Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | fbiz1q17ceoletter8-k.htm |

Exhibit 99.1

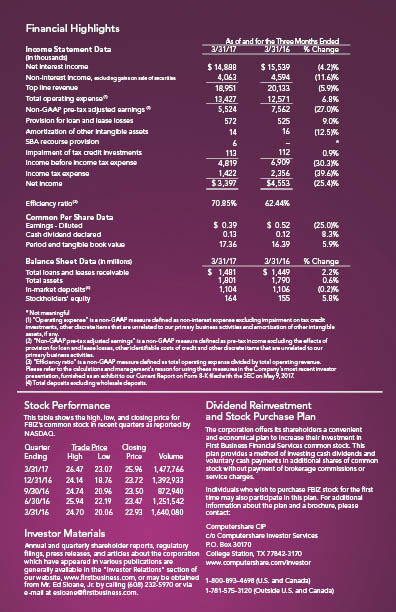

Our first quarter results exhibit the great progress we’ve made toward generating high-quality growth with best-in-class talent and infrastructure. We earned profits totaling $3.4 million, despite our deliberate and temporary slowdown of Small Business Administration (“SBA”) loan production. Our trust and investment services business posted record revenues, expanding 28% over the first quarter of 2016. Loan growth of $30.3 million in the first three months of this year marked our strongest first quarter expansion since 2008. Our team created strong momentum, positioning us well to achieve our loan growth goals in 2017 and demonstrating the merits of our significant investments in talent.

Unfortunately, our first quarter progress was blemished by asset quality challenges we experienced with a unique Wisconsin-based commercial loan and two unrelated SBA loans, increasing non-performing assets to $39.0 million at March 31, 2017, compared to $26.7 million at December 31, 2016 and $19.5 million at March 31, 2016. We are obviously disappointed with this increase in non-performing loans but are confident our credit process remains intact throughout First Business.

As a reminder, our niche business-banking model is predicated on the efficiency of larger than average loan, deposit and trust relationships relative to that of more traditional community banks. This inherently introduces the potential for both positive and negative volatility on our balance sheet and income statement over the life of a client relationship. As a result, it is imperative that we continue to structure our loans appropriately and remain firmly committed to our core credit culture and high standards long established within the First Business franchise.

A LONG-TERM VIEW

While we delivered another profitable quarter and are making excellent progress, we are not satisfied with our performance. We are determined to achieve our long-term performance goals of 1% ROA and 12% ROE, with outstanding credit quality and the characteristic efficiency with which our franchise has historically operated. The path is clear, and we believe we are on track to reach our destination. Our route to targeted earnings performance and above-market growth is marked by specific cost and revenue initiatives we expect will produce growing and diverse sources of revenue supported by a best-in-class infrastructure.

Important initiatives along the way will include (1) completing our charter consolidation during the second quarter, (2) completing our core system conversion at the end of 2017, (3) increasing loan growth while maintaining our targeted net interest margin and (4) growing fee income. With successful execution, we expect these levers will drive the Company's efficiency ratio to our long-term target range of 58-62%. In short, we expect expenses to slow to a sustainable run-rate that will support a growing and scalable revenue base.

STREAMLINING DAILY OPERATIONS

On May 1st we announced to our Kansas City market that Alterra Bank will officially change its name to First Business Bank effective June 1, 2017, as we move toward completing our previously announced charter consolidation by the end of the second quarter. Upon completion, all of our locations and business lines will operate under the same name, brand, bank charter, bank board and bank regulators. Most importantly, eliminating redundancies inherent in managing the day-to-day operations of three separate legal entity structures will free our employees’ capacity to focus on business activities that support our growth objectives.

The completion of our previously announced core system conversion in late 2017 will also yield operational benefits beyond the expected cost savings inherent in eliminating duplicative services. Streamlined processes are expected to improve the speed and quality of loan origination, credit review, loan approval, deposit pricing and relationship management at all levels of the organization.

ACCELERATING REVENUES

Likewise, we are cultivating revenue streams that we expect will create a sustainable, diverse and scalable path to above-market growth across economic cycles.

The cornerstone of a bank’s profitability is its ability to generate and increase net interest income through loan growth, efficient funding and a stable margin. In what is typically our weakest quarter for loan growth, our team created great momentum to begin the year by increasing loans $30.3 million, or 8.4% annualized. We look to build on this momentum heading into the second half of the year as we anticipate our higher-yielding specialty finance lines of business such as asset-based lending – where First Business has years of experience and strong expertise – to drive additional growth. We also expect higher-yielding SBA lending to pick up in the second half of 2017 as we ramp up production in both Kansas and Wisconsin. On the funding side of the balance sheet, through successful efforts to decrease deposit rates and utilize an efficient mix of wholesale funding sources, our cost of interest-bearing liabilities declined from 1.07% for the first quarter of 2016 to 1.04% for the first quarter of 2017, despite a rising interest rate environment. We believe our success in attracting and retaining appropriately priced deposits combined with an improving earning asset mix should allow us to maintain our net interest margin and help combat ongoing competitive loan pricing pressure.

On the fee income front, we see a runway for substantial growth from several areas. As we’ve discussed for the past three quarters, we are deliberately rebuilding our SBA business to accommodate the significant growth opportunity we see in this market. We invested heavily in the platform, and today we believe we have a strong infrastructure in place to originate and sell relationship-based small business loans.

At the same time, the trust and investment services business we started in 2001 delivered a record $1.6 million in non-interest income in the first quarter of 2017, increasing $356,000, or 28%, compared to the same quarter in the prior year driven by assets under management and administration that reached a record $1.3 billion at March 31, 2017, up almost $200 million, or 18%, from March 31, 2016. Our trust and investment services business has steadily increased revenue production at a compound annual rate of 16% since 2011 – demonstrating consistency and growth we hope to continue.

The process is in motion, and we expect continued execution toward our revenue and expense goals will gradually lower our efficiency ratio to our targeted 58-62% range. By also maintaining margin at our target of 3.50% or better, we expect to again achieve the 1% ROA and 12% ROE objectives we aim to deliver for our shareholders.

INVESTING FOR TOMORROW

We believe an investment in First Business today is an investment in a differentiated business model with superior growth prospects. We thank you for your confidence and continued support. Along our path to growth we have consistently and proudly provided a meaningful cash dividend to bolster our shareholders’ returns. We believe our Board’s January decision to increase our quarterly cash dividend by 8% exhibits both a commitment to providing meaningful returns and confidence in our ability to achieve our long-term performance goals.

We look forward to sharing our continued progress in the coming quarters.

Sincerely,

Corey Chambas, President and CEO

This letter includes “forward-looking statements" related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company’s future plans, objectives, goals or expectations. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company’s future results, please see the Company’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission (the "SEC").