Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Paramount Gold Nevada Corp. | pzg-8k_20170803.htm |

NYSE American: PZG AUGUST 2017 Exhibit 99.1

This Presentation contains “forward-looking statements” within the meaning of applicable securities laws relating to Paramount Gold Nevada Corp. (“Paramount”, “we”, “us”, “our”, or the “Company”) which represent our current expectations or beliefs including, but not limited to, statements concerning our operations, performance, and financial condition. These statements by their nature involve substantial risks and uncertainties, credit losses, dependence on management and key personnel, variability of quarterly results, and our ability to continue growth. Statements in this presentation regarding planned drilling activities and any other statements about Paramount’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements. For this purpose, any statements contained in this presentation that are not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such as “may”, “anticipate”, “intend”, “could”, “estimate”, or “continue” or the negative or other comparable terminology are intended to identify forward-looking statements. Other matters such as our growth strategy and competition are beyond our control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect, actual outcomes and results could differ materially from those indicated in the forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time and it is not possible for us to predict all of such factors, nor can we assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Cautionary Note to U.S. Investors - All mineral resources have been estimated in accordance with the definition standards on mineral resources and mineral reserves of the Canadian Institute of Mining, Metallurgy and Petroleum referred to in National Instrument 43-101. U.S. reporting requirements for disclosure of mineral properties are governed by the Securities and Exchange Commission (“SEC”) Industry Guide 7. Canadian and Guide 7 standards are substantially different. The SEC permits mining companies, in their filings, to disclose only those mineral deposits that a company can economically and legally extract or produce. We use certain terms in this document, such as "reserves," "resources," "geologic resources," "proven," "probable," "measured," "indicated," and "inferred," which are not recognized under Industry Guide 7. U.S. Investors should be aware that the issuer has no "reserves" as defined by Industry Guide 7 and are cautioned not to assume that any part or all of mineral resources will be confirmed or converted into Industry Guide 7 compliant "reserves". Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute Industry Guide 7 "reserves" by SEC standards as in-place tonnage and grade without reference to unit measures. Mineral resources that are not mineral reserves do not have demonstrated economic viability. paramountnevada.com | NYSE American: PZG FORWARD LOOKING STATEMENTS

8 million paramountnevada.com | NYSE American: PZG

paramountnevada.com | NYSE American: PZG

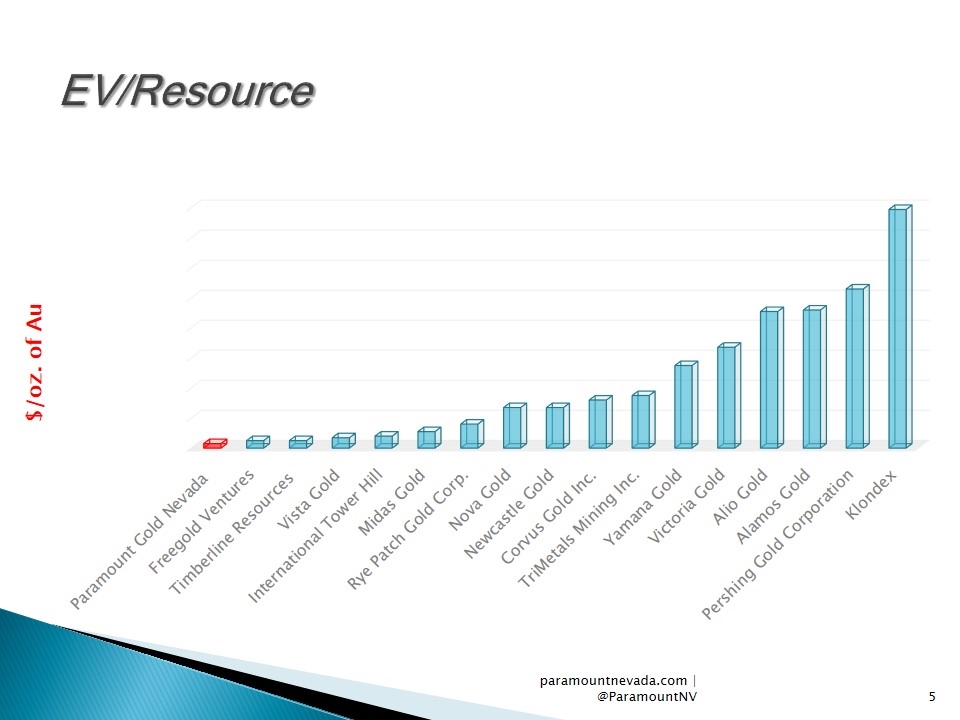

paramountnevada.com | @ParamountNV EV/Resource $/oz. of Au

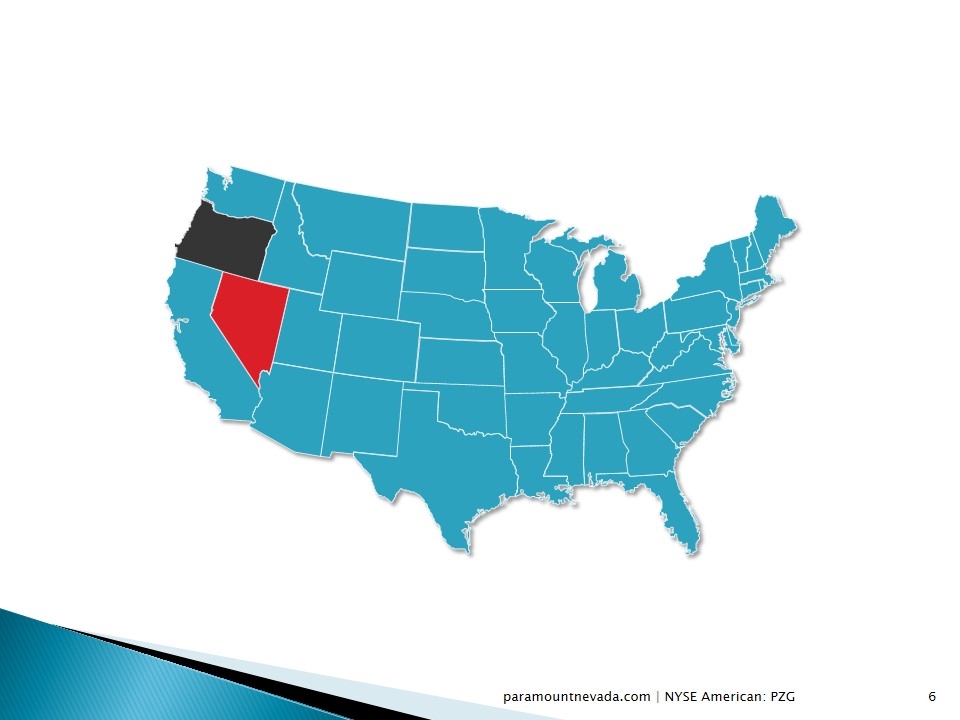

paramountnevada.com | NYSE American: PZG

paramountnevada.com | NYSE American: PZG Grassroots Known Deposits

paramountnevada.com | NYSE American: PZG FCMI Albert Friedberg Seabridge Gold 25%

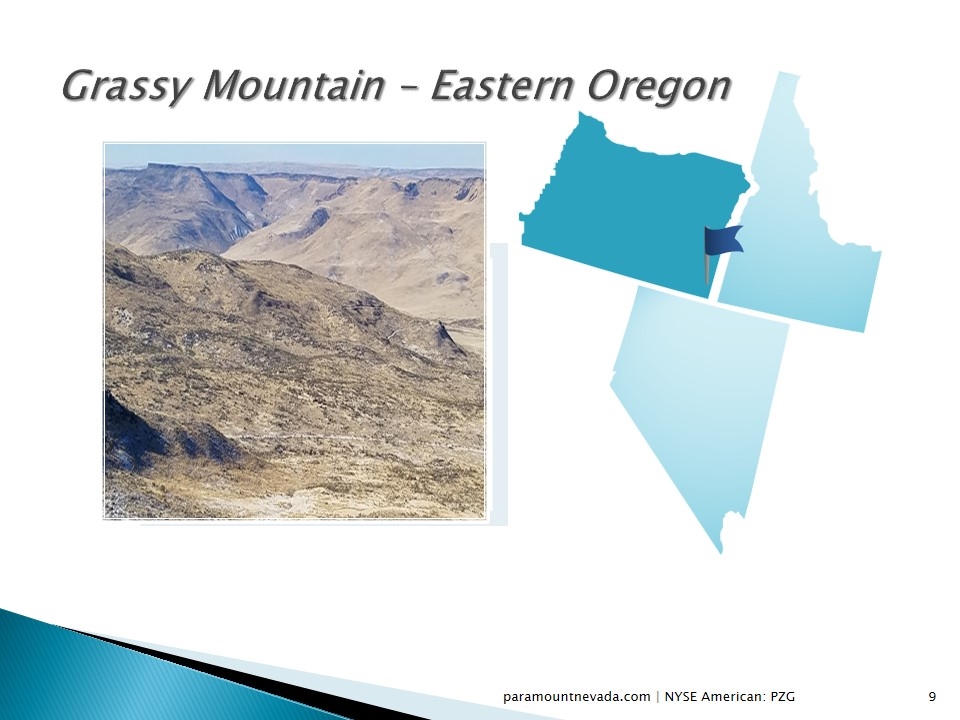

paramountnevada.com | NYSE American: PZG Grassy Mountain – Eastern Oregon

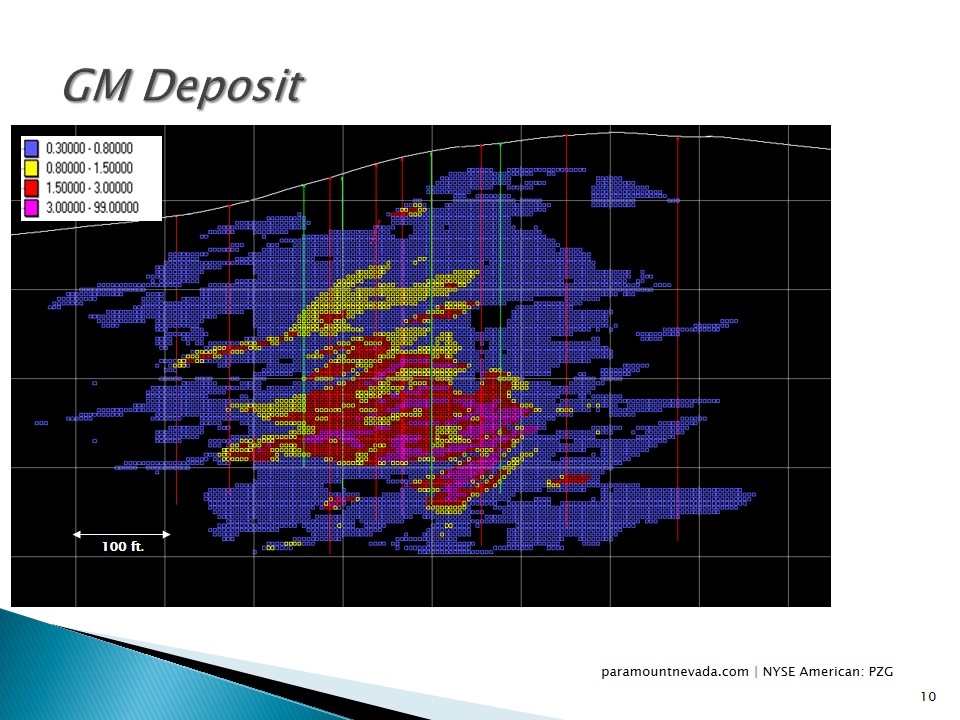

paramountnevada.com | NYSE American: PZG GM Deposit 100 ft.

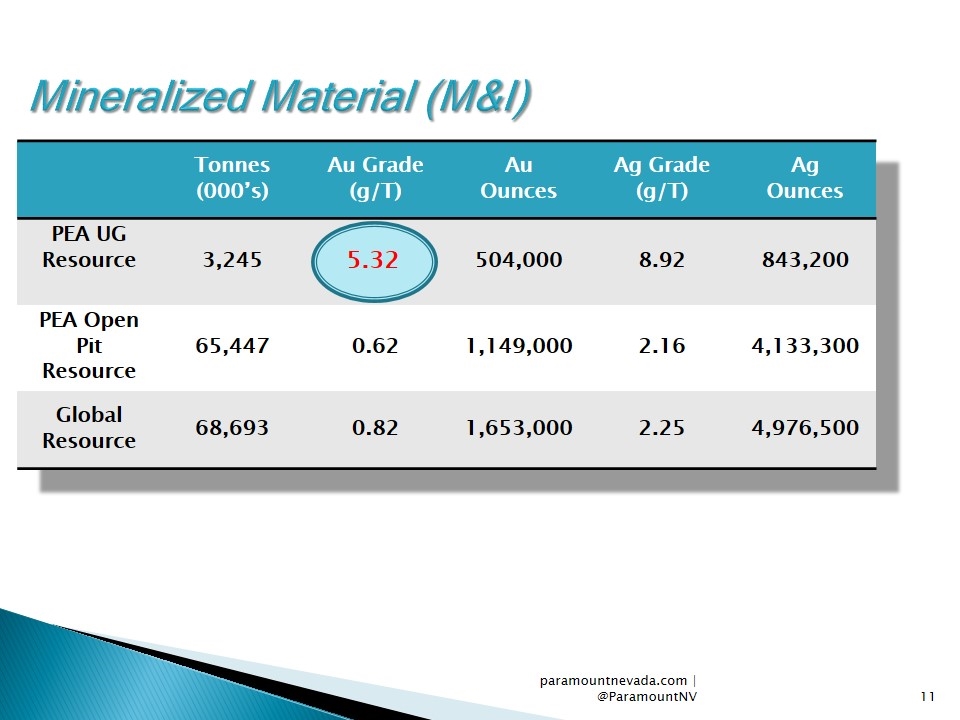

Mineralized Material (M&I) paramountnevada.com | @ParamountNV Tonnes (000’s) Au Grade (g/T) Au Ounces Ag Grade (g/T) Ag Ounces PEA UG Resource 3,245 5.32 504,000 8.92 843,200 PEA Open Pit Resource 65,447 0.62 1,149,000 2.16 4,133,300 Global Resource 68,693 0.82 1,653,000 2.25 4,976,500 5.32

paramountnevada.com | @ParamountNV Gold Grade/Recovery 5.32g/T 95%

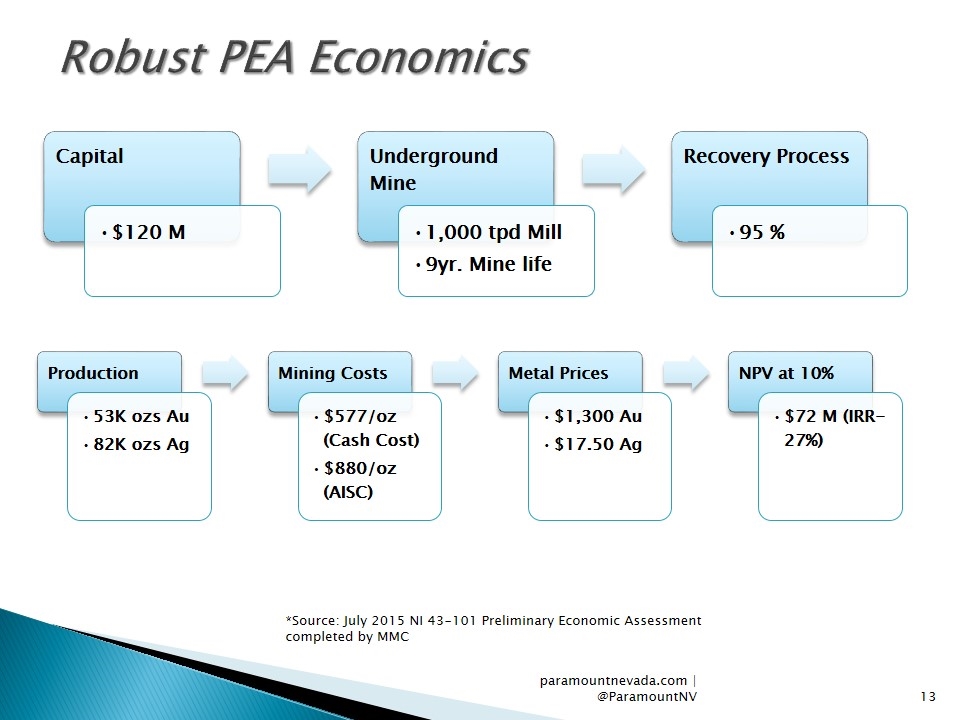

Robust PEA Economics paramountnevada.com | @ParamountNV *Source: July 2015 NI 43-101 Preliminary Economic Assessment completed by MMC Mining Costs NPV at 10% Production $577/ oz (Cash Cost) 53K ozs Au 82K ozs Ag $880/ oz (AISC) $72 M (IRR-27%) Metal Prices $1,300 Au $17.50 Ag Capital Underground Mine Recovery Process 95 % $120 M 1,000 tpd Mill 9yr. Mine life

paramountnevada.com | @ParamountNV Pre Feasibility Study Reduce Capex by $20 to 30 million Convert M&I resources to reserves Necessary input for mining permit application

paramountnevada.com | NYSE American: PZG Permitting in Oregon 58%

paramountnevada.com | NYSE American: PZG Oregon is open for business

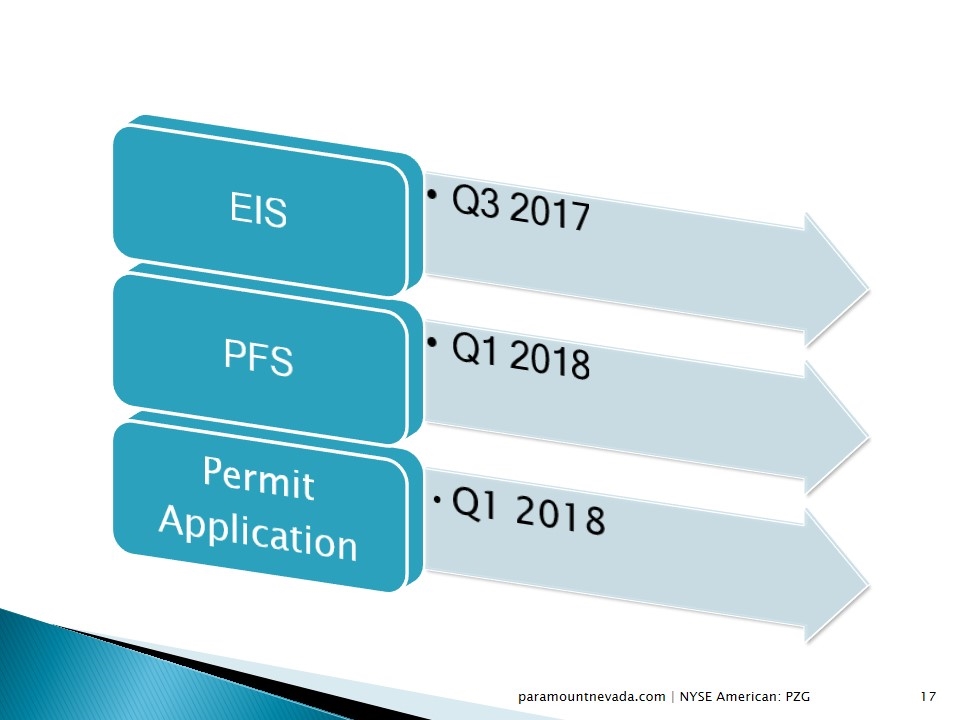

paramountnevada.com | NYSE American: PZG EIS Permit Application Q3 2017 PFS Q1 2018 Q1 2018

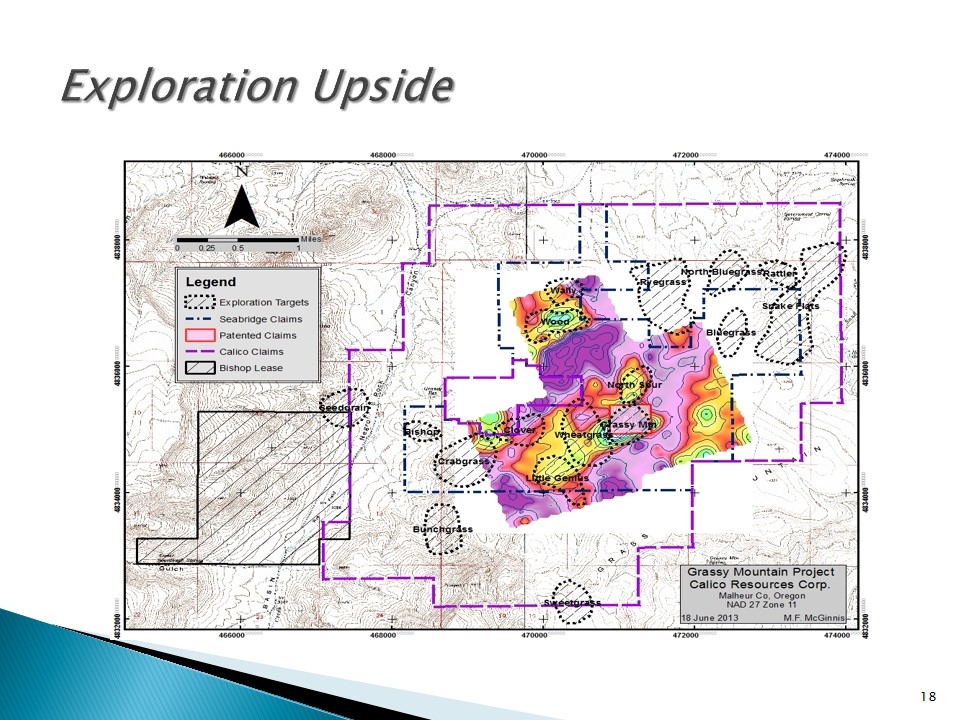

Exploration Upside

paramountnevada.com | @ParamountNV The Sleeper Gold -Nevada

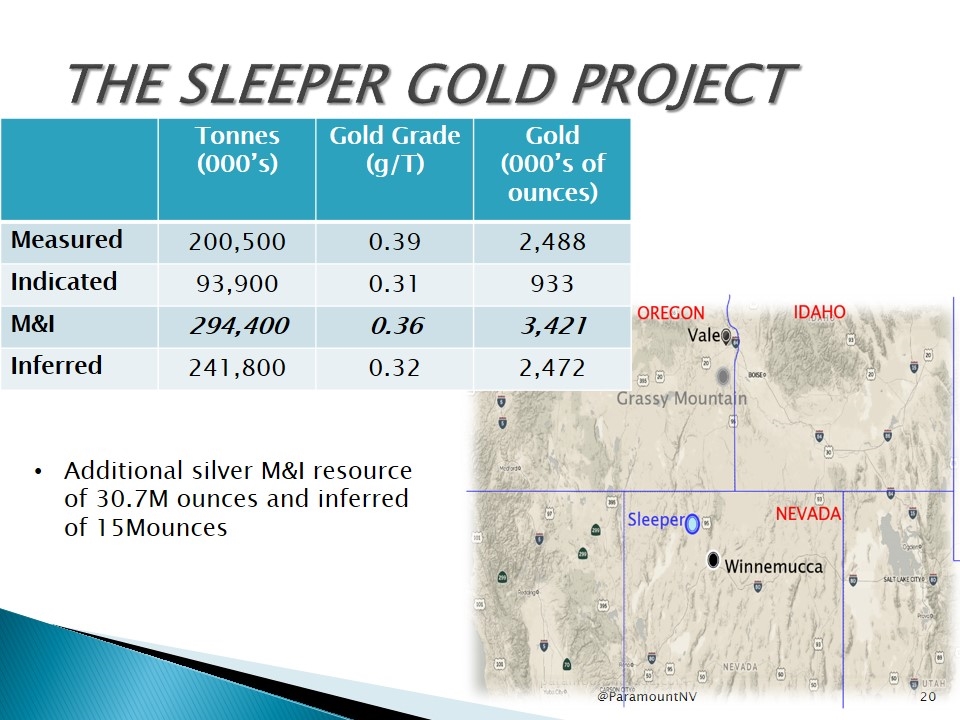

THE SLEEPER GOLD PROJECT paramountnevada.com | @ParamountNV Tonnes (000’s) Gold Grade (g/T) Gold (000’s of ounces) Measured 200,500 0.39 2,488 Indicated 93,900 0.31 933 M&I 294,400 0.36 3,421 Inferred 241,800 0.32 2,472 Additional silver M&I resource of 30.7M ounces and inferred of 15Mounces

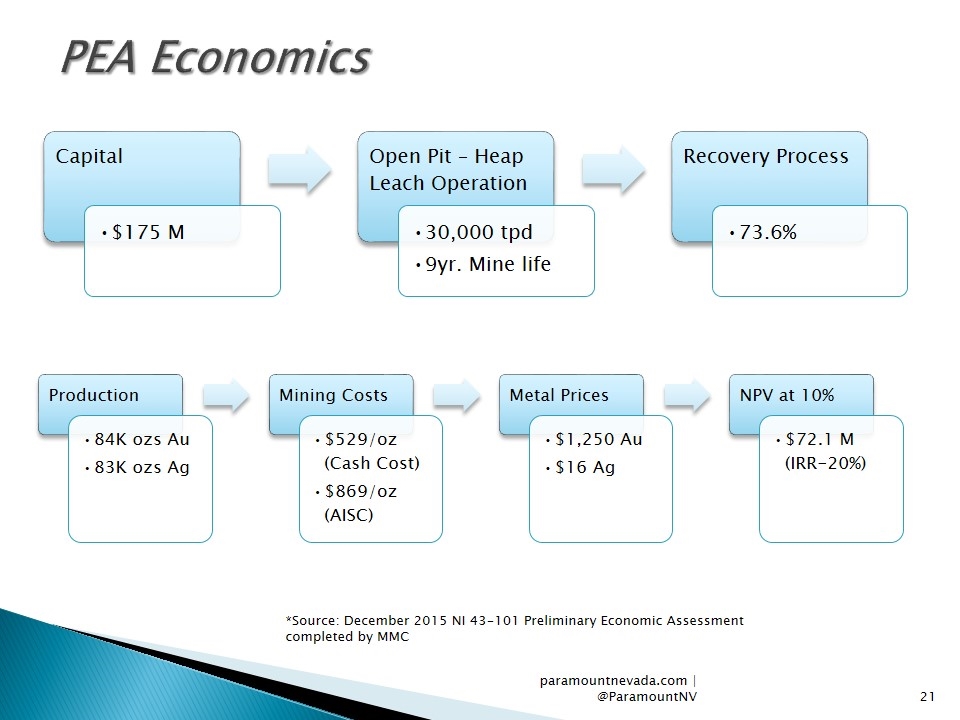

PEA Economics paramountnevada.com | @ParamountNV *Source: December 2015 NI 43-101 Preliminary Economic Assessment completed by MMC Mining Costs NPV at 10% Production $529/ oz (Cash Cost) $869/ oz (AISC) $72.1 M (IRR-20%) Metal Prices $1,250 Au $16 Ag 83K ozs Ag 84K ozs Au Capital Open Pit – Heap Leach Operation Recovery Process 73.6% $175 M 30,000 tpd 9yr. Mine life

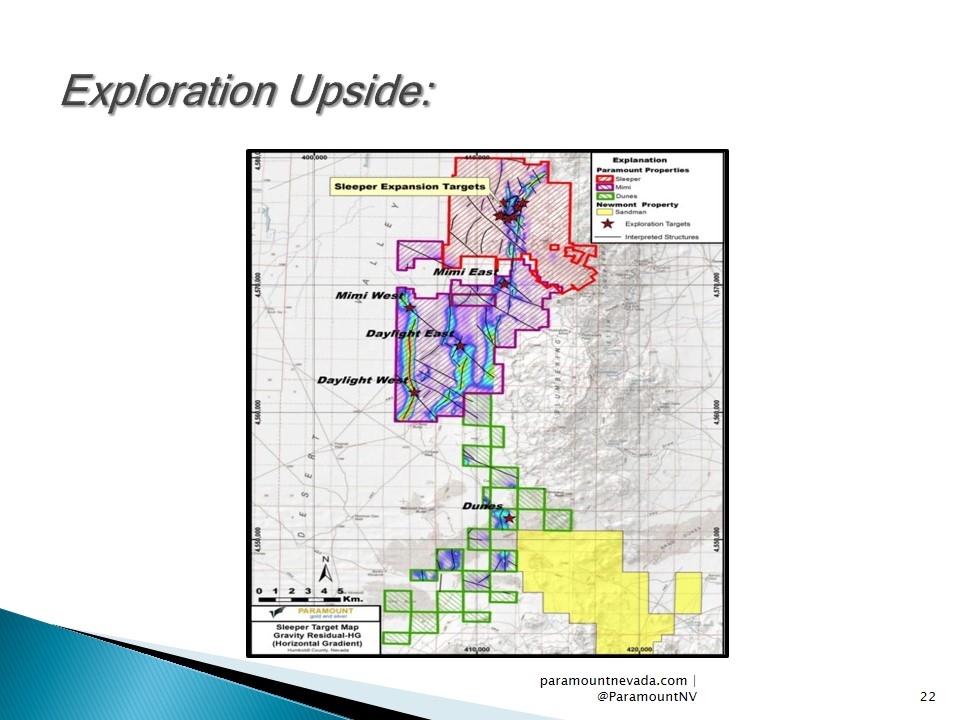

paramountnevada.com | @ParamountNV Exploration Upside:

8 million paramountnevada.com | NYSE American: PZG

Build a Mine paramountnevada.com | @ParamountNV

paramountnevada.com | @ParamountNV NYSE American: PZG