Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOPFED BANCORP INC | d572337d8k.htm |

Exhibit 99.1

Welcome Shareholders 2017

Annual Meeting

1

Disclosure

The information provided in this presentation is for the May 17, 2017 Shareholders meeting of Hopfed Bancorp, Inc. and it’s subsidiary Heritage Bank USA, Inc.

Forward-Looking Statements

Statements herein that are not historical facts are fmward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements are subject to known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You should understand that these statements are not guarantees of performance or results and are preliminary in nature. Statements preceded by, followed by or that otherwise include the words “believes”, “expects”, “anticipates”, “intends”, “projects”, “estimates”, “plans”, “may increase”, “may result”, “will result”, “may fluctuate” and similar expressions or future or conditional verbs such as “will”, “should”, “would”, “may” and “could” are generally forward-looking in nature and not historical facts. You should consider the areas of risk described under the heading “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in our periodic reports filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934 in connection with any forward-looking statements that may be made by us and our businesses generally. Except for our ongoing obligations to disclose material information under the federal securities laws, we undertake no obligation to release publicly any updates or revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events unless required by law.

2

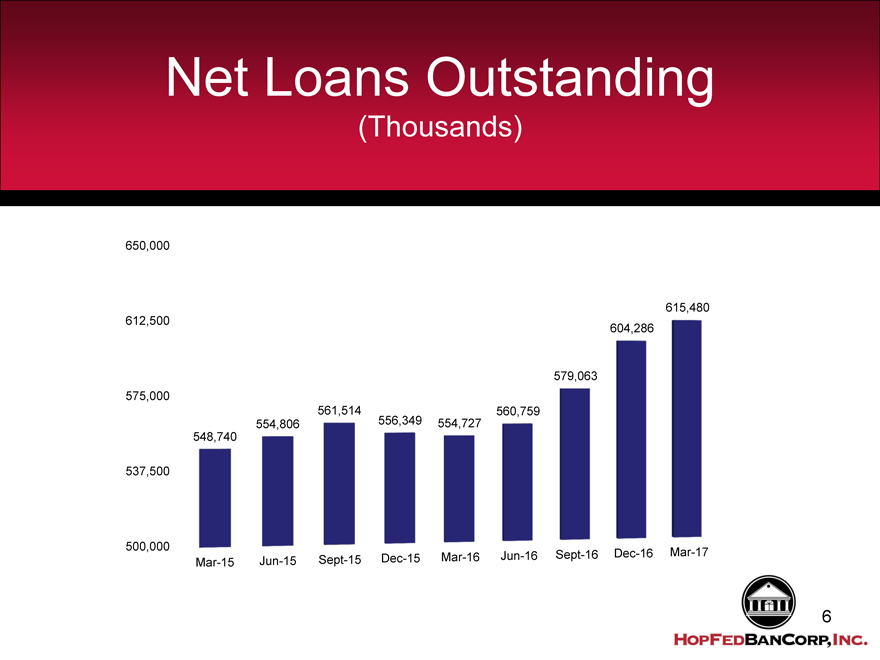

2016 Highlights • Loans grew 8.6% to $604.3 million • Net income rose 20.8% to $2.9 million • Net income per share increased 23.7% to $0.47 • Repurchased 160,248 shares - $1.9 million • Strong loan pipeline for 2017 3

First Quarter 2017 vs First Quarter 2016 Highlights • Loans grew 11.0% to $615.5 million • Deposits increased 5.6% to $765.7 million • Non-interest DDA deposits up 7.3% to $136.3 million • Net income rose 83.7% to $935,000 • Net income per share increased 87.5% to $0.15 4

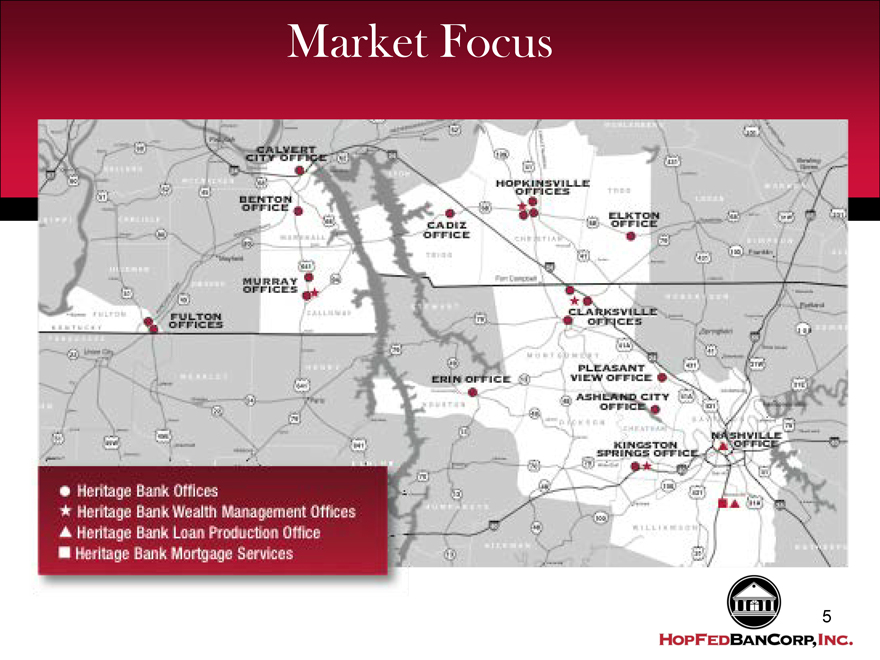

Market Focus

Heritage Bank offices

Heritage Bank Wealth Managemeny offices

Heritage Bank Loan Production Office

Heritage Bank Loan Mortgage Services

5

Net Loans Outstanding (Thousands) 650,000 612,500 615,480 604,286 579,063 575,000 561,514 560,759 554,806 556,349 554,727 548,740 537,500 500,000 Mar-17 Dec-15 Mar-16 Jun-16 Sept-16 Dec-16 Mar-15 Jun-15 Sept-15 6

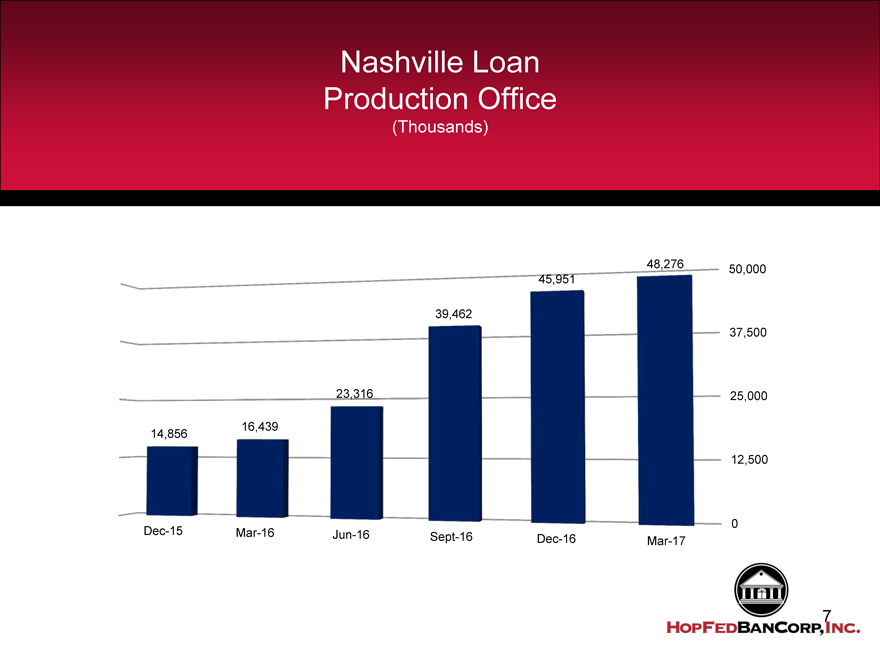

Nashville Loan Production Office (Thousands) 48,276 50,000 45,951 39,462 37,500 23,316 25,000 16,439 14,856 12,500 0 Dec-15 Mar-16 Jun-16 Sept-16 Dec-16 Mar-17

7

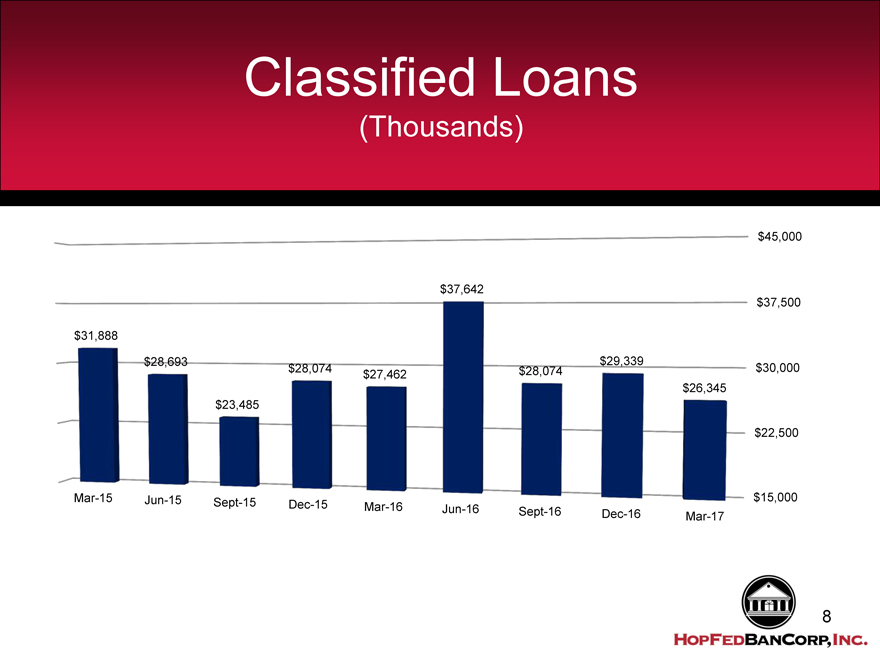

Classified Loans (Thousands) $45,000 $37,642 $37,500 $31,888 $28,693 $29,339 $28,074 $28,074 $30,000 $27,462 $26,345 $23,485 $22,500 Mar-15 Jun-15 Sept-15 $15,000 Dec-15 Mar-16 Jun-16 Sept-16 Dec-16 Mar-17

8

Common Stock Price Per Share $14.32 $13.46 $11.45 $11.59 $11.20 Mar-16 Jun-16 Sept-16 Dec-16 Mar-17

9

Strategy For the Future • Expand loan growth potential • Continue stock buybacks • Expand Nashville lending opportunities • Focus on asset quality • Evaluate accretive growth opportunities • Improve operational efficiency 10

THANK YOU

Building relationships, strengthening neighborhoods.

Heritage Bank Yesterday .Today. Tomorrow WWW.BANKWITHHERITAGE.COM

11