Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 5-31-2017 - Sprague Resources LP | f8-kmlpa.htm |

1

Sprague Resources LP

MLPA Conference

May 31, 2017

Exhibit 99.1

2

Safe Harbor

This presentation contains unaudited quarterly results which should not be taken as an indication of the results of operations to be reported for

any subsequent period or for the full fiscal year.

Forward-Looking Statements: Some of the statements in this presentation may contain forward-looking statements within the meaning of the

safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such

as “may,” “assume,” “forecast,” “position,” “predict,” “strategy,” “expect,” “intend,” “plan,” “estimate,” “anticipate,” “believe,” “will,” “project,” “budget,”

“potential,” or “continue,” and similar references to future periods. However, the absence of these words does not mean that a statement is not

forward looking. Descriptions of our objectives, goals, plans, projections, estimates, anticipated capital expenditures, cost savings, strategy for

customer retention and strategy for risk management and other statements of future events or conditions are also forward looking statements.

Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs,

expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the

economy and other future conditions. Our actual future results and financial condition may differ materially from those indicated in the forward-

looking statements. These forward-looking statements involve risks and uncertainties and other factors that are difficult to predict and many of

which are beyond management’s control. Therefore, you should not rely on any of these forward-looking statements. Important factors that could

cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, but are not

limited to, increased competition for our products or services; changes in supply or demand for our products; changes in operating conditions and

costs; challenges in integrating acquired assets; changes in the level of environmental remediation spending; potential equipment malfunction;

potential labor issues; the legislative or regulatory environment; terminal construction repair/delays; nonperformance by major customers or

suppliers; litigation, and political, economic and capital market conditions, including the impact of potential terrorist acts and international

hostilities. For a more detailed description of these and other risks and uncertainties, please see the “Risk Factors” section in our most recent

Annual Report on Form 10-K and/or most recent Form10-Q, Form 8-K and other items filed with the U.S. Securities and Exchange Commission

“SEC” and also available in the “Investor Relations” section of our website www.spragueenergy.com.

Any forward-looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the

date of this presentation. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made

from time to time, whether as a result of new information, future developments or otherwise.

Non-GAAP Measures: In this presentation, and in statements we make in connection with this presentation, we refer to certain historical and

forward looking financial measures not prepared in accordance with U.S. generally accepted accounting principles, or GAAP. Non-GAAP

measures include adjusted gross margin, EBITDA, adjusted EBITDA, distributable cash flow, coverage ratio, permanent leverage ratio, and

liquidity. For more information on the non-GAAP measures used in this presentation, including reconciliations with comparable GAAP financial

measures, please refer to the Non-GAAP Measures in the Appendix at the end of this presentation.

3

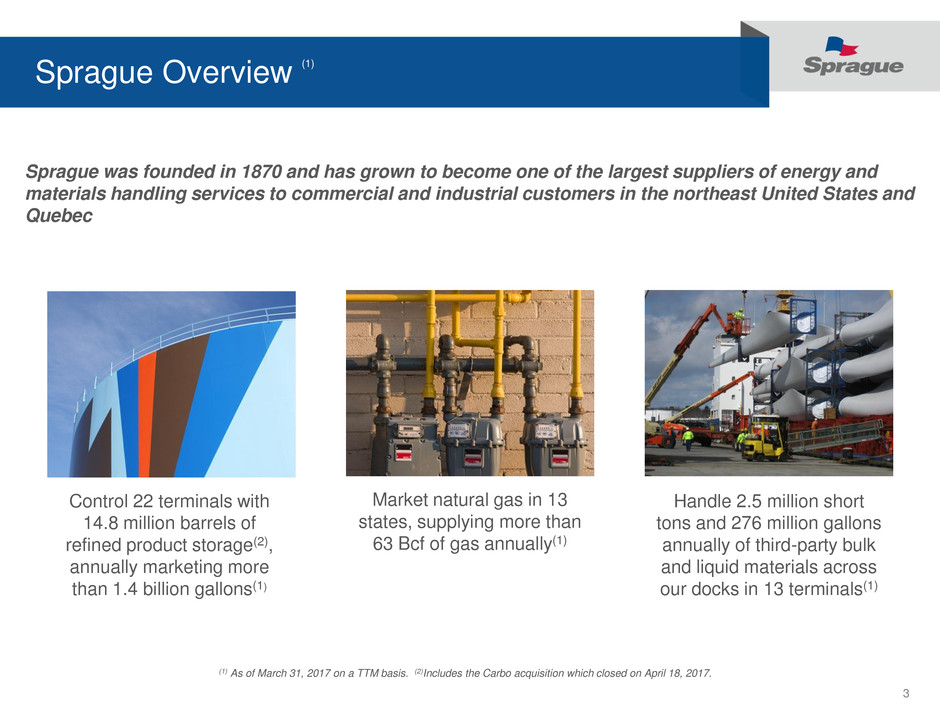

Sprague Overview

(1)

Sprague was founded in 1870 and has grown to become one of the largest suppliers of energy and

materials handling services to commercial and industrial customers in the northeast United States and

Quebec

Control 22 terminals with

14.8 million barrels of

refined product storage(2),

annually marketing more

than 1.4 billion gallons(1)

(1) As of March 31, 2017 on a TTM basis. (2)Includes the Carbo acquisition which closed on April 18, 2017.

Market natural gas in 13

states, supplying more than

63 Bcf of gas annually(1)

Handle 2.5 million short

tons and 276 million gallons

annually of third-party bulk

and liquid materials across

our docks in 13 terminals(1)

4

Sprague Overview

Since going public in October 2013, we’ve:

− Grown distributions for 12 consecutive quarters at a double-digit annual pace

− Closed on 9 acquisitions across 3 business lines, representing over $400

million in committed capital

o No external equity raise

o While maintaining permanent leverage(1) below 3x

− Maintained a TTM Distribution Coverage Ratio(1) above 1.5x

− Outperformed the Alerian MLP index in all 14 quarters

(1) Permanent Leverage and Distribution Coverage Ratio are a Non-GAAP financial measure. Please see Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations.

5

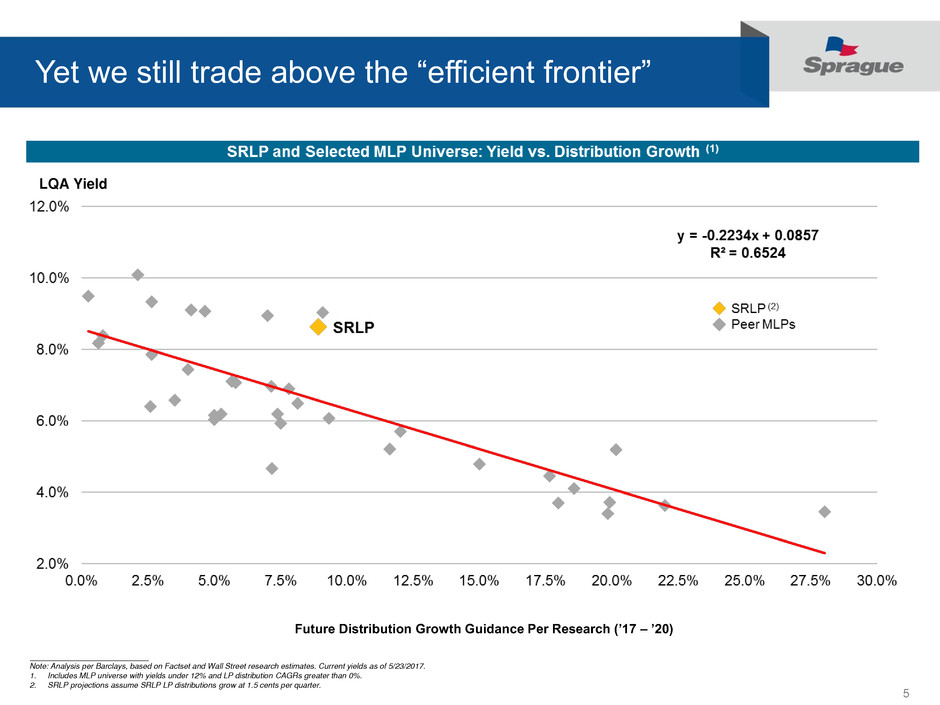

Yet we still trade above the “efficient frontier”

LQA Yield

___________________________

Note: Analysis per Barclays, based on Factset and Wall Street research estimates. Current yields as of 5/23/2017.

1. Includes MLP universe with yields under 12% and LP distribution CAGRs greater than 0%.

2. SRLP projections assume SRLP LP distributions grow at 1.5 cents per quarter.

Future Distribution Growth Guidance Per Research (’17 – ’20)

6

Our distribution coverage is healthy…

(1) Source: BAML / Wall Street estimates of Expected Distribution Coverage for 2017.. Market data as of March 31, 2017. Refined Products includes ARCX, BKEP, BPL, DKL, GEL, HEP, MMLP, MPLX, NS, PBFX, PSXP, RRMS, TLLP, TLP, VLP,

VTTI, WNRL, and WPT; Wholesale Distribution includes CAPL, GLP, SRLP and SUN; Propane includes APU, SPH and FGP. Based on annualized latest announced quarterly distribution.

(2) Distribution Coverage is a Non-GAAP financial measure. Please see Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations.

(3) GLP excludes non-recurring charges related to lease exist and early termination, and impairment of goodwill and long-lived assets.

1.2x 1.2x

0.8x

1.6x

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

Refined Products

MLPs

Wholesale

Distribution MLPs

Propane MLPs SRLP

TTM Distribution Coverage(1)(2)

vs. MLP Sectors

1.9x(3)

0.9x

1.2x

1.1x

0.6x

1.4x

1.6x

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

GLP CAPL ARCX BPL SPH TLP SRLP

TTM Distribution Coverage(1)(2) vs. Direct Peers

7

…and our Leverage remains low

(1) Source: BAML. Company disclosures and FactSet as March 31, 2017. Refined Products includes ARCX, BKEP, BPL, DKL, GEL, HEP, MMLP, MPLX, NS, PBFX, PSXP, RRMS, TLLP, TLP, VLP, VTTI, WNRL, and WPT; Wholesale Distribution

includes CAPL, GLP, SRLP and SUN; Propane includes APU, SPH and FGP. Excludes working capital revolving credit facility balances for GLP and SLRP.

3.8x

4.2x

4.9x

2.6x

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Refined Products

MLPs

Wholesale

Distribution MLPs

Propane MLPs SRLP

Leverage(1) vs. MLP Sectors

4.2x 4.1x 4.0x

4.2x

4.9x

2.7x 2.6x

0.0

1.0

2.0

3.0

4.0

5.0

6.0

GLP CAPL ARCX BPL SPH TLP SRLP

Leverage(1) vs. Direct Peers

8

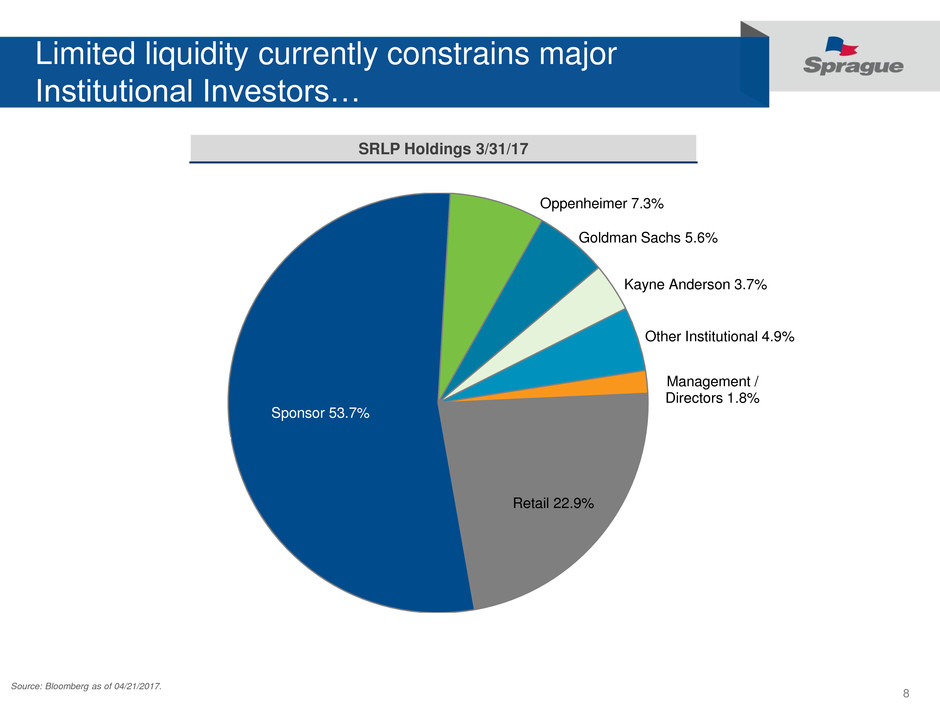

Sponsor 53.7%

Oppenheimer 7.3%

Goldman Sachs 5.6%

Kayne Anderson 3.7%

Other Institutional 4.9%

Management /

Directors 1.8%

Retail 22.9%

Limited liquidity currently constrains major

Institutional Investors…

Source: Bloomberg as of 04/21/2017.

SRLP Holdings 3/31/17

9

…though SRLP continues to demonstrate a

compelling Total Return outlook

(1) Source: BAML. Market data as of March 31, 2017. Total Return is based on Current Yield and 3-Year Expected Growth CAGR. Yield based on annualized latest announced quarterly distribution. CAGR calculated based on LQA - Q4 2019E

distributions. Refined Products includes ARCX, BKEP, BPL, DKL, GEL, HEP, MMLP, MPLX, NS, PBFX, PSXP, RRMS, TLLP, TLP, VLP, VTTI, WNRL, and WPT; Wholesale Distribution includes CAPL, GLP, SRLP and SUN; Propane includes APU, SPH

and FGP.

11.7%

10.1%

8.6%

16.9%

7.3%

9.5%

8.6% 8.7%

4.4%

0.6%

0.0%

8.2%

0%

3%

6%

9%

12%

15%

18%

Refined Products

MLPs

Wholesale

Distribution MLPs

Propane MLPs SRLP

Total Return(1) vs. MLP Sectors

10.5%

9.7%

14.5%

10.6%

15.0%

12.1%

16.9%

9.3% 9.7%

12.3%

7.5%

15.0%

6.8%

8.7%

1.2%

0.0%

2.2%

3.1%

0.0%

5.3%

8.2%

0%

5%

10%

15%

GLP CAPL ARCX BPL SPH TLP SRLP

Total Return(1) vs. Direct Peers

Yield

3-Year Expected

Growth CAGR

Total Return

10

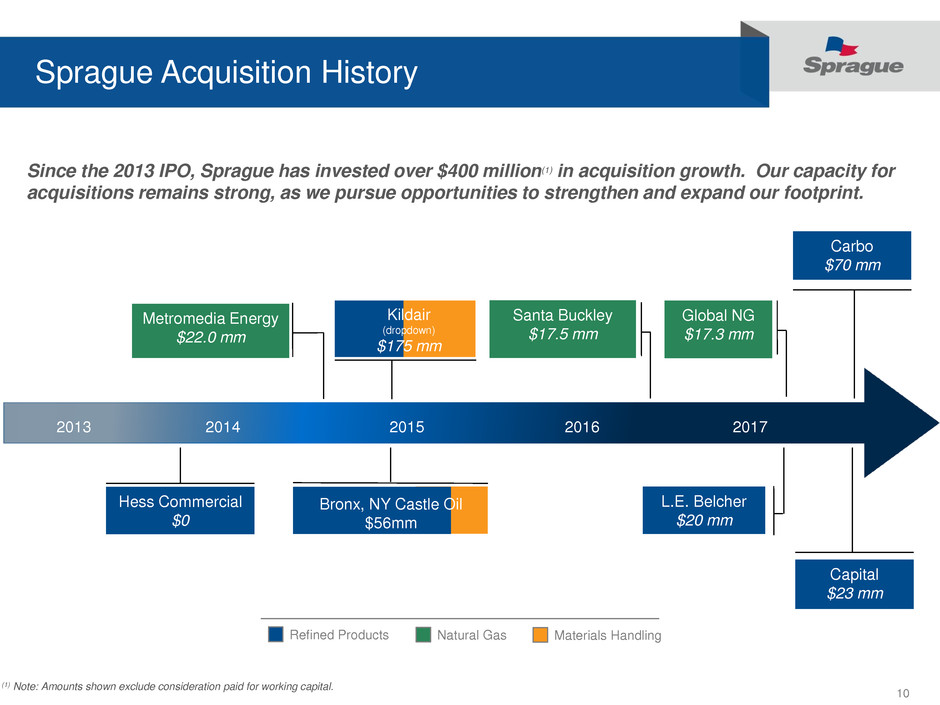

Sprague Acquisition History

2013 2014 2015 2016 2017

Since the 2013 IPO, Sprague has invested over $400 million(1) in acquisition growth. Our capacity for

acquisitions remains strong, as we pursue opportunities to strengthen and expand our footprint.

Refined Products Natural Gas Materials Handling

Metromedia Energy

$22.0 mm

Hess Commercial

$0

Kildair

(dropdown)

$175 mm

(1) Note: Amounts shown exclude consideration paid for working capital.

Santa Buckley

$17.5 mm

Global NG

$17.3 mm

L.E. Belcher

$20 mm

Carbo

$70 mm

Capital

$23 mm

Bronx, NY Castle Oil

$56mm

11

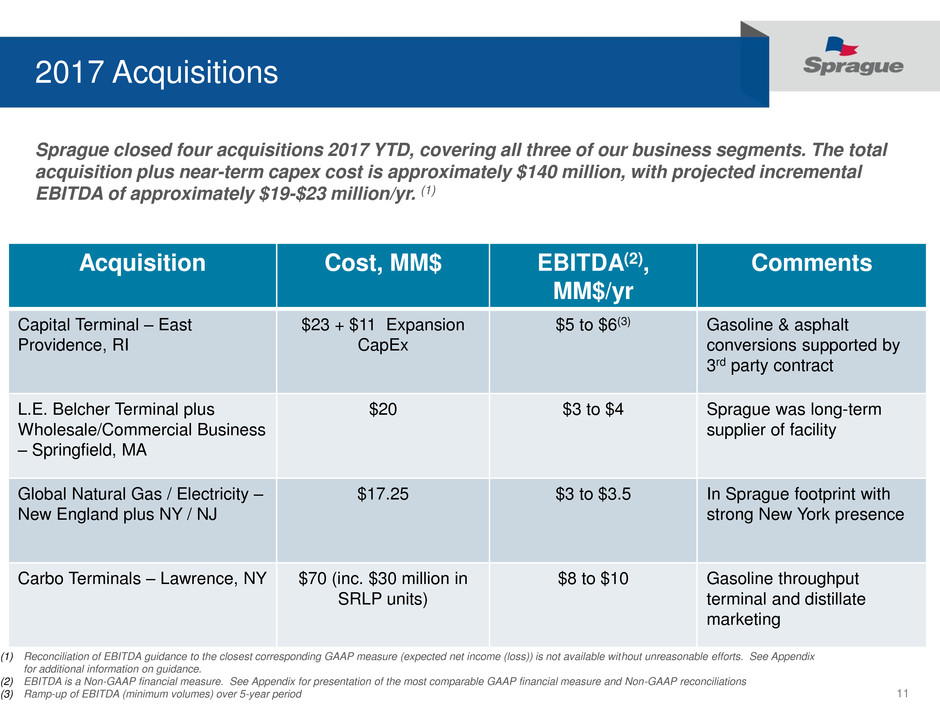

2017 Acquisitions

Sprague closed four acquisitions 2017 YTD, covering all three of our business segments. The total

acquisition plus near-term capex cost is approximately $140 million, with projected incremental

EBITDA of approximately $19-$23 million/yr. (1)

Acquisition Cost, MM$ EBITDA(2),

MM$/yr

Comments

Capital Terminal – East

Providence, RI

$23 + $11 Expansion

CapEx

$5 to $6(3) Gasoline & asphalt

conversions supported by

3rd party contract

L.E. Belcher Terminal plus

Wholesale/Commercial Business

– Springfield, MA

$20 $3 to $4 Sprague was long-term

supplier of facility

Global Natural Gas / Electricity –

New England plus NY / NJ

$17.25 $3 to $3.5 In Sprague footprint with

strong New York presence

Carbo Terminals – Lawrence, NY $70 (inc. $30 million in

SRLP units)

$8 to $10 Gasoline throughput

terminal and distillate

marketing

(1) Reconciliation of EBITDA guidance to the closest corresponding GAAP measure (expected net income (loss)) is not available without unreasonable efforts. See Appendix

for additional information on guidance.

(2) EBITDA is a Non-GAAP financial measure. See Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations

(3) Ramp-up of EBITDA (minimum volumes) over 5-year period

12

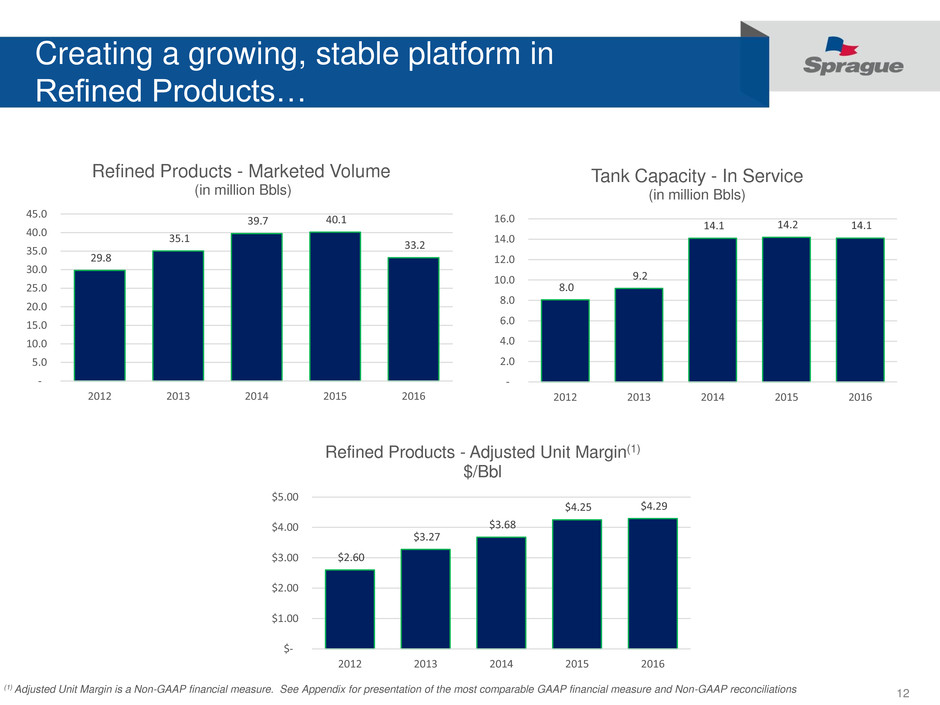

Creating a growing, stable platform in

Refined Products…

29.8

35.1

39.7 40.1

33.2

-

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

45.0

2012 2013 2014 2015 2016

Refined Products - Marketed Volume

(in million Bbls)

$2.60

$3.27

$3.68

$4.25 $4.29

$-

$1.00

$2.00

$3.00

$4.00

$5.00

2012 2013 2014 2015 2016

Refined Products - Adjusted Unit Margin(1)

$/Bbl

8.0

9.2

14.1 14.2 14.1

-

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

2012 2013 2014 2015 2016

Tank Capacity - In Service

(in million Bbls)

(1) Adjusted Unit Margin is a Non-GAAP financial measure. See Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations

13

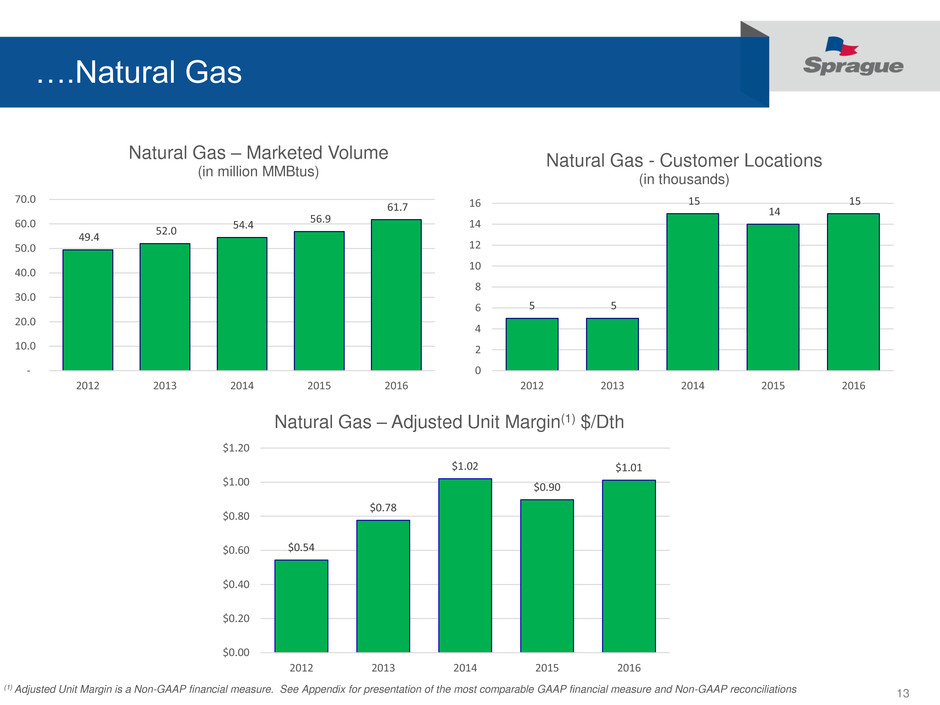

….Natural Gas

49.4

52.0

54.4

56.9

61.7

-

10.0

20.0

30.0

40.0

50.0

60.0

70.0

2012 2013 2014 2015 2016

Natural Gas – Marketed Volume

(in million MMBtus)

5 5

15

14

15

0

2

4

6

8

10

12

14

16

2012 2013 2014 2015 2016

Natural Gas - Customer Locations

(in thousands)

$0.54

$0.78

$1.02

$0.90

$1.01

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

2012 2013 2014 2015 2016

Natural Gas – Adjusted Unit Margin(1) $/Dth

(1) Adjusted Unit Margin is a Non-GAAP financial measure. See Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations

14

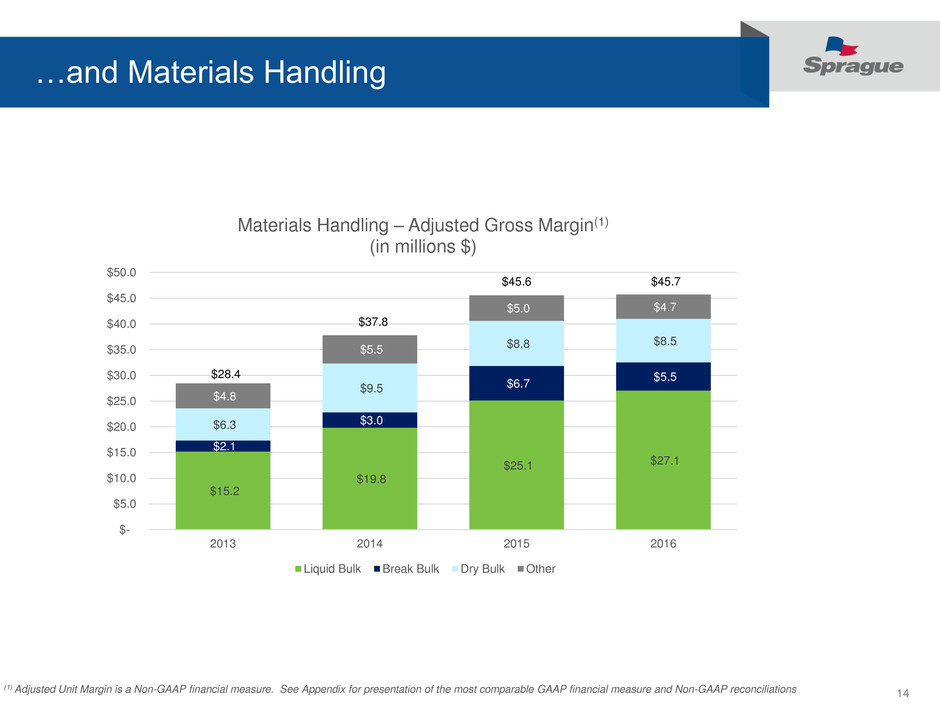

…and Materials Handling

(1) Adjusted Unit Margin is a Non-GAAP financial measure. See Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations

$15.2

$19.8

$25.1 $27.1

$2.1

$3.0

$6.7

$5.5

$6.3

$9.5

$8.8 $8.5

$4.8

$5.5

$5.0 $4.7

$-

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

$35.0

$40.0

$45.0

$50.0

2013 2014 2015 2016

Materials Handling – Adjusted Gross Margin(1)

(in millions $)

Liquid Bulk Break Bulk Dry Bulk Other

$45.7

$28.4

$37.8

$45.6

15

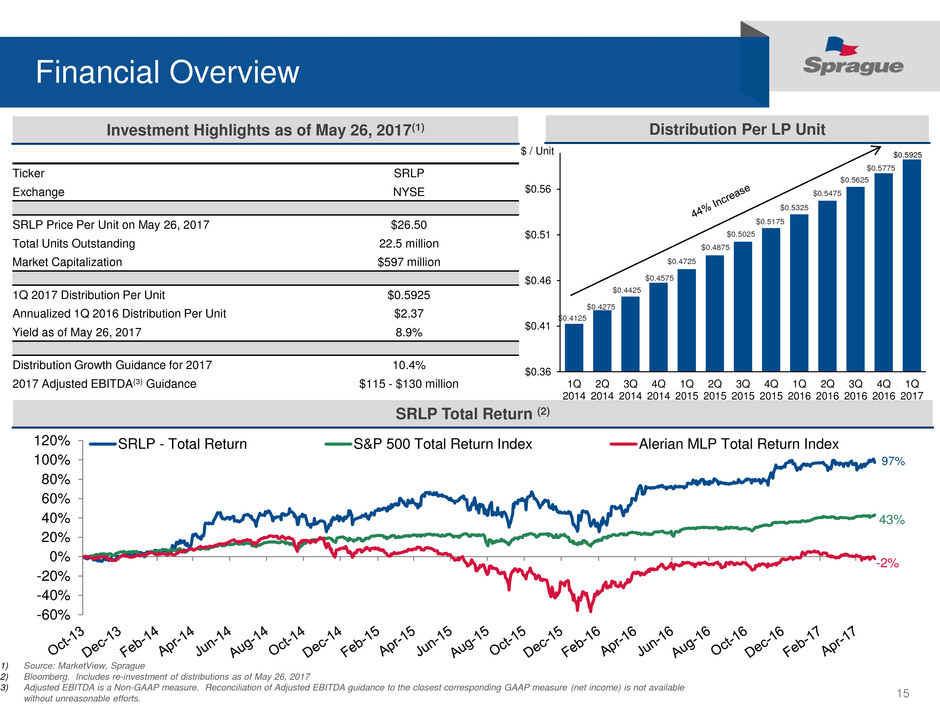

Financial Overview

Distribution Per LP UnitInvestment Highlights as of May 26, 2017(1)

SRLP Total Return (2)

Ticker SRLP

Exchange NYSE

SRLP Price Per Unit on May 26, 2017 $26.50

Total Units Outstanding 22.5 million

Market Capitalization $597 million

1Q 2017 Distribution Per Unit $0.5925

Annualized 1Q 2016 Distribution Per Unit $2.37

Yield as of May 26, 2017 8.9%

Distribution Growth Guidance for 2017 10.4%

2017 Adjusted EBITDA(3) Guidance $115 - $130 million

1) Source: MarketView, Sprague

2) Bloomberg. Includes re-investment of distributions as of May 26, 2017

3) Adjusted EBITDA is a Non-GAAP measure. Reconciliation of Adjusted EBITDA guidance to the closest corresponding GAAP measure (net income) is not available

without unreasonable efforts.

$0.5925

$0.36

$0.41

$0.46

$0.51

$0.56

1Q

2014

2Q

2014

3Q

2014

4Q

2014

1Q

2015

2Q

2015

3Q

2015

4Q

2015

1Q

2016

2Q

2016

3Q

2016

4Q

2016

1Q

2017

$ / Unit

$0.4275

$0.4425

$0.4575

$0.4725

$0.4875

$0.5025

$0.4125

$0.5175

$0.5325

$0.5475

$0.5625

$0.5775

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

120% SRLP - Total Return S&P 500 Total Return Index Alerian MLP Total Return Index

97%

43%

-2%

16

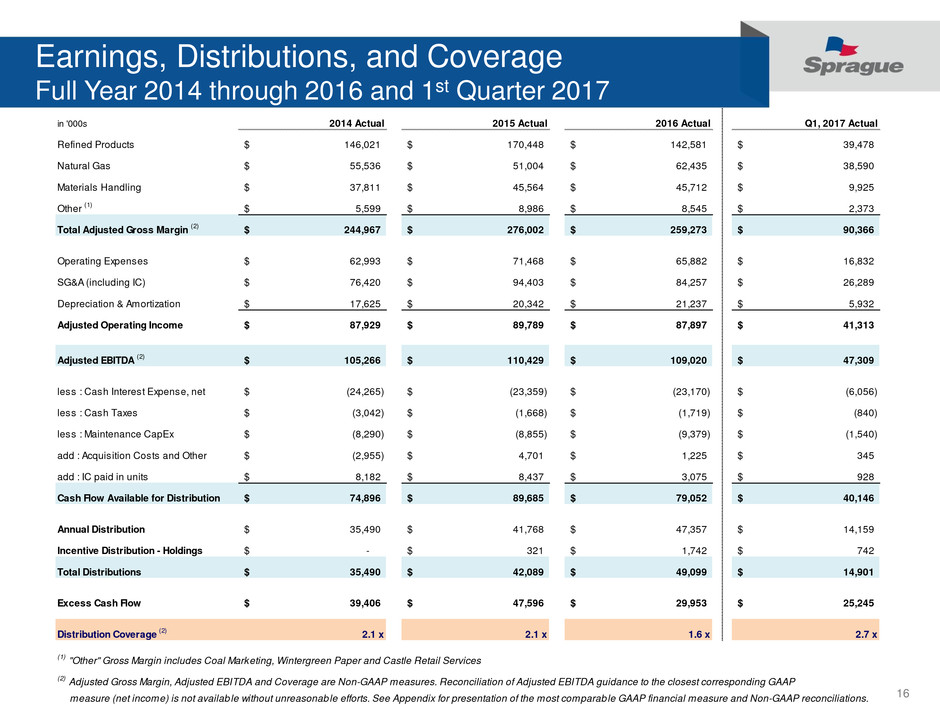

Earnings, Distributions, and Coverage

Full Year 2014 through 2016 and 1st Quarter 2017

in '000s 2014 Actual 2015 Actual 2016 Actual Q1, 2017 Actual

Refined Products 146,021$ 170,448$ 142,581$ 39,478$

Natural Gas 55,536$ 51,004$ 62,435$ 38,590$

Materials Handling 37,811$ 45,564$ 45,712$ 9,925$

Other

(1)

5,599$ 8,986$ 8,545$ 2,373$

Total Adjusted Gross Margin

(2)

244,967$ 276,002$ 259,273$ 90,366$

Operating Expenses 62,993$ 71,468$ 65,882$ 16,832$

SG&A (including IC) 76,420$ 94,403$ 84,257$ 26,289$

Depreciation & Amortization 17,625$ 20,342$ 21,237$ 5,932$

Adjusted Operating Income 87,929$ 89,789$ 87,897$ 41,313$

Adjusted EBITDA

(2)

105,266$ 110,429$ 109,020$ 47,309$

less : Cash Interest Expense, net (24,265)$ (23,359)$ (23,170)$ (6,056)$

less : Cash Taxes (3,042)$ (1,668)$ (1,719)$ (840)$

less : Maintenance CapEx (8,290)$ (8,855)$ (9,379)$ (1,540)$

add : Acquisition Costs and Other (2,955)$ 4,701$ 1,225$ 345$

add : IC paid in units 8,182$ 8,437$ 3,075$ 928$

Cash Flow Available for Distribution 74,896$ 89,685$ 79,052$ 40,146$

Annual Distribution 35,490$ 41,768$ 47,357$ 14,159$

Incentive Distribution - Holdings -$ 321$ 1,742$ 742$

Total Distributions 35,490$ 42,089$ 49,099$ 14,901$

Excess Cash Flow 39,406$ 47,596$ 29,953$ 25,245$

Distribution Coverage

(2)

2.1 x 2.1 x 1.6 x 2.7 x

(1)

"Other" Gross Margin includes Coal Marketing, Wintergreen Paper and Castle Retail Services

(2)

Adjusted Gross Margin, Adjusted EBITDA and Coverage are Non-GAAP measures. Reconciliation of Adjusted EBITDA guidance to the closest corresponding GAAP

measure (net income) is not availab le without unreasonable efforts. See Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations.

17

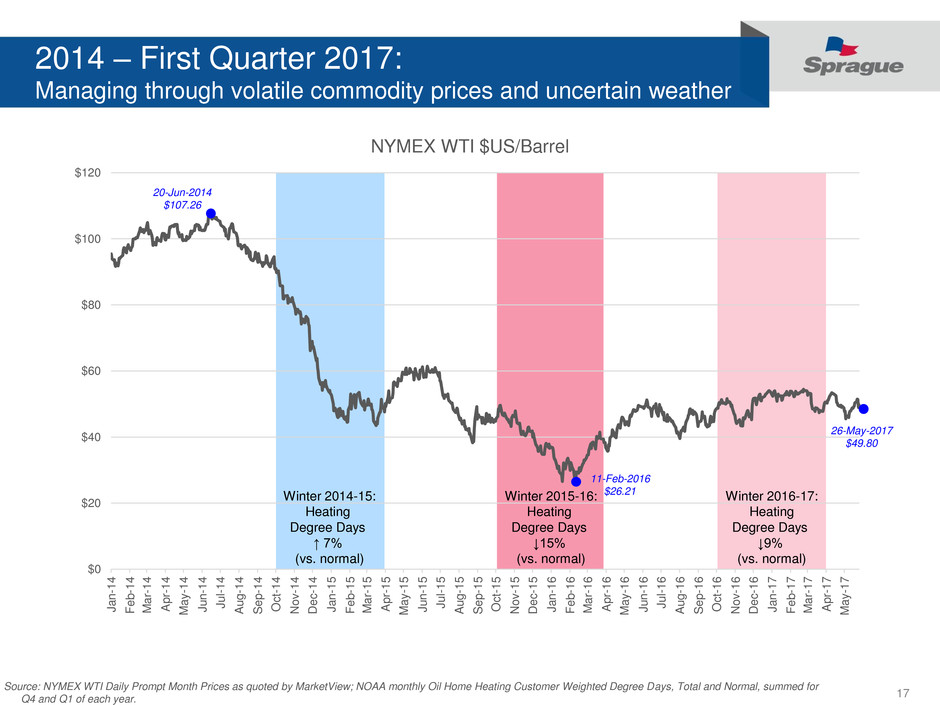

2014 – First Quarter 2017:

Managing through volatile commodity prices and uncertain weather

Winter 2014-15:

Heating

Degree Days

↑ 7%

(vs. normal)

Winter 2015-16:

Heating

Degree Days

↓15%

(vs. normal)

Winter 2016-17:

Heating

Degree Days

↓9%

(vs. normal)

Source: NYMEX WTI Daily Prompt Month Prices as quoted by MarketView; NOAA monthly Oil Home Heating Customer Weighted Degree Days, Total and Normal, summed for

Q4 and Q1 of each year.

$0

$20

$40

$60

$80

$100

$120

J

a

n

-1

4

F

e

b

-1

4

M

a

r-

1

4

A

p

r-

1

4

M

a

y

-1

4

J

u

n

-1

4

J

u

l-

1

4

A

u

g

-1

4

S

e

p

-1

4

O

c

t-

1

4

No

v

-1

4

De

c

-1

4

J

a

n

-1

5

F

e

b

-1

5

M

a

r-

1

5

A

p

r-

1

5

M

a

y

-1

5

J

u

n

-1

5

J

u

l-

1

5

A

u

g

-1

5

S

e

p

-1

5

O

c

t-

1

5

No

v

-1

5

De

c

-1

5

J

a

n

-1

6

F

e

b

-1

6

M

a

r-

1

6

A

p

r-

1

6

M

a

y

-1

6

J

u

n

-1

6

J

u

l-

1

6

A

u

g

-1

6

S

e

p

-1

6

O

c

t-

1

6

No

v

-1

6

De

c

-1

6

J

a

n

-1

7

F

e

b

-1

7

M

a

r-

1

7

A

p

r-

1

7

M

a

y

-1

7

NYMEX WTI $US/Barrel

20-Jun-2014

$107.26

11-Feb-2016

$26.21

26-May-2017

$49.80

18

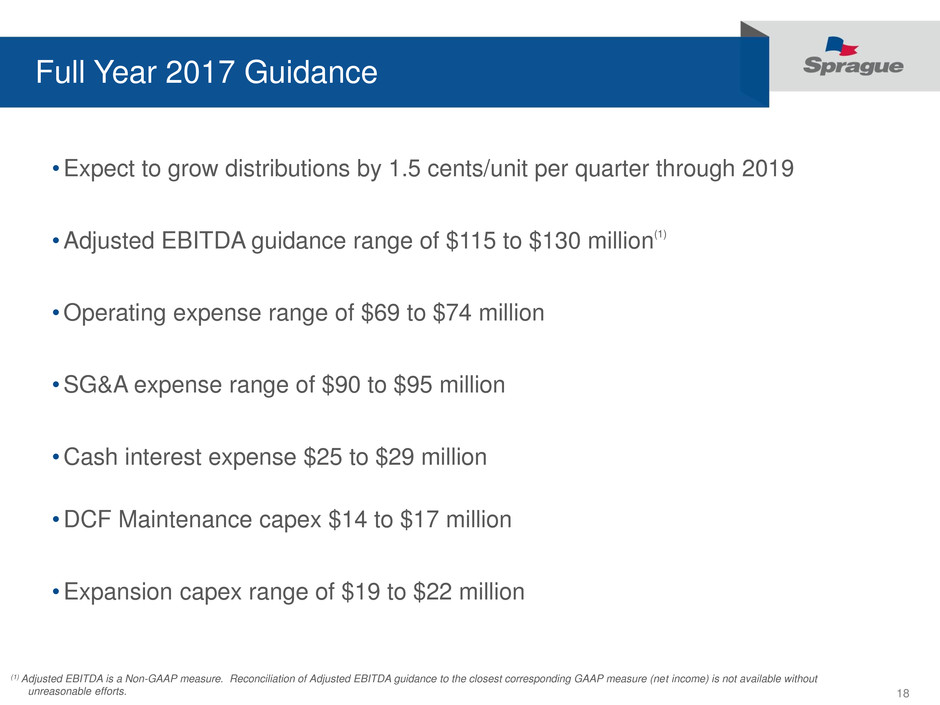

Full Year 2017 Guidance

•Expect to grow distributions by 1.5 cents/unit per quarter through 2019

•Adjusted EBITDA guidance range of $115 to $130 million(1)

•Operating expense range of $69 to $74 million

•SG&A expense range of $90 to $95 million

•Cash interest expense $25 to $29 million

•DCF Maintenance capex $14 to $17 million

•Expansion capex range of $19 to $22 million

(1) Adjusted EBITDA is a Non-GAAP measure. Reconciliation of Adjusted EBITDA guidance to the closest corresponding GAAP measure (net income) is not available without

unreasonable efforts.

19

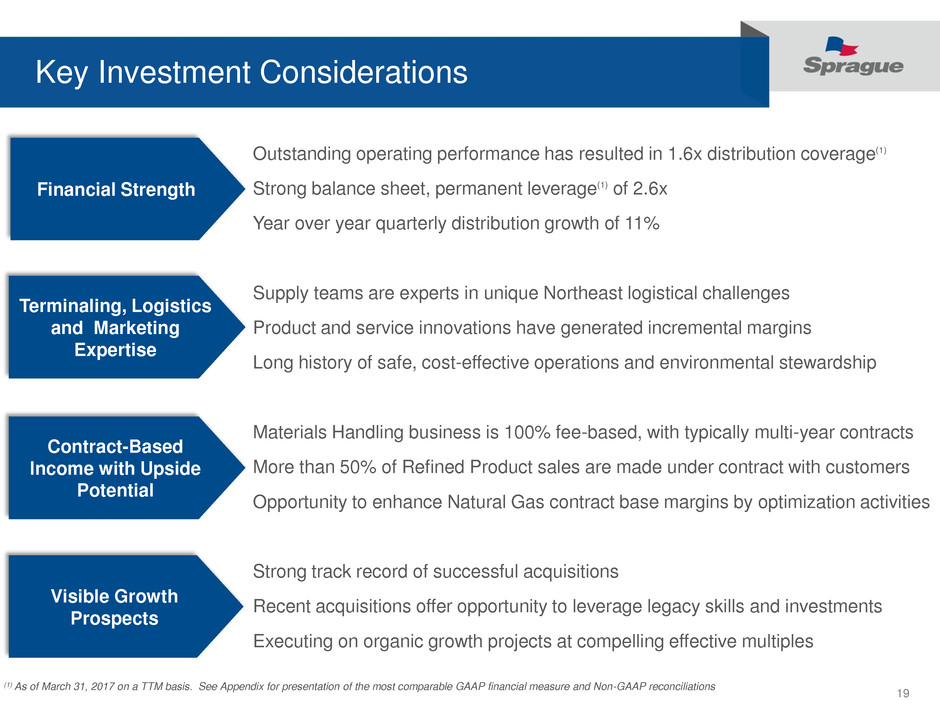

Key Investment Considerations

Outstanding operating performance has resulted in 1.6x distribution coverage(1)

Strong balance sheet, permanent leverage(1) of 2.6x

Year over year quarterly distribution growth of 11%

Supply teams are experts in unique Northeast logistical challenges

Product and service innovations have generated incremental margins

Long history of safe, cost-effective operations and environmental stewardship

Materials Handling business is 100% fee-based, with typically multi-year contracts

More than 50% of Refined Product sales are made under contract with customers

Opportunity to enhance Natural Gas contract base margins by optimization activities

Strong track record of successful acquisitions

Recent acquisitions offer opportunity to leverage legacy skills and investments

Executing on organic growth projects at compelling effective multiples

Terminaling, Logistics

and Marketing

Expertise

Contract-Based

Income with Upside

Potential

Financial Strength

Visible Growth

Prospects

(1) As of March 31, 2017 on a TTM basis. See Appendix for presentation of the most comparable GAAP financial measure and Non-GAAP reconciliations

20

Appendix

21

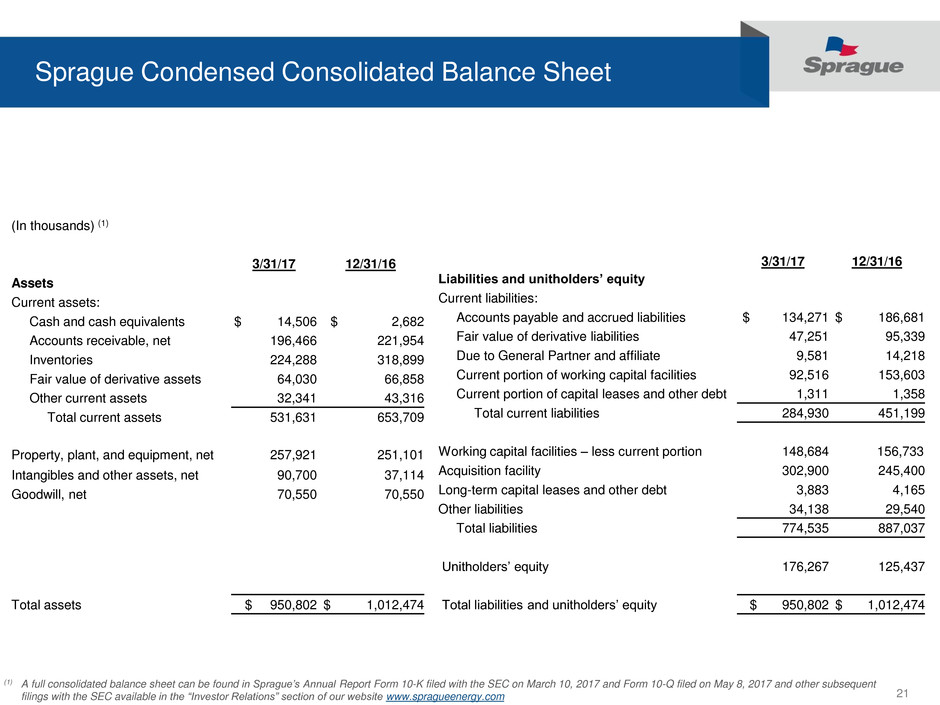

Sprague Condensed Consolidated Balance Sheet

(In thousands) (1)

3/31/17 12/31/16

Assets

Current assets:

Cash and cash equivalents $ 14,506 $ 2,682

Accounts receivable, net 196,466 221,954

Inventories 224,288 318,899

Fair value of derivative assets 64,030 66,858

Other current assets 32,341 43,316

Total current assets 531,631 653,709

Property, plant, and equipment, net 257,921 251,101

Intangibles and other assets, net 90,700 37,114

Goodwill, net 70,550 70,550

Total assets $ 950,802 $ 1,012,474

3/31/17 12/31/16

Liabilities and unitholders’ equity

Current liabilities:

Accounts payable and accrued liabilities $ 134,271 $ 186,681

Fair value of derivative liabilities 47,251 95,339

Due to General Partner and affiliate 9,581 14,218

Current portion of working capital facilities 92,516 153,603

Current portion of capital leases and other debt 1,311 1,358

Total current liabilities 284,930 451,199

Working capital facilities – less current portion 148,684 156,733

Acquisition facility 302,900 245,400

Long-term capital leases and other debt 3,883 4,165

Other liabilities 34,138 29,540

Total liabilities 774,535 887,037

Unitholders’ equity 176,267 125,437

Total liabilities and unitholders’ equity $ 950,802 $ 1,012,474

(1) A full consolidated balance sheet can be found in Sprague’s Annual Report Form 10-K filed with the SEC on March 10, 2017 and Form 10-Q filed on May 8, 2017 and other subsequent

filings with the SEC available in the “Investor Relations” section of our website www.spragueenergy.com

22

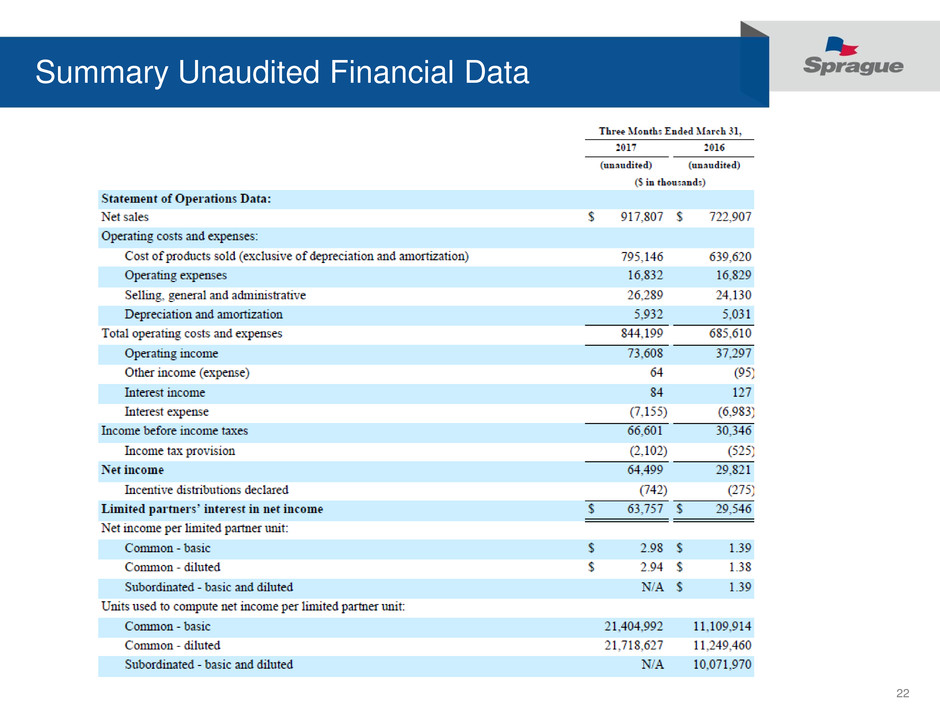

Summary Unaudited Financial Data

23

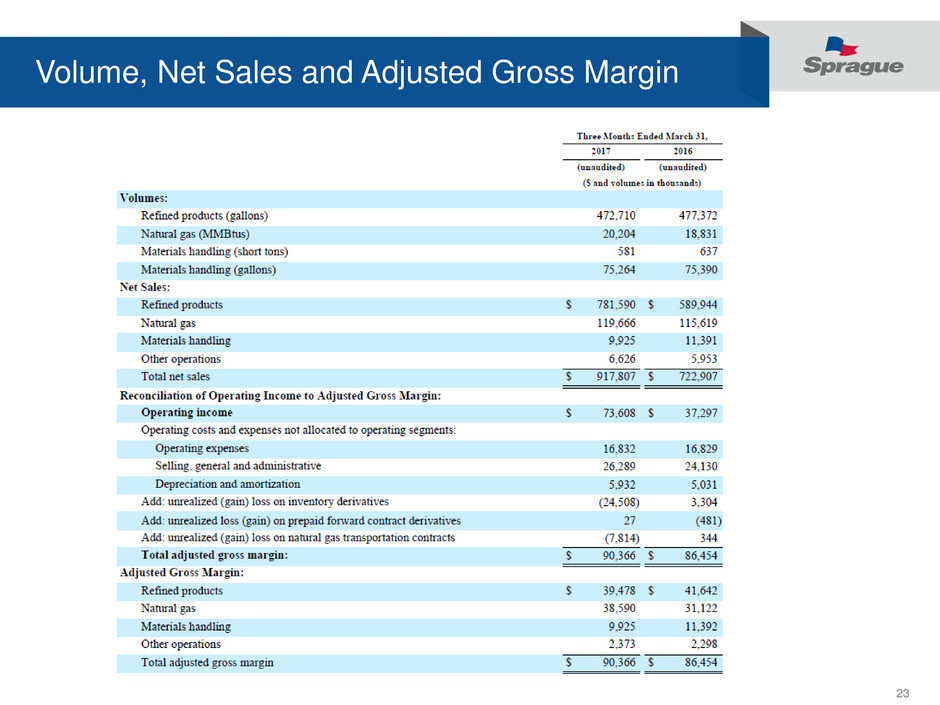

Volume, Net Sales and Adjusted Gross Margin

24

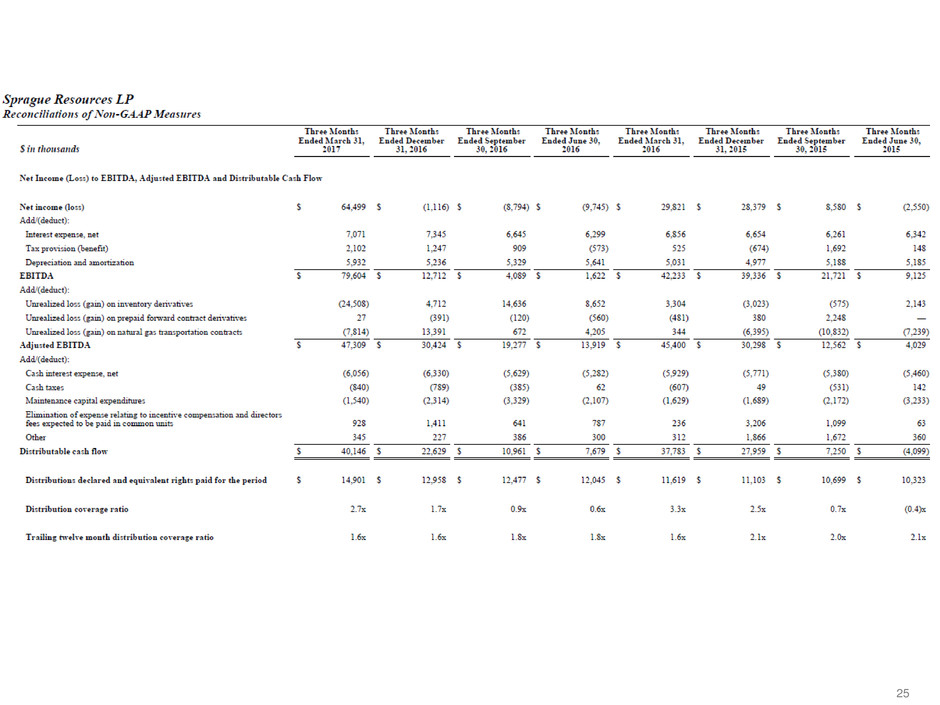

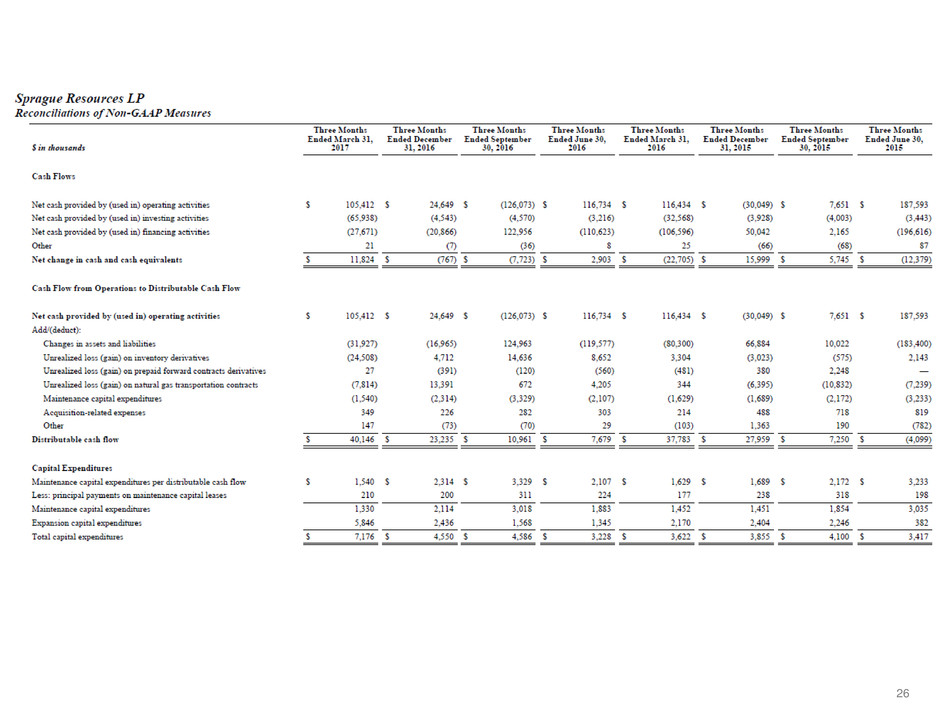

25

26

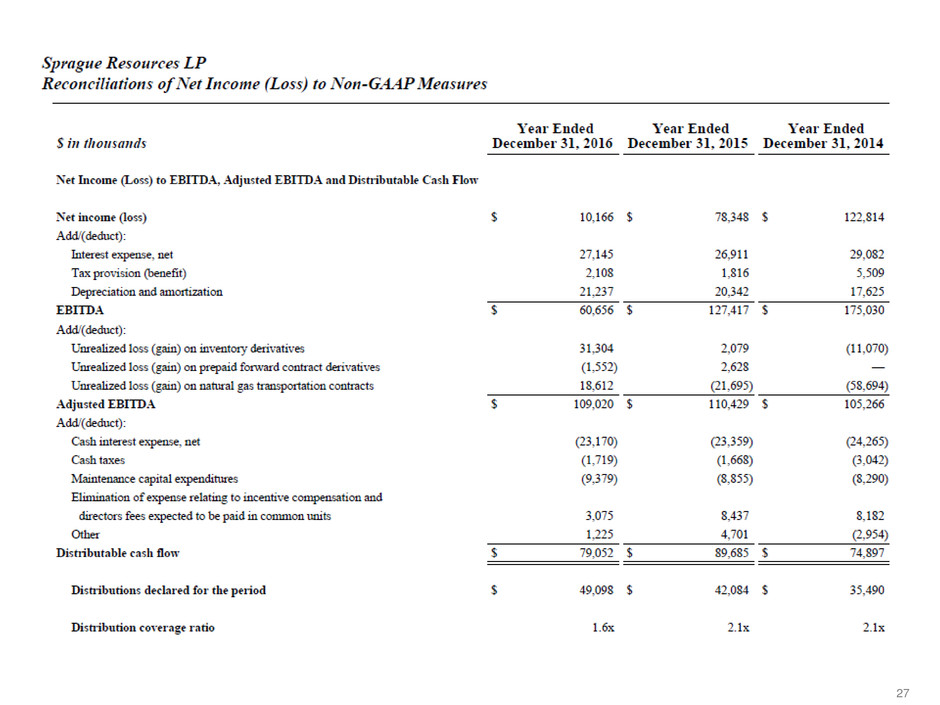

27

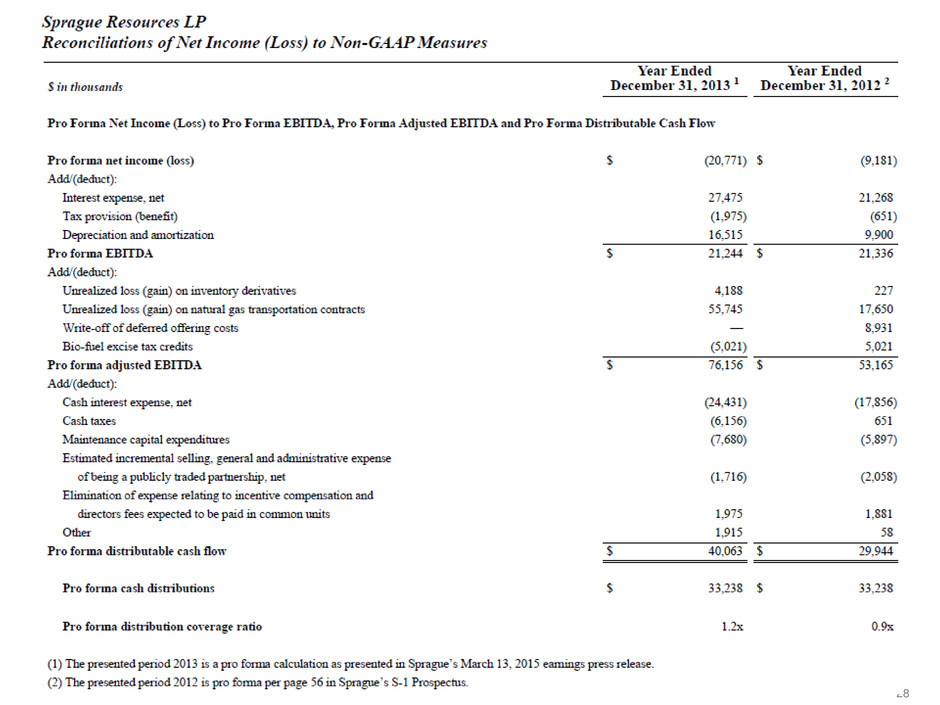

28

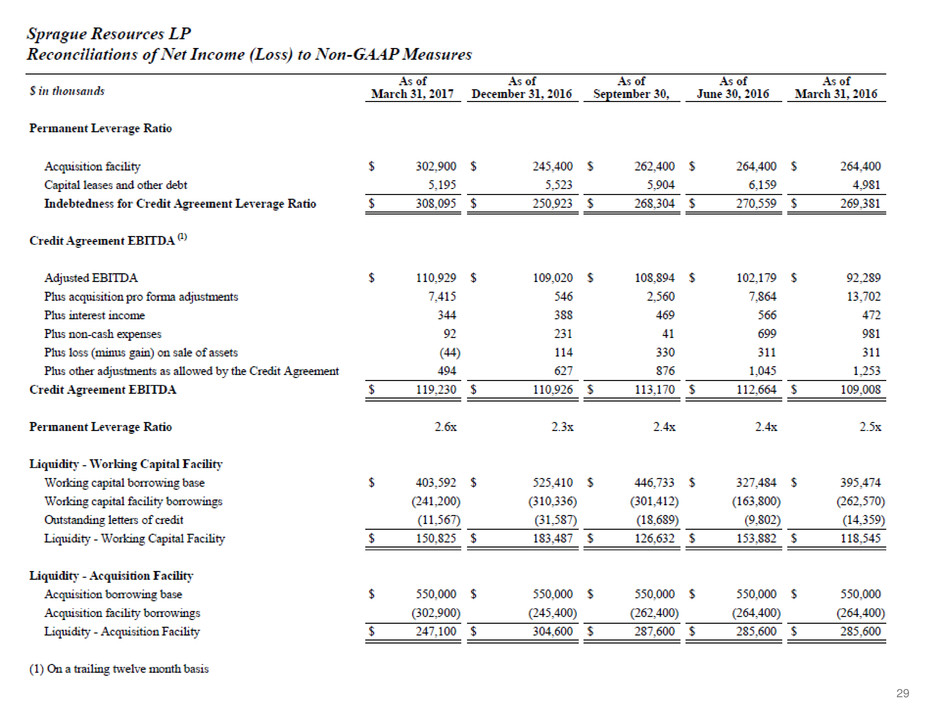

29