Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - Extended Stay America, Inc. | exhibit993-distributionann.htm |

| EX-99.1 - EXHIBIT 99.1 - Extended Stay America, Inc. | exhibit991-earningsrelease.htm |

| 8-K - 8-K - Extended Stay America, Inc. | stay-8xkannouncingq22017fo.htm |

August 1, 2017

Extended Stay America, Inc.

ESH Hospitality, Inc.

Q2 2017

Earnings Summary

2

important disclosure information

This presentation contains forward-looking statements within the meaning of the federal securities laws. Statements related to,

among other things, future financial performance, including our 2017 outlook, the expected timing, completion and effects of any

proposed asset disposals, expected performance, free cash flow, debt reduction, distribution growth, asset sales, franchised new

builds, owned new builds and other growth opportunities, as such, involve known and unknown risks, uncertainties and other

factors that may cause Extended Stay America, Inc.’s (the “Corporation”) and ESH Hospitality, Inc.’s (“ESH REIT,” and together with

the Corporation, the “Company”) actual results or performance to differ from those projected in the forward-looking statements,

possibly materially. For a description of factors that may cause the Company’s actual results or performance to differ from

projected results or performance implied by forward-looking statements, please review the information under the headings

“Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” included in the Company’s combined annual report

on Form 10-K filed with the Securities and Exchange Commission (“SEC”) on February 28, 2017 and other documents of the

Company on file with or furnished to the SEC. Any forward-looking statements made in this presentation are qualified by these

cautionary statements, and there can be no assurance that the actual results or developments anticipated by the Company will be

realized or, even if substantially realized, will have the expected consequences to, or effects on, the Company, its business or

operations. Except as required by law, the Company undertakes no obligation to update publicly or revise any forward-looking

statement, whether as a result of new information, future developments or otherwise. We caution you that actual results may

differ materially from what is expressed, implied or forecasted by the Company’s forward-looking statements.

This presentation includes certain non-GAAP financial measures, including Hotel Operating Profit, Hotel Operating Margin,

EBITDA, Adjusted EBITDA, Funds From Operations (“FFO”), Adjusted Funds From Operations (“Adjusted FFO”), Adjusted FFO per

diluted Paired Share, Paired Share Income, Adjusted Paired Share Income and Adjusted Paired Share Income per diluted Paired

Share. These non-GAAP financial measures should be considered only as supplemental to, and not as superior to, financial

measures prepared in accordance with U.S. GAAP. Please refer to the appendix of this presentation for a reconciliation of these

non-GAAP financial measures to the most directly comparable financial measures prepared in accordance with U.S. GAAP, and to

the Company’s combined annual report on Form 10-K filed with the SEC on February 28, 2017 for definitions of these non-GAAP

measures.

3

1Comparable Hotels include the 625 Extended Stay America hotels owned and operated during the full the three and six month periods ended June 30, 2017 and 2016.

2 Net Income, Adjusted FFO and Adjusted Paired Share Income Per Diluted Paired Share were affected by a one time tax benefit in Q2 2016. Net Income this quarter was also affected by an impairment charge and

loss on sale of hotels.

3See Appendix for Hotel Operating Margin, Adjusted FFO per diluted Paired Share, Adjusted EBITDA and Adjusted Paired Share Income per diluted Paired Share reconciliations.

Q2 2017 Operating Results & Financial Highlights

$51.81

$53.04

Q2 2016 Q2 2017

Comparable Hotel1 Revenue Per Available Room

(“RevPAR”)

$0.51 $0.53

Q2 2016 Q2 2017

Adjusted FFO per Diluted Paired Share2,3

+2.4%

+2.4%

$61.4

$49.7

Q2 2016 Q2 2017

Net Income (in millions)2

$164.7

$172.8

Q2 2016 Q2 2017

Hotel Operating Margin3

55.8%

56.7%

Q2 2016 Q2 2017

Adjusted EBITDA (in millions) 3

+90bps

+5.0%

$0.31 $0.31

Q2 2016 Q2 2017

Adjusted Paired Share Income

per Diluted Paired Share2,3

4

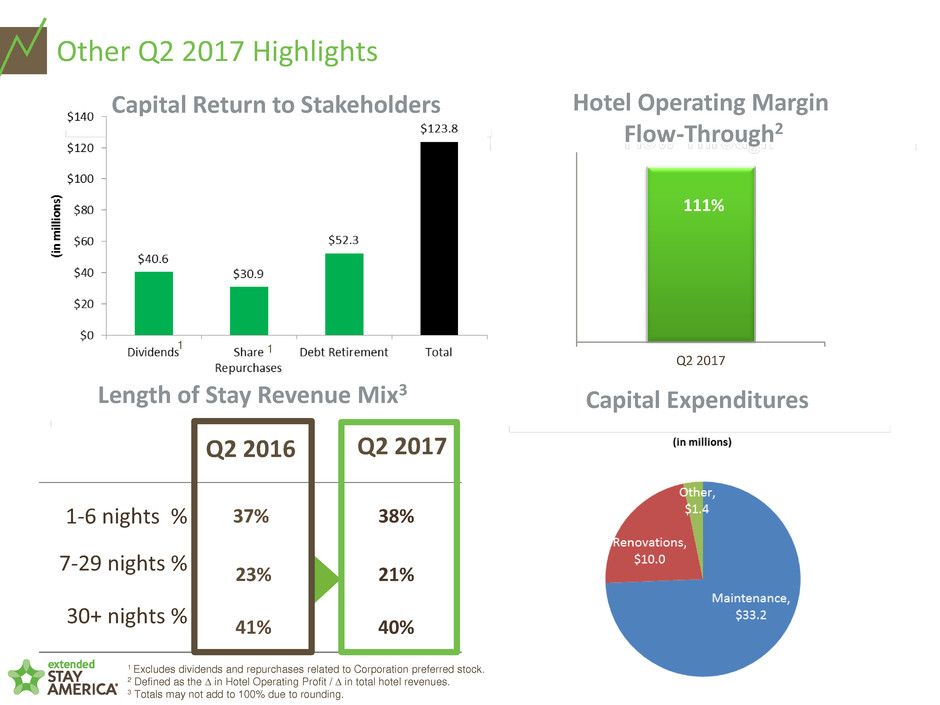

Other Q2 2017 Highlights

Length of Stay Revenue Mix3

1-6 nights % 37% 38%

7-29 nights %

23% 21%

30+ nights %

41% 40%

Q2 2017 Q2 2016

Capital Expenditures

Hotel Operating Margin

Flow-Through2

111%

Q2 2017

1 Excludes dividends and repurchases related to Corporation preferred stock.

2 Defined as the D in Hotel Operating Profit / D in total hotel revenues.

3 Totals may not add to 100% due to rounding.

Capital Return to Stakeholders

1 1

5

ESA 2.0 Updates

New Build Owned & Operated

Asset Dispositions New Build Franchisee Hotels

» Completed 4 hotel asset sales for

gross proceeds of $60.7 million in early

May for a blended 12.7x TTM EBITDA

sale multiple

» At term sheet discussions with

8 experienced firms to purchase

approximately 90 existing ESA hotels

with an ESA franchise agreement

» Recently completed our franchise

disclosure document (“FDD”), valid in 36

states

» Expect to file the FDD in the

remaining 14 states in August

» In discussions with 8 experienced firms to

build as many as 85 or more new ESA 2.0

hotels

» 4 signed purchase agreements for land

with 4 more expected in August 2017

» Expect to begin construction in early

2018 on the first Company owned ESA

2.0 build

6

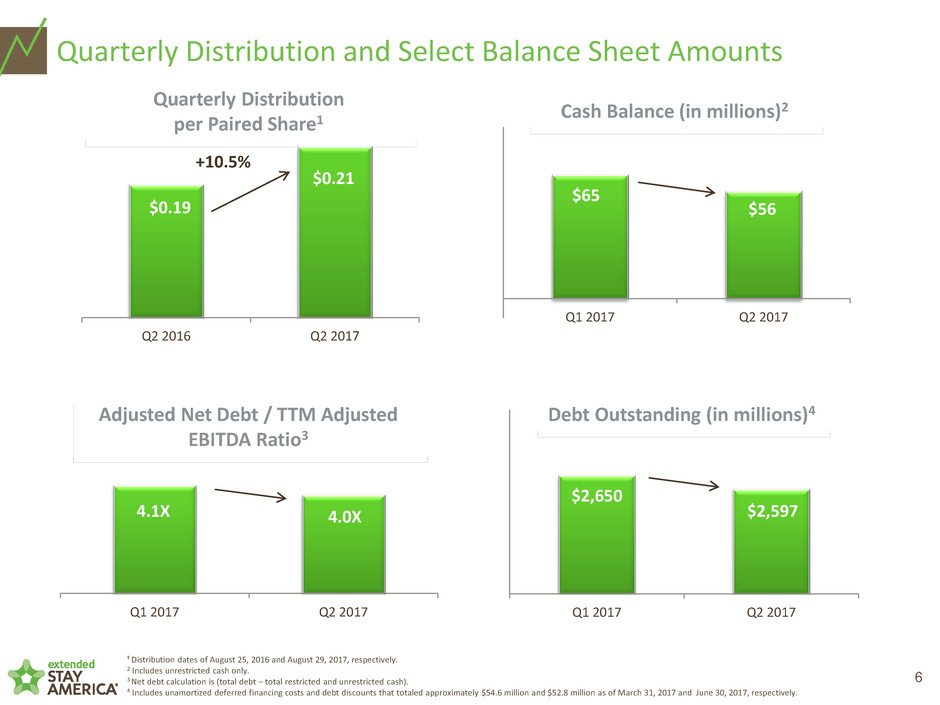

Quarterly Distribution and Select Balance Sheet Amounts

Quarterly Distribution

per Paired Share1

$0.19

$0.21

Q2 2016 Q2 2017

+10.5%

Adjusted Net Debt / TTM Adjusted

EBITDA Ratio3

4.1X 4.0X

Q1 2017 Q2 2017

¹ Distribution dates of August 25, 2016 and August 29, 2017, respectively.

2 Includes unrestricted cash only.

3 Net debt calculation is (total debt – total restricted and unrestricted cash).

4 Includes unamortized deferred financing costs and debt discounts that totaled approximately $54.6 million and $52.8 million as of March 31, 2017 and June 30, 2017, respectively.

Cash Balance (in millions)2

$65

$56

Q1 2017 Q2 2017

Debt Outstanding (in millions)4

$2,650

$2,597

Q1 2017 Q2 2017

7

Q2 2017 Results, Q3 2017 and Full Year 2017 Guidance

1.5% to 3.5%

175$ 188$

625$ 640$

233$ 233$

130$ 130$

23% 24%

150$ 180$

Previous 2017 Guidance1

1Guidance as of Q1 2017 earnings call on April 27, 2017. Our guidance for Q2 2017 included the 4 hotels sold in early May for the entire

quarter. The lost hotel contribution for the quarter was approximately $1.5 million for these hotels.

2On a Comparable Hotel basis.

3Guidance as of Q2 2017 earnings call on August 1, 2017. RevPAR % D shown on a Comparable Hotel basis.

4 Net Income guidance lowered due to impairment charge, loss on asset sales, and lost contribution from sold hotels.

5Adjusted EBITDA reduced by the approximate amount of lost contribution from four hotels sold in early May 2017 for the remainder of 2017.

(in millions, except %)

RevPAR % D 1.5% to 3.5%

Net Income4 161$ 174$

Adjusted EBITDA5 620$ 635$

Depreciation and Amortization 233$ 233$

Net Interest Expense 130$ 130$

Effective Tax Rate 23% 24%

Capital Expenditures 150$ 180$

Updated 2017 Guidance3

(in millions, except %)

RevPAR % D 2% to 4% | 2.4%

Adjusted EBITDA $170 to $175 | 172.8$

Q2 2017

Guidance1 | Actual1

(in millions, except ) Q3 2016 Actual

2

RevPAR % D 3.8% 1% to 3%

Adjusted EBITDA $183.7 184$ to 190$

Q3 2017 Guidance

3

appendix

9

NON-GAAP RECONCILIATION OF ROOM REVENUES, OTHER HOTEL REVENUES AND HOTEL OPERATING

EXPENSES TO HOTEL OPERATING PROFIT, HOTEL OPERATING MARGIN AND OPERATING METRICS FOR THE

FOUR HOTELS SOLD IN MAY 2017

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Hotels Sold in May 2017 (4) (in USD)

Room revenues 3,295$ 3,805$ 2,702$ 2,069$ 747$

Other hotel revenues 95 120 94 93 31

Total hotel revenues 3,390 3,925 2,796 2,162 778

Hotel operating expenses

(1)

1,675 1,892 2,124 1,815 530

Hotel Operating Profit 1,715$ 2,033$ 672$ 347$ 248$

Hotel Operating Margin 50.6% 51.8% 24.0% 16.0% 31.9%

(1)

Excludes loss (gain) on disposal of assets of appproximately: 58 (6) 11 - -

(In thousands)

(Unaudited)

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Hotels sold in May 2017 (4) (in USD)

Number of rooms 603 603 603 603 603

Occupancy 72.9% 81.6% 65.5% 58.5% 69.9%

ADR $82.31 $84.03 $74.37 $70.83 $63.25

RevPAR $60.04 $68.58 $48.70 $41.42 $44.21

(Unaudited)

Hotel Operating Metrics for the Four Hotels Sold in May 2017

10

NON-GAAP RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA FOR THE THREE AND SIX

MONTHS ENDED JUNE 30, 2017 AND 2016

2017 2016 2017 2016

$ 49,725 $ 61,386 Net income $ 65,788 $ 76,139

31,701 35,764 Interest expense, net 65,307 82,749

15,943 7,448 Income tax expense 20,426 10,344

57,804 55,011 Depreciation and amortization 115,475 108,319

155,173 159,609 EBITDA 266,996 277,551

3,646 2,939 Equity-based compensation 6,329 5,619

1,073 (1) 114 (2) Other non-operating expense (income) (148) (3) (764) (4)

7,934 - Impairment of long-lived assets 20,357 -

1,897 - Loss on sale of hotel properties 1,897 -

3,125 (5) 1,997 (6) Other expenses 7,019 (7) 5,052 (8)

$ 172,848 $ 164,659 Adjusted EBITDA $ 302,450 $ 287,458

5.0% % growth 5.2%

(In thousands)

(Unaudited)

Six Months Ended

(5)

Includes loss on disposal of assets of approximately $2.5 million and costs incurred in connection with the second quarter

2017 secondary offerings of approximately $0.6 million.

(6)

Includes loss on disposal of assets of approximately $2.1 million and transaction costs of approximately $(0.1) million due to

the revision of an estimate related to the sale of 53 hotel properties in December 2015.

(7)

Includes loss on disposal of assets of approximately $6.0 million and costs incurred in connection with the first and second

quarter 2017 secondary offerings of approximately $1.0 million.

June 30,

(8)

Includes loss on disposal of assets of approximately $5.0 million and transaction costs of approximately $0.1 million due to

the revision of an estimate related to the sale of the 53 hotel properties in December 2015.

Three Months Ended

June 30,

(4)

Includes foreign currency transaction gain of approximately $0.8 million.

(1)

Includes loss related to interest rate swap of approximately $1.5 million and foreign currency transaction gain of approximately

$0.4 million.

(2)

Includes foreign currency transaction loss of approximately $0.1 million.

(3)

Includes foreign currency transaction gain of approximately $0.4 million and loss related to interest rate swap of approximately

$0.3 million.

11

NON-GAAP RECONCILIATION OF ROOM REVENUES, OTHER HOTEL REVENUES AND HOTEL OPERATING

EXPENSES TO HOTEL OPERATING PROFIT AND HOTEL OPERATING MARGIN FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2017 AND 2016

2017 2016 Variance 2017 2016 Variance

332,608$ 327,833$ 1.5% Room revenues 618,416$ 610,970$ 1.2%

5,755 4,956 16.1% Other hotel revenues 10,938 9,377 16.6%

338,363 332,789 1.7% Total hotel revenues 629,354 620,347 1.5%

146,363 146,973 (0.4)% Hotel operating expenses

(1)

284,553 289,637 (1.8)%

192,000$ 185,816$ 3.3% Hotel Operating Profit 344,801$ 330,710$ 4.3%

56.7% 55.8% 90 bps Hotel Operating Margin 54.8% 53.3% 150 bps

(1)

Excludes loss on disposal of assets of approximately $2.5 million, $2.1 million, $6.0 million and $5.0 million, respectively.

June 30,

Six Months EndedThree Months Ended

June 30,

(In thousands)

(Unaudited)

12

NON-GAAP RECONCILIATION OF NET INCOME ATTRIBUTABLE TO EXTENDED STAY AMERICA, INC. COMMON SHAREHOLDERS TO

FUNDS FROM OPERATIONS, ADJUSTED FUNDS FROM OPERATIONS AND ADJUSTED FUNDS FROM OPERATIONS PER DILUTED

PAIRED SHARE FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2017 AND 2016

2017 2016 2017 2016

$ 0.27 $ 0.30

Net income per Extended Stay America, Inc. common

share - diluted

$ 0.39 $ 0.38

$ 51,775 $ 60,729

Net income attributable to Extended Stay America, Inc.

common shareholders

$ 74,876 $ 77,775

(2,054) 653

Noncontrolling interests attributable to Class B

common shares of ESH REIT

(9,096) (1,644)

56,649 53,918 Real estate depreciation and amortization 113,182 106,118

7,934 - Impairment of long-lived assets 20,357 -

1,897 - Loss on sale of hotel properties 1,897 -

(15,423) (11,754)

Tax effect of adjustments to net income attributable to

Extended Stay America, Inc. common shareholders

(31,697) (23,708)

100,778 103,546 Funds from Operations 169,519 158,541

- - Debt modification and extinguishment costs 1,168 12,103

1,495 - Loss on interest rate swap 253 -

(347) - Tax effect of adjustments to Funds from Operations (330) (2,772)

$ 101,926 $ 103,546 Adjusted Funds from Operations $ 170,610 $ 167,872

$ 0.53 $ 0.51

Adjusted Funds from Operations

per Paired Share – diluted $ 0.88 $ 0.83

193,944 201,689

Weighted average Paired Shares

outstanding – diluted 194,372 203,029

Three Months Ended Six Months Ended

June 30, June 30,

(In thousands, expect per share and per Paired Share data)

(Unaudited)

13

NON-GAAP RECONCILIATION OF NET INCOME ATTRIBUTABLE TO EXTENDED STAY AMERICA, INC. COMMON SHAREHOLDERS TO

PAIRED SHARE INCOME, ADJUSTED PAIRED SHARE INCOME AND ADJUSTED PAIRED SHARE INCOME PER DILUTED PAIRED SHARE

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2017 AND 2016

2017 2016 2017 2016

$ 0.27 $ 0.30

Net income per Extended Stay America, Inc. common

share - diluted

$ 0.39 $ 0.38

51,775$ 60,729$

Net income attributable to Extended Stay America, Inc.

common shareholders 74,876$ 77,775$

(2,054) 653

Noncontrolling interests attributable to Class B

common shares of ESH REIT (9,096) (1,644)

49,721 61,382 Paired Share Income 65,780 76,131

- - Debt modification and extinguishment costs 1,168 12,103

1,073 (1) 114 (2) Other non-operating expense (income) (148) (3) (764) (4)

7,934 - Impairment of long-lived assets 20,357 -

1,897 - Loss on sale of hotel properties 1,897 -

3,125 (5) 1,997 (6) Other expenses 7,019 (7) 5,052 (8)

(3,255) (460) Tax effect of adjustments to Paired Share Income (7,093) (3,730)

60,495$ 63,033$ Adjusted Paired Share Income 88,980$ 88,792$

0.31$ 0.31$ Adjusted Paired Share Income per Paired Share – diluted 0.46$ 0.44$

193,944 201,689 Weighted average Paired Shares outstanding – diluted 194,372 203,029

(4)

Includes foreign currency transaction gain of approximately $0.8 million.

(5)

Includes loss on disposal of assets of approximately $2.5 million and costs incurred in connection with the second quarter

2017 secondary offerings of approximately $0.6 million.

(6)

Includes loss on disposal of assets of approximately $2.1 million and transaction costs of approximately $(0.1) million due to

the revision of an estimate related to the sale of 53 hotel properties in December 2015.

(7)

Includes loss on disposal of assets of approximately $6.0 million and costs incurred in connection with the first and second

quarter 2017 secondary offerings of approximately $1.0 million.

(8)

Includes loss on disposal of assets of approximately $5.0 million and transaction costs of approximately $0.1 million due to

the revision of an estimate related to the sale of the 53 hotel properties in December 2015.

(3)

Includes foreign currency transaction gain of approximately $0.4 million and loss related to interest rate swap of

approximately $0.3 million.

(In thousands, expect per share and per Paired Share data)

(1)

Includes loss related to interest rate swap of approximately $1.5 million and foreign currency transaction gain of

approximately $0.4 million.

(Unaudited)

June 30,

Six Months EndedThree Months Ended

June 30,

(2)

Includes foreign currency transaction loss of approximately $0.1 million.

14

TOTAL REVENUES AND NON-GAAP RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA FOR THE YEARS ENDED

DECEMBER 31, 2016 (ACTUAL) AND 2017 (OUTLOOK)

Year Ended

December 31, 2016

(Actual) Low High

$ 1,270,593 Total revenues 1,278,000$ 1,303,000$

$ 163,352 Net income 160,659$ 174,323$

164,537 Interest expense, net 130,000 130,000

34,351 Income tax expense 50,735 52,071

221,309 Depreciation and amortization 232,500 232,500

583,549 EBITDA 573,894 588,894

12,000 Equity-based compensation 12,500 12,500

(1,576) Other non-operating income (148) (148)

9,828 Impairment of long-lived assets 20,357 20,357

- Loss on sale of hotel properties 1,897 1,897

11,857 (1) Other expenses 11,500

(2)

11,500

(2)

$ 615,658 Adjusted EBITDA $ 620,000 $ 635,000

% growth 0.7% 3.1%

(1)

(2) Includes loss on disposal of assets and other non-operating transaction costs.

(Outlook)

Includes loss on disposal of assets of approximately $10.7 million, costs incurred in connection with the fourth quarter 2016 secondary offerings of

approximately $1.1 million and transaction costs of approximately $0.1 million due to the revision of an estimate related to the sale of 53 hotel properties in

December 2015.

Year Ending December 31, 2017

(In thousands)

(Unaudited)