Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MKS INSTRUMENTS INC | d414699d8k.htm |

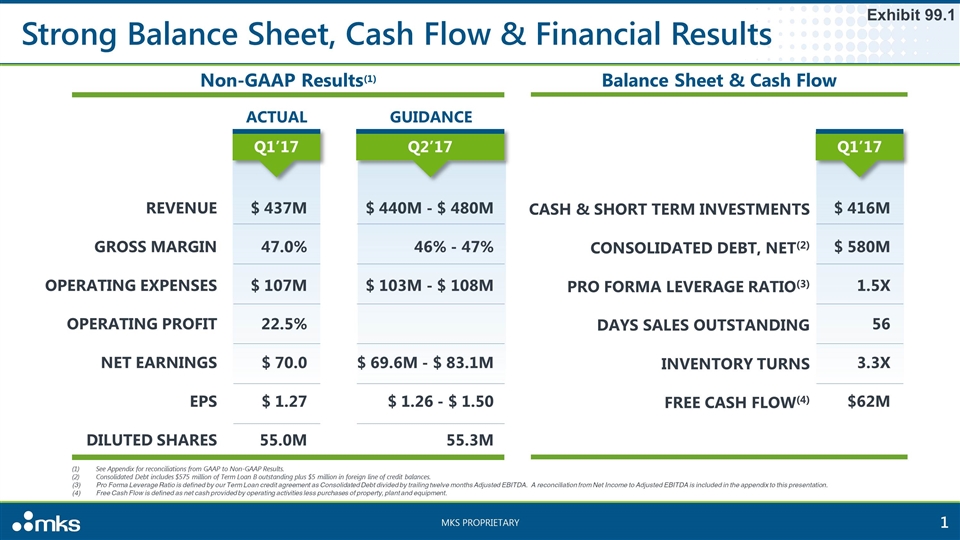

Strong Balance Sheet, Cash Flow & Financial Results MKS PROPRIETARY ACTUAL REVENUE GROSS MARGIN OPERATING EXPENSES OPERATING PROFIT NET EARNINGS EPS DILUTED SHARES Non-GAAP Results(1) Balance Sheet & Cash Flow CASH & SHORT TERM INVESTMENTS CONSOLIDATED DEBT, NET(2) PRO FORMA LEVERAGE RATIO(3) DAYS SALES OUTSTANDING INVENTORY TURNS FREE CASH FLOW(4) $ 437M 47.0% $ 107M 22.5% $ 70.0 $ 1.27 55.0M $ 416M $ 580M 1.5X 56 3.3X $62M Q1’17 Q1’17 GUIDANCE $ 440M - $ 480M 46% - 47% $ 103M - $ 108M $ 69.6M - $ 83.1M $ 1.26 - $ 1.50 55.3M Q2’17 See Appendix for reconciliations from GAAP to Non-GAAP Results. Consolidated Debt includes $575 million of Term Loan B outstanding plus $5 million in foreign line of credit balances. Pro Forma Leverage Ratio is defined by our Term Loan credit agreement as Consolidated Debt divided by trailing twelve months Adjusted EBITDA. A reconciliation from Net Income to Adjusted EBITDA is included in the appendix to this presentation. Free Cash Flow is defined as net cash provided by operating activities less purchases of property, plant and equipment. Exhibit 99.1

Appendix GAAP to Non-GAAP Reconciliations

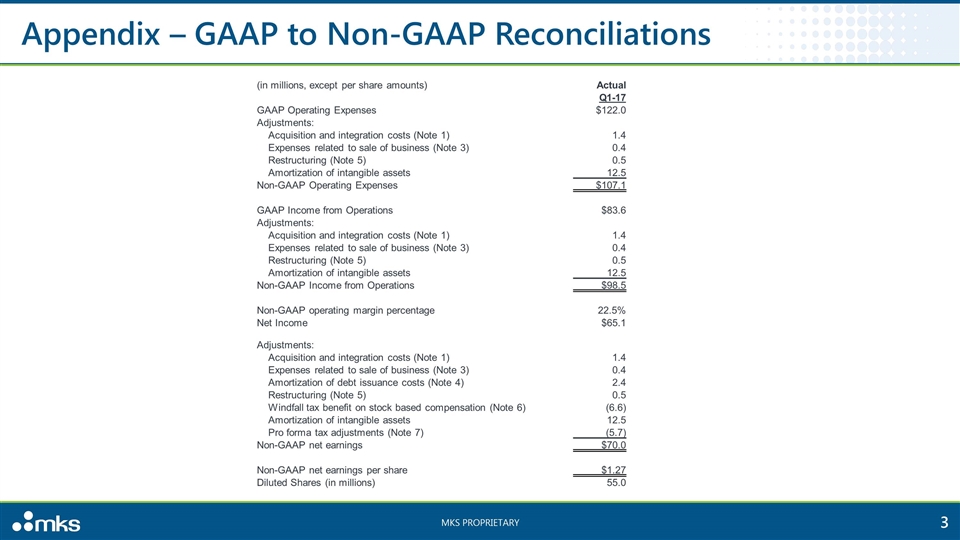

Appendix – GAAP to Non-GAAP Reconciliations MKS PROPRIETARY (in millions, except per share amounts) Actual Q1-17 GAAP Operating Expenses $122.0 Adjustments: Acquisition and integration costs (Note 1) 1.4 Expenses related to sale of business (Note 3) 0.4 Restructuring (Note 5) 0.5 Amortization of intangible assets 12.5 Non-GAAP Operating Expenses $107.1 GAAP Income from Operations $83.6 Adjustments: Acquisition and integration costs (Note 1) 1.4 Expenses related to sale of business (Note 3) 0.4 Restructuring (Note 5) 0.5 Amortization of intangible assets 12.5 Non-GAAP Income from Operations $98.5 Non-GAAP operating margin percentage 22.5% Net Income $65.1 Adjustments: Acquisition and integration costs (Note 1) 1.4 Expenses related to sale of business (Note 3) 0.4 Amortization of debt issuance costs (Note 4) 2.4 Restructuring (Note 5) 0.5 Windfall tax benefit on stock based compensation (Note 6) (6.6) Amortization of intangible assets 12.5 Pro forma tax adjustments (Note 7) (5.7) Non-GAAP net earnings $70.0 Non-GAAP net earnings per share $1.27 Diluted Shares (in millions) 55.0

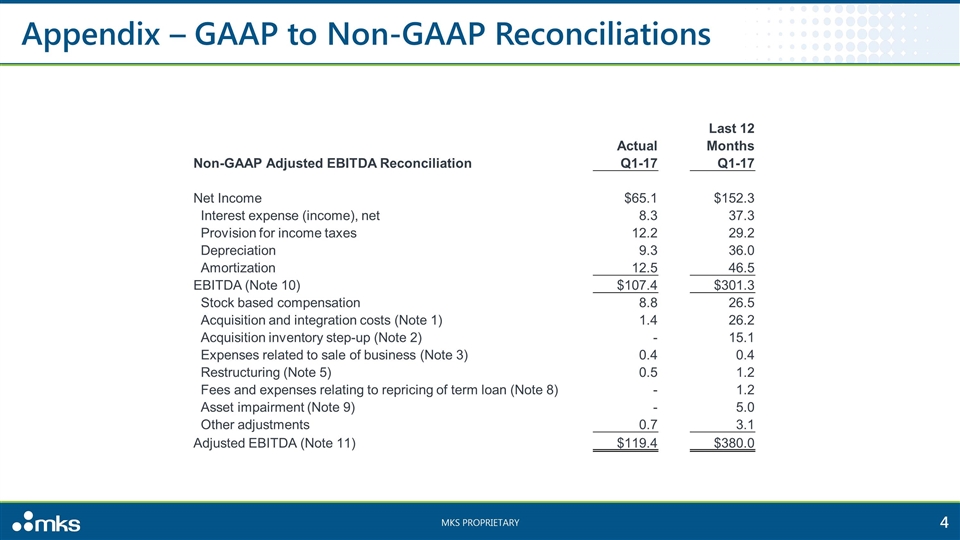

Appendix – GAAP to Non-GAAP Reconciliations MKS PROPRIETARY Last 12 Actual Months Non-GAAP Adjusted EBITDA Reconciliation Q1-17 Q1-17 Net Income $65.1 $152.3 Interest expense (income), net 8.3 37.3 Provision for income taxes 12.2 29.2 Depreciation 9.3 36.0 Amortization 12.5 46.5 EBITDA (Note 10) $107.4 $301.3 Stock based compensation 8.8 26.5 Acquisition and integration costs (Note 1) 1.4 26.2 Acquisition inventory step-up (Note 2) - 15.1 Expenses related to sale of business (Note 3) 0.4 0.4 Restructuring (Note 5) 0.5 1.2 Fees and expenses relating to repricing of term loan (Note 8) - 1.2 Asset impairment (Note 9) - 5.0 Other adjustments 0.7 3.1 Adjusted EBITDA (Note 11) $119.4 $380.0

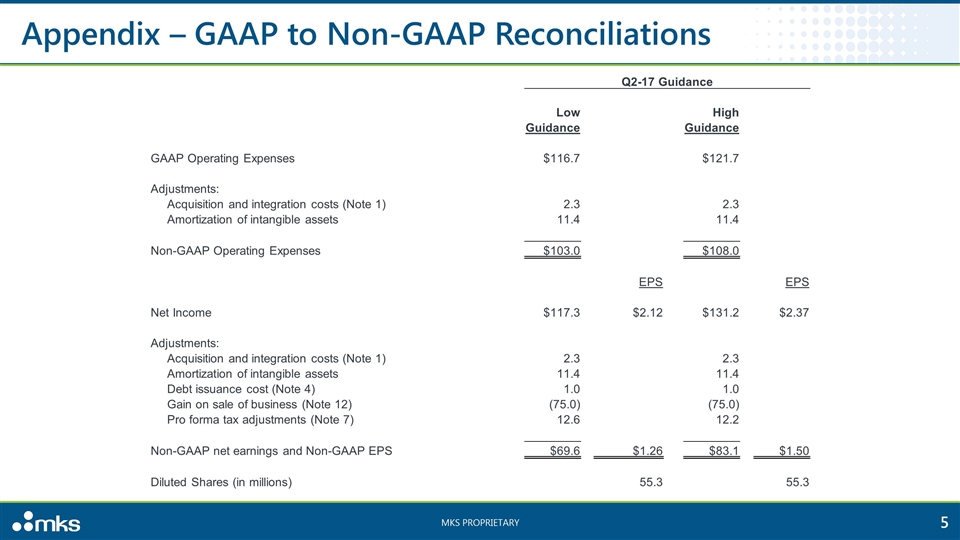

Appendix – GAAP to Non-GAAP Reconciliations MKS PROPRIETARY Q2-17 Guidance Low High Guidance Guidance GAAP Operating Expenses $116.7 $121.7 Adjustments: Acquisition and integration costs (Note 1) 2.3 2.3 Amortization of intangible assets 11.4 11.4 Non-GAAP Operating Expenses $103.0 $108.0 EPS EPS Net Income $117.3 $2.12 $131.2 $2.37 Adjustments: Acquisition and integration costs (Note 1) 2.3 2.3 Amortization of intangible assets 11.4 11.4 Debt issuance cost (Note 4) 1.0 1.0 Gain on sale of business (Note 12) (75.0) (75.0) Pro forma tax adjustments (Note 7) 12.6 12.2 Non-GAAP net earnings and Non-GAAP EPS $69.6 $1.26 $83.1 $1.50 Diluted Shares (in millions) 55.3 55.3

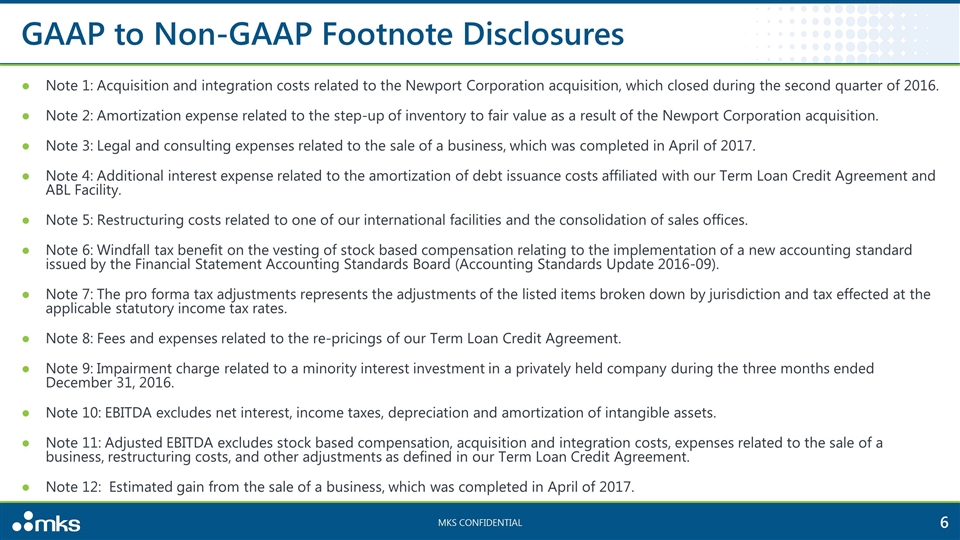

GAAP to Non-GAAP Footnote Disclosures Note 1: Acquisition and integration costs related to the Newport Corporation acquisition, which closed during the second quarter of 2016. Note 2: Amortization expense related to the step-up of inventory to fair value as a result of the Newport Corporation acquisition. Note 3: Legal and consulting expenses related to the sale of a business, which was completed in April of 2017. Note 4: Additional interest expense related to the amortization of debt issuance costs affiliated with our Term Loan Credit Agreement and ABL Facility. Note 5: Restructuring costs related to one of our international facilities and the consolidation of sales offices. Note 6: Windfall tax benefit on the vesting of stock based compensation relating to the implementation of a new accounting standard issued by the Financial Statement Accounting Standards Board (Accounting Standards Update 2016-09). Note 7: The pro forma tax adjustments represents the adjustments of the listed items broken down by jurisdiction and tax effected at the applicable statutory income tax rates. Note 8: Fees and expenses related to the re-pricings of our Term Loan Credit Agreement. Note 9: Impairment charge related to a minority interest investment in a privately held company during the three months ended December 31, 2016. Note 10: EBITDA excludes net interest, income taxes, depreciation and amortization of intangible assets. Note 11: Adjusted EBITDA excludes stock based compensation, acquisition and integration costs, expenses related to the sale of a business, restructuring costs, and other adjustments as defined in our Term Loan Credit Agreement. Note 12: Estimated gain from the sale of a business, which was completed in April of 2017. MKS CONFIDENTIAL