Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Atlantic Union Bankshares Corp | v467560_ex99-1.htm |

| 8-K - FORM 8-K - Atlantic Union Bankshares Corp | v467560_8k.htm |

Merger Investor Presentation May 22, 2017 Exhibit 99.2

1 Forward Looking Statements Certain statements in this presentation may constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements are statements that include projections, predictions, expectations, o r beliefs about future events or results or otherwise are not statements of historical fact, are based on certain assumptions as of the ti me they are made, and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Such state men ts are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “p roj ect,” “anticipate,” “intend,” “will,” “may,” “view,” “opportunity,” “potential,” or words of similar meaning or other statements co nce rning opinions or judgment of Union Bankshares Corporation (“Union” or “UBSH”) or Xenith Bankshares, Inc. (“Xenith” or “XBKS”) or their management about future events. Such statements include statements as to the anticipated benefits of the merger, including f utu re financial and operating results, cost savings and enhanced revenues as well as other statements regarding the merger. Althou gh each of Union and Xenith believes that its expectations with respect to forward - looking statements are based upon reasonable assumpti ons within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, pe rfo rmance, or achievements of Union or Xenith will not differ materially from any projected future results, performance, or achievements ex pressed or implied by such forward - looking statements. Actual future results and trends may differ materially from historical results o r those anticipated depending on a variety of factors, including but not limited to: (1) the businesses of Union and Xenith may not b e i ntegrated successfully or such integration may be more difficult, time - consuming or costly than expected; (2) expected revenue synergies a nd cost savings from the merger may not be fully realized or realized within the expected time frame; (3) revenues following the me rger may be lower than expected; (4) customer and employee relationships and business operations may be disrupted by the merger; ( 5) the ability to obtain required regulatory and shareholder approvals, and the ability to complete the merger on the expected t ime frame may be more difficult, time - consuming or costly than expected; (6) changes in interest rates, general economic conditions, tax r ates, legislative/regulatory changes, monetary and fiscal policies of the U.S. government, including policies of the U.S. Treasury and the Board of Governors of the Federal Reserve System; the quality and composition of the loan and securities portfolios; demand f or loan products; deposit flows; competition; demand for financial services in the companies’ respective market areas; their implemen tat ion of new technologies; their ability to develop and maintain secure and reliable electronic systems; and accounting principles, po lic ies, and guidelines, and (7) other risk factors detailed from time to time in filings made by Union or Xenith with the Securities and Exc hange Commission (the “SEC”). Forward - looking statements speak only as of the date they are made and Union and Xenith undertake no obligation to update or clarify these forward - looking statements, whether as a result of new information, future events or other wise.

2 Additional Information Additional Information and Where to Find It In connection with the proposed merger, Union will file with the SEC a registration statement on Form S - 4 to register the shares of Union common stock to be issued to the shareholders of Xenith. The registration statement will include a joint proxy statement of Union an d X enith and a prospectus of Union. A definitive joint proxy statement/prospectus will be sent to the shareholders of Union and Xenith seeking their a ppr oval of the merger and related matters. This release does not constitute an offer to sell or the solicitation of an offer to buy any securities or a so licitation of any vote or approval. Before making any voting or investment decision, investors and shareholders of Union and Xenith are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments there to, because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described below. Investors and shareholders of both companies are urged to read the registration statement on Form S - 4 and the joint proxy statem ent/prospectus included within the registration statement and any other relevant documents to be filed with the SEC in connection with the p rop osed merger because they will contain important information about Union, Xenith and the proposed transaction. Investors and shareholders of both com panies are urged to review carefully and consider all public filings by Union and Xenith with the SEC, including but not limited to their Annual Rep orts on Form 10 - K, their proxy statements, their Quarterly Reports on Form 10 - Q, and their Current Reports on Form 8 - K. Investors and shareholders may ob tain free copies of these documents through the website maintained by the SEC at www.sec.gov. Free copies of the joint proxy statement/prospec tus and other documents filed with the SEC also may be obtained by directing a request by telephone or mail to Union Bankshares Corporation , 1 051 East Cary Street, Suite 1200, Richmond, Virginia 23219, Attention: Investor Relations (telephone: (804) 633 - 5031), or Xenith Bankshares, Inc., 901 E. Cary Street Richmond, Virginia, 23219, Attention: Thomas W. Osgood (telephone: (804) 433 - 2200), or by accessing Union’s website at www.banka tunion.com under “Investor Relations” or Xenith’s website at www.xenithbank.com under “Investor Relations” under “About Us.” The informa tio n on Union’s and Xenith’s websites is not, and shall not be deemed to be, a part of this release or incorporated into other filings either com pan y makes with the SEC. Union and Xenith and their respective directors and executive officers may be deemed to be participants in the solicitation o f p roxies from the shareholders of Union and/or Xenith in connection with the merger. Information about the directors and executive officers of Uni on is set forth in the proxy statement for Union’s 2017 annual meeting of shareholders filed with the SEC on March 21, 2017. Information about the dir ectors and executive officers of Xenith is set forth in Xenith’s Annual Report on Form 10 - K, as amended, filed with the SEC on May 1, 2017. Additiona l information regarding the interests of these participants and other persons who may be deemed participants in the merger may be obtained by reading th e joint proxy statement/prospectus regarding the merger when it becomes available. Free copies of these documents may be obtained as descri bed above.

3 2017 Priorities for Union Diversification Core Funding Efficiency $10 billion Asset Crossing • Loan portfolio • Revenue streams • Pace loan growth with deposit growth • Target 95% loan - to - deposit ratio over time • Drive efficiency ratio to <60 % • More revenue + lower cost structure • Finalize preparations in 2017 “We would love to continue to increase density in Virginia, particularly in some of the larger markets where we have a presence, but are not as dense as we would like to be. A good example would be the Greater Hampton Roads, second most populous area of Virginia .” - John C. Asbury, President & CEO, Q4 ’16 Earnings Call

4 Transaction Highlights x Solidifies position as Virginia’s preeminent community bank with ~$ 12 billion in pro forma assets x Provides breadth and depth across Virginia, including significant expansion in the attractive Hampton Roads market x Leverages Xenith’s C&I expertise throughout the combined footprint x Attractive commercial lending expertise x Strong core deposit base x Compatible cultures with similar strategies and community focus x Efficiently crosses $10 billion in assets with positive operating leverage x Immediately accretive to EPS in 2018 x Immediately accretive to tangible book value with no earnback period x Transaction metrics remain attractive under a lower federal corporate tax rate x Comprehensive due diligence and integration planning process x Strong understanding of markets and credit culture x Readiness to cross $10 billion in assets Strategically Compelling Builds Upon Strengths Financially Attractive Low Risk

5 Overview of Xenith Bankshares, Inc. Dollars in millions Source: SNL Financial Data as of or for the three months ended 3/31/17 • Headquartered in Richmond, Virginia with 42 branches across Virginia, Maryland, North Carolina and the greater Washington , D.C . area • 5 th largest bank by assets headquartered in Virginia • In July 2016 legacy Hampton Roads Bankshares closed the acquisition of $1.1 billion legacy Xenith Bankshares. The combined entity assumed the Xenith name with many legacy Xenith executive management maintaining their leadership roles Key Franchise Facts XBKS (42) FINANCIAL HIGHLIGHTS Headquarters Richmond, VA Year Established 1987 Branches 42 CEO (Age) T. Gaylon Layfield III (65) Total Assets $3,199 Total Loans 2,357 Deposits 2,620 Loans / Deposits 90.0 % ROAA 0.70 % Net Interest Margin 3.45 Efficiency Ratio 67.8 NPAs / Assets 1.82 % Reserves / NPLs 34.4 Reserves / Loans 0.78 Tang. Com. Equity / Tang. Assets 13.89 % Leverage Ratio 11.17 CET1 Ratio 12.76 Tier 1 Capital Ratio 12.86 Total Capital Ratio 13.85 C&D / Total Bank Capital 77 % CRE / Total Bank Capital 250

6 Virginia North Carolina Maryland Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Staunton Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Charlottesville Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Richmond Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Roanoke Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Fredricksburg Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Norfolk Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Raleigh Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Greensboro Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Virginia Beach Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Asheville Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Washington Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Baltimore Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte Charlotte 40 40 95 95 8 5 8 5 66 64 81 81 77 64 70 270 95 95 Note: Financial data as of 3/31/2017 Dollars in billions (1) Excludes purchase accounting adjustments (2) Regional bank defined as having less than $50 billion in assets UBSH (113) XBKS (42) Our Combined Company Pro Forma Branch Footprint Pro Forma Highlights (1) x #1 pro forma Regional Bank deposit market share ranking in Virginia (2) x Accelerates growth in attractive Hampton Roads market x Expands Union’s retail footprint into North Carolina and Maryland x Leverages Xenith’s C&I expertise throughout Union’s markets x Increased scale – serving a larger, diversified client base x Added convenience and wider product and service offerings for customers Assets $11.9B Loans $8.9B Deposits $9.2B Branches 155

7 Deposits Market Rank Institution ($mm) Share Branches 1 Wells Fargo & Co. $38,613 20.32% 284 2 Bank of America Corp. 26,154 13.76 130 3 BB&T Corp. 22,631 11.91 344 4 SunTrust Banks Inc. 19,015 10.01 193 5 Capital One Financial Corp. 14,812 7.79 59 Pro Forma 8,105 4.26 143 6 United Bankshares Inc. 7,090 3.73 73 7 Union Bankshares Corp. 6,102 3.21 113 8 TowneBank 5,704 3.00 32 9 Carter Bank & Trust 3,948 2.08 88 10 PNC Financial Services Group Inc. 3,479 1.83 96 13 Xenith Bankshares Inc. 2,003 1.05 30 Enhanced Presence in Key Markets Source: SNL Financial Deposit data as of 6/30/16; pro forma for announced transactions Virginia Beach - Norfolk - Newport News, VA - NC MSA Deposits Market Rank Institution ($mm) Share Branches 1 TowneBank $5,133 21.51% 26 2 Wells Fargo & Co. 4,713 19.75 52 3 SunTrust Banks Inc. 3,887 16.29 36 4 BB&T Corp. 3,120 13.07 47 5 Bank of America Corp. 2,855 11.96 32 Pro Forma 1,080 4.52 26 6 Xenith Bankshares Inc. 922 3.86 21 7 Old Point Financial Corp. 729 3.06 20 8 Southern BancShares (N.C.) Inc. 459 1.92 11 9 PNC Financial Services Group Inc. 389 1.63 11 10 Chesapeake Financial Shares Inc. 331 1.39 8 14 Union Bankshares Corp. 157 0.66 5 Deposits Market Rank Institution ($mm) Share Branches 1 Bank of America Corp. $12,320 35.60% 23 2 Wells Fargo & Co. 6,754 19.52 62 3 SunTrust Banks Inc. 4,434 12.81 39 4 BB&T Corp. 3,200 9.25 40 Pro Forma 2,502 7.23 36 5 Union Bankshares Corp. 1,827 5.28 32 6 C&F Financial Corp. 776 2.24 17 7 TowneBank 735 2.12 9 8 Xenith Bankshares Inc. 675 1.95 4 9 South State Corp. 542 1.57 8 10 Community Bankers Trust Corp. 519 1.50 10 Richmond, VA MSA Virginia

8 Market Demographics Deposits (1) UBSH XBKS Pro Forma '17-'22 2022 Proj. Gross Population Household Domestic Number Market 2017 Growth Income Product (2) of Deposits Deposits Deposits Share Market UBSH XBKS Population (%) ($) ($bn) Businesses ($mm) ($mm) ($mm) (%) Washington, D.C. 6,203,724 5.5% $95,629 $491.0 219,675 $1,166.5 $174.8 $1,341.3 0.7% Virginia Beach, VA 1,743,468 3.5 63,930 95.7 58,790 157.4 922.2 1,079.6 4.5 Richmond, VA 1,285,883 4.6 67,686 74.1 46,613 1,827.3 674.5 2,501.8 7.2 Raleigh, NC 1,305,052 8.2% $70,453 $75.8 45,485 -- $67.9 $67.9 0.3% Salisbury, MD 402,439 5.2 63,679 16.1 17,569 -- 127.1 127.1 1.8 Elizabeth City, NC 63,536 1.3 51,437 NA 2,523 -- 248.3 248.3 30.6 Kill Devil Hills, NC 40,288 4.4 61,158 NA 3,648 -- 54.1 54.1 4.8 Roanoke, VA 316,013 2.7% $55,867 $14.5 13,288 $378.4 -- $378.4 5.2% Lynchburg, VA 262,137 3.4 53,020 9.3 9,151 180.3 -- 180.3 3.8 Charlottesville, VA 233,423 4.7 67,126 12.2 10,643 446.7 -- 446.7 9.9 Blacksburg, VA 183,199 2.9 48,740 6.7 6,059 614.5 -- 614.5 20.6 Winchester, VA 135,021 3.8 58,405 5.9 5,416 91.8 -- 91.8 3.7 Harrisonburg, VA 133,374 4.6 54,686 7.4 4,615 128.2 -- 128.2 6.0 Staunton, VA 121,226 2.7 54,245 5.0 4,417 368.4 -- 368.4 25.1 UBSH XBKS Shared Builds Presence in Key Markets Source: SNL Financial; Bureau of Economic Analysis (1) Deposits and deposit market share data is as of 6/30/2016 (2) GDP is for the year ended 12/31/2015

9 Hampton Roads Market Highlights Source: SNL Financial; Hampton Roads Chamber of Commerce; Hampton Roads Economic Development Alliance (1) Includes companies in the Virginia Beach MSA with NAICs as Healthcare and Social Assistance, Wholesale Trade, Manufacturing or Transportation and Warehousing. Demographics Hampton Roads Market Overview ▪ The Hampton Roads market is roughly defined as the Virginia Beach Metropolitan Statistical Area (MSA) ▪ It is recognized as the 33rd largest MSA in the United States, eighth largest metro area in the Southeast United States and the second largest between Atlanta and Washington, DC ▪ It is the second largest in Virginia, with a total population of 1.7 million people ▪ It is a vibrant, Mid - Atlantic region with a skilled workforce, world - class port facilities and a diverse economy ▪ The region boasts presence of 155+ international companies, a 50 foot shipping channel and 128 million consumers within one day’s drive ▪ 120,000 active duty, reserve and civilian military / defense personnel and 838,400 person civilian labor force, 91% with a high school diploma or higher ▪ Home to three Fortune 500 Corporations ▪ Hampton Roads is the mid - Atlantic leader in U.S. waterborne foreign commerce and is ranked second nationally behind the Port of South Louisiana based on export tonnage ▪ Total C&I businesses (1) : 9,126 3.5% 5.9% 4.2% 4.4% 3.8% 7.3% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Projected Population Growth 2017 - 2022 (%) Projected Median HHI Growth 2017 - 2022 (%) Virginia Beach MSA Virginia United States Companies Headquartered in the Area

10 Achieves 2017 Priorities for Union • Lowers CRE concentration and increases C&I portfolio • Adds dedicated C&I team in Northern Virginia and significant C&I opportunity in Hampton Roads and Raleigh • Lowers loan to deposit ratio to 97% • Adds meaningful retail presence in Hampton Roads • Expands commercial deposit base and opportunity • Efficiency ratio expected to be below 60% after cost savings are realized • Efficiently crosses from a financial perspective • Infrastructure build out substantially complete Diversification Core Funding Efficiency $10 billion Asset Crossing • Loan portfolio • Revenue streams • Pace loan growth with deposit growth • Target 95% loan to deposit ratio over time • Drive efficiency ratio to <60 % • More revenue + lower cost structure • Finalize preparations in 2017

11 Consideration (2) Pro Forma Ownership Executive Management Board of Directors Anticipated Close Transaction Structure and Key Terms Note: Financial data as of 3/31/2017, unless otherwise noted Dollars in millions (1) Combined represents the sum of UBSH and XBKS data and excludes any purchase accounting marks or merger adjustments (2) Based upon closing prices as of 5/19/2017 Combined (1) Total assets $8,670 $3,199 $11,869 Loans held for investment 6,554 2,357 8,911 Total deposits 6,617 2,620 9,237 Market capitalization (2) 1,378 621 1,999 Branches 113 42 155 • $701 million in diluted transaction value • Fixed exchange ratio of 0.9354x of a share of UBSH for each share of XBKS common stock • 100% stock • Outstanding in - the - money options and U.S. Treasury warrants to be cashed out at closing • Remaining in - the - money warrants to be converted into UBSH warrants at closing • 67% UBSH / 33% XBKS • John C. Asbury – President & Chief Executive Officer • T. Gaylon Layfield – Executive Vice Chairman (for a transitional period) • Robert M. Gorman – Executive Vice President and Chief Financial Officer • Two Xenith representatives to join the combined company board of directors • First quarter of 2018, subject to customary regulatory and shareholder approvals

12 Key Assumptions Cost Savings Credit Mark ▪ Gross loan credit mark of approximately 1.5%, or $37 million ▪ Expected to be approximately $28 million pre - tax (fully phased - in) − ~40 % of XBKS ’ 2018 estimated noninterest expense − 80% realized in 2018, 100% annually thereafter Merger & Integration Costs ▪ Expected to be approximately $33 million after - tax $10 Billion Crossing Impact ▪ Pre - tax impact ~$11 million annualized, beginning third quarter 2019 Other Adjustments ▪ Core deposit intangible of 1.50% ($26 million) assumed on non - time deposits, amortized sum - of - years’ - digits over 10 years ▪ Borrowings write - up of $9 million Deferred Tax Asset ▪ No write - down of deferred tax asset required under current federal corporate tax rate of 35% ▪ Under a 25% federal corporate tax rate the deferred tax asset would be written down by ~$42 million Revenue Enhancements ▪ Identified revenue opportunities, but none assumed in financial model F ederal Corporate Tax Rate ▪ 3 5%

12 Key Assumptions Cost Savings Credit Mark ▪ Gross loan credit mark of approximately 1.5%, or $37 million ▪ Expected to be approximately $28 million pre - tax (fully phased - in) − ~40 % of XBKS ’ 2018 estimated noninterest expense Merger & Integration Costs ▪ Expected to be approximately $33 million after - tax $10 Billion Crossing Impact ▪ Pre - tax impact ~$11 million annualized, beginning third quarter 2019 Other Adjustments ▪ Core deposit intangible of 1.50% ($26 million) assumed on non - time deposits, amortized sum - of - years’ - digits over 10 years ▪ Borrowings write - up of $9 million Deferred Tax Asset ▪ No write - down of deferred tax asset required under current federal corporate tax rate of 35% ▪ Under a 25% federal corporate tax rate the deferred tax asset would be written down by ~$42 million Revenue Enhancements ▪ Identified revenue opportunities, but none assumed in financial model F ederal Corporate Tax Rate ▪ 3 5%

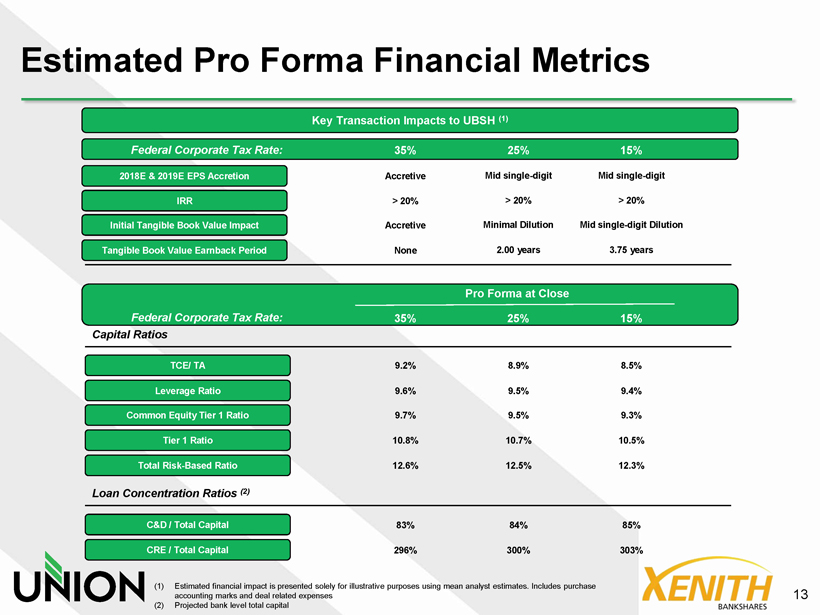

13 Estimated Pro Forma Financial Metrics (1) Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates. Includes purchase accounting marks and deal related expenses (2) Projected bank level total capital Key Transaction Impacts to UBSH (1) 2018E & 2019E EPS Accretion IRR Initial Tangible Book Value Impact Tangible Book Value Earnback Period Capital Ratios TCE/ TA Leverage Ratio Common Equity Tier 1 Ratio Tier 1 Ratio Total Risk - Based Ratio Loan Concentration Ratios (2) C&D / Total Capital CRE / Total Capital Accretive > 20% Accretive None 9.2% 9.6% 9.7% 10.8% 12.6% 8 .9% 9.5% 9.5% 10.7% 12.5% 8.5% 9.4% 9.3% 10.5% 12.3% 83% 296% 84% 300% 85% 303% Pro Forma at Close 35% Federal Corporate Tax Rate: 25% 1 5% Mid single - digit > 20% Minimal Dilution 2.00 years Mid single - digit > 20% Mid single - digit Dilution 3.75 years 35% Federal Corporate Tax Rate: 25% 1 5%

14 Comprehensive Due Diligence and Preparation Deferred Tax Asset ▪ Tax advisors completed thorough analysis on Xenith’s $154.9 million deferred tax asset ‒ Expect no impairment of Xenith’s deferred tax asset due to Section 382 ‒ Anticipate up to $42 million write - off under an assumed federal tax rate of 25% Thorough Due Diligence Process ▪ Engaged third party resources for Credit, Tax and Legal diligence ▪ Credit diligence ‒ Reviewed 50% of all outstanding commercial loan balances ‒ Reviewed 74% of all commercial loans risk - graded special mention or worse ‒ Reviewed 78% of all commercial classified loan balances ▪ Additional diligence in areas of ‒ Retail / marketing strategy ‒ Commercial segment ‒ Marine finance ‒ Finance / accounting Crossing $10 Billion ▪ Union has been preparing to cross $10 billion in assets since 2014 ▪ Merger will help defray the incremental regulatory expenses over a larger earnings and asset base ▪ Expect Durbin impact on interchange fees starting July 1, 2019 ▪ Expect first DFAST submission by July 31, 2019 ‒ Risk management ‒ IT / bank operations ‒ Human resources Capital Plan ▪ Pro forma company to remain “well capitalized” ▪ C&D and CRE loan concentration ratios anticipated to remain in - line with current ratios

15 Crossing $10 Billion ▪ Union has been preparing to grow through $10 billion in assets since 2014 − Union has invested approximately $5 million pre - tax annual run rate in people, systems and infrastructure in IT, Enterprise Risk and DFAST (Dodd Frank Stress Test) − Accelerates Union’s growth over $10 billion in assets by one year ▪ Organic growth: Mid 2019 ▪ With this transaction closing: Q1 2018 − Based on a Q1 2018 closing of the transaction, Union expects its reporting timeline to be as follows: ▪ “As - of” date for first stress test December 31, 2018 ▪ First stress test reporting date July 31, 2019 ▪ First public disclosure October 15 - 31, 2019 ▪ Durbin amendment − The Durbin amendment will limit the combined company’s fees charged to retailers for debit card processing − The limit will go into effect on July 1 st following the year in which the combined company reports $10 billion in assets as of December 31 st − Based on a Q1 2018 closing of the merger, the combined company expects the impact to begin on July 1, 2019, which is one year earlier than previously expected on a standalone basis

16 Summary x Creates Virginia’s preeminent community bank with more than $12 billion in pro forma assets at closing x Enhances presence in key markets and provides a platform for future growth x Financially attractive transaction for all shareholders with conservative assumptions x Proven track record of successful conversions and integrations at both companies

17 Appendix

18 Pro Forma Loan Portfolio Source: SNL Financial Dollars in millions Data as of or for the three months ended 3/31/2017 (1) Excludes purchase accounting adjustments UBSH XBKS Pro Forma (1) C&D 12% 1 - 4 Family 24% Multifamily 5% Owner - Occupied CRE 13% Non Owner - Occupied CRE 25% C&I 9% Consumer & Other 11% C&D 10% 1 - 4 Family 17% Multifamily 6% Owner - Occupied CRE 11% Non Owner - Occupied CRE 18% C&I 21% Consumer & Other 17% C&D 11% 1 - 4 Family 22% Multifamily 6% Owner - Occupied CRE 13% Non Owner - Occupied CRE 24% C&I 12% Consumer & Other 12% Yield on Total Loans: 4.29% Yield on Total Loans : 4.59% Total Loans: $6,574 Total Loans: $2,357 Total Loans: $8,931

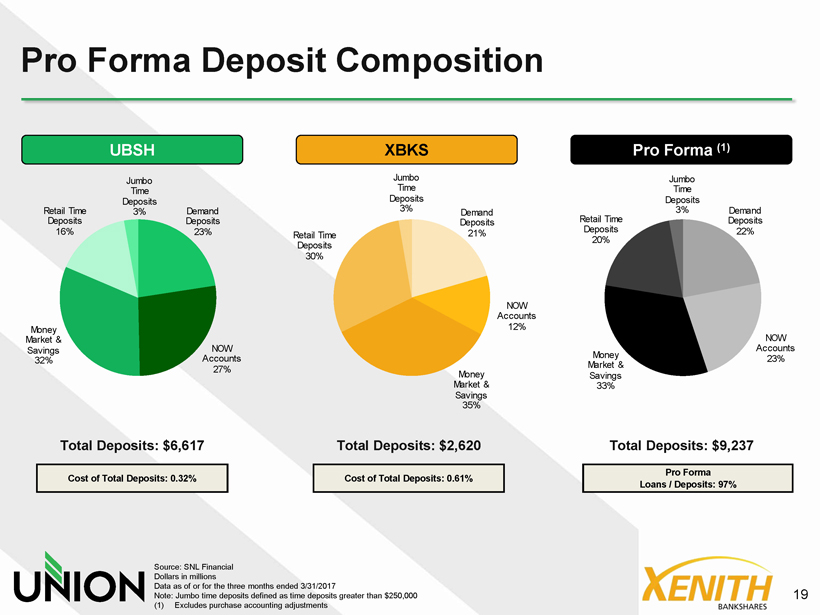

19 Pro Forma Deposit Composition Source: SNL Financial Dollars in millions Data as of or for the three months ended 3/31/2017 Note: Jumbo time deposits defined as time deposits greater than $250,000 (1) Excludes purchase accounting adjustments UBSH XBKS Pro Forma (1) Demand Deposits 23% NOW Accounts 27% Money Market & Savings 32% Retail Time Deposits 16% Jumbo Time Deposits 3% Demand Deposits 21% NOW Accounts 12% Money Market & Savings 35% Retail Time Deposits 30% Jumbo Time Deposits 3% Cost of Total Deposits: 0.32% Cost of Total Deposits: 0.61% Demand Deposits 22% NOW Accounts 23% Money Market & Savings 33% Retail Time Deposits 20% Jumbo Time Deposits 3% Total Deposits: $6,617 Total Deposits: $2,620 Total Deposits: $9,237 Pro Forma Loans / Deposits: 97%