Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTH STATE Corp | f8-k.htm |

Exhibit 99.1

|

|

SunTrust Robinson Humphrey 2017 Financial Services Conference May 23, 2017 |

|

|

Forward Looking Statements CAUTION REGARDING FORWARD-LOOKING STATEMBNTS Statements included in this communication which are not historical in nature or do not relate to current facts are intended tobe, and are hereby identified as, forward-looking lllatements for purposes of the safe harbor provided by Section 27A of the Securities.Act of1933 and Section 21E of the Securities Exchange.Act of 1934·The words "may," "wiil," "anticipate,• "could,""should,""would," "believe,""contemplate,""expect," "estimate,•"continue," "plan,""project" and "intend,"as well as other similar words and expressions of the future, are intended to identify forward-looking statenlents.South State Corporation ("South State") and Park Sterling Corporation ark Sterling") caution readers that forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differmaterially from anticipated results.Such risks and uncertainties, include, among others, the following posst1lilities: the occurrence of lillY event, change or other circumstances that could give rise to the right of one or both of the psrties to terminate the definitive muger agreement between South State and Park Sterling; the outcome of lillY legal proceedings that may be instituted against South Stste or Park Sterling; the failure to obtain necessary regu]a.toty approvals (and the risk that suchapprovals may rerult in the inlposition of conditions that could adversely affect the combined company or the expected benefits of the transamon), and shareholder approvals or to satisfy lillY of the other conditions to the transaction on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at aD, inclnding as a result of the inlpact of, or problems arising from,the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas whereSouth State and Park Sterling do business; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; diversion of management's attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationship&, including tho8eresulting from the announcement or completion of the transaction;South State's ability to complete the acquisition and integration of Park Sterling successfully; credit risk associated with commercial real estate, commercial business and construction lending; interest risk involving the effect of a change in interest rates on both of South State's and Park Sterling's earnings and themarket value of the portfolio equity; liquidity risk affecting each bank's ability to meet its obligations when they come due; price risk focusing on changes in market factors that may affect the value of traded instruments; transaction risk arising from problems with service or product delivery; compliance risk involving risk to earnings or capital resulting from violations of or nonconformance with laws, rules, regulations, prescribed practices, or ethical standards;strategicrisk resulting from adverse business decisions or inlproper inlplementation of business decisions; reputation risk that adversely affects earnings or capital arising from negative public opinion; cybersecurity risk related to the dependence of South State and Park Sterling on internal computer systems and the technology of outside service providers, aswell as the potential inlpacts of third-party security breaches, which subjects each company to potential business disruptions or :financial losses resulting from deliberate attacks or unintentional events;economic downturn risk resulting from changes in the credit markets, greater than expected noninterest expenses, excessive loanlosses and other factors and the inlplementation of federsl spending Clits cnrrently scheduled to go into effect; and other factors that may affect future results of South State and Park Sterling. Additional factors that could cause results to differ materially from those described above can be found in South State's Annual Report on Form 10-K for the year ended December 31, 2016, and in itasubsequent Quarterly Report on Form 10-Q, inclnding for the quarter ended March 31, 2017, wbichis on file with the Securities and Exchange Commission (the "SEC") and available in the "Investor Relations"section of South Stste's website, http:flwww.southstatebank.com, under the heading "SEC ·and in other documents South Stste files with the SEC, and in Park Sterling's Annual Report on Form to-X for the year ended December 31,2016, and in its subsequent Quarterly Report on Form 10-Q, including for the quarter ended March 31, 2017, which is on file with theSEC and available on the "Investor Relations" page linked to Park Sterling's website, http:/fwww.parlcsterlingbank.com, under the heading "Regulatory Filings" and in other docnments Park Sterling files with theSEC. All forward-looking statements speak only uof the date they are made and are based on information available at that tinle. Neither South State nor Park Sterling assumes lillY obligation to update forward-looking statements to reflect circumstances or events that ooeur after the date the forward-looking statements were made or to reflect the occurrence of unanticipated events except as required byfederal securities laws.As forward-looking statements involve significant risks and uncertainties, caution should be eJrercised agllin.st placing undue reliance on such statements. IMPORTANT ADDmONAL INFORMATION In connection with the proposed transaetion between South State and Park Sterling,South State will file with the SEC a Registration Statenlent on Form 8-4 that will include a Joint Proxy Statement of South State and Park Sterling and a Prospectus of South State, as well as other relevant documenta concerning the proposed transaction. The propO&ld transaction involving South State and Park Sterling will be submitted to Park Sterling's shareholders and South State's shareholders for their consideration. This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities nor shall therebe any sale of securities in any jurisdietion in which such offer, solicitation or sale would be unlawfulprior to registration or qualification under the securities laws of such jurisdiction. Shareholders of South State and llhareholdera of Park Sterlillg 11reurgedto read the registration at.tem.ent and the joint proxy at.tem.ent/prospec:twl reprdina the triiDACtion whenit becomes available and any other relevant documents filed with the SEC, uwell as any amendmentlll or supplementlll to thoae documents, beeauae they willeontain important informadon. Shareholders will be able to obtain a free copy of the definitive joint proxy lllatement/prospectus, as well as other filings containing information about South State and Park Sterling, without charge, at the SEC's website (http://www.sec.gov). Copies of the joint proxy lllatement/prospectus and the filings with the SEC that will be incorporated by reference in the joint proxy statenlent/prospectus can also be obtained, without charge, by directing a request to South Stste Corporation, 520 Gervais Street, Columbia, South Carolina 29201, Attention:John C. Pollok, Senior Executive Vice President, CFO and COO, (8oo) 277-2175 or to Park Sterling Corporation, 1043 E. Morehead Street, Snite 201, Charlotte, North Carolina 28204. Attention:Donald K. Truslow, (704) 323-4292. PARTICIPANTS IN THE SOLICITATION South State, Park Sterling and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proldes in respect of the propO&ld transaction. Information regarding South Stste's directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 6, 2017, and certain of its Current Reports on Form 8-K. Information regarding Park Sterling's directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on Aprt113, 2017, and certain of ita Current Reports on Form 8-K. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests,by security holdings or otherwise, will be contained in the joint proxy statenlentfprospectus and other relevant materials filed with the SEC. Free copies of this docuntent may be obtained as described in the preceding paragraph. $ SoUTH STATE CORPORATION 2 |

|

|

Contents• Southeastern • Park Sterling • Appendix $SoUTH STATE CORPORATION 3 |

|

|

Southeastern Update $ SoUTH STATE CORPORATION 4 • One-time merger expenses • -$6 million remaining to be expensed by Q4 • Cost Savings -35% (-$17 million) • 38% realized in Q1, estimate So% realization in Q2 and 100% thereafter • Incremental Durbin impact beginning in 2H 2018 • $1.1 million annually pre-tax • Low single digit EPS Accretion • ..., 2% TBVDilution • ..., 3 years estimated TBV Eamback • Closed on January 3, 2017 • Total assets of $1.8 billion • Core system conversion completed in February |

|

|

Park Sterling Merger Rationale Strategic Markets FinancialCombination of two great companies with complementary strengths Increases density and depth Extends footprint throughout the Carolinas, Georgia and into Virginia Common vision of the future of regional banking Management continuity and improved team talent across entire franchise Improved market share position in several metropolitan markets Meaningfully enhances competitive position and ability to attract talent in Charlotte Entrance into growth markets of Richmond and Raleigh -70% of PSTB branches are in MSAs which SSB already operates Mid single-digit EPS accretion post integration Less than 4% tangible book value dilution Tangible book value earnback in 3 to 4 years Preservation of strong capital position and balance sheet $ SoUTH STATE CORPORATION 5 |

|

|

Park Sterling Transaction Terms South State Corporation (Nasdaq:SSB) J Park Sterling Corporation (Nasdaq: PSTB) 0.14 shares of SSB common stock for each share of PSTB common stock 100% stock J $_1_2_.8_7_<_1)------------------------------------------J $690.8 million (t) J 8_o_%_S_S_B_/_2_o_%_P_S_T_B ) 2 Directors to be appointed to SSBts Board of Directors, including Jim Cherry Employment Agreements with Bryan Kennedy & Don Truslow Regulatory and shareholder approvals from both SSB and PSTB 4th Quarter 2017 J (1) Pricing data as of 4/26/17 $ SoUTH STATE CORPORATION 6 Expected Closing Required Approvals Management Retention Board Representation Ownership Split Aggregate Transaction Value Implied Price per Share Consideration Fixed Exchange Ratio Seller Buyer |

|

|

Park Sterling Transaction Assumptions Purchase Accounting Expense Savings Pro Forma Capital Merger Costs Durbin Amendment CDI • Expected to be -$30 million pre-tax Expense • • 75% realized in 2018 and 100% thereafter Savings -35% of PSTB's noninterest expense Tangible Common Equity I Tangible Assets: -8.7% Pro Forma Capital Total Capital Ratio: -12.6% I· Approximately $50 imllio_n_ af_te_r_-t_ax . interchange revenue is -$2 million pre-tax SYD method $SoUTH STATE CORPORATION 7 • Core deposit intangible equal to 1.5% amortized over 10 years using Durbin Amendment • Incremental annual impact of lost Merger Costs • • • Net credit mark of $49-5 million • Gross credit mark of $61million (2.4%) less existing net credit discount of $11.5 million Other Adjustments of -$4.2 million • Includes adjustments to Fixed Assets, OREO, Securities etc. Cumulative Impact to net assets of ($45.3) million |

|

|

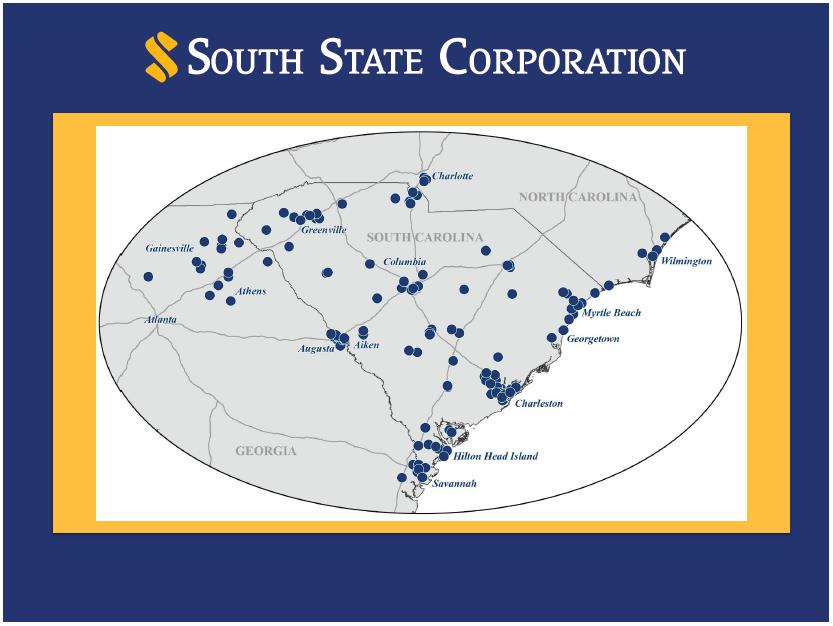

Pro Forma Overview Pro Forma Highlights (l) Assets $14.5 bn Loans Deposits 11.5 Branches VIR.GINIA Loans f Deposits 9096 NORTH CAROLINA Market Cap $ 3·3 bn Raleigh • ' Employees 2,600 Athens GEORGIA I •SSB + PSTB (183) Source: SNL Financial (1) Excludes purchase D.C001lll1illg adjustments $ SoUTH STATE CORPORATION 8 |

|

|

Pro Forma Market Share Deposits U!bnl Market Share 19·7% 17.7 10.6 7·6 5·7 Rank 1 2 3 4 5 Institution Branches Wells Fargo & Co. Bank ofAmerica Corp. BB&TCorp. SunTrust Banks Inc. First Citizens BancShares Inc. 411 234 283 208 206 $39·9 36.0 21.5 15·5 11.5 SouthStateCorp. Synovus Financial Corp. United Community Banks Inc. Toronto-Dominion Bank PNC FinancialServices Group Inc. Regions Financial Corp. F.N.B. Corp. Fifth Third Bancorp Park Sterling Corp. Capital Bank Financial Corp. Brand Group Holdings Inc. Pinnacle Financial Partners Inc. Bank of the Ozarks Inc. Union Bankshares Corp. Carolina Financial Corp. 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 129 58 69 65 71 69 33 42 54 38 8 36 32 28 30 8.8 5·0 4·9 4·0 2.4 3.2 2.8 2.5 2.5 2.0 2.0 1.7 1.7 1.5 1.5 4·3 2.5 2.4 2.0 1.2 1.6 1.4 1.2 1.2 1.0 1.0 0.9 0.8 0.8 0.7 *Raleigh GA ProForma eountvMvlretSbve D #tto#s • #6to#to D Greaterthan#10 Source: SNL Financial Deposit data as of 6/30/16 Inclucres combined counties of operation for SSB and PSTB;exclucres money center or super regional bank branclles with greater than $1.0 billion in deposits (1) $ SoUTH STATE CORPORATION 9 ProForma 183 11.3 5·5 Combined Counties of Operation b) |

|

|

Better Positioned in Top C&I Markets Totalca:I Sales ($bn) TotalCid Budne••es ..!!2... Market Name Atlanta-Sandy Springs-Roswell, GA Washington-Arlington-Alexandria. DC-VA-M[).WV 1 :1. 183.6 116.9 35,686 31,466 CharloHe.Coneord-Gutonia,NC-SC 90.11 3 15.854 1 so.s Virginia Beach-Norlblk-Newport New8,VA-NC 9,126 4 Richmond,VA 5 49·7 8,253 1 6 GreeD8boro-High Point,NC 41.1 6,o6s Rale!gh,NC 7 404 7.369 1 Greenville-ADdel'!lon-Mauldln,8C 8 40.0 5.378 1 Colnmbia,8C ll5.6 9 4.547 1 Win8ton-Salem,NC 10 24-4 3,932 Spartanburg, 8C ll4-3 11 2,154 1 Charlcnon-North Charlcnon,8C ll4.1 1& 4.475 1 Chattanooga, 1N-GA 21.8 19-4 13 14 3,779 3,306 Durham-<:hapel Hill, NC Aupna-Riehmond County, GA-SC 18.6 15 3,285 1 16 17 18 19 A8heville, NC ffickory-Lenoir-Morga.nton, NC Roanoke,VA King8port-Bristoi-Bristol, 1N-VA 18.3 17.1 15.6 13·7 3,371 2,638 :1.,415 1,988 Total C&I Sales S.V1111nalt,GA liO 13-3 R,797 1 ByMSA II> $40.0 billion 21 :1.:1. Fayetteville, NC ColumbWI, GA-AL u.o :1.,134 1,794 9·9 D $4.7billion-$40.0 billion D $2.8billion·$4.7billion D $1.7 billion-$2.8billion D < $1.7billion st,oss l Wilmington, NC ll3 8-5 Myrtle Beach-Conway-North Myrtle Beach,SC-NC B.a ll4 R,694 1 Charlottesville, VA :1.5 6.7 1,720 Demographic data as of 6/30/16 Note:Gray highlight denotes pro fonna market of operation Inclucres companies classifiedwith the NAICs as Healthcare and Social Assistance, Wholesale Trade, Manufacturing or Tran8portati.on and Warehousing $SoUTH STATE CORPORATION 10 Top 25 MSAs by C&I Sales |

|

|

Multiples Comparison ) Source: SNL Financial Pricing data as of 4/26/17 (1) Based on PSTB's tangible book value per share of $5.45 as of 3/31/2017 (2) Based on FactSet consensus estimates (3) Based on PSTB's closing price of $12.52 (4) Based on PSTB's quarterly dividend per share of $0.04 and SSB's quarterly dividend per share of $0.33 $SoUTH STATE CORPORATION 11 Price I Tangible Book Value (1): 236% Price I 2017 Earnings (2 :21.8 X Other Transaction Data Market Premium C3J:2.8% PSTB Dividend Increase (4): 289% 22.0 X SSB Trading Multiples Transaction Multiples |

|

|

Loan Concentrations (l) 40096 30096 :n696 20096 18896 10096 o96 +----SSB - PSTB c::::::::J CRE Loans I Risk-Based Capital ProForma C&D Loans I Risk-Based Capital Source: SNL Financial Data as of 3/31/17 Dashed lines denote regulatory recommended threshold (1) Excludes purchase accounting adjustmentll $SoUTH STATE CORPORATION 12 |

|

|

Appendix$SoUTH STATE CORPORATION 13 |

|

|

Tangible Book Value + Cumulative Dividends $so.oo 15 YEAR RETURN 291% Cumulative Dividends I TBV $43.21 40.00 $28.56 30.00 $17·74 20.00 10.00 0.00 2001 2002 2003 2004 2005 2006 2007 2008 2009 201020112012 2013 2014 2015 2016 1Q17 $ 14 SoUTH STATE CORPORATION |

|

|

Crossing $10 Billion: Interchange Fees • Durbin amendment imposes a cap on interchange fees from debit card transactions • • Results in 45% reduction in card Effective: July 2018 Lost Revenue (before tax) revenue South State Bank Georgia Bank & Trust Park Sterling Bank Total $14 million 1 2 ---$17 million • EPS impact: $0.30 annually $ SoUTH STATE CORPORATION 15 |

|

|

Pro Forma Loan Composition - ---------- ----PSTB 1 I 1 Cansumer& Other 10% Consumer& Other 2% Cansumer& Other 8% C&I 17% Non Owner-Occupied CRE 14% NonOwner-Occupied CRE 16% Non Owner-Occupied CRE 2296 Owner-Occupied CRE 19% Owner-Occupied CRE 18% 1-4 Family 3796 1-4Family 34% Owner-Occupied CRE 15% Multimmily 4% Multifiunily 196 Multibmily 2% 1-4 Family 36.8 2,929,522 Owner-occupied CRE 1,546,696 19·4 8.1 C&l 644,105 " " " Gra.LoansI< Lea11e11 Gra.LoansI< Lea11e11 Gra.Loans A: Lea11e11 .7.9!18 833 ••.466.776 100.0 100.0 .10,42!1,6o9 100.0 Sourre: SNL Financial Dollars inthOU!Iands Data as of or for the three months ended 3/31/17 (1) Excludes purchase accounting adjustments $SoUTH STATE CORPORATION 16 loan Portfolio C&D$838,04010.5 % Multifamily 109,200 1.4 Non Owner-occupied CRE1,090,10113.7 Consumer & Other 801,16910.1 'J6 ofTotal Amount loan Portfolio Amount 'J6 of Total C&D$1,260,300 12.1 % 1-4 Family 3,501,267 33·6 Multifamily211,5412.0 Owner-occupied CRE1,910,85718.3 Non Owner-occupied CRE1,630,466 15.6 C&I1,068,55410.2 Consumer & Other 842,624 8.1 loan Portfolio Amount 'J6 of Total C&D$422,26017.1 % 1-4 Family 571,74523.2 Multifamily102,341 4·1 Owner-occupied CRE364,16114.8 Non Owner-occupied CRE540,365 21.9 C&I424.44917.2 Consumer & Other 41.4551.7 (l) SSB Pro Forma |

|

|

Pro Forma Deposit Composition - ----- ----- ----1 I 1 Jumbo Jumbo Jumbo Time RetailTime Deposits 796 Time Deposits 696 Time Deposits 1396 Demand Deposits 2196 596 Deposits Retail Time Deposits 996 Demand Deposits 2796 Demand Deposits 29% Retail Time Deposits 1596 Money Market& Savings 3696 NOW Accoo.nts 1996 Money Market& Savings 3596 Money Market& Savings 32% " " " 8 Total 6 100.0 100.0 t• 100.0 Source:SNL Financial Dollars in thousands Data as of or for the three months ended 3/31/17 Note:Jumbo time deposits defined as timedeposits greater than $100,000 (1) Excludes purchase accounting adjustments $ SoUTH STATE CORPORATION 17 Demand Dep!Ets $3,123,491 27.1 % NOW Accounts2,607,65222.6 Money Market &Savings4,040,642 35.0 Retail Time Dep!Ets 1,025,2998.9 JumboTime Deposits 745.5496.5 Demand Dep!Ets $524,380 20.9 % NOW Accounts466,00018.6 Money Market &Savings811,98632.4 Retail Time Dep!Ets 385,329 15·4 JumboTime Deposits 321,50012.8 Totalt• 96 of Total Amount Deposit Composition 96 of Total Amount Deposit Composition Deposit Composition Demand Dep!Ets $2,599,11128.8 % NOW Accounts2,141,65223.7 Money Market &Savings3,228,656 35·7 Retail Time Dep!Ets 639.970 7·1 JumboTime Deposits 424,049 4·7 Totalt• 96 of Total Amount Pro FormaCI) PSTB SSB |

|

|

Pro Forma Deposit Market Share by State (l) Deposits ·mm! Depoaits $mm! Market Share Market Share ..!!!2. ..!!!!2 Institution Brllllchea Institution Wells Fargo &.:Co. BB&TCorp. Bank of America Corp. Firat Citizen& BaneSharesInc. BB&TCorp. WelJJI Fargo &.:Co. First Citizens BancShares Inc. Bank of America Corp. SunTrust Banks Inc. PNC Financial Services Group Inc. F.N.B. Corp. PacWest Bancorp Cspital Bank Financial Corp. Pinnacle Financial Partners Inc. $11,080 7,889 7,722 6,719 145 111 79 147 $25,070 23,822 14,776 13,085 7,611 6,303 5,247 4,419 4.397 4,306 348 16.08 " 11.45 11.21 9-75 17.68 " 2 3 4 2 3 4 5 6 7 8 9 10 16.80 10.42 9-23 5-37 4-44 3.70 3.12 3.10 3-04 South State Corp. Toronto-Dominion Bank Synovus Financial Corp. SunTrust Bank& Inc. United Community Bank& Inc. Carolina Financial Corp. 88 65 38 43 32 24 5,611 3,882 3,059 1,851 1,473 1,348 8.14 5.63 4-44 2.6g 2.14 1.96 5 6 7 8 9 10 zs• 1.06 •s 18 Park Sterlin1Corp. 18 Park Sterlin& Corp. 0.68 38 South State Corp. 399 0.11 Depoaits $mm! Market Share Depo•it• '!mm! Market Share ..!!!!2 1 2 3 4 5 6 7 8 9 10 Rank Institution Brllllchea Institution 15.15 " BB&TCorp. SuuTrust Banks Inc. United Bankshares Inc. Union Bankshares Corp. TowneBank Cspital One Financial Corp. Carter Bank ItTrust PNC Financial Services Group Inc. Burke It Hf!rbert Bank &Trust Co. Access National Corp. Wells Fargo ItCo. Bank of America Corp. SunTrust Bank& Inc. Synovus Financial Corp. BB&TCorp. Regions Financial Corp. United Community Bank& Inc. Bank of the O.arb Inc. State Bank Financial Corp. JPMorgan Cha&e &Co. $24,600 19,447 14,896 10,568 9,224 5,868 5.348 4,031 3.354 3,179 13.80 " 275 168 237 115 154 122 70 67 32 83 $22,631 15,554 7,090 6,102 5,704 5,171 3.948 3.479 2,262 2,114 344 10.41 4-75 4.08 3.82 3-46 2.64 2-33 1.51 1.42 2 3 4 5 6 7 8 9 10 10.91 8.36 5·93 5-17 3-29 3.00 2.26 1.88 1.78 :16 Park Sterlinl Co!J! . 0 6 South State Corp. !.§5 33 Park Sterlln& Corp. R41 o.y 5 Source:SNL Financial Deposit data as of 6/30/t6; pro fonna for announced transactiona (1) Total deposits and branches adjusted to exclude individual money center and super regional bank branches with greater than $1.0 billion in deposits $ SoUTH STATE CORPORATION 18 11 Pro Forma 3,013 L6g 38 Brllllchea 281 129 196 83 113 32 58 88 96 8 Virginia Georgia U1 g.21 6.343 Pro Forma Brllllchea 328 244 151 137 142 95 1 96 44 8 North Carolina South Carolina |

|

|

Pro Forma Deposit Market Share by MSA (l) Depollita ·mm! Depoalta ·mm! Market Sbare Market Share Institution Branches Rank Institution Branches 22.47 " Wells Fargo &: Co. Bank of America Corp. BB&TCorp. Fifth Third Bancorp First Citizens BancShares Inc. Wells Fargo I< Co. Bankof America Corp. BB&TCorp. Toronto-Dominion Bank $2,648 2,179 1,822 1,515 $7,124 5,037 4.777 2,329 2,296 89 59 69 39 46 30 18 27 :1.0 17.24 " 14.19 11.87 g.86 2 3 4 5 15.89 15.07 7-35 7-24 2 3 4 Sun'fnat Banks Inc. First Citizellll BancShares Inc. Senath State Cory. United Community Banks Inc. Southern First Bancshares Inc. Travelers Reat Bancshares Inc. Park Sterlins Cory. 6.11 5-18 5.04 4-83 4-03 3-59 ya 938 795 773 741 619 552 al8 19 19 9 15 4 10 9 5 6 7 8 9 10 14 6 SunTrust Banks Inc. Park Sterlby Cory. 1,471 24Z 838 674 632 568 4-64 2.99 2.64 2.13 1.99 1·Z2 33 12 16 16 8 8 z 8 9 10 1ll F.N.B. Corp. Capital Bank Financial Corp. Pinnacle Financial Partners Inc. South State Corp. Depoalta ·mm! Market Sbare Deposita <•mm! $1,165 1,097 826 685 496 368 Market Share Institution Branches Institution 1 2 3 4 5 6 Live O&.lr.BaneshAres Inc. Wells Fargo B< Co. Blli:TCorp. First Citizens BancShares Inc. Bank of America Corp. F.N.B. Corp. SunTrust Banks Inc. Wells Fargo llr: Co. BB&TCorp. Union Banksharea Corp. Bank of America Corp. OkF Financial Corp. TowneBank $4,434 4.336 3,200 1,827 1,792 776 735 12.81 " 12.53 9-25 5.28 5-18 2,24 2.12 40 61 40 32 22 17 9 19-75 " 18.60 14.01 11,62 8.41 6.23 1 10 10 10 7 4 7 2 3 4 5 6 7 PNC Financial Services GrouJ) Inc. 7 j12 28 ;iM Q.J ...f: 4 8 Xenith Banlrshares Inc. 675 1.95 5 8 9 10 SunTrust Banks Inc. Toronto-Dominion Bank First Bancorp 201 186 164 3-40 3-16 2.78 8:37 3 2 5 3 1 2 Park SterlCory. 8 10 1::JIZ 1.50 2 519 10 Community Bankers Trust Corp. South State Corp. 140 11 13 Park Sterlin1 Corp. 69 1.18 Source:SNL Financial Deposit data as of 6/30/t6; pro forma for announced transactions (1) Total deposits and branches adjusted to exclude individual money center and super regional bank branches withgreater than $1.0 billion in deposits $SoUTH STATE CORPORATION 19 3-55 209 Richmond, VA Wilmington, NC 18 6-46 991 Pro Forma Greenville-Anderson-Mauldin, SC Charlotte-Concord-Gastonia, NC-SC |

|

|

Combined Key Markets I · SSB 1 "' l.::_ PSTB Deposit market share data as of 6/30/16 Circle denotes pro forma deposit market share rank in each respective MSA $SoUTH STATE CORPORATION 20 Greenville Richmond o0o )HC\ROLINA JlTIH CAROI...INA. Charlotte Charlotte |

|

|

Market Highlights: Charlotte 1 1 • Charlotte is the most accessible city between Washington, D.C. and Dallas, Texas 6.9 million people live within a 100-mile radius MSA Population: 2.49 million Nation's second largest banking center, sixth busiest airport and home to seven Fortune soo companies C&I statisticsC1>: Total C&I businesses:15,854 Total C&I sales: $90 bn Charlotte ranked #8 best big cities for jobs by Forbes Charlotte was rated the 3rd most attractive real estate market in America (PWC) Charlotte has been ranked No. 15 of the 'Best Places to Live in the USA' • Charlotte North Carolina Southeast 7.2% 7.0% • s.o% • • • jected Population Growth 017-2022 (96) Projected Median HHI Growth 2017-2022 (%) • - ----1 Charlotte 0 '-=--' Domtar BARINGS SealedAir Re-imagine· Source: SNL Financial, WalletHub, Forbes, Charlotte Chamber of Economic Development, RLCO, CBRE Demographic data as of 6/J0/16 (1) Inclucres companies clusified with the NAICs as Healthcare and Social Assistance, Wholesale Trade, Manufacturing or Transportation and Warehousing $SoUTH STATE CORPORATION 21 HCAR.OLINA Companies Headquartered in Charlotte Pro 2 Demographics Charlotte Market Overview |

|

|

Market Highlights: Richmond • Focal point of the state of Virginia State capital, headquarters of Fifth Federal Reserve District, home to six Fortune soo companies Central location within the Commonwealth MSA population: 1.29 million Multiple top tier Universities in and around the greater Richmond MSA C&I statisticsC1): Total C&I businesses: 8,253 Total C&I sales: $so bn Richmond was named was named 4th hottest housing market in 2016 (Zillow) Richmond was ranked nth best metro area to start a business inAmerica (CNBC) •Richmond Virginia Southeast • • Population Growth 2017-2022 (%) Projected Median HHI 2022 ($) • AItria Dominion ...ty,. CARm--a-x--Genworth'l,t Owens &?vfinor Source: SNL Financial, Richmond Chamber of Commerce, the City of Richmond Economic&:Community Development Authority Demographic data as of 6/30/16 * WestRock Includes companies classifiedwith the NAICs as Healthcare and Social Assistance, Wholesale Trade, Manufacturing or Transportation and Warehousing (1) $SoUTH STATE CORPORATION 22 Companies Headquartered in Richmond Projected Demographics Richmond Market Overview |

|

|

Focused on High Growth Markets Projected Change 2017-2022 :p MSA Population Growth ./ ./ ./ ./ ./ ./ ./ ./ ./ ./ Myrtle Beach Hilton Head Charleston Raleigh Charlotte Savannah Wilmington Greenville Columbia Spartanburg Richmond Augusta us ./ ./ ./ ./ ./ ./ ./ ./ State Population Growth ./ ./ ./ ./ ./ ./ ./ South Carolina s.B% Georgia North Carolina o96 Vrrginia us Source:SNLFinancial Population data as of 6/30/16 SSouTH STATE CoRPORATION 23 5.296 s. 4.296 8.7% 8.796 8.296 7.296 7-1% 7.196 6.1% 5-796 4-996 4.696 4.696 3-896 |

|

|

Leverages Presence in Key Markets I _ 0 Raleigh J!> 8.2% 0.1 % 1,305,052 $70,453 $75·8 45.485 $14 $14 $ o.8% $ $ Savannah 17.0 388,564 7·1 59.407 15,570 543 543 7·7 Hilton Head 8.7 604 604 14.8 214.431 57.762 7·9 9.774 Source: SNL Financial Deposit data as of 6/30/16; pro funna fur announced transactions (1) Per the Bureau of Economic Analysis' 2015 Regional GDP news release $ SoUTH STATE CORPORATION 24 ------------------------------------SSB PSTB ProForma '17-'22 2022 Proj. Gross Population HouseholdDomestic Market 2017Gr-owthIncome Product C•lDeposits Deposits DepositsShare Market SSB PSTB Po ulation ! !!l (!bnl Businesses (!mml (!mml (!mml Richmond:P1,285,8834-6 67,68674-1 46,613542 542 1.6 Charlotte.'P2,485,5297-2% $62,735$152-4 88,983 $568 $947 $1,515 Greenville$ :P891,7026.1 49.92438.331,008 773 218 991 6.5 Columbia$ .'P823,4885-7 56,90138.4 28,583466 72 538 2.9 Charleston$ :P768,9378.7 61,72136·4 27,783 1,53713 1,549 12.7 Spartanburg$ J!>329.4374·9 47.423 14.211,39633 109 142 2.7 Wilmington$ J!>284,7337-1 57,14013.6 12,655140 69 209 3.6 Augusta$ 598,0394.6% $51,812$22.320,295$1,593$1,59319·9 % l Myrtle Beach $ 449.5419.8 48,57216.0 20,856326 326 4-3 D_e D_e_rnograp_h_ic_s Market |

|

|

Analyst Coverage FIG Partners ' NAB Research LLC Piper Jaffray _ Sandler O'Neill SunTrust Robinson Humphrey $ SOUTH STATE CORPORATION 25 Stephens --------' . - -----' Keefe, Bruyette & Woods . - ------Brean Capital |

|

|

Investor Contacts Robert r. Hill, Jr. Chief Executive Officer John C. Pollok Senior Executive Vice President and Chief Financial Officer / Chief Operating Officer James C. Mabry IV Executive Vice President investor Relations and Mergers & Acquisitions South State Corporation 520 Gervais Street Columbia, South Carolina 29201 800-277-2175 www.southstatebank.com |

|

|

South State Corporation |