Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HomeStreet, Inc. | a8-kfor2q2017investorslides.htm |

SECOND QUARTER

2017

NASDAQ:HMST

as of July 28, 2017

Important Disclosures

Forward-Looking Statements

This presentation includes forward-looking statements, as that term is defined for purposes of applicable securities laws, about our industry, our future financial performance and business plans

and expectations. These statements are, in essence, attempts to anticipate or forecast future events, and thus subject to many risks and uncertainties. These forward-looking statements are

based on our management's current expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not

historical facts, as well as a number of assumptions concerning future events. Forward-looking statements in this release include, among other matters, statements regarding our business plans

and strategies (including our expansion strategies) and the expected effects of those initiatives, general economic trends (particularly those that affect mortgage origination and refinance

activity) and growth scenarios and performance targets. Readers should note, however, that all statements in this presentation other than assertions of historical fact are forward-looking in

nature. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings, including but not limited to our quarterly report on Form 10-Q for

the quarter ended June 30, 2107, which we expect to file on or before August 4, 2017. Many of these factors and events that affect the volatility in our stock price and shareholders’ response to

those events and factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These

limitations and risks include without limitation changes in general political and economic conditions that impact our markets and our business, actions by the Federal Reserve Board and

financial market conditions that affect monetary and fiscal policy, regulatory and legislative findings or actions that may increase capital requirements or otherwise constrain our ability to do

business, including restrictions that could be imposed by our regulators on certain aspects of our operations or on our growth initiatives and acquisition activities, risks related to our ability to

realize the expected value of our recent acquisitions, continue to expand our banking operations geographically and across market sectors, grow our franchise and capitalize on market

opportunities, optimize our mortgage operations and manage our overall growth efforts cost-effectively to attain the desired operational and financial outcomes, manage the losses inherent in

our loan portfolio, make accurate estimates of the value of our non-cash assets and liabilities, maintain electronic and physical security of customer data, respond to restrictive and complex

regulatory environment, and attract and retain key personnel. In addition, the volume of our mortgage banking business as well as the ratio of loan lock to closed loan volume may fluctuate due

to challenges our customers may face in meeting current underwriting standards, a change in interest rates, an increase in competition for such loans, changes in general economic conditions,

including housing prices and inventory levels, the job market, consumer confidence and spending habits either nationally or in the regional and local market areas in which the Company does

business, and legislative or regulatory actions or reform that may affect our business or the banking or mortgage industries more generally. Actual results may fall materially short of our

expectations and projections, and we may change our plans or take additional actions that differ in material ways from our current intentions. Accordingly, we can give no assurance of future

performance, and you should not rely unduly on forward-looking statements. All forward-looking statements are based on information available to the Company as of the date hereof, and we do

not undertake to update or revise any forward-looking statements, for any reason.

Basis of Presentation of Financial Data

Unless noted otherwise in this presentation, all reported financial data is being presented as of the period ending June 30, 2017, and is unaudited, although certain information related to the

year ended December 31, 2016, has been derived from our audited financial statements. All financial data should be read in conjunction with the notes in our consolidated financial statements.

Non-GAAP Financial Measures

Information on any non-GAAP financial measures such as core measures or tangible measures referenced in this presentation, including a reconciliation of those measures to GAAP measures,

may also be found in the appendix, our SEC filings, and in the earnings release available on our web site.

2

Expanding West Coast Franchise

• Seattle-based diversified

commercial bank -

company founded in

1921

• Growing commercial &

consumer bank with

concentrations in major

metropolitan areas of the

West Coast and Hawaii

• Market leading mortgage

originator and servicer

• 112 primary offices (1) in

the Western United

States and Hawaii

• Total assets $6.6 billion

3

(1) The number of offices listed above does not include satellite offices with a limited number of staff who report to a manager located

in a separate primary office.

Strategy

Optimize Single Family

Mortgage Banking &

Servicing Segment

• Organic growth opportunities

• Focused on increased Commercial Lending in large metropolitan markets

• Increase density of commercial and consumer deposits via existing market penetration and de novo branch expansion

• Growth via acquisition of branches and smaller institutions, primarily in Washington,

Oregon, and California

• Committed to being a leading mortgage originator and servicer in our markets with retail

focus, broad product mix, and competitive pricing

• Focus on optimizing mortgage banking capacity within existing geographic footprint

• Strategy of converting mortgage customer to full bank customer by offering attractive

products, features, and service

• Drive operating leverage through disciplined expense control

• Target consolidated efficiency ratio of less than 70%

• Commercial and Consumer segment <65% and Mortgage Banking segment <80%

• Long-term ROTE target of 12% - 15%

Expand Commercial &

Consumer Banking

Segment

Disciplined expense

management

Efficient use of capital

Grow and diversify earnings with the goal of becoming a leading West Coast

regional bank

4

$1,000

$2,000

$3,000

$4,000

$5,000

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

$ in

mil

lion

s

Total Deposits

Compounded Annual Growth Rate: 24%

Capitol Hill

Everett

Ballard

Greenlake

Madison PK

Phinney Ridge

University

Issaquah

Kaimuki

Mission Gorge

Kearny Mesa

Riverside

Point Loma

Kennewick Baldwin Park

Redmond

Delivering Consistent Growth

5

De novo branch openings

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17

$ in

mil

lion

s

Total Assets

Compounded Annual Growth Rate: 26%

Organic Acquired

November 2013:

Fortune ($142M)

&

Yakima ($125M)

March 2015:

Simplicity

($879M)

February 2016:

OCBB ($200M)

August 2016:

The Bank of

Oswego

($42M)

December2015:

1 Branch

($26M)

December 2013:

2 Branches ($32M)

November2016:

2 Branches

($105M)

Diversification

Growth in our Commercial & Consumer Banking Segment is diversifying earnings

and reducing earnings volatility

6

(1) Excludes acquisition-related expenses. See appendix for reconciliation of non-GAAP financial measures.

7

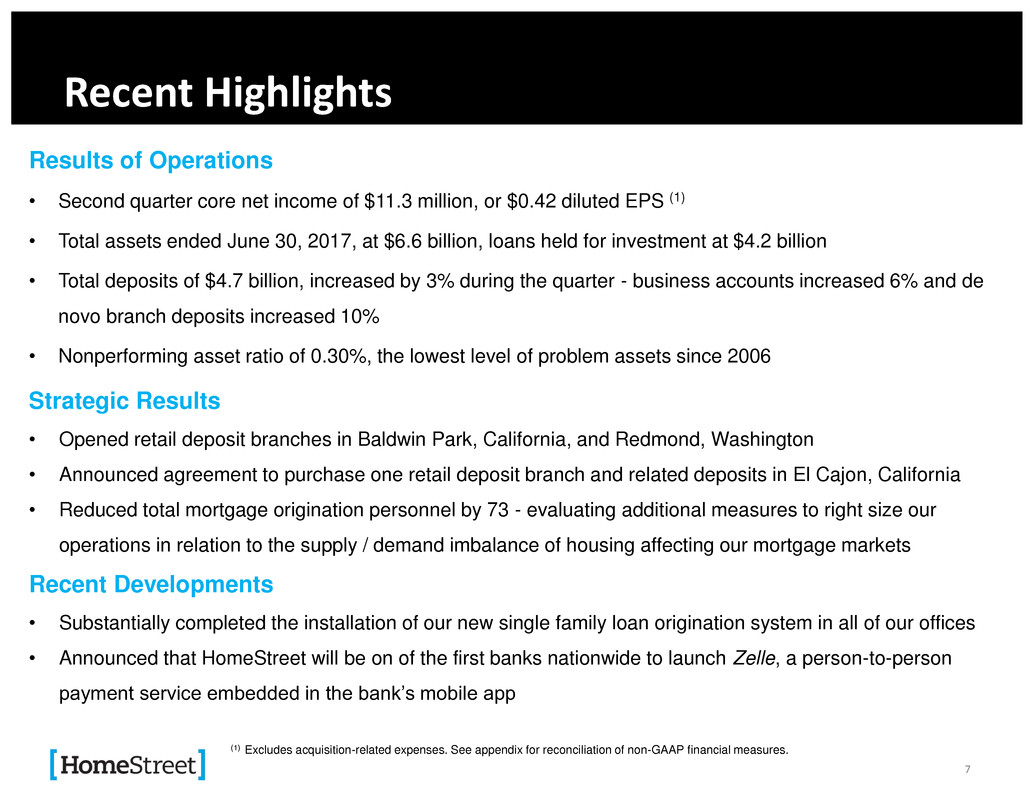

Recent Highlights

Results of Operations

• Second quarter core net income of $11.3 million, or $0.42 diluted EPS (1)

• Total assets ended June 30, 2017, at $6.6 billion, loans held for investment at $4.2 billion

• Total deposits of $4.7 billion, increased by 3% during the quarter - business accounts increased 6% and de

novo branch deposits increased 10%

• Nonperforming asset ratio of 0.30%, the lowest level of problem assets since 2006

Strategic Results

• Opened retail deposit branches in Baldwin Park, California, and Redmond, Washington

• Announced agreement to purchase one retail deposit branch and related deposits in El Cajon, California

• Reduced total mortgage origination personnel by 73 - evaluating additional measures to right size our

operations in relation to the supply / demand imbalance of housing affecting our mortgage markets

Recent Developments

• Substantially completed the installation of our new single family loan origination system in all of our offices

• Announced that HomeStreet will be on of the first banks nationwide to launch Zelle, a person-to-person

payment service embedded in the bank’s mobile app

(1) Excludes acquisition-related expenses. See appendix for reconciliation of non-GAAP financial measures.

Results of Operations

For the three months ended

(1) Excludes acquisition-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

(2) See appendix for reconciliation of non-GAAP financial measures.

For the nine months ended

8

($ in thousands)

Jun. 30,

2017

Jun. 30,

2016

Jun. 30,

2017

Jun. 30,

2016

Net interest income $ 46,868 $ 44,482 $ 92,519 $ 85,173

Provision for credit losses 500 1,100 500 2,500

Noninterest income 81,008 102,476 155,469 174,184

Noninterest expense 111,244 111,031 218,118 212,384

Net income before taxes 16,132 34,827 29,370 44,473

Income taxes 4,923 13,078 9,178 16,317

Net income $ 11,209 $ 21,749 $ 20,192 $ 28,156

Diluted EPS $ 0.41 $ 0.87 $ 0.75 $ 1.15

Core net income

(1) $ 11,324 $ 22,415 $ 20,307 $ 32,200

Core EPS

(1) $ 0.42 $ 0.90 $ 0.75 $ 2.64

Tangible BV/share (2) $ 23.30 $ 21.38 $ 23.30 $ 21.38

Core ROAA (1) 0.70% 1.59% 0.64% 1.21%

Core ROAE (1) 6.78% 16.36% 6.16% 12.16%

Core ROATE (1) 7.10% 17.27% 6.46% 12.84%

Net Interest Margin 3.29% 3.48% 3.26% 3.52%

Core efficiency ratio (1) 86.9% 74.9% 87.9% 79.5%

Tier 1 Leverage Ratio (Bank) 10.12% 10.28% 10.12% 10.28%

Total Risk-Based Capital (Bank) 13.87% 14.33% 13.87% 14.33%

For the three months ended For the six months ended

Results of Operations – Quarter Trend

For the three months ended

(1) Excludes acquisition-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

(2) See appendix for reconciliation of non-GAAP financial measures.

For the nine months ended

9

($ in thousands) Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016 Jun. 30, 2016

Net interest income $ 46,868 $ 45,651 $ 48,074 $ 46,802 $ 44,482

Provision for credit losses 500 - 350 1,250 1,100

Noninterest income 81,008 74,461 73,221 111,745 102,476

Noninterest expense 111,244 106,874 117,539 114,399 111,031

Net income before taxes 16,132 13,238 3,406 42,898 34,827

Income taxes 4,923 4,255 1,112 15,197 13,078

Net income $ 11,209 $ 8,983 $ 2,294 $ 27,701 $ 21,749

Diluted EPS $ 0.41 $ 0.33 $ 0.09 $ 1.11 $ 0.87

Core net income

(1) $ 11,324 $ 8,983 $ 2,555 $ 28,034 $ 22,415

Core EPS

(1) $ 0.42 $ 0.33 $ 0.10 $ 1.12 $ 0.90

Tangible BV/share (2) $ 23.30 $ 22.73 $ 22.33 $ 22.45 $ 21.38

Core ROAA (1) 0.70% 0.57% 0.16% 1.81% 1.59%

Core ROAE (1) 6.78% 5.53% 1.67% 19.07% 16.36%

Core ROATE (1) 7.10% 5.81% 1.74% 20.04% 17.27%

Net Interest Margin 3.29% 3.23% 3.42% 3.34% 3.48%

Core efficiency ratio (1) 86.9% 89.0% 96.6% 71.8% 74.9%

Tier 1 Leverage Ratio (Bank) 10.12% 9.98% 10.26% 9.91% 10.28%

Total Risk-Based Capital (Bank) 13.87% 14.02% 14.69% 14.41% 14.33%

For the three months ended

3.48%

0.03

0.032

0.034

0.036

0.038

0.04

0.042

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

Ne

t In

ter

est

Ma

rgi

n (%

)

Ne

t In

ter

est

Inc

om

e (i

n m

illio

ns) $44.5 $46.8

$48.1

$45.7

$46.9

3.48%

3.34%

3.42%

3.23%

3.29%

2.75%

2.95%

3.15%

3.35%

3.55%

3.75%

3.95%

4.15%

$-

$10.0

$2 .0

$30.0

$40.0

$50.0

$6 .0

2Q16 3Q16 4Q16 1Q17 2Q17

Ne

t In

ter

est

Ma

rgi

n (%

)

Ne

t In

ter

est

Inc

om

e (i

n m

illio

ns)

Net Interest Income & Margin

• 2Q17 NIM increased 6 bps and net interest income increased $1.2 million compared to the prior

quarter

• NIM and net interest income growth primarily due to:

• Growth in average loans held for investment balances

• Decrease in lower yielding investment securities that we temporarily invested the levered proceeds of our

December 2016 common stock offering

10

Avg. Yield

$5.19

$5.69 $5.71 $5.78

$5.84

3.20%

3.40%

3.60%

3.80%

4.00%

4.20%

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00

2Q16 3Q16 4Q16 1Q17 2Q17

Av

era

ge

Yi

eld

Av

era

ge

Ba

lan

ce

s (

in

bil

lio

ns

)

Loans Held for Sale

Cash & Cash Equivalents

Investment Securities

Loans Held for Investment

Average Yield

Interest-Earning Assets

• Average total interest-earning assets increased $56 million or 1% in 2Q

• Loans held for investment ending balances increased $200 million or 5% in 2Q

Avg. Yield 4.00% 3.93% 4.03% 3.90% 3.96%

11

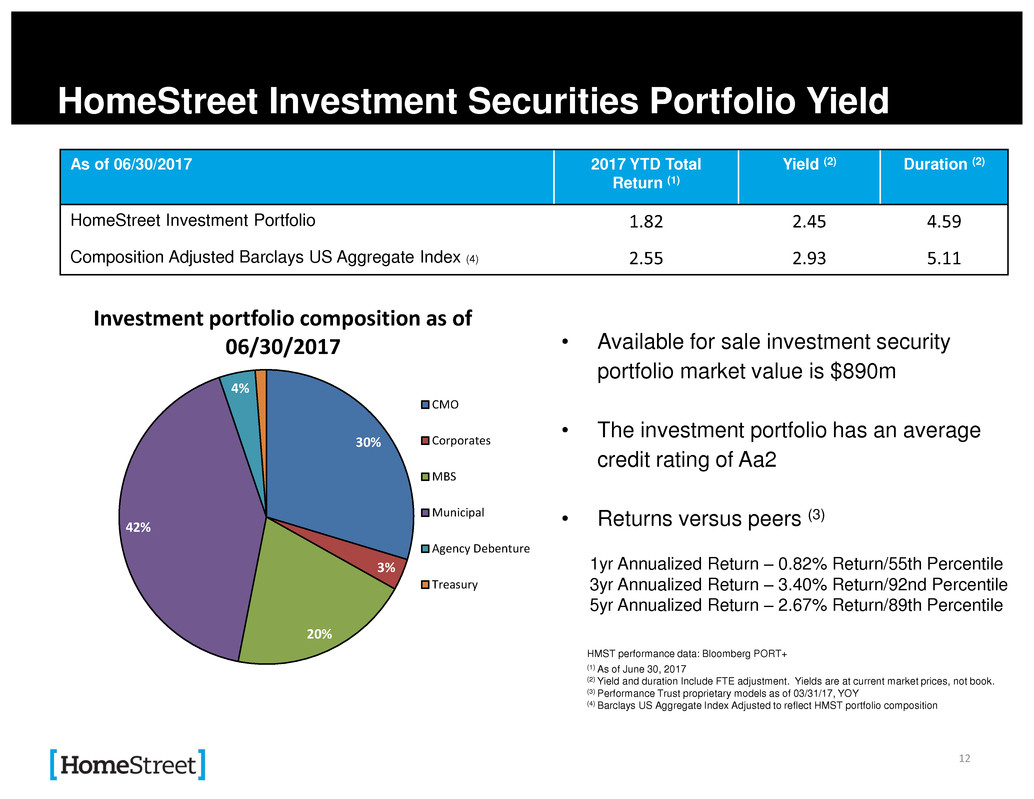

HomeStreet Investment Securities Portfolio Yield

As of 06/30/2017 2017 YTD Total

Return (1)

Yield (2)

Duration (2)

HomeStreet Investment Portfolio 1.82 2.45 4.59

Composition Adjusted Barclays US Aggregate Index (4) 2.55 2.93 5.11

HMST performance data: Bloomberg PORT+

(1) As of June 30, 2017

(2) Yield and duration Include FTE adjustment. Yields are at current market prices, not book.

(3) Performance Trust proprietary models as of 03/31/17, YOY

(4) Barclays US Aggregate Index Adjusted to reflect HMST portfolio composition

• Available for sale investment security

portfolio market value is $890m

• The investment portfolio has an average

credit rating of Aa2

• Returns versus peers (3)

1yr Annualized Return – 0.82% Return/55th Percentile

3yr Annualized Return – 3.40% Return/92nd Percentile

5yr Annualized Return – 2.67% Return/89th Percentile

12

30%

3%

20%

42%

4%

1%

Investment portfolio composition as of

06/30/2017

CMO

Corporates

MBS

Municipal

Agency Debenture

Treasury

$4.1 $6.5 $5.7 $4.9 $6.3

$12.7

$12.6

$9.2 $8.8

$85.6

$92.6

$67.8

$60.3

$65.9

$102.5

$111.7

$73.2 $74.5

$81.0

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

2Q16 3Q16 4Q16 1Q17 2Q17

No

nin

ter

st I

nc

om

e (i

n m

illio

ns

)

Net gain on mortgage loan

origination and sale activities

Loan servicing income

Other noninterest income

Noninterest Income

• Noninterest income increased 9% to $81.0 million in 2Q primarily due to higher net gain on loan origination

and sale activities

• Net gain on loan origination and sale activities increased $5.6 million primarily due to 20% higher single

family rate lock volume

13

$110.0 $113.9

$117.1

$106.9

$111.1

1,000

1,400

1,800

2,200

2,600

3,000

$-

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

2Q16 3Q16 4Q16 1Q17 2Q17

FTE

No

nin

ter

st E

xpe

nse

(in

mi

llio

ns)

Core noninterest expense Merger-related expenses FTE

Total noninterest expense $111.0 $114.4 $117.5 $106.9 $111.2

Merger-related expenses $1.0 $0.5 $0.4 $0.0 $0.2

Core noninterest expense (1) $110.0 $113.9 $117.1 $106.9 $111.1

Salaries & related costs (1) $74.5 $79.2 $81.7 $71.3 $76.4

General & administrative (1) $17.1 $15.5 $15.9 $17.1 $15.9

Other noninterest expense (1) $18.4 $19.2 $19.5 $18.5 $18.8

FTE 2,335 2,431 2,552 2,581 2,542

Core efficiency ratio (1) 74.9% 71.8% 96.6% 89.0% 86.9%

Noninterest Expense

• Excluding acquisition-related expenses, salaries and related costs grew by 7% in 2Q, primarily influenced by increased

commissions and incentives on higher Mortgage Banking Segment closed loan volume

• Core efficiency ratio decreased from the prior quarter due mainly to increase in Mortgage Banking Segment revenue

• Noninterest expense will continue to vary primarily based on headcount and mortgage origination volume

(1) Excludes acquisition-related expenses, which are shown in “acquisition-related expenses” in the table. See appendix for

reconciliation of non-GAAP financial measures. 14

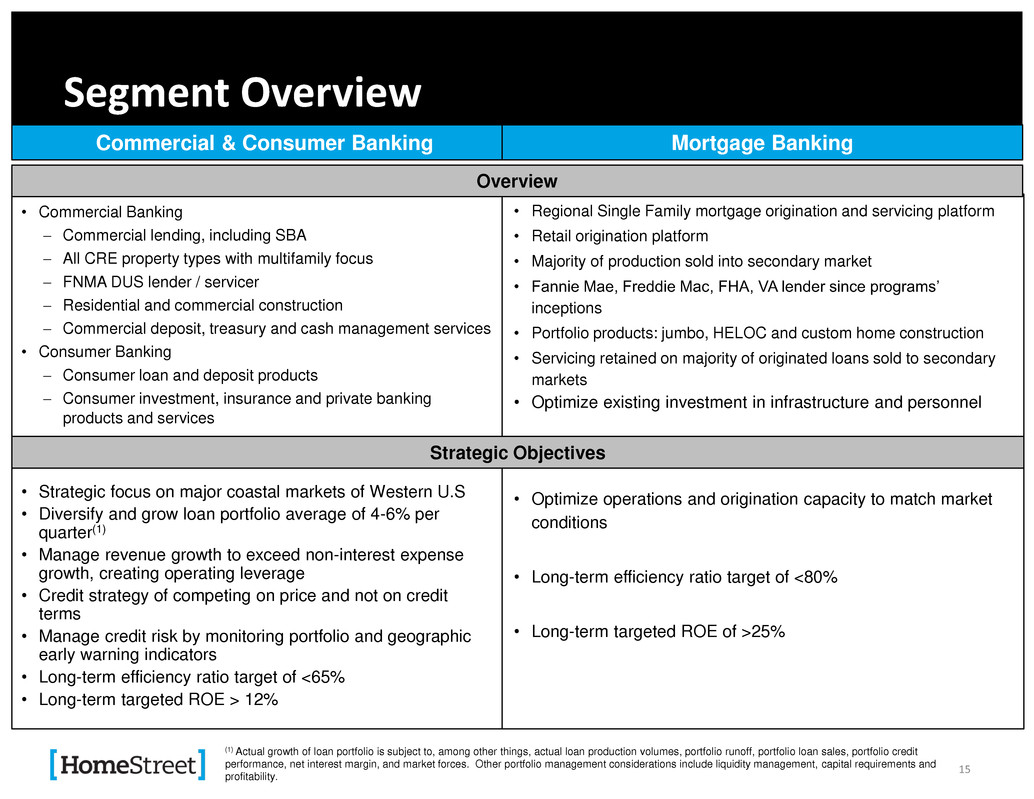

Segment Overview

Commercial & Consumer Banking

• Regional Single Family mortgage origination and servicing platform

• Retail origination platform

• Majority of production sold into secondary market

• Fannie Mae, Freddie Mac, FHA, VA lender since programs’

inceptions

• Portfolio products: jumbo, HELOC and custom home construction

• Servicing retained on majority of originated loans sold to secondary

markets

• Optimize existing investment in infrastructure and personnel

• Optimize operations and origination capacity to match market

conditions

• Long-term efficiency ratio target of <80%

• Long-term targeted ROE of >25%

Mortgage Banking

Overview

• Commercial Banking

Commercial lending, including SBA

All CRE property types with multifamily focus

FNMA DUS lender / servicer

Residential and commercial construction

Commercial deposit, treasury and cash management services

• Consumer Banking

Consumer loan and deposit products

Consumer investment, insurance and private banking

products and services

• Strategic focus on major coastal markets of Western U.S

• Diversify and grow loan portfolio average of 4-6% per

quarter(1)

• Manage revenue growth to exceed non-interest expense

growth, creating operating leverage

• Credit strategy of competing on price and not on credit

terms

• Manage credit risk by monitoring portfolio and geographic

early warning indicators

• Long-term efficiency ratio target of <65%

• Long-term targeted ROE > 12%

Strategic Objectives

(1) Actual growth of loan portfolio is subject to, among other things, actual loan production volumes, portfolio runoff, portfolio loan sales, portfolio credit

performance, net interest margin, and market forces. Other portfolio management considerations include liquidity management, capital requirements and

profitability.

15

Commercial & Consumer Banking

16

Commercial & Consumer Banking Segment

17

(1) Excludes acquisition-related expenses, net of tax. See appendix for reconciliation of non-GAAP financial measures.

($ in thousands)

Jun. 30,

2017

Jun. 30,

2016

Jun. 30,

2017

Jun. 30,

2016

Net interest income $ 42,448 $ 38,393 $ 83,351 $ 74,039

Provision for credit losses 500 1,100 500 2,500

Noninterest income 8,276 8,181 17,701 12,824

Noninterest expense 36,631 34,103 73,100 70,733

Net income before taxes 13,593 11,371 27,452 13,630

Income taxes 4,147 4,292 8,714 5,009

Net income $ 9,446 $ 7,079 $ 18,738 $ 8,621

Core net income

(1) $ 9,561 $ 7,745 $ 18,853 $ 12,665

Core ROAA

(1) 0.69% 0.66% 0.69% 0.57%

Core ROAE

(1) 7.16% 6.87% 7.27% 5.83%

Core ROATE

(1) 7.59% 7.34% 7.71% 6.22%

Core efficiency ratio

(1) 71.9% 71.0% 72.2% 74.3%

Net Interest Margin 3.22% 3.44% 3.21% 3.48%

Total average earning assets $5,229,120 $4,476,524 $ 5,162,918 $ 4,257,773

FTE 1,055 926 1,055 926

For the three months ended For the six months ended

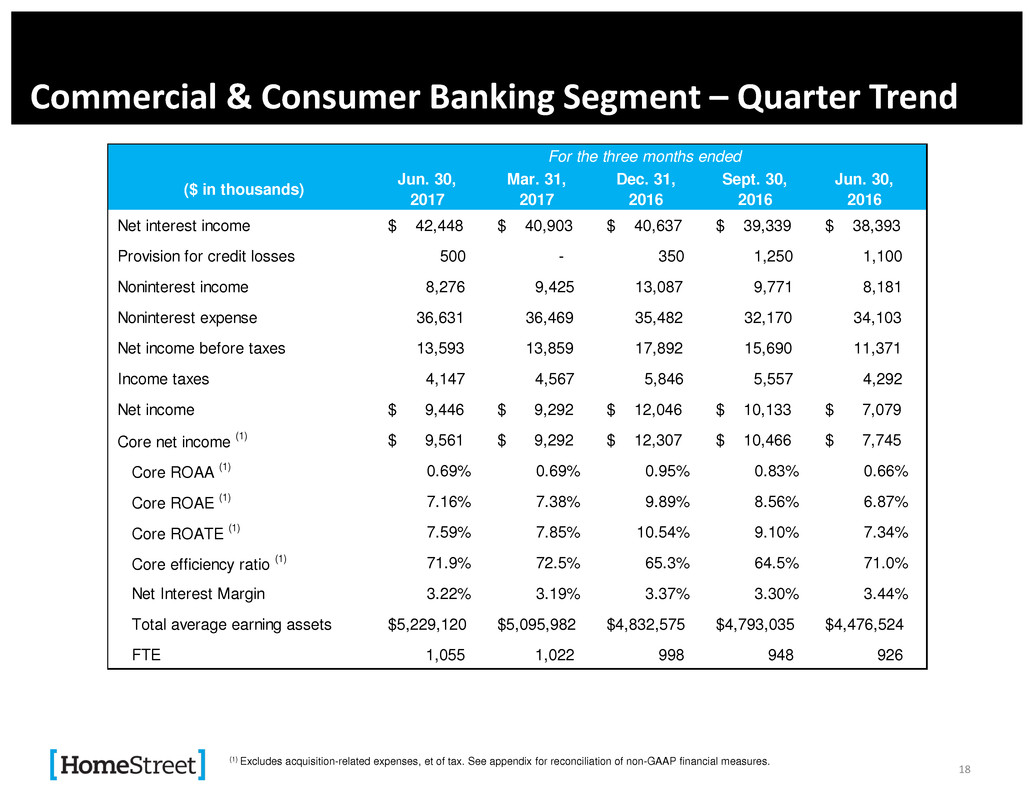

Commercial & Consumer Banking Segment – Quarter Trend

18

(1) Excludes acquisition-related expenses, et of tax. See appendix for reconciliation of non-GAAP financial measures.

($ in thousands)

Jun. 30,

2017

Mar. 31,

2017

Dec. 31,

2016

Sept. 30,

2016

Jun. 30,

2016

Net interest income $ 42,448 $ 40,903 $ 40,637 $ 39,339 $ 38,393

Provision for credit losses 500 - 350 1,250 1,100

Noninterest income 8,276 9,425 13,087 9,771 8,181

Noninterest expense 36,631 36,469 35,482 32,170 34,103

Net income before taxes 13,593 13,859 17,892 15,690 11,371

Income taxes 4,147 4,567 5,846 5,557 4,292

Net income $ 9,446 $ 9,292 $ 12,046 $ 10,133 $ 7,079

Core net income

(1) $ 9,561 $ 9,292 $ 12,307 $ 10,466 $ 7,745

Core ROAA

(1) 0.69% 0.69% 0.95% 0.83% 0.66%

Core ROAE

(1) 7.16% 7.38% 9.89% 8.56% 6.87%

Core ROATE

(1) 7.59% 7.85% 10.54% 9.10% 7.34%

Core efficiency ratio

(1) 71.9% 72.5% 65.3% 64.5% 71.0%

Net Interest Margin 3.22% 3.19% 3.37% 3.30% 3.44%

Total average earning assets $5,229,120 $5,095,982 $4,832,575 $4,793,035 $4,476,524

FTE 1,055 1,022 998 948 926

For the three months ended

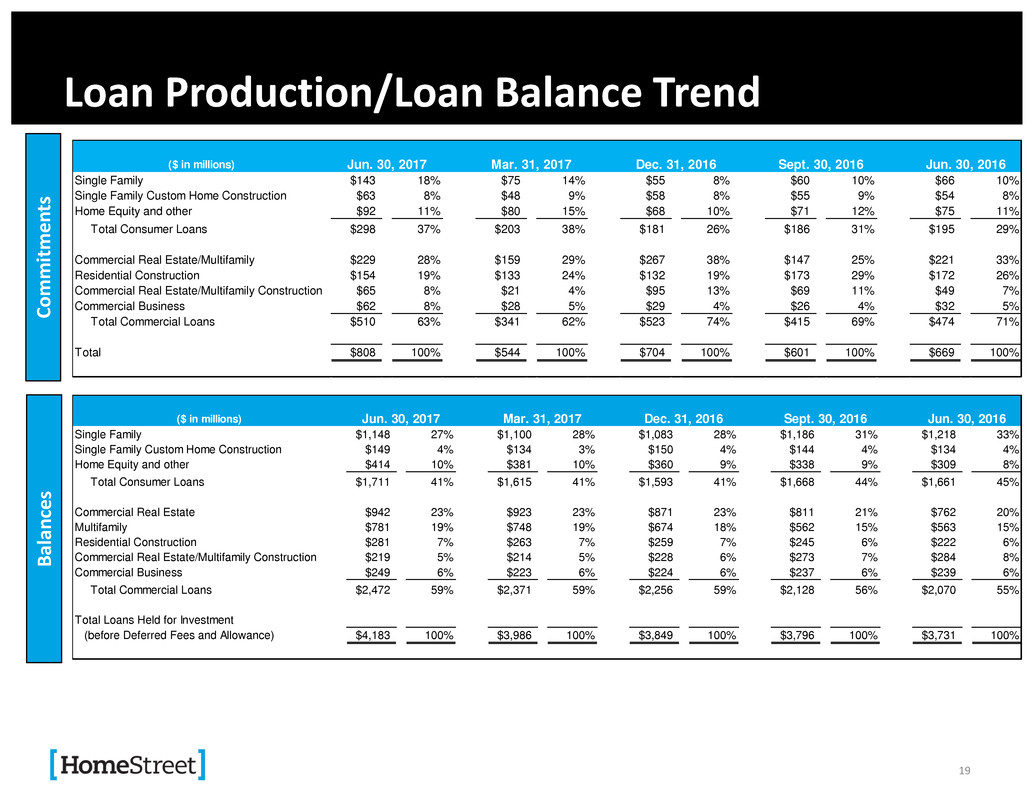

Loan Production/Loan Balance Trend

19

Commitme

n

ts

B

al

an

ce

s

($ in millions)

Single Family $143 18% $75 14% $55 8% $60 10% $66 10%

Single Family Custom Home Construction $63 8% $48 9% $58 8% $55 9% $54 8%

Home Equity and other $92 11% $80 15% $68 10% $71 12% $75 11%

Total Consumer Loans $298 37% $203 38% $181 26% $186 31% $195 29%

Commercial Real Estate/Multifamily $229 28% $159 29% $267 38% $147 25% $221 33%

Residential Construction $154 19% $133 24% $132 19% $173 29% $172 26%

Commercial Real Estate/Multifamily Construction $65 8% $21 4% $95 13% $69 11% $49 7%

Commercial Business $62 8% $28 5% $29 4% $26 4% $32 5%

Total Commercial Loans $510 63% $341 62% $523 74% $415 69% $474 71%

Total $808 100% $544 100% $704 100% $601 100% $669 100%

Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016 Jun. 30, 2016

($ in illions)

Single Family $1,148 27% $1,100 28% $1,083 28% $ ,186 31% $1,218 33%

Single Family Custom Home Construction $149 4% $134 3% $150 4% $144 4% $134 4%

Home Equity and other $414 10% $381 10% $360 9% $338 9% $309 8%

Total Consumer Loans $1,711 41% $1,615 41% $1,593 41% $1,668 44% $ ,661 45%

eal Estate $942 23% $923 23% $871 23% $811 21% $762 20%

Multifamily $781 19% $748 19% $674 18% $562 15% $563 15%

Residential Construction $281 7% $263 7% $259 7% $245 6% $222 6%

Commercial Real Estate/Multifamily Construction $219 5% $214 5% $228 6% $273 7% $284 8%

Commercial Business $249 6% $223 6% $224 6% $237 6% $239 6%

Total Commercial Loans $2,472 59% $2,371 59% $2,256 59% $2,128 56% $2,070 55%

Total Loans Held for Investment

(before Deferred Fees and Allowance) $4,183 100% $3,986 100% $3,849 100% $3,796 100% $3,731 100%

Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016 Jun. 30, 2016

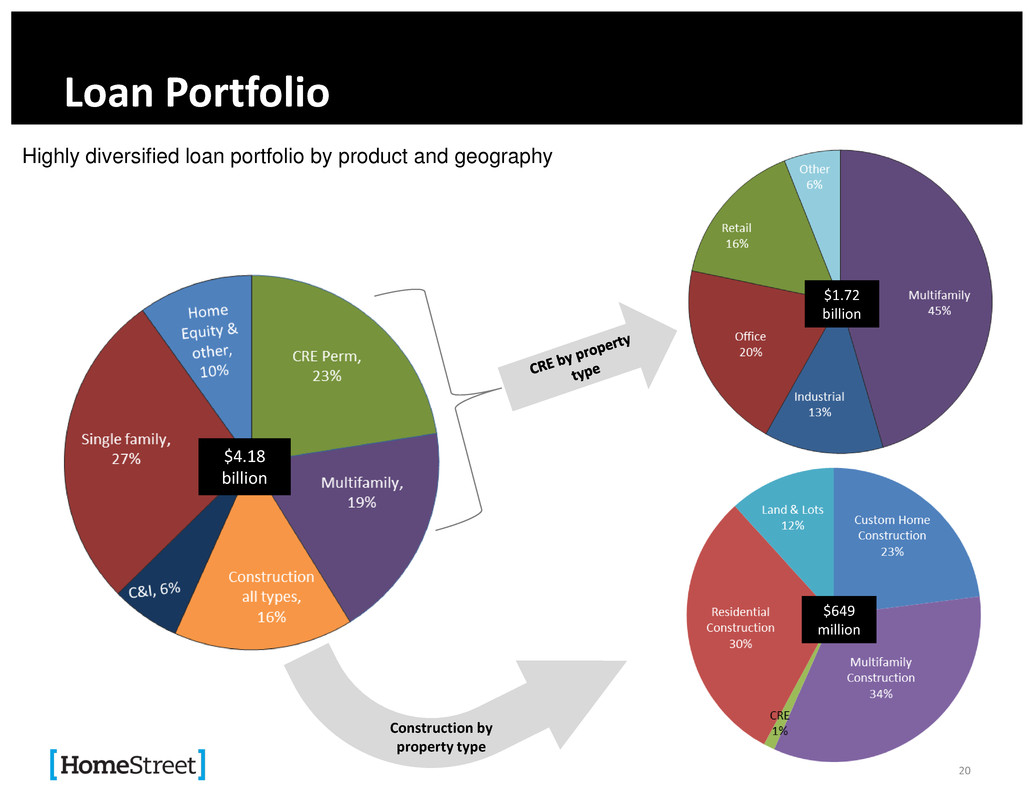

$1.72

billion

Loan Portfolio

20

Highly diversified loan portfolio by product and geography

$4.18

billion

$649

million

Construction by

property type

Other Includes: AK,AZ, CO,HI,ID,NV,TX,UT CA-Los Angeles County

•Additional property types are

reviewed on a case by case basis

• Includes acquired loan types

• Examples include: Self Storage &

Hotel

•Up To 15 Year Term

• $30MM Loan Amt. Max

• ≥ 1.25 DSCR

•Avg. LTV @ Orig. ~ 61%

•Up To 15 Year Term

• $30MM Loan Amt. Max

• ≥ 1.25 DSCR

•Avg. LTV @ Orig. ~ 68%

•Up To 30 Year Term

• $30MM Loan Amt. Max

• ≥ 1.15 DSCR

•Avg. LTV @ Orig. ~ 62%

•Up To 15 Year Term

• $30MM Loan Amt. Max

• ≥ 1.25 DSCR

•Avg. LTV @ Orig. ~ 62%

CA-Other Oregon WA-Other WA-Puget Sound

Commercial Real Estate Perm Lending Overview

21

HomeStreet lends within the full spectrum of commercial real estate lending types, but is deliberate in achieving diversification among

property types and geographic areas to mitigate concentration risk

Balance: $271M

% of Balances: 16%

% Owner Occupied: 27%

Portfolio LTV ~ 52% (1)

Portfolio Avg. DSCR ~ 1.73x

Avg. Loan Size: $1.8M

Largest Dollar Loan: $16.6M

6/30/17 Balances Outstanding totaling $1.72 billion

Loan Characteristics

Commercial Real Estate Property Types

Multifamily Office Industrial/

Warehouse

Retail Other

Balance: $783M

% of Balances: 45%

Portfolio Avg. LTV ~ 57% (1)

Portfolio Avg. DSCR ~ 1.46x

Avg. Loan Size: $3.3M

Largest Dollar Loan: $24.7M

Geographical Distribution (balances)

Balance: $219M

% of Balances: 13%

% Owner Occupied: 47%

Portfolio LTV ~ 50% (1)

Portfolio Avg. DSCR ~ 1.68x

Avg. Loan Size: $1.6M

Largest Dollar Loan: $11.4M

Balance: $346M

% of Balances: 20%

% Owner Occupied: 26%

Portfolio LTV ~ 57% (1)

Portfolio Avg. DSCR ~ 1.72x

Avg. Loan Size: $3.6M

Largest Dollar Loan: $25.5M

Balance: $104M

% of Balances: 6%

% of Owner Occupied: 57%

Portfolio LTV ~ 46% (1)

Portfolio Avg. DSCR ~ 1.78x

Avg. Loan Size: $1.4M

Largest Dollar Loan: $21.3M

(1) Property values as of origination date

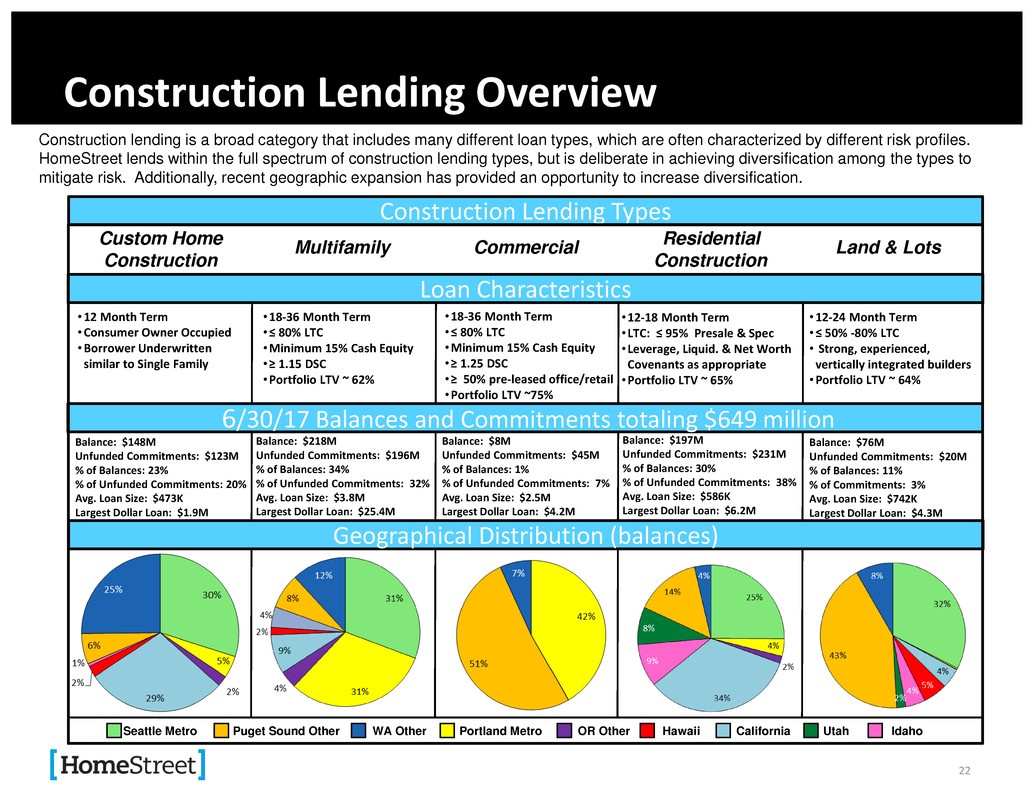

Construction Lending Overview

22

Construction lending is a broad category that includes many different loan types, which are often characterized by different risk profiles.

HomeStreet lends within the full spectrum of construction lending types, but is deliberate in achieving diversification among the types to

mitigate risk. Additionally, recent geographic expansion has provided an opportunity to increase diversification.

Balance: $197M

Unfunded Commitments: $231M

% of Balances: 30%

% of Unfunded Commitments: 38%

Avg. Loan Size: $586K

Largest Dollar Loan: $6.2M

6/30/17 Balances and Commitments totaling $649 million

Loan Characteristics

Construction Lending Types

Custom Home

Construction

Multifamily Commercial Residential

Construction

Land & Lots

•12 Month Term

•Consumer Owner Occupied

•Borrower Underwritten

similar to Single Family

Balance: $148M

Unfunded Commitments: $123M

% of Balances: 23%

% of Unfunded Commitments: 20%

Avg. Loan Size: $473K

Largest Dollar Loan: $1.9M

Geographical Distribution (balances)

Balance: $218M

Unfunded Commitments: $196M

% of Balances: 34%

% of Unfunded Commitments: 32%

Avg. Loan Size: $3.8M

Largest Dollar Loan: $25.4M

Balance: $8M

Unfunded Commitments: $45M

% of Balances: 1%

% of Unfunded Commitments: 7%

Avg. Loan Size: $2.5M

Largest Dollar Loan: $4.2M

Balance: $76M

Unfunded Commitments: $20M

% of Balances: 11%

% of Commitments: 3%

Avg. Loan Size: $742K

Largest Dollar Loan: $4.3M

Seattle Metro Puget Sound Other WA Other Portland Metro OR Other Hawaii California Utah Idaho

•18-36 Month Term

•≤ 80% LTC

•Minimum 15% Cash Equity

•≥ 1.15 DSC

•Portfolio LTV ~ 62%

•18-36 Month Term

•≤ 80% LTC

•Minimum 15% Cash Equity

•≥ 1.25 DSC

•≥ 50% pre-leased office/retail

•Portfolio LTV ~75%

•12-18 Month Term

• LTC: ≤ 95% Presale & Spec

•Leverage, Liquid. & Net Worth

Covenants as appropriate

•Portfolio LTV ~ 65%

•12-24 Month Term

•≤ 50% -80% LTC

• Strong, experienced,

vertically integrated builders

•Portfolio LTV ~ 64%

Credit Quality

23

• Credit Quality continues to reflect excellent loan quality:

• Nonperforming assets declined to 0.30% of total assets compared to 0.38% in 1Q17

• Nonperforming loans declined to $15.5 million compared to $18.7 million in 1Q17

• OREO balances decreased to $4.6 million compared to $5.6 million in 1Q17

• Total delinquencies (adjusted2) declined to 0.45% compared to 0.50% in 1Q17

(1) Nonperforming assets includes nonaccrual loans and OREO, excludes performing TDRs and SBAs

(2) Total delinquencies and total loans - adjusted (net of Ginnie Mae EBO loans (FHA/VA loans) guaranteed portion of SBA loans

(3) Not available at time of publishing

(4) While not a loss reserve, purchase discounts are available to absorb credit related losses on loans purchased with discounts

($ in thousands) HMST Peer Mdn HMST Peer Mdn HMST Peer Mdn HMST Peer Mdn HMST Peer Mdn

Nonperforming assets

(1)

$20,073 -- $24,322 -- $25,785 -- $32,361 -- $26,443 --

Nonperforming loans $15,476 -- $18,676 -- $20,542 -- $25,921 -- $15,745 --

OREO $4,597 -- $5,646 -- $5,243 -- $6,440 -- $10,698 --

Nonperforming assets/total assets

(1)

0.30%

(3)

0.38% 0.31% 0.41% 0.35% 0.52% 0.33% 0.45% 0.38%

Nonperforming loans/total loans 0.37%

(3)

0.47% 0.28% 0.53% 0.35% 0.68% 0.38% 0.42% 0.34%

Total delinquencies/total loans 1.56%

(3)

1.67% 0.67% 1.88% 0.74% 1.89% 0.66% 1.59% 0.60%

Total delinquencies/total loans - adjusted

(2)

0.45%

(3)

0.50% 0.67% 0.58% 0.74% 0.77% 0.66% 0.45% 0.60%

ALLL / total loans 0.86%

(3)

0.87% 1.19% 0.88% 1.20% 0.89% 1.23% 0.88% 1.22%

ALLL / Nonperforming loans (NPLs) 233.50%

(3)

185.99% 345.22% 165.52% 334.43% 131.07% 329.53% 207.41% 321.37%

ALLL / total loans, excluding purchased loans 0.95% -- 0.97% -- 1.00% -- 1.05% -- 1.03% --

Purchased Discount & Reserves/Gross Purchased Loans

(4)

3.03% -- 2.93% -- 2.96% -- 2.92% -- 3.03% --

Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016 Jun. 30, 2016

Deposits

24

Total Cost of Deposits

10% 13% 10% 9% 9%

27%

24%

25% 26% 27%

52%

51% 54% 52%

51%

12%

11% 12% 13%

12%4,239

$4,505 $4,430 $4,596

$4,748

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

6/30/2016 9/30/2016 12/31/2016 3/31/2017 6/30/2017

Bala

nce

s (in

mil

lion

s)

Noninterest-Bearing Transaction &

Savings Deposits

Interest-Bearing Transaction &

Savings Deposits

Time Deposits

Mortgage Svcg. Escrow Accts. &

Other

Total Cost of Deposits 0.46% 0.50% 0.51% 0.52% 0.52%

• Total deposits of $4.75 billion at June 30, 2017 increased $152 million or 3% from March 31, 2017 and increased

$509 million or 12% from June 30, 2016

• Transaction and savings accounts increased 1%, time deposits increased 7% and servicing and escrow balances

increased 11% during the quarter. The increase in servicing and escrow balances reflects seasonal changes in

mortgage loan servicing activity

• Deposit growth during the quarter of 10% in our de novo branches opened since 2012. Opened 18 branches, or

32% of our total network, since 2012

• Business deposits increased by 6% during the quarter

Mortgage Banking

25

West Coast Housing Shortage

26

• December 2016 forecast by the Mortgage Bankers Association predicted sales of existing homes to increase 5%

during 2017

• According to Zillow, the number of homes listed for sale in June 2017 is actually down 11% nationwide compared

to June 2016

• Down 21% in Washington

• Down 18% in California

• New home construction timeline exceeds five years and is constrained by:

• Geography of West Coast

• Lack of suitable land or zoning restrictions

• Municipal planning departments that shrank following the recession leaving them unable to process increased

demand

• Supply constraints reducing inventory and marketing time of homes to historical lows in major west coast

markets

• Demand remains strong with home shoppers in our pipeline up 4% for the six months ended June 30, 2017

compared to the six months ended June 30, 2016

• Consequently, we lowered our expectations for mortgage lock volume by 21% and mortgage closing

volume by 20% since the beginning of 2017, and we also implemented cost reduction strategies that

included reducing mortgage origination personnel by 73 during the quarter

Mortgage Banking Segment

27

($ in thousands)

Jun. 30,

2017

Jun. 30,

2016

Jun. 30,

2017

Jun. 30,

2016

Net interest income $ 4,420 $ 6,089 $ 9,167 $ 11,134

Noninterest income 72,732 94,295 137,768 161,360

Noninterest expense 74,613 76,928 145,017 141,651

Net income before taxes 2,539 23,456 1,918 30,843

Income taxes 776 8,786 464 11,308

Net income $ 1,763 $ 14,670 $ 1,454 $ 19,535

ROAA 0.80% 6.67% 0.33% 4.72%

ROATE 5.32% 62.45% 2.16% 42.59%

Efficiency Ratio 96.7% 76.6% 98.7% 82.1%

FTE 1,487 1,409 1,487 1,409

For the three months ended For the six months ended

Mortgage Banking Segment – Quarter Trend

28

($ in thousands)

Jun. 30,

2017

Mar. 31,

2017

Dec. 31,

2016

Sept. 30,

2016

Jun. 30,

2016

Net interest income $ 4,420 $ 4,747 $ 7,437 $ 7,463 $ 6,089

Noninterest income 72,732 65,036 60,134 101,974 94,295

Noninterest expense 74,613 70,404 82,057 82,229 76,928

Net income (loss) before taxes 2,539 (621) (14,486) 27,208 23,456

Income taxes 776 (312) (4,734) 9,640 8,786

Net income (loss) $ 1,763 $ (309) $ (9,752) $ 17,568 $ 14,670

ROAA 0.80% (0.14)% (3.55)% 6.04% 6.67%

ROATE 5.32% (0.90)% (31.91)% 68.36% 62.45%

Efficiency Ratio 96.7% 100.9% 121.4% 75.1% 76.6%

FTE 1,487 1,558 1,554 1,483 1,409

For the three months ended

Mortgage Origination

(1) Represents combined value of secondary market gains and originated mortgage servicing rights stated as a

percentage of interest rate lock commitments.

(2) Loan origination and funding fees stated as a percentage of mortgage originations from the retail channel and

excludes loans purchased from WMS.

29

2Q16 3Q16 Q416 Q117 Q217

Secondary gains/rate locks (1) 312 297 299 312 294

Loan fees/closed loans (2) 35 37 35 37 37

Composite Margin 347 334 334 349 331

0

50

100

150

200

250

300

350

400

2Q16 3Q16 Q416 Q117 Q217

Single Family Composite Margin

(bps)

Secondary gains/rate locks Loan fees/closed loans

-

500

1,000

1,500

2,000

2,500

3,000

2Q16 3Q16 Q416 Q117 Q217

Held for Sale Closed Loan Production

($ in millions)

HMST WMS Rate locks

Bps

2Q16 3Q16 Q416 Q117 Q217

HMST $2,118 $2,451 $2,376 $1,544 $1,866

WMS $144 $197 $138 $77 $145

Closed Loans $2,262 $2,648 $2,514 $1,621 $2,011

Purchase % 69% 64% 57% 67% 78%

Refinance % 31% 36% 43% 33% 22%

Rate locks $2,362 $2,690 $1,766 $1,623 $1,950

Purchase % 65% 53% 63% 73% 77%

Refinance % 35% 47% 37% 27% 23%

Mortgage Servicing

As of June 30, 2017

• Constant Prepayment Rate (CPR) – 11.8% for Q2 2017

• W.A. servicing fee – 28.2 bps

• MSRs represent 1.12% of ending UPB – 3.97 W.A. servicing fee multiple

• W.A age – 27.8 months

• W.A. expected life – 69.7 months as of 6/30/17

• Composition of government – 25.3%

• Total delinquency – 1.07% (including foreclosures)

• W.A. note rate – 3.98%

30

$17,074 $18,199

$19,488 $20,303

$21,105

2.67

2.87

4.10 4.10

3.97

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

5.00

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

$22,000

$24,000

2Q16 3Q16 Q416 Q117 Q217

Mortgage Servicing Portfolio

($ in millions)

Mortgage Servicing Portfolio ($ in millions) W.A. Servicing Fee Multiple

Mortgage Market & Competitive Landscape

31

Mortgage Market

• The most recent Mortgage Bankers Association monthly forecast projects total loan originations to decrease 14.1% in

2017 over last year, and to decrease 2.1% in 2018.

• Despite the recent increase in mortgage rates, rates remain historically low on an absolute basis. Low rates should

continue to support housing affordability. Nationally, purchases are expected to increase by 10.0% from 2016 and

comprise 67% of volume in 2017.

• Purchases comprised 68% of originations nationally and 64% in the Pacific Northwest in the second quarter.

HomeStreet continues to perform above the national and regional averages, with purchases accounting for 78% of our

closed loans and 77% of our interest rate lock commitments in the quarter.

Competitive Landscape

• HomeStreet maintained its position as the number one loan originator by volume of purchase mortgages in the Pacific

Northwest and in the Puget Sound region, and increased market share to number one for total originations in the same

areas.

• Purchase demand continues to remain strong in many of our markets, however limited inventory continues to be a

significant constraining issue. Months supply of inventory and time on the market are both down significantly in most of

our major markets.

• New home construction in our markets is constrained by the geography of the West Coast and the lingering effects of the

last recession.

Outlook

32

The information in this presentation, particularly including but not limited to that presented on this slide, is forward-looking in nature, and you should review Item 1A, “Risk

Factors,” in our most recent Annual Report on Form 10-K for a list of factors that may cause us to deviate from our plans or to fall short of our expectations.

• Locations in the high-growth markets of the Western United States and Hawaii

• Above average loan growth while containing credit risk

• Invest in de novo branch openings to grow core, relationship-based deposits

• Optimizing existing investment in Mortgage Banking segment

• Augment organic growth with acquisitions in our target markets

Metric 3Q17 4Q17 2017

Mortgage loan locks and forward sale commitments $1.9B $1.8B $7.3B

Mortgage loan held for sale closing volume $2.1B $1.8B $7.5B

Mortgage banking gain on sale composite margin 310-320 bps 310-320 bps N/A

Average quarterly net loan portfolio growth 4% - 6% 4% - 6% N/A

Net interest margin N/A 3.35% - 3.45% N/A

Average quarterly net interest expense growth 1% 1% N/A

Key Drivers Guidance

Revenue Growth Outpacing Expense Growth, Driving Operating Efficiencies and

Strong Returns

.

Appendix

33

Statements of Financial Condition

34

($ in thousands) Jun. 30, 2017 Mar. 31, 2017 Dec. 31, 2016 Sept. 30, 2016 Jun. 30, 2016

Cash and cash equivalents $ 54,447 $ 61,492 $ 53,932 $ 55,998 $ 45,229

Investment securities 936,522 1,185,654 1,043,851 991,325 928,364

Loans held for sale 784,556 537,959 714,559 893,513 772,780

Loans held for investment, net 4,156,424 3,957,959 3,819,027 3,764,178 3,698,959

Mortgage servicing rights 258,222 257,421 245,860 167,501 147,266

Other real estate owned 4,597 5,646 5,243 6,440 10,698

Federal Home Loan Bank stock, at cost 41,769 41,656 40,347 39,783 40,414

Premises and equipment, net 101,797 97,349 77,636 72,951 67,884

Goodwill 22,175 22,175 22,175 19,900 19,846

Other assets 226,048 233,832 221,070 215,012 209,738

Total assets $ 6,586,557 $ 6,401,143 $ 6,243,700 $ 6,226,601 $ 5,941,178

Deposits $ 4,747,771 $ 4,595,809 $ 4,429,701 $ 4,504,560 $ 4,239,155

Federal Home Loan Bank advances 867,290 862,335 868,379 858,923 878,987

Accounts payable and other liabilities 190,421 176,891 191,189 151,968 138,307

Long-term debt 125,234 125,189 125,147 125,122 125,126

Total liabilities 5,930,716 5,760,224 5,614,416 5,640,573 5,381,575

Preferred stock - - - - -

Common stock 511 511 511 511 511

Additional paid-in capital 337,515 336,875 336,149 276,844 276,303

Retained earnings 323,228 312,019 303,036 300,742 273,041

Accumulated other comprehensive income (loss) (5,413) (8,486) (10,412) 7,931 9,748

Total shareholders’ equity 655,841 640,919 629,284 586,028 559,603

Total liabilities and shareholders’ equity $ 6,586,557 $ 6,401,143 $ 6,243,700 $ 6,226,601 $ 5,941,178

Non-GAAP Financial Measures

Tangible Book Value:

35

Jun. 30, Mar. 31, Dec. 31, Sept. 30, Jun. 30, Jun. 30, Jun. 30,

(dollars in thousands, except share data) 2017 2017 2016 2016 2016 2017 2016

Shareholders' equity $655,841 $640,919 $629,284 $586,028 $559,603 $655,841 $559,603

Less: Goodwill and other intangibles (29,783) (30,275) (30,789) (28,573) (28,861) (29,783) (28,861)

Tangible shareholders' equity $626,058 $610,644 $598,495 $557,455 $530,742 $626,058 $530,742

Common shares outstanding 26,874,871 26,862,744 26,800,183 24,833,008 24,821,349 26,874,871 24,821,349

Book value per share $24.40 $23.86 $23.48 $23.60 $22.55 $24.40 $22.55

Impact of goodwill and other intangibles (1.10) (1.13) (1.15) (1.15) (1.17) (1.10) (1.17)

Tangible book value per share $23.30 $22.73 $22.33 $22.45 $21.38 $23.30 $21.38

Average hareholders' equity $668,377 $649,439 $616,497 $588,335 $548,080 $658,961 $529,482

Less: Average goodwill and other intangibles (30,104) (30,611) (29,943) (28,769) (28,946) (30,356) (27,796)

Average tangible shareholders' equity $638,273 $618,828 $586,554 $559,566 $519,134 $628,605 $501,686

Return on average shareholders’ equity 6.71% 5.53% 1.49% 18.83% 15.87% 6.13% 10.64%

Impact of goodwill and other intangibles 0.31% 0.28% 0.07% 0.97% 0.89% 0.29% 0.58%

Return on average tangible shareholders' equity 7.02% 5.81% 1.56% 19.80% 16.76% 6.42% 11.22%

Quarter Ended Six Months Ended

Non-GAAP Financial Measures

Core Net Income:

36

Jun. 30, Mar. 31, Dec. 31, Sept. 30, Jun. 30, Jun. 30, Jun. 30,

(dollars in thousands) 2017 2017 2016 2016 2016 2017 2016

Net income $11,209 $8,983 $2,294 $27,701 $21,749 $20,192 $28,156

Impact of acquisition-related items (net of tax) 115 - 261 333 666 115 4,044

Net income, excluding acquisition-related items (net of tax) $11,324 $8,983 $2,555 $28,034 $22,415 $20,307 $32,200

Noninterest expense $111,244 $106,874 $117,539 $114,399 $111,031 $218,118 $212,384

Deduct: acquisition-related expenses (177) - (401) (512) (1,025) (177) (6,223)

Noninterest expense, excluding acquisition-related expenses $111,067 $106,874 $117,138 $113,887 $110,006 $217,941 $206,161

Diluted earnings per common share $0.41 $0.33 $0.09 $1.11 $0.87 $0.75 $1.15

Impact of acquisition-related items (net of tax) 0.01 - 0.01 0.01 0.03 - 1.49

Diluted earnings per common share, excluding acquisition-

related items (net of tax) $0.42 $0.33 $0.10 $1.12 $0.90 $0.75 $2.64

Return on average assets 0.70% 0.57% 0.15% 1.79% 1.54% 0.63% 1.06%

Impact of acquisition-related items (net of tax) 0.00% 0.00% 0.01% 0.02% 0.05% 0.01% 0.15%

Return on average assets, excluding acquisition-related

items (net of tax)

0.70% 0.57% 0.16% 1.81% 1.59% 0.64% 1.21%

Return on average shareholders' equity 6.71% 5.53% 1.49% 18.83% 15.87% 6.13% 10.64%

Impact of acquisition-related items (net of tax) 0.07% 0.00% 0.18% 0.24% 0.49% 0.03% 1.52%

Return on average shareholders' equity, excluding

acquisition-related items (net of tax)

6.78% 5.53% 1.67% 19.07% 16.36% 6.16% 12.16%

Return on average tangible shareholders' equity 7.02% 5.81% 1.56% 19.80% 16.76% 6.42% 11.22%

Impact of acquisition-related items (net of tax) 0.08% 0.00% 0.18% 0.24% 0.51% 0.04% 1.62%

Return on average tangible shareholders' equity, excluding

acquisition-related items (net of tax)

7.10% 5.81% 1.74% 20.04% 17.27% 6.46% 12.84%

Efficiency ratio 86.99% 88.98% 96.90% 72.15% 75.55% 87.96% 81.89%

Impact of acquisition-related items (net of tax) (0.13)% 0.00% (0.33)% (0.32)% (0.69)% (0.08)% (2.40)%

Efficiency ratio, excluding acquisition-related items (net of

tax)

86.86% 88.98% 96.57% 71.83% 74.86% 87.88% 79.49%

Six Months EndedQuarter Ended

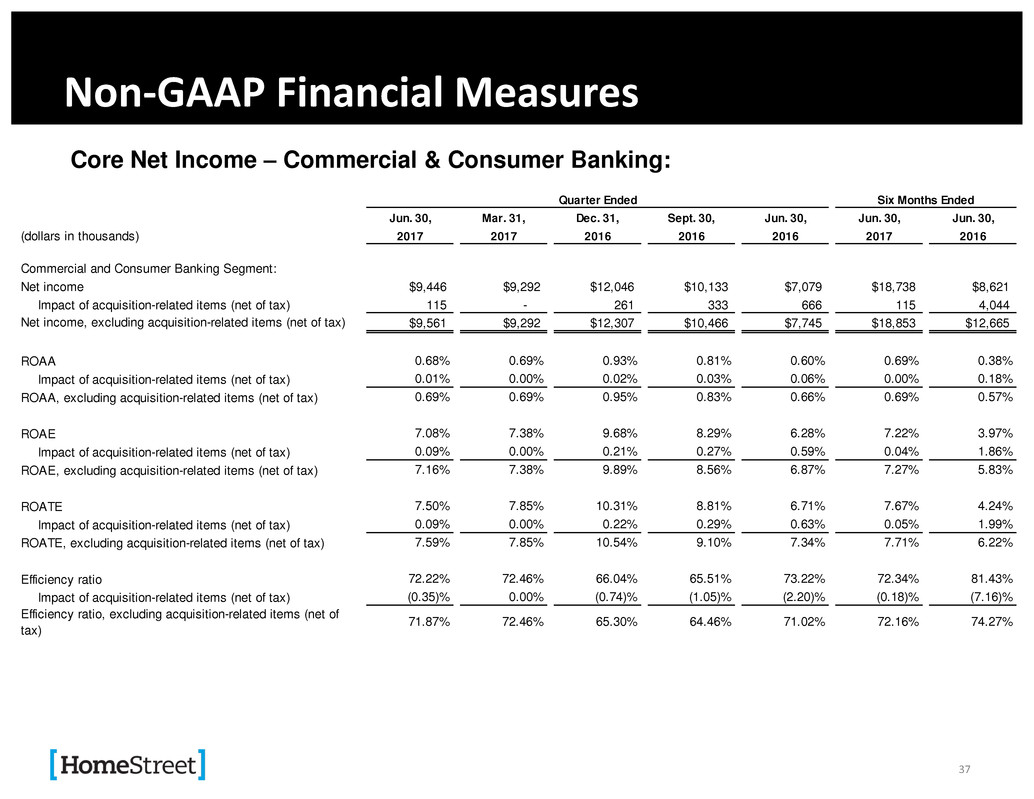

Non-GAAP Financial Measures

Core Net Income – Commercial & Consumer Banking:

37

Jun. 30, Mar. 31, Dec. 31, Sept. 30, Jun. 30, Jun. 30, Jun. 30,

(dollars in thousands) 2017 2017 2016 2016 2016 2017 2016

Commercial and Consumer Banking Segment:

Net income $9,446 $9,292 $12,046 $10,133 $7,079 $18,738 $8,621

Impact of acquisition-related items (net of tax) 115 - 261 333 666 115 4,044

Net income, excluding acquisition-related items (net of tax) $9,561 $9,292 $12,307 $10,466 $7,745 $18,853 $12,665

ROAA 0.68% 0.69% 0.93% 0.81% 0.60% 0.69% 0.38%

Impact of acquisition-related items (net of tax) 0.01% 0.00% 0.02% 0.03% 0.06% 0.00% 0.18%

ROAA, excluding acquisition-related items (net of tax) 0.69% 0.69% 0.95% 0.83% 0.66% 0.69% 0.57%

ROAE 7.08% 7.38% 9.68% 8.29% 6.28% 7.22% 3.97%

Impact of acquisition-related items (net of tax) 0.09% 0.00% 0.21% 0.27% 0.59% 0.04% 1.86%

ROAE, excluding acquisition-related items (net of tax) 7.16% 7.38% 9.89% 8.56% 6.87% 7.27% 5.83%

ROATE 7.50% 7.85% 10.31% 8.81% 6.71% 7.67% 4.24%

Impact of acquisition-related items (net of tax) 0.09% 0.00% 0.22% 0.29% 0.63% 0.05% 1.99%

ROATE, excluding acquisition-related items (net of tax) 7.59% 7.85% 10.54% 9.10% 7.34% 7.71% 6.22%

Efficiency ratio 72.22% 72.46% 66.04% 65.51% 73.22% 72.34% 81.43%

Impact of acquisition-related items (net of tax) (0.35)% 0.00% (0.74)% (1.05)% (2.20)% (0.18)% (7.16)%

Efficiency ratio, excluding acquisition-related items (net of

tax)

71.87% 72.46% 65.30% 64.46% 71.02% 72.16% 74.27%

Six Months EndedQuarter Ended