Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Future FinTech Group Inc. | fs12017ex23i_skypeoplefruit.htm |

| EX-21.1 - DESCRIPTION OF SUBSIDIARIES OF THE REGISTRANT - Future FinTech Group Inc. | fs12017ex21i_skypeoplefruit.htm |

| EX-5.1 - OPINION OF GARVEY SCHUBERT BARER - Future FinTech Group Inc. | fs12017ex5i_skypeoplefruit.htm |

| EX-3.6 - ARTICLES OF AMENDMENT TO THE ARTICLES OF INCORPORATION - Future FinTech Group Inc. | fs12017ex3vi_skypeoplefruit.htm |

As filed with the United States Securities and Exchange Commission on May 26, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SKYPEOPLE FRUIT JUICE, INC.

(Name of Registrant as specified in its charter)

| Florida | 2033 | 98-0222013 | ||

(State or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

SkyPeople Fruit Juice, Inc.

16F, National Development Bank Tower

No. 2 Gaoxin 1st Road, Xi’an, PRC 710075

011-86-29-88377216

(Address and telephone number of principal executive offices and principal place of business)

Hongke Xue

16F, National Development Bank Tower

No. 2 Gaoxin 1st Road, Xi’an, PRC 710075

011-86-29-88377216

(Name address and telephone number of agent for service)

Copies to:

Jeffrey Li

Peter B. Cancelmo

Chelsea Anderson

Garvey Schubert Barer

Flour

Mill Building

1000 Potomac Street NW, Suite 200

Washington, D.C. 20007-3501

(202) 965-7880

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ (Do not check if smaller reporting company) | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered | Proposed maximum | Proposed maximum offering price | Amount of registration fee | ||||||||||||

| Common Stock, par value $0.001 per share | 1,561,781 | (1) | $ | 2.61 | (2) | $ | 4,076,248.41 | $ | 472.44 | |||||||

| (1) | This registration statement registers for resale by the selling shareholders (i) 862,097 shares of common stock of the registrant, par value $0.001 per share (“Common Stock”), that are issuable upon the exercise of common stock purchase warrants of the registrant issued pursuant to a private placement; (ii) 34,484 shares of Common Stock that are issuable upon the exercise of common stock purchase warrants of the registrant issued to the placement agent’s designees in connection with such private placement; and (iii) 665,200 shares of Common Stock sold to a selling shareholder in a prior private placement. In accordance with Rule 416(a), there also are being registered hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends, recapitalizations or similar transactions. |

| (2) | Estimated pursuant to Rule 457(c) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee based on the average of the high and low prices reported on the Nasdaq Global Market on May 23, 2017. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 26, 2017

SKYPEOPLE FRUIT JUICE, INC.

1,561,781 Shares of Common Stock

The selling shareholders identified in this prospectus may offer and sell up to 1,561,781 shares of our common stock issuable upon exercise of warrants issued pursuant to a certain private placement, of which (i) 862,097 shares of common stock of the registrant, par value $0.001 per share (“Common Stock”), are issuable upon the exercise of common stock purchase warrants of the registrant issued pursuant to a private placement (the “Investor Warrants”); (ii) 34,484 shares of Common Stock are issuable upon the exercise of common stock purchase warrants of the registrant issued to the placement agent’s designees in connection with such private placement (the “Agent Warrants,” and together with the Investor Warrants, the “Warrants”); and (iii) 665,200 shares of Common Stock were sold to a selling shareholder in a prior private placement (as adjusted following the Company’s 1-for-8 reverse stock split).

We are not selling any shares of our common stock in this offering and will not receive any proceeds from this offering. However, upon a cash exercise of the Warrants by the selling stockholders, we will receive a per share exercise price of $5.20, before any adjustments as set forth in the Warrants. If the Warrants are exercised in a cashless exercise, we will not receive any proceeds from the exercise of the Warrants. We have agreed to pay certain registration expenses, other than underwriting discounts and commissions.

The selling stockholders may from time to time sell, transfer or otherwise dispose of any or all of their shares of Common Stock in a number of different ways and at varying prices. See “Plan of Distribution” for more information.

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus and any amendments or supplements carefully before you make your investment decision.

Our common stock trades on the Nasdaq Global Market under the symbol “SPU.” The closing price of our common stock on the Nasdaq Global Market on May 25, 2017, was $2.71 per share.

Investing in our Common Stock involves significant risks. See “Risk Factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2017.

This prospectus is part of a registration statement that we have filed with the SEC pursuant to which the selling stockholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our common stock covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares of common stock are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the documents incorporated by reference herein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the captions “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus.

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of common stock other than the shares of our common stock covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

As used in this prospectus, “SkyPeople Fruit Juice, Inc.,” the “Company,” “we,” “our” or “us” refers to SkyPeople Fruit Juice, Inc., and its subsidiaries on a consolidated basis, unless otherwise indicated.

Our functional currency is the U.S. Dollar, or USD, while the functional currency of our subsidiaries in China are denominated in Chinese Yuan Renminbi, or RMB, the national currency of the People’s Republic of China, which we refer to as the PRC or China. The functional currencies of our foreign operations are translated into USD for balance sheet accounts using the current exchange rates in effect as of the balance sheet date and for revenue and expense accounts using the average exchange rate during the fiscal year. See Note 2 of the consolidated financial statements included herein.

This summary highlights information contained elsewhere in this prospectus, is not complete, and does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus, including the information presented under the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” and the consolidated financial statements and the notes thereto and other documents incorporated by reference in this prospectus before making an investment decision.

Overview

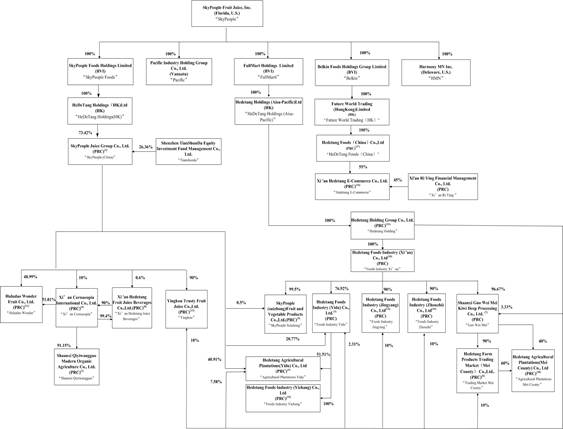

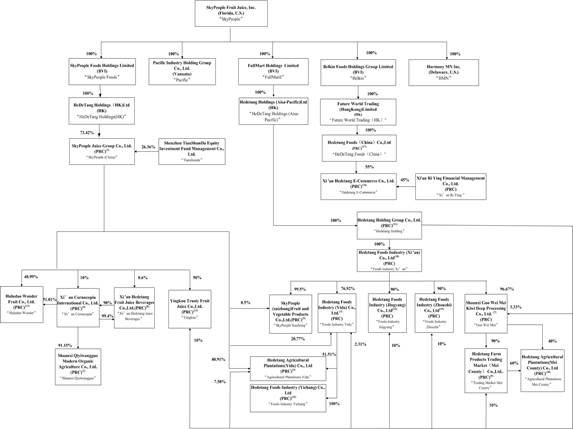

We are a holding company incorporated under the laws of the State of Florida. We have five direct wholly-owned subsidiaries: Pacific Industry Holding Group Co., Ltd., (“Pacific”), a company incorporated under the laws of the Republic of Vanuatu, Belkin Foods Holdings Group Co., Ltd., (“Belkin”), a company incorporated under the laws of the British Virgin Island, FullMart Holding Limited (“FullMart”), a company organized under the laws of British Virgin Island, Harmony MN Inc., (“Harmony”), a company organized under the laws of the State of Delaware, and SkyPeople Food Holding Limited (“SkyPeople Food”), company organized under the laws of British Virgin Island. SkyPeople Food holds 100% equity interest of HeDeTang Holding (HK) Ltd. (“HeDeTang Holding (HK)”), a company organized under the laws of the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”), HeDeTang Holding (HK) holds 73.42% of the equity interest of SkyPeople Juice Group Co., Ltd., (“SkyPeople (China)”), a company incorporated under the laws of the PRC. SkyPeople (China) has eight subsidiaries, all limited liability companies organized under the laws of the PRC: (i) Shaanxi Qiyiwangguo Modern Organic Agriculture Co., Ltd. (“Shaanxi Qiyiwangguo”); (ii) Huludao Wonder Fruit Co., Ltd. (“Huludao Wonder”); (iii) Yingkou Trusty Fruits Co., Ltd. (“Yingkou”); (iv) Hedetang Foods Industry (Yidu) Co. Ltd. (“Food Industry Yidu”); (v) SkyPeople (Suizhong) Fruit and Vegetable Products Co., Ltd. (“SkyPeople Suizhong”); (vi) Hedetang Agricultural Plantation (Yidu) Co. Ltd. (“Agricultural Plantation Yidu”); (vii) Xi’an Hedetang Fruit Juice Beverages Co., Ltd. (“Xi’an Hedetang”); and (viii) Xi’an CornucopiaInternational Co., Ltd. (“Xi’an Cornucopia”). Shenzhen TianShunDa Equity Investment Fund Management Co., Ltd. (the “TSD”), a limited liability corporation registered in China, holds another 26.36% of the equity interest of SkyPoeple (China). FullMart holds 100% of equity interest of Hedetang Holdings (Asia Pacific) Ltd. (“Hedetang Holdings (Asia Pacific)”), a company organized under the laws of Hong Kong. Hedetang Holdings (Asia Pacific) holds 100% of the equity interest of Hedetang Holding Group Co. Ltd., (“Hedetang Holding”), a company incorporated under the laws of the PRC, which holds 100% of Hedetang Foods Industry (Xi’an) Co. Ltd., (“Food Industry Xi’an”), a company incorporated under the laws of the PRC. Food Industry Xi’an has nine subsidiaries: (i) SkyPeople Suizhong; (ii) Food Industry Yidu; (iii) Hedetang Food Industry (Jingyang) Co. Ltd. (“Fruit Industry Jingyang”); (iv) Hedetang Foods Industry (Zhouzhi) Co. Ltd. (“Foods Industry Zhouzhi”); (v) Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. (“Guo Wei Mei”); (vi) Hedetang Agricultural Plantations (Yidu) Co., Ltd (“Agricultural Plantations Yidu”); (vii) Hedetang Agricultural Plantations (Mei County) Co., Ltd (“Agricultural Plantations Mei County”); (viii) Hedetang Farm Products Trading Market (Mei County) Co., Ltd (“Trading Market Mei County”); and (ix) Hedetang Farm Products Trading Market (Yidu) Co., Ltd (“Trading MarketYidu”). Belkin holds 100% of the equity interest of Future World Trading (Hong Kong) Limited (“Future World Trading (HK)”), a company organized under the laws of Hong Kong. Future World Trading (HK) holds 100% of the equity interest of Hedetang Foods (China) Ltd. (“Hedetang Foods (China)”), and Hedetang Foods (China) holds 55% of the equity interest of Xi’an Hedetang E-commerce Co. Ltd. (“Hedetang E-commerce”), a company incorporated under the laws of the PRC. Xi'an Ri Ying Financial Management Limited holds the remaining 45% of the equity interest of Hedetang E-commerce.

| 1 |

Products and Market

Through our indirect subsidiaries in the PRC, we are engaged in the production and sale of (1) fruit juice concentrates (including fruit purees, concentrated fruit purees and concentrated fruit juices); (2) fruit beverages (including fruit juice beverages and fruit cider beverages); and (3) other fruit-related products (including primarily organic and non-organic fresh fruits, dried fruit, preserved fruit, fructose) in and from the PRC.

We were recognized and certified as the Leading Agricultural Commercialization Enterprise of Shaanxi Province by Shaanxi Agricultural Bureau in March 2016. In November 2016, we were recognized and certified as the Star Enterprise in Agricultural Industrialization in Shaanxi province, China. In December 2016, we were awarded the title of The Demonstration Enterprise in Industrial Convergence Innovation. Our Company was granted an AA level Certificate of the Standard and Good Conduct Enterprise by the Standardization Administration of China (“SAC”) in April 2015, and a Best Small and Middle Enterprises by Forbes China in 2011. Our concentrated pear juice and concentrated kiwi juice were awarded the Most Famous Products in Shaanxi Province by the People’s Government of Shaanxi in February 2012. The certificate was renewed in 2014; the period of validity of new certificate is from December 2015 to December 2017. Our fruit juice concentrates, which primarily include apple, pear and kiwi, are sold to domestic customers and exported directly or via distributors to customers in Asia, North America, Europe, Russia and the Middle East. Our Hedetang branded fruit juice concentrates were awarded the Famous Brand in Shaanxi Province by the Shaanxi Government in February 2015. This award will expire in December 2017. We sell our Hedetang branded bottled fruit beverages domestically, primarily to supermarkets in the PRC. Our brand name “Hedetang” was awarded the Most Famous Brand in Shaanxi Province by the Shaanxi Administration Bureau for Industry and Commerce, and this award will expire in December 2018.

Our Huludao Wonder operation, a subsidiary which produces concentrated apple juice, suffered continued operating losses in the three fiscal years ended December 31, 2016 and the cash flows were minimal during the same three fiscal years. Thus, in December 2016, we established a restructuring plan to close our Huludao Wonder operation.

Specialty fruit juices, or “small breed” fruit juices, are juices squeezed from fruits that are grown in relatively small quantities such as kiwi juice, mulberry juice, turnjujube juice and pomegranate juice. Currently, our specialty juice beverage offerings include pear juice, kiwi juice and mulberry juice. At the end of 2016, we possessed 21 patents and proprietary technologies in the processing technology of specialty fruit juice and gained a number of honors and qualifications in the fruit juice industry.

We intend to complete our current construction in progress, which will help to further diversify our business to reduce market risk, and also expand our distribution channel of fruit juice beverages to meet increasing customer demand.

| 2 |

Organizational Structure

Our current organizational structure is set forth in the diagram below:

(1) Xi’an Qinmei Food Co., Ltd., an entity not affiliated with the Company, owns the remaining 8.85% of the equity interest in Shaanxi Qiyiwangguo.

(2) Formerly known as Shaanxi Tianren Organic Food Co. Ltd.

(3) Hedetang Foods Industry (Yidu) Co., Ltd., formerly known as SkyPeople Juice Group Yidu Orange Products Co., Ltd., was established on March 13, 2012. Its scope of business includes deep processing and sales of oranges.

(4) Hedetang Agricultural Plantations (Yidu) Co., Ltd., formerly known as Hedetang Fruit Juice Beverages (Yidu) Co., Ltd., was established on March 13, 2012. Its scope of business includes the planting, acquisition and sales of vegetables, fruits, flowers, farm products; fresh fruit picking; research, training and promotion of planting and breeding technology.

(5) SkyPeople (Suizhong) Fruit and Vegetable Products Co., Ltd. was established on April 26, 2012. Its scope of business includes the initial processing, quick-frozen and sales of agricultural products and related by-products.

(6) Hedetang Farm Products Trading Market (Mei County) Co., Ltd., formerly known as SkyPeople Juice Group (Mei County) Kiwi Fruit and Farm Products Trading Market Co., Ltd. (“Kiwi Fruit & Farm Products”) was established on April 19, 2013. Its scope of business includes preliminary processing of agricultural and subsidiary products, establishment of trading market for agriculture products, and similar activities.

(7) Shaanxi Guo Wei Mei Kiwi Deep Processing Co., Ltd. was established on April 19, 2013. Its scope of business includes producing kiwi fruit juice, kiwi puree, cider beverages, and similar products.

(8) Xi’an Hedetang Fruit Juice Beverages Co., Ltd. (“Xi’an Hedetang”) was established on March 31, 2014. Its scope of business includes the production and sales of fruit juice beverages.

(9) Xi’an Cornucopia International Co., Ltd. (“Cornucopia”) was established on July 2, 2014. Its scope of business includes the retail and wholesale of pre-packaged food.

(10) Shaanxi Fruitee Fun Co., Ltd. (“Fruitee Fun”) was established on July 3, 2014. Its scope of business includes retail and wholesale of pre-packaged food. Shaanxi Fruitee Fun Co., Ltd. (also known as Shaanxi Guoweiduomei Beverage Co., Limited) changed its name to Hedetang Foods Industry (Xi'an) Co., Ltd. (“Foods Industry Xi'an”) on July 5, 2016.

| 3 |

(11) Hedetang Holding Group Co., Ltd., formerly known as Hedetang Holding Co., Ltd. (“Hedetang Holding”) was established on July 21, 2014. Its scope of business includes corporate investment consulting, corporate management consulting, corporate imagine design and corporative marketing planning.

(12) The Company acquired Huludao Wonder Co. Ltd. (“Huludao”) on June 10, 2008. Its scope of business mainly includes the manufacture and sale of concentrated fruit juice and fruit juice beverages.

(13) The Company acquired Yingkou Trusty Fruits Co., Ltd. (“Yingkou”) on November 25, 2009. Its scope of business mainly includes the manufacture of concentrated fruit juice.

(14) Hedetang Foods Industry (Jingyang) Co., Ltd. was established on June 7, 2016. Its scope of business includes processing, storage and sales of farm products, fruits, tea and snacks; and research and promotion of processing technology of organic agriculture, fruit industry and agricultural products.

(15) Hedetang Farm Products Trading Market (Yidu) Co., Ltd. was established on March 23, 2016. Hedetang Farm Products Trading Market (Yidu) Co., Ltd. changed its name to Hedetang Foods Industry (Yichang) Co., Ltd. on May 15, 2017. Its scope of business includes construction, operation, and property management of a farm products trading market; e-commerce service of farm products; and construction and operation management of e-commerce information platform.

(16) Xi’an Hedetang E-Commerce Co., Ltd. was established on April 21, 2016. Its scope of business includes online sales of pre-packaged foods and bulk foods.

(17) The company acquired Hedetang Foods (China) Co., Ltd. (“Hedetang Foods China”) on May 18, 2016 through the acquisition of Belking Foods Holdings Group Co., Ltd., the 100% indirect shareholder of Hedetang Foods China, on the same date. The scope of business of Hedetang Foods China includes wholesale and retail of foods and beverages; import and export trade of fruit, vegetables, dried fruit; packaging; logistics and distribution; online sales; and business management consulting services.

(18) Hedetang Agricultural Plantations (Mei County) Co., Ltd. was established on September 2nd, 2016. Its scope of business includes the planting, acquisition and sales of vegetables, fruits, flowers, Chinese herbal medicine, farm products; fresh fruit picking; research, training and promotion of planting and breeding technology, development and training of E-commerce and online sales of agricultural and sideline products.

(19) Hedetang Foods Industry (Zhouzhi) Co., Ltd. was established on November 29, 2016. Its scope of business includes production, processing and sales of f kiwifruit wine, juice, puree and beverages; the storage and sales of fresh fruits; and import and export of a variety of products and technology.

(20) Future World Trading (Hong Kong) Limited (“Future World Trading (HK)”) was established on July 27, 2016, formerly known as SkyPeople International Trading (HK) Limited. It mainly engages in the import and export of food products.

(21) Xi’an RiYing Financial Management Co. Ltd (“Xi’an RiYing”) was established on January 21, 2014. Its main business scope includes financial consulting for NEEQ listed companies, M&A and reorganization planning, strategic planning for enterprise development, industrial competition analysis, financial tax planning, equity incentive system and market value management.

Corporate History

We were initially incorporated in 1998 in Florida as Cyber Public Relations, Inc. for the purpose of providing internet electronic commerce consulting services to small and medium sized businesses and did not have any material operations or revenue. On January 21, 2004, we purchased all of the outstanding share capital of Environmental Technologies, Inc., (“Environmental Technologies”), a Nevada corporation, in exchange for approximately 29,051 shares of the Company’s common stock (“Common Stock”). As a result, Environmental Technologies became our wholly-owned subsidiary and the Environmental Technologies shareholders acquired approximately 97% of our issued and outstanding Common Stock. We changed our name to Entech Environmental Technologies, Inc.

After our acquisition of Environmental Technologies, we operated through our wholly-owned subsidiary, H.B. Covey, Inc., (“H.B. Covey”), a business providing construction and maintenance services to petroleum service stations in the southwestern part of the United States and installation services for consumer home products in Southern California. In July 2007, we entered into and consummated a Stock Sale and Purchase Agreement pursuant to which we sold H.B. Covey.

| 4 |

We were a shell company with no significant business operations after we sold H.B. Covey. As a result of the consummation of a reverse merger transaction, on February 26, 2008 we ceased being a shell company and became an indirect holding company for SkyPeople (China) through Pacific. In May 2008, we changed our name to SkyPeople Fruit Juice, Inc.

On June 10, 2008, we acquired Huludao Wonder from Shaanxi Hede Investment Management Co., Ltd., (“Hede”), for a total purchase price of RMB 48,250,000, or approximately $6,308,591, based on the exchange rate on June 1, 2007. The payment was made through the offset of related party receivables. Prior to that, we operated our apple concentrate business out of the facilities of Huludao Wonder under a one-year lease agreement with Hede.

On June 17, 2009, we incorporated a new Delaware corporation called Harmony to be a wholly owned subsidiary of the Company with offices initially in California to act as a sales company for the Company. The total number of shares of capital stock that Harmony has authority to issue is 3,000 shares, all of which are Common Stock with a par value of $1.00 per share. On June 20, 2009, HMN was registered in the State of California to transact business in such state. HMN has not yet commenced operations and the Company plans to close down this dormant subsidiary.

On November 25, 2009, we acquired Yingkou for a purchase price of RMB 22,700,000 (or $3,325,569 based on the exchange rate of December 31, 2009), pursuant to the Stock Purchase Agreement that SkyPeople (China) entered into with Shaanxi Boai Pharmaceutical & Scientific Development Co., Ltd. (“Shaanxi Boai”, formerly known as “Xi’an Dehao Investment & Consultation Co., Ltd.”), on November 18, 2009. Yingkou commenced operating activities in the fourth quarter of 2010.

On March 13, 2012, we established Foods Industry Yidu (formerly known as SkyPeople Juice Group Yidu Orange Products Co., Ltd.) to engage in the business of deep processing and sales of oranges.

On March 13, 2012, we established Agricultural Plantations Yidu, (formerly known as Hedetang Fruit Juice Beverages (Yidu) Co., Ltd.) to engage the business of production and sales of fruit juice beverages.

On April 26, 2012 we established SkyPeople Suizhong to engage in the business of initial processing, quick-frozen and sales of agricultural products and related by-products.

On May 28, 2012, we acquired Hededetang Holdings (Asia-Pacifc) to engage in the store and sales of pre-packed foods, production and sales of fruit juice beverages through its controlling of its subsidiaries.

On April 19, 2013, we established Trading Market Mei County (formerly known as SkyPeople Juice Group (Mei County) Kiwi Fruit and Farm Products Trading Market Co., Ltd.) to engage in preliminary processing of agricultural and subsidiary products, the establishment of trading market and similar activities.

On April 19, 2013, we established Guo Wei Mei to engage in the business of producing kiwi fruit juice, kiwi puree and cider beverages, and similar products.

On March 31, 2014, we established Xi’an Hedetang to engage in the business of production and sales of fruit juice beverages.

On July 2, 2014, we established Xi’an Cornucopia to engage in the business of the retail and wholesale of pre-packaged food.

On July 3, 2014, we established Foods Industry Xi’an (formerly known as Shaanxi Fruitee Fun Co., Ltd.) to engage in the business of the retail and wholesale of pre-packaged food.

| 5 |

On July 21, 2014, we established Hedetang Holding to engage in the business of the retail and wholesale of pre-packaged food, research and development regarding pre-packaged food, bio-tech, machinery and packages, export of manufactured products and technology, business consulting and marketing planning.

On October 16, 2015, SkyPeople signed a Share Purchase Agreement with Skypeople International Holdings Group Limited to sell 5,321,600 shares of its common stock at $1.50 per share to Skypeople International Holdings Group Limited. The purchase price of $7,928,400 was paid by the cancellation of the loan from Skypeople International Holdings Group Limited to Skypeople under the loan agreement dated February 18, 2013, and renewed on February 18, 2014, in its principle amount. The remaining loan amount and interest owed was paid in cash.

On November 16, 2015, Agricultural Plantations Yidu (formerly known as Hedetang Fruit Juice Beverages (Yidu) Co., Ltd.) signed a construction agreement with China Yi Ye Group Co. Ltd. to engage China Yi Zhi Group Co. Ltd. to establish an orange comprehensive deep processing zone in Yidu. On November 23, 2015, construction began on the agricultural products trading market. The Company plans to finish the construction of the office building, R&D center, fruit juice production facility, cold storage and other areas in the second quarter of 2017, and construction on the distribution center is planned to be completed by the last quarter of 2017.

The Yidu project includes the establishment of one orange comprehensive utilization deep processing zone (the “deep processing zone”), including:

a) one 45 ton/hour concentrated orange juice and byproduct deep processing production line;

b) one bottled juice drink production line with a capacity to produce 6,000 glass bottles per hour;

c) one storage freezer facility with a capacity to store 20,000 tons of concentrated orange juice; and

d) general purpose facilities within the zone, office space, general research and development facilities, service area, living quarters and other ancillary support areas.

On March 11, 2016, SkyPeople China entered into a Share Transfer Agreement and a Capital Contribution (the “Agreements”) with Shenzhen TianShunDa Equity Investment Fund Management Co., Ltd. (the “TSD”), a limited liability corporation registered in China. Pursuant to the Agreements, TSD shall acquire 112,809,100 shares of SkyPeople China from SkyPeople HK and shall make a total capital contribution RMB 131,761,028.80 (approximately $20,270,928) to SkyPeople China, which is calculated based upon 8 times of SkyPeople China’s net profit per share for 2014 (about RMB 0.146 per share) multiplied by 112,809,100 shares. On March 18, 2016, TSD made a capital contribution of RMB 112,809,100 out of the RMB 131,761,029 (the “Capital Contributions”) as payment for the outstanding capital contribution due to SkyPeople China by SkyPeople HK. On May 9, 2016, TSD made a capital contribution of the remaining RMB 18,951,929 (approximately $2,915,681) as an additional capital contribution to SkyPeople China, which was deposited into SkyPeople China’s capital surplus account. Following SkyPeople China’s receipt of the full Capital Contributions, the shares were transferred, resulting in TSD owning 112,809,100 shares, or 26.36%, of SkyPeople China.

On March 23, 2016, we established Trading Market Yidu to construct, operate, and manage property of the farm products trading market.

On April 21, 2016, we established Hedetang E-Commerce Co., Ltd. to sale pre-packaged foods and bulk foods online.

| 6 |

On May 18, 2016, we acquired Hedetang Foods China through the acquisition of Belkin to wholesale and retail of foods and beverages, import and export fruit, vegetables and dried fruit.

On June 7, 2016, we established Foods Industry Jingyang to engage in the business of processing, storage and sales of farm products, fruits, tea and snacks. This company has not commenced operations as of this report date.

On September 2, 2016, we established Agricultural Plantations Mei County to plant, acquire and sale vegetables, fruits, flowers, Chinese herbal medicine and other farm products.

On November 4, 2016, we acquired Future World Trading (HK) to engage in the import and export of food products.

On November 28, 2016, we acquired SkyPeople Foods to engage in the production and sale of foods and beverages through its subsidiaries.

On November 29, 2016, we established Foods Industry Zhouzhi to produce, process and sale kiwifruit wine, juice, puree and beverages. This company has not commenced operations as of this report date.

On November 30, 2016, we acquired FullMart to engage in foods trading business through its subsidiaries.

In December 2016, we established a restructuring plan to close our Hudludao Wonder operation.

Our Offices

Our principal executive office is located at 16F, National Development Bank Tower No. 2, Gaoxin 1st Road, Xi’an, PRC 710075, tel. 86-29-88377161. Our agent for service of process in the United States is CT Corporation, located at 818 West Seventh Street, Los Angeles, CA 90017.

Other Information

For a complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the Securities and Exchange Commission (the “SEC”) that are incorporated by reference in this prospectus, including our Annual Report on Form 10-K for the year ended December 31, 2016. For instructions on how to find copies of these documents, please see the section titled “Incorporation of Certain Information by reference” beginning on page 66 of this prospectus.

| 7 |

THE OFFERING | |

| Common stock offered by selling shareholders | Up to 1,561,781 shares, of which (i) 862,097 shares of common stock of the registrant, par value $0.001 per share (“Common Stock”), are issuable upon the exercise of common stock purchase warrants of the registrant issued pursuant to a private placement concurrently with our registered direct offering on April 12, 2017 (the “Investor Warrants”); (ii) 34,484 shares of Common Stock that are issuable upon the exercise of common stock purchase warrants of the registrant issued to the placement agent’s designees in connection with such private placement (the “Agent Warrants,” and together with the Investor Warrants, the “Warrants”); and (iii) 665,200 shares of Common Stock sold to a selling shareholder in a prior private placement, dated October 26, 2015 (as adjusted following the Company’s 1-for-8 reverse stock split). |

| Common stock to be outstanding after the offering | Up to 5,173,187 shares. |

Exercise prices, conditions and terms

Use of proceeds |

The Warrants will be exercisable beginning on the six month anniversary of the date of issuance at an initial exercise price of $5.20 per share. The Investor Warrants will expire on the five and a half year anniversary of the date of issuance and the Agent Warrants will expire on April 12, 2022.

We will not receive any proceeds from the sale of shares of our Common Stock by the selling stockholders in this offering. See “Use of Proceeds” for a complete description. |

| Nasdaq Global Market ticker symbol | SPU |

| Risk Factors | Investing in our Common Stock involves a high degree of risk. You should carefully review and consider the “Risk Factors” beginning on page 9 of this prospectus, which incorporates by reference risk factors set forth in our most recent Annual Report on Form 10-K. |

The number of shares of our common stock outstanding after the offering is based on 5,173,187 shares of our common stock outstanding as of May 24, 2017, which excludes 896,581 shares of our Common Stock issuable upon exercise of the Warrants outstanding as of May 24, 2017. The Warrants will not be exercisable until October 18, 2017. | |

| 8 |

An investment in our securities involves significant risks. You should carefully consider each of the risk factors set forth in our most recent Annual Report on Form 10-K, which was filed with the SEC on April 17, 2017, and as may be updated from time to time by our Quarterly Reports on Form 10-Q and other SEC filings filed after such annual report, and future filings with the SEC, which are incorporated by reference into this prospectus. Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate by reference in this prospectus and any prospectus supplement. Any of these risks and uncertainties could have a material adverse effect on our business, financial condition, cash flows and results of operations. If that occurs, the trading price of our common stock could decline materially and you could lose all or part of your investment.

The risks we have incorporated by reference into this prospectus are not the only risks we face. We may experience additional risks and uncertainties not currently known to us, or as a result of developments occurring in the future. Conditions that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, cash flows, results of operations and prospects.

Risks Related to Our Business

We may not be able to effectively control and manage our growth, and a failure to do so could adversely affect our operations and financial condition.

Our revenue increased significantly from 2006 to 2010 and from 2012 to 2014, but decreased in 2015 and 2016. If our business and markets experience significant growth, we will need to expand our business to maintain our competitive position. We may face challenges in managing and financing expansion of our business, facilities and product offerings, including challenges relating to integration of acquired businesses and increased demands on our management team, employees and facilities. Failure to effectively deal with increased demands on us could interrupt or adversely affect our operations and cause production backlogs, longer product development time frames and administrative inefficiencies. Other challenges involved with expansion, acquisitions and operation include:

| ● | unanticipated costs; | |

| ● | the diversion of management’s attention from other business concerns; | |

| ● | potential adverse effects on existing business relationships with suppliers and customers; | |

| ● | obtaining sufficient working capital to support expansion; | |

| ● | expanding our product offerings and maintaining the high quality of our products; |

| ● | continuing to fill customers’ orders on time; | |

| ● | maintaining adequate control of our expenses and accounting systems; | |

| ● | successfully integrating any future acquisitions; and | |

| ● | anticipating and adapting to changing conditions in the fruit juice and beverage industry, whether from changes in government regulations, mergers and acquisitions involving our competitors, technological developments or other economic, competitive or market dynamics. |

| 9 |

Even if we obtain benefits of expansion in the form of increased sales, there may be delay between the time when the expenses associated with an expansion or acquisition are incurred and the time when we recognize such benefits, which could negatively affect our earnings.

Our revenue and profitability are heavily dependent on prevailing prices for our products and raw materials, and if we are unable to effectively offset cost increases by adjusting the pricing of our products, our margins and operating income may decrease.

As a producer of commodities, our revenue, gross margins and cash flows from operations are substantially dependent on the prevailing prices we receive for our products and the cost of our raw materials, neither of which we control. The factors influencing the sales price of concentrated fruit juice include the supply price of fresh fruit, supply and demand of our products in international and domestic markets and competition in the fruit juice industry.

The price of our principal raw materials, fresh fruit, is subject to market volatility as a result of numerous factors including, but not limited to, general economic conditions, governmental regulations, weather, transportation delays and other uncertainties that are beyond our control. Due to such market volatility, we generally do not, nor do we expect to, have long-term contracts with our fresh fruit suppliers. Other significant raw materials used in our business include packing barrels, pectic enzyme, amylase and auxiliary materials such as coal, electricity and water. Prices for these items may be volatile as well and we may experience shortages in these items from time to time. As a result, we cannot guarantee that the necessary raw materials to produce our products will continue to be available to us at prices currently in effect or acceptable to us. In the event raw material prices increase materially, we may not be able to adjust our product prices, especially in the short term, to recover such cost increases. If we are not able to effectively offset these cost increases by adjusting the price of our products, our margins will decrease and earnings will suffer accordingly.

Weather and other environmental factors affect our raw material supply and a reduction in the quality or quantity of our fresh fruit supplies may have material adverse consequences on our financial results.

Our business may be adversely affected by weather and environmental factors beyond our control, such as adverse weather conditions during the growing or squeezing seasons. A significant reduction in the quantity or quality of fresh fruit harvested resulting from adverse weather conditions, disease or other factors could result in increased per unit processing costs and decreased production, with adverse financial consequences to us.

We sell our products primarily through distributors and delays in delivery or poor handling by distributors may affect our sales and damage our reputation.

We primarily sell our products through our distributors and rely on these distributors for the distribution of our products. These distributors are not obligated to continue to sell our products. Any disruptions in our relationships with our distributors could cause interruption to the supply of our products to retailers, which would harm our revenue and results of operations. In addition, delivery disruptions may occur for various reasons beyond our control, including poor handling by distributors or third party transport operators, transportation bottlenecks, natural disasters and labor strikes, and could lead to delayed or lost deliveries. Some of our products are perishable and poor handling by distributors and third party transport operators could also result in damage to our products that would make them unfit for sale. If our products are not delivered to retailers on time, or are delivered damaged, we may have to pay compensation, we could lose business and our reputation could be harmed.

Because we experience seasonal fluctuations in our sales, our quarterly results will fluctuate and our annual performance will depend largely on results from our first and fourth quarters.

Our business is highly seasonal, reflecting the harvest season of our primary source fruits from July or August of a year to April the following year. Typically, a substantial portion of our revenue is earned during our first and fourth quarters. We generally experience lower revenue during our second and third quarters. Generally, sales in the first and fourth quarters accounted for approximately 65% to 72% of our revenue of the whole year. If sales in our first and fourth quarters are lower than expected, our operating results would be adversely affected and it would have a disproportionately large impact on our annual operating results.

| 10 |

If we are unable to gain market acceptance or significant market share for the new products we introduce, our results of operations and profitability could be adversely impacted.

Our future business and financial performance depends, in part, on our ability to successfully respond to consumer preferences by introducing new products and improving existing products. We cannot guarantee that we will be able to gain market acceptance or significant market share for our new products. Consumer preferences change, and any new products that we introduce may fail to meet the particular tastes or requirements of consumers, or may be unable to replace their existing preferences. Our failure to anticipate, identify or react to these particular tastes or changes could result in reduced demand for our products, which could in turn cause us to be unable to recover our development, production and marketing costs, thereby leading to a decline in our profitability.

The development and introduction of new products is key to our expansion strategy. We incur significant development and marketing costs in connection with the introduction of new products. Successfully launching and selling new products puts pressure on our sales and marketing resources, and we may fail to invest sufficient funds in order to market and sell a new product effectively. If we are not successful in marketing and selling new products, our results of operations could be materially adversely affected.

Economic conditions have had and may continue to have an adverse effect on consumer spending on our products.

The worldwide economy has not yet fully recovered from a recession, which has reduced discretionary income of consumers. The adverse effect of a sustained international economic downturn, including sustained periods of decreased consumer spending, high unemployment levels, declining consumer or business confidence and continued volatility and disruption in the credit and capital markets, will likely result in reduced demand for our products as consumers turn to less expensive substitute goods or forego certain purchases altogether. To the extent the international economic downturn continues or worsens, we could experience a reduction in sales volume. If we are unable to reduce our operating costs and expenses proportionately, many of which are fixed, our results of operations would be adversely affected.

Concerns over food safety and public health may affect our operations by increasing our costs and negatively impacting demand for our products.

We could be adversely affected by diminishing confidence in the safety and quality of certain food products or ingredients. As a result, we may elect or be required to incur additional costs aimed at increasing consumer confidence in the safety of our products. For example, a crisis in the PRC over melamine contaminated milk in 2008 has adversely impacted Chinese food exports since October 2008, as reported by the Chinese General Administration of Customs, although most foods exported from the PRC were not significantly affected by the melamine contamination. In addition, our concentrated fruit juices exported to foreign countries must comply with quality standards in those countries. Our success depends on our ability to maintain the quality of our existing and new products. Product quality issues, real or imagined, or allegations of product contamination, even if false or unfounded, could tarnish the image of our brands and may cause consumers to choose other products.

We face increasing competition from both domestic and foreign companies, and any failure by us to compete effectively could adversely affect our results of operations.

The juice beverage industry is highly competitive, and we expect it to continue to become even more competitive. Our ability to compete in the industry depends, to a significant extent, on our ability to distinguish our products from those of our competitors by providing high quality products at reasonable prices that appeal to consumers’ tastes and preferences. There are currently a number of well-established companies producing products that compete directly with ours. Some of our competitors may have been in business longer than we have, may have substantially greater financial and other resources than we have and may be better established in their markets. We anticipate that our competitors will continue to improve their products and introduce new products with competitive price and performance characteristics.

| 11 |

We cannot guarantee that our current or potential competitors will not provide products comparable or superior to those we provide or adapt more quickly than we do to evolving industry trends or changing market requirements. It is also possible that there will be significant consolidation in the juice beverage industry among our competitors, and alliances may develop among competitors. These alliances may rapidly acquire significant market share, and some of our distributors may commence production of products similar to those we sell to them. Increased competition may result in price reductions, reduced margins and loss of market share, any of which could materially adversely affect our profit margins. We cannot guarantee that we will be able to compete effectively against current and future competitors. Aggressive marketing or pricing by our competitors or the entrance of new competitors into our markets could have a material adverse effect on our business, results of operations and financial condition.

We may engage in future acquisitions involving significant expenditures of cash, the incurrence of debt or the issuance of stock, all of which could have a materially adverse effect on our operating results.

As part of our business strategy, we review acquisition and strategic investment prospects that we believe would complement our current product offerings, augment our market coverage, enhance our technological capabilities or otherwise offer growth opportunities. From time to time, we review investments in new businesses and we expect to make investments in, and to acquire, businesses, products or technologies in the future. In the event of any future acquisitions, we may expend significant cash, incur substantial debt and/or issue equity securities and dilute the percentage ownership of current shareholders, all of which could have a material adverse effect on our operating results and the price of our Common Stock. We cannot guarantee that we will be able to successfully integrate any businesses, products, technologies or personnel that we may acquire in the future, and our failure to do so could have a material adverse effect on our business, operating results and financial condition.

We require various licenses and permits to operate our business, and the loss of or failure to renew any or all of these licenses and permits could materially adversely affect our business.

In accordance with PRC laws and regulations, we have been required to maintain various licenses and permits in order to operate our business at the relevant manufacturing facilities including, without limitation, industrial product production permits. We are required to comply with applicable hygiene and food safety standards in relation to our production processes. Our premises and transportation vehicles are subject to regular inspections by the regulatory authorities for compliance with the Detailed Rules for Administration and Supervision of Quality and Safety in Food Producing and Processing Enterprises. Failure to pass these inspections, or the loss of or failure to renew our licenses and permits, could require us to temporarily or permanently suspend some or all of our production activities, which could disrupt our operations and adversely affect our business.

Governmental regulations affecting the import or export of products could negatively affect our revenue.

The United States and various other governments have imposed controls, export license requirements and restrictions on the export of some of our products. Governmental regulation of exports, or our failure to obtain required export approval for our products, could harm our international sales and adversely affect our revenue and profits. In addition, failure to comply with such regulations could result in penalties, costs and restrictions on export privileges. Additionally, the new U.S. presidential administration has indicated that it may seek changes to or withdraw the United States from various international treaties and trade arrangements. Uncertainty regarding policies affecting global trade may make it difficult for our management to accurately forecast our business, and increases in the duties, tariffs and other charges imposed on our products by the United States or other countries in which on our products are sold, or other restraints on international trade, could negatively affect our business and the results of our operations.

We do not presently maintain product liability insurance, and our property and equipment insurance does not cover the full value of our property and equipment, which leaves us with exposure in the event of loss or damage to our properties or claims filed against us.

We currently do not carry any product liability or other similar insurance. Product liability claims and lawsuits in the PRC generally are still rare, unlike in some other countries. Product liability exposures and litigation, however, could become more commonplace in the PRC. Moreover, we have product liability exposure in countries in which we sell our products, such as the United States, where product liability claims are more prevalent. As we expand our international sales, our liability exposure will increase.

| 12 |

We may be required from time to time to recall products entirely or from specific copackers, markets or batches. Although historically we have not had any recall of our products, we cannot guarantee that circumstances or incidents will not occur that will require us to recall our products. We do not maintain recall insurance. In the event we experience product liability claims or a product recall, our business operations and financial condition could be materially adversely affected.

Our business and operations may be subject to disruption from work stoppages, terrorism or natural disasters.

Our operations may be subject to disruption for a variety of reasons, including work stoppages, acts of war, terrorism, pandemics, fire, earthquake, flooding or other natural disasters. If a major incident were to occur in either of the regions where our facilities or main offices are located, our facilities or offices or those of critical suppliers could be damaged or destroyed. Such a disruption could result in a reduction in available raw materials, the temporary or permanent loss of critical data, suspension of operations, delays in shipment of products and disruption of business generally, which would adversely affect our revenue and results of operations.

Our success depends substantially on the continued retention of certain key personnel and our ability to hire and retain qualified personnel in the future to support our growth.

If one or more of our senior executives or other key personnel are unable or unwilling to continue in their present positions, our business may be disrupted and our financial condition and results of operations may be materially and adversely affected. While we depend on the abilities and participation of our current management team generally, we rely particularly upon Mr. Hongke Xue, our chief executive officer (“CEO”); Mr. Yongke Xue, a member of the Company’s Board of Directors (the “Board”); and Mr. Hanjun Zheng, our interim chief financial officer (“CFO”). The loss of the services of Messrs. Hongke Xue, Yongke Xue or Hanjun Zheng for any reason could significantly adversely impact our business and results of operations. Competition for senior management and senior technology personnel in the PRC is intense and the pool of qualified candidates is very limited. Accordingly, we cannot guarantee that the services of our senior executives and other key personnel will continue to be available to us, or that we will be able to find a suitable replacement for them if they were to leave.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by the Sarbanes-Oxley Act of 2002, (“Sarbanes-Oxley”). Our senior management does not have experience managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may be unable to implement programs and policies in an effective and timely manner or that adequately respond to the increased legal, regulatory and reporting requirements associated with being a publicly traded company. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties, distract our management from attending to the management and growth of our business, result in a loss of investor confidence in our financial reports and have an adverse effect on our business and stock price.

As a public company, we are obligated to maintain effective internal controls over financial reporting. Our internal controls may be determined not to be effective, which may adversely affect investor confidence in us and, as a result, decrease the value of our Common Stock.

The PRC has not adopted management and financial reporting concepts and practices similar to those in the United States. We may have difficulty in hiring and retaining a sufficient number of qualified finance and management employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing and maintaining accounting and financial controls, collecting financial data, budgeting, managing our funds and preparing financial statements, books of account and corporate records and instituting business practices that meet investors’ expectations in the United States.

Rules adopted by the SEC, or the Commission, pursuant to Sarbanes-Oxley Section 404 require annual assessment of our internal controls over financial reporting. This requirement first applied to our annual report on Form 10-K for the fiscal year ended December 31, 2008. The standards that must be met for management to assess the internal controls over financial reporting as effective are relatively new and complex, and they require significant documentation, testing and possible remediation to meet the detailed standards. This assessment will need to include disclosure of any material weaknesses identified by our management in our internal control over financial reporting. During the evaluation and testing process, if we identify one or more material weaknesses in our internal control over financial reporting, we will be unable to assert that our internal controls are effective. If we are unable to conclude that our internal control over financial reporting is effective, we could lose investor confidence in the accuracy and completeness of our financial reports, which could harm our business and cause the price of our Common Stock to decline.

| 13 |

We may need additional capital to fund our future operations and, if it is not available when needed, we may need to reduce our planned development and marketing efforts, which may reduce our sales revenue.

We believe that our existing working capital and cash available from operations will enable us to meet our working capital requirements for at least the next 12 months. However, if cash from future operations is insufficient, or if cash is used for acquisitions or other currently unanticipated uses, we may need additional capital. The development and marketing of new products and the expansion of distribution channels and associated support personnel require a significant commitment of resources. In addition, if the markets for our products develop more slowly than anticipated, or if we fail to establish significant market share and achieve sufficient net revenues, we may continue to consume significant amounts of capital. As a result, we could be required to raise additional capital. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities could result in dilution of the shares held by existing stockholders. If additional funds are raised through the issuance of debt securities, such securities may provide the holders certain rights, preferences, and privileges senior to those of common stockholders, and the terms of such debt could impose restrictions on our operations. We cannot guarantee that additional capital, if required, will be available on acceptable terms, or at all. If we are unable to obtain sufficient amounts of additional capital, we may be required to reduce the scope of our planned product development and marketing efforts, which could harm our business, financial condition and operating results.

We may not be able to prevent others from unauthorized use of our patents, which could harm our business and competitive position.

Our success depends, in part, on our ability to protect our proprietary technologies. We hold 21 patents in the PRC covering our fruit processing technology. The process of seeking patent protection can be lengthy and expensive and we cannot guarantee that our existing or future issued patents will be sufficient to provide us with meaningful protection or commercial advantages. We also cannot guarantee that our current or potential competitors do not have, and will not obtain, patents that will prevent, limit or interfere with our ability to make or sell our products in the PRC or other countries.

The implementation and enforcement of PRC intellectual property laws historically have not been vigorous or consistent. Accordingly, intellectual property rights and confidentiality protections in the PRC are not as effective as those in the United States and other countries. We may need to resort to litigation to enforce or defend patents issued to us or to determine the enforceability, scope and validity of our proprietary rights or those of others. Such litigation will require significant expenditures of cash and management efforts and could harm our business, financial condition and results of operations. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business, competitive position, business prospects and reputation.

Intellectual property infringement claims may adversely impact our results of operations.

As we develop and introduce new products, we may be increasingly subject to claims of infringement of another party’s intellectual property. If a claim for infringement is brought against us, such claim may require us to modify our products, cease selling certain products or engage in litigation to determine the validity and scope of such claims. Any of these events may harm our business and results of operations.

| 14 |

If our costs and demands upon management increase disproportionately to the growth of our business and revenue as a result of complying with the laws and regulations affecting public companies, our operating results could be harmed.

As a public company, we do and will continue to incur significant legal, accounting, investor relations and other expenses, including costs associated with public company reporting requirements. We also have incurred and will incur costs associated with current corporate governance requirements, including requirements under Section 404 and other provisions of Sarbanes-Oxley, as well as rules implemented by the SEC and the stock exchange on which our Common Stock is traded. The expenses incurred by public companies for reporting and corporate governance purposes have increased dramatically over the past several years. These rules and regulations have increased our legal and financial compliance costs substantially and make some activities more time consuming and costly. If our costs and demands upon management increase disproportionately to the growth of our business and revenue, our operating results could be harmed.

There are inherent uncertainties involved in estimates, judgments and assumptions used in the preparation of financial statements in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. Any changes in estimates, judgments and assumptions could have a material adverse effect on our business, financial condition and operating results.

The preparation of financial statements in accordance with U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) involves making estimates, judgments and assumptions that affect reported amounts of assets (including intangible assets), liabilities and related reserves, revenue, expenses and income. Estimates, judgments and assumptions are inherently subject to change in the future, and any such changes could result in corresponding changes to the amounts of assets, liabilities, revenue, expenses and income. Any such changes could have a material adverse effect on our business, financial condition and operating results.

We are subject to the risk of increased income taxes, which could harm our business, financial condition and operating results.

We base our tax position upon the anticipated nature and conduct of our business and upon our understanding of the tax laws of the various countries in which we have assets or conduct activities. However, our tax position is subject to review and possible challenge by tax authorities and to possible changes in law, which may have retroactive effect. We currently operate through Pacific, a wholly-owned subsidiary organized under the laws of Vanuatu and SkyPeople (China), a 73.42% owned subsidiary of HeDeTang Holdings (HK) Ltd. organized under the laws of the PRC, and we maintain manufacturing operations in the PRC. Any of these jurisdictions could assert tax claims against us. We cannot determine in advance the extent to which some jurisdictions may require us to pay taxes or make payments in lieu of taxes. If we become subject to additional taxes in any jurisdiction, such tax treatment could materially and adversely affect our business, financial condition and operating results.

Risks Related to Doing Business in the PRC

Inflation in the PRC could negatively affect our profitability and growth.

The rapid growth of China’s economy has been uneven among economic sectors and geographic regions of the country. China’s economy grew at an annual rate of 6.7% in 2016, as measured by the year-over-year change in gross domestic product, or GDP, according to the National Bureau of Statistics of China. Rapid economic growth can lead to growth in the money supply and rising inflation. The inflation rate in China was approximately 2.0% in 2016, as reported by National Bureau of Statistics, and is expected to increase. If prices for our products and services fail to rise at a rate sufficient to compensate for the increased costs of supplies, such as raw materials, due to inflation, it may have an adverse effect on our profitability.

Furthermore, in order to control inflation in the past, the PRC government has imposed controls on bank credits, limits on loans for property, plant and equipment and restrictions on state bank lending. The implementation of such policies may impede future economic growth. The People’s Bank of China has effected increases in interest rates in response to inflationary concerns in the China’s economy. If the central bank again raises interest rates from current levels, economic activity in China could further slow and, in turn, materially increase our costs and reduce demand for our products and services.

| 15 |

We face the risk that changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

We conduct substantially all of our operations and generate most of our revenue in the PRC. Accordingly, economic, political and legal developments in the PRC will significantly affect our business, financial condition, results of operations and prospects. The PRC economy is in transition from a planned economy to a market oriented economy subject to plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on economic conditions in the PRC. While we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and that business development in the PRC will continue to follow market forces, we cannot guarantee that this will be the case. Our interests may be adversely affected by changes in policies by the PRC government, including:

| ● | changes in laws, regulations or their interpretation; |

| ● | confiscatory taxation; | |

| ● | restrictions on currency conversion, imports or sources of supplies; | |

| ● | expropriation or nationalization of private enterprises; and | |

| ● | the allocation of resources. |

Although the PRC government has been pursuing economic reform policies for more than two decades, the PRC government continues to exercise significant control over economic growth in the PRC through the allocation of resources, controlling payments of foreign currency, setting monetary policy and imposing policies that impact particular industries in different ways. We cannot guarantee that the PRC government will continue to pursue policies favoring a market oriented economy or that existing policies will not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting political, economic and social life in the PRC.

The original incorporation of SkyPeople (China) as a joint stock company in 2001 did not obtain all required approvals from the PRC government authorities pursuant to the relevant PRC law effective at the time, and we may be subject to various penalties under the law retroactively.

The original incorporation of SkyPeople (China) (under the original name of Xi’an Zhonglv Ecology Science and Technology Industry Co., Ltd.) as a joint stock company in 2001 was approved by the Xi’an Municipal People’s Government. However, according to the applicable PRC Company Law that was in force in 2001, the incorporation of SkyPeople (China) as a joint stock company shall be subject to the approval by the government authority of Shaanxi Province. Pursuant to the PRC Company Law which was in force in 2001, if company stocks is arbitrarily issued without obtaining the approval of the relevant competent authorities stipulated under the law, the parties concerned may be ordered to cease the issuance of the stock, refund the raised capital and the interests accrued therefrom, and may be subject to a fine of no less than one percent but no more than five percent of the amount of the raised capital. As such, SkyPeople (China) may be subject to any or all of the foregoing penalties as provided under the PRC Company Law effective in 2001 should the relevant government authorities choose to enforce the law retroactively.

However, we believe that the regulatory authorities may consider the following factors as mitigating factors if such authorities choose to enforce the applicable laws:

(i) the incorporation of SkyPeople (China) obtained the approval by the Xi’an local government. As general practice in approval procedures, the applicants may only be able to first approach the Xi’an local government authority in order to acquire the approval by a higher level government authority, and would generally rely on the Xi’an local government to then submit the application to a higher level authority for its final approval; and

(ii) the trend of the PRC Company Law is to deregulate the approvals on the incorporation of joint stock companies in China. In particular, the current PRC Company Law, effective since January 1, 2006, has eliminated the relevant approval requirement relating to the incorporation of joint stock companies. Instead, the current PRC Company Law merely requires a registration with the competent Administration for Industry and Commerce in connection with the incorporation of joint stock companies in the PRC as long as the stock is not issued to the public.

In addition, if needed in the future, we may make efforts to seek a written confirmation from the Shaanxi Provencal People’s Government regarding its ratification of the original incorporation of SkyPeople (China) as a joint stock company.

| 16 |

Our current manufacturing operations are subject to various environmental protection laws and regulations issued by the central and local governmental authorities, and we cannot guarantee that we have fully complied with all such laws and regulations. In addition, changes in the existing laws and regulations or additional or stricter laws and regulations on environmental protection in the PRC may cause us to incur significant capital expenditures, and we cannot guarantee that we will be able to comply with any such laws and regulations.

We carry out our business in an industry that is subject to PRC environmental protection laws and regulations. These laws and regulations require enterprises engaged in manufacturing and construction that may cause environmental waste to adopt effective measures to control and properly dispose of waste gases, waste water, industrial waste, dust and other environmental waste materials, as well as fee payments from producers discharging waste substances. Fines may be levied against producers causing pollution. Although we have made efforts to comply with such laws and regulations, we cannot guarantee that we have fully complied with all such laws and regulations. Except for Yingkou, all of our operating facilities hold a Pollution Emission Permit. The failure of complying with such laws or regulations may subject us to various administrative penalties such as fines. If the circumstances of the breach are serious, the central government of the PRC, including all governmental subdivisions, has the discretion to cease or close any operations failing to comply with such laws or regulations. There can also be no assurance that the PRC government will not change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditure, which we may be unable to pass on to our customers through higher prices for our products. In addition, we cannot guarantee that we will be able to comply with any such laws and regulations.

Changes in existing PRC food hygiene and safety laws may cause us to incur additional costs to comply with the more stringent laws and regulations, which could have an adverse impact on our financial position.

Manufacturers within the PRC beverage industry are subject to compliance with PRC food hygiene laws and regulations. These food hygiene and safety laws require all enterprises engaged in the production of juice and other beverages to obtain a food production license for each of their production facilities. They also set out hygiene and safety standards with respect to food and food additives, packaging and containers, information to be disclosed on packaging as well as hygiene requirements for food production and sites, facilities and equipment used for the transportation and sale of food. Failure to comply with PRC food hygiene and safety laws may result in fines, suspension of operations, loss of business licenses and, in more extreme cases, criminal proceedings against an enterprise and its management. Although we comply with current food hygiene laws, in the event that the PRC government increases the stringency of such laws, our production and distribution costs may increase, which could adversely impact our financial position.

We benefit from various forms of government subsidies and grants, the withdrawal of which could affect our operations.

Certain of our subsidiaries have received government subsidies from local governments. We recognized $0.03 million and $1.2 million in government subsidies for fiscal years 2016 and 2015, respectively. Past government grants or subsidies are not indicative of what we will obtain in the future. We cannot guarantee that we will continue to be eligible for government grants or other forms of government support. In the event that we are no longer eligible for grants, subsidies or other government support, our business and financial condition could be adversely affected.

| 17 |

PRC laws and regulations governing our current business operations are sometimes vague and uncertain and any changes in such laws and regulations may harm our business.