Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Prestige Consumer Healthcare Inc. | exhibit991fy17-q4earningsr.htm |

| 8-K - 8-K - Prestige Consumer Healthcare Inc. | a8-kpressreleaseq42017.htm |

Exhibit 99.2

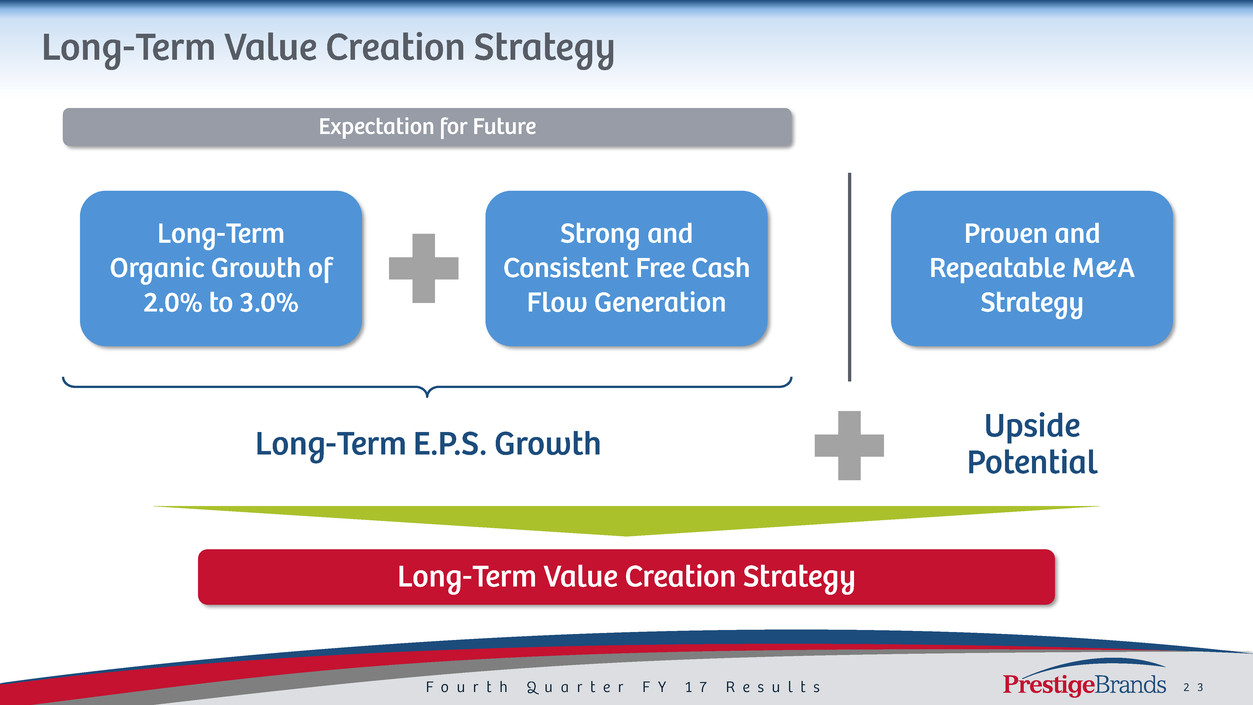

This presentation contains certain “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995, such

as statements regarding the Company’s expected financial performance, including revenue growth, organic growth, adjusted EPS, adjusted free

cash flow, and adjusted EBITDA; the Company’s expected leverage; the Company’s ability to repeat its M&A strategy; the expected growth and

market position of the Company’s core brands; the Company’s brand-building and product development initiatives; and the Company’s ability to

create long-term value. Words such as “trend,” “continue,” “will,” “expect,” “project,” “anticipate,” “likely,” “estimate,” “may,” “should,” “could,”

“would,” and similar expressions identify forward-looking statements. Such forward-looking statements represent the Company’s expectations

and beliefs and involve a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially

from those expressed or implied by such forward-looking statements. These factors include, among others, general economic and business

conditions, competitive pressures, the impact of the Company’s product development and brand-building initiatives, difficulties successfully

integrating the Fleet brands, manufacturing facility and R&D resources, supplier issues, and other risks set forth in Part I, Item 1A. Risk Factors in

the Company’s Annual Report on Form 10-K for the year ended March 31, 2016 and in Part II, Item 1A. Risk Factors in the Company’s Quarterly

Report on Form 10-Q for the quarter ended December 31, 2016. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date this presentation. Except to the extent required by applicable law, the Company undertakes no

obligation to update any forward-looking statement contained in this presentation, whether as a result of new information, future events, or

otherwise.

All adjusted GAAP numbers presented are footnoted and reconciled to their closest GAAP measurement in the attached reconciliation schedule

or in our earnings release in the “About Non-GAAP Financial Measures” section.

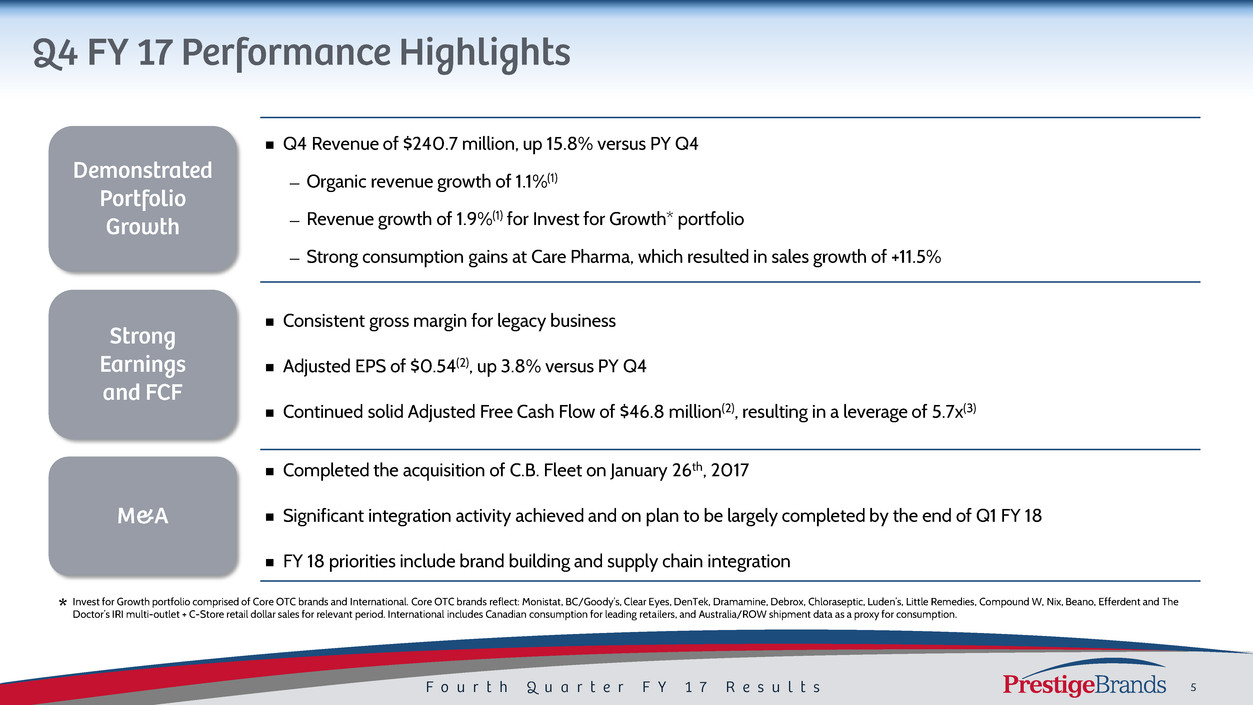

Q4 Revenue of $240.7 million, up 15.8% versus PY Q4

— Organic revenue growth of 1.1%(1)

— Revenue growth of 1.9%(1) for Invest for Growth* portfolio

— Strong consumption gains at Care Pharma, which resulted in sales growth of +11.5%

Consistent gross margin for legacy business

Adjusted EPS of $0.54(2), up 3.8% versus PY Q4

Continued solid Adjusted Free Cash Flow of $46.8 million(2), resulting in a leverage of 5.7x(3)

Completed the acquisition of C.B. Fleet on January 26th, 2017

Significant integration activity achieved and on plan to be largely completed by the end of Q1 FY 18

FY 18 priorities include brand building and supply chain integration

Invest for Growth portfolio comprised of Core OTC brands and International. Core OTC brands reflect: Monistat, BC/Goody’s, Clear Eyes, DenTek, Dramamine, Debrox, Chloraseptic, Luden’s, Little Remedies, Compound W, Nix, Beano, Efferdent and The

Doctor’s IRI multi-outlet + C-Store retail dollar sales for relevant period. International includes Canadian consumption for leading retailers, and Australia/ROW shipment data as a proxy for consumption.*

Manage for CashInvest for Growth

July 2016 December 2016 December 2016 December 2016

February 2016 January 2017

$225MM $825MM

2.5%

1.8%

LTM Growth

2.3%

1.2%

LTM Growth

2.4%

1.7%

LTM Growth

Prestige Brands Prestige Categories

Source: IRI multi-outlet + C-Store retail dollar sales for the period ending 03/29/2017

Consumer research and shopper insights identify unmet needs

Match new product opportunities to each brand’s unique positioning

Goal to launch 3 to 5 meaningful new product innovations annually

Recent new products introduced across our portfolio

Extend Brand Through

Better Consumer

Experience or Claims

Innovate Through

Technology

Expand Brand in New

Channels C-Stores On-the-Go e-Commerce

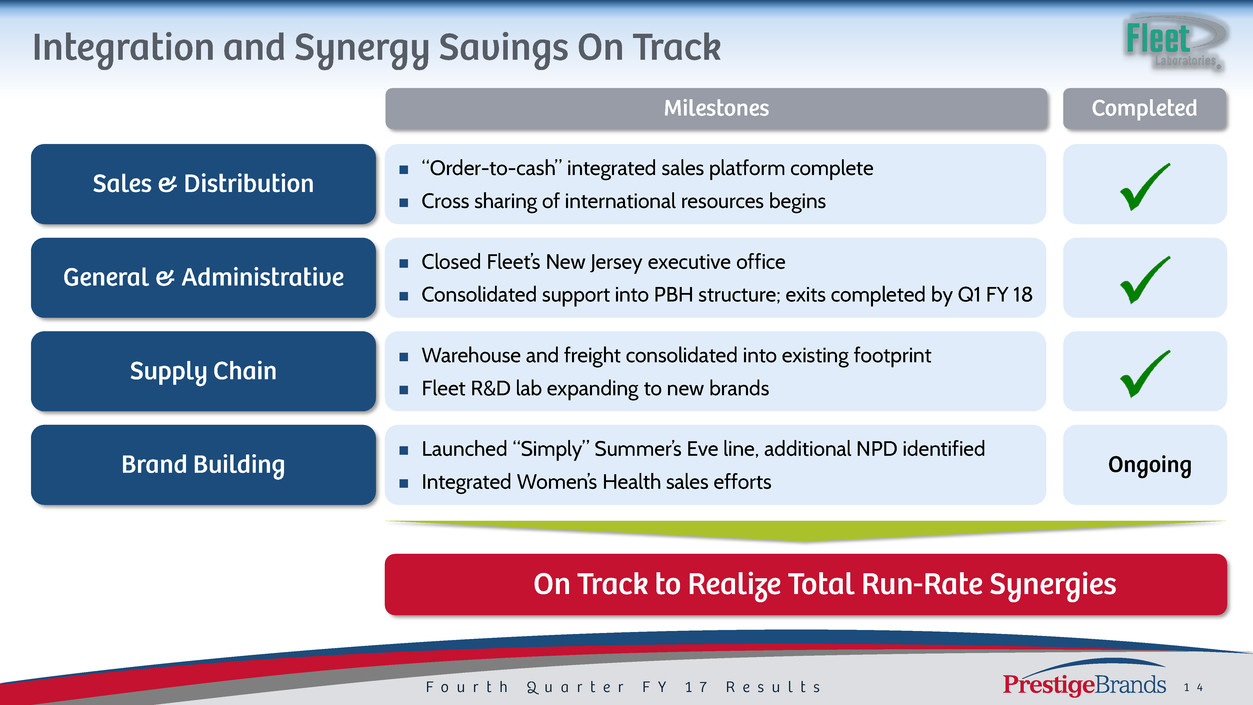

“Order-to-cash” integrated sales platform complete

Cross sharing of international resources begins

Launched “Simply” Summer’s Eve line, additional NPD identified

Integrated Women’s Health sales efforts

Warehouse and freight consolidated into existing footprint

Fleet R&D lab expanding to new brands

Closed Fleet’s New Jersey executive office

Consolidated support into PBH structure; exits completed by Q1 FY 18

$86 $127

$164 $196

FY 11 FY 13 FY 15 FY 17

$101

$218 $252

$305

FY 11 FY 13 FY 15 FY 17

$334

$620 $715

$882

FY 11 FY 13 FY 15 FY 17

17.6% CAGR 20.2% CAGR

14.7% CAGR

$0.79

$1.50 $1.86

$2.37

FY 11 FY 13 FY 15 FY 17

20.1% CAGR

Dollar values in millions, except Adjusted EPS.

~3.2x ~3.5x

~5.0x ~4.3x ~4.3x ~5.2x ~5.0x

~5.7x ~5.0x

FY 10 FY 11 FY 12 FY 13 FY 14 FY 15 FY 16 FY 17 FY 18

$59

$86 $67

$127 $130

$164 $183

$196 $205

FY 10 FY 11 FY 12 FY 13 FY 14 FY 15 FY 16 FY 17 FY 18

Dollar values in millions.

* Peak leverage of 5.75x at close of the Insight Acquisition in September 2014

*

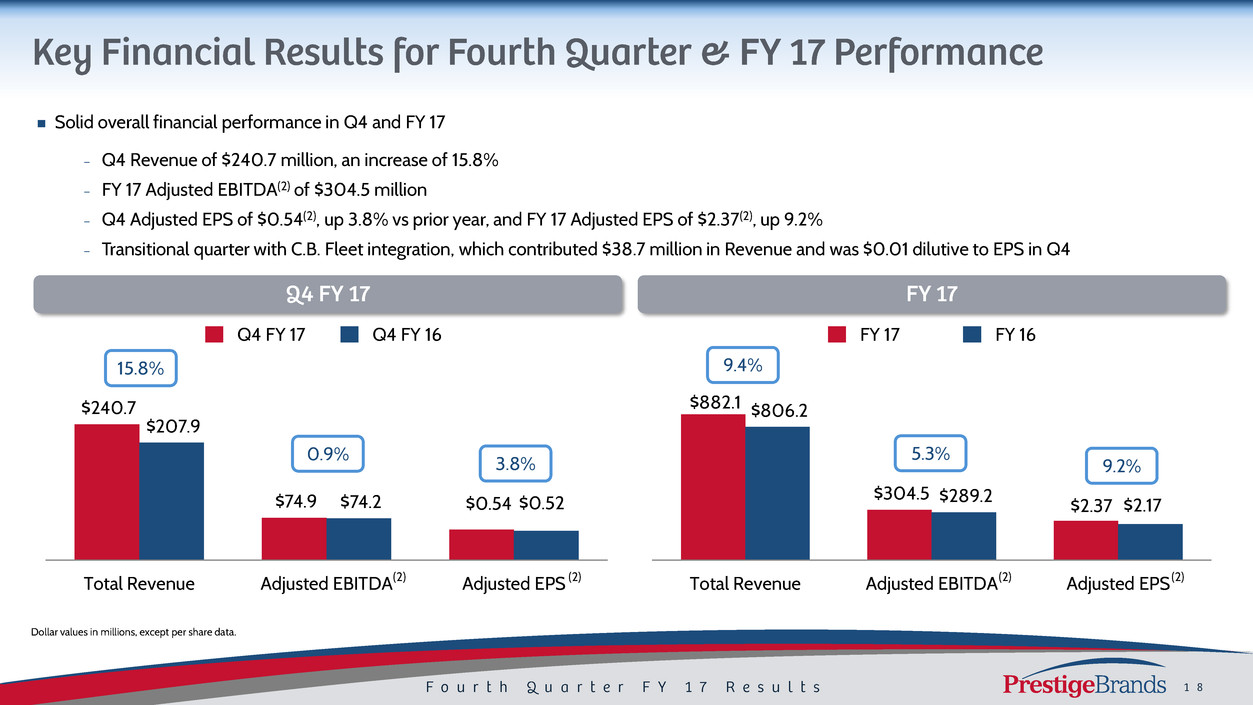

Solid overall financial performance in Q4 and FY 17

− Q4 Revenue of $240.7 million, an increase of 15.8%

− FY 17 Adjusted EBITDA(2) of $304.5 million

− Q4 Adjusted EPS of $0.54(2), up 3.8% vs prior year, and FY 17 Adjusted EPS of $2.37(2), up 9.2%

− Transitional quarter with C.B. Fleet integration, which contributed $38.7 million in Revenue and was $0.01 dilutive to EPS in Q4

$240.7

$74.9

$207.9

$74.2

Total Revenue Adjusted EBITDA Adjusted EPS

Q4 FY 17 Q4 FY 16

15.8%

0.9% 3.8%

$0.54 $0.52

(2) (2)

Dollar values in millions, except per share data.

$882.1

$304.5

$806.2

$289.2

Total Revenue Adjusted EBITDA Adjusted EPS

FY 17 FY 16

9.4%

5.3%

9.2%

$2.37 $2.17

(2) (2)

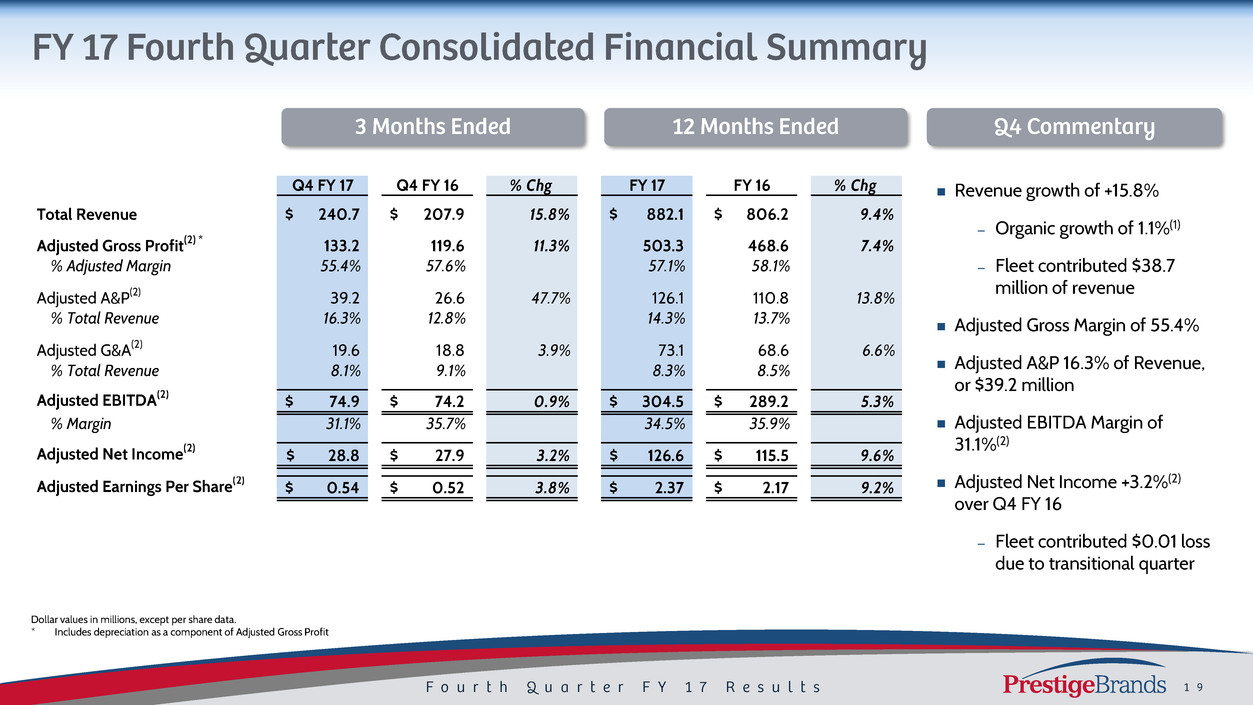

Revenue growth of +15.8%

– Organic growth of 1.1%(1)

– Fleet contributed $38.7

million of revenue

Adjusted Gross Margin of 55.4%

Adjusted A&P 16.3% of Revenue,

or $39.2 million

Adjusted EBITDA Margin of

31.1%(2)

Adjusted Net Income +3.2%(2)

over Q4 FY 16

– Fleet contributed $0.01 loss

due to transitional quarter

Dollar values in millions, except per share data.

* Includes depreciation as a component of Adjusted Gross Profit

Q4 FY 17 Q4 FY 16 % Chg FY 17 FY 16 % Chg

Total Revenue 240.7$ 207.9$ 15.8% 882.1$ 806.2$ 9.4%

Adjusted Gross Profit(2) * 133.2 119.6 11.3% 503.3 468.6 7.4%

% Adjusted Margin 55.4% 57.6% 57.1% 58.1%

Adjusted A&P(2) 39.2 26.6 47.7% 126.1 110.8 13.8%

% Total Revenue 16.3% 12.8% 14.3% 13.7%

Adjusted G&A(2) 19.6 18.8 3.9% 73.1 68.6 6.6%

% Total Revenue 8.1% 9.1% 8.3% 8.5%

Adjusted EBITDA(2) 74.9$ 74.2$ 0.9% 304.5$ 289.2$ 5.3%

% Margin 31.1% 35.7% 34.5% 35.9%

Adjusted Net Income(2) 28.8$ 27.9$ 3.2% 126.6$ 115.5$ 9.6%

Adjusted Earnings Per Share(2) 0.54$ 0.52$ 3.8% 2.37$ 2.17$ 9.2%

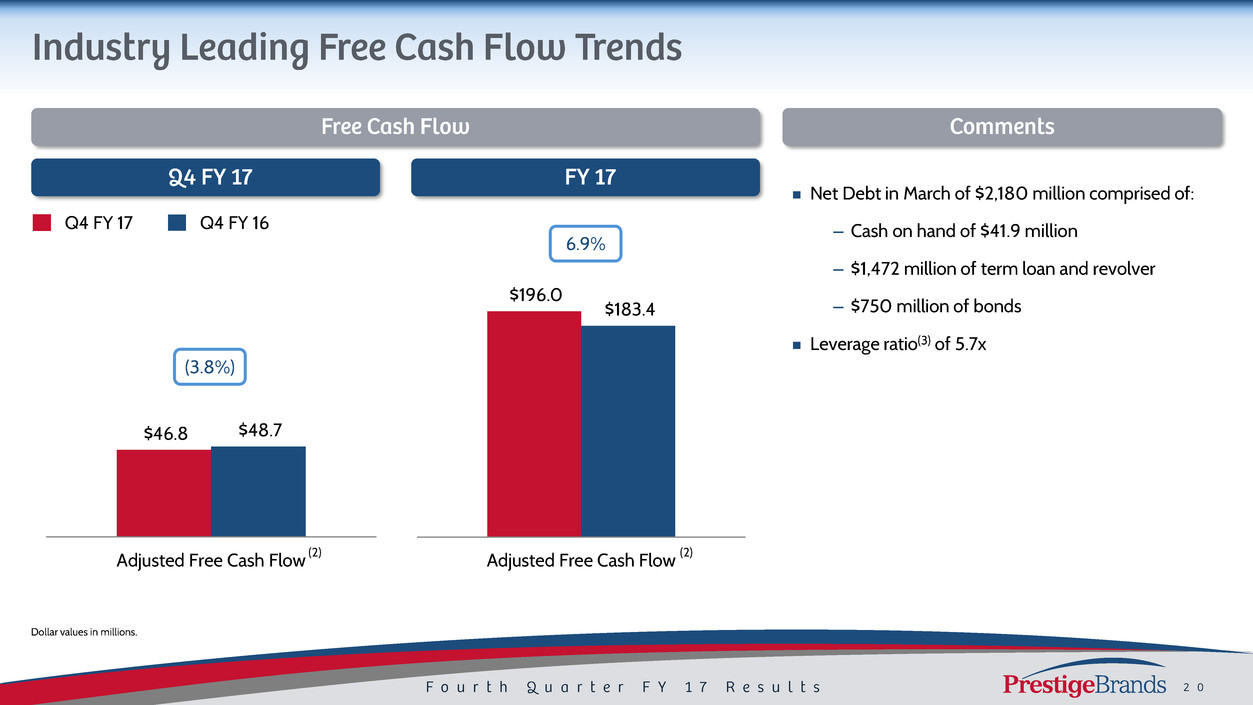

Net Debt in March of $2,180 million comprised of:

– Cash on hand of $41.9 million

– $1,472 million of term loan and revolver

– $750 million of bonds

Leverage ratio(3) of 5.7x

$46.8 $48.7

Adjusted Free Cash Flow

$196.0

$183.4

Adjusted Free Cash Flow

6.9%

(3.8%)

Q4 FY 17 Q4 FY 16

Dollar values in millions.

(2) (2)

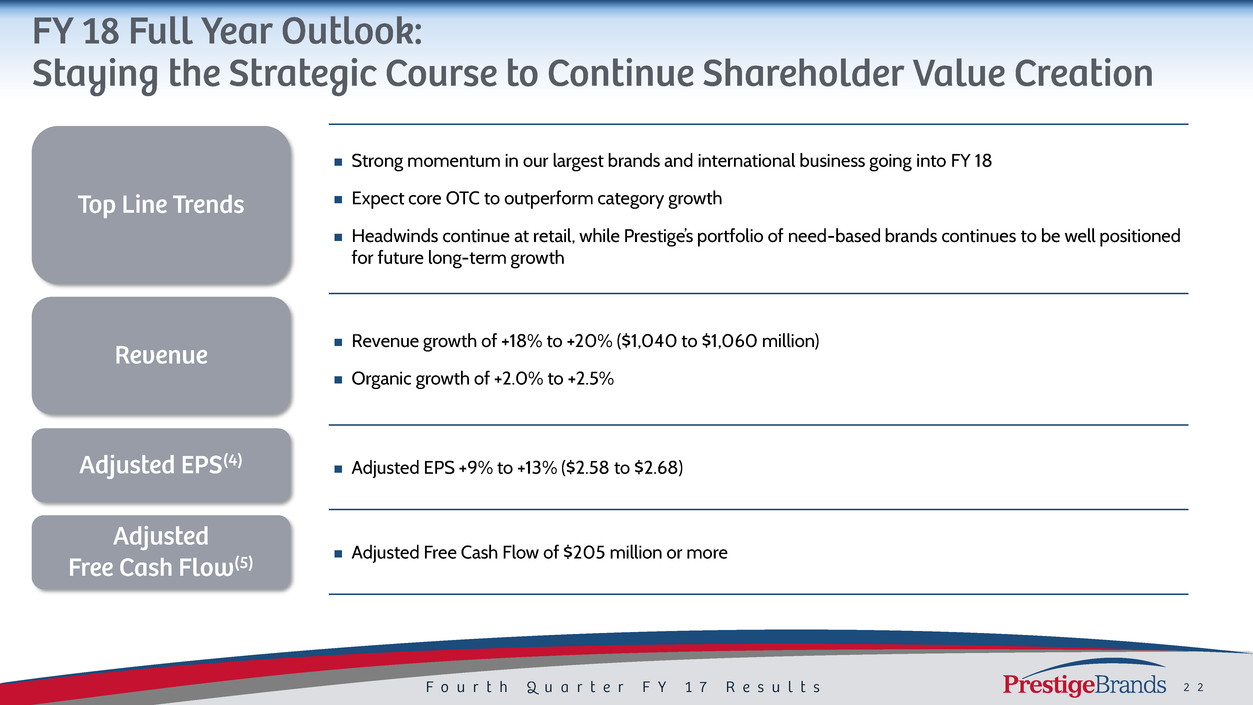

Strong momentum in our largest brands and international business going into FY 18

Expect core OTC to outperform category growth

Headwinds continue at retail, while Prestige’s portfolio of need-based brands continues to be well positioned

for future long-term growth

Revenue growth of +18% to +20% ($1,040 to $1,060 million)

Organic growth of +2.0% to +2.5%

Adjusted EPS +9% to +13% ($2.58 to $2.68)

Adjusted Free Cash Flow of $205 million or more

(1) Organic Revenue Growth is a Non-GAAP financial measure and is reconciled to its most closely related GAAP financial measure

in our earnings release in the “About Non-GAAP Financial Measures” section.

(2) Adjusted Gross Margin, Adjusted A&P, Adjusted G&A, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted

EPS, Adjusted Free Cash Flow are Non-GAAP financial measures and are reconciled to their most closely related GAAP financial

measures in the attached Reconciliation Schedules and / or in our earnings release in the “About Non-GAAP Financial Measures”

section.

(3) Leverage ratio reflects net debt / covenant defined EBITDA.

(4) Adjusted EPS for FY 18 is a projected Non-GAAP financial measure, is reconciled to projected GAAP EPS in our earnings release

in the “About Non-GAAP Financial Measures” section and is calculated based on projected GAAP EPS of $2.50 to $2.60 plus

$0.08 of costs associated with Fleet integration, resulting in $2.58 to $2.68.

(5) Adjusted Free Cash Flow for FY 18 is a projected Non-GAAP financial measure, is reconciled to projected GAAP Net Cash

Provided by Operating Activities in our earnings release in the “About Non-GAAP Financial Measures” section and is calculated

based on projected Net Cash Provided by Operating Activities of $210 million less projected capital expenditures of $10 million

plus payments associated with acquisitions of $8 million less tax effect of payments associated with acquisitions of $3 million

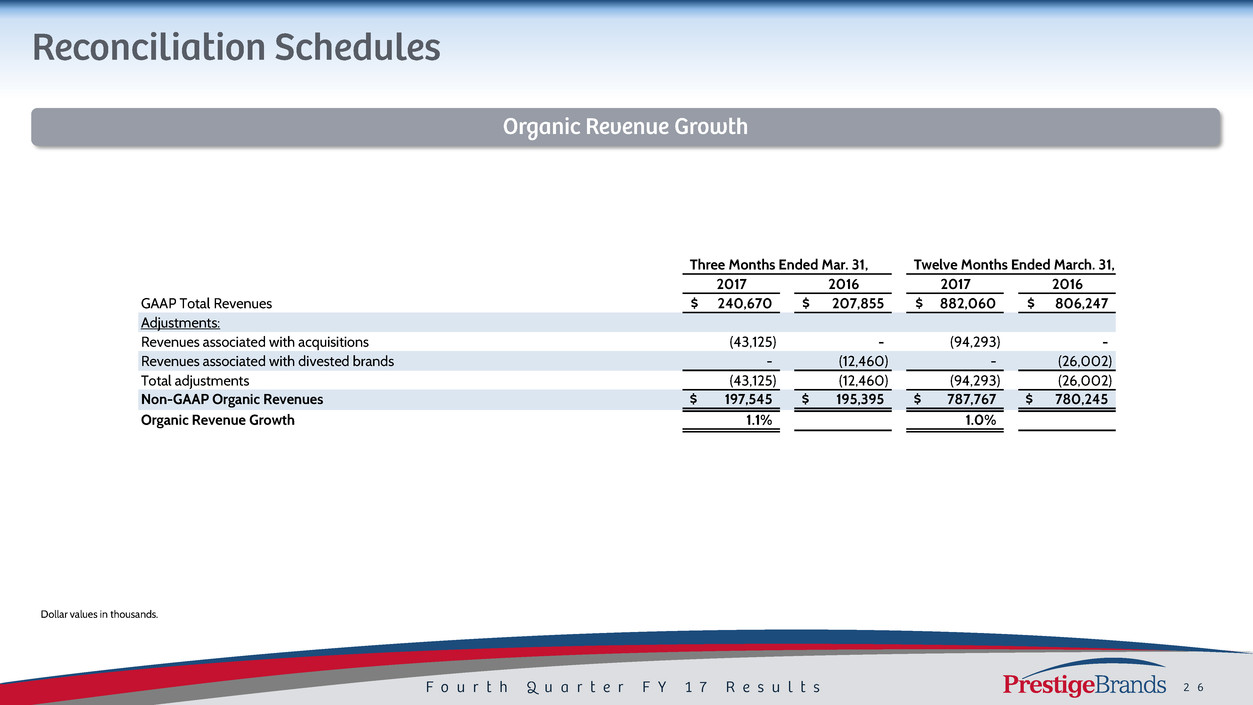

Dollar values in thousands.

Three Months Ended Mar. 31, Twelve Months Ended March. 31,

2017 2016 2017 2016

GAAP Total Revenues 240,670$ 207,855$ 882,060$ 806,247$

Adjustments:

Revenues associated with acquisitions (43,125) - (94,293) -

Revenues associated with divested brands - (12,460) - (26,002)

Total adjustments (43,125) (12,460) (94,293) (26,002)

Non-GAAP Organic Revenues 197,545$ 195,395$ 787,767$ 780,245$

Organic Revenue Growth 1.1% 1.0%

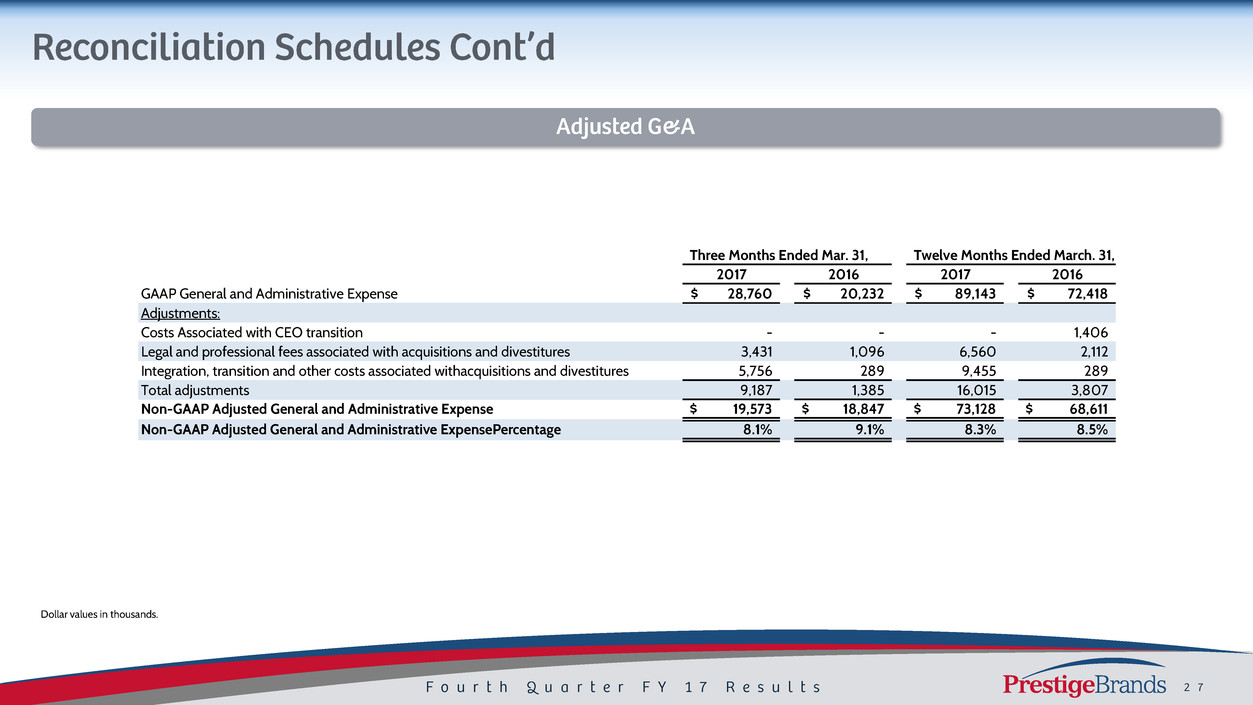

Dollar values in thousands.

Three Months Ended Mar. 31, Twelve Months Ended March. 31,

2017 2016 2017 2016

GAAP General and Administrative Expense 28,760$ 20,232$ 89,143$ 72,418$

Adjustments:

Costs Associated with CEO transition - - - 1,406

Legal and professional fees associated with acquisitions and divestitures 3,431 1,096 6,560 2,112

Integration, transition and other costs associated with acquisitions and divestitures 5,756 289 9,455 289

Total adjustments 9,187 1,385 16,015 3,807

Non-GAAP Adjusted General and Administrative Expense 19,573$ 18,847$ 73,128$ 68,611$

Non-GAAP Adjusted General and Administrative Expense Percentage 8.1% 9.1% 8.3% 8.5%

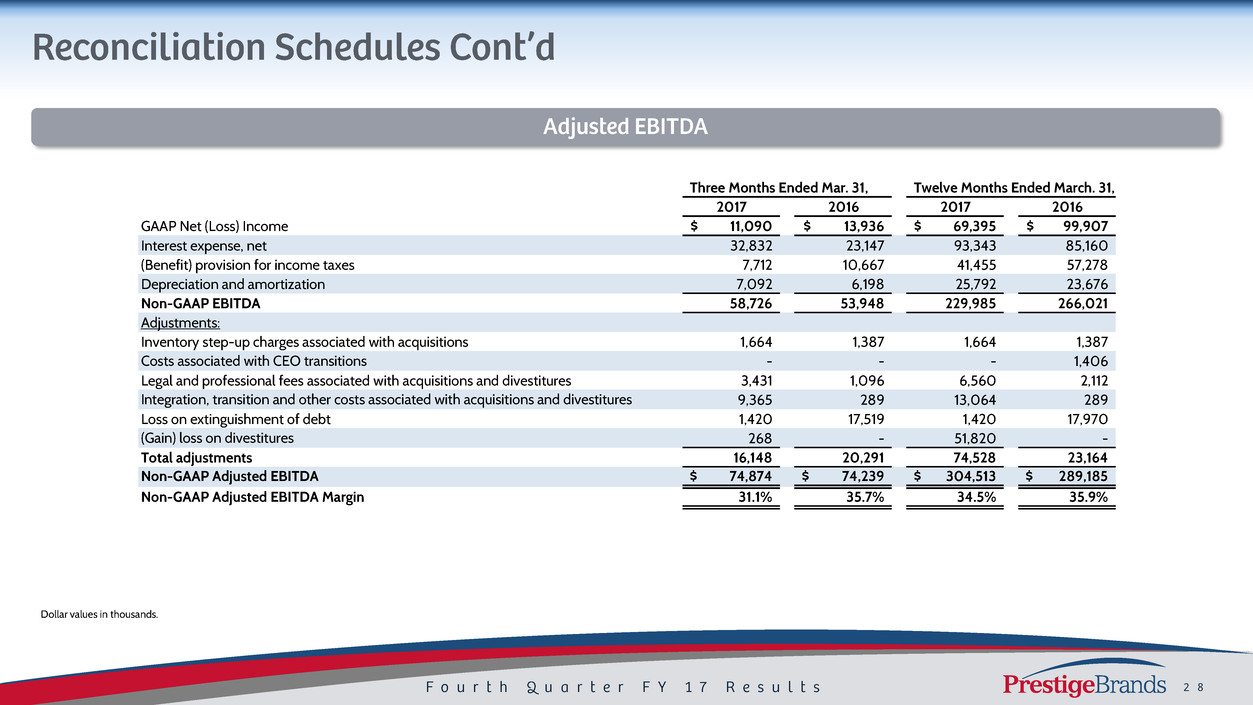

Dollar values in thousands.

Three Months Ended Mar. 31, Twelve Months Ended March. 31,

2017 2016 2017 2016

GAAP Net (Loss) Income 11,090$ 13,936$ 69,395$ 99,907$

Interest expense, net 32,832 23,147 93,343 85,160

(Benefit) provision for income taxes 7,712 10,667 41,455 57,278

Depreciation and amortization 7,092 6,198 25,792 23,676

Non-GAAP EBITDA 58,726 53,948 229,985 266,021

Adjustments:

Inventory step-up charges associated with acquisitions 1,664 1,387 1,664 1,387

Costs associated with CEO transitions - - - 1,406

Legal and professional fees associated with acquisitions and divestitures 3,431 1,096 6,560 2,112

Integration, transition and other costs associated with acquisitions and divestitures 9,365 289 13,064 289

Loss on extinguishment of debt 1,420 17,519 1,420 17,970

(Gain) loss on divestitures 268 - 51,820 -

Total adjustments 16,148 20,291 74,528 23,164

Non-GAAP Adjusted EBITDA 74,874$ 74,239$ 304,513$ 289,185$

Non-GAAP Adjusted EBITDA Margin 31.1% 35.7% 34.5% 35.9%

Dollar values in thousands.

2011 2012 2013 2014 2015 2016 2017

GAAP Net Income 29,220$ 37,212$ 65,505$ 72,615$ 78,260$ 99,907$ 69,395$

Income from Disc Ops (591) - - - - - -

Loss on sale of disc ops 550 - - - - - -

Interest Expense, net 27,317 41,320 84,407 68,582 81,234 85,160 93,343

Provision for income taxes 19,349 23,945 40,529 29,133 49,198 57,278 41,455

Depreciation and amortization 9,876 10,734 13,235 13,486 17,740 23,676 25,792

Non-GAAP EBITDA 85,721 113,211 203,676 183,816 226,432 266,021 229,985

Sales costs related to acquisitions - - 411 - - - -

Inventory step up 7,273 1,795 23 577 2,225 1,387 1,664

Inventory related acquisition costs - - 220 407 - - -

Add'l supplier costs - - 5,426 - - - -

Costs associated with CEO transition - - - - - 1,406

Legal and other professional fees associated with acquisitions 7,729 13,807 98 1,111 10,974 2,112 6,560

Integration, transition, and other Acq costs - 3,588 5,811 - 10,533 289 13,064

Stamp Duty - - - - 2,940 - -

Unsolicited porposal costs - 1,737 534 - - - -

Loss on extinguishment of debt 300 5,409 1,443 18,286 - 17,970 1,420

Gain on settlement - (5,063) - - - - -

Gain on sale of asset - - - - (1,133) - 51,820

Adjustments to EBITDA 15,302 21,273 13,966 20,381 25,539 23,164 74,528

Non-GAAP Adjusted EBITDA 101,023$ 134,484$ 217,642$ 204,197$ 251,971$ 289,185$ 304,513$

Dollar values in thousands.

Three Months Ended Mar. 31, Twelve Months Ended March. 31,

2017 2016 2017 2016

Net

Income EPS

Net

Income EPS

Net

Income EPS

Net

Income EPS

GAAP Net Income 11,090$ 0.21$ 13,936$ 0.26$ 69,395$ 1.30$ 99,907$ 1.88$

Adjustments:

Inventory step-up charges and other costs associate with acquisitions 1,664 0.03 1,387 0.03 1,664 0.03 1,387 0.03

Costs associated with CEO transition - - - - - - 1,406 0.02

Legal and professional fees associated with acquisitions and divestitures 3,431 0.06 1,096 0.02 6,560 0.12 2,112 0.04

Integration, transition and other costs associated with acquisitions and divestitures 9,365 0.18 289 0.01 13,064 0.24 289 0.01

Accelerated amortization of debt orgination costs 575 0.01 - - 1,706 0.03 - -

Additional interest expense from Term Loan B-4 debt refinancing 9,184 0.17 - - 9,184 0.17 - -

Loss on extinguishment of debt 1,420 0.03 17,519 0.33 1,420 0.03 17,970 0.34

(Gain) loss on divestitures 268 0.01 - - 51,820 0.97 - -

Tax impact of adjustments (9,438) (0.18) (6,294) (0.13) (28,024) (0.52) (7,608) (0.15)

Tax impacts related to tax reserve adjustments 1,278 0.02 - - (199) - - -

Total Adjustments 17,747 0.33 13,997 0.26 57,195 1.07 15,556 0.29

Non-GAAP Adjusted Net Income and Adjusted EPS 28,837$ 0.54$ 27,933$ 0.52$ 126,590$ 2.37$ 115,463$ 2.17$

Dollar values in thousands.

2011 2012 2013 2014 2015 2016 2017

Net

Income EPS

Net

Income EPS

Net

Income EPS

Net

Income EPS

Net

Income EPS

Net

Income EPS

Net

Income EPS

GAAP Net Income 29,220$ 0.58$ 37,212$ 0.73$ 65,505$ 1.27$ 72,615$ 1.39$ 78,260$ 1.49$ 99,907$ 1.88$ 69,395$ 1.30$

Adjustments

Income from discontinued ops. (591) (0.01) - - - - - - - - - - - -

Loss on sale of discontinued ops. 550 0.01 - - - - - - - - - - - -

Incremental interest expense to finance Acquisition 800 0.02 - - - - - - - - - - 9,184 0.17

Sales costs related to acquisitions - - - - 411 0.01 - - - - - - - -

Inventory step up 7,273 0.14 1,795 0.04 23 - 577 0.01 2,225 0.04 1,387 0.03 1,664 0.03

Inventory related acquisition costs - - - - 220 - 407 0.01 - - - - - -

Add'l supplier costs - - - - 5,426 0.11 - - - - - - - -

Costs associated with CEO transition - - - - - - - - - - 1,406 0.02 - -

Legal and other professional fees associated with acquisitions 7,729 0.15 13,807 0.27 98 - 1,111 0.02 10,974 0.21 2,112 0.04 6,560 0.12

Integration, Transition, and other Acq costs - - 3,588 0.07 5,811 0.11 - - 10,533 0.20 289 0.01 13,064 0.24

Stamp Duty - - - - - - - - 2,940 0.05 - - - -

Unsolicited porposal costs - - 1,737 0.03 534 0.01 - - - - - - - -

Loss on extinguishment of debt 300 0.01 5,409 0.11 1,443 0.03 18,286 0.35 - - 17,970 0.34 1,420 0.03

Gain on settlement - - (5,063) (0.10) - - - - - - - - - -

(Gain) loss on divestitures - - - - - - - - - - - - 51,820 0.97

(Gain) loss on sale of asset - - - - - - - - (1,133) (0.02) - - - -

Accelerated amortization of debt discounts and debt issue costs - - - - 7,746 0.15 5,477 0.10 218 - - - 1,706 0.03

Tax impact on adjustments (5,513) (0.11) (8,091) (0.16) (8,329) (0.16) (9,100) (0.17) (5,968) (0.11) (7,608) (0.15) (28,024) (0.52)

Impact of state tax adjustments - - (237) - (1,741) (0.03) (9,465) (0.18) - - - - (199) -

Total adjustments 10,548 0.21 18,008 0.36 11,642 0.23 7,293 0.14 19,789 0.37 15,556 0.29 57,195 1.07

Non-GAAP Adjusted Net Income and Non-GAAP Adjusted EPS 39,768$ 0.79$ 55,220$ 1.09$ 77,147$ 1.50$ 79,908$ 1.53$ 98,049$ 1.86$ $115,463 2.17$ $126,590 2.37$

Dollar values in thousands.

Three Months Ended Mar. 31, Twelve Months Ended March. 31,

2017 2016 2017 2016

GAAP Net (Loss) Income 11,090$ 13,936$ 69,395$ 99,907$

Adjustments:

Adjustments to reconcile net (loss) income to net cash provided by operating activities

as shown in the Statement of Cash Flows 21,347 34,206 91,713 96,221

Changes in operating assets and liabilities, net of effects from acquisitions as shown in

the Statement of Cash Flows

(25,013) (10,243) (13,336) (21,778)

Total Adjustments (3,666) 23,963 78,377 74,443

GAAP Net cash provided by operating activities 7,424 37,899 147,772 174,350

Purchase of property and equipment (1,042) (1,028) (2,977) (3,568)

Non-GAAP Free Cash Flow 6,382 36,871 144,795 170,782

Premium payment on extinguishment of 2012 Senior Notes - 10,158 - 10,158

Integration, transition and other payments associated with acquisitions and divestitures 8,304 1,665 10,448 2,461

Additioanl interest on Term Loan B-4 debt refinancing 9,184 - 9,184 -

Pension contribution 6,000 - 6,000 -

Additional income tax payments associated with divestitures 16,956 - 25,545 -

Non-GAAP Adjusted Free Cash Flow 46,826$ 48,694$ 195,972$ 183,401$

Dollar values in thousands, except per share data.

2010 2011 2012 2013 2014 2015 2016 2017

GAAP Net Income 32,115$ 29,220$ 37,212$ 65,505$ 72,615$ 78,260$ 99,907$ 69,395$

Adjustments

Adjustments to reconcile net income to net cash provided by operating

activities as shown in the statement of cash flows 31,137 26,095 35,674 59,497 50,912 64,668 96,221 91,713

Changes in operating assets and liabilities, net of effects from

acquisitions as shown in the statement of cash flows (3,825) 31,355 (5,434) 12,603 (11,945) 13,327 (21,778) (13,336)

Total adjustments 27,312 57,450 30,240 72,100 38,967 77,995 74,443 78,377

GAAP Net cash provided by operating activities 59,427 86,670 67,452 137,605 111,582 156,255 174,350 147,772

Purchases of property and equipment (673) (655) (606) (10,268) (2,764) (6,101) (3,568) (2,977)

Non-GAAP Free Cash Flow 58,754 86,015 66,846 127,337 108,818 150,154 170,782 144,795

Premiuim payment on 2010 Senior Notes - - - - 15,527 - - -

Premiuim payment on extinguishment of 2012 Senior Notes - - - - - - 10,158 -

Accelerated interest payments due to debt refinancing - - - - 4,675 - - 9,184

Integration, transition and other payments associated with acquisitions - - - - 512 13,563 2,461 10,448

Pension contribution - - - - - - 6,000

Additional income tax payments associated with divestitures - - - - - - 25,545

Total adjustments - - - - 20,714 13,563 12,619 51,177

Non-GAAP Adjusted Free Cash Flow 58,754$ 86,015$ 66,846$ 127,337$ 129,532$ 163,717$ 183,401$ 195,972$

2018 Projected EPS

Low High

Projected FY'18 GAAP EPS $ 2.50 $ 2.60

Adjustments:

Costs associated with Fleet integration(1) 0.08 0.08

Total Adjustments 0.08 0.08

Projected Non-GAAP Adjusted EPS $ 2.58 $ 2.68

Dollar values in millions, except per share data.

(1) Acquisition related items represent costs related to integrating recently acquired businesses including (but not limited to), warehouse consolidation, costs to exit or convert contractual obligations, severance, information system conversion and consulting costs;

and certain costs related to the consummation of the acquisition process such as legal and other acquisition related professional fees.

2018 Projected

Free Cash Flow

Projected FY'18 GAAP Net Cash provided by operating activities $ 210

Additions to property and equipment for cash (10)

Projected Non-GAAP Free Cash Flow 200

Payments associated with acquisitions 8

Tax effect of payments associated with acquisitions (3)

Adjusted Non-GAAP Projected Free Cash Flow $ 205