Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - UNITED COMMUNITY BANKS INC | t1700404_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - UNITED COMMUNITY BANKS INC | t1700404_ex99-1.htm |

| EX-2.1 - EXHIBIT 2.1 - UNITED COMMUNITY BANKS INC | t1700404_ex2-1.htm |

Exhibit 99.2

Acquisition of Four Oaks Fincorp, Inc. June 27, 2017 ► Expands franchise footprint into attractive Raleigh, NC MSA ► Partnership with 105 - year - old community bank with significant operations in North Carolina’s fastest - growing MSA ; consistent with United growth strategy ► Strategically and financially attractive combination

ucbi.com | 2 Disclosures CAUTIONARY STATEMENT This investor presentation may contain forward - looking statements, as defined by federal securities laws, including statements about United and its financial outlook and business environment . These statements are based on current expectations and are provided to assist in the understanding of our operations and future financial performance . Our operations and such performance involves risks and uncertainties that may cause actual results to differ materially from those expressed or implied in any such statements . For a discussion of some of the risks and other factors that may cause such forward - looking statements to differ materially from actual results, please refer to United Community Banks, Inc . ’s filings with the Securities and Exchange Commission, including its 2016 Annual Report on Form 10 - K under the section entitled “Forward - Looking Statements . ” Forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward - looking statements . This presentation may include financial information determined by methods other than in accordance with generally accepted accounting principles (“GAAP”) . This financial information includes certain operating performance measures, which exclude merger - related and other charges that are not considered part of recurring operations . Such measures include : “Net income – operating,” “Net income available to common shareholders – operating,” “Earnings per share – operating,” “Diluted earnings per share – operating,” “Tangible book value per share,” “Return on common equity – operating,” “Return on tangible common equity – operating,” “Return on assets – operating,” “Efficiency ratio – operating,” “Expenses – operating,” “Tangible common equity to risk - weighted assets,” and “Average tangible equity to average assets . ” This presentation also includes “pre - tax, pre - credit earnings,” which excludes the provision for credit losses, income taxes and merger - related and other charges . Management has included these non - GAAP measures because we believe they may provide useful supplemental information for evaluating our underlying performance trends . Further, management uses these measures in managing and evaluating our business and intends to refer to them in discussions about our operations and performance . Operating performance measures should be viewed in addition to, and not as an alternative to or substitute for, measures determined in accordance with GAAP, and are not necessarily comparable to non - GAAP measures that may be presented by other companies . ucbi.com | 2

Transaction Overview ucbi.com | 3 ► 105 - year - old community bank with 14 banking offices, including 12 in the high - growth Raleigh MSA ► Entry into attractive markets and substantially increases our North Carolina franchise to approximately $ 2 . 0 billion in assets with 33 banking offices ► Continues M&A strategy of obtaining entry points into key southeast markets and building market share post close by leveraging United’s size, diverse product suites and business model ► $ 0 . 04 , or 2 % , accretive to United’s fully diluted earnings per share for 2018 , excluding one - time transaction costs ► Less than 1 % dilutive to United’s tangible book value per share with an earn back of less than 3 years, excluding expected revenue synergies ► IRR over 20 % ► Strategic use of excess capital with minimal impact to Tier 1 Capital ► Full due diligence completed, including internal and third - party loan reviews ► Successfully completed asset resolution plan, resulting in strong credit metrics ► United has a long track record of successful whole - bank transactions Strategic Rationale Financially Attractive Mitigated Execution Risk

Four Oaks – 105 Years of Local Service Four Oaks United Four Oaks LPO ► Partnering with a 105 - year - old community bank located in North Carolina’s fastest growing market ► 10 branches and 2 LPOs in Raleigh MSA and a branch in Dunn and Wallace, NC ► Locally focused franchise ranked # 2 among local community banks in Raleigh MSA deposit market share ► Stable, low - cost funds to support a strong balance sheet and asset sensitive institution Deposit market share rankings exclude pending targets Pro Forma financials are as of 3/31/17, including the impact of HCSB Financial, Inc. acquisition, excluding purchase accounti ng adjustments Total Assets : Total Loans : Total Deposits : $ 737 mm $ 513 mm $ 560 mm Pro Forma $ 11 . 9 bn $ 7 . 7 bn $ 9 . 6 bn ucbi.com | 4

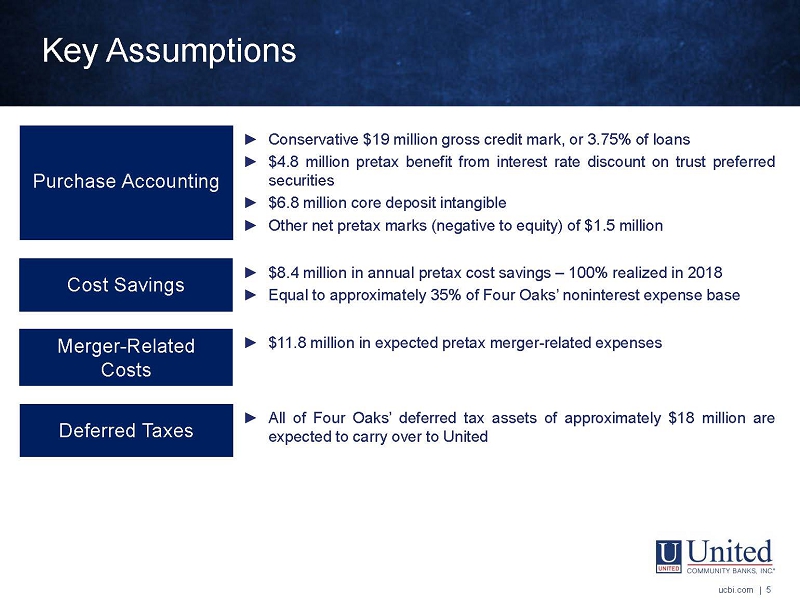

Key Assumptions ucbi.com | 5 ► Conservative $ 19 million gross credit mark, or 3 . 75 % of loans ► $ 4 . 8 million pretax benefit from interest rate discount on trust preferred securities ► $ 6 . 8 million core deposit intangible ► Other net pretax marks (negative to equity) of $ 1 . 5 million ► $ 8 . 4 million in annual pretax cost savings – 100 % realized in 2018 ► Equal to approximately 35 % of Four Oaks’ noninterest expense base ► $ 11 . 8 million in expected pretax merger - related expenses ► All of Four Oaks’ deferred tax assets of approximately $ 18 million are expected to carry over to United Purchase Accounting Cost Savings Merger - Related Costs Deferred Taxes

Transaction Terms ► Consideration : Approximately 90 % stock or . 6178 shares of United and 10 % cash or $ 1 . 90 for each share of Four Oaks ► Implied Transaction Value : $ 18 . 26 per share or $ 124 million in aggregate based on United’s closing price on June 23 , 2017 of $ 26 . 48 ► Implied Price - to - Tangible Book : 177 % ► Required Approvals : Customary regulatory approvals and approval of Four Oaks’ shareholders ► Expected Closing : Fourth quarter of 2017 ucbi.com | 6

Raleigh Market and Growth Opportunities Market disruption creates opportunity: Of the 15 operating banks or bank holding companies headquartered in metro Raleigh a decade ago, 10 have sold or exited the market ucbi.com | 7 Source: SNL Financial ► Four Oaks is one of the most established banks in NC and the Raleigh MSA, with a 105 - year operating history, a strong core deposit franchise, and tremendous customer relationships – Four Oaks’ presence in its rural markets has been a source of financial strength that has allowed it to successfully expand into Raleigh ► United senior management has deep ties to Four Oaks’ markets ; United President and COO Lynn Harton spent 12 years of his banking career in the Four Oaks market area ► The Four Oaks franchise provides an excellent springboard to grow and attract top - quality bankers in the greater Raleigh market, as United has successfully done in other fast - growing markets around the Southeast Raleigh MSA Headquartered Banks, Last 10 Years Capital Bank CapStone Bank Fidelity Bank First-Citizens Bank & Trust Company Four Oaks Bank & Trust Company Greystone Bank KS Bank, Inc. North State Bank Nuestro Banco Paragon Commercial Bank Patriot State Bank RBC Bank (USA) TrustAtlantic Bank VantageSouth Bank Yadkin Financial Corp. Raleigh MSA Headquartered Banks, Last 10 Years

Focused on High - Growth MSAs in the Southeast ► Raleigh is projected to be the fifth fastest growing MSA in the Southeast through 2022 and has the region’s highest median household income ► With the addition of the Raleigh market, the United franchise is present in four of the top 10 high - growth markets in the region – continuing our strategy of geographic and market diversity ucbi.com | 8 Top 10 Fastest Growing MSAs in the Southeast (Projected) 2017 - 2022 Proj. Population Growth 2017 Population 2022 Proj. Median Household Income Myrtle Beach-Conway-North Myrtle Beach, SC-NC 9.80% 449,541 $48,570 Cape Coral-Fort Myers, FL 8.71% 721,068 $53,202 Charleston-North Charleston, SC 8.66% 768,937 $61,722 Orlando-Kissimmee-Sanford, FL 8.28% 2,462,444 $55,142 Raleigh, NC 8.20% 1,305,052 $70,452 Naples-Immokalee-Marco Island, FL 8.01% 366,791 $67,598 North Port-Sarasota-Bradenton, FL 7.35% 788,154 $60,132 Charlotte-Concord-Gastonia, NC-SC 7.16% 2,485,529 $62,736 Savannah, GA 7.10% 388,564 $59,407 Nashville-Davidson-Murfreesboro-Franklin, TN 7.03% 1,881,524 $61,665 Table includes only MSAs with populations of greater than 300,000 Source: SNL Financial

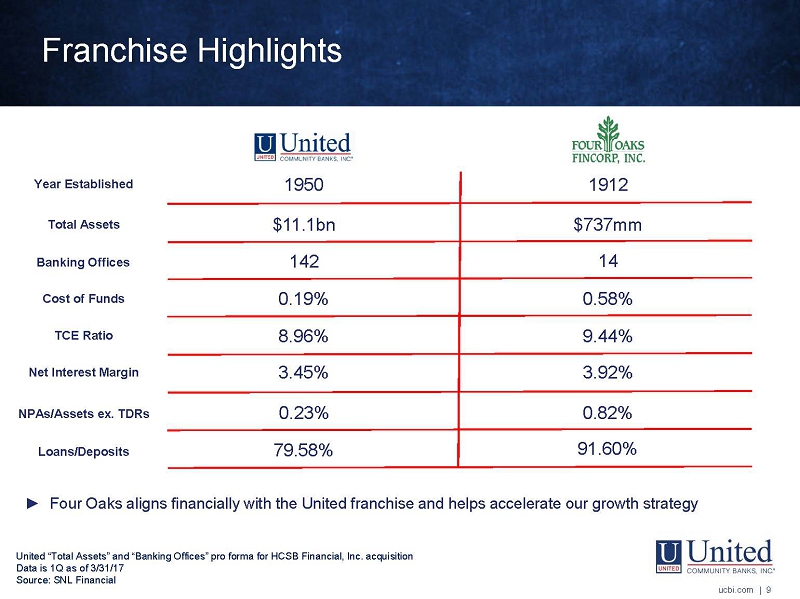

Franchise Highlights TCE Ratio 8.96% Loans/Deposits Net Interest Margin NPAs/Assets ex. TDRs 9.44% 3.45% 0.23% 79.58% 3.92% 0.82% 91.60% Cost of Funds Banking Offices 1950 0.19% 0.58% United “Total Assets” and “Banking Offices” pro forma for HCSB Financial, Inc. acquisition Data is 1Q as of 3/31/17 Source: SNL Financial ucbi.com | 9 ► Four Oaks aligns financially with the United franchise and helps accelerate our growth strategy Total Assets Year Established 1912 $11.1bn 142 $737mm 14

Demand 5% Transaction 3% MMDA & Savings 74% Retail CD 16% Jumbo CD 2% Pro forma figures are bank - level as of 3/31/17 United figures include the impact of HCSB Financial, Inc. acquisition, excluding purchase accounting adjustments Source: SNL Financial Loans Deposits $7.2bn $514mm $7.7bn $561mm Four OaksUnited Combined ADC 12% 1 - 4 26% Owner CRE 22% Other CRE 14% C&I 15% Other 11% ADC 18% 1 - 4 25% Owner CRE 18% Other CRE 22% C&I 4% Other 13% ADC 13% 1 - 4 26% Owner CRE 22% Other CRE 15% C&I 14% Other 10% Demand 5% Transaction 3% MMDA & Savings 75% Retail CD 15% Jumbo CD 2% Demand 8% Transaction 4% MMDA & Savings 54% Retail CD 30% Jumbo CD 4% Demand 5% Transaction 3% MMDA & Savings 74% Retail CD 16% Jumbo CD 2% Demand 5% Transaction 3% MMDA & Savings 75% Retail CD 15% Jumbo CD 2% Demand 8% Transaction 4% MMDA & Savings 54% Retail CD 30% Jumbo CD 4% Demand 5% Transaction 3% MMDA & Savings 74% Retail CD 16% Jumbo CD 2% $9.2bn $9.7bn ucbi.com | 10 Exhibit – Pro Forma Loan and Deposit Mix