Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Atlantic Capital Bancshares, Inc. | acb-form8xkshareholderpres.htm |

2017 ANNUAL SHAREHOLDERS MEETING

May 18, 2017

Forward‐Looking Statements

This presentation contains forward‐looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section

21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements reflect our current views with respect to, among

other things, future events and our financial performance. These statements are often, but not always, made through the use of words or

phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,”

“estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable of a future or

forward‐looking nature. These forward‐looking statements are not historical facts, and are based on current expectations, estimates and

projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are

inherently uncertain and beyond our control. Accordingly, we caution you that any such forward‐looking statements are not guarantees of future

performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations

reflected in these forward‐looking statements are reasonable as of the date made, actual results may prove to be materially different from the

results expressed or implied by the forward‐looking statements.

The following risks, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in

the forward‐looking statements: (1) the expected growth opportunities and cost savings from the transaction with First Security Group, Inc.

(“First Security”) may not be fully realized or may take longer to realize than expected; (2) loss of income from our TriNet division following our

exit of this business; (3) changes in asset quality and credit risk; (4) the cost and availability of capital; (5) customer acceptance of our products

and services; (6) customer borrowing, repayment, investment and deposit practices; (7) the introduction, withdrawal, success and timing of

business initiatives; (8) the impact, extent, and timing of technological changes; (9) severe catastrophic events in our geographic area; (10) a

weakening of the economies in which we conduct operations may adversely affect our operating results; (11) the U.S. legal and regulatory

framework, including those associated with the Dodd‐Frank Wall Street Reform and Consumer Protection Act could adversely affect the

operating results of the combined company; (12) the interest rate environment may compress margins and adversely affect net interest income;

(13) changes in trade, monetary and fiscal policies of various governmental bodies and central banks could affect the economic environment in

which we operate; (14) our ability to determine accurate values of certain assets and liabilities; (15) adverse developments in securities, public

debt, and capital markets, including changes in market liquidity and volatility; (16) our ability to anticipate interest rate changes correctly and

manage interest rate risk presented through unanticipated changes in our interest rate risk position and/or short‐ and long‐term interest rates;

(17) unanticipated changes in our liquidity position, including but not limited to our ability to enter the financial markets to manage and respond

to any changes to our liquidity position; (18) adequacy of our risk management program; (19) increased costs associated with operating as a

public company; (20) competition from other financial services companies in the companies’ markets could adversely affect operations; and (21)

other factors described in Atlantic Capital’s reports filed with the Securities and Exchange Commission and available on the SEC’s website

(www.sec.gov).

2

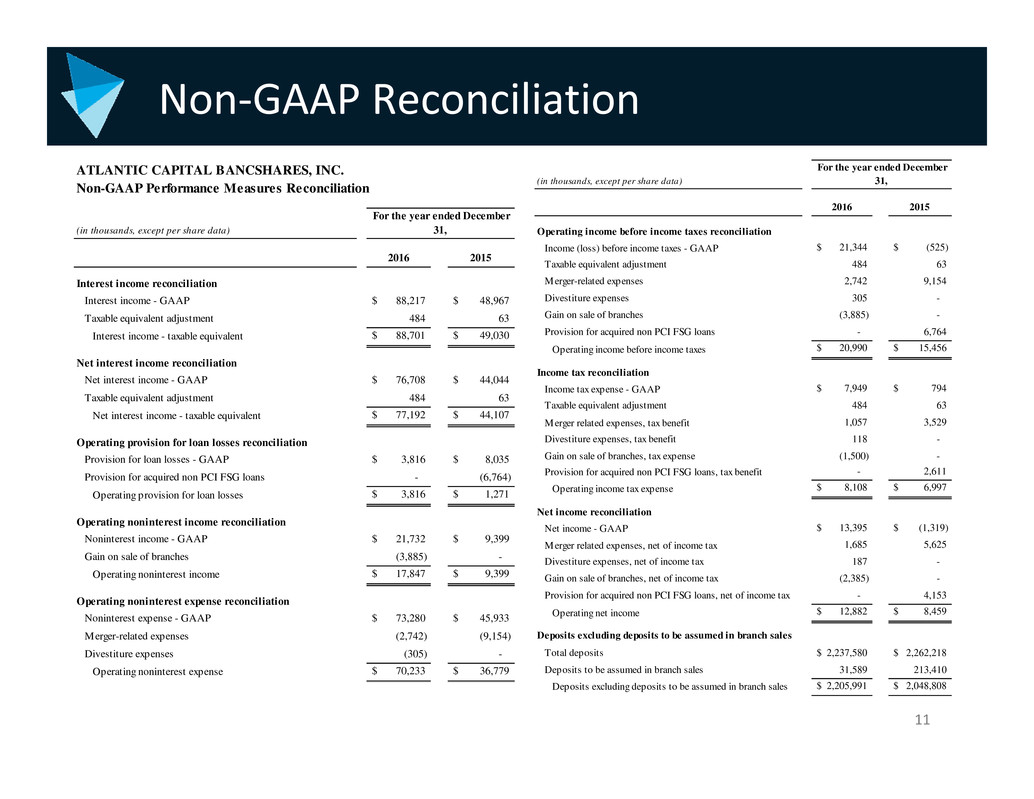

Non‐GAAP Financial Information

Non‐GAAP Financial Measures

Statements included in this presentation include non‐GAAP financial measures and should be read along with the accompanying tables, which

provide a reconciliation of non‐GAAP financial measures to GAAP financial measures. Atlantic Capital management uses non‐GAAP financial

measures, including: (i) operating net income; (ii) taxable equivalent net interest margin; and (iii) deposits excluding deposits held for branch sale,

in its analysis of the Company's performance. Please see slides 11 and 12 for a reconciliation of each of these non‐GAAP financial measures to its

most comparable GAAP measure.

Management uses these non‐GAAP financial measures because it believes they provide a greater understanding of ongoing performance and

operations, enhance comparability with prior periods, and provide users of our financial information with a meaningful measure for assessing our

financial results and credit trends. Non‐GAAP financial measures have limitations as analytical tools, and investors should not consider them in

isolation or as an alternative to any measure of performance or financial condition as determined in accordance with GAAP. In addition, non‐

GAAP financial measures may not be comparable to similarly titled non‐GAAP financial measures presented by other companies. Investors should

consider Atlantic Capital’s performance and financial condition as reported under GAAP and all other relevant information when assessing the

performance or financial condition of the Company.

3

Atlantic Capital Bank: 10 years of success

Atlantic Capital Bank celebrated its

10th anniversary on Monday, May 15th!

Looking Back:

• Grew despite environmental challenges

• Merged with First Security Group in November, 2015

• Listed our stock as ACBI on the NASDAQ

$19.20 ‐ Price of ACBI common stock at closing Monday, May 15th

for an increase of 92% since inception and 39% since listing.

4

Atlantic Capital Bank: Highlights

Branch Location

Loan Production Office

Main Office Location

Legend

$2.8 billion in assets

Offices in Atlanta, Charlotte,

Chattanooga and Knoxville

metropolitan areas

Attractive Markets:*

• Combined population of almost 10 million people

• Projected population growth over the next five years:

• Atlanta and Charlotte: ~ 7%

• Chattanooga and Knoxville: 3%‐4%

• Estimated 7,000 companies in these four markets with revenue

greater than $10 million

*Source: US MSA Census Information + market data from Data.com (Salesforce) 5

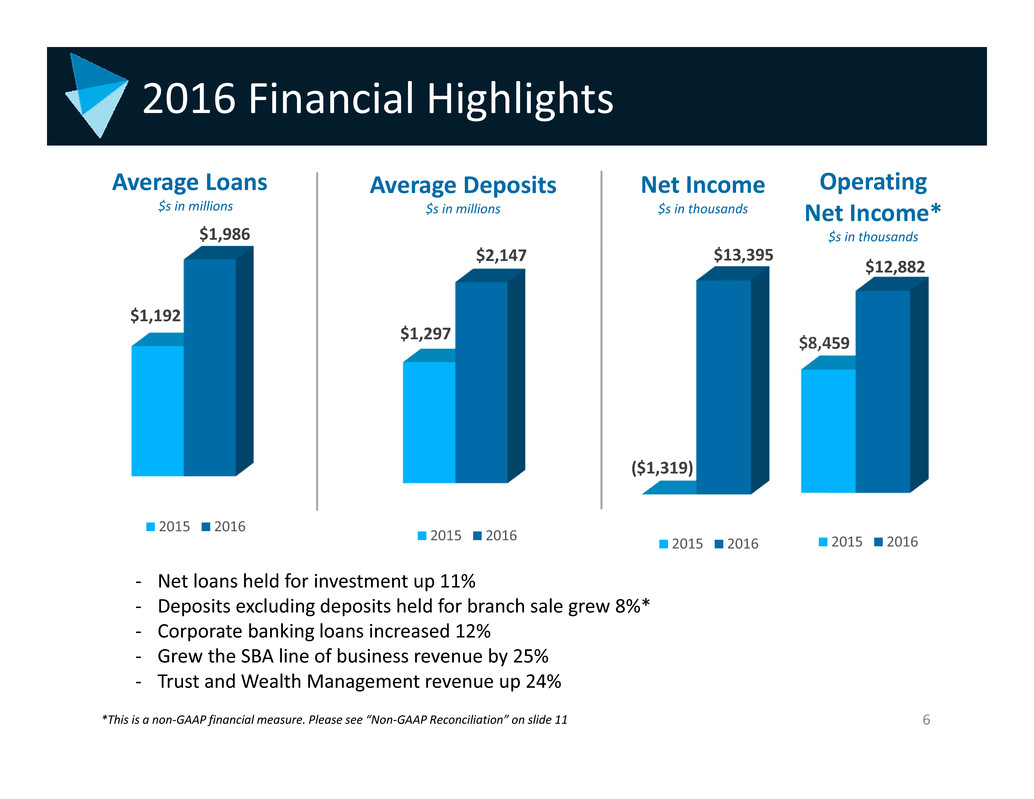

2016 Financial Highlights

Average Loans

$s in millions

Average Deposits

$s in millions

$8,459

$12,882

2015 2016

Net Income

$s in thousands

‐ Net loans held for investment up 11%

‐ Deposits excluding deposits held for branch sale grew 8%*

‐ Corporate banking loans increased 12%

‐ Grew the SBA line of business revenue by 25%

‐ Trust and Wealth Management revenue up 24%

$1,192

$1,986

2015 2016

$1,297

$2,147

2015 2016

*This is a non‐GAAP financial measure. Please see “Non‐GAAP Reconciliation” on slide 11

($1,319)

$13,395

2015 2016

Operating

Net Income*

$s in thousands

6

Repositioned For Better Performance

Added 13 new origination bankers in 2016

Reduced branch network by 40%

Closed TriNet business

Undertook comprehensive review of all businesses

Opened loan production office in Charlotte

7

2017 Q1 Financial Highlights

‐ Increased SBA income to $1.2 million from $600,000 in the fourth quarter of 2016

‐ Decreased noninterest expense to $17.7 million from $18.8 million in the fourth quarter

of 2016

‐ Reported nonperforming assets to total assets of 0.21% as of March 31, 2017

‐ Increased average noninterest bearing deposits $29.2 million, or 19.7% annualized, to

$620 million

‐ Average noninterest bearing deposits equaled 29.4% of total deposits

Linked Quarter Comparison Q1 2017 Q4 2016

Net income $3.2 million $1.6 million

Diluted earnings per share $0.13 $0.06

Taxable equivalent net interest margin* 3.20% 3.11%

NPAs/Total Assets 0.21% 0.13%

*This is a non‐GAAP financial measure. Please see “Non‐GAAP Reconciliation” on slide 12 8

Proprietary & Confidential

Atlantic Capital Strategy

Become a premier

southeastern business and

private banking company

Accelerated Organic Growth

• Investing in people and capabilities to accelerate organic growth and build profitability

• Well positioned in attractive growth markets

• Attractive interest rate risk position

Strategic Expansion

• Completed acquisition of First Security on October 31, 2015

• Ongoing evaluation of new market expansion through mergers

and acquisitions and de novo entry

• Patient and disciplined approach with focus on shareholder value

9

Key Priorities

Improve performance in all of our lines of business and geographies

Invest in capacity for future growth to lever the cost structure

Improve profitability

Building a profitable

and sound future

10

Non‐GAAP Reconciliation

ATLANTIC CAPITAL BANCSHARES, INC.

Non-GAAP Performance Measures Reconciliation

(in thousands, except per share data)

2016 2015

Interest income reconciliation

Interest income - GAAP $ 88,217 $ 48,967

Taxable equivalent adjustment 484 63

Interest income - taxable equivalent $ 88,701 $ 49,030

Net interest income reconciliation

Net interest income - GAAP $ 76,708 $ 44,044

Taxable equivalent adjustment 484 63

Net interest income - taxable equivalent $ 77,192 $ 44,107

Operating provision for loan losses reconciliation

Provision for loan losses - GAAP $ 3,816 $ 8,035

Provision for acquired non PCI FSG loans - (6,764)

Operating provision for loan losses $ 3,816 $ 1,271

Operating noninterest income reconciliation

Noninterest income - GAAP $ 21,732 $ 9,399

Gain on sale of branches (3,885) -

Operating noninterest income $ 17,847 $ 9,399

Operating noninterest expense reconciliation

Noninterest expense - GAAP $ 73,280 $ 45,933

Merger-related expenses (2,742) (9,154)

Divestiture expenses (305) -

Operating noninterest expense $ 70,233 $ 36,779

For the year ended December

31,

(in thousands, except per share data)

2016 2015

Operating income before income taxes reconciliation

Income (loss) before income taxes - GAAP $ 21,344 $ (525)

Taxable equivalent adjustment 484 63

Merger-related expenses 2,742 9,154

Divestiture expenses 305 -

Gain on sale of branches (3,885) -

Provision for acquired non PCI FSG loans - 6,764

Operating income before income taxes $ 20,990 $ 15,456

Income tax reconciliation

Income tax expense - GAAP $ 7,949 $ 794

Taxable equivalent adjustment 484 63

Merger related expenses, tax benefit 1,057 3,529

Divestiture expenses, tax benefit 118 -

Gain on sale of branches, tax expense (1,500) -

Provision for acquired non PCI FSG loans, tax benefit - 2,611

Operating income tax expense $ 8,108 $ 6,997

Net income reconciliation

Net income - GAAP $ 13,395 $ (1,319)

Merger related expenses, net of income tax 1,685 5,625

Divestiture expenses, net of income tax 187 -

Gain on sale of branches, net of income tax (2,385) -

Provision for acquired non PCI FSG loans, net of income tax - 4,153

Operating net income $ 12,882 $ 8,459

Deposits excluding deposits to be assumed in branch sales

Total deposits $ 2,237,580 $ 2,262,218

Deposits to be assumed in branch sales 31,589 213,410

Deposits excluding deposits to be assumed in branch sales $ 2,205,991 $ 2,048,808

For the year ended December

31,

11

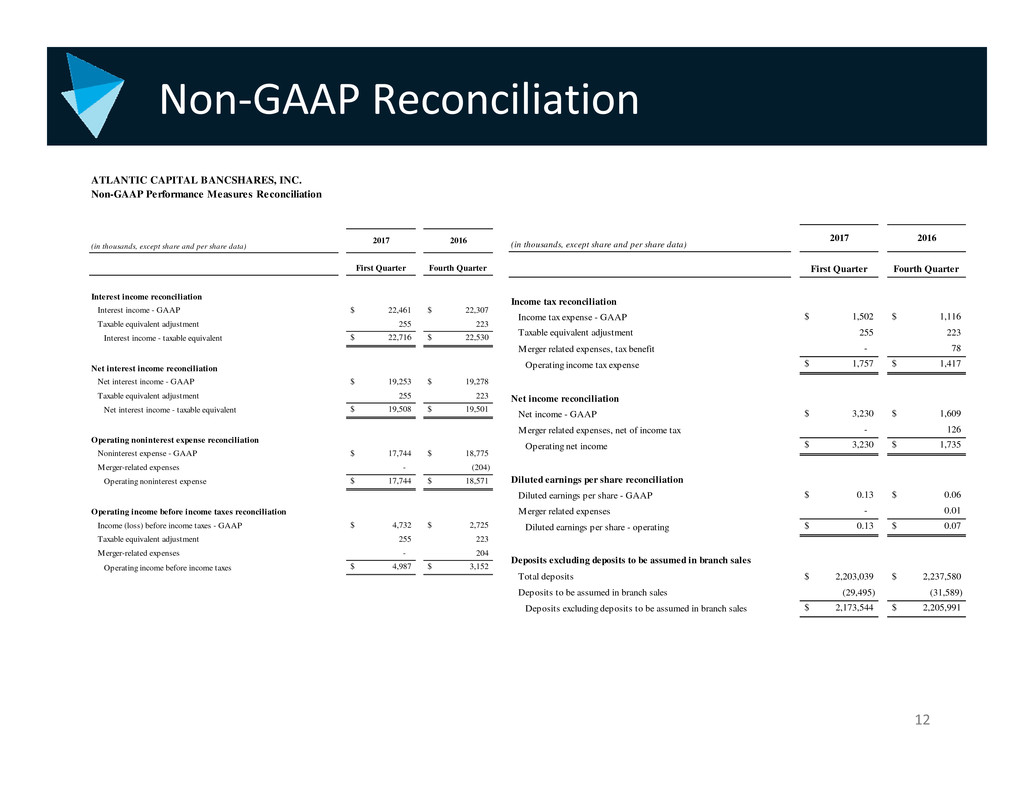

Non‐GAAP Reconciliation

ATLANTIC CAPITAL BANCSHARES, INC.

Non-GAAP Performance Measures Reconciliation

(in thousands, except share and per share data)

2017 2016

First Quarter Fourth Quarter

Interest income reconciliation

Interest income - GAAP $ 22,461 $ 22,307

Taxable equivalent adjustment 255 223

Interest income - taxable equivalent $ 22,716 $ 22,530

Net interest income reconciliation

Net interest income - GAAP $ 19,253 $ 19,278

Taxable equivalent adjustment 255 223

Net interest income - taxable equivalent $ 19,508 $ 19,501

Operating noninterest expense reconciliation

Noninterest expense - GAAP $ 17,744 $ 18,775

Merger-related expenses - (204)

Operating noninterest expense $ 17,744 $ 18,571

Operating income before income taxes reconciliation

Income (loss) before income taxes - GAAP $ 4,732 $ 2,725

Taxable equivalent adjustment 255 223

Merger-related expenses - 204

Operating income before income taxes $ 4,987 $ 3,152

(in thousands, except share and per share data)

2017 2016

First Quarter Fourth Quarter

Income tax reconciliation

Income tax expense - GAAP $ 1,502 $ 1,116

Taxable equivalent adjustment 255 223

Merger related expenses, tax benefit - 78

Operating income tax expense $ 1,757 $ 1,417

Net income reconciliation

Net income - GAAP $ 3,230 $ 1,609

Merger related expenses, net of income tax - 126

Operating net income $ 3,230 $ 1,735

Diluted earnings per share reconciliation

Diluted earnings per share - GAAP $ 0.13 $ 0.06

Merger related expenses - 0.01

Diluted earnings per share - operating $ 0.13 $ 0.07

Deposits excluding deposits to be assumed in branch sales

Total deposits $ 2,203,039 $ 2,237,580

Deposits to be assumed in branch sales (29,495) (31,589)

Deposits excluding deposits to be assumed in branch sales $ 2,173,544 $ 2,205,991

12

THANK YOU