Attached files

| file | filename |

|---|---|

| 8-K - 8-K MAY 2017 INVESTOR PRESENTATION - AZZ INC | form8k-5x17x17corppresenta.htm |

AZZ Inc.

NYSE: AZZ

Corporate Presentation

May 2017

2

Certain statements herein about our expectations of future events or results constitute forward-looking statements for

purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking

statements by terminology such as, “may,” “should,” “expects,“ “plans,” “anticipates,” “believes,” “estimates,” “predicts,”

“potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are

based on currently available competitive, financial and economic data and management’s views and assumptions regarding

future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may

differ from those expressed or implied in the forward-looking statements. This presentation may contain forward-looking

statements that involve risks and uncertainties including, but not limited to, changes in customer demand and response to

products and services offered by AZZ, including demand by the power generation markets, electrical transmission and

distribution markets, the industrial markets, and the hot dip galvanizing markets; prices and raw material cost, including zinc

and natural gas which are used in the hot dip galvanizing process; changes in the political stability and economic conditions of

the various markets that AZZ serves, foreign and domestic, customer requested delays of shipments, acquisition opportunities,

currency exchange rates, adequacy of financing, and availability of experienced management and employees to implement

AZZ’s growth strategy. AZZ has provided additional information regarding risks associated with the business in AZZ’s Annual

Report on Form 10-K for the fiscal year ended February 28, 2017 and other filings with the SEC, available for viewing on AZZ’s

website at www.azz.com and on the SEC’s website at www.sec.gov.

You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to

place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement.

These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-

looking statements, whether as a result of new information, future events, or otherwise.

Forward Looking Statements

3

AZZ is a global provider of specialty electrical equipment and highly

engineered services to the power generation, transmission,

distribution and industrial markets as well as a leading provider of

hot dip galvanizing services to the North American steel fabrication

market

Our Vision: We envision a world where AZZ’s innovation, quality, and

service minded people enable a safer and more sustainable

infrastructure while providing superior returns for shareholders

Corporate Overview and Vision

4

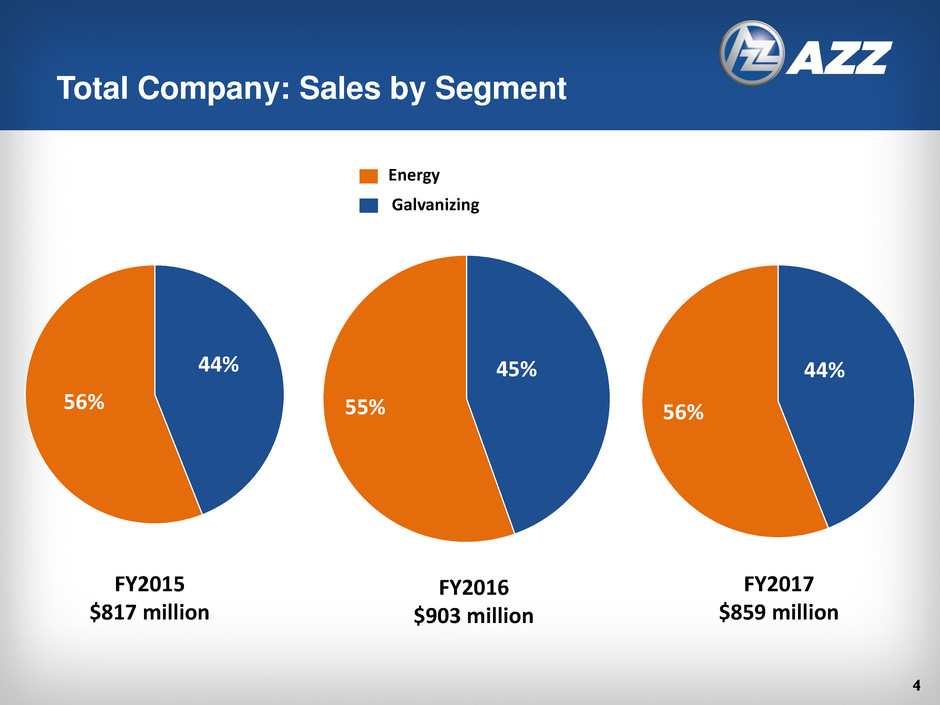

Total Company: Sales by Segment

44%

56%

FY2015

$817 million

Energy

Galvanizing

45%

55%

FY2016

$903 million

44%

56%

FY2017

$859 million

5

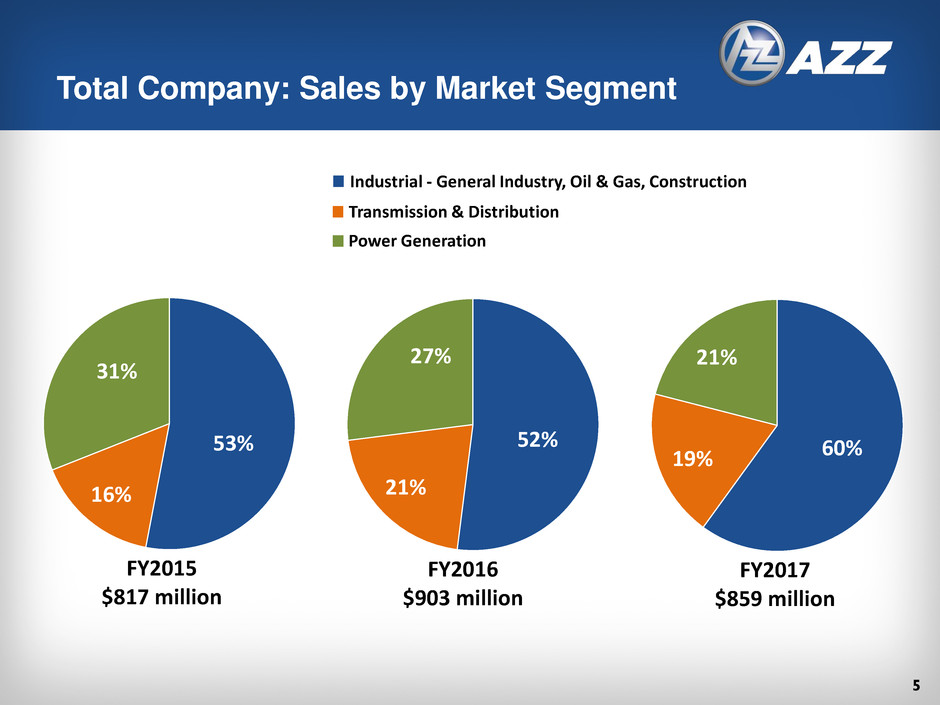

Total Company: Sales by Market Segment

Transmission & Distribution

Industrial - General Industry, Oil & Gas, Construction

Power Generation

53%

16%

31%

FY2015

$817 million

52%

21%

27%

FY2016

$903 million

60% 19%

21%

FY2017

$859 million

Served Markets

Our products help

power up the world

from any generation

source and our services

ensure the safety of

lives and equipment.

Customers & Partners

7

8

Leading Market

Positions

Diversified

Portfolio of

Businesses

Strong Long

Term Growth

Drivers

Strong Historical

Financial

Performance

New Culture

Driving Future

Opportunities

Key Investment Considerations

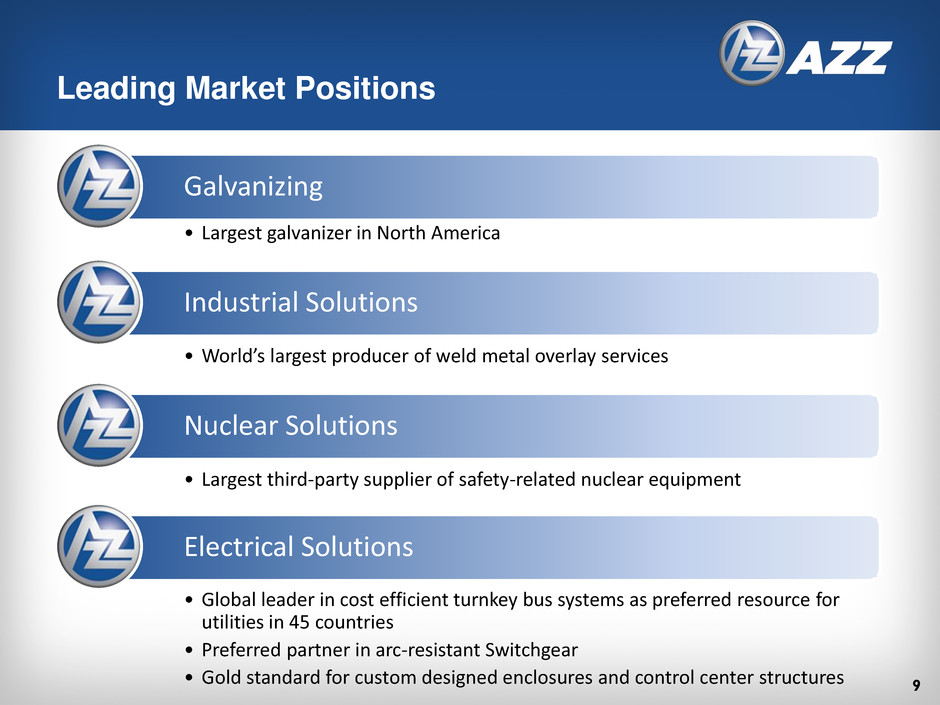

9

Galvanizing

Leading Market Positions

Industrial Solutions

Nuclear Solutions

Electrical Solutions

• Largest galvanizer in North America

• World’s largest producer of weld metal overlay services

• Largest third-party supplier of safety-related nuclear equipment

• Global leader in cost efficient turnkey bus systems as preferred resource for

utilities in 45 countries

• Preferred partner in arc-resistant Switchgear

• Gold standard for custom designed enclosures and control center structures

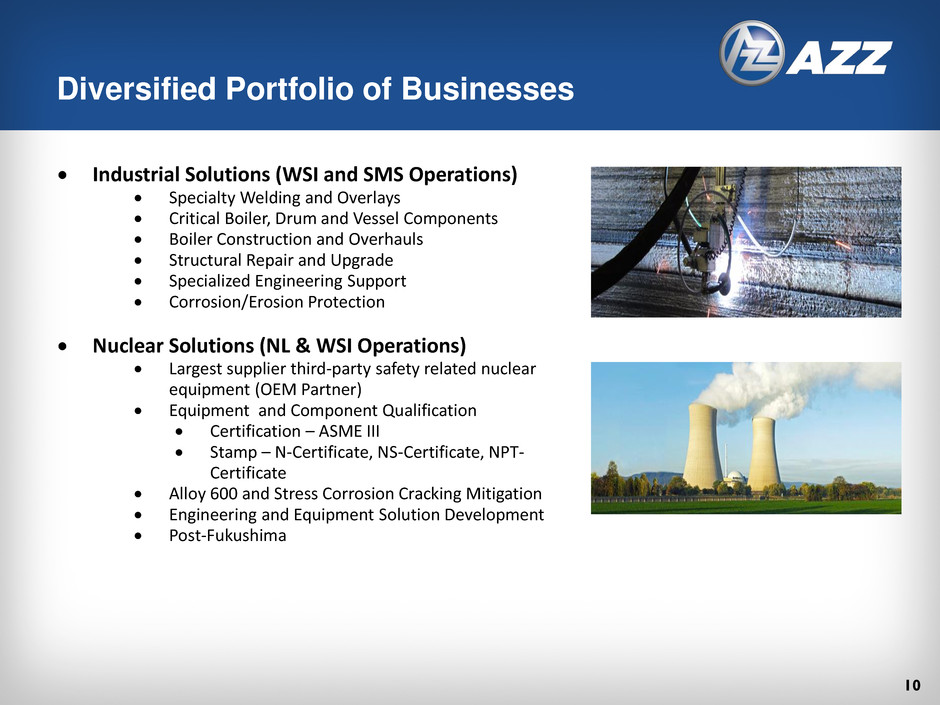

10

Industrial Solutions (WSI and SMS Operations)

Specialty Welding and Overlays

Critical Boiler, Drum and Vessel Components

Boiler Construction and Overhauls

Structural Repair and Upgrade

Specialized Engineering Support

Corrosion/Erosion Protection

Nuclear Solutions (NL & WSI Operations)

Largest supplier third-party safety related nuclear

equipment (OEM Partner)

Equipment and Component Qualification

Certification – ASME III

Stamp – N-Certificate, NS-Certificate, NPT-

Certificate

Alloy 600 and Stress Corrosion Cracking Mitigation

Engineering and Equipment Solution Development

Post-Fukushima

Diversified Portfolio of Businesses

11

Electrical Solutions (Legacy Electrical &

Industrial Products)

High & Medium Voltage Bus Systems

Switchgear Systems

Enclosure Systems

Tubular Products

Hazardous and Specialty Lighting

Systems

Galvanizing

Largest galvanizer in North America

Corrosion protection services for steel

fabrication industry

Leader in quality, dependability, and

service

Diversified end markets

Diversified Portfolio of Businesses

12

• FY 2017 – 30th consecutive year of profitability

• 10 Year CAGR – Revenues 12.7%, Net Income 10.9%

• Strong balance sheet and cash flows, new debt facility in

place

• Superior operating margins in legacy businesses

• Solid Quarterly Cash dividend

Strong Financial Performance

13

• Aging U.S. energy and industrial infrastructure and required

investment

• Emerging North American energy independence

• International demand for electricity and energy

Key Long-Term Growth Drivers

14

Focus of Fiscal 2015-2017:

• Unlocking value at recently acquired businesses (WSI & NL)

• Management changes – “right players on the field”

• Emphasis on project management

• Seeking higher margins through sales leverage, cost control, and selective bidding

• Driving returns-based metrics

• More financially centered organization

• Incentives aligned with performance throughout organization

• RONA focus on investments

• Operational excellence through 6-sigma practices and accountability

• Accountability and change integrated throughout all layers of management

• Early stages of adoption reaping benefits

Driving Performance FY2015 – FY2017

15

Improving Energy segment operating margins through

emphasis on:

international growth

operational excellence

leveraging fixed costs through top-line growth

Growing our Galvanizing segment

organically

by acquisition

seeking adjacent opportunities in metal finishing

Continuing emphasis on cash flow and efficient capital

deployment

Focus Areas for Fiscal Year 2018

AZZ has significant growth opportunities that will provide a platform

for sustainable earnings growth

Galvanizing

17

Galvanizing Market Opportunity

Includes Galvanized:

• Steel Sheet

• Tube Steel

Global Galvanized Steel Market

Post-Fabrication

Galvanized Steel

Electrical Utility

Industrial

Petrochemical Bridge & Highway

OEM

AZZ

Served Markets

Evaluating other metal finishing process technologies

18

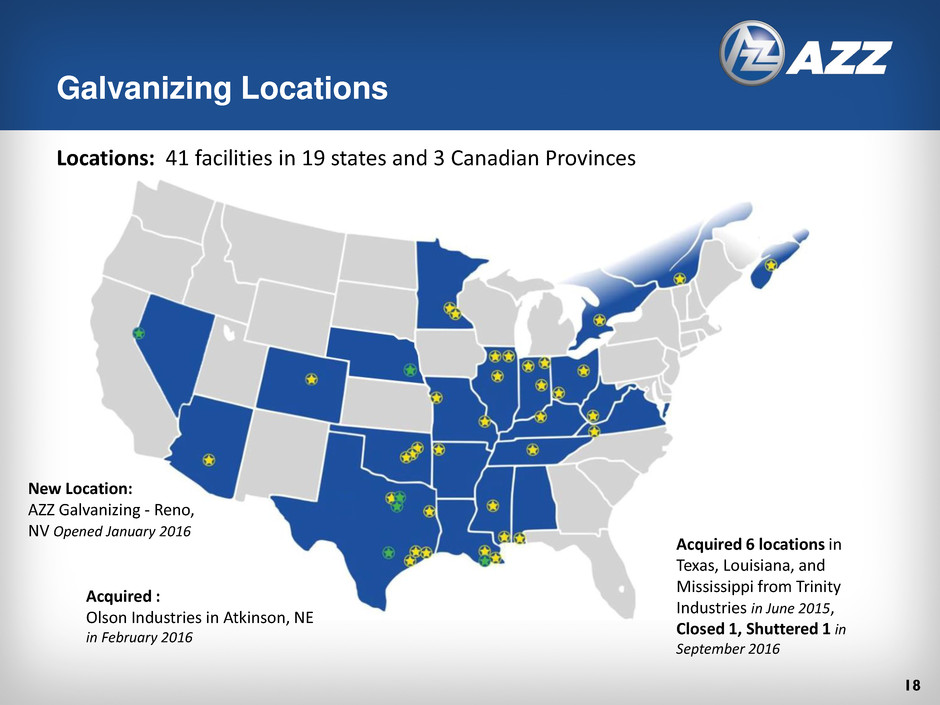

Galvanizing Locations

Acquired 6 locations in

Texas, Louisiana, and

Mississippi from Trinity

Industries in June 2015,

Closed 1, Shuttered 1 in

September 2016

Locations: 41 facilities in 19 states and 3 Canadian Provinces

New Location:

AZZ Galvanizing - Reno,

NV Opened January 2016

Acquired :

Olson Industries in Atkinson, NE

in February 2016

19

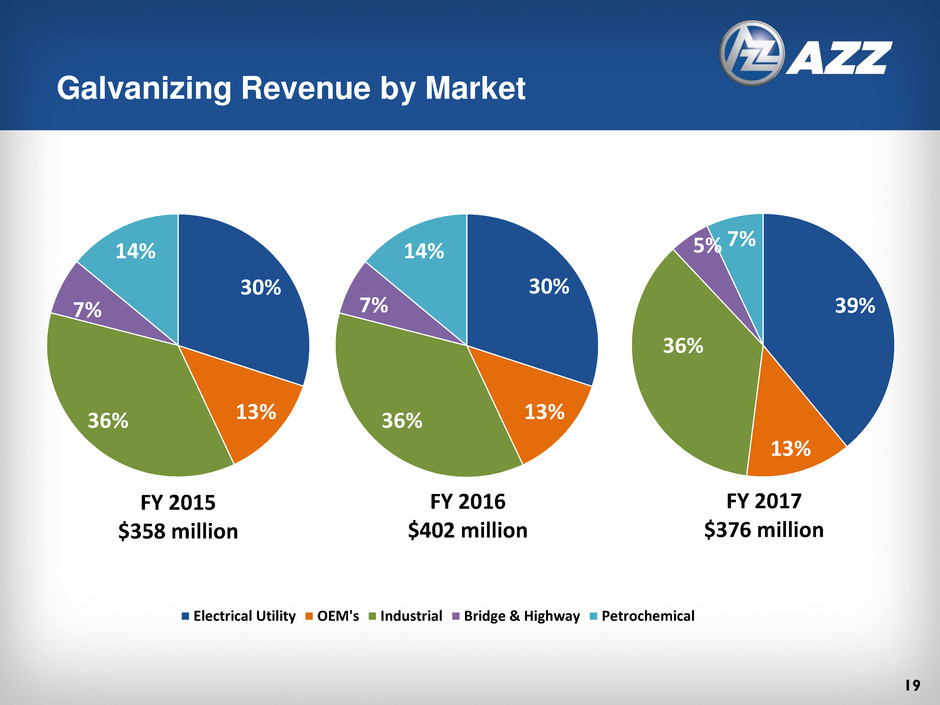

Galvanizing Revenue by Market

30%

13% 36%

7%

14%

FY 2015

$358 million

Electrical Utility OEM's Industrial Bridge & Highway Petrochemical

30%

13% 36%

7%

14%

FY 2016

$402 million

39%

13%

36%

5% 7%

FY 2017

$376 million

20

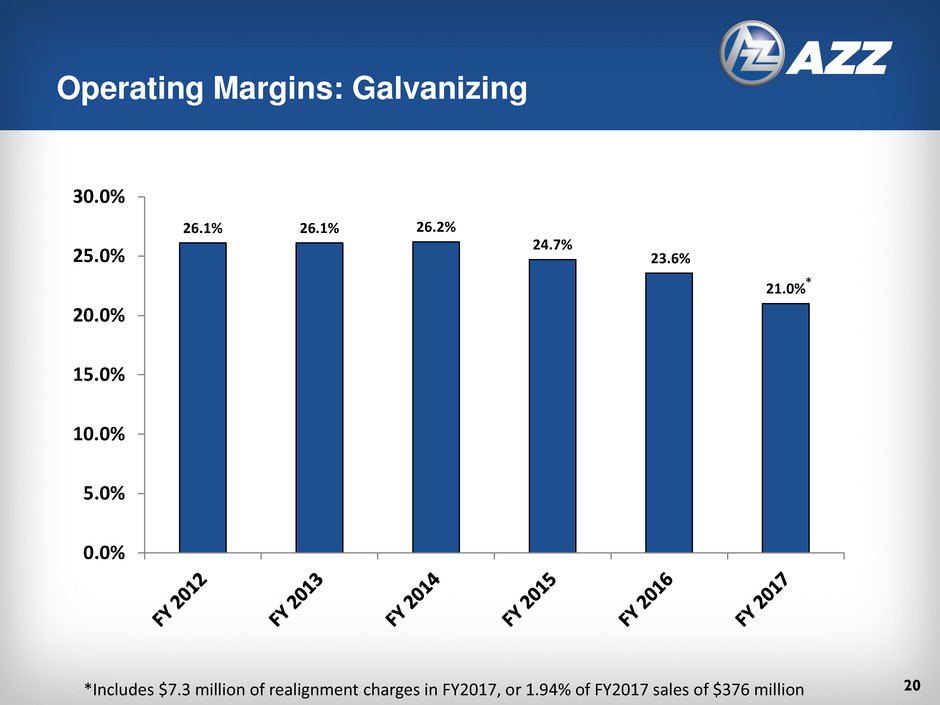

Operating Margins: Galvanizing

26.1% 26.1% 26.2%

24.7%

23.6%

21.0%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

*

*Includes $7.3 million of realignment charges in FY2017, or 1.94% of FY2017 sales of $376 million

Energy

22

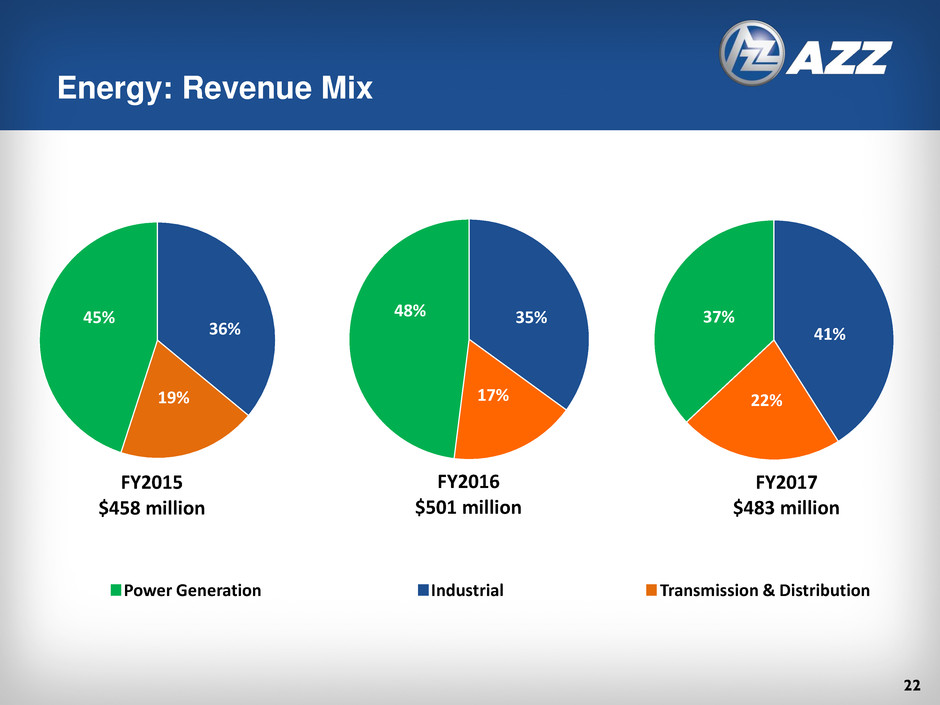

41%

22%

37%

FY2017

$483 million

35%

17%

48%

FY2016

$501 million

Energy: Revenue Mix

36%

19%

45%

FY2015

$458 million

Transmission & Distribution Industrial Power Generation

23

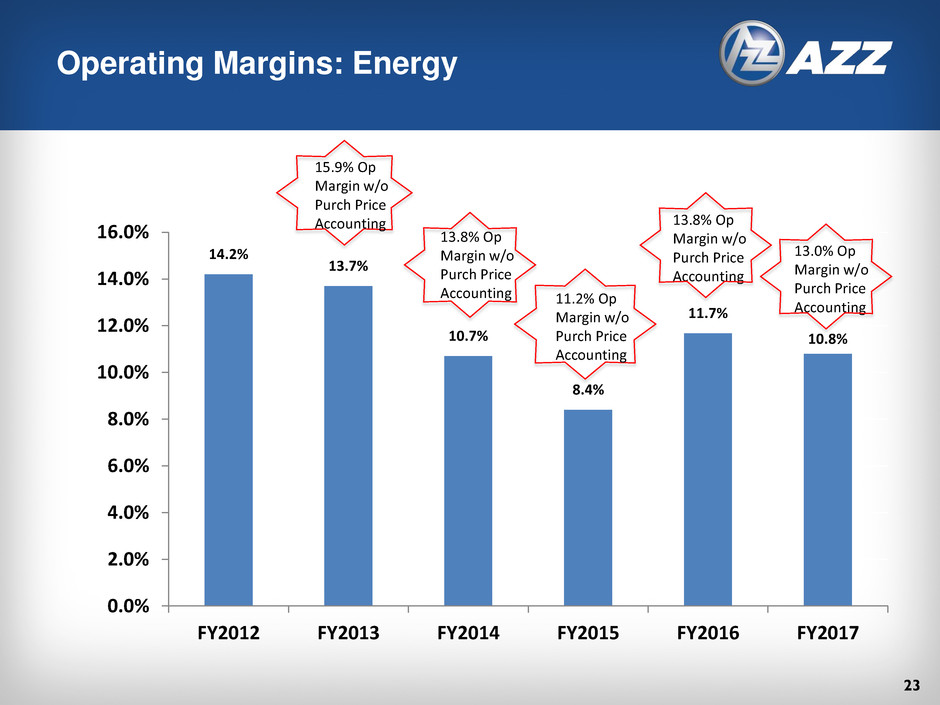

14.2%

13.7%

10.7%

8.4%

11.7%

10.8%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

FY2012 FY2013 FY2014 FY2015 FY2016 FY2017

13.8% Op

Margin w/o

Purch Price

Accounting

13.0% Op

Margin w/o

Purch Price

Accounting

Operating Margins: Energy

15.9% Op

Margin w/o

Purch Price

Accounting

13.8% Op

Margin w/o

Purch Price

Accounting 11.2% Op

Margin w/o

Purch Price

Accounting

24

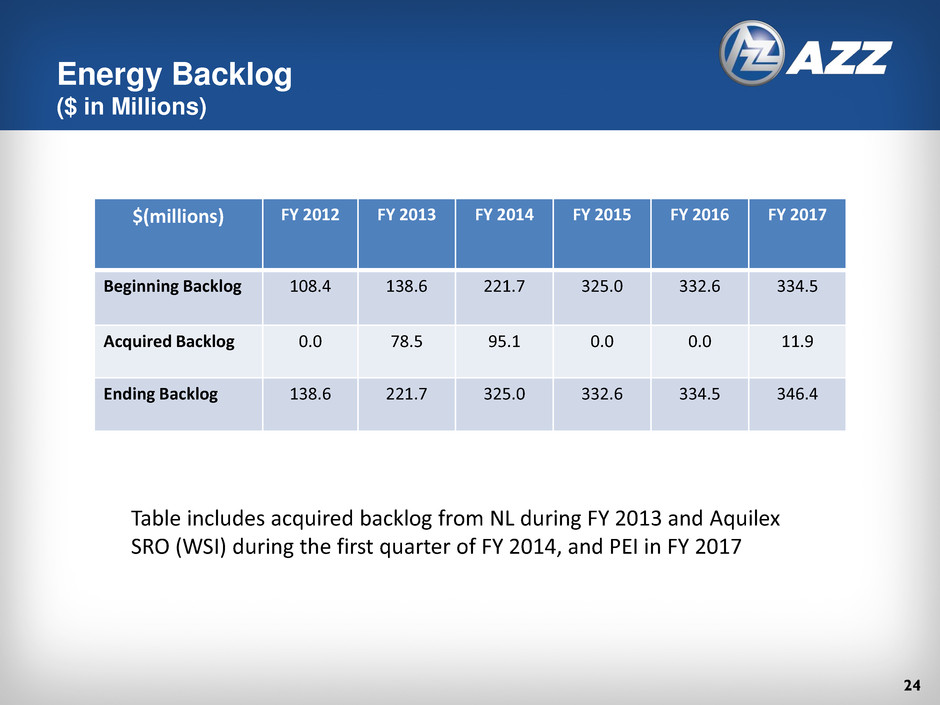

Energy Backlog

($ in Millions)

Table includes acquired backlog from NL during FY 2013 and Aquilex

SRO (WSI) during the first quarter of FY 2014, and PEI in FY 2017

$(millions) FY 2012

FY 2013 FY 2014

FY 2015

FY 2016 FY 2017

Beginning Backlog 108.4 138.6 221.7 325.0 332.6 334.5

Acquired Backlog 0.0 78.5 95.1 0.0 0.0 11.9

Ending Backlog 138.6 221.7 325.0 332.6 334.5 346.4

Consolidated Financials

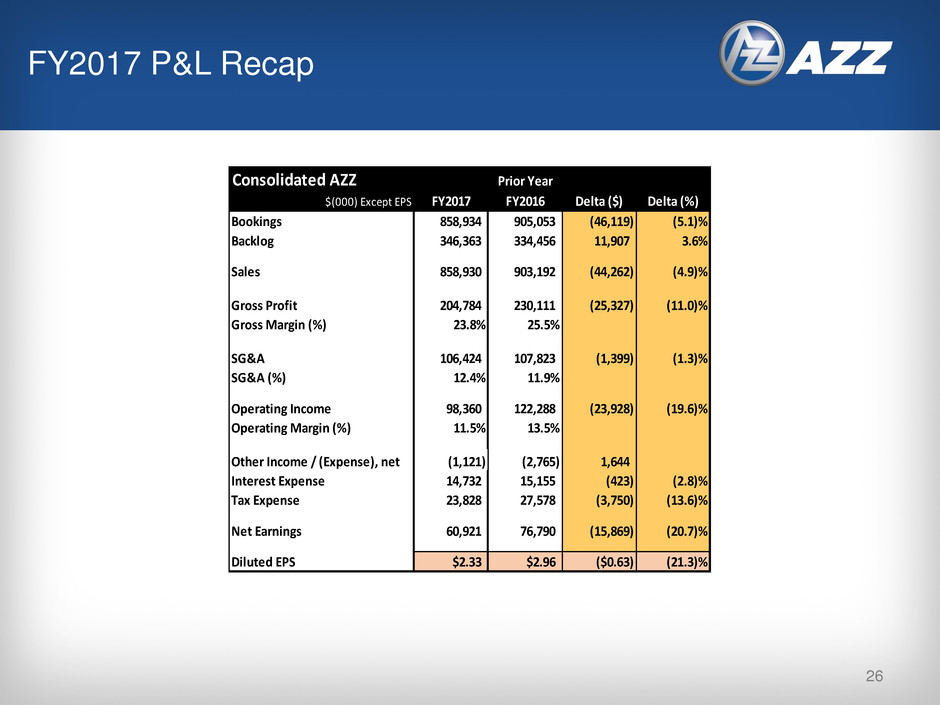

FY2017 P&L Recap

Consolidated AZZ Prior Year

$(000) Except EPS FY2017 FY2016 Delta ($) Delta (%)

Bookings 858,934 905,053 (46,119) (5.1)%

Backlog 346,363 334,456 11,907 3.6%

Sales 858,930 903,192 (44,262) (4.9)%

Gross Profit 204,784 230,111 (25,327) (11.0)%

Gross Margin (%) 23.8% 25.5%

SG&A 106,424 107,823 (1,399) (1.3)%

SG&A (%) 12.4% 11.9%

Operating Income 98,360 122,288 (23,928) (19.6)%

Operating Margin (%) 11.5% 13.5%

Other Income / (Expense), net (1,121) (2,765) 1,644

Interest Expense 14,732 15,155 (423) (2.8)%

Tax Expense 23,828 27,578 (3,750) (13.6)%

Net Earnings 60,921 76,790 (15,869) (20.7)%

Diluted EPS $2.33 $2.96 ($0.63) (21.3)%

26

27

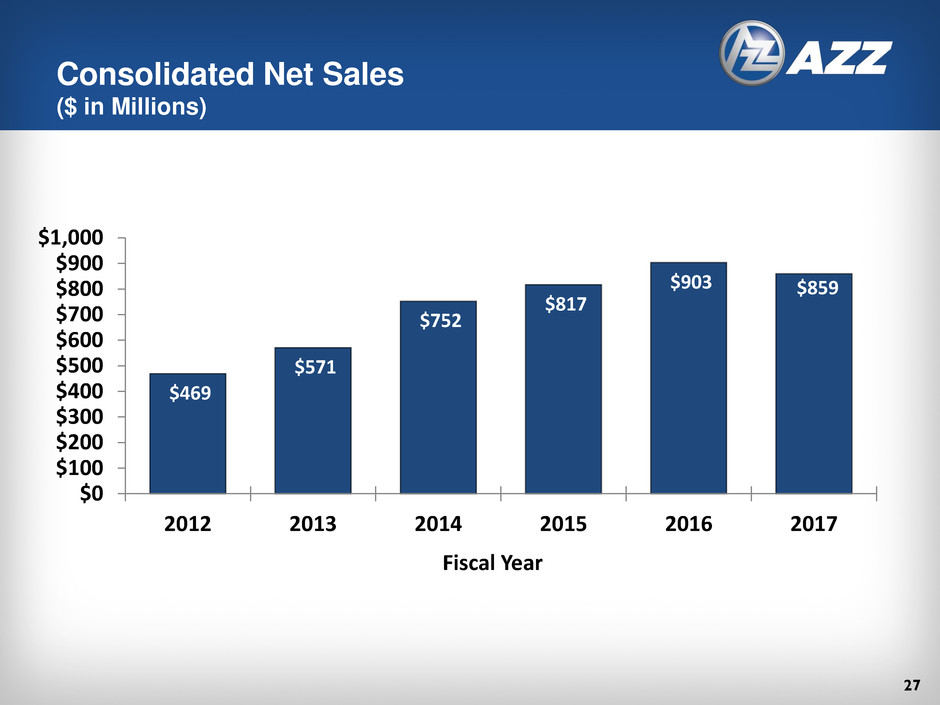

Consolidated Net Sales

($ in Millions)

$469

$571

$752

$817

$903 $859

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2012 2013 2014 2015 2016 2017

Fiscal Year

28

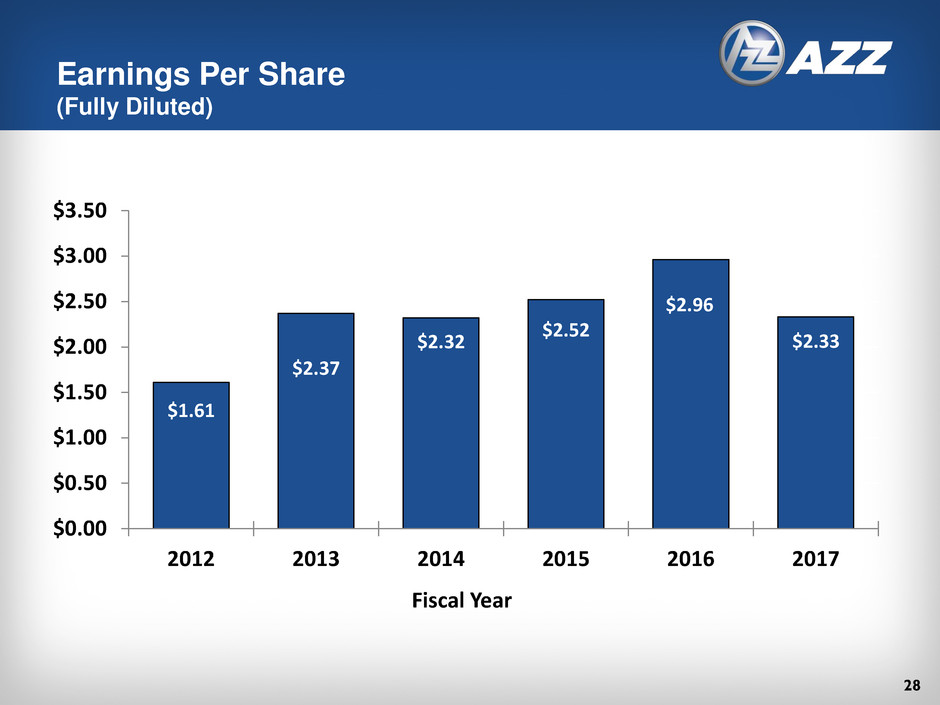

Earnings Per Share

(Fully Diluted)

$1.61

$2.37

$2.32

$2.52

$2.96

$2.33

$0.00

$0.50

$1.00

$1.50

$2.00

$2.50

$3.00

$3.50

2012 2013 2014 2015 2016 2017

Fiscal Year

29

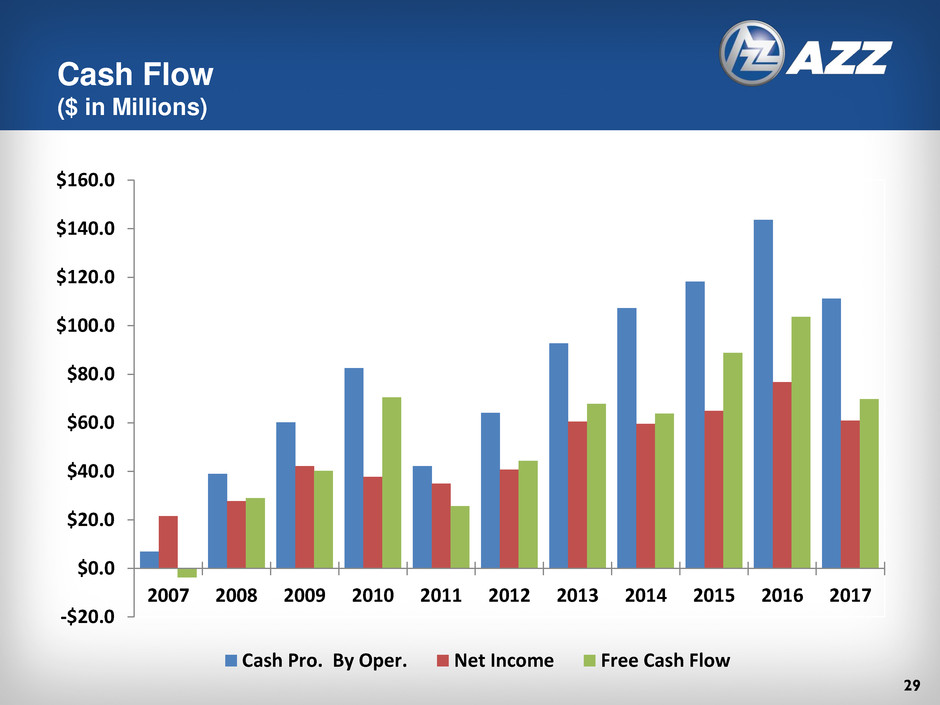

Cash Flow

($ in Millions)

-$20.0

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

$160.0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Cash Pro. By Oper. Net Income Free Cash Flow

30

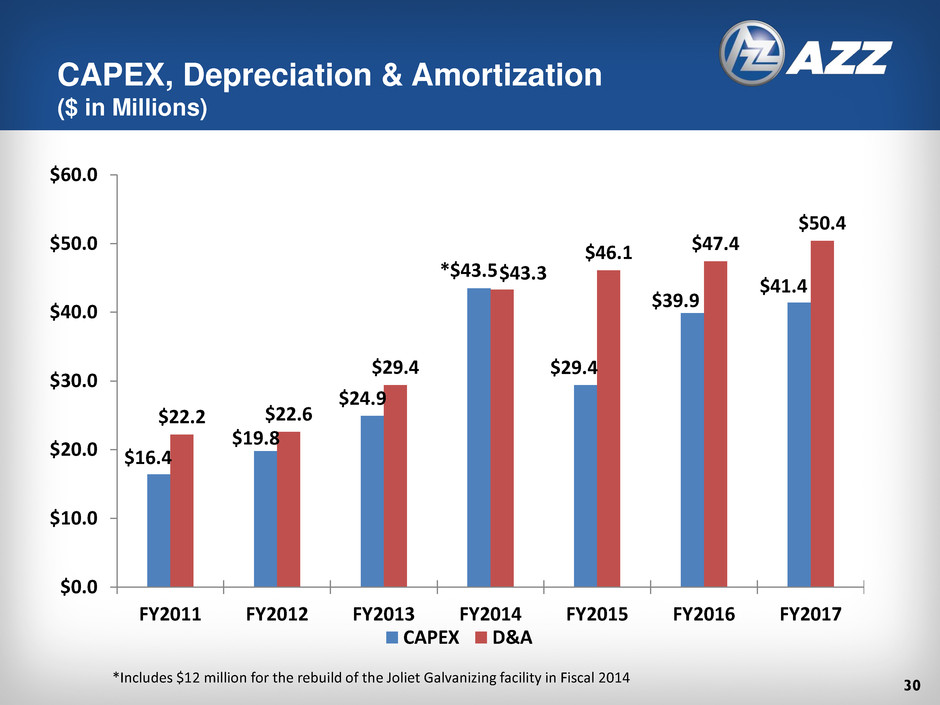

CAPEX, Depreciation & Amortization

($ in Millions)

$16.4

$19.8

$24.9

*$43.5

$29.4

$39.9

$41.4

$22.2 $22.6

$29.4

$43.3

$46.1 $47.4

$50.4

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

FY2011 FY2012 FY2013 FY2014 FY2015 FY2016 FY2017

CAPEX D&A

*Includes $12 million for the rebuild of the Joliet Galvanizing facility in Fiscal 2014

31

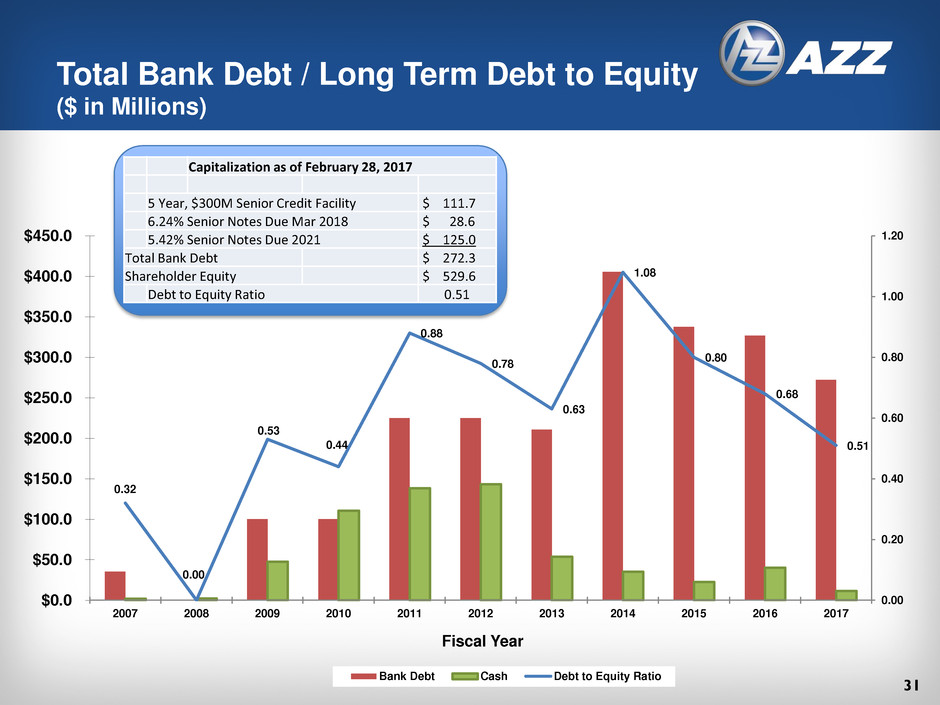

Total Bank Debt / Long Term Debt to Equity

($ in Millions)

0.32

0.00

0.53

0.44

0.88

0.78

0.63

1.08

0.80

0.68

0.51

0.00

0.20

0.40

0.60

0.80

1.00

1.20

$0.0

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

$400.0

$450.0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Fiscal Year

Bank Debt Cash Debt to Equity Ratio

Capitalization as of February 28, 2017

5 Year, $300M Senior Credit Facility $ 111.7

6.24% Senior Notes Due Mar 2018 $ 28.6

5.42% Senior Notes Due 2021 $ 125.0

Total Bank Debt $ 272.3

Shareholder Equity $ 529.6

Debt to Equity Ratio 0.51

32

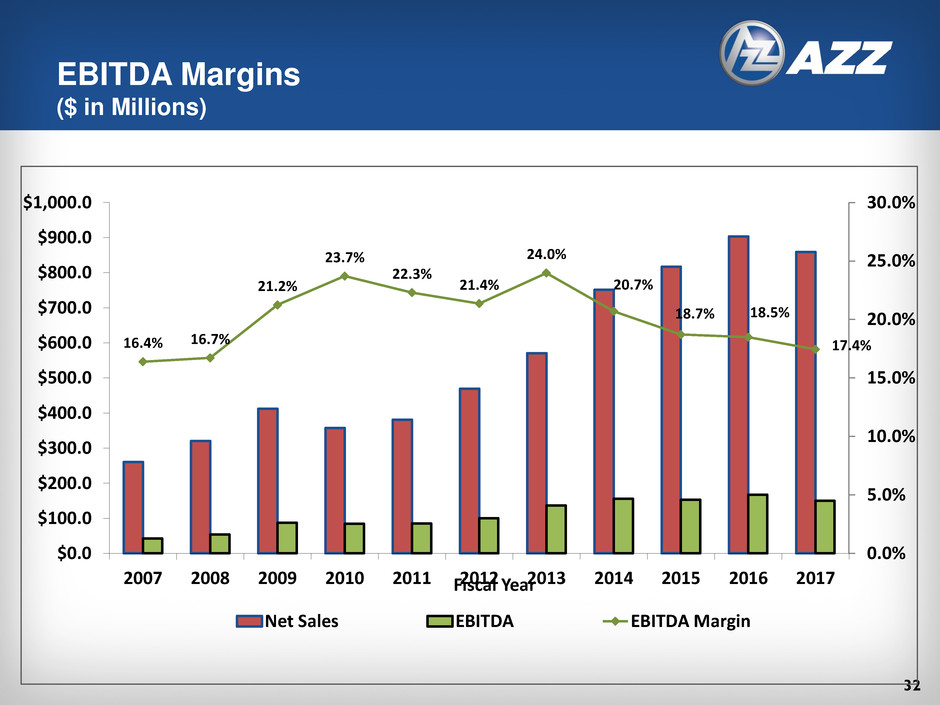

EBITDA Margins

($ in Millions)

16.4% 16.7%

21.2%

23.7%

22.3%

21.4%

24.0%

20.7%

18.7% 18.5%

17.4%

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

$0.0

$100.0

$200.0

$300.0

$400.0

$500.0

$600.0

$700.0

$800.0

$900.0

$1,000.0

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017Fiscal Year

Net Sales EBITDA EBITDA Margin

Q & A

Appendix - Businesses

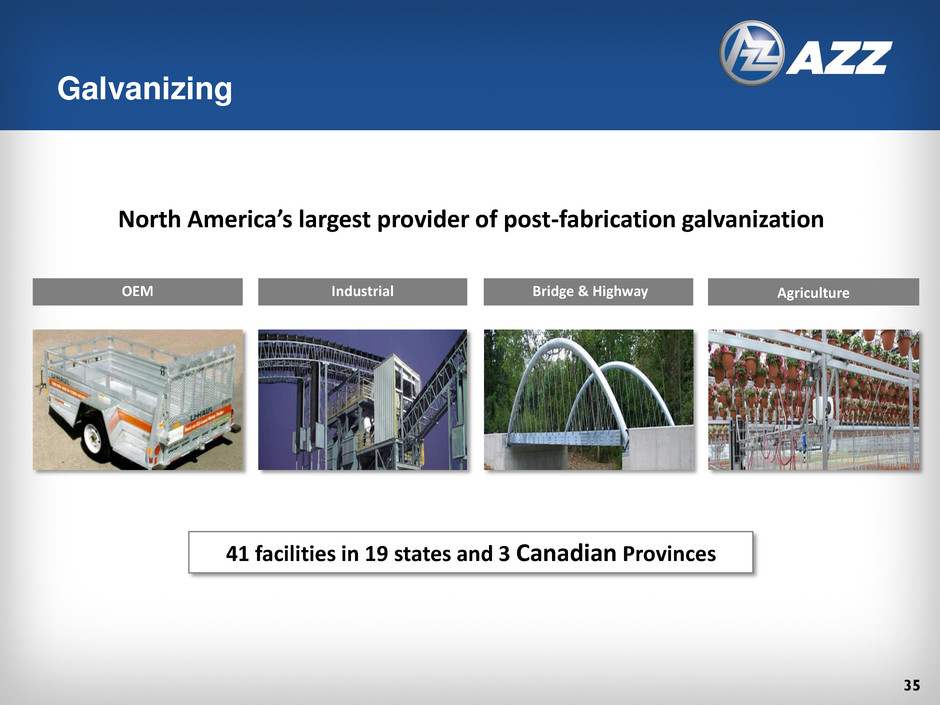

North America’s largest provider of post-fabrication galvanization

Galvanizing

OEM Industrial Bridge & Highway Agriculture

41 facilities in 19 states and 3 Canadian Provinces

35

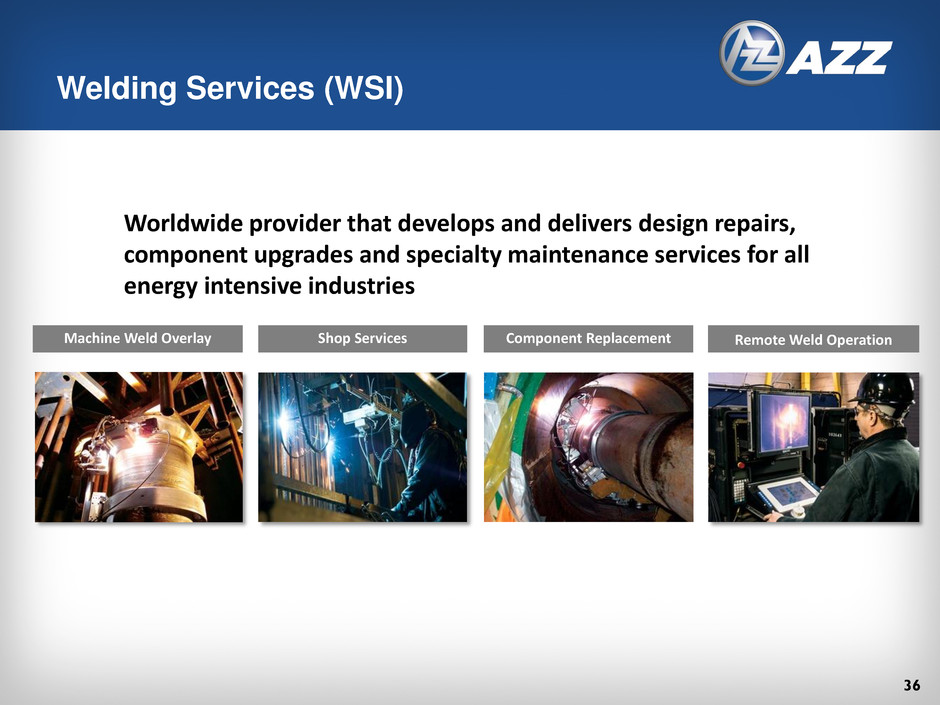

Welding Services (WSI)

Worldwide provider that develops and delivers design repairs,

component upgrades and specialty maintenance services for all

energy intensive industries

Machine Weld Overlay Shop Services Component Replacement Remote Weld Operation

36

Boiler Construction Boiler Overhaul Component Replacement HSRG Maintenance

Southeastern Mechanical Services (SMS)

SMS provides qualified modifications, repairs and fabrication of boiler

components and pressure parts to industries that rely on boilers and heat

recovery units for steam and/or power generation

37

Nuclear Logistics LLC (NL)

A leading 3rd party supplier of critical and safety related equipment for

the nuclear power industry

Electrical Mechanical Instrumentation & Control Qualification & Dedication

38

Switchgear Systems

PowerAisle™ metal clad and arc-resistant switchgear and relay panels

provide the safe and reliable operation of electricity

Renewable /Wind Utility Portable Substation Mining

39

Bus Systems

Electrical bus for domestic and international utilities and industrial markets

Non-Segregated Phase Bus Segregated Phase Bus Isolated Phase Bus Bus Services

600V- 38kV 15kV-69kV 600V-38kV Installation/Emergency Repair

40

High Voltage Bus Systems (HVBS)

AZZ SF6 gas insulated bus provides a long distance power transmission

alternative to transmission lines, high voltage cables, or GIS bus designs

Vertical Underground Overhead Interconnections

41

Enclosure Systems

Factory fabricated electrical enclosures safely and securely protect

instrumentation and control devices across a wide variety of markets

Electrical Industrial Oil & Gas Specialty Applications

42

Hazardous and Specialty lighting for severe and harsh environments

Lighting Systems

Industrial Marine Lighting Food Processing/Inspection Manufacturing

43

Pup Joints and Full Length Tubing serving the Oil Country Tubular Goods Market

Tubular Products

Upset Pipe Thread Pipe Full Length Tubing Pup Joints

44

Reg G Tables

46

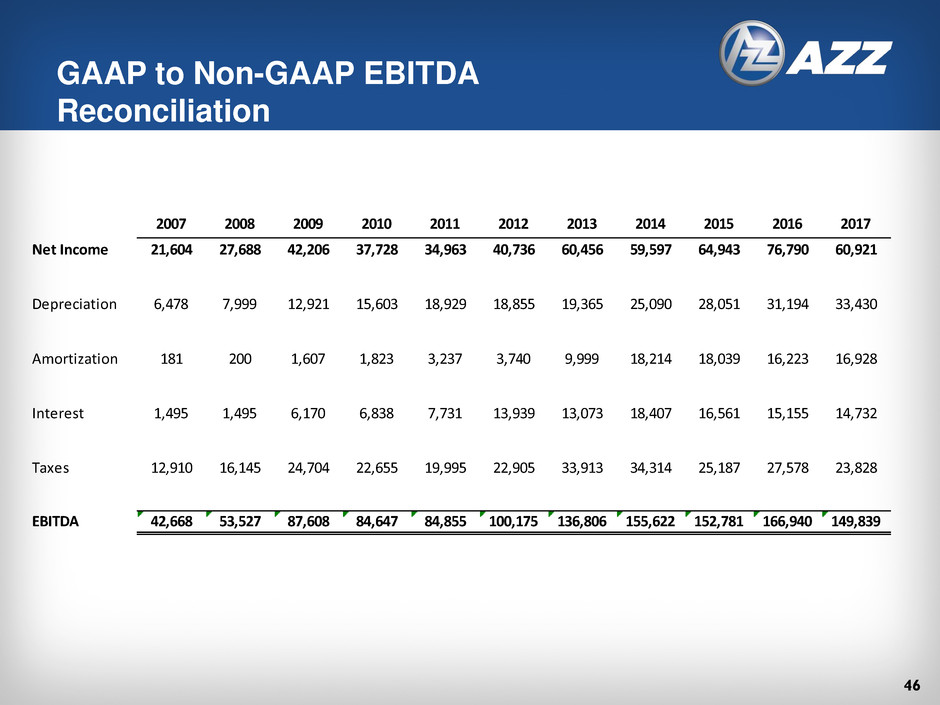

GAAP to Non-GAAP EBITDA

Reconciliation

2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Net Income 21,604 27,688 42,206 37,728 34,963 40,736 60,456 59,597 64,943 76,790 60,921

Depreciation 6,478 7,999 12,921 15,603 18,929 18,855 19,365 25,090 28,051 31,194 33,430

Amortization 181 200 1,607 1,823 3,237 3,740 9,999 18,214 18,039 16,223 16,928

Interest 1,495 1,495 6,170 6,838 7,731 13,939 13,073 18,407 16,561 15,155 14,732

Taxes 12,910 16,145 24,704 22,655 19,995 22,905 33,913 34,314 25,187 27,578 23,828

EBITDA 42,668 53,527 87,608 84,647 84,855 100,175 136,806 155,622 152,781 166,940 149,839

47

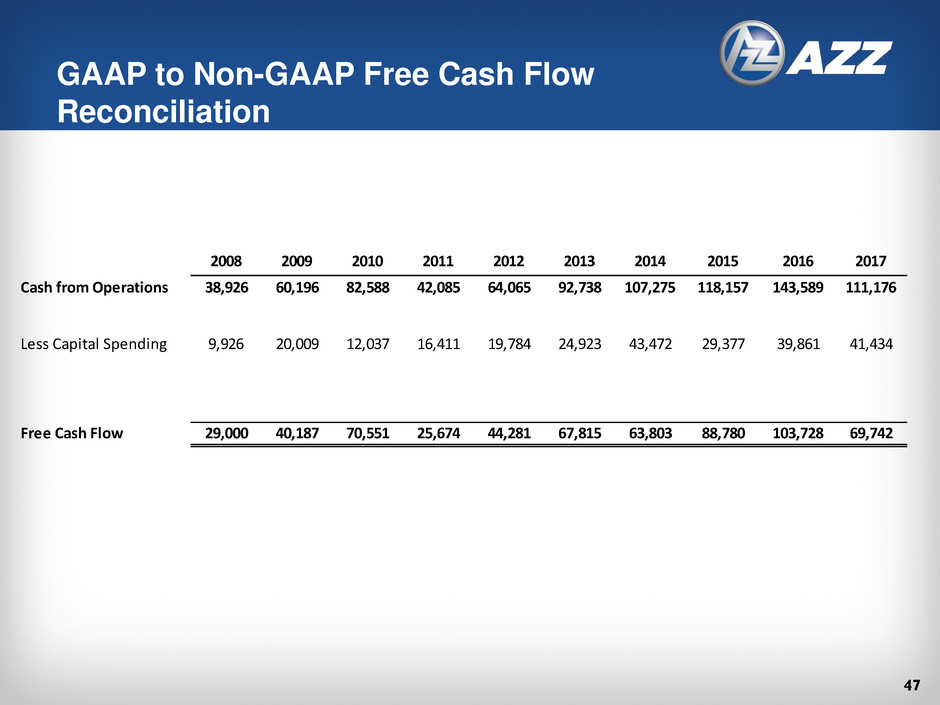

GAAP to Non-GAAP Free Cash Flow

Reconciliation

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Cash from Operations 38,926 60,196 82,588 42,085 64,065 92,738 107,275 118,157 143,589 111,176

Less Capital Spending 9,926 20,009 12,037 16,411 19,784 24,923 43,472 29,377 39,861 41,434

Free Cash Flow 29,000 40,187 70,551 25,674 44,281 67,815 63,803 88,780 103,728 69,742