Attached files

| file | filename |

|---|---|

| EX-99.1 - SOLITARIO ZINC CORP. | exh991.htm |

| 8-K - SOLITARIO ZINC CORP. | vote8k.htm |

Exhibit 99.2

April 26, 2017

Solitario Exploration & Royalty Corp.

4251 Kipling Street, Suite 390

Wheat Ridge, CO

USA 80033

To: The Board of Directors of Solitario Exploration & Royalty Corp.

Mackie Research Capital Corporation (“MRCC”) understands that Solitario Exploration & Royalty Corp. (“Solitario” or the “Company”) and Zazu Metals Corporation (“Zazu”) have entered into a definitive agreement dated April 26, 2017 (the “Agreement”), whereby Solitario will acquire all of the issued and outstanding common shares in the capital of Zazu (the “Transaction”), by means of a plan of arrangement pursuant to Section 182 of the Business Corporation Act (Ontario) (the “Plan of Arrangement”) and that Solitario will continue as the ongoing public entity (the “Resulting Entity”).

MRCC understands that pursuant to the Agreement, each Zazu common share will be exchangeable for 0.3572 Solitario common shares (the “Exchange Ratio”). Pursuant to the Transaction, the holders of common shares of Zazu outstanding at the time of the effective date of the Transaction (the “Effective Date”) will receive Resulting Entity common shares (“Resulting Entity Shares”) based on the Exchange Ratio. All of the currently outstanding options of Zazu, that have not been exercised prior to the Effective Date will be exchanged by the holder thereof for a replacement option (the “Replacement Options”) to purchase a number of Resulting Entity Shares based on the Exchange Ratio at an exercise price based on the Exchange Ratio.

It is our understanding that the final material terms and conditions of, and risks associated with, the Transaction will be described in a management information circular of Solitario (the “Circular”), which will be prepared by Solitario’s management and legal advisors in compliance with applicable laws, regulations, policies and rules. As we understand it, completion of the Transaction is subject to a number of conditions, including, but not limited to, the receipt of all required approvals, including approval of the TSX and TSX Venture Exchange and Solitario’s shareholders. MRCC has assumed that all of the terms and conditions required to implement the Transaction will be satisfied, and that the Transaction will be completed as described in the Agreement without material variation in the terms and conditions.

ENGAGEMENT OF MACKIE RESEARCH CAPITAL CORPORATION

MRCC was engaged by the Company pursuant to a letter agreement (the “Engagement Agreement”) dated April 11, 2017. MRCC was first contacted by the Board of Directors (as such a term is defined below) regarding the Transaction on April 10, 2017.

| 1 |

The Engagement Agreement provides that MRCC will provide and deliver to the board of directors of the Company (the “Board of Directors”) its opinion as to the fairness, from a financial point of view, of the consideration to be paid by Solitario’s shareholders pursuant to the Transaction (this “Fairness Opinion”). The terms of the Engagement Agreement provide that MRCC will receive a fee for rendering the Fairness Opinion. In addition, MRCC is to be reimbursed for reasonable out-of-pocket expenses and MRCC and its directors, officers and employees are to be indemnified by the Company from and against certain liabilities which may be incurred in connection with the provision of its services. The fee payable to MRCC under the Engagement Agreement is not contingent upon the conclusions reached by us in this Fairness Opinion.

The Board of Directors has advised MRCC that the requirement for a valuation under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions does not apply to the Transaction and, accordingly, a formal valuation or other opinion of an independent valuator is not required in respect of the Transaction. MRCC has not been asked to prepare, and has not prepared, a formal valuation of Solitario, or any of its securities or assets, and this Fairness Opinion should not be construed as any such valuation.

This Fairness Opinion is provided to the Board of Directors solely to assist the Board of Directors in discharging its fiduciary obligations to the shareholders of Solitario. MRCC has received no instructions from Solitario in connection with the conclusions reached in this Fairness Opinion.

CREDENTIALS OF MACKIE RESEARCH CAPITAL CORPORATION

MRCC is a licensed and registered Canadian investment dealer providing investment research, equity sales and trading, and investment banking services to a broad range of institutions and companies. MRCC has participated in a significant number of transactions involving public and private companies, including those in the mining sector, and has extensive experience in preparing fairness opinions.

The opinion expressed herein represents the opinion of MRCC and the form and content herein have been approved for release by a committee of senior directors of MRCC, the members of which are experienced in mergers, acquisitions, divestitures, valuations, fairness opinions and other capital markets matters.

RELATIONSHIPS WITH INTERESTED PARTIES

None of MRCC, its associates or affiliates, is an insider, associate or affiliate (as those terms are defined in the Securities Act (Ontario)), or holds any securities of the Company or any of its associates or affiliates. MRCC is not an advisor to any person or company with respect to the Transaction. Other than pursuant to the Engagement Agreement, MRCC has not previously provided any financial advisory services to the Company or any of its respective associates or affiliates for which it has received compensation in the past 12 months.

Other than the Engagement Agreement, there are no understandings, agreements, or commitments between MRCC and the Company. MRCC may, however, in the ordinary course of its business, provide financial advisory or investment banking services to the Company from time to time. In addition, in the ordinary course of its business, MRCC may actively trade common shares and other securities of the Company for its own account and for its client accounts and, accordingly, may at any time hold a long or short position in such securities. MRCC conducts research on securities and may, in the ordinary course of its business, provide research reports and investment advice to its clients on investment matters, including with respect to the Company or the Transaction.

| 2 |

SCOPE OF REVIEW

In connection with this Fairness Opinion, MRCC has reviewed and relied upon, among other things, the following:

| 1. | certain public filings submitted by Solitario to securities commissions or similar regulatory authorities in Canada, which are available on the System for Electronic Document Analysis and Retrieval (“SEDAR”), including technical reports relating to Solitario’s resource properties, annual reports, material change reports, management information circulars and interim financial statements; |

| 2. | press releases issued by Solitario through commercial newswires over the past 24 months; |

| 3. | the current share price levels, recent share price levels, market capitalization and cash position and liabilities of Solitario; |

| 4. | the financial terms, to the extent they are publicly available, of certain transactions of a nature comparable to the Transaction, that MRCC considered to be relevant; |

| 5. | certain public filings and other publicly available information of companies which are comparable in nature to the Company, that MRCC considered to be relevant; |

| 6. | meetings and discussions MRCC held with members of Solitario’s Board of Directors where the Transaction, the financial condition of the Company, and certain other matters MRCC believed necessary or appropriate for the purpose of rendering this Fairness Opinion were discussed; |

| 7. | a draft of the Definitive Agreement in respect of the Transaction; |

| 8. | an officer’s certificate addressed to MRCC, from an officer of Solitario as to the completeness and accuracy of the information provided to MRCC by Solitario for the purposes of rendering this Fairness Opinion; and |

| 9. | such other information, analyses, investigations and discussions as MRCC considered necessary or appropriate in the circumstances. |

MRCC was granted access to the Board of Directors of Solitario and was not, to its knowledge, denied requested information.

This Fairness Opinion has been prepared in accordance with the Disclosure Standards for Formal Valuations and Fairness Opinions of the Investment Industry Regulatory Organization of Canada ("IIROC") but IIROC has not been involved in the preparation or review of this Fairness Opinion.

| 3 |

Please note that all currency amounts in this Fairness Opinion are presented in Canadian dollars unless otherwise indicated.

ASSUMPTIONS AND LIMITATIONS

With the approval of the Board of Directors and as is provided for in the Engagement Agreement, MRCC has relied upon the completeness, accuracy and fair presentation of all of the financial and other information, data, advice, opinions and representations obtained by it from publicly-available sources and from the Company’s officers and directors (collectively, the “Information”). This Fairness Opinion is conditional upon the completeness, accuracy and fair presentation of such Information. Subject to the exercise of professional judgment and except as expressly described herein, MRCC has not attempted to independently verify or investigate the completeness, accuracy or fair presentation of any of the Information. In addition, MRCC has assumed that the Transaction will be consummated in accordance with the terms set forth in the Agreement.

The Company has represented to MRCC in a certificate signed by an officer of the Company, among other things, that:

| a) | the Information and other material (financial and otherwise) provided orally by, or in the presence of, an officer of the Company or in writing by the Company, or its agents to MRCC relating to the Company or any of its respective subsidiaries or the Transaction for the purpose of preparing this Opinion was, at the date such Information was provided to MRCC, and is, complete, true and correct in all material respects, and did not and does not contain any untrue statement of a material fact in respect of the Company, its subsidiaries or the Transaction and did not and does not omit to state a material fact in respect of the Company, its subsidiaries or the Transaction necessary to make such Information not misleading in light of the circumstances under which it was made or provided; |

| b) | since the dates on which Information was provided to MRCC by the Company, except as subsequently disclosed in writing to MRCC or in a public filing with securities regulatory authorities, there has been no material change, financial or otherwise, in the financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of the Company or any of its subsidiaries and no material change has occurred which would have or which would reasonably be expected to have a material effect on this Fairness Opinion; |

| c) | other than as disclosed to MRCC and to the best of the Company’s knowledge, information and belief after due inquiry, there are no independent appraisals or valuations or material non-independent appraisals or valuations relating to the Company or any of its subsidiaries or any of their respective material assets or liabilities which have been prepared as of a date within the two years preceding the date hereof; and |

| d) | since the dates on which the Information was provided to MRCC by the Company, no material transaction has been entered into by the Company or its subsidiaries or contemplated by the Company or its subsidiaries except for transactions that have been disclosed to MRCC or generally disclosed. |

| 4 |

With respect to the financial information regarding the Company, MRCC has assumed that it has been reasonably prepared on bases reflecting the best currently available estimates and judgments of management of the Company. MRCC has also assumed that all of the representations and warranties contained in the Engagement Agreement are correct as of the date hereof, that the Transaction will be completed substantially in accordance with the Agreement, and that the relevant public disclosures will satisfy all applicable legal requirements.

This Fairness Opinion is rendered on the basis of securities markets, economic, financial and general business conditions prevailing as at the date hereof and the condition and prospects, financial and otherwise, of the Company and its subsidiaries and affiliates, as they were reflected in the Information and as they have been represented to MRCC in discussions with management of the Company. In its analyses and in preparing this Fairness Opinion, MRCC has made numerous assumptions with respect to expected industry performance, general business and economic conditions and other matters, many of which are beyond the control of MRCC or any party involved in the Transaction. MRCC believes these assumptions are reasonable under the current circumstances; however, actual future results may demonstrate that certain assumptions were incorrect.

MRCC is an investment dealer and financial advisor only and has relied upon, without independent verification or investigation, the assessment of the Company and its advisors with respect to certain matters, including but not limited to legal, tax, and regulatory matters. MRCC has not made any independent valuation or appraisal of any specific assets or liabilities of the Company. Further, in preparing this Fairness Opinion, in addition to the facts and conclusions contained in the Information, MRCC has assumed, among other things, the validity and efficacy of the procedures being followed to implement the Transaction, and MRCC does not express an opinion on such procedures. The completion of the Transaction is subject to a number of conditions outside the control of Solitario and Zazu, and MRCC has assumed all conditions precedent to the completion of the Transaction can be satisfied in due course and all consents, permissions, exemptions or orders of relevant regulatory authorities will be obtained, without adverse conditions or qualification. In rendering this Fairness Opinion, MRCC does not express a view as to the likelihood that the conditions with respect to the Transaction will be satisfied or waived or that the Transaction will be implemented within the time frame indicated in the Agreement.

This Fairness Opinion has been provided for the exclusive use of the Board of Directors in connection with the Transaction. This Fairness Opinion may not be used by any person or relied upon by any person other than the Board of Directors and may not be used or relied upon by the Board of Directors for any purpose other than the purpose hereinbefore stated, without the express prior written consent of MRCC. MRCC hereby consents to the reference to MRCC and the description, reference and inclusion of this Fairness Opinion in the Circular; subject to MRCC’s prior review and approval thereof.

This Fairness Opinion is limited to the fairness, from a financial point of view, of the Transaction to Solitario’s shareholders and MRCC expresses no opinion as to any alternative transaction. MRCC expresses no opinion as to the fairness of the Transaction relative to the consideration offered under any proposed alternative transaction. This Fairness Opinion does not constitute a recommendation to any shareholder of Solitario as to how such shareholder should vote with respect to the Transaction. Furthermore, MRCC has not been asked to address, and this Fairness Opinion does not address, the fairness of the Transaction to the holders of any class of securities of the Company other than the holders of the Company’s common shares.

| 5 |

MRCC believes that this Fairness Opinion must be considered and reviewed as a whole and that selecting portions of the stated analyses or factors considered by MRCC, without considering all the stated analyses and factors together, could create a misleading view of the process underlying or the scope of this Fairness Opinion. The preparation of a fairness opinion of this nature is a complex process and is not necessarily amenable to partial analysis or summary description. Any attempt to do so could lead to undue emphasis on any particular factor or analysis.

This Fairness Opinion is given as of the date hereof, and MRCC disclaims any undertaking or obligation to advise any person of any change in any fact or matter affecting this Fairness Opinion which may come or be brought to MRCC’s attention after the date hereof. Without limiting the foregoing, in the event that there is any material change (as defined in the Securities Act (Ontario)) in the Company or Zazu, or any change in any material fact (as defined in the Securities Act (Ontario)) affecting this Fairness Opinion after the date hereof, MRCC reserves the right to change, modify or withdraw this Fairness Opinion.

MRCC did not, in considering the fairness, from a financial point of view, of the Transaction to the shareholders of Solitario, assess any tax consequences that any particular shareholder of Solitario may face as a result of the Transaction.

FAIRNESS ANALYSES

MRCC has performed a variety of financial and comparative analyses in connection with the Fairness Opinion as described below. In arriving at this Fairness Opinion, we have weighted each of these analyses based on our experience and judgment.

In assessing the fairness of the Transaction, from a financial point of view, we considered, among other factors, the following items and methodologies relative to Solitario:

1. Comparable companies analysis;

2. Precedent transactions analysis;

3. Historical share price trading analysis; and

4. Discounted cash flow analysis.

1. Comparable companies analysis

MRCC reviewed publicly available information on comparable companies to Solitario in the mining sector, and compared these to Solitario. The analysis of these comparable companies is not purely mathematical, but involves considerations and judgments concerning, among other things, differences in underlying assets, company-specific risk factors such as grade and tonnage of reserves and resources, metallurgical recoveries, extraction costs, jurisdictions, and prevailing economic and market conditions, including but not limited to commodity prices.

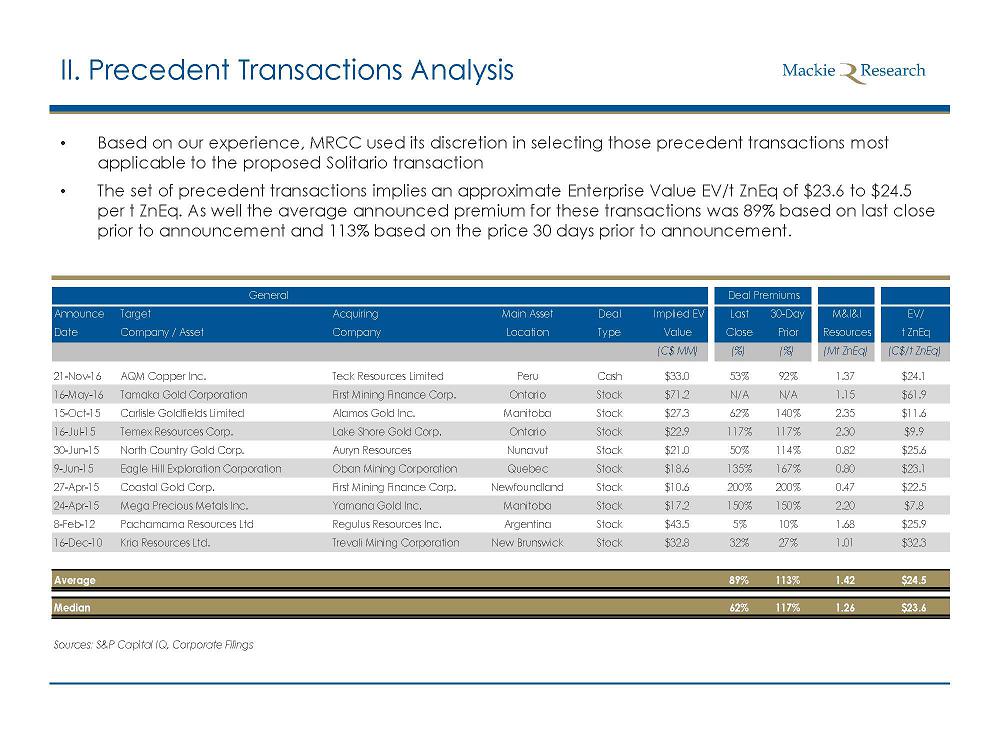

2. Precedent transactions analysis

MRCC reviewed publicly available information on a sample of comparable merger and acquisition transactions in the mining sector, and compared these to the Transaction. The analysis of these precedent transactions is not purely mathematical, but involves considerations and judgments concerning, among other things, differences in the structure, size and share price performance preceding each transaction announcement, risk factors specific to companies involved in such comparable transaction, including but not limited to grade and tonnage of reserves and resource, metallurgical recoveries, extraction costs, jurisdictions, and prevailing economic and market conditions, as well as commodity prices.

| 6 |

3. Historical share price trading analysis

MRCC reviewed the historical stock price of the Company’s common shares. MRCC reviewed the 1-month, 3-month, 6-month and 12-month volume-weighted-average share price of the Company.

4. Discounted cash flow analysis

MRCC, in its view, determined that a discounted cash flow analysis (DCF) of Solitario’s properties to not be a relevant valuation methodology, considering the very early stage of the projects.

MRCC attributed equal weight to the aforementioned methodologies, except for the discounted cash flow analysis which was determined to not be a relevant valuation methodology and therefore was not included.

FAIRNESS OPINION CONCLUSION

Based upon and subject to the foregoing, and such other factors as MRCC considered relevant, MRCC is of the opinion that, as at the date hereof, the consideration to be paid by the shareholders of Solitario pursuant to the Transaction is fair, from a financial point of view, to the shareholders of Solitario.

Yours very truly,

/s/ Jovan Stupar

Jovan Stupar, P.Eng., MBA

Managing Director

Mackie Research Capital Corporation

| 7 |

APPENDIX A

Excerpts from the presentation of the Fairness Opinion to the Board of Directors of Solitario: