Attached files

(OTCQX: HPHW)

Earnings Presentation

Speakers: Henry Dubois, Chief Executive Officer

Steven Balthazor, Chief Financial Officer

Safe Harbor

2

Special Note Regarding Forward-Looking Statements

This presentation contains forward-looking statements, as such term is defined in the Private Securities Litigation Reform Act of 1995,

concerning the Company’s plans, objectives, goals, strategies, future events or performances, which are not statements of historical

fact and can be identified by words such as: “expect,” “continue,” “should,” “may,” “will,” “project,” “anticipate,” “believe,” “plan,”

“goal,” and similar references to future periods. The forward-looking statements contained in this presentation reflect our current

beliefs and expectations. Actual results or performance may differ materially from what is expressed in the forward looking statements.

Among the important factors that could cause actual results to differ materially from those expressed in, or implied by, the forward-

looking statements contained in this presentation are our ability to realize the expected synergies and other benefits from our merger

with Provant Health Solutions; our ability to realize the expected benefits from the acquisition of Accountable Health Solutions and our

strategic alliance with Clinical Reference Laboratory; our ability to successfully implement our business strategy and integrate

Accountable Health Solutions’ and Provant Health Solutions’ business with ours; our ability to retain and grow our customer base; our

ability to recognize operational efficiencies and reduce costs; uncertainty as to our working capital requirements over the next 12 to 24

months; our ability to maintain compliance with the financial covenants contained in our credit facilities; the rate of growth in the

Health and Wellness market and such other factors as discussed in Part I, Item 1A, Risk Factors, and Part II, Item 7, Management’s

Discussion and Analysis of Financial Conditions and Results of Operations of our Annual Report on Form 10-K for the year ended

December 31, 2016. The Company undertakes no obligation to update or release any revisions to these forward-looking statements to

reflect events or circumstances, or to reflect the occurrence of unanticipated events, after the date of this presentation, except as

required by law. This presentation contains information from third-party sources, including data from studies conducted by others and

market data and industry forecasts obtained from industry publications. Although the Company believes that such information is

reliable, the Company has not independently verified any of this information and the Company does not guarantee the accuracy or

completeness of this information. Any references to documents not included in the presentation itself are qualified by the full text and

content of those documents. During our prepared comments or responses to your questions, we may offer incremental metrics to

provide greater insight into the dynamics of our business or our quarterly results, such as references to EBITDA, adjusted EBITDA and

other measures of financial performance. Please be advised that this additional detail may be one-time in nature and we may or may

not provide an update in the future. These and other financial measures may also have been prepared on a non-GAAP basis.

3

Merger Closed

One of the largest pure-play

Health & Wellness companies

Enhanced Financial Model

› $67 + million in 2016 pro-forma revenue

› $54 + million revenue target for Q2 – Q4 2017

› $ 3 + million adjusted EBITDA target for Q2 – Q4 2017

› $ 5 + million adjusted EBITDA target for 2018

› $ 7 million annualized synergy savings

Stronger Operating Position

› On-site screenings, risk assessments and immunizations

› Technology platform capabilities and coaching

› Engagement and advanced data management

4

Standalone Q1 Revenue Results - Hooper Holmes

Q1 Year-Over-Year Revenue Improvements

› 5% revenue growth to $7.6 million

› 44% growth in channel partner and clinical research organization revenue

› 33% growth in channel partner revenue

› 166% growth in clinical research organization revenue

› 16% gross margin improvement

Gross Margin ($mm)

+16%

+5%

Overall

$7.24

Revenue ($mm)

+33%

Channel

5

Adjusted EBITDA ($000’s)

› 28% Improvement in Adjusted EBITDA

› 26% Improvement in Net Loss

› SG&A Improved 9%

Improved Q1 Operating Performance - Hooper Holmes

+26%

Net Loss ($000’s)

Excluding transaction costs

+28%

Adjusted EBITDA ($000’s)

Q1 2016 Q1 2017

Net Los (3,428) (3,129)

Transaction Costs 108 682

Net Loss Excluding Transaction Cost (3,320) (2,447)

Interest expense $212 $219

Other Debt related costs in Int exp $577 $548

Income taxes $5 $5

Depreciation & amortization $701 $623

Stock Payments $230 $38

Transition Costs $52 ($2)

Leases/Ornelas settlements $150 $19

Adjusted EBITDA ($1,393) ($997)

6

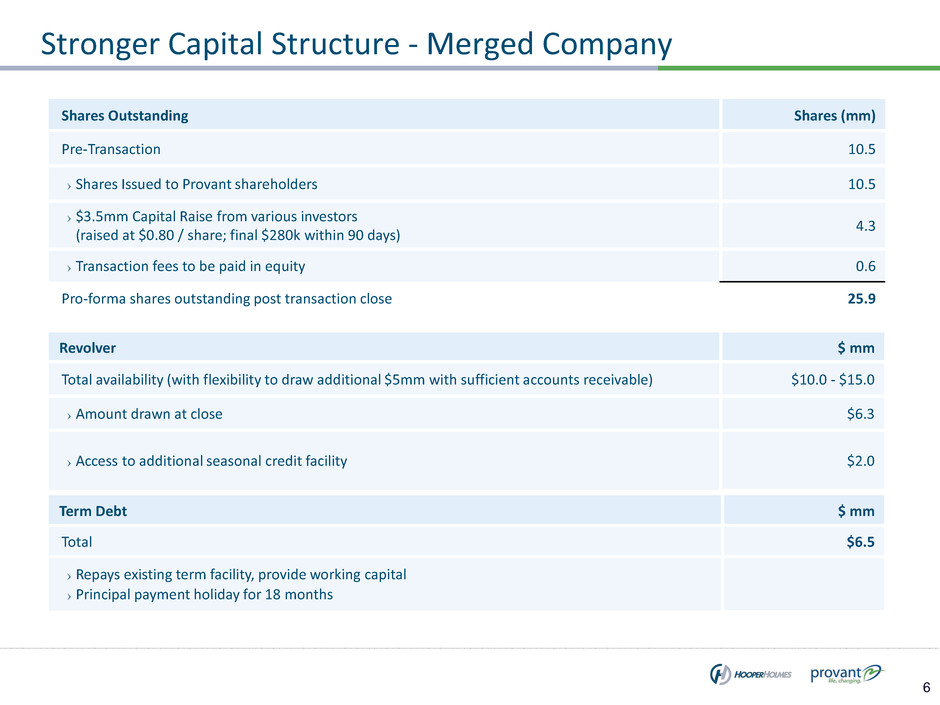

Stronger Capital Structure - Merged Company

Shares Outstanding Shares (mm)

Pre-Transaction 10.5

› Shares Issued to Provant shareholders 10.5

› $3.5mm Capital Raise from various investors

(raised at $0.80 / share; final $280k within 90 days)

4.3

› Transaction fees to be paid in equity 0.6

Pro-forma shares outstanding post transaction close 25.9

Revolver $ mm

Total availability (with flexibility to draw additional $5mm with sufficient accounts receivable) $10.0 - $15.0

› Amount drawn at close $6.3

› Access to additional seasonal credit facility

$2.0

Term Debt $ mm

Total $6.5

› Repays existing term facility, provide working capital

› Principal payment holiday for 18 months

7

Synergies Driven by Integration - Merged Company

Health Professional Network Expansion

Q2 2017 Q3 2017 Q4 2017 Q1 2018

Enhanced Coaching Capabilities

Technology & Infrastructure

Operations Efficiencies

Duplicative SG&A

Screening, clinical, and coaching efficiencies

Realization of technology platform capacity

$7 million Annualized Cost Efficiencies

New sales with an annualized value of $5.5 million in Q1

Growth in Sales

Integration Drives Customer Benefits and Operations Improvements

20% already achieved

$0.7 million in new contracts from existing

channel partners.

$1.6 million from new direct customers.

$3.2 million from new channel partners.

8

2017 Outlook - Merged Company

Advanced and scalable data hub technology

Diversified sales channels

Expanded management team

Infrastructure to Accelerate Growth

Improved cost structure with shift towards higher

margin, recurring revenue mix (e.g., Portal & Coaching)

Increased scale provides operating leverage

Enhanced innovation and speed to market

Road Map to Profitability

Targets

$ 3 + million adjusted EBITDA for Q2 – Q4 2017

$ 7 million annualized synergy savings

$ 5 + million adjusted EBITDA for 2018

Positive 2018 Net Income

$54 million revenue for Q2 - Q4 2017