Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - New York City REIT, Inc. | v468144_8k.htm |

Exhibit 99.1

1 st Quarter 2017 Webinar Series

First Quarter 2017 Investor Presentation Platform Advisor To Investment Programs

Risk Factors For a discussion of the risks which should be considered in connection with our company, see the section entitled “Item 1A. Risk Factors” in American Realty Capital New York City REIT, Inc.’s (the “Company”) Annual Report on Form 10 - K filed with the U.S. Securities and Exchange Commission (“SEC”) on March 28, 2017. Forward - Looking Statements This presentation may contain forward - looking statements. You can identify forward - looking statements by the use of forward looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “intends,” “plans,” “projects,” “estimates,” “anticipates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases. Please review the end of this presentation and the Company’s Annual Report on Form 10 - K and Quarterly Report on Form 10 - Q for a more complete list of risk factors, as well as a discussion of forward - looking statements. American Realty Capital New York City REIT, Inc. 3 Important Information

A Public Non - Traded Real Estate Investment Trust* ▪ Focused on acquiring New York City commercial real estate ▪ 3 Primary objectives*: - Preserve and protect capital - Pay monthly stable cash distributions; and - Increase the value of assets in order to generate capital appreciation. ▪ The targeted period of the investment vehicle for a liquidity event is 3 - 6 years from the close of the initial offering, May 31, 2015. American Realty Capital New York City REIT, Inc. 4 *There is no guarantee these objectives will be met. NYCR seeks to provide: Investment Thesis

5 (1) Bureau of Labor Statistics. (2) Cushman & Wakefield Research, Q1 2017 data. (3) New York City Department of City Planning. NYC Employment Trends NYC Population at Record High Manhattan Overall Net Absorption/Asking Rents (2) (1) (3) NYC population is forecasted to reach 8.8mm people in 2030 New York City Market Trends Overall Vacancy Rate - Manhattan Office (2) 7.07 7.32 8.01 8.24 8.55 8.82 5.00 5.50 6.00 6.50 7.00 7.50 8.00 8.50 9.00 9.50 1980 1990 2000 2010 2020 2030 Millions 3,666 3,745 3,795 3,691 3,709 3,797 3,885 3,984 4,108 4,272 4,387 4,389 3,000 3,250 3,500 3,750 4,000 4,250 4,500 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017Q1 Jobs in 000's Employment is at record levels and reached 4.4mm in 2016 American Realty Capital New York City REIT, Inc. 9.4%

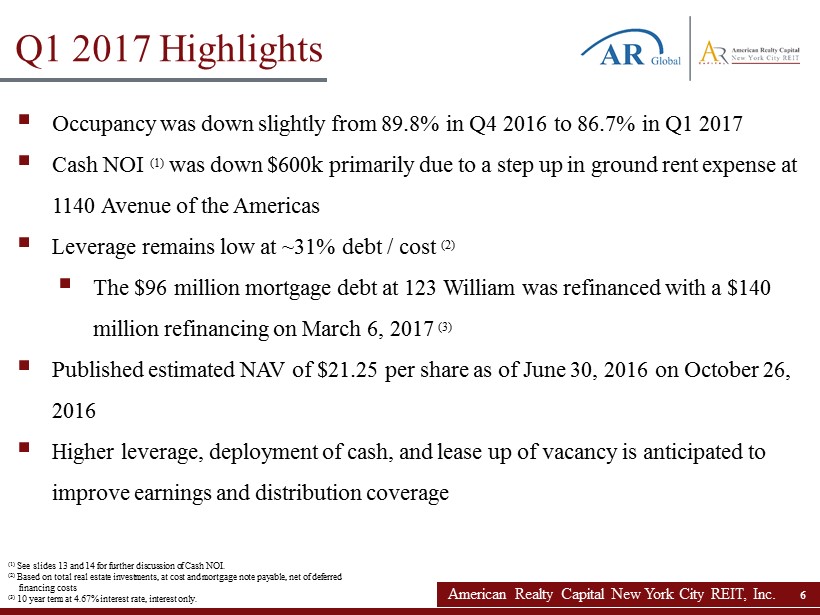

▪ Occupancy was down slightly from 89.8% in Q4 2016 to 86.7% in Q1 2017 ▪ Cash NOI (1) was down $600k primarily due to a step up in ground rent expense at 1140 Avenue of the Americas ▪ Leverage remains low at ~31% debt / cost (2) ▪ The $96 million mortgage debt at 123 William was refinanced with a $140 million refinancing on March 6, 2017 (3) ▪ Published estimated NAV of $21.25 per share as of June 30, 2016 on October 26, 2016 ▪ Higher leverage, deployment of cash, and lease up of vacancy is anticipated to improve earnings and distribution coverage Confidential Material - Not for Distribution American Realty Capital New York City REIT, Inc. 6 (1) See slides 13 and 14 for further discussion of Cash NOI. (2) Based on total real estate investments, at cost and mortgage note payable, net of deferred financing costs (3) 10 year term at 4.67% interest rate, interest only. Q1 2017 Highlights

▪ 6 properties consisting of 1,091,571 square feet ▪ 86.7% occupancy as of 3/31/2017 ▪ Weighted average remaining lease term of 6.1 years Confidential Material - Not for Distribution 7 (1) Calculated as weighted average (based on annualized GAAP rent) as of 3/31/2017. Portfolio Snapshot American Realty Capital New York City REIT, Inc. ($ amounts in thousands) Portfolio Acquisition Date Number of Properties Rentable Square Feet Occupancy (as of 3/31/17) Remaining Lease Term (Years) (1) Debt Unencumbered Assets 421 W 54th Street – Hit Factory Jun. 2014 1 12,327 100% 3.5 - 400 E 67th Street – Laurel Condominium Sept. 2014 1 58,750 100% 7.0 - 200 Riverside Boulevard – ICON Garage Sept. 2014 1 61,475 100% 20.5 - 9 Times Square Nov. 2014 1 166,640 56.0% 4.3 - Unencumbered Sub-total 4 299,192 75.5% 6.4 - Encumbered Assets 123 William Mar. 2015 1 542,676 93.1% 7.2 $140,000 1140 Avenue of the Americas Jun. 2016 1 249,703 86.3% 4.9 $99,000 Encumbered Sub-total 2 792,379 91.0% 6.1 $239,000 Sub-total (Current Portfolio) 6 1,091,571 86.7% 6.1 $239,000

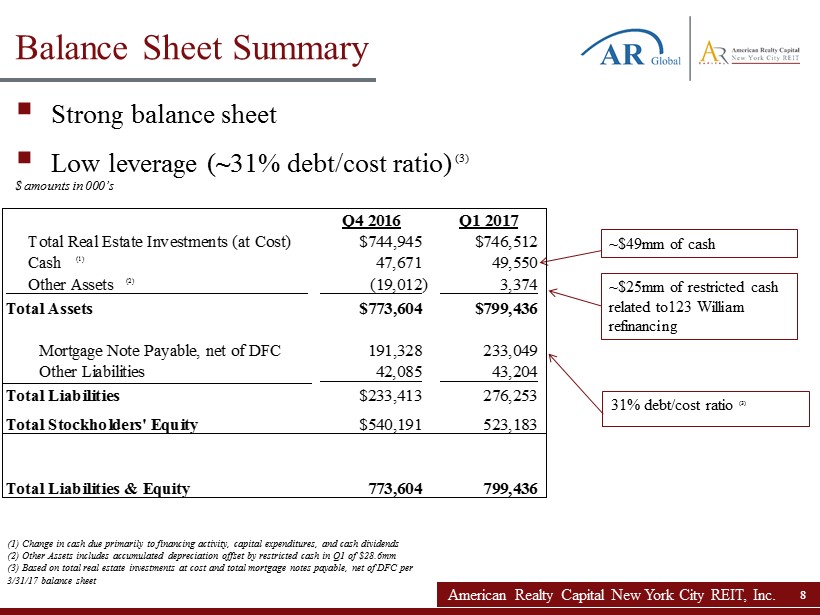

Balance Sheet Summary 8 8 $ amounts in 000’s ~$49mm of cash 31% debt/cost ratio (3) (2) (1) Change in cash due primarily to financing activity, capital expenditures, and cash dividends (2) Other Assets includes accumulated depreciation offset by restricted cash in Q1 of $28.6mm (3) Based on total real estate investments at cost and total mortgage notes payable, net of DFC per 3/31/17 balance sheet (1) ~$25mm of restricted cash related to123 William refinancing ▪ Strong balance sheet ▪ Low leverage ( ~ 31% debt/cost ratio) (3) Q4 2016 Q1 2017 Total Real Estate Investments (at Cost) $744,945 $746,512 Cash 47,671 49,550 Other Assets (19,012) 3,374 Total Assets $773,604 $799,436 Mortgage Note Payable, net of DFC 191,328 233,049 Other Liabilities 42,085 43,204 Total Liabilities $233,413 276,253 Total Stockholders' Equity $540,191 523,183 Total Liabilities & Equity 773,604 799,436 American Realty Capital New York City REIT, Inc. American Realty Capital New York City REIT, Inc. 8

American Realty Capital New York City REIT, Inc. 9 ▪ Finish deployment of capital • Debt/cost ratio remains low at ~32% providing room for additional leverage and portfolio growth (1) • Management may complete $100 to $300 million of additional acquisitions using existing cash and additional leverage • Target leverage for pro forma portfolio is 40 - 50% of the aggregate fair market value of our assets ▪ Continue 9 Times Square office and retail leasing campaign Key Initiatives (1) Based on total real estate investments at cost and total mortgage notes payable, net of DFC per 3/31/17 balance sheet

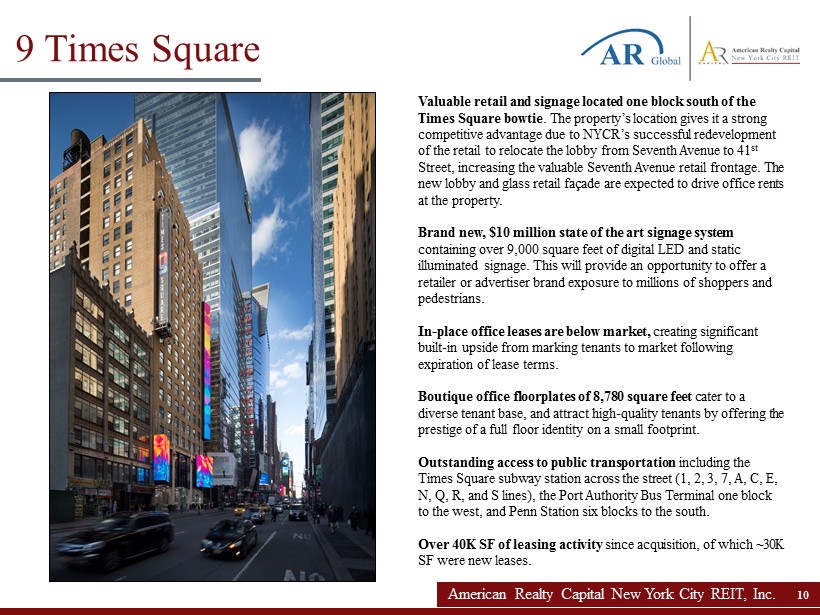

10 Valuable retail and signage located one block south of the Times Square bowtie . The property’s location gives it a strong competitive advantage due to NYCR’s successful redevelopment of the retail to relocate the lobby from Seventh Avenue to 41 st Street, increasing the valuable Seventh Avenue retail frontage. The new lobby and glass retail façade are expected to drive office rents at the property. Brand new, $10 million state of the art signage system containing over 9,000 square feet of digital LED and static illuminated signage. This will provide an opportunity to offer a retailer or advertiser brand exposure to millions of shoppers and pedestrians. In - place office leases are below market, creating significant built - in upside from marking tenants to market following expiration of lease terms. Boutique office floorplates of 8,780 square feet cater to a diverse tenant base, and attract high - quality tenants by offering the prestige of a full floor identity on a small footprint. Outstanding access to public transportation including the Times Square subway station across the street (1, 2, 3, 7, A, C, E, N, Q, R, and S lines), the Port Authority Bus Terminal one block to the west, and Penn Station six blocks to the south. Over 40K SF of leasing activity since acquisition, of which ~30K SF were new leases. 9 Times Square American Realty Capital New York City REIT, Inc.

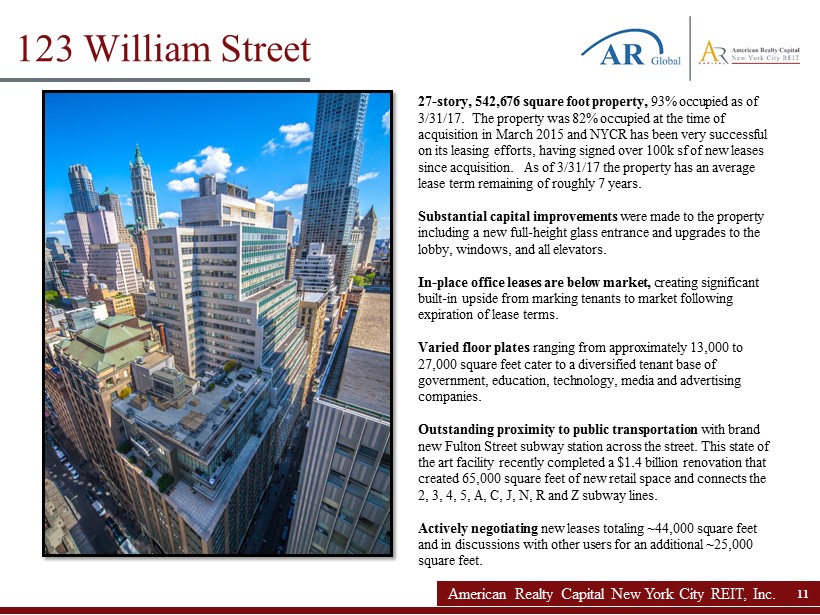

10 27 - story, 542,676 square foot property, 93% occupied as of 3/31/17. The property was 82% occupied at the time of acquisition in March 2015 and NYCR has been very successful on its leasing efforts, having signed over 100k sf of new leases since acquisition. As of 3/31/17 the property has an average lease term remaining of roughly 7 years. Substantial capital improvements were made to the property including a new full - height glass entrance and upgrades to the lobby, windows, and all elevators. In - place office leases are below market, creating significant built - in upside from marking tenants to market following expiration of lease terms. Varied floor plates ranging from approximately 13,000 to 27,000 square feet cater to a diversified tenant base of government, education, technology, media and advertising companies. Outstanding proximity to public transportation with brand new Fulton Street subway station across the street. This state of the art facility recently completed a $1.4 billion renovation that created 65,000 square feet of new retail space and connects the 2, 3, 4, 5, A, C, J, N, R and Z subway lines. Actively negotiating new leases totaling ~44,000 square feet and in discussions with other users for an additional ~25,000 square feet. 123 William Street 11 American Realty Capital New York City REIT, Inc.

Organizational Structure 12 Michael Ead Managing Director & Counsel Stephen Rothstein Associate Elizabeth Tuppeny Independent Director Abby Wenzel Independent Director Michael Weil Executive Chairman Lee Elman Independent Director & Audit Chair Nicholas Radesca CFO and Treasurer Management Team Board of Directors Zachary Pomerantz Senior V.P. Asset Management Michael Weil CEO & President Jason Slear Head of Acquisitions Cindy Dip Controller American Realty Capital New York City REIT, Inc.

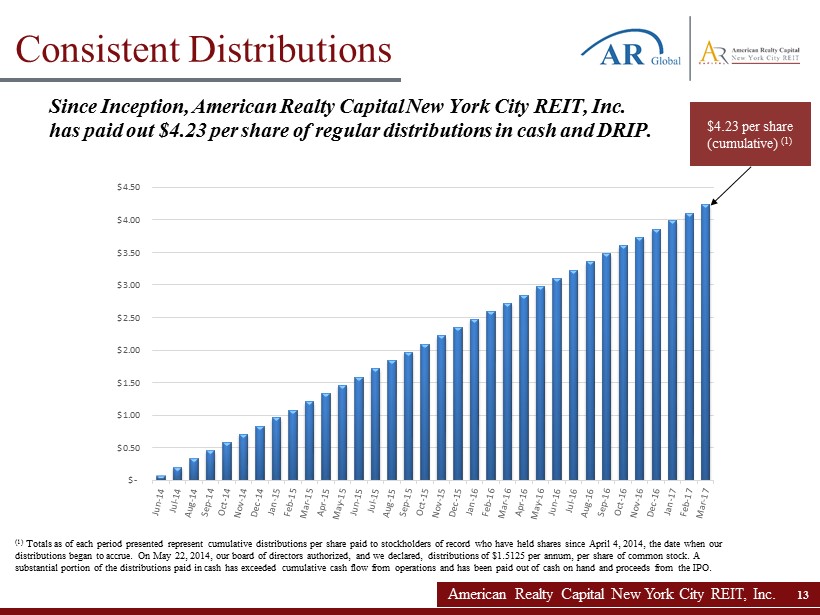

Since Inception, American Realty Capital New York City REIT, Inc. has paid out $4.23 per share of regular distributions in cash and DRIP. American Realty Capital New York City REIT, Inc. 13 Consistent Distributions $4.23 per share (cumulative) (1) (1) Totals as of each period presented represent cumulative distributions per share paid to stockholders of record who have held sh ares since April 4, 2014, the date when our distributions began to accrue. On May 22, 2014, our board of directors authorized, and we declared, distributions of $1.5125 per annum, per share of common stock. A substantial portion of the distributions paid in cash has exceeded cumulative cash flow from operations and has been paid out of cash on hand and proceeds from the IPO. $- $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 $3.50 $4.00 $4.50

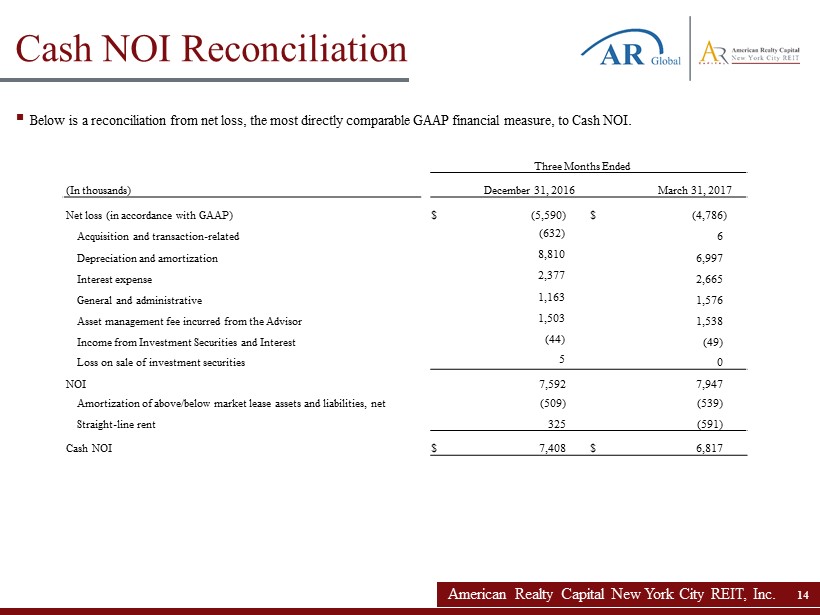

Confidential Material - Not for Distribution 14 Three Months Ended (In thousands) December 31, 2016 March 31, 2017 Net loss (in accordance with GAAP) $ (5,590) $ (4,786 ) Acquisition and transaction - related (632) 6 Depreciation and amortization 8,810 6,997 Interest expense 2,377 2,665 General and administrative 1,163 1,576 Asset management fee incurred from the Advisor 1,503 1,538 Income from Investment Securities and Interest (44) (49) Loss on sale of investment securities 5 0 NOI 7,592 7,947 Amortization of above/below market lease assets and liabilities, net (509) (539) Straight - line rent 325 (591) Cash NOI $ 7,408 $ 6,817 ▪ Below is a reconciliation from net loss, the most directly comparable GAAP financial measure, to Cash NOI. Cash NOI Reconciliation American Realty Capital New York City REIT, Inc.

Confidential Material - Not for Distribution American Realty Capital New York City REIT, Inc. 15 ▪ Cash net operating income ("Cash NOI") is a non - GAAP financial measure equal to net income (loss), the most directly comparable GAAP financial measure, less income from investment securities and interest, plus general and administrative expenses, acquisition an d transaction - related expenses, depreciation and amortization, other non - cash expenses and interest expense. In calculating Cash NOI, we also eliminate the effects of straight - lining of rent and the amortization of above and below market leases. Cash NOI should not be considered an a lternative to net income (loss) as an indication of our performance or to cash flows as a measure of our liquidity. ▪ We use Cash NOI internally as a performance measure and believe Cash NOI provides useful information to investors regarding o ur financial condition and results of operations because it reflects only those income and expense items that are incurred at the property le vel. Therefore, we believe Cash NOI is a useful measure for evaluating the operating performance of our real estate assets and to make decisions ab out resource allocations. Further, we believe Cash NOI is useful to investors as performance measures because, when compared across period s, Cash NOI reflects the impact on operations from trends in occupancy rates, rental rates, operating costs and acquisition activity on a n u nlevered basis. Cash NOI excludes certain components from net income in order to provide results that are more closely related to a property's res ult s of operations. For example, interest expense is not linked to the operating performance of a real estate asset and Cash NOI is not affected by whether the financing is at the property level or corporate level. In addition, depreciation and amortization, because of historical cost ac counting and useful life estimates, may distort operating performance at the property level. Cash NOI presented by us may not be comparable to Ca sh NOI reported by other REITs that define Cash NOI differently. We believe that in order to facilitate a clear understanding of our operatin g r esults, Cash NOI should be examined in conjunction with net income (loss) as presented in our consolidated financial statements. Cash NOI Reconciliation (cont.)

Risk Factors There are risks associated with an investment in our Company. The following is a summary of some of these risks. For a discussion of the risks which should be considered in connection with our Company, see the section entitled “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10 - K filed with the SEC on March 28, 2017. ▪ We have a limited operating history which makes our future performance difficult to predict; ▪ All of our executive officers are also officers, managers or holders of a direct or indirect controlling interest in our advi sor , New York City Advisors, LLC (our "Advisor") and other entities affiliated with AR Global Investments, LLC (the successor business to AR Capital, LLC, "A R Global"); as a result, our executive officers, our Advisor and its affiliates face conflicts of interest, including significant conflicts cr eat ed by our Advisor’s compensation arrangements with us and other investor entities advised by AR Global affiliates, and conflicts in allocating ti me among these entities and us, which could negatively impact our operating results; ▪ We depend on tenants for our revenue and, accordingly, our revenue is dependent upon the success and economic viability of ou r t enants; ▪ We may not be able to achieve our rental rate objectives on new and renewal leases and our expenses could be greater, which m ay impact operations; ▪ Our properties may be adversely affected by economic cycles and risks inherent to the New York metropolitan statistical area ("M SA"), especially New York City; ▪ We are obligated to pay fees, which may be substantial, to our Advisor and its affiliates; ▪ We may fail to continue to qualify to be treated as a real estate investment trust for United States federal income tax purpo ses ("REIT"); American Realty Capital New York City REIT, Inc. 16

▪ Because investment opportunities that are suitable for us may also be suitable for other AR Global - advised programs or investors , our Advisor and its affiliates may face conflicts of interest relating to the purchase of properties and other investments and such conflicts may no t be resolved in our favor, meaning that we could invest in less attractive assets, which could reduce the investment return to our stockholders; ▪ No public market currently exists, or may ever exist, for shares of our common stock and our shares are, and may continue to be, illiquid; ▪ Our stockholders are limited in their ability to sell their shares pursuant to our share repurchase program (the "SRP") and m ay have to hold their shares for an indefinite period of time; ▪ If we and our Advisor are unable to find suitable investments, then we may not be able to achieve our investment objectives, or pay distributions with cash flows from operations; ▪ Increases in interest rates could increase the amount of our debt payments and limit our ability to pay distributions; ▪ We do not expect to generate sufficient cash flow from operations to fund distributions at our current level, and there can b e n o assurance we will be able to continue paying cash distributions at our current level or at all; ▪ We may be deemed to be an investment company under the Investment Company Act of 1940, as amended (the "Investment Company Ac t") , and thus subject to regulation under the Investment Company Act; and ▪ As of December 31, 2016, we owned only six properties and therefore have limited diversification. American Realty Capital New York City REIT, Inc. 17 Risk Factors (continued)

www.NewYorkCityREIT.com ▪ For account information, including balances and the status of submitted paperwork, please call us at (866) 902 - 0063 ▪ Financial Advisors may view client accounts, statements and tax forms at www.dstvision.com ▪ Shareholders may access their accounts at www.ar - global.com