Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Triumph Bancorp, Inc. | tbk-8k_20170801.htm |

Investor Information July 2017 Exhibit 99.1

disclaimer Forward-Looking Statements This presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: our limited operating history as an integrated company; business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market area; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; risks related to the integration of acquired businesses (including our pending acquisition of Valley Bancorp, Inc. and nine branches from Independent Bank in Colorado) and any future acquisitions including the possibility that the expected benefits related to the proposed transactions may not materialize as expected, of the proposed transactions not being timely completed, if completed at all, that prior to the completion of the proposed transactions, Valley’s or the branches’ businesses experiencing disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities, difficulty retaining key employees, and of the parties being unable to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within the expected time-frames or at all; changes in management personnel; interest rate risk; concentration of our factoring services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and their application by our regulators; governmental monetary and fiscal policies; changes in the scope and cost of the Federal Deposit Insurance Corporation insurance and other coverages; failure to receive regulatory approval for future acquisitions; increases in our capital requirements; and risk retention requirements under the Dodd-Frank Act. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and the forward-looking statement disclosure contained in Triumph’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 17, 2017 and Triumph’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2017, filed with the SEC on July 21, 2017. NO OFFER OR SOLICIATION This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities, nor shall there be any offer or sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful. PRO FORMA INFORMATION This presentation contains certain pro forma information that reflects our current expectations and assumptions regarding the effect that our Colorado branch acquisition and our pending acquisition of Valley Bancorp, Inc. would have had they been completed at an earlier date. This pro forma information does not purport to present the results that would have actually occurred had these acquisitions been completed on the assumed dates, or that we may realize if the acquisitions are completed. Non-GAAP Financial Measures This presentation includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non‐GAAP financial measures to GAAP financial measures are provided in the appendix. Numbers in this presentation may not sum due to rounding. Unless otherwise referenced, all data presented is as of June 30, 2017. Page

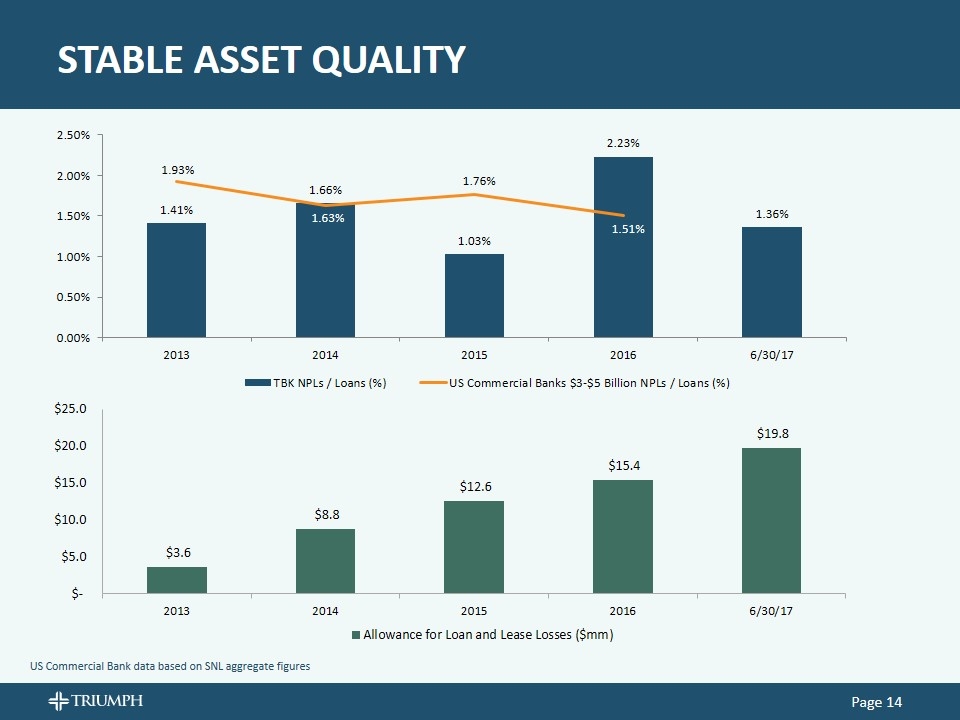

RECENT DEVELOPMENTS: Q2 2017 HIGHLIGHTS Page Diluted EPS of $0.51 for 2Q’17 Increase of $0.26 (104%) over 2Q’16 Total loan portfolio growth of $259.9 million (12.8%) Commercial finance loan portfolio growth of $88.0 million (12.3%) Commercial real estate loan portfolio growth of $43.1 million (8.7%) Mortgage warehouse loan portfolio growth of $107.5 million (87.9%) NPLs declined to 1.36% of loans from 1.80% in 1Q’17 Net interest margin increased to 6.16% from 5.37% in 1Q’17 Announced acquisition of nine Colorado bank branches $9.5 million Net income to common stockholders COMMERCIAL FINANCE LOAN GROWTH 12.3% NIM 6.16% Net Interest Margin (5.70% adjusted)(1) ROAA 1.42% Return on Average Assets TCE/TA 9.22% Tangible Common Equity / Tangible Assets(1) Reconciliations of non-GAAP financial measures can be found in the appendix

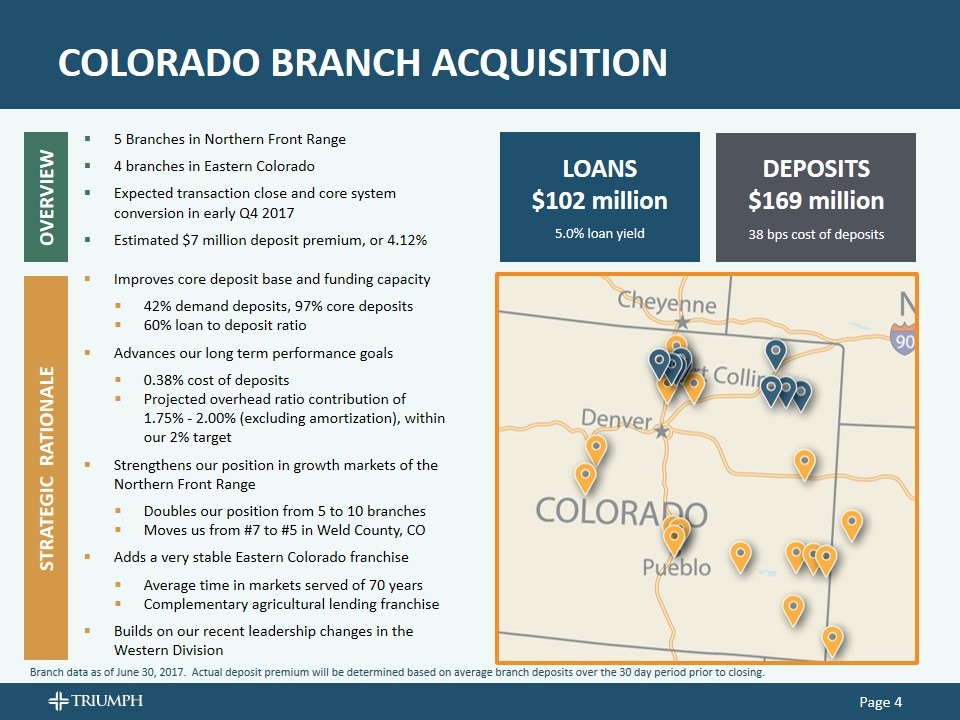

Improves core deposit base and funding capacity 42% demand deposits, 97% core deposits 60% loan to deposit ratio Advances our long term performance goals 0.38% cost of deposits Projected overhead ratio contribution of 1.75% - 2.00% (excluding amortization), within our 2% target Strengthens our position in growth markets of the Northern Front Range Doubles our position from 5 to 10 branches Moves us from #7 to #5 in Weld County, CO Adds a very stable Eastern Colorado franchise Average time in markets served of 70 years Complementary agricultural lending franchise Builds on our recent leadership changes in the Western Division 5 Branches in Northern Front Range 4 branches in Eastern Colorado Expected transaction close and core system conversion in early Q4 2017 Estimated $7 million deposit premium, or 4.12% LOANS $102 million 5.0% loan yield DEPOSITS $169 million 38 bps cost of deposits Strategic Rationale COLORADO BRANCH ACQUISITION Page Overview Branch data as of June 30, 2017. Actual deposit premium will be determined based on average branch deposits over the 30 day period prior to closing.

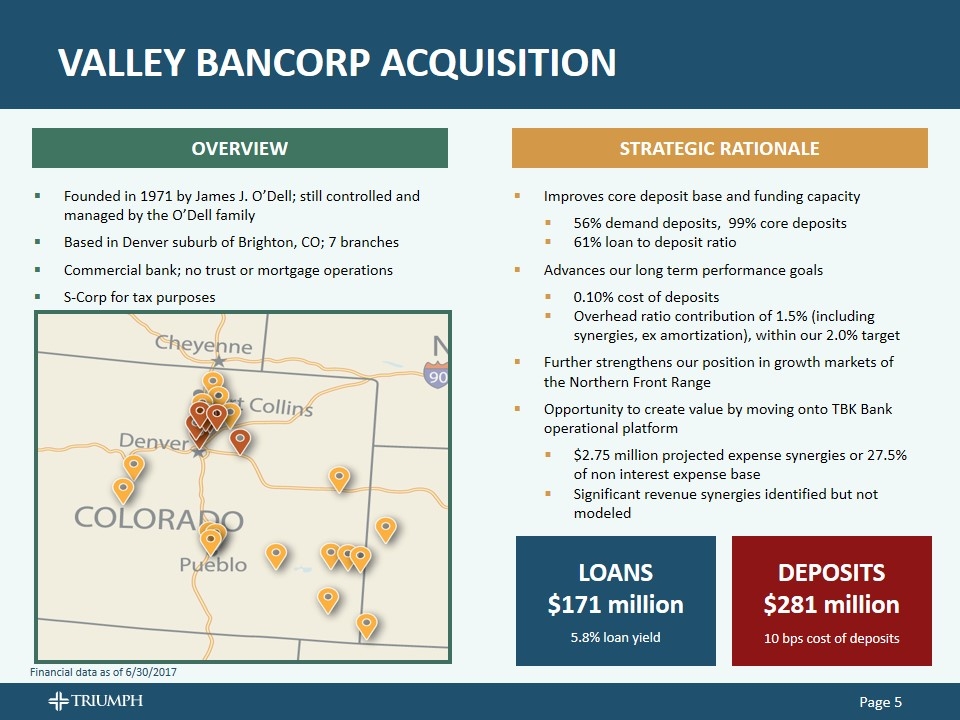

Improves core deposit base and funding capacity 56% demand deposits, 99% core deposits 61% loan to deposit ratio Advances our long term performance goals 0.10% cost of deposits Overhead ratio contribution of 1.5% (including synergies, ex amortization), within our 2.0% target Further strengthens our position in growth markets of the Northern Front Range Opportunity to create value by moving onto TBK Bank operational platform $2.75 million projected expense synergies or 27.5% of non interest expense base Significant revenue synergies identified but not modeled Founded in 1971 by James J. O’Dell; still controlled and managed by the O’Dell family Based in Denver suburb of Brighton, CO; 7 branches Commercial bank; no trust or mortgage operations S-Corp for tax purposes LOANS $171 million 5.8% loan yield DEPOSITS $281 million 10 bps cost of deposits VALLEY BANCORP ACQUISITION Page Overview Strategic Rationale Financial data as of 6/30/2017

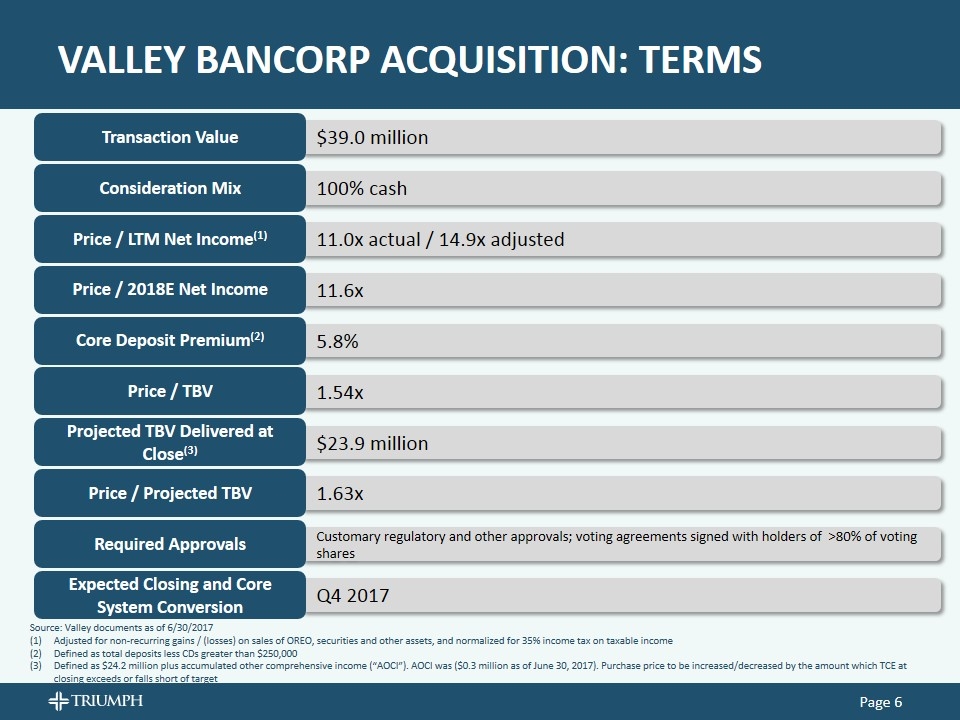

VALLEY BANCORP acquisition: TERMS Page 11.0x actual / 14.9x adjusted Price / LTM Net Income(1) 11.6x Price / 2018E Net Income 5.8% Core Deposit Premium(2) $23.9 million Projected TBV Delivered at Close(3) Q4 2017 Expected Closing and Core System Conversion Customary regulatory and other approvals; voting agreements signed with holders of >80% of voting shares Required Approvals $39.0 million Transaction Value 100% cash Consideration Mix 1.54x Price / TBV Source: Valley documents as of 6/30/2017 Adjusted for non-recurring gains / (losses) on sales of OREO, securities and other assets, and normalized for 35% income tax on taxable income Defined as total deposits less CDs greater than $250,000 Defined as $24.2 million plus accumulated other comprehensive income (“AOCI”). AOCI was ($0.3 million as of June 30, 2017). Purchase price to be increased/decreased by the amount which TCE at closing exceeds or falls short of target 1.63x Price / Projected TBV

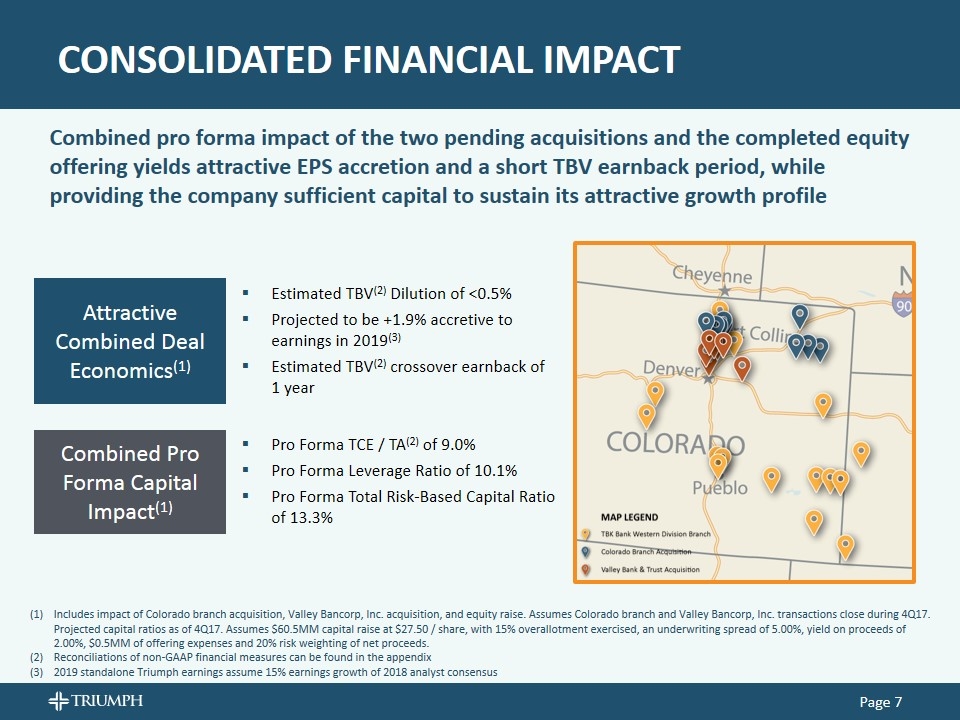

Combined Pro Forma Capital Impact(1) Attractive Combined Deal Economics(1) CONSOLIDATED FINANCIAL IMPACT Page Estimated TBV(2) Dilution of <0.5% Projected to be +1.9% accretive to earnings in 2019(3) Estimated TBV(2) crossover earnback of 1 year Pro Forma TCE / TA(2) of 9.0% Pro Forma Leverage Ratio of 10.1% Pro Forma Total Risk-Based Capital Ratio of 13.3% Includes impact of Colorado branch acquisition, Valley Bancorp, Inc. acquisition, and equity raise. Assumes Colorado branch and Valley Bancorp, Inc. transactions close during 4Q17. Projected capital ratios as of 4Q17. Assumes $60.5MM capital raise at $27.50 / share, with 15% overallotment exercised, an underwriting spread of 5.00%, yield on proceeds of 2.00%, $0.5MM of offering expenses and 20% risk weighting of net proceeds. Reconciliations of non-GAAP financial measures can be found in the appendix 2019 standalone Triumph earnings assume 15% earnings growth of 2018 analyst consensus Combined pro forma impact of the two pending acquisitions and the completed equity offering yields attractive EPS accretion and a short TBV earnback period, while providing the company sufficient capital to sustain its attractive growth profile

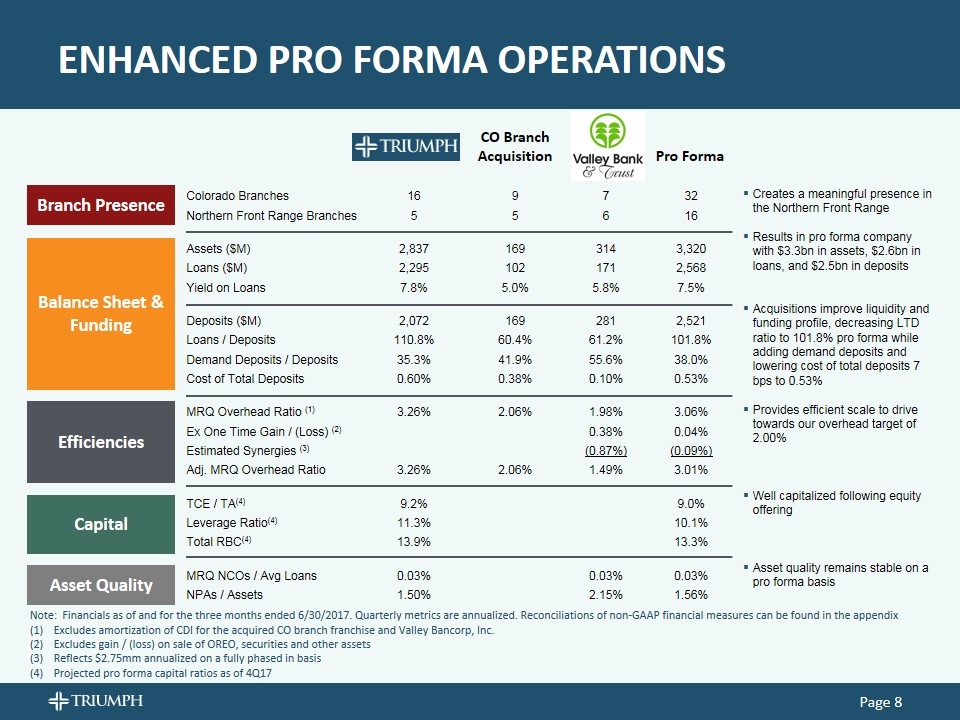

ENHANCED Pro FORMA OPERATIONS Page Branch Presence Creates a meaningful presence in the Northern Front Range Results in pro forma company with $3.3bn in assets, $2.6bn in loans, and $2.5bn in deposits Acquisitions improve liquidity and funding profile, decreasing LTD ratio to 101.8% pro forma while adding demand deposits and lowering cost of total deposits 7 bps to 0.53% Provides efficient scale to drive towards our overhead target of 2.00% Well capitalized following equity offering Asset quality remains stable on a pro forma basis CO Branch Acquisition Note: Financials as of and for the three months ended 6/30/2017. Quarterly metrics are annualized. Reconciliations of non-GAAP financial measures can be found in the appendix Excludes amortization of CDI for the acquired CO branch franchise and Valley Bancorp, Inc. Excludes gain / (loss) on sale of OREO, securities and other assets Reflects $2.75mm annualized on a fully phased in basis Projected pro forma capital ratios as of 4Q17 Colorado Branches 16 9 7 32 Northern Front Range Branches 5 5 6 16 Assets ($M) 2,837 169 314 3,320 Loans ($M) 2,295 102 171 2,568 Yield on Loans 7.8% 5.0% 5.8% 7.5% Deposits ($M) 2,072 169 281 2,521 Loans / Deposits 110.8% 60.4% 61.2% 101.8% Demand Deposits / Deposits 35.3% 41.9% 55.6% 38.0% Cost of Total Deposits 0.60% 0.38% 0.10% 0.53% MRQ Overhead Ratio (1) 3.26% 2.06% 1.98% 3.06% Ex One Time Gain / (Loss) (2) 0.38% 0.04% Estimated Synergies (3) (0.87%) (0.09%) Adj. MRQ Overhead Ratio 3.26% 2.06% 1.49% 3.01% TCE / TA(4) 9.2% 9.0% Leverage Ratio(4) 11.3% 10.1% Total RBC(4) 13.9% 13.3% MRQ NCOs / Avg Loans 0.03% 0.03% 0.03% NPAs / Assets 1.50% 2.15% 1.56% Pro Forma Balance Sheet & Funding Efficiencies Capital Asset Quality

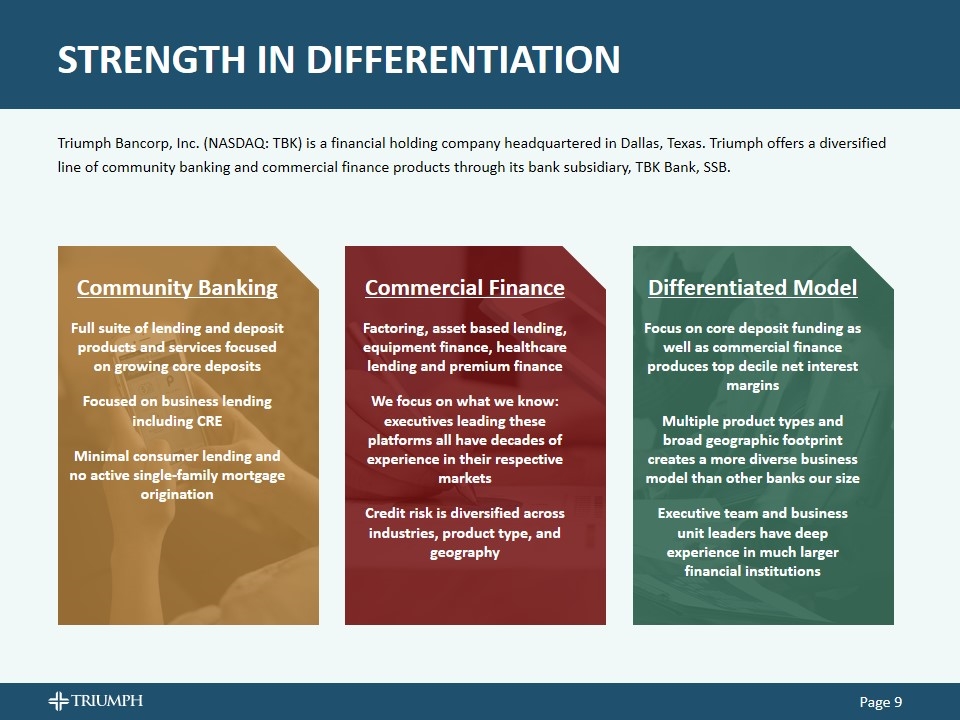

STRENGTH IN DIFFERENTIATION Page Triumph Bancorp, Inc. (NASDAQ: TBK) is a financial holding company headquartered in Dallas, Texas. Triumph offers a diversified line of community banking and commercial finance products through its bank subsidiary, TBK Bank, SSB. Community Banking Full suite of lending and deposit products and services focused on growing core deposits Focused on business lending including CRE Minimal consumer lending and no active single-family mortgage origination Differentiated Model Focus on core deposit funding as well as commercial finance produces top decile net interest margins Multiple product types and broad geographic footprint creates a more diverse business model than other banks our size Executive team and business unit leaders have deep experience in much larger financial institutions Commercial Finance Factoring, asset based lending, equipment finance, healthcare lending and premium finance We focus on what we know: executives leading these platforms all have decades of experience in their respective markets Credit risk is diversified across industries, product type, and geography

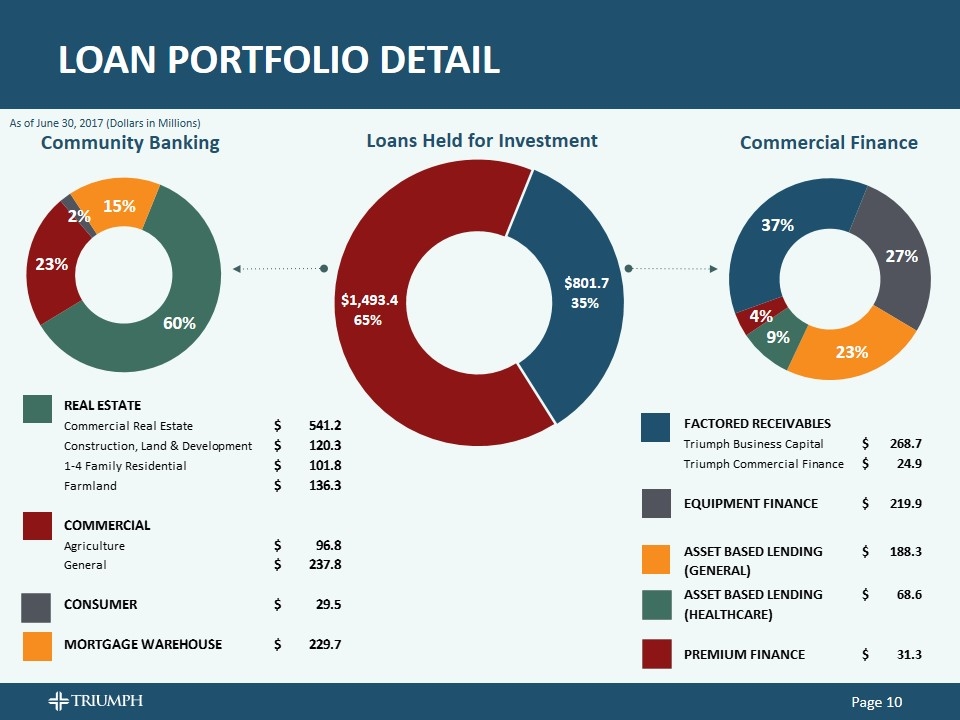

LOAN PORTFOLIO DETAIL Community Banking Commercial Finance Loans Held for Investment Page As of June 30, 2017 (Dollars in Millions) 42551 42643 42735 42825 42916 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Community Banking 803.58500000000004 1,321.9390000000001 1,333.94 1,321.6 1,493.4259999999999 Equipment 167 181.98699999999999 190.393 203.251 219.904 0.27430601466431492 Commercial Finance: Asset based lending (General) 114.63200000000001 129.501 161.45400000000001 166.917 188.25700000000001 0.23482986850016341 Asset based lending (Healthcare) 81.664000000000001 84.9 79.668000000000006 78.207999999999998 68.605999999999995 8.5578427141207017E-2 Premium Finance 6.117 27.573 23.971 23.161999999999999 31.274000000000001 3.9010869755037585E-2 Factored receivables 237.52 213.95500000000001 238.19800000000001 242.09800000000001 293.63299999999998 0.36627481993927707 Q2 2017 Commercial Finance Products $801.67399999999998 Community Banking $1,493.4259999999999 Real Estate & Farmland $899.56100000000004 Commercial Real Estate $541.21699999999998 Commercial $334.67400000000004 Construction, Land Development, Land $120.253 Consumer $29.497 1-4 Family Residential Properties $101.833 Mortgage Warehouse $229.69399999999999 Farmland $136.25800000000001 Commercial $334.67400000000004 Consumer $29.497 Community Banking Mortgage Warehouse $229.69399999999999 Agriculture 96,802 <<<<<<<<<< MANUAL UPDATE REAL ESTATE Commercial Real Estate $541.21699999999998 Construction, Land & Development $120.253 1-4 Family Residential $101.833 Farmland $136.25800000000001 0.60234722041801869 COMMERCIAL 0.22403118735042779 Agriculture $96.8 General $237.77400000000003 <<<<<<<<<< ROUNDED CONSUMER $29.497 1.9751229722798448E-2 MORTGAGE WAREHOUSE $229.69399999999999 0.15380340237815598 FACTORED RECEIVABLES Triumph Business Capital $268.733 Triumph Commercial Finance $24.9 <<<<<<<<<< MANUAL UPDATE EQUIPMENT FINANCE $219.904 ASSET BASED LENDING $188.25700000000001 ASSET BASED LENDING $68.605999999999995 (HEALTHCARE) PREMIUM FINANCE $31.274000000000001 42551 42643 42735 42825 42916 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Community Banking 803.58500000000004 1,321.9390000000001 1,333.94 1,321.6 1,493.4259999999999 Equipment 167 181.98699999999999 190.393 203.251 219.904 0.27430601466431492 Commercial Finance: Asset based lending (General) 114.63200000000001 129.501 161.45400000000001 166.917 188.25700000000001 0.23482986850016341 Asset based lending (Healthcare) 81.664000000000001 84.9 79.668000000000006 78.207999999999998 68.605999999999995 8.5578427141207017E-2 Premium Finance 6.117 27.573 23.971 23.161999999999999 31.274000000000001 3.9010869755037585E-2 Factored receivables 237.52 213.95500000000001 238.19800000000001 242.09800000000001 293.63299999999998 0.36627481993927707 Q2 2017 Commercial Finance Products $801.67399999999998 Community Banking $1,493.4259999999999 Real Estate & Farmland $899.56100000000004 Commercial Real Estate $541.21699999999998 Commercial $334.67400000000004 Construction, Land Development, Land $120.253 Consumer $29.497 1-4 Family Residential Properties $101.833 Mortgage Warehouse $229.69399999999999 Farmland $136.25800000000001 Commercial $334.67400000000004 Consumer $29.497 Community Banking Mortgage Warehouse $229.69399999999999 Agriculture 96,802 <<<<<<<<<< MANUAL UPDATE REAL ESTATE Commercial Real Estate $541.21699999999998 Construction, Land & Development $120.253 1-4 Family Residential $101.833 Farmland $136.25800000000001 0.60234722041801869 COMMERCIAL 0.22403118735042779 Agriculture $96.8 General $237.77400000000003 <<<<<<<<<< ROUNDED CONSUMER $29.497 1.9751229722798448E-2 MORTGAGE WAREHOUSE $229.69399999999999 0.15380340237815598 FACTORED RECEIVABLES Triumph Business Capital $268.733 Triumph Commercial Finance $24.9 <<<<<<<<<< MANUAL UPDATE EQUIPMENT FINANCE $219.904 ASSET BASED LENDING $188.25700000000001 (GENERAL) ASSET BASED LENDING $68.605999999999995 (HEALTHCARE) PREMIUM FINANCE $31.274000000000001

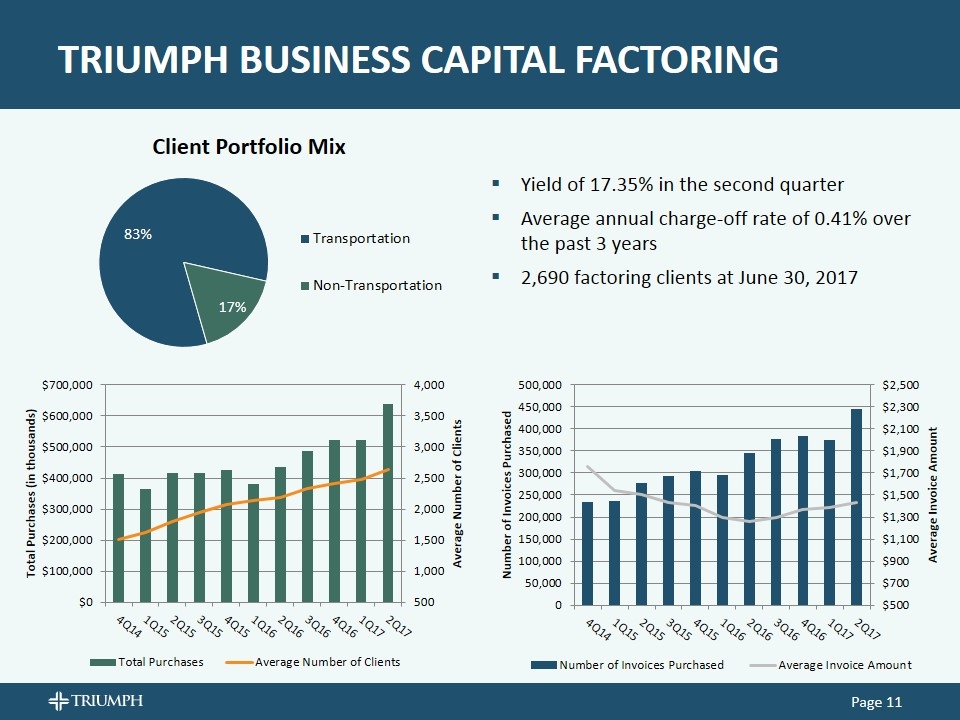

TRIUMPH BUSINESS CAPITAL FACTORING Page Yield of 17.35% in the second quarter Average annual charge-off rate of 0.41% over the past 3 years 2,690 factoring clients at June 30, 2017

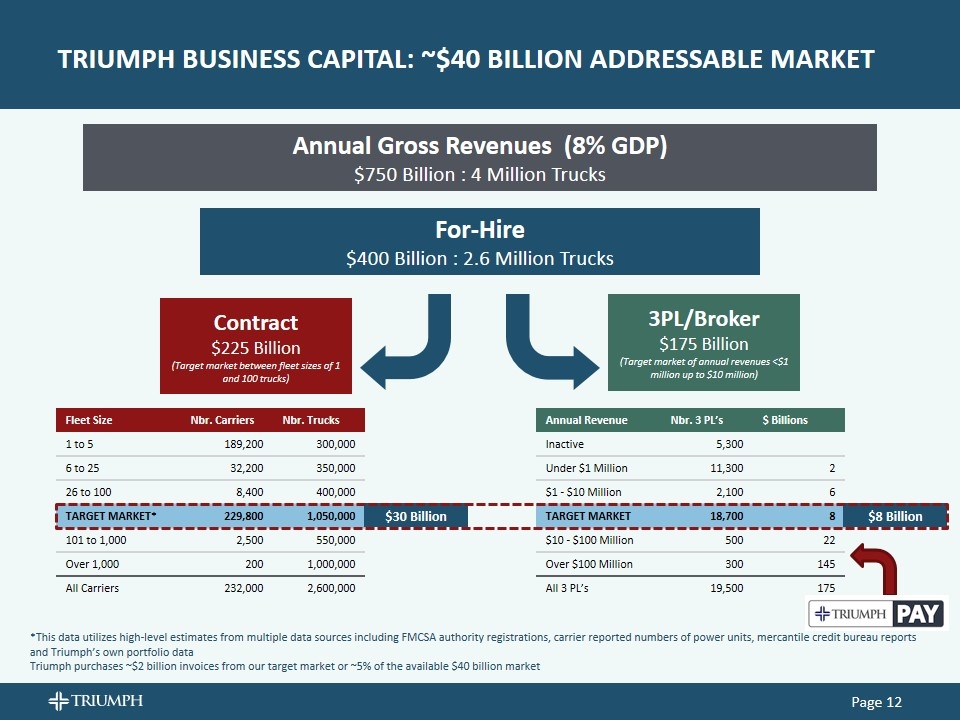

TRIUMPH BUSINESS CAPITAL: ~$40 Billion Addressable Market Page Annual Gross Revenues (8% GDP) $750 Billion : 4 Million Trucks For-Hire $400 Billion : 2.6 Million Trucks Contract $225 Billion (Target market between fleet sizes of 1 and 100 trucks) 3PL/Broker $175 Billion (Target market of annual revenues <$1 million up to $10 million) Fleet Size Nbr. Carriers Nbr. Trucks 1 to 5 189,200 300,000 6 to 25 32,200 350,000 26 to 100 8,400 400,000 TARGET MARKET* 229,800 1,050,000 101 to 1,000 2,500 550,000 Over 1,000 200 1,000,000 All Carriers 232,000 2,600,000 $30 Billion Annual Revenue Nbr. 3 PL’s $ Billions Inactive 5,300 Under $1 Million 11,300 2 $1 - $10 Million 2,100 6 TARGET MARKET 18,700 8 $10 - $100 Million 500 22 Over $100 Million 300 145 All 3 PL’s 19,500 175 $8 Billion *This data utilizes high-level estimates from multiple data sources including FMCSA authority registrations, carrier reported numbers of power units, mercantile credit bureau reports and Triumph’s own portfolio data Triumph purchases ~$2 billion invoices from our target market or ~5% of the available $40 billion market

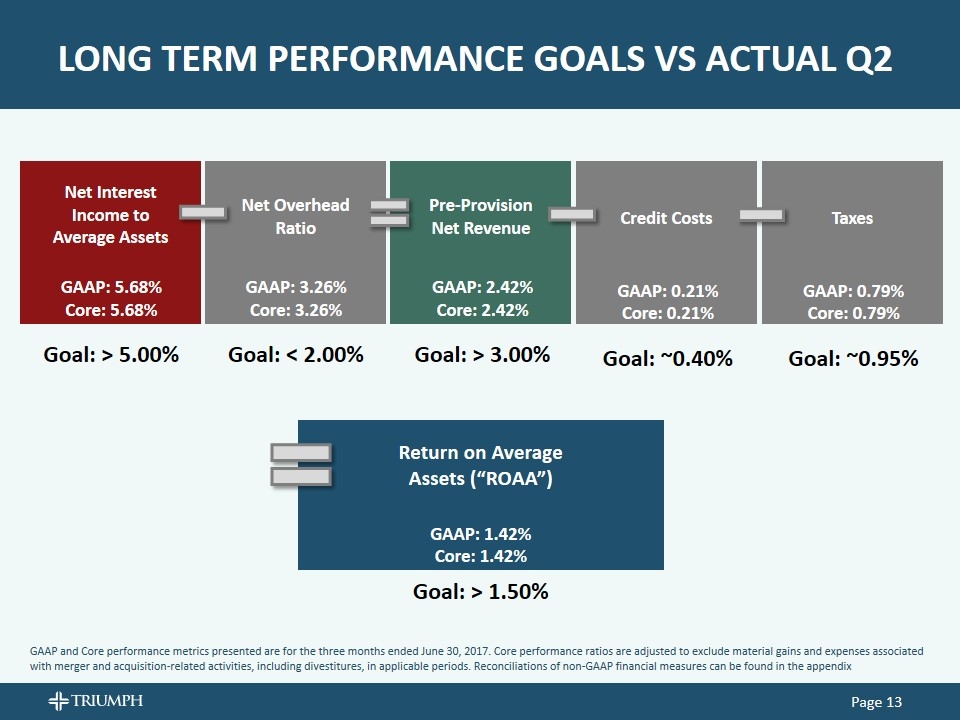

Return on Average Assets (“ROAA”) GAAP: 1.42% Core: 1.42% Goal: > 1.50% Net Overhead Ratio Net Interest Income to Average Assets Credit Costs Pre-Provision Net Revenue Taxes GAAP: 5.68% Core: 5.68% Goal: > 5.00% GAAP: 3.26% Core: 3.26% Goal: < 2.00% GAAP: 2.42% Core: 2.42% Goal: > 3.00% GAAP: 0.21% Core: 0.21% Goal: ~0.40% GAAP: 0.79% Core: 0.79% Goal: ~0.95% Long term performance goals vs Actual Q2 GAAP and Core performance metrics presented are for the three months ended June 30, 2017. Core performance ratios are adjusted to exclude material gains and expenses associated with merger and acquisition-related activities, including divestitures, in applicable periods. Reconciliations of non-GAAP financial measures can be found in the appendix Page

STABLE Asset Quality Page US Commercial Bank data based on SNL aggregate figures

APPENDIX OF SUPPORTING SCHEDULES

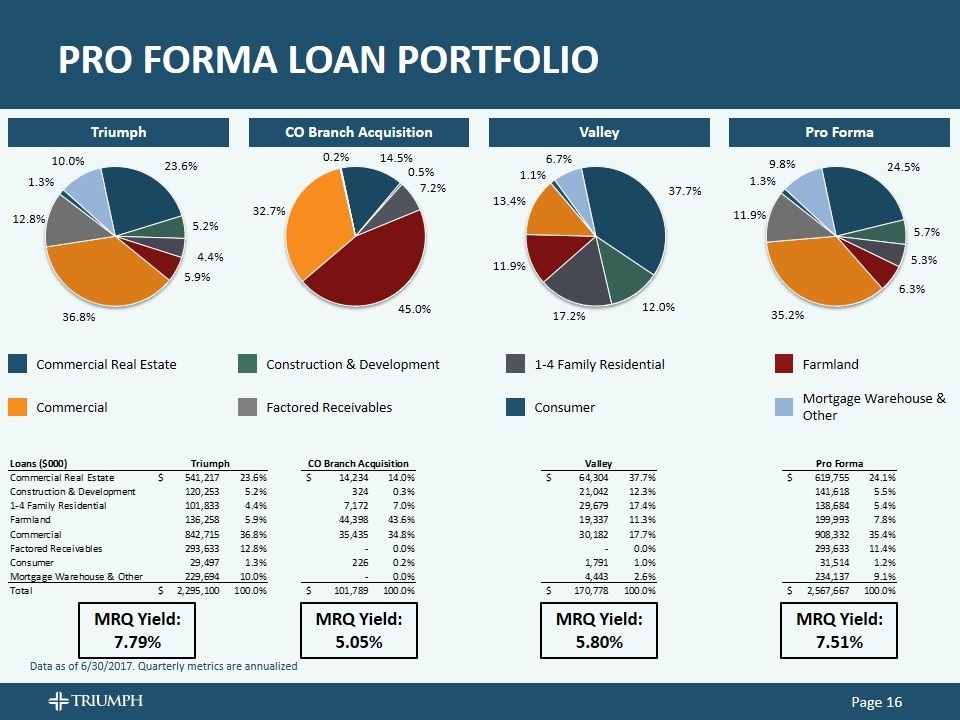

PRO FORMA LOAN PORTFOLIO Page MRQ Yield: 7.79% MRQ Yield: 5.05% MRQ Yield: 5.80% MRQ Yield: 7.51% Commercial Real Estate Construction & Development Farmland Commercial Factored Receivables Mortgage Warehouse & Other 1-4 Family Residential Consumer Triumph CO Branch Acquisition Valley Pro Forma Data as of 6/30/2017. Quarterly metrics are annualized

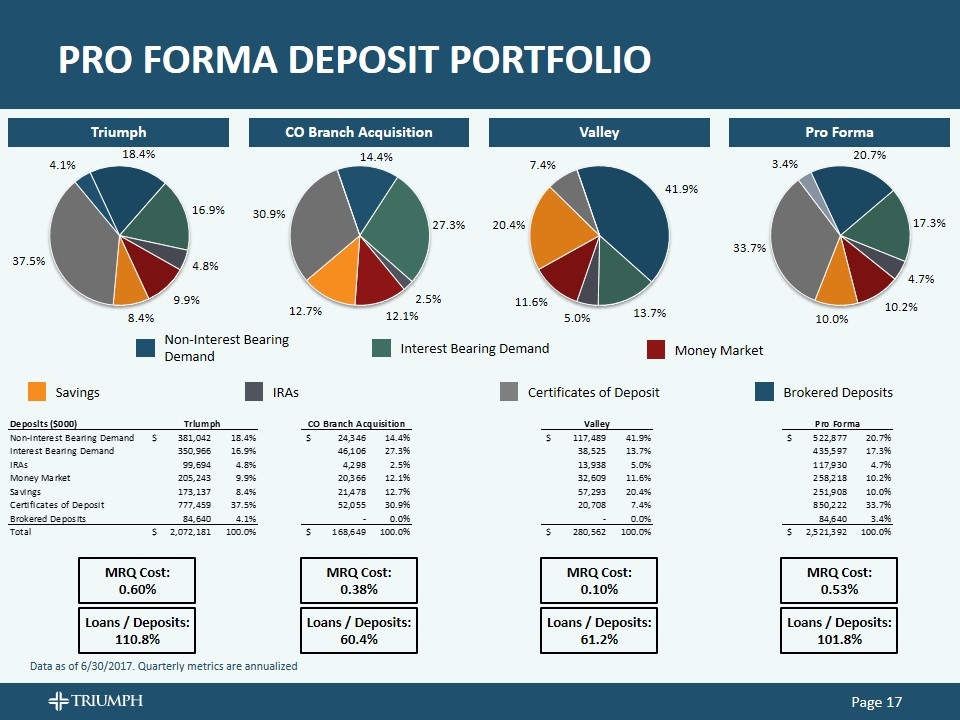

PRO FORMA DEPOSIT PORTFOLIO Page MRQ Cost: 0.60% MRQ Cost: 0.38% MRQ Cost: 0.10% MRQ Cost: 0.53% Non-Interest Bearing Demand Interest Bearing Demand Money Market Savings Certificates of Deposit IRAs Brokered Deposits Triumph CO Branch Acquisition Valley Pro Forma Loans / Deposits: 110.8% Loans / Deposits: 60.4% Loans / Deposits: 61.2% Loans / Deposits: 101.8% Data as of 6/30/2017. Quarterly metrics are annualized

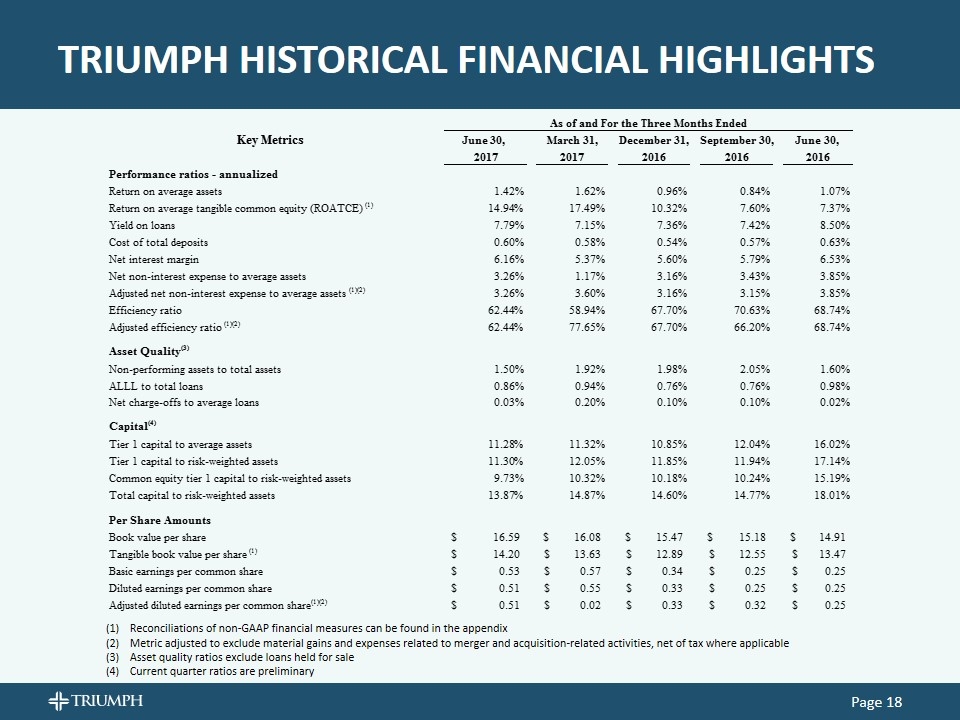

TRIUMPH HISTORICAL FINANCIAL HIGHLIGHTS Page Reconciliations of non-GAAP financial measures can be found in the appendix Metric adjusted to exclude material gains and expenses related to merger and acquisition-related activities, net of tax where applicable Asset quality ratios exclude loans held for sale Current quarter ratios are preliminary 42916 42825 42735 42643 42551 As of and For the Three Months Ended Key Metrics June 30, March 31, December 31, September 30, June 30, 2017 2017 2016 2016 2016 Performance ratios - annualized Return on average assets Return on average assets 1.4226490388491683E-2 1.6216445432006316E-2 9.5677488032248834E-3 8.3787742863370169E-3 1.0674547900535052E-2 Return on average tangible common equity (ROATCE) Return on average tangible common equity (ROATCE) (1) 0.1494382760960809 0.17489447171383407 0.10321717274515334 7.5977771610596309E-2 7.374386390880229E-2 Yield on loans Yield on loans 7.7899999999999997E-2 7.1499999999999994E-2 7.3599999999999999E-2 7.4200000000000002E-2 8.5000000000000006E-2 Cost of total deposits Cost of total deposits 5.9809033046749399E-3 5.7870894220360073E-3 5.4395537180396535E-3 5.6539203948167633E-3 6.294009519880947E-3 Net interest margin Net interest margin 6.1570290326746484E-2 5.3712489446424407E-2 5.5967403968259437E-2 5.7941774080860785E-2 6.5285878056964272E-2 Net noninterest expense to average assets Net non-interest expense to average assets 3.2579015308736643E-2 1.1689734290029601E-2 3.1638892106589753E-2 3.4327383525417435E-2 3.8454449851627055E-2 Net noninterest expense to average assets * Adjusted net non-interest expense to average assets (1)(2) 3.2579015308736643E-2 3.6031186262048875E-2 3.1638892106589753E-2 3.1506819937881125E-2 3.8454449851627055E-2 Efficiency ratio Efficiency ratio 0.62438219436777309 0.58938878398917471 0.67697687346489754 0.7063106929643318 0.68743871513102284 Adjusted efficiency ratio * Adjusted efficiency ratio (1)(2) 0.62438219436777309 0.77649901400000509 0.67697687346489754 0.66199304433551498 0.68743871513102284 Asset Quality(3) Nonperforming assets to total assets Non-performing assets to total assets 1.4996383100831817E-2 1.9193976681725976E-2 1.9764739024038389E-2 2.046756151256654E-2 1.5954401576767908E-2 ALLL to total loans ALLL to total loans 8.6257679403947546E-3 9.3812216371958832E-3 7.597562467202992E-3 7.6087261557615232E-3 9.7637889059196698E-3 Net charge-offs to average loans Net charge-offs to average loans 34795297811221227.34795297811% .204879837205254% 99790302406003984.99790302406004% 97405498102362217.974054981023622% 20216707553661752.202167075536618% Capital(4) Tier 1 capital to average assets Tier 1 capital to average assets 0.11279400000000001 0.11315751101109683 0.108542 0.120437 0.16016301346287154 Tier 1 capital to risk-weighted assets Tier 1 capital to risk-weighted assets 0.11294999999999999 0.12049186526785988 0.118477 0.119351 0.17138530020339404 Common equity tier 1 capital to risk-weighted assets Common equity tier 1 capital to risk-weighted assets 9.7328999999999999E-2 0.1032499892847283 0.10176200000000001 0.10238 0.15190831175754529 Total capital to risk-weighted assets Total capital to risk-weighted assets 0.138684 0.14865483669064053 0.145985 0.1477147 0.18009725306868427 Per Share Amounts Book value per share Book value per share $16.589444167502869 $16.078499990790306 $15.466093322543941 $15.175084224987739 $14.911910747666727 Tangible book value per share Tangible book value per share (1) $14.200295420647416 $13.631839395149086 $12.892230134924036 $12.554628142255437 $13.467204585968915 Basic earnings per share Basic earnings per common share $0.52554545180094692 $0.57260226413786142 $0.3389603195784453 $0.25226796685973479 $0.24812873510521288 Diluted earnings per share Diluted earnings per common share $0.51125508581669088 $0.55378594711677598 $0.33364945402840507 $0.24889441121363498 $0.24561230832499889 Adjusted diluted earnings per share Adjusted diluted earnings per common share(1)(2) $0.51129620247684193 $0.02 $0.33 $0.32325014763265597 $0.25 UPDATE MANUALLY

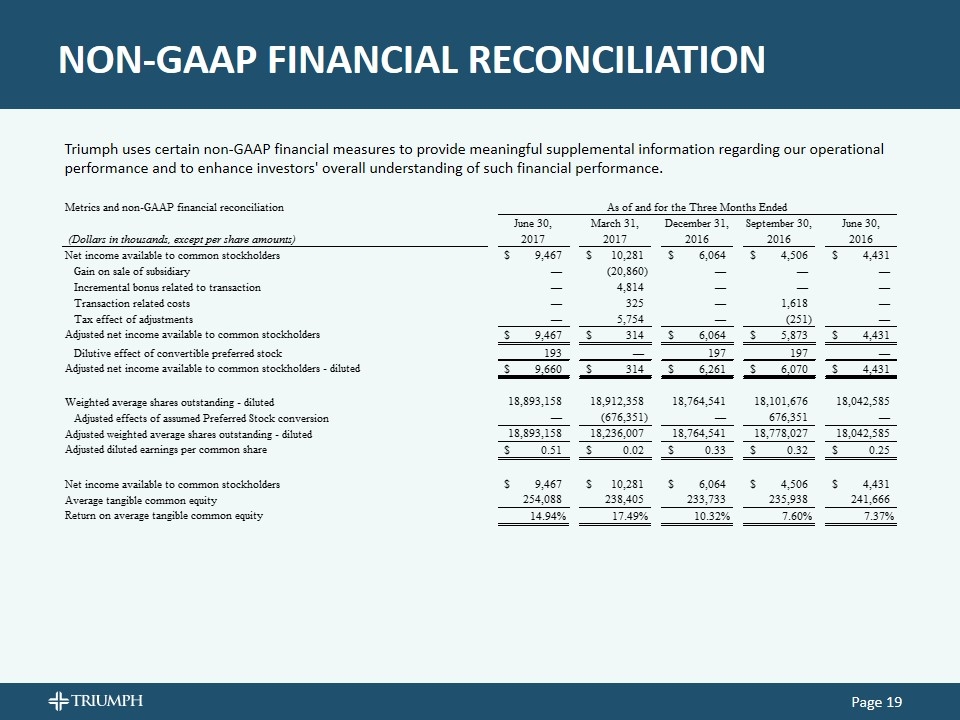

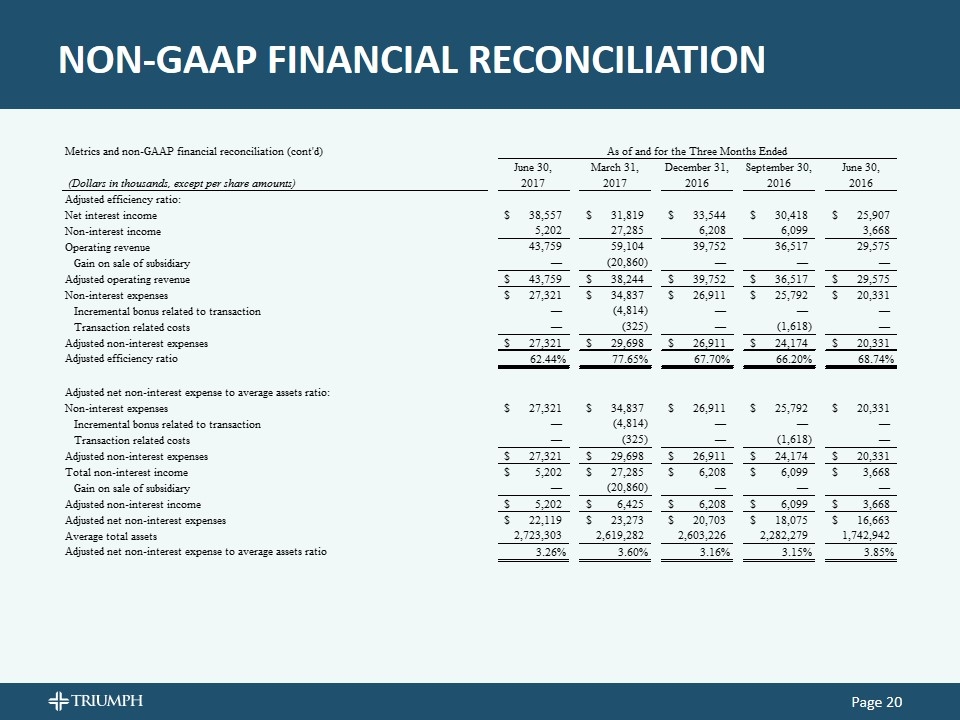

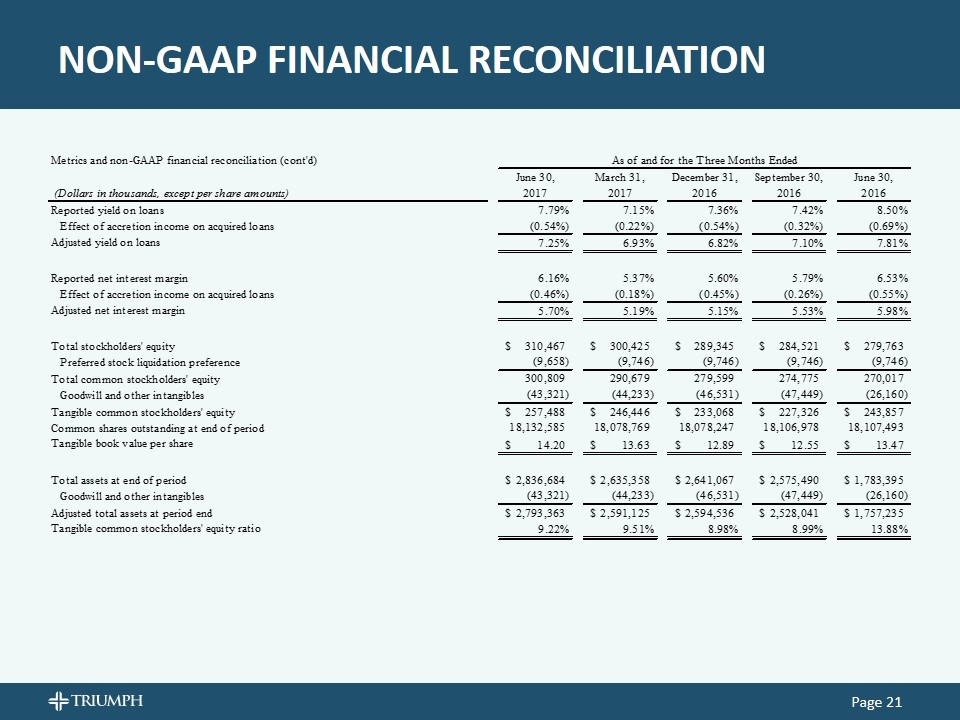

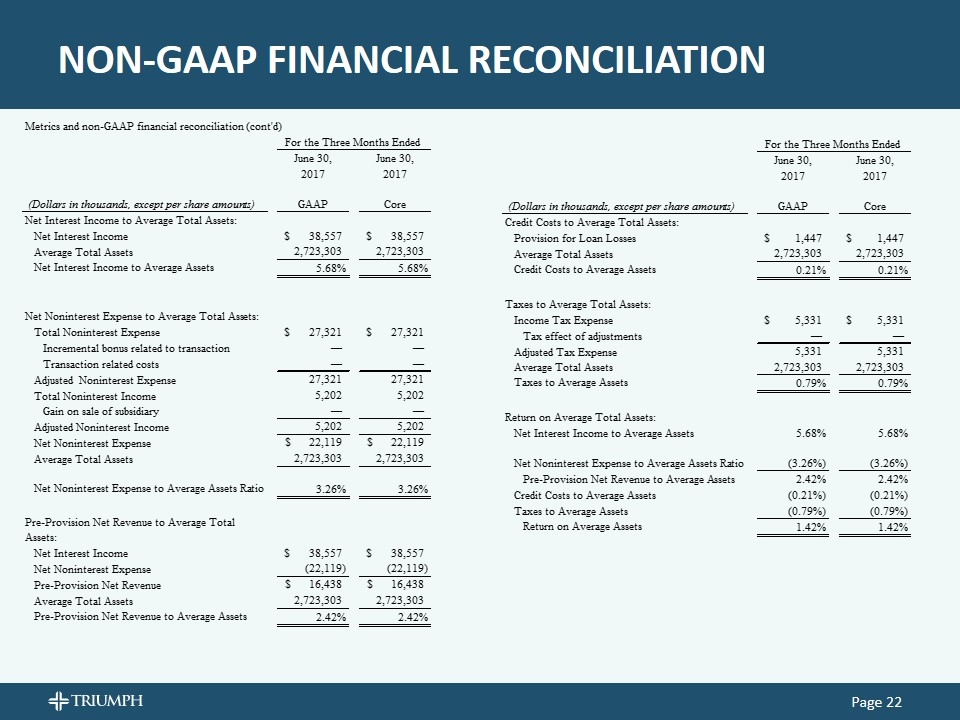

NON-GAAP FINANCIAL RECONCILIATION Page Triumph uses certain non-GAAP financial measures to provide meaningful supplemental information regarding our operational performance and to enhance investors' overall understanding of such financial performance. 42916QTD 42825QTD 42460QTD 42185QTD 42094QTD 42916YTD 42551YTD Period end date 42916 42825 42735 42643 42551 42916 42551 Quarter 2 Days in Year 365 365 366 366 366 365 366 Days in Quarter 91 90 92 92 91 181 182 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2017 2017 2016 2016 2016 2017 2016 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 $19,748 $9,243 Gain on sale of subsidiary 0 ,-20,860 0 0 0 ,-20,860 0 Manual Adj Incremental bonus related to transaction 0 4,814 0 0 0 4,814 0 Transaction related costs 0 325 0 1,618 0 325 0 Tax effect of adjustments 0 5,754 0 -,251 0 5,754 0 Adjusted net income available to common stockholders $9,467 $314 $6,064 $5,873 $4,431 $9,781 $9,243 Manual Adj Dilutive effect of convertible preferred stock 193 0 197 197 0 0 0 Adjusted net income available to common stockholders - diluted $9,660 $314 $6,261 $6,070 $4,431 $9,781 $9,243 Diluted_Shrs Weighted average shares outstanding - diluted 18,893,158.120879121 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 18,899,865 18,011,930.5 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 -,676,351 0 ,676,351 0 -,670,244 0 Adjusted weighted average shares outstanding - diluted 18,893,158.120879121 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 18,229,621 18,011,930.5 Adjusted diluted earnings per common share $0.51129620247684193 $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.53654434176113697 $0.51315987478410485 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 $19,748 $9,243 AvgTangEq Average tangible common equity ,254,087.71438832497 ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,246,289.91883327698 ,238,419.55932672098 Return on average tangible common equity 0.14944458475076014 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 0.16169283381868743 7.796160466474035E-2 Adjusted efficiency ratio: Net interest income $38,557 $31,819 $33,544 $30,418 $25,907 $70,376 $48,396 Non-interest income 5,202 27,285 6,208 6,099 3,668 32,487 8,649 Operating revenue 43,759 59,104 39,752 36,517 29,575 ,102,863 57,045 Manual Adj Gain on sale of subsidiary 0 ,-20,860 0 0 0 ,-20,860 0 Adjusted operating revenue $43,759 $38,244 $39,752 $36,517 $29,575 $82,003 $57,045 Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 $62,158 $40,409 Incremental bonus related to transaction 0 -4,814 0 0 0 -4,814 0 Manual Adj Transaction related costs 0 -,325 0 -1,618 0 -,325 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 $57,019 $40,409 Adjusted efficiency ratio 0.6243515619643959 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.69532821969927927 0.70837058462617231 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 $62,158 $40,409 Incremental bonus related to transaction 0 -4,814 0 0 0 -4,814 0 Manual Adj Transaction related costs 0 -,325 0 -1,618 0 -,325 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 $57,019 $40,409 Total non-interest income $5,202 $27,285 $6,208 $6,099 $3,668 $32,487 $8,649 Gain on sale of subsidiary 0 ,-20,860 0 0 0 ,-20,860 0 Adjusted non-interest income $5,202 $6,425 $6,208 $6,099 $3,668 $11,627 $8,649 Adjusted net non-interest expenses $22,119 $23,273 $20,703 $18,075 $16,663 $45,392 $31,760 AvgAssets Average total assets $2,723,303 $2,619,282 $2,603,226 $2,282,279.2052168939 $1,742,942 $2,671,580 $1,712,783 CHECK ROUNDING $0 Adjusted net non-interest expense to average assets ratio 3.2577743252978436E-2 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.4263003013632463E-2 3.7289610528018421E-2 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2017 2017 2016 2016 2016 2017 2016 Reported yield on loans 7.79% 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.489999999999999% 8.18% DisAcrLYLD Effect of accretion income on acquired loans -0.54% -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.39% -0.53% Adjusted yield on loans 7.2487574833300081E-2 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.0969831950009624E-2 7.6450856922060773E-2 Reported net interest margin 6.157029032674648% 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.775062740791382% 6.22281649958811% DisAcrLNIM Effect of accretion income on acquired loans -0.46% -0.18% -0.45% -0.26% -0.55% -0.33% -0.43% Adjusted net interest margin 5.6963855528600359E-2 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.4497074612335855E-2 5.7941836897354854E-2 Total stockholders' equity $,310,467 $,300,425 $,289,345 $,284,521 $,279,763 $,310,467 $,279,763 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,658 -9,746 -9,746 -9,746 -9,746 -9,658 -9,746 Total common stockholders' equity ,300,809 ,290,679 ,279,599 ,274,775 ,270,017 ,300,809 ,270,017 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-43,321 ,-26,160 Tangible common stockholders' equity $,257,488 $,246,446 $,233,068 $,227,326 $,243,857 $,257,488 $,243,857 Shares outstanding end of period Common shares outstanding 18,132,585 18,078,769 18,078,247 18,106,978 18,107,493 18,132,585 18,107,493 Tangible book value per share $14.200291905428818 $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $14.200291905428818 $13.46718731300904 Total assets at end of period $2,836,684 $2,635,358 $2,641,067 $2,575,490 $1,783,395 $2,836,684 $1,783,395 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-43,321 ,-26,160 Adjusted total assets at period end $2,793,363 $2,591,125 $2,594,536 $2,528,041 $1,757,235 $2,793,363 $1,757,235 Tangible common stockholders' equity ratio 9.2178495956307865E-2 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 9.2178495956307865E-2 0.13877312937654895 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2017 2017 2016 2016 2016 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 Gain on sale of subsidiary 0 ,-20,860 0 0 0 Incremental bonus related to transaction 0 4,814 0 0 0 Transaction related costs 0 325 0 1,618 0 Tax effect of adjustments 0 5,754 0 -,251 0 Adjusted net income available to common stockholders $9,467 $314 $6,064 $5,873 $4,431 Dilutive effect of convertible preferred stock 193 0 197 197 0 Adjusted net income available to common stockholders - diluted $9,660 $314 $6,261 $6,070 $4,431 Weighted average shares outstanding - diluted 18,893,158.120879121 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 Adjusted effects of assumed Preferred Stock conversion 0 -,676,351 0 ,676,351 0 Adjusted weighted average shares outstanding - diluted 18,893,158.120879121 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 Adjusted diluted earnings per common share $0.51129620247684193 $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 Average tangible common equity ,254,087.71438832497 ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 Return on average tangible common equity 0.14944458475076014 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2017 2017 2016 2016 2016 Adjusted efficiency ratio: Net interest income $38,557 $31,819 $33,544 $30,418 $25,907 Non-interest income 5,202 27,285 6,208 6,099 3,668 Operating revenue 43,759 59,104 39,752 36,517 29,575 Gain on sale of subsidiary 0 ,-20,860 0 0 0 Adjusted operating revenue $43,759 $38,244 $39,752 $36,517 $29,575 Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 Incremental bonus related to transaction 0 -4,814 0 0 0 Transaction related costs 0 -,325 0 -1,618 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 Adjusted efficiency ratio 0.6243515619643959 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 Incremental bonus related to transaction 0 -4,814 0 0 0 Transaction related costs 0 -,325 0 -1,618 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 Total non-interest income $5,202 $27,285 $6,208 $6,099 $3,668 Gain on sale of subsidiary 0 ,-20,860 0 0 0 Adjusted non-interest income $5,202 $6,425 $6,208 $6,099 $3,668 Adjusted net non-interest expenses $22,119 $23,273 $20,703 $18,075 $16,663 Average total assets 2,723,303 2,619,282 2,603,226 2,282,279.2052168939 1,742,942 Adjusted net non-interest expense to average assets ratio 3.2577743252978436E-2 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2017 2017 2016 2016 2016 Reported yield on loans 7.79% 7.149999999999999% 7.36% 7.42% 8.500000000000001% Effect of accretion income on acquired loans -0.54% -0.219999999999999% -0.54% -0.320000000000001% -0.69% Adjusted yield on loans 7.2487574833300081E-2 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 Reported net interest margin 6.157029032674648% 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% Effect of accretion income on acquired loans -0.46% -0.18% -0.45% -0.26% -0.55% Adjusted net interest margin 5.6963855528600359E-2 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 Total stockholders' equity $,310,467 $,300,425 $,289,345 $,284,521 $,279,763 Preferred stock liquidation preference -9,658 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,300,809 ,290,679 ,279,599 ,274,775 ,270,017 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 Tangible common stockholders' equity $,257,488 $,246,446 $,233,068 $,227,326 $,243,857 Common shares outstanding at end of period 18,132,585 18,078,769 18,078,247 18,106,978 18,107,493 Tangible book value per share $14.200291905428818 $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 Total assets at end of period $2,836,684 $2,635,358 $2,641,067 $2,575,490 $1,783,395 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 Adjusted total assets at period end $2,793,363 $2,591,125 $2,594,536 $2,528,041 $1,757,235 Tangible common stockholders' equity ratio 9.2178495956307865E-2 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 91 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended June 30, June 30, 2017 2017 (Dollars in thousands, except per share amounts) GAAP Core Net Interest Income to Average Total Assets: Net Interest Income $38,557 $38,557 Average Total Assets 2,723,303 2,723,303 Net Interest Income to Average Assets 5.6800000000000003E-2 5.6800000000000003E-2 Net Noninterest Expense to Average Total Assets: Total Noninterest Expense $27,321 $27,321 Incremental bonus related to transaction 0 0 Transaction related costs 0 0 Adjusted Noninterest Expense 27,321 27,321 Total Noninterest Income 5,202 5,202 Gain on sale of subsidiary 0 0 Adjusted Noninterest Income 5,202 5,202 Net Noninterest Expense $22,119 $22,119 Average Total Assets 2,723,303 2,723,303 Net Noninterest Expense to Average Assets Ratio 3.2599999999999997E-2 3.2599999999999997E-2 Pre-Provision Net Revenue to Average Total Assets: Net Interest Income $38,557 $38,557 Net Noninterest Expense ,-22,119 ,-22,119 Pre-Provision Net Revenue $16,438 $16,438 Average Total Assets 2,723,303 2,723,303 Pre-Provision Net Revenue to Average Assets 2.4199999999999999E-2 2.4199999999999999E-2 For the Three Months Ended June 30, June 30, 2017 2017 (Dollars in thousands, except per share amounts) GAAP Core Credit Costs to Average Total Assets: Provision for Loan Losses $1,447 $1,447 Average Total Assets 2,723,303 2,723,303 Credit Costs to Average Assets 2.0999999999999999E-3 2.0999999999999999E-3 Taxes to Average Total Assets: Income Tax Expense $5,331 $5,331 Tax effect of adjustments 0 0 Adjusted Tax Expense 5,331 5,331 Average Total Assets 2,723,303 2,723,303 Taxes to Average Assets 7.9000000000000008E-3 7.9000000000000008E-3 Return on Average Total Assets: Net Interest Income to Average Assets 5.68% 5.68% Net Noninterest Expense to Average Assets Ratio -3.26% -3.26% Pre-Provision Net Revenue to Average Assets 2.420000000000001% 2.420000000000001% Credit Costs to Average Assets -0.21% -0.21% Taxes to Average Assets -0.79% -0.79% Return on Average Assets 1.4200000000000004E-2 1.4200000000000004E-2 0 0 0

NON-GAAP FINANCIAL RECONCILIATION Page 42916QTD 42825QTD 42460QTD 42185QTD 42094QTD 42916YTD 42551YTD Period end date 42916 42825 42735 42643 42551 42916 42551 Quarter 2 Days in Year 365 365 366 366 366 365 366 Days in Quarter 91 90 92 92 91 181 182 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2017 2017 2016 2016 2016 2017 2016 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 $19,748 $9,243 Gain on sale of subsidiary 0 ,-20,860 0 0 0 ,-20,860 0 Manual Adj Incremental bonus related to transaction 0 4,814 0 0 0 4,814 0 Transaction related costs 0 325 0 1,618 0 325 0 Tax effect of adjustments 0 5,754 0 -,251 0 5,754 0 Adjusted net income available to common stockholders $9,467 $314 $6,064 $5,873 $4,431 $9,781 $9,243 Manual Adj Dilutive effect of convertible preferred stock 193 0 197 197 0 0 0 Adjusted net income available to common stockholders - diluted $9,660 $314 $6,261 $6,070 $4,431 $9,781 $9,243 Diluted_Shrs Weighted average shares outstanding - diluted 18,893,158.120879121 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 18,899,865 18,011,930.5 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 -,676,351 0 ,676,351 0 -,670,244 0 Adjusted weighted average shares outstanding - diluted 18,893,158.120879121 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 18,229,621 18,011,930.5 Adjusted diluted earnings per common share $0.51129620247684193 $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 $0.53654434176113697 $0.51315987478410485 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 $19,748 $9,243 AvgTangEq Average tangible common equity ,254,087.71438832497 ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 ,246,289.91883327698 ,238,419.55932672098 Return on average tangible common equity 0.14944458475076014 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 0.16169283381868743 7.796160466474035E-2 Adjusted efficiency ratio: Net interest income $38,557 $31,819 $33,544 $30,418 $25,907 $70,376 $48,396 Non-interest income 5,202 27,285 6,208 6,099 3,668 32,487 8,649 Operating revenue 43,759 59,104 39,752 36,517 29,575 ,102,863 57,045 Manual Adj Gain on sale of subsidiary 0 ,-20,860 0 0 0 ,-20,860 0 Adjusted operating revenue $43,759 $38,244 $39,752 $36,517 $29,575 $82,003 $57,045 Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 $62,158 $40,409 Incremental bonus related to transaction 0 -4,814 0 0 0 -4,814 0 Manual Adj Transaction related costs 0 -,325 0 -1,618 0 -,325 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 $57,019 $40,409 Adjusted efficiency ratio 0.6243515619643959 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 0.69532821969927927 0.70837058462617231 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 $62,158 $40,409 Incremental bonus related to transaction 0 -4,814 0 0 0 -4,814 0 Manual Adj Transaction related costs 0 -,325 0 -1,618 0 -,325 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 $57,019 $40,409 Total non-interest income $5,202 $27,285 $6,208 $6,099 $3,668 $32,487 $8,649 Gain on sale of subsidiary 0 ,-20,860 0 0 0 ,-20,860 0 Adjusted non-interest income $5,202 $6,425 $6,208 $6,099 $3,668 $11,627 $8,649 Adjusted net non-interest expenses $22,119 $23,273 $20,703 $18,075 $16,663 $45,392 $31,760 AvgAssets Average total assets $2,723,303 $2,619,282 $2,603,226 $2,282,279.2052168939 $1,742,942 $2,671,580 $1,712,783 CHECK ROUNDING $0 Adjusted net non-interest expense to average assets ratio 3.2577743252978436E-2 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 3.4263003013632463E-2 3.7289610528018421E-2 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2017 2017 2016 2016 2016 2017 2016 Reported yield on loans 7.79% 7.149999999999999% 7.36% 7.42% 8.500000000000001% 7.489999999999999% 8.18% DisAcrLYLD Effect of accretion income on acquired loans -0.54% -0.219999999999999% -0.54% -0.320000000000001% -0.69% -0.39% -0.53% Adjusted yield on loans 7.2487574833300081E-2 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 7.0969831950009624E-2 7.6450856922060773E-2 Reported net interest margin 6.157029032674648% 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% 5.775062740791382% 6.22281649958811% DisAcrLNIM Effect of accretion income on acquired loans -0.46% -0.18% -0.45% -0.26% -0.55% -0.33% -0.43% Adjusted net interest margin 5.6963855528600359E-2 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 5.4497074612335855E-2 5.7941836897354854E-2 Total stockholders' equity $,310,467 $,300,425 $,289,345 $,284,521 $,279,763 $,310,467 $,279,763 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,658 -9,746 -9,746 -9,746 -9,746 -9,658 -9,746 Total common stockholders' equity ,300,809 ,290,679 ,279,599 ,274,775 ,270,017 ,300,809 ,270,017 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-43,321 ,-26,160 Tangible common stockholders' equity $,257,488 $,246,446 $,233,068 $,227,326 $,243,857 $,257,488 $,243,857 Shares outstanding end of period Common shares outstanding 18,132,585 18,078,769 18,078,247 18,106,978 18,107,493 18,132,585 18,107,493 Tangible book value per share $14.200291905428818 $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 $14.200291905428818 $13.46718731300904 Total assets at end of period $2,836,684 $2,635,358 $2,641,067 $2,575,490 $1,783,395 $2,836,684 $1,783,395 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 ,-43,321 ,-26,160 Adjusted total assets at period end $2,793,363 $2,591,125 $2,594,536 $2,528,041 $1,757,235 $2,793,363 $1,757,235 Tangible common stockholders' equity ratio 9.2178495956307865E-2 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 9.2178495956307865E-2 0.13877312937654895 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2017 2017 2016 2016 2016 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 Gain on sale of subsidiary 0 ,-20,860 0 0 0 Incremental bonus related to transaction 0 4,814 0 0 0 Transaction related costs 0 325 0 1,618 0 Tax effect of adjustments 0 5,754 0 -,251 0 Adjusted net income available to common stockholders $9,467 $314 $6,064 $5,873 $4,431 Dilutive effect of convertible preferred stock 193 0 197 197 0 Adjusted net income available to common stockholders - diluted $9,660 $314 $6,261 $6,070 $4,431 Weighted average shares outstanding - diluted 18,893,158.120879121 18,912,358.388888888 18,764,540.630434781 18,101,676 18,042,585 Adjusted effects of assumed Preferred Stock conversion 0 -,676,351 0 ,676,351 0 Adjusted weighted average shares outstanding - diluted 18,893,158.120879121 18,236,007.388888888 18,764,540.630434781 18,778,027 18,042,585 Adjusted diluted earnings per common share $0.51129620247684193 $1.7218681332149422E-2 $0.33366124560731814 $0.32325014763265597 $0.24558565194510656 Net income available to common stockholders $9,467 $10,281 $6,064 $4,506 $4,431 Average tangible common equity ,254,087.71438832497 ,238,405.481105716 ,233,732.68610860902 ,235,937.68351725599 ,241,666 Return on average tangible common equity 0.14944458475076014 0.17489181235802964 0.10321266706289275 7.597787352587021E-2 7.374386390880229E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2017 2017 2016 2016 2016 Adjusted efficiency ratio: Net interest income $38,557 $31,819 $33,544 $30,418 $25,907 Non-interest income 5,202 27,285 6,208 6,099 3,668 Operating revenue 43,759 59,104 39,752 36,517 29,575 Gain on sale of subsidiary 0 ,-20,860 0 0 0 Adjusted operating revenue $43,759 $38,244 $39,752 $36,517 $29,575 Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 Incremental bonus related to transaction 0 -4,814 0 0 0 Transaction related costs 0 -,325 0 -1,618 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 Adjusted efficiency ratio 0.6243515619643959 0.77654011086706409 0.67697222781243716 0.66199304433551498 0.68743871513102284 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $27,321 $34,837 $26,911 $25,792 $20,331 Incremental bonus related to transaction 0 -4,814 0 0 0 Transaction related costs 0 -,325 0 -1,618 0 Adjusted non-interest expenses $27,321 $29,698 $26,911 $24,174 $20,331 Total non-interest income $5,202 $27,285 $6,208 $6,099 $3,668 Gain on sale of subsidiary 0 ,-20,860 0 0 0 Adjusted non-interest income $5,202 $6,425 $6,208 $6,099 $3,668 Adjusted net non-interest expenses $22,119 $23,273 $20,703 $18,075 $16,663 Average total assets 2,723,303 2,619,282 2,603,226 2,282,279.2052168939 1,742,942 Adjusted net non-interest expense to average assets ratio 3.2577743252978436E-2 3.6034663104027913E-2 3.1638411256882305E-2 3.1506690790953293E-2 3.8451204790646953E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2017 2017 2016 2016 2016 Reported yield on loans 7.79% 7.149999999999999% 7.36% 7.42% 8.500000000000001% Effect of accretion income on acquired loans -0.54% -0.219999999999999% -0.54% -0.320000000000001% -0.69% Adjusted yield on loans 7.2487574833300081E-2 6.9287190236321197E-2 6.8234777665777166E-2 7.099157023233664E-2 7.8100000000000003E-2 Reported net interest margin 6.157029032674648% 5.371248944642441% 5.596740396825944% 5.794177408086078% 6.53% Effect of accretion income on acquired loans -0.46% -0.18% -0.45% -0.26% -0.55% Adjusted net interest margin 5.6963855528600359E-2 5.1889117637716406E-2 5.1548013635106228E-2 5.5311387151421344E-2 5.9799999999999999E-2 Total stockholders' equity $,310,467 $,300,425 $,289,345 $,284,521 $,279,763 Preferred stock liquidation preference -9,658 -9,746 -9,746 -9,746 -9,746 Total common stockholders' equity ,300,809 ,290,679 ,279,599 ,274,775 ,270,017 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 Tangible common stockholders' equity $,257,488 $,246,446 $,233,068 $,227,326 $,243,857 Common shares outstanding at end of period 18,132,585 18,078,769 18,078,247 18,106,978 18,107,493 Tangible book value per share $14.200291905428818 $13.631790969838709 $12.892179202994626 $12.554607400528129 $13.46718731300904 Total assets at end of period $2,836,684 $2,635,358 $2,641,067 $2,575,490 $1,783,395 Goodwill and other intangibles ,-43,321 ,-44,233 ,-46,531 ,-47,449 ,-26,160 Adjusted total assets at period end $2,793,363 $2,591,125 $2,594,536 $2,528,041 $1,757,235 Tangible common stockholders' equity ratio 9.2178495956307865E-2 9.5111582806695932E-2 8.9830320334734232E-2 8.9921801110029467E-2 0.13877312937654895 91 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended June 30, June 30, 2017 2017 (Dollars in thousands, except per share amounts) GAAP Core Net Interest Income to Average Total Assets: Net Interest Income $38,557 $38,557 Average Total Assets 2,723,303 2,723,303 Net Interest Income to Average Assets 5.6800000000000003E-2 5.6800000000000003E-2 Net Noninterest Expense to Average Total Assets: Total Noninterest Expense $27,321 $27,321 Incremental bonus related to transaction 0 0 Transaction related costs 0 0 Adjusted Noninterest Expense 27,321 27,321 Total Noninterest Income 5,202 5,202 Gain on sale of subsidiary 0 0 Adjusted Noninterest Income 5,202 5,202 Net Noninterest Expense $22,119 $22,119 Average Total Assets 2,723,303 2,723,303 Net Noninterest Expense to Average Assets Ratio 3.2599999999999997E-2 3.2599999999999997E-2 Pre-Provision Net Revenue to Average Total Assets: Net Interest Income $38,557 $38,557 Net Noninterest Expense ,-22,119 ,-22,119 Pre-Provision Net Revenue $16,438 $16,438 Average Total Assets 2,723,303 2,723,303 Pre-Provision Net Revenue to Average Assets 2.4199999999999999E-2 2.4199999999999999E-2 For the Three Months Ended June 30, June 30, 2017 2017 (Dollars in thousands, except per share amounts) GAAP Core Credit Costs to Average Total Assets: Provision for Loan Losses $1,447 $1,447 Average Total Assets 2,723,303 2,723,303 Credit Costs to Average Assets 2.0999999999999999E-3 2.0999999999999999E-3 Taxes to Average Total Assets: Income Tax Expense $5,331 $5,331 Tax effect of adjustments 0 0 Adjusted Tax Expense 5,331 5,331 Average Total Assets 2,723,303 2,723,303 Taxes to Average Assets 7.9000000000000008E-3 7.9000000000000008E-3 Return on Average Total Assets: Net Interest Income to Average Assets 5.68% 5.68% Net Noninterest Expense to Average Assets Ratio -3.26% -3.26% Pre-Provision Net Revenue to Average Assets 2.420000000000001% 2.420000000000001% Credit Costs to Average Assets -0.21% -0.21% Taxes to Average Assets -0.79% -0.79% Return on Average Assets 1.4200000000000004E-2 1.4200000000000004E-2 0 0 0

NON-GAAP FINANCIAL RECONCILIATION Page