Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - AMAG PHARMACEUTICALS, INC. | ex991q22017earningsrelease.htm |

| 8-K - 8-K - AMAG PHARMACEUTICALS, INC. | amagq220178-k.htm |

AMAG Pharmaceuticals

Q2-2017 Financial Results &

Corporate Update

August 3, 2017

1

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995

(PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts, including, among

others, expectations regarding the commercial opportunity and revenue potential of Intrarosa, including the number of women who

suffer from dyspareunia in the U.S.; AMAG’s beliefs that its approach to the Intrarosa launch is well-planned and will result in a

successful launch and the quick capture of market share; AMAG’s unrestricted coverage goal of 65% by year end; beliefs that AMAG’s

commercial copay savings program will maximize the Intrarosa launch uptake; Intrarosa launch priorities, including affordable access for

patients and increased market awareness and physician prescribing; beliefs regarding the Makena market opportunity and Makena’s

position in the market; future growth drivers for Makena, including its ability to continue to gain share from compounders, grow the

Makena @Home administration, expand use in the late preterm birth segment, prepare to launch the Makena subcutaneous auto-

injector and prepare for potential competitive threat; growth drivers for Cord Blood Registry (CBR), including plans to differentiate CBR’s

offerings, build value proposition on storing newborn stem cells and leverage advancements in stem cell research; growth drivers for

Feraheme, including continued growth in key segments, complete recent group purchasing organization (GPO) sales, optimize net

revenue per gram, and expectations that the size of the addressable market, if the broader indication is approved, would double and

would require minimal sales force expansion; AMAG’s 2017 financial guidance, including forecasted GAAP and non-GAAP revenues,

GAAP net income and operating income, and non-GAAP adjusted EBITDA; and expectations regarding regulatory timelines for the

Makena subcutaneous auto-injector, Feraheme broader label, Intrarosa, bremelanotide and Velo, including anticipated FDA action and

commercial launch for each product, as applicable; AMAG’s key priorities for the second half of 2017 related to its products and product

candidates, portfolio expansion and financial goals; are forward-looking statements which involve risks and uncertainties that could

cause actual results to differ materially from those discussed in such forward-looking statements.

Such risks and uncertainties include, among others, those risks identified in AMAG’s Securities and Exchange Commission (“SEC”) filings,

including its Annual Report on Form 10-K for the year ended December 31, 2016 and its Quarterly Report on Form 10-Q for the quarter

ended March 31, 2017 and subsequent filings with the SEC. AMAG cautions you not to place undue reliance on any forward-looking

statements, which speak only as of the date they are made. AMAG disclaims any obligation to publicly update or revise any such

statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based,

or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements.

AMAG Pharmaceuticals® and Feraheme® are registered trademarks of AMAG Pharmaceuticals, Inc. MuGard® is a registered trademark of

Abeona Therapeutics, Inc. Makena® is a registered trademark of AMAG Pharmaceuticals IP, Ltd. Cord Blood Registry® and CBR® are

registered trademarks of Cbr Systems, Inc. IntrarosaTM is a trademark of Endoceutics, Inc.

2

Q2-2017 Earnings Call Agenda

Q2-2017 Highlights and Recent Events 1

5 Q&A

2 Product Portfolio Commercial Overview

4 2017 Key Priorities and Closing Remarks

3 Financial Update and Guidance

3

Bill Heiden

President & CEO

Q2-2017 Highlights and

Recent Events

4

Q2-2017 Financial Highlights

$127.4

$158.4

Q2-2016 Q2-2017

24% increase

driven by

strong growth

across product

portfolio

GAAP Total Net Revenues ($M)

Makena revenue CBR revenue Feraheme/MuGard revenue

5

Q2-2017 Financial Highlights

$18.1

$3.6

Q2-2016 Q2-2017

Investing in new

product launch and

development while

maintaining strong

cash flows

Ended Q2-2017 with

~$400M in cash and

investments

$50.1

Q2-2016 Q2-2017

GAAP Operating Income

($M)

Non-GAAP Adj. EBITDA1

($M)

1 See slide 37 for reconciliation of GAAP to non-GAAP financial results.

$64.6

6

Strong Execution in Q2-2017

Highlights and Recent Events

Closed Endoceutics licensing transaction, hired and trained new sales

team, and launched Intrarosa

Drove record quarterly Makena sales to over $102M and received FDA

acceptance for review of Makena subcutaneous (sub-q) auto-injector sNDA

Achieved record quarterly Feraheme sales and completed submission to

FDA to broaden Feraheme label

Generated strong new family enrollments at Cord Blood Registry

Advanced bremelanotide development and regulatory activities to support

the planned NDA submission in early 2018

Strengthened balance sheet and ended Q2-2017 with ~$400M of cash and

investments

7

AMAG’s Expanding Portfolio of Products

Feraheme

Treatment of iron

deficiency anemia (IDA)

in adult patients with

chronic kidney disease

(CKD)

The only FDA-approved

therapy to reduce

recurrent preterm birth

in certain at-risk women

World’s largest umbilical

cord stem cell collection

and storage company

Candidate for the

treatment of severe

preeclampsia

An investigational

product for the on-

demand treatment of

hypoactive sexual desire

disorder (HSDD)

MuGard

Management of oral

mucositis, a common

side effect of radiation or

chemotherapy

Maternal and Women’s Health Hematology /

Oncology Pregnancy

& Birth

Wellness

Post-Menopausal

Health

Makena

Velo

Option

Cord Blood

Registry

Bremelanotide Intrarosa

FDA-approved non-

estrogen product to

treat moderate-to-

severe dyspareunia

(pain during sex), a

common symptom of

VVA, due to

menopause, which

does not carry a boxed

warning in its label

8

Product Portfolio

Commercial Overview

Nik Grund

Chief Commercial Officer

9

Launched July 24, 2017

W O M E N ’ S H E A L T H : I N T R A R O S A

10

Affected, but not currently seeking treatment

Utilizing OTC treatments

Dyspareunia: Sizable Untapped Treatment Market

Currently

on Rx estrogen

therapy

Local (intra-vaginal)

estrogen therapies = sales

of >$1B per year1

1.7M

women2

~6M

women2

~12M

women2

W O M E N ’ S H E A L T H : I N T R A R O S A

~20M women in U.S. suffer from dyspareunia, a symptom of VVA

New potential

patients represent a

market opportunity

of ~$14B/year3

11

1 Based on IMS SMART Tool NSP and NPA data for total VVA prescriptions. See slide 8 for Intrarosa’s indication.

2 AMAG estimates based on:

a) Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive

Health 2014:8 23–30;

b) Kingsberg et al. Vulvar and Vaginal Atrophy in Postmenopausal Women: Findings from the REVIVE Survey. J Sex Med 2013;101790-1799; and

c) F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study.

3 Company estimated based on IMS SMART Tool NSP and NPA data.

Full HCP

Campaign

NAMS

October 2017

Phase 3

Well-Planned Phased Approach for Commercial Launch

Coming

Soon

ACOG

May 2017

Phase 1

Now Available

Launch Day 1

July 2017

Phase 2

Patient

Engagement

Programs

1H-2018

Phase 4

Time

Sales

W O M E N ’ S H E A L T H : I N T R A R O S A

12

Inventory broadly available in

wholesaler distribution network

Product available at more than

5,000 retail pharmacies

Samples being distributed to HCP

offices to facilitate new patient

starts

Commercial insurance coverage

and copay savings program in

place

Launch Day 1 – Now Available

W O M E N ’ S H E A L T H : I N T R A R O S A

INTRAROSA has no FDA

boxed warning

13

Commercial Lives Covered for Intrarosa

Approximately 2/3 of

prescriptions for VVA are

commercial pay1

– Top 18 accounts represent

>85% of covered lives2

Unrestricted coverage 14%

and growing

W O M E N ’ S H E A L T H : I N T R A R O S A

1 IMS FIA data, last 24 months, July 2017.

2 Market research sponsored by AMAG and conducted Insight Strategy Advisors.

3 MMIT data as of 7/24/17.

62%

14%

24% Not covered

Covered (unrestricted)

Covered (PA/ST)

Today

Year end 2017 goal 65% unrestricted coverage

Working with Medicare on potential reimbursement

Tomorrow

Commercial Lives Covered3

14

Commercial Copay Savings Program in Place

Remove Cost as a Barrier in Order to Maximize Launch Uptake

W O M E N ’ S H E A L T H : I N T R A R O S A

Comprehensive commercial copay savings program

– $0 copay first month on therapy (regardless of formulary access)

– Refill copays are no greater than $25 (regardless of formulary access)

– No activation of card required

– Distributed to HCPs via sales force (printed cards) and downloadable via

Intrarosa.com

15

62%

14%

24%

Not covered

Covered (unrestricted)

Covered (PA/ST)

AMAG Well Positioned for a Successful Launch

Launch Priorities to Watch

M A T E R N A L H E A L T H : I N T R A R O S A

Commercial Lives Covered1

Create affordable access for

patients

‒ Increase percentage of covered

lives

1

Increase physician prescribing

‒ Market share

‒ # of HCPs prescribing

‒ NRx and TRx (growth)

3

1 MMIT Data as of 7/24/17.

Today: 14% covered (unrestricted)

Y/E 2017 goal: 65% covered (unrestricted)

Increase market awareness

‒ # of first time prescribers

2

16

Differentiated mechanism of action

Only FDA-approved non-estrogen local product1 for moderate-

to-severe dyspareunia due to menopause

– Only product without a boxed warning

Well-planned launch strategy to quickly capture market share

Significant market opportunity with sizeable revenue potential

In Summary

W O M E N ’ S H E A L T H : I N T R A R O S A

1 Locally converted to estrogens and androgens.

17

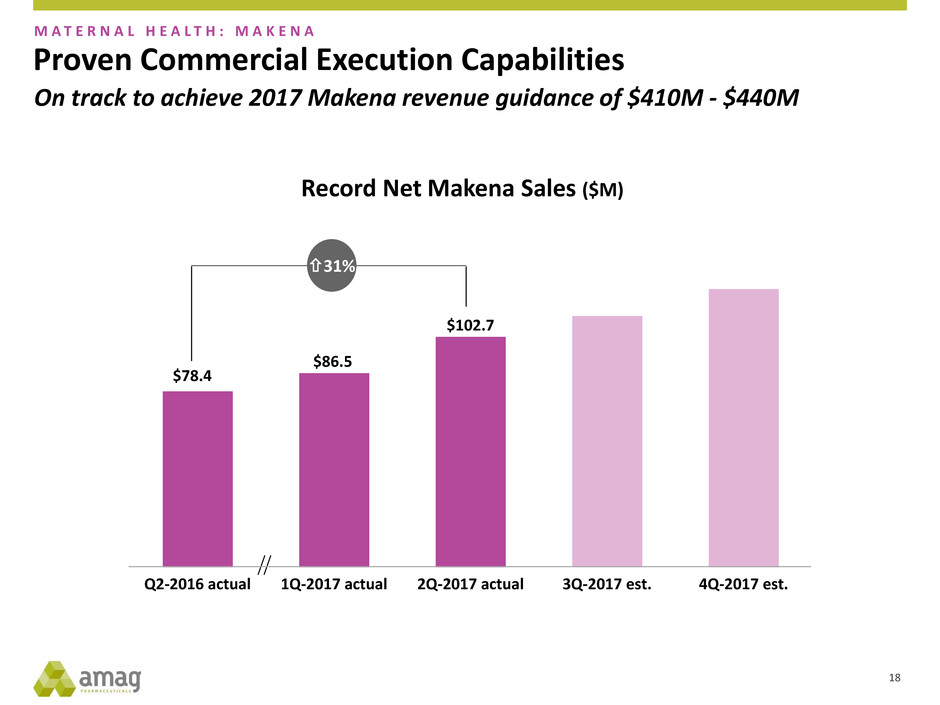

Proven Commercial Execution Capabilities

$78.4

$86.5

$102.7

Q2-2016 actual 1Q-2017 actual 2Q-2017 actual 3Q-2017 est. 4Q-2017 est.

Record Net Makena Sales ($M)

31%

M A T E R N A L H E A L T H : M A K E N A

On track to achieve 2017 Makena revenue guidance of $410M - $440M

18

Makena: Continued Growth

2017 Makena Growth Drivers

M A T E R N A L H E A L T H : M A K E N A

1 Company estimates Makena market share based on distributor dispensing data and all other market share based on physician market

research data conducted by AMAG.

2 AMAG estimates market opportunity based on 140,000 patients, >16 injections/patient and net revenue of ~$425-$450/injection.

3 Off guidance represents patients treated outside guidance of Society for Maternal Fetal Medicine, including patients treated with

unapproved therapies and untreated patients.

4 If regulatory approval is received.

Off Guidance3

30%

At June 30, 2017

Makena

47%

Compounded

Hydroxyprogesterone

Caproate

23%

$1B Market Opportunity2

Estimated Makena market share1 up 3 percentage points over Q1-2017

Continue share gains from

compounders and grow Makena

@Home administration

1

Expand use in late preterm birth

segment 2

Prepare for Q1-2018 launch of

sub-q auto-injector4 3

Prepare for potential competitive

threat in 2018 4

19

$24.4

$28.0

Q2-2016 Q2-2017

$29.4 $29.4

Q2-2016 Q2-2017

GAAP CBR Revenue ($M) Non-GAAP CBR Revenue1 ($M)

CBR: Attractive Recurring Revenue Stream

M A T E R N A L H E A L T H : C O R D B L O O D R E G I S T R Y

1 Non-GAAP CBR revenue includes purchase accounting adjustments related to CBR

deferred revenue of $5.1M and $1.4M for Q2-2016 and Q2-2017, respectively.

20

CBR 2017 Growth Drivers

Differentiate CBR’s offerings

– Increase/stabilize first time enrollments 1

Build value proposition on storing newborn

stem cells

– Harmonizing annual storage price

– Stabilized new enrollment pricing

2

Leverage advancements in stem cell research

with OB/GYN’s and pregnant families 3

M A T E R N A L H E A L T H : C O R D B L O O D R E G I S T R Y

21

Solid Financial Performance; Expected Future Growth

$24.3

$27.5

Q2-2016 Q2-2017

Feraheme Revenue1 ($M)

13%

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

2017 Growth Drivers

Continued growth in key segments

Pull through recent GPO access wins

Optimize net revenue per gram

Prepare for expanded label to include all

IDA patients2

– Completed submission to FDA with

approval and launch anticipated in 1H-2018

– Would double addressable market, if

approved3

– Minimal expansion required from current

commercial footprint

1 Represents Feraheme revenues only. Excludes MuGard revenues as reported on financial statements.

2 If regulatory approval is received.

3 AMAG estimates market opportunity using ~$600/gram and 1.3M grams (Q2-2017 IMS data annualized).

22

Large IV Iron Market Opportunity of $780M1,2

Feraheme

25%3

Other IV irons

75%3

Current

Addressable

Market:

$390M3

Additional

Addressable

Market:

$390M

‒ Iron deficiency anemia

caused by other diseases

– Iron deficiency anemia caused

by chronic kidney disease

Label expansion

doubles

our addressable

market1

Non-dialysis IV iron market

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

23

1 If regulatory approval is received for broad IDA indication.

2 AMAG estimates market opportunity using ~$600/gram and 1.3M grams (Q2-2017 IMS data annualized).

3 AMAG estimates current market using IMS data and internal analytics.

IV Iron Market Represents Small Subset of Patients Who

Suffer from IDA

Opportunity to convert from oral to IV treatments

IDA-CKD Patients

Majority under the care

of current AMAG call

points; hematology /

oncology & hospital

infusion centers

Diagnosed IDA Patients

Under the care of

other physician

specialists, including

1.5M in women’s

health

700,0002

IV Patients

H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E

4.5M Total U.S. Patients Diagnosed with Iron Deficiency Anemia1

24

1 Global Intravenous (I.V.) Iron Drugs Market Report: 2015 Edition.

2 AMAG estimates number of IV patients using 1.3M grams (Q2-2017 IMS data annualized) and an estimated average dose per course

of therapy.

Financial Update and

Guidance

Ted Myles

Chief Financial Officer

25

$236.4

$297.8

$25.5

$(36.4)

1

1

$127.4

$158.4

$3.6

$18.1

Q2-2016 Q2-2017

Makena revenue CBR revenue Feraheme/MuGard revenue GAAP Operating income (loss)

24%

1H-2016 1H-2017

26%

GAAP Financials for the

3-months Ended June 30

($M)

GAAP Financials for the

6-months Ended June 30

($M)

1 Excludes $273,000 and $53,000 of “License fee, collaboration and other revenues” in 1H-2016 and 1H-2017, respectively.

Continued Revenue Growth and Portfolio Investments

26

Continued Revenue Growth and Portfolio Investments

$250.3

$112.1

$300.6

$107.7

1H-2016 1H-2017

20%

Makena revenue CBR revenue Feraheme/MuGard revenue Non-GAAP adjusted EBITDA

$132.5

$64.6

$159.8

$50.1

Q2-2016 Q2-2017

21%

1 See slide 37 for a reconciliation of GAAP to non-GAAP financial results.

Non-GAAP Financials for the

3-months Ended June 30

($M)

Non-GAAP Financials for the

6-months Ended June 30

($M)

1 1

27

Affirming 2017 Financial Guidance

($M) 2017 GAAP

Guidance

2017 Non-GAAP

Guidance1

Makena sales $410 - $440 $410 - $440

Feraheme/MuGard sales $100 - $110 $100 - $110

CBR revenue $110 - $120 $115 - $1252

Intrarosa $5 - $15 $5 - $15

Total revenue $625 - $685 $630 - $690

Net income (loss) ($62) - ($31)1 N/A

Operating income (loss) ($23) - $271 N/A

Adjusted EBITDA N/A $210 - $260

1 See slide 38 for a reconciliation of 2017 financial guidance.

2 Revenue includes purchase accounting adjustments related to CBR deferred revenue. 28

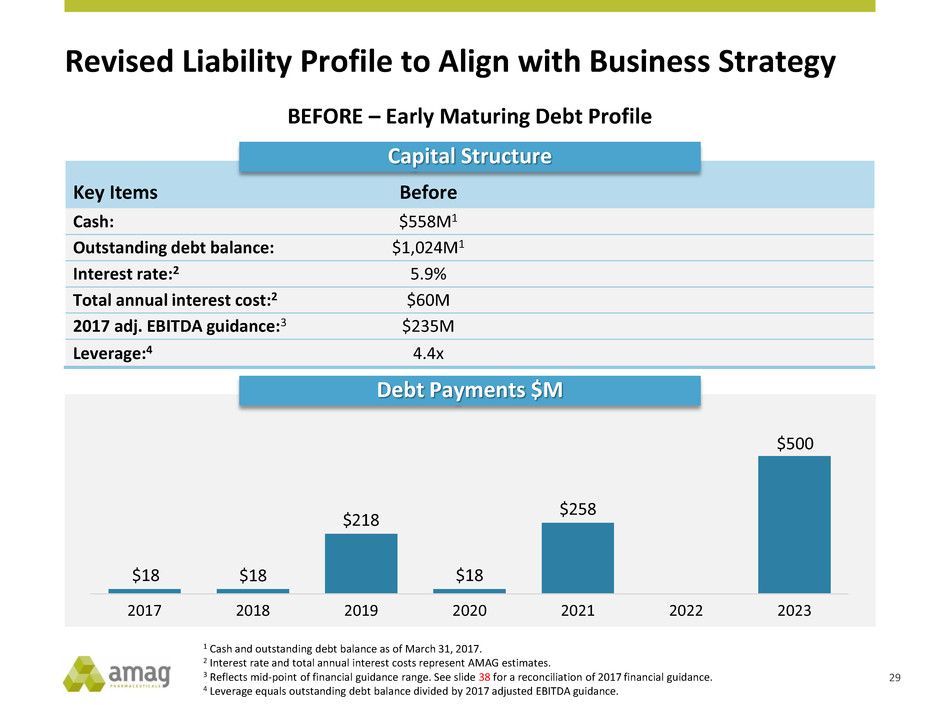

Revised Liability Profile to Align with Business Strategy

BEFORE – Early Maturing Debt Profile

Key Items Before

Cash: $558M1

Outstanding debt balance: $1,024M1

Interest rate:2 5.9%

Total annual interest cost:2 $60M

2017 adj. EBITDA guidance:3 $235M

Leverage:4 4.4x

Capital Structure

$18 $18

$218

$18

$258

$500

2017 2018 2019 2020 2021 2022 2023

Debt Payments $M

29

1 Cash and outstanding debt balance as of March 31, 2017.

2 Interest rate and total annual interest costs represent AMAG estimates.

3 Reflects mid-point of financial guidance range. See slide 38 for a reconciliation of 2017 financial guidance.

4 Leverage equals outstanding debt balance divided by 2017 adjusted EBITDA guidance.

Revised Liability Profile to Align with Business Strategy

AFTER – Extended Debt Maturity Profile

Key Items Before After

Cash: $558M $399M1

Outstanding debt balance: $1,024M $861M1

Interest rate:2 5.9% 5.9%

Total annual interest cost:2 $60M $50.8M

2017 adj. EBITDA guidance:3 $235M $235M

Leverage:4 4.4x 3.7x

Capital Structure

Debt Payments $M

$41

$320

$500

2H-2017 2018 2019 2020 2021 2022 2023

30

1 Cash and outstanding debt balance as of June 30, 2017.

2 Interest rate and total annual interest costs represent AMAG estimates.

3 Reflects mid-point of financial guidance range. See slide 38 for a reconciliation of 2017 financial guidance.

4 Leverage equals outstanding debt balance divided by 2017 adjusted EBITDA guidance.

Debt maturities now align with business strategy

Strong cash balance of $400M and positive EBITDA generation

supportive of investments in:

– Next generation products in current portfolio

– Advancement of new product portfolio (Intrarosa and bremelanotide)

– Expansion of portfolio through business development

Financial Results and Revamped Balance Sheet Support

Evolving Business Model

31

2017 Key Priorities &

Closing Remarks

Bill Heiden

President & CEO

32

AMAG Portfolio: Multiple Value Drivers

Milestone 2017 2018

INTRAROSA Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Commercial launch in dyspareunia

Initiate Phase 3 female sexual dysfunction study

MAKENA AUTO-INJECTOR PROGRAM Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Topline PK data

sNDA submission

Expected FDA action and commercial launch

FERAHEME IDA LABEL EXPANSION Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Enrollment completed

Topline data

Regulatory submission

Expected FDA action and commercial launch

BREMELANOTIDE Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

NDA submission

Expected FDA action and commercial launch

VELO – SEVERE PREECLAMPSIA

Initiate Phase 2b/3a study

33

2H-2017 Key Priorities

Intrarosa

Drive successful launch

‒ Continue to increase the number of covered lives

‒ Market share

‒ NRx and TRx (growth)

Makena

Increase patient market share and adherence to therapy

Prepare for launch of sub-q auto-injector in Q1-20181

Prepare for potential competitive threat in 2018

CBR Continue to grow new enrollments

Feraheme

Hold/increase market share and grow market

Prepare for launch of broad IDA (all causes) label in 1H-20181

Bremelanotide Conclude all work in preparation for Q1-2018 NDA filing

Portfolio

Expansion

Expand and diversify product portfolio with longer-lived, durable assets

through licensing or acquisition transactions

Financial

Continue to drive toward net product sales of $660M (midpoint of guidance)

Grow adjusted EBITDA to $235M (midpoint of guidance)

1 If regulatory approval is received.

34

AMAG Pharmaceuticals

Q&A

35

Appendix

36

Reconciliation of GAAP to Non-GAAP Financial Results

($M)

GAAP operating income (loss)

Purchase accounting adjustments related to CBR

deferred revenue

Depreciation and intangible asset amortization

Non-cash inventory step-up adjustments

Stock-based compensation

Adjustments to contingent consideration

Restructuring costs

Transaction- / acquisition-related costs

Acquired IPR&D

Impairment of intangible assets

Non-GAAP adjusted EBITDA

Q2-2017 Q2-2016 1H-2017 1H-2016

$3.6 $18.1 ($36.4) $25.5

1.4 5.1 2.7 13.6

31.5 21.5 58.6 40.4

0.2 2.3 1.0 3.1

5.9 5.2 11.7 11.4

1.7 (3.7) 2.8 1.4

-- 0.1 -- 0.7

-- -- 1.5 --

5.8 -- 65.8 --

-- 16.0 -- 16.0

$50.1 $64.6 $107.7 $112.1

37

Reconciliation of GAAP to Non-GAAP 2017 Financial Guidance

2017 Financial Guidance

($M)

GAAP net loss ($62) – ($31)

Adjustments:

Interest expense, net 66

Loss on debt extinguishment 10

Provision for income tax benefit (37) – (18)

Operating income (loss) ($23) – $27

Purchase accounting adjustments related to CBR deferred revenue 6

Depreciation & intangible asset amortization 127

Non-cash inventory step-up adjustments 2

Stock-based compensation 27

Adjustments to contingent consideration 5

Acquired IPR&D1 66

Non-GAAP adjusted EBITDA $210 - $260

1 Reflects final transaction accounting treatment for Endoceutics license transaction that closed April 3, 2017.

38

Share Count Reconciliation

1 Employee equity incentive awards, convertible notes and warrants would be anti-dilutive in this period.

2 Reflects the Non-GAAP dilutive impact of employee equity incentive awards.

(M) Q2-2017 Q2-2016 YTD 2017 YTD 2016

Weighted average basic shares

outstanding

35.1 34.2 34.8 34.5

Employee equity incentive awards --1 --1 --1 --1

Convertible notes --1 --1 --1 --1

Warrants --1 --1 --1 --1

GAAP diluted shares outstanding 35.1 34.2 34.8 34.5

Employee equity incentive awards 0.42 0.42 0.52 0.32

Non-GAAP diluted shares outstanding 35.5 34.6 35.3 34.8

39

AMAG Pharmaceuticals

Q2-2017 Financial Results &

Corporate Update

August 3, 2017

40