Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32.1 - Santa Fe Gold CORP | ex32z1.htm |

| EX-31 - EXHIBIT 31.2 - Santa Fe Gold CORP | ex31z2.htm |

| EX-31 - EXHIBIT 31.1 - Santa Fe Gold CORP | ex31z1.htm |

| EX-23 - EXHIBIT 23.2 - Santa Fe Gold CORP | ex23z2.htm |

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2015

or

o TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transaction period from ___________ to _________

Commission File No. 001-12974

SANTA FE GOLD CORPORATION |

(Exact name of registrant as specified in its charter) |

Delaware |

| 84-1094315 |

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

3544 Rio Grande Blvd., NW, Albuquerque, NM 87107

(Address of principal executive offices, Zip Code)

(505)255-4852

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

(Title of each class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. o Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

1

Large accelerated filer | o | Accelerated filer | o |

Non-accelerated filer | o | Smaller reporting company | x |

(Do not check if a smaller reporting company) | Emerging growth company | o | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes x No

The aggregate market value of voting common shares held by non-affiliates of the registrant on second fiscal quarter ended December 31, 2015, was approximately $170,949 based on the last reported sale price of the registrant’s common stock as reported on the OTC Marketplace operated by OTB Market Group, Inc. on December 31, 2015.

As of June 28, 2017, there were 270,171,343 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

2

TABLE OF CONTENTS

| Page | |

|

|

|

| PART I |

|

|

|

|

ITEM 1: | BUSINESS | 5 |

ITEM 1A: | RISK FACTORS | 9 |

ITEM 1B: | UNRESOLVED STAFF COMMENTS | 12 |

ITEM 2: | PROPERTIES | 12 |

ITEM 3: | LEGAL PROCEEDINGS | 14 |

ITEM 4: | MINE SAFETY DISCLOSURES | 14 |

|

|

|

| PART II |

|

|

|

|

ITEM 5: | MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASES OF EQUITY SECURITIES | 14 |

ITEM 6: | SELECTED FINANCIAL DATA | 16 |

ITEM 7: | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION | 16 |

ITEM 7A: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 22 |

ITEM 8: | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 22 |

ITEM 9: | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 55 |

ITEM 9A | CONTROLS AND PROCEDURES | 55 |

ITEM 9B: | OTHER INFORMATION | 56 |

|

|

|

| PART III |

|

|

|

|

ITEM 10: | DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE | 57 |

ITEM 11: | EXECUTIVE AND DIRECTOR COMPENSATION | 59 |

ITEM 12: | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 63 |

ITEM 13: | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 65 |

ITEM 14: | PRINCIPAL ACCOUNTING FEES AND SERVICES | 65 |

|

|

|

| PART IV |

|

|

|

|

ITEM 15: | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 66 |

|

|

|

SIGNATURES |

| 75 |

3

ADDITIONAL INFORMATION

Descriptions of agreements or other documents contained in this report are intended as summaries and are not necessarily complete. Please refer to the agreements or other documents filed or incorporated herein by reference as exhibits. Please see the exhibit index at the end of this report for a complete list of those exhibits.

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K or documents incorporated by reference may contain certain “forward-looking” statements as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent the registrant’s expectations or beliefs, including but not limited to, statements concerning the registrant’s operations, economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intent,” “could,” “estimate,” “might,” “plan,” “predict” or “continue” or the negative or other variations thereof or comparable terminology are intended to identify forward-looking statements. This information may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from the future results, performance or achievements expressed or implied by any forward-looking statements.

This annual report contains forward-looking statements, many assuming that the Company secures adequate financing and is able to continue as a going concern, including statements regarding, among other things:

our ability to continue as a going concern;

we will require additional financing in the future restart production at the Summit Mine property and to bring it into sustained commercial production;

our dependence on our Summit project for our future operating revenue, which property currently has limited proven or probable reserves;

our mineralized material calculations at the Summit property and other projects are only estimates and are based principally on historic data;

actual capital costs, operating costs, production and economic returns may differ significantly from those that we have anticipated;

exposure to all of the risks associated with restarting and establishing new mining operations, if the development of one or more of our mineral projects is found to be economically feasible;

title to some of our mineral properties may be uncertain or defective;

land reclamation and mine closure may be burdensome and costly;

significant risk and hazards associated with mining operations;

we will require additional financing in the future to develop a mine at any other projects, including the Ortiz and Mogollon projects;

the requirements that we obtain, maintain and renew environmental, construction and mining permits, which is often a costly and time-consuming process and may be opposed by local environmental group;

our anticipated needs for working capital;

our ability to secure financing;

claims and legal proceedings against us;

our lack of necessary financial resources to complete development of our projects and the uncertainty of our future financing plans,

our exposure to material costs, liabilities and obligations as a result of environmental laws and regulations (including changes thereto) and permits;

changes in the price of silver and gold;

extensive regulation by the U.S. government as well as state and local governments;

our projected sales and profitability;

anticipated trends in our industry;

unfavorable weather conditions;

the lack of commercial acceptance of our product or by-products;

problems regarding availability of materials and equipment;

4

failure of equipment to process or operate in accordance with specifications, including expected throughput, which could prevent the production of commercially viable output; and

our ability to seek out and acquire high quality gold, silver and/or copper properties.

These statements may be found under “Management’s Discussion and Analysis or Plan of Operations” and “Business,” as well as in this annual report generally. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this annual report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this annual report will in fact occur. We caution you not to place undue reliance on these forward-looking statements. In addition to the information expressly required to be included in this annual report, we will provide such further material information, if any, as may be necessary to make the required statements, in light of the circumstances under which they are made, not misleading.

These risks and uncertainties and other factors include, but are not limited to, those set forth under Item1A.Risk Factors”. All subsequent written and oral forward-looking statements attributable to the company or to persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Given these risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements.

PART I

ITEM 1. BUSINESS |

|

History and Organization

Santa Fe Gold Corporation (“Santa Fe”, "the Company”, “our” or “we”) is a U.S. mining company, incorporated in 1991 in the state of Delaware. Our general business strategy is to acquire explore, develop and to create shareholder value. The Company acquired the Summit project in 2006 and in subsequent years completed engineering studies, raised capital financing, built a process mill, partially developed an underground mine, and began processing mineralized material in 2010. The operation was consistently under-capitalized and on November 8, 2013, the Company suspended all mining and milling operations and placed its Summit mine and mill on care and maintenance for lack of working capital.

As a consequence of chronic underfunding, constrained liquidity, an overly-leveraged balance sheet, operational and management challenges and declining precious metals prices, for the past several years Santa Fe have pursued a strategic or financial partner. In this regard, Santa Fe has entered into three strategic transactions, all of which were subject to certain customary conditions, but unfortunately, they all failed in resolving the issues of Santa Fe Gold.

At this time, each of the projects is non-operational, because of the lack the funding to conduct additional technical work, including drilling and sampling, to reclassify some of the mineralized material at the Summit Project as “reserves,” and to restart any mining, milling, or processing activities. Consequently, there was no way of generating income. With no available cash or even the prospect of generating cash flow, we faced multiple threats, including, without limitation, litigation with the Summit Mine

royalty holder for past due royalties, collection efforts of a judgment creditor, and defaults under numerous debt instruments including, without limitation, the Pre-Petition Credit Agreement and the Sandstorm Gold Supply Agreement. In light of these challenges, along with their failed restructuring efforts to date, Santa Fe have determined that they have no choice but to aggressively pursue and consider all possible transaction scenarios. Most recently, Santa Fe began working with Canaccord Genuity, Inc. (“Canaccord”) as their investment banker to assist with these efforts. Their role has included negotiating with interested parties, preparing for and initiating marketing efforts, and facilitating due diligence requests for the sale of all assets.

In August 2015 the Company filed for Chapter 11 Bankruptcy protection in Delaware in order to secure the existing assets from creditor actions. Case No. 15-11761 (MFW). In the declaration of our CEO on the petition he states: “On the date hereof (the “Petition Date”), the Debtors filed voluntary petitions for relief under Chapter 11 of title 11 of the United States Code, 11 U.S.C. §§ 101-1532 (the “Bankruptcy Code”). As discussed, the Debtors’ primary objective in commencing these Chapter 11 cases is to pursue an expedited sale of their assets in order to maximize value for all shareholders.” See NOTE 19 – CHAPTER 11 and 363 ASSET SALE to the financial statements for more information.

Recent Developments

On July 15, 2014, we entered into a Share Exchange Agreement (the "Share Exchange Agreement") with Canarc Resource Corp., a British Columbia, and a Canada corporation whose common shares are listed on the TSX Exchange under the symbol CCM ("Canarc"). Under the terms of the Share Exchange Agreement, the Company will issue 66,000,000 shares of its common stock to

5

Canarc and, in exchange, Canarc will issue 33,000,000 of its common shares to the Company (the "Share Exchange"). Upon consummation of the Share Exchange, the Company will own approximately 17 percent of Canarc’s outstanding common shares and Canarc will own approximately 34 percent of Santa Fe's outstanding common shares. The Share Exchange Agreement contains representations, warranties, conditions and covenants of the parties customary for transactions of this type.

The purpose of the Share Exchange is to facilitate a significant turnaround for Santa Fe and a material new opportunity for Canarc driven by the appointment of Canarc nominees to the Santa Fe management team and Board of Directors, the re-capitalization of Santa Fe, the re-structuring of Santa Fe secured debt and re-development of its Summit gold-silver mine in New Mexico to production while preserving Santa Fe’s net operating loss carry-forwards totaling in excess of $88 million. The Agreement contains representations, warranties, conditions and covenants of the parties customary for transactions of this type.

In connection with the Share Exchange Agreement, the Company entered into a “best efforts” placement agency agreement with Euro Pacific Capital, Inc. ("Euro Pacific") pursuant to which Euro Pacific agreed to act as placement agent for the Company and use its "best-efforts" to complete the proposed private placement of 8% Subordinated Secured Redeemable GLD Share Delivery Notes and a Detachable Common Stock Purchase Warrant in the aggregate principal amount between $20 million to $22 million. Euro Pacific did not place any securities or raise any capital for the Company. The Euro Pacific best efforts placement agency agreement expired by its terms on September 30, 2014.

Because Euro Pacific failed to raise any capital pursuant to its best-efforts placement agreement, and because the gold and silver prices have declined sharply in recent months, the Company changed its operational strategy from a mine restart plan to a resource drilling and engineering program. Presently, in light of recent historical operational results, combined with lower metal prices, the Company is reporting no reserves for the Summit property. As such, the Company’s strategy was to conduct additional technical work, including drilling and sampling, to reclassify some of the mineralized material at the Summit project as reserves.

Santa Fe’s management and independent special committee have both discussed this change in strategy with Santa Fe’s senior secured creditor, Waterton Global Value, L.P. (“Waterton”). Waterton has indicated support for the Company’s resource drilling strategy. In this regard, Santa Fe is attempting to generate and evaluate several term sheets to provide necessary funding for its revised work program. No assurances can be given that funding for the program will be secured or that the program will be successful.

The Share Exchange Agreement provided that it would terminate, unless a closing of the transactions contemplated occurred on or before October 15, 2014. Since the transactions did not close, the Share Exchange Agreement terminated pursuant to its terms on October 15, 2014.

In connection with the strategic Share Exchange:

Santa Fe’s senior secured creditors, Waterton, Sandstorm Gold Ltd. and Sandstorm Gold (Barbados) Ltd. (“Sandstorm”) entered into respective agreements that demonstrate that they are supportive of the share exchange transaction and that they are amenable to restructuring collectively approximately $20 million of Santa Fe indebtedness. These restructuring agreements are conditional upon the consummation of the transactions contemplated by the Share Exchange Agreement by October 15, 2014. Since Euro Pacific did not raise any funds for Santa Fe pursuant to the terms of the best-efforts placement agency agreement, the transactions contemplated by the Share Exchange Agreement will not likely be consummated by October 15, 2014. Santa Fe has informed Waterton of this development and its revised operation strategy to complete a resource drilling and engineering program at its Summit mine. Waterton has expressed its support for such a program. However, Waterton can revoke its support at any time and notice Santa Fe in default.

Mr. Bradford Cooke, Chairman and Founder of Canarc and Founder and CEO of Endeavour Silver Corp. (NYSE:EXK TSX:EDR) was appointed as Chairman of Santa Fe and Santa Fe’s board of directors.

Canarc CEO, Catalin Chiloflischi has been appointed President and Chief Executive Officer and Director of Santa Fe and Canarc Chief Operating Officer, Garry Biles has been appointed Chief Operating Officer of Santa Fe.

If the transaction contemplated by the Share Exchange Agreement is not consummated and a superior strategic relationship is not available to Santa Fe, or if the Company fails to restructure or refinance its secured indebtedness with Waterton and Sandstorm (the “Debt Restructurings”), or should any of such indebtedness be accelerated, the Company will not have adequate liquidity to fund its operations, meet its obligations (including its debt payment obligations) and continue as a going concern, and will be forced to seek relief under Chapters 11 or 7 of the U.S. Bankruptcy Code (or an involuntary petition for bankruptcy relief or similar creditor action may be filed against it). See Item 1A, “Risk Factors - In the event that we are unable to raise additional capital to satisfy the terms and conditions of the negotiated restructuring of our senior secured indebtedness, we may be forced to seek reorganization or liquidation under the U.S. Bankruptcy Code.”

6

On July 17, 2014, in connection with the Share Exchange Agreement, the Company filed a Form 8-K, which disclosed the Company’s agreement with Canarc that “until the closing of the proposed gold bond financing Messrs. Cooke, Chiloflischi and Biles will be serving without any cash compensation.” On October 3, 2014, Canarc sent an invoice for payment of “allocated” Canarc salaries and expenses for Messrs. Cooke, Chiloflischi, Biles management and expenses fees in the amount of $98,782. After consultation with the Company’s corporate counsel, the Audit Committee determined that Canarc’s demand for payment of such fees was without any valid basis and contradicts the Company’s public disclosures. The Company informed Canarc that the Company cannot accept such invoice from Canarc. In response, Mr. Cooke, Chairman of both the Company and Canarc, demanded that unless the Company accepts Canarc’s invoice, Canarc will terminate the share exchange agreement now and litigate. The Company has informed Canarc that it cannot accept Canarc’s invoice. Subsequently, Canarc has withdrawn the invoice as well as its litigation and termination threats. However, conflicts of interests exist among Canarc affiliated members of the board of directors, on the one hand, and Santa Fe and its stockholders, on the other hand. See Risk Factors -- Conflicts of interest exist among the Company, members of our management team and directors affiliated with Canarc. Canarc affiliated members of our management team and two of our directors owe fiduciary duties to both the Company and Canarc, which may permit them to favor Canarc’s interests to the detriment of Santa Fe and its stockholders.” Canarc and its management were unable to secure the promised funding and they all resigned from their respective positions at Santa Fe Gold and our agreement was terminated on October 15, 2014

Competitive Business Conditions

Many companies are engaged in the acquisition, exploration, development and mining of mineral properties. We are at a disadvantage with respect to those competitors whose technical staff and financial resources exceed our own. Although the Company made appointments to management and the Board of Directors in 2014 to enhance our technical capabilities and experience, our lack of revenues and limited financial resources further hinder our ability to acquire and develop mineral interests.

Government Regulations and Permits

In connection with mining, milling and exploration activities, we are subject to extensive federal, state and local laws and regulations governing the protection of the environment, including laws and regulations relating to protection of air and water quality, hazardous waste management and mine reclamation as well as the protection of endangered or threatened species.

See Item IA. “Risk Factors” for more information.

Reclamation

We generally will be required to mitigate long-term environmental impacts by stabilizing, contouring, re-sloping and revegetating various portions of a site after mining and mineral processing operations are completed. These reclamation efforts would be conducted in accordance with detailed plans, which must be reviewed and approved by the appropriate regulatory agencies.

Our mining operations and exploration activities are subject to various national, state, provincial and local laws and regulations in the United States, and the State of New Mexico, which govern mining, milling, prospecting, development, production, exports, taxes, labor standards, occupational health, and waste disposal, protection of the environment, mine safety, hazardous substances and other matters. For our Summit Project, we have obtained or have pending applications for those licenses, permits or other authorizations currently required conducting our exploration and other programs. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and regulations in all of the jurisdictions in which we operate. There are no current orders or directions relating to us with respect to the foregoing laws and regulations.

Environmental Regulation

Our projects are subject to various federal, state and local laws and regulations governing protection of the environment. These laws are continually changing and, in general, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our operations are conducted in material compliance with applicable laws and regulations.

Changes to current local, state or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could impact the economics of our projects.

7

During our fiscal year ended June 30, 2015, none of our project sites had any material non-compliance occurrences with any applicable environmental regulations.

Significant Developments in Fiscal 2015

Suspension of Mining Operations.

On November 8, 2013, the Company suspended all mining operations and placed its Summit mine and mill on a care and maintenance program due to significant operating losses and a lack of working capital and remained that way for fiscal 2015.

Proposed Tyhee Merger

On January 23, 2014, the Company entered into a definitive merger agreement (the “Merger Agreement”) with Tyhee Gold Corp. (TSX Venture: TDC) (“Tyhee”), and Tyhee Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Tyhee (“Merger Sub”). In connection with the execution of the Merger Agreement, each of Santa Fe’s three senior secured creditors, Waterton, Sandstorm and International Goldfields Limited (“IGS”), entered into respective preliminary agreements to restructure collectively more than $23.1 million of Santa Fe indebtedness (collectively, the “Debt Restructurings”).

In connection with the Merger, Tyhee advanced only $1,745,092 under a $3 million bridge loan agreement, which is presently due and payable. On March 23, 2014, the Company announced that it had terminated the Merger Agreement as a result of Tyhee’s failure to close the Qualified Financing of $20 million and that it demanded payment from Tyhee of a $300,000 break-fee that Tyhee was obligated to pay. Tyhee has not paid $300,000 the break-fee. Tyhee has not advanced any additional funds under Bridge Loan and has given notice to Santa Fe that Santa Fe in default under the Bridge Loan. Tyhee has demanded that Santa Fe repay the amounts advanced $1,745,082 to Santa Fe together with accrued interest and other costs. Tyhee has not paid the $300,000 break fee to Santa Fe as required by the Merger Agreement. Also, Tyhee has failed to return Santa Fe’s confidential information pursuant to the terms of a Confidentiality Agreement between Santa Fe and Tyhee. Santa Fe has commenced legal action against Tyhee and its chief executive officer for injunctive relief and conversion of Santa Fe’s confidential information.

Amendment and Restated Mogollon Option Agreement

Due to lack of funding Santa Fe Gold did elect not making the final payment on or before June 30, 2015 and let the agreement with the last amendment from June 28, 2013 expire without further payments or obligations.

Waterton

On June 30, 2013, the Company signed a Waiver of Default Letter (the “Letter”) with Waterton Global Value, L.P. (“Waterton”) wherein the Company agreed to sell, convey, assign and transfer certain accounts receivable as consideration for a waiver for non-payment to Waterton under the Credit Agreement. Waterton may revoke the waiver at any time and note the Company in default under the Credit Agreement. The transfer of the accounts receivable to Waterton were to be treated as payment towards outstanding interest payable amounts with any remaining transfer of receivables to be treated as a payment towards other indebtedness under the Credit Agreement, including principal on the note. The measurement of receivables transferred is subject to revaluation in accordance with mark-to-market price adjustments and final settlement of the invoices. The valuation of receivables under the Letter was $1,053,599 at June 30, 2013. Under terms of the Letter, interest payable was reduced by $116,693 and the principal portion of the note was reduced by $768,263, while the remaining $168,643 has been recorded as financing costs in interest expense at June 30, 2013. On September 30, 2013, the valuation of receivables sold under the Letter was finalized at $1,018,056. Accordingly, final valuation adjustments were made to increase the principal portion of the note outstanding by $29,145 and to decrease financing costs by $6,398. During the current fiscal year ended additional adjustments were made to the outstanding obligation by Waterton which included various Agreement penalties. The outstanding principal balance after these adjustments at June 30, 2015 was $7,755,685 and accrued interest was $4,565,466. See ITEM 7: Liquidity and Capital Resources; Plan of Operation.

As of June 30, 2015, we had five employees. In addition, we use consultants with specific skills to assist with various aspects of our project evaluation, due diligence, corporate governance and property management.

Office Facilities

8

Our principal executive offices are located at 3544 Rio Grande Blvd. NW, Albuquerque, NM 87107. Our telephone number is (505) 255-4852.

Gold Price History

Not applicable at this time.

None of our properties are subject to material restrictions on our operations due to seasonality.

Available Information

We make available, free of charge, on or through our Internet website, at www.santafegold.com, our annual report on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934. Our Internet website and the information contained therein or connected thereto are not intended to be, and are not incorporated into this annual report on Form 10-K.

ITEM 1A. RISK FACTORS |

|

The Company operates in a dynamic and rapidly changing environment that involves numerous risks and uncertainties. Stockholders should carefully consider the risks described below before purchasing the Company’s common shares. The occurrence of any of the following events could harm the Company. If these events occur, the trading price of the Company’s common shares could decline, and shareholders may lose part or even all of their investment. This report, including Management’s Discussion and Analysis of Financial Condition and Results of Operation, contains forward looking statements that may be materially affected by numerous risk factors, including those summarized below:

Risk Factors Related to Our Business and Operations

We are dependent upon production of precious metals and industrial minerals from a limited number of properties, have incurred substantial losses since our inception in 1991, and may never be profitable.

Since our inception in 1991, we have not been profitable. As of June 30, 2015, our total accumulated deficit was approximately $102.4 million. In November 2013, we suspended mine and mill operations at our Summit mine and Banner mill due to operating losses and a lack of operating capital. We placed the Summit mine and mill on a care and maintenance program. The Summit mine operations remain suspended pending placement of sufficient funds to restart development and bring the operation to full and sustained production. We ceased mining operations at our Black Canyon mica property in 2002 after unsuccessful attempts to begin profitable operations.

To become profitable, we must identify mineralization and establish reserves, and then either develop properties ourselves or locate and enter into agreements with third party operators. We may suffer significant additional losses in the future and may never be profitable. There can be no assurance we will receive significant revenue from operations in the foreseeable future, if at all. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

We have established only limited mineralized materials at our Summit silver-gold property, and we have foregone the opportunities at Mogollon and Ortiz.

In the event that we are unable to raise additional capital to satisfy the terms and conditions of the negotiated restructuring of our senior secured indebtedness, we may be forced to seek reorganization or liquidation under the U.S. Bankruptcy Code which we did in August 2015.

At June 30, 2014, the Company was in arrears on payments totaling approximately $9.1 million under its Senior Secured Gold Stream Credit Agreement (the “Credit Agreement”) with Waterton and approximately $7.1 million under a gold stream agreement (the “Gold Stream Agreement”) with Sandstorm Gold Ltd. (“Sandstorm”). On June 30, 2013, the Company signed a Waiver of Default Letter (the “Letter”) with Waterton wherein Waterton agreed to waive any payment defaults under the Credit Agreement. Also, Waterton may revoke the waiver at anytime and note the Company in default under the Credit Agreement.

9

In connection with the Share Exchange Agreement, Santa Fe and Waterton have executed a term sheet regarding proposed Amendment to the Credit Agreement. The term sheet provides that upon Santa Fe paying Waterton $3,000,000 in cash, the loan and all other amounts outstanding under the Credit Agreement shall be reduced to US$6,000,000.

In connection with the Share Exchange Agreement, Santa Fe and Sandstorm have executed an Amendment No. 3 to Gold Steam Agreement, which contemplates that (i) upon the closing of a debt or equity financing for minimum gross proceeds of $20.0 million; and (ii) Sandstorm Gold receiving $1.0 million out of the proceeds of such financing; then Sandstorm and Santa Fe will enter into an amended and restated purchase agreement, which will provide that after one year, Santa Fe shall deliver and sell to Sandstorm for at least 16 quarterly periods, a minimum of 350 ounces of gold per quarter, at a US$400 per ounce. Upon execution of the amended and restated agreement becoming effective, all amounts currently due and owed to Sandstorm Gold under the original purchase agreement, as amended, shall be deemed to have been settled in full.

As such, the Company can provide no assurance that additional funding will be available on a timely basis, on terms acceptable to the Company, or at all. If the Company is unsuccessful raising additional funding, its business may not continue as a going concern. Even if the Company does find additional funding sources, it may be required to issue securities with greater rights than those currently possessed by holders of its common shares or on terms less favorable than the Convertible Gold Note financing. The Company may also be required to take other actions that may lessen the value of its common shares or dilute its common shareholders, including borrowing money on terms that are not favorable to the Company or issuing additional equity securities. If the Company experiences difficulties raising money in the future, its business and liquidity will be materially adversely affected.

In the event we cannot raise the necessary capital and we cannot restructure our secured debt with Waterton and Sandstorm through negotiated modifications to their agreements or through other forms of restructurings, we may be required to effect under court supervision pursuant to a voluntary bankruptcy filing under Chapter 11 or Chapter 7 of the U.S. Bankruptcy Code (“Chapter 11 or “Chapter 7”). There can be no assurance that any financing or restructuring will be obtained on acceptable terms with the necessary parties or at all. In addition, the default under our Waterton facility could result in a cross-default or the acceleration of our payment obligations under other financing agreements. In any such event, or if an involuntary petition for bankruptcy relief or similar creditor action is filed against us, we will be required to seek reorganization under Chapter 11 or liquidation under Chapter 7.

Our independent registered public accounting firm has included an explanatory paragraph with respect to our ability to continue as a going concern in its report on our consolidated financial statements for the year ended June 30, 2015.

We have classified all amounts outstanding under our Waterton Credit Agreement and Sandstorm Gold Stream Agreement as current liabilities in our consolidated balance sheet as of June 30, 2015, included in this Report. Waterton can claim the Credit Agreement in default at any time. As a result of these factors, as well as adverse industry conditions, our independent registered public accounting firm has included an explanatory paragraph with respect to our ability to continue as a going concern in its report on our consolidated financial statements for the year ended June 30, 2014. The presence of the going concern explanatory paragraph may have an adverse impact on our relationship with third parties with whom we do business, including our customers, vendors and employees and could make it challenging and difficult for us to raise additional debt or equity financing, all of which could have a material adverse impact on our business, results of operations, financial condition and prospects.

A substantial or extended decline in gold and silver prices would have a material adverse effect on the value of our assets, on our ability to raise capital and could result in lower than estimated economic returns.

The value of our assets, our ability to raise capital and our future economic returns are substantially dependent on the prices of gold and silver. The gold and silver price fluctuates on a daily basis and is affected by numerous factors beyond our control. Factors tending to influence gold prices include:

gold sales or leasing by governments and central banks or changes in their monetary policy, including gold inventory management and reallocation of reserves;

speculative short positions taken by significant investors or traders in gold;

the relative strength of the U.S. dollar;

expectations of the future rate of inflation;

changes to economic activity in the United States, China, India and other industrialized or developing countries;

changes in industrial, jewelry or investment demand;

changes in supply from production, disinvestment and scrap; and

forward sales by producers in hedging or similar transactions.

10

A substantial or extended decline in the gold or silver price could:

negatively impact our ability to raise capital on favorable terms, or at all;

jeopardize the restart and development of our Summit silver-gold project;

reduce the potential for future revenues from gold projects in which we have an interest;

reduce funds available to us for exploration with the result that we may not be able to further advance any of our projects; and

reduce the market value of our assets.

In addition to environmental regulations, we are subject to a wide variety of laws and regulations directly and indirectly relating to mining that often change and could adversely affect our business.

We are subject to extensive United States federal, state and local laws and regulations related to mine prospecting, development, transportation, production, exports, taxes, labor standards, occupational health and safety, waste disposal, protection and remediation of the environment, mine safety, hazardous materials, toxic substances and other matters. These laws and regulation frequently change. New laws and regulations or more stringent enforcement of existing ones could have a material adverse impact on us, causing a delay or reduction in production, increasing costs and preventing an expansion of mining activities.

Delaware law and our Articles of Incorporation may protect our directors from certain types of lawsuits. Delaware law provides that our directors will not be liable to our stockholders or to us for monetary damages for all but certain types of conduct as directors of the Company.

Our Articles of Incorporation permit us to indemnify our directors and officers against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our directors and officers against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

Risks Related to our Common Stock

Our common stock is thinly traded, and there is no guarantee of the prices at which the shares will trade.

Trading of our common stock is conducted on the OTCQB Marketplace operated by the OTC Markets Group, Inc., or “OTCQB,” under the ticker symbol “SFEG.” Not being listed for trading on an established securities exchange has an adverse effect on the liquidity of our common stock, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and reduction in security analysts’ and the media’s coverage of the Company. This may result in lower prices for your common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked prices for our common stock. Historically, our common stock has been thinly traded, and there is no guarantee of the prices at which the shares will trade, or of the ability of stockholders to sell their shares without having an adverse effect on market prices.

Because our common stock is a “penny stock,” it may be difficult to sell shares of our common stock at times and prices that are acceptable.

Our common stock is currently a “penny stock.” Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk disclosure document prepared by the SEC. This document provides information about penny stocks and the nature and level of risks involved in investing in the penny stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser, and obtain the purchaser’s written agreement to the purchase. The penny stock rules may make it difficult for you to sell your shares of our common stock. Because of these rules, many brokers choose not to participate in penny stock transactions and there is less trading in penny stocks. Accordingly, you may not always be able to resell shares of our common stock publicly at times and prices that you feel are appropriate.

The sale of our common stock by selling stockholders may depress the price of our common stock due to the limited trading market that exists.

Due to a number of factors, including the lack of listing of our common stock on a national securities exchange, the trading volume in our common stock has historically been limited. Trading volume over the last 3 months has averaged approximately 141,000 shares per day. As a result, the sale of a significant amount of common stock by selling shareholders may depress the price of our common stock and the price of our common stock may decline.

Completion of one or more new acquisitions could result in the issuance of a significant amount of additional common stock, which may depress the trading price of our common stock.

11

Acquisition of one or more additional mineral properties, conceptually, could result in the issuance of a significant amount of common stock. Such issuance could depress the trading price of our common stock.

Our stock price may be volatile and as a result you could lose all or part of your investment. In addition to volatility associated with OTC securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

changes in the worldwide prices for gold or silver;

disappointing results from our exploration or development efforts;

failure to meet our revenue or profit goals or operating budget;

decline in demand for our common stock;

downward revisions in securities analysts’ estimates or changes in general market conditions;

technological innovations by competitors or in competing technologies;

investor perception of our industry or our prospects; and

In addition, stock markets have experienced extreme price and volume fluctuations, and the market prices of securities generally have been highly volatile. These fluctuations commonly are unrelated to operating performance of a company and may adversely affect the market price of our common stock. As a result, investors may be unable to resell their shares at a fair price.

A small number of existing shareholders own a significant portion of our common stock, which could limit your ability to influence the outcome of any shareholder vote.

Our executive officers and directors, together with our three largest shareholders, beneficially own approximately 25% of our common stock as of the date of this report. Under our Articles of Incorporation and Delaware law, the vote of a majority of the shares outstanding is generally required to approve most shareholder action. As a result, these individuals and entities will be able to influence the outcome of shareholder votes for the foreseeable future, including votes concerning the election of directors, amendments to our Articles of Incorporation or proposed mergers or other significant corporate transactions.

We have never paid dividends on our common stock and we do not anticipate paying any in the foreseeable future.

We have not paid dividends on our common stock to date, and we may not be in a position to pay dividends in the foreseeable future. Our ability to pay dividends will depend on our ability to successfully develop one or more properties and generate revenue from operations. Further, our initial earnings, if any, will likely be retained to finance our growth. Any future dividends will depend upon our earnings, our then-existing financial requirements and other factors and will be at the discretion of our Board of Directors.

ITEM 1B. UNRESOLVED STAFF COMMENTS |

|

None.

ITEM 2. PROPERTIES |

|

Summit Silver-Gold Project

Santa Fe Gold acquired the Summit silver-gold project in May 2006. The project includes the underground Summit silver-gold mine and related property consisting of 117 acres of patented mining claims and 740 acres of unpatented mining claims in Grant County, southwestern New Mexico; and the Banner mill, including mineral processing equipment consisting of a crushing and screening plant, a ball mill and a 400 ton-per-day flotation plant, and related property consisting of approximately 1,500 acres of wholly owned and leased patented and unpatented mining claims, located approximately 57 miles south of the Summit mine near Lordsburg, Hidalgo County, New Mexico. The Summit project is owned by The Lordsburg Mining Company, a wholly-owned subsidiary.

Construction of the Banner mill and development of the Summit mine have been the focus of our activities since 2008. In April 2007, Santa Fe received results of an engineering study that concluded the Summit deposit could form the basis of an economically viable underground mining operation. In December 2007, Santa Fe arranged financing of $13.5 million by way of a private placement of senior secured convertible debentures and began construction activities during 2008, including development of the Summit underground mine and construction of the Banner mill. Mineralized material generated in the process of developing the

12

mine was stockpiled for later processing. Construction of the Banner mill was completed in mid-2009 and construction of the tailings disposal impoundment was completed in early 2010. Processing operations at the Banner mill commenced in April 2010. Trial sales of mineralized material as silica flux commenced in the second quarter of 2010 and trial sales of precious metals flotation concentrate began in the third quarter of 2010. Mine development and limited production was on-going through November 8, 2013, at which time the operations were suspended due to a lack of operating capital. The Summit mine and Banner mill operations remain suspended pending placement of sufficient funds to restart development and bring the operation to full and sustained production. Permitting, regulatory reporting and limited care and maintenance have continued to maintain operational viability of the mine and mill facilities. Prior to suspension of operations, 575 new feet of drift were constructed during our fiscal year ending June 30,2014, for a total of about 16,295 feet of mine openings developed in the Summit mine since project inception.

The Summit mining and processing operation involved underground mining of silver and gold-bearing material from the Summit mine and trucking it 57 miles to the Banner mill site where metallurgical processing takes place. At full production, mining was planned to be carried out at a rate of 12,000 tons per month (144,000 tons per year). At the Banner site, processing is accomplished through conventional crushing, grinding and selective flotation to yield a bulk sulfide concentrate containing the recoverable precious metals.

Santa Fe markets concentrate under sales contracts to a German smelter and a Korean smelter, and explored other marketing options. It also produced siliceous flux material, involving crushing and screening of Summit mineralized material, and then shipping of the resulting beneficiated product to copper smelters for use as smelter converter flux. Santa Fe sold siliceous flux material to two Arizona smelters in 2014 and 2013. Sales of siliceous flux material are in addition to sales of concentrate produced at the Banner mill. Both properties, the mine & mill are lost during the Bankruptcy proceedings (Chapter 11) Case # 15-11761 (MFW), See NOTE 19 – CHAPTER 11 and 363 ASSET SALE to the financial statements for more information.

The Summit property is subject to underlying net smelter return royalties capped at $4,000,000 and to a net-proceeds interest on sales of un-beneficiated mineralized rock with an end price of $2,400,000. The Summit acquisition is subject to a property identification royalty agreement between Santa Fe and its former President and Chief Executive Officer. See Item 13. “Certain Relationships and Related Transactions”. All claims were lost during the Bankruptcy proceedings (Chapter 11) Case # 15-11761 (MFW).

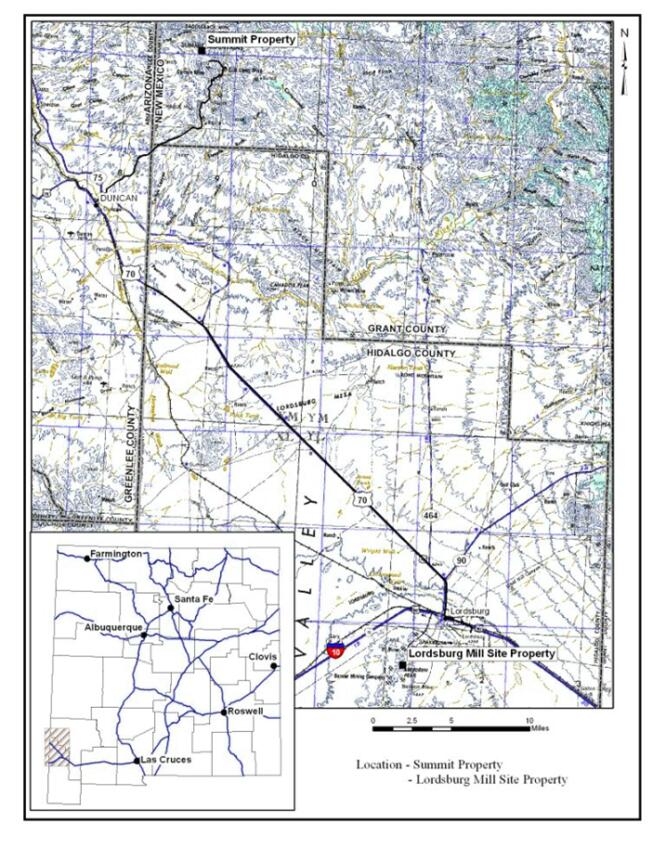

Location Map

Black Canyon Mica

The Black Canyon mine is located 30 miles north of Phoenix, Arizona, and 3.5 miles west-southwest of Black Canyon City. It can be reached via U.S. Interstate 17, which connects Phoenix with Flagstaff, and by a connecting dirt road for the last eight miles. The Glendale processing plant was located in an industrial area on the west side of Phoenix, Arizona, 47 miles to the south of the mine

13

site. The property holdings at and around the Black Canyon mine consist of 67 federal unpatented mining claims in Yavapai County, Arizona and 9 federal unpatented mill site claims in Maricopa County, Arizona, which in total cover approximately 1,385 acres.

In 1999, the Company obtained approval for the Black Canyon Plan of Operations from the Bureau of Land Management and the State of Arizona. An Environmental Assessment, Clean Water Act Permit and Air Quality Procedures were all approved. An Aquifer Protection Permit was not required because processing operations at the mine site did not propose the use of water.

Santa Fe acquired the Black Canyon Mica project in 1999 and spent $15 million in establishing mining and processing facilities at the mine site north of Phoenix, Arizona, and at a separate processing plant in Glendale, Arizona. In 2002, it commissioned the processing facilities at the mine site and in Glendale, operated for several months on a test basis and achieved limited production and commercial sales. However, design capacity of the processing facilities was not achieved due to undercapitalization. In November 2002, after unsuccessful attempts to raise the additional capital necessary to expand plant capacity in order to reach design capacity and to provide working capital, crushing and concentrating activities at the Black Canyon mica mine were suspended. After the suspension of operations, limited production, marketing and sales continued through 2005 at the Glendale mica processing facility

using inventoried mica. Subsequently, the processing equipment was removed from the Glendale plant and Black Canyon mine and placed into storage. All claims on the MICA project are lost during the Bankruptcy proceedings (Chapter 11) Case # 15-11761 (MFW). See NOTE 19 – CHAPTER 11 and 363 ASSET SALE to the financial statements for more information.

Planet Micaceous Iron Oxide (MIO) Project

The Planet property is located in the northwest corner of La Paz County, west central Arizona. It lies just south of the Bill Williams River twelve miles above its junction with the Colorado River. The property is reached by road, either via the Swansea gravel road, twenty-eight miles north from the town of Bouse; or via the Osborne Well paved and gravel road, twenty-five miles east from the town of Parker.

In 2002, Santa Fe leased the Planet property for its potential to produce micaceous iron oxide (“MIO”). In August 2008, Santa Fe exercised its option to purchase the property. Payments made to complete the purchase from 2008 to 2012 totaled $302,376. The Planet property consists of thirty-one patented mining claims totaling 523 acres located in western Arizona. There is a provision for a 5% royalty to be paid on any future production. Claims are lost during the Bankruptcy proceedings (Chapter 11) Case # 15-11761 (MFW). See NOTE 19 – CHAPTER 11 and 363 ASSET SALE to the financial statements for more information.

|

Current Legal Proceedings

Santa Fe is involved in various legal actions in the ordinary course of our business. We do not believe it is feasible to predict or determine the outcome or resolution of the above litigation proceedings, or to estimate the amounts of, or potential range of, loss with respect to those proceedings. In addition, the timing of the final resolution of these proceedings is uncertain. The range of possible resolutions of these proceedings could include judgments against us or settlements that could require substantial payments by us, which could have a material impact on the Company’s financial position, results of operations and cash flows.

We are not aware of any material legal proceedings to which any of our officers or any associate of any of our officers is a party adverse to us or any of our subsidiaries or has a material interest adverse to us or any of our subsidiaries.

We are not aware of any of our officers being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency, criminal proceedings (other than traffic and other minor offenses) or being subject to any of the items set forth under Item 401 of Regulation S-K.

On August 26, 2015 Santa Fe filed for Chapter 11 Bankruptcy protection, Case # 15-11761 (MFW) in Delaware. See NOTE 19 – CHAPTER 11 and 363 ASSET SALE to the financial statements for more information.

ITEM 4. MINE SAFETY DISCLOSURES |

|

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND PURCHASE OF EQUITY SECURITIES

Market Information

14

Our common stock trades over-the-counter and is quoted on the OTC Bulletin Board under the symbol “SFEG.” The table below sets forth the high and low bid prices for our common stock as reflected on the OTC Bulletin Board for the last two fiscal years. Quotations represent prices between dealers, do not include retail markups, markdowns or commissions, and do not necessarily represents at which actual transactions were affected

OTCBB

|

| (U.S. $) |

| |||

Fiscal 2015 |

| HIGH |

|

| LOW |

|

09/30/14 | $ | 0.29 |

| $ | 0.05 |

|

12/31/14 |

| 0.15 |

|

| 0.03 |

|

3/31/15 |

| 0.18 |

|

| 0.05 |

|

6/30/15 |

| 0.18 |

|

| 0.04 |

|

Fiscal 2014 |

|

|

|

|

|

|

9/30/13 |

| 0.20 |

|

| 0.12 |

|

12/31/13 |

| 0.17 |

|

| 0.02 |

|

3/31/14 |

| 0.10 |

|

| 0.03 |

|

6/30/14 |

| 0.08 |

|

| 0.02 |

|

We were delinquent in the filing of our financial statements for the year ended June 30, 2003, and consequently the Securities Commissions of Ontario and British Columbia issued cease trade orders for trading of our common stock by Canadian residents, which cease trade orders are still in effect. We believe that less than 2% of our common stock is recorded as held by Canadian residents as of June 30, 2015.

Holders of Common Equity

As of June 30, 2015, there have 142,396,648 common shares outstanding, the high and low sales prices of our common stock on the OTC Bulletin Board were $0.29 and $0.03, respectively, for fiscal 2015 and we had approximately 790 holders of record of our common stock.

Penny Stock Rules

Due to the price of our common stock, as well as the fact that we are not listed on NASDAQ or a national securities exchange, our stock is characterized as “penny stock” under applicable securities regulations. Our stock therefore is subject to rules adopted by the SEC regulating broker-dealer practices in connection with transactions in penny stocks. The broker or dealer proposing to effect a transaction in a penny stock must furnish his customer a document containing information prescribed by the SEC and obtain from the customer an executed acknowledgment of receipt of that document. The broker or dealer must also provide the customer with pricing information regarding the security prior to the transaction and with the written confirmation of the transaction. The broker or dealer must also disclose the aggregate amount of any compensation received or receivable by him in connection with such transaction prior to consummating the transaction and with the written confirmation of the trade. The broker or dealer must also send an account statement to each customer for which he has executed a transaction in a penny stock each month in which such security is held for the customer’s account. The existence of these rules may have an effect on the price of our stock, and the willingness of certain brokers to effect transactions in our stock.

Colonial Stock Transfer Co. is the transfer agent for our common stock. The principal office of Colonial Stock Transfer Co. is located at 66 Exchange Place, Salt Lake City, Utah 84111 and its telephone number is (801) 355-5740.

Dividend Policy

We have never declared or paid dividends on our common stock. Payment of future dividends, if any, will be at the discretion of our board of directors after taking into account various factors, including the terms of any credit arrangements, our financial condition, operating results, current and anticipated cash needs and plans for expansion.

Performance Graph

Not required.

15

Recent Sales of Unregistered Securities

On July15, 2014, the Company entered into shares for debt settlements with five creditors wherein an aggregate of $200,000 of debt was settled by the aggregate issuance of 4,000,000 shares of common stock.

On October 21, 2014, the Company issued 792,420 shares of restricted common stock at a price of $0.135 per share to Muzz Investments, LLC, in regards to the Company’s obligation for costs incurred related to the 2006 sale of real properly in Glendale, Arizona, formerly owned by Azco Mica, Inc. A gain of $64,980 was recorded on the final extinguishment of the debt of $106,978.The issuance of shares was exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof because such issuance did not involve a public offering.

On November 24, 2014, the Company entered into shares for liability settlements with two related party creditors wherein an aggregate of $40,000 of debt was settled by the aggregate issuance of 800,000 shares of restricted common stock. A loss of $1,360 was recorded on the final extinguishment of the liabilities. The issuance of shares was exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof because such issuance did not involve a public offering.

On November 24, 2014, the Company entered into shares for liability settlement with a creditor wherein an aggregate of $20,000 of debt was settled by the aggregate issuance of 400,000 shares of restricted common stock. A loss of $680 was recorded on the final extinguishment of the liability. The issuance of shares was exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof because such issuance did not involve a public offering.

On November 24, 2014, the Company sold 3,375,000 shares of restricted common stock and issued 3,375,000 warrants expiring on December 30, 2015, giving the holder the right to purchase common stock at $0.06 per share, to an accredited investor and received net cash proceeds of $202,500. The shares and warrants were issued pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended. The Company used the net proceeds for working capital.

On February 6, 2015, the Company sold 3,000,000 restricted shares to an accredited investor and issued 3,240,000 warrants expiring on February 6, 2019, giving the holder the right to purchase common stock at $0.15 per share, to an accredited investor and received net cash proceeds of $300,000. In the event the closing sales price of the common stock shall exceed $0.30 per share for five (5) consecutive trading days, unless exercised, the warrants shall expire upon fifteen (15) days written notice by the Company to the holder. The shares and warrants were issued pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended. The Company used the net proceeds for working capital.

On April 7, 2015, the Company sold 1,000,000 restricted shares to an accredited investor and issued 1,000,000 warrants expiring on April 7, 2019, giving the holder the right to purchase common stock at $0.15 per share, to an accredited investor and received net cash proceeds of $100,000. In the event the closing sales price of the common stock shall exceed $0.30 per share for five (5) consecutive trading days, unless exercised, the warrants shall expire upon fifteen (15) days written notice by the Company to the holder. The shares and warrants were issued pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended. The Company used the net proceeds for working capital.

During the quarter ended June 30, 2015, we issued 1,800,000 shares of restricted common stock in partial conversion of an aggregate of $68,900 in principal and accrued interest under a promissory note. The issuances of shares were exempt from the registration requirements of the Securities Act of 1933, as amended, pursuant to Section 4(a)(2) thereof because such issuance did not involve a public offering.

ITEM 6. SELECTED FINANCIAL DATA |

|

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONAND RESULTS OF OPERATIONS |

Except for the historical information, the following discussion contains forward-looking statements that are subject to risks and uncertainties. Readers are cautioned that the following discussion contains certain forward-looking statements and should be read in conjunction with the “Cautionary Statement on Forward-Looking Statements” appearing at the beginning of this Annual Report. We caution you not to put undue reliance on any forward-looking statements, which speak only as of the date of this report. Our actual results or actions may differ materially from these forward-looking statements for many reasons, including the risks described in “Risk Factors” and elsewhere in this annual report. Our discussion and analysis of

16

our financial condition and results of operations should be read in conjunction with the Financial Statements of the Company and notes thereto included elsewhere in the Annual Report. See “Financial Statements”. Our actual future results may be materially different from what we currently expect.

Overview

During our current fiscal year ended June 30, 2015, we are in a care and maintenance program since November 2013, generating no revenues at all from new production.

The results of operations for the fiscal years ended June 30, 2015 and 2014 reflect a continued under-capitalization of our Summit silver-gold project which requires additional funding to be able to achieve full project performance and sustained profitability. On November 8, 2013, the Company suspended all mining operations and placed its Summit mine and mill on a care and maintenance program due to significant operating losses resulting in part from this under-capitalization.

We are dependent on additional financing to resume our mining operations and continue our exploration efforts in the future if warranted. See Item 1A, “Risk Factors - In the event that we are unable to raise additional capital to satisfy the terms and conditions of the negotiated restructuring of our senior secured indebtedness, we will be forced to seek reorganization or liquidation under the U.S. Bankruptcy Code.” We entered the bankruptcy protection plan (Chapter 11) in Delaware in Aug 2015, Case # 15-11761 (MFW). See NOTE 19 – CHAPTER 11 and 363 ASSET SALE to the financial statements for more information.

The consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities and commitments in the normal course of business. Should we be unable to continue as a going concern, we may be unable to realize the carrying value of our assets and to meet our obligations as they become due.

We have a total accumulated deficit of $95,563,613 at June 30, 2015. To continue as a going concern, we are dependent on continued fund raising. However, currently we have no commitment in place from any party to provide additional capital and there is no assurance that such funding will be available, or if available, that its terms will be favorable or acceptable to us.

On June 15, 2016, Judge M. Walrath from the US Bankruptcy court, signed the dismissal Order for our Case # 15-11761 (MFW), Docket Nos. 312, 326, 337, and 389.

Liquidity and Capital Resources; Plan of Operation

As of June 30, 2015, we had cash of $69,305 as compared to $83,825 at June 30, 2014 and we had a working capital deficit of $32,671,617. We also had an accumulated deficit of $95,563,613.

At June 30, 2015 we were in arrears on payments totaling approximately $12.5 million under its Senior Secured Gold Stream Credit Agreement (the “Credit Agreement”) with Waterton and approximately $6.8 million under a gold stream agreement (the “Gold Stream Agreement”) with Sandstorm.

On July 15, 2014, we entered into a Share Exchange Agreement with Canarc. Effective October 15, 2014, either Santa Fe or Canarc may terminate the Share Exchange Agreement. Canarc was unable to meet their part of the agreement and the Company terminated the agreement on Oct 15, 2014 with the management team (members of Canarc) resigning from their respective positions. If the transaction contemplated by the Share Exchange Agreement is not consummated and an alternative strategic relationship is not available to Santa Fe or if Santa Fe is unable to secure another experienced management team, or if the Company fails to restructure or refinance its secured indebtedness with Waterton and Sandstorm (the “Debt Restructurings”), or should any of such indebtedness be accelerated, the Company will not have adequate liquidity to fund its operations, meet its obligations (including its debt payment obligations) and continue as a going concern, and will be forced to seek relief under Chapters 11 or 7 of the U.S. Bankruptcy Code (or an involuntary petition for bankruptcy relief or similar creditor action may be filed against it). The Company filed for bankruptcy protection Chapter 11 in Delaware in Aug 2015, Case # 15-11761 (MFW).

See Item 1A, “Risk Factors - In the event that we are unable to raise additional capital to satisfy the terms and conditions of the negotiated restructuring of our senior secured indebtedness, we will be forced to seek reorganization or liquidation under the U.S. Bankruptcy Code.”

In July 2014 we entered into shares for debt settlement with five individuals wherein an aggregate of $200,000 of debt was settled by the aggregate issuance of 4,000,000 shares of common stock.

17

In October 2014, the Company issued 792,420 shares of common stock at a price of $0.135 per share to Muzz Investments, LLC, in regards to the Company’s obligation for costs incurred related to the 2006 sale of real properly in Glendale, Arizona, formerly owned by Azco Mica, Inc. A gain of $64,978 was recorded on the final extinguishment of the debt of $106,977.

In November 2014, the Company entered into shares for liability settlements with two related party creditors wherein an aggregate of $40,000 of debt was settled by the aggregate issuance of 800,000 shares of common stock. A loss of $1,360 was recorded on the final extinguishment of the liabilities.

In November 2014, the Company entered into shares for liability settlement with a creditor wherein an aggregate of $20,000 of debt was settled by the aggregate issuance of 400,000 shares of common stock. A loss of $680 was recorded on the final extinguishment of the liability.

On November 24, 2014, the Company sold 3,375,000 shares to an accredited investor and received net cash proceeds of $202,500.

On February 6, 2015, the Company sold 3,000,000 shares to an accredited investor and received net cash proceeds of $300,000

On April 7, 2015, the Company sold 1,000,000 shares to an accredited investor and received net cash proceeds of $100,000.

During the quarter ended June 30, 2015, we issued 3,462,228 shares of restricted common stock in partial conversion of an aggregate of $67,960 in principal and interest under a promissory note.

Fiscal Year Ended June 30, 2015 Compared to Fiscal Year Ended June 30, 2014

Sales, net

Sales were $2,096,774 in fiscal year 2014 and $66,884 for fiscal year 2015. The significant decrease resulted from our decision on November 8, 2013, to suspended all mining operations due to a lack of operating working capital and placed the mine and mill on a care and maintenance program. During the year ended June 30, 2014, we generated $1,491,182 and $605,592 in concentrate and flux sales, respectively, net of treatment charges.

Exploration and Mine Related Costs

Exploration and mine related costs increased $534,559 in the current period of measurement to $1,350,255 from $815,696 for the previous period of measurement. This increase was a result of the Mogollon Option write off of $876,509 and offset by other decreased mine related cost due to the Company ceasing mine and mill operations in November 2013.

General and Administrative

General and administrative expenses decreased to $2,123,540 for the year ended June 30, 2015, from $4,281,761 for the comparative year ended June 30, 2014, a decrease of $2,158,221. General and administrative expenses include salaries and benefits, stock-based compensation, professional and consulting fees, professional fees relating to the transactions contemplated by the Canarc Share Exchange Agreement, which agreement expired in October 2014, marketing and investor relations, and travel costs. The decrease is mainly attributable to cutbacks in current operations due to the Company’s decision to suspended all mining operations in early November 2013 and placed the mine and mill on a care and maintenance program and cutbacks at the administrative support office including cancellation of the office lease. The increase in payroll and related burden is a result of the mine and mill shut down in November 2013 and amounts that were previously allocated to cost of goods sold when operational. The increase in director fees and legal fees are related to the various merger transactions we were involved in during the current fiscal year.

Stock-Based Compensation and Costs Associated With Warrants

Stock-based compensation and costs associated with warrants are included in General and Administrative in fiscal year 2015 and 2014 and increased $621,192 in the current period of measurement. The increase is primarily driven by the increase in issuance of warrants to outside parties for investment banking services and capital transactions of $602,297 and an increase of option awards to

18

employees of the Company aggregating $18,895. In the current year of measurement stock was issued for services aggregating $62,040.

Depreciation and amortization expense decreased to $1,925,690 for year ended June 30, 2015, as compared to $2,465,077 for the year ended June 30, 2014. The decrease of $539,386 in the current period is attributable primarily to the decrease in production and a corresponding decrease in the amortization of mine development costs, which are amortized on a units-of-production basis. Reduced depreciation on fully depreciated equipment and the return of a large piece of equipment to the vendor for sale also contributed to the decrease.

Impairment of Equipment, Mine Development and Miineral Properties

We re-evaluated the carrying value of the mine equipment and development and mineral properties at the end of current year in connection with filing of Chapter 11 in August 2015 subsequent to our current fiscal year ended. It was determined that an additional impairment was not required.

Other Income (Expenses)

Other income and (expenses) for the fiscal year ended June 30, 2015, was $(3,587,681) as compared to $(1,857,147) for the fiscal year ended June 30, 2014, an increase in other expense of $1,730,534. The net increase in other expenses for the current period of measurement is mainly comprised of the following components: increased gain on foreign currency translation of $838,232 and an increased gain recognized on financing costs – commodity supply agreements of $2,133,397. These increased other income items were offset by a decrease gain on extinguishment of debt of $586,915; an increased loss on derivative instrument liabilities of $565,524 and an increase in interest expense of $3,551,404. Further information regarding the changes in the various components of Other Income (Expenses) is discussed below.

For the fiscal year June 30, 2015, the foreign currency translation gain totaling $838,232 related to the ICS Secured convertible note. As of June 30, 2015, the total outstanding balances on all of the IGS Secured Convertible Notes totaled A$3,180,840, which are denominated in Australian dollars (A$). This gain was mainly the result of an increase in the US$ relative to the A$ during the current fiscal year ended.

For the fiscal year ended June 30, 2015, financing costs – commodity supply agreements totaled a reduction of $2,133,397 from the prior year period of measurement. The financing costs for commodity supply agreements relate directly to production for the period and the subsequent delivery of refined precious metals to Sandstorm and Waterton. These financing costs are adjusted period-to-period based upon the total number of undelivered gold and silver ounces outstanding at the end of each period. The reduction in the current fiscal year is driven by a decrease in precious metals prices.