Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bristow Group Inc | d405240d8k.htm |

DRAFT The New Bristow and Our Action Plan for a Competitive and Profitable Future June 9, 2017 Exhibit 99.1

Forward-looking statements Statements contained in this presentation regarding the Company’s or management’s intentions, hopes, beliefs, expectations or predictions of the future are forward-looking statements. These forward-looking statements include statements regarding expected contract wins, operational and capital performance, cost reduction initiatives, cash flow, original equipment manufacturers (OEM) cost recoveries, capex deferral, liquidity, market and industry conditions. It is important to note that the Company’s actual results could differ materially from those projected in such forward-looking statements. Risks and uncertainties include, without limitation: fluctuations in the demand for our services; fluctuations in worldwide prices of and supply and demand for oil and natural gas; fluctuations in levels of oil and natural gas production, exploration and development activities; the impact of competition; actions by clients and suppliers; the risk of reductions in spending on helicopter services by governmental agencies; changes in tax and other laws and regulations; changes in foreign exchange rates and controls; risks associated with international operations; operating risks inherent in our business, including the possibility of declining safety performance; general economic conditions including the capital and credit markets; our ability to obtain financing; the risk of grounding of segments of our fleet for extended periods of time or indefinitely; our ability to re-deploy our aircraft to regions with greater demand; our ability to acquire additional aircraft and dispose of older aircraft through sales into the aftermarket; the possibility that we do not achieve the anticipated benefit of our fleet investment and Operational Excellence programs; availability of employees with the necessary skills; and political instability, war or acts of terrorism in any of the countries in which we operate. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company’s SEC filings, including but not limited to the Company’s annual report on Form 10-K for the fiscal year ended March 31, 2017. Bristow Group Inc. disclaims any intention or obligation to revise any forward-looking statements, including financial estimates, whether as a result of new information, future events or otherwise.

Our FY17 results were impacted by continued pressure on our oil and gas business as offshore activity remains low and the ongoing grounding of the H225, has increased lease and personnel costs for replacement aircraft We increased liquidity by $76M during Q4FY17 to $357M at March 31, 2017 through $26M of operating cash flow and funding of $290M of previously announced secured financings This downturn has our clients focused on safety and increasingly on regional efficiency. We must respond to better serve our clients The new Bristow will build on the successful actions taken in FY17, by implementing far-reaching cost efficiencies and portfolio and fleet optimization; delivering improved competitiveness designed to win more contracts and improve revenue Our successful response to FY17 challenges provides a roadmap for more comprehensive actions to create the New Bristow

The new Bristow will have two primary geographical hubs in key areas of business, Europe and the Americas, to become a more regionally focused, cost efficient and competitive business to win more contracts Safety improvement remains our top priority as these primary hubs employ these other priorities to succeed: Cost efficiencies, including reduced corporate G&A to approximately 12% of revenues, while also implementing lean processes and improving productivity Portfolio and fleet optimization, combined with pursuing original equipment manufacturers (OEM) cost recoveries and capex reduction to improve liquidity and reduce debt Revenue growth through contract wins in our primary hubs with a focus on delivering greater efficiencies to our core oil and gas clients The new Bristow seeks to optimize around our primary hubs, win contracts and improve cash flow and liquidity We anticipate that in 12-24 months, the company will have higher quality revenue, including the $2.3 billion U.K. SAR contract, improved cash flow and liquidity

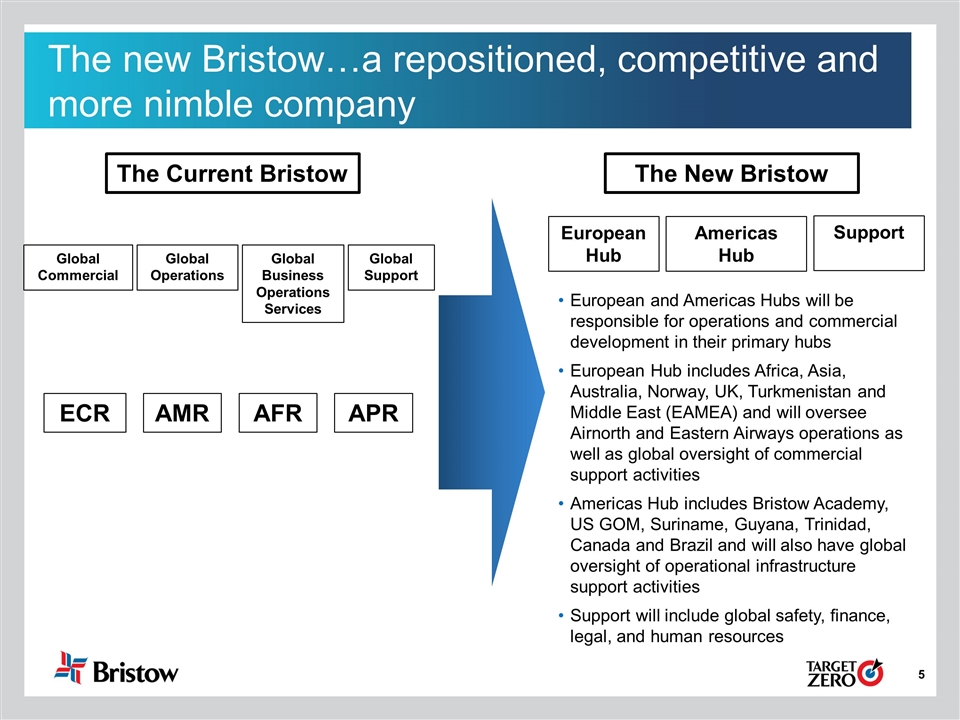

The new Bristow…a repositioned, competitive and more nimble company The Current Bristow Global Commercial Global Operations Global Business Operations Services ECR AMR Global Support AFR APR The New Bristow European Hub Americas Hub Support European and Americas Hubs will be responsible for operations and commercial development in their primary hubs European Hub includes Africa, Asia, Australia, Norway, UK, Turkmenistan and Middle East (EAMEA) and will oversee Airnorth and Eastern Airways operations as well as global oversight of commercial support activities Americas Hub includes Bristow Academy, US GOM, Suriname, Guyana, Trinidad, Canada and Brazil and will also have global oversight of operational infrastructure support activities Support will include global safety, finance, legal, and human resources

We are taking steps to reduce G&A to approximately 12% of revenues, including through the actions announced yesterday With the exception of SAR, we are significantly reducing our diversification effort, while continuing to leverage our fixed wing/UAV capabilities in markets where strong synergy exists with oil and gas operations We will portfolio manage our fleet and businesses. Each of our businesses will have to demonstrate that they can deliver attractive returns while carrying a fair share of our reduced G&A Today we are announcing the sale of a SAR S-92 for approximately $40 million; expected to close next week We continue to progress on the GECAS secured financing with execution of definitive agreements expected by June 30, 2017 All these actions are designed to significantly strengthen our capital structure, while increasing cash flow and improving our financial metrics Our vision to be the world’s safest premier industrial aviation services company remains unchanged Significant change in a challenging environment is never easy, but these changes strengthen our business and help us to better compete and grow over the longer term