Attached files

| file | filename |

|---|---|

| 8-K - 8-K - II-VI INC | d416721d8k.htm |

June 2017 Exhibit 99.1

Company: II-VI Incorporated Presenting:Dr. Vincent D. (Chuck) Mattera, Jr President and CEO Mary Jane Raymond Chief Financial Officer INTRODUCTIONS

Matters discussed in this presentation may contain forward-looking statements that are subject to risks and uncertainties. These risks and uncertainties could cause the forward-looking statements and II-VI Incorporated’s (the “Company’s”) actual results to differ materially. In evaluating these forward-looking statements, you should specifically consider the “Risk Factors” in the Company’s most recent Form 10-K and Form 10-Q. Forward-looking statements are only estimates and actual events or results may differ materially. II-VI Incorporated disclaims any obligation to update information contained in any forward-looking statement. This presentation contains certain non-GAAP financial measures. Reconciliations of non-GAAP financial measures to their most comparable GAAP financial measures are presented at the end of this presentation. Safe Harbor Statement

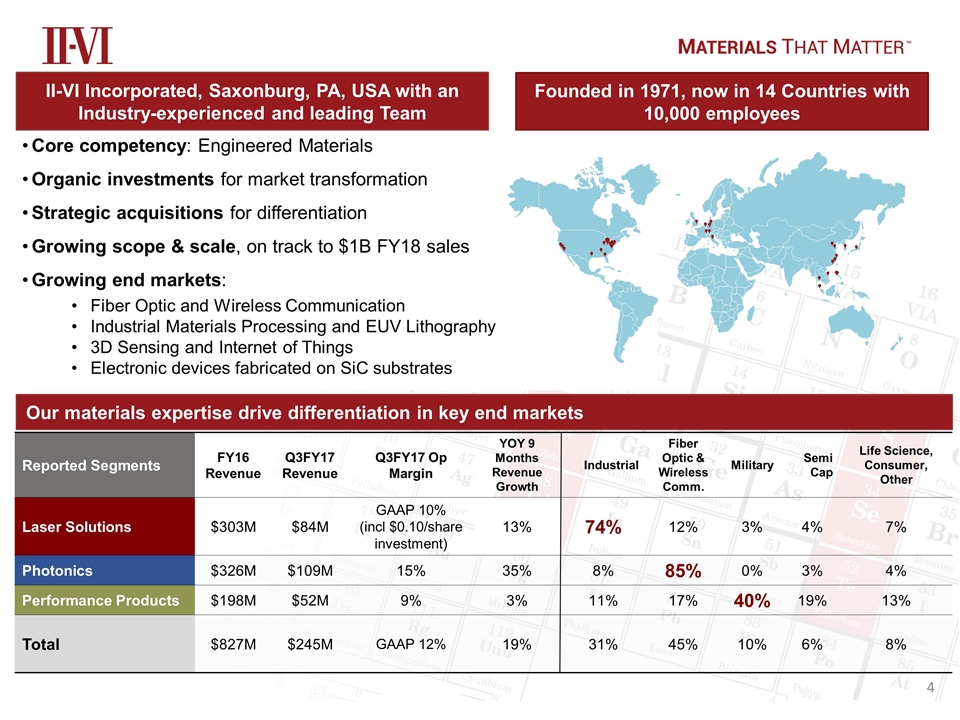

Reported Segments FY16 Revenue Q3FY17 Revenue Q3FY17 Op Margin YOY 9 Months Revenue Growth Industrial Fiber Optic & Wireless Comm. Military Semi Cap Life Science, Consumer, Other Laser Solutions $303M $84M GAAP 10% (incl $0.10/share investment) 13% 74% 12% 3% 4% 7% Photonics $326M $109M 15% 35% 8% 85% 0% 3% 4% Performance Products $198M $52M 9% 3% 11% 17% 40% 19% 13% Total $827M $245M GAAP 12% 19% 31% 45% 10% 6% 8% Core competency: Engineered Materials Organic investments for market transformation Strategic acquisitions for differentiation Growing scope & scale, on track to $1B FY18 sales Growing end markets: Fiber Optic and Wireless Communication Industrial Materials Processing and EUV Lithography 3D Sensing and Internet of Things Electronic devices fabricated on SiC substrates Founded in 1971, now in 14 Countries with 10,000 employees II-VI Incorporated, Saxonburg, PA, USA with an Industry-experienced and leading Team Our materials expertise drive differentiation in key end markets

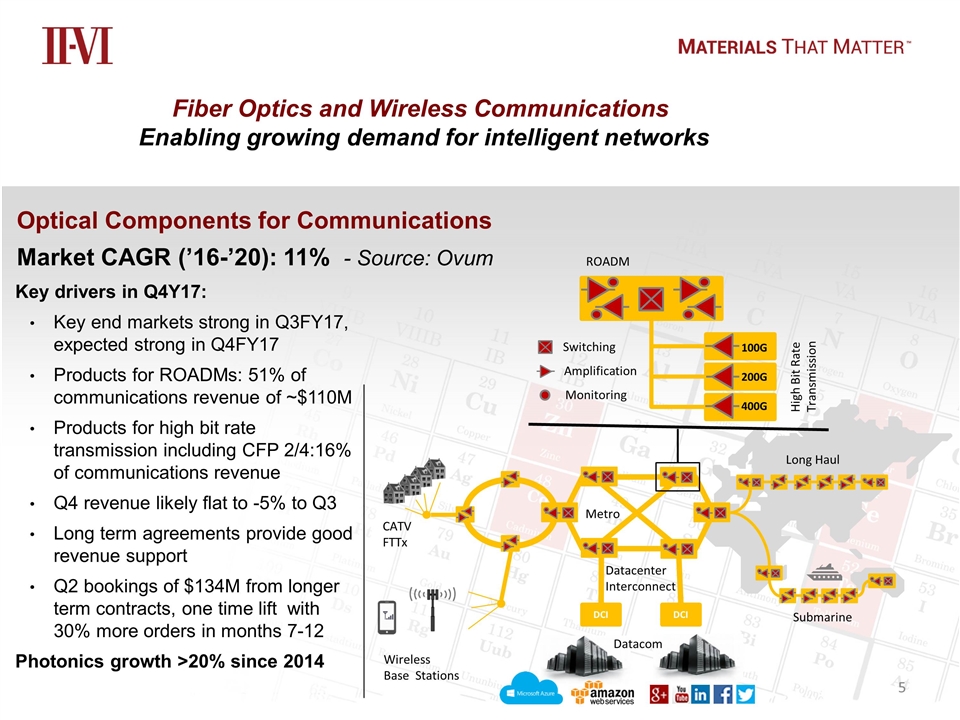

Fiber Optics and Wireless Communications Enabling growing demand for intelligent networks Long Haul Submarine DCI DCI Metro Datacenter Interconnect CATV FTTx Wireless Base Stations Optical Components for Communications Market CAGR (’16-’20): 11% - Source: Ovum Key drivers in Q4Y17: Key end markets strong in Q3FY17, expected strong in Q4FY17 Products for ROADMs: 51% of communications revenue of ~$110M Products for high bit rate transmission including CFP 2/4:16% of communications revenue Q4 revenue likely flat to -5% to Q3 Long term agreements provide good revenue support Q2 bookings of $134M from longer term contracts, one time lift with 30% more orders in months 7-12 Photonics growth >20% since 2014 400G 200G 100G High Bit Rate Transmission ROADM Switching Amplification Monitoring Datacom

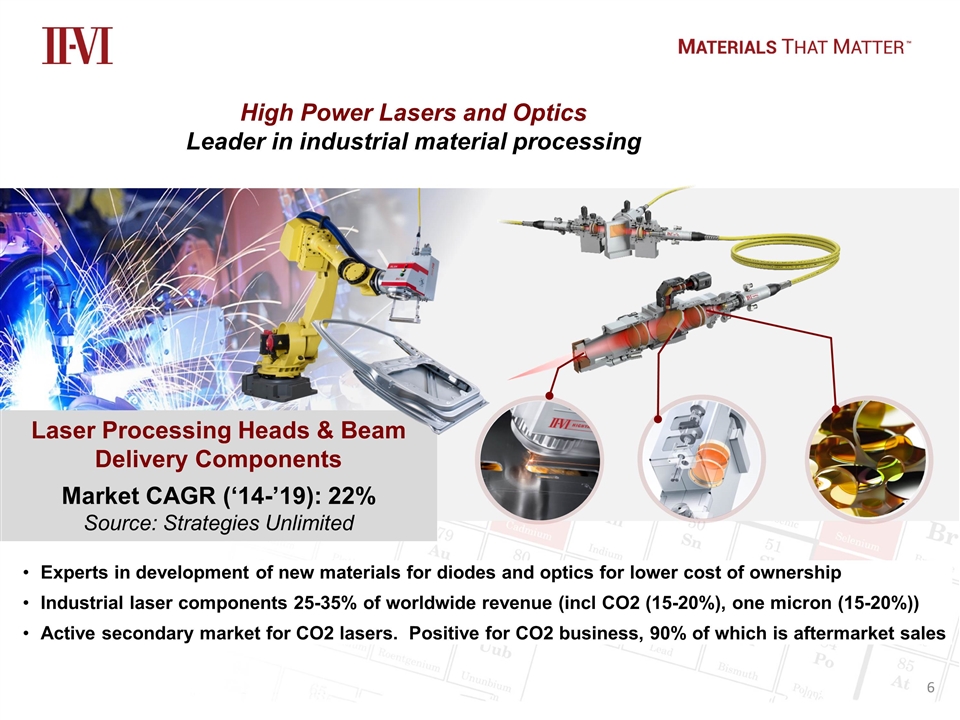

High Power Lasers and Optics Leader in industrial material processing Laser Processing Heads & Beam Delivery Components Market CAGR (‘14-’19): 22% Source: Strategies Unlimited Experts in development of new materials for diodes and optics for lower cost of ownership Industrial laser components 25-35% of worldwide revenue (incl CO2 (15-20%), one micron (15-20%)) Active secondary market for CO2 lasers. Positive for CO2 business, 90% of which is aftermarket sales

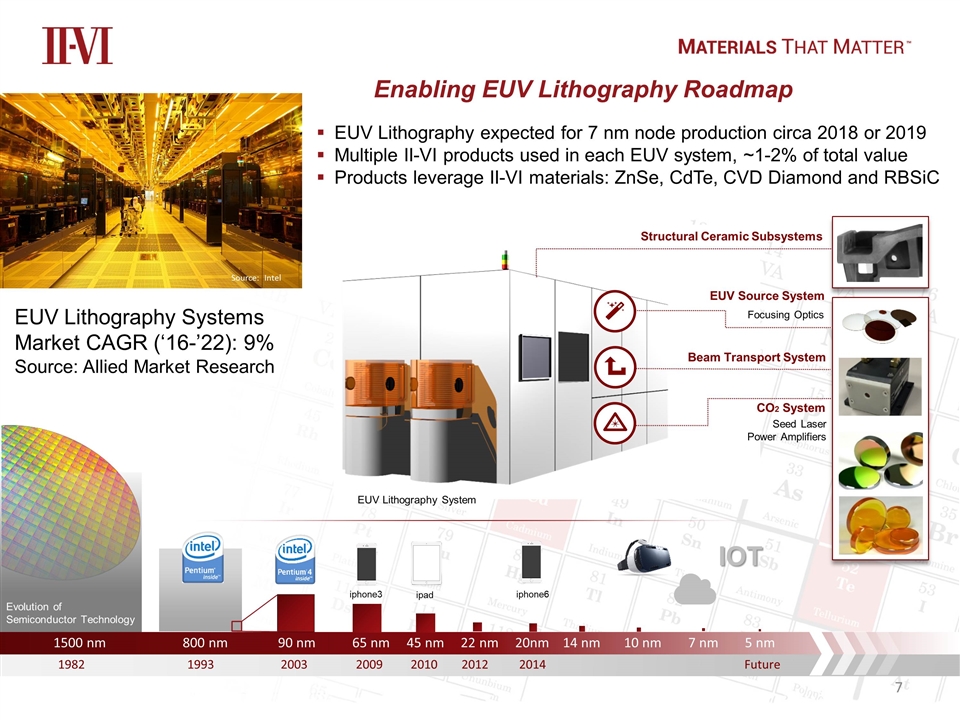

EUV Source System Beam Transport System CO2 System Structural Ceramic Subsystems Seed Laser Power Amplifiers Focusing Optics EUV Lithography System 1500 nm 800 nm 90 nm 65 nm 45 nm 22 nm 20nm 14 nm 10 nm 7 nm 5 nm Evolution of Semiconductor Technology 1982 1993 2003 2009 2010 2012 2014 Future Source: Intel IOT iphone3 iphone6 ipad EUV Lithography Systems Market CAGR (‘16-’22): 9% Source: Allied Market Research Enabling EUV Lithography Roadmap EUV Lithography expected for 7 nm node production circa 2018 or 2019 Multiple II-VI products used in each EUV system, ~1-2% of total value Products leverage II-VI materials: ZnSe, CdTe, CVD Diamond and RBSiC

Optical Communications Internet of Things Semiconductor Laser Technology Enabling Opto-electronic Devices for advanced functionality e.g. 3D sensing II-VI is rapidly ramping its capacity and capability to serve the growing opto-electronic device market Early driver is growing demand for VCSELS - TAM expected to grow from $0.8B in 2015 to $2B by 2020 Major end market work underway are consumer electronics and automotive Key customer manufacturing qualification achieved with anticipated second half CY17 ramp

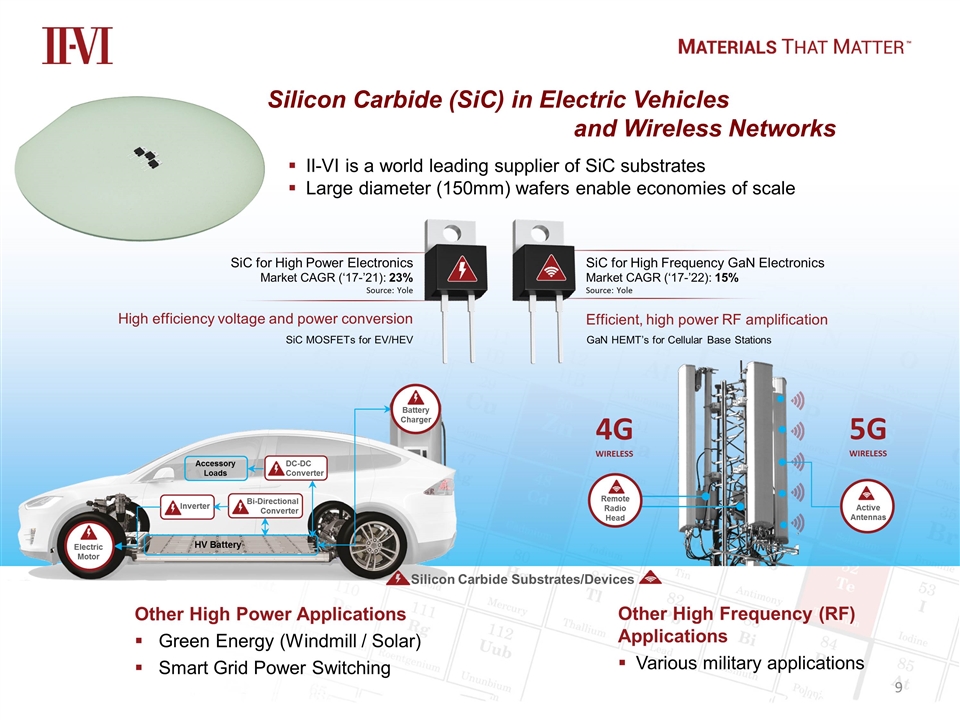

II-VI is a world leading supplier of SiC substrates Large diameter (150mm) wafers enable economies of scale SiC for High Power Electronics Market CAGR (‘17-’21): 23% Source: Yole Other High Power Applications Green Energy (Windmill / Solar) Smart Grid Power Switching SiC for High Frequency GaN Electronics Market CAGR (‘17-’22): 15% Source: Yole Other High Frequency (RF) Applications Various military applications Silicon Carbide (SiC) in Electric Vehicles and Wireless Networks 5G WIRELESS HV Battery Bi-Directional Converter DC-DC Converter Accessory Loads Inverter Battery Charger Electric Motor 4G WIRELESS Remote Radio Head Active Antennas High efficiency voltage and power conversion Efficient, high power RF amplification SiC MOSFETs for EV/HEV GaN HEMT’s for Cellular Base Stations Silicon Carbide Substrates/Devices

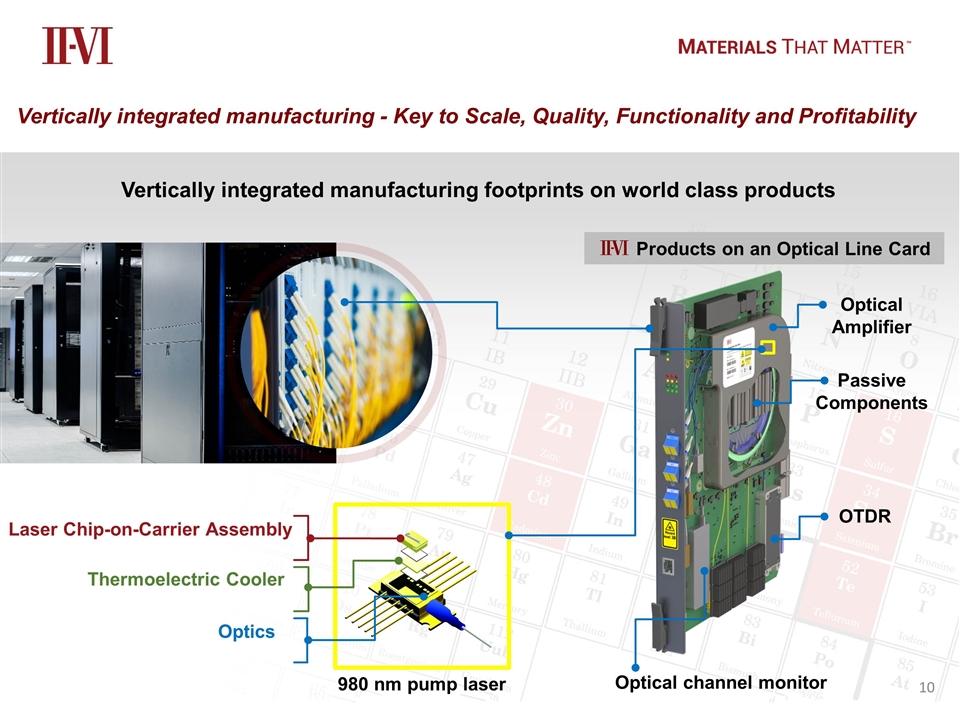

Products on an Optical Line Card Laser Chip-on-Carrier Assembly Thermoelectric Cooler Optics Vertically integrated manufacturing footprints on world class products Vertically integrated manufacturing - Key to Scale, Quality, Functionality and Profitability 980 nm pump laser Optical channel monitor OTDR Passive Components Optical Amplifier

Background Spun from AT&T Bell Labs Murray Hill as Magneto Optic Materials Group in 2000 Size: ~100 people located in Hillsborough, NJ World leader in Faraday rotator crystals Strategic Rationale Further penetration of key end markets: Data center upgrades: Web 2.0 & Cloud Global Optical Network Upgrades: LH/Metro/Access Emerging 5G wireless (backhaul) Laser machining & semiconductor processing Applications: Tunable & DFB lasers, amplifiers, fiber lasers Pro Forma Expectations: Revenue: < 5% incremental annually with GM higher than Corporate average CAGR expected > 20% Expected to be accretive in its first full quarter Demand exceeding capacity today, adding capital investment for growth Vertical integration expected to drive additional revenue growth and profit synergies 11 Our Recent Acquisition: Integrated Photonics Garnet Magnet Magnet P/B Input Output Reflection Garnet (IPI) + magnet = Faraday rotator P/B: Polarizer or Birefringent material Optical Isolator P/B

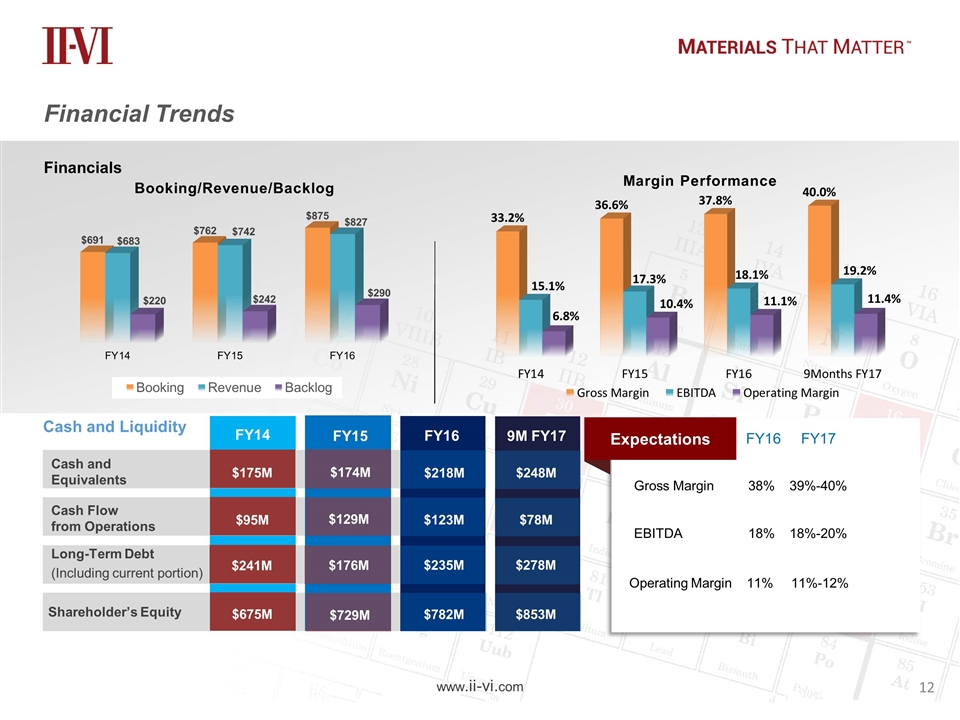

www.ii-vi.com Financial Trends Financials Expectations Gross Margin 38% 39%-40% EBITDA 18% 18%-20% Operating Margin 11% 11%-12% FY16 FY17 Cash and Equivalents Cash Flow from Operations Long-Term Debt (Including current portion) FY16 FY14 FY15 Shareholder’s Equity $218M $175M $174M $123M $95M $129M $235M $241M $176M $782M $675M $729M Cash and Liquidity 9M FY17 $248M $78M $278M $853M

Industry-Experienced Team with Deep Innovation Skills Leading Market Positions in Diverse End Markets 1 Vertically-Integrated and Scalable Manufacturing Successful Return on Investment Within 12-24 months 3 4 Significant Competitive Strengths and Differentiation for Emerging Markets 5 2 www.ii-vi.com Key Investment Considerations

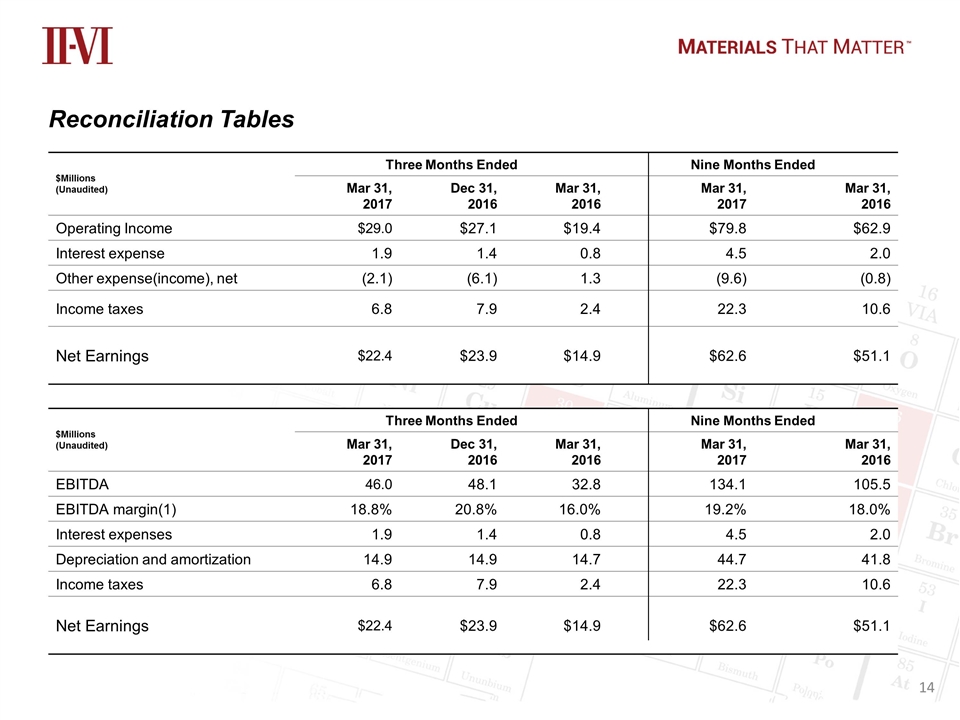

Reconciliation Tables $Millions (Unaudited) Three Months Ended Nine Months Ended Mar 31, 2017 Dec 31, 2016 Mar 31, 2016 Mar 31, 2017 Mar 31, 2016 Operating Income $29.0 $27.1 $19.4 $79.8 $62.9 Interest expense 1.9 1.4 0.8 4.5 2.0 Other expense(income), net (2.1) (6.1) 1.3 (9.6) (0.8) Income taxes 6.8 7.9 2.4 22.3 10.6 Net Earnings $22.4 $23.9 $14.9 $62.6 $51.1 $Millions (Unaudited) Three Months Ended Nine Months Ended Mar 31, 2017 Dec 31, 2016 Mar 31, 2016 Mar 31, 2017 Mar 31, 2016 EBITDA 46.0 48.1 32.8 134.1 105.5 EBITDA margin(1) 18.8% 20.8% 16.0% 19.2% 18.0% Interest expenses 1.9 1.4 0.8 4.5 2.0 Depreciation and amortization 14.9 14.9 14.7 44.7 41.8 Income taxes 6.8 7.9 2.4 22.3 10.6 Net Earnings $22.4 $23.9 $14.9 $62.6 $51.1