of the building to avoid over heating the space; turning off lights and equipment at the end of the work day; and purchasing ENERGY STAR® qualified equipment, including but not limited to lighting, office equipment, commercial and residential quality kitchen equipment, vending and ice machines; and purchasing products certified by the U.S. EPA’s Water Sense® program.

2.10 Recycling and Waste Management. Tenant covenants and agrees, at its sole cost and expense: (a) to comply with all present and future Governmental Requirements regarding the collection, sorting, separation, and recycling of garbage, trash, rubbish and other refuse (collectively, “trash”); (b) to comply with Landlord’s recycling policy, as stated in the Rules and Regulations (as such policy may be amended or supplemented from time to time), as part of Landlord’s sustainability practices where it may be more stringent than applicable Governmental Requirements, including without limitation, recycling such categories of items designated by Landlord and transporting such items to any recycling areas designated by Landlord; (c) to sort and separate its trash and recycling into such categories as are provided by Governmental Requirements or Landlord’s then-current sustainability practices; (d) that each separately sorted category of trash and recycling shall be placed in separate receptacles as directed by Landlord; (e) that Landlord reserves the right to refuse to collect or accept from Tenant any waste that is not separated and sorted as required by Governmental Requirements, and to require Tenant to arrange for such collection at Tenant’s sole cost and expense, utilizing a contractor reasonably satisfactory to Landlord; and (f) that Tenant shall pay all costs, expenses, fines, penalties or damages that may be imposed on Landlord or Tenant by reason of Tenant’s failure to comply with the provisions of this paragraph 2.10.

11

2.11 Accessibility Disclosure. Landlord hereby discloses to Tenant, in accordance with California Civil Code Section 1938, and Tenant hereby acknowledges that the Premises have not undergone an inspection by a Certified Access Specialist (CASp) to determine whether the Premises meet all applicable construction-related accessibility standards pursuant to California Civil Code §55.51 et seq. As required by Section 1938(e) of the California Civil Code, Landlord hereby states as follows: “A Certified Access Specialist (CASp) can inspect the subject premises and determine whether the subject premises comply with all of the applicable construction-related accessibility standards under state law. Although state law does not require a CASp inspection of the subject premises, the commercial property owner or lessor may not prohibit the lessee or tenant from obtaining a CASp inspection of the subject premises for the occupancy or potential occupancy of the lessee or tenant, if requested by the lessee or tenant. The parties shall mutually agree on the arrangements for the time and manner of the CASp inspection, the payment of the fee for the CASp inspection, and the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the premises.” In furtherance of the foregoing, and notwithstanding anything to the contrary contained in this Lease, Landlord and Tenant hereby agree as follows: (i) any CASp inspection requested by Tenant shall be conducted, at Tenant’s sole cost and expense, by a CASp approved in advance by Landlord, subject to Landlord’s rules and requirements; (ii) Landlord shall have no obligation to perform any work or repairs identified in any such CASp inspection; and (iii) to the extent that any work, repairs, replacements, or improvements are recommended or required by the CASp (or otherwise required as a result of any such CASp inspection or anything done by Tenant in its use or occupancy of the Premises), then, at Landlord’s election, Tenant shall be required to perform the same at Tenant’s sole cost and expense (subject to the terms and conditions of this Lease and Landlord’s right to approve of detailed plans and specifications in advance); provided, however, Landlord shall have the option to perform any or all of the foregoing at Tenant’s sole cost and expense (with Tenant to reimburse Landlord upon demand for the reasonable costs and expenses incurred by Landlord in performing the same). Notwithstanding the foregoing (except to the extent any of the following alterations or improvements are required as a result of Tenant’s specific use of the Premises or any alterations, improvements or other work performed by or on behalf of Tenant, in which case Tenant shall be responsible therefor at Tenant’s sole cost and expense), Landlord (not Tenant) shall be responsible, at Landlord’s sole cost and expense, for making all alterations and improvements required under Governmental Requirements to remedy any violation of Governmental Requirements which existed prior to the date Tenant was first granted access to any portion of the Premises (the “Early Access Date”) and which was not subject to any variance or grandfathered code waiver exemption (but only to the extent that (i) remediation is required by a governmental authority with jurisdiction, and (ii) such governmental authority, if it had knowledge of the condition prior to the Early Access Date, would have then required remediation pursuant to then-current applicable requirements of Governmental Requirements, in their form existing as of the Early Access Date and pursuant to the then-current interpretation of such Governmental Requirements by such governmental authority as of the Early Access Date).

2.12 Rooftop Premises. Landlord hereby grants to Tenant the nonexclusive right to occupy a portion of the roof of the Building, as designated by Landlord in Landlord’s reasonable discretion (hereinafter called the “Rooftop Premises”) so that Tenant may install, use, operate and maintain no more than one (1) satellite dish and its appurtenant conduit and cabling (the “Rooftop Equipment”), for receiving purposes only until the expiration or termination of the term of this Lease. Landlord may, from time to time (but not more than twice during the Lease Term), upon not less than thirty (30) days prior written notice to Tenant, require Tenant to relocate the Rooftop Equipment to another location on the roof of the Building as designated by Landlord (which new location shall thereafter be deemed the Rooftop Premises). Tenant shall perform any such relocation at Tenant’s sole cost and expense in accordance with the terms of this Section 2.12 and this Lease. Notwithstanding anything to the contrary set forth in this

12

Section 2.12, neither the Rooftop Equipment, nor any work or act in connection with the Rooftop Equipment, by or on behalf of Tenant may invalidate or otherwise affect the warranty relating to the roof, unless otherwise specified by Landlord in writing in its sole and absolute discretion. The Rooftop Equipment shall not exceed eighteen (18) inches in diameter and shall otherwise have commercially reasonable specifications commonly found in communications Rooftop Equipment of tenants at comparable buildings in the general vicinity of the Building (as reasonably determined by Landlord) and shall be in accordance with the additional following conditions:

2.12.1 The use of the Rooftop Equipment shall be restricted to Tenant’s internal communications purposes only and shall not be used for profit making purposes or available for use by any party except Tenant.

2.12.2 Tenant shall reimburse Landlord, within thirty (30) days after receipt by Tenant of an invoice, and Tenant’s receipt of reasonable supporting documentation, for all reasonable costs and expenses incurred by Landlord for any architectural, engineering, supervisory and/or reasonable legal services in connection with the Rooftop Equipment, including, without limitation, Landlord’s review of the plans and specifications for the Rooftop Equipment. Without limiting the foregoing, Tenant shall promptly, at its sole cost and expense, repair any and all damage resulting from the presence and/or use of the Rooftop Equipment and pay to Landlord any and all other costs actually incurred by Landlord in connection with the Rooftop Equipment. Notwithstanding the foregoing, there shall be no monthly rental for the use of the rooftop for Tenant’s satellite/communications equipment.

2.12.3 The Rooftop Equipment shall be installed, used, operated and maintained solely on the Rooftop Premises and solely at the expense of Tenant. Tenant shall perform the installation of the Rooftop Equipment in accordance with an installation program reasonably approved and supervised by Landlord or Landlord’s contractor, and Tenant shall neither bring the Rooftop Equipment nor any associated equipment to the Premises or Rooftop Premises without first giving Landlord fifteen (15) Business Days’ prior written notice of the date and time of the planned installation. Tenant shall ensure that the Rooftop Equipment shall in all cases be installed, used, operated, maintained and removed in compliance with the following requirements (all as determined by Landlord in its sole and absolute discretion): (i) the Rooftop Equipment shall not interfere in any way with the Building’s existing engineering or other maintenance functions or duties; (ii) the Rooftop Equipment must be properly secured and installed so as not to be affected by high winds or other weather elements; (iii) the Rooftop Equipment must be properly grounded; (iv) the weight of the Rooftop Equipment shall not exceed the load limits of the Building; and (v) in no event shall the Rooftop Equipment or any appurtenant wiring or cable interfere with or otherwise adversely affect the electrical, mechanical, structural, life safety or other building systems of the Building. Tenant shall bear all costs and expenses in connection with the installation, use, operation, maintenance and removal of the Rooftop Equipment, including all costs relating to the repair of any damage to the roof or other parts of the Building caused directly or indirectly by any such installation, use, operation, maintenance or removal, including, without limitation, water damage or other damage resulting from weather elements.

2.12.4 The installation of the Rooftop Equipment, excluding any necessary penetration of the roof of the Building, shall be performed by Tenant’s contractor, as reasonably approved by Landlord, and at Tenant’s expense (or, at Landlord’s option, by Landlord’s contractor, at Tenant’s expense), provided such installation is of a non-penetrating surface mount only. Tenant may not install the Rooftop Equipment in a manner that penetrates the roof membrane of the Building, without Landlord’s prior written consent, which consent may be withheld in Landlord’s sole and absolute discretion. Without limiting Tenant’s other obligations, Tenant shall reimburse Landlord for all actual costs associated with obtaining confirmation that Landlord’s roof warranty will not be affected by any penetration. All work done in connection with any permitted roof penetration shall be performed by Landlord or Landlord’s

13

agent at Tenant’s sole cost and expense. The installation of the Rooftop Equipment shall not damage the Building or existing structures thereon. Landlord may obtain the services of a structural engineer to design any additional supports required to support the Rooftop Equipment, and to monitor the installation thereof, and Tenant shall reimburse Landlord, within thirty (30) days after receipt by Tenant of an invoice, and Tenant’s receipt of reasonable supporting documentation, for Landlord’s cost of such services and such supports. The Rooftop Equipment shall remain the personal property of Tenant and shall be removed by Tenant prior to the expiration or earlier termination of this Lease, and Tenant shall repair any damage caused by the removal of the Rooftop Equipment and its associated wiring, cables and other components and immediately, at Tenant’s sole cost and expense, restore the Rooftop Premises to the condition which existed prior to the installation of the Rooftop Equipment.

2.12.5 Tenant may, at Tenant’s own cost and expense, upon reasonable prior written notice to Landlord, and only when accompanied by a representative of Landlord, access the Rooftop Premises to repair, replace, reorient or remove the Rooftop Equipment, or replace it with generally similar equipment, provided that (i) any new equipment does not weigh more than the original Rooftop Equipment and can be properly accommodated on Rooftop Premises without placing materially greater demands upon the electrical, mechanical, structural, life safety or other building systems of the Building than the original Rooftop Equipment; (ii) Tenant at its cost shall restore the Building to the condition in which it was prior to such repair, reorientation, removal or replacement, and all of such repair, reorientation, removal or replacement shall be performed in accordance with Landlord’s and industry standard engineering practices and by contractors or other persons approved by Landlord; and (iii) all plans and designs of Tenant relating to such repair, reorientation, removal or replacement shall in any case be subject to the prior written approval of Landlord, not to be unreasonably withheld, conditioned or delayed.

2.12.6 Tenant hereby agrees that the Rooftop Premises shall be taken “as is”, “with all faults”, without any representations and warranties, and Tenant hereby agrees and warrants that it has investigated and inspected the condition of the Rooftop Premises and the suitability of same for Tenant’s purposes.

2.12.7 Tenant, at Tenant’s sole cost and expense, will, at all times in connection with the installation, use, operation and maintenance of the Rooftop Equipment, comply with all governmental and legal requirements affecting the installation, use, operation and maintenance of the Rooftop Equipment, including, without limitation, applicable building and fire codes, and will comply with all requirements of the Federal Aviation Administration and Federal Communications Commission in respect thereof. Tenant, at Tenant’s sole cost and expense, shall be obligated to secure and obtain and provide Landlord with copies of all required permits, approvals and licenses for or with respect to the installation or operation of the Rooftop Equipment prior to the commencement of any installation activities hereunder, and Tenant shall be obligated to keep in full force and effect and renew, as applicable, all required permits, approvals and licenses required hereunder.

2.12.8 During the entire period that the Rooftop Equipment is situated in the Rooftop Premises, Tenant agrees to maintain comprehensive general public liability insurance against all claims for bodily injury, death and property damage occurring in the Rooftop Premises and the area surrounding or in any way related to the Rooftop Equipment in the amounts and in accordance with the terms set forth in this Lease and as otherwise reasonably designated by Landlord; Tenant shall ensure that all insurance policies shall name Landlord and any other party reasonably designated by Landlord as additional insureds. Tenant shall pay, immediately upon demand, for the cost of any additional insurance incurred by Landlord or the increase in any premiums on insurance maintained by Landlord arising by reason of the erection or installation and maintenance of the Rooftop Equipment.

2.12.9 Landlord shall not be liable in any respect for damages to either person or property nor shall Tenant be relieved from fulfilling any covenant or agreement hereof as a result of any temporary or

14

permanent interruption of electrical service. Landlord shall use reasonable diligence to restore any interruption in electrical service promptly, but Tenant shall have no claim for damages, consequential or otherwise, on account of any interruption. Tenant acknowledges that Landlord may, as part of its maintenance and repair obligations at the Project, require a temporary interruption of electrical service that may cause a temporary disruption of service to Tenant or the Rooftop Equipment. Except in the event of an emergency (in which case no notice shall be required), Landlord shall endeavor to give at least forty-eight (48) hours’ written notice of any planned electrical interruption. Landlord shall have no obligation hereunder to provide alternate power from emergency power sources.

2.12.10 Each contractor performing any portion of Tenant’s installation of the Rooftop Equipment shall be subject to Landlord’s approval and shall maintain the insurance required by the terms of the Lease.

2.12.11 All work performed by or on behalf of Tenant pursuant to this Section 2.12 shall be subject to all of the terms and conditions of this Lease (including, without limitation, Section 4.4 and Section 4.5 below).

2.13 Option to Renew.

2.13.1 Renewal Option. Provided Tenant is not and has not been in default under this Lease beyond any applicable notice and cure period, and subject to the terms and conditions of this Section 2.13, Tenant shall have one (1) option to renew (the “Option to Renew”) the Lease Term with respect to the entire Premises, for a period of sixty (60) months following the scheduled expiration date of the initial Lease Term (such sixty (60) month period, the “Option Term”). If the Option to Renew is exercised during any applicable cure period following an event, which with the passage of time or the giving of notice, or both, would constitute an Event of Default, then such exercise shall be void and of no further force or effect. Except as set forth in this Section 2.13 or otherwise stated as being applicable only to the initial Lease Term (or any prior portion of the Lease Term), all terms and conditions of this Lease shall remain the same during the Option Term. Monthly Base Rent during the Option Term shall be the then Fair Market Rental Rate. “Fair Market Rental Rate” shall mean the net effective market rental (plus any escalations thereof) then being offered and accepted by tenants for space comparable to the Premises in size, quality, utility and location in the Project and in the Westlake Village market area, taking into account the credit worthiness of the tenant, the length of the term, the base year, allowances and concessions and the quality of the existing tenant improvements. The “net effective market rental” shall equal the arithmetic average of the rental rate over the term of such comparable lease, provided that the value of the then existing improvements in the Premises shall be taken into account in determining what improvements are granted by landlords under similar circumstances, and the value of the free parking under this Lease shall also be taken into account in determining the Fair Market Rental Rate.

2.13.2 Notice of Exercise. In order to timely exercise the Option to Renew, Tenant shall give Landlord written notice of its intent to exercise the Option to Renew on a date which is at least two hundred seventy (270) days but not more than three hundred sixty (360) days prior to the expiration of the immediately preceding Lease Term, time being of the essence. If Tenant fails to timely notify Landlord in writing of its intent to exercise the Option to Renew, the Option to Renew shall terminate, and Landlord shall be free to enter into a lease for the Premises (or any part thereof) with a third party on any terms Landlord desires. Within twenty (20) Business Days after Landlord receives the notice described in the previous sentence, Landlord will provide Tenant with Landlord’s determination of the Base Rent for the Option Term. Tenant shall have thirty (30) days from Landlord’s notification of the proposed Base Rent to accept Landlord’s determination of Base Rent for the Option Term or provide its own determination of Fair Market Rental Rate for Landlord’s consideration accompanied by market information on which Tenant based its determination.

15

2.13.3 Dispute Regarding Fair Market Rental Rate. If Landlord and Tenant are unable to agree on the Fair Market Rental Rate for the Option Term using their best good faith efforts within thirty (30) days from Tenant’s determination of the Fair Market Rental Rate pursuant to Section 2.13.2 above, Landlord shall, no more than ten (10) days thereafter, select an independent real estate broker with at least seven (7) years experience in the Westlake Village, California commercial real estate market, who shall prepare a written market report of the Fair Market Rental Rate using the assumptions described in Section 2.13.1. The report shall be completed and delivered to Tenant and Landlord within thirty (30) days from the date Landlord selects the real estate broker. Such broker’s determination of Fair Market Rental Rate shall be determinative unless Tenant disputes it as provided in the next sentence. If Tenant disputes such report, Tenant shall, within seven (7) days following delivery of the report, deliver to Landlord written notice (a) that Tenant disputes such report, and (b) of the identity of another real estate broker selected by Tenant meeting the qualifications set forth in this paragraph. The broker selected by Tenant shall submit his report of the Fair Market Rental Rate using the assumptions described in Section 2.13.1 within twenty-five (25) days following the delivery of Tenant’s notice to Landlord disputing the initial report. If the two (2) reports are within five percent (5%) of each other, the Fair Market Rental Rate shall be that set forth in the report of Landlord’s broker. If not, then within five (5) days after the delivery of the second report, the two (2) brokers shall appoint a third broker meeting the qualifications set forth in this paragraph, and the third broker shall deliver his decision within ten (10) days following his selection and acceptance of the appraisal assignment. The third broker shall be limited in authority to selecting, in his opinion, which of the two (2) earlier reports determinations best reflects the Fair Market Rental Rate under the assumptions set forth in this paragraph. The third broker must choose one of the two (2) earlier reports, and, upon doing so, the third broker’s determination shall be the controlling determination of the Fair Market Rental Rate. Each party shall pay the costs and fees of the broker it selected; if a third broker is selected, the party whose report is not selected to be the Fair Market Rental Rate by said third broker shall pay all of said third broker’s costs and fees.

2.13.4 Conditions. The Option to Renew shall be conditioned upon the following: (i) at the time of Tenant’s notice to Landlord of its intent to exercise the Option to Renew and continuing thereafter until the commencement of the Option Term, Tenant (or its Affiliate) shall have been in possession of, and occupying, the Premises for the conduct of its business therein and there shall have been no assignment of this Lease or subletting of any portion of the Premises (other than to an Affiliate); (ii) if Tenant fails to timely and properly exercise the Option to Renew then the Option to Renew, and any subsequent Option to Renew, shall immediately terminate and be of no force or effect, and (iii) the rights contained in this Section 2.13 shall be personal to the original Tenant under this Lease, (the “Original Tenant”), or its Affiliate, and not any other assignee or sublessee, and may be exercised only by the Original Tenant or an Affiliate and only if the Original Tenant or an Affiliate occupies the entire Premises as of the date it exercises the Option to Renew in accordance with the terms of this Section 2.13.

ARTICLE III BASE RENT, ADDITIONAL RENT AND OTHER SUMS PAYABLE UNDER LEASE

3.1. Payment of Rental. Tenant agrees to pay Base Rent, Additional Rent and any other sum due under this Lease to Landlord without demand, deduction, credit, adjustment or offset of any kind or nature, in lawful money of the United States when due under this Lease, at the offices of Manager at Manager’s Address, or to such other party or at such other place as Landlord may from time to time designate in writing. Tenant may pay all amounts owing to Landlord under this Lease by ACH or wire transfer pursuant to written instructions furnished by Landlord to Tenant.

16

3.2. Base Rent.

3.2.1 On execution of this Lease, Tenant shall pay to Landlord the amount specified in the definition of Prepaid Rent for the month specified in the definition of that term. Tenant agrees to pay the monthly installments of Base Rent to Landlord, without demand and in advance, on or before the first day of each calendar month of the Lease Term. The monthly Base Rent installment for any partial month at the beginning or end of the Lease Term shall be prorated.

3.2.2 Subject to the terms and conditions of this Section 3.2.2, provided that no Event of Default exists and no Event of Default has occurred beyond any applicable notice and cure period, Tenant shall be credited with the payment of monthly Base Rent due under this Lease for the second (2nd) through sixth (6th) months of the initial Lease Term only (collectively, the “Base Rent Credit”), as and when the same become due and payable (for a total Base Rent Credit equal to Two Hundred Four Thousand Seven Hundred Fifty-Five Dollars ($204,755.00) in the aggregate, subject to the terms hereof). No such Base Rent Credit shall reduce the amount of any other amounts which are otherwise payable by Tenant under this Lease. Tenant understands and agrees that receipt of the full amount of the foregoing Base Rent Credit is conditioned upon no Event of Default occurring under this Lease beyond any applicable notice and cure period during the initial Lease Term. Accordingly, upon the occurrence of any Event of Default under this Lease beyond any applicable cure period, the foregoing Base Rent Credit shall immediately become null and void, and, following any termination of this Lease by Landlord as a result thereof, any unamortized portion of the Base Rent Credit (based upon an amortization period from the Commencement Date until the expiration of the sixty-fifth (65th) month of the initial Lease Term) shall be included in Landlord’s damages under Section 5.2, and Tenant shall no longer receive any credit remaining on account of such Base Rent Credit.

3.3. Lease Security Deposit.

3.3.1 On execution of this Lease, Tenant shall pay to Landlord the sum specified in the definition of the term Lease Security Deposit, as security for the full and faithful payment of all sums due under this Lease and the full and faithful performance of every covenant and condition of this Lease to be performed by Tenant. If Tenant shall breach or default with respect to any payment obligation or other covenant or condition of this Lease beyond any applicable notice and cure period, Landlord may apply all or any part of the Lease Security Deposit to the payment of any sum in default or any damage suffered by Landlord as a result of such breach or default, and in such event, Tenant shall, within five (5) Business Days of Landlord’s written demand, deposit with Landlord the amount so applied so that Landlord shall have the full Lease Security Deposit on hand at all times during the Lease Term. In the event Tenant defaults on its obligations to pay Base Rent, Additional Rent or any other sum as and when due under this Lease on more than two occasions during any twelve (12) month period, Landlord may, at any time thereafter require an increase in the Lease Security Deposit by an amount equal to twenty-five percent (25%) of the amount specified in the definition of the term Lease Security Deposit and Tenant shall immediately deposit such additional amount with Landlord upon Landlord’s demand. Following such increase, the definition of the term Lease Security Deposit shall refer to the amount of the Lease Security Deposit prior to the increase plus the increased amount. The remedy of increasing the Lease Security Deposits for Tenant’s multiple defaults shall be in addition to and not a substitute for any of Landlord’s other rights and remedies under this Lease or applicable law. Additionally, Landlord’s use or application of all or any portion of the Lease Security Deposit shall not preclude or impair any other rights or remedies provided for under this Lease or under applicable law and shall not be construed as a payment of liquidated damages.

3.3.2 If Tenant shall have fully complied with all of the covenants and conditions of this Lease, the remaining Lease Security Deposit shall be repaid to Tenant, without interest, within thirty (30) days after the expiration of this Lease. Tenant may not mortgage, assign, transfer or encumber the Lease Security Deposit and any such act on the part of Tenant shall be without force or effect.

17

3.3.3 In the event any bankruptcy, insolvency, reorganization or other creditor-debtor proceedings shall be instituted by or against Tenant, the Lease Security Deposit shall be deemed to be applied first to the payment of Base Rent, Additional Rent and all other sums payable under this Lease to Landlord for all periods prior to the institution of such proceedings and the balance, if any, may be retained by Landlord and applied against Landlord’s damages.

3.3.4 In the event of a sale or transfer of Landlord’s estate or interest in the Land and Building, Landlord shall have the right to transfer the Lease Security Deposit to the vendee or the transferee, and Landlord shall be considered released by Tenant from all liability for the return of the Lease Security Deposit following such transfer. Tenant shall look solely to the transferee for the return of the Lease Security Deposit, and it is agreed that all of the foregoing shall apply to every transfer or assignment made of the Lease Security Deposit to a new transferee. No mortgagee or purchaser of any or all of the Building at any foreclosure proceeding brought under the provisions of any mortgage shall (regardless of whether the Lease is at the time in question subordinated to the lien of any mortgage) be liable to Tenant or any other person for any or all of such sum (or any other or additional Lease Security Deposit or other payment made by Tenant under the provisions of this Lease), unless Landlord has actually delivered it in cash to such mortgagee or purchaser, as the case may be.

3.3.5 In the event of any rightful and permitted assignment of Tenant’s interest in this Lease, the Lease Security Deposit shall be deemed to be held by Landlord as a deposit made by the assignee, and Landlord shall have no further liability to the assignor with respect to the return or the Lease Security Deposit.

3.3.6 No right or remedy available to Landlord in this Lease shall preclude or extinguish any other right to which Landlord may be entitled. It is understood that if Tenant fails to perform its obligations and to take possession of the Premises as provided in this Lease, the Prepaid Rent and the Security Deposit shall not be deemed liquidated damages. Landlord may apply such sums to reduce Landlord’s damages and such application of funds shall not preclude Landlord from recovering from Tenant all additional damages incurred by Landlord. Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code and all other provisions of law, now or hereafter in effect, which provide that Landlord may claim from a security deposit only those sums reasonably necessary to remedy defaults in the payment of rent, to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified in this Section 3.3 above and/or those sums reasonably necessary to compensate Landlord for any other loss or damage, foreseeable or unforeseeable, caused by the acts or omissions of Tenant or any of Tenant’s Agents.

3.3.7 Provided that no Event of Default exists under this Lease beyond applicable notice and cure periods, and no Event of Default has occurred under this Lease beyond applicable notice and cure periods, Tenant shall be entitled to reimbursement from Landlord in an amount up to: (i) Sixty-Six Thousand Fifty Dollars ($66,050.00) (the “2017 Allowance”) for Tenant’s actual and reasonable costs and expenses paid to unaffiliated third parties for the installation of Tenant Alterations (as defined in Section 4.4 below) during the 2017 calendar year, and (ii) Sixty-Six Thousand Fifty Dollars ($66,050.00) (the “2018 Allowance”) for Tenant’s actual and reasonable costs and expenses paid to unaffiliated third parties for the installation of Tenant Alterations during the 2018 calendar year. Such Tenant Alterations, if any, must be performed by Tenant in accordance with all terms and conditions of the Lease (including, without limitation, Section 4.4 below). The disbursement of the 2017 Allowance and 2018 Allowance to Tenant shall be made by Landlord within thirty (30) days after the later to occur of: (i) Tenant’s payment to Landlord of an amount equal to the 2017 Allowance and 2018 Allowance (as applicable), which amounts shall be added to the Lease Security Deposit and subject to the terms and conditions contained in this Section, (ii) completion of the Tenant Alterations (if any) for which Tenant will seek reimbursement from Landlord pursuant to the 2017 Allowance and/or 2018 Allowance, as applicable (and confirmation from

18