Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SOUTH JERSEY INDUSTRIES INC | form8-kagapresentation.htm |

South Jersey Industries

American Gas Association

Financial Forum

May 21-22, 2017

Certain statements contained in this presentation may qualify as “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act

of 1934. All statements other than statements of historical fact should be considered forward-looking

statements made in good faith and are intended to qualify for the safe harbor from liability established

by the Private Securities Litigation Reform Act of 1995. Words such as “anticipate”, “believe”, “expect”,

“estimate”, “forecast”, “goal”, “intend”, “objective”, “plan”, “project”, “seek”, “strategy” and similar

expressions are intended to identify forward-looking statements. Such forward-looking statements are

subject to risks and uncertainties that could cause actual results to differ materially from those

expressed or implied in the statements. These risks and uncertainties include, but are not limited to, the

following: general economic conditions on an international, national, state and local level; weather

conditions in our marketing areas; changes in commodity costs; changes in the availability of natural

gas; “non-routine” or “extraordinary” disruptions in our distribution system; regulatory, legislative and

court decisions; competition; the availability and cost of capital; costs and effects of legal proceedings

and environmental liabilities; the failure of customers or suppliers to fulfill their contractual obligations;

and changes in business strategies. These cautionary statements should not be construed by you to be

exhaustive. While SJI believes these forward-looking statements to be reasonable, there can be no

assurance that they will approximate actual experience. Further, SJI undertakes no obligation to update

or revise any of its forward-looking statements, whether as a result of new information, future events or

otherwise.

Forward Looking Statements

2

3

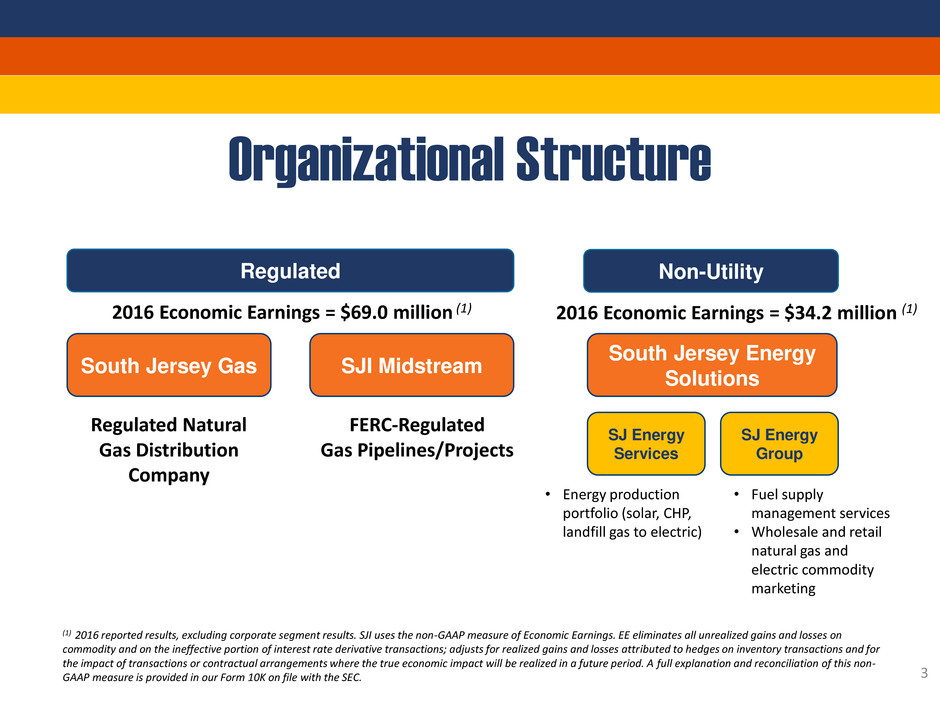

South Jersey Gas SJI Midstream

South Jersey Energy

Solutions

Regulated Natural

Gas Distribution

Company

FERC-Regulated

Gas Pipelines/Projects

SJ Energy

Services

SJ Energy

Group

• Energy production

portfolio (solar, CHP,

landfill gas to electric)

• Fuel supply

management services

• Wholesale and retail

natural gas and

electric commodity

marketing

2016 Economic Earnings = $69.0 million (1)

2016 Economic Earnings = $34.2 million (1)

Regulated Non-Utility

(1) 2016 reported results, excluding corporate segment results. SJI uses the non-GAAP measure of Economic Earnings. EE eliminates all unrealized gains and losses on

commodity and on the ineffective portion of interest rate derivative transactions; adjusts for realized gains and losses attributed to hedges on inventory transactions and for

the impact of transactions or contractual arrangements where the true economic impact will be realized in a future period. A full explanation and reconciliation of this non-

GAAP measure is provided in our Form 10K on file with the SEC.

Organizational Structure

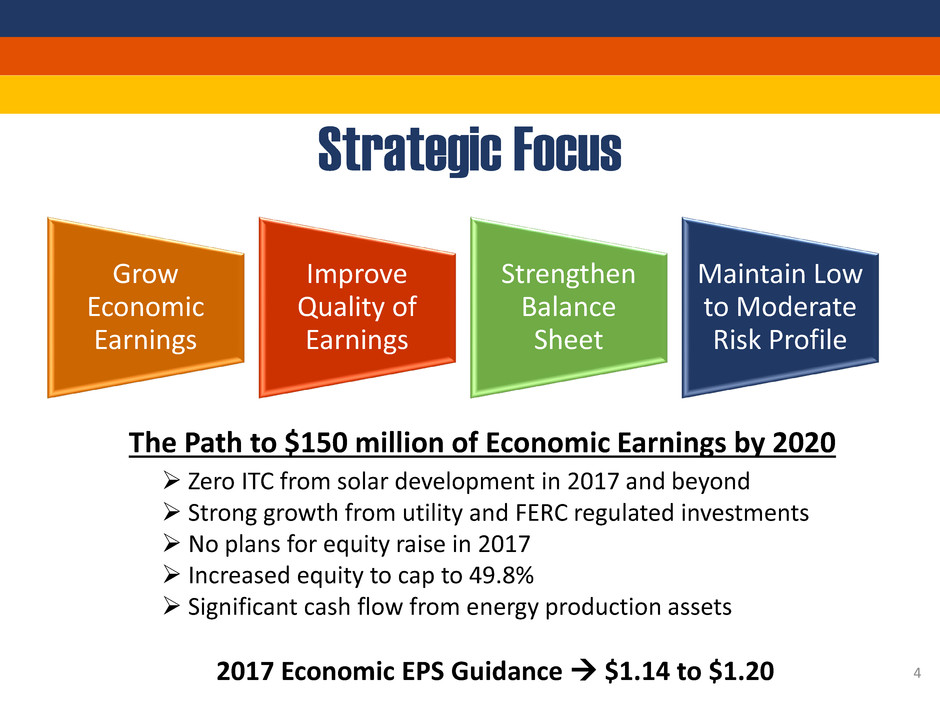

Grow

Economic

Earnings

Improve

Quality of

Earnings

Strengthen

Balance

Sheet

Maintain Low

to Moderate

Risk Profile

Strategic Focus

The Path to $150 million of Economic Earnings by 2020

Zero ITC from solar development in 2017 and beyond

Strong growth from utility and FERC regulated investments

No plans for equity raise in 2017

Increased equity to cap to 49.8%

Significant cash flow from energy production assets

2017 Economic EPS Guidance $1.14 to $1.20 4

5

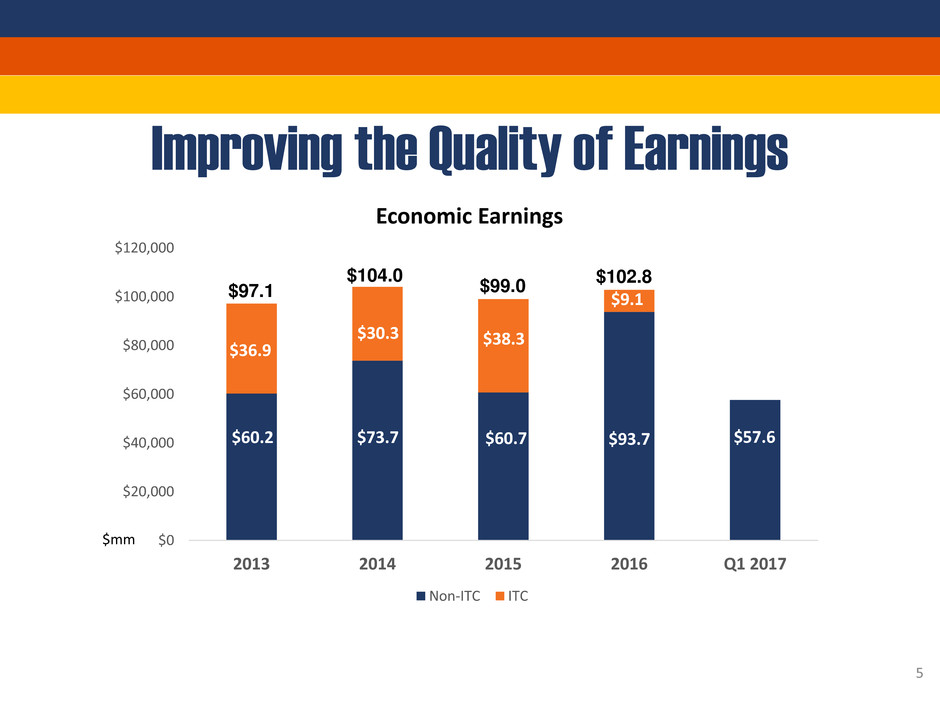

Improving the Quality of Earnings

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

2013 2014 2015 2016 Q1 2017

Economic Earnings

Non-ITC ITC

$57.6

$38.3

$9.1

$60.2 $73.7 $60.7

$36.9

$30.3

$97.1

$104.0

$99.0

$102.8

$mm

$60.7

$38.3

$93.7

$9.1

6

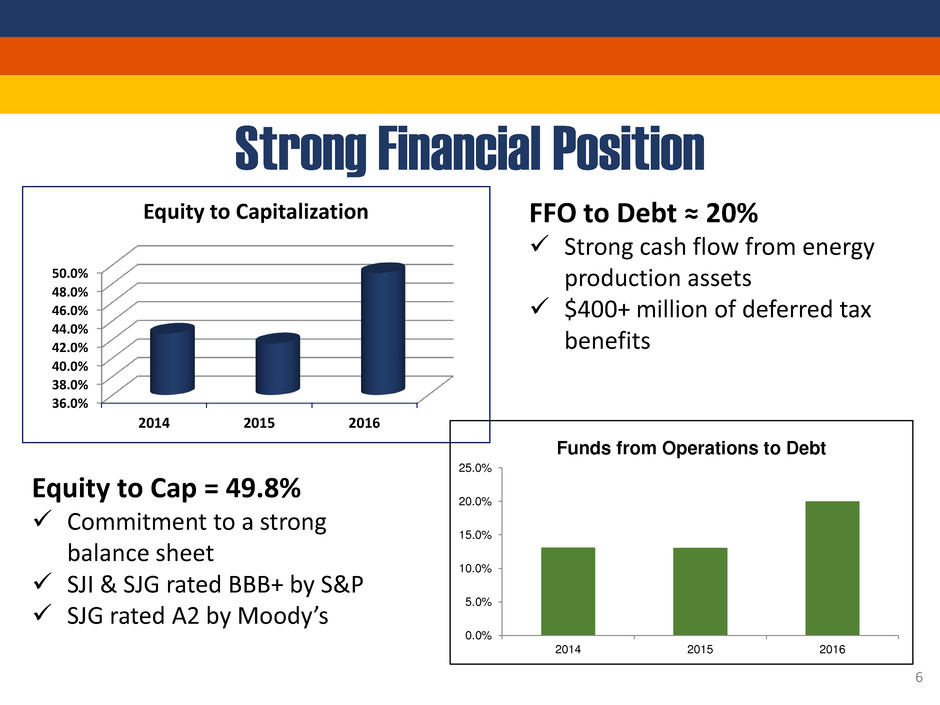

Equity to Cap = 49.8%

Commitment to a strong

balance sheet

SJI & SJG rated BBB+ by S&P

SJG rated A2 by Moody’s

36.0%

38.0%

40.0%

42.0%

44.0%

46.0%

48.0%

50.0%

2014 2015 2016

Equity to Capitalization

Strong Financial Position

FFO to Debt ≈ 20%

Strong cash flow from energy

production assets

$400+ million of deferred tax

benefits

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

2014 2015 2016

Funds from Operations to Debt

7

Improving Risk Profile

Business Lines Expected

Contribution to

2017 EE

Expected

Contribution to

2020 EE

Regulated

Gas Utility Operations 70 – 74 percent 64 – 68 percent

Midstream 3 – 5 percent 8 – 12 percent

Non-Utility

SJ Energy Group 20 – 24 percent 24 – 28 percent

SJ Energy Services 0 – 2 percent 2 – 4 percent

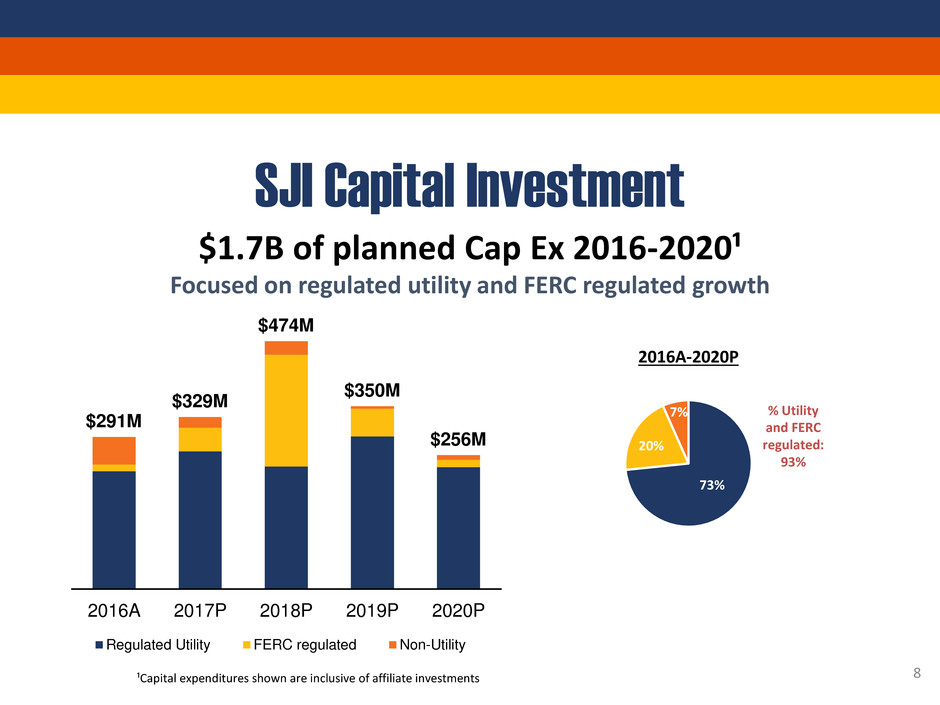

SJI Capital Investment

$1.7B of planned Cap Ex 2016-2020¹

Focused on regulated utility and FERC regulated growth

$291M

$329M

$474M

$350M

$256M

2016A 2017P 2018P 2019P 2020P

Regulated Utility FERC regulated Non-Utility

2016A-2020P

73%

20%

7% % Utility

and FERC

regulated:

93%

8 ¹Capital expenditures shown are inclusive of affiliate investments

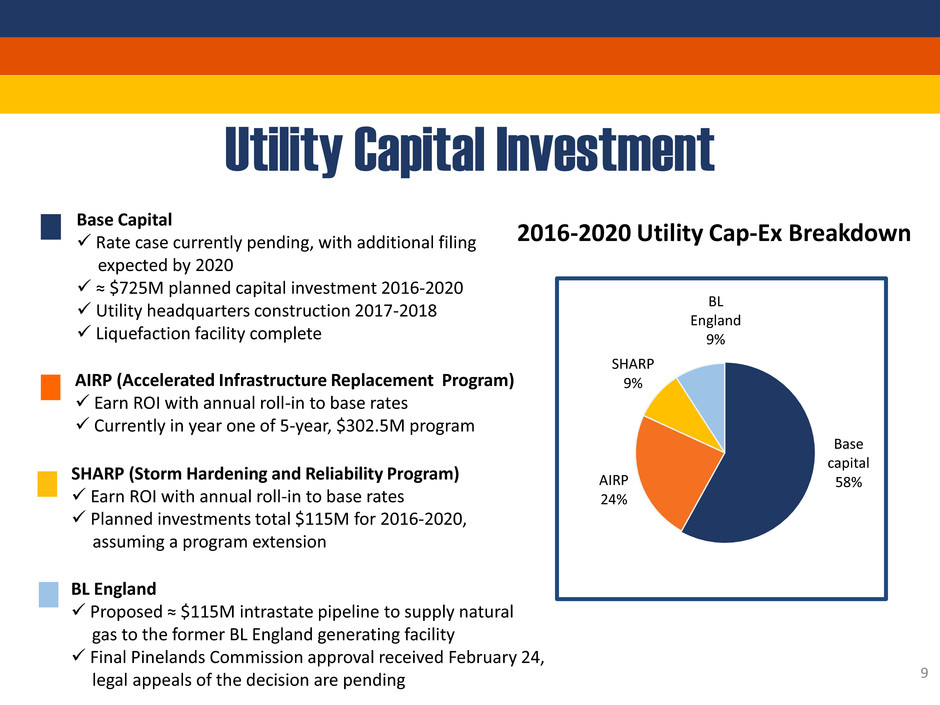

Utility Capital Investment

2016-2020 Utility Cap-Ex Breakdown

Base

capital

58% AIRP

24%

SHARP

9%

BL

England

9%

Base Capital

Rate case currently pending, with additional filing

expected by 2020

≈ $725M planned capital investment 2016-2020

Utility headquarters construction 2017-2018

Liquefaction facility complete

AIRP (Accelerated Infrastructure Replacement Program)

Earn ROI with annual roll-in to base rates

Currently in year one of 5-year, $302.5M program

SHARP (Storm Hardening and Reliability Program)

Earn ROI with annual roll-in to base rates

Planned investments total $115M for 2016-2020,

assuming a program extension

BL England

Proposed ≈ $115M intrastate pipeline to supply natural

gas to the former BL England generating facility

Final Pinelands Commission approval received February 24,

legal appeals of the decision are pending

9

Utility Customer Growth

12 Months Ending

March 31, 2017

Margin Growth from Customer Additions $2.1M

Conversions 4,706

New Construction 2,549

Total Gross Customer Additions 7,255

Net Customer Additions 5,266

Year Over Year Net Growth Rate 1.4%

10

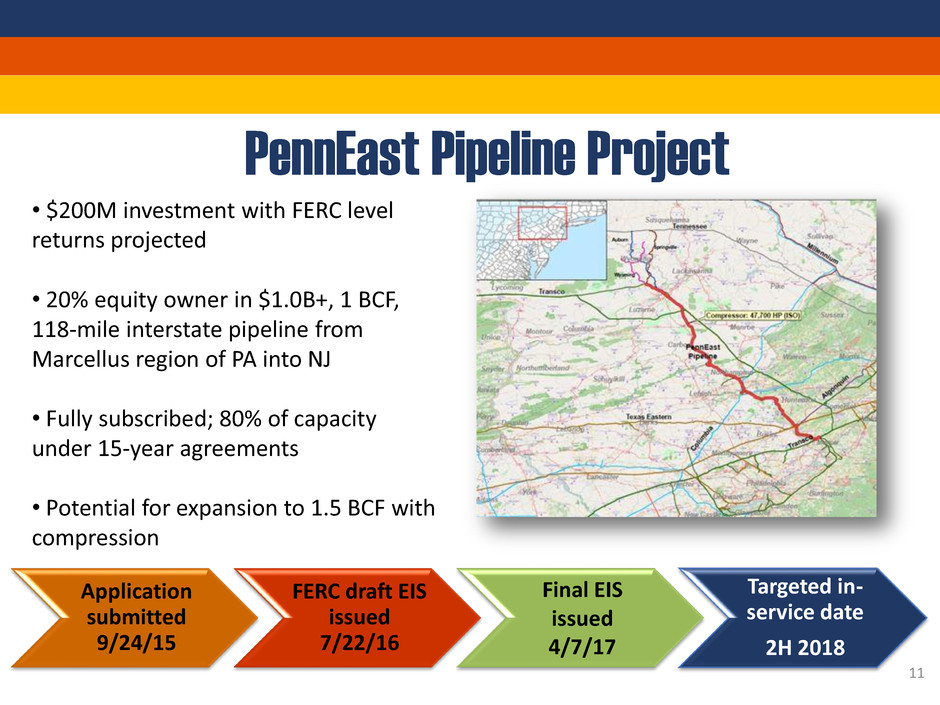

PennEast Pipeline Project

• $200M investment with FERC level

returns projected

• 20% equity owner in $1.0B+, 1 BCF,

118-mile interstate pipeline from

Marcellus region of PA into NJ

• Fully subscribed; 80% of capacity

under 15-year agreements

• Potential for expansion to 1.5 BCF with

compression

Application

submitted

9/24/15

FERC draft EIS

issued

7/22/16

Final EIS

issued

4/7/17

Targeted in-

service date

2H 2018

11

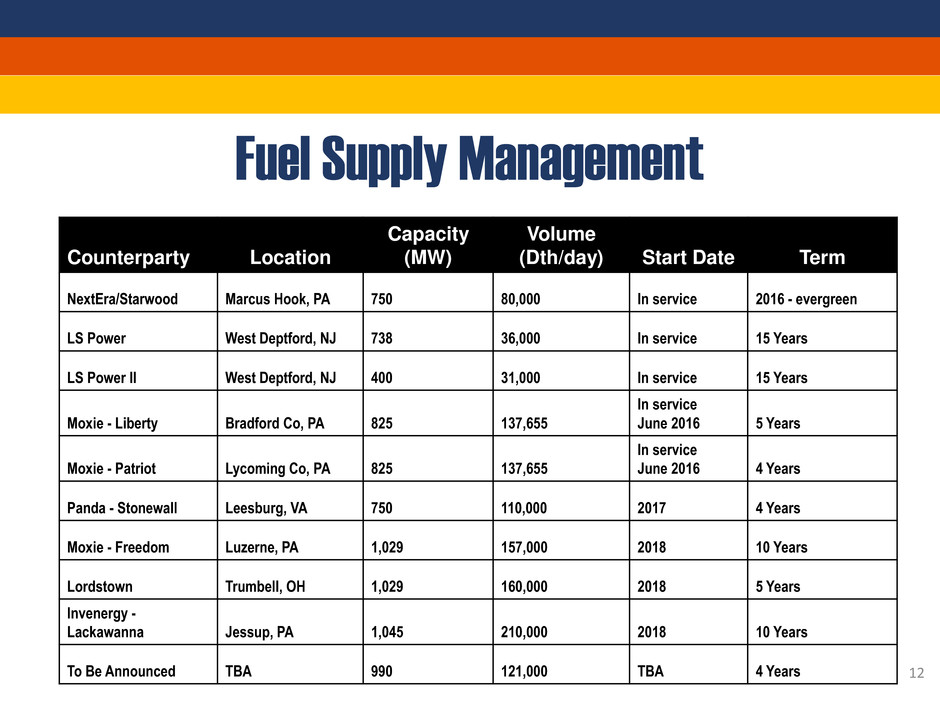

Fuel Supply Management

Counterparty Location

Capacity

(MW)

Volume

(Dth/day) Start Date Term

NextEra/Starwood Marcus Hook, PA 750 80,000 In service 2016 - evergreen

LS Power West Deptford, NJ 738 36,000 In service 15 Years

LS Power II West Deptford, NJ 400 31,000 In service 15 Years

Moxie - Liberty Bradford Co, PA 825 137,655

In service

June 2016 5 Years

Moxie - Patriot Lycoming Co, PA 825 137,655

In service

June 2016 4 Years

Panda - Stonewall Leesburg, VA 750 110,000 2017 4 Years

Moxie - Freedom Luzerne, PA 1,029 157,000 2018 10 Years

Lordstown Trumbell, OH 1,029 160,000 2018 5 Years

Invenergy -

Lackawanna Jessup, PA 1,045 210,000 2018 10 Years

To Be Announced TBA 990 121,000 TBA 4 Years 12

Current Performance

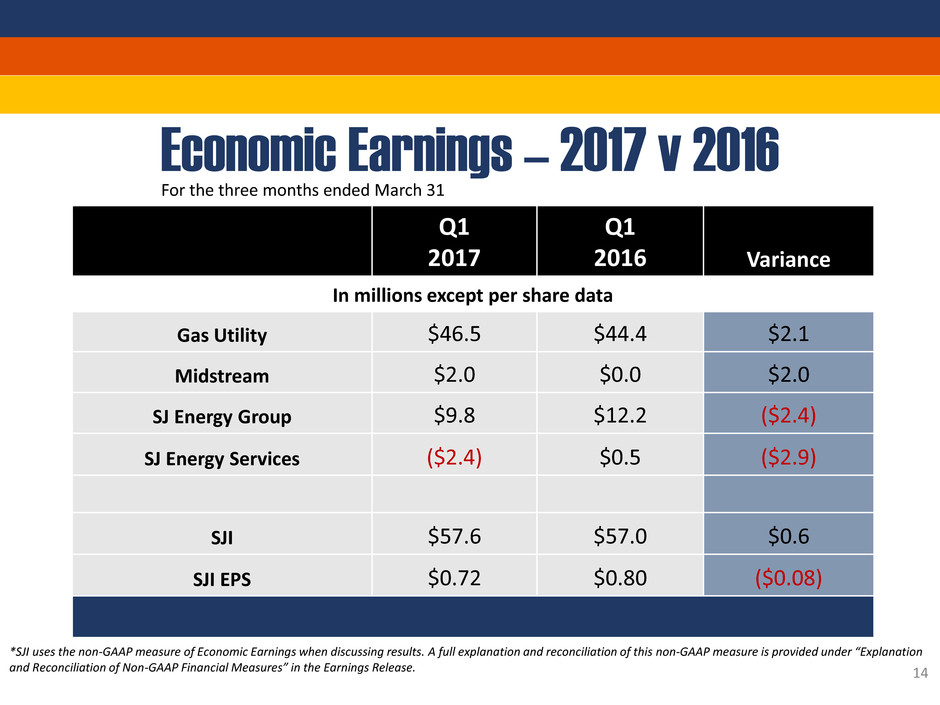

Economic Earnings – 2017 v 2016

For the three months ended March 31

Q1

2017

Q1

2016 Variance

In millions except per share data

Gas Utility $46.5 $44.4 $2.1

Midstream $2.0 $0.0 $2.0

SJ Energy Group $9.8 $12.2 ($2.4)

SJ Energy Services ($2.4) $0.5 ($2.9)

SJI $57.6 $57.0 $0.6

SJI EPS $0.72 $0.80 ($0.08)

*SJI uses the non-GAAP measure of Economic Earnings when discussing results. A full explanation and reconciliation of this non-GAAP measure is provided under “Explanation

and Reconciliation of Non-GAAP Financial Measures” in the Earnings Release.

14

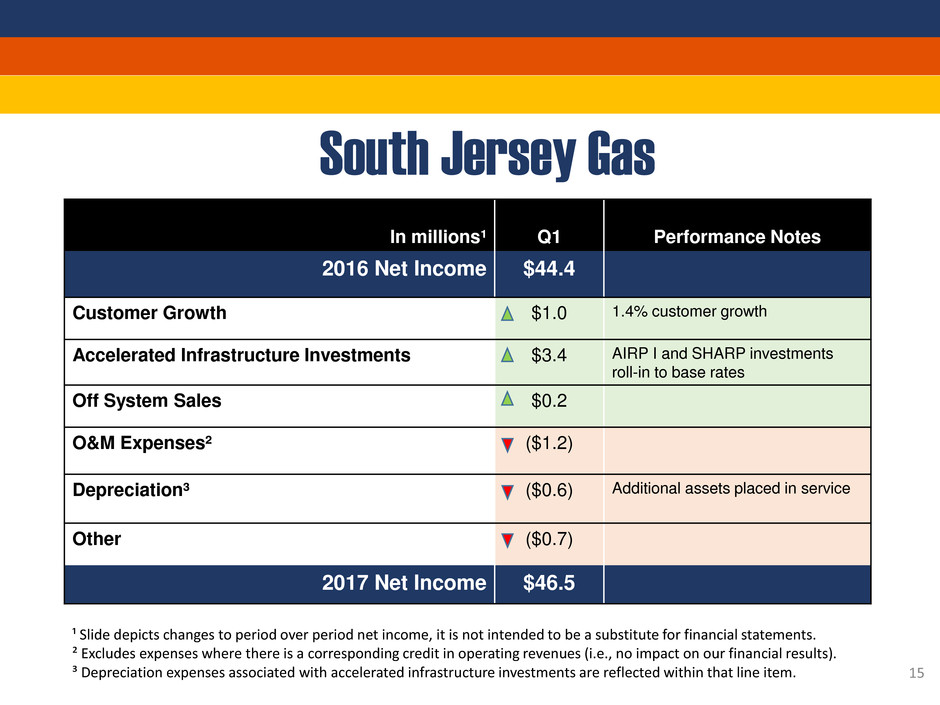

South Jersey Gas

In millions¹

Q1

Performance Notes

2016 Net Income $44.4

Customer Growth $1.0 1.4% customer growth

Accelerated Infrastructure Investments $3.4 AIRP I and SHARP investments

roll-in to base rates

Off System Sales $0.2

O&M Expenses² ($1.2)

Depreciation³ ($0.6) Additional assets placed in service

Other ($0.7)

2017 Net Income $46.5

¹ Slide depicts changes to period over period net income, it is not intended to be a substitute for financial statements.

² Excludes expenses where there is a corresponding credit in operating revenues (i.e., no impact on our financial results).

³ Depreciation expenses associated with accelerated infrastructure investments are reflected within that line item.

15

16

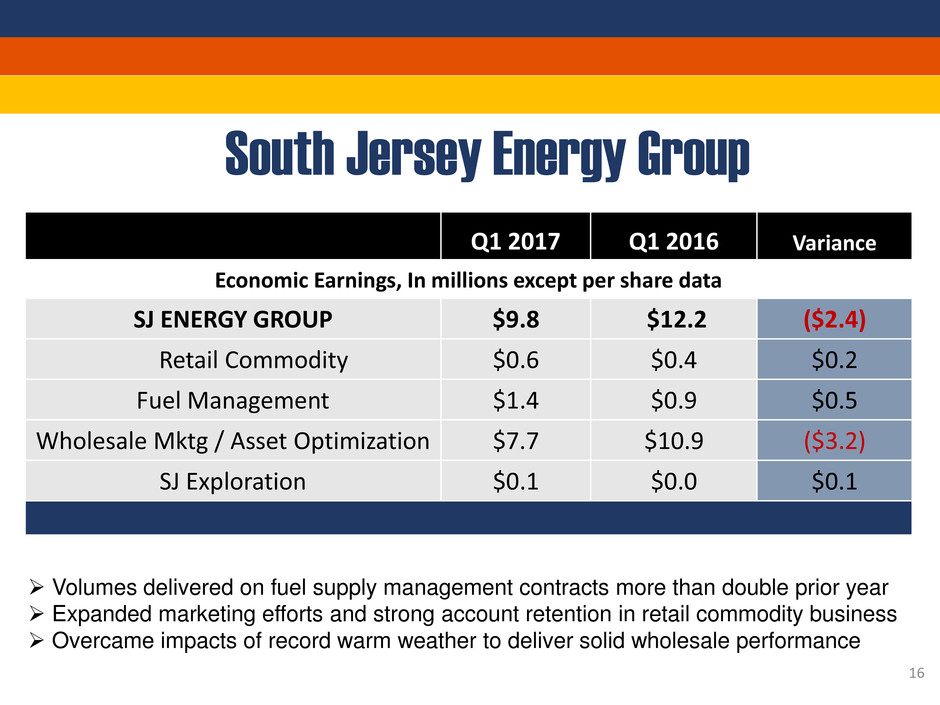

Q1 2017 Q1 2016 Variance

Economic Earnings, In millions except per share data

SJ ENERGY GROUP $9.8 $12.2 ($2.4)

Retail Commodity $0.6 $0.4 $0.2

Fuel Management $1.4 $0.9 $0.5

Wholesale Mktg / Asset Optimization $7.7 $10.9 ($3.2)

SJ Exploration $0.1 $0.0 $0.1

South Jersey Energy Group

Volumes delivered on fuel supply management contracts more than double prior year

Expanded marketing efforts and strong account retention in retail commodity business

Overcame impacts of record warm weather to deliver solid wholesale performance

17

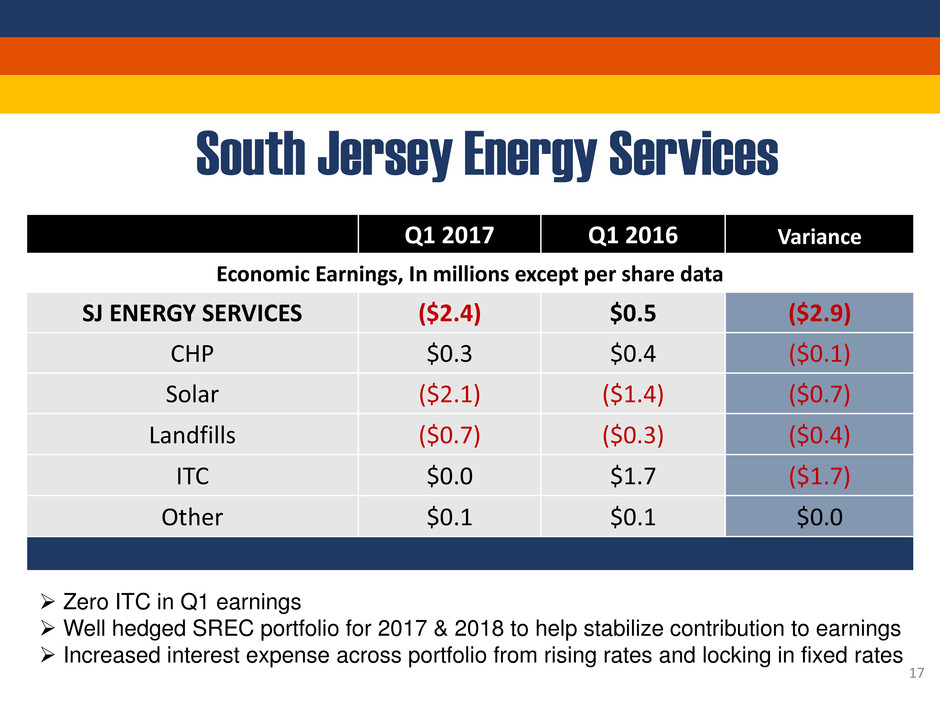

Q1 2017 Q1 2016 Variance

Economic Earnings, In millions except per share data

SJ ENERGY SERVICES ($2.4) $0.5 ($2.9)

CHP $0.3 $0.4 ($0.1)

Solar ($2.1) ($1.4) ($0.7)

Landfills ($0.7) ($0.3) ($0.4)

ITC $0.0 $1.7 ($1.7)

Other $0.1 $0.1 $0.0

South Jersey Energy Services

Zero ITC in Q1 earnings

Well hedged SREC portfolio for 2017 & 2018 to help stabilize contribution to earnings

Increased interest expense across portfolio from rising rates and locking in fixed rates

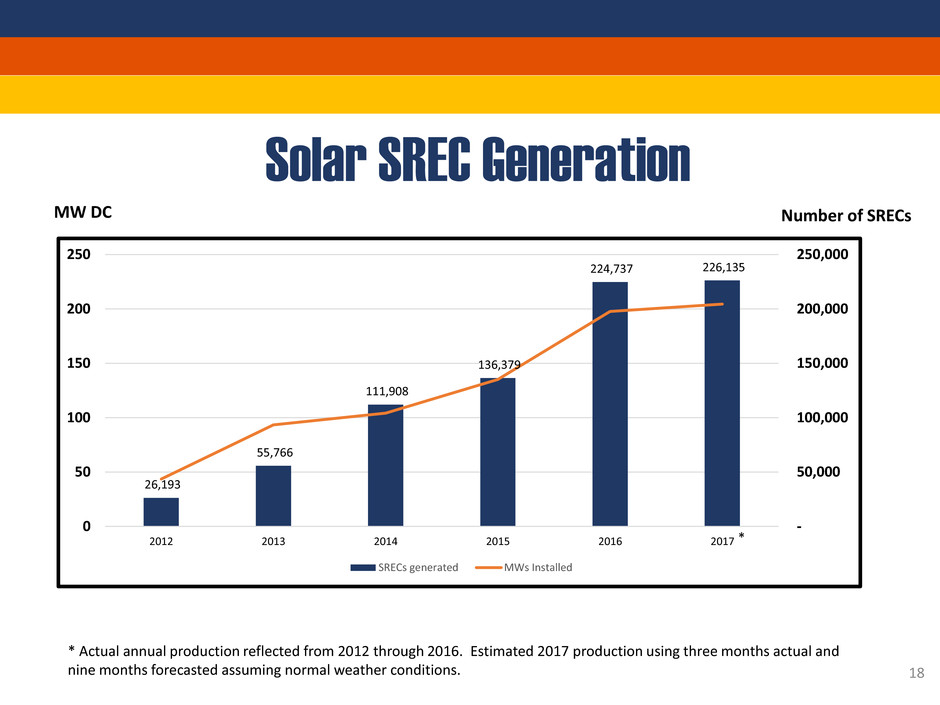

Solar SREC Generation

MW DC Number of SRECs

26,193

55,766

111,908

136,379

224,737 226,135

-

50,000

100,000

150,000

200,000

250,000

0

50

100

150

200

250

2012 2013 2014 2015 2016 2017

SRECs generated MWs Installed

*

* Actual annual production reflected from 2012 through 2016. Estimated 2017 production using three months actual and

nine months forecasted assuming normal weather conditions. 18

Appendix

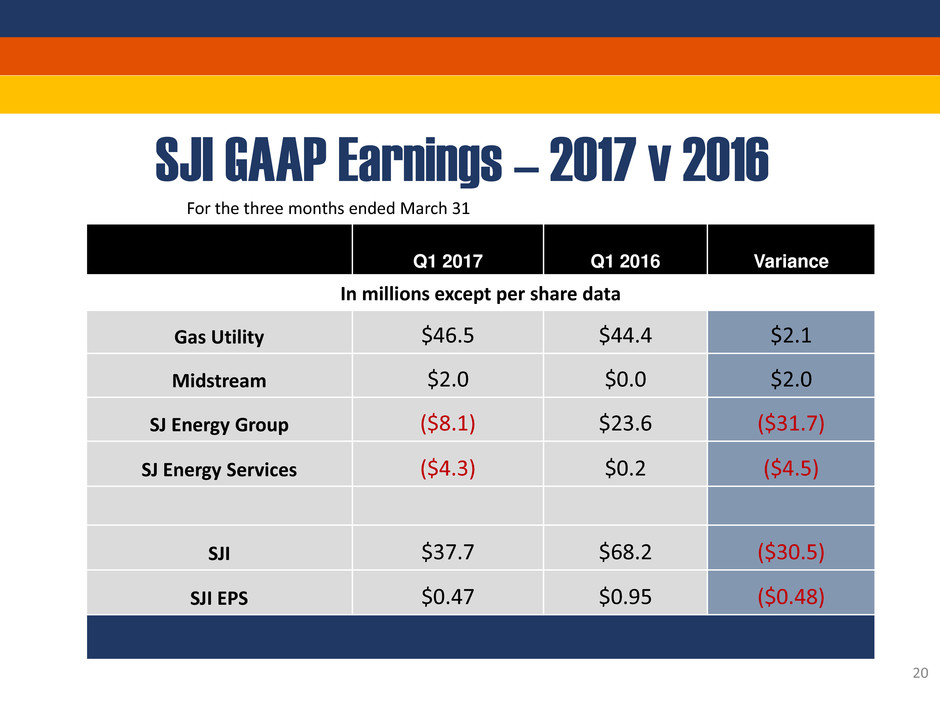

SJI GAAP Earnings – 2017 v 2016

For the three months ended March 31

Q1 2017 Q1 2016 Variance

In millions except per share data

Gas Utility $46.5 $44.4 $2.1

Midstream $2.0 $0.0 $2.0

SJ Energy Group ($8.1) $23.6 ($31.7)

SJ Energy Services ($4.3) $0.2 ($4.5)

SJI $37.7 $68.2 ($30.5)

SJI EPS $0.47 $0.95 ($0.48)

20

21

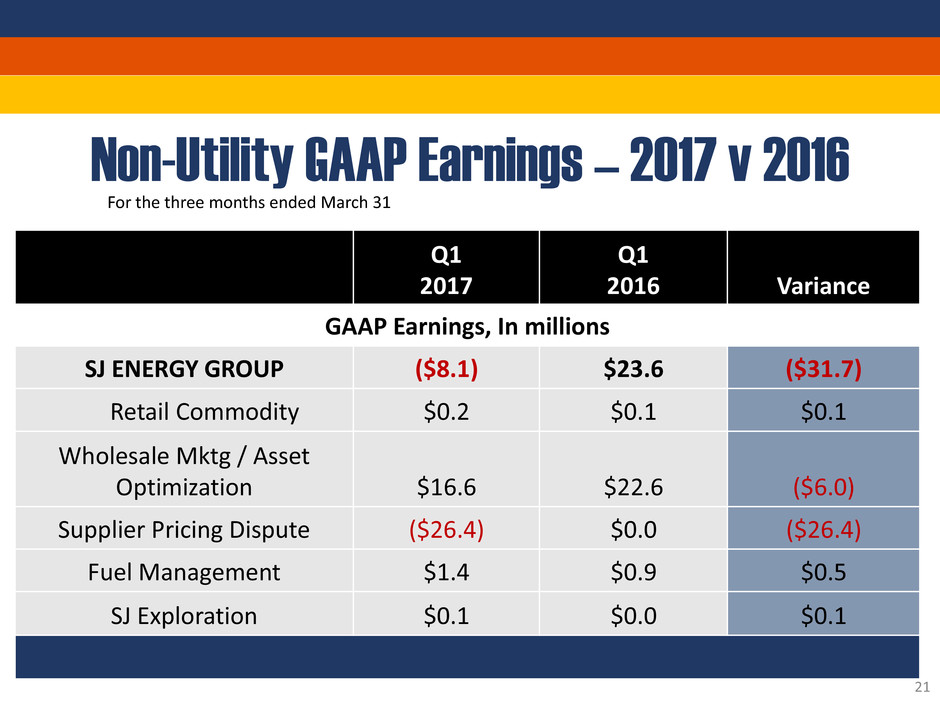

Q1

2017

Q1

2016 Variance

GAAP Earnings, In millions

SJ ENERGY GROUP ($8.1) $23.6 ($31.7)

Retail Commodity $0.2 $0.1 $0.1

Wholesale Mktg / Asset

Optimization $16.6 $22.6 ($6.0)

Supplier Pricing Dispute ($26.4) $0.0 ($26.4)

Fuel Management $1.4 $0.9 $0.5

SJ Exploration $0.1 $0.0 $0.1

Non-Utility GAAP Earnings – 2017 v 2016

For the three months ended March 31

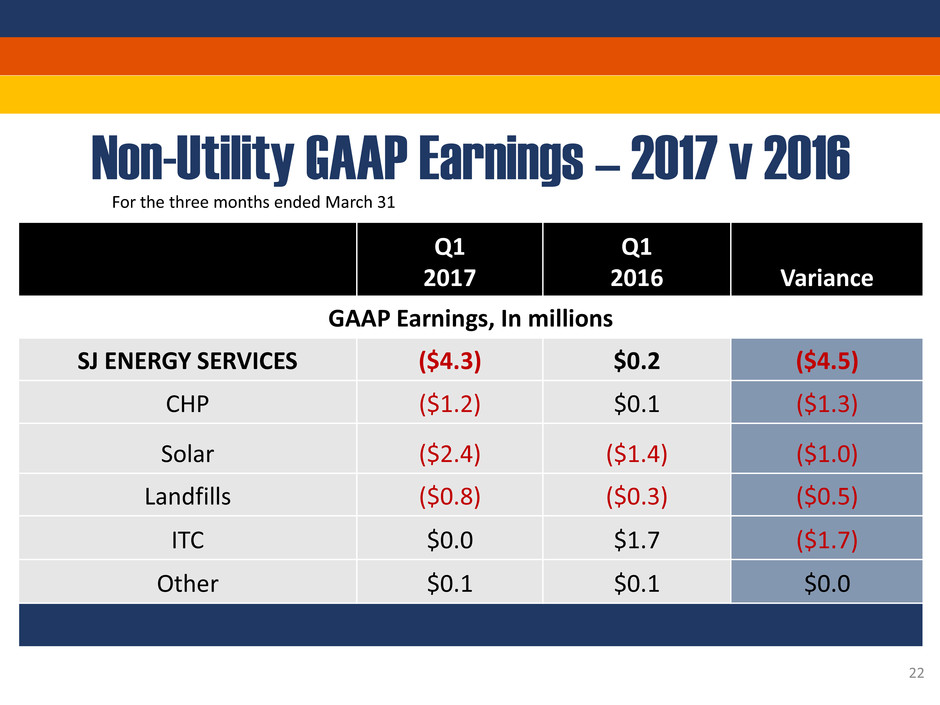

22

Q1

2017

Q1

2016 Variance

GAAP Earnings, In millions

SJ ENERGY SERVICES ($4.3) $0.2 ($4.5)

CHP ($1.2) $0.1 ($1.3)

Solar ($2.4) ($1.4) ($1.0)

Landfills ($0.8) ($0.3) ($0.5)

ITC $0.0 $1.7 ($1.7)

Other $0.1 $0.1 $0.0

Non-Utility GAAP Earnings – 2017 v 2016

For the three months ended March 31