Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 BANNER BRANCH PRESS RELEASE - Altabancorp | pub-ex991_6.htm |

| 8-K - 8-K-BANNER BRANCH ACQUISITION - Altabancorp | pub-8k_20170726.htm |

People’s Utah Bancorp Expands Franchise by Acquiring 7 Utah Branches from Banner Bank July 27, 2017 Exhibit 99.2

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements about our industry, our future financial performance and our plans and objectives. These forward-looking statements are subject to risks and uncertainties, and are based on our management’s current expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions, as well as a number of assumptions concerning future events. These statements are subject to risks, uncertainties, assumptions and other important factors set forth in our SEC filings. Many of these factors are beyond our control. Such factors could cause actual results to differ materially from the results discussed or implied in the forward-looking statements. These factors include, but are not limited to: •The credit and concentration risks of our lending activities; •Changes in general economic conditions, either nationally or in our market areas; •Competitive market pricing factors and interest rate risks; •Market interest rate volatility; •Investments in new branches and new business opportunities; •Balance sheet (for example, loans) concentrations; •Fluctuations in demand for loans and other financial services in our market areas; •Changes in legislative or regulatory requirements or the results of regulatory examinations; •The ability to recruit and retain key management and staff; •Risks associated with our ability to implement our expansion strategy and merger integration; •Stability of funding sources and continued availability of borrowings; •Adverse changes in the securities markets; •The inability of key third-party providers to perform their obligations to us; •Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and •These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission. In addition, closing of the transaction discussed in this presentation will be contingent on meeting certain conditions, including the receipt of federal and state regulatory approval. In particular, statements about the timing and likelihood of the consummation of the acquisitions, revenue enhancements, and net income of the new branches on a go-forward basis, the successful integration of their respective employees and customers, and anticipated size and value of the Company after the acquisition, as well as statements that anticipate these events, are forward-looking in nature. Integration of the acquired operations may take longer or prove more expensive than we anticipate, and may distract management from our operations. We may also change our plans or take additional actions that differ in material ways from our current intentions. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any proxy, vote or approval. Safe Harbor

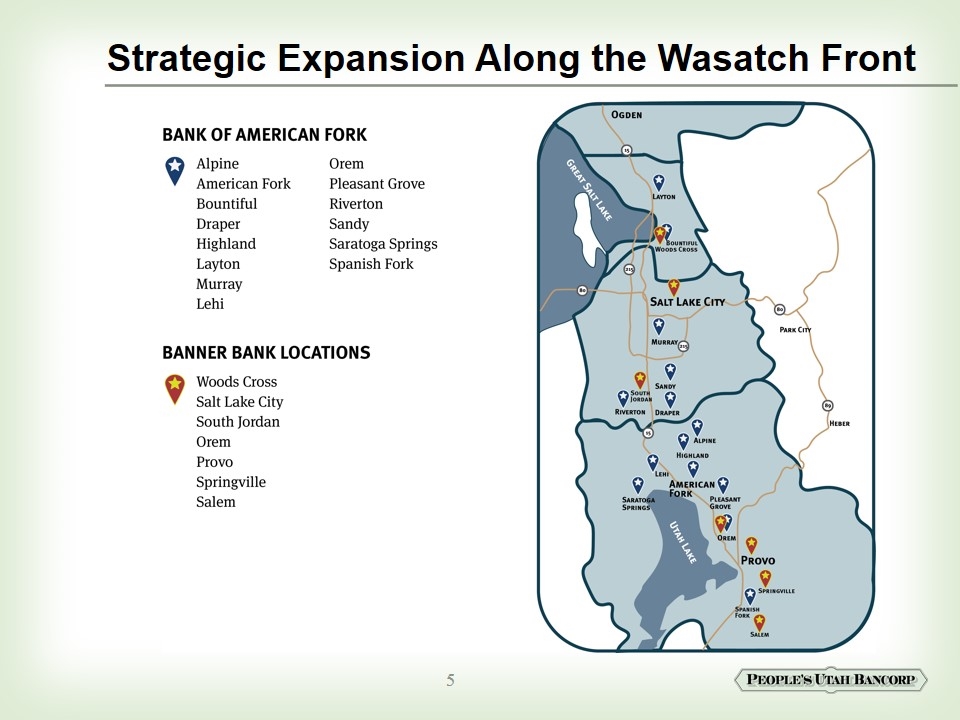

On July 27, 2017, People’s Utah Bancorp (“PUB”) (Nasdaq: PUB) announced that its banking subsidiary, People’s Intermountain Bank (“PIB”), entered into a purchase and assumption agreement to acquire 7 Utah branch locations, including loans and deposits from Banner Corporation’s (Nasdaq: BANR) banking subsidiary Banner Bank (“Banner”) In-market transaction will strengthen PUB’s standing as the largest community bank in Utah and bolster its presence along the I-15 corridor PUB will acquire approximately $260 million in loans and $180 million in deposits along with all real estate Unique opportunity to acquire significantly more loans than deposits in a branch transaction Ability to redeploy existing balance sheet liquidity into higher earnings assets The seven branches are strategically located in strong growth markets including Bountiful, Salt Lake City, South Jordon, Orem, Provo, Salem and Springville. We plan to consolidate the Woods Cross and Orem branches into existing Bank of American Fork branches. Opportunity to leverage PUB’s solid capital base in a strategic and financially compelling transaction Transaction marks PUB’s third transaction in the Utah market in the last four years and second in the last two months Transaction Overview

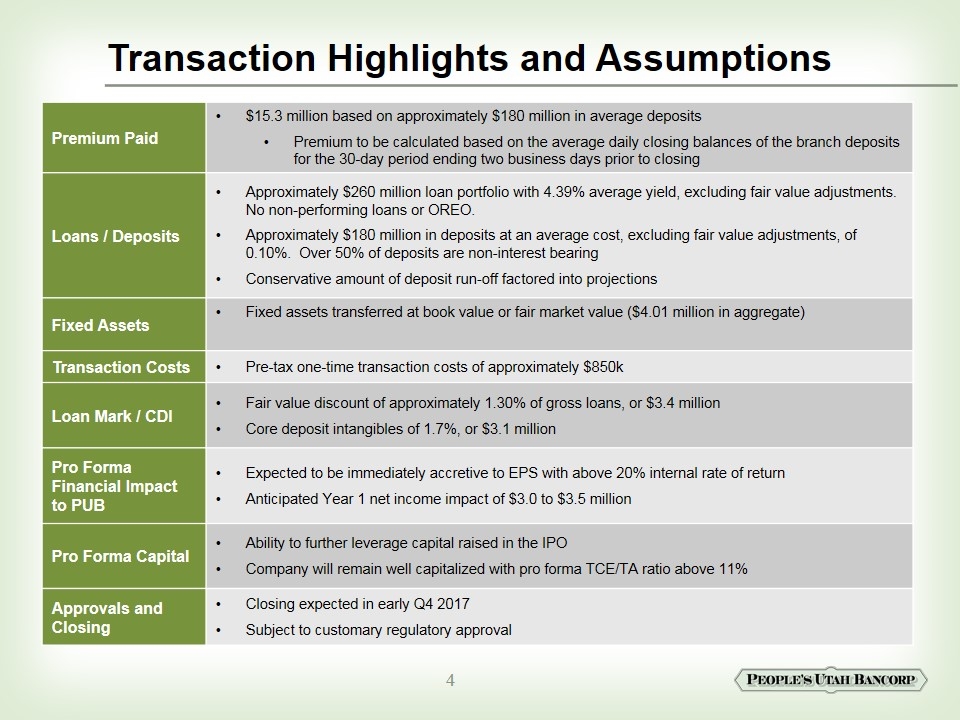

Transaction Highlights and Assumptions Premium Paid $15.3 million based on approximately $180 million in average deposits Premium to be calculated based on the average daily closing balances of the branch deposits for the 30-day period ending two business days prior to closing Loans / Deposits Approximately $260 million loan portfolio with 4.39% average yield, excluding fair value adjustments. No non-performing loans or OREO. Approximately $180 million in deposits at an average cost, excluding fair value adjustments, of 0.10%. Over 50% of deposits are non-interest bearing Conservative amount of deposit run-off factored into projections Fixed Assets Fixed assets transferred at book value or fair market value ($4.01 million in aggregate) Transaction Costs Pre-tax one-time transaction costs of approximately $850k Loan Mark / CDI Fair value discount of approximately 1.30% of gross loans, or $3.4 million Core deposit intangibles of 1.7%, or $3.1 million Pro Forma Financial Impact to PUB Expected to be immediately accretive to EPS with above 20% internal rate of return Anticipated Year 1 net income impact of $3.0 to $3.5 million Pro Forma Capital Ability to further leverage capital raised in the IPO Company will remain well capitalized with pro forma TCE/TA ratio above 11% Approvals and Closing Closing expected in early Q4 2017 Subject to customary regulatory approval

Strategic Expansion Along the Wasatch Front

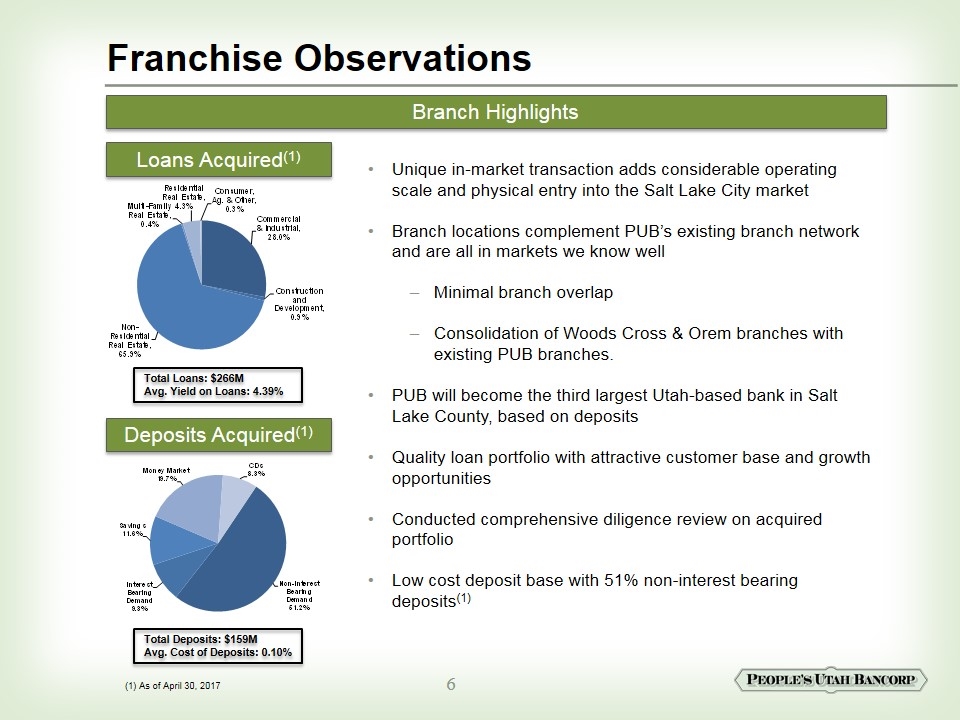

Unique in-market transaction adds considerable operating scale and physical entry into the Salt Lake City market Branch locations complement PUB’s existing branch network and are all in markets we know well Minimal branch overlap Consolidation of Woods Cross & Orem branches with existing PUB branches. PUB will become the third largest Utah-based bank in Salt Lake County, based on deposits Quality loan portfolio with attractive customer base and growth opportunities Conducted comprehensive diligence review on acquired portfolio Low cost deposit base with 51% non-interest bearing deposits(1) Franchise Observations Branch Highlights (1) As of April 30, 2017 Loans Acquired(1) Deposits Acquired(1) Total Loans: $266M Avg. Yield on Loans: 4.39% Total Deposits: $159M Avg. Cost of Deposits: 0.10%

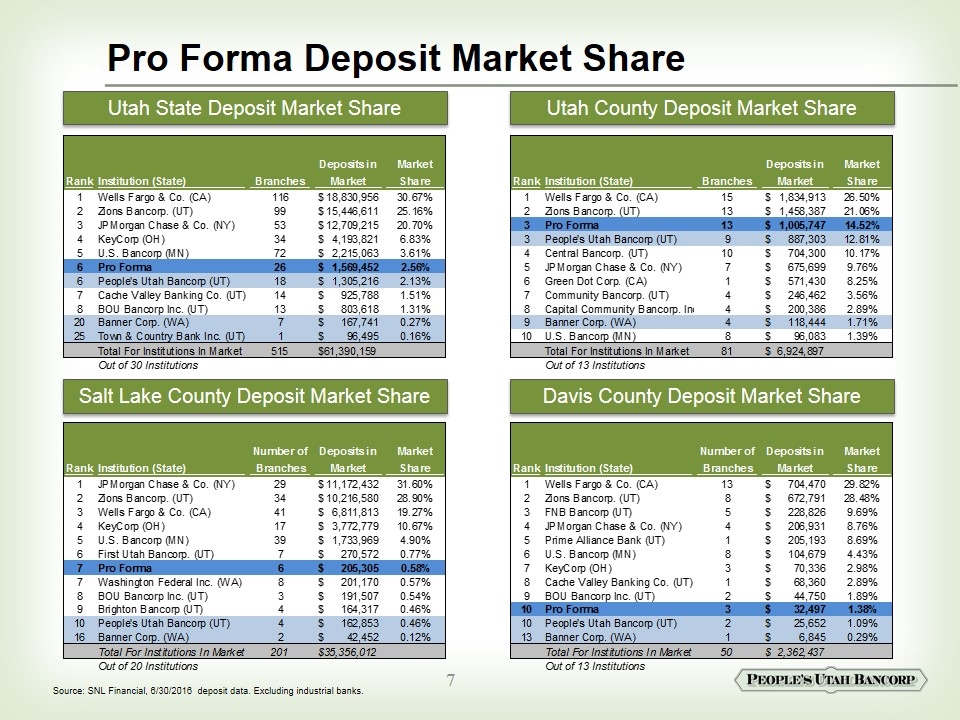

Pro Forma Deposit Market Share Utah County Deposit Market Share Source: SNL Financial, 6/30/2016 deposit data. Excluding industrial banks. Davis County Deposit Market Share Utah State Deposit Market Share Salt Lake County Deposit Market Share

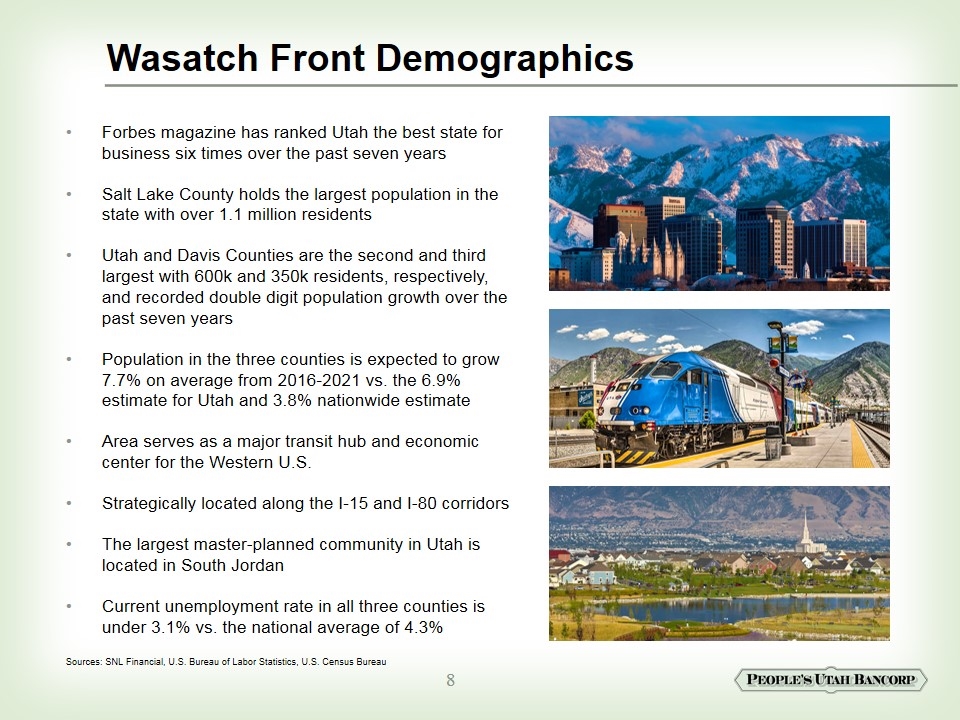

Forbes magazine has ranked Utah the best state for business six times over the past seven years Salt Lake County holds the largest population in the state with over 1.1 million residents Utah and Davis Counties are the second and third largest with 600k and 350k residents, respectively, and recorded double digit population growth over the past seven years Population in the three counties is expected to grow 7.7% on average from 2016-2021 vs. the 6.9% estimate for Utah and 3.8% nationwide estimate Area serves as a major transit hub and economic center for the Western U.S. Strategically located along the I-15 and I-80 corridors The largest master-planned community in Utah is located in South Jordan Current unemployment rate in all three counties is under 3.1% vs. the national average of 4.3% Wasatch Front Demographics Sources: SNL Financial, U.S. Bureau of Labor Statistics, U.S. Census Bureau

Rare in-market acquisition opportunity that expands PUB’s franchise and adds scale along the high-growth Wasatch Front Further strengthens PUB’s statewide footprint with pro forma deposits in Utah reaching $1.7 billion Addition of a highly skilled staff and seasoned lending platform. We plan on retaining as many employees as possible Strategic and financially compelling transaction with conservative assumptions that adhere to PUB’s M&A criteria Leverages capital raised in the IPO while still maintaining strong pro forma capital levels Enhances PUB’s position as the largest true “community bank” in Utah with over $2.0 billion in pro forma assets and 25 branches across Utah and Idaho state after branch consolidation Transaction Summary