Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Heritage-Crystal Clean, Inc. | hcciex311q22017.htm |

| EX-32.2 - EXHIBIT 32.2 - Heritage-Crystal Clean, Inc. | hcciex322q22017.htm |

| EX-32.1 - EXHIBIT 32.1 - Heritage-Crystal Clean, Inc. | hcciex321q22017.htm |

| EX-31.2 - EXHIBIT 31.2 - Heritage-Crystal Clean, Inc. | hcciex312q22017.htm |

| 10-Q - 10-Q - Heritage-Crystal Clean, Inc. | a201710-qq2.htm |

8952497.4

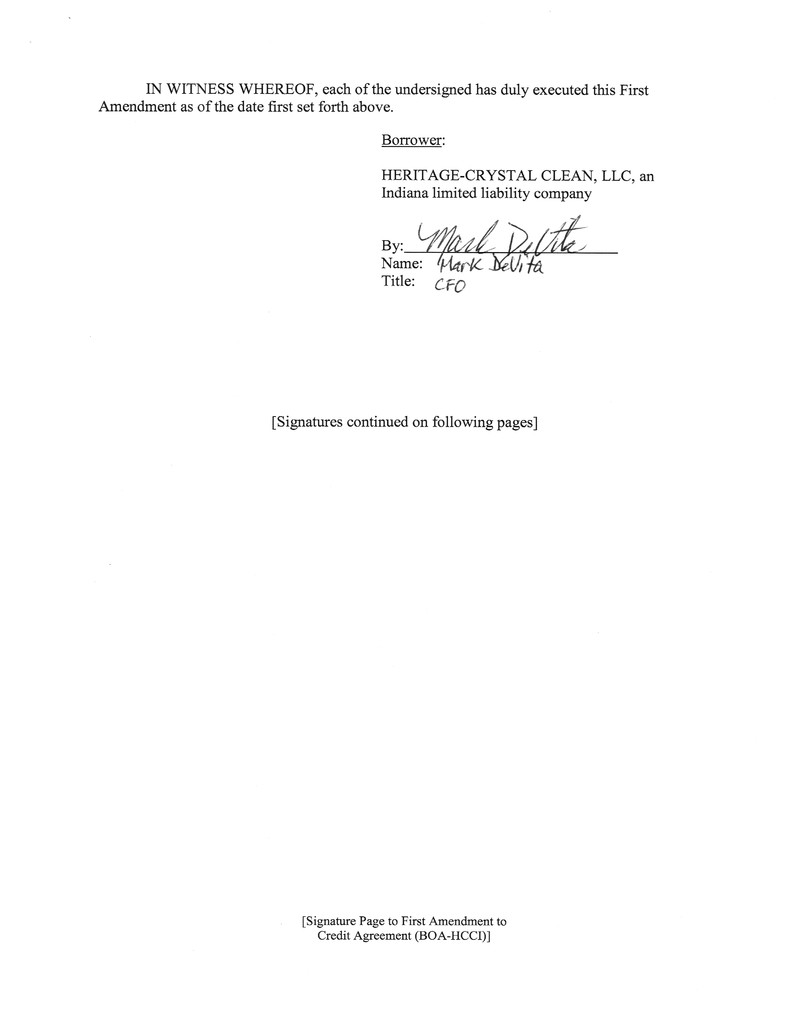

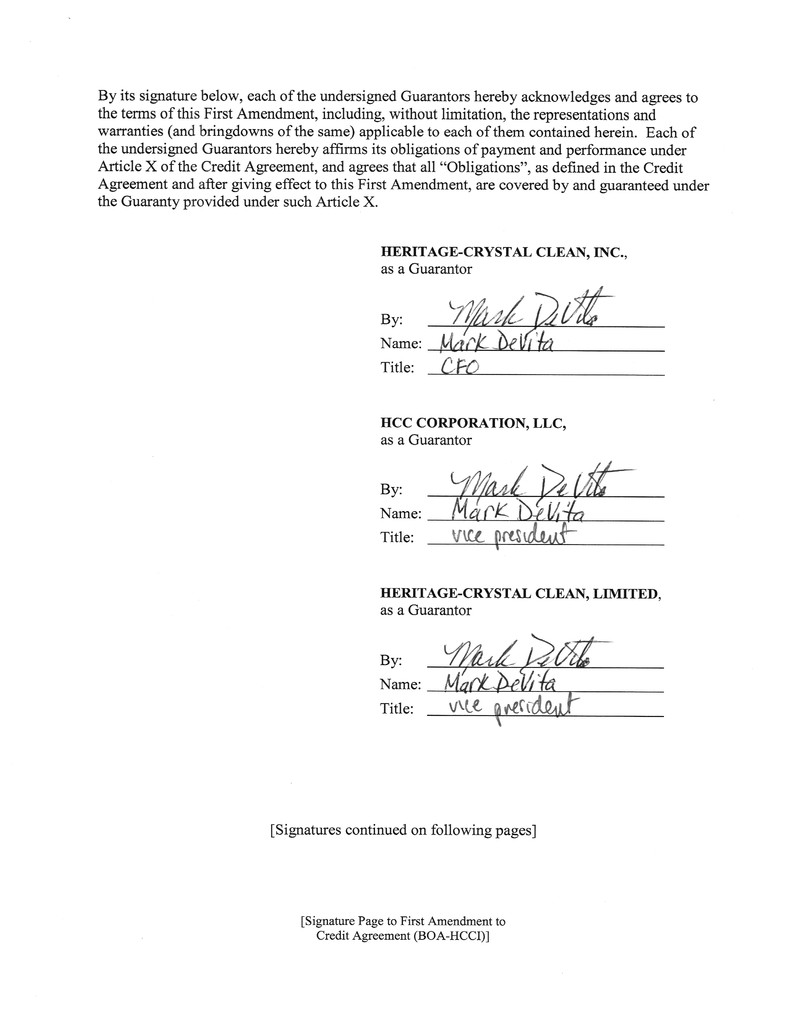

FIRST AMENDMENT TO

CREDIT AGREEMENT

This FIRST AMENDMENT TO CREDIT AGREEMENT (this “First

Amendment”) is made and entered into as of June 28, 2017, among HERITAGE-

CRYSTAL CLEAN, LLC, an Indiana limited liability company (the “Borrower”),

HERITAGE-CRYSTAL CLEAN, INC., a Delaware corporation (“Holdings”), each

Subsidiary of the Borrower from time to time party to the Credit Agreement referred to

below (collectively with Holdings, the “Guarantors”; and the Guarantors together with the

Borrower, the “Loan Parties”), each lender from time to time party to such Credit

Agreement (collectively, the “Lenders” and individually, each a “Lender”), and BANK OF

AMERICA, N.A., as the Administrative Agent (the “Agent”).

WHEREAS, the Borrower, the other Loan Parties, the Lenders and the Agent are

party to that certain Credit Agreement, dated as of February 21, 2017 (as amended,

restated, supplemented or modified from time to time, the “Credit Agreement”), pursuant

to which the Lenders have extended credit to the Borrower on the terms set forth therein;

WHEREAS, the Loan Parties and the Required Lenders have agreed to make

certain amendments and updates to the Credit Agreement on the terms and subject to the

conditions set forth herein;

NOW, THEREFORE, in consideration of the mutual agreements, provisions and

covenants contained herein, and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Definitions. Capitalized terms used herein without definition shall have the

meanings assigned to such terms in the Credit Agreement. This First Amendment shall

constitute a Loan Document for all purposes of the Credit Agreement and the other Loan

Documents.

2. Amendments to Section 7.05 (Dispositions) of the Credit Agreement.

Section 7.05 of the Credit Agreement is hereby amended as follows:

(a) Clause (f) of Section 7.05, is hereby deleted in its entirety and

replaced with the following:

“(f) Other Dispositions, provided that the fair market value of such

Dispositions, individually and/or in the aggregate, shall not exceed 5.0% of

the value of the consolidated total assets of Holdings and its Subsidiaries (as

determined by reference to the most recent fiscal year end consolidated

balance sheet of Holdings and its Subsidiaries delivered to the

Administrative Agent pursuant to Section 6.01(a)) in any fiscal year.”

3. Conditions to Effectiveness. This First Amendment shall be deemed

effective when (i) the Agent shall have received counterpart signature pages to this First

2

8952497.4

Amendment duly executed and delivered by the Borrower, each other Loan Party and the

Required Lenders, and (ii) arrangements completely satisfactory to the Agent shall have

been made for the payment at closing of all fees and expenses incurred in connection with

this First Amendment (including the fees and expenses of counsel for the Agent) to the

extent invoiced on or prior to the date hereof.

4. Representations and Warranties. The Borrower and each other Loan

Party jointly and severally represents and warrants to the Agent and the Lenders as

follows:

(a) The execution, delivery and performance of this First Amendment

(i) are within the authority of each of the Loan Parties, (ii) have been duly authorized by all

necessary corporate proceedings by each of the corporate Loan Parties, and by all

necessary proceedings by the managers or members (as required) by each of the limited

liability company Loan Parties, (iii) do not conflict with or result in any material breach or

contravention of any provision of law, statute, rule or regulation to which any of the Loan

Parties is subject or any judgment, order, writ, injunction, license or permit applicable to

any of the Loan Parties so as to materially adversely affect the assets, business or any

activity of the Loan Parties, and (iv) do not conflict with any provision of the corporate

charter, articles of incorporation or bylaws of the corporate Loan Parties, the articles of

organization or operating agreements of the limited liability company Loan Parties, or any

agreement or other instrument binding upon any of the Loan Parties.

(b) The execution, delivery and performance of this First Amendment

will result in valid and legally binding obligations of the Loan Parties enforceable against

them in accordance with the terms and provisions hereof, except as such enforceability

may be limited by bankruptcy, insolvency, reorganization, moratorium or other laws

relating to or affecting generally the enforcement of creditors’ rights and except to the

extent that availability of the remedy of specific performance or injunctive relief or other

equitable remedy is subject to the discretion of the court before which any proceeding

therefor may be brought.

(c) The execution, delivery and performance by the Loan Parties of this

First Amendment do not require any approval or consent of, or filing with, any third party

or governmental agency or authority.

(d) The representations and warranties contained in Article V of the

Credit Agreement are true and correct in all material respects on and as of the date hereof,

after giving effect to this First Amendment, as though made on and as of the date hereof,

except to the extent that such representations and warranties specifically refer to an earlier

date, in which case they shall be true and correct in all material respects as of such earlier

date. For purposes of this Paragraph 5(d), the representations and warranties contained in

Section 5.05(a) of the Credit Agreement shall be deemed to refer to the most recent

statements furnished pursuant to Section 6.01(a) of the Credit Agreement.

(e) Both before and after giving effect to this First Amendment, no

Default or Event of Default has occurred and is continuing.

3

8952497.4

5. No Waiver. Nothing contained herein shall be deemed to (i) constitute a

waiver of any Default or Event of Default that may heretofore or hereafter occur or have

occurred and be continuing or, except as expressly provided herein, to otherwise modify

any provision of the Credit Agreement or other Loan Document, or (ii) give rise to any

defenses or counterclaims to any Lender’s right to compel payment of the Obligations

when due or to otherwise enforce its rights and remedies under the Credit Agreement and

the other Loan Documents.

6. Ratification, etc. Except as expressly amended hereby, the Credit

Agreement, the other Loan Documents, all documents, instruments and agreements related

thereto and the Obligations are hereby ratified and confirmed in all respects and shall

continue in full force and effect. This First Amendment and the Credit Agreement shall

hereafter be read and construed together as a single document, and all references in the

Credit Agreement, any other Loan Document or any agreement or instrument related to the

Credit Agreement shall hereafter refer to the Credit Agreement as amended by this First

Amendment.

7. GOVERNING LAW. THIS FIRST AMENDMENT SHALL BE

GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF

THE STATE OF NEW YORK.

8. Counterparts; Etc. This First Amendment may be executed in any

number of counterparts and by different parties hereto on separate counterparts, each of

which when so executed and delivered shall be an original, but all of which counterparts

taken together shall be deemed to constitute one and the same instrument. Any counterpart

signed by all parties may be introduced into evidence in any action or proceeding without

having to produce or account for the other counterparts. Likewise, the existence of this

First Amendment may be established by the introduction into evidence of counterparts that

are separately signed, provided they are otherwise identical in all material respects. This

First Amendment, to the extent signed and delivered by means of a facsimile machine or

other electronic transmission in which the actual signature is evident, shall be treated in all

manner and respects as an original agreement or instrument and shall be considered to have

the same binding legal effect as if it were the original signed version thereof delivered in

person. At the request of any party hereto, each other party hereto or thereto shall re-

execute original forms hereof and deliver them to all other parties. No party hereto shall

raise the use of a facsimile machine or other electronic transmission in which the actual

signature is evident to deliver a signature or the fact that any signature or agreement or

instrument was transmitted or communicated through the use of a facsimile machine or

other electronic transmission in which the actual signature is evident as a defense to the

formation of a contract and each party forever waives such defense.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

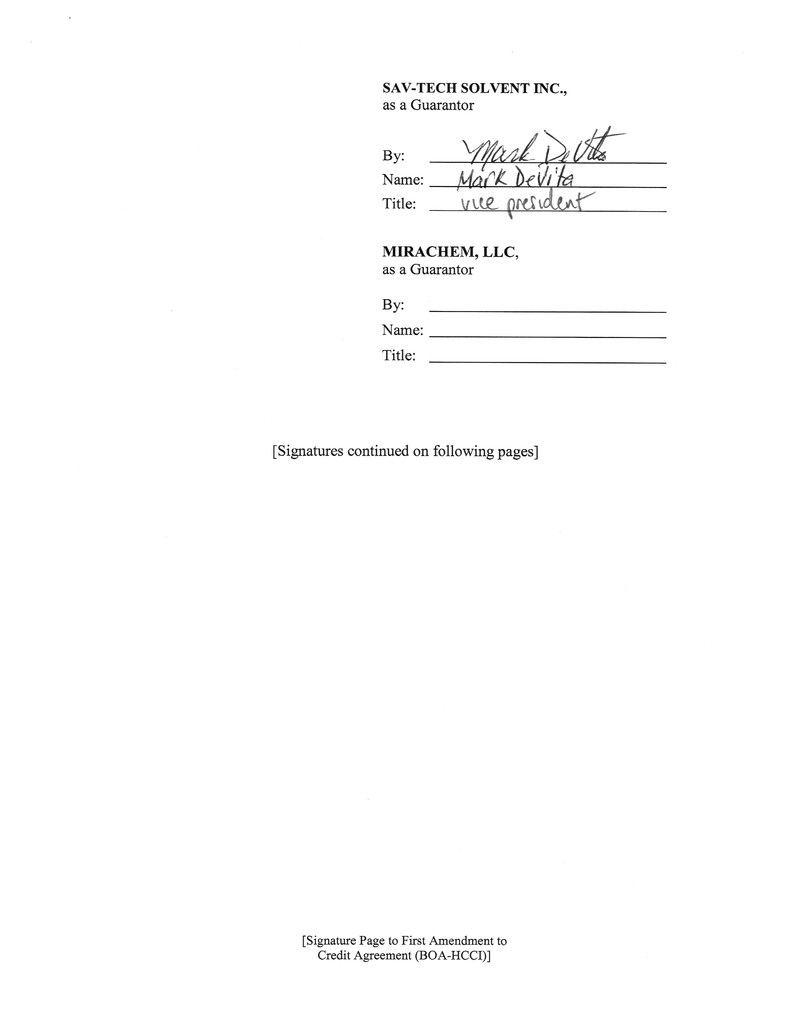

SAV.TECH SOLVENT INC.,

as a Guarantor

By:

Name:

Title:

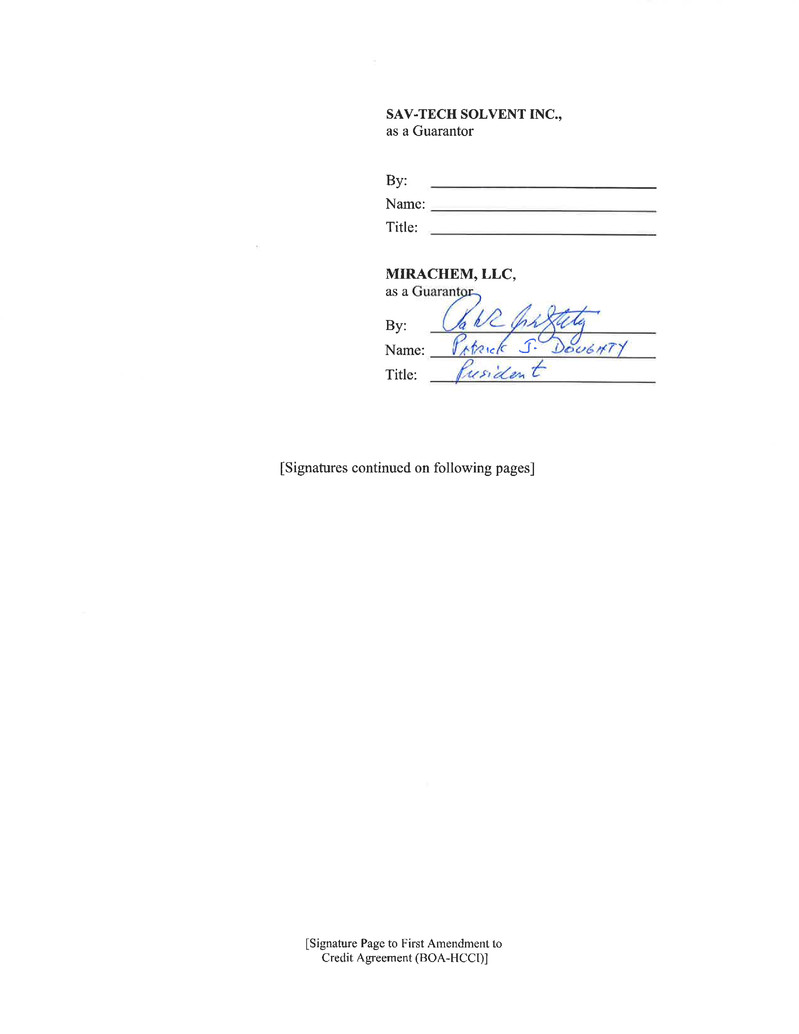

MIRACHEM, LLC,

asa

//¿By:

Name:

Title:

lc I

Zz"

[Signatures continued on following pages]

fSignature Page to First Amendment to

Credit Agreement (BOA-HCCI)I