Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CALGON CARBON Corp | a51638132ex99_1.htm |

| 8-K - CALGON CARBON CORPORATION 8-K - CALGON CARBON Corp | a51638132.htm |

|

Exhibit 99.2

|

vvvv Calgon Carbon Corporation2Q 2017 Earnings Presentation August 4, 2017

Safe Harbor Statement This presentation contains historical information and forward-looking statements. Forward-looking statements typically contain words such as “expect,” “believe,” “estimate,” “anticipate,” or similar words indicating that future outcomes are uncertain. Statements looking forward in time, including statements regarding future growth and profitability, price increases, cost savings, broader product lines, enhanced competitive posture and acquisitions, are included in this presentation pursuant to the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks and uncertainties that may cause Calgon Carbon Corporation’s (the Company’s) actual results in future periods to be materially different from any future performance suggested herein. Further, the Company operates in an industry sector where securities values may be volatile and may be influenced by economic and other factors beyond the Company’s control. Factors that could affect future performance of the Company include, without limitation: the Company’s ability to successfully integrate the November 2, 2016 acquisition of the assets and business of the wood-based activated carbon, reactivation, and mineral-based filtration media of CECA, a subsidiary of Arkema Group (the New Business) and achieve the expected results of the acquisition, including any expected synergies and the expected future accretion to earnings; changes in, or delays in the implementation of, regulations that cause a market for our products; our ability to successfully type approve or qualify our products to meet customer and end market requirements; changes in competitor prices for products similar to ours; higher energy and raw material costs; costs of imports and related tariffs; unfavorable weather conditions and changes in market prices of natural gas relative to prices of coal; changes in foreign currency exchange rates and interest rates; changes in corporate income and cross-border tax policies of the United States and other countries; labor relations; availability of capital and environmental requirements as they relate to both our operations and to those of our customers; borrowing restrictions; validity of patents and other intellectual property; and pension costs. In the context of the forward-looking information provided in this presentation, please refer to the discussions of risk factors and other information detailed in, as well as the other information contained in the Company’s most recently filed Annual Report. Any forward-looking statement speaks only as of the date on which such statement is made and the Company does not intend to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise, unless required to do so by the Federal securities laws of the United States.

New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.GAC = Granular Activated Carbon. 2Q17 sales grew 15.4% compared to 2Q16, exceeding expectations $24.4 million contribution from the New Business (1) Legacy business sales reflect: Strong demand from North America end markets Potable water projects, mercury removal products, specialty respirator productsHigher than expected carbon adsorption equipment salesSales to industrial sector customers higher than last yearSoft sales in Europe and JapanUnfavorable foreign currency translation of $2.0 million2Q17 EPS below 2Q16Customer / product mix burdened gross margin before depreciation and amortization more than expected Operating expenses as a % of sales down to 15.5% compared to 17.6% last year, ahead of expectationsWinding down acquisition-related expenses Higher borrowing costs 2Q17 Business HighlightsSales from U.S. emerging contaminant treatment of ~$6.5 million Awarded contract to supply 2.9 million pounds of GAC to a Singapore water authority(2) 2Q 2017 Highlights ($/Millions) ($/Per share) New Business(1) $24.4 $132.6 $124.0 $137.5 $12.1 $142.7 $153.0 $24.2

End Market Review Industrial Processes Industrial manufacturing & production index trends remain favorable, including recently improving outlook in EuropeSales growth in the Americas, particularly from chemicals customers Environmental Water Good activity levels, but lower remediation project sales vs 2Q16 due to completion of significant project last yearConsistent with 1Q17, solid industrial sector remediation project opportunities including PFC projects(1) Ballast Water equipment sales up slightly on higher 1Q17 order activityIMO Convention amended implementation schedule likely to slow the pace of market formation Environmental Air Maintenance project sales up reflecting increased demand from oil/gas customers; funnel of opportunities remains solidLower Japan sales vs strong 2Q16 which included large activated carbon pellet contract deliveriesModestly higher North America mercury removal sales versus prior year Potable Water Strong sales growth on implementation of PFC and 1,2,3-TCP projects in North America(1) Since 4Q15, awarded 26 PFC projects and five 1,2,3-TCP projects valued at ~$26 millionTotal TCP/PFC projects awarded to date will place ~7.0 million lbs. of GAC online for potential future reactivation(1) Robust funnel of active leads -- more than double the value of projects won to date Eight new North American CMR customers bringing total to ~180(1) Continued slow reactivation activity in the UK Shipments under Singapore contract expected to begin late 4Q Food and Beverage Stable performance in all regions3Q is typically higher in Europe for wine; expected to drive New Business(2) Specialty Carbons Strong sales for commercial and military respirator productsAnnounced grant for up to $15.4 million Defense Production Act Title III Program funding to construct a facility at the Pearl River, Mississippi plant TCP = Trichloropropane; PFC = Perfluorinated compound; GAC = Granular activated carbon; CMR = Custom municipal reactivation. New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.

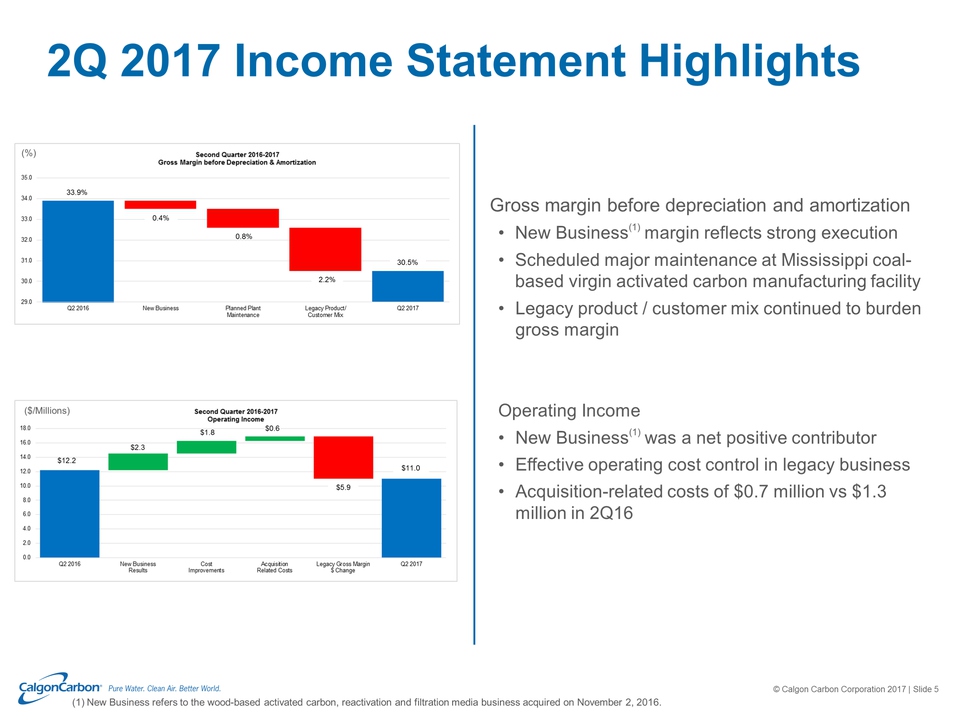

2Q 2017 Income Statement Highlights Gross margin before depreciation and amortizationNew Business(1) margin reflects strong execution Scheduled major maintenance at Mississippi coal-based virgin activated carbon manufacturing facility Legacy product / customer mix continued to burden gross marginOperating Income New Business(1) was a net positive contributor Effective operating cost control in legacy businessAcquisition-related costs of $0.7 million vs $1.3 million in 2Q16 (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016. 33.9% 0.4% 0.8% 30.5% $12.2 $5.9 $1.8 $2.3 $11.0 2.2% ($/Millions) (%) $0.6

YTD 2017 Sources and Uses of Cash Working capital usage includes higher inventory; legal entity reorganization tax payments; and, unbilled receivables related to equipment project sales Capex includes Neville Island, Pennsylvania refurbishment and expansion project; Parentis, France wood-based activated carbon debottlenecking projectOther includes cash settlement of a foreign currency derivative ($/Millions) $38.0 $6.6 $23.8 $20.9 $0.1 $21.3 $29.9 $5.1 $9.8 $24.1 Operating cash flow of$9.6 million

3Q Outlook 3Q ‘16 to 4Q ‘16 ∆ 2% - 5% higher Other Income Statement Line Items Cash Flow Line Items Full year capital expenditures $65 - $70 million Consolidated Sales 3Q16 to 3Q17 ∆ 25% - 29% higher 3Q16 $124.0 M Expect 3Q sales to increase 25% - 29% from 3Q16 New Business(1) contribution of $27 - $29 millionHigher North American legacy business salesPotable water marketIndustrial sectorSlight improvement in European potable water market and industrial sector sales Net sales less the cost of products sold (excluding D&A) as a percentage of net sales 31.5% - 32.5% Depreciation and amortization $11.5 - $12.0 million SG&A and research expenses as a percentage of sales Includes acquisition-related costs comparable to 2Q ($0.7 million) 15.0% - 16.0% Interest and other expense - net ~$2.5 million Effective income tax rate 34.0% - 35.0% (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.

2017 Outlook and Priorities Legacy business sales growth drivers PFC and 1,2,3-TCP removal projects in the potable water market Mercury removal products Specialty market respirator products Industrial sector: becoming more confident in outlook for recovery in demand New Business(1) on track to: Generate ~$100 million in sales Achieve expected synergies Realize debottlenecking project improvements Operating income now expected to improve to between $45 million and $50 million in 2017 from $24.5 million in 2016Continued strong execution by New Business(1) 2H17 gross margin improvements vs 1H17 driven by lower inventory costs, lower plant maintenance costs and price optimization actions2H17 operating expenses as percentage of sales to approach ~15% vs 16.9% for 1H17 (1) New Business refers to the wood-based activated carbon, reactivation and filtration media business acquired on November 2, 2016.

Question & Answer Session Randall S. DearthChairman, President and Chief Executive Officer James A. Coccagno Executive Vice President of Core Carbon and Services Division Stevan R. SchottExecutive Vice President of Advanced Materials, Manufacturing, and Equipment Division Robert FortwanglerSenior Vice President and Chief Financial Officer

Dan CrookshankDirector, Investor Relations & TreasurerDirect Dial: 412-787-6795DCrookshank@calgoncarbon.comwww.calgoncarbon.com For Additional Information: