Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - EMPIRE RESORTS INC | d395843dex992.htm |

| 8-K - FORM 8-K - EMPIRE RESORTS INC | d395843d8k.htm |

Exhibit 99.1

Empire Resorts, Inc.

May 18, 2017

Forward looking statements

This presentation contains forward-looking statements. These statements include statements about our plans, strategies, financial performance, prospects or future

events and involve known and unknown risks that are difficult to predict. As a result, the actual results, performance or achievements of Empire Resorts, Inc. (“Empire”, and together with our subsidiaries, “we”, “us”,

“our”, and together with our subsidiaries, the “Company”) and its subsidiaries, including Montreign Operating Company, LLC, may differ materially from those expressed or implied by these forward-looking statements. In some cases,

you can identify forward-looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,”

“estimate,” “predict,” “potential,” “continue,” “likely,” “will,” “would” and variations of these terms and similar expressions, or the negative of these terms or similar

expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and its management team, are inherently uncertain. All statements in this presentation regarding our

business strategy, future operations, financial position, prospects, construction plans, business plans and objectives, as well as information concerning industry trends and expected actions of third parties, are forward-looking statements. All

forward-looking statements speak only as of the date on which they are made. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions concerning future events that are difficult to predict.

The following factors, among others, could cause actual results to differ materially from those set forth in this presentation, as well as delays in completing the development of the Company’s resort casino (“Resorts World

Catskills”), entertainment village (the “Entertainment Village”) or golf course (the “Golf Course” and together with Resorts World Catskills and Entertainment Village, the “Development Projects”), all of which are

being developed as part of the initial phase of the master planned destination resort (the “Destination Resort”) in Sullivan County, New York on time:

Levels of spending in business and leisure segments as well as consumer confidence;

Difficulties and/or delays in construction of the Development Projects due to inclement weather, issues related to materials and labor or other reasons;

Changes in the scope, cost, or timing of the development and construction of the Development Projects, which could substantially increase our construction costs or delay opening;

Relationships with associates and labor unions and changes in labor law;

The financial condition of, and our relationships with, third-party property owners and

hospitality venture partners, including the ability to enter into an agreement relating to the Genting Rewards Alliance with affiliates of our largest stockholder; Risk associated with the introduction of new brand concepts; Changes in the

competitive environment in our industry and the markets where we operate; Changes in federal, state or local tax law; Our levels of leverage and ability to meet our debt service and other obligations; Lack of history of earnings from the Development

Projects; The financial performance of the Development Projects; Our dependence on a single casino gaming site; Competition from existing gaming properties or the development of new competitive gaming properties; Difficulties in recruiting, training

and retaining qualified employees, including casino management personnel; Changes in gaming laws and the adoption of relevant regulations, including their interpretation or application; Failure to maintain and renew, or the loss of, any license or

permit required under gaming laws to be maintained by the Company or any investor, vendor, agreement party or related party, including our gaming facility license for Resorts World Catskills (the “Gaming Facility License”), or construction

or operating permits and approvals required under applicable laws; Failure to obtain or delay in obtaining a liquor license; General volatility of the capital markets and the ability of the Company to access the capital markets to secure necessary

financing to complete the Development Projects, including furniture, furnishings and equipment financing; and The outcome of existing and future tax controversies.

A more complete description of these risks and uncertainties can be found in the filings of the Company with the U.S. Securities and Exchange Commission. We

caution you not to place undue reliance on any forward-looking statements, which are made as of the date hereof. The Company undertakes no obligation to update any of these forward-looking statements to reflect actual results, new information or

future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will

make additional updates with respect to those or other forward-looking statements.

While certain financial projections for Resorts World Catskills included in this

presentation were prepared in good faith and based on information available at the time of preparation, no assurance can be made regarding future events occurring after the date they were prepared. The estimates and assumptions underlying the

unaudited financial projections involve judgments with respect to, among other things, win per slot/table per day, patronage, complimentaries, utilization of available net operating losses, no change to existing tax laws, inability to use tax

benefits, delays or cost overruns in the construction of Resorts World Catskills or the Destination Resort or future economic, competitive, regulatory and financial market conditions and future business decisions that may not be realized and that

are inherently subject to significant uncertainties and contingencies, all of which are difficult to predict and many of which are beyond the control of the Company. There can be no assurance that the underlying assumptions or projected results will

be realized, and actual results will likely differ, and may differ materially, from those reflected in the unaudited financial projections. As a result, the unaudited financial projections cannot necessarily be considered predictive of actual future

operating results, and this information should not be relied on as such.

By including in this presentation certain unaudited financial projections regarding

Resorts World Catskills, neither the Company nor any of its advisors or other representatives has made or makes any representation to any person regarding the ultimate performance of Resorts World Catskills compared to the information contained in

the financial projections or to any of the Development Projects. The Company undertakes no obligation to update or otherwise revise the unaudited financial projections contained in this presentation to reflect circumstances existing since their

preparation or to reflect the occurrence of unanticipated events or to reflect changes in general economic or industry conditions, even in the event that any or all of the underlying assumptions are shown to be in error.

1

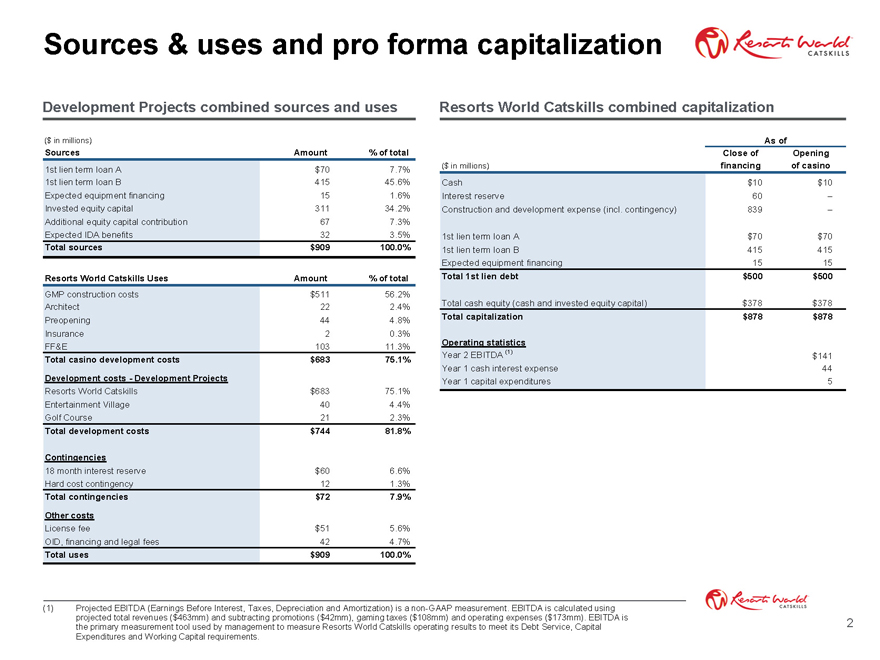

Sources & uses and pro forma capitalization

Development Projects combined sources and uses

($ in millions)

Sources Amount % of total

1st lien term loan A $70 7.7% 1st lien term loan B 415 45.6%

Expected equipment financing 15 1.6% Invested equity capital 311 34.2% Additional equity capital contribution 67 7.3% Expected IDA benefits 32 3.5%

Total sources

$909 100.0%

Resorts World Catskills Uses Amount % of total

GMP construction

costs $511 56.2% Architect 22 2.4% Preopening 44 4.8% Insurance 2 0.3% FF&E 103 11.3%

Total casino development costs $683 75.1%

Development costs—Development Projects

Resorts World Catskills $683 75.1% Entertainment

Village 40 4.4% Golf Course 21 2.3%

Total development costs $744 81.8%

Contingencies

18 month interest reserve $60 6.6% Hard cost contingency 12

1.3%

Total contingencies $72 7.9%

Other costs

License fee $51 5.6% OID, financing and legal fees 42 4.7%

Total uses $909 100.0%

Resorts World Catskills combined capitalization

As of

Close of Opening

($ in millions) financing of casino

Cash $10 $10

Interest reserve 60 –

Construction and development expense (incl. contingency) 839 –

1st lien term loan A $70

$70

1st lien term loan B 415 415

Expected equipment financing 15 15

Total 1st lien debt $500 $500

Total cash equity (cash and invested equity

capital) $378 $378

Total capitalization $878 $878

Operating statistics

Year 2 EBITDA (1) $141

Year 1 cash interest expense 44

Year 1 capital expenditures 5

(1) Projected EBITDA (Earnings Before Interest, Taxes,

Depreciation and Amortization) is a non-GAAP measurement. EBITDA is calculated using projected total revenues ($463mm) and subtracting promotions ($42mm), gaming taxes ($108mm) and operating expenses ($173mm).

EBITDA is the primary measurement tool used by management to measure Resorts World Catskills operating results to meet its Debt Service, Capital Expenditures and Working Capital requirements. 2

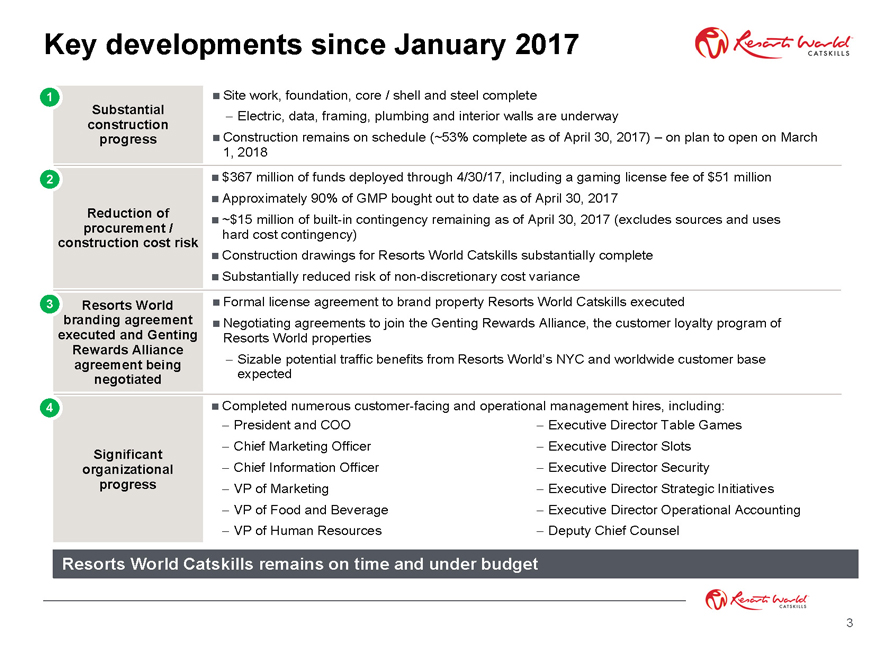

Key developments since January 2017

1 Substantial construction progress

2 Reduction of procurement / construction cost risk

3 Resorts World branding agreement executed and Genting Rewards Alliance agreement being negotiated

4 Significant organizational progress

Site work, foundation, core / shell and steel complete

- Electric, data, framing, plumbing and interior walls are underway

Construction remains on schedule (~53% complete as of April 30, 2017) – on plan to open on March

1, 2018 $367 million of funds deployed through 4/30/17, including a gaming license fee of $51 million Approximately 90% of GMP bought out to date as of April 30,

2017 ~$15 million of built-in contingency remaining as of April 30, 2017 (excludes sources and uses hard cost contingency) Construction drawings for Resorts World Catskills substantially complete

Substantially reduced risk of non-discretionary cost variance Formal license agreement to brand property Resorts World Catskills executed Negotiating agreements to join the Genting Rewards Alliance, the

customer loyalty program of Resorts World properties

- Sizable potential traffic benefits from Resorts World’s NYC and worldwide customer base expected

Completed numerous customer-facing and operational management hires, including:

- President and COO—Executive Director Table Games

- Chief Marketing

Officer—Executive Director Slots

- Chief Information Officer—Executive Director Security

- VP of Marketing—Executive Director Strategic Initiatives

- VP of Food and

Beverage—Executive Director Operational Accounting

- VP of Human Resources—Deputy Chief Counsel

Resorts World Catskills remains on time and under budget

3

1 Substantial construction progress

Key areas of excavation, foundation, podium and steel erection are complete

Note: Pictures as

of May 2017.

4

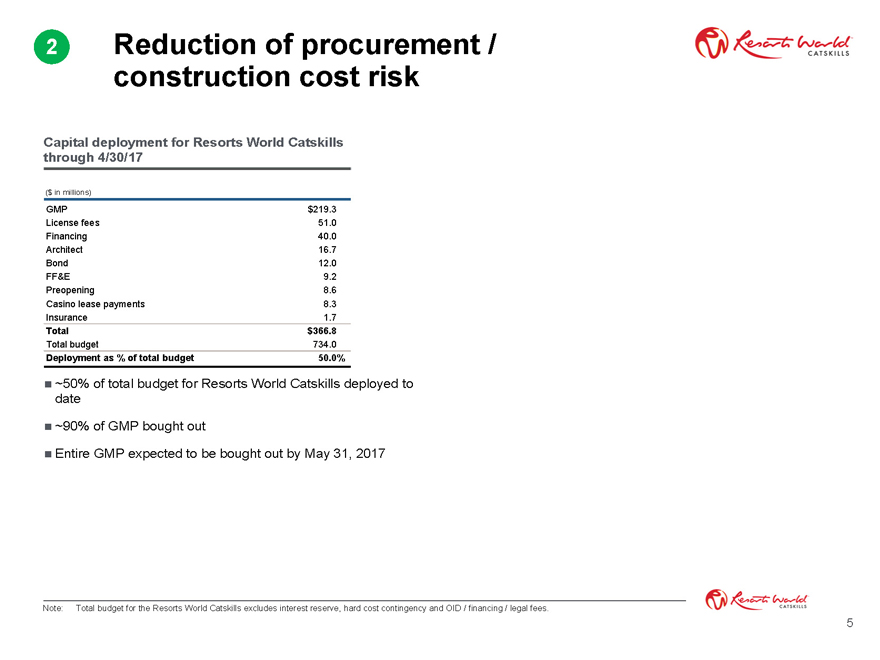

2 Reduction of procurement / construction cost risk

Capital deployment for Resorts World Catskills through 4/30/17

($ in millions)

GMP $219.3 License fees 51.0 Financing 40.0 Architect 16.7 Bond 12.0 FF&E 9.2 Preopening 8.6 Casino lease payments 8.3 Insurance 1.7

Total $366.8

Total budget 734.0

Deployment as % of total budget 50.0%

~50% of total budget for Resorts World Catskills

deployed to date

~90% of GMP bought out

Entire GMP expected to be bought out

by May 31, 2017

Note: Total budget for the Resorts World Catskills excludes interest reserve, hard cost contingency and OID / financing / legal fees.

5

3 Resorts World license agreement and Genting Rewards Alliance agreement

License agreement grants the right to use the “Resorts World” and “Genting” brand names, marks and logos in connection with the marketing, sales, management and

operation of the Development Projects

Negotiating agreement to join the Genting Rewards Alliance, the customer loyalty program across Resorts World-branded

properties

- Expected to provide access to Brand related support and services

- Expected to facilitate cross property promotions across the Resorts World-branded properties, including:

Existing properties Future sites

Resorts World New York Resorts World Bimini Resorts World

Massachusetts Resorts World Las Vegas

- Expected to incentivize existing Resorts World customers to visit multiple properties within the portfolio, inclusive of

Resorts World Catskills, with specific benefit packages

6

4 Ryan Eller

Appointed as

President and Chief Operating Officer of Empire on March 27, 2017

Mr. Eller will oversee the development of Resorts World Catskills and operations of

Monticello Casino and Raceway

Prior to joining the Company, Mr. Eller served in various executive officer positions, including CFO and President, with Genting

NY, which operates Resorts World Casino New York City (RWNYC)

- Oversaw RWNYC’s planning with respect to a $315 million expansion to add 1,000 video

lottery terminals, a new hotel and convention complex

Concurrently with his position at Genting NY, Mr. Eller served as senior vice president of development

of Genting Americas

Oversaw the design and development of the Resorts World Las Vegas integrated resort, a $4 billion project on the Las Vegas Strip

Other experience includes:

CFO of Choctaw Resort Development Enterprise (2012

– 2013)

Treasurer and executive director of finance of PCI Gaming Authority (2007 – 2012)

Regional manager, planning and analysis at Caesar’s Entertainment (2006 – 2007)

Mr. Eller served in the United States Marine Corps from 1997 to 2004 where he attained the rank of Major, holds an MBA with honors from Harvard Business

School and a bachelor’s degree with distinction from the U.S. Naval Academy

7

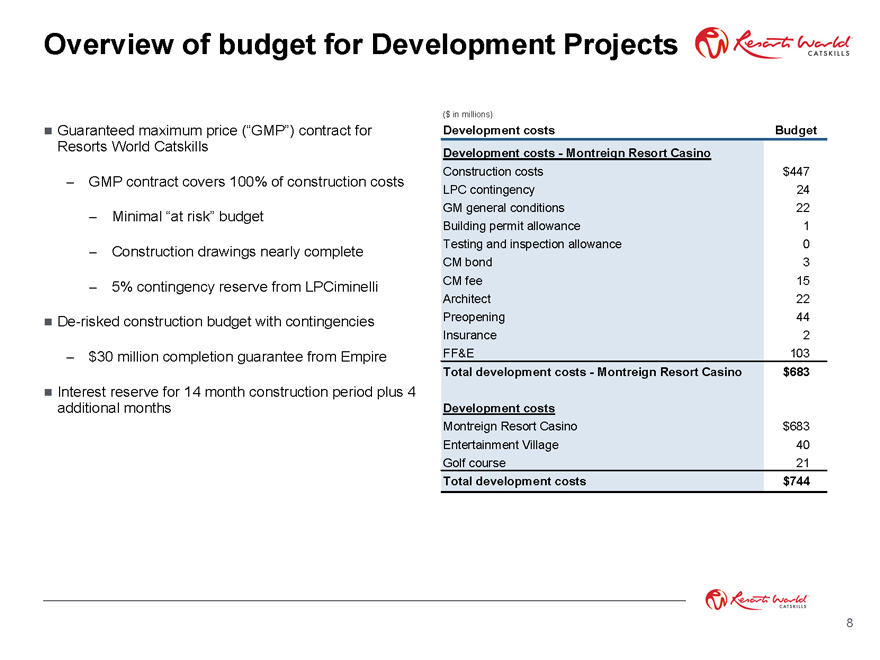

Overview of budget for Development Projects

Guaranteed maximum price (“GMP”) contract for Resorts World Catskills

- GMP contract

covers 100% of construction costs

- Minimal “at risk” budget

-

Construction drawings nearly complete

- 5% contingency reserve from LPCiminelli De-risked construction budget with

contingencies

- $30 million completion guarantee from Empire

Interest reserve for 14 month construction period plus 4 additional months

($

in millions)

Development costs Budget Development costs—Montreign Resort Casino

Construction costs $447 LPC contingency 24 GM general conditions 22 Building permit allowance 1 Testing and inspection allowance 0 CM bond 3 CM fee 15 Architect 22 Preopening 44

Insurance 2 FF&E 103

Total development costs—Montreign Resort Casino $683

Development costs

Montreign Resort Casino $683 Entertainment Village 40 Golf course 21

Total development costs $744

8

Empire Resorts, Inc.