Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BAR HARBOR BANKSHARES | annualmeeting-bhbxregfd8xk.htm |

Annual Shareholders’ Meeting

May 16, 2017

Forward Looking Statements

This document contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. There are several factors that could cause

actual results to differ significantly from expectations described in the forward-looking statements. For a discussion of such factors, please see the Company’s most

recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC’s website at www.sec.gov. The Company

does not undertake any obligation to update forward-looking statements.

2

Non-GAAP Financial Statements

This document contains certain non-GAAP financial measures in addition to results presented in accordance with Generally Accepted Accounting Principles

(“GAAP”). These non-GAAP measures provide supplemental perspectives on operating results, performance trends, and financial condition. They are not a

substitute for GAAP measures; they should be read and used in conjunction with the Company’s GAAP financial information. A reconciliation of non-GAAP

financial measures to GAAP measures is included in the first quarter earnings release and Form 10-Q which can be found at www.bhbt.com, as well as within the

Appendix of this presentation. In all cases, it should be understood that non-GAAP per share measures do not depict amounts that accrue directly to the benefit

of shareholders.

The Company utilizes the non-GAAP measure of core earnings in evaluating operating trends, including components for core revenue and expense. These

measures exclude items which the Company does not view as related to its normalized operations. These items include securities gains/losses, merger costs,

restructuring costs, and systems conversion costs. Non-core adjustments are presented net of an adjustment for income tax expense. This adjustment is determined

as the difference between the GAAP tax rate and the effective tax rate applicable to core income. The efficiency ratio is adjusted for non-core revenue and expense

items and for tax preference items. The Company also calculates measures related to tangible equity, which adjust equity (and assets where applicable) to exclude

intangible assets due to the importance of these measures to the investment community. Charges related to the acquisition of Lake Sunapee Bank Group consist

primarily of severance and retention cost, systems conversion and integration costs, and professional fees. The Company’s disclosure of organic growth of loans in

2017 is also adjusted for the acquisition of Lake Sunapee Bank Group.

A True Community Bank

We understand the unique opportunities and challenges our customers face

We provide exceptional support to the people, businesses and communities in

the places we call home

Our people are resourceful and friendly, and our customers can count on them to

help find solutions

We value geography, heritage and performance while balancing growth and

earnings

Risk management and earnings sustainability while remaining true to our

culture

Commitment to continued improvement and process discipline

3

We recognize, appreciate and support the unique people and culture in the places we call home

Invested in Processes, Products, Technology, Training, Leadership and Infrastructure

Expanded our brand and business model into markets with similar geographic

attributes and like-minded partners

Created opportunity and growth for existing employees, while adding catalyst recruits

across all levels of the organization with broader experience and depth that value our

culture

Maintained our strong commitment to compliance and to risk management given the

evolving environment within the industry

Created a service and sales driven culture with focus on core business growth

Preparing For Our Future

4

Employee and customer experience is the foundation of superior performance,

which leads to significant financial benefit to our shareholders

2016 Achievements

Announced the acquisition of Lake Sunapee Bank Group (“LSBG”) in May 2016

and closed the transaction in January 2017

Total assets increased $175 million in the year to $1.8 billion

Strong loan growth of 14% and deposit growth of 11%

Net income of $14.9 million, which included $2.7 million of expenses related to the

acquisition and core system conversion compared to $15.2 million in 2015

Non-performing assets to total assets of 0.38%, down from 0.46%

Total non-performing loans to total loans of 0.58%, down from 0.71%

5

Highlights represent Bar Harbor Bankshares prior to completing the acquisition of LSBG. A reconciliation of non-GAAP financial measures to GAAP

measures are included in the first quarter earnings release and Form 10-Q which can be found at www.bhbt.com, as well as within the attached Appendix.

As necessary for comparative purposes, amounts are restated to reflect 3-for-2 stock split completed in the first quarter of 2017.

We are now the only community bank

based in New England with a branch presence in

Maine, New Hampshire, and Vermont

6

First Quarter 2017 Highlights

(comparisons are to first quarter 2016 unless otherwise stated)

Completed acquisition of Lake Sunapee Bank Group on January 13, 2017

$3.4 billion in total assets, including $1.6 billion added from the acquisition

Achieved 13% annualized organic total loan growth with 20% annualized in commercial, while

maintaining our risk appetite

Core diluted earnings per share of $0.43 versus $0.38 per share

Core net income of $6.2 million compared to $3.5 million

Core return on average assets of 0.74% compared to 0.86%

Core return on average equity of 7.88% compared to 8.76%

Non-performing assets to total assets of 0.19% compared to 0.40%

Completed a three-for-two split payable in the form of a large stock dividend to common

stockholders of record at the close of business on March 7, 2017

Tangible book value of $15.07 per share after giving effect to the stock split

7

Highlights represent Bar Harbor Bankshares. A reconciliation of non-GAAP financial measures to GAAP measures are included in the first quarter

earnings release and Form 10-Q which can be found at www.bhbt.com, as well as within the attached Appendix. As necessary for comparative purposes,

amounts are restated to reflect 3-for-2 stock split completed in the first quarter of 2017.

Larger Scale . . . Same Culture and Model

Assets: $3.4 billion

Loans: $2.4 billion

Deposits: $2.2 billion

Core Net Income: $6.2 million

AUM: $1.8 billion

Branches: 53 including 4 locations for Trust and Insurance only

Footprint: Maine, New Hampshire, Vermont

Shareholders’ Equity: $341.0 million

Market Capitalization: $508.9 million

8

Additional size and expertise to compete with larger competitors while

remaining a True Community Bank

(As of 3/31/17)

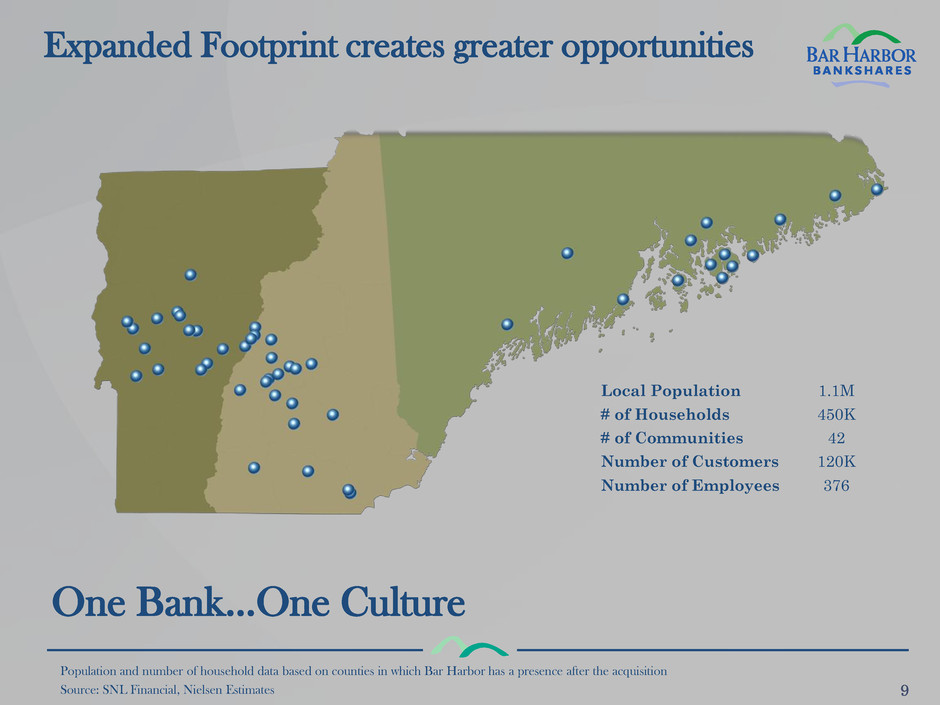

One Bank…One Culture

Expanded Footprint creates greater opportunities

Population and number of household data based on counties in which Bar Harbor has a presence after the acquisition

Source: SNL Financial, Nielsen Estimates

Local Population 1.1M

# of Households 450K

# of Communities 42

Number of Customers 120K

Number of Employees 376

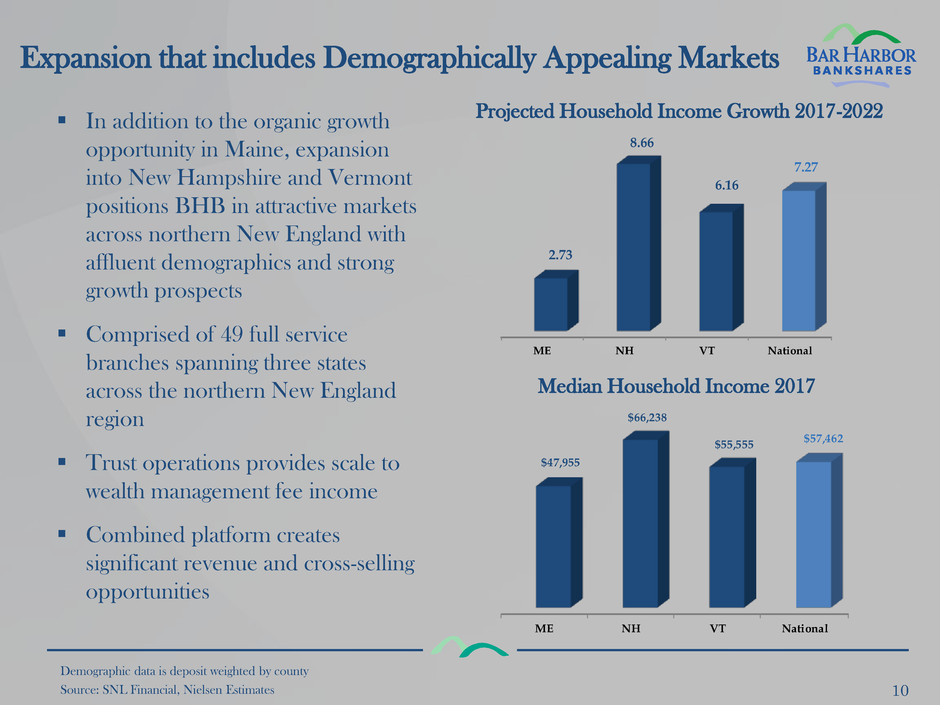

Expansion that includes Demographically Appealing Markets

10

Demographic data is deposit weighted by county

Source: SNL Financial, Nielsen Estimates

Projected Household Income Growth 2017-2022

Median Household Income 2017

In addition to the organic growth

opportunity in Maine, expansion

into New Hampshire and Vermont

positions BHB in attractive markets

across northern New England with

affluent demographics and strong

growth prospects

Comprised of 49 full service

branches spanning three states

across the northern New England

region

Trust operations provides scale to

wealth management fee income

Combined platform creates

significant revenue and cross-selling

opportunities

ME NH VT National

$47,955

$66,238

$55,555

$57,462

ME NH VT National

2.73

8.66

6.16

7.27

Strong Market Share with Growth Opportunity

11

Source: SNL Financial. Deposit market share as of June 30, 2016 by city

In the top 5 deposit market share

position for 39 of the 42

communities we serve

#2 Rank

#3 Rank

#4 Rank

#5 Rank

Other

#1 Rank

Number 1 or 2 deposit

market share position in

31 of the 42 communities

we serve

Solid market share

foundation with new client

growth opportunity and

cross-sell potential

Validation of Our Approach

12

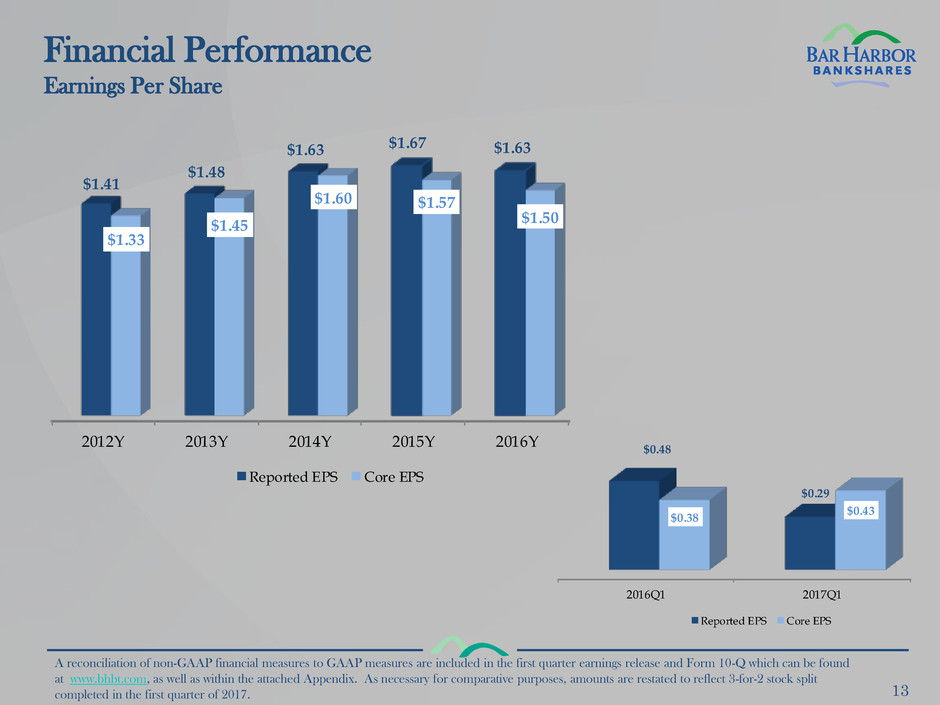

Financial Performance

Earnings Per Share

13

2012Y 2013Y 2014Y 2015Y 2016Y

$1.41

$1.48

$1.63 $1.67 $1.63

$1.33

$1.45

$1.60 $1.57

$1.50

Reported EPS Core EPS

2016Q1 2017Q1

$0.48

$0.29

$0.38

$0.43

Reported EPS Core EPS

A reconciliation of non-GAAP financial measures to GAAP measures are included in the first quarter earnings release and Form 10-Q which can be found

at www.bhbt.com, as well as within the attached Appendix. As necessary for comparative purposes, amounts are restated to reflect 3-for-2 stock split

completed in the first quarter of 2017.

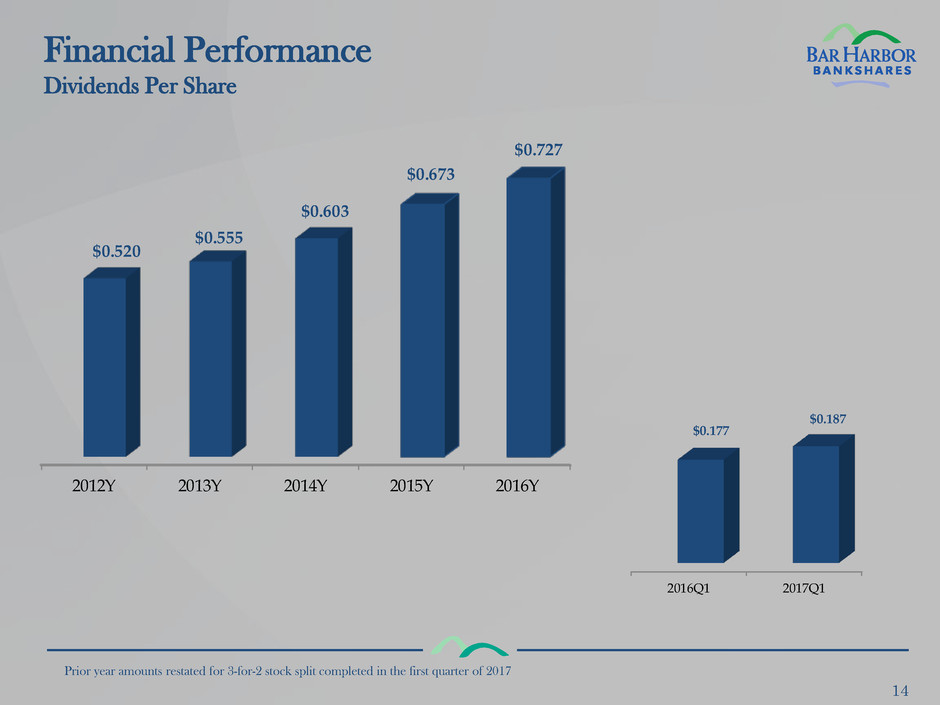

Financial Performance

Dividends Per Share

14

Prior year amounts restated for 3-for-2 stock split completed in the first quarter of 2017

2012Y 2013Y 2014Y 2015Y 2016Y

$0.520

$0.555

$0.603

$0.673

$0.727

2016Q1 2017Q1

$0.177

$0.187

15

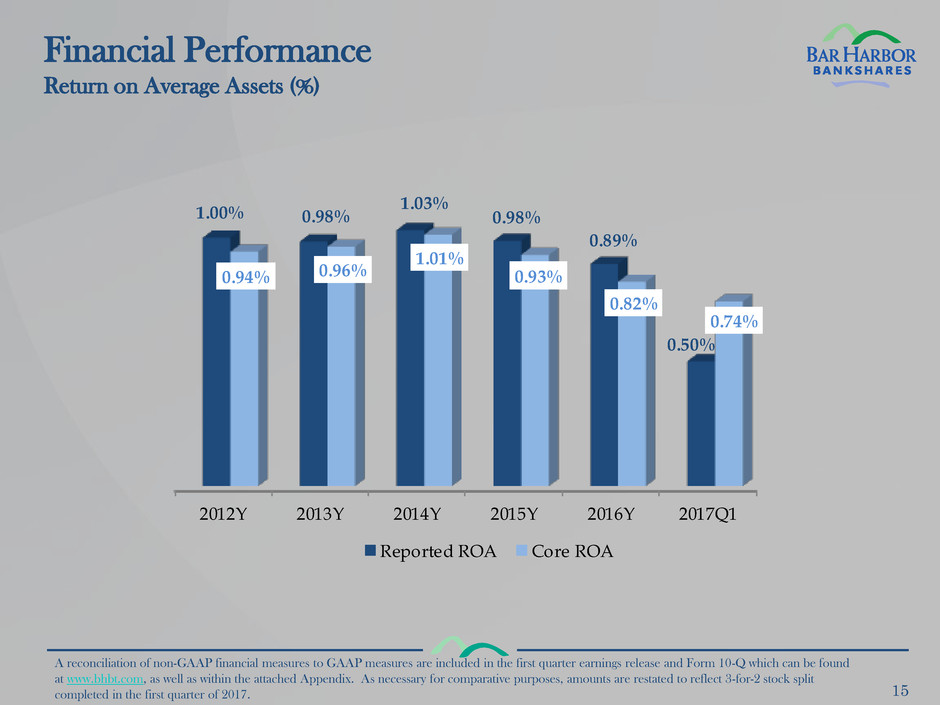

Financial Performance

Return on Average Assets (%)

A reconciliation of non-GAAP financial measures to GAAP measures are included in the first quarter earnings release and Form 10-Q which can be found

at www.bhbt.com, as well as within the attached Appendix. As necessary for comparative purposes, amounts are restated to reflect 3-for-2 stock split

completed in the first quarter of 2017.

2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1

1.00% 0.98%

1.03%

0.98%

0.89%

0.50%

0.94% 0.96%

1.01%

0.93%

0.82%

0.74%

Reported ROA Core ROA

16

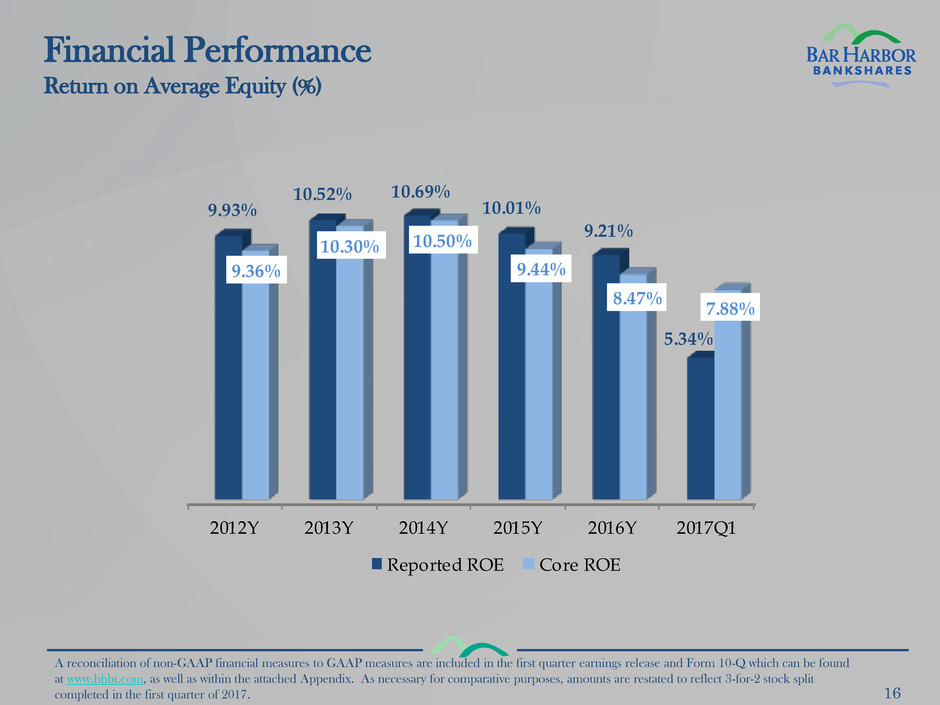

Financial Performance

Return on Average Equity (%)

A reconciliation of non-GAAP financial measures to GAAP measures are included in the first quarter earnings release and Form 10-Q which can be found

at www.bhbt.com, as well as within the attached Appendix. As necessary for comparative purposes, amounts are restated to reflect 3-for-2 stock split

completed in the first quarter of 2017.

2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1

9.93%

10.52% 10.69%

10.01%

9.21%

5.34%

9.36%

10.30% 10.50%

9.44%

8.47%

7.88%

Reported ROE Core ROE

17

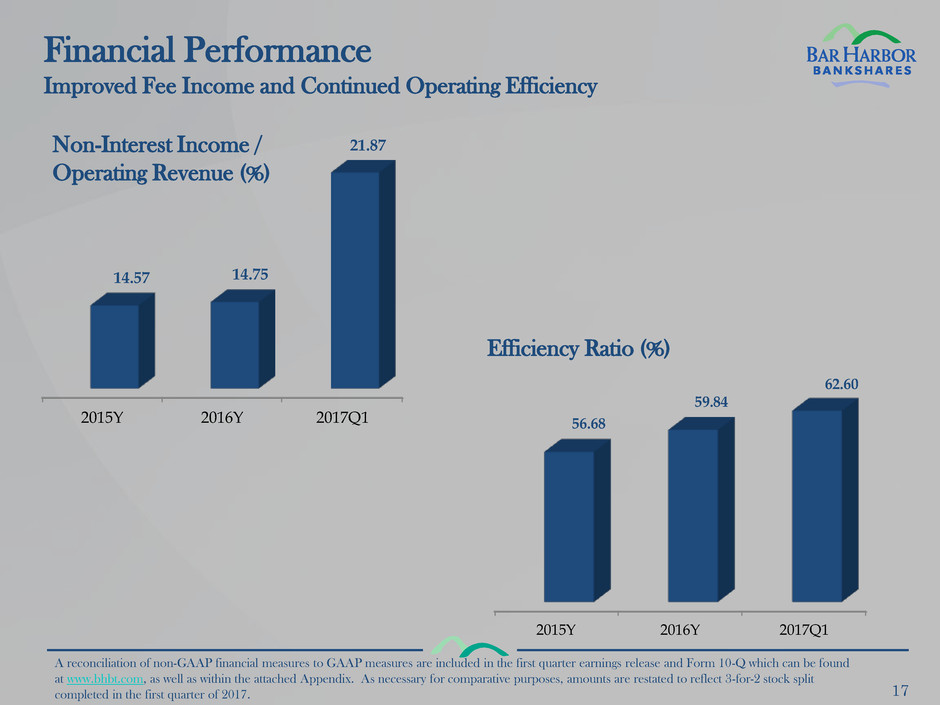

2015Y 2016Y 2017Q1

14.57 14.75

21.87

Non-Interest Income /

Operating Revenue (%)

Financial Performance

Improved Fee Income and Continued Operating Efficiency

2015Y 2016Y 2017Q1

56.68

59.84

62.60

Efficiency Ratio (%)

A reconciliation of non-GAAP financial measures to GAAP measures are included in the first quarter earnings release and Form 10-Q which can be found

at www.bhbt.com, as well as within the attached Appendix. As necessary for comparative purposes, amounts are restated to reflect 3-for-2 stock split

completed in the first quarter of 2017.

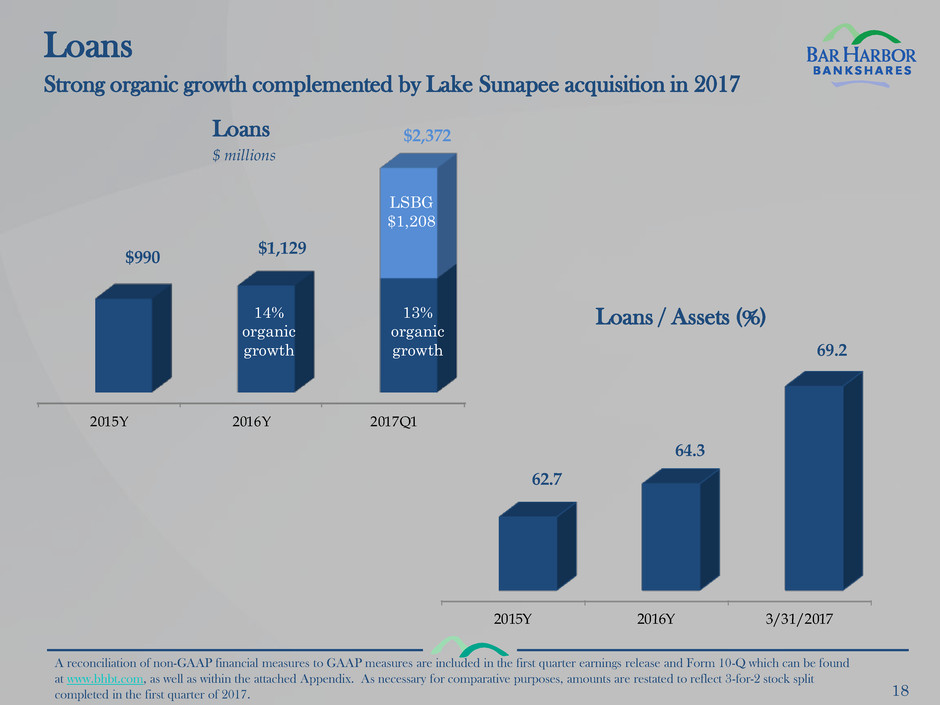

Loans

18

2015Y 2016Y 2017Q1

$990

$1,129

$2,372

Strong organic growth complemented by Lake Sunapee acquisition in 2017

Loans

2015Y 2016Y 3/31/2017

62.7

64.3

69.2

Loans / Assets (%) 14%

organic

growth

13%

organic

growth

LSBG

$1,208

$ millions

A reconciliation of non-GAAP financial measures to GAAP measures are included in the first quarter earnings release and Form 10-Q which can be found

at www.bhbt.com, as well as within the attached Appendix. As necessary for comparative purposes, amounts are restated to reflect 3-for-2 stock split

completed in the first quarter of 2017.

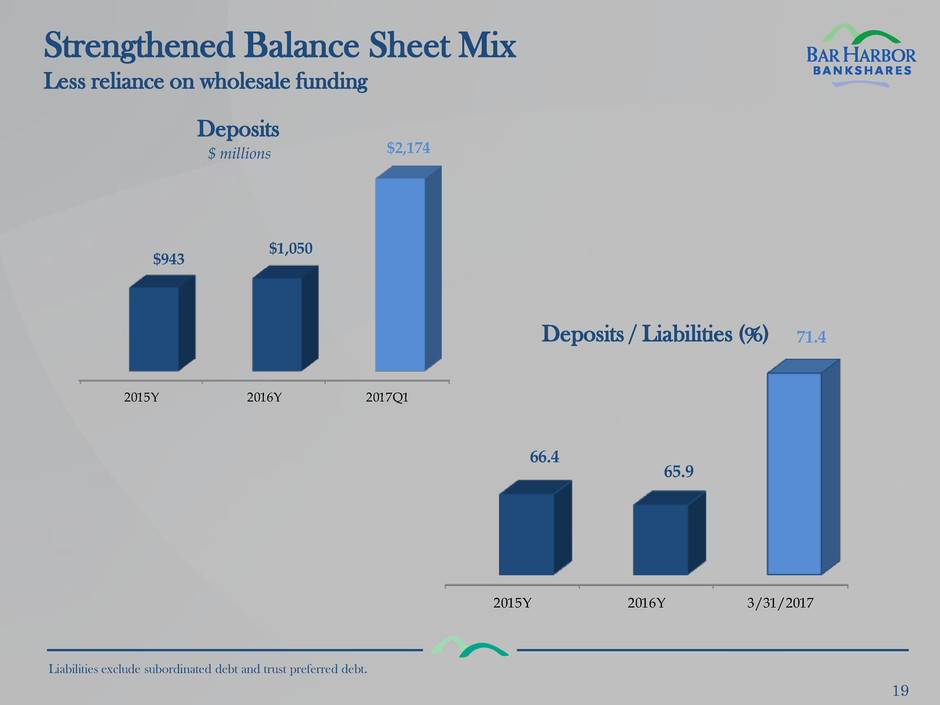

Strengthened Balance Sheet Mix

19

Less reliance on wholesale funding

2015Y 2016Y 3/31/2017

66.4

65.9

71.4

Deposits / Liabilities (%) 2015Y 2016Y 2017Q1

$943

$1,050

$2,174

Deposits

$ millions

Liabilities exclude subordinated debt and trust preferred debt.

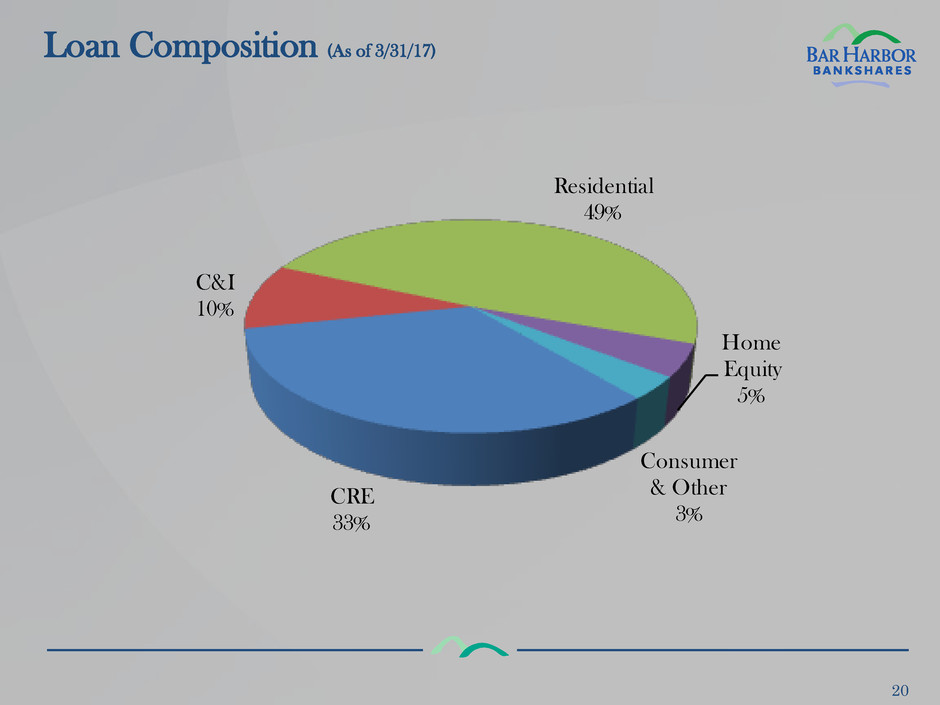

Loan Composition (As of 3/31/17)

20

CRE

33%

C&I

10%

Residential

49%

Home

Equity

5%

Consumer

& Other

3%

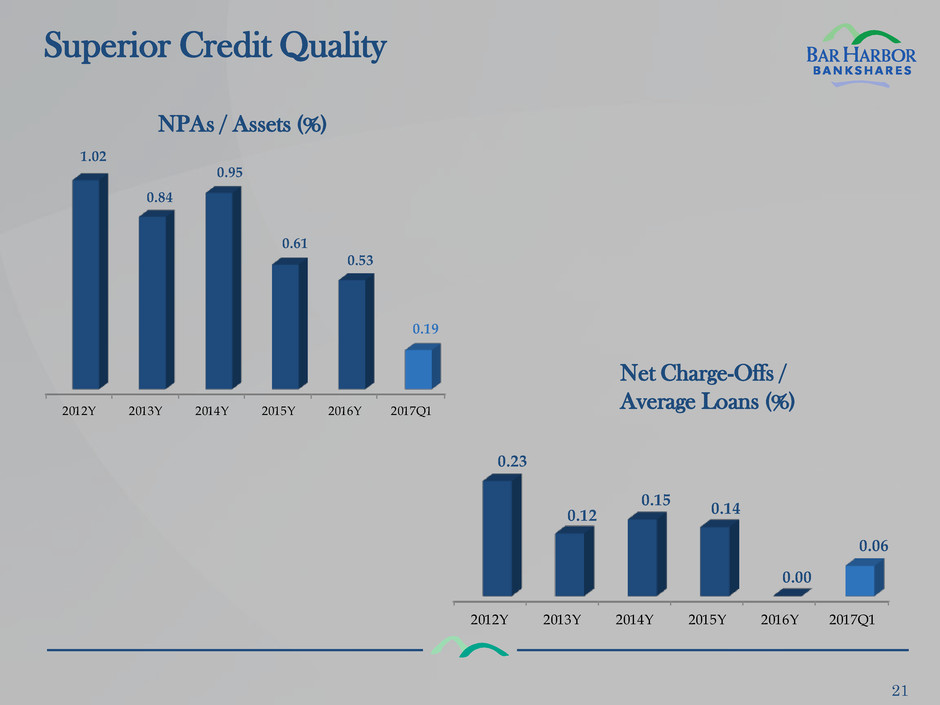

Superior Credit Quality

21

2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1

1.02

0.84

0.95

0.61

0.53

0.19

NPAs / Assets (%)

2012Y 2013Y 2014Y 2015Y 2016Y 2017Q1

0.23

0.12

0.15

0.14

0.00

0.06

Net Charge-Offs /

Average Loans (%)

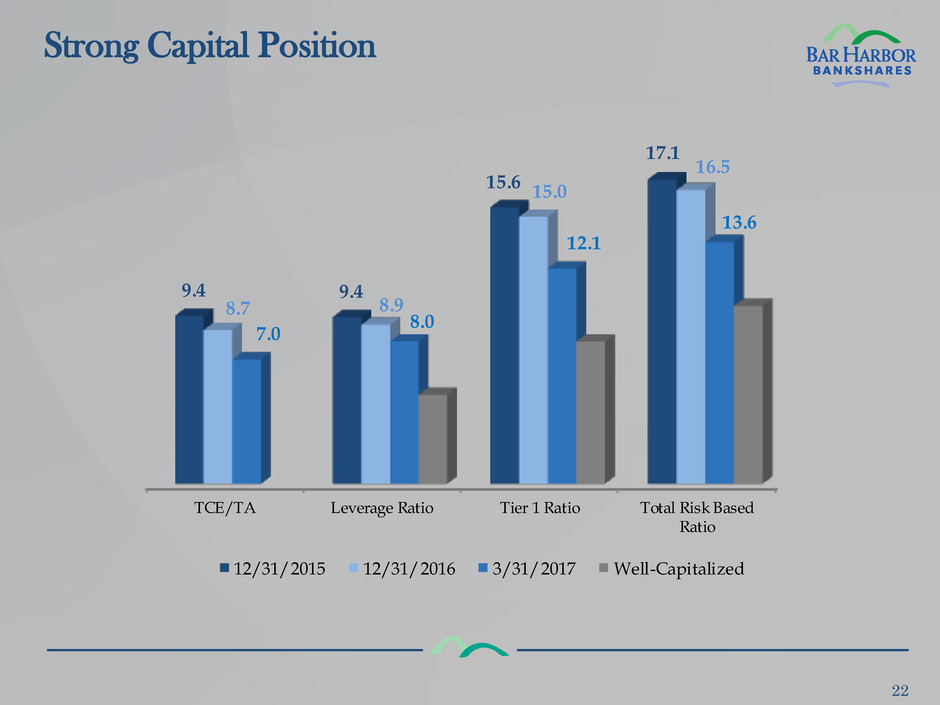

Strong Capital Position

22

TCE/TA Leverage Ratio Tier 1 Ratio Total Risk Based

Ratio

9.4 9.4

15.6

17.1

8.7 8.9

15.0

16.5

7.0

8.0

12.1

13.6

12/31/2015 12/31/2016 3/31/2017 Well-Capitalized

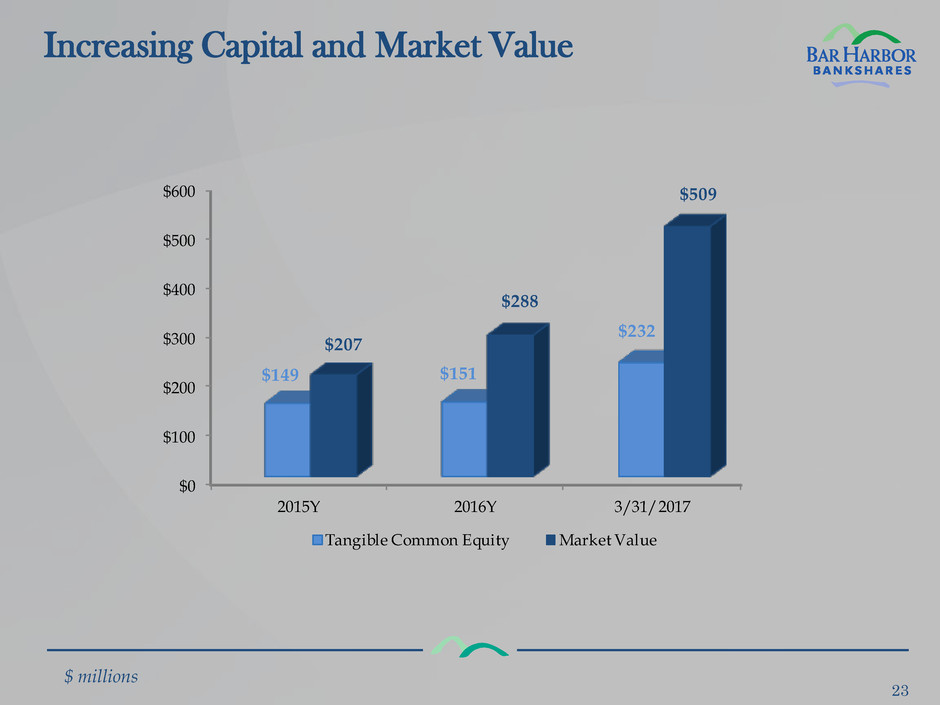

Increasing Capital and Market Value

23

$0

$100

$200

$300

$400

$500

$600

2015Y 2016Y 3/31/2017

$149 $151

$232

$207

$288

$509

Tangible Common Equity Market Value

$ millions

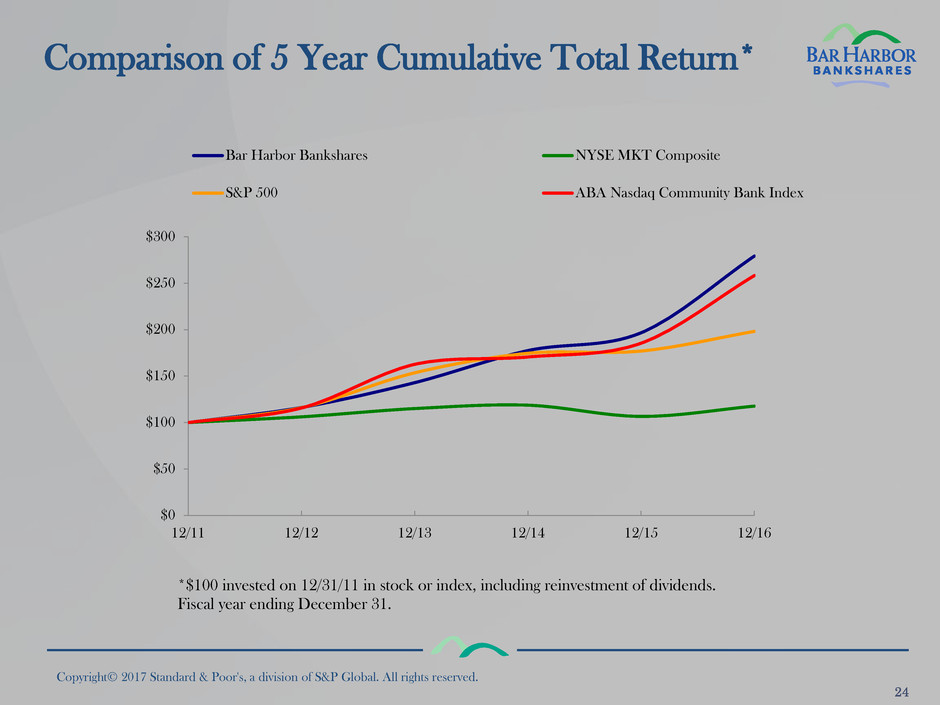

Comparison of 5 Year Cumulative Total Return*

Copyright© 2017 Standard & Poor's, a division of S&P Global. All rights reserved.

$0

$50

$100

$150

$200

$250

$300

12/11 12/12 12/13 12/14 12/15 12/16

Bar Harbor Bankshares NYSE MKT Composite

S&P 500 ABA Nasdaq Community Bank Index

*$100 invested on 12/31/11 in stock or index, including reinvestment of dividends.

Fiscal year ending December 31.

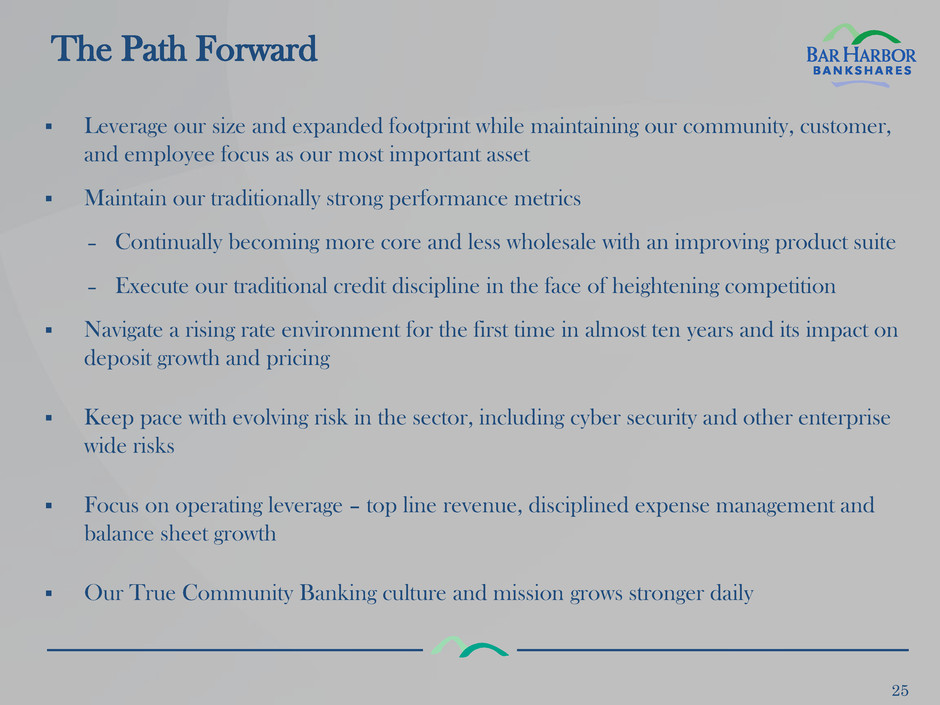

The Path Forward

Leverage our size and expanded footprint while maintaining our community, customer,

and employee focus as our most important asset

Maintain our traditionally strong performance metrics

– Continually becoming more core and less wholesale with an improving product suite

– Execute our traditional credit discipline in the face of heightening competition

Navigate a rising rate environment for the first time in almost ten years and its impact on

deposit growth and pricing

Keep pace with evolving risk in the sector, including cyber security and other enterprise

wide risks

Focus on operating leverage – top line revenue, disciplined expense management and

balance sheet growth

Our True Community Banking culture and mission grows stronger daily

25

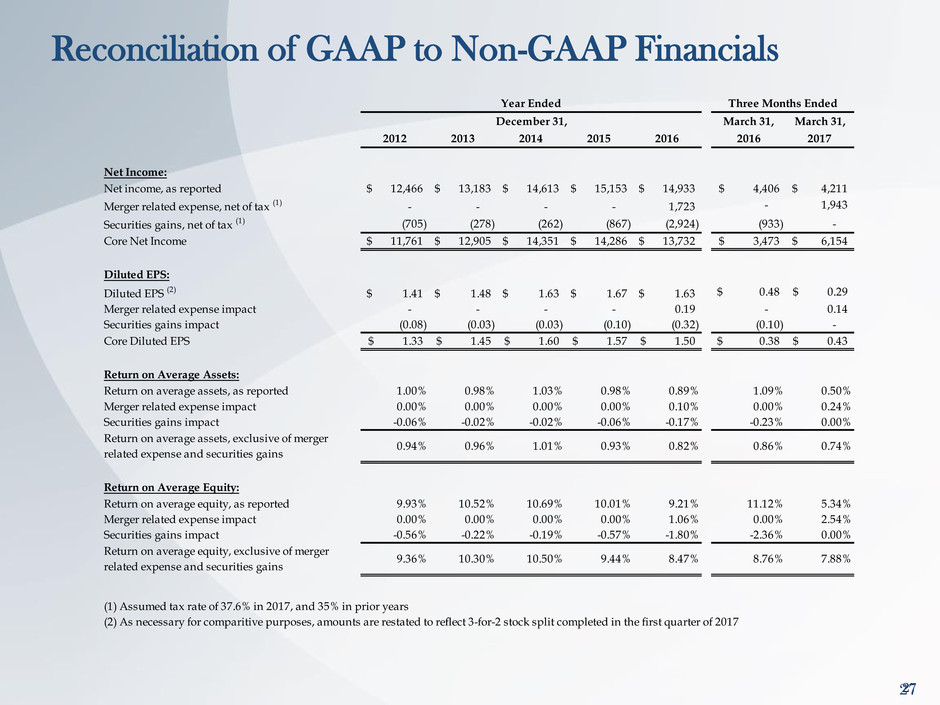

Appendix

27

Reconciliation of GAAP to Non-GAAP Financials

2

Year Ended

December 31, March 31, March 31,

2012 2013 2014 2015 2016 2016 2017

Net Income:

Net income, as reported 12,466$ 13,183$ 14,613$ 15,153$ 14,933$ 4,406$ 4,211$

Merger related expense, net of tax (1) - - - - 1,723 - 1,943

Securities gains, net of tax (1) (705) (278) (262) (867) (2,924) (933) -

Core Net Income 11,761$ 12,905$ 14,351$ 14,286$ 13,732$ 3,473$ 6,154$

Diluted EPS:

Diluted EPS (2) 1.41$ 1.48$ 1.63$ 1.67$ 1.63$ 0.48$ 0.29$

Merger related expense impact - - - - 0.19 - 0.14

Securities gains impact (0.08) (0.03) (0.03) (0.10) (0.32) (0.10) -

Core Diluted EPS 1.33$ 1.45$ 1.60$ 1.57$ 1.50$ 0.38$ 0.43$

Return on Average Assets:

Return on average assets, as reported 1.00% 0.98% 1.03% 0.98% 0.89% 1.09% 0.50%

Merger related expense impact 0.00% 0.00% 0.00% 0.00% 0.10% 0.00% 0.24%

Securities gains impact -0.06% -0.02% -0.02% -0.06% -0.17% -0.23% 0.00%

Return on average assets, exclusive of merger

related expense and securities gains

0.94% 0.96% 1.01% 0.93% 0.82% 0.86% 0.74%

Return on Average Equity:

Return on average equity, as reported 9.93% 10.52% 10.69% 10.01% 9.21% 11.12% 5.34%

Merger related expense impact 0.00% 0.00% 0.00% 0.00% 1.06% 0.00% 2.54%

Securities gains impact -0.56% -0.22% -0.19% -0.57% -1.80% -2.36% 0.00%

Return on average equity, exclusive of merger

related expense and securities gains

9.36% 10.30% 10.50% 9.44% 8.47% 8.76% 7.88%

(1) Assumed tax rate of 37.6% in 2017, and 35% in prior years

(2) As necessary for comparitive purposes, amounts are restated to reflect 3-for-2 stock split completed in the first quarter of 2017

Three Months Ended