Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Bluerock Residential Growth REIT, Inc. | v472414_ex99-1.htm |

| EX-10.6 - EXHIBIT 10.6 - Bluerock Residential Growth REIT, Inc. | v472414_ex10-6.htm |

| EX-10.5 - EXHIBIT 10.5 - Bluerock Residential Growth REIT, Inc. | v472414_ex10-5.htm |

| EX-10.4 - EXHIBIT 10.4 - Bluerock Residential Growth REIT, Inc. | v472414_ex10-4.htm |

| EX-10.3 - EXHIBIT 10.3 - Bluerock Residential Growth REIT, Inc. | v472414_ex10-3.htm |

| EX-10.2 - EXHIBIT 10.2 - Bluerock Residential Growth REIT, Inc. | v472414_ex10-2.htm |

| EX-10.1 - EXHIBIT 10.1 - Bluerock Residential Growth REIT, Inc. | v472414_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - Bluerock Residential Growth REIT, Inc. | v472414_ex2-1.htm |

| 8-K - 8-K - Bluerock Residential Growth REIT, Inc. | v472414_8k.htm |

Exhibit 99.2

- 3 - Forward - Looking Statements - 2 - Cautionary Statement Regarding Forward - Looking Statements This presentation contains statements that are “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws . Forward - looking statements are statements that are not historical, including statements regarding management’s intentions, beliefs, expectations, representations, plans or predictions of the future, and are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “may,” “will,” “should” and “could . ” Because such statements include risks, uncertainties and contingencies, actual results may differ materially from those expressed or implied by such forward - looking statements . These forward - looking statements are based upon the present expectations of Bluerock Residential Growth REIT, Inc . (the “Company”), but these statements are not guaranteed to occur, including, without limitation, with respect to the completion of the proposed internalization on the terms described or at all and the expected benefits of the proposed internalization . Among others, the following uncertainties and other factors could cause actual results to differ from those set forth in the forward - looking statements : the failure to receive, on a timely basis or otherwise, the required approvals by the Company’s stockholders, governmental or regulatory agencies and third parties ; the risk that a condition to closing of the proposed internalization may not be satisfied ; and the Company’s ability to consummate the proposed internalization . Furthermore, the Company disclaims any obligation to publicly update or revise any forward - looking statement to reflect changes in underlying assumptions or factors, of new information, data or methods, future events or other changes . Investors should not place undue reliance upon forward - looking statements .

- 3 - Company Highlights - 3 - Park & Kingston | Charlotte, NC Arium Grandewood | Orlando, FL ▪ Building an Institutional Quality Portfolio in Growth Markets ▪ Partnering with Leading Real Estate Owners for Deal Access and Execution ▪ Deep Experienced Management Team with 24 Years Average Experience ▪ Attractive Investment Metrics with Stock Trading at Significant Discount to NAV ▪ Proven Property Level Value Creation; Validated by Asset Recycling

▪ Acquisition of over 19,500 apartment units and 2.5 million square feet of office space ▪ 29 years in real estate, private equity, investment banking ▪ Previously, Lehman Brothers ▪ 27 years experience in real estate ▪ Previously, Starwood Capital – Founding Member; Co - Managed Starwood Multifamily and Office effort for 12 years ▪ Involved in creation of Equity Residential; Starwood Hotels; iStar Financial ▪ Co - Founder of Bluerock Real Estate – 2002 ▪ 30 years experience in real estate, capital markets ▪ Previously, Bank of America, JP Morgan Chase, Smith Barney ▪ 12 years experience in real estate private equity, capital markets ▪ Previously, PNC Realty Investors ▪ Transaction experience exceeding $4B ▪ 19 years experience in accounting ▪ Prior Corporate Controller for Roberts Realty Investors, a multifamily REIT ▪ Previously, Pulte Homes, Deloitte & Touche ▪ 30 years experience ▪ Previously, General Counsel at New World Restaurant Group Internal Management with Strong, Aligned, Committed Team - 4 - Ramin Kamfar Chief Executive Officer James G. Babb III Chief Investment Officer Jordan Ruddy Chief Operating Officer + President Ryan MacDonald Chief Acquisitions Officer Christopher Vohs Chief Financial Officer Michael L. Konig Chief Legal Officer

- 3 - Transaction Details - 5 - Transaction: The Company will internalize the external management of the Company and directly employ the existing management team and other employees Cost: To be calculated pursuant to a formula established at IPO; expected to be $41 - $42 million Payment Form: 0.01% in cash; 99.9% equity, split as follows: - 98% in OP units - 2% in Class C stock (to provide voting commensurate with economic interests) OP Unit Redemption Rights: No redemptions for 1 year Voting rights limited to 9.9% of o utstanding voting rights Administrative Services Agreement: Bluerock agreement to provide human resources, investor relations, marketing, legal and other administrative services at cost to facilitate transaction, efficiency. Terminable by Company upon notice Timing: Shortly after Shareholder Meeting currently scheduled for October 26, 2017 Subject to: Approval of majority of disinterested stockholders at the annual meeting; Other customary closing conditions

- 3 - Internalization Benefits - 6 - Cost Savings: Savings based on 3Q ’17 annualized base management fee (excluding incentive fees) estimated at $3.8 MM (1) ; estimated to increase to $10.1 MM annually at $1.5B in equity, and $18.9 MM annually at $2.5B in equity Alignment of Interests through Deal Structure: Consideration paid 99.9% in Equity Expanded Investor Base: Institutional Preference for Internal Management Structure should lead to improved pricing and access to capital over time Simplified Structure: Simplified Structure under a single, transparent corporate structure with the Company’s Control of Key Functions Elimination of Conflicts: Both Actual and Perceived Continuity of Management: All C - level executives entering into employment agreements directly with the Company Notes (1) Excludes amortization of non - cash compensation expense

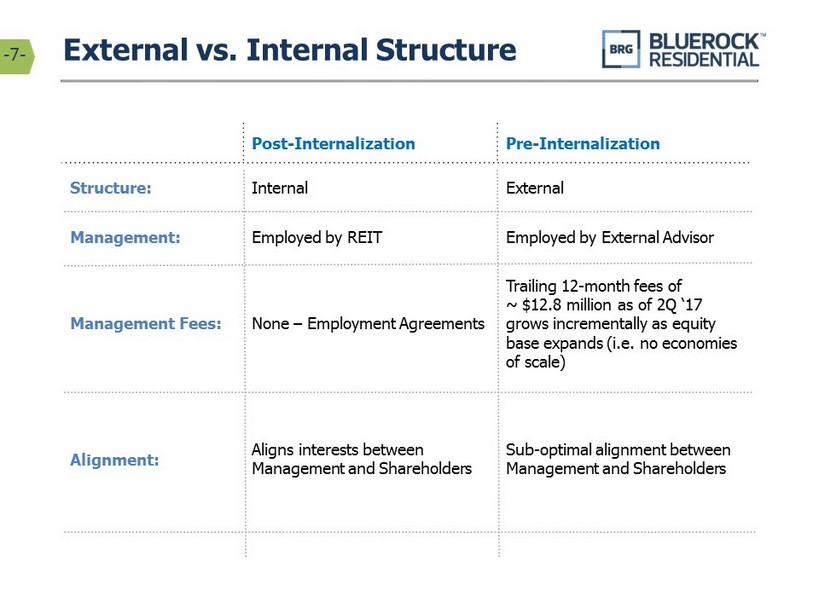

- 3 - External vs. Internal Structure - 7 - Post - Internalization Pre - Internalization Structure: Internal External Management: Employed by REIT Employed by External Advisor Management Fees: None – Employment Agreements Trailing 12 - month fees of ~ $12.8 million as of 2Q ‘17 grows incrementally as equity base expands (i.e. no economies of scale) Alignment: Aligns interests between Management and Shareholders Sub - optimal alignment between Management and Shareholders

- 8 - Appendix: Financial Impact on G&A Notes Estimated Impact on G&A ▪ Pre - Internalization: Based on 3Q ‘17 projected equity base, the Company is projected to incur annualized run rate Base Management Fees of ~ $11.5 MM, excluding Incentive Fees which totaled $4.1 MM on a trailing 12 - month basis, plus direct costs estimated to be ~ $4.5 MM ▪ Post - Internalization: G&A is expected to be ~ $12.2 MM, inclusive of both Direct Costs and Salaries (1) ▪ In light of the internalization, the Company expects to experience savings over the first 12 months of ~ $3.8 MM against Base Management Fees alone, based on 3Q ’17 annualized run rate (1) ▪ The savings against Base Management Fees are expected to increase as the Company scales as outlined below. For simplicity, the projections assume no Incentive Fees (1) Excludes amortization of non - cash compensation expense (2) Assumes internalized G&A grows by 62.5bps on incremental equity (3) Includes $4.5MM of Direct Costs in all scenarios Projected 3Q ‘17 Annualized $1.5B Equity Base $2.5B Equity Base Projected 3Q ’17 Annualized At $1.5B Equity At $2.5B Equity Internalized Corporate G&A (2,3) (12.2)$ (16.9) (23.1)$ Elimination of Management Fees 11.5 22.5 37.5 Direct Costs 4.5 4.5 4.5 Total External Costs 16.0$ 27.0 42.0$ Savings From Internalization (1) 3.8$ 10.1 18.9$

- 3 - - 9 - Additional Information and Where to Find It This presentation is being made in respect of the proposed internalization involving the Company, Bluerock Residential Holdings, LP (the “Operating Partnership”), BRG Manager, LLC (the “Manager”) and certain other parties . The proposed internalization will be submitted to the stockholders of the Company for their consideration . In connection with the proposed internalization, the Company intends to file a proxy statement and other documents regarding the proposed internalization with the United States Securities and Exchange Commission (the “SEC”) . INVESTORS AND STOCKHOLDERS OF THE COMPANY ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) REGARDING THE PROPOSED INTERNALIZATION AND OTHER DOCUMENTS RELATING TO THE PROPOSED TRANSACTION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED INTERNALIZATION . The definitive proxy statement will be mailed to the Company’s stockholders . You may obtain copies of all documents filed with the SEC concerning the proposed internalization, free of charge, at the SEC’s website at www . sec . gov, including the Company’s Current Report on Form 8 - K filed with the SEC on August 4 , 2017 . In addition, stockholders may obtain free copies of the documents filed with the SEC by the Company through its website at http : //www . bluerockresidential . com . The information on our website is not, and shall not be deemed to be a part hereof or incorporated into this or any other filings with the SEC . You may also request them in writing, by telephone or via the Internet at : Bluerock Residential Growth REIT, Inc . 27777 Franklin Road, Suite 900 Southfield, Michigan 48034 ( 248 ) 226 - 5700 Attn : Investor Relations Website : http : //www . bluerockresidential . com Participants in the Solicitation The Company, the Operating Partnership, the Manager and the Contributors and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in respect of the proposed internalization . Information about the Company’s directors and executive officers is available in the Company’s Annual Report on Form 10 - K, filed with the SEC on February 22 , 2017 . Other information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies from the Company’s stockholders in connection with the proposed internalization, including a description of their direct or indirect interests, by security holdings or otherwise, in the Company will be set forth in the proxy statement in respect of the proposed internalization when it is filed with the SEC . You can obtain free copies of these documents, which are filed with the SEC, from the Company using the contact information above .