Attached files

| file | filename |

|---|---|

| EX-10.1 - AMENDED AND RESTATED 2013 EQUITY INCENTIVE AWARD PLAN - ZAGG Inc | f8k062217ex10i_zagginc.htm |

| 8-K - CURRENT REPORT - ZAGG Inc | f8k062217_zagginc.htm |

Exhibit 99.1

Statements in this presentation relating to ZAGG's future plans, expectations, beliefs, intentions and prospects are "forward - looking statements" and are subject to material risks and uncert ai nties. Many factors could affect our current expectations and our actual results, and could cause actual results to differ materially . We presently consider the following to be among the important factors that could cause actual results to differ materially from exp ect atio ns: the ability to design, produce, and distribute the creative product solutions required to retain existing customers and to attract new customers; building and maintaining marketing and distribution functions sufficient to gain meaningful international market share for our p ro d ucts ; the ability to respond quickly with appropriate products after the adoption and introduction of new mobile devices by major manufacturers like Samsung and Apple; the impact of changes or delays in announced launch schedules for (or recalls or withdrawals of) new mobile devices by major manufacturers like Samsung and Apple; the ability to successfully integrate new operations or acquisitions, specifically including mophie inc.; the impact of inconsistent quality or reliability of new product offerings; the impact of lower profit margins in certain new and existing product categories, including certain mophie products; the impact of changes in economic conditions, including on customer demand; managing inventory in light of constantly shifting consumer demand ; the failure of our information systems or technology solutions or the failure to secure information system data, failure to comply with privacy laws, security breaches, or the effect on the Company from cyber - attacks, terrorist incidents, or the threat of terrorist incidents; and adoption of or changes in accounting policies, principles, or estim ates . A detailed discussion of these factors and other risks that affect our business is contained in our SEC filings, including our most recent reports on Form 10 - K and Form 10 - Q, particularly under the heading "Risk Facto rs. " Copies ofthese filings are available online from the SEC or by contacting ZAGG's Investor Relations Department at (801) 263 - 0699 or by clicking on SEC Filings on ZAGG's Investor Relations website at htt p :/ / investo rs.zag g .co m / or at the SEC's website at htt p:/ / www .se c.gov. All information set forth in this presentation is current as of May 4, 2017 . ZAGG undertakes no duty to update any statement in light of new information or future events. This presentation also contains estimates and other statistical data made by independent parties and by ZAGG relating to market size, market share, growth and other industry data . These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estim ates . We have not independently verified the statistical and other industry data generated by independent parties and contained in this presentation and, accordingly, cannot guarantee their accuracy or co mp leteness . In addition, projections, assumptions and estimates of our future performance and the future performance ofthe markets in which we compete are necessarily subject to a high degree of uncertainty and risk due to a variety of facto rs. These and other factors could cause results or outcomes to differ materially from those expressed in the estimates made by the independent parties and by ZAGG . This presentation also includes certain non - GAAP financial measures . These non - GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures, and should be read only in conjunction with our consolidated financial statements prepared in accordance with GA AP. There are a number of limitations related to the use of these non - GAAP financial measures versus their nearest GAAP eq uivalents . We have provided a reconciliation of those measures to the most directly comparable GAAP measures, which is available in the ap p e nd ix.

Portable Battery Packs #1 market share (29%) Folio keyboards #2 market share (28%) Stereo Headphones (In Ear/Bud) #5 unit market share (6%) Cell Phone Screen protection #1 market share (51%) Battery cases #1 market share (64%) NPD 2016 Award Winner for Largest Dollar Volume Gain in the Combined Cell Phone Accessories & Mobile Power Category GLOBAL LEADER IN MOBILE LIFESTYLE Source: The NPD Group, Inc. / U.S. Retail Tracking Service, March, 2017. See Appendix for further details. Market share perc en tages represent dollar share, except for stereo headphones representing unit share. 3

100% Screen protection 54% 15% 15% 9% 6 % Battery cases Audio Cases Screen protection Tablet keyboards External power 1 % 2005 2016 $730K net sales $402MM net sales BUILDING A DIVERSIFIED PRODUCT PORTFOLIO Source: ZAGG Form 10 - K, December 31, 2016 4

5 Z • \ GG

2017 BUSINESS OUTLOOK • Net sales of $470 - $500 million • Gross profit margin ranging from low to mid 30’s • Adjusted EBITDA of $71 - $75 million • 15% EBITDA margin on midpoint of $73 million 6 $485 $0 $100 $200 $300 $400 $500 $600 2016A 2017E Consolidated Net Sales - 2017 Guidance vs. 2016 Actual $402 +21% $37 $73 $- $10 $20 $30 $40 $50 $60 $70 $80 2016A 2017E Consolidated Adj. EBITDA - 2017 Guidance vs. 2016 Actual + 96 % ($ amounts in millions) Midpoint of Guidance Midpoint of Guidance

References to market share data on slide# 3 can be found in the reports from The NPD Group cited below: 1. The NPD Group, Inc., U.S. Retail Tracking Service, Cell Phone Screen Protection, and Tablet & e - readers - Accessories, Accessory Type: Screen Protector, March 2017. 2. The NPD Group, Inc., U.S. Retail Tracking Service, Cell Phone Device Protection, Charging Case, March 2017. 3. The NPD Group, Inc., U.S. Retail Tracking Service, Mobile Power, Charger Type: Portable Power Packs, March 2017. 4. The NPD Group, Inc., U.S. Retail Tracking Service, Tablet & e - readers - Cases, Keyboard Included, March 2017. 5. The NPD Group, Inc., U.S. Retail Tracking Service, Stereo Headphones, Earbuds/ln - Ear Stereo Headphones, March 2017. 8 Z • \ GG

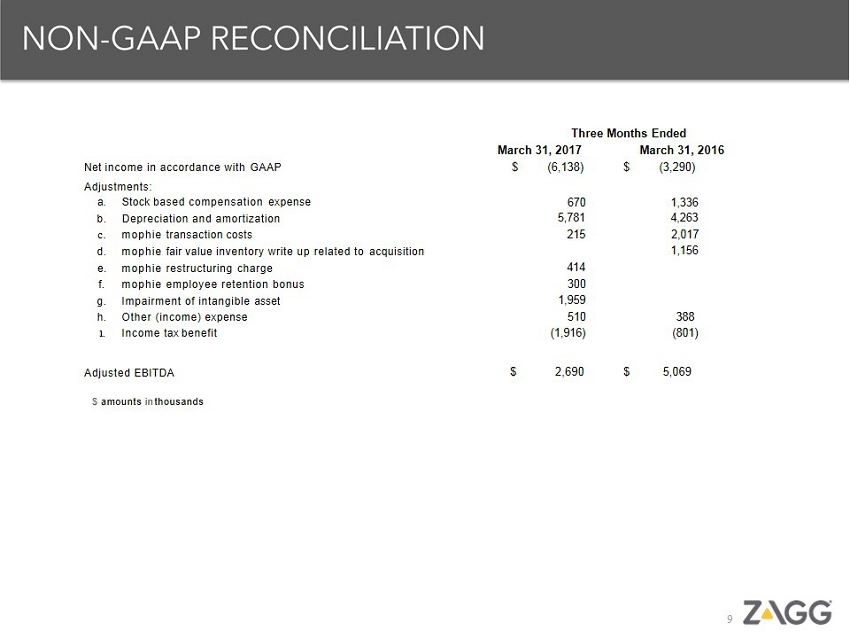

Adjusted EBITDA Three Months Ended $ 2,690 Net income in accordance with GAAP March 31, 2017 $ (6,138) March 31, 2016 $ (3,290) Adjustments: a. Stock based compensation expense 670 1,336 b. Depreciation and amortization 5,781 4,263 c. mophie transaction costs 215 2,017 d. mophie fair value inventory write up related to acquisition 1,156 e. mophie restructuring charge 414 f. mophie employee retention bonus 300 g. Impairment of intangible asset 1,959 h. Other (income) expense 510 388 1. Income tax benefit ( 1,916 ) ( 801 ) $ 5,069 $ amounts in thousands 9 Z • \ GG

June 2017