Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - CB Financial Services, Inc. | exh_993.htm |

| EX-99.2 - EXHIBIT 99.2 - CB Financial Services, Inc. | exh_992.htm |

| 8-K - FORM 8-K - CB Financial Services, Inc. | f8k_051717.htm |

Exhibit 99.1

0 2017 Annual Shareholders' Meeting of CB Financial Services, Inc. The holding company of

1 Barron P. (“Pat”) McCune, Jr. Vice Chairman, President & CEO

2 Ralph J. Sommers, Jr. Chairman of the Board of Directors

3 Barron P. (“Pat”) McCune, Jr. Vice Chairman, President & CEO

4 Shareholder Presentation May 2017

5 Statements contained in this shareholder presentation that are not historical facts may constitute forward - looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements are subject to significant risks and uncertainties . The Company intends such forward - looking statements to be covered by the safe harbor provisions contained in the Act . The Company’s ability to predict results or the actual effect of future plans or strategies is inherently uncertain . Factors which could have a material adverse effect on the operations and future prospects of the Company and its subsidiaries include, but are not limited to, changes in market interest rates, general economic conditions, changes in federal and state regulation, actions by our competitors, loan delinquency rates, our ability to control costs and expenses, and other factors that may be described in the Company’s periodic reports as filed with the Securities and Exchange Commission . These risks and uncertainties should be considered in evaluating forward - looking statements and undue reliance should not be placed on such statements . The Company assumes no obligation to update any forward - looking statement except as may be required by applicable law or regulation . Forward - Looking Statements

6 The Strengths of Community Bank

7 Source: Company documents and SNL Financial; Data is as of 12/31/16. (1) Represents the period from 12/31/15 through 12/31/16. Based on period end balance sheet data. (2) Average cost of total deposits includes interest and non - interest bearing deposits. 2016 Average Cost of Total Deposits: 0.33% (2) 12/31/16 Deposits ($698M) Stable, low cost deposit base; 33 bps cost of deposits for the year ended December 31, 2016 Nearly 80% non - time deposits; 7% time deposits >$250,000 and brokered deposits Minimal increase in year over year (1 ) higher cost time deposit funding; 3.5% increase in noninterest bearing and transaction account deposits Deposit Composition Demand 24% NOW 15% MMDA & Savings 38% Time Deposits >$250,000 6% Time Deposits <$250,000 16% Brokered Deposits 1%

8 Loan Composition 12/31/16 Gross Loans HFI ($682M) Source: Company documents and SNL Financial; Data is as of 12/31/16. 2016 Average Yield on Loans: 4.42% Balanced loan portfolio Approximately 5% year over year C&I loan growth No commercial real estate loan concentration issues Consumer portfolio consists primarily of in - market, prime indirect auto lending Residential RE 40% Commercial RE 29% Construction 2% Commercial and Industrial 12% Consumer 17% Other 1%

9 Cost of Funds Source: SNL Financial and company documents, Peers include all commercial banks and bank holding companies headquartered in Pennsylvania with assets $300 million to $1.0 bil lion. Excludes mutual institutions and announced merger targets. Net Interest Margin Strong net interest margin supported by stable cost of funds Our stable, low cost core deposit base becomes increasingly important in a rising rate environment Net Interest Margin 3.89% 3.78% 3.83% 3.77% 3.90% 3.82% 3.68% 3.87% 2.50% 3.00% 3.50% 4.00% 4.50% CBFV PA Peer Median 0.38% 0.36% 0.36% 0.36% 0.38% 0.38% 0.39% 0.40% 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% CBFV PA Peer Median

10 Nonperforming Assets / Assets (1) Nonperforming Assets / Loans + OREO (1) NCOs / Avg. Loans Source: SNL Financial and company documents, Peers include all commercial banks and bank holding companies headquartered in Pennsylvania with assets $300 million to $1.0 billio n. Excludes mutual institutions and announced merger targets. (1) Non - Performing Assets = Nonaccrual + TDRs + 90 day past due and still accruing + OREO . Strong Asset Quality 1.23% 0.78% 0.86% 1.32% 1.02% 0.00% 0.50% 1.00% 1.50% 2.00% 2012Y 2013Y 2014Y 2015Y 2016Y CBFV PA Peer Median 1.92% 1.12% 1.01% 1.58% 1.26% 0.00% 1.00% 2.00% 3.00% 2012Y 2013Y 2014Y 2015Y 2016Y CBFV PA Peer Median 0.12% 0.17% 0.04% 0.11% 0.11% 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 2012Y 2013Y 2014Y 2015Y 2016Y CBFV PA Peer Median

11 Allowance for Loan Losses / NPLs (1) Allowance for Loan Losses / Loans Source: SNL Financial and company documents, Peers include all commercial banks and bank holding companies headquartered in Pennsylvania with assets $300 million to $1.0 billio n. Excludes mutual institutions and announced merger targets. (1) Non - Performing Loans = Nonaccrual + TDRs + 90 day past due and still accruing . Reserve Levels Support Capital Strength Conservative credit culture Allowance for loan loss balance rebuilt following the acquisition of FedFirst Remaining FedFirst credit mark provides additional reserve support Allowance for loan loss balance plus the remaining FedFirst credit mark has remained approximately 1.4% since the transaction closed in Q4 2014 1.70% 1.42% 0.76% 0.95% 1.14% 1.39% 1.43% 1.38% 0.00% 0.40% 0.80% 1.20% 1.60% 2.00% 2012Y 2013Y 2014Y 2015Y 2016Y CBFV Credit Mark PA Peer Median 102.1% 137.0% 73.9% 60.7% 92.6% 0% 50% 100% 150% 200% 2012Y 2013Y 2014Y 2015Y 2016Y CBFV PA Peer Median

12 Net Interest Income 80% Fee Income 20% Balanced Fee Revenue Mix With Opportunity For Continued Improvement Source: Company documents. Note: Fee income defined as noninterest income less net gain on sales of investments. Fee Revenue Mix – 2016 Fee income sources comprise approximately 20% of total revenue Continued opportunity to improve deposit fee income from legacy FedFirst franchise Wealth management business being incorporated into legacy FedFirst locations Insurance business being incorporated into legacy Community Bank locations 2016 YTD Fee Income: $7.2 Million Revenue Mix – 2016 Deposit Fees & Sevice Charges 33% Insurance Commissions 43% BOLI Income 7% Other Noninterest Income 17%

13 Bank Capital Exceeds Regulatory Requirements 0% 2% 4% 6% 8% 10% 12% 14% 16% Common Equity Tier 1 Capital Tier 1 Capital (to Risk Weighted Assets) Total Capital (to Risk Weighted Assets) Tier 1 Leverage Capital (to Adjusted Total Assets) Capital Adequacy Purposes To Be Well Capitalized CB Actual Capital 13.38% 14.63% 9.80% 6.50% 6.00% 8.00% 8.00% 10.00% 4.00% 5.00% Community Bank Capital Ratios – FY 2016 - 12/31/2016 13.38% 4.50% Source: Company documents.

14

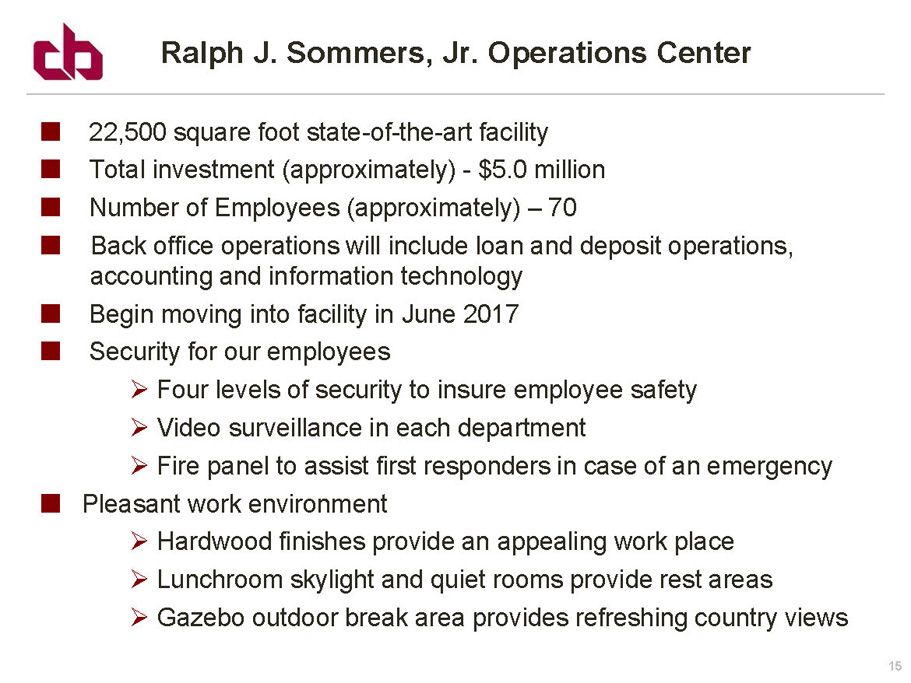

15 Ralph J. Sommers, Jr. Operations Center 22,500 square foot state - of - the - art facility Total investment (approximately) - $5.0 million Number of Employees (approximately) – 70 Back office operations will include loan and deposit operations, accounting and information technology Begin moving into facility in June 2017 Security for our employees » Four levels of security to insure employee safety » Video surveillance in each department » Fire panel to assist first responders in case of an emergency Pleasant work environment » Hardwood finishes provide an appealing work place » Lunchroom skylight and quiet rooms provide rest areas » Gazebo outdoor break area provides refreshing country views

16 Patrick G. O’Brien Senior Executive Vice President & COO

17 2016 Financial Performance

18 2016 Economic Review Local economy of Greene, Fayette, Washington and Westmoreland Counties struggled during 2016 with retraction in coal and natural gas industries Mid - year 2016, natural gas prices increased and started to spur natural gas exploration activity Activity ramped up through rest of 2016 into 2017 Pittsburgh economy continued to be relatively strong Technology, Medicine, Education

19 Shell Cracker Plant Site Source: The Pittsburgh Post - Gazette, Marcellus Drilling News and Google Earth. 340 - acre expanse on the southern bank of the Ohio and visible just off Interstate 376 Site specific infrastructure project already completed: » $70M relocation of the Center Township water supply » $60M relocation of Route 18 to accommodate the footprint of the facility; new bridge leading into the site was recently finished » Estimated total expenditures to date of $500 million On June 7, 2016, Shell Chemical announced it would move forward to complete an ethane cracker plant in Beaver County, PA Planning and construction on the estimated $6 billion facility is well underway The project is estimated to employ up to 6,000 people during construction

20 Community Bank in 2016 Net Income - $7.6 million ROA – 0.91% ROE – 8.48% Loan production was good » New commercial loans closed - $79.2 million » New mortgage loans closed - $48.3 million » New consumer loans closed - $70.3 million » Amounts disbursed under existing commercial lines of credit - $129.8 million But experienced unusually high level of loan payoffs Deposits grew $13.5 million during 2016 Deposits grew $13.3 million in the fourth quarter Source: Company documents.

21 First Quarter of 2017 Financial Results Net Income - $1.7 million ROA – 0.81% (1) ROE – 7.66% (1) Loan Growth – Recognized commercial and industrial and construction loan growth through originations Deposit Growth - $25.0 million lead by transactional accounts Credit Quality – Nonperforming loans to total loans decreased 13 basis points to 1.11% and nonperforming assets to total assets decreased 12 basis points to 0.90% Loan Loss Metrics – Maintained total allowance for loan losses of approximately $7.8 million while reducing first quarter provision by $430,000 as compared to prior year’s first quarter Exchange Underwriters – Contributed an increase of $214,000 in insurance commissions related to commercial lines and contingency income Source: Company documents (1) Financial ratios are reflected as projected annualized results.

22 April 2016: Bauer Financial awarded CBFV with its highest “Five Star” rating, available only to the strongest banks in the nation April 25, 2016: American Banker magazine recognized CBFV as being among the “Top 200” performing community banks (2) in the nation for its three year average Return on Equity (2013 - 2015) April 28, 2016: Pat McCune, President & CEO, was awarded the Good Neighbor Individual Community Member by Range Resources for his advocacy of the Marcellus November 3, 2016: Washington County Community Foundation awarded Community Bank with the Charles C. Keller Excellence Award for Corporate Philanthropy November 5, 2016 : Pat O’Brien and his wife Christine were awarded the Charles W. Pruitt, Jr. Difference Award by the Presbyterian SeniorCare CB Financial Services – Recent Achievements (1) Ambassador Financial Group 4 th Quarter Community Bank Report. (2) Includes bank holding companies, banks, and thrifts that had total assets of less than $2 billion as of 12/31/15 and that are publicly traded or report financials to the SEC.

23 Opportunistically grow to over $1.0 billion in total assets in the tri - state area Create a sales culture which builds full relationships with our commercial business customers Maintain above peer profitability while continuing to invest for the future Empower our experienced, high quality employees to provide superior customer service in all aspects of our business Be the Community Bank of choice in the tri - state area for small and medium sized businesses Strategic Vision for CB Financial Services