Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ABRAXAS PETROLEUM CORP | julypresentation.htm |

Abraxas Petroleum Corporation

The Bakken Conference & Expo

July 2017

Exhibit 99.1

The information presented herein may contain predictions, estimates and other forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Although the Company believes that its expectations are based on

reasonable assumptions, it can give no assurance that its goals will be achieved.

Important factors that could cause actual results to differ materially from those included in the forward-looking statements include the timing and extent

of changes in commodity prices for oil and gas, availability of capital, the need to develop and replace reserves, environmental risks, competition,

government regulation and the ability of the Company to meet its stated business goals.

Oil and Gas Reserves. The SEC permits oil and natural gas companies, in their SEC filings, to disclose only reserves anticipated to be economically

producible, as of a given date, by application of development projects to known accumulations. We use certain terms in this presentation, such as total

potential, de-risked, and EUR (expected ultimate recovery), that the SEC’s guidelines strictly prohibit us from using in our SEC filings. These terms

represent our internal estimates of volumes of oil and natural gas that are not proved reserves but are potentially recoverable through exploratory

drilling or additional drilling or recovery techniques and are not intended to correspond to probable or possible reserves as defined by SEC regulations. By

their nature these estimates are more speculative than proved, probable or possible reserves and subject to greater risk they will not be realized.

Non-GAAP Measures. Included in this presentation are certain non-GAAP financial measures as defined under SEC Regulation G. Investors are urged to

consider closely the disclosure in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and its subsequently filed

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and the reconciliation to GAAP measures provided in this presentation.

Initial production, or IP, rates, for both our wells and for those wells that are located near our properties, are limited data points in each well’s

productive history. These rates are sometimes actual rates and sometimes extrapolated or normalized rates. As such, the rates for a particular well may

change as additional data becomes available. Peak production rates are not necessarily indicative or predictive of future production rates, expected

ultimate recovery, or EUR, or economic rates of return from such wells and should not be relied upon for such purpose. Equally, the way we calculate and

report peak IP rates and the methodologies employed by others may not be consistent, and thus the values reported may not be directly and

meaningfully comparable. Lateral lengths described are indicative only. Actual completed lateral lengths depend on various considerations such as lease-

line offsets. Standard length laterals, sometimes referred to as 5,000 foot laterals, are laterals with completed length generally between 4,000 feet and

5,500 feet. Mid-length laterals, sometimes referred to as 7,500 foot laterals, are laterals with completed length generally between 6,500 feet and 8,000

feet. Long laterals, sometimes referred to as 10,000 foot laterals, are laterals with completed length generally longer than 8,000 feet.

Forward-Looking Statements

2

Headquarters.......................... San Antonio

Employees(1)............................ 84

Shares outstanding(2)……......... 163.9 mm

Market cap(2) …………………….... $265.4 mm

Net debt(2)……………………………. $20.7 mm

2017E CAPEX……………………….. $110 mm

(1)

(2)

(3)

(4)

(5)

(6)

(7)

Abraxas full time employees as of March 31, 2017. Does not include 25 employees associated with the Company’s wholly owned subsidiary, Raven Drilling.

Shares outstanding as of May 5, 2017. Market cap using share price as of June 30, 2017. Total debt including RBL facility and building mortgage less cash as of March 31, 2017

Enterprise value includes working capital deficit (excluding current hedging assets and liabilities) as of March 31, 2017, but does not include building mortgage. Includes RBL facility and building mortgage less cash as of March 31, 2017.

Proved reserves as of December 31, 2016. See appendix for reconciliation of PV-10 to standardized measure.

Net book value of other assets as of March 31, 2017.

Average production for the quarter ended March 31, 2017

Calculation using average production for the quarter ended March 31, 2017 annualized and net proved reserves as of December 31, 2016.

EV/BOE(2,3)…………………………… $6.67

Proved Reserves(4)……………….. 44.7 mmboe

NBV Non-Oil & Gas Assets(5)… $22.2 mm

Production(6).……………………….. 6,820 boepd

R/P Ratio(7)…………………………… 17.9x

NASDAQ: AXAS

3

Corporate Profile

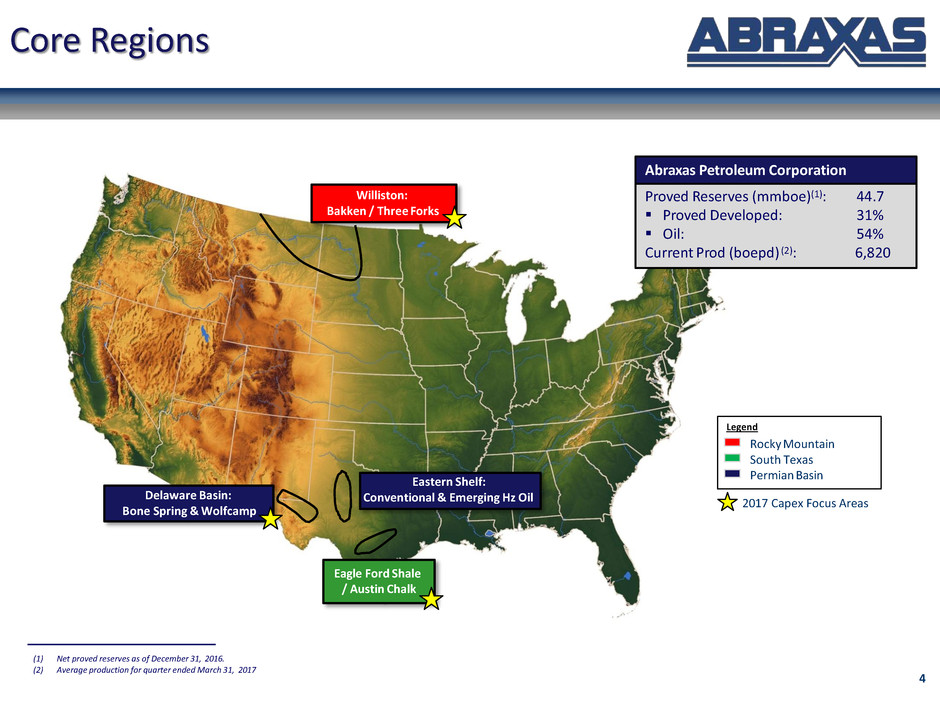

Williston:

Bakken / Three Forks

Eastern Shelf:

Conventional & Emerging Hz Oil

Eagle Ford Shale

/ Austin Chalk

Delaware Basin:

Bone Spring & Wolfcamp

Legend

Rocky Mountain

South Texas

Permian Basin

Proved Reserves (mmboe)(1): 44.7

Proved Developed: 31%

Oil: 54%

Current Prod (boepd) (2): 6,820

Abraxas Petroleum Corporation

Core Regions

(1) Net proved reserves as of December 31, 2016.

2017 Capex Focus Areas

(2) Average production for quarter ended March 31, 2017

4

Area

Capital

($MM)

% of

Total

Gross

Wells

Net

Wells

Permian - Delaware $56.5 51.4% 7.0 6.0

Bakken/Three Forks 42.2 38.4% 13.0 6.6

Eagle Ford/Austin Chalk 11.0 10.0% 2.0 2.0

Other 0.3 0.3% 0.0 0.0

Total $110.0 100% 22.0 14.6

2017 Operating and Financial Guidance

2017 Capex Budget Allocation 2017 Operating Guidance

Operating Costs

Low

Case

High

Case

LOE ($/BOE) $6.00 $8.00

Production Tax (% Rev) 8.0% 10.0%

Cash G&A ($mm) $10.0 $12.5

Production (boepd) 7,800 8,600

(1) Yearly CAPEX for each year ending December 31, 2012, 2013, 2014, 2015 and 2016. 2017 based on management guidance.

(2) 2017 estimates assume the midpoint of 2017 guidance.

66% 22%

2017 Expected Production Mix

12%

Oil Gas NGL

$0

$50,000

$100,000

$150,000

$200,000

$250,000

7,500

6,000

4,500

3,000

1,500

0

9,000

2

0

1

2

A

2

0

1

3

A

2

0

1

4

A

2

0

1

5

A

2

0

1

6

A

2

0

1

7

E

(2

)

Daily Production vs Yearly CAPEX (2)

5

6

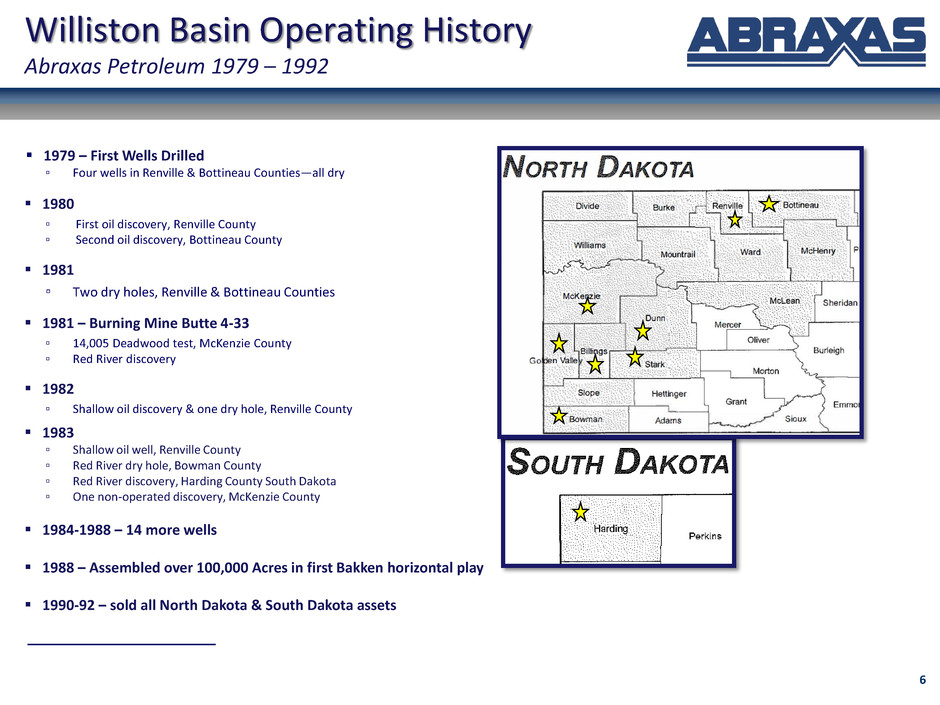

Williston Basin Operating History

Abraxas Petroleum 1979 – 1992

1979 – First Wells Drilled

▫ Four wells in Renville & Bottineau Counties—all dry

1980

▫ First oil discovery, Renville County

▫ Second oil discovery, Bottineau County

1981

▫ Two dry holes, Renville & Bottineau Counties

1981 – Burning Mine Butte 4-33

▫ 14,005 Deadwood test, McKenzie County

▫ Red River discovery

1982

▫ Shallow oil discovery & one dry hole, Renville County

1983

▫ Shallow oil well, Renville County

▫ Red River dry hole, Bowman County

▫ Red River discovery, Harding County South Dakota

▫ One non-operated discovery, McKenzie County

1984-1988 – 14 more wells

1988 – Assembled over 100,000 Acres in first Bakken horizontal play

1990-92 – sold all North Dakota & South Dakota assets

7

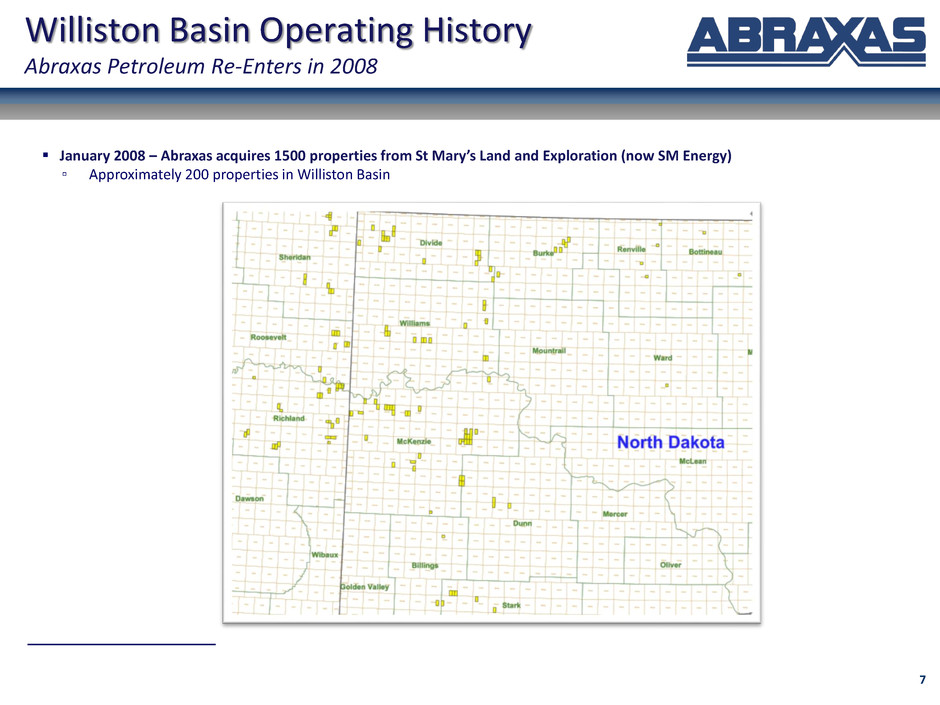

January 2008 – Abraxas acquires 1500 properties from St Mary’s Land and Exploration (now SM Energy)

▫ Approximately 200 properties in Williston Basin

Williston Basin Operating History

Abraxas Petroleum Re-Enters in 2008

8

2011

▫ Built Raven Rig #1

▫ 2,000 HP walking rig capable of pad drilling

2012

▫ Commenced operated Bakken-Three Forks drilling program

▫ 2013 Sold most Non-Op Bakken Assets

▫ Concentration on operated position at North Fork, McKenzie County

Williston Basin Operating History

Abraxas Petroleum Becomes a Bakken Operator

9

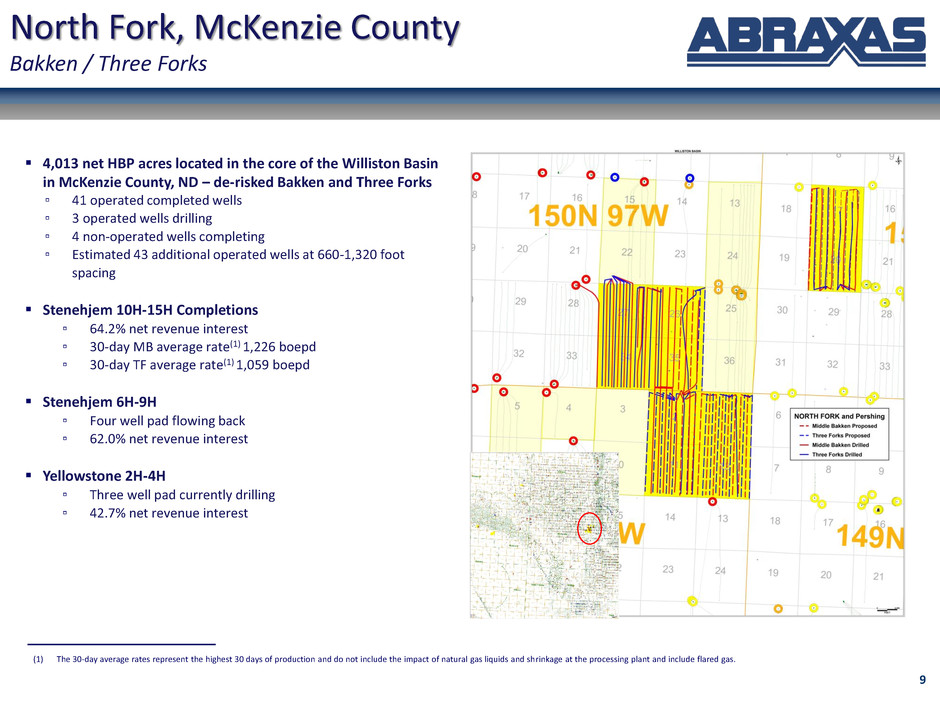

North Fork, McKenzie County

Bakken / Three Forks

4,013 net HBP acres located in the core of the Williston Basin

in McKenzie County, ND – de-risked Bakken and Three Forks

▫ 41 operated completed wells

▫ 3 operated wells drilling

▫ 4 non-operated wells completing

▫ Estimated 43 additional operated wells at 660-1,320 foot

spacing

Stenehjem 10H-15H Completions

▫ 64.2% net revenue interest

▫ 30-day MB average rate(1) 1,226 boepd

▫ 30-day TF average rate(1) 1,059 boepd

Stenehjem 6H-9H

▫ Four well pad flowing back

▫ 62.0% net revenue interest

Yellowstone 2H-4H

▫ Three well pad currently drilling

▫ 42.7% net revenue interest

(1) The 30-day average rates represent the highest 30 days of production and do not include the impact of natural gas liquids and shrinkage at the processing plant and include flared gas.

10

Bakken/Three Forks

Completion Design

Highlights

• Cemented liners and high density perf

clusters

o create more frac points

o enhance SRV

o help localize the stimulation.

• PLA diverters

o used to increase cluster efficiency

• Focusing on increasing total energy

o more fluid & prop usage

o higher pump rate

Metrics

• Prop - 870 lbs/ft

• Fluid – 15 bbls/ft

• Fluid type - HCFR

• Staging – 240’/stage

• Clusters – 12 /stage

• Perfs – 2/cluster, 180 deg phase

• Pump rate – 50 BPM

11

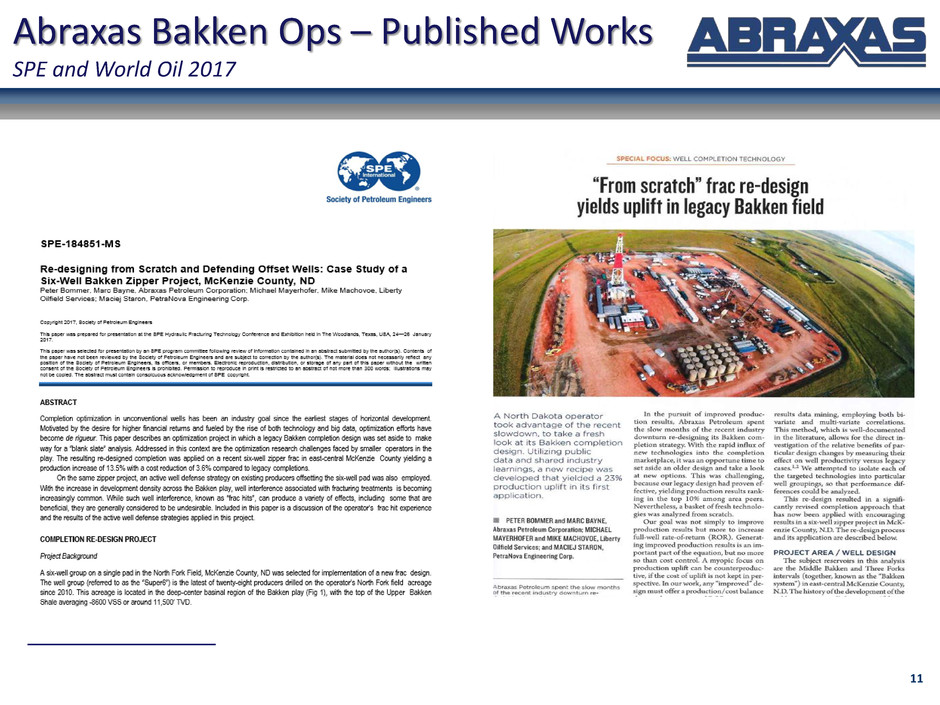

Abraxas Bakken Ops – Published Works

SPE and World Oil 2017

Middle Bakken

North Fork Economics

Middle Bakken: ROR vs WTI Middle Bakken: Type Curve Assumptions

Abraxas EOY16 Assumptions

845 MBOE gross type curve

▫ 76% Oil

▫ Initial rate: 1120 boepd

▫ di: 98.5%

▫ dm: 8.0%

▫ b-factor: 1.5

CWC: $6.0 million

12

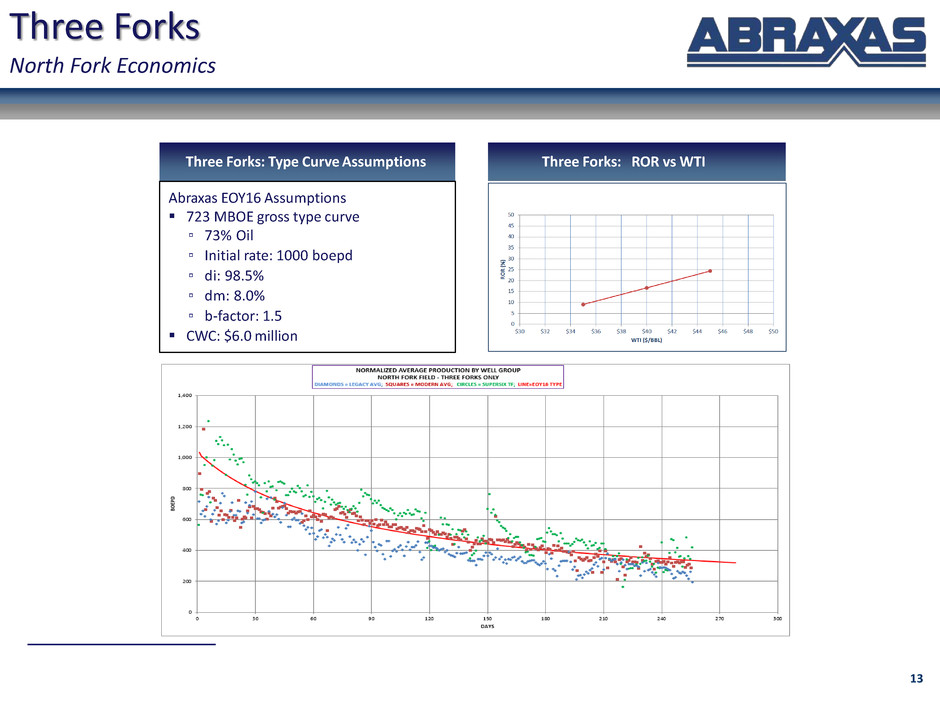

Three Forks

North Fork Economics

Three Forks: ROR vs WTI Three Forks: Type Curve Assumptions

Abraxas EOY16 Assumptions

723 MBOE gross type curve

▫ 73% Oil

▫ Initial rate: 1000 boepd

▫ di: 98.5%

▫ dm: 8.0%

▫ b-factor: 1.5

CWC: $6.0 million

13

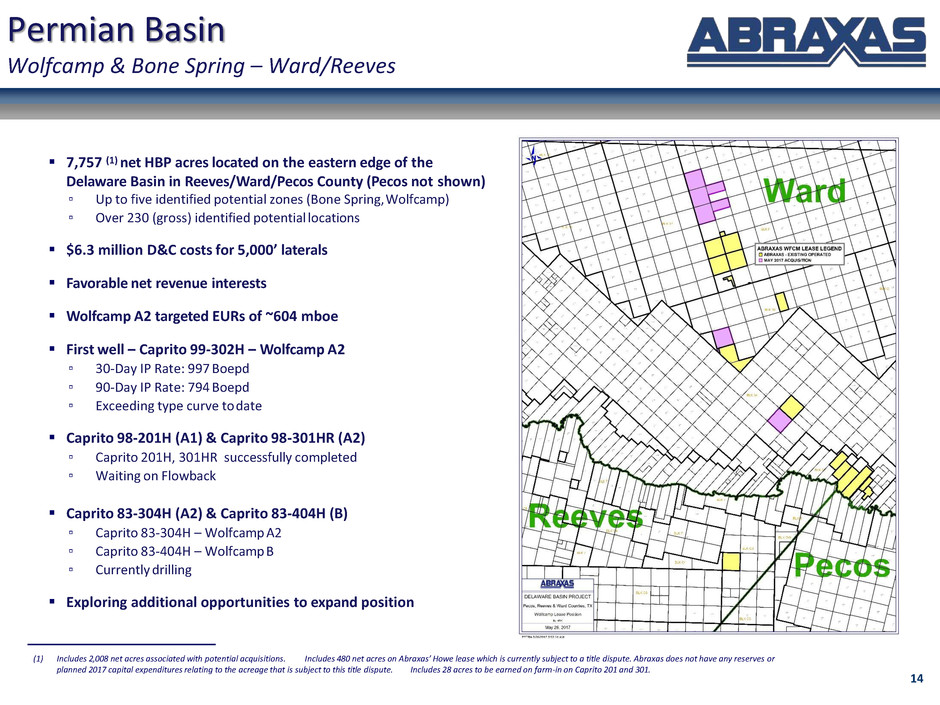

7,757 (1) net HBP acres located on the eastern edge of the

Delaware Basin in Reeves/Ward/Pecos County (Pecos not shown)

▫ Up to five identified potential zones (Bone Spring, Wolfcamp)

▫ Over 230 (gross) identified potential locations

$6.3 million D&C costs for 5,000’ laterals

Favorable net revenue interests

Wolfcamp A2 targeted EURs of ~604 mboe

First well – Caprito 99-302H – Wolfcamp A2

▫ 30-Day IP Rate: 997 Boepd

▫ 90-Day IP Rate: 794 Boepd

▫ Exceeding type curve to date

Caprito 98-201H (A1) & Caprito 98-301HR (A2)

▫ Caprito 201H, 301HR successfully completed

▫ Waiting on Flowback

Caprito 83-304H (A2) & Caprito 83-404H (B)

▫ Caprito 83-304H – Wolfcamp A2

▫ Caprito 83-404H – Wolfcamp B

▫ Currently drilling

Exploring additional opportunities to expand position

(1) Includes 2,008 net acres associated with potential acquisitions. Includes 480 net acres on Abraxas’ Howe lease which is currently subject to a title dispute. Abraxas does not have any reserves or

planned 2017 capital expenditures relating to the acreage that is subject to this title dispute. Includes 28 acres to be earned on farm-in on Caprito 201 and 301.

Permian Basin

Wolfcamp & Bone Spring – Ward/Reeves

14

Wolfcamp

Completion Design

Highlights

• High rate, high volume slickwater

• High density perf clusters

o create more frac points

o enhance SRV

o help localize the stimulation.

• PLA diverters

o used to increase cluster efficiency

Metrics

• Prop - 2400 lbs/ft

• Fluid – 80 bbls/ft

• Fluid type - Slickwater

• Staging – 190’/stage

• Clusters – 10 /stage

• Perfs – 2/cluster, 180 deg phase

• Pump rate – 90 BPM

15

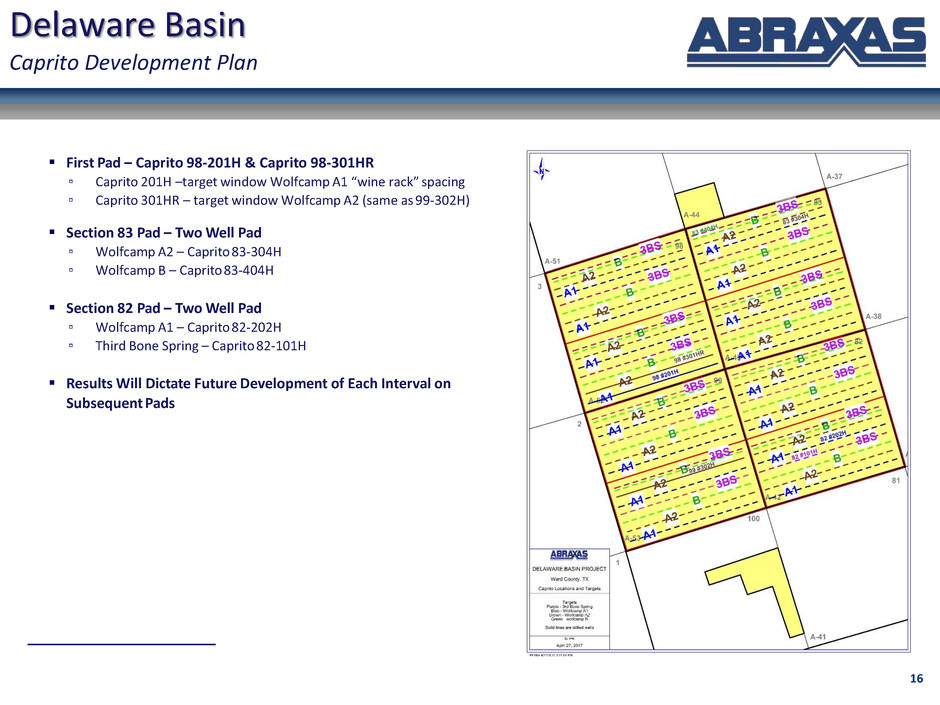

Delaware Basin

Caprito Development Plan

First Pad – Caprito 98-201H & Caprito 98-301HR

▫ Caprito 201H –target window Wolfcamp A1 “wine rack” spacing

▫ Caprito 301HR – target window Wolfcamp A2 (same as 99-302H)

Section 83 Pad – Two Well Pad

▫ Wolfcamp A2 – Caprito 83-304H

▫ Wolfcamp B – Caprito 83-404H

Section 82 Pad – Two Well Pad

▫ Wolfcamp A1 – Caprito 82-202H

▫ Third Bone Spring – Caprito 82-101H

Results Will Dictate Future Development of Each Interval on

Subsequent Pads

(1)

(1)

16

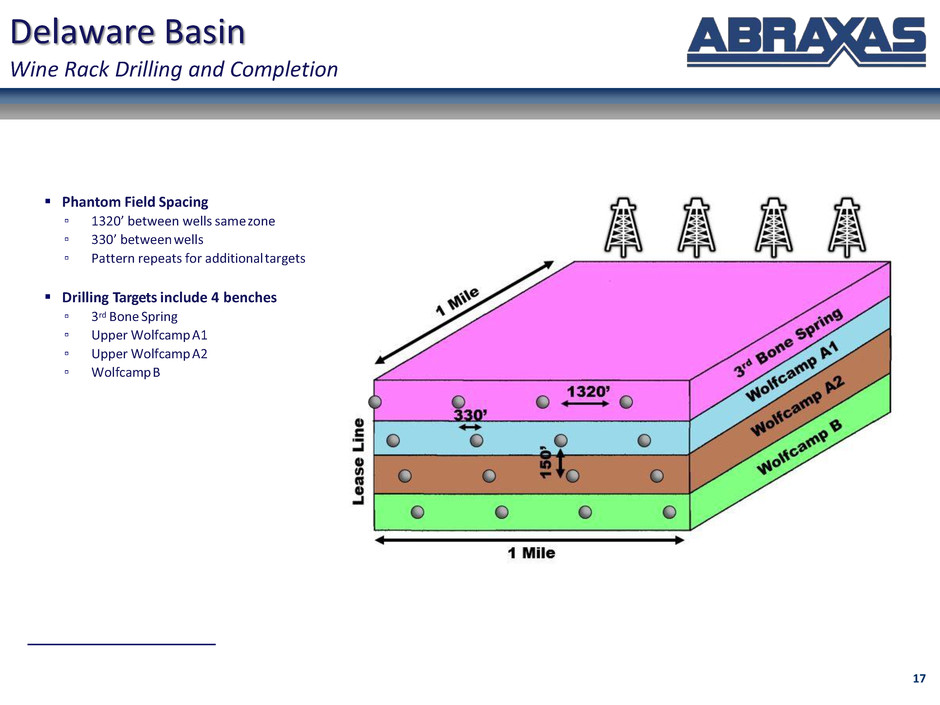

Delaware Basin

Wine Rack Drilling and Completion

Phantom Field Spacing

▫ 1320’ between wells same zone

▫ 330’ between wells

▫ Pattern repeats for additional targets

Drilling Targets include 4 benches

▫ 3rd Bone Spring

▫ Upper Wolfcamp A1

▫ Upper Wolfcamp A2

▫ Wolfcamp B

17

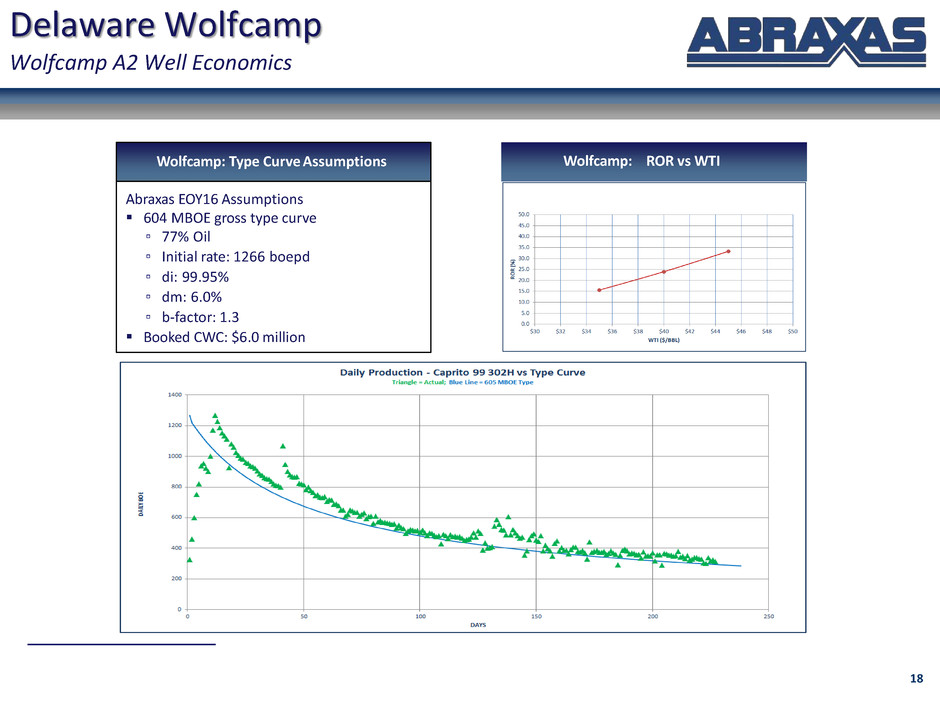

Delaware Wolfcamp

Wolfcamp A2 Well Economics

Wolfcamp: ROR vs WTI Wolfcamp: Type Curve Assumptions

Abraxas EOY16 Assumptions

604 MBOE gross type curve

▫ 77% Oil

▫ Initial rate: 1266 boepd

▫ di: 99.95%

▫ dm: 6.0%

▫ b-factor: 1.3

Booked CWC: $6.0 million

18

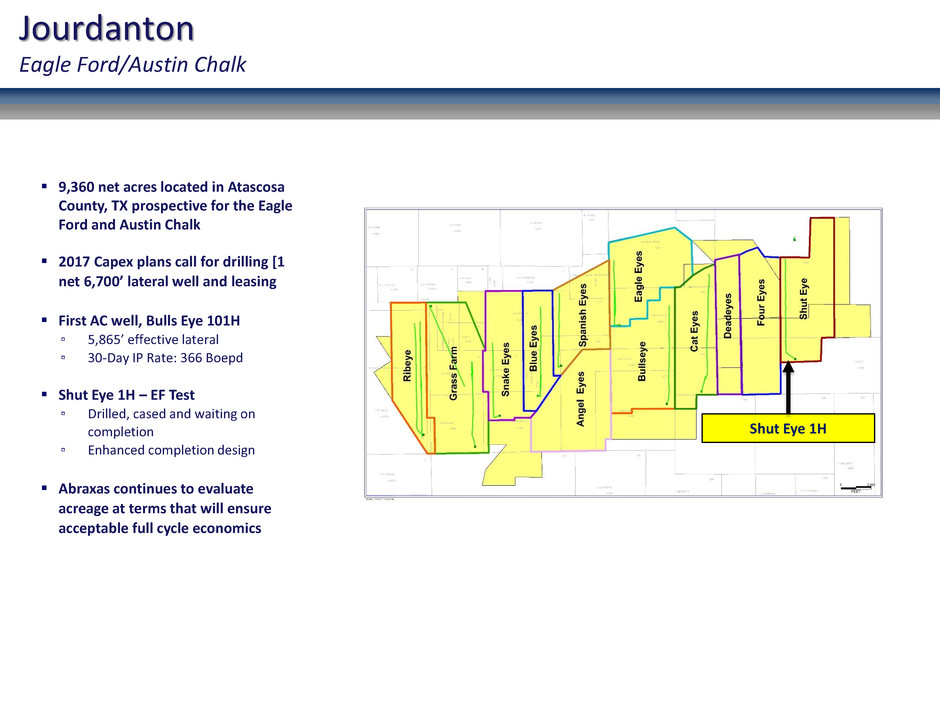

Shut Eye 1H

9,360 net acres located in Atascosa

County, TX prospective for the Eagle

Ford and Austin Chalk

2017 Capex plans call for drilling [1

net 6,700’ lateral well and leasing

First AC well, Bulls Eye 101H

▫ 5,865’ effective lateral

▫ 30-Day IP Rate: 366 Boepd

Shut Eye 1H – EF Test

▫ Drilled, cased and waiting on

completion

▫ Enhanced completion design

Abraxas continues to evaluate

acreage at terms that will ensure

acceptable full cycle economics

Jourdanton

Eagle Ford/Austin Chalk