Attached files

| file | filename |

|---|---|

| 8-K - NEW PEOPLES BANKSHARES INC | npbs8k051817.htm |

2017 Annual Shareholders’ Meeting Exhibit 99.1

INTRODUCTION OF DIRECTORS • Lynn Keene, Chairman • Charles Gent, Vice - Chairman • Tim Ball • Joe Carter • John Cox • Eugene Hearl • Michael McGlothlin • Fred Meade • Scott White 2

INTRODUCTION OF SENIOR MANAGEMENT TEAM • Todd Asbury, President and CEO • Frank Sexton, Jr., EVP and COO • Karen Wimmer, EVP and Director of Special Assets • Bill Beard, EVP and CCO • Joseph Pennington, SVP and CFO • Andy Mullins, FSVP and Senior Retail Officer • J. W. Kiser, FSVP and Senior Commercial Banking Officer • Debbie Arrington, SVP - Banking Operations • Landon McGlothlin, SVP & Chief Information Officer • Doug Horne, SVP and Area Manager – Cumberland Area • Richard Smith, SVP and Area Manager – Mountain Area • Gary Keyes, SVP and Senior Business Development Officer • Dorothy Meade, SVP and Senior Consumer Credit Underwriter 3

CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING STATEMENTS This presentation includes forward - looking statements . These forward - looking statements are based on current expectations that involve risks, uncertainties, and assumptions . Should one or more of these risks or uncertainties materialize or should underlying assumptions prove incorrect, actual results may differ materially . These risks include : changes in business or other market conditions ; the timely development, production and acceptance of new products and services ; the challenge of managing asset/liability levels ; the management of credit risk and interest rate risk ; the difficulty of keeping expense growth at modest levels while increasing revenues ; and other risks detailed from time to time in the Company's Securities and Exchange Commission reports including, but not limited to , the most recent quarterly report filed on Form 10 - Q, current reports filed on Form 8 - K, and the Annual Report on Form 10 - K for the most recent fiscal year end . Pursuant to the Private Securities Litigation Reform Act of 1995 , the Company does not undertake to update forward - looking statements to reflect circumstances or events that occur after the date the forward - looking statements are made . 4

5 Why does New Peoples Bank exist?

6 Answer: To Help Make Dreams Come True

7 • Our Shareholders • Our Customers • Our Employees • Our Communities

8 People Have Dreams

9 Our Shareholders Have Dreams

The mission of New Peoples Bank is to provide high quality, state of the art, golden rule banking services to our communities, while generating a reasonable return to our stockholders and providing a challenging and rewarding work environment for our family of employees 10 Our Mission

11 • High Performing Stock Yielding a Great Return • High earning • Dividend Paying • Safe and Strong • Highly efficient

12 • Excellent Customer Service • # 1 In Total Deposits in market area • Lender of choice • Meeting customer needs and exceeding expectations • Deep multiple account relationships • Knowledgeable and professional bankers

13 • Innovative • Cutting edge technology • Products and Services that meet customer’s needs • Staying ahead of the competition

14 • Making a Positive Difference for our Region • Deeply involved in the community • Economic catalyst for our region • Stellar reputation • Employer of choice

15 Making Shareholders’ Dreams Come True

16 Our Customers Have Dreams

Helping people get that New Home Giving Peace of Mind through Life Insurance Helping people plan for Retirement 17 Customer Dreams

Helping Business E xpansion creating New Jobs Helping People to get ahead financially Provide Reliable, Hassle free, Convenient Banking 18 Customer Dreams (Cont.)

19 Making Customers’ Dreams Come True

20 Our Employees Have Dreams

21 Employees’ Dreams

• Fair compensation and benefits • Opportunities for advancement • Recognition and appreciation for a good job • Well trained and equipped • Peace of mind 22 Employee Dreams

• Low stress work environment • Knowing that their employer cares • Being heard and knowing that their opinion matters • Being respected and kept abreast of what is going on 23 Employee Dreams (Cont.)

24 Making Employees’ Dreams Come True

25 Our Communities Have Dreams

26 Community Dreams

• Helping improve the quality of life • Providing leadership in the community • Promoting great things happening in our region • Improving the economy • Serving underserved areas • Working with local government and politicians to help improve our area 27 Community Dreams

28 Making Community Dreams Come True

29 “Your dreams will remain just a dream unless you take small and realistic steps towards achieving them.” ― Eileen Anglin

30

31

32 In order for us to fulfill our purpose of Helping Make Dreams Come True…

33 There is a Process

34 Strategic Organization Theme

STRATEGIC PRIORITIES NEAR - TERM PRIORITIES (1 - 2 years) Reduce Credit Risk Profile Conservative/ Modest Balance Sheet Growth Increase Earnings and Capital Maximize Efficiencies Improve Risk Management Capabilities Continue to Recruit, Develop and Support Our People Be the Market Leader in Introducing New Banking Technologies

STRATEGIC PRIORITIES LONG - TERM PRIORITIES (2 - 5 years) Enhance Shareholder Liquidity, Value and Return Differentiate Ourselves from the Competition Through the Technologies We Offer, Superior Service and Local Market Presence Continue Targeted Growth in Clearly Defined Segments Expand on Building a Growing Portfolio of Low Cost Relationship - Based Deposits Continue to Develop and Support Our People

37 Where are We in the Process?

Financial Goals 2016 & GREAT Goals 38 Financial Goals 2016 & Great Goals 12/31/16 12/31/2016 GREAT! Financial Actual Goals Goals Assets $634M $639M Asset Growth 1.35% 2.10% > 5.00% Loan Growth 6.22% 2.11% > 5.00% Deposit Growth (0.64%) 1.81% > 5.00% Return on Average Assets 0.15% 0.48% > 1.25% Return on Average Equity 2.00% 6.24% > 12.50% Net Interest Margin 3.93% >3.90% > 4.00% Non - Interest Income 1.16% >0.90% > 1.00% Non - Performing Assets 3.79% <4.0% < 1.00% Classified Assets to Tier 1+ALLL ratio 42.26% <40% < 10% Tier 1 Capital Leverage 9.93% >9.00% > 10.00 % Operating DDA/ Int Chking /MMA as % of Total Deposits 55.30% >50% > 55% Efficiency 99.33% <85% < 65%

We are Safer and Stronger We are Growing We are Improving Efficiencies We are Differentiating Ourselves 39 State of New Peoples Bankshares

40 We are Safer and Stronger

We are Safer and Stronger • Asset quality is continually improving but still higher levels than desired • Capital Levels are stronger and closer to peer • Risk management tools are robust and effective to help us manage appropriately 41 State of New Peoples Bankshares

NONPERFORMING ASSETS (IN THOUSANDS) DECEMBER 31, 2010 THROUGH DECEMBER 31, 2016 2010 2011 2012 2013 2014 2015 2016 Total NPAs $59,820 $58,912 $47,956 $44,161 $36,910 $27,245 $24,060 OREO $12,346 $15,092 $13,869 $15,853 $15,049 $12,398 $10,655 Nonaccrual Loans $45,781 $42,316 $33,536 $28,307 $21,861 $14,847 $13,405 90 Days + Accruing Interest $1,693 $1,504 $551 $1 $- $- $- $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 $55,000 $60,000 Dollars in thousands Nonperforming Assets 42

CAPITAL RATIO TREND – ACTUAL TIER 1 LEVERAGE RATIO (BANK ONLY) DECEMBER 31, 2010 THROUGH DECEMBER 31, 2016 2010 2011 2012 2013 2014 2015 2016 Leverage Ratio 6.00% 5.99% 7.08% 7.49% 8.19% 9.67% 9.93% Short Term Goal 7.00% 7.00% 7.00% 7.00% 7.00% 7.00% 9.00% Long Term Goal 9.00% 9.00% 9.00% 9.00% 9.00% 9.00% 10.00% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 43

44 We are Growing

We are Growing • Balance Sheet continues to increase • Net interest margin remains higher than peers • Noninterest income revenue sources are being added • Common Stock Book Value is increasing • Stock Performance is improving • New products and services have been added during 2016 • Employees are growing in knowledge and expertise 45 State of New Peoples Bankshares

STRATEGIC BALANCE SHEET TREND (IN MILLIONS) DECEMBER 31, 2010 THROUGH MARCH 31, 2017 2010 2011 2012 2013 2014 2015 2016 2017 Q1 Total Assets $852.6 $780.4 $719.0 $684.7 $651.1 $625.9 $634.3 $647.6 Total Loans $707.8 $597.8 $522.4 $493.0 $457.5 $441.2 $468.6 $476.5 Total Deposits $766.1 $708.3 $652.9 $619.0 $585.2 $558.0 $554.4 $572.8 $400 $450 $500 $550 $600 $650 $700 $750 $800 $850 $900 $950 $1,000 Dollars in millions 46

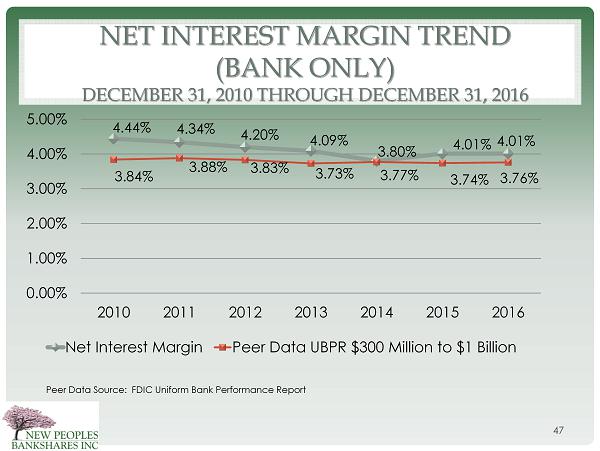

NET INTEREST MARGIN TREND (BANK ONLY) DECEMBER 31, 2010 THROUGH DECEMBER 31, 2016 4.44% 4.34% 4.20% 4.09% 3.80% 4.01% 4.01% 3.84% 3.88% 3.83% 3.73% 3.77% 3.74% 3.76% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2010 2011 2012 2013 2014 2015 2016 Net Interest Margin Peer Data UBPR $300 Million to $1 Billion 47 Peer Data Source: FDIC Uniform Bank Performance Report

NON - INTEREST INCOME AS % OF AVERAGE ASSETS TREND (BANK ONLY) DECEMBER 31, 2010 THROUGH DECEMBER 31, 2016 0.67% 0.66% 0.62% 0.68% 0.85% 0.97% 1.12% 0.72% 0.70% 0.78% 0.78% 0.75% 0.76% 0.76% 0.00% 0.50% 1.00% 1.50% 2.00% 2010 2011 2012 2013 2014 2015 2016 NII Peer Data $300 Million to $1 Billion 48 Peer Data Source: FDIC Uniform Bank Performance Report

STOCK PRICE & BOOK VALUE TREND DECEMBER 31, 2013 THROUGH MAY 15, 2017 2013 2014 2015 2016 5/15/2017 Stock Price $1.00 $1.26 $1.51 $1.75 $1.65 Book Value 1.83 1.87 1.97 2.01 2.01 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25 $1.50 $1.75 $2.00 $2.25 $2.50 $2.75 $3.00 Dollars 49

RETAINED DEFICIT TREND (IN THOUSANDS) DECEMBER 31, 2010 THROUGH DECEMBER 31, 2016 2010 2011 2012 2013 2014 2015 2016 3/31/2017 Retained Deficit (4,175) (13,085) (19,409) (17,925) (17,685) (15,023) (14,065) (13,950) -$20,000 -$15,000 -$10,000 -$5,000 $0 $5,000 $10,000 $15,000 $20,000 Dollars in thousands 50

51 New Products & Services – 2016 & 2017 • Chairman’s Club Shareholder Account • iTMs • Heroes Checking Account • OOPS – Optional Overdraft Protection Services • EMV Chip Cards • Card Valet • Instant Balance enhancement to mobile app • Online account opening • ClickSwitch • NPB Credit Cards • Secondary Mortgage Services – 30 year fixed, VA, USDA, FHA • 360 View Smart Pops • Digital Website • SBA Lending • Loan Production Office – Jonesborough, TN

52 New Products & Services – 2016 & 2017

53 Employee Development • Started Bankwide meetings for employees and managers • Training Site • Establishing a Management Training Program • Exploring developing a Library for Employee Development • Tuition Assistance Program • Payscale Enhancement • Profit Sharing Plan • Changed sick time to 2 hour increments • Increased Bereavement Time and expanded • Established Voluntary Sick Leave Bank • Enhanced Hiring Procedures and hired 28 employees • New employee evaluation and career path assistance • Wellness Programs and incentives • HR Site • Hired college students for summer help and future positions

54 We are Improving Efficiency

We are Improving Efficiency • Transforming Branch network and how we operate • New systems and processes are being implemented but not complete yet • Facilities optimization • Exceptions are improving • Asset quality related expenses are decreasing • Technology is being utilized more 55 State of New Peoples Bankshares

EFFICIENCY RATIO (BANK ONLY) DECEMBER 31, 2010 THROUGH DECEMBER 31, 2016 78.01% 103.06% 96.28% 91.59% 96.37% 96.32% 97.25% 68.45% 67.92% 66.85% 67.62% 66.62% 66.28% 65.63% 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% 110.00% 120.00% 2010 2011 2012 2013 2014 2015 2016 NII Peer Data $300 Million to $1 Billion 56 Peer Data Source: FDIC Uniform Bank Performance Report

57 Efficiency Improvement Initiatives • Relationship Bankers transition • Retail Training University • Revised job descriptions • Cross training • Complete by end of 2017 for all branches

58 Efficiency Improvement Initiatives (Cont .) • Centralization • Overdraft approval • Retail and Mortgage Collections • File Maintenance • Underwriting • Loan Processing • Customer Contact Center • Taking incoming calls and assisting with customer questions

59 Efficiency Improvements Initiatives (Cont.) • Specialization • Commercial Loans with Commercial Bankers • Problem loans with Special Assets • Mortgage loans through Mortgage Originators • Retail banking with Retail Bankers • Support services with Support Specialists • Loss Mitigation department

60 Efficiency Improvements Initiatives (Cont.) • Technology enhancements • Cash Recyclers installation • iTMs to help with drive thru traffic and hours of operation • Digital signage • 360 View • Electronic signatures • Coin counters • Video Monitors • Network Upgrades

61 Efficiency Initiatives Improvements (Cont.) • Process Refinement • Reviewing and refining policies and processes to be more efficient • Transformed Operations area to accommodate new branch operations

62 Efficiency Initiatives Improvements (Cont.) • Facilities Optimization • Branch remodeling • Teller pods • Conference rooms • Possible layout changes of some locations • Sale/ Leaseback of facilities • Lease out unused space • Determining best use for closed offices • iTMs in remote locations • Loan production office – Jonesborough, TN

63 We are Differentiating Ourselves

• We are Differentiating Ourselves • Incorporating technology focused on enhancing the customer experience • Golden Rule Banking is being lived out • Caring for our customers through excellent service • Actively involved in the community • Generously showing love and compassion 64 State of New Peoples Bankshares

65 President’s Award

66 Community Involvement • Farm, Fishing, Hunting and Camping Show – Meadow View Conference Center • Remote Area Medical of Southwest Virginia • Washington Co. Tennessee Agricultural Business Appreciation Dinner • ICBA Community Banking Month • Wise Co. Chamber of Commerce Gala • Bank Day for High School Students • Bristol Virginia Tennessee Association of Realtors Expo • Bluefield Better Living Show • Local High School Players of the Week Sponsorship • Gathering in the Gap – Big Stone Gap • Career Fair – Richlands Middle School • Career Fair – ETSU • Camp Jacob • Russell Co. Kids Fishing Day • Russell Co. Chamber of Commerce Business to Business Showcase

67 Community Involvement (Cont.) • Tazewell Co. Spring Expo • Best Friends Festival, Wise County/Norton • Pound Heritage Days • Scott Co. Fair • Tazewell Co. Fair • Dickenson Co. Fair • Bluefield College Scholarship Golf Tournament • Russell Co Fair • Washington Co. Fair • Tazewell Co. Business to Business Showcase • Spirit Fest – Grundy, VA • Chilhowie Apple Festival • Bristol Rhythm and Roots • Autumn Jamboree - Bluefield • Virginia Highlands Festival • Cedar Bluff Heritage Days • Agriculture Show – Castlewood Fair Grounds

68 Community Involvement (Cont.) • Community Thanksgiving – Honaker VA • Area Christmas Parades • 4 - H Organization • American Cancer Society • Relay for Life • Appalachian Soccer Association • Clinch River Days • Chuck Mathena Center • Duffield Daze • Little League • Lions Club • Police, Fire and Rescue • Local School Programs • Maple Grove Healthcare • Operation Christmas Child • Project Graduation and after School Prom Night • Redbud Festival

69 Community Involvement (Cont.) • St. Jude’s Hospital • Southwest Virginia Music Festival • Southwest VA Ecomic Summit Sponsorship and Committee members • Special Olympics • Southwest Virginia Children’s Choir • Ruritan Club • Rotary Club • United Way Sponsorship • West Virginia Flood Relief assistance • Healing Hands Sponsorship • Serving on Several Boards of Schools, Civic Clubs, Economic Development

70 Where are We in the Process?

71 What we strive to do to be Great & Help Make Dreams come true? • Follow the Golden Rule • Take excellent and genuine care of our customers and exceed their expectations • Build Trustworthy Relationships • Establish relationships with our customers based on integrity and trust that creates loyalty to NPB. Never give them a reason to leave. • Meet People at Their Needs - It’s Always About the People • Provide solutions that takes care of customer’s needs through relevant products, services, convenience, hours of operation, delivery systems and technology • Work diligently to retain existing customers and to recruit new customers from all generations and diversify to minimize risk

72 What we strive to do to be Great & Help Make Dreams come true? (Cont.) • Continue to Improve • Understand that there is always room for improvement • How can I be and do better tomorrow? • Make your voice heard if you have an idea • Work Together as a Team • Not one person can do it all alone, it takes a committed team working together to make it happen • Share Great News! • Positively promote NPB and the great things that are happening

73 Again, Where Are We in the Process?

74 Thank You! But We Are Headed to Greater things…

75 Helping Make Dreams Come True Buy or Sell Stock Contact Information Mike Acampora Senior Vice President FIG Partners, LLC 1654 Pearl Street Jacksonville, Florida 32206 Office: 904 - 354 - 0441 macampora@figpartners.com