Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CrossAmerica Partners LP | capl2017mayform8-kinvestor.htm |

May 2017

MLPA Conference

Jeremy Bergeron, President, and

Steven Stellato, Chief Accounting Officer

Investor Update May 2017

Safe Harbor Statement

Statements contained in this presentation that state the Partnership’s or

management’s expectations or predictions of the future are forward-looking

statements. The words “believe,” “expect,” “should,” “intends,” “estimates,” “target”

and other similar expressions identify forward-looking statements. It is important to

note that actual results could differ materially from those projected in such forward-

looking statements. For more information concerning factors that could cause actual

results to differ from those expressed or forecasted, see CrossAmerica’s Forms 10-Q or

Form 10-K filed with the Securities and Exchange Commission and available on

CrossAmerica’s website at www.crossamericapartners.com. If any of these factors

materialize, or if our underlying assumptions prove to be incorrect, actual results may

vary significantly from what we projected. Any forward-looking statement you see or

hear during this presentation reflects our current views as of the date of this

presentation with respect to future events. We assume no obligation to publicly

update or revise these forward-looking statements for any reason, whether as a result

of new information, future events, or otherwise.

2

CrossAmerica Business Overview

Jeremy Bergeron, President

3

Investor Update May 2017

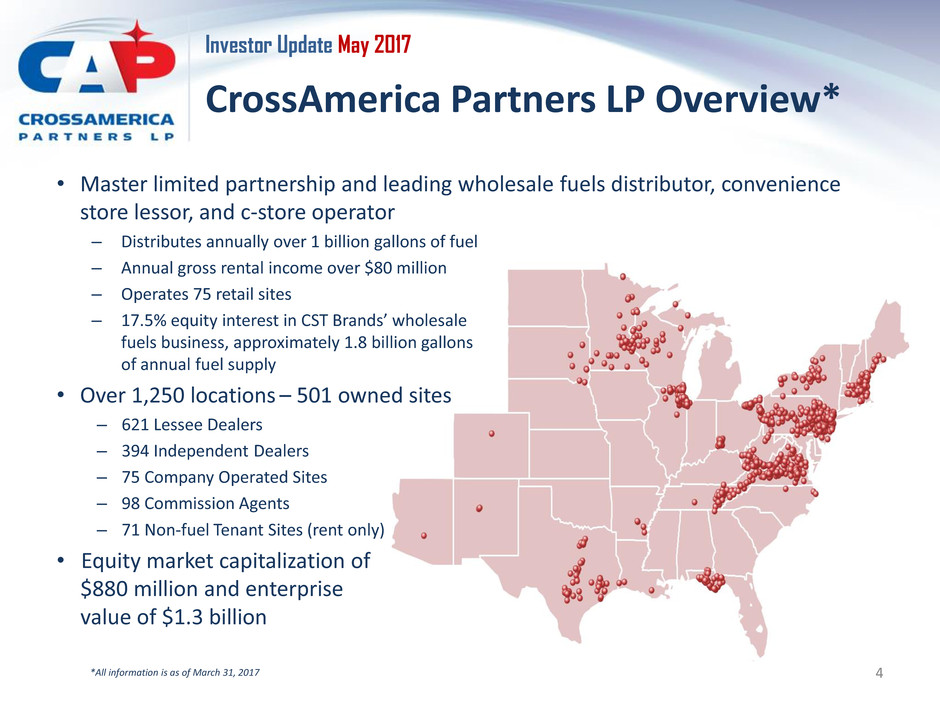

CrossAmerica Partners LP Overview*

• Master limited partnership and leading wholesale fuels distributor, convenience

store lessor, and c-store operator

– Distributes annually over 1 billion gallons of fuel

– Annual gross rental income over $80 million

– Operates 75 retail sites

– 17.5% equity interest in CST Brands’ wholesale

fuels business, approximately 1.8 billion gallons

of annual fuel supply

• Over 1,250 locations – 501 owned sites

– 621 Lessee Dealers

– 394 Independent Dealers

– 75 Company Operated Sites

– 98 Commission Agents

– 71 Non-fuel Tenant Sites (rent only)

• Equity market capitalization of

$880 million and enterprise

value of $1.3 billion

*All information is as of March 31, 2017 4

Investor Update May 2017

2016 and Recent Highlights

• Acquisitions in 2016

– 31 stores acquired from S/S/G Corp (Franchised Holiday Stores), approx. 26 million annual fuel gallons

– 55 lessee dealer and 25 independent dealer accounts acquired from State Oil, approx. 60 million annual

gallons

• Portfolio Optimization

– Continued dealerization process with 77 sites dealerized in 2016

– Closed on a $25 million sale-leaseback transaction in late 2016 (17 properties in the Chicago market)

• Expense Reduction

– Reduced expenses (operating and G&A) 21% from 2015 to 2016

• Capital Strength

– Leverage, as defined under our credit facility, was 4.23 times as of 03/31/17

– Amended credit facility at year-end 2016 to provide additional borrowing flexibility and sale-leaseback

optionality

• Sustained Distribution Growth

– Grew annual distributions 6.1% in 2016 compared to 2015

– Declared distribution attributable to first quarter 2017 of $0.6175 per unit

– 12 consecutive quarters of distribution growth

• Couche-Tard/Circle K proposed merger with CST Brands

– Announced in August 2016

– Potential strategic benefits to CrossAmerica

– Pending regulatory approvals, expected closing in Second Quarter 2017 5

Investor Update May 2017

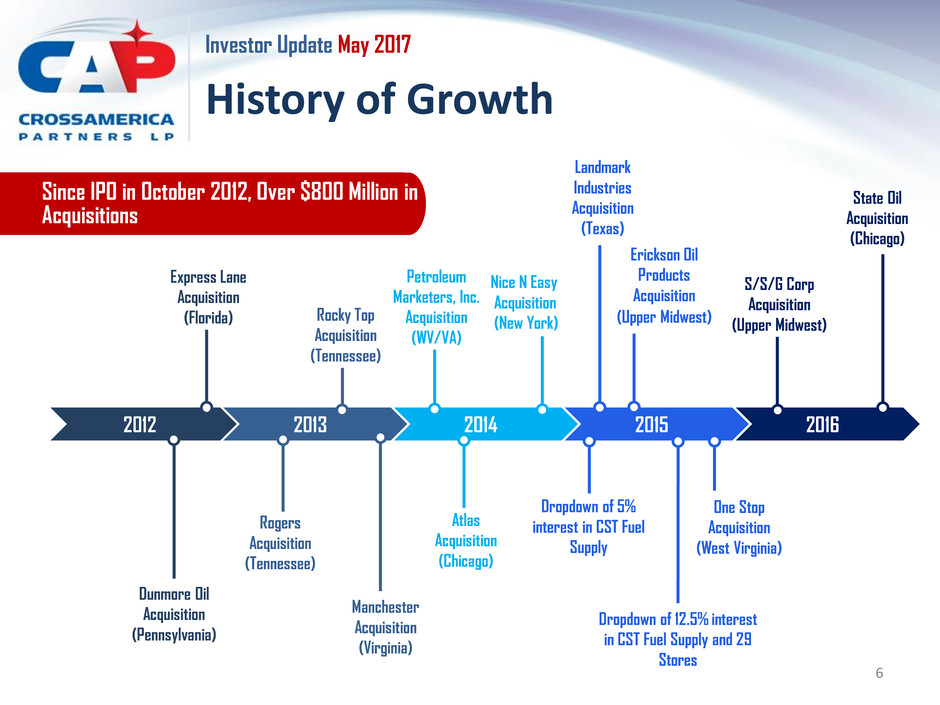

2012

Dunmore Oil

Acquisition

(Pennsylvania)

Express Lane

Acquisition

(Florida)

2013

Rocky Top

Acquisition

(Tennessee)

Rogers

Acquisition

(Tennessee)

2014 2014 2015 2016

Manchester

Acquisition

(Virginia)

Atlas

Acquisition

(Chicago)

Landmark

Industries

Acquisition

(Texas)

Dropdown of 5%

interest in CST Fuel

Supply

Erickson Oil

Products

Acquisition

(Upper Midwest)

State Oil

Acquisition

(Chicago)

Since IPO in October 2012, Over $800 Million in

Acquisitions

History of Growth

Nice N Easy

Acquisition

(New York)

Dropdown of 12.5% interest

in CST Fuel Supply and 29

Stores

One Stop

Acquisition

(West Virginia)

S/S/G Corp

Acquisition

(Upper Midwest)

6

Petroleum

Marketers, Inc.

Acquisition

(WV/VA)

Investor Update May 2017

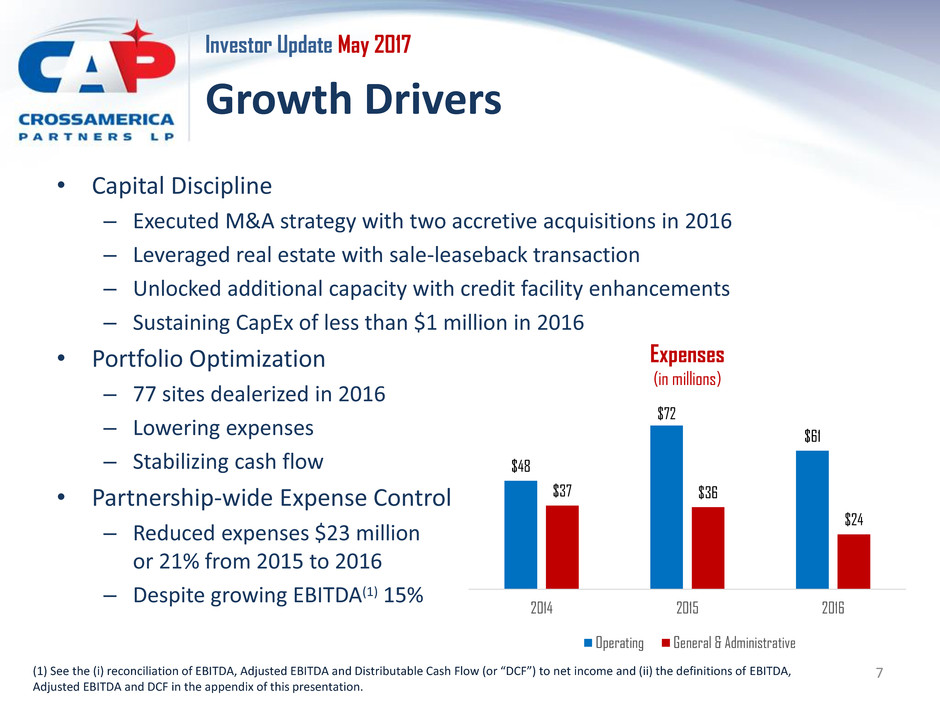

Growth Drivers

• Capital Discipline

– Executed M&A strategy with two accretive acquisitions in 2016

– Leveraged real estate with sale-leaseback transaction

– Unlocked additional capacity with credit facility enhancements

– Sustaining CapEx of less than $1 million in 2016

• Portfolio Optimization

– 77 sites dealerized in 2016

– Lowering expenses

– Stabilizing cash flow

• Partnership-wide Expense Control

– Reduced expenses $23 million

or 21% from 2015 to 2016

– Despite growing EBITDA(1) 15%

$48

$72

$61

$37 $36

$24

2014 2015 2016

Expenses

(in millions)

Operating General & Administrative

7 (1) See the (i) reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA,

Adjusted EBITDA and DCF in the appendix of this presentation.

Investor Update May 2017

Overview of Business Segments

Wholesale Fuels Distributor Convenience Store Lessor Convenience Store Operator

• Purchase and sale of wholesale

motor fuel

– Distribute branded and unbranded

fuel (83% of the motor fuel we

distributed in 2016 was branded)

– Distribute motor fuel to over 1,200

sites located in 29 states

– In 2016, 87% of our gallons sold were

based on a fixed mark-up per gallon

– Provide fuel to several different

types of customer sites including

independent dealers, lessee dealers,

affiliated dealers, CST, our company-

operated stores (Retail Segment) and

commission agents

• Lease or sublease real and

personal property to tenants

– Sites used in the retail distribution

of motor fuels

– Lease agreements are generally 3-

10 years

– Leases are generally triple net

leases

– As of 12/31/16, 810 sites

generating rental income

– We own 57% of our properties that

we lease to our dealers or utilize in

our retail business

• Operation of convenience stores

– Primarily through our Erickson and S/S/G

Corporation (Franchised Holiday) stores

– Own or lease the property

– Retain all profits from motor fuel and

convenience store operations

– Own the motor fuel inventory at the sites

and set the motor fuel pricing at the sites

– As of 03/31/17, operating 75 retail sites

• Manage commission agent sites

– CAPL owns fuel inventory and sets the

retail price, earning retail fuel profit

– As of 03/31/17, own/lease 98

commission agent sites (Retail Segment)

8

WHOLESALE SEGMENT RETAIL SEGMENT

Investor Update May 2017

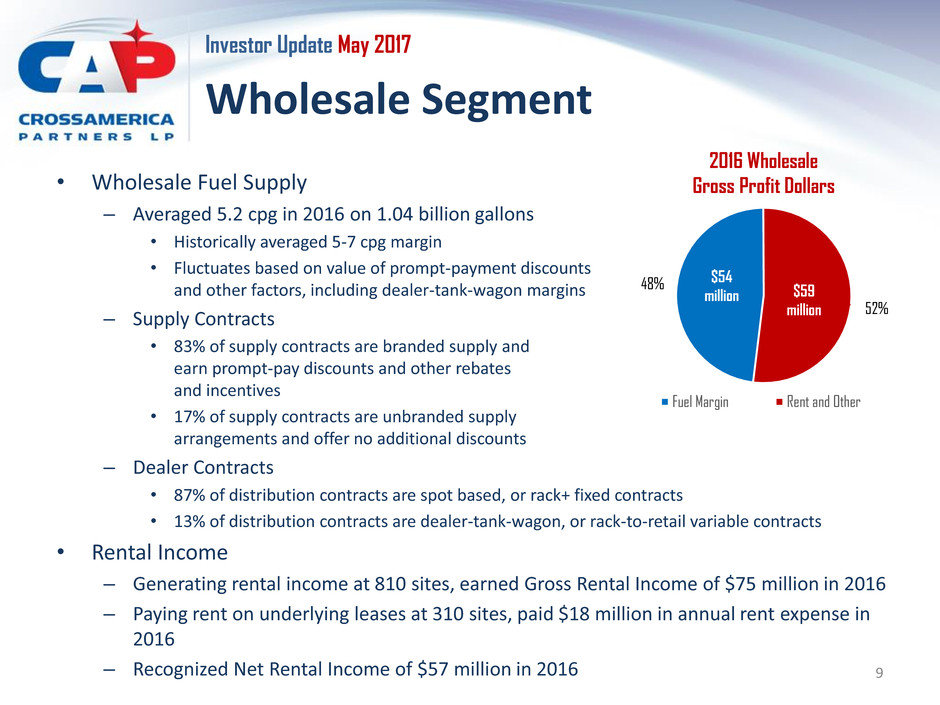

Wholesale Segment

• Wholesale Fuel Supply

– Averaged 5.2 cpg in 2016 on 1.04 billion gallons

• Historically averaged 5-7 cpg margin

• Fluctuates based on value of prompt-payment discounts

and other factors, including dealer-tank-wagon margins

– Supply Contracts

• 83% of supply contracts are branded supply and

earn prompt-pay discounts and other rebates

and incentives

• 17% of supply contracts are unbranded supply

arrangements and offer no additional discounts

– Dealer Contracts

• 87% of distribution contracts are spot based, or rack+ fixed contracts

• 13% of distribution contracts are dealer-tank-wagon, or rack-to-retail variable contracts

• Rental Income

– Generating rental income at 810 sites, earned Gross Rental Income of $75 million in 2016

– Paying rent on underlying leases at 310 sites, paid $18 million in annual rent expense in

2016

– Recognized Net Rental Income of $57 million in 2016

48%

52%

Fuel Margin Rent and Other

2016 Wholesale

Gross Profit Dollars

9

$54

million $59

million

Investor Update May 2017

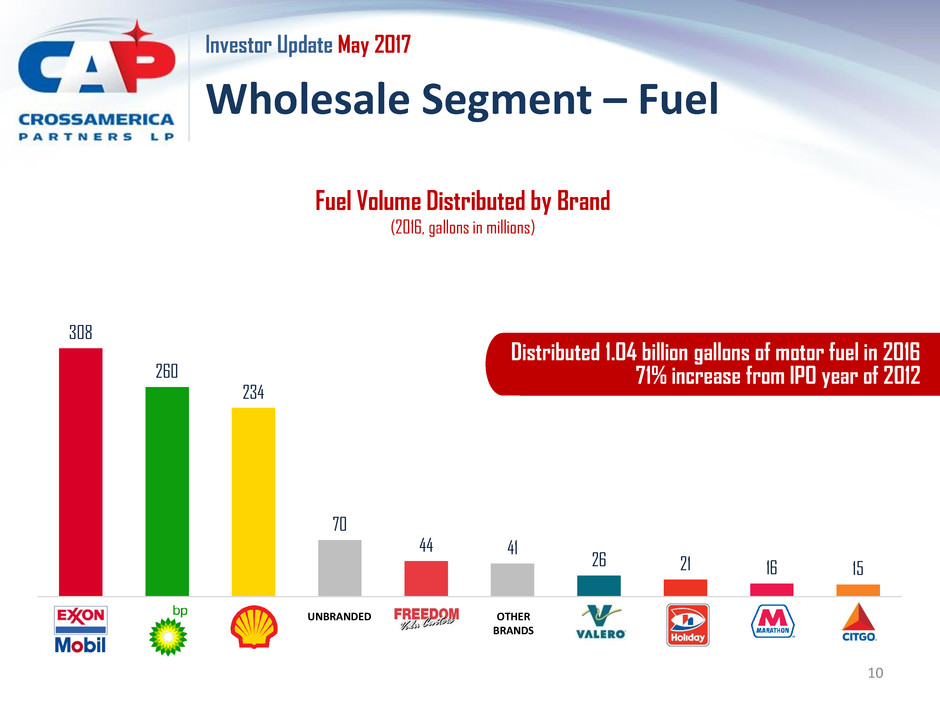

Wholesale Segment – Fuel

10

Fuel Volume Distributed by Brand

(2016, gallons in millions)

308

260

234

70

44 41

26 21 16 15

UNBRANDED

Distributed 1.04 billion gallons of motor fuel in 2016

71% increase from IPO year of 2012

OTHER

BRANDS

Investor Update May 2017

Wholesale Segment – Rent

• Rental Income (annuity stream) has become a sizable portion of cash flow contribution

– We own nearly 60% of all sites from which we generate rental income

– Gross Rental Income grew 25% from 2015 to 2016

• Own convenient fueling locations in areas of high consumer demand

– Many of our sites are located in markets where limited availability of undeveloped real estate

provides us a first mover advantage

– Due to prime locations, owned real estate sites have high alternate use values, which provides

additional risk mitigation

332 368

511 556 571

691

810

87

116

76

2010 2011 2012 2013 2014 2015 2016

Sites Owned & Leased

(end of period)

Generating Rental Income Company Operated

$18,961 $20,425 $21,222

$41,577

$47,348

$59,956

$74,955

2010 2011 2012 2013 2014 2015 2016

Gross Rental Income

(in thousands)

11

Investor Update May 2017

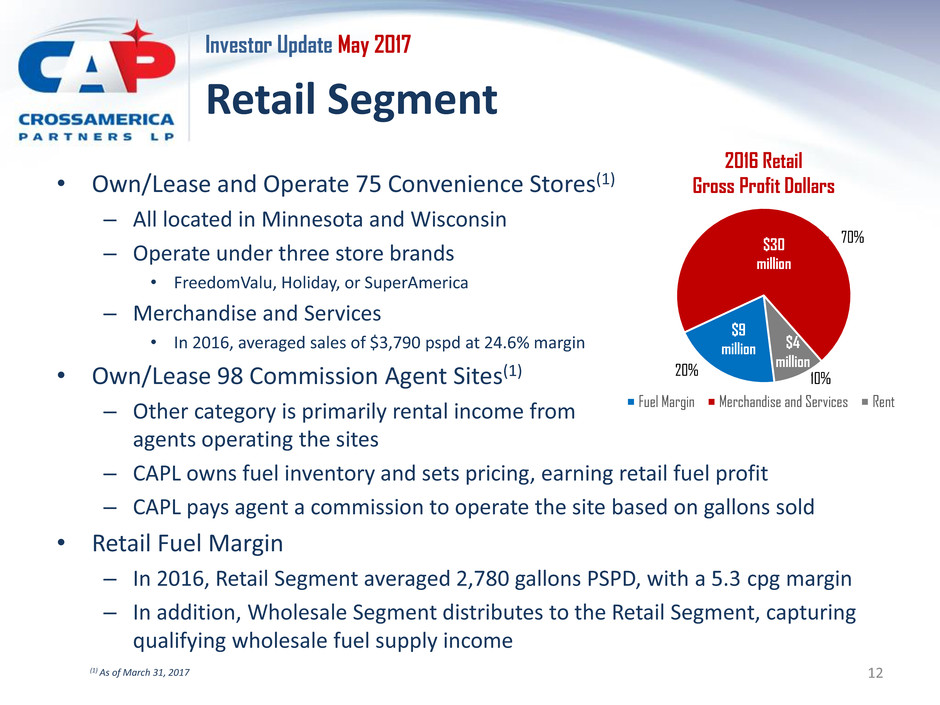

Retail Segment

• Own/Lease and Operate 75 Convenience Stores(1)

– All located in Minnesota and Wisconsin

– Operate under three store brands

• FreedomValu, Holiday, or SuperAmerica

– Merchandise and Services

• In 2016, averaged sales of $3,790 pspd at 24.6% margin

• Own/Lease 98 Commission Agent Sites(1)

– Other category is primarily rental income from

agents operating the sites

– CAPL owns fuel inventory and sets pricing, earning retail fuel profit

– CAPL pays agent a commission to operate the site based on gallons sold

• Retail Fuel Margin

– In 2016, Retail Segment averaged 2,780 gallons PSPD, with a 5.3 cpg margin

– In addition, Wholesale Segment distributes to the Retail Segment, capturing

qualifying wholesale fuel supply income

12

20%

70%

10%

Fuel Margin Merchandise and Services Rent

2016 Retail

Gross Profit Dollars

$9

million

$30

million

$4

million

(1) As of March 31, 2017

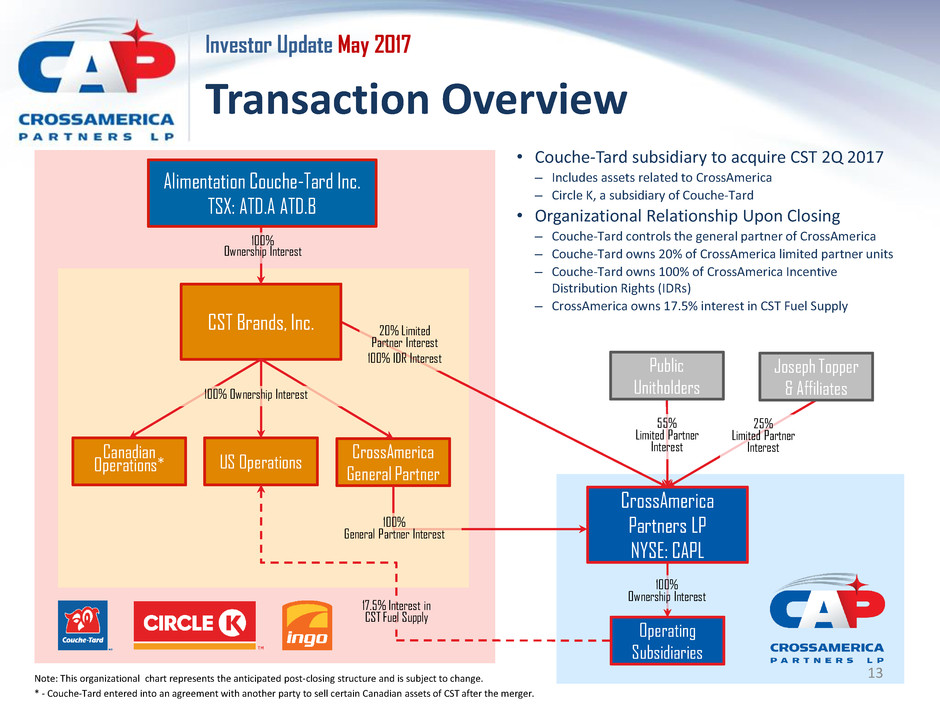

Investor Update May 2017

Transaction Overview

• Couche-Tard subsidiary to acquire CST 2Q 2017

– Includes assets related to CrossAmerica

– Circle K, a subsidiary of Couche-Tard

• Organizational Relationship Upon Closing

– Couche-Tard controls the general partner of CrossAmerica

– Couche-Tard owns 20% of CrossAmerica limited partner units

– Couche-Tard owns 100% of CrossAmerica Incentive

Distribution Rights (IDRs)

– CrossAmerica owns 17.5% interest in CST Fuel Supply

Operating

Subsidiaries

55%

Limited Partner

Interest

CrossAmerica

Partners LP

NYSE: CAPL

Public

Unitholders

Joseph Topper

& Affiliates

CST Brands, Inc.

Canadian

Operations* US Operations

CrossAmerica

General Partner

25%

Limited Partner

Interest

100%

Ownership Interest

100% Ownership Interest

20% Limited

Partner Interest

100% IDR Interest

100%

Ownership Interest

100%

General Partner Interest

* - Couche-Tard entered into an agreement with another party to sell certain Canadian assets of CST after the merger.

17.5% Interest in

CST Fuel Supply

Note: This organizational chart represents the anticipated post-closing structure and is subject to change. 13

Alimentation Couche-Tard Inc.

TSX: ATD.A ATD.B

Investor Update May 2017

Strategic Benefit to CAPL

• Provides continuity with a sponsor whose management culture is aligned

with CrossAmerica

– Disciplined operator with best practices in acquisitions and integration

– Strong and consistent financial performance throughout all economic cycles

– Heightened focus on growing free cash flow, with particular expertise in cost

management

– Well capitalized with solid balance sheet

– Well positioned to lead further consolidation in fragmented industry

• Scale and global reach provides additional operational benefits

– Further strengthens relationship with many of our key suppliers

– Many turnkey branding and franchise programs that can complement our dealer

offerings

• Supports dealer health, which impacts fuel volume growth and additional rental income

potential

• Wholesale operations with

complementary geographic

reach

14

CrossAmerica Financial Overview

Steven Stellato, Chief Accounting Officer

15

Investor Update May 2017

Operating Results

Operating Results

(in thousands, except for per gallon and site count)

2016 2015 % Change

WHOL

ES

AL

E

Motor Fuel Distribution Sites (period avg.) 1,128 1,064 6%

Volume of Gallons Distributed 1,034,585 1,051,357 (2%)

Wholesale Fuel Margin per Gallon $0.052 $0.056 (7%)

Sites Generating Rental Income 810 691 17%

Rental & Other Gross Profit (Net) $58,672 $45,757 28%

RE

TA

IL

Company Operated Sites (period avg.) 86 132 (35%)

Commission Agent Sites (period avg.) 71 70 1%

Volume of Retail Gallons Distributed 159,721 211,243 (24%)

Retail Fuel Margin per Gallon $0.053 $0.092 (42%)

General, Admin. & Operating Expenses $85,230 $108,467 (21%)

16

Investor Update May 2017

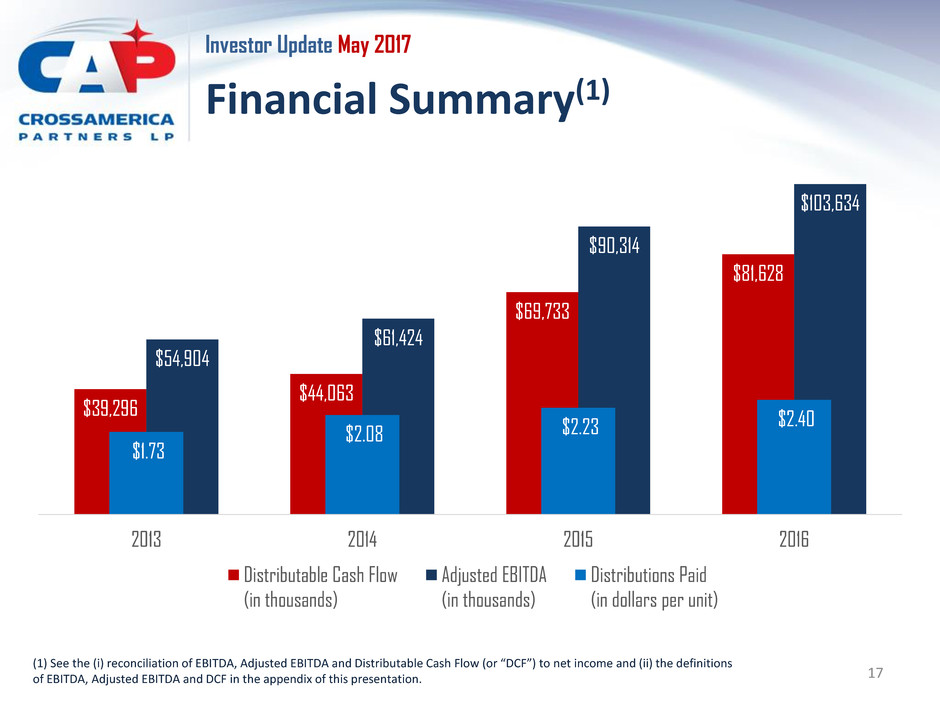

$39,296

$44,063

$69,733

$81,628

$54,904

$61,424

$90,314

$103,634

$1.73

$2.08 $2.23

$2.40

$0

$20 ,000

$40 ,000

$60 ,000

$80 ,000

$10 0,000

$12 0,000

2013 2014 2015 2016

Distributable Cash Flow

(in thousands)

Adjusted EBITDA

(in thousands)

Distributions Paid

(in dollars per unit)

Financial Summary(1)

17

(1) See the (i) reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions

of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Investor Update May 2017

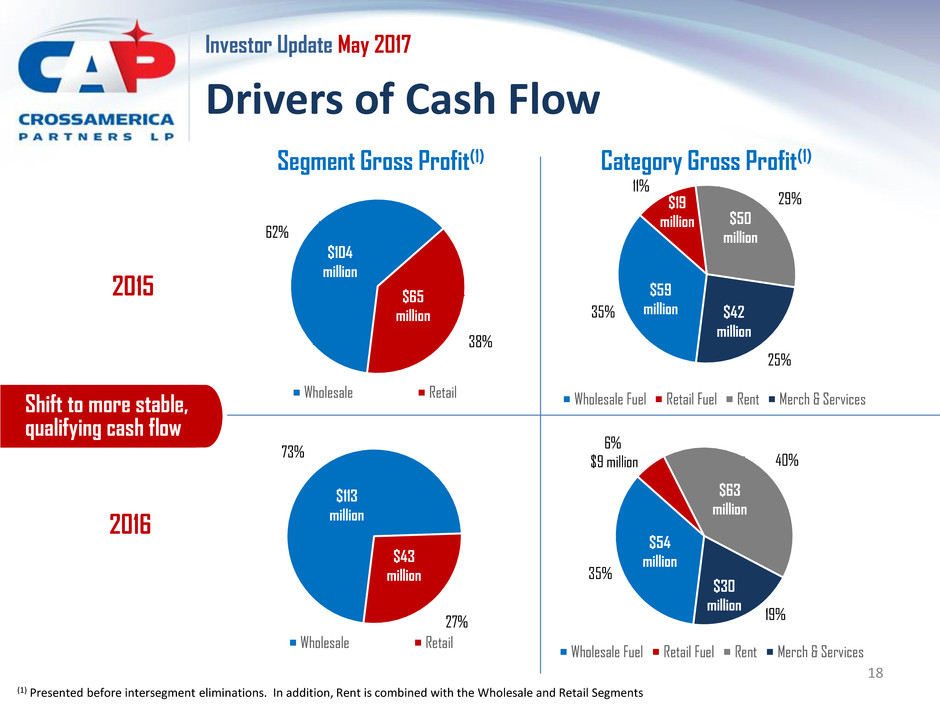

Drivers of Cash Flow

Segment Gross Profit(1) Category Gross Profit(1)

(1) Presented before intersegment eliminations. In addition, Rent is combined with the Wholesale and Retail Segments

18

2016

73%

27%

Wholesale Retail

$113

million

$43

million 35%

6%

$9 million 40%

19%

Wholesale Fuel Retail Fuel Rent Merch & Services

$63

million

$30

million

$54

million

2015

62%

38%

Wholesale Retail

$104

million

$65

million 35%

11%

29%

25%

Wholesale Fuel Retail Fuel Rent Merch & Services

$50

million

$42

million

$59

million

$19

million

Shift to more stable,

qualifying cash flow

Investor Update May 2017

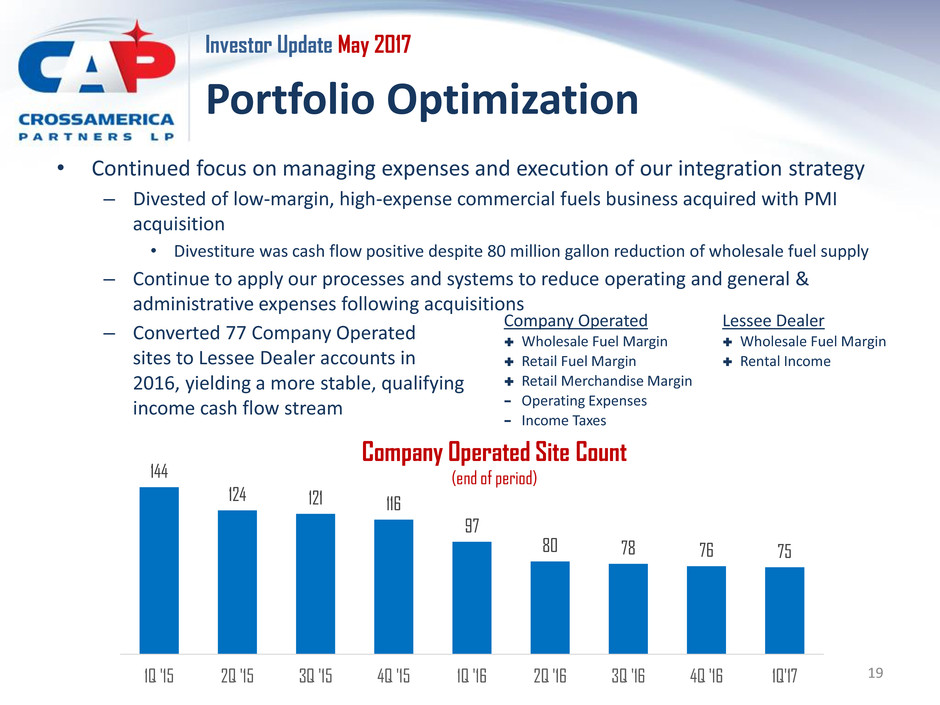

Portfolio Optimization

• Continued focus on managing expenses and execution of our integration strategy

– Divested of low-margin, high-expense commercial fuels business acquired with PMI

acquisition

• Divestiture was cash flow positive despite 80 million gallon reduction of wholesale fuel supply

– Continue to apply our processes and systems to reduce operating and general &

administrative expenses following acquisitions

– Converted 77 Company Operated

sites to Lessee Dealer accounts in

2016, yielding a more stable, qualifying

income cash flow stream

Company Operated

Wholesale Fuel Margin

Retail Fuel Margin

Retail Merchandise Margin

− Operating Expenses

− Income Taxes

Lessee Dealer

Wholesale Fuel Margin

Rental Income

19

144

124 121 116

97

80 78 76 75

1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 2Q '16 3Q '16 4Q '16 1Q'17

Company Operated Site Count

(end of period)

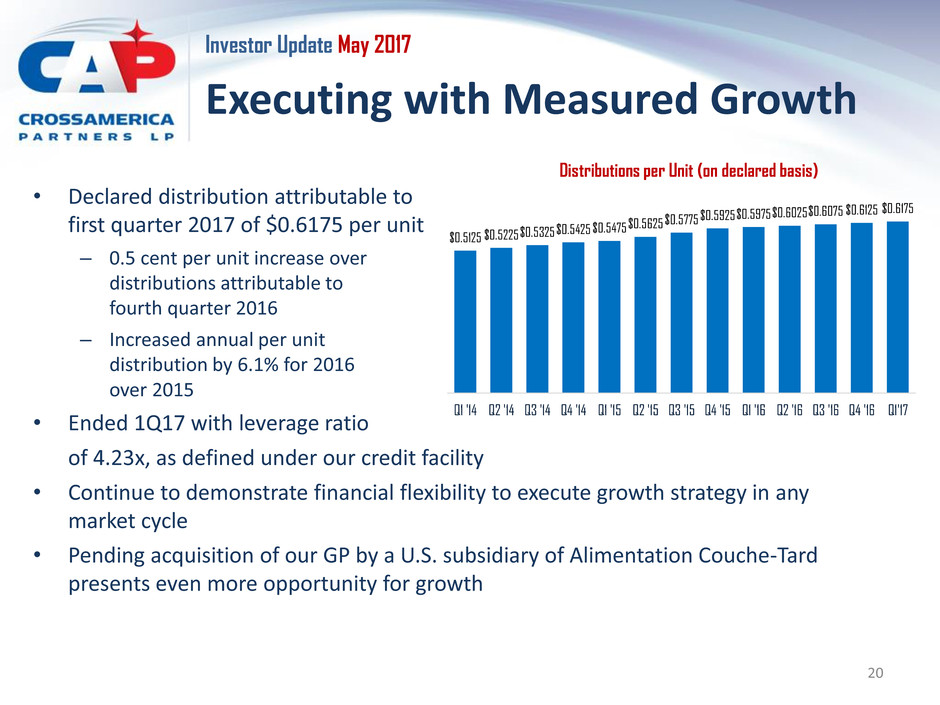

Investor Update May 2017

Executing with Measured Growth

• Declared distribution attributable to

first quarter 2017 of $0.6175 per unit

– 0.5 cent per unit increase over

distributions attributable to

fourth quarter 2016

– Increased annual per unit

distribution by 6.1% for 2016

over 2015

• Ended 1Q17 with leverage ratio

of 4.23x, as defined under our credit facility

• Continue to demonstrate financial flexibility to execute growth strategy in any

market cycle

• Pending acquisition of our GP by a U.S. subsidiary of Alimentation Couche-Tard

presents even more opportunity for growth

$0.5125 $0.5225 $0.5325

$0.5425 $0.5475 $0.5625

$0.5775 $0.5925 $0.5975

$0.6025 $0.6075 $0.6125 $0.6175

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1'17

Distributions per Unit (on declared basis)

20

Appendix

Investor Update

21

Investor Update May 2017

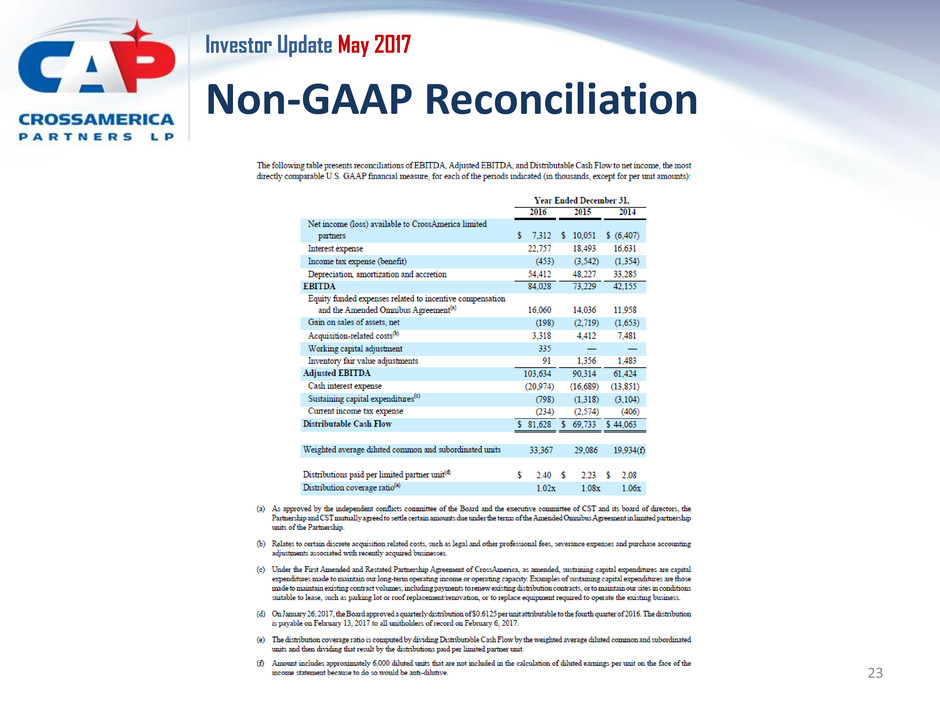

Non-GAAP Financial Measures

22

Investor Update May 2017

Non-GAAP Reconciliation

23