Attached files

| file | filename |

|---|---|

| EX-32 - EXHIBIT 32 - PERRIGO Co plc | cy16q310qex32restatement.htm |

| EX-31.2 - EXHIBIT 31.2 - PERRIGO Co plc | cy16q310qex312restatement.htm |

| EX-31.1 - EXHIBIT 31.1 - PERRIGO Co plc | cy16q310qex311restatement.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________________

FORM 10-Q/A

(Amendment No. 1)

_______________________________________________

[X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-36353

_______________________________________________

Perrigo Company plc

(Exact name of registrant as specified in its charter)

_______________________________________________

Ireland | Not Applicable | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

Treasury Building, Lower Grand Canal Street, Dublin 2, Ireland | - | |

(Address of principal executive offices) | (Zip Code) | |

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report), and (2) has been subject to such filing requirements for the past 90 days. YES [ ] NO [X]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES [ ] NO [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | [X] | Accelerated filer | [ ] | Non-accelerated filer | [ ] | Smaller reporting company | [ ] | |||

Emerging growth company | [ ] | (Do not check if a smaller reporting company) | ||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | [ ] | |||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] YES [X] NO

As of November 4, 2016, there were 143,374,427 ordinary shares outstanding.

PERRIGO COMPANY PLC

FORM 10-Q

INDEX

PAGE NUMBER | ||

PART I. FINANCIAL INFORMATION | ||

1 | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

8 | ||

9 | ||

10 | ||

11 | ||

12 | ||

13 | ||

14 | ||

15 | ||

16 | ||

17 | ||

PART II. OTHER INFORMATION | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in this report are “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created thereby. These statements relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our, or our industry's actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions, future events or future performance contained in this report, including certain statements contained in “Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. In some cases, forward-looking statements can be identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential” or the negative of those terms or other comparable terminology.

Please see Item 1A of our Form 10-K for the year ended December 31, 2016 for a discussion of certain important risk factors that relate to forward-looking statements contained in this report. We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control, including: the timing, amount and cost of any share repurchases; future impairment charges; customer acceptance of new products; competition from other industry participants, some of whom have greater marketing resources or larger market shares in certain product categories than we do; pricing pressures from customers and consumers; potential third-party claims and litigation, including litigation relating to our restatement of previously-filed financial information; potential impacts of ongoing or future government investigations and regulatory initiatives; general economic conditions; fluctuations in currency exchange rates and interest rates; the consummation of announced acquisitions or dispositions, and our ability to realize the desired benefits thereof; and the ability to execute and achieve the desired benefits of announced cost-reduction efforts and other initiatives. In addition, we may identify and be unable to remediate one or more material weaknesses in our internal control over financial reporting, may encounter unanticipated material issues or additional adjustments that could delay the filing of required periodic reports with the United States Securities and Exchange Commission, or may be unable to regain compliance with the NYSE continued listing rules. Furthermore, we and/or our subsidiaries may incur additional tax liabilities in respect of 2016 and prior years as a result of any restatement or may be found to have breached certain provisions of Irish company legislation in respect of prior financial statements and if so may incur additional expenses and penalties. These and other important factors, including those discussed in our Form 10-K for the year ended December 31, 2016 and in this report under "Risk Factors" and in any subsequent filings with the Securities and Exchange Commission, may cause actual results, performance or achievements to differ materially from those expressed or implied by these forward-looking statements. The forward-looking statements in this report are made only as of the date hereof, and unless otherwise required by applicable securities laws, we disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

This report contains trademarks, trade names and service marks that are the property of Perrigo Company plc, as well as, for informational purposes, trademarks, trade names, and service marks that are the property of other organizations. Solely for convenience, certain trademarks, trade names, and service marks referred to in this report appear without the ®, ™ and SM symbols, but those references are not intended to indicate that we or the applicable owner, as the case may be, will not assert, to the fullest extent under applicable law, our or their rights to such trademarks, trade names, and service marks.

1

EXPLANATORY NOTE

We are filing this Amendment No. 1 to the Quarterly Report on Form 10-Q ("Form 10-Q/A") for the quarterly period ended October 1, 2016, which was filed with the United States Securities and Exchange Commission (“SEC”) on November 10, 2016 (the "Original Filing"), to reflect restatements of the Condensed Consolidated Balance Sheet at October 1, 2016, and December 31, 2015, and the Condensed Consolidated Statements of Operations, Condensed Consolidated Statement of Comprehensive Income (Loss), and Condensed Consolidated Cash Flows for the three and nine months ended October 1, 2016, and September 26, 2015, and the related notes thereto. We intend to file our Annual Report on Form 10-K for the year ended December 31, 2016 (“2016 Form 10-K”), which will include consolidated financial statements and selected financial data for the six months ended December 31, 2015, and the years ended June 27, 2015 and June 28, 2014 which are restated (the “Restated Periods”). As described below, the restatement follows a correction in accounting under U.S. generally accepted accounting principles (“U.S. GAAP”) related to the Tysabri® royalty stream.

In connection with our year-end financial statement close and preparation of our 2016 Form 10-K, misstatements were identified in certain of our previous financial statements. As a result on April 19, 2017, the Board of Directors, after recommendation from the Audit Committee and consultation with Management, concluded that such financial statements, and certain financial statements for interim periods within the Restated Periods, should no longer be relied upon and would require restatement. This determination follows a correction in accounting under U.S. GAAP related to the contingent payments from Elan's May 2013 sale of Tysabri® to Biogen (the "Tysabri® royalty stream"). It was determined that the Tysabri® royalty stream should be recorded as a financial asset, rather than an intangible asset, on the date of acquisition. We have elected to account for the Tysabri® financial asset using the fair value option model. In addition, we identified certain misstatements related to the calculation of deferred tax liabilities that existed at the time of the acquisition of Omega Pharma Invest N.V. ("Omega"). As part of this restatement we also considered other previously identified adjustments. Refer to Item 1. Note 1 for additional information on the restatement. Refer to Item 1. Note 10 for additional information on how this restatement affects our debt covenants.

The following sections in the Original Filing are revised in this Form 10-Q/A, solely as a result of, and to reflect, the restatement:

Part I - Item 1 - Consolidated Financial Statements

Part I - Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

Part I - Item 4 - Controls and Procedures

Part II - Item 1A - Risk Factors

Part II - Item 6 - Exhibits

Pursuant to the rules of the SEC, Part II, Item 6 of the Original Filing has been amended to include the currently-dated certifications from our principal executive officer and principal financial officer, as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002. The certifications of the principal executive officer and principal financial officer are included to this Form 10-Q/A as Exhibits 31.1, 31.2 and 32.

For the convenience of the reader, this Form 10-Q/A sets forth the information in the Original Filing in its entirety, as such information is modified and superseded where necessary to reflect the restatement and related revisions. Except as provided above, this Form 10-Q/A does not reflect events occurring after the date of the Original Filing and should be read in conjunction with our filings with the SEC subsequent to date of the Original Filing, in each case as those filings may have been superseded or amended.

2

Perrigo Company plc - Item 1

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

(unaudited)

Three Months Ended | Nine Months Ended | ||||||||||||||

October 1, 2016 | September 26, 2015 | October 1, 2016 | September 26, 2015 | ||||||||||||

Restated | Restated | Restated | Restated | ||||||||||||

Net sales | $ | 1,261.6 | $ | 1,273.1 | $ | 3,949.3 | $ | 3,655.6 | |||||||

Cost of sales | 777.1 | 737.9 | 2,385.2 | 2,150.0 | |||||||||||

Gross profit | 484.5 | 535.2 | 1,564.1 | 1,505.6 | |||||||||||

Operating expenses | |||||||||||||||

Distribution | 21.6 | 24.9 | 65.9 | 63.3 | |||||||||||

Research and development | 50.2 | 41.6 | 142.5 | 139.7 | |||||||||||

Selling | 154.6 | 167.9 | 506.9 | 391.6 | |||||||||||

Administration | 105.4 | 123.3 | 317.2 | 343.1 | |||||||||||

Impairment charges | 1,614.4 | — | 2,028.8 | 6.8 | |||||||||||

Restructuring | 6.6 | 2.2 | 17.9 | 3.1 | |||||||||||

Total operating expenses | 1,952.8 | 359.9 | 3,079.2 | 947.6 | |||||||||||

Operating income (loss) | (1,468.3 | ) | 175.3 | (1,515.1 | ) | 558.0 | |||||||||

Tysabri® royalty stream - change in fair value | 377.4 | (173.8 | ) | 1,492.6 | (205.4 | ) | |||||||||

Interest expense, net | 54.6 | 43.4 | 163.2 | 132.7 | |||||||||||

Other expense, net | 1.0 | 10.9 | 32.4 | 284.8 | |||||||||||

Loss on extinguishment of debt | 0.7 | — | 1.1 | 0.9 | |||||||||||

Income (loss) before income taxes | (1,902.0 | ) | 294.8 | (3,204.4 | ) | 345.0 | |||||||||

Income tax expense (benefit) | (311.8 | ) | 33.9 | (550.7 | ) | 128.6 | |||||||||

Net income (loss) | $ | (1,590.2 | ) | $ | 260.9 | $ | (2,653.7 | ) | $ | 216.4 | |||||

Income (loss) per share | |||||||||||||||

Basic | $ | (11.10 | ) | $ | 1.78 | $ | (18.53 | ) | $ | 1.50 | |||||

Diluted | $ | (11.10 | ) | $ | 1.78 | $ | (18.53 | ) | $ | 1.50 | |||||

Weighted-average shares outstanding | |||||||||||||||

Basic | 143.3 | 146.3 | 143.2 | 144.4 | |||||||||||

Diluted | 143.3 | 146.9 | 143.2 | 145.0 | |||||||||||

Dividends declared per share | $ | 0.145 | $ | 0.125 | $ | 0.435 | $ | 0.375 | |||||||

See accompanying Notes to the Condensed Consolidated Financial Statements

3

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in millions)

(unaudited)

Three Months Ended | Nine Months Ended | ||||||||||||||

October 1, 2016 | September 26, 2015 | October 1, 2016 | September 26, 2015 | ||||||||||||

Restated | Restated | Restated | Restated | ||||||||||||

Net income (loss) | $ | (1,590.2 | ) | $ | 260.9 | $ | (2,653.7 | ) | $ | 216.4 | |||||

Other comprehensive income (loss): | |||||||||||||||

Foreign currency translation adjustments | 27.5 | (39.9 | ) | 71.5 | 50.9 | ||||||||||

Change in fair value of derivative financial instruments, net of tax | 3.6 | 0.1 | (3.5 | ) | 5.6 | ||||||||||

Change in fair value of investment securities, net of tax | 9.8 | 2.5 | 18.4 | (2.4 | ) | ||||||||||

Change in post-retirement and pension liability adjustments, net of tax | (0.2 | ) | — | 0.4 | 4.7 | ||||||||||

Other comprehensive income (loss), net of tax | 40.7 | (37.3 | ) | 86.8 | 58.8 | ||||||||||

Comprehensive income (loss) | $ | (1,549.5 | ) | $ | 223.6 | $ | (2,566.9 | ) | $ | 275.2 | |||||

See accompanying Notes to the Condensed Consolidated Financial Statements

4

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

October 1, 2016 | December 31, 2015 | ||||||

Restated | Restated | ||||||

Assets | |||||||

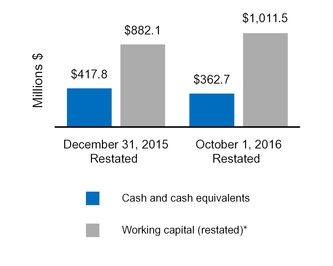

Cash and cash equivalents | $ | 362.7 | $ | 417.8 | |||

Accounts receivable, net of allowance for doubtful accounts of $5.7 million and $4.5 million, respectively | 1,124.1 | 1,189.0 | |||||

Inventories | 884.6 | 898.7 | |||||

Prepaid expenses and other current assets | 250.6 | 286.1 | |||||

Total current assets | 2,622.0 | 2,791.6 | |||||

Property, plant and equipment, net | 881.3 | 886.2 | |||||

Tysabri® royalty stream - at fair value | 3,550.0 | 5,310.0 | |||||

Goodwill and other indefinite-lived intangible assets | 5,145.6 | 7,069.0 | |||||

Other intangible assets, net | 3,336.2 | 2,973.1 | |||||

Non-current deferred income taxes | 136.2 | 71.4 | |||||

Other non-current assets | 216.8 | 248.3 | |||||

Total non-current assets | 13,266.1 | 16,558.0 | |||||

Total assets | $ | 15,888.1 | $ | 19,349.6 | |||

Liabilities and Shareholders’ Equity | |||||||

Accounts payable | $ | 502.9 | $ | 555.8 | |||

Payroll and related taxes | 106.8 | 125.3 | |||||

Accrued customer programs | 324.3 | 396.0 | |||||

Accrued liabilities | 258.7 | 351.9 | |||||

Accrued income taxes | 55.1 | 62.7 | |||||

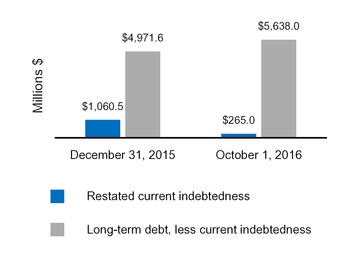

Current indebtedness | 265.0 | 1,060.5 | |||||

Total current liabilities | 1,512.8 | 2,552.2 | |||||

Long-term debt, less current portion | 5,638.0 | 4,971.6 | |||||

Non-current deferred income taxes | 798.0 | 1,372.7 | |||||

Other non-current liabilities | 456.7 | 346.3 | |||||

Total non-current liabilities | 6,892.7 | 6,690.6 | |||||

Total liabilities | 8,405.5 | 9,242.8 | |||||

Commitments and contingencies - Note 14 | |||||||

Shareholders’ equity | |||||||

Controlling interest: | |||||||

Preferred shares, $0.0001 par value, 10 million shares authorized | — | — | |||||

Ordinary shares, €0.001 par value, 10 billion shares authorized | 8,148.6 | 8,142.6 | |||||

Accumulated other comprehensive income (loss) | 71.5 | (15.3 | ) | ||||

Retained earnings (accumulated deficit) | (736.9 | ) | 1,980.1 | ||||

Total controlling interest | 7,483.2 | 10,107.4 | |||||

Noncontrolling interest | (0.6 | ) | (0.6 | ) | |||

Total shareholders’ equity | 7,482.6 | 10,106.8 | |||||

Total liabilities and shareholders' equity | $ | 15,888.1 | $ | 19,349.6 | |||

Supplemental Disclosures of Balance Sheet Information | |||||||

Preferred shares, issued and outstanding | — | — | |||||

Ordinary shares, issued and outstanding | 143.4 | 143.1 | |||||

See accompanying Notes to the Condensed Consolidated Financial Statements

5

Perrigo Company plc - Item 1

PERRIGO COMPANY PLC

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

Nine Months Ended | |||||||

October 1, 2016 | September 26, 2015 | ||||||

Restated | Restated | ||||||

Cash Flows From (For) Operating Activities | |||||||

Net income (loss) | $ | (2,653.7 | ) | $ | 216.4 | ||

Adjustments to derive cash flows | |||||||

Depreciation and amortization | 338.4 | 252.9 | |||||

Loss on acquisition-related foreign currency derivatives | — | 300.0 | |||||

Share-based compensation | 15.3 | 29.7 | |||||

Impairment charges | 2,028.8 | 6.8 | |||||

Tysabri® royalty stream - change in fair value | 1,492.6 | (205.4 | ) | ||||

Loss on extinguishment of debt | 1.1 | 0.9 | |||||

Restructuring charges | 17.9 | 3.1 | |||||

Amortization of financing fees and debt premium | (24.6 | ) | (8.5 | ) | |||

Deferred income taxes | (674.1 | ) | 13.1 | ||||

Other non-cash adjustments | 34.5 | 8.4 | |||||

Subtotal | 576.2 | 617.4 | |||||

Increase (decrease) in cash due to: | |||||||

Accounts receivable | 113.0 | (8.4 | ) | ||||

Inventories | 25.1 | (28.9 | ) | ||||

Accounts payable | (57.7 | ) | (28.1 | ) | |||

Payroll and related taxes | (40.0 | ) | (26.6 | ) | |||

Accrued customer programs | (73.7 | ) | 25.9 | ||||

Accrued liabilities | (90.0 | ) | 41.1 | ||||

Accrued income taxes | 5.2 | 11.3 | |||||

Other | (9.4 | ) | 13.7 | ||||

Subtotal | (127.5 | ) | — | ||||

Net cash from (for) operating activities | 448.7 | 617.4 | |||||

Cash Flows From (For) Investing Activities | |||||||

Proceeds from royalty rights | 259.5 | 250.3 | |||||

Acquisitions of businesses, net of cash acquired | (436.8 | ) | (2,499.9 | ) | |||

Asset acquisitions | (65.1 | ) | (4.0 | ) | |||

Additions to property, plant and equipment | (84.6 | ) | (127.6 | ) | |||

Proceeds from sale of business | 58.5 | — | |||||

Settlement of acquisition-related foreign currency derivatives | — | (304.8 | ) | ||||

Other investing | (1.0 | ) | (2.7 | ) | |||

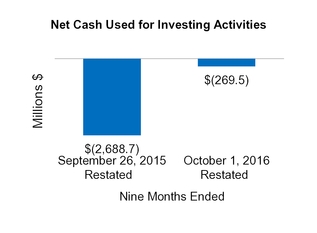

Net cash from (for) investing activities | (269.5 | ) | (2,688.7 | ) | |||

Cash Flows From (For) Financing Activities | |||||||

Issuances of long-term debt | 1,190.3 | — | |||||

Payments on long-term debt | (545.8 | ) | (903.3 | ) | |||

Borrowings (repayments) of revolving credit agreements and other financing, net | (803.6 | ) | 27.6 | ||||

Deferred financing fees | (2.8 | ) | (3.3 | ) | |||

Premium on early debt retirement | (0.6 | ) | — | ||||

Issuance of ordinary shares | 8.2 | 6.2 | |||||

Cash dividends | (62.4 | ) | (54.2 | ) | |||

Other financing | (17.4 | ) | (15.5 | ) | |||

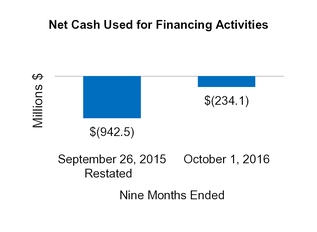

Net cash from (for) financing activities | (234.1 | ) | (942.5 | ) | |||

Effect of exchange rate changes on cash and cash receipts | (0.2 | ) | (75.8 | ) | |||

Net increase (decrease) in cash and cash equivalents | (55.1 | ) | (3,089.6 | ) | |||

Cash and cash equivalents, beginning of period | 417.8 | 3,596.1 | |||||

Cash and cash equivalents, end of period | $ | 362.7 | $ | 506.5 | |||

Supplemental Disclosures of Cash Flow Information | |||||||

Cash paid/received during the year for: | |||||||

Interest paid | $ | 124.1 | $ | 92.5 | |||

Interest received | $ | 1.1 | $ | 1.0 | |||

Income taxes paid | $ | 116.6 | $ | 130.0 | |||

Income taxes refunded | $ | 6.0 | $ | 3.1 | |||

See accompanying Notes to the Condensed Consolidated Financial Statements

6

Perrigo Company plc - Item 1

Note 1

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General Information

The Company

Perrigo Company plc was incorporated under the laws of Ireland on June 28, 2013 and became the successor registrant of Perrigo Company, a Michigan corporation, on December 18, 2013 in connection with the acquisition of Elan Corporation, plc ("Elan"). Unless the context requires otherwise, the terms "Perrigo," the "Company," "we," "our," "us," and similar pronouns used herein refer to Perrigo Company plc, its subsidiaries, and all predecessors of Perrigo Company plc and its subsidiaries. We are a leading global over-the-counter ("OTC") consumer goods and specialty pharmaceutical company, offering patients and customers high quality products at affordable prices. From our beginning in 1887 as a packager of home remedies, we have grown to become the world's largest manufacturer of OTC healthcare products and supplier of infant formulas for the store brand market. We are also a leading provider of generic extended topical prescription products, and we receive royalties from sales of the multiple sclerosis drug Tysabri®. We provide “Quality Affordable Healthcare Products®” across a wide variety of product categories and geographies, primarily in North America, Europe, and Australia, as well as in other markets, including Israel, China, and Latin America.

Basis of Presentation

The accompanying unaudited Condensed Consolidated Financial Statements have been prepared in accordance with U.S. generally accepted accounting principles ("U.S. GAAP") for interim financial information and with the instructions to Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by GAAP for complete financial statements. The unaudited Condensed Consolidated Financial Statements should be read in conjunction with the consolidated financial statements and footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2016. In the opinion of management, all adjustments (consisting of normal recurring accruals and other adjustments) considered necessary for a fair presentation have been included. The Condensed Consolidated Financial Statements include our accounts and the accounts of all majority-owned subsidiaries. All intercompany transactions and balances have been eliminated in consolidation.

Our fiscal year previously consisted of a 52- or 53-week year ending on or around June 30 of each year with each quarter ending on the Saturday closest to each calendar quarter-end. Beginning on January 1, 2016, we changed our fiscal year to begin on January 1 and end on December 31 of each year. We will continue to cut off our quarterly accounting periods on the Saturday closest to the end of the calendar quarter, with the fourth quarter ending on December 31 of each year.

Restatement

In connection with our year-end financial statement close and preparation of our Annual Report on Form 10-K for 2016, we identified misstatements in our historical financial statements, including for the nine months ended October 1, 2016, six months ended December 31, 2015, and the years ended June 27, 2015 and June 28, 2014 (the "Restated Periods"). Accordingly, we have restated the Condensed Consolidated Financial Statements for the three and nine months ended October 1, 2016 and September 26, 2015 to reflect the correction of the misstatements, the most significant of which are described below. The segments predominantly affected by this restatement are Specialty Sciences and Consumer Healthcare International. Refer to Note 10 for additional information on how this restatement affects our debt covenants.

During the 2016 year-end financial statement close process, and in anticipation of our potential sale of our royalty rights, we evaluated the potential effects of the Tysabri® royalty stream sale accounting and the accounting and disclosures associated with the pending 2018 adoption of ASC 606 “Revenues from Contracts with Customers.” After an extensive evaluation of the facts and circumstances and the judgments required to determine the appropriate classification, it was determined that under existing U.S. GAAP the contingent payments from Elan's May 2013 sale of Tysabri® to Biogen (the "Tysabri® royalty stream") should have been recorded as a financial asset, rather than an intangible asset, on the date of our acquisition of Elan.

7

Perrigo Company plc - Item 1

Note 1

Our Tysabri® royalty stream is now accounted for in our financial statements for fiscal 2016 and prior restated periods as a financial asset using the fair value option. We made the election to account for the Tysabri® financial asset using the fair value option as we believe this method is most appropriate for an asset that does not have a par value, a stated interest stream, or a termination date. Accounting for the Tysabri® royalty stream as a financial asset required us to adjust our financial statements for the Restated Periods to (1) remove the Tysabri® royalty stream from net sales in our Condensed Consolidated Statements of Operations, (2) remove the amortization expense (reflected in cost of goods sold) associated with recording the Tysabri® royalty stream as an intangible asset, and (3) include the quarterly changes in fair value of the Tysabri® royalty stream as a component of other non-operating income/expense. The cash payments we received from the royalty stream are included in our Condensed Consolidated Statements of Cash Flows for the Restated Periods and reflect the cash received from the Tysabri® royalty stream as cash from investing activities, rather than as cash from operating activities.

In addition, in connection with the financial closing for the year ended December 31, 2016, we identified certain tax basis intangible assets that existed at the time of the acquisition of Omega Pharma Invest N.V. (“Omega”) on March 30, 2015, which reduced the deferred tax liabilities in acquired intangible assets and increased our valuation allowance resulting in a net change to our deferred taxes of approximately $236.3 million. The resulting balance sheet reclassification required a reduction of goodwill, offset by a corresponding reduction to net deferred taxes at the date of the Omega acquisition. Further, we have evaluated the accounting effect subsequent to the acquisition date related to the remeasured deferred tax liability, including the impairments of Omega goodwill recorded in 2016 and certain adjustments to valuation allowances, which have been reflected in the Restated Periods.

In restating our financial statements to correct the misstatement discussed above, we are also making adjustments for previously identified required corrections with respect to the three and nine months ended October 1, 2016 and September 26, 2015, which were recorded in our year ended December 31, 2016 and six months ended December 31, 2015 financial results. In conjunction with the restatement, we have determined that it would be appropriate within this Form 10-Q/A to reflect these adjustments in the three and nine months ended October 1, 2016 and September 26, 2015.

The Condensed Consolidated Balance Sheet, Condensed Consolidated Statements of Operations, Condensed Consolidated Comprehensive Income (Loss), and Condensed Consolidated Statement of Cash Flows, and Notes 2, 3, 4, 5, 6, 7, 8, 10, 11, 12, 13, and 17 in these financial statements were updated to reflect the restatement.

The tables below present the impact of the changes to our Condensed Consolidated Financial Statement line items in our Original Filing:

8

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Statement of Operations

(in millions, except per share amounts)

(unaudited)

Three Months Ended | |||||||||||||||

October 1, 2016 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Net sales | $ | 1,354.9 | $ | (92.4 | ) | $ | (0.9 | ) | $ | 1,261.6 | |||||

Cost of sales | 848.6 | (72.5 | ) | 1.0 | 777.1 | ||||||||||

Gross profit | 506.3 | (19.9 | ) | (1.9 | ) | 484.5 | |||||||||

Operating expenses | |||||||||||||||

Distribution | 21.6 | — | — | 21.6 | |||||||||||

Research and development | 50.2 | — | — | 50.2 | |||||||||||

Selling | 154.6 | — | — | 154.6 | |||||||||||

Administration | 108.6 | — | (3.2 | ) | 105.4 | ||||||||||

Impairment charges | 1,679.9 | — | (65.5 | ) | (a) | 1,614.4 | |||||||||

Restructuring | 6.6 | — | — | 6.6 | |||||||||||

Total operating expenses | 2,021.5 | — | (68.7 | ) | 1,952.8 | ||||||||||

Operating loss | (1,515.2 | ) | (19.9 | ) | 66.8 | (1,468.3 | ) | ||||||||

Tysabri® royalty stream - change in fair value | — | 377.4 | — | 377.4 | |||||||||||

Interest expense, net | 54.6 | — | — | 54.6 | |||||||||||

Other expense, net | 1.0 | 0.2 | (0.2 | ) | 1.0 | ||||||||||

Loss on extinguishment of debt | 0.7 | — | — | 0.7 | |||||||||||

Loss before income taxes | (1,571.5 | ) | (397.5 | ) | 67.0 | (1,902.0 | ) | ||||||||

Income tax (benefit) | (316.3 | ) | (49.7 | ) | 54.2 | (a)(c) | (311.8 | ) | |||||||

Net loss | $ | (1,255.2 | ) | $ | (347.8 | ) | $ | 12.8 | $ | (1,590.2 | ) | ||||

Loss per share | |||||||||||||||

Basic | $ | (8.76 | ) | $ | (2.43 | ) | $ | 0.09 | $ | (11.10 | ) | ||||

Diluted | $ | (8.76 | ) | $ | (2.43 | ) | $ | 0.09 | $ | (11.10 | ) | ||||

Weighted-average shares outstanding | |||||||||||||||

Basic | 143.3 | 143.3 | |||||||||||||

Diluted | 143.3 | 143.3 | |||||||||||||

(a) | Adjustments primarily related to certain tax basis intangible assets that existed at the time of the acquisition of Omega on March 30, 2015, which reduced the deferred tax liabilities in acquired intangible assets and increased our valuation allowance resulting in a net change to our deferred taxes. The resulting balance sheet reclassification required a reduction of goodwill, offset by a corresponding reduction to net deferred taxes at the date of the Omega acquisition. The adjustment made at the date of the Omega acquisition also had an impact on previously reported goodwill impairment charges. ("BCH Deferred Tax Matters"). (Income tax expense (benefits): $39.8 million) |

(c) | Adjustment related to income tax expense (benefit) for interim period tax accounting required under ASC 740, Accounting for Income Taxes. (Income tax expense (benefit): $14.2 million) |

9

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Statement of Operations

(in millions, except per share amounts)

(unaudited)

Nine Months Ended | |||||||||||||||

October 1, 2016 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Net sales | $ | 4,219.1 | $ | (267.0 | ) | $ | (2.8 | ) | (b) | $ | 3,949.3 | ||||

Cost of sales | 2,622.7 | (217.5 | ) | (20.0 | ) | (b) | 2,385.2 | ||||||||

Gross profit | 1,596.4 | (49.5 | ) | 17.2 | 1,564.1 | ||||||||||

Operating expenses | |||||||||||||||

Distribution | 65.9 | — | — | 65.9 | |||||||||||

Research and development | 142.5 | — | — | 142.5 | |||||||||||

Selling | 506.9 | — | — | 506.9 | |||||||||||

Administration | 316.8 | — | 0.4 | 317.2 | |||||||||||

Impairment charges | 2,127.1 | — | (98.3 | ) | (a) | 2,028.8 | |||||||||

Restructuring | 17.9 | — | — | 17.9 | |||||||||||

Total operating expenses | 3,177.1 | — | (97.9 | ) | 3,079.2 | ||||||||||

Operating loss | (1,580.7 | ) | (49.5 | ) | 115.1 | (1,515.1 | ) | ||||||||

Tysabri® royalty stream - change in fair value | — | 1,492.6 | — | 1,492.6 | |||||||||||

Interest expense, net | 163.2 | — | — | 163.2 | |||||||||||

Other expense, net | 34.1 | 0.4 | (2.1 | ) | 32.4 | ||||||||||

Loss on extinguishment of debt | 1.1 | — | — | 1.1 | |||||||||||

Loss before income taxes | (1,779.1 | ) | (1,542.5 | ) | 117.2 | (3,204.4 | ) | ||||||||

Income tax (benefit) | (383.7 | ) | (192.8 | ) | 25.8 | (a)(b)(c) | (550.7 | ) | |||||||

Net loss | $ | (1,395.4 | ) | $ | (1,349.7 | ) | $ | 91.4 | $ | (2,653.7 | ) | ||||

Loss per share | |||||||||||||||

Basic | $ | (9.74 | ) | $ | (9.42 | ) | $ | 0.63 | $ | (18.53 | ) | ||||

Diluted | $ | (9.74 | ) | $ | (9.42 | ) | $ | 0.63 | $ | (18.53 | ) | ||||

Weighted-average shares outstanding | |||||||||||||||

Basic | 143.2 | 143.2 | |||||||||||||

Diluted | 143.2 | 143.2 | |||||||||||||

(a) | Adjustments primarily related to the BCH Deferred Tax Matters as described above. (Income tax expense: $13.4 million) |

(b) | Adjustments primarily related to certain contracts related to a specific Belgium distributor that were consignment in nature due to an option for the distributor to return the product if it was not sold timely. The characterization of the contracts as consignment impacted the timing of revenue recognition in the Condensed Consolidated Statement of Operations and, due to the impact on factoring arrangements, required a reclassification between accounts receivable and current liabilities for the amounts factored for these contracts. (“BCH Belgium Distribution Contracts”) (Income tax expense (benefit): $3.5 million) |

(c) | Adjustment related to income tax expense (benefit) for interim period tax accounting required under ASC 740, Accounting for Income Taxes. (Income tax expense (benefit): $6.2 million) |

10

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Statement of Operations

(in millions, except per share amounts)

(unaudited)

Three Months Ended | |||||||||||||||

September 26, 2015 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Net sales | $ | 1,344.7 | $ | (83.1 | ) | $ | 11.5 | (b) | $ | 1,273.1 | |||||

Cost of sales | 795.9 | (72.5 | ) | 14.5 | (b) | 737.9 | |||||||||

Gross profit | 548.8 | (10.6 | ) | (3.0 | ) | 535.2 | |||||||||

Operating expenses | |||||||||||||||

Distribution | 24.9 | — | — | 24.9 | |||||||||||

Research and development | 41.6 | — | — | 41.6 | |||||||||||

Selling | 167.9 | — | — | 167.9 | |||||||||||

Administration | 123.6 | — | (0.3 | ) | 123.3 | ||||||||||

Restructuring | 2.2 | — | — | 2.2 | |||||||||||

Total operating expenses | 360.2 | — | (0.3 | ) | 359.9 | ||||||||||

Operating income | 188.6 | (10.6 | ) | (2.7 | ) | 175.3 | |||||||||

Tysabri® royalty stream - change in fair value | — | (173.8 | ) | — | (173.8 | ) | |||||||||

Interest expense, net | 43.4 | — | — | 43.4 | |||||||||||

Other expense, net | 13.0 | 0.7 | (2.8 | ) | 10.9 | ||||||||||

Loss on extinguishment of debt | — | — | — | — | |||||||||||

Income before income taxes | 132.2 | 162.5 | 0.1 | 294.8 | |||||||||||

Income tax expense | 19.6 | 20.3 | (6.0 | ) | (a)(c) | 33.9 | |||||||||

Net income | $ | 112.6 | $ | 142.2 | $ | 6.1 | $ | 260.9 | |||||||

Income per share | |||||||||||||||

Basic | $ | 0.77 | $ | 0.97 | $ | 0.04 | $ | 1.78 | |||||||

Diluted | $ | 0.77 | $ | 0.97 | $ | 0.04 | $ | 1.78 | |||||||

Weighted-average shares outstanding | |||||||||||||||

Basic | 146.3 | 146.3 | |||||||||||||

Diluted | 146.9 | 146.9 | |||||||||||||

(a) | Adjustments primarily related to the BCH Deferred Tax Matters as described above. (Income tax expense (benefit): ($19.5) million) |

(b) | Adjustments primarily related to BCH Belgium Distribution Contracts as described above. |

(c) | Adjustment related to income tax expense (benefit) for interim period tax accounting required under ASC 740, Accounting for Income Taxes. (Income tax expense (benefit)): $13.6 million) |

11

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Statement of Operations

(in millions, except per share amounts)

(unaudited)

Nine Months Ended | |||||||||||||||

September 26, 2015 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Net sales | $ | 3,925.4 | $ | (244.6 | ) | $ | (25.2 | ) | (b) | $ | 3,655.6 | ||||

Cost of sales | 2,369.7 | (217.5 | ) | (2.2 | ) | (b) | 2,150.0 | ||||||||

Gross profit | 1,555.7 | (27.1 | ) | (23.0 | ) | 1,505.6 | |||||||||

Operating expenses | |||||||||||||||

Distribution | 63.3 | — | — | 63.3 | |||||||||||

Research and development | 139.7 | — | — | 139.7 | |||||||||||

Selling | 391.6 | — | — | 391.6 | |||||||||||

Administration | 343.3 | — | (0.2 | ) | 343.1 | ||||||||||

Impairment charges | — | — | 6.8 | 6.8 | |||||||||||

Restructuring | 3.1 | — | — | 3.1 | |||||||||||

Total operating expenses | 941.0 | — | 6.6 | 947.6 | |||||||||||

Operating income | 614.7 | (27.1 | ) | (29.6 | ) | 558.0 | |||||||||

Tysabri® royalty stream - change in fair value | — | (205.4 | ) | — | (205.4 | ) | |||||||||

Interest expense, net | 132.7 | — | — | 132.7 | |||||||||||

Other expense, net | 294.2 | 0.8 | (10.2 | ) | 284.8 | ||||||||||

Loss on extinguishment of debt | 0.9 | — | — | 0.9 | |||||||||||

Income before income taxes | 186.9 | 177.5 | (19.4 | ) | 345.0 | ||||||||||

Income tax expense | 112.7 | 22.2 | (6.3 | ) | (a)(b)(c) | 128.6 | |||||||||

Net income | $ | 74.2 | $ | 155.3 | $ | (13.1 | ) | $ | 216.4 | ||||||

Income per share | |||||||||||||||

Basic | $ | 0.51 | $ | 1.08 | $ | (0.09 | ) | $ | 1.50 | ||||||

Diluted | $ | 0.51 | $ | 1.08 | $ | (0.09 | ) | $ | 1.50 | ||||||

Weighted-average shares outstanding | |||||||||||||||

Basic | 144.4 | 144.4 | |||||||||||||

Diluted | 145.0 | 145.0 | |||||||||||||

(a) | Adjustments primarily related to the BCH Deferred Tax Matters as described above. (Income tax expense (benefit): ($13.0) million) |

(b) | Adjustments primarily related to BCH Belgium Distribution Contracts as described above. (Income tax expense (benefit): ($3.3) million) |

(c) | Adjustment related to income tax expense (benefit) for interim period tax accounting required under ASC 740, Accounting for Income Taxes. (Income tax expense (benefit): $13.4 million) |

12

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Balance Sheet

(in millions)

(unaudited)

October 1, 2016 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Assets | |||||||||||||||

Cash and cash equivalents | $ | 362.7 | $ | — | $ | — | $ | 362.7 | |||||||

Accounts receivable, net of allowance for doubtful accounts of $5.7 million | 1,129.2 | — | (5.1 | ) | 1,124.1 | ||||||||||

Inventories | 884.6 | — | — | 884.6 | |||||||||||

Prepaid expenses and other current assets | 250.6 | — | — | 250.6 | |||||||||||

Total current assets | 2,627.1 | — | (5.1 | ) | 2,622.0 | ||||||||||

Property, plant and equipment, net | 881.3 | — | — | 881.3 | |||||||||||

Tysabri® royalty stream - at fair value | — | 3,550.0 | — | 3,550.0 | |||||||||||

Goodwill and other indefinite-lived intangible assets | 5,282.7 | — | (137.1 | ) | (a)(b) | 5,145.6 | |||||||||

Other intangible assets, net | 8,340.9 | (4,994.7 | ) | (10.0 | ) | 3,336.2 | |||||||||

Non-current deferred income taxes | 129.3 | — | 6.9 | (a)(c) | 136.2 | ||||||||||

Other non-current assets | 206.3 | — | 10.5 | 216.8 | |||||||||||

Total non-current assets | 14,840.5 | (1,444.7 | ) | (129.7 | ) | 13,266.1 | |||||||||

Total assets | $ | 17,467.6 | $ | (1,444.7 | ) | $ | (134.8 | ) | $ | 15,888.1 | |||||

Liabilities and Shareholders’ Equity | |||||||||||||||

Accounts payable | $ | 507.9 | $ | — | $ | (5.0 | ) | $ | 502.9 | ||||||

Payroll and related taxes | 106.8 | — | — | 106.8 | |||||||||||

Accrued customer programs | 325.5 | — | (1.2 | ) | 324.3 | ||||||||||

Accrued liabilities | 258.7 | — | — | 258.7 | |||||||||||

Accrued income taxes | 76.2 | — | (21.1 | ) | (a)(b)(c) | 55.1 | |||||||||

Current indebtedness | 265.0 | — | — | 265.0 | |||||||||||

Total current liabilities | 1,540.1 | — | (27.3 | ) | 1,512.8 | ||||||||||

Long-term debt, less current portion | 5,638.0 | — | — | 5,638.0 | |||||||||||

Non-current deferred income taxes | 1,169.3 | (180.6 | ) | (190.7 | ) | (a)(b)(c) | 798.0 | ||||||||

Other non-current liabilities | 448.9 | — | 7.8 | 456.7 | |||||||||||

Total non-current liabilities | 7,256.2 | (180.6 | ) | (182.9 | ) | 6,892.7 | |||||||||

Total liabilities | 8,796.3 | (180.6 | ) | (210.2 | ) | 8,405.5 | |||||||||

Commitments and contingencies - Note 14 | |||||||||||||||

Shareholders’ equity | |||||||||||||||

Controlling interest: | |||||||||||||||

Preferred shares, $0.0001 par value, 10 million shares authorized | — | — | — | — | |||||||||||

Ordinary shares, €0.001 par value, 10 billion shares authorized | 8,151.4 | — | (2.8 | ) | 8,148.6 | ||||||||||

Accumulated other comprehensive income | 71.5 | — | — | 71.5 | |||||||||||

Retained earnings (accumulated deficit) | 449.0 | (1,264.1 | ) | 78.2 | (736.9 | ) | |||||||||

Total controlling interest | 8,671.9 | (1,264.1 | ) | 75.4 | 7,483.2 | ||||||||||

Noncontrolling interest | (0.6 | ) | — | — | (0.6 | ) | |||||||||

Total shareholders’ equity | 8,671.3 | (1,264.1 | ) | 75.4 | 7,482.6 | ||||||||||

Total liabilities and shareholders' equity | $ | 17,467.6 | $ | (1,444.7 | ) | $ | (134.8 | ) | $ | 15,888.1 | |||||

(a) | Adjustments primarily related to the BCH Deferred Tax Matters as described above. (Goodwill and other indefinite-lived intangible assets: $231.2 million, Non-current deferred income tax asset: $281.1 million, Non-current deferred income tax liability $83.7 million, and Accrued income taxes: ($20.9 million)) |

(b) | Adjustments primarily related to BCH Belgium Distribution Contracts as described above. (Goodwill and other indefinite-lived intangible assets: $5.4 million, Non-current deferred income tax liability: $0.1 million, and Accrued income taxes: $($5.5 million)) |

(c) | Adjustment related to income tax expense (benefit) for interim period tax accounting required under ASC 740, Accounting for Income Taxes. (Accrued income taxes: $6.1 million). The balance of the adjustment to deferred taxes relates to jurisdictional netting. |

13

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Balance Sheet

(in millions)

December 31, 2015 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Assets | |||||||||||||||

Cash and cash equivalents | $ | 417.8 | $ | — | $ | — | $ | 417.8 | |||||||

Accounts receivable, net of allowance for doubtful accounts of $4.5 million | 1,193.1 | — | (4.1 | ) | (b) | 1,189.0 | |||||||||

Inventories | 844.4 | — | 54.3 | (b) | 898.7 | ||||||||||

Prepaid expenses and other current assets | 289.1 | — | (3.0 | ) | 286.1 | ||||||||||

Total current assets | 2,744.4 | — | 47.2 | 2,791.6 | |||||||||||

Property, plant and equipment, net | 886.2 | — | — | 886.2 | |||||||||||

Tysabri® royalty stream - at fair value | — | 5,310.0 | — | 5,310.0 | |||||||||||

Goodwill and other indefinite-lived intangible assets | 7,281.2 | — | (212.2 | ) | (a)(b) | 7,069.0 | |||||||||

Other intangible assets, net | 8,190.5 | (5,212.2 | ) | (5.2 | ) | 2,973.1 | |||||||||

Non-current deferred income taxes | 54.6 | — | 16.8 | (a)(c) | 71.4 | ||||||||||

Other non-current assets | 237.0 | — | 11.3 | 248.3 | |||||||||||

Total non-current assets | 16,649.5 | 97.8 | (189.3 | ) | 16,558.0 | ||||||||||

Total assets | $ | 19,393.9 | $ | 97.8 | $ | (142.1 | ) | $ | 19,349.6 | ||||||

Liabilities and Shareholders’ Equity | |||||||||||||||

Accounts payable | $ | 554.9 | $ | — | $ | 0.9 | (b) | $ | 555.8 | ||||||

Payroll and related taxes | 125.3 | — | — | 125.3 | |||||||||||

Accrued customer programs | 398.0 | — | (2.0 | ) | (b) | 396.0 | |||||||||

Accrued liabilities | 308.4 | — | 43.5 | (b) | 351.9 | ||||||||||

Accrued income taxes | 85.2 | — | (22.5 | ) | (a) | 62.7 | |||||||||

Current indebtedness | 1,018.3 | — | 42.2 | (b) | 1,060.5 | ||||||||||

Total current liabilities | 2,490.1 | — | 62.1 | 2,552.2 | |||||||||||

Long-term debt, less current portion | 4,971.6 | — | — | 4,971.6 | |||||||||||

Non-current deferred income taxes | 1,563.7 | 12.2 | (203.2 | ) | (a)(b)(c) | 1,372.7 | |||||||||

Other non-current liabilities | 332.4 | — | 13.9 | (a) | 346.3 | ||||||||||

Total non-current liabilities | 6,867.7 | 12.2 | (189.3 | ) | 6,690.6 | ||||||||||

Total liabilities | 9,357.8 | 12.2 | (127.2 | ) | 9,242.8 | ||||||||||

Commitments and contingencies - Note 14 | |||||||||||||||

Shareholders’ equity | |||||||||||||||

Controlling interest: | |||||||||||||||

Preferred shares, $0.0001 par value, 10 million shares authorized | — | — | — | — | |||||||||||

Ordinary shares, €0.001 par value, 10 billion shares authorized | 8,144.6 | — | (2.0 | ) | 8,142.6 | ||||||||||

Accumulated other comprehensive (loss) | (15.5 | ) | — | 0.2 | (b) | (15.3 | ) | ||||||||

Retained earnings | 1,907.6 | 85.6 | (13.1 | ) | 1,980.1 | ||||||||||

Total controlling interest | 10,036.7 | 85.6 | (14.9 | ) | 10,107.4 | ||||||||||

Noncontrolling interest | (0.6 | ) | — | — | (0.6 | ) | |||||||||

Total shareholders’ equity | 10,036.1 | 85.6 | (14.9 | ) | 10,106.8 | ||||||||||

Total liabilities and shareholders' equity | $ | 19,393.9 | $ | 97.8 | $ | (142.1 | ) | $ | 19,349.6 | ||||||

(a) | Adjustments primarily related to the BCH Deferred Tax Matters as described above. (Goodwill and other indefinite-lived intangible assets:$(223.3) million, Non-current deferred income tax asset: $272.2 million, and Non-current deferred income tax liability $65.4 million) |

(b) | Adjustments primarily related to BCH Belgium Distribution Contracts as described above. (Goodwill and other indefinite-lived intangible assets: $10.2 million and Non-current deferred income taxes: $8.7 million) |

(c) | Adjustment related to income tax expense (benefit) for interim period tax accounting required under ASC 740, Accounting for Income Taxes. The balance of the adjustment to deferred taxes relates to jurisdictional netting. |

14

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Statement of Cash Flows

(in millions)

(unaudited)

Nine Months Ended | |||||||||||||||

October 1, 2016 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Cash Flows From (For) Operating Activities | |||||||||||||||

Net income (loss) | $ | (1,395.4 | ) | $ | (1,349.7 | ) | $ | 91.4 | $ | (2,653.7 | ) | ||||

Adjustments to derive cash flows | |||||||||||||||

Loss on extinguishment of debt | 1.1 | — | — | 1.1 | |||||||||||

Restructuring charges | 17.9 | — | — | 17.9 | |||||||||||

Depreciation and amortization | 556.3 | (217.5 | ) | (0.4 | ) | 338.4 | |||||||||

Impairment charges | 2,127.1 | — | (98.3 | ) | (a) | 2,028.8 | |||||||||

Tysabri® royalty stream - change in fair value | — | 1,492.6 | — | 1,492.6 | |||||||||||

Share-based compensation | 16.1 | — | (0.8 | ) | 15.3 | ||||||||||

Amortization of financing fees and debt premium | — | — | (24.6 | ) | (24.6 | ) | |||||||||

Deferred income taxes | (507.2 | ) | (192.8 | ) | 25.9 | (a)(b) | (674.1 | ) | |||||||

Other non-cash adjustments | 34.5 | — | — | 34.5 | |||||||||||

Subtotal | 850.4 | (267.4 | ) | (6.8 | ) | 576.2 | |||||||||

Increase (decrease) in cash due to: | |||||||||||||||

Accounts receivable | 113.6 | 9.5 | (10.1 | ) | 113.0 | ||||||||||

Inventories | (29.9 | ) | — | 55.0 | (b) | 25.1 | |||||||||

Accounts payable | (51.8 | ) | — | (5.9 | ) | (57.7 | ) | ||||||||

Payroll and related taxes | (40.0 | ) | — | — | (40.0 | ) | |||||||||

Accrued customer programs | (74.7 | ) | — | 1.0 | (b) | (73.7 | ) | ||||||||

Accrued liabilities | (42.8 | ) | — | (47.2 | ) | (b) | (90.0 | ) | |||||||

Accrued income taxes | 9.7 | — | (4.5 | ) | (a)(b)(c) | 5.2 | |||||||||

Other | (31.0 | ) | — | 21.6 | (9.4 | ) | |||||||||

Subtotal | (146.9 | ) | 9.5 | 9.9 | (127.5 | ) | |||||||||

Net cash from (for) operating activities | 703.5 | (257.9 | ) | 3.1 | 448.7 | ||||||||||

Cash Flows From (For) Investing Activities | |||||||||||||||

Proceeds from royalty rights | — | 257.9 | 1.6 | 259.5 | |||||||||||

Acquisitions of businesses, net of cash acquired | (432.1 | ) | — | (4.7 | ) | (436.8 | ) | ||||||||

Asset acquisitions | (65.1 | ) | — | — | (65.1 | ) | |||||||||

Additions to property, plant and equipment | (84.6 | ) | — | — | (84.6 | ) | |||||||||

Proceeds from sale of business | 58.5 | — | — | 58.5 | |||||||||||

Other investing | (1.0 | ) | — | — | (1.0 | ) | |||||||||

Net cash from (for) investing activities | (524.3 | ) | 257.9 | (3.1 | ) | (269.5 | ) | ||||||||

Cash Flows From (For) Financing Activities | |||||||||||||||

Issuances of long-term debt | 1,190.3 | — | — | 1,190.3 | |||||||||||

Payments on long-term debt | (545.8 | ) | — | — | (545.8 | ) | |||||||||

Borrowings (repayments) of revolving credit agreements and other financing, net | (803.6 | ) | — | — | (803.6 | ) | |||||||||

Deferred financing fees | (2.8 | ) | — | — | (2.8 | ) | |||||||||

Premium on early debt retirement | (0.6 | ) | — | — | (0.6 | ) | |||||||||

Issuance of ordinary shares | 8.2 | — | — | 8.2 | |||||||||||

Cash dividends | (62.4 | ) | — | — | (62.4 | ) | |||||||||

Other financing | (17.4 | ) | — | — | (17.4 | ) | |||||||||

Net cash from (for) financing activities | (234.1 | ) | — | — | (234.1 | ) | |||||||||

Effect of exchange rate changes on cash and cash receipts | (0.2 | ) | — | — | (0.2 | ) | |||||||||

Net increase (decrease) in cash and cash equivalents | (55.1 | ) | — | — | (55.1 | ) | |||||||||

Cash and cash equivalents, beginning of period | 417.8 | — | — | 417.8 | |||||||||||

Cash and cash equivalents, end of period | $ | 362.7 | $ | — | $ | — | $ | 362.7 | |||||||

(a) | Adjustments primarily related to the BCH Deferred Tax Matters as described above. |

(b) | Adjustments primarily related to BCH Belgium Distribution Contracts as described above. |

(c) | Adjustment related to income tax expense (benefit) for interim period tax accounting required under ASC 740, Accounting for Income Taxes. |

15

Perrigo Company plc - Item 1

Note 1

Condensed Consolidated Statement of Cash Flows

(in millions)

(unaudited)

Nine Months Ended | |||||||||||||||

September 26, 2015 | |||||||||||||||

Adjustments | |||||||||||||||

Previously Reported | Tysabri® | Other | Restated | ||||||||||||

Cash Flows From (For) Operating Activities | |||||||||||||||

Net income (loss) | $ | 74.2 | $ | 155.3 | $ | (13.1 | ) | $ | 216.4 | ||||||

Adjustments to derive cash flows | |||||||||||||||

Loss on extinguishment of debt | 0.9 | — | — | 0.9 | |||||||||||

Restructuring charges | 3.1 | — | — | 3.1 | |||||||||||

Depreciation and amortization | 470.4 | (217.5 | ) | — | 252.9 | ||||||||||

Impairment charges | — | — | 6.8 | 6.8 | |||||||||||

Tysabri® royalty stream - change in fair value | — | (205.4 | ) | — | (205.4 | ) | |||||||||

Share-based compensation | 29.7 | — | — | 29.7 | |||||||||||

Loss on acquisition-related foreign currency derivatives | 300.0 | — | — | 300.0 | |||||||||||

Amortization of financing fees and debt premium | — | — | (8.5 | ) | (8.5 | ) | |||||||||

Deferred income taxes | 7.7 | 22.2 | (16.8 | ) | (a)(b) | 13.1 | |||||||||

Other non-cash adjustments | 15.3 | (6.9 | ) | 8.4 | |||||||||||

Subtotal | 901.3 | (245.4 | ) | (38.5 | ) | 617.4 | |||||||||

Increase (decrease) in cash due to: | |||||||||||||||

Accounts receivable | (30.9 | ) | (3.1 | ) | 25.6 | (b) | (8.4 | ) | |||||||

Inventories | (28.6 | ) | — | (0.3 | ) | (b) | (28.9 | ) | |||||||

Accounts payable | (6.5 | ) | — | (21.6 | ) | (b) | (28.1 | ) | |||||||

Payroll and related taxes | (26.6 | ) | — | — | (26.6 | ) | |||||||||

Accrued customer programs | 17.7 | — | 8.2 | (b) | 25.9 | ||||||||||

Accrued liabilities | 46.7 | — | (5.6 | ) | 41.1 | ||||||||||

Accrued income taxes | 0.3 | — | 11.0 | (a) | 11.3 | ||||||||||

Other | (6.7 | ) | — | 20.4 | 13.7 | ||||||||||

Subtotal | (34.6 | ) | (3.1 | ) | 37.7 | — | |||||||||

Net cash from (for) operating activities | 866.7 | (248.5 | ) | (0.8 | ) | 617.4 | |||||||||

Cash Flows From (For) Investing Activities | |||||||||||||||

Proceeds from royalty rights | — | 248.5 | 1.8 | 250.3 | |||||||||||

Acquisitions of businesses, net of cash acquired | (2,499.9 | ) | — | — | (2,499.9 | ) | |||||||||

Asset acquisitions | (4.0 | ) | — | — | (4.0 | ) | |||||||||

Settlement of acquisition-related foreign currency derivatives | (304.8 | ) | — | — | (304.8 | ) | |||||||||

Additions to property, plant and equipment | (127.6 | ) | — | — | (127.6 | ) | |||||||||

Other investing | (2.7 | ) | — | — | (2.7 | ) | |||||||||

Net cash from (for) investing activities | (2,939.0 | ) | 248.5 | 1.8 | (2,688.7 | ) | |||||||||

Cash Flows From (For) Financing Activities | |||||||||||||||

Payments on long-term debt | (903.3 | ) | — | — | (903.3 | ) | |||||||||

Borrowings (repayments) of revolving credit agreements and other financing, net | 28.6 | — | (1.0 | ) | 27.6 | ||||||||||

Deferred financing fees | (3.3 | ) | — | — | (3.3 | ) | |||||||||

Issuance of ordinary shares | 6.2 | — | — | 6.2 | |||||||||||

Cash dividends | (54.2 | ) | — | — | (54.2 | ) | |||||||||

Other financing | (15.5 | ) | — | — | (15.5 | ) | |||||||||

Net cash from (for) financing activities | (941.5 | ) | — | (1.0 | ) | (942.5 | ) | ||||||||

Effect of exchange rate changes on cash and cash receipts | (75.8 | ) | — | — | (75.8 | ) | |||||||||

Net increase (decrease) in cash and cash equivalents | (3,089.6 | ) | — | — | (3,089.6 | ) | |||||||||

Cash and cash equivalents, beginning of period | 3,596.1 | — | — | 3,596.1 | |||||||||||

Cash and cash equivalents, end of period | $ | 506.5 | $ | — | $ | — | $ | 506.5 | |||||||

(a) | Adjustments primarily related to the BCH Deferred Tax Matters as described above. |

(b) | Adjustments primarily related to BCH Belgium Distribution Contracts as described above. |

16

Perrigo Company plc - Item 1

Note 1

The Condensed Consolidated Statement of Comprehensive Income (Loss) was adjusted primarily for a $335.0 million increase in net loss and $1.3 billion increase in net loss for the three and nine months ended October 1, 2016, respectively, and a $148.3 million increase in net income and $142.2 million increase in net income for the three and nine months ended September 26, 2015, respectively, as well as an adjustment in foreign currency translation of $0.5 million and $0.3 million for the three and nine months ended October 1, 2016, respectively, and $0.1 million for the three months ended September 26, 2015.

The accumulated effect on Shareholders' Equity at December 27, 2014 was a $41.7 million increase.

Recent Accounting Standard Pronouncements

Below are recent accounting standard updates that we are still assessing to determine the effect on our consolidated financial statements. We do not believe that any other recently issued accounting standards could have a material effect on our consolidated financial statements. As new accounting pronouncements are issued, we will adopt those that are applicable under the circumstances.

Recently Issued Accounting Standards Not Yet Adopted | ||||||

Standard | Description | Effective Date | Effect on the Financial Statements or Other Significant Matters | |||

Improvements to Employee Share-Based Payment Accounting | This guidance is intended to simplify several aspects of the accounting for share-based payment award transactions. It will require all income tax effects of awards to be recorded through the income statement when they vest or settle as opposed to certain amounts being recorded in additional paid-in capital. An entity will also have to elect whether to account for forfeitures as they occur or by estimating the number of awards expected to be forfeited and adjusting the estimate when it is likely to change (as currently required). The guidance will also increase the amount an employer can withhold to cover income taxes on awards. Early adoption is permitted. | January 1, 2017 | We are currently evaluating the implications of adoption on our consolidated financial statements. | |||

Revenue from Contracts with Customers | The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. To achieve that core principle, an entity should apply the following steps: identify the contract(s) with a customer; identify the performance obligations in the contract; determine the transaction price; allocate the transaction price to the performance obligations in the contract; and recognize revenue when (or as) the entity satisfies a performance obligation. This guidance allows for two adoption methods, full retrospective approach or modified retrospective approach. Early adoption is not permitted. | January 1, 2018 | We are currently evaluating the possible adoption methodologies and the implications of adoption on our consolidated financial statements. | |||

Leases | This guidance was issued to increase transparency and comparability among organizations by requiring recognition of lease assets and lease liabilities on the balance sheet and disclosure of key information about leasing arrangements. For leases with a term of 12 months or less, lessees are permitted to make an election to not recognize right-of-use assets and lease liabilities. Upon adoption, lessees will apply the new standard as of the beginning of the earliest comparative period presented in the financial statements, however lessees will be able to exclude leases that expire as of the implementation date. Early adoption is permitted. | January 1, 2019 | We are currently evaluating the implications of adoption on our consolidated financial statements and considering whether to early adopt the standard. | |||

17

Perrigo Company plc - Item 1

Note 1

Recently Issued Accounting Standards Not Yet Adopted (continued) | ||||||

Standard | Description | Effective Date | Effect on the Financial Statements or Other Significant Matters | |||

Measurement of Credit Losses on Financial Instruments | This guidance changes the impairment model for most financial assets and certain other instruments, replacing the current "incurred loss" approach with an "expected loss" credit impairment model, which will apply to most financial assets measured at amortized cost and certain other instruments, including trade and other receivables, loans, held-to-maturity debt securities, and off-balance sheet credit exposures such as letters of credit. Early adoption is permitted. | January 1, 2020 | We are currently evaluating the new standard for potential impacts on our receivables, debt, and other financial instruments and considering whether to early adopt the standard. | |||

NOTE 2 – ACQUISITIONS AND DIVESTITURES

All of the below acquisitions, with the exception of the generic Benzaclin™ product purchase, have been accounted for under the acquisition method of accounting based on our analysis of the acquired inputs and processes, and the related assets acquired and liabilities assumed were recorded at fair value as of the acquisition date.

Fair value estimates are based on a complex series of judgments about future events and rely heavily on estimates and assumptions. The judgments used to determine the estimated fair value assigned to each class of assets acquired and liabilities assumed, as well as asset lives, can materially impact our results of operations.

The effects of all of the acquisitions described below are included in the Condensed Consolidated Financial Statements prospectively from the date of each acquisition. Unless otherwise indicated, acquisition costs incurred were immaterial and were recorded in Administration expense.

Current Year Acquisitions

Generic Benzaclin™ Product

On August 2, 2016, we purchased the remaining 60.9% product rights to a generic Benzaclin™ product ("Generic Benzaclin™"), which we had developed and marketed in collaboration with Barr Laboratories, Inc. ("Barr"), a subsidiary of Teva Pharmaceuticals, for $62.0 million in cash. In September 2007, we entered into an initial development, marketing and commercialization agreement with Barr, in which Barr contributed to the product's development costs and we developed and marketed the product in the U.S. and Israel. Under this agreement, we paid Barr a percentage of net income from the product's sales in these territories, adjusted for Barr's contributions to the product's development costs. By purchasing the remaining product right from Barr, we are now entitled to 100% of income from sales of the product. Operating results attributable to Generic Benzaclin™ are included within our Prescription Pharmaceuticals ("Rx") segment. The intangible asset acquired is a distribution and license agreement with a nine-year useful life.

Tretinoin Product Portfolio

On January 22, 2016, we acquired a portfolio of generic dosage forms and strengths of Retin-A® (tretinoin), a topical prescription acne treatment, from Matawan Pharmaceuticals, LLC, for $416.4 million in cash ("Tretinoin Products"), which further expanded our extended topicals portfolio. We were the authorized generic distributor of these products from 2005 to 2013. Operating results attributable to the acquisition are included within our Rx segment. The intangible assets acquired included generic product rights valued using the multi-period excess earnings method and assigned a 20-year useful life, and non-compete agreements valued using the lost income method and assigned a five-year useful life. The goodwill acquired is deductible for tax purposes.

18

Perrigo Company plc - Item 1

Note 2

Development-Stage Rx Products

In May 2015, we entered into an agreement with a clinical stage biotechnology company for two specialty pharmaceutical products in development ("Development-Stage Rx Products"). We paid $18.0 million for an option to acquire the two products, which was recorded in Research and Development expense. On March 1, 2016, to further invest in our specialty Rx portfolio, we exercised the option for both products, which requires us to make contingent payments if we obtain regulatory approval and achieve certain sales milestones. We will also be obligated to make certain royalty payments over periods ranging from seven to ten years from the launch of each product.

We accounted for the option exercise as a business acquisition within our Rx segment, recording IPR&D and contingent consideration on the balance sheet. The IPR&D was valued using the multi-period excess earnings method and has an indefinite useful life until such time as the research is completed (at which time it will become a definite-lived intangible asset), or is determined to have no future use (at which time it would be impaired). The contingent consideration is an estimate of the future milestone payments and royalties based on probability-weighted outcomes, sensitivity analysis, and discount rates reflective of the risk involved. The amount of contingent consideration recognized was $24.9 million and was recorded in Other non-current liabilities.

Purchase Price Allocation of Current Year Acquisitions

The purchase accounting allocation for four small product acquisitions in our Consumer Healthcare ("CHC") and Rx segments (included in "All Other" in the table below) are preliminary and are based on the valuation information, estimates, and assumptions available at October 1, 2016. As we finalize the fair value estimate, additional purchase price adjustments may be recorded during the measurement period to contingent consideration and intangible assets.

19

Perrigo Company plc - Item 1

Note 2

The below table indicates the purchase price allocation for acquisitions completed in the current year (in millions):

Tretinoin Products | Development-Stage Rx Products | All Other(1)* | |||||||||

Purchase price paid | $ | 416.4 | $ | — | $ | 26.6 | |||||

Contingent consideration | — | 24.9 | 30.6 | ||||||||

Total purchase consideration | $ | 416.4 | $ | 24.9 | $ | 57.2 | |||||

Assets acquired: | |||||||||||

Cash and cash equivalents | $ | — | $ | — | $ | 3.8 | |||||

Accounts receivable | — | — | 4.9 | ||||||||

Inventories | 1.4 | — | 7.1 | ||||||||

Prepaid expenses and other current assets | — | — | 0.1 | ||||||||

Property and equipment | — | — | 1.2 | ||||||||

Goodwill | 1.7 | — | 0.2 | ||||||||

Definite-lived intangibles: | |||||||||||

Distribution and license agreements, supply agreements | — | — | 3.4 | ||||||||

Developed product technology, formulations, and product rights | 411.0 | — | 28.0 | ||||||||

Customer relationships and distribution networks | — | — | 8.2 | ||||||||

Non-compete agreements | 2.3 | — | — | ||||||||

Indefinite-lived intangibles: | |||||||||||

In-process research and development | — | 24.9 | 7.0 | ||||||||

Total intangible assets | $ | 413.3 | $ | 24.9 | $ | 46.6 | |||||

Total assets | $ | 416.4 | $ | 24.9 | $ | 63.9 | |||||

Liabilities assumed: | |||||||||||

Accounts payable | $ | — | $ | — | $ | 2.8 | |||||

Accrued liabilities | — | — | 0.1 | ||||||||

Long-term debt | — | — | 3.3 | ||||||||

Net deferred income tax liabilities | — | — | 0.5 | ||||||||

Total liabilities | $ | — | $ | — | $ | 6.7 | |||||

Net assets acquired | $ | 416.4 | $ | 24.9 | $ | 57.2 | |||||

* Opening balance sheet is preliminary

(1) | Consists of four product acquisitions in the CHC and Rx segments |

Prior Year Acquisitions

Entocort®

On December 15, 2015, we completed our acquisition of Entocort® (budesonide) capsules, as well as the authorized generic capsules, for sale within the U.S., from AstraZeneca plc for $380.2 million in cash. Entocort® is a gastroenterology medicine for patients with mild to moderate Crohn's disease. The acquisition complemented our Rx portfolio. Operating results attributable to the acquisition are included within our Rx segment. The intangible assets acquired included branded and authorized generic product rights with useful lives of 10 and 15 years, respectively, which were valued using the multi-period excess earnings method.

20

Perrigo Company plc - Item 1

Note 2

Naturwohl Pharma GmbH

On September 15, 2015, we completed our acquisition of 100% of Naturwohl Pharma GmbH ("Naturwohl"), a Munich, Germany-based nutritional business known for its leading German dietary supplement brand, Yokebe®. The acquisition built on our BCH segment's OTC product portfolio and European commercial infrastructure. The assets were purchased through an all-cash transaction valued at €133.5 million ($150.4 million). Operating results attributable to Naturwohl are included in the BCH segment. The intangible assets acquired included a trademark with a 20-year useful life, customer relationships with a 15-year useful life, non-compete agreements with a three-year useful life, and a licensing agreement with a three-year useful life. We utilized the relief from royalty method for valuing the trademark, the multi-period excess earnings method for valuing the customer relationships, and the lost income method for valuing the non-compete agreements and the licensing agreement. The goodwill acquired is not deductible for tax purposes.

ScarAway®

On August 28, 2015, we completed our acquisition of ScarAway®, a leading U.S. OTC scar management brand portfolio comprised of five products, from Enaltus, LLC, for $26.7 million in cash. This acquisition served as our entry into the niche branded OTC business in the U.S. Operating results attributable to ScarAway® are included in the CHC segment. The intangible assets acquired included a trademark with a 25-year useful life, non-compete agreements with a four-year useful life, developed product technology with an eight-year useful life, and customer relationships with a 15-year useful life. We utilized the relief from royalty method for valuing the trademark and developed product technology, the multi-period excess earnings method for valuing the customer relationships, and the lost income method for valuing the non-compete agreements. The goodwill acquired is deductible for tax purposes.

GlaxoSmithKline Consumer Healthcare Product Portfolio

On August 28, 2015, we completed our acquisition of a portfolio of well-established OTC brands from GlaxoSmithKline Consumer Healthcare (“GSK Products”). This acquisition further leveraged our European market share and expanded our product offerings. The assets were purchased through an all-cash transaction valued at €200.0 million ($223.6 million). Operating results attributable to the acquired GSK Products are included primarily in the BCH segment. The intangible assets acquired included trademarks with a 20-year useful life and customer relationships with a 15-year useful life. We utilized the relief from royalty method for valuing the trademarks and the multi-period excess earnings method for valuing the customer relationships. The goodwill acquired is deductible for tax purposes and recorded primarily in the BCH segment.

Gelcaps Exportadora de Mexico, S.A. de C.V.

On May 12, 2015, we completed our acquisition of 100% of Gelcaps Exportadora de Mexico, S.A. de C.V. ("Gelcaps"), the Mexican operations of Durham, North Carolina-based Patheon Inc., for $37.9 million in cash. The acquisition added softgel manufacturing technology to our supply chain capabilities and broadened our presence, product portfolio, and customer network in Mexico. Operating results attributable to Gelcaps are included in the CHC segment. The intangible assets acquired included a trademark with a 25-year useful life and customer relationships with a 20-year useful life. We utilized the relief from royalty method for valuing the trademark and the multi-period excess earnings method for valuing the customer relationships.

Based on valuation estimates utilizing the comparative sales method, a step-up in the value of inventory of $0.6 million was recorded in the opening balance sheet, which was charged to cost of goods sold during the three months ended June 27, 2015. In addition, property, plant and equipment was written up by $0.9 million to its estimated fair market value based on a valuation method that included both the cost and market approaches. This additional step-up in value is being depreciated over the estimated remaining useful lives of the assets. The goodwill recorded is not deductible for tax purposes.

Omega Pharma Invest N.V.

On March 30, 2015, we completed our acquisition of Omega Pharma Invest N.V. ("Omega"), a limited liability company incorporated under the laws of Belgium. Omega was a leading European OTC company and is

21

Perrigo Company plc - Item 1

Note 2

providing us several key benefits, including advancing our growth strategy outside the U.S. by providing access across a larger global platform with critical mass in key European countries, establishing commercial infrastructure in the high barrier-to-entry European OTC marketplace, strengthening our product portfolio while enhancing scale and distribution, and expanding our international management capabilities.

We purchased 95.77% of the issued and outstanding share capital of Omega (685,348,257 shares) from Alychlo N.V. (“Alychlo”) and Holdco I BE N.V. (together with Alychlo, the “Sellers”), limited liability companies incorporated under the laws of Belgium, under the terms of the Share Purchase Agreement dated November 6, 2014 (the "Share Purchase Agreement"). Omega holds the remaining 30,243,983 shares as treasury shares.

The acquisition was a cash and stock transaction made up of the following consideration (in millions except per share data):

Perrigo ordinary shares issued | 5.4 | |||

Perrigo per share price at transaction close on March 30, 2015 | $ | 167.64 | ||

Total value of Perrigo ordinary shares issued | $ | 904.9 | ||

Cash consideration | 2,078.3 | |||

Total consideration | $ | 2,983.2 | ||

The cash consideration shown in the above table was financed by a combination of debt and equity. We issued $1.6 billion of debt as described in Note 10, and issued 6.8 million ordinary shares, which raised $999.3 million, net of issuance costs.

The Sellers agreed to indemnify us for certain potential future losses. The Sellers’ indemnification and other obligations to us under the Share Purchase Agreement are secured by up to €120.9 million ($135.9 million as of October 1, 2016) in cash that has been escrowed or is committed to be escrowed and 1.08 million of our ordinary shares, which are both being held in escrow to secure such obligations. Under the terms of the Share Purchase Agreement, Alychlo and its affiliates are subject to a three-year non-compete in Europe, and the Sellers are subject to a two-year non-solicit, in each case subject to certain exceptions. The Share Purchase Agreement contains other customary representations, warranties, and covenants of the parties thereto. Our Board of Directors has authorized us to issue an arbitral claim against the Sellers, which we plan to do.

The operating results attributable to Omega are included in the BCH segment. We incurred general transaction costs (legal, banking and other professional fees), financing fees, and debt extinguishment charges in connection with the Omega acquisition. The amounts recorded were not allocated to a reporting segment. The table below details the acquisition costs, as well as losses on hedging activities associated with the acquisition purchase price, and where they were recorded for the nine months ended September 26, 2015 (in millions):

Nine Months Ended | ||||

Line item | September 26, 2015 | |||

Administration | $ | 18.1 | ||

Interest expense, net | 18.7 | |||

Other expense, net | 258.2 | |||

Total acquisition-related costs | $ | 295.0 | ||

See Note 8 for further details on losses on the Omega-related hedging activities shown above in Other expense, net, and Note 10 for details on the loss on extinguishment of debt.

22

Perrigo Company plc - Item 1

Note 2

We acquired the following intangible assets: indefinite-lived brands, a definite-lived trade name with an eight-year useful life, definite-lived brands with a 22-year useful life, a distribution network with a 21-year useful life, and developed product technology with useful lives ranging from four to 13 years. We also recorded goodwill, which is not deductible for tax purposes and represents the value we assigned to the expected synergies described above, in our BCH segment. We utilized the multi-period excess earnings method to value the indefinite-lived brands, the definite-lived brands, and distribution network. We utilized the relief from royalty method to value the developed product technology and definite-lived trade name. The weighted-average useful life of all intangible assets acquired is 20.6 years.