Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Shutterstock, Inc. | a2017-q2_exx991.htm |

| 8-K - 8-K - Shutterstock, Inc. | a2017-q2_8xkdocument.htm |

Second Quarter 2017

August 2, 2017

2

This presentation contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on

our management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include information

concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment,

potential growth opportunities, potential market opportunities and the effects of competition.

Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,”

“could,” “seeks,” “estimates,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the

negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the

forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of our most

recent public filings. You should read our public filings, including the Risk Factors set forth therein and the documents that we have filed as exhibits

to those filings, completely and with the understanding that our actual future results may be materially different from what we currently expect.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results

could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future.

Safe Harbor Statement

3

In addition to reporting financial results in accordance with GAAP, we also refer to adjusted EBITDA, adjusted net income, revenue growth on a constant currency basis, adjusted EBITDA

margin and adjusted EBITDA growth on a constant currency basis and free cash flow. We define adjusted EBITDA as net income adjusted for foreign currency transaction gains and

losses, changes in fair value of contingent consideration related to acquisitions, interest income and expense, income taxes, depreciation, amortization, disposals and non-cash equity-

based compensation; adjusted net income as net income excluding the impact of non-cash equity-based compensation, the amortization of acquisition-related intangible assets and

changes in the fair value of contingent consideration related to acquisitions and the estimated tax impact of such adjustments; revenue growth on a constant currency basis (expressed as

a percentage) as the increase in current period revenues over prior period revenues, utilizing fixed exchange rates for translating foreign currency revenues for both periods; adjusted

EBITDA margin (expressed as a percentage) as the ratio of adjusted EBITDA to revenue; adjusted EBITDA growth on a constant currency basis (expressed as a percentage) as the

increase in current period adjusted EBITDA over prior period adjusted EBITDA, utilizing fixed exchange rates for translating foreign currency revenues and expenses for both periods; and

free cash flow as cash provided by/(used in) operating activities adjusted for capital expenditures and content acquisition. These figures are non-GAAP financial measures and should be

considered in addition to results prepared in accordance with generally accepted accounting principles (GAAP), and should not be considered as a substitute for, or superior to, GAAP

results.

We use the non-GAAP financial measures adjusted EBITDA, adjusted net income, revenue growth on a constant currency basis, adjusted EBITDA margin, adjusted EBITDA growth on a

constant currency basis and free cash flow, in conjunction with GAAP financial measures, as an integral part of managing the business and to, among other things: (i) monitor and evaluate

the performance of Shutterstock’s business operations, financial performance and overall liquidity; (ii) facilitate management's internal comparisons of the historical operating performance

of its business operations; (iii) facilitate management's external comparisons of the results of its overall business to the historical operating performance of other companies that may have

different capital structures and debt levels; (iv) review and assess the operating performance of Shutterstock’s management team and, together with other operational objectives, as a

measure in evaluating employee compensation and bonuses; (v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for

and prepare future annual operating budgets and determine appropriate levels of operating investments.

We believe that adjusted EBITDA, adjusted net income, revenue growth on a constant currency basis, adjusted EBITDA margin, adjusted EBITDA growth on a constant currency basis are

useful to investors to provide them with disclosures of our operating results on the same basis as that used by management. Additionally, we believe that adjusted EBITDA and adjusted

net income provide useful information to investors about the performance of the Company's overall business because such measures eliminate the effects of unusual or other infrequent

charges that are not directly attributable to our underlying operating performance, and, with respect to revenue growth and adjusted EBITDA growth on a constant currency basis, provides

useful information to investors by eliminating the effect of foreign currency fluctuations that are not directly attributable to Shutterstock’s business. Additionally, we believe that providing

these non-GAAP financial measures enhances the comparability for investors in assessing our financial reporting. We believe that free cash flow is useful for investors because it provides

them with an important perspective on the cash available for strategic measures, after making necessary capital investments in property and equipment to support the Company's ongoing

business operations, and provides them with the same measures that we use as the basis for making resource allocation decisions.

Please refer to the reconciliation of the differences between adjusted EBITDA, adjusted net income, and free cash flow, and the most comparable financial measure calculated and

presented in accordance with GAAP, presented under the heading “Reconciliation of Non-GAAP Financial Information to GAAP” immediately following the Consolidated Balance Sheets in

today’s earnings release, which is available in the Investor Relations section of our website.

Non-GAAP Financial Measures

4

Compared to Q2'16:

• Revenue increased 8% to $134.0 million primarily driven by new customers, an increase in paid

downloads and increased activity from enterprise clients

• Revenue increased 9% on a constant currency basis

• Income from Operations decreased 69% to $3.3 million driven by higher royalty costs associated

with the increase in paid downloads and an increase in marketing spend year-over-year

• Net income decreased 58% to $3.1 million

• Adjusted net income during the quarter decreased 34% to $8.3 million

• Adjusted EBITDA decreased 19% to $18.3 million

• Generated $10.1 million of free cash flow during the quarter

Q2’17 Financial Highlights

5

Q2’17 Operating Highlights

• Image library expanded to 144.7 million images, up 57% vs. Q2'16

• Video library expanded to 7.6 million video clips, up 55% vs. Q2'16

• More than 250,000 contributors made their images, video clips & music tracks available

• Paid downloads of 42.7 million decreased 2% vs. Q2'16

• More than 1.7 million customers contributed to revenue over past 12 months, which was up 11%

vs. Q2'16

• Launched Workstream™, a workflow management tool on the Webdam platform

• Entered into a definitive agreement to acquire FlashStock Technologies, Inc. which closed in July

2017 for approximately $50 million. Flashstock is a Toronto-based company that enables the

creation of custom content through a propriety software platform.

6

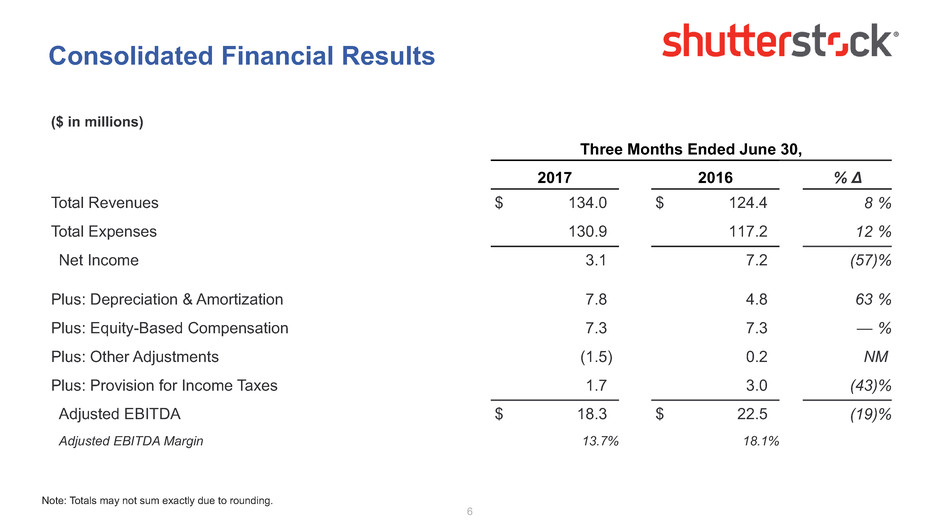

Consolidated Financial Results

($ in millions)

Three Months Ended June 30,

2017 2016 % Δ

Total Revenues $ 134.0 $ 124.4 8 %

Total Expenses 130.9 117.2 12 %

Net Income 3.1 7.2 (57)%

Plus: Depreciation & Amortization 7.8 4.8 63 %

Plus: Equity-Based Compensation 7.3 7.3 — %

Plus: Other Adjustments (1.5) 0.2 NM

Plus: Provision for Income Taxes 1.7 3.0 (43)%

Adjusted EBITDA $ 18.3 $ 22.5 (19)%

Adjusted EBITDA Margin 13.7% 18.1%

Note: Totals may not sum exactly due to rounding.

7

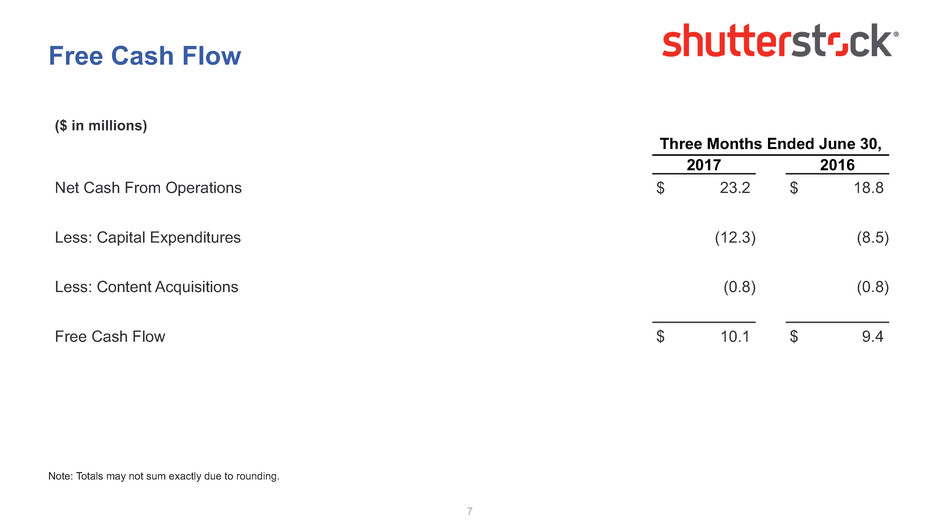

Free Cash Flow

($ in millions)

Three Months Ended June 30,

2017 2016

Net Cash From Operations $ 23.2 $ 18.8

Less: Capital Expenditures (12.3) (8.5)

Less: Content Acquisitions (0.8) (0.8)

Free Cash Flow $ 10.1 $ 9.4

Note: Totals may not sum exactly due to rounding.

8

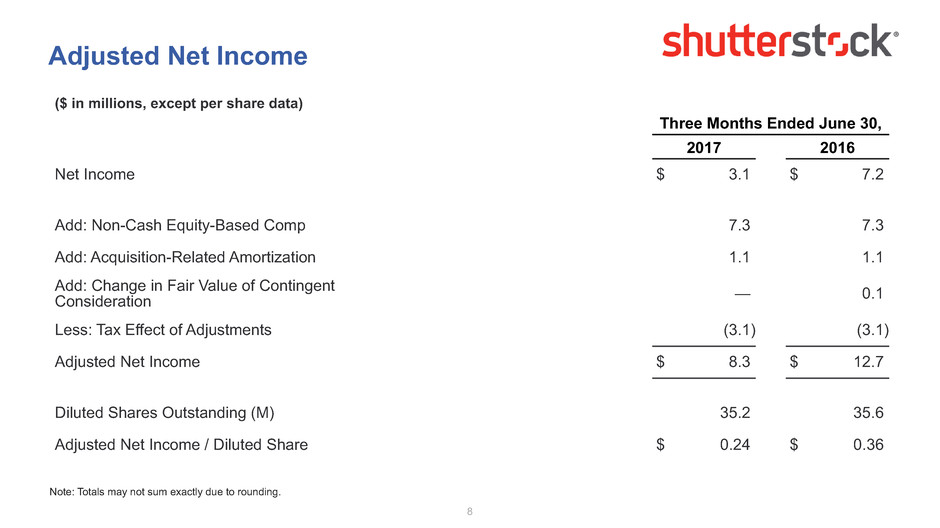

Adjusted Net Income

($ in millions, except per share data)

Three Months Ended June 30,

2017 2016

Net Income $ 3.1 $ 7.2

Add: Non-Cash Equity-Based Comp 7.3 7.3

Add: Acquisition-Related Amortization 1.1 1.1

Add: Change in Fair Value of Contingent

Consideration — 0.1

Less: Tax Effect of Adjustments (3.1) (3.1)

Adjusted Net Income $ 8.3 $ 12.7

Diluted Shares Outstanding (M) 35.2 35.6

Adjusted Net Income / Diluted Share $ 0.24 $ 0.36

Note: Totals may not sum exactly due to rounding.

9

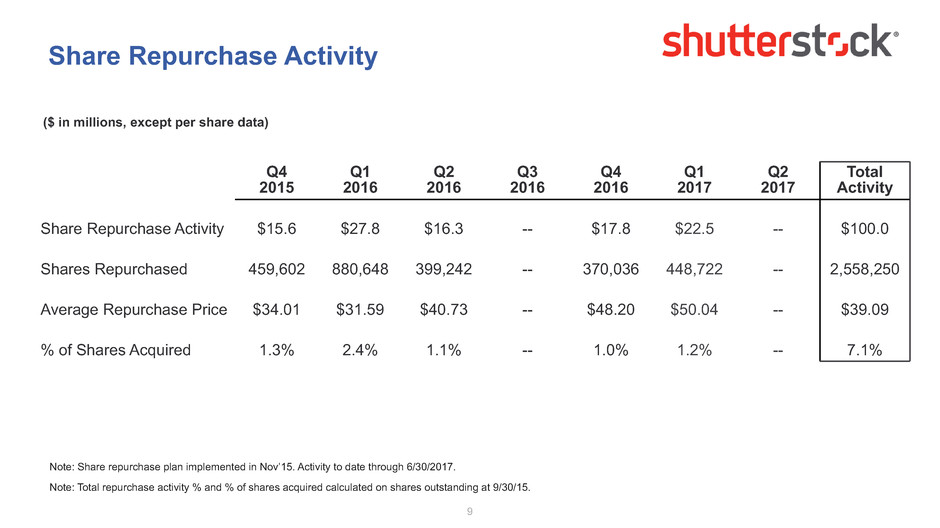

Share Repurchase Activity

Note: Share repurchase plan implemented in Nov’15. Activity to date through 6/30/2017.

Note: Total repurchase activity % and % of shares acquired calculated on shares outstanding at 9/30/15.

Q4

2015

Q1

2016

Q2

2016

Q3

2016

Q4

2016

Q1

2017

Q2

2017

Total

Activity

Share Repurchase Activity $15.6 $27.8 $16.3 -- $17.8 $22.5 -- $100.0

Shares Repurchased 459,602 880,648 399,242 -- 370,036 448,722 -- 2,558,250

Average Repurchase Price $34.01 $31.59 $40.73 -- $48.20 $50.04 -- $39.09

% of Shares Acquired 1.3% 2.4% 1.1% -- 1.0% 1.2% -- 7.1%

($ in millions, except per share data)

10

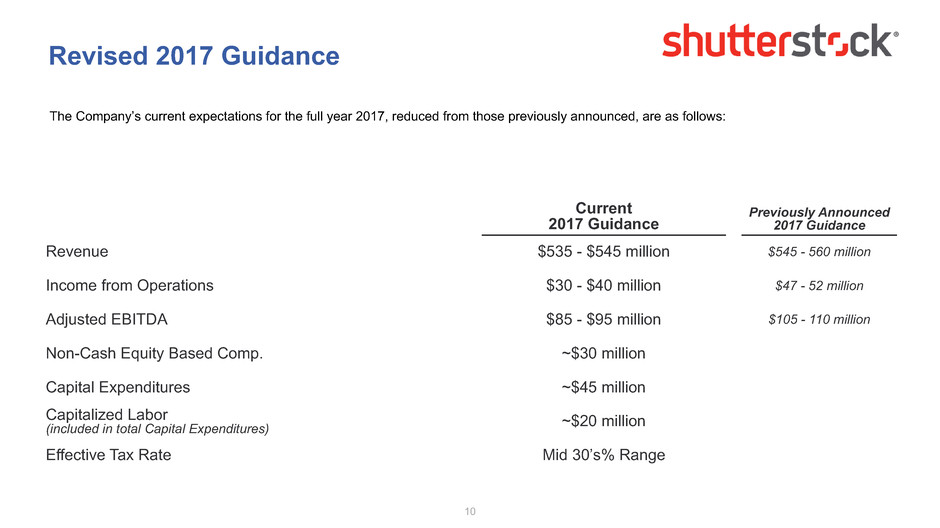

Revised 2017 Guidance

Current

2017 Guidance

Previously Announced

2017 Guidance

Revenue $535 - $545 million $545 - 560 million

Income from Operations $30 - $40 million $47 - 52 million

Adjusted EBITDA $85 - $95 million $105 - 110 million

Non-Cash Equity Based Comp. ~$30 million

Capital Expenditures ~$45 million

Capitalized Labor

(included in total Capital Expenditures) ~$20 million

Effective Tax Rate Mid 30’s% Range

The Company’s current expectations for the full year 2017, reduced from those previously announced, are as follows: