Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - BERKSHIRE HILLS BANCORP INC | t1701614_ex99-2.htm |

| EX-10.1 - EXHIBIT 10.1 - BERKSHIRE HILLS BANCORP INC | t1701614_ex10-1.htm |

| EX-2.1 - EXHIBIT 2.1 - BERKSHIRE HILLS BANCORP INC | t1701614_ex2-1.htm |

| 8-K - FORM 8-K - BERKSHIRE HILLS BANCORP INC | t1701614_8k.htm |

Exhibit 99.1

May 22, 2017 Berkshire Hills announces acquisition of Commerce Bancshares 1

Overview of the Transaction Strategically Compelling • Accelerates growth in Greater Boston and Eastern MA • Builds on existing ~$1.5 billion in loans and ~$200 million in Boston - based deposits (1) • Enhances density in desirable and growing markets • Pro forma market share rank of #1 in the city of Worcester • Provides significant step over $10 billion mark while absorbing all related impacts • Catalyst for moving corporate headquarters into Boston • Berkshire will be the 1 st regional bank headquartered (2) in Boston in decades • Acquisition provides affordable scale Financially Attractive (4) • Mid - single digit 2018 EPS accretion (3) • < 1% tangible book value (TBV) dilution and 1.0 year earn - back (cross - over/simple method) • Includes absorption of all revenue/expense impact associated with $10 billion cross • 15%+ Internal Rate of Return well in excess of cost of capital • Conservative earnings assumptions and appropriate balance sheet marks based on extensive due diligence • Enhances balance sheet liquidity • 73% Loan/Deposit ratio (Commerce) • Asset sensitive balance sheet in projected rising rate environment (1) Data as of 03/31/2017 (2) Subject to regulatory approval (3 ) Excludes $32 million one - time transaction cost (pre - tax ) (4) Inclusive of $100 million common equity capital raise 2

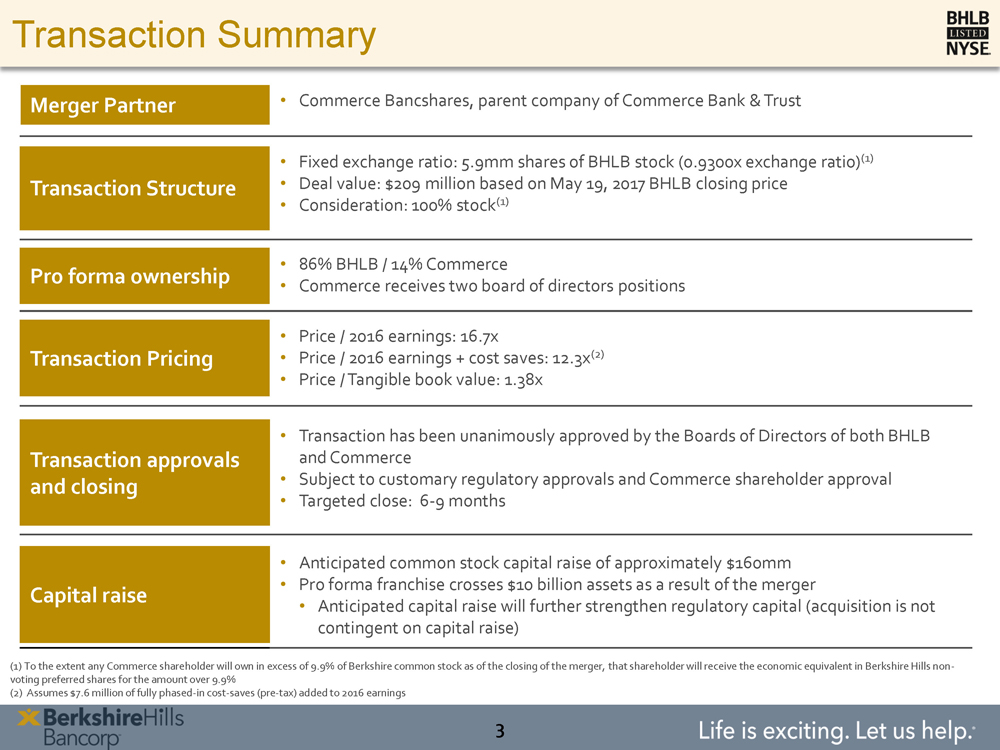

Transaction Summary Merger Partner • Commerce Bancshares, parent company of Commerce Bank & Trust Transaction Structure • Fixed exchange ratio: 5.9mm shares of BHLB stock (0.9300x exchange ratio) (1) • Deal value: $209 million based on May 19, 2017 BHLB closing price • Consideration: 100% stock (1) Pro forma ownership • 86% BHLB / 14% Commerce • Commerce receives two board of directors positions Transaction Pricing • Price / 2016 earnings: 16.7x • Price / 2016 earnings + cost saves: 12.3x (2) • Price / Tangible book value: 1.38x Transaction approvals and closing • Transaction has been unanimously approved by the Boards of Directors of both BHLB and Commerce • Subject to customary regulatory approvals and Commerce shareholder approval • Targeted close: 6 - 9 months Capital raise • Anticipated common stock capital raise of approximately $160mm • Pro forma franchise crosses $10 billion assets as a result of the merger • Anticipated capital raise will further strengthen regulatory capital (acquisition is not contingent on capital raise) (1) To the extent any Commerce shareholder will own in excess of 9.9% of Berkshire common stock as of the closing of the merger, tha t shareholder will receive the economic equivalent in Berkshire Hills non - voting preferred shares for the amount over 9.9% (2) Assumes $7.6 million of fully phased - in cost - saves (pre - tax) added to 2016 earnings 3

Largest Regional Bank Headquartered in Massachusetts (1) Pro forma metrics (2) » Assets: $11.5 billion » Loans: $ 8.2 billion » Deposits: $ 8.7 billion » Revenue (1Q17 annualized) : $475 million » Branches: 113 » Footprint: New England, New York, New Jersey and Pennsylvania » Market Cap: approximately $1.5 billion » NYSE: BHLB Note: All data as of 03/31/17, market c ap as of 5/15/2017 (including merger, before capital raise) (1) Source: SNL Financial, based on most recently reported total assets for banks headquartered in Massachusetts (2) Pro forma metrics represent the sum of BHLB and Commerce data and are not reflective of any purchase accounting marks or acc ounting adjustments Combined Franchise 4

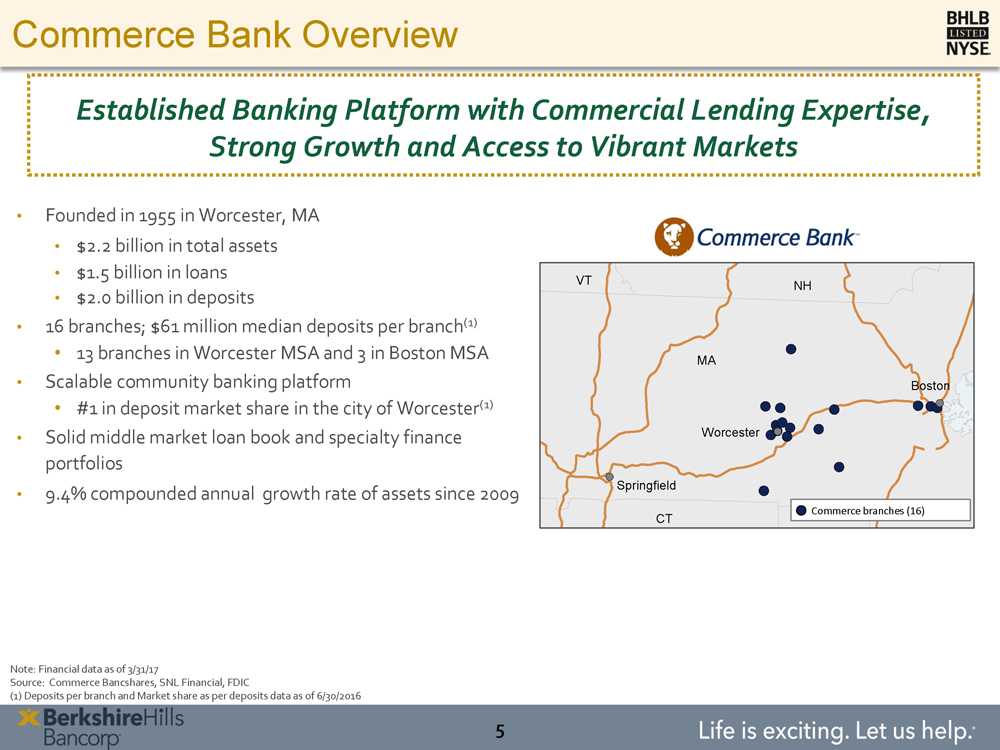

Commerce Bank Overview Established Banking Platform with Commercial Lending Expertise, Strong Growth and Access to Vibrant Markets • Founded in 1955 in Worcester, MA • $2.2 billion in total assets • $1.5 b illion in loans • $2.0 billion in deposits • 16 branches; $ 61 million median deposits per branch (1) • 13 branches in Worcester MSA and 3 in Boston MSA • Scalable community banking platform • #1 in deposit market share in the city of Worcester (1) • Solid middle market loan book and specialty finance portfolios • 9.4% compounded annual growth rate of assets since 2009 This map is saved in Dealworks folder 2339813 - 003 MA CT RI VT NH Worcester Springfield Boston NY Commerce branches (16) Note: Financial data as of 3/31/17 Source: Commerce Bancshares, SNL Financial, FDIC (1) Deposits per branch and Market share as per deposits data as of 6/30/2016 5

Loan composition Deposit Complementary Balance Sheet Profiles Consumer 15% Residential real estate¹ 34% CRE 29% C&D 5% C&I 17% Transaction 27% Savings & MMDA 37% Total time 2 36% Combined Consumer 6% Residential real estate¹ 15% CRE 30% C&D 5% C&I 44% Transaction 24% Savings & MMDA 65% Total time 2 11% Consumer 13% Residential real estate¹ 31% CRE 29% C&D 5% C&I 22% Total loans: $6.7bn MRQ Yield on loans: 4.24% Total loans: $1.5bn MRQ Yield on loans: 4.24% Total loans: $8.2bn Total deposits: $ 6.7bn MRQ Cost of deposits : 0.56% Total deposits: $2.0bn MRQ Cost of deposits: 0.40% Total deposits: $8.7bn Transaction 26% Savings & MMDA 44% Total time 2 30% Note: Financial data as of quarter ended 3/31/17 Source: Company financials, SNL Financial (1) Residential real estate includes 1 - 4 family and multifamily loans ( 2 ) Includes jumbo and retail time deposits 6

Boston Expansion Establishing the first Regional Bank headquartered in Boston in decades (1) Worcester MA Boston MA Population 940M 4,832M GDP (2015) $39B $397B % Change Y/Y 3.6% 4.6% Avg household income $90M $112M Unemployment rate (12/2016) 3.0% 2.3% Total deposits $17B $309B % Change Y/Y 7.1% 2.5% Combined deposit market share 10.08% 0.08% Note: All data by MSA and as of 06/30/2016 unless otherwise stated » Pro forma Boston market combination ◦ Will operate corporate headquarters, 6 branches, and 3 lending offices in Greater Boston ◦ Over $3.0 billion assets and $2.0 billion deposits in Eastern MA ◦ Acquisition will provide significant scale in region » Building on strategic partnerships ◦ Relationships already provide significant marketing value Official Bank of NESN’s Boston Bruins coverage Community partner of Boston Seasons at City Hall Plaza Ray Bourque, hockey legend and Berkshire Bank spokesperson » Creating growth opportunities ◦ Boston accounts for 45% of New England GDP ◦ Robust metropolitan area ◦ Enhances ability to attract talent ◦ Provides visibility with customers and investors Note: Pro forma metrics represent the sum of BHLB and Commerce data and are not reflective of any purchase accounting marks or accounti ng adjustments (1) Subject to regulatory approval 7

Transaction Assumptions Key Assumptions Synergies • 20% of Commerce’s expense base • $32 million one - time transaction costs (pre - tax) Core deposit intangible • ~$19mm core deposit intangibles or ~1% Regulatory costs • Berkshire has been preparing to cross $10bn for several years – expected incremental regulatory costs/revenue impacts as a result of the transaction: • Annual run - rate pre - tax impact from Durbin of ~$5 million, phased - in 50% in 2019 and 100% in 2020 • Annual pre - tax incremental cost of ~$1.5 million to comply with advanced supervisory requirements (DFAST, FDIC) Credit review and fair value markets • Extensive credit due diligence, including thorough loan file review • Detailed review of 80% of outstanding loans, 100% of criticized loans • ~$105 mm total loan mark (7.2%) primarily tied to Taxi Medallion portfolio • ~65% mark on medallion portfolio and ~2.7% mark on remaining portfolio • $103mm medallion portfolio representing ~390 medallions in Boston and Cambridge as of 3/31/17 (85% Boston, 15% Cambridge) Source: Company data Financial data as of 03/31/2017 8

Estimated Pro Forma Impact Key Transaction Impacts to Berkshire Hills (1) 2018E EPS Accretion (2) ~4 - 5% IRR ~15%+ Tangible Book Value Dilution ~(0.7%) Tangible Book Value Earnback ~1.0 yr As of March 31, 2017 Capital Ratios Berkshire Hills Commerce Pro Forma (3) TCE / TA 7.6% 6.9% 7.6% +/ - Leverage Ratio 7.9% 7.4% 7.8% +/ - Common Equity Tier 1 Ratio 9.9% 9.5% 10.0% +/ - Tier 1 Ratio 10.1% 9.5% 10.2% +/ - Total Risk - based Capital Ratio 11.8% 11.8% 11.6% +/ - Source : Company filings, SNL Financial (1) Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates per research analyst reports and inclusive of $100 million common stock capital raise (2) Calculation excludes $32 million one - time transaction costs (pre - tax ) (3) Estimated impact as of 03/31/2017 is presented solely for illustrative purposes. Includes purchase accounting marks and transaction costs, as well as $100 million common stock capital raise 9

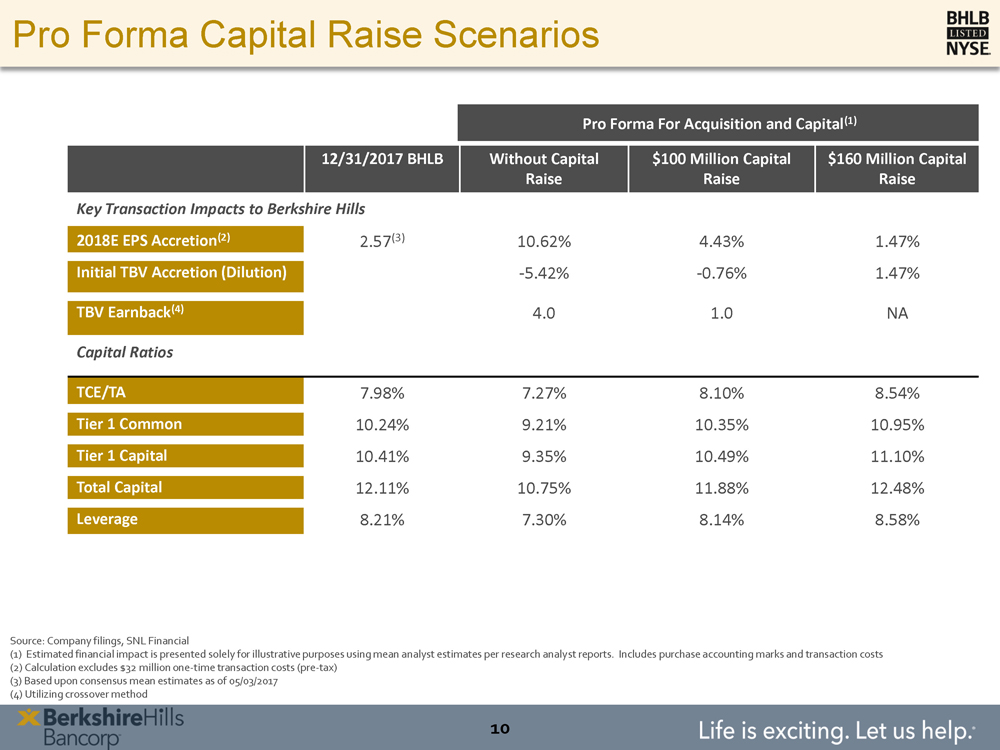

Pro Forma Capital Raise Scenarios Pro Forma For Acquisition and Capital (1) 12/31/2017 BHLB Without Capital Raise $100 Million Capital Raise $160 Million Capital Raise Key Transaction Impacts to Berkshire Hills 2018E EPS Accretion (2) 2.57 (3) 10.62% 4.43% 1.47% Initial TBV Accretion (Dilution) - 5.42% - 0.76% 1.47% TBV Earnback (4) 4.0 1.0 NA Capital Ratios TCE/TA 7.98% 7.27% 8.10% 8.54% Tier 1 Common 10.24% 9.21% 10.35% 10.95% Tier 1 Capital 10.41% 9.35% 10.49% 11.10% Total Capital 12.11% 10.75% 11.88% 12.48% Leverage 8.21% 7.30% 8.14% 8.58% Source: Company filings, SNL Financial (1) Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates per research analy st reports. Includes purchase accounting marks and transaction costs (2) Calculation excludes $32 million one - time transaction costs (pre - tax ) (3) Based upon consensus mean estimates as of 05/03/2017 (4) Utilizing crossover method 10

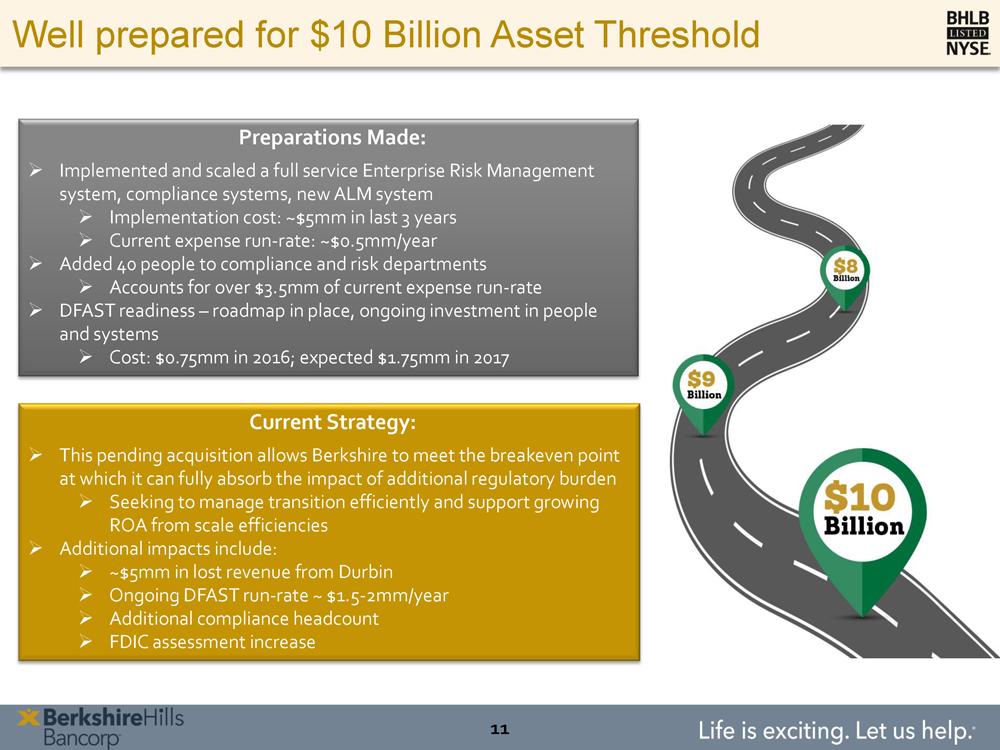

Current Strategy: » This pending acquisition allows Berkshire to meet the breakeven point at which it can fully absorb the impact of additional regulatory burden » Seeking to manage transition efficiently and support growing ROA from scale efficiencies » Additional impacts include: » ~$5mm in lost revenue from Durbin » Ongoing DFAST run - rate ~ $1.5 - 2mm/year » Additional compliance headcount » FDIC assessment increase Well prepared for $10 Billion Asset Threshold Preparations Made: » Implemented and scaled a full service Enterprise Risk Management system, compliance systems, new ALM system » Implementation cost: ~$5mm in last 3 years » Current expense run - rate: ~$0.5mm/year » Added 40 people to compliance and risk departments » Accounts for over $3.5mm of current expense run - rate » DFAST readiness – roadmap in place, ongoing investment in people and systems » Cost: $0.75mm in 2016; expected $1.75mm in 2017 11

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Acquired Woronoco Bancorp, Inc. 6/1/2005 Assets: $898MM MA Acquired 6 independent insurance agencies 2006 MA Acquired Factory Point Bancorp, Inc. 9/21/2007 Assets: $339MM VT Acquired Rome Bancorp, Inc. 4/1/2011 Assets: $330MM NY Acquired Legacy Bancorp, Inc. 7/21/2011 Assets: $972MM MA Acquired Greenpark Mortgage Corporation 4/30/2012 Assets: $48MM MA/Northeast Acquired Connecticut Bank and Trust Company 4/20/2012 Assets: $283MM CT Acquired 20 branches from Bank of America 1/17/2014 Deposits: $440MM NY Acquired Beacon Federal Bancorp, Inc. 10/19/2012 Assets: $1,024MM NY Acquired Firestone Financial Corporation 8/7/2015 Assets: $192MM MA/Nat’l Acquired 44 Business Capital, LLC 4/29/2016 Assets: $40MM PA/Mid - Atlantic Acquired First Choice Bank & First Choice Loan Services 12/6/2016 Assets: $1,100MM NJ Acquired Hampden Bancorp, Inc. 4/17/2015 Assets: $706MM MA » Successful acquisition and integration is a core competency ◦ 8 whole banks, 3 specialty finance companies, 6 insurance agencies, & 1 branch deal Announced acquisition of Commerce Bancshares Corp. 5/22/2017 Assets: $2,219MM MA History of Successful Acquisitions Note: Only includes significant acquisitions since 2005 12

Appendix 13

FORWARD LOOKING STATEMENTS This document contains certain forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the proposed merger of Berkshire and Commerce Bancshares. These statements include statements regarding the anticipated closing date of the transaction and anticipated future results. Forward - looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words like “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Certain factors that could cause actual results to differ materially from expected results include delays in completing the merger, difficulties in achieving cost savings from the merger or in achieving such cost savings within the expected timeframe, difficulties in integrating Berkshire and Commerce Bancshares, increased competitive pressures, changes in the interest rate environment, changes in general economic conditions, legislative and regulatory changes that adversely affect the business in which Berkshire Bank and Commerce Bancshares. are engaged, changes in the securities markets and other risks and uncertainties disclosed from time to time in documents that Berkshire files with the Securities and Exchange Commission. 14

NON - GAAP FINANCIAL MEASURES This presentation references non - GAAP financial measures incorporating tangible equity and related measures, as well as core deposits. These measures are commonly used by investors in evaluating business combinations and financial condition. The calculation of tangible book value dilution includes transaction costs related to the business combination, including professional fees, severance, contract terminations, systems conversion costs, and other one - time costs of the transaction. These costs are subtracted from equity as if they are all recorded by Berkshire at the time the merger is completed. These adjustments are stated net of a tax benefit based on the estimated tax deductibility of the projected costs . Transaction costs are not included in references related to earnings, including references to earnings accretion, the payback period for dilution to tangible book value, and cost save estimates. The Company estimates that transaction costs will total $32 million. It is presently undetermined as to which of these transactions costs will be recorded by Berkshire and which will be recorded by Commerce Bancshares. Accordingly, the Company is presently unable to estimate GAAP earnings related measures . Non - GAAP measures are not a substitute for GAAP measures; they should be read and used in conjunction with the Company’s GAAP financial information. In all cases, it should be understood that non - GAAP per share measures do not depict amounts that accrue directly to the benefit of shareholders . 15

ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed merger, Berkshire will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S - 4 that will include a Proxy Statement of Commerce Bancshares and a Prospectus of Berkshire, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the proposed merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Registration Statement and Proxy Statement/Prospectus, as well as other filings containing information about Berkshire and Commerce Bancshares, when they become available, may be obtained at the SEC’s Internet site (www.sec.gov). Copies of the Registration Statement and Proxy Statement/Prospectus (when they become available) and the filings that will be incorporated by reference therein may also be obtained, free of charge, from Berkshire’s website at ir.berkshirebank.com or by contacting Berkshire Investor Relations at 413 - 236 - 3149 or William Burke at Commerce at 508 - 797 - 6996. PARTICIPANTS IN SOLICITATION Berkshire and Commerce Bancshares and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Commerce Bancshares in connection with the proposed merger. Information about the directors and executive officers of Berkshire is set forth in the proxy statement for Berkshire’s 2017 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on April 7, 2017. Information about the directors and executive officers of Commerce Bancshares will be set forth in the Proxy Statement/Prospectus. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the Proxy Statement/Prospectus and other relevant documents regarding the proposed merger to be filed with the SEC (when they become available). Free copies of these documents may be obtained as described in the preceding paragraph. 16