Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atlantic Capital Bancshares, Inc. | acb-form8xkinvestorpresent.htm |

Atlantic Capital Bancshares, Inc. (ACBI)

May 24, 2017

Forward‐Looking Statements

This presentation contains forward‐looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section

21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements reflect our current views with respect to, among

other things, future events and our financial performance. These statements are often, but not always, made through the use of words or

phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or

forward‐looking nature. These forward‐looking statements are not historical facts, and are based on current expectations, estimates and

projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are

inherently uncertain and beyond our control. Accordingly, we caution you that any such forward‐looking statements are not guarantees of future

performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations

reflected in these forward‐looking statements are reasonable as of the date made, actual results may prove to be materially different from the

results expressed or implied by the forward‐looking statements.

The following risks, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in

the forward‐looking statements: (1) the expected growth opportunities and cost savings from the transaction with First Security Group, Inc.

(“First Security”) may not be fully realized or may take longer to realize than expected; (2) loss of income from our TriNet division following our

exit of this business; (3) changes in asset quality and credit risk; (4) the cost and availability of capital; (5) customer acceptance of our products

and services; (6) customer borrowing, repayment, investment and deposit practices; (7) the introduction, withdrawal, success and timing of

business initiatives; (8) the impact, extent, and timing of technological changes; (9) severe catastrophic events in our geographic area; (10) a

weakening of the economies in which we conduct operations may adversely affect our operating results; (11) the U.S. legal and regulatory

framework, including those associated with the Dodd‐Frank Wall Street Reform and Consumer Protection Act could adversely affect the

operating results of the combined company; (12) the interest rate environment may compress margins and adversely affect net interest income;

(13) changes in trade, monetary and fiscal policies of various governmental bodies and central banks could affect the economic environment in

which we operate; (14) our ability to determine accurate values of certain assets and liabilities; (15) adverse developments in securities, public

debt, and capital markets, including changes in market liquidity and volatility; (16) our ability to anticipate interest rate changes correctly and

manage interest rate risk presented through unanticipated changes in our interest rate risk position and/or short‐ and long‐term interest rates;

(17) unanticipated changes in our liquidity position, including but not limited to our ability to enter the financial markets to manage and respond

to any changes to our liquidity position; (18) adequacy of our risk management program; (19) increased costs associated with operating as a

public company; (20) competition from other financial services companies in the companies’ markets could adversely affect operations; and (21)

other factors described in Atlantic Capital’s reports filed with the Securities and Exchange Commission and available on the SEC’s website

(www.sec.gov).

2

Non‐GAAP Financial Information

Statements included in this presentation include non‐GAAP financial measures and should be read long with the accompanying tables, which

provide a reconciliation of non‐GAAP financial measures to GAAP financial measures. Atlantic Capital management uses non‐GAAP financial

measures, including: (i) operating net income; (ii) operating non‐interest expense; (iii) operating provision for loan losses; (iv) taxable equivalent

net interest margin; (v) efficiency ratio; (vi) operating return on assets; (vii) operating return on equity; (viii) tangible common equity; and (ix)

deposits excluding deposits assumed in branch sales, in its analysis of the Company's performance.

Management believes that non‐GAAP financial measures provide a greater understanding of ongoing performance and operations, and enhance

comparability with prior periods. Non‐GAAP financial measures should not be considered as an alternative to any measure of performance or

financial condition as determined in accordance with GAAP, and investors should consider Atlantic Capital’s performance and financial condition

as reported under GAAP and all other relevant information when assessing the performance or financial condition of the Company. Non‐GAAP

financial measures have limitations as analytical tools, and investors should not consider them in isolation or as a substitute for analysis of the

results or financial condition as reported under GAAP. Non‐GAAP financial measures may not be comparable to non‐GAAP financial measures

presented by other companies.

3

• Established in May 2007 with $125 million in equity capital, which was, and still is, the largest de novo bank

capital raise in US history

• Publicly traded on NASDAQ since November 2nd, 2015, under the symbol “ACBI”

• Exceptional record of soundness and growth through financial crisis, recession and recent recovery

• Differentiated by providing superior expertise, competitive capabilities, and customized service delivery

4

Atlantic Capital Bank: Our Story

Atlantic Capital Bank: Highlights

Target Markets:

• Small to mid‐sized enterprises with revenues up to $250 million

• Highly‐select group of institutional caliber commercial real estate developers and investors

• Principals of our commercial clients, professionals, and their practices

• Has grown to $2.8 billion in assets

• Initiatives in place to maintain robust top line growth

• Operating model expected to produce enhanced efficiencies going forward

• Consistently maintaining high asset quality

• NPAs/total assets 0.21% as of March 31, 2017

• Focused on Atlanta, Charlotte, Chattanooga, and Knoxville metropolitan markets

• Strong leadership continuity in key markets

• Broad management experience in all business lines

5

Proprietary & Confidential

Atlantic Capital Strategy

Become a premier

southeastern business and

private banking company

6

Accelerate Organic Growth

• Investing in people and capabilities to accelerate organic growth and build profitability

• Well positioned in attractive growth markets

• Attractive interest rate risk position

Strategic Expansion

• Completed acquisition of First Security on October 31, 2015

• Ongoing evaluation of new market expansion through mergers

and acquisitions and de novo entry

• Patient and disciplined approach with focus on shareholder value

7

Key Investment Considerations

Attractive Growth Markets

Strong Deposit Growth

Asset Sensitivity

Loan Growth with Superior Credit Quality

Building a profitable

and sound future

Atlantic Capital Bank Locations

8

Branch Location

Loan Production Office

Main Office Location

Legend

A leading middle market commercial bank operating throughout the southeast

Attractive Market Demographics

1) In thousands; Source: US MSA Census Information + market data from Data.com (Salesforce). 9

City

MSA

Population1

Projected

population growth

for the

next 3 years

# Target

Companies

(>$10MM REV)

# Total

businesses

(>$5MM REV)

# Total

businesses

Median

Household

Income

Atlanta 5,614 6.2% 4,271 8,600 1,261,291 $51,948

Chattanooga 544 3.0% 351 695 88,967 $37,411

Charlotte 2,380 7.4% 1,583 3,028 314,130 $46,119

Knoxville 857 2.4% 535 1,023 112,095 $36,874

10

Financial Highlights

Financial

Performance

Balance Sheet

Capital

Asset Quality

Diluted EPS $ 0.13 $ 0.06 $ 0.15 $ 0.20 $ 0.12

Diluted EPS – operating 0.13 0.07 0.16 0.15 0.14

Efficiency ratio (1) 76.78 % 78.33 % 71.57 % 72.00 % 75.22 %

Return on average assets – operating (1) (2) (3) (5) 0.48 0.25 0.60 0.54 0.52

Net interest margin (tax equivalent) (1) 3.20 3.11 3.12 3.12 3.26

Total assets(4) $ 2,802 $ 2,728 $ 2,761 $ 2,808 $ 2,727

Commercial loans held for investment (4)(6) 1,616 1,609 1,610 1,580 1,527

Deposits (excl. to be assumed in branch sale) (1) (4) 2,174 2,206 2,189 2,158 2,085

Tier 1 capital ratio 10.73 % 10.30 % 9.68 % 9.99 % 9.48 %

Total risk‐based capital ratio 13.77 13.31 12.50 12.96 12.37

Tangible common equity to tangible assets 10.16 10.16 10.19 9.81 9.69

Net charge offs to average loans (5) 0.26 % 0.03 % 0.06 % 0.00 % 0.35 %

NPAs to total assets 0.21 0.13 0.09 0.07 0.08

Allowance for loan and lease losses to loans held for

investment

1.05 1.04 0.92 0.95 0.93

(1) This is a non‐GAAP financial measure. Please see “Non‐GAAP Reconciliation” on slides 26 and 27 for more details.(2) Excludes provision for acquired non PCI

FSG loans. (3) Excludes merger related expenses. (4) Dollars in millions. (5) Annualized. (6) Excluding mortgage warehouse loans.

METRICS Q1 ‘17 Q4 ‘16 Q3 ‘16 Q2 ‘16 Q1 ‘16

$0

$500

$1,000

$1,500

$2,000

$2,500

FY 2013 FY 2014 FY 2015 FY 2016 Q1 2017

11

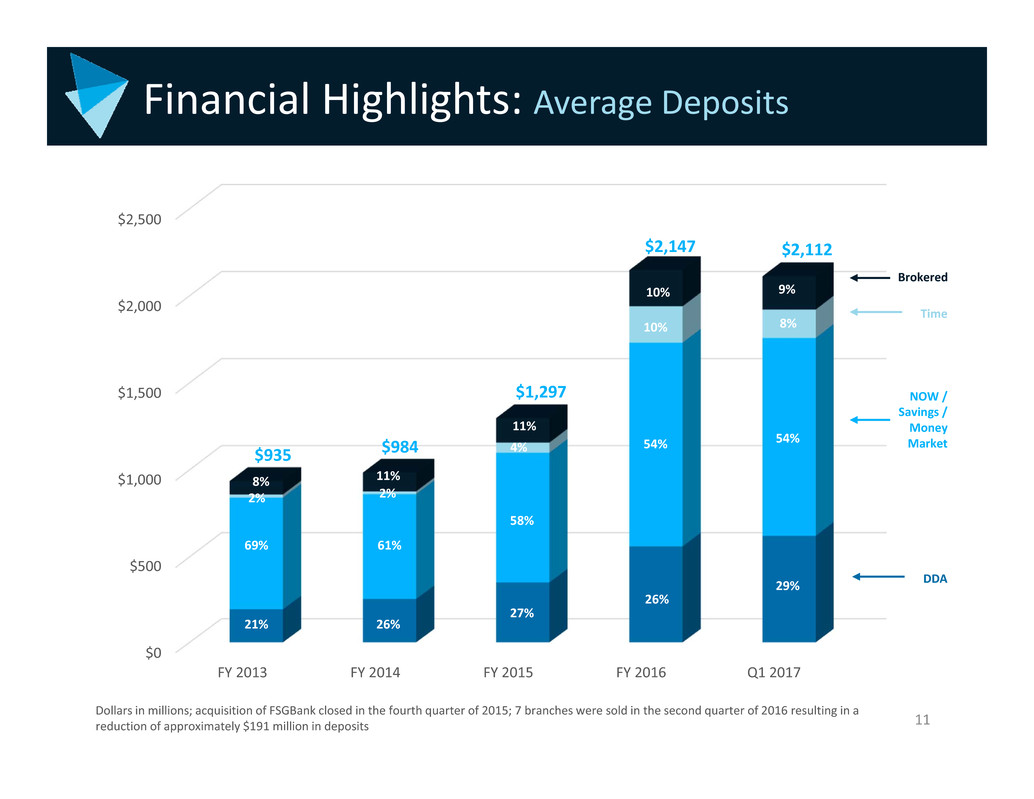

Financial Highlights: Average Deposits

Dollars in millions; acquisition of FSGBank closed in the fourth quarter of 2015; 7 branches were sold in the second quarter of 2016 resulting in a

reduction of approximately $191 million in deposits

DDA

NOW /

Savings /

Money

Market

Time

Brokered

21% 26%

27%

26%

29%

69% 61%

58%

54% 54%

2%

8%

2%

11%

11%

4%

10%

10%

8%

9%

$935 $984

$1,297

$2,147 $2,112

12

Financial Highlights: Average Deposits

Dollars in millions; acquisition of FSGBank closed in the fourth quarter of 2015; 7 branches were sold in the second quarter of 2016 resulting in a

reduction of approximately $191 million in deposits

$0

$500

$1,000

$1,500

$2,000

$2,500

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

26% 25% 26% 28% 29%

52% 55%

57% 54% 54%

12% 10%

8%

8% 8%

10% 10% 9% 10% 9%

$2,156

$2,112$2,095

$2,164$2,135

DDA

NOW /

Savings /

Money

Market

Time

Brokered

Financial Highlights:

13

$0

$500

$1,000

$1,500

$2,000

Dec. 31, 2013 Dec. 31, 2014 Dec. 31, 2015 Dec. 31, 2016 Mar. 31, 2017

$809

$923

$1,707

$1,833 $1,844

$8

$117

$84

$148 $58

$817

$1,040

$1,791

$1,981

$1,902

Dollars in millions; acquisition of FSGBank closed in the fourth quarter of fiscal 2015

Loans Held For Investment

Mortgage

warehouse

14

Financial Highlights: Loans Held for Investment

Dollars in millions

$0

$500

$1,000

$1,500

$2,000

$2,500

Mar. 31, 2016 Jun. 30, 2016 Sep. 30, 2016 Dec. 31, 2016 Mar. 31, 2017

$1,527 $1,580 $1,610 $1,609

$1,616

$236

$236 $227 $224 $228

$124

$126

$171 $148 $58

$1,887 $1,942

$2,008 $1,981

Commercial

Other

Mortgage

warehouse

$1,902

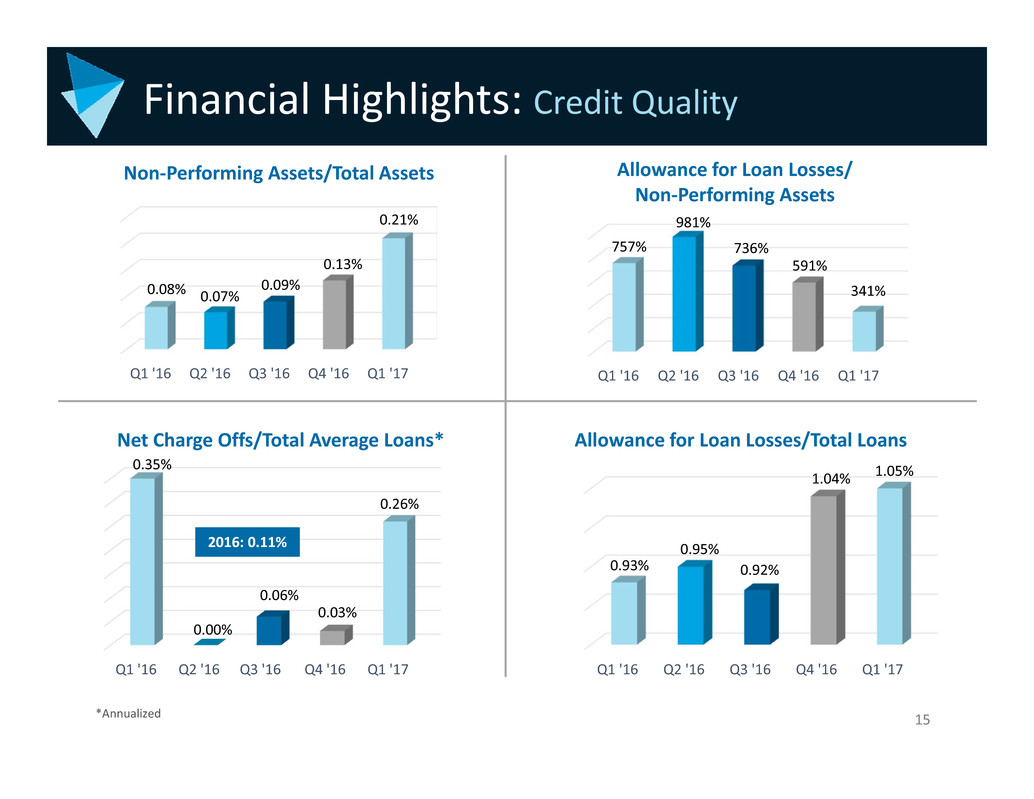

Financial Highlights: Credit Quality

15

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

0.08% 0.07%

0.09%

0.13%

0.21%

Allowance for Loan Losses/

Non‐Performing Assets

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

757%

981%

736%

591%

341%

Net Charge Offs/Total Average Loans* Allowance for Loan Losses/Total Loans

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

0.93%

0.95%

0.92%

1.04% 1.05%

Non‐Performing Assets/Total Assets

Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17

0.35%

0.00%

0.06%

0.03%

0.26%

2016: 0.11%

*Annualized

16

Financial Highlights:

$18,921 $19,283 $19,487 $19,501

$19,508

3.26%

3.12% 3.12% 3.11%

3.20%

3.05%

3.00% 3.00% 2.99%

3.07%

2.70%

2.80%

2.90%

3.00%

3.10%

3.20%

3.30%

$0

$5,000

$10,000

$15,000

$20,000

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Net interest income* Net interest margin* Net interest margin (excl purchase accounting)*

Dollars in thousands

*Net interest margin is taxable equivalent and is a non‐GAAP financial measure. Please see “Non‐GAAP Reconciliation” on slides 26 and 27 for more

details.

Net Interest Margin*

Financial Highlights: Asset Sensitivity

Change in Net Interest Income

17

0%

5%

10%

15%

20%

25%

Up 100 bps Up 200 bps Up 300 bps

7.4%

14.8%

22.1%

1 Year

As of March 31, 2017:

63% of loans are variable rate

28% of deposits are noninterest bearing

18

Financial Highlights: Noninterest Income

Dollars in thousands

$3,885 gain on

sale of branches

Service

charges

Other

noninterest

income

Mortgage

income

SBA lending

activities

Trust income

$0

$2,000

$4,000

$6,000

$8,000

$10,000

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

$1,498 $1,392 $1,270 $1,327 $1,349

$880 $1,204

$959 $599

$1,227

$314

$386

$361

$350

$407$339

$447

$632

$499

$257

$1,389

$5,451

$780 $1,655 $617

$4,995

$3,857

$4,420

$4,002

$8,880

$4,430

19

$0

$5,000

$10,000

$15,000

$20,000

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

$10,555 $10,420 $10,059

$11,269 $11,065

$1,100 $1,274

$1,235

$995 $1,230

$748 $760

$442

$968 $904$916 $694

$617

$1,064 $987

$4,198 $4,280

$4,364

$4,275

$3,558

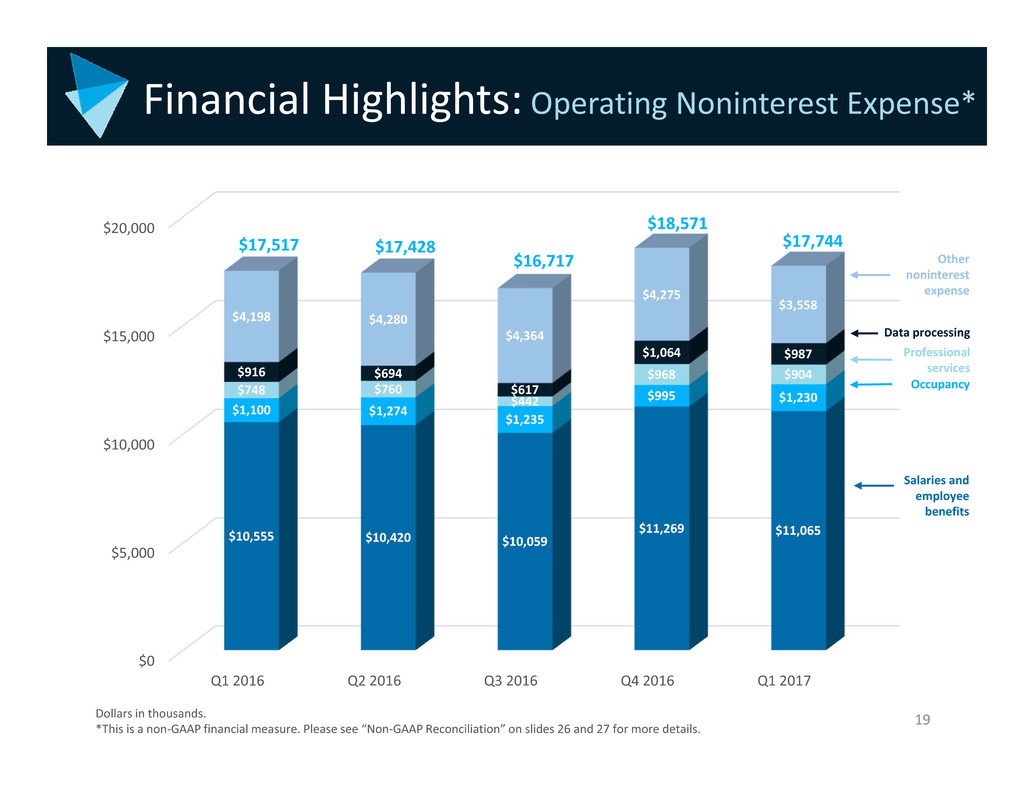

Financial Highlights: Operating Noninterest Expense*

$17,517 $17,428

$16,717

$18,571

Dollars in thousands.

*This is a non‐GAAP financial measure. Please see “Non‐GAAP Reconciliation” on slides 26 and 27 for more details.

Salaries and

employee

benefits

Occupancy

Professional

services

Data processing

Other

noninterest

expense

$17,744

20

Financial Highlights: Regulatory Capital at 3/31/17

0%

2%

4%

6%

8%

10%

12%

14%

10.8%

12.2% 12.2%

13.1%

9.5%

10.7% 10.7%

13.8%

Bank BankHolding

Company

Bank BankHolding

Company

Holding

Company

Holding

Company

Tier 1 leverage ratio Common equity tier 1 capital ratio Tier 1 capital ratio Total capital ratio

APPENDIX

Management Biographies

22

Douglas Williams

Chief Executive Officer

• CEO of Atlantic Capital since its inception

• Former Managing Director and Head of Wachovia Corporation’s International Corporate Finance Group

• Held numerous roles within Wachovia, including EVP and Head of the Global Corporate Banking Division; CRO for all corporate, institutional, and wholesale

banking activities; EVP and Co‐Head of Wachovia’s Capital Markets Division and EVP and Head of Wachovia’s US Corporate Banking Division

• Chairman of the Community Depository Institutions Advisory Council (CDIAC) of the Federal Reserve Bank of Atlanta and its representative to the CDIAC of the

Federal Reserve Board of Governors

• Serves on the Boards of the Metro Atlanta Chamber of Commerce, the Georgia Chamber of Commerce, and the YMCA of Metropolitan Atlanta and the High

Museum of Art and is a Member of the Buckhead Coalition

Michael Kramer

President, Chief Operating Officer

• CEO and President of First Security and CEO of FSGBank from 2011 to 2015

• Former Managing Director of Ridley Capital Group

• Former Director, CEO and President of Ohio Legacy Corporation

• Former COO and CTO of Integra Bank Corporation

• Serves on the Boards of Chattanooga Chamber of Commerce, Chattanooga United Way, The Tennessee Bankers Association and the Chattanooga Young Life

Committee

Patrick Oakes

Executive Vice President,

Chief Financial Officer

• Former CFO of Square 1 Financial, Inc.

• Former EVP and CFO of Encore Bancshares, Inc.

• Former SVP and Treasurer for Sterling Bancshares, Inc.

• Chartered Financial Analyst

Rich Oglesby

Executive Vice President,

Chief Risk Officer

• CRO of Atlantic Capital since its inception

• Former Chief Credit Officer for Wachovia’s Capital Finance business

• Former Head of Risk Management for all of Wachovia’s Capital Markets business

• Serves on the Board of Trustees at Children’s Literature for Children

23

ACBI Historical Balance Sheets

March 31, December 31, March 31,

(in thousands, except share data) 2017 2016 2016

ASSETS

Cash and due from banks $ 34,626 $ 36,790 $ 36,585

Interest-bearing deposits in banks 158,920 118,039 91,608

Other short-term investments 20,870 10,896 32,861

Cash and cash equivalents 214,416 165,725 161,054

Securities available-for-sale 456,942 347,705 366,641

Other investments 28,331 23,806 11,899

Loans held for sale 29,241 35,219 95,291

Loans held for investment 1,901,724 1,981,330 1,886,763

Less: allowance for loan losses (19,939) (20,595) (17,608)

Loans held for investment, net 1,881,785 1,960,735 1,869,155

Branch premises held for sale 2,897 2,995 7,200

Premises and equipment, net 12,308 11,958 22,780

Bank owned life insurance 62,516 62,160 60,981

Goodwill and intangible assets, net 29,186 29,567 33,914

Other real estate owned 1,869 1,872 1,760

Other assets 82,587 85,801 96,213

Total assets $ 2,802,078 $ 2,727,543 $ 2,726,888

LIABILITIES AND SHAREHOLDERS' EQUITY

Deposits:

Noninterest-bearing demand $ 606,386 $ 643,471 $ 560,363

Interest-bearing checking 259,760 264,062 215,176

Savings 30,756 27,932 29,788

Money market 916,390 912,493 862,120

Time 150,867 157,810 187,750

Brokered deposits 209,385 200,223 229,408

Deposits to be assumed in branch sale 29,495 31,589 197,857

Total deposits 2,203,039 2,237,580 2,282,462

Federal funds purchased and securities sold under agreements to repurchase – – 11,824

Federal Home Loan Bank borrowings 217,000 110,000 60,000

Long-term debt 49,408 49,366 49,239

Other liabilities 21,664 26,939 27,348

Total liabilities 2,491,111 2,423,885 2,430,873

SHAREHOLDERS' EQUITY

Preferred stock, no par value; 10,000,000 shares authorized; no shares issued and outstanding

as of March 31, 2017, December 31, 2016, and March 31, 2016 – – –

Common stock, no par value; 100,000,000 shares authorized;

25,535,013, 25,093,135, and 24,569,823 shares issued and outstanding as of

March 31, 2017, December 31, 2016, and March 31, 2016, respectively 296,608 292,747 288,271

Retained earnings 19,766 16,536 6,072

Accumulated other comprehensive income (loss) (5,407) (5,625) 1,672

Total shareholders’ equity 310,967 303,658 296,015

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 2,802,078 $ 2,727,543 $ 2,726,888

Atlantic Capital Bancshares, Inc.

Consolidated Balance Sheets (unaudited)

24

ACBI Historical Income Statements

Atlantic Capital Bancshares, Inc.

Consolidated Statements of Income (unaudited)

(in thousands except share and per share data)

March 31,

2017

December

31, 2016

September

30, 2016

June 30,

2016

March 31,

2016

INTEREST INCOME

Loans, including fees $ 19,994 $ 20,363 $ 20,511 $ 20,282 $ 19,625

Investment securities - available-for-sale 2,018 1,477 1,293 1,327 1,601

Interest and dividends on other interest‑earning assets 449 467 491 507 273

Total interest income 22,461 22,307 22,295 22,116 21,499

INTEREST EXPENSE

Interest on deposits 2,047 1,929 1,956 1,841 1,673

Interest on Federal Home Loan Bank advances 302 234 133 147 44

Interest on federal funds purchased and securities sold under

agreements to repurchase 36 38 37 87 67

Interest on long-term debt 823 828 815 832 810

Other – – – – 38

Total interest expense 3,208 3,029 2,941 2,907 2,632

NET INTEREST INCOME BEFORE PROVISION FOR LOAN LOSSES 19,253 19,278 19,354 19,209 18,867

Provision for loan losses 634 2,208 463 777 368

NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 18,619 17,070 18,891 18,432 18,499

NONINTEREST INCOME

Service charges 1,349 1,327 1,270 1,392 1,498

Gains on sale of securities available-for-sale – – – 11 33

Gains on sale of other assets 78 238 71 31 48

Mortgage income 257 499 632 447 339

Trust income 407 350 361 386 314

Derivatives income (51) 346 69 98 65

Bank owned life insurance 378 395 424 398 393

SBA lending activities 1,227 599 959 1,204 880

TriNet lending activities 20 357 – 761 383

Gains on sale of branches – – – 3,885 –

Other noninterest income 192 319 216 267 467

Total noninterest income 3,857 4,430 4,002 8,880 4,420

NONINTEREST EXPENSE

Salaries and employee benefits 11,065 11,269 10,059 10,420 10,555

Occupancy 1,230 995 1,235 1,274 1,100

Equipment and software 805 694 862 724 686

Professional services 904 968 442 760 748

Postage, printing and supplies 85 73 61 159 169

Communications and data processing 987 1,064 617 694 916

Marketing and business development 270 247 269 317 267

FDIC premiums 314 262 415 493 398

Merger and conversion costs – 204 579 1,210 749

Amortization of intangibles 470 495 520 668 762

Foreclosed property/problem asset expense 3 666 39 55 104

Other noninterest expense 1,611 1,838 2,198 2,169 1,812

Total noninterest expense 17,744 18,775 17,296 18,943 18,266

INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES 4,732 2,725 5,597 8,369 4,653

Provision for income taxes 1,502 1,116 1,889 3,222 1,722

NET INCOME (LOSS) $ 3,230 $ 1,609 $ 3,708 $ 5,147 $ 2,931

Net income (loss) per common share ‑ basic $ 0.13 $ 0.06 $ 0.15 $ 0.21 $ 0.12

Net income (loss) per common share ‑ diluted $ 0.13 $ 0.06 $ 0.15 $ 0.20 $ 0.12

Weighted average shares - basic 25,320,690 25,027,304 24,891,822 24,644,755 24,485,900

Weighted average shares - diluted 25,672,286 25,407,728 25,260,280 25,158,694 24,993,597

Three months ended

25

ACBI Operating Income

(1) Interest income has been increased to reflect comparable interest on taxable securities. The rate used was 35%, reflecting the statutory

federal income tax rate. (2) Excludes merger related expenses. This is a non‐GAAP financial measure. Please see “Non‐GAAP Reconciliation” on

slides 26 and 27 for more details.

ATLANTIC CAPITAL BANCSHARES, INC.

Selected Financial Information

2017

(in thousands; taxable equivalent)

First

Quarter

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

INCOME SUMMARY

Interest income (1) 22,716$ 22,530$ 22,428$ 22,190$ 21,553$

Interest expense 3,208 3,029 2,941 2,907 2,632

Net interest income 19,508 19,501 19,487 19,283 18,921

Provision for loan losses 634 2,208 463 777 368

Net interest income after provision for loan losses 18,874 17,293 19,024 18,506 18,553

Operating noninterest income 3,857 4,430 4,002 4,995 4,420

Operating noninterest expense (2) 17,744 18,571 16,717 17,428 17,517

Operating income before income taxes 4,987 3,152 6,309 6,073 5,456

Operating income tax expense 1,757 1,417 2,245 2,381 2,065

Operating net income (2) 3,230 1,735 4,064 3,692 3,391

Merger related expenses, net of income tax - 126 356 743 460

Net gain on sale of branches, net of income tax - - - 2,198 -

Net income - GAAP 3,230$ 1,609$ 3,708$ 5,147$ 2,931$

2016

Non‐GAAP Reconciliation

26

ATLANTIC CAPITAL BANCSHARES, INC.

Non-GAAP Performance Measures Reconciliation

(in thousands, except share and per share data)

2017

First Quarter Fourth Quarter Third Quarter Second Quarter First Quarter

Interest income reconciliation

Interest income - GAAP $ 22,461 $ 22,307 $ 22,295 $ 22,116 $ 21,499

Taxable equivalent adjustment 255 223 133 74 54

Interest income - taxable equivalent $ 22,716 $ 22,530 $ 22,428 $ 22,190 $ 21,553

Net interest income reconciliation

Net interest income - GAAP $ 19,253 $ 19,278 $ 19,354 $ 19,209 $ 18,867

Taxable equivalent adjustment 255 223 133 74 54

Net interest income - taxable equivalent $ 19,508 $ 19,501 $ 19,487 $ 19,283 $ 18,921

Operating noninterest income reconciliation

Noninterest income - GAAP $ 3,857 $ 4,430 $ 4,002 $ 8,880 $ 4,420

Gain on sale of branches - - - (3,885) -

Operating noninterest income $ 3,857 $ 4,430 $ 4,002 $ 4,995 $ 4,420

Operating noninterest expense reconciliation

Noninterest expense - GAAP $ 17,744 $ 18,775 $ 17,296 $ 18,943 $ 18,266

Merger-related expenses - (204) (579) (1,210) (749)

Divestiture expenses - - - (305) -

Operating noninterest expense $ 17,744 $ 18,571 $ 16,717 $ 17,428 $ 17,517

Operating income before income taxes reconciliation

Income (loss) before income taxes - GAAP $ 4,732 $ 2,725 $ 5,597 $ 8,369 $ 4,653

Taxable equivalent adjustment 255 223 133 74 54

Merger-related expenses - 204 579 1,210 749

Divestiture expenses - - - 305 -

Gain on sale of branches - - - (3,885) -

Operating income before income taxes $ 4,987 $ 3,152 $ 6,309 $ 6,073 $ 5,456

Income tax reconciliation

Income tax expense - GAAP $ 1,502 $ 1,116 $ 1,889 $ 3,222 $ 1,722

Taxable equivalent adjustment 255 223 133 74 54

Merger related expenses, tax benefit - 78 223 467 289

Divestiture expenses, tax benefit - - - 118 -

Gain on sale of branches, tax expense - - - (1,500) -

Operating income tax expense $ 1,757 $ 1,417 $ 2,245 $ 2,381 $ 2,065

Net income reconciliation

Net income - GAAP $ 3,230 $ 1,609 $ 3,708 $ 5,147 $ 2,931

Merger related expenses, net of income tax - 126 356 743 460

Divestiture expenses, net of income tax - - - 187 -

Gain on sale of branches, net of income tax - - - (2,385) -

Operating net income $ 3,230 $ 1,735 $ 4,064 $ 3,692 $ 3,391

Diluted earnings per share reconciliation

Diluted earnings per share - GAAP $ 0.13 $ 0.06 $ 0.15 $ 0.20 $ 0.12

Merger related expenses - 0.01 0.01 0.03 0.02

Net gain on sale of branches - - - (0.08) -

Diluted earnings per share - operating $ 0.13 $ 0.07 $ 0.16 $ 0.15 $ 0.14

Book value per common share reconciliation

Total shareholders’ equity $ 310,967 $ 303,658 $ 308,463 $ 304,066 $ 294,652

Intangible assets (29,186) (29,567) (30,071) (31,674) (33,914)

Total tangible common equity $ 281,781 $ 274,091 $ 278,392 $ 272,392 $ 260,738

Common shares outstanding 25,535,013 25,093,135 24,950,099 24,750,163 24,569,823

Book value per common share - GAAP $ 12.18 $ 12.10 $ 12.36 $ 12.29 $ 11.99

Tangible book value 11.04 10.92 11.16 11.01 10.61

2016

Non‐GAAP Reconciliation (continued)

27

ATLANTIC CAPITAL BANCSHARES, INC.

Non-GAAP Performance Measures Reconciliation

(in thousands, except share and per share data)

2017

First Quarter Fourth Quarter Third Quarter Second Quarter First Quarter

Return on average equity reconciliation

Net income - GAAP $ 3,230 $ 1,609 $ 3,708 $ 5,147 $ 2,931

Merger related expenses, net of income tax - 126 356 743 460

Divestiture expenses, net of income tax - - - 187 -

Gain on sale of branches, net of income tax - - - (2,385) -

Operating net income $ 3,230 $ 1,735 $ 4,064 $ 3,692 $ 3,391

Average shareholders' equity 308,261 308,588 306,642 299,170 291,806

Return on average equity - GAAP 4.19% 2.09% 4.84% 6.88% 4.02%

Return on average equity - operating 4.19% 2.25% 5.30% 4.94% 4.65%

Return on average assets reconciliation

Net income - GAAP $ 3,230 $ 1,609 $ 3,708 $ 5,147 $ 2,931

Merger related expenses, net of income tax - 126 356 743 460

Divestiture expenses, net of income tax - - - 187 -

Gain on sale of branches, net of income tax - - - (2,385) -

Operating net income $ 3,230 $ 1,735 $ 4,064 $ 3,692 $ 3,391

Average assets 2,694,715 2,722,444 2,717,996 2,718,110 2,620,750

Return on average assets - GAAP 0.48% 0.24% 0.55% 0.76% 0.45%

Return on average assets - operating 0.48% 0.25% 0.60% 0.54% 0.52%

Efficiency ratio reconciliation

Noninterest income - GAAP $ 3,857 $ 4,430 $ 4,002 $ 8,880 $ 4,420

Gain on sale of branches - - - (3,885) -

Operating noninterest income $ 3,857 $ 4,430 $ 4,002 $ 4,995 $ 4,420

Noninterest expense - GAAP $ 17,744 $ 18,775 $ 17,296 $ 18,943 $ 18,266

Merger-related expenses - (204) (579) (1,210) (749)

Divestiture expenses - - - (305) -

Operating noninterest expense $ 17,744 $ 18,571 $ 16,717 $ 17,428 $ 17,517

Net interest income 19,253 19,278 19,354 19,209 18,867

Efficiency ratio 76.78% 78.33% 71.57% 72.00% 75.22%

Tangible common equity to tangible assets reconciliation

Total shareholders’ equity $ 310,967 $ 303,658 $ 308,463 $ 304,066 $ 294,652

Intangible assets (29,186) (29,567) (30,071) (31,674) (33,914)

Total tangible common equity $ 281,781 $ 274,091 $ 278,392 $ 272,392 $ 260,738

Total assets $ 2,802,078 $ 2,727,543 $ 2,761,244 $ 2,807,822 $ 2,724,669

Intangible assets (29,186) (29,567) (30,071) (31,674) (33,914)

Total tangible assets $ 2,772,892 $ 2,697,976 $ 2,731,173 $ 2,776,148 $ 2,690,755

Tangible common equity to tangible assets 10.16% 10.16% 10.19% 9.81% 9.69%

Deposits excluding deposits to be assumed in branch sales

Total deposits $ 2,203,039 $ 2,237,580 $ 2,188,856 $ 2,158,305 $ 2,282,462

Deposits to be assumed in branch sales (29,495) (31,589) - - (197,857)

Deposits excluding deposits to be assumed in branch sales $ 2,173,544 $ 2,205,991 $ 2,188,856 $ 2,158,305 $ 2,084,605

Loans held for investment excluding mortgage warehouse loans

Total loans held for investment $ 1,901,724 $ 1,981,330 $ 2,008,102 $ 1,942,137 $ 1,886,763

Mortgage warehouse loans (58,357) (147,519) (171,251) (126,108) (123,875)

Loans held for investment excluding mortgage warehouse loans $ 1,843,367 $ 1,833,811 $ 1,836,851 $ 1,816,029 $ 1,762,888

2016