Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23 - Trade Desk, Inc. | d358104dex231.htm |

| EX-5.1 - EX-5.1 - Trade Desk, Inc. | d358104dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 22, 2017.

Registration No. 333-218137

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

THE TRADE DESK, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 7370 | 27-1887399 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

42 N. Chestnut Street

Ventura, California 93001

(805) 585-3434

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Jeff T. Green

Chief Executive Officer

The Trade Desk, Inc.

42 N. Chestnut Street

Ventura, California 93001

(805) 585-3434

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Richard A. Kline |

Michael Nordtvedt Damien Weiss Megan Baier Wilson Sonsini Goodrich & Rosati Professional Corporation 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☒ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Class A Common Stock, par value $0.000001 per share |

$275,000,000 | $31,873 | ||

|

| ||||

|

| ||||

| (1) | Includes shares of Class A common stock that may be purchased by the underwriters pursuant to an option to purchase additional shares. |

| (2) | Estimated solely for the purpose of computing the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended, on the basis of the maximum aggregate offering price. |

| (3) | The Registrant previously paid $23,180 of the registration fee in connection with the initial filing of this Registration Statement. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 22, 2017

PRELIMINARY PROSPECTUS

3,326,324 Shares

The Trade Desk, Inc.

Class A Common Stock

$ per share

The selling stockholders named in this prospectus are selling up to 3,326,324 shares of Class A common stock. We will not receive any proceeds from the sale of any shares of Class A common stock by the selling stockholders. The public offering price is $ per share of Class A common stock.

We have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except for voting and conversion rights. Each share of Class A common stock is entitled to one vote. Each share of Class B common stock is entitled to ten votes and is convertible at any time into one share of Class A common stock. Following this offering, outstanding shares of Class B common stock will represent approximately 86% of the voting power of our outstanding capital stock, and outstanding shares of common stock held by our executive officers, directors and holders of more than 5% of our capital stock will represent approximately 82% of the voting power of our outstanding capital stock, assuming, in each case, no exercise by the underwriters of their option to purchase additional shares.

Our Class A common stock is listed on The NASDAQ Global Market under the symbol “TTD”. The last reported sale price of our Class A common stock on the NASDAQ Global Market on May 19, 2017 was $50.07.

We are an “emerging growth company” as defined under federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discount |

$ | $ | ||||||

The selling stockholders have granted the underwriters the option to purchase up to an additional 498,948 shares of Class A common stock at the public offering price, less the underwriting discount.

The underwriters expect to deliver the shares to purchasers on or about , 2017 through the book-entry facilities of The Depository Trust Company.

| Citigroup | Jefferies | RBC Capital Markets | ||

| Needham & Company | Raymond James |

, 2017

Table of Contents

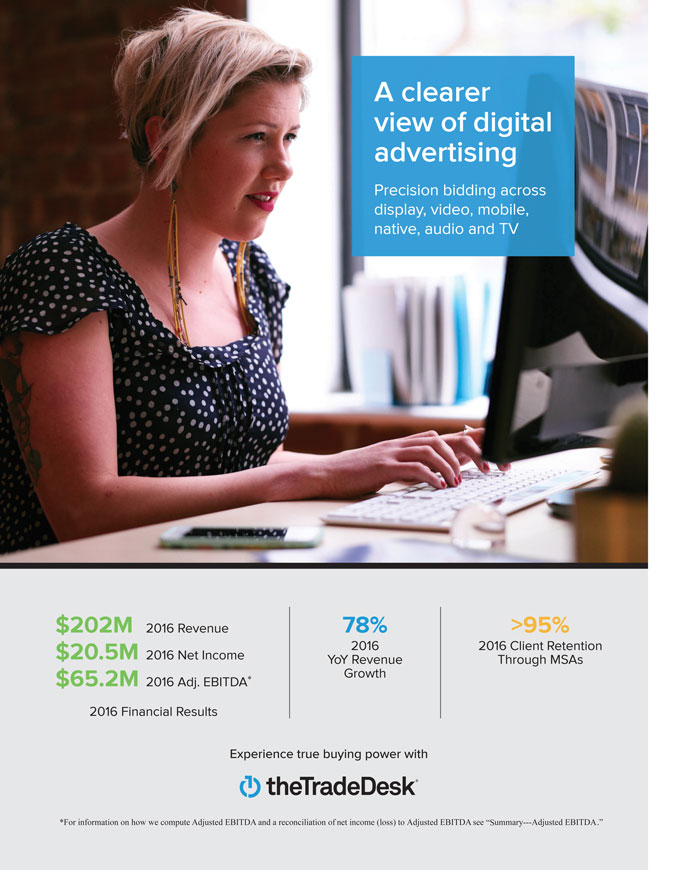

A clearer view of digital advertising Precision bidding across display, video, mobile, native, audio and TV $202M 2016 Revenue $20.5M 2016 Net Income $65.2M 2016 Adj. EBITDA* 2016 Financial Results 78% 2016 YoY Revenue Growth >95% 2016 Client Retention Through MSAs Experience true buying power with * For information on how we compute Adjusted EBITDA and a reconciliation of net income (loss) to Adjusted EBITDA see “Summary---Adjusted EBITDA.”

Table of Contents

| Page | ||||

| 1 | ||||

| 13 | ||||

| 38 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 44 | ||||

| 47 | ||||

| 52 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders |

54 | |||

| 58 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

None of us, the selling stockholders or underwriters have authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not, and the selling stockholders and underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus or incorporated by reference in this prospectus is accurate as of any date other than its date.

i

Table of Contents

This summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus. This summary does not contain all of the information you should consider before investing in our Class A common stock. You should read this entire prospectus carefully, including the sections captioned “Risk Factors” in this prospectus and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, filed with the Securities and Exchange Commission, or the SEC, on February 16, 2017, or the 2016 10-K, and in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2017, filed with the SEC on May 11, 2017, or the First Quarter 10-Q, each incorporated by reference in this prospectus, and our consolidated financial statements and the related notes incorporated by reference in this prospectus, before making an investment decision. Unless the context otherwise requires, the terms “The Trade Desk,” “the Company,” “we,” “us” and “our” refer to The Trade Desk, Inc. and its consolidated subsidiaries.

Our Company

Our company provides a technology platform for ad buyers.

With our self-serve platform, ad buyers are able to share their customized messages and ideas with the people and in the context they deliberately choose.

Our mission is to help our clients compete in the marketplace of ideas—the place in media and public discourse where ideas and messages compete in the open market for the mindshare of men and women around the world. Since most traditional and digital media is primarily monetized with advertising, ads are the currency of media and the Internet, and therefore at the center of the marketplace of ideas.

Our platform makes media monetization more effective. Instead of disrupting the foundation of media and advertising, we enable it. By offering compelling improvements in effectiveness, efficiency and reporting, we aim to change media and advertising globally.

Our platform makes it possible to message specific ideas to specific people. We give advertisers of all sizes the power to have simultaneous 1-to-1 customized interactions with billions of people around the world. Most advertising dollars are spent on awareness, where a brand pushes new information and ideas to a broad audience. Conversely, search engines respond to specific requests from individuals for information. Our technology combines the best of both, making it possible to push out a precise idea or message to a targeted audience with global scale.

Founded by some of the pioneers of the programmatic ad market, we established our company in 2009 with the intent to make advertising better by deploying massive amounts of data. By providing ad buyers with tools to leverage their first-party data as well as third-party data, we aim to provide a higher return on every advertising dollar spent. While our technology platform is deployed to directly serve ad buyers, the entire advertising marketplace benefits—publishers and content creators can experience a higher yield on their inventory, while consumers can receive advertising that is more relevant and interesting to them.

We believe that an average consumer might be exposed to over one thousand digital advertisements on a typical day. Most consumers are unaware that when they land on a webpage, watch a video, use a mobile app or watch an Internet-connected TV, there is often an auction for advertising inventory being run in about 1/10th of one second behind the scenes as the content loads. Our platform provides access to approximately 4.7 million ad spots on average every second for our clients to bid on across millions of different scaled media sources—websites, shows, channels, stations and streams. Our technology makes it possible for ad buyers to compete in those real-time auctions. Our platform helps our clients determine what ad will display and what price they should pay for every ad opportunity a buyer can consider.

In 2016, approximately $651.7 billion was spent on global advertising (including approximately $225.4 billion on TV advertising and approximately $54.6 billion on display advertising), according to

1

Table of Contents

International Data Corporation, or IDC, and in 2016, approximately $19 billion was transacted in the programmatic advertising spot market via real-time marketplaces, according to Magna Global. We aim to power every agent of every advertiser in both the spot and forward markets, including upfront purchases, for programmatic advertising.

We also believe that the efficiency of programmatic advertising will lead to a greater percentage of every advertising dollar ending up in the pocket of publishers. Publishers can now generate revenue without the large sales forces that were required in the past. Higher revenue yields and lower operating costs make it possible for publishers to increase their investment in creating high quality content.

Programmatic advertising is currently a small portion of total global advertising spend. Largely because of the price discovery benefits, we believe eventually the vast majority of advertising will be transacted programmatically.

We enable the programmatic marketplace with our self-serve platform. The unique architecture of our platform allows users access to highly granular targeting and reporting options, which we refer to as expressiveness. When combined with our data management capability and first-party data, our clients can reach their highly specified audiences with customized messages and generate favorable campaign outcomes.

By using our technology and the reach of the Internet, we can power this data-driven 1-to-1 messaging with massive global scale. We believe in order to do this effectively, we have to be a buy-side only platform across a spectrum of media, which we refer to as omnichannel. As the biggest brands desire to communicate with consumers worldwide, we have to be global, which is why we have employees and offices around the world.

We derive nearly all of our gross spend and revenue from ongoing master service agreements that give users constant access to our platform, instead of insertion orders, which typically are one-off deals to run single campaigns.

We have grown faster than the programmatic market and have achieved significant revenue scale with $1.0 billion in gross spend in 2016. Our revenue was $202.9 million in 2016, representing a growth rate of 78% over $113.8 million in 2015, while programmatic advertising spend in the industry grew to $19 billion in 2016, according to Magna Global, representing a growth rate of over 27% from 2015.

We generated net income of $15.9 million in 2015 and $20.5 million in 2016. We generated Adjusted EBITDA of $39.2 million in 2015 and $65.2 million in 2016. Our net income (loss) was $(1.0) million for the three months ended March 31, 2016 and $4.9 million for the three months ended March 31, 2017. Our Adjusted EBITDA was $4.3 million for the three months ended March 31, 2016 and $6.3 million for the three months ended March 31, 2017. Adjusted EBITDA is a financial measure not presented in accordance with generally accepted accounting principles, or GAAP. For a definition of Adjusted EBITDA, an explanation of our management’s use of this measure and a reconciliation of net income (loss) to Adjusted EBITDA, see “—Adjusted EBITDA.” For additional financial information, see the consolidated financial statements and related notes incorporated by reference herein.

Our Industry

Since the introduction of ad-funded television in the middle of the 20th century and continuing through the present day, most advertising inventory has been transacted based on a rate card. Publishers, content owners, and their agents set a price for their inventory, and buyers place an order to purchase that inventory. Similar to how the equities and commodities markets have transitioned from paper transactions on trading floors to electronic trading, advertising is transitioning from manual to programmatic.

Several trends, happening in parallel, are revolutionizing the way that advertising is bought and sold. The rise of the Internet has led to a wholesale change in the way that media is consumed and monetized, as ads can be digitally delivered on a 1-to-1 basis. In traditional methods of advertising, such as broadcast TV, ads can target a specific network, program or geography, but not a single household or individual as digital ads can.

2

Table of Contents

Some of the key industry trends are:

Media is Becoming Digital. Media is increasingly becoming digital as a result of advances in technology and changes in consumer behavior. This shift has enabled unprecedented options for advertisers to target and measure their advertising campaigns across nearly every media channel and device. The digital advertising market is a significant and growing part of the total advertising market. According to IDC, global advertising spend was approximately $651.7 billion in 2016 and is expected to grow to $767.1 billion in 2020, a compound annual growth rate of 4.2%. Also according to IDC, global digital advertising spend was $205.4 billion in 2016 and is expected to grow to $339.9 billion in 2020, a compound annual growth rate of 13.4%. We believe that the market is evolving and that advertisers will shift more spend to digital media. Since media is becoming increasingly digital, decisions based on consumer and behavioral data are more prevalent.

Fragmentation of Audience. As digital media grows, audience fragmentation is accelerating. A growing “long tail” of websites and content presents a challenge for advertisers trying to reach a large audience. Audience fragmentation has substantially impacted TV content distribution, perhaps more than any other channel, which we believe is setting up a significant change in how TV advertising inventory is monetized. Mirroring the fragmentation occurring in content, the number of devices used by individual consumers has increased. Both of these fragmentation trends are opportunities for technology companies that can consolidate and simplify media buying options for advertisers and their agencies.

Shift to Programmatic Advertising. We believe that the advertising industry is in the early stages of a shift to programmatic advertising, which is the ability to buy and sell advertising inventory electronically. Initially available for digital display advertising and transacted through real-time bidding platforms, programmatic advertising has evolved and is increasingly being used to transact across a wide range of advertising inventory, including display, mobile, video and audio among other inventory types, including TV.

We believe that TV advertising is just beginning its transition to programmatic. According to IDC research sponsored by our company, programmatic TV advertising spend is projected to grow from $239.8 million in 2015 to $17.3 billion in 2019.

Automation of Ad Buying. The growing complexity of digital advertising has increased the need for automation. Technology that enables fast, accurate and cost-effective decision-making through the application of computer algorithms that use extensive data sets has become critical for the success of digital advertising campaigns. Using programmatic inventory buying tools, advertisers are able to automate their campaigns, providing them with better price discovery, on an impression by impression basis. As a result, advertisers are able to purchase the advertising inventory they value the most, pay less for advertising inventory they do not value as much, and abstain from buying advertising inventory that does not fit their campaign parameters. Most of the growth in programmatic advertising to date has been driven by transactions on spot markets on advertising exchanges. Forward advertising markets and upfront purchases, which have traditionally been delivered manually, are also beginning to be handled programmatically.

Increased Use of Data. Advances in software and hardware and the growing use of the Internet have made it possible to collect and rapidly process massive amounts of user data. Data vendors are able to collect user information across a wide range of Internet properties and connected devices, aggregate it and combine it with other data sources. This data is then made non-identifiable and available within seconds based on specific parameters and attributes. Advertisers can integrate this targeting data with their own or an agency’s proprietary data relating to client attributes, the advertisers’ own store locations and other related characteristics. Through the use of these data sources, together with real-time feedback on consumer reactions to the ads, programmatic advertising increases the value of impressions for advertisers, inventory owners and viewers who receive more relevant ads.

Driven by these industry trends, programmatic advertising is expected to grow from $19 billion during 2016 to $42 billion by 2020, according to Magna Global. We believe that programmatic advertising will continue to

3

Table of Contents

grow as more content providers, content distributors and advertisers are able to realize its benefits. In addition, we expect that programmatic advertising will help grow the overall advertising market by enabling more advertisers to deploy more spend across a broader range of inventory channels.

What We Do

We are a technology company that empowers advertising agencies to purchase advertising more efficiently and effectively. We provide an intuitive self-serve platform that enables our clients to manage data-driven, digital advertising campaigns using their own teams.

| • | We Are an Enabler, Not a Disruptor. With our self-serve platform, we enable advertising agencies and service providers. We do not compete with our clients by selling our platform directly to their advertisers. Our self-service technology platform provides control to our clients and gives us the benefits of a highly scalable business model. |

| • | We Are Exclusively Focused on the Buy-Side. We focus on buyers since they control the advertising budgets. Also, the supply of digital advertising inventory exceeds demand, and accordingly we believe it is a buyer’s market. We also believe that by aligning our business only with buyers, we are able to avoid inherent conflicts of interest that exist when serving both the buy- and sell-side. This focus allows us to build trust with clients, many of whom incorporate their proprietary data into our platform. |

| • | We Are Data-Driven. Our technology platform was founded on the principle that data-driven decisions would be the future of advertising. We built a data management platform first, before building our ad buying technology. While data from disparate third-party data providers can improve campaign performance, our clients’ success often relies largely on our ability to ingest first-party data from brands and their agencies to enable intelligent decisioning that optimizes advertising campaigns. |

| • | We Do Not Arbitrage Advertising Inventory. To further align our interests with those of our clients, we do not buy advertising inventory in order to resell it to our clients for a profit. Instead, we provide our clients with a technology platform that allows them to manage their omnichannel advertising campaigns, on a self-serve basis and with full transparency. We derive substantially all of our revenue from ongoing master service agreements with our clients rather than episodic insertion orders. |

| • | We Are a Clear Box, Not a Black Box. Our platform is transparent and shows our clients their costs of advertising inventory, data, our platform fee and detailed performance metrics on their advertising campaigns. Our clients directly access and execute campaigns on our platform, control all facets of inventory purchasing decisions, and receive detailed, real-time reporting on all their advertising campaigns. |

| • | We Are an Open Platform. Clients can customize and build their own features on top of our platform. Clients may use our application programming interfaces, or APIs, to, for example, design their own user interface, bulk manage advertising campaigns, and link other systems including ad servers or reporting tools. As of December 31, 2016, all of our top 10 clients used our APIs. |

| • | We Are Omnichannel. Our platform enables our clients to deliver unified advertising campaigns across multiple devices, including computers, smartphones, tablets, gaming consoles, digital TV and broadcast TV. We also support multiple formats, including display, video, broadcast TV, Internet-connected TV, mobile web, in-app mobile and native. The breadth of data that we collect from a multitude of data sources across all channels gives our clients a holistic view of audiences, enabling more effective targeting across different channels. |

4

Table of Contents

Our Strengths

We believe the following attributes and capabilities form our core strengths and provide us with competitive advantages:

| • | Expressiveness of Our Platform. Our platform allows clients to easily define and manage advertising campaigns with multiple targeting parameters that may result in quadrillions of permutations, which we refer to as expressiveness. We believe that expressiveness provides clients with the ability to target audiences with an extremely high level of precision and thus obtain higher returns on their advertising spend. |

| • | Scalable Self-Service Model. We offer a self-service model that lets clients direct their own purchases of advertising inventory without extensive involvement by our personnel. This model helps us scale efficiently and has allowed us to grow our business at a faster pace than the growth of our sales and support organization. |

| • | Loyal Client Base. We had approximately 566 clients, including the advertising industry’s largest agencies, as of December 31, 2016. Many of our clients use our platform regularly as part of their digital advertising purchase workflow, creating ongoing relationships. As a result, our clients are loyal, with over 95% client retention during 2015 and 2016. In addition, our clients typically grow their use of our platform over time, with our clients who spent with us in 2015 increasing their spend on our platform by 71% during 2016. |

| • | Extensive Data Access. Our clients can easily buy targeting data from over 105 sources through our platform. We also provide clients access to our proprietary data, which increases with continued use of our platform. We believe that the integration of data and decisioning within a single platform enables us to better serve our clients. |

| • | Focus on Innovation. Our focus on innovation enables us to enhance our platform rapidly for our clients in a constantly evolving industry. We have designed the technology for our platform to enable us to develop new features and make changes quickly and efficiently. For example, we enhanced our platform with 47 releases of updated features and increased functionality in 2016. |

| • | Scaled and Profitable Business Model. We have grown our business rapidly while achieving profitability, demonstrating the power of our platform, the strength of our client relationships and the leverage inherent to our business model. During 2016, gross spend was $1.0 billion, helping us generate $202.9 million in revenue, up 78% from 2015. In 2016, our net income was $20.5 million and our Adjusted EBITDA increased by 67% to $65.2 million. See “—Adjusted EBITDA.” |

Our Growth Strategy

The key elements of our long-term growth strategy include:

| • | increasing our share of existing clients’ digital advertising spend; |

| • | growing our client base; |

| • | expanding our omnichannel capabilities; |

| • | extending our reach to TV, including connected TV; |

| • | continuing to innovate in technology and data; and |

| • | expanding our international presence. |

5

Table of Contents

Risk Factors Summary

Our business is subject to numerous risks and uncertainties, including those in the section captioned “Risk Factors” in this prospectus. These risks include, but are not limited to, the following:

| • | our limited operating history, which makes it difficult to evaluate our business and prospects and may increase the risks associated with your investment; |

| • | the loss of advertising agencies as clients, which could significantly harm our business, operating results and financial condition; |

| • | our failure to innovate and make the right investment decisions in our offerings and platform, which could compromise our ability to attract and retain advertisers and advertising agencies, and cause our revenue and results of operations to decline; |

| • | if the market for programmatic advertising, which is relatively new and evolving, develops slower or differently than we expect, our business, growth prospects and financial condition would be adversely affected; |

| • | our failure to manage our growth effectively, which could cause our business to suffer and have an adverse effect on our financial condition and operating results; |

| • | the market in which we participate is intensely competitive, and we may not be able to compete successfully with our current or future competitors; |

| • | we have identified material weaknesses in our internal control over financial reporting and, if our remediation of these material weaknesses is not effective, or if we fail to maintain an effective system of internal control over financial reporting in the future, we may not be able to accurately or timely report our financial condition or results of operations, which may adversely affect investor confidence in us and the price of our common stock; |

| • | insiders will continue to have substantial control over our company after this offering, including as a result of the dual class structure of our common stock, which could limit your ability to influence the outcome of key decisions, including a change of control; |

| • | our sales cycle can take significant time before executing a client agreement, which may make it difficult to project when, if at all, we will obtain new clients and when we will generate revenue from those clients; |

| • | we are subject to payment-related risks and, if our clients do not pay or dispute their invoices, our business, financial condition and operating results may be adversely affected; |

| • | because our business is primarily dependent on advertisers purchasing display advertising, a decrease in the use of display advertising would harm our business, growth prospects, financial condition and results of operations; and |

| • | if our access to quality advertising inventory is diminished, our revenue could decline and our growth could be impeded. |

Corporate Information

We were incorporated in Delaware in November 2009. Our principal executive offices are located at 42 N. Chestnut Street, Ventura, California 93001, and our telephone number is (805) 585-3434. Our website address is www.thetradedesk.com. The information on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider any such information as part of this prospectus or when deciding whether to purchase our Class A common stock.

6

Table of Contents

The Trade Desk and our other registered or common law trademarks, service marks or trade names appearing in this prospectus are the property of The Trade Desk, Inc. Other trademarks, service marks or trade names appearing in this prospectus are the property of their respective owners. We have omitted the ® and ™ designations, as applicable, for the trademarks used in this prospectus.

Implications of Being an Emerging Growth Company

The Jumpstart Our Business Startups Act, or the JOBS Act, was enacted in April 2012 with the intention of encouraging capital formation in the United States and reducing the regulatory burden on newly public companies that qualify as “emerging growth companies.” We are an emerging growth company within the meaning of the JOBS Act. As an emerging growth company, we may take advantage of certain exemptions from various public reporting requirements, including the requirement that our internal control over financial reporting be audited by our independent registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, certain requirements related to the disclosure of executive compensation in this prospectus and in our periodic reports and proxy statements, and the requirement that we hold a non-binding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions until we are no longer an emerging growth company.

We will remain an emerging growth company until the earliest to occur of: (1) the last day of the fiscal year in which we have $1.07 billion or more in annual gross revenue; (2) the date we qualify as a “large accelerated filer” with, among other things, at least $700 million of equity securities held by non-affiliates; (3) the date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; and (4) the last day of the fiscal year ending after the fifth anniversary of our initial public offering, or our IPO, which was completed in September 2016. Based on the trading price of our common stock and holdings of our non-affiliate stockholders as of the date of this prospectus, we expect to lose emerging growth company status at the end of 2017.

For certain risks related to our status as an emerging growth company, see the section captioned “Risk Factors.”

7

Table of Contents

The Offering

| Class A common stock offered by the selling stockholders |

3,326,324 shares (or 3,825,272 shares if the underwriters exercise their option to purchase additional shares in full) |

| Class A common stock to be outstanding after this offering |

24,725,227 shares (or 25,224,175 shares if the underwriters exercise their option to purchase additional shares in full) |

| Class B common stock to be outstanding after this offering |

15,062,765 shares (or 14,563,817 shares if the underwriters exercise their option to purchase additional shares in full) |

| Total Class A and Class B common stock to be outstanding after this offering |

39,787,992 shares |

| Option to purchase additional shares of Class A common stock from the selling stockholders |

498,948 shares |

| Use of proceeds |

We will not receive any proceeds from the sale of shares of Class A common stock by the selling stockholders. |

| Voting Rights |

Shares of Class A common stock are entitled to one vote per share. Shares of Class B common stock are entitled to ten votes per share. Holders of our Class A common stock and Class B common stock generally vote together as a single class, unless otherwise required by law. |

| Assuming no exercise of the underwriters’ option to purchase additional shares, following this offering, outstanding shares of Class B common stock will represent approximately 86% of the voting power of our outstanding capital stock, and outstanding shares of common stock held by our executive officers, directors and holders of more than 5% of our capital stock will represent approximately 82% of the voting power of our outstanding capital stock. |

| See the section captioned “Description of Capital Stock.” |

| Trading symbol on The NASDAQ Global Market |

“TTD” |

The total number of shares of Class A common stock and Class B common stock that will be outstanding after this offering includes 24,725,227 shares of our Class A common stock and 15,062,765 shares of our Class B common stock, and excludes, in each case as of March 31, 2017:

| • | an aggregate of 4,274,412 shares of Class B common stock issuable upon the exercise of outstanding options under The Trade Desk, Inc. 2010 Stock Plan, or our 2010 Plan, and The Trade Desk, Inc. 2015 Equity Incentive Plan, or our 2015 Plan, with a weighted-average exercise price of approximately $3.21 per share; and 392,943 shares of Class A common stock issuable upon the exercise of outstanding options under our 2016 Equity Incentive Plan, or our 2016 Plan, with a weighted-average exercise price of approximately $29.59 per share; |

| • | 248,424 shares of Class A common stock issuable upon the vesting of restricted stock awards and units under our 2016 Plan; and |

8

Table of Contents

| • | shares of Class A common stock, subject to annual increase, reserved for future grant or issuance under our 2016 Plan, consisting of: |

| • | 5,016,704 shares of Class A common stock reserved under our 2016 Plan; and |

| • | an additional number of shares of Class A common stock equal to the number of shares of Class B common stock subject to outstanding awards under the 2015 Plan which are forfeited or lapse unexercised after March 31, 2017. |

Except as otherwise indicated, all information in this prospectus reflects where applicable, a 1-for-3 reverse stock split of our common stock and a proportional adjustment to the conversion ratio of our convertible preferred stock, which was effected on September 2, 2016, and assumes no exercise of outstanding options to purchase common stock after March 31, 2017 and no exercise of the underwriters’ option to purchase additional shares. We have assumed that all of the shares of Class A common stock to be sold in this offering will be issued at closing upon the conversion of outstanding shares of Class B common stock.

We refer to our Series Seed, Series A-1, Series A-2, Series A-3, Series B and Series C convertible preferred stock collectively as “convertible preferred stock” in this prospectus.

9

Table of Contents

Summary Consolidated Financial Data

The following tables set forth our summary consolidated financial data for the periods indicated. We have derived the consolidated statements of operations data for the years ended December 31, 2014, 2015, and 2016 and the consolidated balance sheet data as of December 31, 2015 and 2016 from our audited consolidated financial statements included in our 2016 10-K that is incorporated by reference in this prospectus. The summary consolidated statements of operations data for the three months ended March 31, 2016 and 2017 and the summary consolidated balance sheet data as of March 31, 2017 are derived from our unaudited condensed consolidated financial statements included in our First Quarter 10-Q that is incorporated by reference in this prospectus. The consolidated balance sheet data as of December 31, 2014 were derived from our audited consolidated financial statements that are not included, or incorporated by reference into, in this prospectus.

The following consolidated financial data should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2016 10-K and First Quarter 10-Q incorporated by reference herein and our consolidated financial statements and the related notes appearing in our 2016 10-K and First Quarter 10-Q incorporated by reference herein. The unaudited interim consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and reflect, in the opinion of management, all adjustments of a normal, recurring nature that are necessary for a fair statement of the unaudited interim consolidated financial statements. Our historical results are not necessarily indicative of our future results, and the results for the three months ended March 31, 2017 are not necessarily indicative of the results to be expected for the full year or any other period.

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2014 | 2015 | 2016 | 2016 | 2017 | ||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenue |

$ | 44,548 | $ | 113,836 | $ | 202,926 | $ | 30,378 | $ | 53,352 | ||||||||||

| Operating expenses(1): |

||||||||||||||||||||

| Platform operations |

12,559 | 22,967 | 39,876 | 7,513 | 12,549 | |||||||||||||||

| Sales and marketing |

14,590 | 26,794 | 46,056 | 8,431 | 12,476 | |||||||||||||||

| Technology and development |

7,250 | 12,819 | 27,313 | 4,639 | 10,461 | |||||||||||||||

| General and administrative |

9,385 | 13,276 | 32,163 | 6,399 | 15,930 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

43,784 | 75,856 | 145,408 | 26,982 | 51,416 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income from operations |

764 | 37,980 | 57,518 | 3,396 | 1,936 | |||||||||||||||

| Total other expense, net |

1,707 | 8,125 | 13,684 | 5,264 | 792 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

(943 | ) | 29,855 | 43,834 | (1,868 | ) | 1,144 | |||||||||||||

| Provision for (benefit from) income taxes |

(948 | ) | 13,926 | 23,352 | (828 | ) | (3,765 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | 5 | $ | 15,929 | $ | 20,482 | (1,040 | ) | 4,909 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to common stockholders(2) |

$ | — | $ | 8,764 | $ | (26,727 | ) | (48,249 | ) | 4,909 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share attributable to common stockholders—basic(2) |

$ | — | $ | 0.85 | $ | (1.46 | ) | $ | (4.45 | ) | $ | 0.13 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share attributable to common stockholders—diluted(2) |

$ | — | $ | 0.39 | $ | (1.46 | ) | $ | (4.45 | ) | $ | 0.11 | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2014 | 2015 | 2016 | 2016 | 2017 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Non-GAAP Financial and Operating Data: |

||||||||||||||||||||

| Adjusted EBITDA(3) |

$ | 5,683 | $ | 39,159 | $ | 65,221 | $ | 4,328 | $ | 6,263 | ||||||||||

| Gross spend(4) |

211,266 | 552,325 | 1,027,984 | |||||||||||||||||

| Gross billings(5) |

201,804 | 529,975 | 990,561 | |||||||||||||||||

10

Table of Contents

| (1) | Includes stock-based compensation expense as follows: |

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2014 | 2015 | 2016 | 2016 | 2017 | ||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Platform operations |

$ | 14 | $ | 71 | $ | 756 | $ | 15 | $ | 229 | ||||||||||

| Sales and marketing |

50 | 127 | 1,707 | 50 | 539 | |||||||||||||||

| Technology and development |

909 | 85 | 1,513 | 40 | 665 | |||||||||||||||

| General and administrative |

3,572 | 91 | 1,080 | 54 | 889 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total |

$ | 4,545 | $ | 374 | $ | 5,056 | $ | 159 | $ | 2,322 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| For more information regarding stock-based compensation expense, see Note 10 in the Notes to Consolidated Financial Statements contained in Item 8 in our 2016 10-K incorporated by reference herein and Note 8 in the Notes to Condensed Consolidated Financial Statements contained in Item 1 in our First Quarter 10-Q incorporated by reference herein. |

| (2) | For a description of the net income (loss) attributable to common stockholders and net income (loss) per share attributable to common stockholders—basic and diluted computations, see Note 3 in the Notes to Consolidated Financial Statements contained in Item 8 in our 2016 10-K incorporated by reference herein and Note 3 in the Notes to Condensed Consolidated Financial Statements contained in Item 1 in our First Quarter 10-Q incorporated by reference herein. |

| (3) | For information on how we compute Adjusted EBITDA and a reconciliation of net income (loss) on a GAAP basis to Adjusted EBITDA, see “—Adjusted EBITDA.” |

| (4) | Gross spend includes the value of a client’s purchases through our platform plus our platform fee, which is a percentage of a client’s purchases through the platform. We review gross spend for internal management purposes to assess market share and scale, and to plan for optimal levels of support for our clients. Some companies in our industry report revenue on a gross basis or use similar metrics, so tracking our gross spend allows us to compare our results to the results of those companies. Gross spend does not represent our revenue reported on a GAAP basis. Our gross spend is influenced by the volume and characteristics of bids for advertising inventory won through our platform. We expect our revenue as a percentage of gross spend, which is sometimes referred to as take rate, to fluctuate due to the types of services and features selected by our clients through our platform and certain volume discounts. We track gross spend based on the location of our office servicing the respective clients. Other companies, including companies in our industry, may calculate gross spend or similarly titled measures differently, which reduces its usefulness as a comparative measure. |

| (5) | Gross billings represents the amount we invoice our clients, net of allowances. As some of our clients have payment relationships directly with advertising inventory suppliers for the amount of advertising inventory the clients purchase through our platform, we do not invoice these clients for this spend, and we only invoice such clients for data, other services and our platform fee. Accordingly, gross billings are less than gross spend and represent gross spend, less platform discounts and less the value of advertising inventory and data that our clients purchase directly from publishers through our platform. We report revenue on a net basis which represents gross billings net of amounts we pay suppliers for the cost of advertising inventory, data and add-on features. We expect our revenue as a percentage of gross billings to fluctuate due to the types of services and features selected by our clients through our platform and certain volume discounts. We review gross billings for internal management purposes to adequately plan for our working capital needs and monitor collection risk. We track gross billings based on the billing address of the client. In many cases, international clients are serviced from our United States offices resulting in gross billings exceeding gross spend for international clients. |

| As of December 31, | As of March 31, |

|||||||||||||||

| 2014 | 2015 | 2016 | 2017 | |||||||||||||

| (in thousands) | ||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||

| Cash |

$ | 17,315 | $ | 4,047 | $ | 133,400 | $ | 106,573 | ||||||||

| Accounts receivable, net |

78,364 | 191,943 | 377,240 | 315,283 | ||||||||||||

| Total assets |

102,238 | 210,231 | 537,596 | 455,267 | ||||||||||||

| Accounts payable |

58,293 | 108,461 | 321,163 | 231,524 | ||||||||||||

| Long-term debt, net of current portion |

16,493 | 45,918 | 25,847 | 25,847 | ||||||||||||

| Total liabilities |

80,372 | 171,885 | 373,216 | 283,336 | ||||||||||||

| Convertible preferred stock |

27,997 | 24,204 | — | — | ||||||||||||

| Total stockholders’ equity (deficit) |

(6,131 | ) | 14,142 | 164,380 | 171,931 | |||||||||||

11

Table of Contents

Adjusted EBITDA

In addition to our results determined in accordance with GAAP, we believe that Adjusted EBITDA, a non-GAAP measure, is useful in evaluating our business. The following table presents a reconciliation of net income (loss) to Adjusted EBITDA for each of the periods indicated:

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2014 | 2015 | 2016 | 2016 | 2017 | ||||||||||||||||

| (in thousands) | (in thousands) |

|||||||||||||||||||

| Net income (loss) |

$ | 5 | $ | 15,929 | $ | 20,482 | $ | (1,040 | ) | $ | 4,909 | |||||||||

| Add back (deduct): |

||||||||||||||||||||

| Depreciation and amortization expense |

680 | 1,828 | 3,798 | 819 | 1,493 | |||||||||||||||

| Stock-based compensation expense |

4,545 | 374 | 5,056 | 159 | 2,322 | |||||||||||||||

| Interest expense |

843 | 1,141 | 3,075 | 835 | 364 | |||||||||||||||

| Secondary offering costs |

— | — | — | — | 940 | |||||||||||||||

| Change in fair value of preferred stock warrant liabilities |

558 | 5,961 | 9,458 | 4,383 | — | |||||||||||||||

| Provision for (benefit from) income taxes |

(948 | ) | 13,926 | 23,352 | (828 | ) | (3,765 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | 5,683 | $ | 39,159 | $ | 65,221 | $ | 4,328 | $ | 6,263 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

We use Adjusted EBITDA as a measure of operational efficiency to understand and evaluate our core business operations. We believe that Adjusted EBITDA is useful to investors for period to period comparisons of our core business. Accordingly, we believe Adjusted EBITDA provides useful information to investors and others in understanding and evaluating our operating results in the same manner as our management and board of directors.

Our use of Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our financial results as reported under GAAP. Some of these limitations are as follows:

| • | although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements; |

| • | Adjusted EBITDA does not reflect: (1) changes in, or cash requirements for, our working capital needs; (2) the potentially dilutive impact of stock-based compensation; (3) secondary offering costs not considered part of our core business; or (4) tax payments that may represent a reduction in cash available to us; and |

| • | other companies, including companies in our industry, may calculate Adjusted EBITDA or similarly titled measures differently, which reduces its usefulness as a comparative measure. |

Because of these and other limitations, you should consider Adjusted EBITDA along with other GAAP-based financial performance measures, including various cash flow metrics, net income (loss) and our GAAP financial results.

12

Table of Contents

Investing in our Class A common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including the consolidated financial statements and the related notes, before deciding whether to purchase shares of our Class A common stock. The risks and uncertainties described below include those that we consider material and that we are currently aware of, but are not the only ones we face. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the market price of our Class A common stock could decline and you could lose part or all of your investment. We have organized the description of these risks into groupings in an effort to enhance readability but many of the risks interrelate and could be grouped or ordered in other ways. Therefore, no special significance should be attributed to the groupings or order below.

Risks Related to Our Business and Industry

We have a limited operating history, which makes it difficult to evaluate our business and prospects and may increase the risks associated with your investment.

We were incorporated in 2009 and, as a result, have only a limited operating history upon which our business and prospects may be evaluated. Although we have experienced substantial revenue growth in our limited operating history, we may not be able to sustain this rate of growth or maintain our current revenue levels. We have encountered and will continue to encounter risks and challenges frequently experienced by growing companies in rapidly developing industries, including risks related to our ability to:

| • | build a reputation for providing a superior platform and client service, and for creating trust and long-term relationships with clients; |

| • | distinguish ourselves from competitors; |

| • | develop and offer a competitive platform that meets our clients’ needs as they change; |

| • | scale our business efficiently to keep pace with demand for our platform; |

| • | maintain and expand our relationships with suppliers of quality advertising inventory and data; |

| • | respond to evolving industry standards and government regulation that impact our business, particularly in the areas of data collection and consumer privacy; |

| • | prevent or mitigate failures or breaches of security; |

| • | expand our business internationally; and |

| • | hire and retain qualified and motivated employees. |

We cannot assure you that we will be successful in addressing these and other challenges we may face in the future. If we are unable to do so, our business may suffer, our revenue and operating results may decline and we may not be able to achieve further growth or sustain profitability.

Our failure to maintain and grow our client base and spend through our platform may negatively impact our revenue and business.

To sustain or increase our revenue, we must regularly add new clients and encourage existing clients to maintain or increase the amount of advertising inventory purchased through our platform and adopt new features and functionalities that we add to our platform. If competitors introduce lower cost or differentiated offerings that compete with or are perceived to compete with ours, our ability to sell access to our platform to new or existing clients could be impaired. We have spent significant effort in cultivating our relationships with advertising agencies, which has resulted in an increase in the budgets allocated to, and the amount of advertising purchased on, our platform. However, it is possible that we may reach a point of saturation at which we cannot continue to grow our revenue from such agencies because of internal limits that advertisers may place on the allocation of

13

Table of Contents

their advertising budgets to digital media to a particular provider or otherwise. While we generally have master services agreements in place for our clients, such agreements allow our clients to change the amount of spend through our platform or terminate our services with limited notice. Our clients typically have relationships with different providers and there is limited cost to moving budgets to our competitors. As a result, we may have limited visibility as to our future advertising revenue streams. We cannot assure you that our clients will continue to use our platform or that we will be able to replace, in a timely or effective manner, departing clients with new clients that generate comparable revenue. If a major client representing a significant portion of our business decides to materially reduce its use of our platform or to cease using our platform altogether, it is possible that our revenue could be significantly reduced.

The loss of advertising agencies as clients could significantly harm our business, operating results and financial condition.

Our client base consists primarily of advertising agencies. We do not have exclusive relationships with advertising agencies and we depend on agencies to work with us as they embark on advertising campaigns for advertisers.

The loss of agencies as clients could significantly harm our business, operating results and financial condition. If we fail to maintain satisfactory relationships with an advertising agency, we risk losing business from the advertisers represented by that agency.

Advertisers may change advertising agencies. If an advertiser switches from an agency that utilizes our platform to one that does not, we will lose revenue from that advertiser. In addition, some advertising agencies have their own relationships with suppliers of advertising inventory and can directly connect advertisers with such suppliers. Our business may suffer to the extent that advertising agencies and inventory suppliers purchase and sell advertising inventory directly from one another or through intermediaries other than us.

We had approximately 566 clients, consisting primarily of advertising agencies, as of December 31, 2016. Many of these agencies are owned by holding companies, where decision making is decentralized such that purchasing decisions are made, and relationships with advertisers, are located, at the agency, local branch or division level. If all of our individual client contractual relationships were aggregated at the holding company level, Omnicom Group Inc., WPP plc and Publicis Groupe would each represent more than 10% of our gross billings for 2016.

In most cases, we enter into separate contracts and billing relationships with the individual agencies and account for them as separate clients. However, some holding companies for these agencies may choose to exert control over the individual agencies in the future. If so, any loss of relationships with such holding companies and, consequently, of their agencies, local branches or divisions, as clients could significantly harm our business, operating results and financial condition.

If we fail to innovate and make the right investment decisions in our offerings and platform, we may not attract and retain advertisers and advertising agencies and our revenue and results of operations may decline.

Our industry is subject to rapid and frequent changes in technology, evolving client needs and the frequent introduction by our competitors of new and enhanced offerings. We must constantly make investment decisions regarding offerings and technology to meet client demand and evolving industry standards. We may make wrong decisions regarding these investments. If new or existing competitors have more attractive offerings, we may lose clients or clients may decrease their use of our platform. New client demands, superior competitive offerings or new industry standards could require us to make unanticipated and costly changes to our platform or business model. If we fail to adapt to our rapidly changing industry or to evolving client needs, demand for our platform could decrease and our business, financial condition and operating results may be adversely affected.

Failure to manage our growth effectively could cause our business to suffer and have an adverse effect on our financial condition and operating results.

We have experienced significant growth in a short period of time. To manage our growth effectively, we must continually evaluate and evolve our organization. We must also manage our employees, operations,

14

Table of Contents

finances, technology and development and capital investments efficiently. Our efficiency, productivity and the quality of our platform and client service may be adversely impacted if we do not train our new personnel, particularly our sales and support personnel, quickly and effectively, or if we fail to appropriately coordinate across our organization. Additionally, our rapid growth may place a strain on our resources, infrastructure and ability to maintain the quality of our platform. You should not consider our revenue growth and levels of profitability in recent periods as indicative of future performance. In future periods, our revenue or profitability could decline or grow more slowly than we expect. Failure to manage our growth effectively could cause our business to suffer and have an adverse effect on our financial condition and operating results.

The market for programmatic buying for advertising campaigns is relatively new and evolving. If this market develops slower or differently than we expect, our business, growth prospects and financial condition would be adversely affected.

The substantial majority of our revenue has been derived from clients that programmatically purchase advertising inventory through our platform. We expect that spending on programmatic ad buying will continue to be our primary source of revenue for the foreseeable future, and that our revenue growth will largely depend on increasing spend through our platform. The market for programmatic ad buying is an emerging market, and our current and potential clients may not shift quickly enough to programmatic ad buying from other buying methods, reducing our growth potential. If the market for programmatic ad buying deteriorates or develops more slowly than we expect, it could reduce demand for our platform, and our business, growth prospects and financial condition would be adversely affected.

In addition, revenue may not necessary grow at the same rate as spend on our platform. Growth in spend may outpace growth in our revenue as the market for programmatic buying for advertising matures due to a number of factors including quantity discounts and product, media, client and channel mix shifts. For example, TV advertising typically entails relatively large advertising budgets that carry a smaller fee as a percentage of spend. Growth in the use of our platform for TV advertising could impact the rate of our revenue growth relative to the rate of growth in spend on our platform. A significant change in revenue as a percentage of spend could reflect an adverse change in our business and growth prospects. In addition, any such fluctuations, even if they reflect our strategic decisions, could cause our performance to fall below the expectations of securities analysts and investors, and adversely affect the price of our common stock.

The market in which we participate is intensely competitive, and we may not be able to compete successfully with our current or future competitors.

We operate in a highly competitive and rapidly changing industry. With the introduction of new technologies and the influx of new entrants to the market, we expect competition to persist and intensify in the future, which could harm our ability to increase revenue and maintain profitability. New technologies and methods of buying advertising present a dynamic competitive challenge, as market participants offer multiple new products and services, such as analytics, automated media buying and exchanges, aimed at capturing advertising spend. In addition to existing competitors and intermediaries, we may also face competition from new companies entering the market, which may include large established companies, all of which currently offer, or may in the future offer, products and services that result in additional competition for advertising spend or advertising inventory.

Further, we derive a significant portion of our revenue from the display advertising market, which is rapidly evolving, highly competitive, complex and fragmented. We face significant competition in this market which we expect will intensify in the future. We currently compete for advertising spend with large, well-established companies as well as smaller, privately-held companies. Some of our larger competitors with more resources may be better positioned to execute on advertising campaigns conducted over multiple channels such as social media, mobile and video.

We may also face competition from companies that we do not yet know about or do not yet exist. If existing or new companies develop, market or resell competitive high-value marketing products or services, acquire one

15

Table of Contents

of our existing competitors or form a strategic alliance with one of our competitors, our ability to compete effectively could be significantly compromised and our results of operations could be harmed.

Our current and potential competitors may have significantly more financial, technical, marketing and other resources than we have, allowing them to devote greater resources to the development, promotion, sale and support of their products and services. They may also have more extensive advertiser bases and broader publisher relationships than we have, and may have longer operating histories and greater name recognition. As a result, these competitors may be better able to respond quickly to new technologies, develop deeper advertiser relationships or offer services at lower prices. Any of these developments would make it more difficult for us to sell our platform and could result in increased pricing pressure, increased sales and marketing expense or the loss of market share.

Economic downturns and market conditions beyond our control could adversely affect our business, financial condition and operating results.

Our business depends on the overall demand for advertising and on the economic health of advertisers that benefit from our platform. Economic downturns or unstable market conditions may cause advertisers to decrease their advertising budgets, which could reduce spend though our platform and adversely affect our business, financial condition and operating results. As we explore new countries to expand our business, economic downturns or unstable market conditions in any of those countries could result in our investments not yielding the returns we anticipate.

We may experience fluctuations in our operating results, which could make our future operating results difficult to predict or cause our operating results to fall below analysts’ and investors’ expectations.

Our quarterly and annual operating results have fluctuated in the past and we expect our future operating results to fluctuate due to a variety of factors, many of which are beyond our control. Fluctuations in our operating results could cause our performance to fall below the expectations of analysts and investors, and adversely affect the price of our common stock. Because our business is changing and evolving rapidly, our historical operating results may not be necessarily indicative of our future operating results. Factors that may cause our operating results to fluctuate include the following:

| • | changes in demand for our platform, including related to the seasonal nature of our clients’ spending on digital advertising campaigns; |

| • | changes in our pricing policies, the pricing policies of our competitors and the pricing or availability of inventory, data or of other third-party services; |

| • | changes in our client base and platform offerings; |

| • | the addition or loss of advertising agencies and advertisers as clients; |

| • | changes in advertising budget allocations, agency affiliations or marketing strategies; |

| • | changes to our product, media, client or channel mix; |

| • | changes and uncertainty in the regulatory environment for us or advertisers; |

| • | changes in the economic prospects of advertisers or the economy generally, which could alter advertisers’ spending priorities, or could increase the time or costs required to complete advertising inventory sales; |

| • | changes in the availability of advertising inventory through real-time advertising exchanges or in the cost of reaching end consumers through digital advertising; |

| • | disruptions or outages on our platform; |

| • | the introduction of new technologies or offerings by our competitors; |

| • | changes in our capital expenditures as we acquire the hardware, equipment and other assets required to support our business; |

16

Table of Contents

| • | timing differences between our payments for advertising inventory and our collection of related advertising revenue; |

| • | the length and unpredictability of our sales cycle; and |

| • | costs related to acquisitions of businesses or technologies, or employee recruiting. |

Based upon the factors above and others beyond our control, we have a limited ability to forecast our future revenue, costs and expenses, and as a result, our operating results may, from time to time, fall below our estimates or the expectations of analysts and investors.

We often have long sales cycles, which can result in significant time between initial contact with a prospect and execution of a client agreement, making it difficult to project when, if at all, we will obtain new clients and when we will generate revenue from those clients.

Our sales cycle, from initial contact to contract execution and implementation can take significant time. Our sales efforts involve educating our clients about the use, technical capabilities and benefits of our platform. Some of our clients undertake an evaluation process that frequently involves not only our platform but also the offerings of our competitors. As a result, it is difficult to predict when we will obtain new clients and begin generating revenue from these new clients. Even if our sales efforts result in obtaining a new client, under our usage-based pricing model, the client controls when and to what extent it uses our platform. As a result, we may not be able to add clients, or generate revenue, as quickly as we may expect, which could harm our growth prospects.

We are subject to payment-related risks and, if our clients do not pay or dispute their invoices, our business, financial condition and operating results may be adversely affected.

Many of our contracts with advertising agencies provide that if the advertiser does not pay the agency, the agency is not liable to us, and we must seek payment solely from the advertiser, a type of arrangement called sequential liability. Contracting with these agencies, which in some cases have or may develop higher-risk credit profiles, may subject us to greater credit risk than if we were to contract directly with advertisers. This credit risk may vary depending on the nature of an advertising agency’s aggregated advertiser base. We may also be involved in disputes with agencies and their advertisers over the operation of our platform, the terms of our agreements or our billings for purchases made by them through our platform. If we are unable to collect or make adjustments to bills to clients, we could incur write-offs for bad debt, which could have a material adverse effect on our results of operations for the periods in which the write-offs occur. In the future, bad debt may exceed reserves for such contingencies and our bad debt exposure may increase over time. Any increase in write-offs for bad debt could have a materially negative effect on our business, financial condition and operating results. Even if we are not paid by our clients on time or at all, we are still obligated to pay for the advertising we have purchased for the advertising campaign, and as a consequence, our results of operations and financial condition would be adversely impacted.

A substantial portion of our business is from advertising agencies that do not pay us until they receive payment from the advertiser, resulting in an increased length of time between our payment for media inventory and our receipt of payment for use of our platform, and our ability to collect for non-payment may be limited to the advertiser, thereby increasing our risk of non-payment.

Substantially all of our platform spend is from advertising agencies. We are generally contractually required to pay advertising inventory and data suppliers within a negotiated period of time, regardless of whether our clients pay us on time, or at all. Additionally, while we attempt to negotiate long payment periods with our suppliers and shorter periods from our clients, we are not always successful. As a result, we often face a timing issue with our accounts payable on shorter cycles than our accounts receivables, requiring us to remit payments from our own funds, and accept the risk of bad debt.

This payment process will increasingly consume working capital if we continue to be successful in growing our business. In addition, we typically experience slow payment by advertising agencies as is common in our

17

Table of Contents

industry. In this regard, we had average days sales outstanding, or DSO, of 82 days, and average days payable outstanding, or DPO, of 60 days at March 31, 2017. We compute our DSO and DPO as of a given date based on our average trade receivables or trade payables, respectively, for the trailing 12-month period divided by, for DSO, average daily gross billings for the period, and for DPO, by the average daily cost of media, data and operating expenses over such period. The average trade receivables or trade payables are the average of the trade receivables or trade payables balances at the beginning and end of the 12-month period. Historically, our DSOs have fluctuated over time. If our DSOs increase significantly, and we are unable to borrow against these receivables on commercially acceptable terms, our working capital availability could be reduced, and as a consequence our results of operations and financial condition would be adversely impacted.

Due to this imbalance in our DSOs and DPOs, we rely on our credit facility to partially or completely fund our working capital requirements. We cannot assure you that as we continue to grow, our business will generate sufficient cash flow from operations or that future borrowings will be available to us under the credit facility in an amount sufficient to fund our working capital needs. If our cash flows and credit facility borrowings are insufficient to fund our working capital requirements, we may not be able to grow at the rate we currently expect or at all. In addition, in the absence of sufficient cash flows from operations, we might be unable to meet our obligations under our credit facility and we may therefore be at risk of default thereunder. We cannot assure you that we would be able to locate additional financing or increase amounts borrowed under our existing credit facility to on commercially reasonable terms or at all.

Our business is primarily dependent on advertisers buying display advertising. A decrease in the use of display advertising would harm our business, growth prospects, financial condition and results of operations.

Historically, our clients have predominantly used our platform to purchase display advertising inventory. We expect that display advertising will continue to be a significant channel used by our clients. Should our clients lose confidence in the value or effectiveness of display advertising, the demand for our platform could decline.

We are working to enhance our social, native, digital radio and television offerings, including the capability to buy ads on digital television using our platform. We refer to the ability to provide offerings across these channels as omnichannel. These markets may not reach the scale of display advertising, and our omnichannel offerings may not gain market acceptance. A decrease in the use of display advertising, or our inability to further penetrate display and other advertising channels, would harm our growth prospects, financial condition and results of operations.

If our access to quality advertising inventory is diminished, our revenue could decline and our growth could be impeded.